- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 10-01-2022

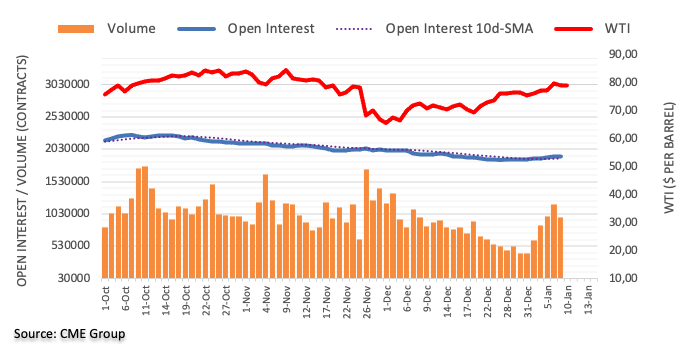

- WTI holds steady in the Asian session as supply risks start to abate.

- Investors keeping an eye on Russia risks and Omricon.

West Texas Intermediate (WTI) crude oil settled lower on Monday as supply disruptions in Libya and Kazakhstan eased. Some supplies were restored in Kazakhstan, while Libyan oil production rose to 900,000b/d after maintenance work. However, rising Omicron cases didn’t help either.

At the time of writing, WTI is trading at $78.50 and is flat on the day so far while investors watch closely China’s Omicron spread, as policy could trigger more travel restrictions.

China is battling to stamp out its first outbreak of the Omicron variant, only weeks before the Chinese new year and the Beijing Winter Olympics, with cases recorded in at least two distant provinces. On Monday, health authorities reported 97 new locally transmitted cases for the preceding 24 hours, across several cities.

At least 30 cases were in Henan province, while at least 31 new cases were reported in Tianjin, including 15 children aged five to 15. Omicron, the latest variant of Covid-19 is tearing through other countries around the world also. Sweden became the latest country to introduce new restrictions to halt the spread of the omicron variant.

Elsewhere, oil could still find support on tighter supplies and supply risk from Russia. There is much focus on security discussions this week between Russia and the West in order to address tension in eastern Ukraine.

Talks took place with the US today (Geneva) and will now move to Brussels for discussions with NATO on Wednesday and subsequently with the OSCE. However, the bar for a 'break-through' is high which is potential support for the price of oil.

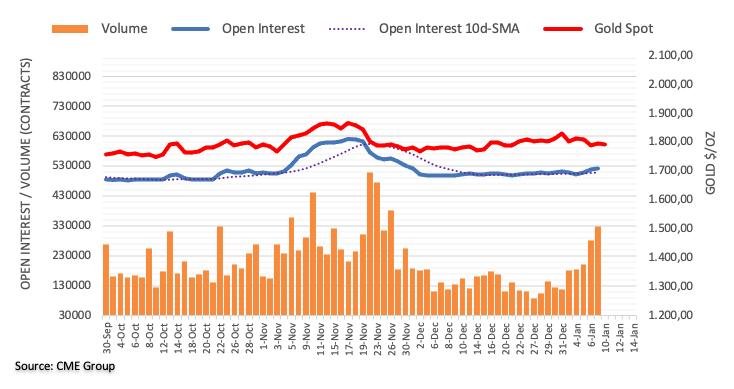

- Gold extends two-day rebound from a monthly low, recently picking up bids.

- Market sentiment dwindles amid inflation, Fed rate hike chatters.

- Fed’s Powell cites upbeat economic momentum, robust labor market to back the pledge against inflation.

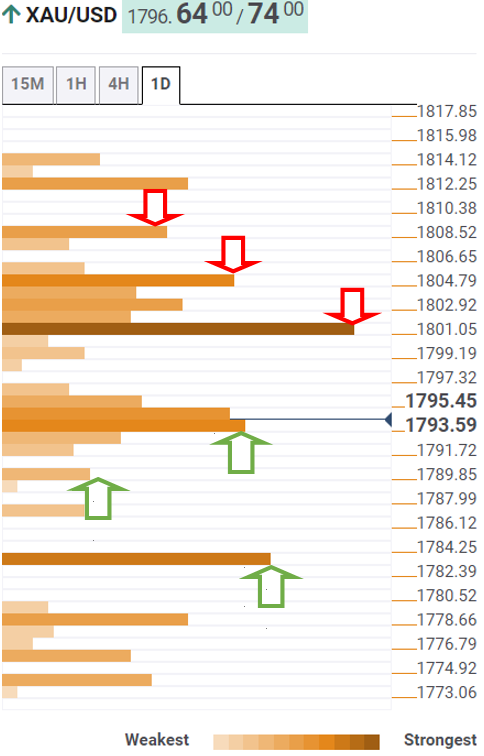

- Gold Price Forecast: Quick pullback from 1,800 area hints at further slides

Gold (XAU/USD) picks up bids to $1,802 during a quiet Asian session on Tuesday, keeping the previous two-day advances.

The bullion rose during the last two days as markets braces for this week’s US inflation data and the US Treasury yields have been on the defensive despite the refreshing multi-day high of late.

The gold’s latest upside takes clues from mildly bid S&P 500 Futures and softer US 10-year Treasury yields. That said, the US stock futures rise 0.12% while the benchmark bond yields drop one basis point (bp) to 1.77% after easing from the yearly peak the previous day.

Behind the recent market optimism are the hawkish comments from Fed Chair Jerome Powell, per the prepared remarks for today’s Testimony. The Fed Boss said, “The economy is growing at its fastest rate in years, and the labor market is robust,” to back his pledge to stop higher inflation from getting entrenched.

Additionally, comments from Merck’s official saying, “Expect Molnupiravir mechanism to work against omicron, any covid variant,” could also be cited as positive for the risk appetite.

Previously, steady US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED), joined higher inflation components of the December NY Fed’s survey of consumer expectations to portray inflation fears. The same propelled US bond coupons to refresh multi-day peaks and drown the equities before providing a mixed daily closing.

Looking forward, gold traders will keep their eyes on Powell’s testimony for intraday moves even as the prepared remarks are out. However, major attention will be given to Wednesday’s US Consumer Price Index (CPI) data for fresh impulse.

Read: Inflation and rising yields to guide investors

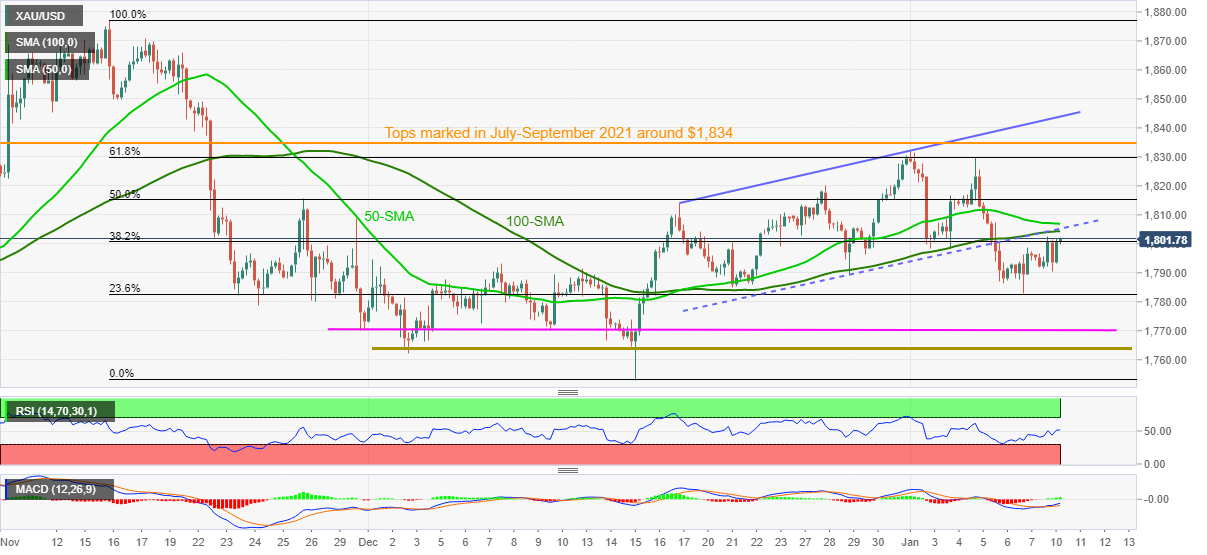

Technical analysis

Having confirmed a bearish bias by breaking a short-term ascending trend channel and 100-SMA support, gold prices bounced off 23.6% Fibonacci retracement (Fibo.) of November-December declines. However, the metal remains below a convergence of the stated support-turned-resistance, around $1,805, amid sluggish MACD and RSI lines to keep sellers hopeful.

That said, the 23.6% Fibo. retest, near $1,782, acts as immediate support during the quote’s fresh declines, before directing gold bears towards the $1,770 and $1,760 levels.

In a case where gold prices remain weak past $1,760, December’s low of $1,753 and September’s bottom surrounding $1,721 will be in focus.

Alternatively, recovery moves remain elusive below $1,805 resistance confluence, previous support. Also challenging gold buyers is the 50-SMA near $1,808 and 50% Fibonacci retracement level of $1,815.

Given the gold buyer’s dominance past $1,815, 61.8% Fibonacci retracement level around $1,830 may act as an immediate resistance before the tops marked in July and September of 2021, close to $1,834. Also acting as an upside filter is the upper line of the ascending trend channel, close to $1,843.

Overall, gold’s failure to keep Friday’s corrective pullback hints at the commodity’s further weakness.

Gold: Four-hour chart

Trend: Further weakness expected

- EUR/USD pares the week-start losses, picks up bids of late.

- Successful bounce off seven-week-old support line, 200- SMA keep buyers hopeful.

- Steady oscillators also favor rebond towards weekly resistance line.

EUR/USD consolidates Monday’s losses above 1.1300, around 1.1330 during Tuesday’s Asian session.

In doing so, the major currency pair keeps the corrective pullback from an upward sloping support line from November 24 and the 200-SMA.

Given the steady RSI and firmer Momentum lines, the latest rebound is likely extending towards a one-week-old resistance line near 1.1360.

However, any further downside will be challenged by the December-end peak near 1.1385 and the 1.1400 threshold.

Alternatively, the stated 200-SMA and short-term support line, respectively around 1.1300 and 1.1280, restricts the quote’s immediate downside.

Also acting as the key support is the 61.8% Fibonacci retracement level of late November to December advances, close to 1.1260.

It’s worth noting that the repeated failures on the way to 1.1400 keep EUR/USD bears hopeful despite the latest corrective bounce.

EUR/USD: Four-hour chart

Trend: Further recovery expected

- AUD/USD consolidates Monday’s losses but stays pressured of late.

- Growing fears of inflation, Fed’s rate hike join covid and geopolitical jitters to favor bears.

- Aussie TD Securities Inflation eased YoY in December, Building Permits shrank in November.

- Aussie Retail Sales, Trade Balance may exert additional downside pressure amid bearish hopes.

AUD/USD picks up bids to 0.7175, licking the previous day’s wounds amid the early Asian session on Tuesday.

The risk barometer pair began the week with mild losses as traders brace for Wednesday’s US inflation data amid hawkish hopes from the Fed. Adding to the quote’s weakness were downbeat data at home and challenges emanating from geopolitics, as well as covid, frontiers.

Increasing chatters over inflation weighed down the market’s risk appetite and propelled the yields, as well as the US dollar. Recently, the prepared remarks for today’s Testimony by Fed Chair Jerome Powell also mentioned the Fed Boss as saying, “Will stop higher inflation from getting entrenched.”

It should be noted that the steady US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED), joins higher inflation components of the December NY Fed’s survey of consumer expectations to magnify the key concerns and weigh on AUD/USD.

Elsewhere, Australia’s easing in covid cases during the weekend fades with the latest figures above 63,000 daily infections, with major threats from New South Wales. The Pacific major is also known to have witnessed a dearth of Ambulance services and vaccines for a short period recently.

Additionally, the US-China tussles continue, recently over trade and the human rights issues, and the Russia-Ukraine matter gains major attention ahead of this week’s Washington-Moscow meeting, weighing on the commodities and Antipodeans amid cautious mood.

Against this backdrop, the US 10-year Treasury yields crossed 1.80% before closing with 1.4 basis points (bps) of a downside to 1.75%. Further, Wall Street also dropped more in the initial hours ahead of the daily mixed close.

Moving on, Australia’s Retail Sales and Trade Balance for November will be the immediate catalysts for the AUD/USD pair. Forecasts suggest downbeat figures of Retail Sales to 3.9% from 4.9%, as well as a reduction in the trade surplus from 11220M to 10600M.

Technical analysis

AUD/USD portrays a Break-Pullback-Continuation (BPC) chart pattern on the four-hour play while observing Thursday’s rising wedge confirmation, followed by a corrective pullback from 50% Fibonacci retracement of December’s advances.

Given the recent U-turn from the previous resistance, the Aussie pair eyes further losses below the 0.7200 round figure, backed by receding bullish bias of the MACD signals.

It’s worth noting, however, that buyers will gain confidence on a clear upside break of the 0.7200 mark, comprising the 100-SMA and bearish wedge’s support line, now resistance.

- The New Zealand dollar edges lower some 0.07%.

- A downbeat market sentiment triggered a sell-off of risk-sensitive currencies, boosted safe-haven peers.

- NZD/JPY is neutral-bearish after a break below the 200-DMA lying at 78.15.

As the Asian Pacific session begins amid a risk-off market mood, the NZD/JPY failed to break above the confluence of the 50 and the 100-day moving averages (DMAs), is trading at 77.85 at the time of writing.

As previously mentioned, US equity markets finished in the red, a trend that began on Friday, January 7. A mixed US Nonfarm Payrolls report, alongside “hawkish” Federal Reserve minutes, triggered a jump in global bond yields, particularly US Treasuries, to the detriment of risk-sensitive currencies, like the New Zealand dollar.

NZD/JPY Price Forecast: Technical outlook

On Monday, the NZD/JPY plunged some 95-pips in the session, from 78.53 to 77.54, and even broke below the 200-day moving average (DMA) at 78.15. However, since the middle of the North American session, the NZD gained some ground against the Japanese yen but failed to reclaim the 200-DMA alongside the neckline of the double-bottom formation.

That said, the NZD/JPY is neutral-bearish, and the first support on the way down would be the January 10 daily low at 77.58. A clear break of that level would expose December 22, 2021, a daily low at 76.91, followed by December 20, 2021, a cycle low at 76.02.

To the upside, the pair’s first resistance is December 16, 2021, daily high at 77.98. A breach of the latter exposes the 200-DMA at 78.15, followed by the confluence of the 50 and 100-DMA around 78.48-60.

-637774516673649295.png)

- NZD/USD struggles to keep the bounce off monthly horizontal support.

- Market sentiment dwindles amid inflation fears, virus woes.

- Powell’s prepared remarks for Testimony showed readiness to fight inflation.

- No major data at home but Fedspeak, inflation chatters and covid updates are the key for fresh impulse.

NZD/USD dribbles around 0.6750-60 during early Tuesday morning in Asia, following a negative start to the key week.

The kiwi pair struggles around short-term horizontal support, despite an absence of major data, as traders remain cautious ahead of Wednesday’s US inflation fears. Adding to the bearish bias for the quote are the coronavirus fears and geopolitical tussles among the leading global economies.

“Market chatter points the finger of blame for the rout on the usual suspects – inflation, tighter policy and COVID, and in that environment, given how much positivity is priced in locally, New Zealand seemingly does have more to lose than other countries,” said analysts at the Australia and New Zealand Banking Group (ANZ).

The fears of a faster rate hike by the US Federal Reserve (Fed) recently got support from prepared remarks of Fed Chair Jerome Powell, for Tuesday’s Testimony. The Fed Boss said, “Will stop higher inflation from getting entrenched.”

Earlier in the day, December NY Fed’s survey of consumer expectations remained unchanged for three-year and one-year basis at 4.0% and 6.0%. The figures are much higher than the Fed’s inflation forecasts and hence push the US central bank towards speedy rate lifts.

On the same line, recently steady US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED), also hint at the tighter monetary policy by the Fed and reduction in the carry trade opportunities, which in turn weigh on the NZD/USD prices.

Elsewhere, worsening virus conditions in Auckland also challenges the Kiwi policymakers and challenges NZD/USD pair’s corrective rebound. Additionally, the US-China tussles continue, recently over trade and the human rights issues, and the Russia-Ukraine matter gains major attention ahead of this week’s Washington-Moscow meeting, weighing on the commodities and Antipodeans amid cautious mood.

Amid these plays, US 10-year Treasury yields crossed 1.80% before closing with 1.4 basis points (bps) of a downside to 1.75%. Further, Wall Street also dropped more in the initial hours ahead of the daily mixed close.

Moving on, Australia’s Retail Sales and Testimony by Fed Chair Powell will decorate today’s calendar and will be important for NZD/USD traders to watch. However, major attention will be given to inflation and covid chatters for clear direction.

Technical analysis

NZD/USD fails to keep the bounce off five-week-old horizontal support around 0.6740, suggesting further downside towards 2021 low near 0.6700 amid downbeat MACD and RSI line.

Meanwhile, a convergence of the 100 and 200 SMAs, as well as 23.6% Fibonacci retracement (Fibo.) level of mid-November to December downside, around 0.6790 acts as a wall of resistance for the Kiwi pair.

Federal Reserve Jerome Powell is set to appear before the Senate for his confirmation hearing on Tuesday.

In prepared remarks he will state that the economy is expanding at its fastest pace in many years, labor market is strong - prepared remarks for a reappointment confirmation hearing.

He will say that the economy has rapidly gained strength despite the ongoing pandemic, giving rise to elevated inflation

He will explain that the Fed is strongly committed to achieving maximum employment, price stability and that the central bank will use its tools to support the economy, strong labour market, prevent inflation from becoming entrenched.

He will state that the US economy will be a different following pandemic, fed must adapt to those changes and that he is committed to making decisions with objectivity, integrity, impartiality.

The Fed will aim to stop higher inflation from getting entrenched.

There has been no market reaction to these prepared remarks with investors already priced for a faster pare of tapering and rate hikes.

- USD/CAD is carving out a bearish structure on the daily chart.

- Some consolidation would be expected prior to the next downside move with 1.2600 eyed.

As per the start of the week's analysis, The Chart of the Week: USD/CAD has complied with the medium-term bearish bias, the price is adhering to the market's structure and the following illustrates sth bearish perspective:

USD/CAD daily chart, prior analysis

As illustrated above, the head and shoulders were in the making...

USD/CAD daily chart analysis

The price is now leaving an M-formation on the chart as illustrated above and is drawing the bulls into the neckline.

This can be seen on the 4-hour time frame as in the following prior analysis:

As see, the prior analysis at the start of the week forecasted a move into the 1.27 area and it has played out as follows:

USD/CAD H4 chart

We can now expect the price to mitigate the imbalance to a restest of what would be expected to act as support on first attempts near 1.2650. This could lead to a deeper bullish correction into the daily M-formation's neckline near 1.2700/10 again prior to a full-on downside break to test 1.26 the figure.

- The British pound barely losses some 0.12% as the New York session ends.

- A risk-off market mood and higher US T-bond yields boosted the greenback, weighed on the pound.

- GBP/USD is neutral, though a break above 1.3600 would expose a challenge of the 200-DMA.

On Monday, US central bank’s rising rates expectations and omicron woes dampened the market sentiment, boosting the safe-haven peers like the greenback and the Japanese yen, the strongest currencies of the G8. That said, the British pound retreats from daily highs and turns into negative territory, down some 0.12% in the North American session, trading at 1.3579 at the time of writing.

Higher US Treasury yields boost the buck

In the meantime, the US 10-year Treasury yield advance one basis point sits at 1.778%, a tailwind for the US Dollar Index, which tracks the greenback’s performance against a basket of its rivals, advances some 0.26%, currently at 95.97, weighing on the GBP/USD pair.

During the New York session, a report from Goldman Sachs (GS), revealed that the bank estimates four rate hikes in 2022. The same report noted that the Fed could begin to reduce its balance sheet by mid-2022.

In the same tone, JP Morgan brought forward the first hike to the Federal Funds Rate (FFR), from June to March.

GBP/USD traders attention turns to US inflation figures and the testimony of Federal Reserve policymakers Jerome Powell and Lael Brainard against the US Senate Banking Committee.

GBP/USD Price Forecast: Technical outlook

The GBP/USD pair has a neutral bias, though it has been seesawing around the 100-day moving average (DMA) at 1.3554 for the last five days. Worth noting that GBP bulls showed around the abovementioned and broke a nine-month-old downslope trendline on January 7, exposing the 1.3600 figure.

The GBP/USD’s faced strong resistance at 1.3600. A breach of the latter would expose November 4 daily high at 1.3698, followed by the 200-DMA at 1.3737.

On the flip side, a break below the 100-DMA would expose the trendline mentioned above around the 1.3525-50 region, which once cleared would reveal the 1.3500 figure, followed by the January 3 daily low at 1.3431.

- AUD/USD bears are lurking in various resistance areas as the price corrects.

- 0.7220 is eyed near the counter-trendline but 0.7180 could be a critical resistance.

AUD/USD could be on the verge of a downside continuation and break of dynamic daily support. The following illustrates this from a daily and 4-hour perspective taking into account the Fibonacci levels.

AUD/USD daily chart

As illustrated, the bulls are moving in for a restest of higher liquidity in a correction of the recent bearish impulse. 0.7180 is currently coming under pressure which could hold initial tests.

AUD/USD H4 chart

Meanwhile, the 4-hour chart shows that the price is moving in on resistance also and a number of liquidity areas of interest are highlighted. A break of 0.7180 and then 0.72 the figure open risk to the counter-trendline and the 61.8% Fibonacci retracement level near 0.7220. This would be expected to be the last area of defence.

- EUR/JPY is trading close to the 130.50 mark following a volatile session dominated by risk-off flows.

- Though the pair did recover from earlier lows in tandem with US stocks, the scope for further downside is high.

EUR/JPY broke to the south of a bullish trend channel on Monday and the following acceleration of technical selling pressure eventually pushed it to lows in the 130.10s from Asia Pacific levels in the 131.20s. But the pair has recovered some posture in recent trade and is back above 130.50, though further gains are for now being stopped by the presence of the 200-day moving average at 130.56. The recovery from earlier session lows in EUR/JPY coincides with a recovery in US equity markets. Though still down on the day by about 0.5%, the Nasdaq 100 was at one point over 2.5% lower.

Spurring the downturn in risk appetite that has seen the safe-haven yen outperform in the G10 space, though USD has also done well, has been concerns about more abrupt Fed tightening. Monday’s rebound from lows, for stocks or for EUR/JPY, should not be taken as an indication that these worries are over. Indeed, investors nervously await US December Consumer Price Inflation data on Wednesday, which is expected to show a further build-up of inflationary pressures and further turn up the heat on the Fed to act this year. There will also be plenty of Fed speak this week, including from Fed Chair Jerome Powell and Fed Vice Chair Lael Brainard, both of whom testify at their respectively nomination confirmation hearings before the Senate.

In other words, there are plenty of potential catalysts to rekindle Fed tightening fears this week, meaning plenty of opportunity for further EUR/JPY downside. Key levels to watch include the psychologcially important 130.00 mark, which also coincides with last week’s lows and an important balance area at 129.60, which also coincides with the 21 and 50-day moving averages. EUR/JPY has so far ignored hawkish comments from influential ECB governing council member Isabel Schnabel over the weekend who talked about how if inflation continues to come in higher than expected, the ECB may have to adjust policy to combat it. Further hawkish ECB speak after last week’s hot inflation numbers could well spur some euro appreciation versus the yen, with no changes expected to BoJ policy for the foreseeable future.

What you need to know on Tuesday, January 11:

The greenback seesawed between gains and losses, unable to find a clear direction and led by US Treasury yields once again. Market players await news about US inflation, as the country will release the final reading of the December Consumer Price Index next Wednesday, and it is expected to have been upwardly revised to 7% YoY.

Meanwhile, US Fed’s head Jerome Powell is due to testify on Tuesday on the renomination to chair the Federal Reserve Board of Governors before Senate Banking Committee. His remarks will likely be released before the event and will be closely watched for any hint on the future of monetary policy.

The EUR/USD pair trades around 1.1330, while GBP/USD hovers in the 1.3570 level, posting modest intraday losses. AUD/USD is unchanged on a daily basis, although USDCAD advanced, with the Canadian Dollar weakening alongside oil. The black gold spent the day under pressure, with WTI settling at $78.10 a barrel.

Gold, on the other hand, managed to recover some ground and trades just above the 1,800 threshold heading into the Asian opening. Nevertheless, its bullish potential remains limited.

The Japanese yen appreciated vs the dollar, with the pair currently trading at around 115.20. The sour tone of global indexes weighed on the pair as European and American indexes closed in the red.

US Treasury yields were up amid inflation-related concerns. The yield on the 10-year note touched 1.80% but currently stands at 1.77%.

Australia will publish November Retail Sales and the Trade Balance for the same month, likely to spur some action in the Asian session.

Like this article? Help us with some feedback by answering this survey:

- USD/CHF surged 0.9% on Monday from under 0.9200 to current levels around 0.9270 and is eyeing December highs near 0.9300.

- The dollar was strong on Monday as market participants revise their Fed calls towards more aggressive hikes in 2022.

- But CHF also weakened substantially in wake of a jump in Swiss sight deposits that could indicate SNB intervention.

USD/CHF hit its highest levels in nearly four weeks on Monday after breaking convincingly above the 0.9250 level for the first time since mid-December. It’s been a broadly decent day for the buck as various banks/analysts revise their Fed forecasts in wake of last week’s hawkish Fed minutes and US December jobs report to expect as many as four rate hikes in 2022. But that doesn’t explain the full extent of the upside on Monday, which has seen USD/CHF surge from opening levels to the south of 0.9200 to current levels around 0.9270, an on-the-day gain of around 0.9%.

That surge has seen USD/CHF break to the north of a bullish trend channel that had been constraining the price action over the past week or so. It also marks a clean break back above the pair’s 21, 50 and 200DMAs, all of which reside between the 0.9160-0.9210 area. Technically speaking, a test of the December high at just under 0.9300 now seems highly likely and if that level is broken, eyes will turn to the next area of resistance around 0.9375, a double top of the September/November highs.

The Swiss franc’s near 1.0% depreciation on the day versus the US dollar means it is by far and away the worst performing G10 currency. Some traders attributed the weakness to weekly Swiss sight deposit data released early during Monday’s European session. Total sight deposits jumped to CHF 724.631B from CHF 722.771B a week earlier, a sign that the SNB may have stepped up its forex interventions to weaken CHF last week.

As noted by analysts at Reuters, “the SNB… has long used foreign currency purchases and negative interest rates as the foundation of its expansive monetary policy… (and) increases to sight deposits - cash which commercial banks store with the central bank overnight - are normally seen as a proxy for foreign currency purchases”. But economists cautioned not to read too much into the data, as it is usual to see lower deposits towards the end of the year before jump in January.

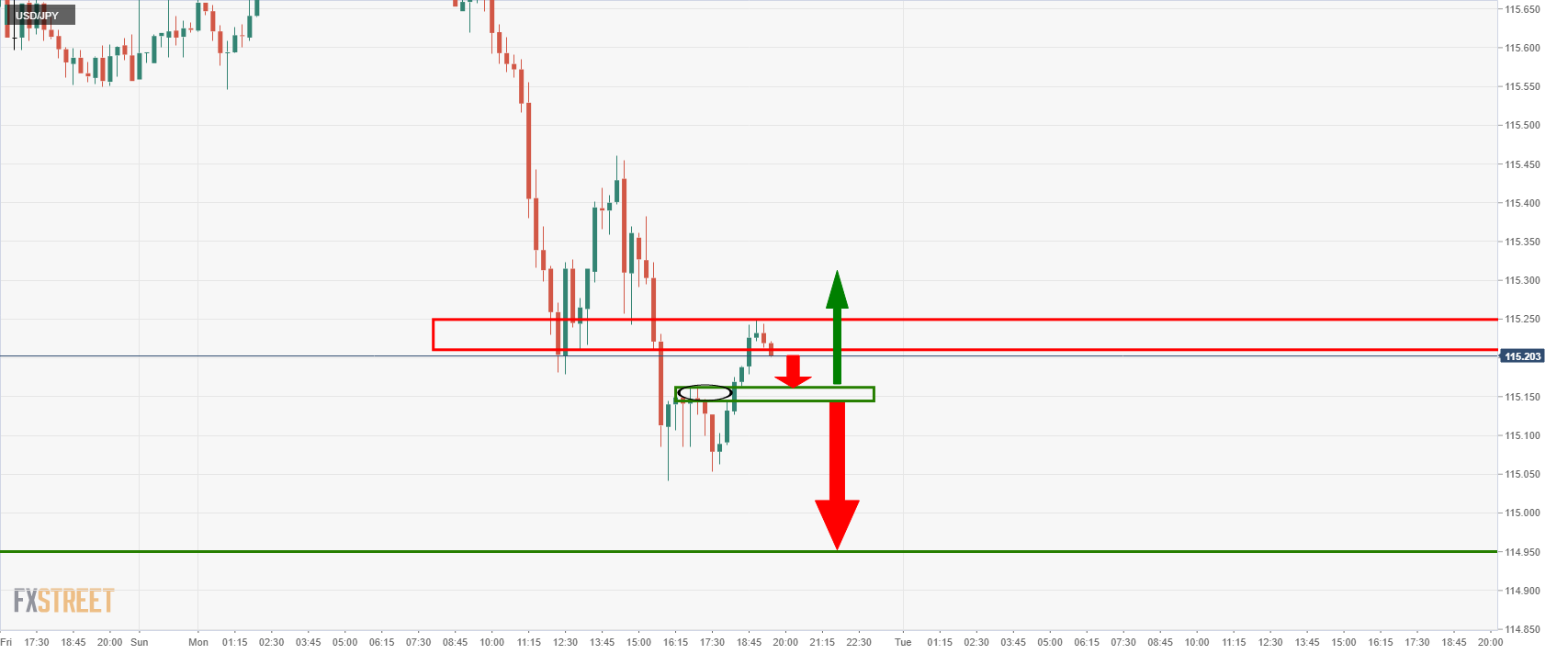

- USD/JPY is under pressure and below daily support.

- Bears eye a test below 115 the figure for the coming session.

The price has been melting in a risk-off environment supporting the yen in the day. The following illustrates the market structure and the prospects of a downside continuation for the session ahead.

USD/JPY daily chart

The daily chart is showing that the price is under pressure with room towards 114.95 given that it has pierced the prior highs and old resistance near 115.50

USD/JPY H1 chart

A break of the current support opens risk into the 114.40s for the near term as per the structure highlighted on the hourly chart above and the 15-min chart below:

The price could be on the verge of a test of the neckline of the 15-min chart's W-formations as illustrated above. If this were to give, then the price would be expected to melt to test and break 115 the figure in the coming session. If on the other hand, the area holds, ten a re-run into 115.25 would be back on the cards. If the bulls engage, then 115.60 will be eyed:

- The euro keeps afloat above the 1.1300 figure, after reaching a daily low at 1.1284.

- High US Treasury yields, and omicron variant woes, spurred demand for safe-haven peers but the euro.

- The EUR/USD formed an ascending wedge that targets the 1.1090-1.1100 region.

The shared currency slides on Monday, trimming Friday’s gains down due to high US Treasury yields a headwind for the EUR/USD, while some companies are warning about the impact of the omicron coronavirus variant. At the time of writing, the EUR/USD is trading at 1.1325.

EUR/USD Price Forecast: Technical outlook

In the overnight session, the pair faced strong resistance at the 50-day moving average around 1.1346, though it was trading above it, slumped from 1.1360s to 1.1284 as the market sentiment worsened. The EUR/USD broke crucial support levels on its way south, like the daily pivot at 1.1338 and the S1 daily pivot at 1.1311.

From the EUR/USD daily chart perspective, the EUR/USD formed an ascending wedge, which has bearish implications, that in the event of breaking downwards, would target 1.1090, though it would face some hurdles on the way down.

The EUR/USD’s first support level is the January 4 daily low at 1.1272. A breach of the latter would expose December 15, 2021, pivot low at 1.1222, followed by the 2021 yearly low at 1.1186, and then the ascending wedge target around the 1.1090-1.1100 area.

On the flip side, to negate the EUR/USD’s downward bias, a clear break above December’s 31, 2021, cycle high at 1.1387 would open the door towards 1.1400, followed by a re-test of a nine-month-old downslope trendline around the 1.1425-50 area.

-637774393608554708.png)

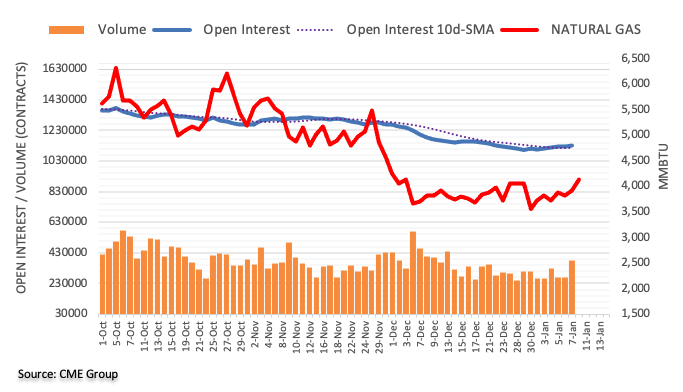

- Gold is a mix of geopolitics, the Fed and Omricon risks.

- Bears are looking for a break of $1,790 for a run to $1,770.

At $1,796, gold is flat for the day despite geopolitical risks back into the limelight, the US yields touching a two-year high and stocks looking into the abyss.

Gold remains in familiar ranges between $1,790.43 and $1,802.37. Traders are balancing an accelerated tapering at the Federal Reserve, which should also give officials the option of raising rates as soon as March, and the acceleration of omicron infections around the world.

Barely a month after its detection in southern Africa, the new Omricon COVID-19 variant was already dominant in countries around the world, with more cases than ever before, potentially making it the fastest spreading studied virus in history.

“It is the most explosive and the fastest-spreading virus in history,” a historian and physician, Anton Erkoreka, who is the director of the Basque Museum of the History of Medicine, said.

However, uncertainty remains over whether it is less serious for unvaccinated people and the immunocompromised. Nevertheless, even with fewer people getting really sick, hospitals are still strained.

Dr. Anthony Fauci, the US top infectious disease expert, recently told ABC News that the country is seeing "almost a vertical increase" in cases and that even a relatively lower rate of hospitalizations could strain already overwhelmed hospitals.

"We have got to be careful about that, because, even if you have a less of a percentage of severity, when you have multi-multi-multi-fold more people getting infected, the net amount is you're still going to get a lot of people that are going to be needing hospitalization," Fauci explained. "And that's the reason why we're concerned about stressing and straining the hospital system."

The same can be said for other market-relevant nations around the world that is likely a weight for global equities and a positive for gold as a safe haven for the foreseeing future.

Meanwhile, as analysts at TD securities explained, Investors had a mixed response to recent hawkish statements from the Federal Reserve and the acceleration of omicron infections around the world.

''On the one hand,'' the analysts said, ''the ever-louder hawkish tone from the Fed has prompted money managers to aggressively reduce long gold exposure, while on the other hand, concerns that a global slowdown due to covid in early-2022 may reduce pressure on central banks to introduce more restrictive policy.''

The latest data from the US, however, suggest that the Fed could be too hawkish in their forecasts. The Nonfarm Payrolls data showed that job growth in the US continues to slow and is now at an 11-month low. The Us dollar responded in kind by sliding in the aftermath of the report. However, it is attempting to recover.

''The fall in the unemployment rate and rise in earnings show inflationary pressures are building rapidly in the labour market,'' analysts at ANZ Bank said at the start of the week, nothing that this is consistent with the Fed tightening "relatively soon". Moreover, the analysts noted that ''Nonfarm Payrolls are still 3.6m shy of the pre-pandemic high, but due to a lack of supply, rather than demand, and that’s only adding to underlying inflation pressures.

Nevertheless, gold has moved slightly higher following the December payrolls report, even as wage inflation was higher-than-expected, which analysts at TD Securities suggest there may be more short-covering to come.

''The ever-louder hawkish tone from the Fed has prompted money managers to aggressively reduce long gold exposure, while on the other hand, concerns that a global slowdown due to covid in early-2022 may reduce pressure on central banks to introduce more restrictive policy and the likely hedging of risk drove specs to cover shorts in a robust way,'' the analysts said in reference to the latest CFTC positioning data.

The analysts argued in a note today that ''central banks will continue to buy gold, while investors are looking to diversify given a higher perceived risk of equity market volatility, suggesting that gold speculators' relative short positioning may still drive the yellow metal into the $1,850s/oz in the early months of 2022.''

In the same vein, US stocks have slumped at the start of this week, extending declines from last. The velocity of a recent surge in government bond yields unnerved investors.

The Nasdaq Composite has been leading the way and has sank to a low of 15,165.53 today. The index is currently down 1.6% but of its lows. The S&P 500 was down 1.2% and the Dow Jones Industrial Average is 1% lower at the time of writing, with both index also recovering from their lows of the day. All sectors were in the red on an intraday basis. Meanwhile, The 10-year US Treasury yield rose to 1.808% intraday, touching its highest intraday level since January 2020. The 10-year yield, which ended last year at 1.52%, surged to about 1.76% by the end of last week, a 24 basis-point jump in just five days.

Gold could be supported on geopolitical risks

Meanwhile, Kazakhstan is a risk for the commodity complex. The central Asian country is the world's biggest uranium exporter and is among the top oil and coal producers. The resource-rich state has seen some of the biggest public protests in years, unnerving energy amongst other commodity markets.

Days of unrest — set-off initially by a rise in fuel prices and eventually turning into an uprising against corruption and nepotism — prompted President Kassym-Jomart Tokayev to declare a state of emergency.

The demonstrations and the subsequent crackdown in the world's top uranium exporter and a major oil and gas producer have left investors anxious which could help support gold as a safe haven.

Gold technical analysis

There is a downside bias on the daily chart as per the head and shoulders taking shape.

A break and retest of $1,790 4-hour support structure would be expected to lead to a downside continuation putting $1,770 on the map:

- Silver edges higher for the second consecutive day, up some 0.72%.

- Goldman Sachs and Deutsche Bank estimate four rate hikes in 2022, while JP Morgan brought forward its first hike to March.

- XAG/USD is downward biased as the 50-DMA crossed under the 100-DMA, spurring a $1.00 drop.

Silver (XAG/USD) advances during the New York session, despite the greenback rising firmly in the session, trading at $22.47 at the time of writing. Risk-appetite conditions remained dampened since the European session, spurred by expectations of higher rates as investors assess the last US employment report. Additionally, Goldman Sachs revealed that they expect four Federal Reserve rate hikes.

Some commercial banks expect four Fed hikes in the year

In the European session, a report emerged that Goldman Sachs, the North American investment bank, expects four hikes to the Federal Funds Rate. Also, the bank noted that the US central bank would begin reducing its balance sheet by July of 2022, if not earlier.

On Friday, JP Morgan brought forward the first rate hike from June to the March 2022 meeting. In the meantime, Deutsche Bank said it expects four increases to the Federal Funds rate (FFR) after the Nonfarm Payrolls report.

In the last week, FOMC’s December meeting minutes revealed that the Federal Reserve is ready to raise rates and discussed the possibility of reducing its $8 Trillion balance sheet that could begin as soon as the US central bank began raising rates.

In the meantime, in the bond market, the US 10-year benchmark note rises almost two basis points, up at 1.789%, a tailwind for the US Dollar Index, which advances some 0.40%, sitting at 96.15 at press time.

Market participants’ attention turns to US inflation data and the testimony of Federal Reserve policymakers Jerome Powell and Lael Brainard against the US Senate Banking Commission this week for more clues regarding the speed of monetary policy normalization.

XAG/USD Price Forecast: Technical outlook

Spot silver has a neutral-downward bias. The 50-day moving average (DMA) crossed under the 100-DMA on January 5, a bearish signal that propelled the white metal from $23.25 down to $22.00, a $1.00 fall.

On the downside, XAG/USD’s first support would be the January 7 daily low at $21.96. A breach of the latter exposes October 20, 2021, a daily low at $21.83, followed by December 15, 2021, a cycle low at $21.43.

- EUR/GBP has rebounded back above 0.8350 in recent trade and is flat on the day after hitting multi-year lows earlier.

- Many FX strategists continue to favour a lower EUR/GBP with the BoE/ECB policy divergence expected to widen further.

After hitting its lowest level since February 2020 earlier in the session at 0.8332 and, in doing so, marginally eclipsing the multi-year low it set last week at 0.8333, EUR/GBP has since rebounded back to the north of the 0.8350 level. As things stand, the pair is now back to trading flat on the day in the 0.8350s, with the bears likely to eye any retest of last week’s highs in the 0.8370 area as an opportunity to reload on short positions.

Indeed, shorting EUR/GBP has been a profitable strategy in recent weeks. Since 20 December, the pair has reversed more than 2.0% lower from around the 0.8550 mark, mainly as a result of fears surrounding the impact of the Omicron variant on the European and global economy subsiding. That’s evidence really started to compound in the week starting on 20 December that the new variant is far milder than anything seen before, resulting in the UK and other governments opting against lockdowns.

But sterling’s recent strength against the euro also likely reflects growing expectations of central bank divergence between the ECB and BoE. The UK government’s decision not to lockdown has kept the prospect of a second post-pandemic BoE rate hike in February alive. By contrast, the main debate at the ECB is currently about the appropriateness of its inflation forecast. Most recently, influential governing council member Isabel Schnabel said the ECB would need to act to curb inflation if it continued to surprise on the upside, joining a throng of others to espouse a similar view.

That implies that if the ECB is forced to upgrade its 2023 inflation forecast to substantially above 2.0% from its current 1.8%, then perhaps the central bank may axe its QE buying in 2022 and start tentatively hiking in 2023. Compare that to the BoE, which is seen implementing multiple rate hikes over the same timeframe to likely get the bank rate above 1.0%. The wide and growing divergence is one key reason why many FX strategists remain bearish on EUR/GBP and target an eventual retest of the late 2019/early 2020 lows under 0.8300.

- AUD/JPY fell below last week’s lows and its 200DMA in the 82.60s and is now under 82.50.

- The pair has been moving lower to reflect the continued downturn in US equity markets driven by Fed tightening fears.

- AUD traders will be watching November Australian Retail Sales data and how the Aussie Omicron outbreak develops this week.

As US equity markets continue where they left off with things last week by tumbling at the start of this week, risk-sensitive currencies have also been taking a hit. As a result, AUD/JPY, a particularly risk-sensitive currency pair given the AUD’s high beta to risk appetite versus the yen’s appeal as a safe-haven asset, has dipped below a key area of support in the 82.60s on Monday. The pair has now even dipped below the 82.50 mark, though the losses are for now being contained as the 21 and 50-day moving averages in the 82.43-82.48 area offer support.

But AUD/JPY’s tumble back from earlier session highs in the 83.30s saw it fall beneath its 200-day moving average at 82.65, which coincided with last week’s lows, a far more significant area of support to break. Should the 82.50 area, which has been an important zone of market balance in recent weeks, break, then AUD/JPY may well continue lower. Given a lack of notable areas of support to the immediate downside, short-term bearish speculators may bet on a drop all the way to test mid-December lows in the 80.50 area.

The main fundamental catalyst for Monday’s downturn in the pair, and more broadly in the market’s appetite for risk, are fears about Fed tightening and the impact on the US equity space. These fears may well be exaccerbated with a number of key Fed speaks on deck this week (including the Fed Chairman and Vice Chairwoman), as well as if Wednesday’s release of the December Consumer Price Inflation report comes in as hot as expected. That suggests downside risks for AUD/JPY.

Aussie fundamentals will also be a driver. Australian November Retail Sales figures are out on Tuesday and should show a continued decent pace of recovery from the recent lockdown induced contraction earlier in the year. But the latest numbers pertain to a time before Australia experiences its first (Omicron driver) serious Covid-19 outbreak, which has been accelerating since December. Wells Fargo note “the latest increase in cases has not seen any imposition of widespread restrictions so far, and we believe Australia remains on course for respectable economic growth this year”, while Credit Agricole notes that “if Australia’s omicron wave were to follow the South African pattern of cresting and coming off quickly, this would be a positive for the currency (AUD)”. Either way, it's an important theme for AUD traders to keep an eye on.

- The British pound falls in tandem with risk-sensitive currencies as market mood conditions dampen.

- The Japanese yen is the strongest currency of the day.

- GBP/JPY has an upward bias; despite falling 100-pips on the day, GBP bulls showed around the 156.00 figure.

On Monday, the British pound plunges against the safe-haven Japanese yen, on a risk-off market mood, spurred by expectations of higher rates in the US and worldwide inflationary pressures. Equity indices record losses between 1.39% and 2.44% in the US, while the Japanese yen gain against most G8 currencies. At the time of writing, the GBP/JPY is trading at 156.13.

In the overnight session for North American traders, the GBP/JPY pair was subdued in the 157.00-40 range. However, a break of an upslope trendline amid dampened market conditions spurred a 100-pip drop from 157.00 to 156.00, which fulfilled the Average Daily Range (ADR) of the cross-currency for the last ten days, of 98 pips.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY pair is upward biased. The daily moving averages (DMAs) reside below the spot price, but the high reached on January 5 at 157.76, short of October 20, 2021, daily high at 158.22, exposed the pair to downward pressure, leaving it at the mercy of the market mood.

To the upside, the first resistance level would be the 200-hour simple moving average (SMA) at 156.20. A decisive break above that level would expose the S2 daily pivot at 156.47, followed by the S1 daily pivot at 156.76.

On the downside, the first support would be the psychological 156.00 figure which almost intersects with the S3 daily pivot at 155.97. A breach of the latter would expose the January 4 daily low at 155.34. and then the January 3 daily low at 154.90.

-637774292448187618.png)

Uncertainties around Brexit remain but the influence on the exchange rate will diminish further according to analysts at MUFG Bank They forecast GBP/USD at 1.3170 by the end of the first quarter and at 1.3730 by the third. Regarding the EUR/GBP they forecast at 0.8350 by the end of Q1 and at 0.8300 by Q3.

Key Quotes:

“The pound was the second best performing G10 currency in 2021 which we believe in part reflects some catch-up after being the third worst performing G10 currency in 2020. The global lead in covid vaccinations played an important role in GBP performance over the whole year.”

“Like with a number of other G10 countries, the OIS market pricing for rate hikes this year looks excessive to us. At the time of writing, the 1-year forward OIS implies close to 100bps of monetary tightening. After the annual CPI jump in November to 5.1%, the BoE acknowledged in its December statement when it raised rates that inflation would hit 5.0% through the winter months and peak at about 6.0% in April, reflecting the jump in utility bills. But under this scenario, the MPC guidance in December was that further “modest tightening” of monetary policy would be required. We do not view what is priced in the OIS market over the next 12mths as modest and we suspect at some stage in the coming months, the markets will pare back monetary tightening expectations.”

“This paring back of rate hike expectations will see GBP underperform versus the US dollar before gains materialise in the second half of the year. By then we assume the uncertainty over the Northern Ireland protocol will have been resolved. There is of course a risk that this issue escalates again and undermines GBP performance but we suspect each passing year will see less and less impact in FX from Brexit uncertainties. Problems related to the rising cost of living at a time of rising taxation will dominate the political landscape this year.”

“We are maintaining our profile of GBP underperformance initially versus the US dollar before recovery takes hold later in the year. The BoE signalling greater caution perhaps following a Feb rate hike will curtail GBP strength over the near-term.”

- NZD/USD recently slipped back to the 0.6750 level as the dollar picks up amid safe-haven flows.

- The kiwi and other risk-sensitive currencies are performing poorly as equities tumble amid Fed tightening fears.

NZD/USD has dipped back to the 0.6750 level in recent trade and has recently been probing last week’s lows in the 0.6740 area. At present, the pair trades with losses of about 0.5%, worse than that of its antipodean counterpart, but roughly in line with that being seen in other USD majors. Having failed in its early European session attempts to test its 21-day moving average in the 0.6780s, NZD/USD has come under selling pressure as markets adopt a more risk-off posture during US trade. Further risk-off induced USD strength may see the pair break lower towards a test of December lows in the 0.6700 area.

The yen and US dollar are the best performing G10 currencies amid a safe-haven bid as Wall Street continues to crater. Notably, the Nasdaq 100 index recently fell more than 10% back from its recent record highs, classing the latest downturn for the big-tech heavy index as a “correction”. This is undermining the appeal of risk-sensitive currencies such as the kiwi. The main driver of risk-off at the start of the new week appears to be fears regarding a faster pace of Fed monetary policy normalisation this year.

Risk appetite has been ropey since last week’s hawkish Fed minutes that showed strong support on the FOMC for the Fed to get going with rate hikes and balance sheet reduction in 2022. Last Friday’s strong US labour market report, strong in the sense that wage inflation picked up and measures of slack (such as the unemployment rate) improved more than expected, at least, is being viewed as endorsing the Fed’s newer, more hawkish mantra. US Consumer Price Inflation (CPI) data on Wednesday is expected to do the same, as it is likely to show headline inflation surpassing 7.0% YoY.

Fed Chair Jerome Powell will be speaking on Tuesday and Vice Chairwoman Lael Brainard on Thursday at their respective nomination confirmation hearings. These remarks will be the highlights as far as Fed rhetoric is concerned this week, though other FOMC members will also be orating. There is also the (not so) small matter of the US December Retail Sales report on Friday and the preliminary January University of Michigan Consumer Sentiment survey, with the latter a timely gauge on the economic impact of the spread of Omicron. Risk appetite and USD flows will be the dominant force for NZD/USD this week, with New Zealand Building Consents data on Thursday unlikely to receive much market attention.

Analysts at MUFG Bank, forecast the USD/INR pair at 74.00 by the end of the first quarter, at 73.50 by the third quarter and at 74.00 by the end of the year.

Key Quotes:

“The Indian rupee’s 1.7% drop against the US dollar in 2021 was one of the least amongst Asia ex-Japan currencies. This is despite the US dollar heft and swing in the current account to an estimated deficit at 0.8% of GDP in 2021 from 2020’s surplus at 1.3% of GDP. The rupee’s resilience underscores the impact from substantial capital flows mainly driven by a record amount of funds raised via IPOs in 2021. This is a key factor that would continue to keep the rupee supported even in the midst of US dollar strength in Q1 as a few blockbuster IPOs are in the pipeline. This is in addition to the potential inclusion of Indian government bonds into a few global bond indices for the first time, with the announcement expected in Q1.”

“Passive inflows into Indian government bonds due to the inclusion are estimated to be at least USD40bn, concentrated in 1H22. This will lend further support to the rupee. But when those inflows start to taper and IPO activity moderates, we expect the rupee to be back on a structural depreciation trend in 2H22 driven in part by the deterioration of India’s current account deeper into negative territory. This is in view of the widening of trade deficits as imports increase amid ongoing recovery in private consumption.”

Analysts at the National Bank of Canada point out that despite the uncertainty created by the latest COVID variant, they remain comfortable with their current forecast of USD/CAD pair at 1.20 in 2022.

Key Quotes:

“We still expect the loonie to appreciate further in the coming months. For one, global manufacturing production continues to expand at a relatively brisk pace.”

“Rising commodity prices, a current account surplus, a strong labour market and positive interest rate differentials argue for an appreciation of the Canadian dollar. According to our model, the CAD remains significantly undervalued against the greenback

“Despite the uncertainty created by the latest COVID variant, we remain comfortable with our current forecast of a C$1.20 rate for the US dollar in 2022.”

The Euro is set to grind lower for now, according to analysts at MUFG Bank. They point out the European Central Bank view inflation riks different to elsewhere. Their forecast is for EUR/USD to drop to 1.10 by the end for the first quarter and to recovery to 1.14 by the third quarter.

Key Quotes:

“Omicron looks set to be more disruptive in Europe than in the US and hence the ECB monetary stance will continue to be viewed as well behind that of the Fed. EUR/USD did bounce in December but we view this as reflective of positioning liquidation and a seasonal bias that favours EUR in December. Q1, and January in particular, tends to be the worst seasonal period for EUR and we expect EUR/USD to fall and possibly breach the 1.1000 level through the course of Q1 and into Q2.”

“While the ECB policy stance is set to weigh on EUR, the macro backdrop should limit the downside. At the end of December Italy passed a EUR 32bn spending plan that includes tax cuts while the EU Recovery Fund impact should be seen more widely across the EU this year. Furthermore, while there is likely to be some uncertainty related to the French presidential election in April, the polling data suggests a reduce risk of any surprise defeat for President Macron. While EUR/USD could hit 1.1000 or below over the coming months, more positive factors and ECB liquidity withdrawal should see EUR/USD rebound in H2 to our year-end target of 1.1600.”

- The S&P 500 has dipped under 4600 and is down another more than 1.5% as the equity downturn continues.

- Concerns about Fed tightening and higher US bond yields continue to be the main driver of the selling.

The equity bears have picked up where they left off with things last week, with US equity markets back under severe selling pressure on Monday shortly after the US open. The S&P 500 index, the futures of which were trading about 0.5% lower in pre-market trade, has accelerated to the downside in recent trade. The index recently dipped below the 4600 level. Bears will be looking for a test of the late-December lows in the 4530s and below that a test of the early December lows at 4500.

There hasn’t been much by way of fresh fundamentals to drive the downside, which instead seems driven by a continuation of some of the bearish themes that were at play last week. Chief among them is concern about an accelerated pace of Fed monetary tightening in 2020 that was initially triggered in wake of last week’s Fed minutes – recall that the minutes showed that FOMC participants agreed that rate hikes would soon be warranted to combat inflation so long as the labour market continues to tighten and progress.

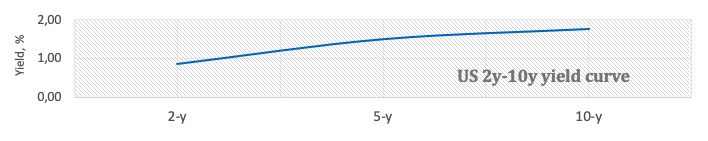

Last Friday’s December US jobs report showed that it did both of those things, with a further 200K jobs added and the unemployment rate dropping under 4.0% for the first time since onset of the pandemic. Thus, the report has been widely interpreted as endorsing a potential Fed rate hike as soon as March and a prompt start to quantitative tightening soon thereafter and a chorus of institutions/analysts have been publically revising their Fed policy calls in a more hawkish direction. Long-term bond yields continue to march higher, with the US 10-year above the key 1.80% level, which once cleared should open the door to a run at 2.0%.

Higher long-term yields are having their usual impact on different equity sectors, with growth/big-tech stocks underperforming amid their greater sensitivity to higher opportunity cost that higher yields represent. The tech-heavy Nasdaq 100 is down over 2.0% and has now cratered below December lows in the 15.5K area to trade in the 15.2K area. Value/cyclical stocks that have a tighter correlation to the economy’s underlying performance and tend to perform better in an environment of rising rates are holding up better. The Dow, which has a higher weighting towards these sectors, is by comparison down under 1.5% and trade close to 35.75K after it lost the 36.0K level shortly after the open.

The Fed tightening story will receive further inputs this week with a heavy slate of Fedspeak on the calendar, including nomination hearings for Fed Chair Jerome Powell and Vice-Chair Lael Brainard. Meanwhile, what analysts expect to be a very hot December US Consumer Price Inflation report on Wednesday is likely to increase the inflation discomfort being felt at the Fed ahead of its 26 January meeting. If the net result of all this is a further increase in hawkish Fed bets coupled with further upside in US bond yields, that would likely mean that Monday’s equity market downside is just the beginning of what could be a very rough week. Dip buying has been a profitable strategy in the post-pandemic world, but its future reliability is in serious doubt as the Fed removes the monetary coolaid so supportive of equities in recent years.

- Risk-sensitive currencies edge lower in the North American session.

- Goldman Sachs expects four Fed hikes in 2022, per Reuters.

- AUD/USD is downward biased, retreated from an upslope support-trendline turned resistance.

The Australian dollar slides as the North American session begins, in a risk-off-dominated session, as portrayed by US equity futures indices, point towards a lower open. In the meantime, the AUD/USD is trading at 0.7154 at the time of writing.

Some market participants and a US Bank expects four Fed hikes in 2022

In the mid-European session, a report said that Goldman Sachs, the North American investment bank, expects four hikes to the Federal Funds Rate. Also, the bank noted that the US central bank would begin reducing its balance sheet by July of 2022, if not earlier.

That comes as the last Federal Reserve minutes said that the central bank is ready to hike rates and would also begin the Quantitative Tightening (QT), as it scrambles to drag inflation lower from close to 7%. According to the minutes, the balance-sheet reduction would probably kick-in in tandem with the Fed first-rate hike.

Meanwhile, the market mood environment benefits the safe-haven peers, like the US dollar. The US Dollar Index, which tracks the greenback’s value against its peers, advances firmly 0.45%, sitting at 96.15.

In the bond market, the US !0-year Treasury yield, one of the barometer’s for inflation, sits at 1.806%, a tailwind for the greenback, to the detriment of the risk-sensitive Australian dollar.

At press time, the US economic docket featured Wholesale Inventories for November on a monthly basis, up some 1.4%, higher than the 1.2% estimated but short of October’s reading at 2.5%.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is downward biased. The daily moving averages (DMAs) reside above the spot price, with the 50-DMA with a bearish slope. Also, the AUD/USD broke below an upslope trendline drawn in December 2021 lows in the last two trading days.

In the overnight session, the AUD/USD daily high was around 0.7200s, testing the previous-mentioned trendline to retreat towards the 0.7150s price level amid dampening market conditions.

On the downside, the AUD/USD first support would be the January 7 daily low at 0.7130. A breach of the latter would expose the December 20, 2021, pivot low at 0.7082, followed by the December 3, 2021, cycle low at 0.6993.

- US dollar gains momentum as market sentiment deteriorates.

- DXY up 0.40%, US 10-year yields back at 1.80%.

- GBP/USD is still bullish but facing strong resistance at 1.3600.

The GBP/USD dropped further from above 1.3600 and printed a fresh daily low at 1.3531. It remains near the lows, under pressure amid a stronger US dollar across the board.

The greenback benefit from deterioration in market sentiment and higher US yields. The Dow Jones is falling 1.40% and the Nasdaq tumbles 2.23%. Treasury bonds are not being helped from the risk aversion tone. With US yields holding near recent highs, DXY rose further. The index gains 0.40% and trades at 96.10.

Technical outlook

“GBP/USD is trading in an uptrend, benefiting from upside momentum on the daily chart and surpassing the 50 and 100-day SMAs on its way up. For the scenario of a fall in the next month to materialize, it would need to break below this uptrend support line. Horizontally, 1.3480, 1.3430, and critically 1.3380 provide support. Further below, 1.3280 and 1.32 are eyed, before the December trough of 1.3175”, said Yohay Elam, Analyst at FXStreet.

On the upside, GBP/USD could face immediate resistance at 1.3565. Above the critical level continues to be the 1.3600 area. A consolidation above is needed to open the doors to more gains.

Technical levels

- USD/TRY posts modest gains and eyes a test of 14.0000.

- The pair looks side-lined between 13.00 and 14.00 so far.

- Turkey’s Unemployment Rate remained at 11.2% in November.

The Turkish lira depreciates further and pushes USD/TRY back to the proximity of the 14.00 hurdle at the beginning of the trading week.

USD/TRY stays capped by 14.00… for now

USD/TRY resumes the upside albeit at a slow pace on Monday, managing at the same time to leave behind Friday’s inconclusive price action.

Despite starting the new year on a positive footing, the lira quickly returned to the normality and depreciated to the vicinity of the 14.00 mark vs. the US dollar in the subsequent sessions, in the usual context of heightened fragility and uncertainty surrounding the next steps of the Turkish central bank, at a time when politics could intensify its pressure on the monetary policy.

Indeed, investors’ attention could shift to the political scenario, where speculation of earlier presidential and parliamentary elections (originally due in late June 2023) seems to have picked up pace against the backdrop of latest poll results showing support to President Erdogan diminished somewhat.

In the domestic calendar, Turkey’s jobless rate stayed unchanged at 11.2% in November, while the employment rate improved a bit to 46.6% in the same period.

What to look for around TRY

The ongoing recovery in the pair seems to have met an initial tough resistance in the 14.00 area so far. The higher-than-expected inflation figures released at the beginning of the year put the lira under extra pressure in combination with some cracks in the confidence among Turks regarding the government’s recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under intense pressure for the time being.

Key events in Turkey this week: Unemployment Rate (Monday) - Current Account (Tuesday) - Industrial Production (Thursday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.33% at 13.8620 and a drop below 12.7523 (weekly low Jan.3) would pave the way for a test of 12.0478 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (YTD high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- EUR/USD has dipped back under 1.1300 and is now below its pre-US jobs data levels from last Friday.

- Hawkish remarks from ECB’s Schnabel in wake of last Friday’s hot Eurozone inflation have been ignored.

- FX markets remain primarily focussed on incoming US data and the Fed right now.

EUR/USD has on Monday returned back to or even slightly below its pre-US labour market data levels where it traded last Friday and has in recent trade dipped under the 1.1300 handle. To recap, the latest US labour market report revealed a weaker than expected headline payroll gain in December but stronger than expected measures of economic slack and wage growth in December. In the wake of the report – and despite the near-unanimous interpretation by analysts that it endorses the emergent Fed stance that accelerated monetary tightening in 2022 is warranted – EUR/USD broke to the north of a short-term pennant structure and went as high as 1.1360 (from previously just above 1.1300).

Whilst technical buying and dollar-profit taking were attributed as behind the pair’s post-jobs data bounce, analysts at the time warned that the move went against recent fundamental developments. Indeed, last week’s sharp surge in US government bond yields as markets price in a more aggressive Fed tightening cycle (that includes quantitative tightening to commence this year) points to a stronger, not weaker dollar. EUR/USD trade on Monday now seems to be corroborating that view. Strategists are warning that the USD’s recovery against the euro may be set to continue this week amid an incoming chorus of Fedspeak which will likely back up the hawkishness of last week’s minutes, as well as December Consumer Price Inflation.

Ahead of the release of the CPI report on Wednesday – which is expected to show inflationary pressures continued to heat up at the end of 2022, pushing headline CPI above 7.0% YoY – a chorus of analysts have been bringing forward Fed tightening bets. The December labour market report “was consistent with the Fed's evolving view that the labour market is getting close to or is already at maximum employment with wage pressures building” analysts at NatWest Markets remarked. “This should add to speculation about a March hike, and we have pulled our expectation for the Fed's lift-off to occur in March instead of June,” analysts at the bank added, whilst Goldman Sachs announced that they now expect four 25bps rate hikes in 2022 versus their previous forecast for three. “The Fed is likely to feel the pressure from this early additional price pressure and feel compelled to start the hiking cycle even as soon as the March meeting,” said an analyst at RBC Capital Markets.

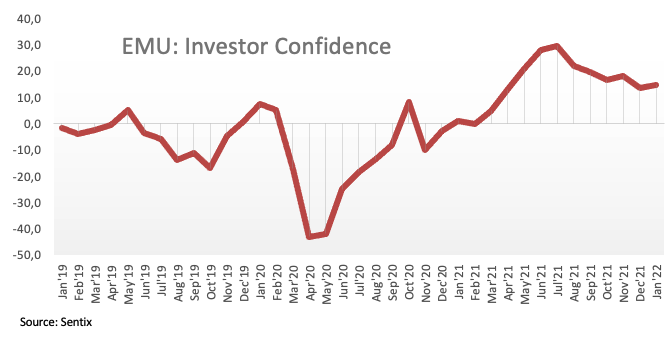

With the focus primarily on US data and the Fed this week, FX markets seem to be ignoring developments that increasingly point to an increasingly hawkish ECB. In the wake of last Friday’s hotter than expected Eurozone HICP inflation numbers, influential ECB governor Isabel Schnabel was on the wires over the weekend echoing some of the rhetoric that up until only very recently was only espoused by the central bank’s hawks. Schnabel said that rising energy prices may force the ECB to stop “looking through” elevated inflation and instead act to temper it, particularly if the green transition proves more inflationary than expected. Elsewhere, the EU Sentix Index for January was out on Monday and showed a surprise improvement, indicative of expectations amongst Eurozone investors that Omicron will not inflict lasting economic damage.

- EUR/USD starts the week deep into the red territory.

- Further downside opens the door to a retest of 1.1270.

EUR/USD fades Friday’s strong advance and returns to the sub-1.1300 area at the beginning of the week.

The lack of a firm direction in either way should prompt the pair to maintain the current consolidative move, at least in the very near term. The initial up barrier is located past the 1.1380 level (January 3), while sellers should meet contention near 1.1270 (January 4).

The broader negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1740.

EUR/USD daily chart

- DXY regains composure and advances above 96.00.

- The next target of note is seen at the 96.50 region.

DXY manages to regain the smile and reclaim the 96.00 barrier and above at the beginning of the week.

In case the buying pressure regains conviction, then the next hurdle of relevance should come at the so far YTD high at 96.46 (January 4) ahead of December’s high at 96.90 (December 15).

In the meantime, while above the 4-month support line (off September’s low) around 95.00, further gains in DXY are likely. Looking at the broader picture, the longer-term positive stance remains unchanged above the 200-day SMA at 93.07.

DXY daily chart

- Resurgent USD demand pushed USD/CHF to a near three-week high on Monday.

- Hawkish Fed expectations, elevated US bond yields extended support to the USD.

- The cautious mood could underpin the safe-haven CHF and cap gains for the pair.

The USD/CHF pair added to its strong intraday gains and shot to a nearly three-week high, around mid-0.9200s during the early North American session.

Following Friday's post-NFP retracement slide, the USD/CHF pair caught fresh bids on the first day of a new week and was supported by a strong pickup in the US dollar demand. As investors looked past the mixed US monthly jobs report, the greenback made a solid comeback amid elevated US Treasury bond yields.

In fact, the yield on the benchmark 10-year US government bond shot to the 1.80% threshold amid the prospects for a faster policy tightening by the Fed. The money markets have fully priced in the possibility of an eventual Fed lift-off in March and are anticipating four interest rate hikes by the end of 2022.

The strong intraday move up could further be attributed to some technical buying above the 0.9230 resistance zone. A subsequent strength beyond a strong horizontal zone, around the 0.9250 supply zone, will be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move.

Meanwhile, an extended selloff in the US bond markets tempered investors' appetite for perceived riskier assets, which was evident from the cautious mood around the equity markets. This could undermine the safe-haven Swiss franc and cap the USD/CHF pair amid absent relevant economic releases from the US.

Investors might also prefer to wait on the sidelines ahead of this week's key event/data risks, starting with Fed Chair Jerome Powell's testimony on Tuesday. Apart from this, traders will also take cues from the release of the latest US consumer inflation figures on Wednesday and the US monthly Retail Sales data on Friday.

Technical levels to watch

Economist at UOB Group Enrico Tanuwidjaja reviews the latest FX reserves figures in Indonesia.

Key Takeaways

“Indonesia’s foreign exchange reserves decreased to USD144.9bn in December 2021; down by USD1.0bn from the previous month.”

“The decrease of reserve assets in December was attributable to the repayment of the government’s external debt.”

“Bank Indonesia views that the official reserve assets will remain adequate with several responsive policies to support long-term economic recovery.”

- EUR/JPY resumes the downside and breaches 131.00.

- Further decline exposes a test of the 130.00 zone.

EUR/JPY posts moderate losses and return to the sub-131.00 area at the beginning of the week.

Sellers seem to have regained the upper hand and now push the cross below the key 200-day SMA, today at 130.52. Extra losses now seem likely, with the initial target at the monthly low at 130.04 (January 3) ahead of the temporary contention at the 100-day SMA at 129.92.

While below the 200-day SMA the near-term outlook for EUR/JPY should remain negative.

EUR/JPY daily chart

- Gold is subdued just under the $1795 mark, having failed to rally above the 21 and 50DMA and $1800 level.

- XAU/USD is at risk of incurring further losses this week if US data and Fedspeak ignite further hawkish Fed bets.

The fact that spot gold (XAU/USD) has thus far this Monday failed to sustain attempts at breaking to the north of its 21 and 200-day moving averages, both of which sit between the $1798 and $1800 levels, may prove a bearish signal. The precious metal was battered last week as US real and nominal yields surged in the lead up to and aftermath of a resoundingly hawkish Fed minutes release, with spot prices cratering from highs at $1830 to under the big figure. For now, the precious metal is content to trade in the mid to low $1790s and at current levels just under $1795 it only trades lower by about 0.1% on the day. Lackluster trading conditions in the spot gold market reflect subdued trading conditions in US bond markets and the fact that though the US dollar is firmer on the day, it continues to trade well within recent ranges and well below recent highs.

But market strategists have been warning of the very real risk that hawkish Fed vibes return as the dominant market driver again this week, meaning upside risks to US real yields and the US dollar (and downside risks for gold). Wednesday sees the release of the December US Consumer Price Inflation report which will probably see headline inflation go above 7.0% YoY and Core inflation move above 5.0% YoY. That, coupled with last Friday’s December labour market report which showed further declines in the unemployment rate, further hotting up of wage growth and improvement in other measures of slack, out to strengthen the Fed’s conviction that prompt monetary tightening in 2022 is appropriate.

Fed members including Fed Chair Jerome Powell and Vice-Chair Lael Brainard will have the opportunity to orate this week and react to the latest labour market report. Powell and Brainard will be speaking at their nomination confirmation hearings on Tuesday and Thursday respectively. Other US data worth watching include the December Retail Sales report and the University of Michigan’s preliminary January Consumer Sentiment survey, both out on Friday. Ultimately, if the dollar can regain some composure and rally above 2021 highs (which are around 97.00 for the DXY) and if US real yields can continue their recent push back towards zero, this signals further losses for gold. Key levels of near-term support to watch are the December $1750 low and the September lows just above $1720.

- A combination of supporting factors assisted USD/CAD to reverse an early dip to a one-month low.

- Retreating oil prices undermined the loonie and remained supportive amid resurgent USD demand.

The USD/CAD pair rallied over 50 pips from over one-month low touched during the mid-European session and jumped to the 1.2665 region, or a fresh daily high in the last hour.

Having shown some resilience below the 100-day SMA, the USD/CAD pair staged a goodish intraday bounce from the 1.2610 region on Monday and was supported by a combination of factors. Crude oil prices edged lower for the second successive day and moved further away from a near two-month high touched on Friday. This, in turn, undermined the commodity-linked loonie and acted as a tailwind for the major amid a strong pickup in the US dollar demand.

The greenback made a solid comeback on the first day of a new week amid elevated US Treasury bond yields, bolstered by the prospects for a faster policy tightening by the Fed. In fact, the money markets have fully priced in the possibility of an eventual lift-off in March and anticipate four interest rate hikes by the end of 2022. This, in turn, continued pushing the US Treasury bond yields higher and extended some support to the greenback.

Meanwhile, a prolonged sell-off in the US bond markets tempered investors' appetite for perceived riskier assets, which was evident from the prevalent cautious mood around the equity markets. This was seen as another factor that benefitted the greenback's relative safe-haven status and provided an additional boost to the USD/CAD pair. It, however, remains to be seen if bulls are able to capitalize on the move amid absent relevant fundamental catalyst.

Moreover, investors might also refrain from placing aggressive bets and wait on the sidelines ahead of this week's important event/data risks, starting with Fed Chair Jerome Powell's testimony on Tuesday. This will be followed by the US consumer inflation figures on Wednesday and the US monthly Retail Sales data on Friday. Apart from this, the US bond yields will influence the USD, which along with oil price dynamics would provide a fresh impetus to the USD/CAD pair.

Technical levels to watch

- USD/JPY turned lower for the fourth successive day and dropped to a one-week low on Monday.

- The prevalent cautious mood benefitted the safe-haven JPY and exerted some downward pressure.

- A strong pickup in the USD demand did little to impress bulls or stall the ongoing corrective slide.

The USD/JPY pair dropped to a one-week low during the mid-European session, with bears now eyeing a move to challenge the key 115.00 psychological mark.

The pair struggled to capitalize on its intraday move up, instead met with a fresh supply near the 115.85 region and turned lower for the fourth successive day on Monday. The downfall dragged the USD/JPY pair further away from a five-year high touched last week and was sponsored by reviving demand for the safe-haven Japanese yen.

The US Treasury bond yields prolonged their recent strong move up amid growing acceptance for an eventual Fed lift-off in March 2022. The market bets were reaffirmed by Friday's release of the US jobs report, which highlighted a tight labour market and pushed the yield on the benchmark 10-year US government bond to a two-year high.

An extended sell-off in the US bond markets weighed on investors' sentiment, which was evident from a cautious mood around the equity markets. This, in turn, forced investors to take refuge in traditional safe-haven currencies, including the JPY, which was seen as a key factor that exerted some downward pressure on the USD/JPY pair.

Meanwhile, the downtick seemed rather unaffected by a strong pickup in the US dollar demand, bolstered by elevated US bond yields. It, however, remains to be seen if the ongoing corrective pullback marks the end of a one-month-old up-trend or attract fresh buying at lower levels amid absent relevant market-moving macro data from the US.

Market participants now look forward to Fed Chair Jerome Powell's testimony on Tuesday. This will be followed by the latest US consumer inflation figures on Wednesday, which along with Friday's release of the US Retail Sales data will influence the USD price dynamics and provide some meaningful impetus to the USD/JPY pair.

Technical levels to watch

- WTI has started the week in subdued fashion, currently trading about 50 cents lower just under $78.50.

- Oil markets are weighing up themes this week including US inflation, supply disruptions and Omicron outbreaks in China.

Oil is in the red at the start of the week, with front-month WTI futures currently down about 50 cents on the session and probing the low-$78.00s, as the gradual pullback from last week’s highs above $80.00 continues. The price action thus far this Monday has been fairly uninspired, with WTI so far contained within a low-$78.00 to mid-$79.00 range. Newsflow has been fairly light, allowing market participants time to mull some of the ongoing macro themes.