- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 09-11-2011

The euro slid to a four-week low versus the dollar as Italian bond yields climbed to euro-era records after a firm raised the deposits it demands for clearing the nation’s securities, intensifying Europe’s debt crisis. The shared currency fell to a two-week low versus the yen on concern Italy will join Greece in struggling to form a new regime strong enough to implement austerity measures. LCH Clearnet SA announced the changes to its margin requirements on Italian government-debt on its website.

The 17-nation currency remained lower versus the dollar as Greek Prime Minister George Papandreou said in Athens his country’s two biggest political parties reached agreement on the creation of a national unity government after three days of talks. Papandreou will step down. He didn’t disclose the name of the new prime minister.

The dollar rose as U.S. 10-year note yields declined the most in a week as demand for refuge surged. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners climbed 1.3 percent to 77.630.

The yen strengthened against most of its major peers as traders sought a haven. The Japanese currency and yen- denominated bonds were the most-sought assets today, according to Bank of New York Mellon Corp. The yen tends to gain because Japan’s export-reliant economy doesn’t need foreign capital to balance current accounts -- the broadest measure of trade while the greenback tends to strengthen during periods of financial stress due to its status as the world’s reserve currency.

Bids eyed $1.3520/25 with stops in the same area.

European stocks dropped for the third day in four as Italian bond yields surged to their highest since the introduction of the euro and Italy’s credit-default swaps jumped to a record.

Italian bonds tumbled, pushing two-, five-, 10- and 30-year yields to euro-era records. The 10-year note yield climbed to 7.25 percent.

Berlusconi last night said he will step down as soon as parliament passes austerity measures. He had pledged to cut spending in a bid to convince investors that Italy can manage the euro area’s second-largest debt. The government has yet to write the austerity bill, said Mario Baldassarri, head of the Senate Finance Committee.

In Greece, Prime Minister George Papandreou’s talks on forming an interim government to avert the economy’s collapse dragged into a third day as a near-agreement with the biggest opposition party stalled on European Union demands for written commitments. The makeup of Greece’s new government is to be announced today, the Associated Press reported, citing a government official who it did not name.

China’s inflation slowed by the most in almost three years, giving officials more room to support growth as industrial production cools, a report today showed. Consumer prices rose 5.5 percent in October from a year earlier, the statistics bureau said. The measure declined 0.6 percentage points from September, its biggest slide since February 2009.

National benchmark indexes fell in all of the 18 western European markets. France’s CAC 40 Index and Germany’s DAX Index retreated 2.2 percent. The U.K.’s FTSE 100 Index lost 1.9 percent.

HSBC Holdings Plc, Europe’s largest bank, retreated 5.8. The bank said pretax profit at its investment bank led by Samir Assaf fell to about $1 billion in the third quarter from a year-earlier. Bad-loan provisions increased to $3.89 billion from $3.15 billion, mainly related to its U.S. unit, the bank said.

Bank shares fell 3.7 percent, among the biggest drops of the 19 industry groups in the Stoxx 600, as Greek and Italian lenders slid. Piraeus Bank SA retreated 6.3 percent to 25.3 euro cents. Alpha Bank AE sank 9 percent to 1.11 euros.

Dexia SA, the lender being broken up after running out of short-term funding, plunged 11 percent to 37.2 euro cents. The bank said shareholder equity shrank 84 percent after the nationalization of its Belgian bank unit and declines in the value of government bond holdings.

Mediaset SpA, the broadcaster controlled by Berlusconi, tumbled 12 percent to 2.21 euros after the premier offered to resign once parliament approves stability measures.

Admiral Group sank 26 percent to 887.5 pence for the biggest decline on the Stoxx 600 and the shares’ largest retreat since 2004. The U.K. car insurer that owns the confused.com website said full-year pretax profit will be toward the lower end of analysts’ estimates.

Deutsche Post, Europe’s biggest postal service, rallied 3.8 percent to 11.10 euros. The company lifted its full-year forecast as increasing express shipments in Asia and parcel volume from Internet retailing boosted third-quarter earnings. Earnings before interest and taxes in 2011 will exceed 2.4 billion euros, the company said. That compared with an earlier prediction for Ebit at the upper end of a 2.2 billion-euro to 2.4 billion-euro range.

Backdrop of weak stocks, Dow down 240ish, not helping the single currency via risk consideration.

U.S. stocks slumped as a surge in Italian bond yields to euro-era records bolstered concern that Europe’s sovereign debt crisis is worsening. Today’s equity slump erased the month-to-date gain in the S&P 500. Stocks snapped a five-month losing streak in October on optimism European leaders were taking steps to solve region’s debt crisis. Benchmark gauges rose yesterday as Prime Minister Silvio Berlusconi’s offer to resign boosted optimism Italy would appoint a new leader who can tame the crisis. In Greece, Prime Minister George Papandreou will step down after announcing an agreement with the main opposition party on an interim government charged with averting the economy’s collapse.

Dow 11,915.73 -254.45 -2.09%, Nasdaq 2,660.05 -67.44 -2.47%, S&P 500 1,245.56 -30.36 -2.38%

All 10 groups in the S&P 500 fell as gauges of financial, commodity and industrial companies slumped at least 2.3 percent.

Bank of America Corp. (BAC) and Morgan Stanley dropped at least 3.1 percent, following losses in European lenders, after LCH Clearnet SA raised the extra charge it levies on clients for trading Italian government bonds and index-linked securities.

General Motors Co. tumbled 8.6 percent after abandoning its target for European results. The automaker, which hasn’t turned an annual profit in Europe in more than a decade, fell after rescinding its target for break- even results in the region. Europe operations lost $292 million before interest and taxes in the quarter. GM said it no longer expects to break even on an EBIT basis before restructuring costs in Europe, citing “deteriorating economic conditions.”

Adobe Systems Inc. sank 7.7 percent on plans to cut jobs as it lessens its focus on older products. The reduction of 750 jobs, mostly in North America and Europe, will cost $87 million to $94 million before taxes, the company said. After the costs, net income will be 30 cents to 38 cents a share, compared with a previous forecast of 41 cents to 50 cents.

Gold prices are falling as the dollar is growing, and doubts about the ability of Italy to resolve the debt problems remain even after the resignation of Prime Minister Silvio Berlusconi.

Italian Prime Minister Berlusconi resigned on Tuesday after ceasing to resist the increasing pressure after a vote in Parliament showed that he had lost the support of most members.

Euro drops, and the dollar rising against all currencies. The yield on the 10-year government bonds in Italy reached 7 percent, with the level of profitability of Portugal and Ireland have been forced to seek financial help.

Against the backdrop of the growing debt crisis in Europe the price of gold reached a record high in September in the 1,920 dollars per ounce, and from the beginning of the year the price has risen by 25 percent.

Stocks of the world's largest gold ETF-secured fund SPDR Gold Trust on Tuesday rose 0.67%. Demand for gold in China will grow by 50 percent this year to 400 tons, exceeding domestic production by investment demand, said Wednesday edition of the China Securities Journal quoting the president of China Association of gold Sun Zhao Xue.

Today, December gold futures on the COMEX traded in the range of 1779-1801 dollar / oz.

Oil futures were little changed in New York, rebounding from a decline of 2.3 percent after the U.S. government reported an unexpected decline in supplies last week.

Crude oil for December delivery fell 2 cents to $96.78 a barrel on the New York Mercantile Exchange. Oil traded at $94.84 a barrel before the release of the report at 10:30 a.m. in Washington.

Oil pared losses after the U.S. Energy Department said supplies fell 1.37 million barrels last week. Analysts had expected a gain of 500,000 barrels.

Must begin talks on debt write down

EUR/USD $1.3700, $1.3750, $1.3800, $1.3840, $1.4000

USD/JPY Y77.75, Y78.00, Y79.00, Y76.50

EUR/GBP stg0.8500

USD/CHF Chf0.9100

USD/JPY C$1.0200

U.S. stock futures slumped as a surge in Italian bond yields to euro-era records bolstered concern that Europe’s sovereign debt crisis is worsening.

Currently the pair is in $1,3590 area. Bids seen at $1.3585/80 and futher at $1,3565.

Data:

09:30 UK Trade in goods (September), bln -9.8

09:30 UK Non-EU trade (September), bln -5.7

The euro dropped amid concern Italy will join Greece in struggling to form a new regime strong enough to implement austerity measures following the resignation of Prime Minister Silvio Berlusconi.

The yield on Italy’s two-year notes rose above the rate on 10-year bonds. The five-year note yield climbed above 7.5 percent for the first time since the euro was introduced in 1999.

Greek Prime Minister George Papandreou’s talks on forming an interim government dragged into a third day as a near- agreement with the biggest opposition party stalled on European Union demands for written commitments.

EUR/USD: the pair fell in $1.3610 area where met support.

GBP/USD: the pair fell below $1.5900.

USD/JPY: the pair held in Y77,55-Y77,80 area.

EUR/USD:

Offers $1.3800/05, $1.3770, $1.3740/50, $1.3710/20, $1.3680

Bids $1.3610/00, $1.3585/80, $1.3565, $1.3555/50, $1.3525/20

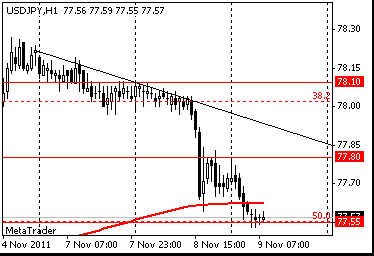

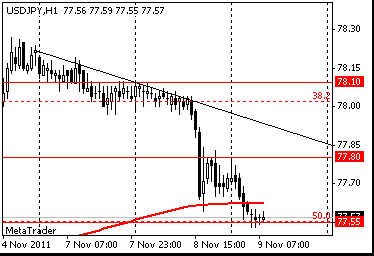

Resistance 3: Y78.40 (Nov 2 high)

Resistance 2: Y78.10 (resistance line from Nov 2)

Resistance 1: Y77.80 (session high)

Current price: Y77.65

Support 1:Y77.55 (session low, 50.0 % FIBO Y75,55-Y79,55)

Support 2:Y77.10 (61.8 % FIBO Y75,55-Y79,55)

Support 3:Y76.30 (area of Oct 25-26 highs)

Resistance 3: Chf0.9300 (area of high of October)

Resistance 3: Chf0.9120 (Oct 11 high)

Resistance 1: Chf0.9070/80 (area of Nov 8 and Oct 20 highs)

Current price: Chf0.9046

Support 1: Chf0.9000 (38,2 % FIBO of growth from Chf0,9010)

Support 2: Chf0.8910 (session low, 50,0 % FIBO Chf0,8760-Chf0,9070, support line from Oct 27)

Support 3: Chf0.8880 (61,8 % FIBO Chf0,8760-Chf0,9070)

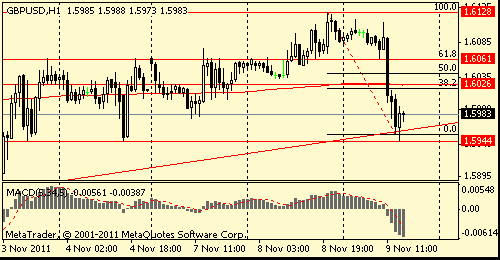

Resistance 3: $ 1.6130 (Nov 8 high)

Resistance 2: $ 1.6060 (61,8 % FIBO of falling from $1,6130)

Resistance 1: $ 1.6030 (area of Nov 8 low, 38,2 % FIBO of falling from $1,6130, МА (200) for Н1)

Current price: $1.5962

Support 1 : $1.5960 (support line from Oct 12)

Support 2 : $1.5940 (Nov 4 low)

Support 3 : $1.5875 (Nov 7 low)

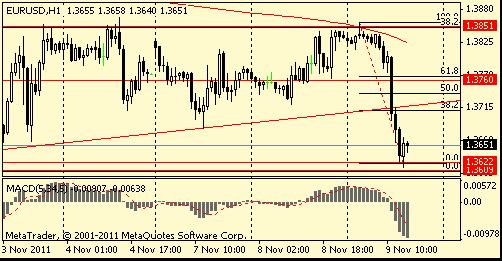

Resistance 3: $ 1.3850/60 (area of 38,2 % FIBO $1,4240-$ 1,3610, Nov 3-8 high, session high)

Resistance 2: $ 1.3760 (50,0 % FIBO of today's falling)

Resistance 1: $ 1.3720 (38,2 % FIBO of today's falling, Nov 8 low)

Current price: $1.3671

Support 1 : $1.3650 (session low, Nov 3 low)

Support 2 : $1.3610 (Nov 1 low)

Support 3 : $1.3560 (Oct 11 low)

Currently:

FTSE 5,507.22 -60.12 -1.08%

DAX 5,880.81 -80.63 -1.35%

Italian 10-year bonds underperformed similar-maturity benchmark German bunds, driving the difference in yield between the securities to 500 basis points for the first time since before the euro was introduced in 1999.

Company news:

Shares of Deutsche Post AG jumped 4.2% after company raised its full-year forecast.

Shares of HSBC dropped 4.5% as the bank said pretax profit at its investment bank led by Samir Assaf fell to about $1 billion in the third quarter from a year-earlier.

EUR/USD $1.3700, $1.3750, $1.3800, $1.3840, $1.4000

USD/JPY Y77.75, Y78.00, Y79.00, Y76.50

EUR/GBP stg0.8500

USD/CHF Chf0.9100

USD/JPY C$1.0200

Nikkei 225 8,755 +99.93 +1.15%

Hang Seng 20,014 +335.96 +1.71%

S&P/ASX 4,346 +52.22 +1.22%

Shanghai Composite 2,525 +21.08 +0.84%

00:30 Australia Home Loans September +2.2%

02:00 China CPI y/y October +5.5%

02:00 China PPI y/y October +5.0%

02:00 China Industrial Production y/y October +13.2%

05:00 Japan Eco Watchers Survey: Current October 45.9

05:00 Japan Eco Watchers Survey: Outlook October 45.9

The euro traded near its highest level this week against the greenback after Italy’s Prime Minister Silvio Berlusconi offered to quit, spurring optimism a new leader may be better able to tame the nation’s debt crisis.

The yen advanced against the majority of its most-traded peers as concern waned that the Bank of Japan will act to weaken the currency.

The yen climbed to its strongest versus the dollar since Oct. 31, when Japan made what’s estimated to be its biggest currency-market intervention to curb gains.

Australia’s dollar fell against the yen for a fourth day before a report tomorrow forecast to show the country’s unemployment rate rose in October.

The New Zealand dollar slid versus most of their 16 major counterparts after growth slowed in China’s consumer prices and industrial production.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair holds in range Y78.05-Y78.20.

On Wednesday UK data at 0930GMT includes the Trade Balance and also BOE Quoted Rates data. Despite turbulence in the euro zone, the UK's largest export market by far, the August trade data were surprisingly robust, with the global goods, and EU trade, deficits narrowing. US data starts at 1100GMT with the weekly MBA Mortgage Application Index. At 1430GMT, Fed Chairman Ben Bernanke gives welcoming remarks at the Fed's Small Business and Entrepreneurship conference in Washington. US data continues at 1500GMT with Wholesale Inventories and then at 1530GMT with the weekly EIA Crude Oil Stocks data. At 1715GMT, Fed Governor Daniel Tarullo delivers a speech on financial regulation at a Clearing House conference in New York.

The euro pared its advance versus the dollar after Italian Prime Minister Silvio Berlusconi won a vote today in parliament on last year’s budget report without an absolute majority, fueling more calls for him to quit. Italy’s 630-seat Chamber of Deputies approved the routine budget report with 308 votes, Speaker Gianfranco Fini said in Rome. Berlusconi’s failure to muster an absolute majority spurred further calls for his resignation as Italy struggles to convince investors it can fund itself. The chamber had failed to pass the report in an initial ballot last month, prompting a confidence motion won by Berlusconi on Oct. 14 with 316 votes. Since then he has faced defections that reduced his majority.

The yen gained to its strongest level against the dollar since Japan intervened Oct. 31 to stem its rise. The yen reached a post-World War II high of 75.35 on Oct. 31, threatening exporters, and the Bank of Japan sold the currency to weaken it.

The franc rose versus the euro as Swiss National Bank Vice President Thomas Jordan said the SNB is not weakening it to gain export advantage. The franc appreciated 0.4 percent to 1.2359 per euro and gained 0.4 percent to 89.65 centimes per dollar.

Australia’s dollar fell against the greenback after the nation’s trade surplus shrank more than forecast. Australia’s dollar weakened after statistics bureau data showed exports exceeded imports by A$2.56 billion ($2.64 billion), compared with a revised A$2.95 billion surplus in August.

EUR/USD: the pair traded with increase.

GBP/USD: the pair grew.

USD/JPY: the pair fell and closed day below Y78.00.

On Wednesday UK data at 0930GMT includes the Trade Balance and also BOE Quoted Rates data. Despite turbulence in the euro zone, the UK's largest export market by far, the August trade data were surprisingly robust, with the global goods, and EU trade, deficits narrowing. US data starts at 1100GMT with the weekly MBA Mortgage Application Index. At 1430GMT, Fed Chairman Ben Bernanke gives welcoming remarks at the Fed's Small Business and Entrepreneurship conference in Washington. US data continues at 1500GMT with Wholesale Inventories and then at 1530GMT with the weekly EIA Crude Oil Stocks data. At 1715GMT, Fed Governor Daniel Tarullo delivers a speech on financial regulation at a Clearing House conference in New York.

Asian stocks closed in different directions as investors are cautious in anticipation of the vote in Italy on the reporting of budgetary expenditures, which, in turn, is closely connected with the vote of confidence to the Government of Berlusconi, and if the latter will not gain a majority, then in Italy can take a snap election. The political instability in Italy adversely affect the investment climate.

Japan's Nikkei 225 closed down 1.3%. The stock price of the investment bank Nomura Holdings fell by 15% in anticipation of the vote in Italy. According to estimates of management, the bank's exposure to European risk is $ 3.55 billion, while investments in Italian assets represent 80% of this amount. Shares of rival Daiwa Securities declined by 7%.Hong Kong's Hang Seng index has not changed and China's Shanghai Composite eased 0.2%. On the eve of the vote in Italy and the release of statistics on inflation in China were trading on low volumes.

Australia's ASX / 200 rose 0.5% mainly due to winnings of the banking and mining sectors. Quotes of the banks Commonwealth Bank of Australia and Westpac Banking rose by 0.7% and 0.8% respectively, while the market capitalization of Australia and New Zealand Banking Group rose by 1.8%.

Steel companies Rio Tinto and Oz Minerals, in turn, added 1.4% and 1.9% respectively.

European stocks rose, with the Stoxx Europe 600 Index rebounding from two days of losses, as Italy’s Prime Minister Silvio Berlusconi won a parliamentary vote on the budget yet still lost his absolute majority.

Berlusconi won 308 votes out of 630 on a routine report on Italy’s 2010 budget, Speaker Gianfranco Fini said in Rome. The yield on 10-year Italian bonds rose to 6.7 percent today after yesterday climbing to a euro-era record. European stocks dropped over the past two days, as two Berlusconi allies defected to the opposition and a third one quit.

In Greece, Prime Minister George Papandreou said a Greek national-unity government will be named “soon” and told his ministers to prepare to resign, spokesman Elias Mosialos said.

In Germany, a report from the Federal Statistics Office in Wiesbaden showed that the country’s exports unexpectedly rose for a second month in September, helping Europe’s largest economy weather the sovereign-debt crisis. Exports, adjusted for work days and seasonal changes, increased 0.9 percent, the report said. Economists had forecast a drop of 0.8 percent, according to the median of 14 estimates.

National benchmark indexes gained in every western-European market except Luxembourg and Portugal. France’s CAC 40 Index advanced 1.3 percent, Germany’s DAX Index rose 0.6 percent and the U.K.’s FTSE 100 Index (UKX) added 1 percent.

Vodafone advanced 1.8 percent to 176 pence. Europe’s third- largest phone company by sales predicted full-year adjusted operating profit of 11.4 billion pounds ($18.3 billion) to 11.8 billion pounds, the upper half of the range indicated in May. First-half earnings before interest, taxes, depreciation and amortization gained 2.3 percent to 7.53 billion pounds in the six months through September. Analysts had predicted profit of 7.42 billion pounds.

Repsol surged 6.3 percent to 22.23 euros after its YPF SA unit in Argentina raised estimates for the Loma La Lata field in northern Patagonia to 927 million barrels of shale oil.

Lloyds jumped 4.4 percent to 28.9 pence after posting smaller-than-estimated provisions for bad loans in the third quarter and saying it may miss its income target for 2014.

Societe Generale SA shares advanced 7.3 percent to 18.77 euros after the bank said it won’t pay a dividend for 2011, a decision that will reduce its capital needs under European Banking Authority requirements.

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher a second day, as Prime Minister Silvio Berlusconi’s offer to resign boosted optimism Italy will appoint a new leader who can tame the debt crisis. President Giorgio Napolitano said Berlusconi has agreed to quit after the parliament approves the country’s austerity plans next week. The government has yet to present the final text of the amendment to the budget law with the austerity measures. Berlusconi’s resignation came after he failed to muster an absolute majority on a routine parliamentary ballot, obtaining only 308 votes in the 630-seat Chamber of Deputies today.

All 10 groups in the S&P 500 advanced as financial, energy and technology companies rallied at least 1.1 percent. JPMorgan Chase & Co. (JPM) and Intel Corp. (INTC) added more than 1.9 percent.

Toll Brothers Inc. gained 7.4 percent after the luxury-home builder said revenue increased.

Homebuilding revenue for the three months ended Oct. 31 rose to $427.7 million from $402.6 million a year earlier, the Horsham, Pennsylvania-based company said today in a statement. Analysts expected Toll to have revenue of $414.2 million.

Priceline.com Inc. surged 8.6 percent, the most in the S&P 500, to $552.85. The biggest U.S. online travel agency reported third-quarter profit and sales topped analyst estimates. Excluding some costs, profit was $9.95 a share, compared with the $9.30 average of 20 analyst estimates compiled by Bloomberg.

Rockwell Automation Inc. jumped 6.5 percent to $74.33 after the maker of factory-automation software projected 2012 sales growth that may exceed analysts’ estimates on demand from automobile, food and beverage producers.

DryShips Inc. advanced 9.9 percent to $2.99. The Greek owner of deep-water drilling rigs and vessels that haul iron ore and coal reported third-quarter earnings excluding some items of 16 cents a share, beating the average analyst estimate by 13 percent.

Activision Blizzard Inc. added 1.4 percent to $13.93. The world’s largest video-game maker released its eighth “Call of Duty” game, “Modern Warfare 3.” The game may sell as many as 6 million copies in the first day, according to Arvind Bhatia, an analyst at Sterne Agee & Leach Inc.

Resistance 3: Y78.45 (Nov 1 high)

Resistance 2: Y78.10 (Nov 8 high)

Resistance 1: Y77.80 (session high)

The current price: Y77.56

Support 1:Y77.55 (session low, 50.0% FIBO Y75.55-Y79.55)

Support 2: Y77.10 (61.8% FIBO Y75.55-Y79.55)

Support 3: Y76.50 (76.4% FIBO Y75.55-Y79.55)

Comments: the pair weakened.

Resistance 3: Chf0.9065 (Nov 8 high)

Resistance 2: Chf0.9010 (61.8% FIBO Chf0.8920-Chf0.9065)

Resistance 1: Chf0.8980 (high of the American session on Nov 8)

The current price: Chf0.8980

Support 1: Chf0.8920 (session low)

Support 2: Chf0.8880 (MA(233) H1)

Support 3: Chf0.8835 (low of the American session on Nov 4)

Comments: the pair decreased. In focus support Chf0.8920.

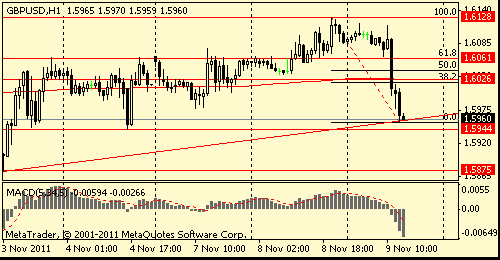

Resistance 3: $1.6205 (Sep 6 high)

Resistance 2: $1.6165 (Oct 31 high)

Resistance 1: $1.6125 (Nov 8 high)

The current price: $1.6086

Support 1 : $1.6065 (support line from Nov 3)

Support 2 : $1.6035 (Nov 8 low)

Support 3 : $1.6000 (low of the American session on Nov 7)

Comments: the pair is on uptrend. In focus resistance $1.6125.

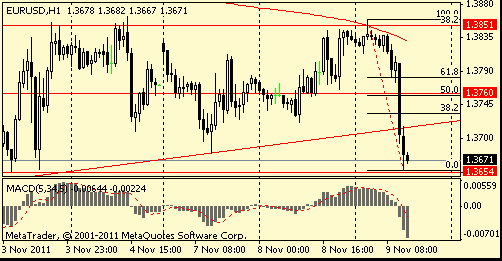

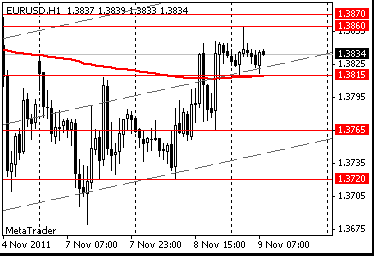

Resistance 3: $1.4000 (61.8% FIBO $1.3610-$1.4245)

Resistance 2: $1.3925 (50.0% FIBO $1.3610-$1.4245)

Resistance 1: $1.3860/70 (session high, Nov 4 high)

The current price: $1.3834

Support 1 : $1.3815 (session low)

Support 2 : $1.3765 (low of the American session on Nov 8)

Support 3 : $1.3720 (Nov 8 low)

Comments: the pair is on uptrend. In focus resistance $1.3860/70.

Change % Change Last

Nikkei 225 8,656 -111.58 -1.27%

Hang Seng 19,678 +0.58 0.00%

S&P/ASX 200 4,294 +20.43 +0.48%

Shanghai Composite 2,504 -5.96 -0.24%

FTSE 100 5,567 +56.52 +1.03%

CAC 40 3,143 +39.70 +1.28%

DAX 5,961 +32.76 +0.55%

Dow 12,170.18 +101.79 +0.84%

Nasdaq 2,727.49 +32.24 +1.20%

S&P 500 1,275.92 +14.80 +1.17%

10 Year Yield 2.06% +0.07 --

Oil $96.95 +0.15 +0.15%

Gold $1,786.50 -12.70 -0.71%

00:30 Australia Home Loans September +1.2% +1.7% +2.2%

02:00 China CPI y/y October +6.1% +5.4% +5.5%

02:00 China PPI y/y October +6.5% +5.7% +5.0%

02:00 China Industrial Production y/y October +13.8% +13.3%

05:00 Japan Eco Watchers Survey: Current October 45.3 46.7 45.9

05:00 Japan Eco Watchers Survey: Outlook October 46.4 45.9

09:30 United Kingdom Trade in goods September -7.8 -8.0

09:30 United Kingdom Non-EU trade September -4.9 -5.0

13:30 Canada New Housing Price Index September +0.1% +0.2%

14:30 U.S. Fed Chairman Bernanke Speaks

15:00 U.S. Wholesale Inventories September +0.4% +0.5%

18:02 U.S. EIA Crude Oil Stocks change +1.8

20:00 New Zealand RBNZ Financial Stability Report November

23:30 Australia Consumer Inflation Expectation November +3.1%

23:50 Japan Core Machinery Orders September +11.0% -7.2%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.