- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 07-01-2022

- The New Zealand dollar advances some 0.46% as the North American session ends.

- A risk-off market mood was no excuse for the NZD to gain vs. the USD.

- NZD/USD Technical Outlook: Downward biased as long as it remains below 0.6859.

On Friday, the New Zealand dollar trimmed some of its Thursday’s losses despite a risk-off market mood. At the time of writing, the NZD/USD is trading at 0.6776 as the North American session ends.

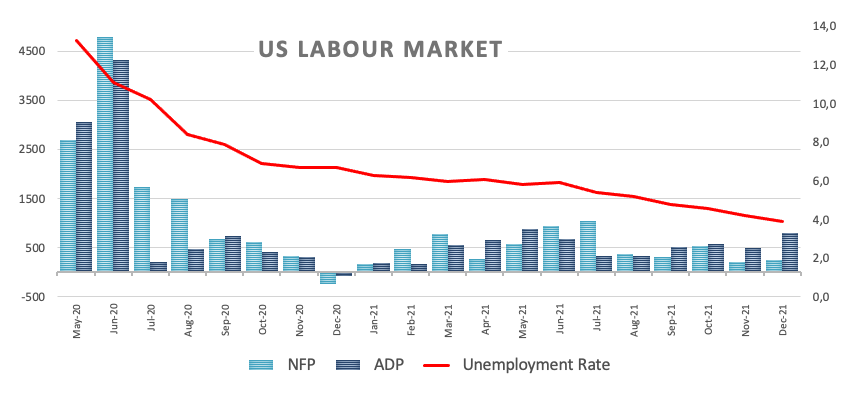

US Nonfarm Payrolls headline misses expectations wages rose

The day’s highlight was the US Nonfarm Payrolls report, which was mixed. The headline showed that the US economy added “just” 199K employments in December, 201K short than the 400K estimated by analysts.

Nevertheless, the Unemployment Rate -Fed’s gauge of labor market conditions- dropped 0.2%, from 4.1% to 3.9%, a level was last seen in February 2020, before the pandemic hit the US. Furthermore, Average Hourly Earnings for December grew 4.7% annually based, 0.5% higher than estimations, further cementing the Federal Reserve stance.

Market's reaction

The NZD/USD seesawed around Thursday’s lows and the daily pivot, in the 0.6738-65 range, to finally break above the latter, stabilizing around the 100-hour simple moving average (SMA) lying at 0.6780. furthermore, the US Treasury yields, led by the 10-year benchmark note, rose to a daily high at 1.801%, while the US Dollar Index, which tracks the greenback’s performance against a basket of its rivals, slumped some 0.61%, sitting at 05.74.

NZD/USD Price Forecast: Technical outlook

The NZD/USD remains downward biased, per the daily chart. The simple moving averages (SMAs) on the latter reside above the spot price; additionally, a daily close above the last lower high around 0.6859 is needed for NZD bulls to have a chance of launching an attack towards the 100-day SMA at 0,6965.

The NZD/USD first support is the January 6 daily low at 0.6733. The latter’s breach would expose the psychological 0.6700 level, followed by a 2021 yearly low at 0.6701.

- AUD/USD has been choppy on Friday in wake of a mixed US labour market report.

- The pair is now trading in the 0.7180s having dipped as low as the 0.7130s.

- The dollar weakened broadly despite the jobs report spurring upside in yields on Fed tightening expectations.

AUD/USD was choppy on the final day of the first week of 2022, dipping as low as the 0.7130s in pre-US open European trade before eventually rebounding 50 pips in wake of a mixed US jobs report to the 0.7180s. The rally has stalled in this area given the presence of the 21-day moving average at 0.7190 and the Monday/Tuesday lows at 0.7185. On the day, that means AUD/USD is on course to gain around 0.3%, a fairly uninspired performance when compared to the gains some of its G10 peers are enjoying versus the US dollar in wake of the jobs data. And on the week, AUD/USD is still set to close about 1.2% lower.

FX strategists were perplexed at the dollar reaction to the latest jobs report. Yes, the headline monthly gain in non-farm payrolls came in at 199K, well below median forecasts for 400K. But that won’t matter too much to the Fed has acknowledged that the main problem holding the US labour market back from further job gains is a lack of labour supply, not demand. Meanwhile, the unemployment rate dropped under 4.0% and a measure of underemployment also fell substantially and back very close to pre-pandemic levels. Wage growth was also strong. Thus, the data endorses the Fed stance laid out in the minutes this week that the labour market is very “tight” and is either very close to or already at “short-term” full-employment.

The jobs report thus meets the criteria that, so long as labour market progression remains reasonable, rate hikes will soon be warranted. In other words, the central banks tightening plans for 2022, as laid out at the December meeting and in its minutes, remain very much intact. This helped boost long-term US bond yields, with the 10-year yield hitting its highest since January 2020 at just under 1.80%. Typically, surging US yields would be dollar positive. Perhaps the dollar bulls will regain control next week, a week which sees the release of the December US Consumer Price Inflation report on Wednesday, Producer Price Inflation on Thursday and December Retail Sales on Friday. Fed Chair Jerome Powell will also testify on Monday. That’s plenty of catalysts for dollar bulls to latch onto.

- The British pound advances some 0.18% vs. the Japanese yen.

- GBP/JPY failure to reclaim above 158.22 exposes the pair to downward pressure unless GBP bulls keep the pair above 156.00.

As the end of the first trading week of 2022 approaches, the British pound trimmed some of Thursday’s losses and reclaimed the 157.00 figure. At the time of writing, the GBP/JPY is trading at 157.12 during the North American session.

On Friday, the GBP/JPY was subdued amid the lack of UK and Japanese economic data in the docket. During the overnight session for North American traders, the GBP/JPY was range-bound in the 156.70-157.10 range, trendless and seesawing around the 50-hour simple moving average (SMA).

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is still bullish biased, though failed short of breaking above the 158.00 figure, once broken in October of 2021, when the GBP/JPY printed the yearly high at 158.22. However, Friday’s recovery leaves some doubts on the table. The cycle high reached on January 5 at 157.76, is lower than the abovementioned, so any strong twist in the market mood would exert downward pressure on the GBP/JPY.

To the upside, the GBP/JPY first resistance level is the January 5 daily high at 157.76. A breach of the latter would expose October 20, 2021, cycle high at 158.22, followed by the 160.00 figure and then May’s 2016 monthly highs around 163.86.

On the flip side, the cross-currency first support is the 157.00 figure. A clear break of the figure opens the door for a challenge of the January 6 daily low at 156.09, followed by the January 3 daily low at 154.89, and then December 28, 2021, pivot low at 154.00.

-637771829915539303.png)

- EUR/JPY has pushed back above the 131.00 level on Friday as the euro puts in a strong performance.

- The pair is eyeing a test of resistance in the 131.50 area.

- Eurozone inflation surprised on the upside on Friday; further Eurozone inflation surprises could see EUR gain versus JPY this year.

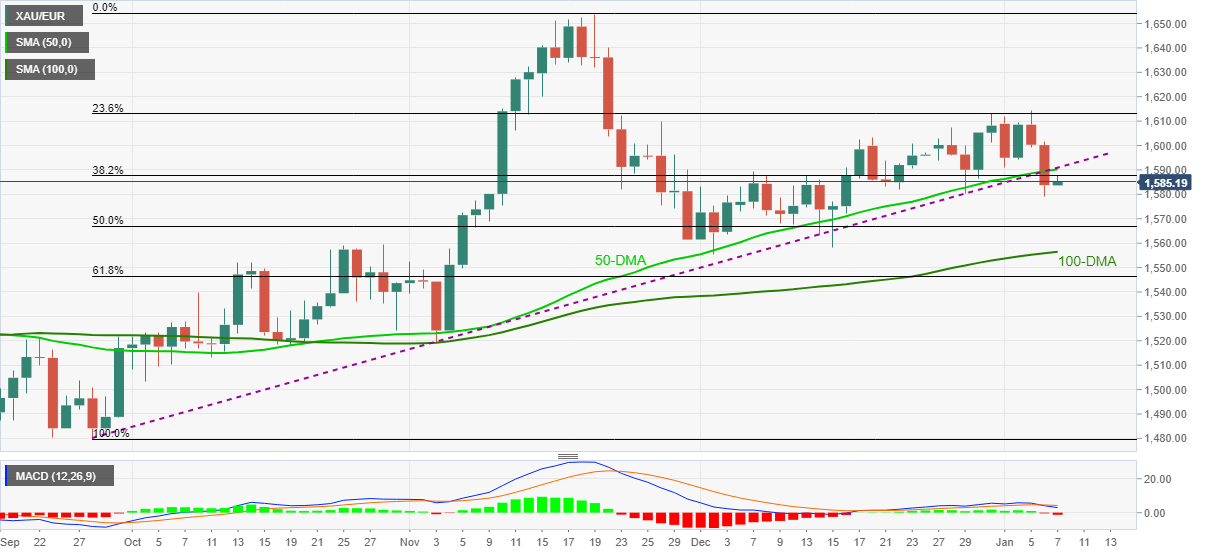

The euro has put in a solid performance on the final trading day of the first week of 2022. Though not the best performing currency in the G10, the euro has rallied about 0.4% versus the safe-haven yen and nearly 0.6% against the underperforming dollar. As a result, EUR/JPY has rallied from Asia Pacific session levels under 131.00 to current levels in the 131.30 area, with bulls eyeing an imminent test of the key 131.50 balance area, which market this week’s top and was a key area f support turned resistance in late-October/mid-November.

The euro’s outperformance on Friday likely has something to do with another Eurozone inflation surprise. Eurostat released the flash estimate of December Eurozone HICP inflation on Friday, which came in at 5.0% YoY from 4.9% in November versus forecasts for a drop to 4.7%. Meanwhile, the core measure also rose unexpectedly to 2.7% from 2.6% versus forecasts for it to remain unchanged. As Reuters put it, the data will likely make “for more uncomfortable reading at the European Central Bank, which has consistently underestimated price pressures and come under fire for this from some of its own policymakers”.

Risks are clearly tilted towards a further hawkish shift in ECB policy. Euro money markets earlier this week had a 10bps hike in October fully priced in, which seems excessive. As ECB Chief Economist Philip Lane reminded market participants on Monday, a 2022 rate hike is very unlikely. But Q1 2023 is very much on the cards and this is something hawkish ECB members have talked about in the past if inflation continues to surprise to the upside. A Q1 2023 rate hike would presumably be preceded APP QE purchases being axed by the end of Q4 2022.

Traders should be prepared to trade expectations for a widening ECB/BoJ policy divergence in 2022 and any associated widening impact this might have on Eurozone/Japan yields. For now, German 10-year yields remain below 0% and thus still below Japan 10-year yields. Much fanfare will likely be made if the German 10-year climbs back above the Japanese and such a move could well couple with EUR/JPY moving back towards Q4 2021 highs in the 133.50 area.

- The EUR/GBP advances during the North American session, up some 0.18%.

- Eurozone inflation rose more than expected, breaking the 5% threshold.

- EUR/GBP Technical outlook: Bearish biased as long as it remains below 0.8500.

The shared currency rises for the third day in a row against the British pound, on higher than expected Eurozone inflation figures. The EUR/GBP is trading at 0.8361 during the North American session at press time.

Eurozone HICP Flash for December rises above the 5% threshold

On Friday, during the overnight session for North American traders, the Eurozone economic docket featured inflation figures. The HICP Flash for December on an annual basis rose by 5.0%, higher than the 4.7% estimated by analysts. The jump in the figure is attributed to high energy prices, rising 26%, compared to 2021. However, increases for food, services, and imported goods were also above the European Central Bank’s target of 2%.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP portrays its inability to break under the YTD low at 0.8335 two times, one in Friday’s session. Nevertheless, the daily moving averages (DMAs) position 90-pips above the spot price, confirming the downward bias in the pair.

The EUR/GBP first resistance would be a resistance trendline drawn from January 5 highs, which confluences near the R1 daily pivot point around the 0.8366-72 region. A breach of that area would expose the 200-hour SMA at 0.8380, followed by the R2 daily pivot at 0.8386.

On the other hand, EUR/GBP’s first support level would be the 100-hour SMA at 0.8356, once broken would expose the 50-hour SMA at 0.8350, followed by the S1 daily pivot at 0.8334.

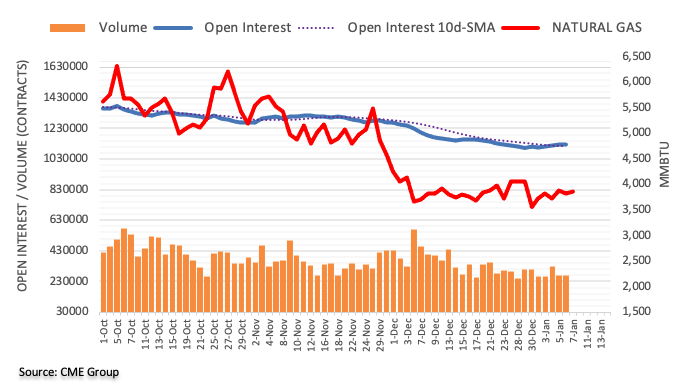

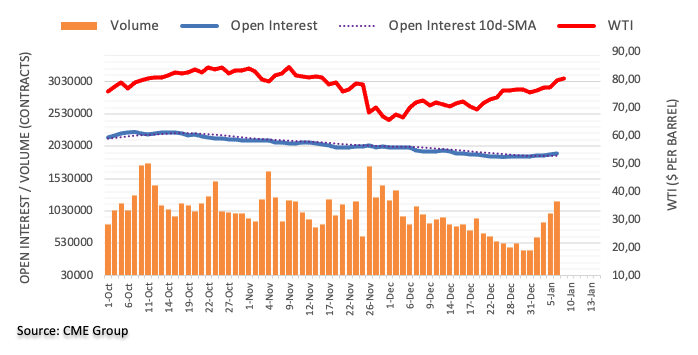

- WTI slipped back under $79.00 on Friday but remains on course for substantial weekly gains.

- Supply/geopolitical issues have been key drivers of oil this week, with the broader macro story taking a back seat.

Oil prices have come under modest selling pressure on the final day of the first trading week of 2022, with front-month WTI futures dupping back below $79.00 in recent trade from earlier weekly highs above $80.00. At current levels in the $78.75 region, WTI is still on course to post a weekly gain of around $3.50, which would mark a third successive week in the green. Order appears to have been restored in the capital city of Kazakhstan, with the President declaring constitutional order restored after Russia sent paratroopers to help the government quell widespread protests which had turned into an uprising.

Crucially for oil markets, it appears that there hasn’t been a lasting impact on Kazakhstan’s 1.6M barrel per day (BPD) in output, so Friday’s losses may represent a modest reduction in geopolitical risk premia. But output problems elsewhere amongst OPEC+ nations remain a key theme for oil traders. Reports earlier in the week said that Libyan output had dropped to just 729K BPD from recent highs of 1.3M BPD amid infrastructure maintenance work. Libya’s most recent output hiccup is indicative of a broader struggle of many of the smaller OPEC+ nations to keep up with rising output quotas in recent months.

For instance, a survey by Reuters earlier in the week showed that OPEC+ output rose just 70K BPD in December versus a more than 250K allowed output increase, amid declining output in Libya and Nigeria. That took the group's compliance to 127% - in other words, OPEC+ nationals are producing 27% less than allowed under their current output quotas. This has been a key source of support for oil markets this week and the theme of OPEC+ struggles to up supply is set to remain a key talking point in 2022.

Oil prices have this week deviated from trading as a function of the broader macro story, gaining despite steep losses in US equities (primarily in tech) in wake of a hawkish Fed minutes release and sharp upside in bond yields. Rocky sentiment in equities adds to the downside risk for crude oil prices at these levels, with crude oil relatively more “expensive” than if stocks were still trading close to record levels. Traders will be attentive to how the broader macro story plays out next week and whether this comes back as a major crude oil market driver.

- US Nonfarm Payrolls disappointed, but the Unemployment Rate improved.

- Eurozone inflation hits the 5% threshold, higher than estimations.

- EUR/USD Technical Outlook: The 1-hour chart depicts an upward bias, though a break above 1.1400 increases the opportunity of an attempt to the 100-DMA at 1.1500.

After a mixed than expected US employment report weakened the US dollar, the euro advances for the second time of the week. During the New York session, the EUR/USD is trading at 1.1346 at press time.

The market mood is risk-off as portrayed by European equity indices closing in the red, while US ones are losing, except for the Dow Jones Industrial (DJI) rising 0.34%. Also, the US 10-year Treasury yield printed a YTD high around 1.801%, failing to boost the greenback, with the US Dollar Index dropping 0.56%, sitting at 95.78.

US Nonfarm Payrolls report came mixed while Eurozone inflation reached the 5% threshold

Earlier in the North American session, the Bureau of Labor Statistics (BLS) released the US Nonfarm Payrolls report for December. The figures came shorter than expected, with the US economy adding 199K jobs, lower than the 400K foreseen by analysts. However, the Unemployment Rate improved, from 4.1% down to 3.9%, hitting a 22-month low.

December’s report was unlikely to reflect the impact of the fourth wave of the Covid-19, linked to the Omicron variant. The survey was done by mid-December, just as the newly discovered strain hit the US.

In the meantime, the Eurozone economic docket featured inflation figures. The HICP Flash for December on an annual basis rose by 5.0%, higher than the 4.7% estimated by analysts. The jump in the figure is attributed to high energy prices, rising 26%, compared to 2021. However, increases for food, services, and imported goods were also above the European Central Bank’s target of 2%.

EUR/USD Price Forecast: Technical outlook

Once macroeconomic data from the Eurozone and the US are on the rearview mirror, the EUR/USD pair stabilized around the 50-day moving average (DMA) at 1.1352. Given that the Relative Strength Index (RSI) is at 53 in bullish territory, the pair might print a leg up, but it would face strong resistance around December 31, 2021, daily high at 1.1386. A decisive break of that supply zone would send the pair towards 1.1400.

On the flip side, the EUR/USD first support is the January 5 high at 1.1346. A breach of the latter exposes the R1 daily pivot at 1.1325, immediately followed by a robust support area where ALL the hourly simple moving averages (SMAs) confluence with the daily pivot point around the 1.1308-16 region.

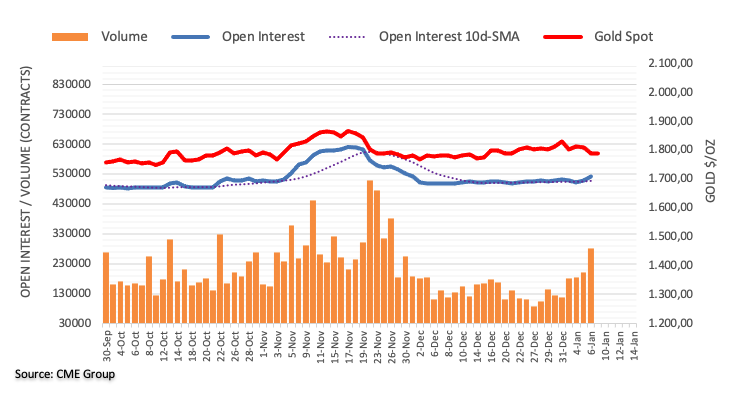

- Spot gold has been swinging either side of the $1790 level in recent trade in wake of the latest jobs report.

- XAU/USD is being shielded from higher yields by a weaker dollar, though if this reverses, gold will be in trouble.

Spot gold (XAU/USD) is nervously holding on to very modest on-the-day gains of about 0.2%, with prices swinging either side of the $1790 level as traders digest the implications of the latest US labour market report. Trading conditions in wake of the mixed report, which saw headline jobs growth disappoint but also saw improvements in measures of slack and strong wage growth, have been choppy and two-way. XAU/USD hit lows around $1782 and high around $1796 and is currently trading towards the upper end of this intra-day range around $1794.

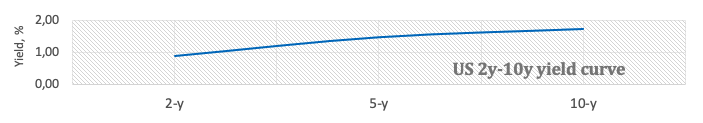

Gold has been surprisingly resilient in wake of the report which analysts interpreted as endorsing the Fed’s tightening plans for 2022. Earlier in the week, the FOMC minutes laid out the stance, so long as labour market progression continues at the current pace (which the latest jobs report revealed that it did in December), rate hikes would soon be warranted. Whilst the jobs report appears not to have boosted the market’s expectations for further near-term rate hikes (hence US 2-year yields remaining flat around 0.87%), it does seem to have boosted the market’s conviction in the Fed’s long-term rate trajectory. 10-year yields recently broke above the 2021 high at 1.77% and came within a whisker of hitting 1.80%. At current levels of around 1.78%, they are around 5bps higher on the day.

Half of this move came from a small boost to inflation expectations, but half is coming from a boost to underlying real yields, with the 10-year TIPS hitting fresh multi-month highs above -0.75% in recent trade. Usually, when real and nominal yields rise, this increase in the opportunity cost of holding non-yielding assets weighs on the demand for precious metals. However, US dollar-denominated gold prices are being held up by weakness in the buck. In a surprise for FX strategists, the dollar has been weakening in recent trade despite the positive reaction seen in US bond yields to the latest jobs report. Positioning could be overstretched, and the buck could be struggling amid profit-taking. Either way, the weaker dollar is making the price of USD-denominated gold more affordable for international investors, thus negating the negative impact of higher real yields.

Many FX strategists have been calling for the dollar to move higher given the recent surge in long-term US bond yields this week as conviction in the Fed’s ability to get rates back to pre-pandemic levels grows. On the week, 10-year nominal yields are up over 25bps, whilst 10-year real yields are up more than 35. The dollar may well now be seen by some as “cheap” given the recent widening in US/G10 rate differentials in favour of the buck. Meanwhile, the bigger relative moves higher in real yields represent a drop in inflation expectations, diminishing the appeal for inflation protection, a key reason why investors buy gold. If current trends in bond markets continue and the dollar starts to pick up, XAU/USD may well be headed back to 2021 lows under $1700 in the next few weeks/months.

- The greenback ignores rising US Treasury yields, with the 10-year hitting 1.785%.

- US Nonfarm Payrolls report came at 199K, lower than estimations, unemployment rate dips under 4%.

- USD/JPY Technical Outlook: Downward biased, unless it reclaims the 116.00 figure.

The USD/JPY fails to gain traction after a mixed US Nonfarm Payrolls report, trading under the 116.00 threshold during the New York session. At the time of writing, the USD/JPY is exchanging hands at 115.67. The market sentiment is downbeat, as witnessed by US equity indices trading in the red, after the US employment report showed that the labor market is tight, with unemployment falling but wages rising.

Nonfarm Payrolls fell short than expected, but the unemployment rate dipped below 4%

Before Wall Street opened, the US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls rose by 199K, lower than the 400K median foreseen by economists. In the meantime, the Unemployment Rate fell to a 22-month low of 3.9% from 4.1% in the previous report.

In 2021, the labor market improved, creating 6.4 million jobs. That is the largest increase in employment record-keeping in 1939.

“January will paint a weaker picture, and the remaining months are in the hands of the latest COVID wave,” per analyst cited by Reuters.

December’s report was unlikely to reflect the impact of the fourth wave of the Covid-19, linked to the Omicron variant. The survey was done by mid-December, just as the newly discovered strain hit the US.

In the meantime, US Treasury yields keep skyrocketing, with the 10-year Treasury yield at 1.7850% up some five basis points in the day. Contrarily, the US Dollar Index, a greenback measurement against a basket of six peers, drops 0.40%, sitting at 95.93.

USD/JPY Price Forecast: Technical outlook

The USD/JPY 1-hour chart depicts the pair still has an upward bias, as long as the spot price remains above the 200-hour simple moving average (SMA), which lies at 115.43. On the downside, the first support would be the S1 daily pivot, tested two previous times in the day at 115.59, followed by the 200-hour SMA at 115.43, and then the S2 daily pivot at 115.33.

The US/JPY first resistance would be 116.00. A breach of the latter would expose the January 6 high at 116.18, followed by the January 4 cycle high at 116.34.

- The S&P 500 is down about 0.6% as yields rally, hurting the dominant tech sector.

- The latest US jobs report, while mixed, has been interpreted as endorsing the Fed's monetary tightening plans for 2022.

The S&P 500 is trading on the back foot as its heavyweight tech sector suffers amid a rise in long-term US government bond yields in wake of the latest US labour market report. The index is down about 0.6% and trading close to the 4670 mark, having now dropped more than 3.0% from Tuesday’s all-time highs near 4820. The upside in bond yields seems to be the market's way of saying that the latest jobs report, despite headline non-farm payroll gains in December missing expectations, keeps the Fed’s 2022 monetary policy tightening plans on track. Either way, higher long-term yields increase the opportunity cost of holding stocks whose valuation is derived on bets for future earnings growth, thus weighing on their value.

As a result, so-called “growth” stocks are underperforming and this is weighing heavily on the Nasdaq 100 index, which is down more than 1.0% on the day and probing the 15.5K level. That means the index is more than 6.0% below the highs it posted above 16.6K just after Christmas. Upside in bond yields is giving the S&P 500 financial sector a boost (+0.4%), while defensive S&P 500 sectors such as utilities and consumer staples are also holding up well. Disproportionate weighting towards stocks in so-called “value” sectors which tend to hold up better when yields are rising means the Dow is performing better than the other major US indices and is down just 0.1% on the day.

Equity strategists have warned this week that higher yields amid decisively more hawkish Fed policy in 2022 pose a major downside risk to “growth” stocks in 2022 and that, as a result, rotation into “value” and “cyclical” stocks may well continue. Some strategists have suggested that European and Japanese equities, that are less dominated by the tech sector, may outperform US indices. Certainly, that has been the case thus far this year, with the Stoxx 600 down just 0.5% on the week versus losses of over 2.0% for the S&P 500.

San Francisco Federal Reserve Bank President Mary Daly said on Friday that inflation is not as temporary as the Fed once thought because Coivd-19 isn't either. A wage-price spiral isn't showing up in the data yet, she added, but is worth watching for.

Further remarks:

On wage-price spiral...

"Anchored longer-run inflation expectations also make me a little less worried than some others are about an upward inflation spiral."

"I don't feel we are at the precipice of a price-wage spiral."

"Definitely believe we need to adjust policy."

On QE/QT...

"Supportive of tapering asset purchases."

"Would prefer to see rate hikes gradual, and move to balance sheet reductions earlier than during the last cycle."

"Would not want to start trimming balance sheet at the same time as start raising rates."

"Could imagine adjusting balance sheet after one or two rate hikes."

"Would prefer flatter funds rate path, faster adjustment of balance sheet."

Other remarks...

"We face tradeoffs as policymakers."

"Once Covid is gone, every likelihood inflation pressure will still be downward."

- NZD/USD is probing session highs in the 0.6760s as the dollar weakens after a mixed US jobs report.

- The jobs report likely won’t impact the Fed’s tightening plans so USD weakness is perplexing and could be positioning-related.

NZD/USD is probing session highs in the 0.6760s, though the gains are currently capped by the presence of resistance in the form of the Tuesday lows, as the US dollar weakens in wake of Friday’s mixed US jobs report. A break above resistance could open the door to a test of the 21-day moving average just under 0.6790. At current levels, the pair is trading about 0.25% higher and sits around the middle of the G10 performance table. Ahead, a smattering of Fedspeak from the likes of Mary Daly, Thomas Barkin and Raphael Bostic over the course of the afternoon will keep FX traders entertained, though may not provide markets with any impetus.

NFP review

The US economy added less jobs than expected in December (just 199K versus 400K forecasts), but measures of economic slack showed improvement across the board (unemployment fell to 3.9% from 4.2%) and wage growth was solid. The implication is that the labour market is 1) tight and 2) suffering from a lack of fresh workers (hence weak monthly job gain). This is very much in fitting with the way the Fed has been viewing the labour market. Fed Chair Jerome Powell and others at the bank have said they see the pandemic as artificially holding back millions of workers from returning to the labour market, which has upped the competition amongst employers for those workers who are available.

The Fed minutes revealed FOMC participants viewed the US labour market as either already at “short-term” full employment or close to it, amid the expectation it will take some time (and the subsiding of the pandemic) for labour supply to start picking up again. The FOMC minutes also revealed that, as a result of near-term full employment being close, it may soon be time to start raising interest rates, a statement markets took as indicating potential lift-off in March. The latest jobs report will not change any of this thinking, so it is a little odd to see the US dollar weakening.

USD weakness could be a reflection of fears of a Fed mistake. In other words, it could reflect a view that it would be economically optimal for the Fed to wait a little longer before raising rates, as starting the hiking cycle in March could stymie growth and bring down the eventual terminal rate. Given the fact that US bond yields haven't seen much of a post-NFP reaction (you would expect to see lower longer-term yields if there were fears of a hawkish Fed mistake), that may be overthinking it. Perhaps the weakness reflects USD profit-taking in a market already very long dollars. Either way, if the current weakness persists, that could put NZD/USD on course to break back above 0.6800 and have a go at recent 0.6850 highs next week.

- Ivey PMI dropped sharply to 45.0 in December from above 60.0 in November.

- The seasonally adjusted measure also dropped sharply, but remained above 50.0.

- The loonie ignored the data and continues to bask in the afterglow of a strong December labour market report.

Canada's Ivey PMI, which is released by the Richard Ivey School of Business each month and captures business conditions in Canada, fell to 45.0 in December from 61.2 in November. As with other PMI indicators, a result above 50 is generally associated with MoM growth in economic activity. Thus, Canada's Ivey PMI suggests business conditions in the country fell into contractionary territory last month. However, the less volatile seasonally adjusted version of the PMI index fell to 51.1, remaining in expansion territory, after slipping from 61.2 in November.

Market Reaction

The loonie continues to bask in the afterglow of a stronger than anticipated December labour market report and has thus, for now, ignored the weaker Ivey PMI report.

Nonfarm Payrolls disappointed, but the labor market tightness indicators were stronger than expected. The employment numbers had a modest impact on the FX market. Looking ahead, economists at TD Securities think the bar is very high to undermine the USD, especially as the Fed is very determined to move out of very accommodative policy settings.

Risk of earlier QT to cause yen underperformance

“We do not think that the disappointment in headline payrolls will do much to undermine the USD. The Fed is on a mission to move into restrictive policy; taper is almost over, lift-off is happening, inflation is very high with evidence of second round price pressures, and QT is all the rage. And, despite the back-up in yields this week, financial conditions remain accommodative especially relative to the growth and inflation backdrop.”

“We are not putting much stock on Omicron to sway sentiment in risk or FX, and consequently, we think the Fed's determination should keep the USD in resilient form.”

“USD/JPY is the best FX expression of Fed policy given it is just a mirror image of the Fed funds futures. Ultimately, we remain biased to USD/JPY topside with an eye to 118/19 in the coming weeks and months, as further acknowledgement of QT should reinforce duration supply and higher 10y real yields.”

- The Canadian economy added double of the jobs foreseen by economists, while the unemployment rate fell below 6%.

- The US Nonfarm Payrolls disappointed, but the Unemployment Rate dipped under 4%.

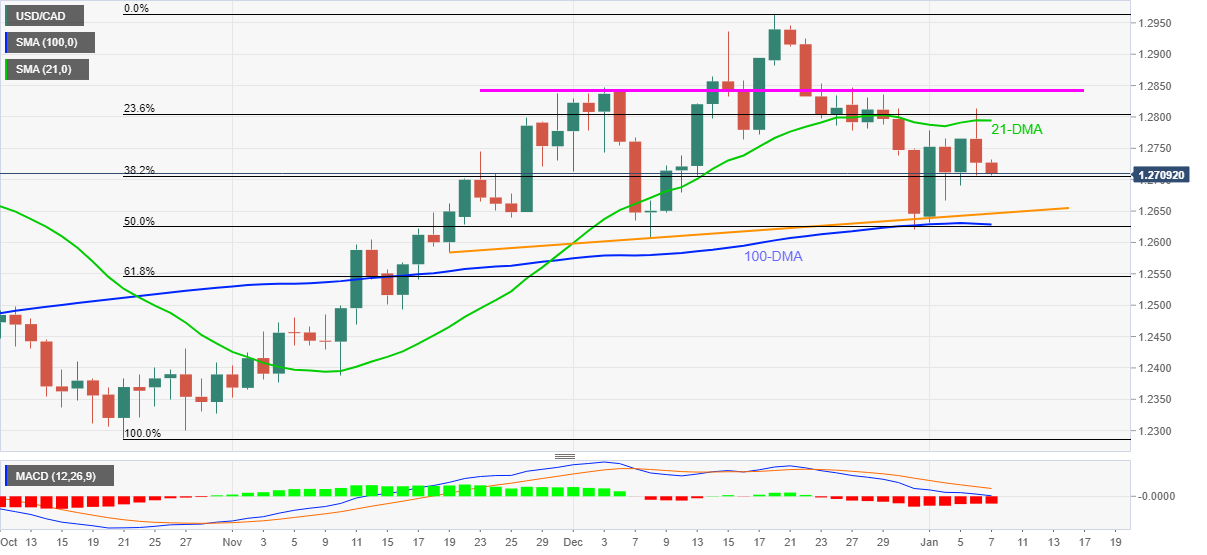

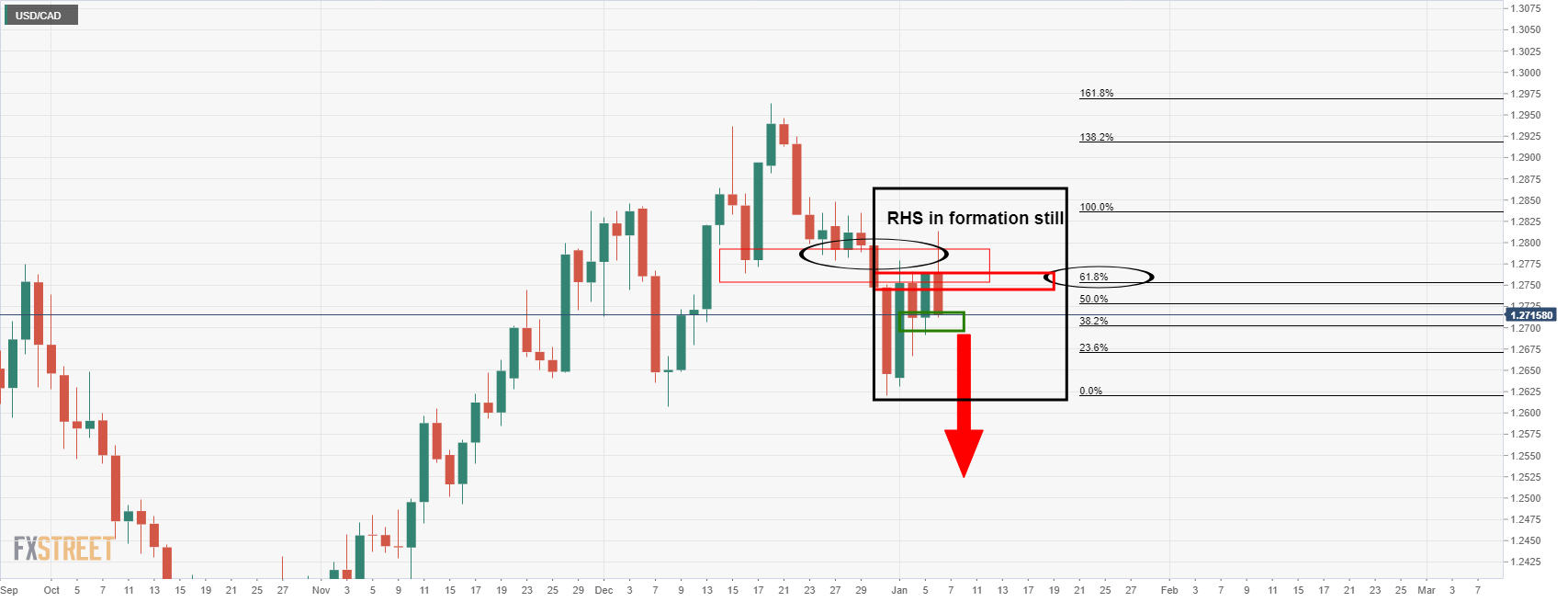

- USD/CAD Technical Outlook: A break under 1.2700 opens the door for a fall towards 1.2642.

The USD/CAD is extending its fall to two consecutive days in the week, briefly pierced the 50-day moving average (DMA) around 1.2687, to then reclaim the 1.2700 figure after Canadian and US employment data struck the wires. At the time of writing, it is trading at 1.2686.

Canadian jobs report overshadowed US Nonfarm Payrolls

The Canadian economy docket featured the employment report for December 2021. Statistics Canada said that the country added 54,700 jobs to the economy, doubling analysts’ estimations for a 27,500 gain. Additionally, the Unemployment Rate fell from 6.0% t0 5.9%.

The dip in the jobless rate is the lowest seen since February 2020, before Covid-19 emerged. After December’s report, Canada’s labor market is up 240,500 jobs above the pre-pandemic level. However, it is worth noting that the poll was done between December 5 and December 11, pre-Omicron outbreak in the country. Analysts expect a weaker January 2022 report on the latter mentioned.

At the same time, the US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls rose by 199,000, worse than the 400,000 foreseen by economists. The positive of the employment report is that Unemployment Rate in the US dipped under the 4% threshold, at 3.9%, lower than the estimated 4.1%.

In the meantime, US Treasury yields fell some, after reaching a daily high of around 1.771%, retreated four basis points down to 1.741%. The US Dollar Index, briefly pierced under 96.00 at press time, sits at 96.03.

USD/CAD Price Forecast: Technical outlook

The USD/CAD 1-hour chart depicts the pair as downward biased after breaching the 50, 100, and 200-hour simple moving averages (SMAs), leaving them residing above the spot price. Additionally, the pierce of the 1.2700 threshold opened the door for a further dip towards the S1 daily pivot level at 1.2684. A break of that level would expose the January 4 daily low at 1.2667, followed by the S2 daily pivot at 1.2642.

- USD/TRY trades within a tight range in the sub-14.00 area.

- Turkey 5y, 10y bond yields reverse the recent drop.

- Elevated inflation keeps weighing on Turk’s sentiment.

The Turkish lira halted its depreciation in levels just below the 14.00 mark vs. the US dollar at the end of the week, all amidst a narrow trading range in USD/TRY.

USD/TRY remains poised for extra gains

USD/TRY seems to have met quite a decent barrier near 14.00 the figure on Friday, although it managed to record new highs for the year, nonetheless.

In the meantime, the lira remains under scrutiny amidst the current feeble outlook, which has been exacerbated after inflation figures recorded a 19-year peak beyond 36% in the year to December (Monday).

From the Turkish cash markets, yields of the 5y and 10y bonds reverse the recent multi-session weakness and resume the upside to past the 24% mark and just above 23%, respectively. The recent decline in yields have been promoted by purchases of government debt by the Turkish central bank (CBRT) according to latest news.

What to look for around TRY

The lira resumed the downtrend while market participants continue to digest the recent inflation figures and the government scheme to protect deposits in the domestic currency. The reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the lira under intense pressure for the time being, That said, another visit to the all-time high north of the 18.00 mark in USD/TRY should not be ruled out just yet.

Eminent issues on the back boiler: Progress (or lack of it) of the new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Presidential elections in 2023.

USD/TRY key levels

So far, the pair is losing 0.24% at 13.7871 and a drop below 12.7523 (weekly low Jan.3) would pave the way for a test of 11.9694 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.8967 (YTD high Jan.3) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- Spot silver prices were choppy post-NFP but are little changed from pre-data levels in the $22.20 area.

- Headline US job gains missed expectations but measures of slack point to an improving and tight labour market.

Spot silver (XAG/USD) prices have seen a confused, two-way reaction to the latest US labour market report. Spot prices at one point dipped under the $22.00 level, but have since rebounded back to in line with pre-data levels near $22.20 after printing session highs just under $22.30. For reference, headline job gains in the US disappointed, but measures of slack showed indicated that the US labour market continued to make progress to “near-term” full employment (i.e., full utilisation of workers actually willing to engage in the labour force at present). As such, the money market impied probability that the Fed lifts interest rates by 25bps in March moved slightly higher to 90% from 80% prior to the release.

Given the mixed nature of the report and as traders continue to digest what it means for the outlook for Fed policy, FX and bond markets arent much moved. If anything, the dollar is a tad weaker, with the DXY currently testing the 96.00 level. Meanwhile, US 5 and 10-year TIPS (real) yields are flat in the respective -1.34% and -0.77% areas, roughly in line with pre-data levels. From a correlation standpoint, it thus makes sense that data hasn’t had much follow-through for precious metals yet either.

While silver appears to have made it through NFP unscathed (to the surprise of some), it may be too soon for the bulls to declare this week’s selling pressure over, given that three Fed speakers will be orating over the course of the afternoon. Fed’s Mary Daly is up first at 1500GMT, followed by remarks from Fed’s Raphael Bostic at 1715GMT and Thomas Barkin at 1730GMT. The tone of their remarks is likely to echo the hawkish minutes, with FOMC participants seemingly in agreement on most aspects of monetary policy. Bond yields have come a long way higher on the week to price in a more hawkish Fed and, at current levels, XAG/USD is set to end the week nearly 5.0% lower. Perhaps that limits the scope for further losses. If not, a break below $22.00 would open the door to a test of December lows around $21.40.

The Canadian labour market continues to make solid progress in its recovery with another 55K jobs created during the month of December. The data had little impact on the CAD but there is enough here to adopt a bias that the upcoming Bank of Canada meeting is live. As such, economists at TD Securities think risk/reward has moved in favour of the loonie.

Canadian labour market enters 2022 on strong footing

“The Canadian economy added 55K jobs during the month of December, above the market consensus for 25K (TD: 30K), pulling the unemployment rate down to 5.9%. Details were somewhat mixed, with full-time employment up 123K, while hours worked rose just 0.3% and wage growth slipped to 2.7% YoY.”

“Today's report should place some added pressure on the BoC ahead of the January meeting, where markets are currently pricing a roughly 50% chance of a rate hike, although we continue to look for lift-off in April.”

“We hold a bearish USD/CAD bias but we think that the USD leg could be a bit resilient given a very hawkish Fed and deeply entrenched USD positioning.”

EUR/USD continues to trade in a 1.1225-1.1385 channel since late-November. Upside momentum over the past few days has been limited and economists at Scotiabank expect the world’s most popular currency pair to drift lower towards the 1.10 level.

ECB is unlikely to increase rates before late-2023

“We think it’s more likely that the Fed hikes by 100bps this year (markets are at 75bps) than the ECB hikes by 10bps – with OIS markets penciling a first ECB increase in October. The 50bps in rate increases that markets are seeing by end-2023 would be a sharp turnaround from the ultra-dovish ECB.”

“As markets adjust expectations around the Fed and the ECB, EUR/USD losses toward 1.10 should resume.”

“Support is ~1.1270/85 followed by 1.1260 and 1/1235/40.”

“Key resistance is the 50-day MA at 1.1351 and the recent high of 1.1386.”

GBP/USD is stable in mid 1.35s. Economists at Scotiabank notes that the bullish trend in cable could drive the pair towards the 1.36 level on a break above the 100-day moving average at 1.3556.

100-DMA of 1.3556 acts as resistance

“The pound should find decent support at the 1.35/high-1.34s zone on dips with the mid-figure area following.”

“Resistance after the 100-day MA of 1.3556 stands at 1.3577, the 38.2% Fib retracement of its Jun-Dec drop, with the 1.36 level acting as another key mark to beat on the charts.”

EUR/CAD fails at key 1.4615 resistance. Now, the pair looks soft and prone to renewed weakness again, in the view of economists at Scotiabank.

Key resistance seen at 1.4615

“The late year consolidation in EUR/CAD has taken the form of a rough – but validlooking – bear flag.”

The EUR is testing the base of the consolidation and a break below 1.4325 should signal a resumption of the losses we have been expecting to (eventually) unfold.”

“Key support remains 1.4165.”

“Key resistance remains 1.4615.”

- USD/CHF gained some positive traction on Friday and shot to over a two-week high.

- The disappointing headline NFP was offset by a larger drop in the jobless rate.

- Rising US bone yields acted as a tailwind for the USD and remained supportive.

The USD/CHF pair finally broke out of its intraday consolidative range and shot to over a two-week high, around the 0.9230-35 area during the early North American session.

The latest uptick witnessed over the past hour or so followed the release of the mixed US jobs report, which showed that the US economy added 199K new jobs in December. This was far below consensus estimates pointing to a reading of 400K, though was offset by an upward revision of the previous month's print to 249K from 210K reported early.

Moreover, the unemployment rate fell more than anticipated to 3.9% from 4.2% in November. Despite the disappointing headline NFP, additional details reinforced speculations for an eventual Fed lift-off in March. This was evident from a fresh leg up in the US Treasury bond yields, which provided a modest lift to the US dollar and the USD/CHF pair.

In fact, the yield on the benchmark 10-year US government bond rose to levels not since March 2021. Adding to this, the US 2-year notes, which are highly sensitive to rate hike expectations along with 5-year notes, climbed to a near two-year high. The USD bulls, however, seemed reluctant to place aggressive bets.

Apart from this, an intraday slide in the equity markets extended some support to the safe-haven Swiss franc and kept a lid on any meaningful gains for the USD/CHF pair. Nevertheless, the overnight sustained strength beyond the 0.9200 round-figure and the subsequent move up supports prospects for a further near-term appreciating move.

Technical levels to watch

USD/JPY is taking a healthy breather. Economists at Credit Suisse view this as a healthy pause ahead of a test of the long-term downtrend from April 1990 at 116.83.

Support at 114.96 ideally now holds

“With 10yr US Bond yields now seen completing a major base as looked for we expect this to further reinforce the existing base in USD/JPY.”

“We look for a break above 116.35 for a test of the long-term downtrend from April 1990, now seen at 116.83. Whilst we would expect to see a fresh phase of consolidation to emerge here, we look for a break higher post this for a challenge on the 118.61/66 highs of late 2016 and 2017.”

“Big picture, we look for an eventual rise to 1222.90/123.00.”

“Near-term support moves to 115.62, then 115.68/62 which we look to ideally hold. A close below 114.96 though remains needed to ease the immediate upside bias.”

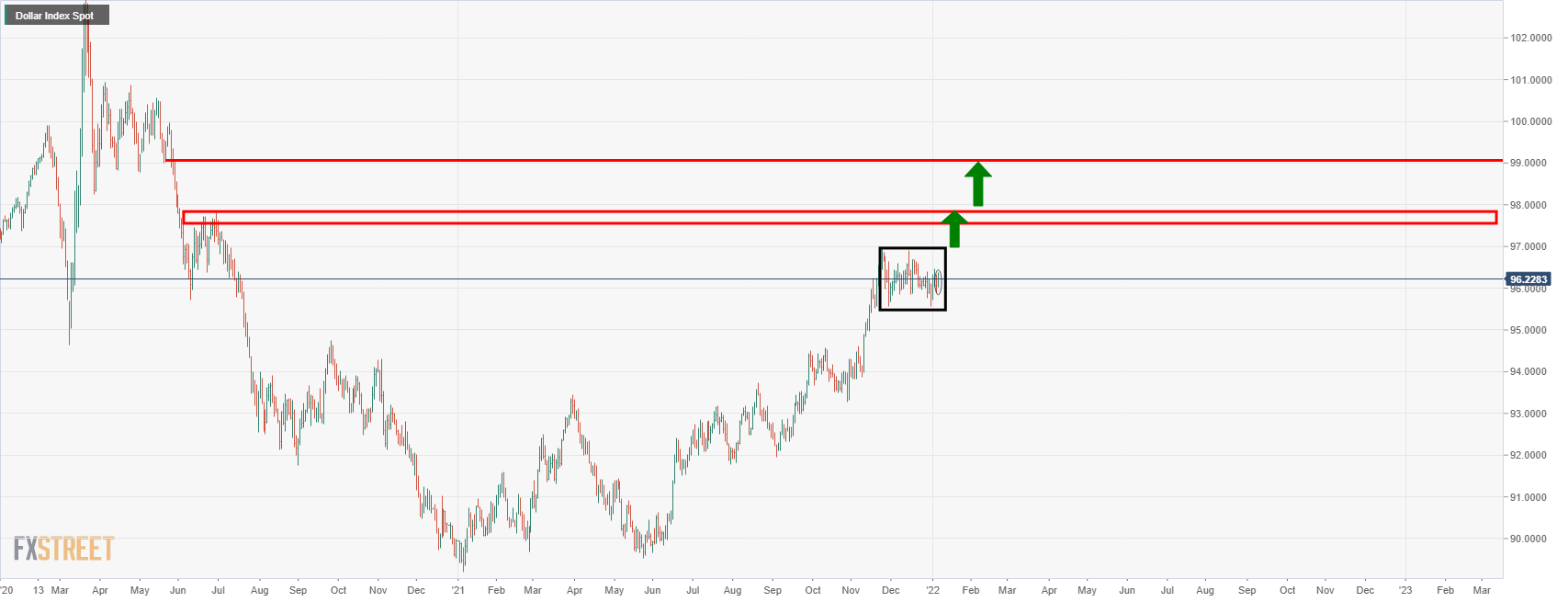

- The index keeps the bearish note above the 96.00 mark.

- US Non-farm Payrolls rose by 199K jobs in December.

- The unemployment rate ticked lower to 3.9%.

The selling interest around the greenback remains well and sound at the end of the week and keeps the US Dollar Index in the area above the 96.00 barrier in the wake of the Nonfarm Payrolls.

US Dollar Index remains side-lined

The index appears offered on Friday after the US economy created 199K jobs during last month, coming in short of expectations for a gain of 400K jobs. The November’s reading was revised to 249K (from 210K).

Further data showed the jobless rate eased to 3.9% and the critical Average Hourly Earnings – a proxy for inflation via wages – rose 0.6% MoM and expanded 4.7% from a year earlier. Another key gauge, the Participation Rate, improved a tad to 61.9%.

Later in the session, San Francisco Fed M.Daly (2024 voter, hawkish), Atlanta Fed R.Bostic (2024 voter, centrist) and Richmond Fed T.Barkin (2024 voter, centrist) are all due to speak.

US Dollar Index relevant levels

Now, the index is retreating 0.13% at 96.11 and a break above 96.46 (weekly top Jan.4) would open the door to 96.90 (weekly high Dec.15) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 95.57 (monthly low Dec.31) followed by 95.51 (weekly low Nov.30) and then 94.96 (weekly low Nov.15).

- Canada added 54.7K jobs in December, above the 27.5K expected.

- CAD saw some kneejerk strength, though conditions have been choppy.

The Canadian economy added 54.7K jobs in the month of December, above expectations for a 27.5K gain, though still a marked deceleration from the 153.7K jobs added in November, according to the latest release from Statistics Canada released on Friday. Canada saw 122.5K new jobs in full-time employment, whilst part-time employment fell 67.7K. The unemployment rate fell to 5.9% from 6.0% in November, below expectations for it to remain unchanged.

Market Reaction

CAD saw kneejerk strength in wake of the latest Canadian jobs report, but trade has been choppy.

- NFP rose by 199K in December, below the 400K expected.

- The unemployment rate fell to 3.9% and Average Hourly Earings rose 0.6% MoM.

- The dollar has seen a choppy reaction even though the report boosted money market pricing for a March Fed hike.

Nonfarm Payrolls (NFP) rose by 199K in December versus the median forecast for a 400K rise (some newswires had reported the median forecast at 447K), data published by the US Bureau of Labor Statistics showed on Friday. That meant the pace of job gains was roughly in line with November, when 249K jobs (revised up from 210K) were added to the US economy. Private employment rose by 211K, below expectations for a 365K rise and below last month's 279K rise (which was revised up from 235K). Manufacturing employment rose 26K, below expectations for a 35K rise and down from November's 35K gain (which was revised up from 31K). Government payrolls fell 12K.

The unemployment rate fell to 3.9% from 4.2% in November, versus expectations for a drop to 4.1% and continued to close in on its pre-pandemic levels of 3.5% in December. The U6 underemployment rate fell to 7.3% from November's 7.7% (which was revised lower from 7.8%), only slightly above its pre-pandemic level of 7.0%. The participation rate rose to 61.9% from 61.8% and the employment-population ratio rose to 59.5% from 59.2%, still well below its pre-pandemic level at 61.1%.

Meanwhile, the MoM gain in Average Hourly Earnings came in at 0.6%, above expectations for it to rise to 0.4% from November's 0.4% MoM level (which was revised up from 0.3%). That meant that the YoY rate of Average Hourly Earnings growth came in at 4.7% in December versus median forecasts for a fall to 4.2% from 5.1% (revised up from 4.8%).

Market Reaction

The dollar has seen a choppy reaction to the latest jobs report. It initially saw downside, likely due to the headline number missing expectations. The DXY dipped as low as 96.05 but has since been choppy in the 96.10-20 area in tandem with the money market-implied probability of the Fed hiking interest rates in March rising to 90% from 80% prior to the data.

Yes, the job gains seen in December were weaker than expected. But measures of economic slack, such as the unemployment rate, the U6 underemployment rate and the participation rate all showed further improvement. Wage gains were also stronger than expected. The Fed minutes of the December meeting suggested that most members view the economy as very close to or having already reached "short-term" full employment. That is to say, with the ongoing pandemic holding workers back from re-entering the workforce, the available labour supply seems to be at or close to full utilisation.

Friday's labour report likely then fulfills the criteria set out by the Fed in the minutes that rate hikes might soon be appropriate so long as the labour market continues to make rapid progress towards full employment. USD bulls will wonder whether this can reignite some upside in the buck.

- GBP/USD is subdued at just under 1.3550 as the key US jobs report looms.

- The pair continues to trade within its recent bullish trend channel, with traders eyeing resistance at 1.3600 and support at 1.3400.

GBP/USD is unsurprisingly trading in subdued fashion as FX market participants await the release of the latest official US labour market report at 1330GMT. So far on Friday, the pair has been unable to poke above the 1.3550s and has mostly been going sideways in the 1.3530-50 area. In the broader technical context, GBP/USD’s has been moving higher within the confines of a bullish trendline since just after Christmas and this trend currently remains intact. But traders may be leery about chasing the pair any higher if the upcoming US labour market report comes in as good as expected, thus boosting the prospect of a March Fed rate hike.

GBP/USD bulls will be relieved that the hawkish Fed minutes from earlier in the week and associated sharp upside in US bond yields didn’t translate into broad USD strength. Indeed, the pair is actually on course to post a modest weekly gain of about 0.1%, which would mark a third successive week in the green, with sterling having gained recently as UK pandemic/lockdown fears subsided. But some FX strategists have argued that the proximity of the jobs report so close after the release of the hawkish Fed minutes may have deterred USD bulls from, at the time, increasing their long exposure. With the jobs report out of the way (as long as it is decent), the dollar may get the “green light” to push higher, analysts have warned.

Was that to be the case, GBP/USD likely would suffer and the 1.3500 level would below vulnerable. A break below that could open the door to technical selling to drive the pair as low as 1.3400 where the 50-day moving average resides. In the reverse case where the dollar sees post-jobs report weakness, the key area of resistance to watch is at 1.3600.

- AUD/USD attracted fresh sellers on Friday and dropped to over a two-week low.

- The overnight decisive break below an ascending trend-line favours bearish traders.

- Bears now await the release of the closely-watched US monthly jobs report (NFP).

The AUD/USD pair remained on the defensive and languished near the lowest level since December 22, around mid-0.7100s heading into the North American session.

The pair did attempt a minor recovery during the early part of the trading on Friday, though struggled to capitalize on the move despite modest US dollar weakness. This comes on the back of the recent repeated failures near the 100-DMA and the overnight decisive break below a one-month-old ascending trend-line, which favours bearish traders.

The negative outlook is reinforced by the fact that technical indicators on the daily chart have again started drifting into bearish territory. Investors, however, seemed reluctant to place aggressive bets, preferring rather to wait on the sidelines ahead of the release of the closely-watched US monthly jobs data – popularly known as the NFP report.

Nevertheless, the technical set-up support prospects for a further near-term depreciating move towards testing the 0.7100 round-figure mark. Some follow-through selling should pave the way for a further downfall and drag the AUD/USD pair back towards challenging 2021 low,s around the key 0.7000 psychological mark touched early December.

On the flip side, attempted recovery moves might now confront resistance and meet with a fresh supply near the daily swing high, around the 0.7175-80 region. This, in turn, should cap the upside near the ascending trend-line support breakpoint, currently around the 0.7200 mark. This should act as a key pivotal point for short-term traders.

A sustained strength beyond might trigger a short-covering move and push the AUD/USD pair back towards the 0.7255-60 region, or the 100-day SMA barrier. A subsequent move up will negate the negative bias and pave the way for a move towards the next relevant hurdle near the 0.7340-45 region en-route the 0.7375-80 zone and the 0.7400 round-figure mark.

AUD/USD daily chart

Technical levels to watch

European Central Bank Chief Economist Philip Lane on Thursday told Ireland's RTE News that he believes inflation will come down later in the year. He labeled the current spike in inflation as a part of a "pandemic cycle of inflation". Moreover, he called the spike in energy costs a "major economic issue", before reiterating that it was highly unlikely that the bank would hike interest rates this year.

Lane's remarks come after headline HICP inflation in the Eurozone rose to a fresh post-pandemic high of 5.0% in December, according to a Eurostat flash estimate. Earlier in the week, euro money markets were pricing a full 10bps rate hike from the ECB as soon as October.

Market Reaction

His remarks do not seem to have stirred any reaction in FX markets.

- EUR/USD struggles for direction amidst a cautious price action.

- The loss of the 1.1270 region opens the door to extra losses.

Consolidation remains the name of the game around EUR/USD ahead of the release of the US labour market figures on Friday.

In the meantime, bouts of weakness should initially put the 1.1270 region to the test. If breached, then spot could slip further back and retest the weekly low at 1.1234 (December 20) ahead of the December’s low at 1.1221 (December 15).

The broader negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1742.

EUR/USD daily chart

- DXY fades Thursday’s modest advance and retests 96.00.

- If bulls wake up, then the next target comes near 96.50.

DXY alternates gains with losses at/above the 96.00 yardstick ahead of the key US Nonfarm Payrolls on Friday.

If the buying interest gathers impulse, the index should initially target the area of YTD highs near 96.50 to allow for further gains to 96.90 (December 15) and the 2021 peak at 96.93 (November 24).

In the meantime, while above the 4-month support line (off September’s low) around 95.00, further upside in DXY is likely. Looking at the broader picture, the longer-term positive stance remains unchanged above the 200-day SMA at 93.06.

DXY daily chart

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly jobs report for December later this Friday at 13:30 GMT. The Canadian economy is anticipated to have added 27.5K new jobs during the reported month, marking a sharp decelerating from a massive growth of 153.7K in November. That said, the unemployment rate is expected to hold steady at 6.0% and the Participation Rate is also likely to remain unchanged at 65.3%.

How could the data affect USD/CAD?

Ahead of the key release, bullish crude oil prices underpinned the commodity-linked loonie and acted as a headwind for the USD/CAD pair. Apart from this, modest US dollar weakness weighed on the major for the second successive day. Stronger Canadian employment details should provide additional lift to the domestic currency, though the data is likely to be overshadowed by the simultaneous release of the US NFP report.

Nevertheless, any significant divergence from the expected readings might still influence the Canadian dollar and infuse some volatility around the major.

Meanwhile, Dhwani Mehta, Senior Analyst at FXStreet, offered a brief technical outlook and important technical levels to trade the major: “USD/CAD has confirmed a falling wedge breakout on the daily sticks a day before, with the bulls now recapturing the critical 21-Daily Moving Average (DMA) at 1.2798. The pain in the Canadian dollar could be exacerbated if the jobs data fall short of the market’s expectations, prompting the pair to break through the recent range highs around 1.2850. Further up, all eyes will remain on the 1.2900 level. The 14-day Relative Strength Index (RSI) looks north just above the midline, backing the bullish view.”

“Only an upside surprise on the Canadian jobs data or a big disappointment on the US NFP report could save the day for CAD bulls. In that case, the spot could retrace to test the wedge resistance-turned-support at 1.2723, below which a sharp drop towards the bullish 50-DMA at 1.2684 will be in the offing,” Dhwani added further.

Key Notes

• Canadian Jobs Preview: Slowdown in jobs growth could worsen CAD’s plight

• USD/CAD bounces off daily low, defends 1.2700 mark ahead of US/Canadian jobs report

• USD/CAD Outlook: Overnight pullback warrants caution for bulls amid rallying oil prices

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

- EUR/JPY manages to resume the upside after Thursday’s drop.

- The cross faces the next target at 131.60 ahead of 132.17.

EUR/JPY regains upside traction and recovers ground lost after Thursday’s noticeable retracement.

Further gains remain on the cards for the time being if the cross surpasses the so far YTD high at 131.60 (January 5). Once cleared, the next hurdle is seen at the Fibo level (of the October-December drop) at 132.17.

While above the 200-day SMA, today at 130.52, the outlook for EUR/JPY should point to extra gains.

EUR/JPY daily chart

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data. The popularly known NFP report is scheduled for release at 13:30 GMT and is expected to show that the economy added 400K new jobs in December, up from the previous month's dismal reading of 210K. The unemployment rate is expected to edge lower to 4.1% from 4.2% in November. Given Wednesday's stellar US ADP report on private-sector employment, market participants are bracing for a positive surprise from the official figures.

As Joseph Trevisani, Senior Analyst at FXStreet, explains: “The availability of employment, the extremely low level of layoffs, the desire of many workers to improve their wages to cope with soaring inflation, and the vibrant US expansion, should give Nonfarm Payrolls a good December. Given the strength of the attendant indicators and the ADP result, risk is weighted to a substantially better number than forecast.”

How could the data affect EUR/USD?

Heading into the key release, a generally positive risk tone, along with softer US Treasury bond yields kept the US dollar bulls on the defensive and acted as a tailwind for the EUR/USD pair. That said, the divergence in monetary policy stance between the Fed and the European Central Bank (ECB) kept a lid on any meaningful gains for the major. A stronger NFP print would reaffirm hawkish Fed expectations and provide a fresh lift for the greenback. Conversely, any disappointment is more likely to be offset by growing acceptance for an eventual Fed liftoff in March. This, in turn, suggests that the path of least resistance for the pair remains to the downside and any attempted recovery move could still be seen as a selling opportunity.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the major: “EUR/USD's near-term technical picture shows that the pair is struggling to find direction with the Relative Strength Index (RSI) indicator moving sideways near 50 on the four-hour chart. Moreover, the pair is currently fluctuating in a tight range in between the 100-period and 200-period SMA's on the same chart, reflecting its indecisiveness.”

Eren also outlined important technical levels to trade the EUR/USD pair: “In case US T-bond yields start to push higher after NFP data, the first target on the downside aligns at 1.1270 (static level) ahead of 1.1240 (static level) and 1.1200 (psychological level). Resistances are located at 1.1320 (50-period SMA), 1.1340 (static level) and 1.1360 (static level, post-ECB high).”

Key Notes

• Nonfarm Payrolls Preview: A strengthening labor market backs a tighter monetary policy

• US Nonfarm Payrolls December Preview: The labor market seconds Fed policy

• EUR/USD Forecast: Sellers move to sidelines while waiting for NFP's impact on rate hike bets

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

Senior Economist at UOB Group Alvin Liew reviews the recently published FOMC Minutes of the December meeting (Wednesday).

Key Takeaways

“The Dec 2021 FOMC minutes were seen as overtly hawkish with an extensive discussion about policy normalisation considerations, especially on reducing the Fed’s signifcant balance sheet.”

“The minutes revealed FOMC policymakers’ thoughts of an earlier and faster timeline to raise interest rates in 2022 due to inflation concerns and tighter labor market conditions. It also extensively discussed reducing the US$8.8 trillion balance sheet with participants looking at a shorter time frame between the start of the balance sheet runoff and the policy rate liftoff this time (versus 2018 which was a gap of 2 years).”

“Post-FOMC minutes, our projection for the faster pace of QE reduction by Mar 2022 remains intact. Thereafter, we still expect three Fed funds target rate hikes in 2022, the first hike in Jun 2022 by 25bps to 0.25-0.50%, followed by 2 more hikes in Sep 2022 and Dec 2022. While the risk admittedly is skewed towards the Fed to hike even earlier in Mar FOMC, our principal concern is about Omicron variant developments, given the rapid spread across US accompanied by the country’s relatively low vaccination rate, when compared to its G7 peers.”

According to a recently conducted Reuters survey, experts expect the Canadian dollar to strengthen against the greenback in 2022.

The median forecast for the USD/CAD pair stands at 1.2600 in three months, compared to 1.2500 in December's poll. By the end of the year, the pair is expected to decline by 3% to 1.2350, slightly higher than the previous forecast of 1.2300.

"Canada is a major producer of commodities, including oil, so the loonie tends to be sensitive to the outlook for the global economy. Oil has rallied 27% since December," Reuters noted.

Market reaction

USD/CAD showed no immediate reaction to this headline and was last seen posting small daily losses at 1.2718.

Friday’s jobs data will be important. And the markets are likely braced for a strong report. An upside surprise on wage inflation numbers could lift the USD/JPY pair to the 117.00 level, economists at MUFG Bank report.

The decider is likely to be the wage data

“We will be looking closely at the wage today and upside surprises there coupled with a strong NFP print would ensure the upward momentum for yields likely continues.”

“USD/JPY has struggled in circumstances of equity market underperformance but we still see scope for further upside to test and probably breach the long-term trendline resistance (1990 & 2015 highs) at around the 117.00 level.”

- USD/CHF was seen consolidating the previous day’s strong move up to a two-week high.

- A positive risk tone undermined the safe-haven CHF and continued lending some support.

- Softer US bond yields have kept the USD on the defensive and capped upside for the major.

- Investors also seem reluctant to commit, preferring to wait for the release of the US NFP report.

The USD/CHF pair lacked any firm directional bias and seesawed between tepid gains/minor losses, above the 0.9200 mark through the first half of the European session.

A combination of diverging forces failed to assist the USD/CHF pair to capitalize on the overnight strong gains to a two-week high and led to a subdued/range-bound price move on Friday. A softer tone surrounding the US Treasury bond yields kept the US dollar bulls on the defensive and capped the upside. That said, a generally positive risk tone undermined the safe-haven Swiss franc and extended some support.

Overall the Fed's hawkish outlook is acting as a tailwind for the greenback and has helped limit any meaningful slide for the USD/CHF pair. It is worth recalling that the December 14-15 FOMC monetary policy meeting minutes released on Wednesday indicated that the US central bank could hike interest rates earlier than anticipated. Moreover, the money market is now pricing in a roughly 80% chance for an eventual lift-off in March 2022.

The fundamental backdrop supports prospects for an extension of this week's goodish rebound from the 0.9100 mark – a two-month low. Bulls, however, are are staying on the sidelines in anticipation of Friday's release of the market moving US monthly jobs data. The popularly known NFP release, due for later today during the early North American session, will play a key role in determining the next leg of a directional move for the USD/CHF pair.

Technical levels to watch

Economist at UOB Group Ho Woei Chen, CFA, notes the Bank of Korea (BoK) is seen hiking rates further in Q1 2022 on the back of persistent elevated inflation.

Key Takeaways

“Inflation is expected to remain elevated this year due to sustained high oil prices and the economic recovery coupled with supply disruption. After rising to a decade-high of 2.5% in 2021 (2020: 0.5%), we expect headline inflation to average 2.0% this year while core inflation could edge slightly higher from 1.8% in 2021. The monthly headline inflation is likely to stay above the BOK’s target through 1H22.”

“South Korea’s economic fundamentals have stayed strong but export growth is expected to cool due to the moderation of growth in the major economies and a high comparison base while a slowdown in China poses further downside risk. Overall, export growth had rebounded 25.8% in 2021 from -5.5% in 2020. The government forecasts exports to post a small gain of 2% this year.”

“We continue to project the next BOK rate hike in 1Q22, likely at the 24th Feb meeting instead of the upcoming meeting on 14th Jan in line with its gradual normalisation approach. The BOK remains wary of the coronavirus spread that would threaten the global recovery as well as an increase in credit risk among households and small businesses as the central bank raises interest rates.”

Economists at TD Securities look for further sharp Turkish lira depreciation. They forecast the USD/TRY above the 20.00 level in the second quarter of the year.

The nightmare after Christmas

“We think that USD/TRY will rise to 16.25 by end-Q1 and breach well over 20 in Q2. However, this is when we expect the CBRT to start tightening, which should help bring the pair down to around 19 by end-Q2.”

“The lira can continue appreciating in a gradual manner throughout the rest of 2022 assuming no further policy missteps.”

“From 2023 onwards, however, policy mistakes are yet again likely to set TRY on a weakening trajectory.”

EUR/JPY’s decline in mid-December reversed from a 127.39 low. The monthly chart shows the cross retaining its bullish bias, receiving positive hues from a bullish inverse head-and-shoulders pattern, Benjamin Wong, Strategists at DBS Bank, reports.

Retaining constructive bias

“The bullish outlook resonates well with the long-term monthly chart. We are now trending higher with a likely bullish inverse head-and-shoulders pattern.”

“The recent 127.39 low is fashioned as the penultimate support leg, before prices move on higher towards the 1.764 price extension located at 135.19 (beyond that rests the February 2018 peak at 137.50). This needs to bypass 134.42, the 61.8% Fibonacci retracement of 149.78 (December 2014 major peak) – 109.57(June 2016 major low).”

- Eurozone Retail Sales rose by 1.0% MoM in November vs. -0.5% expected.

- Retail Sales in the bloc arrived at 7.8% YoY in November vs. 5.6% expected.

Eurozone’s Retail Sales rose by 1.0% MoM in November versus -0.5% expected and 0.3% last, the official figures released by Eurostat showed on Friday.

On an annualized basis, the bloc’s Retail Sales came in at 7.8% in November versus 1.7% recorded in September and 5.6% estimated.

FX implications

The euro is holding onto its latest leg up on the upbeat Eurozone Retail Sales data.

At the time of writing, the major trades at 1.1316, higher by 0.24% on the day.

About Eurozone Retail Sales

The Retail Sales released by Eurostat are a measure of changes in sales of the Eurozone retail sector. It shows the performance of the retail sector in the short term. Percent changes reflect the rate of changes of such sales. The changes are widely followed as an indicator of consumer spending. Usually, the positive economic growth anticipates "Bullish" for the EUR, while a low reading is seen as negative, or bearish, for the EUR.

Economists at TD Securities maintain a positive view on the Polish zloty. As a result of positive fundamentals, they expect the EUR/PLN pair to drop towards 4.30 throughout the year.

Policy normalisation in Poland is in full swing

“We continue to hold a positive view on zloty. The policy normalisation in Poland is in full swing. The NBP already delivered 215bps of tightening since October 2021 as well as ended QE. In addition, the recovery in Poland continues at a robust pace.”

“We continue to see EUR/PLN gradually converging back towards the pre-pandemic level of 4.30 over the course of 2022.”

The annualized Eurozone Consumer Price Index (CPI) rises by 5.0% in December, surprising markets to the upside while a tad higher from the previous jump of 4.9%, the latest data published by Eurostat showed on Tuesday. The consensus forecast was for a drop to 4.7%.

The core figures arrived at 2.6% YoY in December when compared to 2.5% expectations and 2.6% registered in November.

Earlier this week, Reuters reported that long-term Eurozone inflation expectations rose above 2.0% for the first time since late October 2021.

The Euro area figures come a day after Germany’s annual inflation eased for the first time in six months, arriving at 5.7% following a record increase of 6.0% in November.

Key details (via Eurostat)

“Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in December (26.0%, compared with 27.5% in November), followed by food, alcohol & tobacco (3.2%, compared with 2.2% in November), non-energy industrial goods (2.9%, compared with 2.4% in November) and services (2.4%, compared with 2.7% in November).”

EUR/USD reaction

EUR/USD is testing highs on unexpectedly hotter Eurozone inflation. The spot is currently adding 0.24% on the day, trading at daily highs near 1.1320.

Nasdaq-100 uptrend faced stiff resistance at the upper limit of an ascending channel drawn since October 2020 at 16760. Range-bound price action has developed after this test. A break below the lower limit at 15500/15350 would open up the October trough of 14380, economists at Société Générale report.

A rebound towards the recent peak of 16760 is not ruled out

“The index is now near the lower limit at 15500/15350. This is a crucial support.”

“A rebound towards 16230 and recent peak of 16760 is not ruled out.”

“Only a break below 15500/15350 would mean possibility of a deeper pullback towards the 200-DMA at 14880 and October trough of 14380.”

A very hawkish set of FOMC minutes on Wednesday is still reverberating across markets, keeping the dollar reasonably well-supported. With the minutes revealing that the Fed already feels that conditions have been met for a first hike, today's December jobs data should keep the dollar bid on dips, according to economists at ING.

Fed would welcome a stronger dollar

“Given that the Fed seems to have fully swung behind the hawkish narrative, we would expect the dollar to stay strong today and be bid on dips even if the nonfarm payrolls disappoint.”

“The consensus seems to be for a 450K headline jobs number, a 4.1% unemployment rate, and 0.4% month-on-month average hourly earnings. Right now, with the Fed's rotation to inflation, it feels like the unemployment rate and average earnings will be more important. Any strong readings there could see the dollar pop higher.”

“DXY is in the middle of its six-week trading range, but today could be a catalyst for a push back to the highs near 97.00.”

- GBP/USD gained some positive traction and build on the overnight bounce from sub-1.3500 levels.

- A positive risk tone, softer US bond yields undermined the safe-haven USD and extended support.

- Investors seemed to have moved on the sidelines and waited for the release of the US NFP report.

The GBP/USD pair maintained its bid tone, around the 1.3540-50 area through the first half of the European session, albeit seemed struggling to break through the 100-day SMA resistance.

Following the previous day's modest pullback and the subsequent bounce from sub-1.3500 levels, the GBP/USD pair managed to regain positive traction on Friday amid modest US dollar weakness. A generally positive tone around the equity markets was seen as a key factor that undermined the safe-haven greenback and extended some support to the major.

The British pound was further underpinned by hopes that the Omicron outbreak won't derail the UK economy and rising bets for additional interest rate hikes by the Bank of England. That said, the worsening COVID-19 situation in Britain could act as a headwind for the sterling and keep a lid on any further gains for the GBP/USD pair, at least for now.

Investors also seemed reluctant to place aggressive bets, rather preferred to wait on the sidelines ahead of Friday's release of the closely watched US monthly jobs data. The popularly known NFP report, due later during the early North American session, will be looked upon to reinforce growing market expectations about a faster policy tightening by the Fed.

It is worth recalling that the December 14-15 FOMC monetary policy meeting minutes released on Wednesday indicated that the US central bank could hike interest rates earlier than anticipated. Hence, a stronger reading would reaffirm hawkish Fed expectations, which should be enough to provide a fresh lift to the USD and prompt some selling around the GBP/USD pair.

Apart from this, the broader market risk sentiment will influence the USD price dynamics. Traders will further take cues from developments surrounding the coronavirus saga to grab some short-term opportunities around the GBP/USD pair.

Technical levels to watch

In contemporary capitalism, the return on equity for shareholders is high. But, in the future, an equilibrium with a lower return on capital will probably inevitably emerge. In this new equilibrium, the share of wages and taxes in GDP will increase, and the share of capital income will decrease, according to economists at Natixis.

Return on capital and the share of capital income in GDP to decline

“We believe that the upward trend in return on equity for shareholders (rising share of capital income in GDP) will reverse due to the upward pressure on wages, especially low wages (e.g., the decision to increase the minimum wage by 25% in Germany) and the need to finance a legitimate increase in many types of public spending through increased corporate taxation.”

“If there is a shift from an upward trend to a downward trend in the share of capital income in GDP, we should also expect a much less favourable trend for stock market indices.”

GBP/USD has been moving sideways around 1.3550 so far on Friday after closing in the negative territory on Thursday. FXStreet’s Eren Sengezer doubts buyers can defend the 1.35 level on a strong Nonfarm Payrolls report.

US December jobs report could ramp up volatility ahead of the weekend

“The market expectation is for NFP to rise by 400,000 following November's disappointing increase of 210,000. A print close to market consensus should be good enough to for the Fed to stick to its hawkish outlook.”

“The Average Hourly Earnings are forecast to edge lower to 4.1% on a yearly basis in December from 4.8% in November. The Fed is more concerned about wage inflation feeding into more persistent price pressures than a one-month increase in NFP and a strong figure could trigger a dollar rally and vice versa.”

“In case the NFP report provides a boost to the dollar, 1.3500 (psychological level, 50-period SMA) aligns as key support. A break below that level could open the for additional losses toward 1.3450 (static level) and 1.3420 (100-period SMA).”

“An interim resistance seems to have formed at 1.3565 (static level) before 1.3600 (psychological level).”

The US Dollar Index (DXY) has unfolded a pause in its uptrend after facing resistance near 97.00. It has so far defended 95.50, the 38.2% retracement from October. DXY is moving sideways above 96.20, reflecting a neutral tone, but expected to resume the uptrend once above the 97.00 level, economists at Société Générale report.

95.10/94.50 to be a crucial support zone near-term

“Daily RSI is near the lower end of its bullish territory which denotes this still looks like a consolidation within uptrend.”

“Once the index establishes itself beyond 97.00, the uptrend will resume towards next objectives at 97.70 and projections of 98.30.”

“Multi-month ascending trend line at 95.10/94.50 will be a crucial support zone near-term.”

- EUR/USD is in wait-and-see mode and trading close to 1.1300 ahead of the latest official US jobs report.

- The data will primarily be viewed in the context of how it impacts expectations for a March Fed rate hike.

- The euro didn’t react to the latest hotter than expected Eurozone inflation figures for December.