- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 06-01-2022

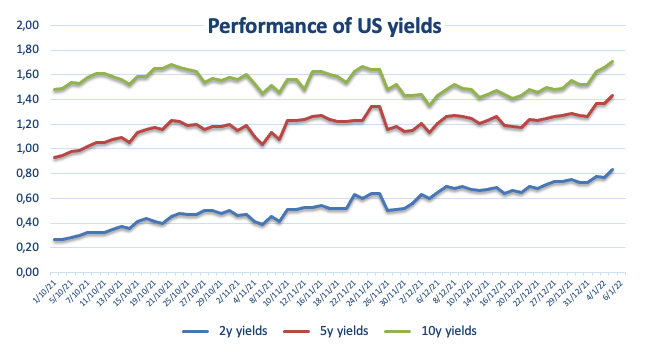

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, dropped for the third consecutive day to by the end of Thursday’s North American session, per the FRED website.

That said, the inflation gauge dropped to the 2.46% level at the latest, the lowest readings since December 21.

The softer inflation expectations test the market fears of the Fed’s early rate hike, which in turn challenge US Treasury yields and US dollar advances.

It’s worth noting that the recently hawkish Fedspeak and FOMC Minutes weighed on the commodity prices. As a result, the US 10-year Treasury yields refreshed a nine-month high to poke 1.75% before closing with 2.5 basis points (bps) of a daily gain near 1.728%. The same weighed on the Wall Street benchmarks even as downbeat data pushed bears to satisfy with smaller losses.

While the easy inflation expectations may allow traders to pare recent losses linked to the commodities and Antipodeans, hawkish hopes from the scheduled US jobs report may favor the US bond yields and the US dollar, which in turn may weigh on the commodities.

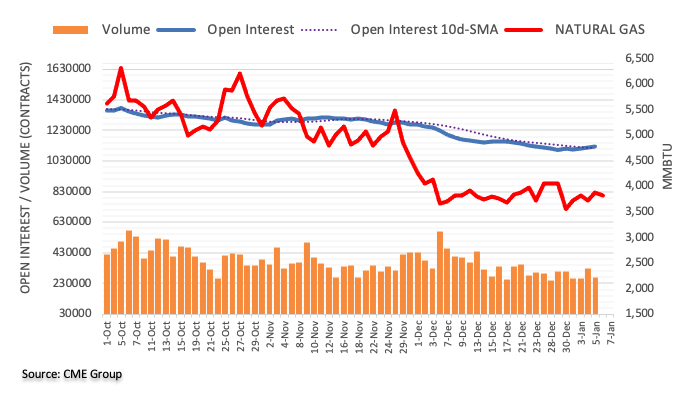

Read: Gold Price Forecast: XAU/USD bears await US NFP near five-month-old support below $1,800

- Gold remains pressured around two-week low, sidelined ahead of the key US employment data.

- Yields weighed down the commodities, Antipodeans, Omicron adds to the bearish bias.

- Fedspeak, FOMC Minutes raised hopes of faster rate hikes, fuelling yields and USD, but today’s US NFP is the key.

- Fed hawks grow stronger: Will gold stand its ground?

Gold (XAU/USD) licks its wound around $1,790 while bracing for the first weekly fall in four during early Friday’s Asian session. The yellow metal seesaws near a 12-day low amid the market’s cautious mood ahead of the US jobs report for December. Even so, bears remain hopeful on the recent hawkish signs from the US Federal Reserve (Fed).

The yellow metal slumped to the multi-day low the previous day after the latest Fedspeak backed a rush to rate lifts, after the Federal Open Market Committee (FOMC) Meeting Minutes conveyed hawkish bias of the policymakers, suggesting a faster rate-hike and plans to discuss balance-sheet normalization. That said, St. Louis Fed President James Bullard pushed for a March rate hike whereas Federal Reserve Bank of San Francisco President and an FOMC member Mary C. Daly marked the need to raise interest rates to keep the economy in balance.

Following the increased pressure towards tighter monetary policy and balance-sheet alteration, the US Treasury yields refreshed multi-day high. That said, the US 10-year Treasury yields refreshed a nine-month high to poke 1.75% before closing with 2.5 basis points (bps) of a daily gain near 1.728%. The same weighed on the Wall Street benchmarks even as downbeat data pushed bears to satisfy with smaller losses.

Other than the hawkish Fedspeak, fears of the South African covid variant, namely Omicron, also underpin the US Treasury yields and weigh on gold prices. Although figures in the UK have eased from record tops, the record-high numbers elsewhere push policymakers to announce multiple local activity restrictions, recently in Australia. It’s worth noting that the finding of a new virus variant in France, which spreads faster than Omicron, also challenges the market sentiment and weighs on gold prices.

Talking about the data, US Factory Orders, Weekly Jobless Claims, ISM Services PMI and Good Trade Balance all came in downbeat but couldn’t stop the US dollar bulls amid strong favor for the faster Fed rate hike, which in turn propelled the yields.

Looking forward, market fears of Omicron can entertain the gold sellers but major attention will be given to the December month jobs report from the US. Forecasts suggest the headlines Nonfarm Payroll (NFP) to rise from 210K to 400K while the Unemployment Rate may have eased to 4.1% from 4.2% prior. The underemployment rate, however, is likely rising from 7.8% to 8%. Given the upbeat expectations from the US employment data, Fed’s hawkish rhetoric is likely to be justified, which in turn could propel yields and the US dollar and may weigh on the gold prices.

Technical analysis

Although a clear break of the 200-DMA joins downbeat MACD signals and RSI retreat to keep gold sellers hopeful, an upward sloping trend line from August, close to $1,780, challenges the metals further downside.

Should gold bears conquer the $1,780 support, odds of a south-run towards a two-month-long horizontal area surrounding $1,760 can’t be ruled out. However, any further weakness will make gold prices vulnerable to slump towards September’s low surrounding $1,721.

Meanwhile, corrective pullback needs to stay beyond the 200-DMA level of $1,800 for a while before directing gold buyers towards October’s peak of $1,814 and the latest swing high close to $1,831.

It’s worth mentioning that tops marked in July and September offer a crucial resistance around $1,834, followed by the $1,850 threshold, to test the gold bulls during the bumpy road to November’s peak of $1,877.

Overall, gold prices have signaled bearish bias but the key support line challenges sellers ahead of the all-important US jobs report for December.

Gold: Daily chart

Trend: Further weakness expected

“The United States and Japan will sign a new research and development agreement to make it easier to collaborate on countering new defense threats, including hypersonics and space-based capabilities,” said US Secretary of State Antony Blinken on Thursday per Reuters.

“Blinken also told the opening of a virtual meeting between the foreign and defense ministers of Japan and the United States that they would sign a new five-year agreement covering the continued basing of U.S. troops in Japan that would invest greater resources to deepen military readiness and interoperability,” adds the news.

FX implications

The news should ideally help USD/JPY while being a risk-positive headline. However, cautious sentiment ahead of the US Nonfarm Payrolls (NFP) and steady yields weigh on the yen pair around 115.85 during early Friday morning in Asia.

Read: USD: Why a strong Nonfarm Payrolls may not be enough?

- NZD/JPY plummets 120-pips as market participants dump assets that have the “risk” word attached to them.

- The market mood dampened on the back of aggressive US stock selling after the Fed released its last meeting minutes.

- NZD/JPY Price Forecast: Neutral-bullish, but downside risks remains as the spot approaches the 200-DMA.

The New Zealand dollar pares most of its weekly gains and some more as market participants assess the Federal Reserve hawkish minutes released on Wednesday. In the meantime, the NZD/JPY pair slides some 0.74%, trading at 78.15 at the time of writing.

On Thursday’s overnight session, the NZD/JPY plunged from 79.14 to 77.90s on the back of a risk-off market environment, spurred by the sell-off of US stocks after the Federal Reserve released its monetary policy meeting minutes.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY daily chart shows that the cross-currency pair is neutral- bullish. Even though the 50 and the 100-daily moving averages (DMAs) reside above the spot price, the 200-DMA is below the aforementioned, meaning the uptrend remains in place.

Lately, the 50-DMA is accelerating towards the 100-DMA. In the event of the former crossing under the latter, it would trigger a bearish signal, but caution is warranted, as the overall longer time-frame trend is bullish unless the 200-DMA gives way.

The NZD/JPY first resistance would be the 100-DMA at 78.55, which opens the door for further gains once broken. The next ceiling would be December 30, 2021, daily high at 78.93, followed by the January 4 cycle high of 79.22.

On the flip side, the pair’s first support level would be the 200-DMA at 78.14, which would expose the immediate 78.00 psychological level once broken. The breach of the latter would expose December 8, 2021, the previous resistance-turned-support level at 77.56, followed by the 77.00 figure.

-637771081756361192.png)

- GBP/USD holds onto corrective pullback from 1.3490, seesaws near two-month high.

- UK’s Jacob Rees-Mogg defends government’s Brexit approach, British Competition Chief steps back.

- British covid numbers ease but scientists warn covid not getting milder.

- Yields challenge bulls with eyes on US NFP for December.

GBP/USD stays above 1.3500, taking rounds to 1.3530 during Friday’s Asia session. The cable pair snapped a two-day uptrend the previous day amid broad US dollar strength and soft UK Services PMI but covid figures and hopes of the easy path on Brexit seem to favor buyers amid the market’s inaction ahead of the key US jobs data for December.

The UK reported around 180,000 daily covid cases and 231 virus-linked deaths the previous day. The numbers have been easing since the early weekdays when above 200,000 figures were seen. While the government authorities praise strong vaccinations and activity restrictions as reasons, a leading Indian-origin scientist from the University of Cambridge warned on Thursday that it is an "evolutionary mistake". Ravindra Gupta, Professor of Clinical Microbiology at the Cambridge Institute for Therapeutic Immunology and Infectious Diseases (CITIID) also hints that the reduction in the numbers does not indicate that the virus which causes COVID-19 is becoming less virulent.

Elsewhere, news that the UK’s Head of Competition and Markets Authority (CMA), Andrea Coscelli, will step down raised hopes of softer Brexit negotiations ahead. “According to government insiders, ministers regarded Mr. Coscelli as an impediment to post-Brexit economic reforms and saw him as a hurdle to breaking with EU competition policy,” said The Telegraph.

On the other hand, US Treasury yields rallied and helped the US dollar to remain firmer as the recent Fedspeak backed faster rate hikes, after the Federal Open Market Committee (FOMC) Meeting Minutes, conveyed hawkish bias of the policymakers, suggesting a faster rate-hike and plans to discuss balance-sheet normalization. That said, St. Louis Fed President James Bullard pushed for a March rate hike whereas Federal Reserve Bank of San Francisco President and an FOMC member Mary C. Daly marked the need to raise interest rates to keep the economy in balance.

It should be noted that the UK’s Services PMI rose past the initial forecast to 53.6 in December while the US data came in softer. Among them were, US Factory Orders, Weekly Jobless Claims, ISM Services PMI and Good Trade Balance.

Amid these plays, the US 10-year Treasury yields refreshed a nine-month high to poke 1.75% before closing with 2.5 basis points (bps) of a daily gain near 1.728%. The same weighed on the Wall Street benchmarks even as downbeat data pushed bears to satisfy with smaller losses whereas the S&P 500 Futures print mild gains by the press time.

Looking forward, a light calendar in Asia-Pacific, as well as the UK, will join the cautious mood ahead of the key US data and may restrict immediate GBP/USD moves. However, Brexit and covid updates may favor the bulls.

That said, forecasts suggest the headline US Nonfarm Payroll (NFP) rise from 210K to 400K while the Unemployment Rate may have eased to 4.1% from 4.2% prior. The underemployment rate, however, is likely rising from 7.8% to 8%.

Read: US Nonfarm Payrolls December Preview: The labor market seconds Fed policy

Technical analysis

Although GBP/USD portrayed another failure to cross the 100-DMA level surrounding 1.3560 on Thursday, bears need a clear downside break of the late November’s swing high close to 1.3510 to take entries.

“Australia's New South Wales state, home to Sydney and a third of Australia's 25 million population, will reinstate restrictions including shutting nightclubs and canceling non-urgent surgeries because of record coronavirus infections, the Sydney Morning Herald reported on Friday,” per Reuters.

The news adds that the measures are expected to be approved by the state government's economic recovery committee on Friday in a bid to ease pressure on hospitals, the report said, citing senior government sources.

Key quotes

People admitted to NSW hospitals with COVID-19 have nearly doubled to a record 1,609 in just over a week. There were around 150 daily cases in the state in late November, when the first Omicron case was detected. That shot up to 35,000 on Thursday.

Neighboring Victoria state a day earlier brought back restrictions that would limit people at pubs and clubs.

FX reaction

AUD/USD remains on the back foot around a two-week low, recently taking rounds to 0.7165 amid early Friday morning in Asia. The pair’s lack of reaction to the news could be linked to the pre-NFP caution.

Read: AUD/USD slams into weekly support ahead of critical NFPs

- NZD/USD stays range-bound after refreshing 13-day low.

- US Treasury yields refreshed nine-month high as Fedspeak backs hawkish FOMC minutes.

- Downbeat US data failed to disappoint greenback buyers, Omicron woes also weaken Antipodeans.

- Light calendar in Asia, pre-NFP mood may restrict immediate moves ahead of US session, risk catalysts are the key.

NZD/USD holds lower grounds near 0.6750 during early Friday morning in Asia, keeping the immediate range after renewing a two-week low the previous day.

The kiwi pair’s latest inaction could be linked to the typical pre-NFP cautious and a light calendar in Asia-Pacific while the Fed policymakers’ comments and the FOMC Minutes need to be thanked for the pair’s previous fall. On the same line were the fears of the South African covid variant, namely Omicron.

The recent Fedspeak backed, as well as faster rate hikes, after the Federal Open Market Committee (FOMC) Meeting Minutes, conveyed hawkish bias of the policymakers, suggesting a faster rate-hike and plans to discuss balance-sheet normalization. That said, St. Louis Fed President James Bullard pushed for a March rate hike whereas Federal Reserve Bank of San Francisco President and an FOMC member Mary C. Daly marked the need to raise interest rates to keep the economy in balance.

Elsewhere, virus conditions continue to worsen and challenge the commodities, as well as Antipodeans. While global infection figures keep refreshing record tops, NZ Herald cited 19 and 43 new community cases and infections at the borders compared to 17 and 23 respective figures marked the previous day. Chatters of return of some covid-linked activity restrictions in Australia’s most populous state New South Wales (NSW) also exert downside pressure on the NZD/USD due to the strong trading links.

Talking about the data, US Factory Orders, Weekly Jobless Claims, ISM Services PMI and Good Trade Balance all came in downbeat but couldn’t stop the US dollar bulls amid strong favor for the faster Fed rate hike, which in turn propelled the yields.

That said, the US 10-year Treasury yields refreshed a nine-month high to poke 1.75% before closing with 2.5 basis points (bps) of a daily gain near 1.728%. The same weighed on the Wall Street benchmarks even as downbeat data pushed bears to satisfy with smaller losses.

Moving on, market fears of Omicron can entertain the NZD/USD traders, mostly to the sellers, but major attention will be given to the December month jobs report from the US. Forecasts suggest the headlines Nonfarm Payroll (NFP) to rise from 210K to 400K while the Unemployment Rate may have eased to 4.1% from 4.2% prior. The underemployment rate, however, is likely rising from 7.8% to 8%. Given the upbeat expectations from the US employment data, Fed’s hawkish rhetoric is likely to be justified, which in turn could propel yields and the US dollar and may weigh on the NZD/USD prices.

Technical analysis

A clear downside break of 21-DMA and a two-week-old ascending trend line joins descending RSI line, as well as receding bullish bias of the MACD, to keep NZD/USD sellers hopeful to revisit the year 2021 bottom surrounding the 0.7000 threshold.

Alternatively, the support-turned-resistance line near 0.6775 will precede the 21-DMA level surrounding 0.6790 to limit short-term advances of the NZD/USD prices.

- On Thursday, the euro edges lower some 0.11%.

- A risk-off market mood and higher US bond yields boost the greenback prospects.

- EUR/USD Technical Outlook: Bearish biases, but a daily close below the 1.1300 figure could accelerate the downtrend towards the 2021 yearly low at 1.1186.

The shared currency slumps as the North American session ends, trading at 1.1293 at the time of writing. Market conditions worsened as the US equity markets indices closed in the red, with losses between 0.04% and 0,47%, favoring the greenback’s prospects to the detriment of the euro.

Also, as Wall Street closes, the US 10-year Treasury yield advances 2.99 basis points, sitting at 1.7299%, underpins the greenback. The US Dollar Index, which measures the buck’s value against six peers, advances 0.11%, up at 96.26.

EUR/USD Price Forecast: Technical outlook

On Thursday, during the overnight session, the EUR/USD seesawed around the daily pivot point in the 1.1300-18 range, ahead of the European session. In the overlap of the Asian and European session, the EUR]/USD dipped to 1.1285, followed by a jump above the confluence of the 100 and the 200-hour simple moving averages (SMAs) at 1.1313 and 1.1317, respectively, reaching a daily high of 1.1332.

At press time, the euro is under selling pressure, as witnessed by the price action around the daily pivot point, which shows seven candlesticks, with just one piercing aggressively upwards, surrendered later, as sellers meander around the confluence of the 100 and the 200-hour SMA.

On the downside, the first support would be the S1 daily pivot point at 1.1278. A break under that level exposes crucial support levels like the January 4 daily low at 1.1272, followed by the upslope trendline around 1.1255-60 area, and then the S2 daily pivot point at 1.1243.

To the upside, the EUR/USD first resistance would be the confluence of the daily pivot point and the 100 and 200-hour SMA around the 1.1310-20 area. The breach of the latter would expose the January 5 daily high at 1.1346, followed by the January 3 cycle high at 1.1366.

-637771047519668545.png)

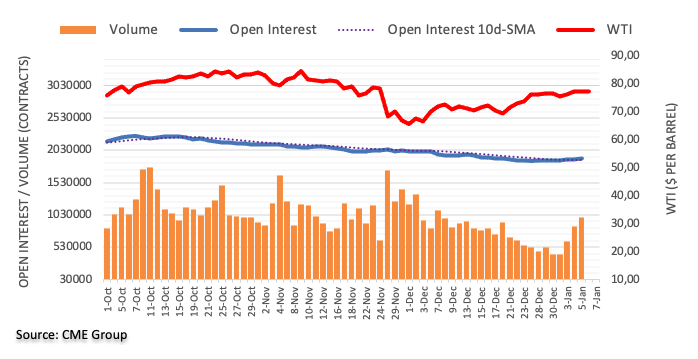

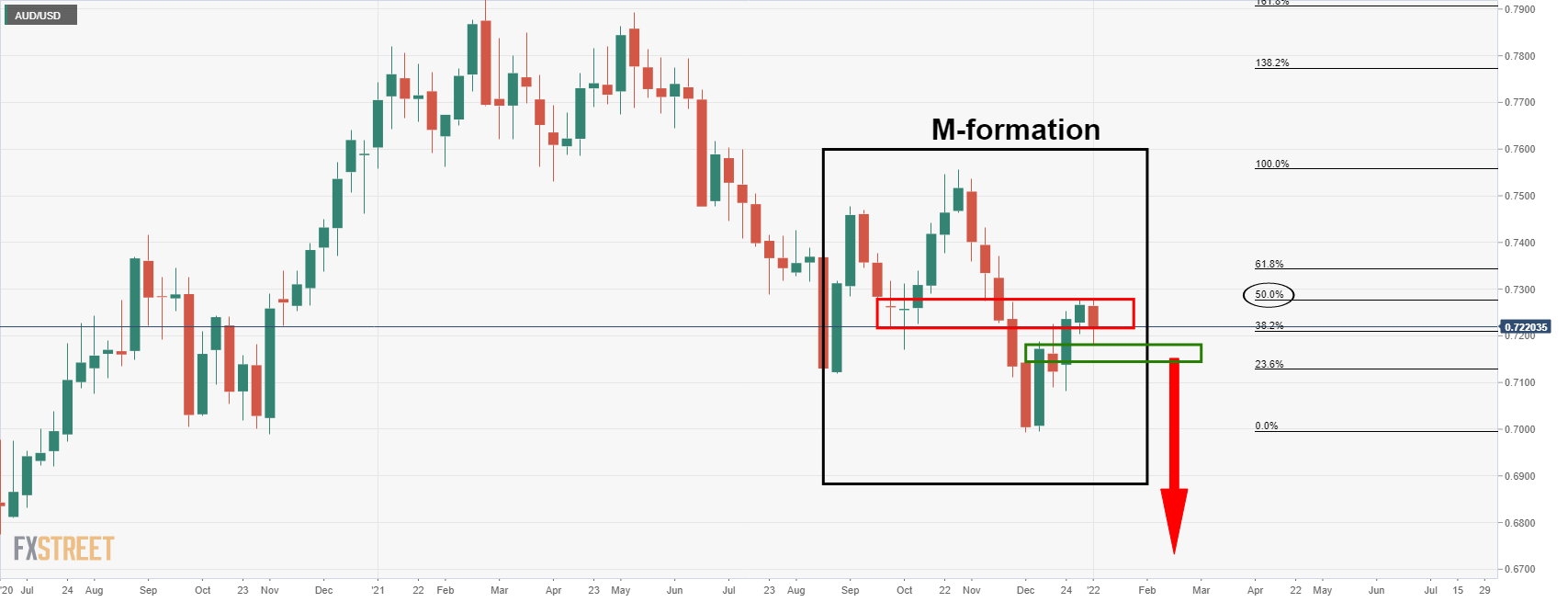

- AUD/USD take on critical weekly support and stall.

- Fed and RBA divergence is running the show, contrary to seasonality. NFP next in line.

Around 0.7160, AUD/USD ended the day down some 0.80% on Thursday after falling from a high of 0.7222 to a low of 0.7145 in a technical move that has pierced important daily trendline support. The hawkishness at the Federal Reserve is driving sentiment and has resulted in an offer in the Aussie, to the contrary to the usual bullish seasonal factor.

Over several years, the start of the year has been typically bullish for the commodity sector and high beta currencies, such as the Aussie. However, the caveat for the seasonal bullishness was always going to be how hawkish the Fed comminuted at the start of the year. That came sooner than the market had expected in Wednesday's Federal Open Market Committee minutes.

First off, “Participants generally noted that, given their individual outlooks for the economy, the labour market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.”

Additionally, the Fed has shown to markets that it is already thinking two steps ahead in discussing balance sheet runoff, as "Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate. However, participants judged that the appropriate timing of balance sheet runoff would likely be closer to that of policy rate liftoff than in the Committee’s previous experience."

as such, the divergence between the Reserve bank of Australia and the Fed is playing out in the price action of AUD/USD and couples up with the prior technical analysis as follows:

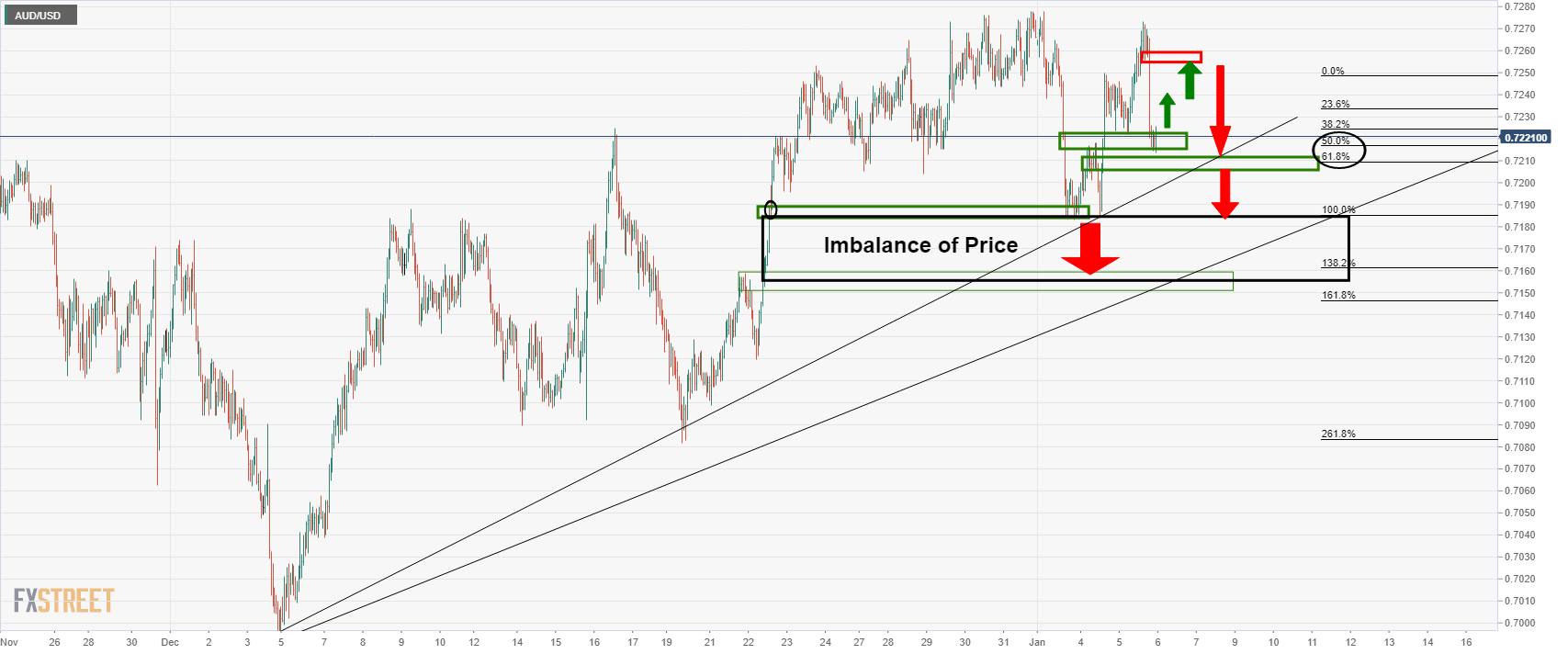

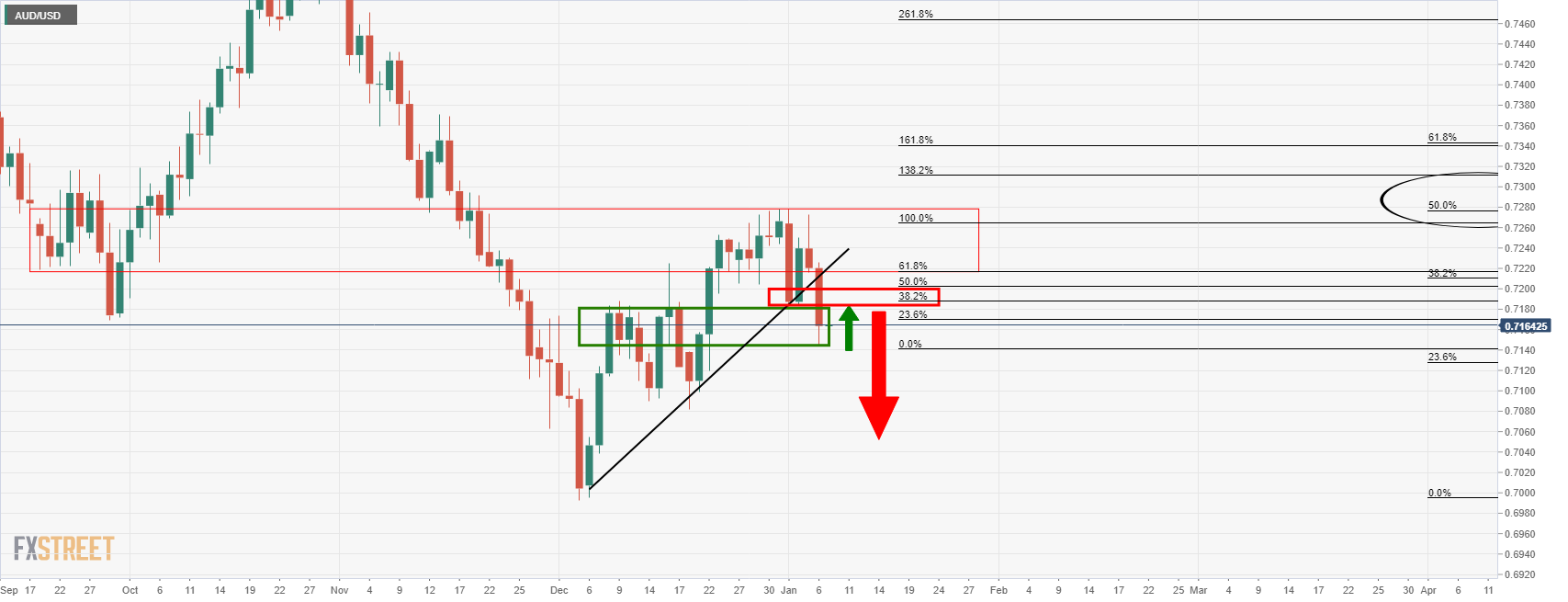

AUD/USD technical analysis

AUD/USD Price Analysis: Bears are moving in, a case building for longer-term downside

On this occasion, the price did not revisit the inefficiency of the Fed drop yesterday and instead moved in on the imbalance of price below support as follows:

The Fed's communication meant that there will be a much quicker timeline between rate hikes and balance sheet runoff than the last time, as such, it is full steam ahead with respect to the central bank divergences. Overall, that spells a lower Aussie for the weeks ahead which leaves the weekly technical outlook intact as follows:

On a break of weekly support, near 0.7150, the prospect of a downside continuation will be in play. Meanwhile, there is room for a correction to the old daily support near 0.72 the figure.

Nonfarm Payrolls is next in line for prospects of another shakeup in financial markets. However, anything outside of what is expected and a shock is unlikely to move the needle. ''The late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor,'' analysts at TD Securities explained.

As traders continue to digest Wednesday’s hawkish Fed minutes, which at the time sent US equities tumbling, and discuss its implication for the outlook for Fed policy tightening, US equity trade has been much more subdued. The S&P 500 has pivoted either side of the 4700 level on Thursday between 4670 lows and 4720ish highs and at current levels, pretty much bang on the big figure is trading about 0.3% lower on the day. That leaves it roughly 2.5% below the record levels printed near 4820 earlier in the week.

The Nasdaq 100 index, which tumbled more than 3.0% on Wednesday as sharp upside in yields triggered selling in so-called “growth” stocks (which include big tech), is about 0.2% lower in the 15,700s. The Dow, which held up comparatively better on Wednesday, dropping just over 1.0% at the time, is underperforming on Thursday and is down about 0.6% but still well above the 36K mark. In terms of the sectors, as yields continue to press higher the S&P 500 financial sectors outperformed and gained nearly 1.5%. The S&P 500 CBOE volatility index or VIX was broadly flat just below 20.00, having risen from around 17.00 when equities sold off on Wednesday.

Attention turns to NFP

Having largely ignored the week’s busy slate of tier 1 US data thus far, equity investors are now turning their focus to the release of the official US labour market report on Friday. With money markets now pricing a strong possibility of a first Fed rate hike in March, traders will be looking at Friday’s jobs report through the lense of whether it boosts or hinders the chances of March lift-off. Note that the Fed in December framed the labour market as making “rapid” progress back to full employment, even in light of December’s sub-par non-farm payrolls number of 210K and has said that if this rate of improvement continues, rate hikes will soon be warranted.

The Fed is likely looking through softer monthly NFP numbers so long as measures of slack (the unemployment rate) show signs of improvement. Indeed, unemployment dropped to 4.2% in November from 4.6% in October. Fed policymakers have acknowledged that the pandemic is holding people back from the labour market (hence why the participation rate remains well below pre-pandemic levels), meaning the scope for large MoM employment gains in the foreseeable future at present is limited.

As long as measures of slack continue to point to a tight labour market (as other data releases this week did), the bar is low for Friday’s headline NFP number to fulfill the Fed’s continued rapid progress criteria. Consensus expectations for 400K jobs having been created in December easily fits this bill. If Friday’s jobs report does feed into the Fed tightening fears that have in recent days sent real and nominal yields scorching higher and weighed on equities (with the pain most concentrated in), the outlook for equities on Friday could be grim.

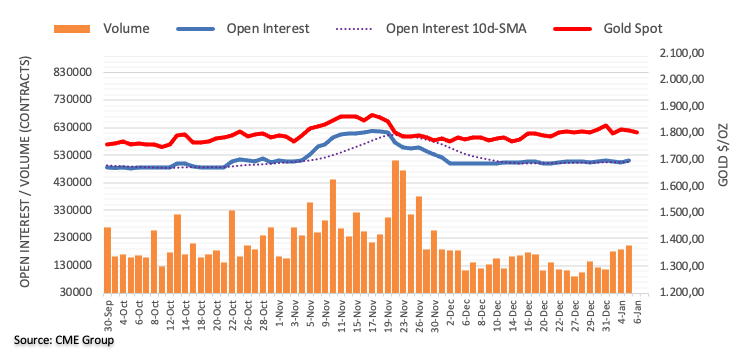

- Silver has taken a beating on Thursday but stabilised just above the $22.00 level as focus switches to Friday’s NFP.

- The precious metal has been under selling pressure recently as Wednesday’s hawkish Fed minutes pump Fed tightening bets.

- XAG/USD could be headed for a retest of December lows under $21.50 if the jobs report endorses a March hike.

Spot silver (XAG/USD) prices have taken a beating thus far on Thursday, though the selling pressure has eased in recent trade after the precious metal found support at the $22.00 level. At current levels just below $22.20, XAG/USD trades lower by more than 2.5% on the day and is nearly 5.0% below the highs at set above $23.20 on Wednesday prior to the latest hawkish Fed minutes. The minutes surprised on a number of fronts, with FOMC participants uniformly concerned about elevated inflation and in support of a potential sooner and faster rate hiking cycle to address risks. Moreover, strong support for a prompt reduction in the size of the Fed’s balance sheet once the hiking cycle is underway also came as a surprise, with it previously just having been hawkish Fed members to jawbone about quantitative tightening.

The hawkish nature of the minutes sent bond yields shooting higher and, most notably for precious metals markets, the move has been driven by real yields. While the US 10-year is up more than 20bps on the week, the 10-year TIPS yield is up around 25bps and recently broke out to its highest levels since June of last year. Above -0.80%. Higher real yields increase the opportunity of non-yielding assets such as precious metals, thus weighing on their appeal to investors. Precious metals traders will also note that market-based measures of inflation expectations have been heading sharply lower this week, with 10-year break-evens reversing from Tuesday’s highs above 2.64% to current levels around 2.45%. Lower inflation expectations reduce the demand for assets that offer inflation protection such as silver and gold.

In terms of what's next for spot silver, trade is likely to now enter wait-and-see mode ahead of Friday’s US jobs report. With markets pricing a strong possibility of a March rate hike, traders primarily seek to interpret how the December jobs report boosts or hinders the chances of March lift-off. The Fed in December framed the labour market as making “rapid” progress back to full-employment, even in light of December’s sub-par non-farm payrolls number of 210K and has said that if this rate of improvement continues, rate hikes will soon be warranted.

The Fed is likely looking through softer monthly NFP numbers so long as measures of slack (the unemployment rate and participation rate) show signs of improvement (particularly the former). Fed policymakers have acknowledged that the pandemic is holding people back from the labour market, meaning the scope for large MoM employment gains at present is limited. As long as slack measures continue to point to a tight labour market (as other data releases this week did), the bar is low for Friday’s headline NFP number to fulfill the Fed’s continued rapid progress criteria. Consensus expectations for 400K jobs having been created in December easily fits this bill.

That suggests the scope for a rebound in precious metals on a dollar/real yield pull-back as traders reverse recent hawkish bets for a March hike is limited. If that was to be the case and XAG/USD did rally, the main levels of resistance to look out for are the 21-day moving average and recent lows of the last few weeks around $22.60 and then the highs from the last few weeks in the $23.40 area. If a strong labour market does give a thumbs up to a March rate hike, then spot silver prices could be headed back for a test of December lows just under $21.50, a further 3.0% decline from current levels.

What you need to know on Friday, January 7:

The greenback retained most of its post-FOMC Minutes gains, despite US data being generally disappointing. Stocks maintained the sour tone, while US government bond yields held near the multi-month highs achieved on Wednesday.

The EUR/USD pair settled around 1.1290, at the lower end of its weekly range, while GBP/USD trades at around 1.3520. The AUD/USD pair edged lower, now trading in the 0.7160 area, undermined by gold prices, as the bright metal fell to end the day at $1,788 a troy ounce. The Canadian dollar, on the other hand, appreciated against the greenback, with USD/CAD trading in the 1.2720 region, as crude oil prices surged to fresh multi-month highs. The barrel of WTI peaked at $80.11, now trading at 79.70.

US Federal Reserve officials reinforced the idea of a more aggressive Fed. St. Louis Fed President James Bullard said that the Federal Reserve could raise interest rates as soon as March, while Federal Reserve Bank of San Francisco President and FOMC member Mary Daly said that they will need to raise interest rates to keep the economy in balance.

The focus on Friday will be on the US December Nonfarm Payrolls report. The country is expected to have added 400K new jobs positions after gaining 210K in November. The unemployment rate is foreseen at 4.1%, down from 4.2% previously, although the under-employment rate is seen ticking higher, from 7.8% to 8%.

Ethereum enters support zone that will see ETH return to $4,000

Like this article? Help us with some feedback by answering this survey:

St Louis Fed President and FOMC voting member in 2022 James Bullard said on Thursday that he was among those who projected that the Fed would hike interest rates three time in 2022. Moreover, he added, it is better to get started with rates hikes "sooner rather than later" and the pace of rate hikes can be moderated later if inflation slows. The balance sheet run-off (or quantitative tightening or QT) should begin "shortly after" the initial interest rate rise, he added.

Further remarks:

"It's uncertain how much inflation control will depend on "natural moderation" versus Fed intervention."

"Expect inflation to moderate naturally to some degree, but "not dramatically" and still above 3% at end of the year."

"Balance sheet could decline even below pre-pandemic levels given existence now of standing repo facility."

"Good reasons for labor force participation to be lower today than before the pandemic."

"Fed "very surprised" by the level of inflation, "incumbent" on the central bank to act to maintain its credibility."

"Pre-pandemic employment level not a good benchmark of current "very tight" labor market."

"A smaller balance sheet and higher policy rate means that both ends of the yield curve should rise in tandem."

- The GBP/JPY records a 0.34% loss, following the GBP/USD footsteps.

- In the overnight session, a risk-off market mood spurred a 150-pip drop of the pair.

- GBP/JPY Technical Outlook: It has an upward bias, as long as it remains above 156.00.

The British pound slides against the Japanese yen for the first time in the week, attributed to risk-off market mood during Thursday’s Asian and European session, influencing risk-sensitive currencies like the GBP, the AUD, and the NZD. At the time of writing, the cross-currency is trading at 156.80, down some 0.34%.

In the overnight session, the GBP/JPY opened near the highs of Wednesday, around 157.30s. However, as the Asian Pacific session began, the pair slumped sharply, breaching on its way south, support levels like the daily pivot point at 157.25, followed by the S1 daily pivot at 156.73, to finally stall at the S2 daily pivot at 156.06.

At press time, the GBP/JPY is seesawing around the S1 daily pivot and the 50-hour simple moving average (SMA), which lies at 156.96, some 30-pips above an upslope trendline in the 1-hour chart, drawn from December 2021 lows up to January swing lows.

That said, the GBP/JPY first resistance to the upside would be the 50-hour SMA at 156.96. A breach around the aforementioned and the psychological 157.00 price level would open the door for further gains. The next ceiling level would be the daily pivot at 157.25.

On the flip side, in the event of dropping further, the GBP/JPY’s first support would be the 100-hour SMA at 156.41. A breach of the latter would expose the cross-currency for a renewed test of the S2 daily pivot at 156.06, followed by the 200-hour SMA at 155.60.

GBP/JPY 1-hour chart

-637770960816100461.png)

- EUR/GBP is on the verge of completing a fifth consecutive bear week.

- The next significant support from 2020 and 2019, 0.8282 and 0.8278 respectively.

- However, UK politics could be a spanner in the works.

At 0.8347, EUR/GBP is virtually flat on the day although the range has been between 0.8338 and 0.8372 on what has been a relatively busy calendar with plenty of fundamental themes that are ongoing in the background.

Eurozone data coming through positive

Firstly, Germany reported firm November factory orders. The data was impressive jumping to 3.7% vs the expectations of just 2.3% for the month. This could be a positive prelude for the Industrial production and trade data tomorrow.

However, ''while the bounce in the German November data is welcome, the December PMI readings suggest rising risks of recession,'' analysts at Brown Brother Harriman explained in a note on Thursday. ''The composite PMI came in at 49.9, the first time below the 50 boom/bust level since June 2020 and down sharply from the 62.4 peaks in July 2021.''

The Eurozone also reported November the Producer Price Index today. These also beat expectations and arrived at 23.7% YoY vs. 23.2 expected and 21.9% in November. ''This suggests that pipeline price pressures remain strong, with upside risks to the CPI reading in early 2022,'' the analysts at BBH explained.

Meanwhile, the December eurozone inflation readings were released on Thursday, and Germany's Consumer Price Index beat prior and the expectations marginally for the month of December, both MoM and YoY. Traders will now wait for the eurozone reports that come out tomorrow. The headline inflation is expected at 4.8% YoY vs. 4.9% in November and core is expected at 2.5% YoY vs. 2.6% in November.

This all boils down to sentiment surrounding the European Central Bank and officials there remain split. With that being said, the ECB won’t meet until February 3, giving it some time to better assess the economic outlook as more data comes out. The meeting, however is expected to be a low key event for forex considering the bank has already tipped PEPP will end as scheduled in March.

One member, Martins Kazaks sounded hawkish yesterday though. On Wednesday, he said that the ECB is ready to raise rates and cut stimulus if needed. The bank, he continued, is ready to take action if the inflation outlook picks up and an early 2023 rate hike is a possible scenario.

Today, Francois Villeroy de Galhau sounded dovish and argued that the eurozone inflation is close to peaking, noting that December CPI data from France is showing the first signs of stabilization. Villeroy added that “While remaining very vigilant, we believe that supply difficulties and energy pressures should gradually subside over the course of the year.”

But the stabilization in prices doesn’t imply a policy shift. Rather, Villeroy repeated earlier in the week that his prediction for a “new inflation regime” under which price growth will be closer to the ECB’s 2% target than in the years preceding the pandemic. On that basis, monetary policy would “normalize in stages,” he argues.

As for the covid variant, Villeroy also shrugged that off. The ECB Governing Council member said the economic effects will be “relatively limited.”

“We have learned over the past two years that every Covid wave, however serious, has diminishing economic effects,” Villeroy said.

Overall, the analysts at BBH see financial conditions tightening in the eurozone this year at the worst possible time. The analysts explained that ''we are already seeing other signs of stress. Italian yields have risen over the past few weeks and low demand for its 30-year bond offer yesterday is just another sign of trouble ahead.''

UK data, not much to cheer

As for the UK, firm final services and composite PMIs were reported. Services PMI came in at 53.6 vs. 53.2 preliminary to 52.1, which dragged the composite up to 53.6 from 53.2 preliminary. Still, the composite PMI is down two straight months and the lowest since February 2021.

''There is not much to cheer about,'' analysts at BBH argued.

''Much of the November data came in firmer than expected, though some of the strength in consumption was attributed to early shopping due to supply chain concerns ahead of the holidays. We may have to wait until January to get a cleaner read on the UK economy but we see headwinds ahead from Brexit, energy shortages, and planned fiscal and monetary tightening.''

Elsewhere, besides Brexit and covid lockdown risks, investors are keeping a close eye on UK tax cut possibilities and implications for the pound. ''Cabinet member Jacob Rees-Mogg told his colleagues that the 1.25% increase in the payroll tax should be shelved as the rise in inflation and energy costs is hurting family pocketbooks,'' the analysts at BBH explained.

A toxic cocktail of Brexit, rising energy costs, covid and pressures on the healthcare system has been a burden on the UK economy. There are pressures in the UK government which are calling for cuts and Rees-Mogg’s comments come after twenty Tory backbenchers called for Johnson and Chancellor Sunak to end the 5% VAT on energy and to remove environmental taxes on electricity.

UK politics is a spanner in the works for the bears

Overall, traders are happy to be long of the pound due to the hawkishness at the Bank of England and prospects of tax cuts, so long as covid remains a minor threat. With that being said, UK political angst could throw in a spanner in the works for the pound bulls.

Recent press has reported that some in Westminster are openly talking about a potential leadership challenge.

''While there is no imminent general election in the UK, Johnson’s leadership is looking weak,'' analysts at Rabobank recent explained. ''This does nothing to strengthen confidence in post-Brexit Britain and, on the margin, will undermine the pound We see EUR/GBP creeping up towards 0.87 during the course of next year.''

EUR/GBP technical analysis

Meanwhile, from a technical standpoint, the cross is on the verge of completing a fifth consecutive bear week and the increasing bearish momentum with lower RSI readings are confirming the latest drop. 0.8338 is key as being the wick of 24 February 2020. The next significant support from 2020 and 2019 will be 0.8282 and 0.8278 respectively. This is an area of imbalance that could well be mitigated in the coming weeks prior to any significant bullish correction.

- US Initial Jobless Claims increased above the 200K mark, blaming resurgent Covid-19 cases.

- US ISM Non-Manufacturing (Services) PMI rose to 62.0, lower than the previous month's reading.

- USD/CHF Technical Outlook: It has a neutral bias.

On Thursday, during the New York session, the USD/CHF pair advances for the second time of the week, exchanging hands at 0.92016 at the time of writing. The market sentiment has improved as portrayed by US equities rising, while the Dow Jones trimmed earlier losses, now down some 0.14%.

In the overnight session, the USD/CHF was subdued, seesawing around the daily pivot point and the R1 daily pivot at the 0.9160-91 range. In the middle of the European session, the pair dipped to the confluence of the 50 and the daily pivot around 0.9158, to then resume the upward move on mixed economic data and rising US Treasury yields.

Mixed US economic data boosts the USD vs. the CHF

The US economic docket featured Initial Jobless Claims for the week ending on January 1, which showed an increase of 207K higher than the 197K estimated by economists. The 4-week moving average rose 204.5K, a tick more elevated than the 199.75K in the prior week.

In the meantime, the Institute for Supply Management (ISM) revealed that the ISM Services PMI for December came at 62.0, short of the 69.1 November reading. Despite shrinking, a reading above 50 indicates growth in the services sector.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart shows the pair has a neutral bias, aiming towards the 50 and 100-daily moving averages (DMAs) confluence. After bouncing off an upslope trendline drawn

from January to May 2021 lows, which passes under the 0.9160 price level, the pair reclaimed the 0.9200 figure.

To the upside, the first ceiling level would be December 22, 2021, daily high at 0.9152, followed by December 7, 2021, cycle high at 0.9274, and then the 0.9300 figure.

On the flp side, the USD/CHF first support would be 0.9200. A breach of the latter would open the door for further losses, being the next support level the upslope trendline around 0.9160-75 area. A decisive break below that level would expose December 31 daily low at 0.9102.

-637770937065241460.png)

St. Louis Fed President James Bullard said on Thursday that the Federal Reserve could raise interest rates as soon as March.

The official, known as an uber hawk and aligned with the market sentiment, explained that the Fed is now in a "good position" to take even more aggressive steps against inflation, as needed after a policy reset last month.

How comments follow yesterday's hawkish minutes and the spike in US yields and the greenback as a consequence.

In December, the Fed agreed to end its asset purchases in March and laid the groundwork for the start of rate increases that all policymakers, even the most dovish, now feel will be appropriate in 2022.

Today, Bullard explained that the Fed "is in good position to take additional steps as necessary to control inflation, including allowing passive balance sheet runoff, increasing the policy rate, and adjusting the timing and pace of subsequent policy rate increases," Bullard said in prepared remarks to the CFA Society of St. Louis.

''Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments," Bullard said.

The tone reinforces the idea that an initial rate increase could be approved "as early as the March meeting.

Reuters explained in a note following Bullard's comments that ''projections issued in December showed half of the Fed policymakers expect three quarter-percentage-point rate increases will be needed this year.''

''Inflation is now running at more than twice the Fed's 2% target, and Bullard said that the inflation 'shock' experienced by the country means the central bank should be able to satisfy its inflation targeting goals now for several years to come.''

Covid will not throw Fed of course

Additionally, Bullard said he did not think the current wave of cases would throw the US economy or the Fed off course.

He explained that Infections in the United States "are projected to follow the pattern where the variant was first identified," while citing projections that daily case counts may peak late this month.

Key notes

St. Louis Fed's Bullard says the first interest rate hike could come in March.

Bullard says the Fed is now in a 'good position' to address inflation with rate increases, balance sheet runoff if needed.

Bullard says expects omicron infections to peak late this month, following a path similar to that seen in South Africa.

Bullard says the recent inflation shock means Fed's average 2% target should be met for next several years.

Bullard says focus on returning US labour force participation to pre-pandemic levels ignores trend decline.

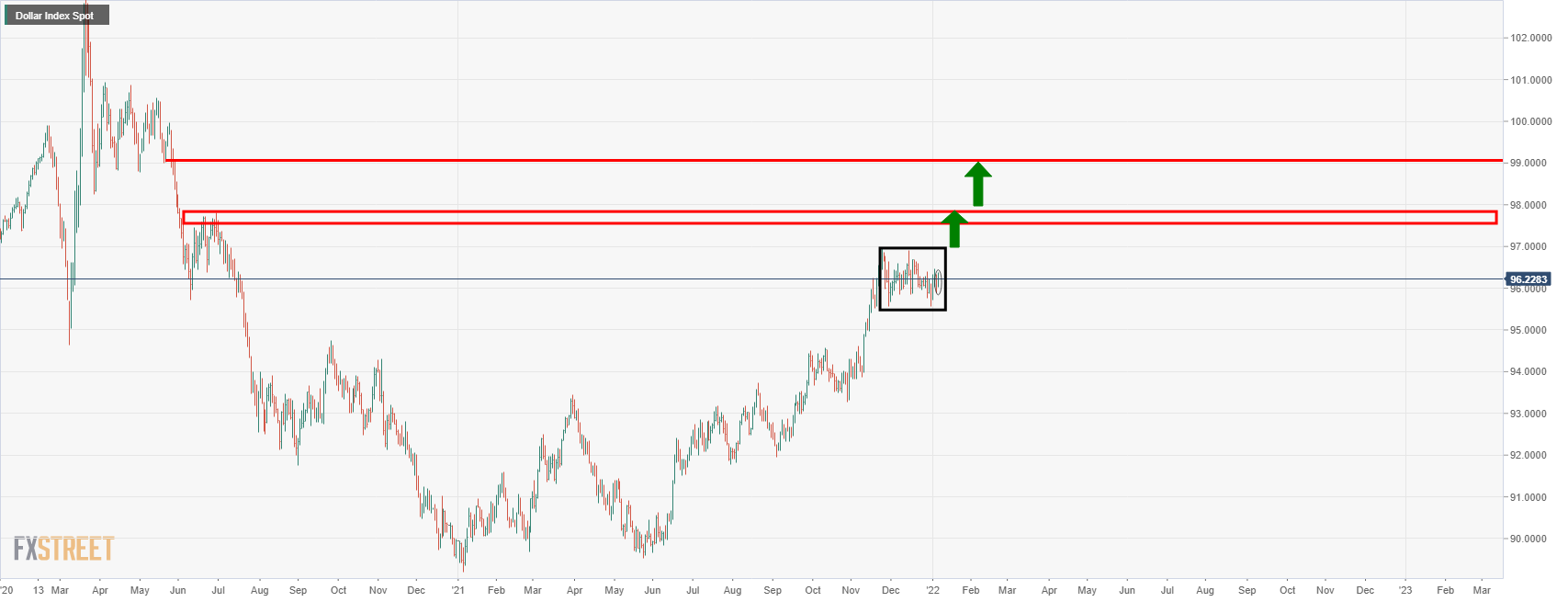

US dollar remains in a familiar consolidated range

Despite the hawkishness, the greenback remains in the familiar consolidation on the daily chart.

However, if this is a phase of reaccumulation, then 98 the figure and then 99 the figure would be expected to be revisited in due course:

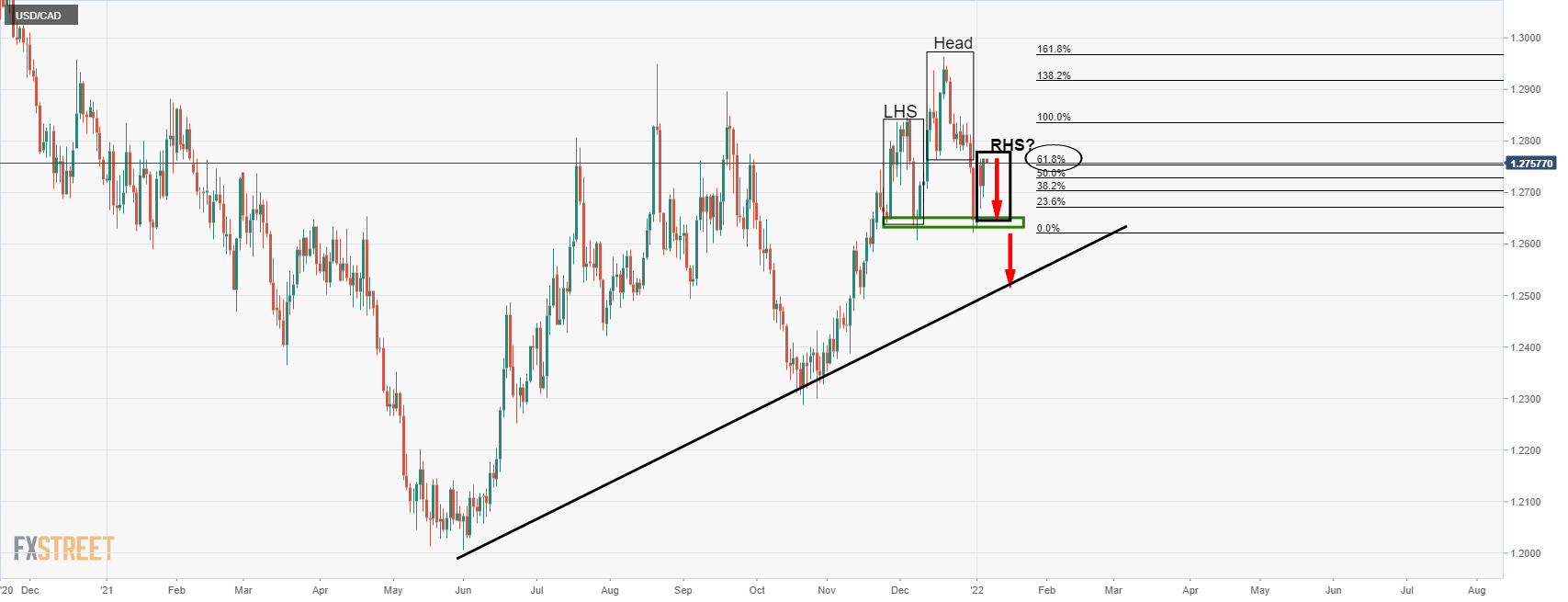

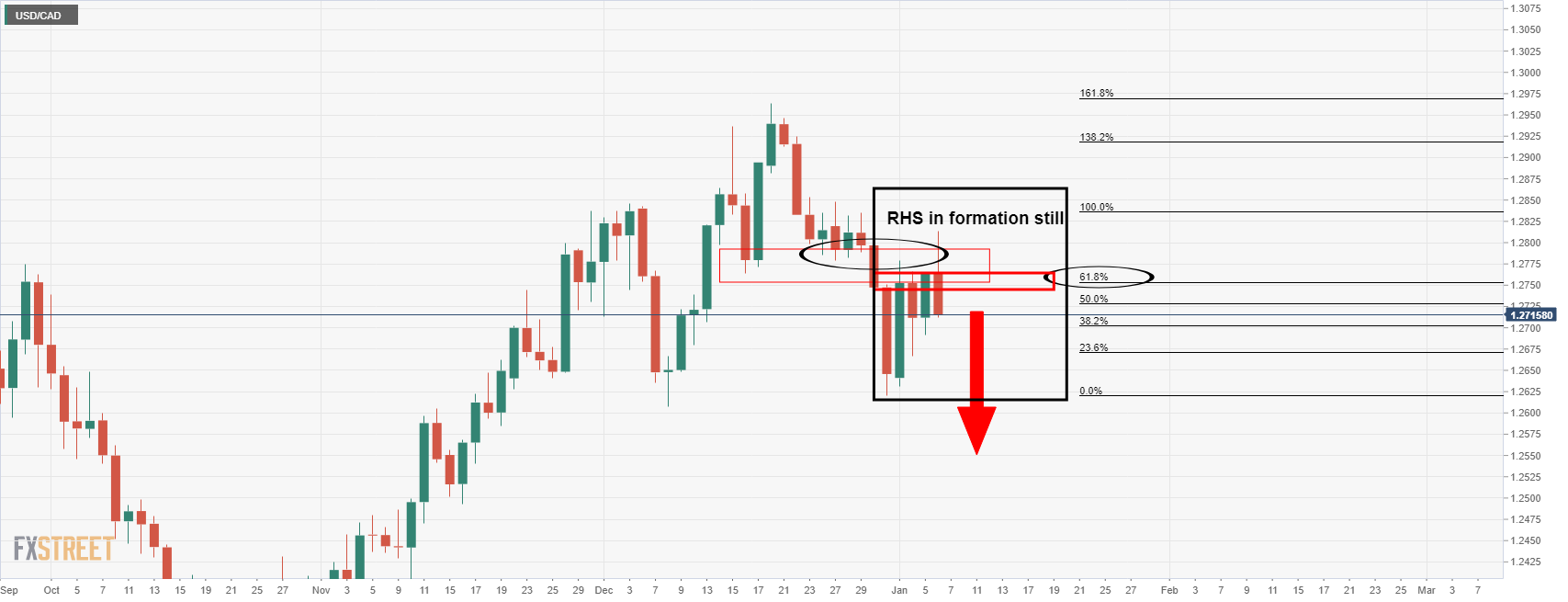

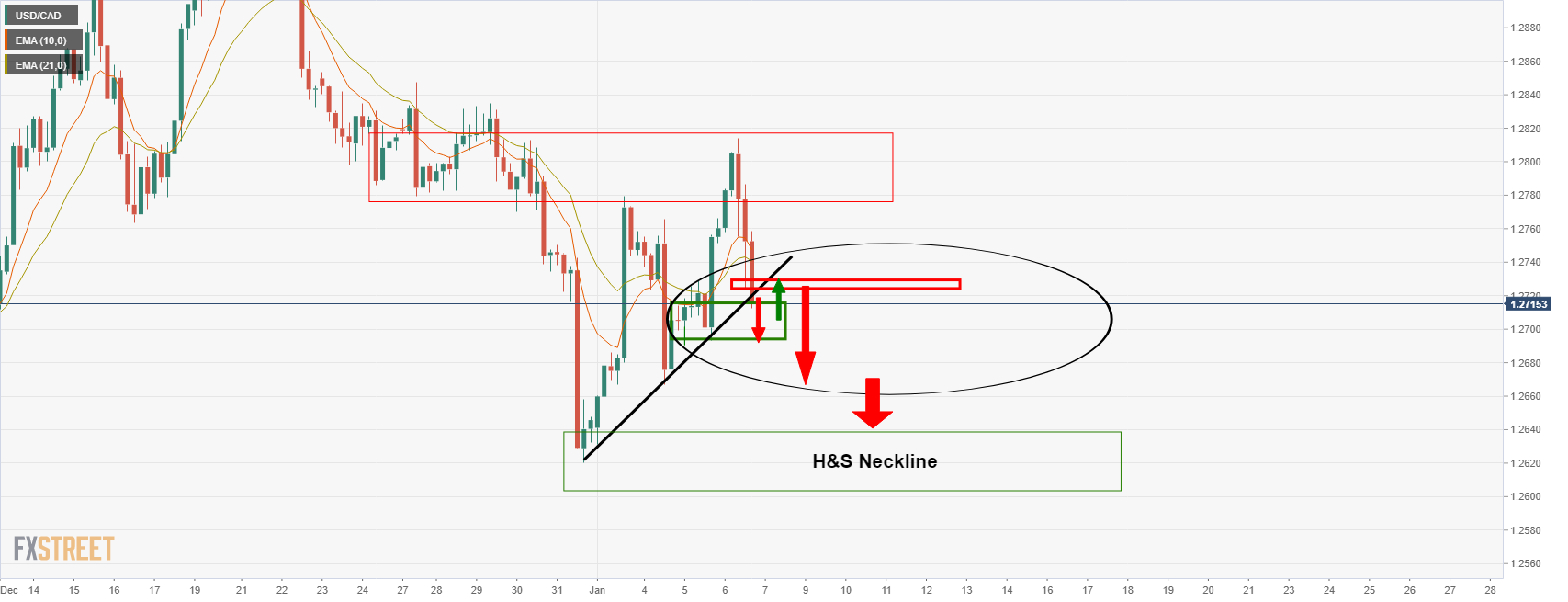

- USD/CAD is in the hands of the bears and eyes are on the daily H&S taking shape.

- The US dollar remains consolidated despite hawkish FOMC minutes.

The US dollar was making life difficult for the impatient bears midweek following a firmly hawkish confirmation at the Federal Reserve on the back of the Federal Open Market Committee minutes. However, following a brief rally in the greenback, the market has rebalanced and the US dollar is struggling to stay green on the day within familiar ranges as follows:

This has enabled the bears to take back control in USD/CAD and as per yesterday's analysis, USD/CAD Price Analysis: Bears line up for their discounts, as a case for a bearish breakout can still be made. The following illustrates the market structure from a daily and 4-hour bearish perspective:

USD/CAD, prior analysis

USD/CAD H&S formation in the making;

The formation of the head and shoulders pattern was explained as being a potential topping formation for the days ahead.

So, the price would be expected to run significantly lower on a break and retest of the neckline near 1.2630.

1.2520 will be earmarked as per the dynamic trendline support:

Bearish structure playing out

For this to play out, we wanted to see a down move in the US dollar, despite the hawkish Federal Reserve minutes.

From a 4-hour perspective, we were looking for a move as follows as illustrated in the prior analysis:

The price action is starting to play out:

As illustrated above, the price ran into the sell stops above the prior highs and into a high volume area where the sellers took back control as a discount, as per the title of the prior analysis: (USD/CAD Price Analysis: Bears line up for their discounts).

This has marked the price action on the daily chart as follows:

The right-hand shoulder (RHS) of the head and shoulders is taking shape. We now need to see a break out below the 4-hour support for a run to the H&S neckline between 1.2620 and 1.2600:

- USD/JPY continues to trade to the south of the 116.00 level on Thursday, having failed to rally post-hawkish Fed minutes.

- Long-term US yields will need to continue pushing higher if USD/JPY is to test late-2016 highs above 118.00.

- US 10-year yields are up sharply on the week, but are yet to break above 2021 highs around 1.77%.

After briefly moving back above the 116.00 level on Wednesday, but failing to test Tuesday’s multi-year high at 116.40, USD/JPY has gradually slipped lower on Thursday and has spent the last few hours going sideways in the 115.70s area. The pair, which has thus far failed to garner any impetus in wake of a more hawkish than expected Fed minutes release on Wednesday despite it sending US yields sharply higher across the curve, has found support in the form of Wednesday’s low close to 115.60. Below that, technicians note further support in the form of the November 2021 and February 2017 highs at 115.50.

Some FX strategists are surprised at the dollar’s failure to pick up in wake of the Fed minutes that clearly showed a strong appetite at the Fed for a fairly swift rate hiking cycle coupled with prompt balance sheet reduction. US data has been mixed this week in the run-up to Friday’s official December labour market report and not influenced FX markets too much. The labour market data already out this week continues to endorse the idea that the US labour market is very tight and businesses are continuing to struggle with personnel/skills shortages, something Friday’s data is expected to confirm. Tokyo Consumer Price Inflation figures out during Friday’s Asia Pacific session are unlikely to move the pair given that inflationary pressure in Japan remains highly subdued and unlikely to force the BoJ into deviating from its ultra-dovish policy stance any time soon.

Some have suggested that USD bulls might be keeping their powder dry ahead of the jobs report, which if as expected, might give them the green light to chase the dollar higher. However, with the yen the most sensitive G10 currency to rate differentials, long-term US yields will likely need to resume their march higher if USD/JPY is to surpass recent highs and test late-2016 highs above 118.00. Speaking of, the US 10-year poked above 1.70% on Thursday and is up over 20bps on the week, but the key level being watched by bond market participants is the 2021 high at 1.77%.

- The Mexican peso strengthens during the day, up some 0.73% against the greenback.

- Banxico’s last meeting minutes stressed concerns over inflation, labor wages as new head Victoria Rodriguez takes the helm of Banxico.

- Mixed US macroeconomic data weakened the greenback vs. the Mexican peso.

On Thursday, during the New York session, the Mexican peso advances in the North American session, trading at 20.4387 at the time of writing. The market sentiment is mixed, as European stock indices closed in the red, whereas the US equity markets advance, except for the Dow Jones, down some 0.34%.

Banxico last meeting minutes shows its members are worried over inflation and higher wages

On Thursday, the Mexican central bank, also known as Banxico, released its last meeting minutes where the central bank hiked 50 basis points the benchmark rates, up to 5.50%.

The minutes showed that all of the members said that headline and core inflation expectations for 2021, 2022, and for the next 12 months increased again. Furthermore, the policymakers noted that economic integration with the US and high inflation levels spurred elevated prices in Mexico.

Banxico’s members said that the forecasts of inflationary pressures were revised upwards, especially in 2022. Also, the minimum wage increase between the Mexican government and business groups of 22% could add upward pressures on labor costs, per Banxico’s policymakers noted.

In the meantime, the US economic docket featured Initial Jobless Claims for the week ending on January 1, which showed an increase of 207K higher than the 197K estimated by economists. The 4-week moving average rose 204.5K, a tick more elevated than the 199.75K in the prior week.

The Institute for Supply Management reported that the Services PMI in the US fell from 69.1 in November to 62.0 in December. Despite contracting, a reading above 50 indicates growth in the services sector.

On Wednesday, the Federal Reserve released its December minutes. The US central bank noted that monetary policy accommodation was unnecessary and that a faster reduction of its bond-purchasing program was needed before hiking rates. Moreover, Fed members began discussions of a contraction of its balance sheet, which was perceived by a hawkish signal by the markets, with investors selling stocks aggressively. US money market futures have priced in an 80% chance of a rate hike in the March 2022 meeting.

Federal Reserve Bank of San Francisco President and FOMC member Mary Daly said on Thursday that we will need to raise interest rates to keep the economy in balance. Even if we do a couple of interest rate increases, monetary policy will still be accommodative, she added.

Additional Remarks:

"Inflation is a regressive tax... I take it really seriously."

"Inflation has been higher than I'm comfortable with for a long time."

"If we act too aggressively to offset high inflation, we won't actually do much to solve supply chain problems."

"We've come to a point where it is clear inflation is rising in sectors not affected directly by Covid."

"We need to be vigilant on data and take a measured approach to policy."

Market Reaction

There does not seem to have been a market reaction to Daly's latest remarks.

- NZD/USD has stabilised in recent trade in the 0.6750 area after being hit after risk-appetite deteriorated post-hawkish Fed minutes.

- Risk appetite and USD flows will remain the key drivers in the days ahead.

- A break below the 0.6750 region would likely see the pair drop back to test 0.6700 again for the first time since mid-December.

NZD/USD has stabilised in the 0.6750 area as global risk appetite settles following Wednesday’s sharp post-hawkish Fed minutes deterioration. As US (and global) equities sold off on Wednesday, led by duration-sensitive big tech and growth names, risk-sensitive currencies like NZD were hit. As a result, NZD/USD dipped all the way from the 0.6820/30 area to current levels around 0.6750. The pair is now roughly 1.3% below Wednesday’s highs near 0.6840 and is about 0.7% down on the day, the pair having lost a grip on its 21-day moving average close to 0.6790 during Asia Pacific trade.

NZD/USD focused US themes

Amid an ongoing lack of domestic economic events/fundamental developments worth noting in New Zealand to drive the pair, risk appetite and dollar flows are likely to continue to reign supreme. Hawkish Fed minutes and the associated move higher in US yields and lower in US (and global) equities aside, another key point of focus this week has been US data. For the most part, the data out so far this week has been ignored. On first glance, the December data this week has been mixed to poor; yes, ADP was strong, but both headline ISM survey indices missed forecasts and JOLTs showed a drop of about half a million in job openings as opposed to an expected rise.

But digging a little deeper reveals a few key trends. Firstly, a record number of quits in November, as shown by the JOLTs data plus survey participant comments about the state of the US labour market suggest that the worker/skills shortage continues to bite, adding upside risks to wage inflation. Secondly, the ISM surveys revealed that while supply chain disruptions continue to hamper output, they are at least beginning to ease, with the manufacturing survey seeing a large associated drop in the price paid subindex.

The minutes revealed that the Fed is now acutely aware that, though total employment remains well below pre-pandemic levels, the labour market is fast approaching “short-term” full employment, something which Fed’s Mary Daly just alluded too. As Daly and other Fed members have pointed out, the pandemic continues to hold back worker supply and so the Fed must work with the labour market its got today, rather than working with the labour market it hopes to have in a post-pandemic world of higher labour supply.

That suggests that even if Friday’s US non-farm payrolls number is weak, the Fed will likely shrug this off as a result of weak labour supply rather than demand. In other words, a weak headline number (as was the case last month) shouldn’t dent Fed tightening expectations, which have leapt substantially this week. It thus feels as though the risks for NZD/USD are tilted to the downside as Fed tightening beckons. A break below the 0.6750 region would likely see the pair drop back to test 0.6700 again for the first time since mid-December.

Federal Reserve Bank of San Francisco President and FOMC member Mary Daly said on Thursday that the US labour market looks very strong, though the US remains millions of jobs short of pre-pandemic levels, with the pandemic still holding back workers.

Additional Remarks:

"Don't think monetary policy should accept today's labour market as what we want to see in the future."

"We are closing in on achieving our two goals in short-run."

"Balancing the short-run and longer-run goals in 2022 will be critical for Fed policy."

"Right now it is 'very appropriate' to taper asset purchases, so as to be out of it by the end of March."

"Normalizing the balance sheet would come after raising interest rates."

Market Reaction

The dollar does not seem to have reacted to Daly's latest remarks, which do not add any new information on top of Wednesday's minutes.

- The single currency has been unable to recover from hawkish FOMC minutes, down 0.13%.

- US ISM Services PMI slowed a tick though it remains at expansionary territory.

- US Initial Jobless Claims rose by 207K, 10K more than estimations.

- EUR/USD Technical Outlook: Bearish biased though a daily close below 1.1300 could accelerate a challenge to 2021 yearly low at 1.1186.

On Thursday, the shared currency is barely flat during the day, though it trims some Wednesday gains, as market participants assess last FOMC’s meeting minutes. The EUR/USD is trading at 1.1295 at press time.

US ISM Services PMI slowed in December

The Institute for Supply Management reported that the Services PMI in the US fell from 69.1 in November to 62.0 in December. Despite contracting, a reading above 50 indicates growth in the services sector. The contraction is likely attributed to the resurgence of Covid-19 cases, but supply constraints appear to be easing.

Before Wall Street opened, the Department of Labor reported that Initial Jobless Claims for the week ending on January 1, 2022, increased by 207K higher than the 197K foreseen by economists. The 4-week average topped 204.5K, more than the 199.75K in the prior week. In spite of rising, jobless claims hovered near a five-decade low in recent weeks.

On Wednesday, the Federal Reserve released its December minutes. The US central bank noted that monetary policy accommodation was unnecessary and that a faster reduction of its bond-purchasing program was needed before hiking rates. Moreover, Fed members began discussions of a contraction of its balance sheet, which was perceived by a hawkish signal by the markets, with investors selling stocks aggressively. US money market futures have priced in an 80% chance of a rate hike in the March 2022 meeting.

In the meantime, the US Dollar Index, which measures the greenback’s performance against six rivals, is up 0.02%, sitting at 96.20, underpinned by rising US 10-year Treasury yields rising three and a half basis points, currently at 1.7369%.

EUR/USD Price Forecast: Technical outlook

The EUR/USD daily chart depicts the pair as downward biased. The daily moving averages (DMAs) reside well above the spot price. Given that the Relative Strength Index is at 46, under the 50-midline, it means that the EUR/USD might print a leg-down before reaching oversold conditions.

On the downside, the EUR/USD first support level would be the January 4 low at 1.1273. A breach of the latter would open the door for crucial support levels, with December 15, 2021, a daily low at 1.1222, followed by a 2021 yearly low at 1.1186.

- GBP/USD has remained supported above 1.3500, but failed to rally about 1.3550 as traders await Friday’s key US jobs report.

- The dollar has so far failed to see broad strength in wake of the latest hawkish Fed minutes.

- USD bulls may be waiting for the report to confirm progress to the Fed’s full-employment goal before chasing USD higher.

GBP/USD continues to trade on the back foot on Thursday as the US session gets underway, despite a weaker than expected US December ISM Services PMI survey, having failed to recover back to the north of the 1.3550 mark earlier. At current levels in the 1.3520s, the pair is trading lower by about 0.2% or 30 pips on the day, and about 0.5% below Wednesday’s pre-hawkish Fed minutes highs at 1.3600. Some FX strategists are surprised that the dollar hasn’t strengthened more in wake of the latest Fed minutes, having been surprised by the apparent appetite amongst FOMC members for a faster pace of tightening (using rate hikes and quantitative tightening).

Its probably worth noting that even if the dollar does start to pick up in the coming sessions, sterling is likely to hold up better than other G10 currencies given that the BoE is already and set to remain well ahead of the Fed when it comes to monetary policy normalisation (both in terms of rate hikes and expectations for imminent QT). For now though, GBP/USD remains well supported above the 1.3500 level, having fended off a test of it earlier in the session.

December jobs report looms

USD bulls seem to be waiting for a “green light” in the form of a strong US December jobs report before chasing the dollar higher. Ahead of Friday’s key report, which the median economist forecast suggests will show 400K jobs being added to the US economy, taking the unemployment rate lower to 4.1% from 4.2%, labour market indicators have been strong. Weekly jobless claims and continued jobless claims in December fell below pre-pandemic levels. The November JOLTs report showed that, heading into December, the number of job vacancies far outnumbered the number of unemployed persons and that quits (a lead indicator of wage pressures) hit a record high above 4M.

Meanwhile, the ADP report on Wednesday estimated December employment change at double expectations at over 800K. Tuesday’s ISM Manufacturing PMI saw its employment subindex rise to 54.2, its highest since H1 2021 and while Thursday’s ISM Services PMI fell to 54.9 from 56.5, survey participants continued to complain of personel and skills shortages. The suggestion is that either Friday’s NFP numbers is very strong, which the Fed would see as a bullish indicator of further rapid progress to their goal of full employment, or the number is weak, but only as a result of lack of labour supply. The latter, while a less favourable outcome, is likely to still be interpreted as evidence of further progress to full-employment, given that the Fed has recently come to the conclusion that it may take some time for labour supply to properly recover and they need to “work with what they’ve got” in terms of the current, smaller labour market when making policy.

- The Australian dollar falls at the mercy of a hawkish US central bank that eyes reducing its balance sheet.

- US Initial Jobless Claims rose more than foreseen but remain at five-decade lows.

- AUD/USD Technical Outlook: The pair is bearish biased and soon might test the 0.7100.

In the North America session, the AUD/USD slides for the second day of the week, courtesy by a hawkish Federal Reserve alongside a rise in US Treasury yields, with the 10-year benchmark note above 1.70%, the highest since April 2021. At the time of writing, exchanges hands at 0.7161.

US Initial Jobless Claims increased more than estimated

In the meantime, US Initial Jobless Claims for the week ending on January 1, 2022, rose by 207,000 more than the 197,000 estimated by economists. The 10,000 increase of claims on the first week of the year impacted the 4-week average, which topped 204,500, higher than the 199,750 in the prior week. Despite rising, jobless claims hovered near a five-decade low in recent weeks.

Next on the US calendar, the ISM Services PMI for December, estimated at 66.9, would be released at 15:00 GMT, while St. Louis Fed President James Bullard (voter 2022) would cross the wires later in the day.

That said, on Wednesday, the US central bank revealed on its December minutes that monetary policy accommodation was not needed and that a faster reduction of its QE program was required before hiking rates. Also, Fed policymakers began discussions of a contraction of its balance sheet, which was perceived by a hawkish signal by the markets, with investors selling stocks aggressively. At the same time, US T-bond yields rose, with the 10-year hitting the highest level since April 2021.

Furthermore, US money market futures have priced in an 80% chance of a rate hike in the March 2022 meeting. In the meantime, the US Dollar Index, which measures the buck's value against six rivals, is barely flat at 96.16.

AUD/USD Price Forecast: Technical outlook

The AUD/USD daily chart depicts the pair as bearish biased, as the daily moving averages (DMAs) reside above the spot price, with a downslope acting as dynamic resistance levels. Additionally, at press time, the pair pierced an upslope trendline drawn from December 6, 2021, daily low up to December 20, 2021, low, that opened the door for a test of the latter at 0.7082, but it would find some hurdles on its way down.

The AUD/USD first support level would be the 0.7100 psychological level. A breach of the latter would send the pair tumbling towards the December 20, 2021, cycle low at 0.7082.

- US Factory Orders rose 1.6% in November, slightly above expected.

- There was no FX market reaction to the data.

According to US Census Bureau data, US Factory Order rose by 1.6% MoM in November. That was slightly above the expected 1.5% gain and marked an acceleration on the 1.2% MoM gain seen back in October (which was revised up from 1.0%). Excluding transportation, orders were up 0.8% on the month, though this marked a deceleration from last month's MoM growth rate of 1.5% (which was revised down from 1.6%.

Market Reaction

There was no FX market reaction to the latest factory orders figures.

- The headline ISM Services index fell to 62.0 in December from 69.1 in November.

- The New Orders subindex fell to its lowest since November.

The Institute of Supply Management's headline Services PMI index fell to 62.0 in December versus forecasts for a fall to 66.9 from 69.1 in November.

Subindices:

- Business Activity fell to 67.6 from 74.6.

- Prices Paid rose to 82.5 from 82.3.

- New Orders fell to 61.5 from 69.7, the lowest such reading since February 2021.

- Employment fell to 54.9 from 56.5.

Market Reaction

The DXY does not seem to have reacted much to the latest US ISM survey, even though it was a tad weaker than forecast.

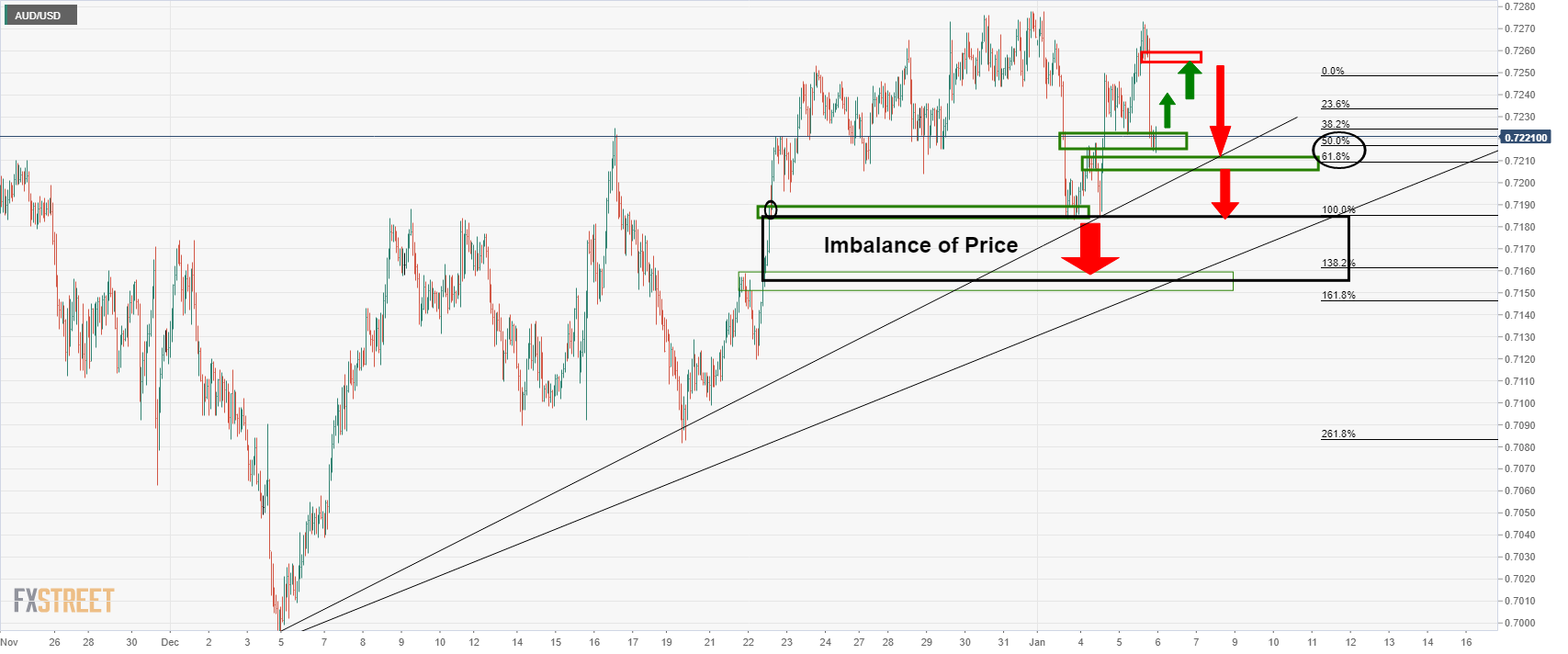

- WTI briefly eclipsed the $80 per barrel level for the first time since mid-November as OPEC+ struggles to lift output.

- Crude oil prices have rallied despite recent downside in global equities after hawkish Fed minutes, and are watching Kazakhstan unrest.

Front-month WTI futures have surged on Thursday despite recent hawkish Fed minutes induced downside in other risk assets which oil tends to have a tight correlation to such as US and global equities. Prices momentarily eclipsed $80 per barrel for the first time since mid-November before easing back a little and at current levels in the mid-$79.00s, WTI is trading with gains of about $2.50 on the day. With the last key area of chart resistance in the $79.50 area ahead 2021 highs around $85.00 now cleared, oil bulls may now be expecting WTI to push more decisively into the $80s.

Supply-side rather than demand/macro dynamics have been dictating the price action in crude oil markets on Thursday. Kazakhstan’s 1.6M barrel per day (BPD) producing oil infrastructure is yet to face disruption, but civil unrest there adds further notable downside risk to OPEC+ supply at a time when other members are struggling to meet output quotas. Libya’s National Oil Company (NOC) said on Thursday that oil output currently stands at just over 700K BPD. Libyan output faces severe disruptions as infrastructure undergoes maintenance and repairs – output was as high as 1.3M BPD at the end of last year.

Libya has not been the only country struggling to hit output quotas and a Reuters survey release on Thursday highlighted this dynamic. The survey showed the group’s output only rose by 70K BPD in December, far below the 400K monthly output hike allowed under OPEC+’s agreement. The survey noted that output in Libya and Nigeria fell and that, as a result, OPEC+ net compliance with its output reduction pact rose in December to 127% from 1.20% in November. Concerns about OPEC+ struggles to lift output in line with plans and tightness this exerts upon global oil markets has distracted markets from the news that Saudi Arabia lowered its official selling price for all crude oil grades to Asian customers (an indicator of slowing demand).

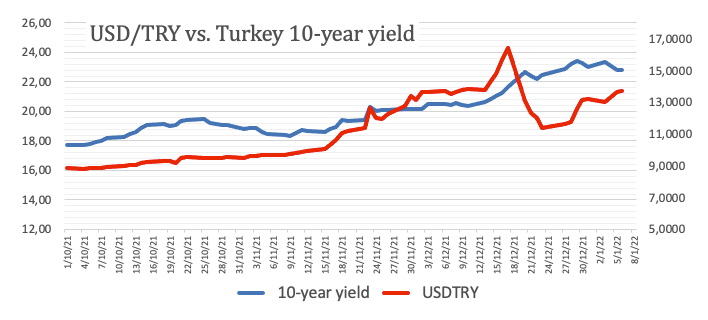

- USD/TRY extends the march north near the 14.00 mark.

- The lira drops further after N.Nebati comments midweek.

- Investors’ attention remains on the CBRT event on January 20.

Another day, another drop in the lira. This time, the depreciation of the Turkish currency lifts USD/TRY to the vicinity of the 14.00 level, challenging at the same time the area of YTD tops.

USD/TRY up on stronger US yields, lira weakness

USD/TRY advances since Tuesday on the back of the move higher in US yields and increasing depreciation of the domestic currency, which has particularly exacerbated its losses following the 19-year high in Turkey’s inflation figures. It is worth recalling that consumer prices tracked by the CPI rose past 36% in December vs. the same month of 2020.

An extra hit to the lira (as if needed) came after Finance Minister N.Nebati said on Wednesday that the country will now abandon orthodox policies when it comes to tackle the rampant inflation, shifting instead to “heterodox policies” (or whatever that means), as the country will now chart its own course (?).

Further news from agency Reuters cited President Erdogan saying that “From now on, it is time to reap the benefits of our efforts, to show our people that we are approaching our goals”… (which would be…)

In the meantime, the lira shed nearly 45% in 2021 vs. the US dollar, making it one of the worst performers during the past year. Furthermore, since the Turkish central bank (CBRT) started its easing cycle back in mid/late September, TRY lost around 33%.

What to look for around TRY

The lira resumed the downtrend while market participants continue to digest the recent inflation figures and the government scheme to protect deposits in the domestic currency. The reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the lira under intense pressure for the time being, That said, another visit to the all-time high north of the 18.00 mark in USD/TRY should not be ruled out just yet.

Eminent issues on the back boiler: Progress (or lack of it) of the new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges.

USD/TRY key levels

So far, the pair is gaining 0.91% at 13.7531 and a drop below 12.7523 (weekly low Jan.3) would pave the way for a test of 11.8918 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.8967 (YTD high Jan.3) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- Spot gold prices have been choppy on Thursday and current trade around $1790, down over 1.0% on the day.

- Real yields have been surging in wake of Wednesday’s hawkish Fed minutes and this is weighing on precious metals.

Trading conditions in precious metal markets have been choppy in recent trade, though bearish momentum in wake of Wednesday’s hawkish Fed minutes seems to be winning through for now. Spot gold (XAU/USD) prices have tumbled from Asia Pacific session levels in the $1810 area to current levels (and session lows) around $1790, with on-the-day losses currently standing at just over 1.0%. A late-European morning rebound that saw spot prices rebound from the mid-$1790s to near the $1810 level again ultimately proved nothing more than an intra-day dead-cat bounce and a good opportunity for gold bears to add to short positions.

On its way lower to test the $1790 area, XAU/USD has fallen through a succession of key moving averages (the 21, 50 and 200DMAs which all reside between $1797 and $1805). But the bears have so far not been able to send gold prices decisively underneath support in the form of recent lows, including last week’s low at $1789.50 and the low from the week before at $1785. Should these lows go, bearish technicians will likely target a swift test of December’s sub-$1760 lows.

Selling pressure in gold markets has not come as a surprise to many analysts who observed US real yields, with which gold typically has a tight negative correlation, surging in wake of Wednesday’s Fed minutes. Short-Term Interest Rate markets have busily been bringing forward bets as to when the Fed’s rate-hiking cycle will get underway and how high the bank will ultimately take rates. But with markets also increasingly buying into the Fed’s bullish economic outlook, this added dose of Fed hawkishness has not been depressing long-term growth and inflation expectations. The net result is surging real yields and the 10-year TIPS yield notable surged to its highest level in over six months on Thursday above -0.80%. When the 10-year TIPS yield was last close to the 0.80% level back in September, XAU/USD was trading under $1750.

For spot gold’s losses to really accelerate, the US dollar is likely going to need to pick up a little more from current levels. The DXY remains locked within the 95.50-96.90ish range that has prevailed now for multiple weeks, despite recent upside in yields and downside in stocks in wake of the hawkish Fed. If the dollar does start kicking higher (perhaps Friday’s US jobs report could be a catalyst), that combined with higher real yields could be a big bearish risk for gold.

US ISM Services PMI Overview

The Institute of Supply Management (ISM) will release the Non-Manufacturing Purchasing Managers' Index (PMI) - also known as the ISM Services PMI – at 15:00 GMT this Tuesday. The gauge is expected to fall to 66.9 in December from 69.1 recorded in the previous month. The market focus, however, will be on the Prices Paid sub-component, which represents inflation and is expected to edge higher to 83.6 from 82.3 in November.

How Could it Affect EUR/USD?

Against the backdrop of surprisingly hawkish FOMC meeting minutes released on Wednesday, a stronger print should be enough to provide a fresh lift to the US dollar. Conversely, the market reaction to any disappointment is more likely to be muted amid expectations for an eventual Fed liftoff in March 2022. Apart from this, elevated US Treasury bond yields should continue to underpin the greenback. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the EUR/USD pair: “The Relative Strength Index (RSI) indicator on the four-hour chart dropped below 50 following the sharp U-turn late Wednesday. Confirming the bearish shift in the near-term outlook, EUR/USD is trading below the 200-period and 100-period SMAs, which form resistance around 1.1300.”

Eren also outlined important technical levels to trade the major: “On the downside, the next support aligns at 1.1270 (static level) before 1.1240 (static level) and 1.200 (psychological level). In case buyers manage to lift the pair back above 1.1300 and hold it there, 1.1320 (50-period SMA) could be seen as the next resistance before 1.1340 (static level) and 1.1360 (post-ECB high).”

Key Notes

• EUR/USD Forecast: FOMC Minutes remind sellers of Fed-ECB policy divergence

• EUR/USD continues to hover above 1.1300 in defiance of calls for USD strength post-hawkish Fed minutes

• EUR/USD: No change to the mixed outlook – UOB

About the US ISM Services PMI

The ISM Non-Manufacturing Index released by the Institute for Supply Management (ISM) shows business conditions in the US non-manufacturing sector. It is worth noting that services constitute the largest sector of the US economy and results above 50 should be seen as supportive for the USD.

- EUR/USD alternates gains with losses around the 1.1300 zone.

- Extra range bound remains in the pipeline in the very near term.

EUR/USD navigates the lower end of the so far yearly range near the 1.1300 area on Thursday.

The lack of a firm direction in either way should prompt the pair to maintain the current consolidative move in the very near term. The initial up barrier is located past the 1.1380 level (January 3), while sellers should meet contention near 1.1270 (January 4).

The broader negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1744.

EUR/USD daily chart

- Canada posted a bigger than expected trade surplus on Thursday.

- The Canadian dollar did not react to the data, with focus on Friday's jobs report.

Canada's merchandise trade surplus with the world widened to C$3.13 billion in November from C$2.26 billion in October (which has been revised up from C$2.09 billion), monthly data published by Statistics Canada revealed on Thursday. This reading beat market expectations for a surplus of C$2.03 billion. Canadian exports in October rose to C$58.57 billion from C$56.42 billion in October (which was revised up from C$56.18 billion), whilst imports rose to C$55.44 billion from C$54.16 billion (which was revised up from C$54.09 billion).

Market Reaction

The Canadian dollar did not react to the latest trade figures, with traders much more focused on Friday's Canadian jobs report, which will be closely watched by BoC policymakers.

- Initial claims rose to 207K in the week ending on January 1, above the 197K expected.

- The insured unemployment rate remains steady at 1.3%.

There were 207,000 initial claims for unemployment benefits in the US during the week ending January 1, data published by the US Department of Labor (DoL) revealed on Thursday. This reading followed last week's print of 200,000 (which was revised up from 198,000) and came in slightly above consensus market expectations for 197,000.

Continued jobless claims rose to 1.754M in the week ending December 25, the data showed, above expectations for a decline to 1.688M from 1.718M the week prior (which was revised up from 1.716M). The insured unemployment rate remained at 1.3% versus 1.3% last week.

Market Reaction