- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 12-01-2022

- NZD/USD seesaws around two-week high as 50-DMA, multi-day-old horizontal hurdle challenge bulls.

- Market sentiment dwindles after surprising reaction to US inflation.

- New Zealand Building Permits improved to +0.6% in November, monthly Filled Jobs rose too.

- Fed policymakers support faster rate hikes starting from March during the final days before blackout period.

Having jumped the most in more than three months, NZD/USD battles a strong resistance of around 0.6860 during Thursday’s Asian session.

The kiwi pair seesaws around the fortnight high, flashed the previous day, as market players recheck bullish bias following the recently hawkish Fedspeak.

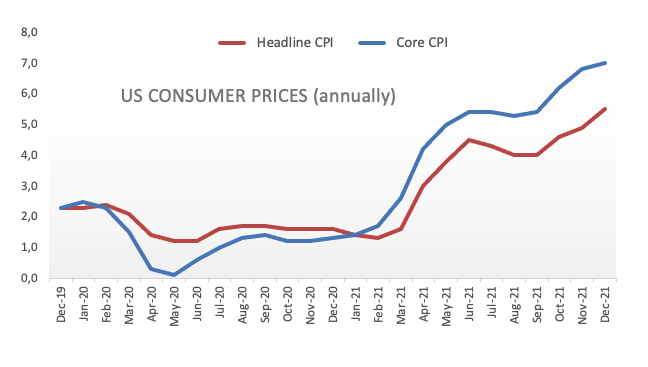

It’s worth noting that the quote’s rally on Wednesday ignored a 40-year high US inflation as markets turned risk-on following the US Consumer Price Index (CPI) release. US CPI jumped to the highest levels since 1982 while matching 7.0% YoY forecasts, up from 6.8% previous readouts. The monthly figures rose to 0.5% versus 0.4% expected but softened below 0.8% prior.

At home, New Zealand’s Building Permits for November rose to +0.6% versus -2.0% revised prior. On Wednesday, the country reported upbeat second-tier jobs data and favored the NZD/USD during early hours despite downbeat China inflation figures for December.

Following the NZ jobs data, the ANZ report said, “Monthly filled jobs data released by Stats NZ yesterday showed jobs growth accelerated to 0.4% m/m (4.3% y/y) in November (0.2% m/m previously). Kiwi firms have now posted 10 months in a row of jobs gains, despite spending the last four of those months (August to November) battling the latest Delta outbreak.”

It should be observed that the recent Fedspeak has been too hawkish, suggesting rate hikes and raising concerns over the higher inflation, which in turn probes the NZD/USD buyers. On the same line are the covid woes as Australia becomes vulnerable with a fresh record high of daily COVID-19 infections and virus cases at home also keep running higher.

Amid these plays, US Treasury yields remain sluggish, mainly the 10-year bond, while the S&P 500 Futures fail to track the Wall Street gains.

Moving on, a snap national cabinet meeting in Australia to battle the virus can affect NZD/USD prices due to New Zealand’s trade links with Canberra. However, major attention will be given to the Fedspeak and US jobless claims as Fed policymakers will sneak into the blackout period for speeches by the end of this week.

To sum up, virus woes and inflation fears join the hawkish Fed to challenge the NZD/USD buyers. However, markets seem to wait for strong catalysts as most of the recent news march the previous forecasts and have already been priced.

Technical analysis

A clear upside break of the two-month-old descending trend line, around 0.6800 by the press time, joins bullish MACD and firmer RSI to favor NZD/USD to battle a horizontal area comprising multiple levels marked since late September and 50-DMA around 0.6860.

While the 0.6900 threshold and 100-DMA level surrounding 0.6960 lures NZD/USD bulls, pullback moves remain less important until staying beyond the resistance-turned-support from November, near 0.6800.

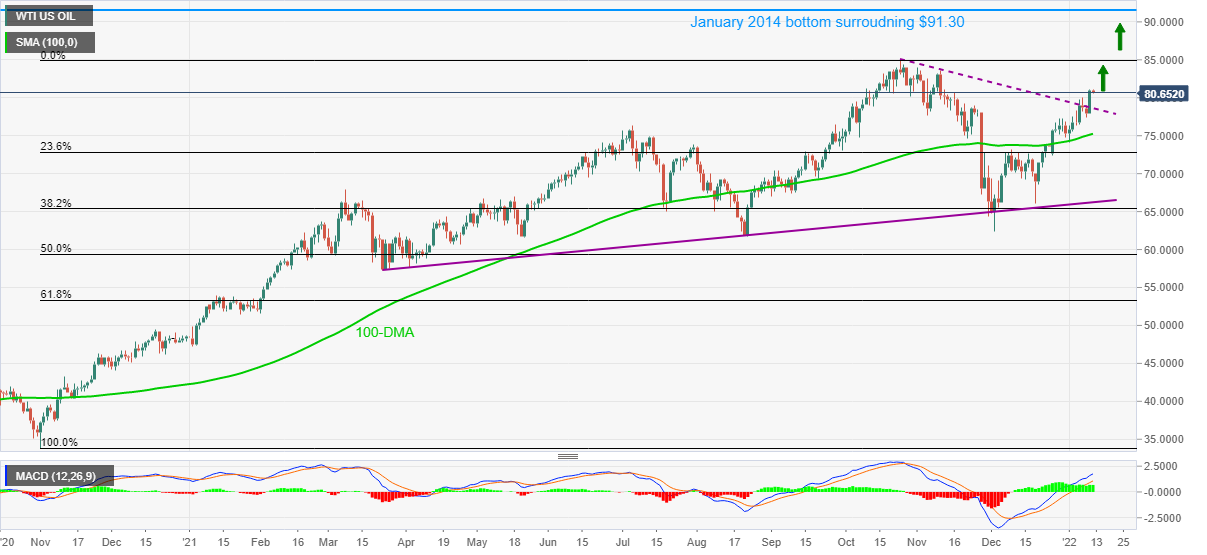

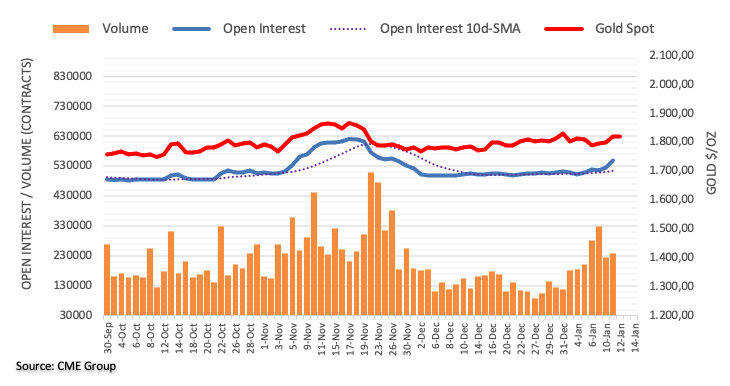

- Gold prices seesaw around one-week high after four-day uptrend.

- US Treasury yields, DXY remains pressured despite 40-year high US inflation, hawkish Fedspeak, virus fears also test gold buyers.

- Fed policymakers’ speeches before the blackout period will be crucial for fresh impulse.

- Gold Price Forecast: Bulls maintain the pressure despite a better market mood

Gold (XAU/USD) buyers take a breather around the weekly top near $1,825-26 during the initial Asian session on Thursday. The yellow metal refreshed multi-day high on Wednesday after the US Treasury yields and the greenback marked a surprise fall despite a four-decade high inflation data, as well as hawkish Fedspeak.

That said, US CPI jumped to the highest levels since 1982 while matching 7.0% YoY forecasts, up from 6.8% previous readouts. The monthly figures rose to 0.5% versus 0.4% expected but softened below 0.8% prior.

After the US inflation data release, Federal Reserve Bank of St. Louis President James Bullard said, per Wall Street Journal (WSJ), “Four rate hikes in 2022 now appear to be on the table and, in the face of high inflation, a rate hike in March seems likely.” On the same line were comments from, Fed Board of Governors’ member and incoming Vice Chairman of the FOMC Lael Brainard who said, “Inflation control is Fed's most important task. Furthermore, White House Economic Adviser Brian Deese mentioned that supply chain issues are worse than expected, suggesting further inflation pressure.

Elsewhere, Japan witnesses the four-month high daily covid infections and is ready to push Tokyo towards the second highest COVID-19 alert level while Australian policymakers called for a snap Cabinet meeting to tackle the steady jump in the daily infections. Furthermore, the US and Europe aren’t behind the curve while China and India have also started reporting multi-day high daily covid numbers.

That said, the US Dollar Index (DXY) slumped to the lowest levels since November 11, also marking the biggest daily loss in nearly seven weeks. The US Treasury bond yields also marked a surprising extension of the previous weakness, which in turn propelled the Wall Street benchmark before the day-end pullback.

To sum up, the gold prices are likely consolidating November’s losses amid the softer yields and the US dollar. However, the fundamentals are against the bulls and hence incoming catalysts should be given higher attention while expecting a pullback. Among them, weekly prints of US jobless claims and Fedspeak can direct intraday moves while Friday’s US Retail Sales will be important too.

Read: Riding out inflation in style

Technical analysis

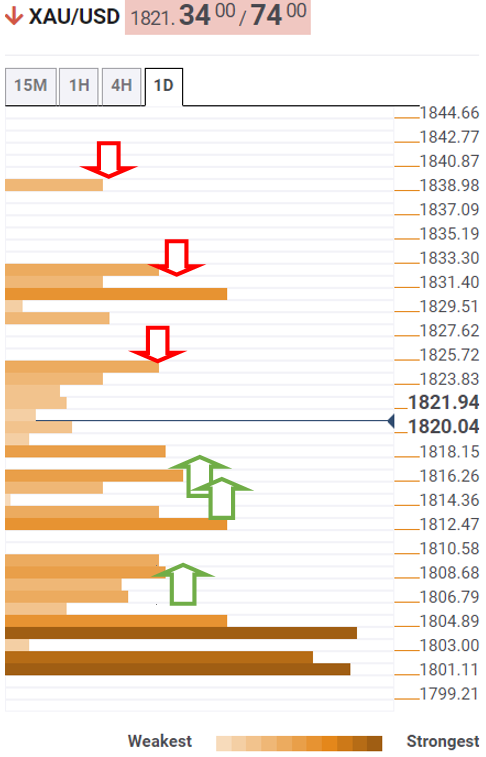

Gold refreshed one-week top post-US inflation data, extending the previous run-up beyond 100 and 50 SMAs. However, a descending resistance line from December 03, around $1,826, restricts the metal’s immediate upside.

Given the key SMA breakout, as well as bullish MACD signals and firmer RSI, gold buyers are likely to overcome the $1,826 immediate hurdle.

Following that, the 61.8% Fibonacci retracement (Fibo.) of November-December downside, near $1,830 and tops marked during July and September around $1,834 will be crucial to watch for gold’s further upside momentum.

Alternatively, pullback moves could eye 50 and 100-SMA region surrounding $1,805-08, a break of which will need validation from the $1,800 threshold to convince gold sellers.

During the quote’s downturn past $1,800, the 23.6% Fibo. level near $1,782, $1,770 and $1,762 will test the gold bears before directing them to December 2021 trough surrounding $1,753.

Gold: Four-hour chart

Trend: Further upside expected

The President and CEO of the Federal Reserve Bank of San Francisco Mary Daly has stated that the Fed does not want to get too far ahead on calling a number of rate increases.

She explained that they definitely see rate increases as early as March because inflation is uncomfortably high.

She explained that it is time to start removing some accommodation and that she sees prices moderating as supply imbalances ease.

Market implications

Fed speakers will enter blackout on communications this weekend and the markets are already expecting a rate increase as soon as the end of this quarter. The Fed has guided that rates can start to go up as soon as March.

''We agree with that assessment and expect that the Fed will hike 25bps in March (once they’ve halted further asset purchases), delivering a total of five hikes over 2022. Capping inflation is the Fed’s key priority for 2022,'' analysts at ANZ Bank explained.

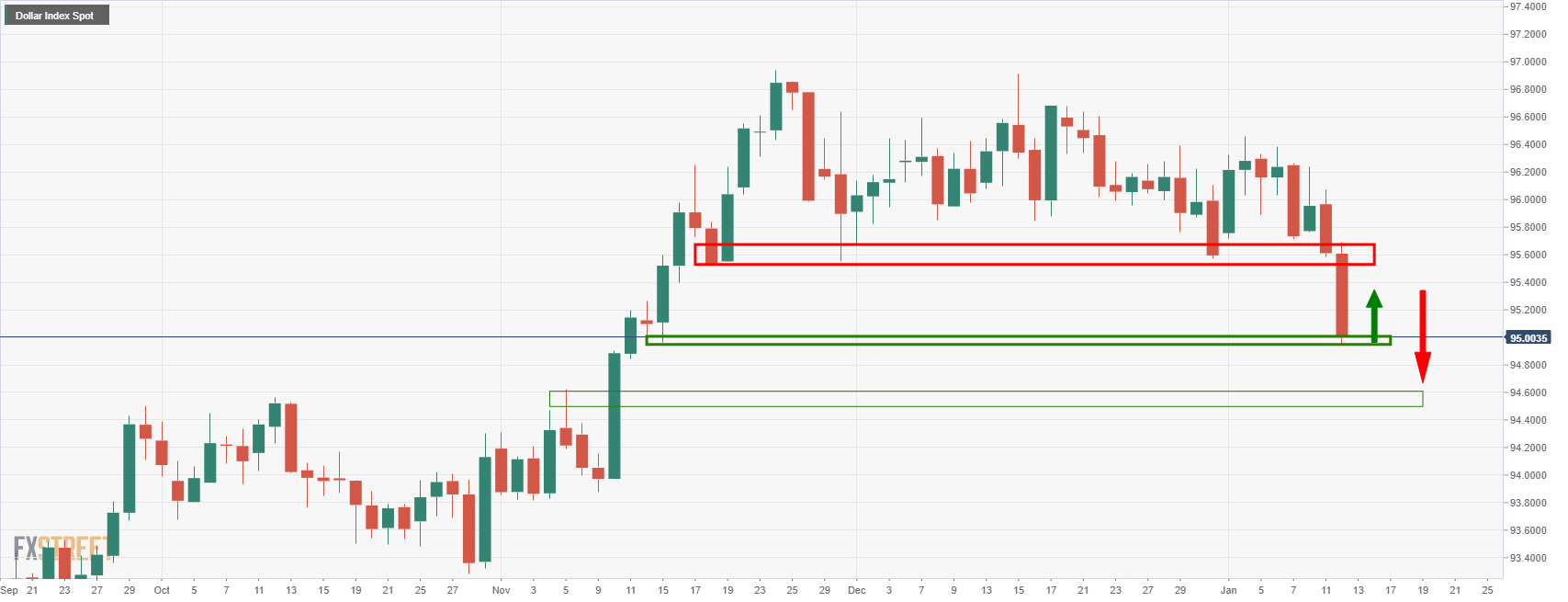

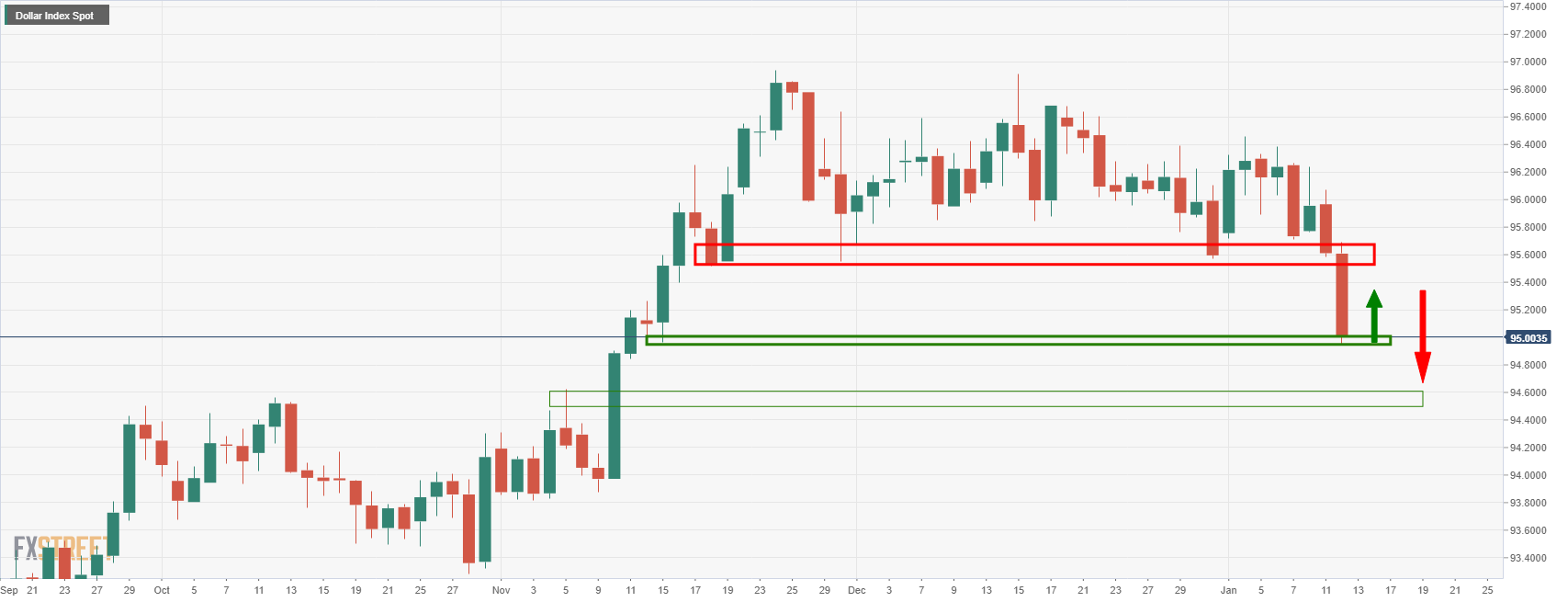

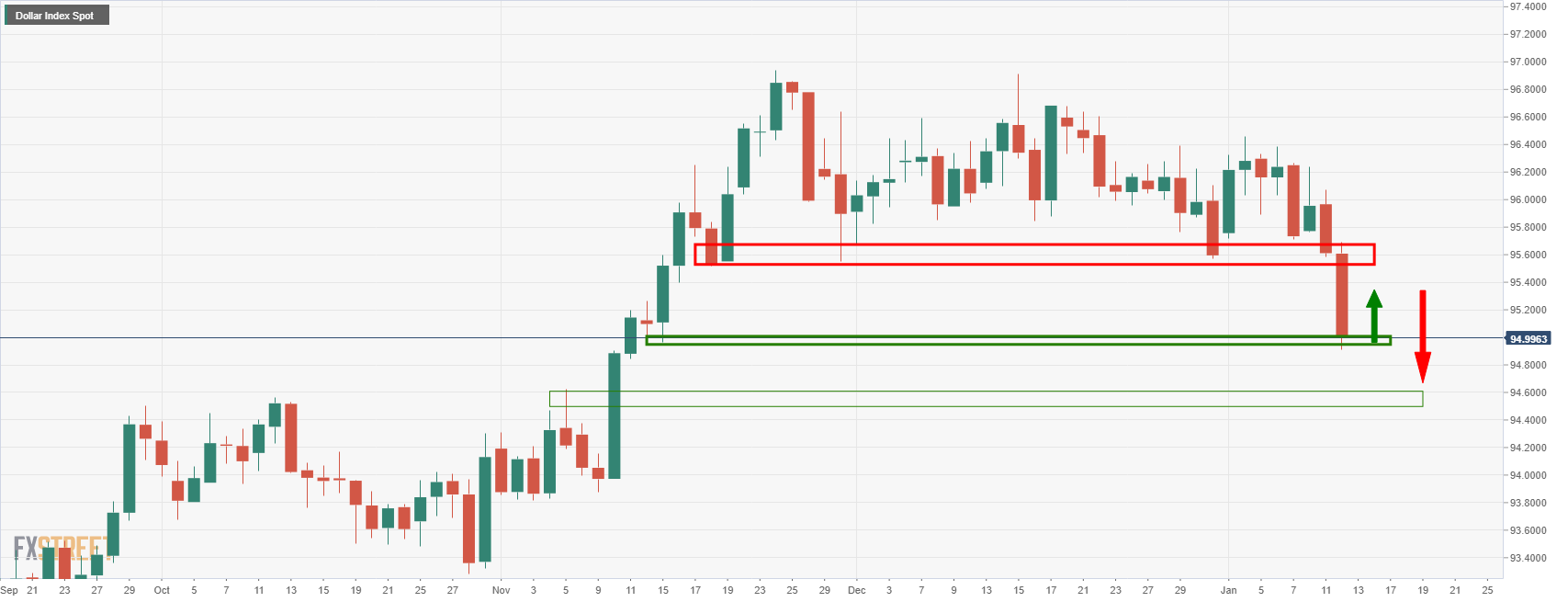

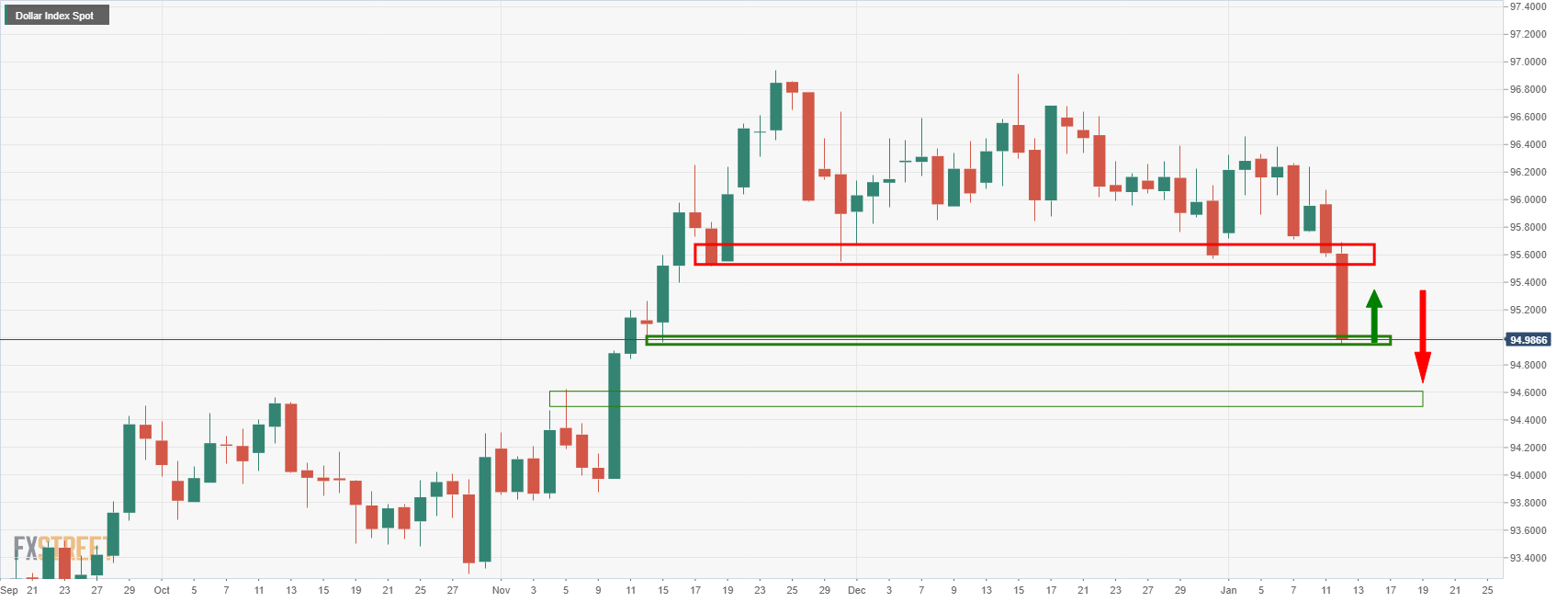

Meanwhile, the US dollar, as measured by the DXY index, has moved in on a critical level of daily support and would now be expected to correct higher as follows:

- The GBP/USD rallies amid broad US dollar weakness across the FX board for the fourth consecutive trading day.

- GBP/USD Technical Outlook: Neutral-bullish biased though GBP bull’s need to reclaim the 200-DMA so that they could aim towards 1.3900.

The British pound extends its rally in the week, advancing for the fourth day in a row as the Asian Pacific session kicks in. The GBP/USD edges up some 0.02% at press time, trading at 1.3705.

GBP/USD Price Forecast: Technical outlook

On Wednesday, the GBP/USD rallied 100-pips fundamentally driven by US inflation hitting the 7.00% threshold the most since 1982, as commented by Joel Frank, an analyst at FX Street, on his article GBP/USD surges towards 1.3700 as dollar dives post-CPI, but now looking overbought.

Putting fundamentals aside, the GBP/USD upward move stalled around the 1.3700 figure, 31 pips short of the 200-day moving average (DMA), which lies at 1.3733, leaving the British pound exposed to downward pressure, unless GBP bulls reclaim the DMA mentioned above.

At the time of writing, the GBP/USD first resistance is the 200-DMA. A breach of the latter would expose October’s 20 of 2021, daily high at 1.3834, followed by September 14 of 2021, daily high at 1.3913.

Conversely, on the downside, the GBP/USD first demand area would be 1.3700. A clear break under the figure could send the pair tumbling towards 1.3600, followed by the 100-DMA at 1.3549 and then the 1.3500 thresholds.

Japan’s worsening coronavirus conditions push policymakers towards the reintroduction of harsh activity controls. The Asian major reported the highest daily COVID-19 cases in four months on Wednesday, per Kyodo news, which in turn hints at the return of the second-higher coronavirus alert level in Tokyo.

“The nationwide tally stood at 13,244, with Tokyo accounting for 2,198 of the cases and marking the first time in over four months that the count has surpassed 2,000,” said Kyodo News.

Following that, NHK came out with the update saying, “Tokyo to raise covid-19 alert to second-highest level.”

It’s worth noting that Okinawa, Hiroshima and Yamaguchi prefectures have already entered a quasi-state of emergency from Sunday.

FX implications

Given the faster pace of the virus spread, coupled with the hawkish Fedspeak and multi-month high US inflation, the US Treasury yields should regain the upside momentum and weigh on the risk barometers like AUD/USD while also likely to fuel USD/JPY prices. However, the immediate reaction to the news seems moderate.

Read: AUD/USD battles 100-DMA on the way to 0.7300 amid broad USD weakness

Early Thursday morning in Asia, White House (WH) Economic Advisor Brian Deese said, “Forecasters see prices moderating during the course of 2022 which is consistent with our perspective.”

“The delay in fed appointments has had no effect on inflation response,” adds WH Eco. Advisor Deese.

The diplomat also mentioned, “We are watching impact of China's covid-19 lockdowns on supply chains.”

Read: Fed’s Brainard: Inflation control is Fed's most important task

FX reaction

Although the news should have helped Antipodeans to extend the previous rally, prices of AUD/USD paused around a two-month high after release.

Read: AUD/USD battles 100-DMA on the way to 0.7300 amid broad USD weakness

Fed Board of Governors’ member and incoming Vice Chairman of the FOMC Lael Brainard recently crossed wires, via Reuters, while saying, “Returning inflation to the 2% target is the ‘most important task’ facing the US central bank.” The FOMC member said in remarks prepared for delivery on Thursday to a Senate panel considering her for promotion to the vice-chair position, per Reuters.

Key quotes

Our monetary policy is focused on getting inflation back down while sustaining recovery that includes everyone.

Economy is making 'welcome progress,' pandemic continues to pose challenges.

Our priority is to protect gains we've made, support full recovery.

Committed to pursuing fed's two goals of price stability, maximum employment.

Committed to independent, nonpartisan status of Fed.

Will support policies that are in the interests of the American people.

FX reaction

Following the news, AUD/USD prices pause near the two-month high around 0.7290 after rising the most since late November 2021.

Read: AUD/USD battles 100-DMA on the way to 0.7300 amid broad USD weakness

- AUD/USD bulls take a breather around two-month high, after rising the most since August.

- US Dollar slumped despite 40-year high inflation, US Treasury yields remain pressured, equities rallied before closing with mild gains.

- Fed’s Brainard said inflation is too high, WH Advisor Deese feared supply chain issues.

- No major data at home, Fedspeak will be in focus.

After portraying a roller coaster ride on Wednesday, AUD/USD seesaws around 0.7285-90, the two-month high during the early hours of Thursday’s Asian session. In doing so, the risk barometer pair reveals the buyer’s indecision over the previous day’s heavy run-up, the most since late August, amid a quiet start to the day’s trading.

Although softer yields and Fed Chair Powell’s Testimony helped AUD/USD bulls during early Wednesday’s trading, the real push to the north came after the US Consumer Price Index (CPI) release. It’s worth noting that the Aussie pair not only ignored multi-year high price pressure, which should have favored bears but also ignored downbeat China inflation data and virus woes.

That said, US CPI jumped to the highest levels since 1982 while matching 7.0% YoY forecasts, up from 6.8% previous readouts. The monthly figures rose to 0.5% versus 0.4% expected but softened below 0.8% prior. On the other hand, China's CPI eased to 1.5% YoY compared to 1.8% forecast and 2.3% prior while the MoM readings also dropped to -0.3% versus +0.2% expected and +0.4% previous readouts. Additionally, the factory-gate inflation, namely the Producer Price Index (PPI) also dropped to 10.3% YoY for December, below 11.1% expected and 12.9% prior.

Following that US inflation data, Federal Reserve Bank of St. Louis President James Bullard said, per Wall Street Journal (WSJ), “Four rate hikes in 2022 now appear to be on the table and, in the face of high inflation, a rate hike in March seems likely.” On the same line were comments from, Fed Board of Governors’ member and incoming Vice Chairman of the FOMC Lael Brainard who said, “Inflation control is Fed's most important task.

Despite the heavy inflation data, the US Dollar Index (DXY) slumped to the lowest levels since November 11, also marking the biggest daily loss in nearly seven weeks. Further, the US Treasury bond yields also marked a surprising extension of the previous weakness despite the strong inflation data and hawkish Fedspeak, which in turn propelled the Wall Street benchmark before the day-end pullback.

Recently, White House Economic Adviser Deese mentioned that supply chain issues are worse than expected, suggesting further inflation pressure.

In addition to the inflation fears and Fed’s readiness to act, worsening coronavirus conditions at home and aboard also should test the AUD/USD bulls. Australia reported the weekly high of covid cases, near 95,000, the previous day while shortages of the virus testing kits were revealed. Elsewhere, Tokyo is ready to raise the covid alert to the second-highest level, per NHK.

To sum up, the market’s reaction to the US inflation data and recently hawkish Fedspeak doesn’t fit the fundamentals and hence signal pullback moves. However, an absence of major data/events, except for the Fedspeak and weekly US jobless claims, can keep the buyers on board amid downbeat USD.

Technical analysis

A clear upside break of 50-DMA and a downward sloping resistance line from mid-November joins firmer RSI and bullish MACD signals to keep AUD/USD buyers hopeful. However, the 100-DMA surrounding 0.7290 challenges the Aussie pair’s further advances targeting the 61.8% Fibonacci retracement (Fibo.) of October-December downside near 0.7340.

Should the quote take a U-turn, a 50-DMA level of 0.7210 joins 38.2% Fibo. to put a floor under the prices. Though, a pullback towards the previous resistance line near 0.7260 can’t be ruled out.

- The NZD/JPY edges higher for the second day in a row, up some 0.37%.

- NZD/JPY Technical Outlook: The pair is upward biased, but downside risks remain as the 200-DMA is near the current spot price.

The NZD/JPY surges higher for the second day consecutive day, as investors assess the last US inflation report that said the US economy reached the 7% threshold for the first time since 1982. That said, US stocks rallied as risk appetite improved. In the meantime, in the FX market, risk-sensitive currencies like the antipodeans advanced. At the time of writing, the NZD/JPY is trading at 78.50 as the Asian session begins.

NZD/JPY Price Forecast: Technical outlook

On Wednesday, the cross-currency pair was sideways within the 78.14-40 area, with no clear direction. Nevertheless, macroeconomic news improved the market sentiment, so the upward move was fundamentally driven but stalled due to technical reasons.

Once the US CPI headline crossed the wires, the NZD/JPY breached 78.40, edging higher though the rally stalled around 78.70, 25-pips above the 100-day moving average (DMA) around 78.44.

On Tuesday, in my previous article (read here), notes mentioned that “the NZD/JPY daily chart depicts an upward bias, as Tuesday’s price action broke above the 200-day moving average (DMA).” Nevertheless, the attempt towards 79.00 was rejected at around 78.70, leaving a candle with a long upper wick, indicating that buyers were rejecting higher prices.

To the upside, the first resistance would be the January 12 daily high at 78.70. A decisive break of the first ceiling level would expose a three-month-old downslope trendline around the 78.75-90 area, immediately followed by the previous-mentioned 79.00 figure.

Conversely, the first demand zone for NZD/JPY bulls is the 50-DMA at 78.39. A breach of the latter would open the door for lower prices. The next floor would be the 200-DMA at 78.16, followed by the 78.00 figure, and then the January 10 cycle low at 77.58.

- AUD/JPY recovered back to the 83.50 area on Wednesday as the Aussie benefitted disproportionately amid USD weakness.

- A surge in base and industrial metal, as well as energy prices, disproportionately benefitted the currency of export-dependent Australia.

AUD/JPY rallied 0.4% to close to the 83.50 mark on Wednesday as a sharp deterioration in the US dollar fortunes triggered outperformance in risk-sensitive currencies across the board. Though the yen also gained a solid 0.6% on the day versus the battered buck, it could not keep pace with the Aussie, which soured over 1.0% on the session versus the dollar, hence the move higher in AUD/JPY. The pair has now reversed more than 1.3% higher versus Monday’s sub-82.50 lows and has thus pared slightly more than half of the pullback from last week’s 84.30ish highs to Monday’s lows.

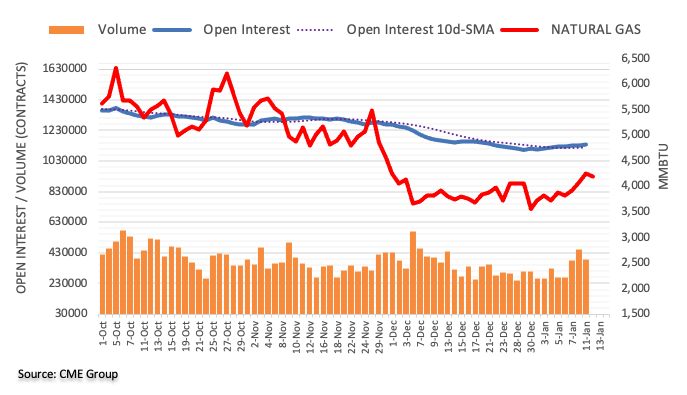

The dollar’s sharp post-US Consumer Price Inflation data decline, which occurred despite the report revealing headline inflation hitting its highest levels since 1982 at 7.0% YoY and prompted hawkish Fed member James Bullard to overtly call for four hikes in 2022 (the first Fed member to do so), spurred a rally in industrial metals. Copper was last up nearly 3.0% on the session, whilst the Bloomberg Industrial Metals Subindex, which tracks prices in copper, nickel, aluminium and zinc, was up closer to 1.5%. This, coupled with sharp upside in crude oil and US natural gas prices, benefitted the currencies of commodity and energy export-dependent countries like Australia.

Note that commodities (particularly the base metals) are also getting a boost after the latest inflation data out of China came in cooler than expected, which gives the PBoC and Chinese authorities to support growth this year. If dollar weakness and commodity price strength can continue like this for a few more sessions, AUD/JPY is in with a decent shout of recovering back to last week’s highs above the 84.00 mark. The big risk to this call would be if something happens that hurt risk appetite once again, just as happened last week when risk assets tumbled amid Fed tightening fears.

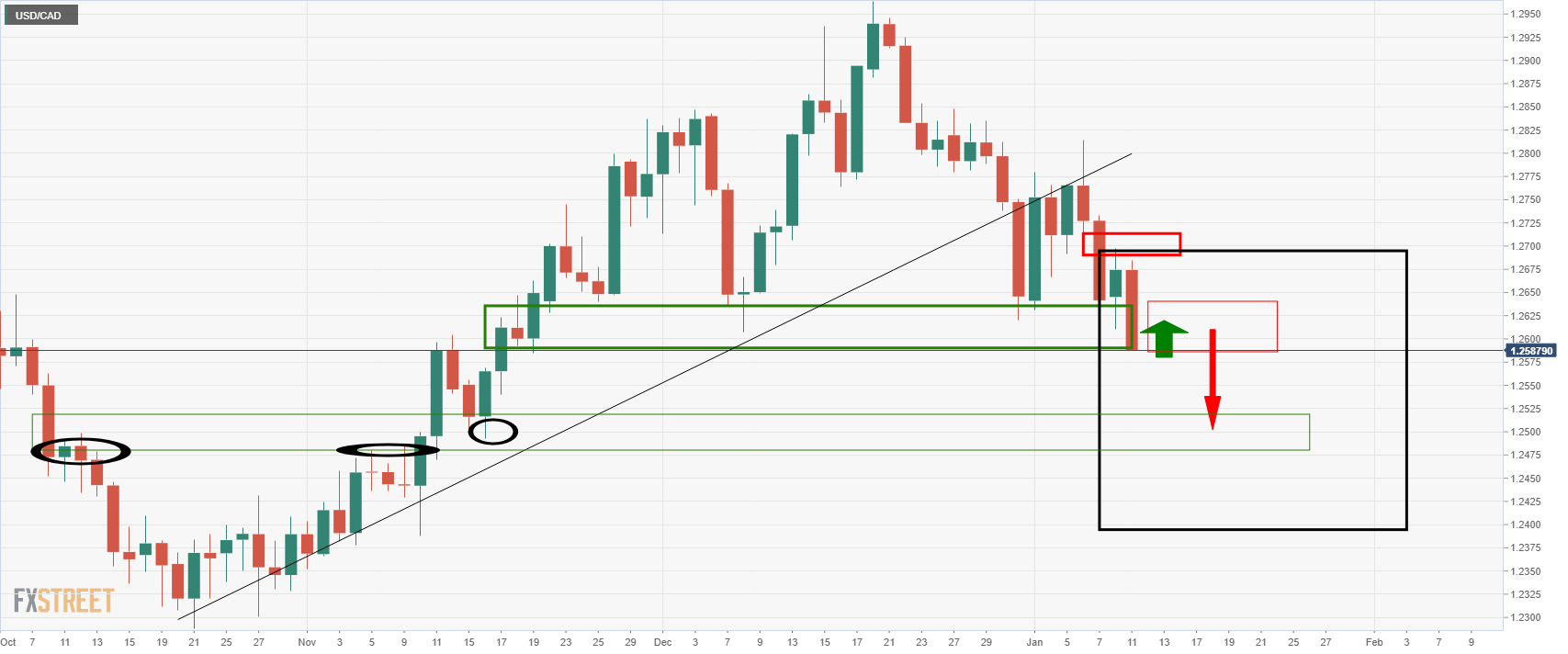

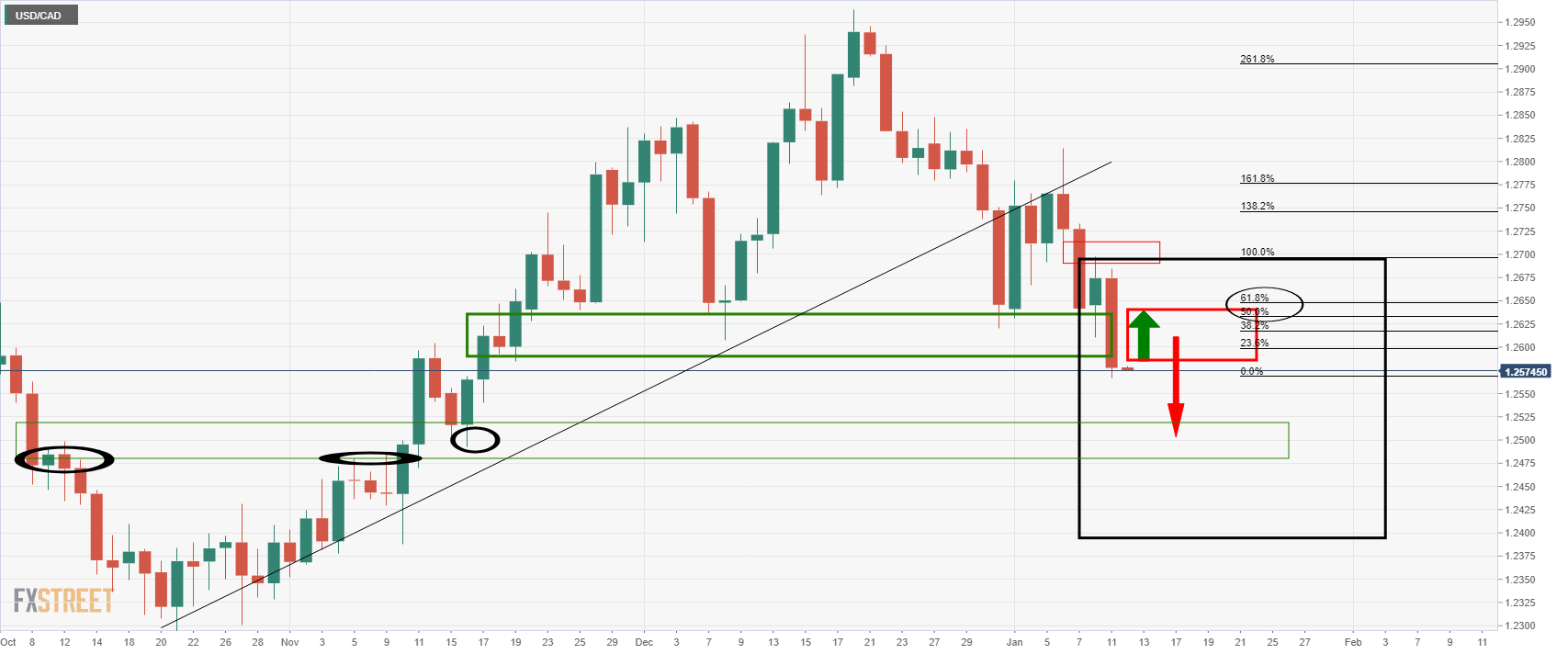

- USD/CAD broke the neckline of the H&S pattern and subsequently fell towards the 1.25 figure.

- Bulls looking to step in as bears exit before the close of the New York session.

Following the prior session's analysis, where it was stated that the ''bears can look near to 1.25 the figure and 1.2480 as the next area of expected support:

... the price has fallen sharply to test below 1.25 the figure.

The less committed bears will be seeking to take profits at this juncture which gives rise to prospects of a bullish correction.

The following illustrates the potential for at least a 50% mean reversion of the prior two sessions:

USD/CAD daily chart

As its stands, the New York session is coming to a close and traders will be keen to square positions ahead of the rollover and start of the Asian day. 1.26 is a figure that will be eyed for the forthcoming days if bears cannot keep control below 1.25 the figure.

DXY techncial analysis

-

US dollar dives despite sentiment of a March Fed hike

A break of this critical area of support could open the way to the midpoint of the 94 area. However, a bullish correction back into the midpoint of the 95 handle prior to any further downside might be on the cards first.

- GBP/JPY has eased back under the 157.00 level on Wednesday after rejecting an attempted push above 157.50.

- As the dollar dives post-US CPI data, overbought sterling has been struggling to benefit as much as its G10 peers.

GBP/JPY ran out of steam when it attempted to rally above the 157.50 level and test last week’s 157.77 high on Wednesday and has since subsided back below the 157.00 level. At current levels in the 156.80s, the pair is trading lower by a very modest 0.2% on the day and is back to trading flat on the week. Wednesday’s pullback from earlier session highs marks a failure of the pair to break out of its recent 156.00-157.80ish range that it has been locked within over the last week.

The main focus in FX markets on Wednesday has been on the dollar’s large post-in line with expectations US Consumer Price Inflation report decline, with less focus than usual on the yen crosses. Despite gaining more than 0.5% on the day versus the buck, sterling is one of the worst G10 performers. The yen is sat closer to the middle of the G10 performance table, up 0.75% on the day versus the buck. The more risk-sensitive AUD, NZD, NOK and SEK are all up more than 1.0% on the day against the dollar. GBP’s relatively poor on-the-day performance may be explained by the fact that, before today and over the last few weeks, GBP has been one of the best performing G10 currencies and may have entered overbought territory, incentivizing profit-taking.

Since bottoming out in December underneath 149.00, GBP/JPY has rallied over 5.0%. Compare that to EUR/JPY, which is up under 3.0% since its December lows, USD/JPY, which is now up under 2.0% and CAD/JPY which is up closer to 4.5%. Of the major G10 currencies, GBP’s performance has been particularly impressive as of late as fears about Omicron and its economic impact have subsided, thus allowing GBP to finally benefit from BoE hawkishness (the bank started lifting rates in December). Midway through last week, GBP/JPY’s 14-day Relative Strength Index rose above 70 (signaling overbought conditions) and though it has since dropped back under, the pair may still be suffering from the effects.

- The Australian dollar advances some 1.11% as the Wall Street end approaches.

- The AUD/USD rallied 80-pips after the release of the US CPI.

- AUD/USD Technical Outlook: A daily close above the 100-DMA would open the door for a challenge at 0.7300.

After the reléase of important US macroeconomic data, the Australian dollar rallies 1.11%. At the time of writing, the AUD/USD exchanges hands at 0.7286 during the New York session.

AUD/USD Price Forecast: Technical outlook

On Wednesday, the AUD/USD remained subdued in the Asian/European session, as investors awaited the release of the US inflation report. When the headline crossed the wires, the AUD/USD rally started.

The AUD/USD rallied almost 80-pips, from 0.7209 up to 0.7281, three hours following the release of the US CPI. The rally stalled around the 100-day moving average (DMA), which lies at 0.7286, short of the 0.7300 figure.

A daily close above December’s 31 daily high at 0.7277 could spur an upward move towards November’s 15, 2021, daily high at 0.7371, but it would find some hurdles on the way north. The first resistance would be 0.7300. A breach of the latter would expose 0.7350, mid-point between the 0.7300-0.7400 range, followed by the previous-mentioned 0.7371.

Contrarily, the AUD/USD first support would be the 100-DMA at 0.7286. A decisive break of it would expose the 50-DMA at 0.7212, immediately followed by the psychological 0.7200.

What you need to know on Thursday, January 13:

The greenback plummeted following the release of US inflation figures. The December Consumer Price Index was confirmed at 7% YoY, as expected, while the core reading beat expectations, up to 5.5%. The news, which usually spurs risk aversion, had the opposite effect this time.

Stocks rallied, although indexes gave up gains unevenly ahead of the close, while government bond yields ticked lower, sending the American dollar in a selling spiral, exacerbated by the breakout of technical levels.

The EUR/USD pair trades at its highest in two months at around 1.1450, while GBP/USD jumped to 1.3710, its highest since October. Commodity-linked currencies were also on the run, with AUD/USD trading in the 0.7280 region as USD/CAD flirting with 1.2500.

The dollar lost ground vs safe-haven assets also, as the USD/JPY pair plunged to 114.37, holding nearby heading into the Asian opening.

Gold advanced modestly, as investors looked for high-yielding assets. The bright metal trades around $1,827 a troy ounce. Crude oil prices were also up, with WTI trading at $82.60 a barrel.

Ethereum price gears up for explosive rally as buying activity accelerates

According to Federal Reserve Bank of St. Louis President James Bullard, four rate hikes in 2022 now appear to be on the table and, in the face of high inflation, a rate hike in March seems likely. The labour market is as tight as anyone has ever seen it, Bullard added in a interview with the WSJ, adding that the unemployment rate may fall below 3.0% this year.

Additional Takeaways:

"Rate hikes should be accompanied by balance sheet reductions."

"High inflation necessitates policy tightening sooner rather than later."

"The majority of what is driving inflation right now is demand."

"I expect inflation to ebb to 3.0% annualised by the end of 2022."

"Liquidity in 2021 may be eliminated with minimal disruption."

"An earlier start to rate hikes could help the Fed avoid a more hawkish rate path."

"Fed's asset purchases in 2021 were more than the economy required."

"The Fed's pandemic aid is a driver of the present level of inflation."

"The monetary and fiscal assistance provided in response to the pandemic may have been excessive."

"Fed should have stopped purchasing assets sooner than it is right now".

Market Reaction

Hawkish commentary from Bullar have done little to stem what has been a severe tide of dollar selling on Wednesday, with the DXY still trading underneath the 95.00 level and eyeing a test of support in the 94.50s.

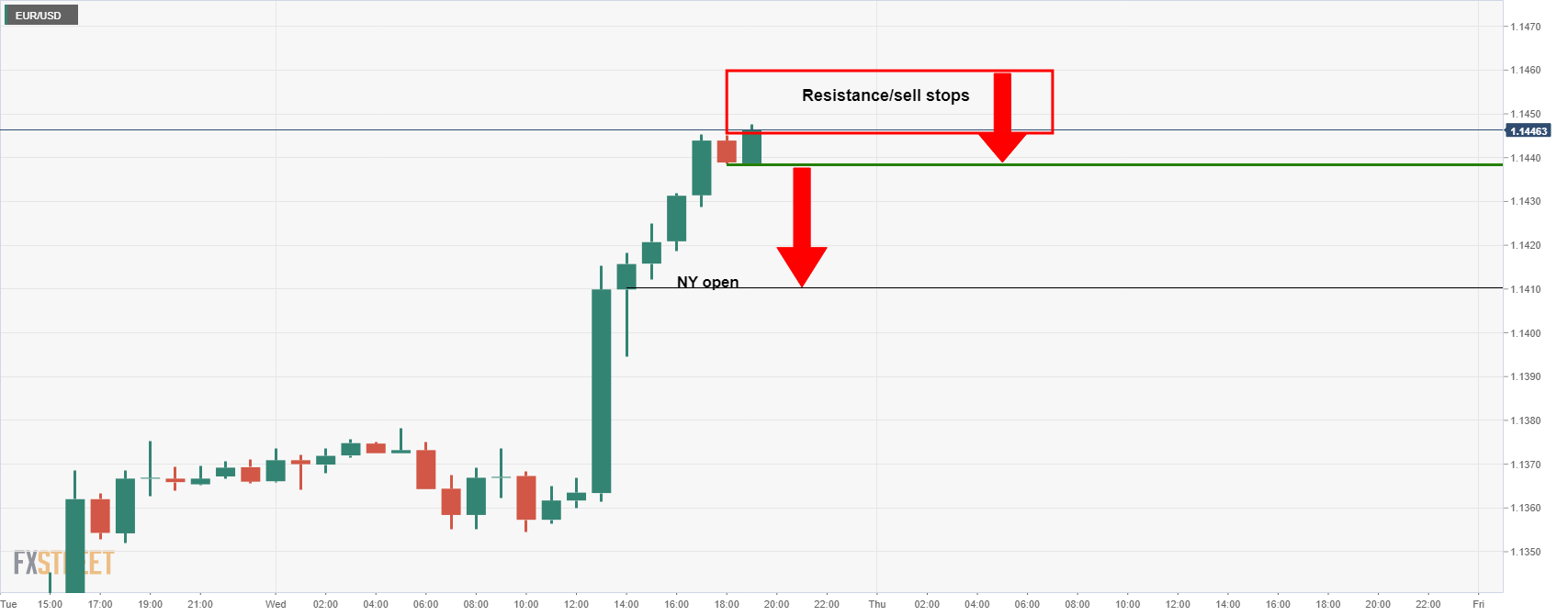

- EUR/USD has been an impressive performer on the bid on Wednesday.

- Bulls have reached a critical level, bears will be looking for a test of 1.1410 NY open.

EUR/USD rallied on Wednesday from a low of 1.1354 towards 1.1450. The high at the time of writing has been 1.14492 so far. The following illustrates the scalping day trading structures and prospects of a downside correction for the sessions ahead.

EUR/USD H1 chart

The bulls have rallied into a key 1.1450 area on the chart and following a test of the area, profit targets will be met and subsequent selling could come into force. The bears looking to engage at a high probability area could look for a break below the recent lows near 1.1438.

EUR/USD H4 chart

Meanwhile, the 4-hour chart shows where the liquidity is located as per the structure looking left. A run through to trigger stop losses would be a common occurrence, so wicks on the lower time frames would be expected to test as high as 1.1460/65. Either way, the countertrend traders will be looking for an optimal entry to target a correction as profit-taking unfolds into the New York close and ahead of the rollovers and widening of spreads.

EUR/USD M15 chart

On the 15-min time frame, the support that the bears will want to see is located just below 1.1440. A run to 1.1422 and then the New York open near 1.1410 would be in focus.

According to the Fed's Beige Book, a report on current economic conditions in each of the 12 Federal districts, most districts noted a sudden pullback in leisure and travel spending, as well as hotel occupancy and patronage at restaurants as the number of Covid-19 Omicron infections rose.

Additional Takeaways:

Growth...

"Contacts from many districts indicated growth continued to be constrained by ongoing supply chain disruptions and labor shortages."

"Economic activity across the United States expanded at a modest pace in the final weeks of 2021."

"The manufacturing sector continued to expand nationally, with some regional differences in the pace of growth."

"Although optimism remained high generally, several districts cited reports from businesses that expectations for growth over the next several months cooled somewhat during the last few weeks."

Labour market...

"Despite the modest pace of growth, demand for materials and inputs, and demand for workers, remained elevated among businesses."

"Employment grew modestly in recent weeks, but contacts from most districts reported that demand for additional workers remains strong."

"Job openings were up but overall payroll growth was constrained by persistent labor shortages."

"Ongoing labor shortages and associated wage growth also added cost pressures to businesses."

"Tightness in labor markets drove robust wage growth nationwide, with some districts highlighting additional growth in labor costs associated with non-wage benefits."

"Many contacts noted that wage gains among low-skill workers were particularly strong."

"Compensation growth remained well above historical averages across industries, across worker demographics, and across geographies."

Consumer health...

"Consumer spending continued to grow at a steady pace ahead of the rapid spread of the Omicron Covid-19 variant."

Inflation, supply chains...

"Contacts from most federal reserve districts reported solid growth in prices charged to customers, but some also noted that price increases had decelerated a bit from the robust pace experienced in recent months."

"Wholesale and materials prices contributed to pricing pressures across a wide range of industries, spanning service providers and goods producers."

"Many contacts attributed the high cost of inputs to ongoing supply chain disruptions."

"Some districts reported that transportation bottlenecks had stabilized in recent weeks, though procurement costs remained elevated."

- The USD/JPY drops 100-pips in the North American session.

- The market was positioned for a higher US inflation reading, per the reaction weakening the greenback.

- USD/JPY Technical Outlook: Bullish despite Wednesday’s pullback towards a four-month-old upslope trendline.

On Wednesday, after the Bureau of Labor Statistics (BLS) revealed that US inflation reached a level not seen since 1982, the USD/JPY plunges, exchanging hands at 114.60 at the time of writing.

Hot US CPI reading fail to boost the greenback as US T-bond yields slide

Broad US dollar weakness is due to the market participants’ expectations of the US CPI inflation figures. The Consumer Price Index (CPI) for December rose by 7.0%, higher than the 6.8% estimations, but it did not come as higher than market positioning. That is witnessed by the market reaction, sending the US 10-year Treasury yield down almost two-basis points, sitting at 1.727%, while the US Dollar Index just breached under the 95.00 handle for the first time since November 15, 2021.

In the meantime, the so-called Core CPI number for the same period, which excludes volatile items like food and energy, rose by 5.5%, a tenth up from the 5.4% foreseen by analysts.

Putting US consumer inflation figures aside, the USD/JPY trader’s focus turns to Thursday. The Japanese economic docket will feature the Machine Tool Orders (YoY). Across the pond, the US economic docket will feature the Producer Price Index for December, Initial Jobless Claims (IJC), and Fed speaking, led by the Vice-Chairwoman nomination of Lael Brainard. She will appear at the US Senate Banking Committee.

USD/JPY Price Forecast: Technical outlook

With US consumer inflation data on the rearview mirror, the USD/JPY dipped near a four-month-old bullish trendline, drawn from September 2021 cycle lows, which passes above the 50-day moving average (DMA), which lies at 114.24.

Fundamentally and technically driven, the USD/JPY is upward biased. The daily moving averages (DMAs) reside well below the spot price, in a bullish order, meaning the shorter-time frame is above the longer-time ones.

That said, USD/JPY’s pullbacks could be viewed opportunities for USD bulls if that is the case. The following support lies at the above-mentioned trendline, around the 114.35-45 area at press time. A breach of the latter would expose the 50-DMA at 114.24, followed by 114.00

To the upside, the pair’s first resistance would be 115.00. A break above the psychological double-zero level would expose November’s 24 of 2021, daily high at 115.52, followed by a challenge of the YTD high at 116.35.

- Bears move in to take the US dollar to fresh breakout lows in the DXY.

- US CPI continues to run hot, but investors are cautious to price Fed too hawkish.

The US dollar has buckled under pressure from the bears that sent the greenback over a cliff on Wednesday. As measured by the DXY index, the US dollar is down some 0.6% at the time of writing. The index is trading at 95 the figure but off from the lows of that day that were made in the last hour of trade at 94.953.

US government bond yields retreated from a two-year high after the annualized inflation rate for December hit the highest level in four decades. The 10-year US Treasury yield fell 3.3 basis points to 1.71% despite the Bureau of Labor Statistics saying that the seasonally adjusted consumer price index rose 0.5% in December, ahead of expectations for a 0.4% increase. However, this was below the 0.8% increase in November. The year-over-year rate advanced to 7% from 6.8% in the previous month and the overall rate is the highest since 1982.

''There is no evidence whatsoever that inflation pressures are abating,'' analysts at ANZ Bank argued. ''Energy prices declined slightly in December, but pressures have broadened significantly beyond this, with core goods and services prices all surging.''

Moreover, the analysts explained that inflation pressures are likely to intensify as the labour market tightens further and wage pressures grow. ''The peak in US inflation is not in yet, and the Fed will be grappling with inflation in a 7.0-8.0% YoY range for quite a few months to come.''

However, stocks on Wall Street remained in the green, buoyed by the fact that Fed Chair Powell did not mention the prospect of a March rate rise in his Senate confirmation hearing. Markets are of the mind that the US dollar is a crowded trade and that there are risks that the market is pricing the Fed too hawkish.

Meanwhile, Fed speakers enter blackout on communications this weekend, but they have already given the nod to a rate hike as soon as March.

''We agree with that assessment, and expect that the Fed will hike 25bps in March (once they’ve halted further asset purchases), delivering a total of five hikes over 2022,'' the analysts at ANZ Bank said. ''Capping inflation is the Fed’s key priority for 2022.''

DXY daily chart

The price is moving in on the next level of the critical support structure on the daily chart. A break here would open the way to the midpoint of the 94 area. What we could see, in the meantime, is a bullish correction back into the midpoint of the 95 handle prior to any further downside.

- USD/TRY bears move in as bulls take profits on weaker US dollar.

- Bears eye 12.00/20 territories on a break of the critical support structure.

A combination of Turkish politics and a weaker US dollar is sending USD/TRY lower as bulls begin to take profits in what has been a strong correction in a 50% mean reversion of the prior bearish impulse as follows:

USD/TRY weekly chart

-637776066746182412.png)

As illustrated, the price fell heavily and corrected in volatile price action owing to the unprecedented course of action by Turkish officials combatting the highest levels of inflation since 2002, (Turkey's consumer price inflation jumped to 36.08 per cent year-on-year in December 2021, up from 21.31 per cent in the previous month).

USD/TRY daily chart

-637776066992128223.png)

The daily chart shows that the price has attempted to base near 12.90 from where it moved in on the 50% reversion level. However, renewed US dollar weakness has enabled the bears to take back control this week.

USD/TRY H4 chart

-637776067274315009.png)

From a 4-hour perspective, the price is moving in on the 200-EMA. This would be expected to hold initial tests and the current resistance, old support, near the 21 EMA could see the bears moving in at a discount. This would force the price lower and potentially lead to a significant break of support and the 200 EMA.

USD/TRY H1 chart

-637776067526525011.png)

There is still room for the price to move lower according to the hourly chart. Nevertheless, the support is eyed and a meanwhile correction could evolve to test the various significant Fibonacci retracement levels along the way.

Turkish politics and a weaker US dollar

From a political front, the lira could find further stability as we approach planned elections scheduled for no later than mid-2023. The economic turmoil has already started to hit President Erdogan's opinion poll ratings as Erdogan's scheme to curb the lira's weakness has been seen to fail.

The US dollar is a major driving force of emerging market currency performances. As it stands, the greenback is an overcrowded trade that is starting to unwind given the Federal Reserve's hawkish sentiment is a fact that is now being sold off:

DXY daily chart

- The yellow-metal rallies for the fourth day out of the last five despite that US inflation cements Fed hikes.

- US: The Consumer Price Index (CPI) for December increased the most since 1982.

- XAU/USD Technical Outlook: It is neutral-bullish, but gold bulls beware of the fundamental outlook and the US economy developments.

Gold (XAU/USD) extends its rally during the week, buoyed for the fourth consecutive day as the Bureau of Labor Statistics (BLS) revealed that US inflation reached the highest level since 1982. At the time of writing, XAU/USD is trading at $1,826 during the New York session.

The market’s reaction to the US CPI headline figure was adverse, despite further cementing that the Fed would need to hike rates faster than estimated. The US 10-year Treasury yield is down almost two basis points, sitting at 1.722%, weighing on the greenback, as shown by the US Dollar Index, plunging 0.60%, sitting at 95.06.

Meanwhile, the US 10 year Treasury Inflation Protected Securities (TIPS), used as a proxy for real yields, which means nominal yields minus inflation, recovers some ground after falling to -0.842%, up to -0.810%.

Inflation in the US overshoots the 7% threshold

Earlier in the North American session, the US economic docket revealed that the Consumer Price Index (CPI), an inflation gauge of the US economy, in December of 2021 in a year-over-year reading, increased 7%, higher than the 6.8% estimated. Furthermore, the Core CPI (YoY) that excludes volatile items like food and energy prices rose by 5.5%, two-tenths more than expected.

XAU/USD Price Forecast: Technical outlook

Gold’s daily chart depicts the yellow-metal as neutral-bullish biased, but downside risks remain. Fundamentally driven, the non-yielding metal is subject to rising nominal and real yields, which could be negative news for gold bulls. However, the softer tone of the USD keeps the yellow-metal bulls hopeful of higher prices ahead of the first-rate hike, which per money market futures, could happen in the FOMC March 2022 meeting.

To the upside, XAU/USD’s first resistance level would be September 3, 2021, a daily high at $1,834. Once that level is breached, the next stop would be November 16, 2021, cycle high at $1,877,18, followed by $1,900.

On the other hand, gold’s first support is $1,800. The breach of the latter would expose the 100-day moving average (DMA) at $1,793, followed by January 7 daily low at $1,782.60.

- US equities are up broadly higher with markets relieved that the latest US CPI report was in line with expectations.

- The S&P 500 is about 0.3% in the 4730 area whilst the Nasdaq 100 is probing 16,000.

- The S&P 500 is 3.0% up from Monday’s lows and the Nasdaq 100 5.0%.

US equities are trading broadly in the green, with the S&P 500 up 0.3%, the Nasdaq 100 up 0.5% and the Dow up 0.1%, as equity investors digest the implications of the latest US inflation report for Fed policy this year. Broadly speaking, and despite headline Consumer Price Inflation (CPI) reaching its highest level since June 1982 at 7.0% in December, the report was not seen as boosting already very hawkish Fed policy expectations for 2022 any further. Indeed, equity investors seem to have reacted to the fact that the CPI report came in broadly as expected with relief. Even though the report strongly endorses the Fed’s stance that multiple rate hikes and a reduction in the size of the balance sheet is likely warranted this year, the lack of fresh hawkish surprises has weighed heavily on the dollar. This seems to be offering some support to the equity space.

Wednesday’s gains come on the back of upside seen in wake of Tuesday’s Fed Chair Jerome Powell Senate testimony. Just as seen in the market’s reaction to Wednesday’s inflation data, the lack of hawkish surprises from Powell, who largely stuck to the main points/takeaways from the December meeting and its minutes, saw US stocks rally at the time. The S&P 500 index, which is right now trading around the 4730 level, is now more than 3.0% up versus its earlier weekly lows. The growth stock/tech-heavy Nasdaq 100 index, which is currently probing the 16,000 level, it up roughly 5.0% from earlier weekly lows.

A key driver of the rebound, particularly in duration-sensitive big tech names, has been a pullback from recent highs in US yields. For example, the US 10-year is down 3bps on Wednesday and back to trading just above 1.70% having been above 1.80% on Monday. Equity investors will be keeping a key eye on bond markets going forward, as a further rapid push higher (like seen last week) could easily trigger another equity market tumble (like seen last week). For the rest of the week, Fedspeak and US data will remain important to monitor, especially Vice Chair nominee Lael Brainard’s Senate hearing on Thursday and the release of the US December Retail Sales report on Friday.

But arguably the most important US equity market driver for the rest of the week will be the unofficial start of earnings season on Friday when big US banks including JP Morgan, Citigroup and Morgan Stanley will report Q4 results. “Earnings may exceed expectations and that is what is keeping investors active despite knowing that the Fed is going to start tightening in the next several months” one analyst was quoted by newswires as saying. “You'll also see less commentary on earnings calls referencing supply chain constraints this season” he added. If true, earnings season could be a welcome bullish distraction from the theme of Fed tightening and higher interest rates for a few weeks ahead of the Fed’s January 26 meeting.

- GBP/USD has surged in recent trade and is now testing the 1.3700 level and a key downtrend.

- USD is weakening after the latest CPI report and Powell’s remarks on Tuesday failed to spur fresh hawkish Fed bets.

- But GBP/USD now looks quite overbought/overstretched on a few metrics, which could hamper further gains.

GBP/USD upside has accelerated in recent trade as the US dollar suffers substantial post Consumer Price Inflation (CPI) data weakness, with the pair eyeing a bullish break above a key long-term downtrend and the key 1.3700 level. At current levels just below the big figure, cable is trading at its highest since early November, up just under 0.5% on the day and now looking at gains of about 0.8% on the week. If the pair can close out the week at current levels and in the green, that would mark a fourth consecutive week of gains during which time GBP/USD would have rallied a stunning 3.5%. The pair is over 4.0% up from its mid-December lows in the mid-1.3100s.

The rally over the last few weeks was initially driven by factors including a drastic improvement in risk appetite as it become clear the Omicron variant would be much less severe, thus enabling the UK economy to avoid lockdowns. That then in turn boosted the market's confidence that the BoE will follow up on its 15bps December rate hike with multiple further 25bps rate hikes in 2022. But the most recent leg higher has more to do with the US dollar, which failed to garner any meaningful impetus last week amid a sharp hawkish shift in the market’s expectations for Fed policy. Indeed, the dollar has been sharply declining on Tuesday and Wednesday across the board after Fed Chair Jerome Powell’s testimony and the latest US inflation report failed to spur fresh hawkish Fed bets.

Though the fundamentals (tight labour market, hot inflation, hawkish Fed) are arguably still very much supportive of a stronger dollar in 2022, FX markets seem to be in the process of flushing out overly one-way dollar positioning. Indeed, the most recent CFTC positioning data showed Dollar Index long positioning at a 52 week high in the week ending on January 4. A break above the downtrend linking the July, September and late October highs and the 1.3700 level in GBP/USD could open the door to an extension of upside to test October highs above 1.3800.

But cable bulls will be growing increasingly wary of the pair entering short-term overbought conditions. GBP/USD’s 14-day Relative Strength Index (RSI) recently entered overbought territory (i.e. above 70) for the first time since February 2021. Back then, after surpassing 70 in the RSI, cable had a few more good days before then abruptly turning lower. Meanwhile, GBP/USD’s Z-score to its 50-day moving average has now risen above 2.0 (implying it it more than two standard deviations from its 50DMA). In the last 18 or so months, a Z-score above 2.0 has suggested consolidation or a slower pace of gains ahead. Indeed, when looking at the past ten years, GBP/USD five, 21 and 65 day returns after a day when its Z-score to 50DMA was above 2.0 is on average negative by 0.2-0.4%.

Analysts at Credit Suisse expect the EUR/USD pair to trade in the range 1.1050 – 1.1600 during the first quarter. They have a target of 1.1150 for the end of the quarter.

Key Quotes:

“Our expected EURUSD range for Q1 is 1.1050 – 1.1600, and we continue to target 1.1150 for end-Q1. Levels above 1.1450 represent acceptable entry levels for fresh shorts from a risk-return perspective.”

“Despite the insistence of key ECB representatives that policy rate hikes are a long way off, euro area rates markets are pricing in a 25bp rate hike over the next 12 months and at least one more thereafter. This is more remarkable for the fact that the ECB has committed to ending balance sheet expansion before a rate hike is possible.”

“Markets appear to feel high current euro area inflation and the spillover effect of the Fed’s dynamic will force the ECB to act. This is providing EUR with some degree of support by limiting the extent of US - euro area rates divergence.”

- The white-metal advances as demand for USD softened after hot US inflation figures.

- The US 10-year Treasury Inflation Protected Securities (TIPS) extend its fall to -0.838%, boosting silver.

- XAG/USD Technical Outlook: Despite the uptick in silver remains downward, as portrayed by the DMAs located above the spot price.

Silver (XAG/USD) rallies during the New York session, at press time trading at $23.03, up some 1.10%. The white-metal climb is courtesy of a hot US inflation reading, with the Consumer Price Index (CPI) increasing by 7.0% aligned with estimations, spurring a fall of US T-bond yields.

The 10-year benchmark note is down one and a half basis points, sitting at 1.728%, a headwind for the greenback. In the meantime, the US Dollar Index, a measure of the buck’s value against a basket of six rivals, slides 0.43%, currently at 95.21.

Alongside the fall in nominal yields, the US 10 year TIPS, used as a proxy for real yields, which means nominal yields minus inflation, in the last five days dropped from -0.765% reached on January 7 to -0.838%.

US inflation in December increased above 7%

Before Wall Street opened, the US Bureau of Labor Statistics (BLS) featured the Consumer Price Index (CPI) for December, which came at 7.0%, as foreseen by analysts on its annual number. Additionally, the Core CPI figure, which excludes volatile items like food and energy prices, increased annually by 5.5%, higher than the 5.4% estimated by market participants.

XAG/USD Price Forecast: Technical outlook

In the overnight session, the white-metal seesawed around the 200-hour simple moving average (SMA), in fact, dipped below it to print a daily low at $22.65. Nevertheless, when the US CPI figures crossed the wires, silver rallied above $23.00 for the first time in five days.

However, the XAG/USD daily chart portrays the white metal as downward biased. The daily moving averages (DMAs) reside above the spot price. Worth noting, the upward move spurred by US economic data was capped 20-pips below the confluence of the 50 and the 100-DMAs around the $23.20-30 area, which would be the first resistance level on its way up. A breach of the latter would expose the $24.00 psychological level, that once broke, could send silver towards a nine-month-old bearish trendline, drawn from May 2021 cycle highs that pass near the $24.35 area.

Contrarily, silver bull’s first line of defense would be the psychological $23.00. A decisive break would exert downward pressure on the non-yielding metal, exposing the January 11 daily low at $22.44, followed by $22.00.

The US dollar will likely continue to trade versus the Indian rupee in the 74/76 trading range during the first quarter, according to economists at Credit Suisse. They are optimistic about the outlook for the Indian economy.

Key Quotes:

“In Q4 we expected higher USDINR as India’s strong re-opening momentum was likely to boost imports and further widen the trade deficit. As such we did not anticipate the late December rally in INR (from 76 per dollar to 74). However we still think the 74-76 trading range will persist in Q1.”

“Although the rupee has weakened against the dollar by 30% since 2011, the cumulative impact of years of high inflation has eroded any competitiveness gained from a weaker rupee. INR REER (Real Efective Exchange Rate) has traded in a steady range since 2017, when RBI began accumulating FX reserves more aggressively."

“We think the RBI is managing the currency for REER stability. Although the RBI intervenes to enforce a narrow USDINR trading range (which we currently think is 74-76), over time this range gradually shifts higher as the RBI aims for steady inflation-adjusted currency competitiveness.”

“We remain optimistic on the outlook for Indian GDP, but that optimism (and associated high investment and consumption) amid re-opening is actually negative for the trade balance and INR.”

Federal Reserve Bank of Cleveland President Loretta Mester said in an interview with the WSJ that, depending on what happens with the economy, some of the rate increase further out may need to be moved forward.

Additional Remarks:

"There are many things pushing up inflation now, including supply chain issues and wages."

"We've moved from pandemic driven inflation to something broader."

"If we can get beyond the pandemic we'll see inflation measures come back down."

"That is incumbent on the fed doing what it needs to do to move off extraordinary accommodation."

"Depending on what happens with the economy some of the rate increases further out may need to be moved forward."

"The case is very compelling that we remove accommodation."

"The Fed is also considering what it can do to balance sheet to bring the level of assets down."

"If things look like they do today in march she would support lifting rates from zero at that point."

"Because of demographics, labor force participation trend is downward and we are back to that trend."

"The pace of interest rate increases will depend on how the economy plays out."

"The Fed will have to take policy actions to make sure inflation expectations remain consistent with its 2% goal."

"The Fed had to put in a lot of accommodation early in the pandemic but now the economy is basically back to full employment and above its inflation target."

Analysts at Rabobank point out that there is potential for the AUD/USD pair to be whipsawed by US dollar related volatility in the early months of this year on the back of Federal Reserve policy signals. That said, they expect AUD/USD to push higher to 0.74 during the second half of the current year.

Key Quotes:

“Nobody would argue with the expectation that the Federal Reserve is positioning itself to hike rates well ahead of the RBA. The relevant questions for the outlook for AUD/USD relate to what degree this forecast is already priced in and the risk that expectations regarding the pace of tightening by either central bank could change in the coming months.”

“Exactly one year ago, the market consensus was forecasting that AUD/USD would end 2021 at 0.78. In February last year AUD/USD hit a high around 0.8007 which underpinned enthusiasm among AUD bulls. This level, however, proved to be the peak and in early December AUD/USD dipped below 0.70 as Fed hawkishness increased. Aside from the pick-up in the broad-based value of the USD in H2 last year, one of the major drivers behind the relative softness of the AUD/USD last year was, in our view, the continued dovish position of the RBA. Headed into 2022 there is scope for this to change.”

“It can be assumed that further evidence of strength in the labour market will trigger expectations regarding scope for a potential positive shift in RBA rhetoric which will underpin the outlook for the AUD.”

“There is potential for AUD/USD to be whipsawed by USD related volatility in the early months of this year on the back of Fed policy signals. That said, we expect AUD/USD to push higher to 0.74 in H2 2022.”

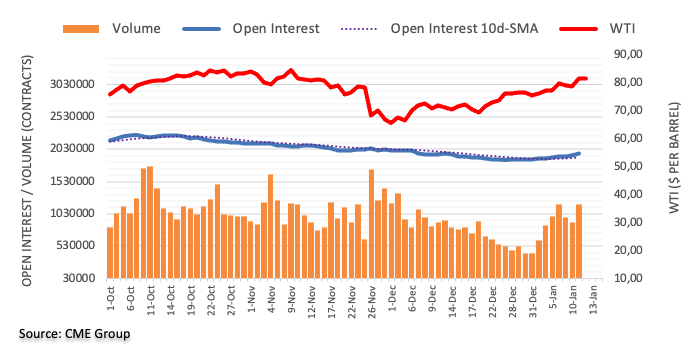

- WTI has surged into the mid-$82.00s and is trading at more than two-month highs as the dollar falls post-CPI.

- Oil prices saw a positive reaction to the latest weekly US EIA inventory report which showed an eighth successive draw.

Oil prices hit more than two-month highs on Wednesday, buoyed as the US dollar weakened in wake of a broadly in line with expectations US inflation report. Front-month WTI futures recently hit the $82.50 mark, their highest level since 10 November and well above their levels prior to the initial news of the Omicron Covid-19 variant (in the $78.00 area). WTI has bounced more than $4.50 since its earlier weekly lows under $78.00 a rally of roughly 6.0%, with prices up a further $1.20 or 1.5% on Wednesday as the dollar crumbles. Oil bulls will now surely be eyeing a test of 2021 highs in the $85.00s area.

Despite showing inflationary pressures hitting their highest in the US since 1982 with the headline Consumer Price Index up 7.0% YoY in December, traders have taken the data, which was broadly in line with expectations, as a green light to take profit on dollar long positions. The DXY now trades down nearly 0.5% on the day having cratered from above 95.50 towards the 95.00 level. A weaker dollar makes USD-denominated crude oil cheaper for purchase by international buyers, hence boosting its demand.

The weakening of the US dollar has been one of the primary drivers of higher oil prices this week, with the DXY now down more than a percent from earlier weekly highs, though crude oil-specific factors are also being cited. Market participants remain bullish on the demand outlook for 2022 with the economic impact of Omicron seen as likely to be short-lived, which spurred the US EIA to upgrade its oil demand outlook for the year. The agency said on Tuesday that it now sees US demand rising 840K barrels per day (BDP) in 2022 versus its forecast last month of demand rising 700K.

Meanwhile, OPEC+ output remains a supportive theme, with smaller producers (Libya and Nigeria) still struggling to keep up with recent output quota increases and talks between Western powers and Iran on a return to the JCPOA not making any progress. That suggests no return of large amounts of Iranian crude oil exports to global markets anytime soon. Some a fretting about the risks to demand in China/Asia as China maintains its zero Covid-19 stance even in the face of the much more transmissible Omicron variant, but lockdowns there, for now, remain localised.

Finally, WTI saw a modest boost from the recently released weekly US EIA crude oil inventory report. The report showed a draw in crude oil stocks of roughly 4.5M barrels, much larger than the expected 1.9M barrels, despite Tuesday’s private inventory report pointing to a smaller than expected draw of roughly 1M barrels. However, Distillate stocks rose by roughly 2.5M barrels, more than the 1.75M barrels expected, and gasoline stocks saw a massive near 8M barrel rise, well above expectations for a 2.4M build. Nonetheless, the bullish headline number stole the focus, with headline crude oil stocks having now drawn for eight successive weeks.

Taking into accont the minutes from the last Banxico meeting and recent events, analysts at Standard Chartered expected the Bank of Mexico to raise the policy rate 50bps (instead of 25bps) at each of the next two meetings.

Key Quotes:

“Banxico increased the policy rate 50bps, bringing it to 5.50%, at December’s policy meeting. Four board members who voted for the 50bps hike expressed concerns over wide-spread inflationary shocks, rising inflation expectations, and the ongoing tightening of global financial conditions, arguing that rate hikes need to be more aggressive and decisive to maintain Banxico’s credibility.”

“We now expect Banxico to deliver two more 50bps hikes at the next two meetings (instead of 25bps), bringing the policy rate to 6.5% by end-Q1-2022 (6.0%).”

“We see a possible surge in COVID cases, sluggish economic growth and labour market recovery as major downside risks to our policy rate forecast. Economic growth slowed by 0.21% m/m in October amid a contraction in agricultural and services activities, and the unemployment rate is still well above the pre-pandemic level, especially in urban areas. Limited monetary and fiscal stimulus provided during the pandemic could also justify slower rate hikes. However, given the concerns over inflation expectations and possible Fed tightening in March, we expect Banxico to frontload and increase rate hikes in Q1-2022.”

- Kiwi benefits from risk appetite and lower US yields.

- DXY tumbles despite inflation hitting the highest in decades in the US.

- NZD/USD having the best day in weeks.

The NZD/USD is having the best day in weeks on Wednesday, supported by a broad-based slide of the US dollar. The pair trades at 0.6840, the highest since January 3 as the DXY tumbles 0.47%, to the lowest in more than a month.

US yields down, despite inflation reading

The US CPI reached in December 7%, in line with expectations. It was the highest reading since 1982. Despite the numbers, US yields moved to the downside and together with higher equity prices on Wall Street, pushed the dollar to the downside.

“If CPI inflation is still around 7% heading into the March FOMC meeting, as we expect it to be, it will be hard for the Fed to stand by idly”, warned analysts at Wells Fargo. The next FOMC meeting is on January 24/25.

The DXY is falling for the third time out of the last four trading days, breaking the 95.50 support area. Now it appears to be heading toward 95.00. At the same time, NZD/USD, broke above 0.6800 and is now looking at the December peak at 0.6856.

A daily close above 0.6860 should clear the way to more gains, with the next critical level seen at the 55-day simple moving average at 0.6890. If NZD/USD reverses from current levels, the support emerges at 0.6795 (20-day moving average).

Technical levels

Data released on Wednesday showed that US inflation reached 7% the highest level since 1982. Analysts at Wells Fargo point out that if CPI inflation is still around 7% heading into the March FOMC meeting, as they expect it to be, it will be hard for the Federal Reserva to stand by idly.

Key Quotes:

“December's 0.5% increase in the Consumer Price Index marks a slowdown from November's gain, but the relative size should not detract from the absolute size which shows prices continue to rise at a menacing pace. The ongoing strength of inflation was underscored by the year-over-year change rising to 7%, which is the largest increase in nearly 40 years.”

“Although the exceptional pace of goods inflation and momentum in shelter costs are still firmly rooted in the pandemic, the increasingly tight labor market and ensuing wage pressures will make it difficult for inflation to fall back on its own. The FOMC has been discussing a more aggressive response to inflation in recent weeks, and with the core CPI still likely to be around 4% by the end of the year, we do not believe it will end up being just talk. If CPI inflation is still around 7% heading into the March meeting, as we expect it to be, it will be hard for the Fed to stand by idly.”

- A general slide of the dollar boosts AUD/USD to the upside.

- Pair faces next resistance around 0.7275.

- US inflation rises to 7%, largest increase in nearly 40 years.

The US dollar is falling sharply amid higher equity prices and following the US CPI December report. The AUD/USD jumped to 0.7266 during the American session, reaching the highest level in a week. It remains around the top, with the bullish momentum intact.

The decline of the dollar and a rally in commodity prices are boosting AUD/USD. The DXY is falling by 0.40%, at 95.20, the lowest since November 15. The annual inflation rate in the US reached at 7% the highest since 1982. The number did not boost US yields the printed fresh lows and weighed on the dollar.

AUD/USD likely to test recent tops

The pair is approaching the 0.7275/80 zone that capped the upside late in December and early January. A break higher would strengthen the positive outlook for the aussie. The next level to watch is the 100-day simple moving average at 0.7285.

If AUD/USD fails to break the mentioned resistance, a retreat toward the 20-day moving average at 0.7200 seems likely.

Technical levels

- USD/CHF dipped below the 0.9200 level in recent trade, weighed amid a broad flushing out of USD long positions.

- The move lower in USD comes despite near-four decade-high CPI, which seemingly failed to spur fresh hawkish Fed bets.

Amid what appears to be a large flushing out of dollar long positions after the latest US inflation report failed to spur fresh hawkish Fed bets, USD/CHF has slumped from the mid-0.9200s to underneath 0.9200 in recent trade. On its way lower, the pair has broken below a key uptrend that had been supporting the price action so far in 2022, its 50-day moving average at 0.9215 and its 21-day moving average at 0.9196. That means the door is open for a retest of the last weekly lows at 0.9180 and a test of the 200-day moving average in the 0.9160s. At current levels in the 0.9180s, USD/CHF is trading lower by about 0.5% on the day, having now reversed a full percent lower from Tuesday’s near-0.9280 peaks.

The dollar’s loss of bullish momentum which had seen it rally from near-0.9100 at the start of 2022 to this week’s highs near-0.9280 began after Fed Chair Jerome Powell failed to spur fresh hawkish Fed bets in wake of his testimony on Tuesday. Though the Fed Chair, who was speaking at his renomination hearing before Congress, endorsed the idea of multiple hikes in 2022 and a start to quantitative tightening, his tone didn’t deviate much from the December Fed meeting or its minutes. Traders seemingly took this as a green light to take profit on long-held USD bullish positions and, despite headline CPI on Wednesday showing inflationary pressures reached their highest level since June 1982 at 7.0% in December, the latest inflation report seems to have been interpreted the same way.

Looking at the DXY from a technical perspective, with the index having now broken below key support in the 95.50 area, the current pullback has some room to run. The next area of significant support is in the 94.50 zone. A drop back to these sorts of levels suggests that USD/CHF could be headed back for a test of Q4 2021 lows in the 0.9100s. This would be a very attractive level for longer-term USD bulls betting that the hawkish Fed will ultimately push US yields and the US dollar higher to reload on longs.

Whilst not the case on Wednesday, in the long-run high US inflation is likely to benefit the buck. And as ING put it, “the risks are likely skewed towards higher for longer inflation with the Federal Reserve ending up responding more aggressively to keep it in check.” “After all,” continues the bank, “labour costs are accelerating, companies have pricing power, Asia lockdowns in response to a zero-Covid policy risk prolonging supply chain strains while inventory rebuilding could keep demand outstripping supply for a good while yet.”

- USD/JPY trades on the defensive near the 115.00 mark.

- US yields show a mixed performance on Wednesday.

- US headline CPI rose 7% YoY in December, in line with estimates.

The greenback accelerates its losses and drags USD/JPY to the area of weekly lows near the 115.00 figure on Wednesday.

USD/JPY looks to yields, weaker on data

USD/JPY resumes its monthly decline and quickly fades Tuesday’s uptick, refocusing once again on the lower end of the range in the 115.00 neighbourhood.

Mixed performance in the US cash markets show modest gains in yields in the short end of the curve, while the belly and the long end add to the recent decline and revisit the 1.70% area and the 2.05% zone, respectively.

In the docket, the selloff in the buck – and the downside in spot - gathered extra pace after US inflation figures measured by the headline CPI rose 7.0% in the year to December, matching forecasts and thus removing the surprise factor, which seems to have hurt the sentiment of many. The Core reading came above consensus after prices gained 5.4% vs. the same month in 2021.

USD/JPY levels to consider

As of writing the pair is losing 0.20% at 115.07 and faces the next support at 114.94 (2022 low Jan.3) seconded by 114.19 (55-day SMA) and then 113.14 (low Dec.17). On the upside, a surpass of 116.35 (2022 high Jan.4) would aim to 115.00 (round level) and finally 115.62 (high Jan.19 2017).

- In the New York session, the euro is gaining 0.44%.

- Fed’s Chief Jerome Powell said that the US central bank would use its tools to tackle inflation.

- US inflation figures aligned with expectations but boosted the EUR instead of the USD.

On Wednesday, as the North American session begins, the euro surges against the greenback, on the back of US inflation figures, which came in line with expectations, though weighed on the US dollar. Per the market’s reaction, it appears a “buy the rumor, sell the fact” event, as the EUR/USD exchanges hands at 1.1416 at the time of writing.

On Tuesday, Fed’s Chief Jerome Powell, who has been renominated for the job by US President Joe Biden, appeared at the US Senate. Over there, he said that the US economy does not need to be accommodative, and when asked about inflation, Powell emphasized that “if we have to raise interest rates more over time, we will.” It is worth noting that the Fed’s Chief stated that the Federal Reserve should focus more on elevated prices than on achieving the maximum employment goal, though the importance of the US CPI reading, on the day.

US Consumer Price Index (CPI) came within forecasts

In the meantime, the US Bureau of Labor Statistics (BLS) revealed that the Consumer Price Index (CPI) for December rose by 7.0%, as foreseen by analysts on its annual reading. Excluding volatile items like food and energy prices, the so-called Core CPI increased annually by 5.5%, a tenth up from the estimated 5.4%, close to expectations.

In the overnight session for North American traders, the Eurozone economic docket revealed the Industrial Production for the Euro area. Industrial Production rose 2.3% on its monthly reading but fell 1.5% on an annual reading, per Reuters reported.

EUR/USD Price Forecast: Technical outlook

In the EUR/USD daily chart, the euro finally trades above the 1.1386 strong resistance level for the first time since November 15, 2021. The breach of the trading range maintains EUR bulls hopeful of launching an attack towards an eight-month-old downslope trendline, drawn from May 2021, cycle highs, that the EUR/USD would face around the 1.1440-60 area. Once that level is broken, the next ceiling level would be the confluence of the 100-day moving average (DMA) and the 1.1500 psychological level.

Contrarily on the downside, the EUR/USD first support would be the January 11 daily high, previous resistance-turned-support, at 1.1375, followed by the 50-DMA at 1.1338 and then the 1.1313.

- Gold continues to trade broadly flat on the day in the $1820 area post-hotter than expected US CPI.

- In an unintuitive reaction, the dollar has been weakening in recent trade, but technical resistance is stopping gold from benefitting.

In wake of a broadly hotter than expected US Consumer Price Inflation (CPI) report, spot gold (XAU/USD) prices continue to trade sideways in the $1820 area where it trades broadly flat on the day. In a somewhat unintuitive reaction to headline CPI rising in line with expectations to 7.0% YoY, its highest levels since June 1982, and Core CPI rising above expectations to 5.5%, the US dollar has come under pressure. The data, which comes on the heels of last Friday’s jobs report which showed the unemployment rate falling under 4.0%, strongly supports the case for Fed tightening this year, even if much of the recent pressures come from used car prices.

But market participants appear to be taking the view that positioning in the US dollar has in recent weeks become too bullish, hence the downside in both. For reference, the DXY recently fell under the 95.50 mark to hit its lowest level since mid-November. The dollar’s case isn't being helped by the fact that, in wake of the data, 10-year TIPS yields are going sideways in the -0.85% area, having dropped back about 10bps since Fed Chair Jerome Powell’s not as hawkish as feared comments on Tuesday. The combination of a weakening dollar plus subdued real yields would typically be a positive for spot gold prices.

However, resistance in the form of a downtrend from the 2 and 5 January highs appears to have blocked XAU/USD from pushing higher. Perhaps if the dollar continues to crater and real yields build on Tuesday’s pullback from recent highs then spot gold can see a bullish breakout a test last week’s highs in the $1830 area. It is worth bearing in mind that many rate and FX strategists think that in the medium to long-term as the Fed tightens monetary policy, the trajectory for the dollar and US real yields will ultimately be higher. That suggests traders should guard against the building of medium-term bullish positions in gold and should instead be nimble if they are going to trade on the long side.

- EUR/JPY adds to Tuesday’s gains and surpasses the 131.00 mark.

- The dollar's soft stance is sustaining upside for the cross.

- US headline CPI failed to surprise markets in December.

The selling bias in the greenback is sustaining a better mood in the risk complex and pushing EUR/JPY to new multi-day highs near 131.50 midweek.

EUR/JPY poised for further upside

EUR/JPY is advancing for the second session in a row on Wednesday, and at the same time extending the recent breakout of the always relevant 200-day SMA, today at 130.53.

Further gains continue to be sustained by an improvement in the sentiment surrounding risk-associated assets, always at the back of the US dollar's persistent selloff.

US yields are trading on a mixed note with the belly of the curve drifting lower vs. the move up in the short and long ends of the curve.

The dollar's weakness came after US inflation figures failed to surprise markets, with the headline CPI rising 7.0% YoY in December and the Core CPI up 5.5% YoY, almost in line with investors’ expectations.

EUR/JPY relevant levels

So far, the cross has gained 0.26% and is at 131.41, whilst a surpassing of 131.60 (2022 high Jan.5) would expose 132.17 (Fibo level) and then 132.56 (high Nov.4 2021). On the downside, the next support comes in at 130.53 (200-day SMA) followed by 130.15 (weekly low Jan.10) and finally 130.02 (2022 low Jan.3).

- GBP/USD shot to over a two-month high during the early North American session.

- The latest US inflation figures did little to revive the USD demand or stall the move.

- Sustained strength beyond a descending trend-line will set the stage for further gains.

The GBP/USD pair caught fresh bids during the early North American session and jumped to the highest level since November, around the 1.3680-85 area post-US consumer inflation figures.

The headline US CPI rose 0.5% MoM in December as against consensus estimates pointing to a fall to 0.4% from 0.8% in the previous month. This was enough to push the yearly rate to a fresh multi-decade high level of 7% from 6.8% in November. Moreover, core inflation, which excludes food and energy prices, surpassed market expectations and accelerate to 5.5% from a year ago as compared to 4.9% in November.

Given that an eventual Fed lift-off in March 2022 is fully priced in the markets, the data did little to impress the US dollar bulls. Conversely, a positive risk tone and softer US Treasury bond yields continued denting the greenback's relative safe-haven status. Apart from this, hopes that the Omicron outbreak won't derail the UK economy acted as a tailwind for the British pound and provided a fresh lift to the GBP/USD pair.

With the latest leg up, spot prices climbed to a resistance marked by a downward sloping trend-line resistance extending from the July 2021 swing high. Some follow-through buying will be seen as a fresh trigger for bullish traders and set the stage for an extension of the GBP/USD pair's recent strong move up witnessed since December 20.

Technical levels to watch

- Headline CPI rose 7.0% YoY as expected in December.

- But the MoM pace of headline price growth, as well as Core CPI measures were above expected.

Inflation in the US, as measured by the Consumer Price Index (CPI), rose to 7.0% on a yearly basis in December from 6.8% in November, the US Bureau of Labor Statistics reported on Wednesday. That was the highest reading since June 1982 and was in line with the median economist forecast for a reading of 7.0%. The MoM pace of price increases as per the CPI came in at 0.5%, slightly above expectations for a MoM gain of 0.4%, though still marking a deceleration from November's 0.8% MoM reading.

Core CPI rose at a pace of 5.5% YoY, above market expectations for a 5.4% reading and a significant jump from November's 4.9%. The pace of Core price growth was also faster than expected MoM, coming in at 0.6% versus forecasts for it to remain unchanged at 0.5%.

Many economists argue that consumer price inflation in the US peaking in December, or will do so by the end of Q1 2022 given early indications that supply chain disruptions that have driven up costs are easing. But the rapid spread of the Omicron variant, which has been highly disruptive for businesses, threatens this thesis and may delay supply chain normalization.

Market Reaction

Despite core CPI measures coming in hotter than expected, the Dollar Index has seen some downside in the initial market reaction to the latest CPI report. The DXY has in recent trade dipped below the 95.50 level breaking below its late-November lows and hitting its lowest since November 15.

- USD/CAD recently dipped below 1.2550 as FX market focus shifts to upcoming US CPI data.

- The loonie has been supported in recent sessions as oil prices have surged.

- A potential hawkish shift from the BoC in the coming weeks might further add to recent CAD tailwinds.