- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 11-11-2011

The euro gained the most in two weeks against the dollar as renewed optimism European leaders are taking steps to contain the region’s sovereign-debt crisis spurred appetite for risk.

The 17-nation currency rose as former European Central Bank Vice President Lucas Papademos was sworn in as prime minster of Greece and as Italy’s Senate approved a debt-cutting bill.

The euro rose versus a majority of its 16 most-traded peers as Italy’s 10-year government bond yield declined to as low as 6.43 percent, the least in four days. The rate soared on Nov. 9 to as high as 7.48 percent, exceeding the 7 percent level that led Greece, Ireland and Portugal to seek international bailouts.

Italy’s Chamber of Deputies will give final approval to the austerity legislation tomorrow and Prime Minister Silvio Berlusconi will resign “a minute later,” Chamber Speaker Gianfranco Fini said. The new government may be led by former European Union Competition Commissioner Mario Monti.

Greek Finance Minister Evangelos Venizelos will remain in his post in the new coalition government headed by Papademos, which is charged with the immediate task of securing funds to avert an economic collapse. Venizelos will also be deputy premier, according to an e-mailed statement today from the press ministry in Athens.

The yen reached its highest versus the dollar since Japan intervened last month to weaken it. Finance Minister Jun Azumi of Japan said today he’s on guard against speculative yen trades while declining to comment on whether the nation has been selling the currency this month. Japan sold the yen after it reached a post-World War II high of 75.35 per dollar on Oct. 31. Barclays Plc and Tokyo- based Totan Research Co. estimate the nation sold 8 trillion yen ($103 billion) that day, based on changes in the central bank’s balance sheet.

Updated US bank stress tests to start in two weeks

Length of weak phase depends on solving acute political issues

He sees a risk of deflation in 2012 if there's an economic downturn

Ready to take further measures on the franc

European stocks advanced, recouping this week’s losses, after the Italian Senate approved an austerity package, raising optimism that the euro area’s second- most indebted country will contain the debt crisis.

The Senate in Rome voted 156 to 12 to pass the package of measures promised to the European Union in a bid to boost growth and cut Italy’s debt of 1.9 trillion euros ($2.6 trillion), the world’s fourth biggest. Opposition lawmakers did not take part in the vote, allowing the bill to pass.

In Greece, a new unity government led by Lucas Papademos was sworn in today with a mandate to implement budget measures and decisions related to a 130 billion-euro bailout agreed on an Oct. 26. Elections may take place on Feb. 19. The new government said Evangelos Venizelos will remain the country’s finance minister and deputy prime minister.

National benchmark indexes advanced in 15 of the 18 western European markets today. France’s CAC 40 rose 2.8 percent and the U.K.’s FTSE 100 gained 1.9 percent. Germany’s DAX rose 3.2 percent, while Italy’s FTSE MIB jumped 3.7 percent.

Telecom Italia SpA gained 5.3 percent after third-quarter net income surged 33 percent to 807 million euros, beating analysts’ estimates for 708.5 million euros.

Banks and insurers paced gains. BNP Paribas surged 5.7 percent to 32.24 euros. National Bank of Greece SA gained 2.5 percent to 2.09 euros and Alpha Bank SA added 2.9 percent to 1.08 euros.

Allianz SE, Europe’s biggest insurer, rose 5.6 percent to 76.25 euros after saying it is “ready to take a closer look” at assets such as mortgages that some troubled banks may sell. The company posted a bigger-than-estimated 84 percent drop in third-quarter profit after writing down Greek government debt and investments in financial companies.

Vivendi jumped 2.6 percent to 15.87 euros after its Universal Music Group unit agreed to buy the recorded-music assets of EMI Group from Citigroup Inc. in a deal valued at 1.2 billion pounds ($1.9 billion).

Aker Solutions ASA, Norway’s biggest oil rig maker, rallied 8.5 percent to 71.50 kroner after the company signed a contract with Lundin Petroleum AB to build a 700 million kroner ($124 million) subsea production system for the Brynhild project on the Norwegian continental shelf. The contract is valued at 700 million kroner. Lundin Petroleum gained 5.5 percent to 176.20 kroner.

Galp Energia SGPS, Portugal’s largest oil company, slumped 11 percent to 13.25 euros, its biggest decline in three months, after an agreement to sell a 30 percent stake in its Brazil unit to China’s Sinopec Group for $3.54 billion.

U.S. stocks rallied, preventing a weekly drop in benchmark indexes, as American consumer confidence topped estimates and Italy’s approval of debt- reduction plans eased concern about Europe’s debt crisis.

Stocks extended gains as the Thomson Reuters/University of Michigan preliminary index of consumer sentiment rose to 64.2 this month, the highest since June. The median estimate of economists surveyed called for 61.5. Earlier gains were driven by a drop in Italian bonds yields as the Senate approved budget measures in a bid to allow for a new government. In Greece, Lucas Papademos, a former vice president of the European Central Bank, will be sworn in as premier of a unity government.

Dow 12,155.50 +261.71 +2.20%, Nasdaq 2,677.01 +51.86 +1.98%, S&P 500 1,263.74 +24.04 +1.94%

All 10 groups in the Standard & Poor’s 500 Index rose as 491 stocks climbed.

Bank of America Corp. (BAC) and Citigroup Inc. (C) increased at least 3.1 percent as financial shares advanced.

Caterpillar Inc. (CAT) and Alcoa Inc. (AA) climbed more than 2.6 percent to pace gains among the biggest companies.

Walt Disney Co. (DIS) jumped 7 percent as the biggest theme-park operator reported a 30 percent gain in profit, beating estimates. Higher fees from pay-TV operators, advertising gains and improved results at resorts drove revenue and profit growth. Audience ratings for ESPN increased 13 percent in the quarter, according to Nielsen data provided by Barclays Capital. Disney resorts benefited from higher ticket prices and a new ship.

E*Trade Financial Corp. fell 3.3 percent to $9.17. The online brokerage’s board rejected putting the company up for sale following a strategic review spurred by Citadel LLC, the company’s biggest shareholder.

At the moment the pound is trading at 1.6080 zone, 0.9% above the opening price. A pair of fully compensated for losses incurred in the outgoing week. The next resistance levelsare at 1.6100, 1.6130 (week high) and 1.6165 (peak maximum of 31 October), while support is provided to 1.6030, 1.6000 and 1.5950.

Gold prices grow at the expense of the dollar declines, caused by a stabilization of the political situation in Italy and Greece.

Italy’s Senate approved the debt-reduction package in a bid to cut the country’s debt of 1.9 trillion euros ($2.6 trillion), shore up investor confidence and pave the way for a new government that may be led by former European Union Competition Commissioner Mario Monti. The timing of the ballot was moved forward after Prime Minister Silvio Berlusconi’s parliamentary majority unraveled this week, leading bond yields to surge to euro-era records. Lucas Papademos, a former vice president of the European Central Bank, has been sworn in as prime minister of a Greek unity government.

Rising gold prices in 2010 was a record 30%. For the third quarter of this year, gold has risen in price by 8% in October - 6%. Ten-year growth in the value of the metal became the most prolonged period of price increases, at least since 1920.

Gold for December deliveries went up to 1778.80 dollars per troy ounce on Comex in New York.

Oil gained, heading for the longest streak of weekly advances since April 2009, on speculation that signs of U.S. economic growth and Europe’s efforts to contain the debt crisis will boost fuel demand.

Crude climbed for a second day as the Thomson Reuters/University of Michigan preliminary index of consumer sentiment for November rose to 64.2, higher than economists’ projection of 61.5. Italy’s Senate approved a key budget bill today to clear the way for new leadership, while Greece formed a unity government.

The Dollar Index, which tracks the U.S. currency against six major peers including the euro and the yen, slid 0.7 percent to 77.216. A weaker dollar increased oil’s appeal as an investment alternative.

Crude for December delivery climbed to $99.20 a barrel on the New York Mercantile Exchange.

Brent oil for December settlement gained 47 cents, or 0.4 percent, to $114.18 a barrel on the London-based ICE Futures Europe exchange.

EUR/USD $1.3550, $1.3715, $1.3720, $1.3845, $1.3900

GBP/USD $1.6230

AUD/USD $1.0155, $1.0200, $1.0260

EUR/CHF Chf1.2425

AUD/JPY Y79.00

09:30 UK PPI (Output) (October) unadjusted 0.0%

09:30 UK PPI (Output) (October) unadjusted Y/Y 5.7%

09:30 UK PPI Output ex FDT (October)) adjusted -0.1%

09:30 UK PPI Output ex FDT (October) unadjusted Y/Y 3.4%

09:30 UK PPI (Input) (October) adjusted -0.8%

09:30 UK PPI (Input) (October) unadjusted Y/Y 14.1%

The euro extended its advance from a one-month low against the dollar as the Italian Senate approved a budget bill.

The euro rose as former European Central Bank Vice President Lucas Papademos prepared to be sworn in as prime minster while the Italian budget vote paved the way for a new administration that may be led by former European Union Competition Commissioner Mario Monti.

The nation’s 10-year government bond yield soared to as high as 7.48 percent on Nov. 9 and fell to 6.65 percent today. Bond investors charged the nation an interest rate of 6.087 percent yesterday to buy 5 billion euros of one-year bills, the highest in 14 years. Italy plans to sell as much as 3 billion euros of five-year bonds on Nov. 14, testing investor appetite for the nation’s debt.

EUR/USD: the pair grown in $1.3670 area.

GBP/USD: the pair was consolidating in $1.5890-$ 1,5950 area.

USD/JPY: the pair decreased to Y77,30.

The limited US data is released at 1455GMT, with the release of the Nov Consumer Sentiment (UM) numbers. The Michigan Sentiment Index is expected to rise to a reading of 62.0 in early-November.

Resistance 3: Y78.40 (Nov 2 high)

Resistance 2: Y78.00 (resistance line from Nov 2)

Resistance 1: Y77.70 (session high)

Current price: Y77.36

Support 1:Y77.30 (session low)

Support 2:Y77.10 (61.8 % FIBO Y75,55-Y79,55)

Support 3:Y76.30 (area of Oct 25-26 highs)

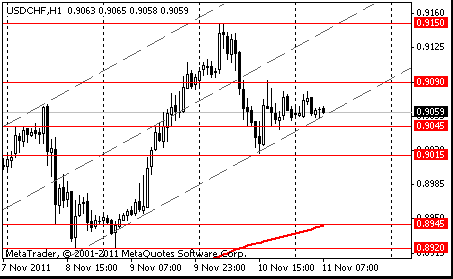

Resistance 3: Chf0.9310 (area of high of October)

Resistance 2: Chf0.9150 (Nov 10 high)

Resistance 1: Chf0.9080 (session high)

Current price: Chf0.9052

Support 1: Chf0.9040/30 (session low, 50.0 % FIBO Chf0,8920-Chf0,9150)

Support 2: Chf0.9010 (61,8 % FIBO Chf0,8920-Chf0,9150, support line from Nov 3)

Support 3: Chf0.8920 (Nov 8-9 low)

Resistance 3: $ 1.6000 (50,0 % FIBO $1,6130-$ 1,5870, support line from Oct 12)

Resistance 2: $ 1.5980 (Nov 10 high)

Resistance 1: $ 1.5950 (session high)

Current price: $1.5915

Support 1 : $1.580 (Nov 10 low)

Support 2 : $1.5875 (Nov 7 low)

Support 3 : $1.5820 (38,2 % FIBO $1,5270-$ 1,6130)

EUR/USD $1.3550, $1.3715, $1.3720, $1.3845, $1.3900

GBP/USD $1.6230

AUD/USD $1.0155, $1.0200, $1.0260

EUR/CHF Chf1.2425

AUD/JPY Y79.00

Resistance 3: $ 1.3750 (support line from Nov 1)

Resistance 2: $ 1.3720 (area of 61,8 % FIBO $1,3850-$ 1,3485, МА (200) for Н1)

Resistance 1: $ 1.3670 (50,0 % FIBO $1,3850-$ 1,3485, session high)

Current price: $1.3636

Support 1 : $1.358 (session low)

Support 2 : $1.3485 (Nov 10 low)

Support 3 : $1.3370 (Oct 10 low)

Currently

CAC 3,083.24 +18.40 +0.60%

DAX 5,914.41 +46.60 +0.79%

European stocks advanced before the Italian Senate votes on austerity measures and a new unity government takes charge in Greece.

Demand seen into Y105.30/25 (Y105.25 - 10 Nov intraday low),ahead of strong bids at Y104.75/70 (Y104.77/74 - 26 Oct/10 Nov lows).

Offers seen at Y105.75/80 (Y105.74/79 - Asian/European lows), more at Y105.95/00 (Y105.98 - 10 Nov high).

Being restored from Thursday’s low $1.3484, the pair break $1.3653. Resistance which needs to be broken to the investors putting on growth of euro, is located on $1.3775, but levels of resistance $1.3695 and $1.3730 will resolutely protect this area. Break of a level of closing of the last week $1.3790 it is not expected. Break below low of the Asian session of Friday $1.3580 will change short-term tone of pair on bear and again will aim it at a low of this week $1.3485. Target levels of a dominating 2-week wave of decrease are on $1.3230 and about October 4 low $1.3145.

Nikkei 225 8,514 +13.67 +0.16%

Hang Seng 19,137 +173.28 +0.91%

S&P/ASX 4,297 +52.42 +1.24%

Shanghai Composite 2,481 +1.55 +0.06%

The yen rose to the strongest against the dollar since Japan’s government intervened last month to weaken it as concern Europe’s spreading debt crisis will dent global growth spurred investors to seek haven assets.

The Japanese currency was poised to gain against all 16 major counterparts this week before Italy sells as much as 3 billion euros ($4.1 billion) of five-year bonds on Nov. 14, testing investor appetite for the nation’s debt.

The dollar strengthened against most peers for the period after U.S. Treasury Secretary Timothy F. Geithner said Europe remains the “central challenge” to growth.

EUR/USD: on Asian session the pair grows.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair continues falling.

On Friday US bond and forex markets closed for the Veterans' Day holiday - although equity markets are open. UK data is up at 0930GMT, with the release of third quarter construction output numbers and October producer price data. The limited US data is released at 1455GMT, with the release of the Nov Consumer Sentiment (UM) numbers. The Michigan Sentiment Index is expected to rise to a reading of 62.0 in early-November.

The euro advanced from a one-month low versus the dollar after Standard & Poor’s clarified that France’s credit rating remains AAA, easing concern that a crisis was imminent in the region’s second-largest economy.

The 17-nation currency advanced earlier versus most major peers after Italy drew double the bids for the amount on offer at a bill sale, damping bets the nation will face a challenge funding itself. Greece chose an interim prime minister. Europe’s shared currency rallied from little-changed as S&P said a message was erroneously sent to some of its subscribers suggesting France’s top-notch credit rating had been lowered. It affirmed the country’s AAA rating.

The euro gained earlier as Italy sold 5 billion euros ($6.8 billion) of bills to yield 6.087 percent, compared with 3.57 percent the last time it auctioned 12-month securities on Oct. 11, and European Central Bank was said to have bought Italy’s government bonds. Demand at the auction was 1.99 times the amount on offer.

Lucas Papademos, a former vice president of the ECB, was chosen to lead a new Greek unity government, paving the way for a coalition charged with securing additional financing to avert the country’s economic collapse. Papademos, 64, steered the country into the euro region as central bank governor more than a decade ago. He has never held elective office.

The Dollar Index declined 0.5 percent to 77.543 on reduced demand for a refuge after a report showed the number of Americans filing applications for unemployment benefits fell to the lowest level in seven months.

EUR/USD: the pair restored and closed day growth on a figure.

GBP/USD: the pair has fallen having lost two figures.

USD/JPY: the pair was under pressure.

On Friday US bond and forex markets closed for the Veterans' Day holiday - although equity markets are open. UK data is up at 0930GMT, with the release of third quarter construction output numbers and October producer price data. The limited US data is released at 1455GMT, with the release of the Nov Consumer Sentiment (UM) numbers. The Michigan Sentiment Index is expected to rise to a reading of 62.0 in early-November.

Asian stocks plunged, with the regional index headed for its biggest drop in seven weeks, after Japan’s machinery orders dropped and China’s export growth slowed and Europe’s debt crisis has infected Italy.

Global stocks dropped this week as Europe’s sovereign-debt crisis stirred political turmoil across the region, with Italian Prime Minister Silvio Berlusconi and Greek Prime Minister George Papandreou both offering to step down. Italian 10-year bond yields have breached the 7 percent level at which Greece, Portugal and Ireland sought bailouts.

Japan’s Nikkei 225 (NKY) Stock Average slipped 2.9 percent, the most since Aug. 5. Australia’s S&P/ASX 200 dropped 2.4 percent. China’s Shanghai Composite Index fell 1.8 percent as the nation’s exports rose at the slowest pace in almost two years. India’s markets were closed today.

Hong Kong’s Hang Seng Index tumbled 5.3 percent, the most since Aug. 9.

Financial stocks were the main drag for the MSCI Asia Pacific Index amid concern political wrangling in Europe will hinder efforts to contain the debt crisis. Papandreou’s drive to put together a unity government in Greece descended into disarray as rival parties squabbled over his replacement.

HSBC Holdings Plc, the U.K.’s largest lender by market value, sank 9.1 percent in Hong Kong after profit at its investment bank declined amid political and economic uncertainty in Europe. Industrial & Commercial Bank of China Ltd. sank 8.7 percent to HK$4.74 after Goldman Sachs Group Inc. raised $1.1 billion selling shares of ICBC, as the world’s biggest lender is known, at a discount.

Japanese industrial companies dropped after a report showed the nation’s machinery orders fell more than economists forecast in September, indicating companies may hold off capital outlays as Europe’s crisis threatens the global economic recovery.

Fanuc Corp., a maker of industrial robots slipped 4.1 percent to 12,280 yen in Tokyo. Komatsu Ltd., Asia’s biggest maker of construction equipment, dropped 5.1 percent to 1,898 yen.

Chipmakers tumbled after the price of computer-storage chips dropped to their cheapest levels on record. Elpida dropped 10 percent to 377 yen. Toshiba Corp., which receives 18 percent of sales from semiconductors, retreated 6.7 percent to 323 yen. Inotera Memories Inc., a Taiwanese DRAM-chip maker, dropped 7 percent to NT$4.12.

Raw-material producers declined after copper dropped to a two-week low, crude oil fell for a second day and rubber plunged to the lowest price in 18 months.

BHP Billiton Ltd., the world’s biggest mining company and the Australia’s No. 1 oil producer, slipped 2.2 percent to A$37.48. Glencore International Plc, the world’s largest commodities trader, sank 3.9 percent to HK$53.60 in Hong Kong.

European stocks dropped, erasing earlier gains, as a surge in French borrowing costs added to concern the region’s debt crisis is spreading.

Stocks tumbled yesterday after Italian borrowing costs surged to euro-era records. Italy’s 10-year bond yield yesterday closed at 7.25 percent, near levels that prompted Greece, Ireland and Portugal to seek bailouts.

French 10-year bonds extended their declines today, sending the yield 20 basis points higher to 3.40 percent. The difference in yield with similar-maturity benchmark German bunds increased 18 basis points to 166 basis points, the most since the euro was introduced in 1999.

National benchmark indexes declined in 15 of the 18 western European markets today. France’s CAC 40 and the U.K.’s FTSE 100 both slid 0.3 percent, while Germany’s DAX rose 0.7 percent.

Credit Agricole SA slid 2.3 percent after France’s third- largest bank reported a drop in profit. The bank reported a 65 percent drop in third-quarter profit to 258 million euros as writedowns on Greek debt crimped earnings.

Vedanta Resources Plc led a retreat in mining companies, falling 9.5 percent after the largest copper producer in India reported a 92 percent drop in first-half profit to $27.8 million on foreign-exchange losses. The shares also fell as copper tumbled in London.

Air France-KLM lost 5 percent to 4.62 euros after Europe’s biggest airline reported a 31 percent drop in quarterly profit and said it expects to post a full-year loss as fuel costs surge and a sluggish economy weighs on ticket prices.

European Aeronautic Defence and Space Co. paced advancing shares, climbing 5 percent to 20.97 euros after third-quarter profit surged to 312 million euros from 13 million euros and the German government agreed to buy a 7.5 percent stake in the company from Daimler AG. The maker of Mercedes-Benz cars lost 1.2 percent to 33.16 euros.

U.S. stocks advanced, rebounding from yesterday’s tumble, as jobless claims declined while a retreat in Italian bond yields and the selection of a new Greek premier tempered concern about Europe’s debt crisis. Stocks tumbled yesterday as Italian bond yields surged to a record after Prime Minister Silvio Berlusconi said he won’t resign until austerity measures are passed. Concern about Greece’s leadership also contributed to the selloff as rival parties squabbled over the name of the next premier.

Today, the appointment of Lucas Papademos, the former vice president of the European Central Bank, to lead a unity government in Greece sent stocks higher. Italian government bonds rose after the ECB was said to purchase the securities and the nation sold the maximum amount of one-year bills on offer at an auction. A statement from S&P affirming France’s rating and saying that a “technical error” was to blame for a earlier message suggesting a downgrade also lifted equities.

The report showed the number of Americans filing applications for unemployment benefits fell to the lowest level in seven months, a sign the recovery may be encouraging companies to limit cuts in headcount. Federal Reserve Chairman Ben S. Bernanke said the central bank is concentrating “intently” on reducing unemployment and projects inflation to stay under control for the “foreseeable future.”

Dow 11,893.86 +112.92 +0.96%, Nasdaq 2,625.15 +3.50 +0.13%, S&P 500 1,239.70 +10.60 +0.86%

Cisco Systems Inc., the largest maker of networking equipment, climbed 5.7 percent, the most in the Dow, as profit and sales beat estimates. Chief Executive Officer John Chambers is eliminating jobs, scaling back operating expenses and revamping a management structure that slowed decision making. The company also is refocusing on its main products: switches and routers, which ferry data across networks.

The second-biggest U.S. drugmaker Merck & Co. jumped 3.5 percent after raising its dividend for the first time since 2004 and emphasized drug discovery in a meeting with analysts today.

Apple Inc. slumped 2.6 percent amid concern that the company may ship fewer units of its iPad tablet this year due to supply constraints.

Resistance 3: Chf0.9215 (Oct 3 high)

Resistance 2: Chf0.9150 (Nov 10 high)

Resistance 1: Chf0.9090 (high of the American session on Nov 10)

The current price: Chf0.9060

Support 1: Chf0.9045 (low of the American session on Nov 10)

Support 2: Chf0.9015 (low on Nov 10)

Support 3: Chf0.8945 (MA(233) H1)

Comments: the pair is on uptrend. In focus resistance Chf0.9090.

Resistance 3: $1.6015 (50.0% FIBO $1.5900-$1.6130)

Resistance 2: $1.5985 (Nov 10 high, 38.2% FIBO $1.5900-$1.6130)

Resistance 1: $1.545 (session high)

The current price: $1.5928

Support 1 : $1.5905 (session low)

Support 2 : $1.5870 (Nov 10 low)

Support 3 : $1.5840 (Sep 9 low)

Comments: the pair is corrected after falling on Nov 9. In focus resistance $1.5945.

Resistance 3: $1.3740 (MA(233) H1)

Resistance 2: $1.3685 (50.0% FIBO $1.3515-$1.3860)

Resistance 1: $1.3635 (session high)

The current price: $1.3624

Support 1 : $1.3575 (session low)

Support 2 : $1.3550 (low of the American session on Nov 10)

Support 3 : $1.3485 (low on Nov 10)

Comments: the pair is corrected after falling on Nov 9. In focus resistance $1.3635.

Change % Change Last

Nikkei 225 8,755 +99.93 +1.15%

Hang Seng 20,014 +335.96 +1.71%

S&P/ASX 200 4,346 +52.22 +1.22%

Shanghai Composite 2,525 +21.08 +0.84%

FTSE 100 5,460 -106.96 -1.92%

CAC 40 3,075 -68.14 -2.17%

DAX 5,830 -131.90 -2.21%

Dow 11,780.94 -389.24 -3.20%

Nasdaq 2,621.65 -105.84 -3.88%

S&P 500 1,229.10 -46.82 -3.67%

10 Year Yield 1.96% -0.11 --

Oil $95.91 +0.17 +0.18%

Gold $1,770.90 -20.70 -1.16%

00:30 Australia Changing the number of employed October 20.4K 10.3K

00:30 Australia Unemployment rate October 5.2% 5.3%

02:00 China Trade Balance, bln October 14.5 26.3

05:00 Japan Consumer Confidence October 38.6 39.3

05:00 Japan Consumer Confidence Households October 38.5

06:00 Japan Prelim Machine Tool Orders, y/y October +20.1%

06:30 France CPI, m/m October -0.1% +0.1%

06:30 France CPI, y/y October +2.2% +2.3%

07:00 Germany CPI (final), m/m September 0.0% 0.0%

07:00 Germany CPI (final), y/y September +2.5% +2.5%

07:45 France Industrial Production, m/m September +0.5% -0.6%

07:45 France Industrial Production, y/y September +4.4% +3.9%

09:00 Eurozone ECB Monthly Report

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:15 Eurozone ECB’s Juergen Stark Speaks

13:30 Canada Trade balance, billions September -0.6 -0.5

13:30 U.S. International trade, bln September -45.6 -46.1

13:30 U.S. Initial Jobless Claims 397 402

15:40 U.S. FOMC Member Charles Evans Speaks

16:45 U.S. Fed Chairman Bernanke Speaks

19:00 U.S. Federal budget October -64.6 -110.3

23:50 Japan Tertiary Industry Index September -0.2% -0.4%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.