- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 14-11-2011

Italians may be forced to make 'sacrifices'

Morgan Stanley's Asia private equity arm is in talks to buy a majority stake in Chinese packaging firm HCP Holdings Inc, four sources with knowledge of the matter told Reuters, a deal that could value the company at about $500 million. The private equity firm aimed to buy about 80 percent of HCP, one of the sources said. UBS AG was advising the fund on the acquisition, and was seeking lenders for a $260 million loan to back the deal, said the sources, who declined to be named because the transaction was private. HCP, Morgan Stanley and UBS declined comment.

The euro dropped more than 1 percent versus the dollar and yen as Italy’s borrowing costs increased at a five-year note sale, stoking concern its new government will struggle to contain debt turmoil. Italy’s Treasury auctioned 3 billion euros ($4.1 billion) of September 2016 notes, the maximum target. The yield was 6.29 percent, up from 5.32 percent at the previous auction and the highest since June 1997. Demand rose to 1.47 times the amount on offer, from 1.34 times last month. Former European Union Competition Commissioner Mario Monti will head a new government as Italy reaches outside the political arena for a leader to restore confidence in its ability to cut the euro region’s second-biggest debt. Italy’s President Giorgio Napolitano offered the position of premier to Monti after the resignation of Silvio Berlusconi.

Yields on Spanish 10-year bonds rose above 6 percent today for the first time since Aug. 5. The European Central Bank was said to resume its purchases of government debt, including buying Spanish and Italian securities, on Aug. 8.

The franc snapped a two-day gain versus the dollar, sliding 1 percent to 90.86 centimes versus the dollar, after the Federal Statistics Office said producer and import prices decreased 1.8 percent last month from a year earlier. Swiss National Bank President Philipp Hildebrand is proving intervention in foreign-exchange markets can succeed as speculators bow to his decision to cap the franc against the euro as he seeks to stave off the threat of deflation. The currency has depreciated 10 percent against the euro and 13 percent versus the dollar since Sept. 5, the day before the central bank imposed a ceiling at 1.20 per euro.

Sterling fell 1 percent to $1.5899 after the Chartered Institute of Personnel and Development said its gauge of U.K. hiring fell to minus 3 in the fourth quarter from minus 1 in the previous three months.

European stocks dropped as Italy’s borrowing costs rose after the nation sold 3 billion euros ($4.1 billion) of bonds at the highest yield since 1997. Stocks initially climbed after Mario Monti, a former European Union competition commissioner, was appointed Italy’s new prime minister, as the country tackles the euro region’s second-biggest debt. Silvio Berlusconi resigned after defections ended his parliamentary majority and the country’s 10-year bond yield surged over the 7 percent threshold that prompted Greece, Ireland and Portugal to seek EU bailouts.

Italy sold 3 billion euros of five-year bonds, the maximum target for the auction, as borrowing costs climbed. The Rome- based Treasury sold the bonds to yield 6.29 percent, the highest since June 1997 and up from 5.32 percent at the last auction on Oct. 13. The yield on five-year Italian notes rose 17 basis points to 6.63 percent following the auction.

In Greece, the nation’s finance minister, Evangelos Venizelos, said his priority is to ensure the country gets a sixth loan under an EU-led bailout after Prime Minister Lucas Papademos took charge of a new interim government.

Spiegel magazine reported that German lawmakers are preparing for Greece’s departure from the euro if the debt- strapped country’s new government doesn’t commit to reforms. The magazine did not say where it got the information.

National benchmark indexes fell in 13 of the 18 western- European markets today. France’s CAC 40 Index lost 1.3 percent, the U.K.’s FTSE 100 Index slid 0.5 percent and Germany’s DAX Index dropped 1.2 percent.

UniCredit sank 6.2 percent to 77.4 euro cents after the board approved a share sale to boost capital. The Italian lender also reported a 10.6 billion-euro loss for the third quarter, following almost 10 billion euros in goodwill impairments and writedowns, and said it won’t pay a dividend for 2011.

Spain’s government securities also slid, pushing the 10- year yield to 6.11 percent, surpassing 6 percent for the first time since the European Central Bank was said to resume buying the nation’s debt on Aug. 8. ECB Governing Council member Jens Weidmann suggested policy makers should end their support of the region’s most indebted nations. Banco Bilbao Vizcaya Argentaria, Spain’s second-biggest bank, dropped 3.2 percent to 5.97 euros and Banco Santander SA, Spain’s largest lender, slid 2.7 percent to 5.65 euros and Bankinter SA slipped 2.3 percent to 4.15 euros.

Hochtief declined 11 percent to 45.55 euros for the biggest drop on the Stoxx 600 after Germany’s largest construction company said that the “macroeconomic situation” has delayed the sale of its airport-operating unit. The company predicted it will post a net loss if the sale isn’t concluded this year.

Q-Cells SE slumped 27 percent to 85 euro cents after the German solar cell and module maker posted a third-quarter loss before interest and taxes of 47.3 million euros, wider than analysts had estimated. Q-Cells also announced the resignation of its chief financial officer Marion Helmes.

U.S. stocks declined, snapping a two-day advance in the Standard & Poor’s 500 Index, as an increase in Italian borrowing costs deepened concern Europe will struggle to contain its sovereign debt crisis.

Stocks rose last week, restoring the year-to-date gain for the S&P 500, as improving economic data and leadership changes in Greece and Italy bolstered investor optimism. Equities tumbled on Nov. 9 as yields on Italian government bonds surged, fueling concern European leaders will struggle to fund bailouts.

Italy sold 3 billion euros ($4 billion) of five-year bonds, the maximum target, at the highest yield in more than 14 years as Mario Monti seeks to form a new government to restore investor confidence in public finances. Spanish 10-year bonds slid, pushing the yield on the securities to more than 6 percent for the first time since Aug. 5. German Chancellor Angela Merkel called for an overhaul of the European Union, advocating closer political ties and tighter budget rules.

Dow 12,075.88 -77.80 -0.64%, Nasdaq 2,659.17 -19.58 -0.73%, S&P 500 1,251.91 -11.94 -0.94%

Morgan Stanley and Citigroup Inc. fell at least 2.6 percent as European lenders sank. Bank of America Corp. (BAC) slid 2 percent after selling most of its China Construction Bank Corp. stake to boost capital. The second-biggest U.S. lender by assets sold about 10.4 billion shares in China Construction Bank through private transactions with a group of investors. The sales are expected to generate an after-tax gain of about $1.8 billion, the lender said today. After the closing, the company will own about 1 percent of the common shares of CCB, Bank of America said.

J.C. Penney Co. slid 1.3 percent to $33.47. The department- store chain led by the former head of Apple Inc.’s retail operations reported a third-quarter loss because of costs from an early retirement plan.

Boeing Co. (BA) added 2.6 percent after winning its biggest-ever civil jet order. The company signed an agreement with Emirates at the Dubai Air show for 50 of its 777-300ER jets and an option for 20 more, in a deal valued at $26 billion. The accord extends their relationship in the wide- body market, with Emirates operating more than 90 of the 777s for the industry’s biggest such fleet.

International Business Machines Corp. (IBM) rose 0.8 percent as Warren Buffett told CNBC that his company, Berkshire Hathaway Inc. (BRK/A), bought a 5.5 percent stake. The holding of about 64 million shares was acquired mostly in the third quarter and cost more than $10 billion, Buffett said.

Lowe’s Cos. rallied 2.7 percent to $23.74. The second- largest U.S. home-improvement retailer reported third-quarter profit that exceeded analysts’ estimates, helped by sales at older stores.

Gold prices are down against the dollar and strengthen the enduring risk of slipping into the EU economy into recession. Reducing the cost of gold is also caused by technical selling of gold futures, for the last trading week of November 7-11 rose markedly, and their interest in further purchases weakened.

Today, December gold futures on the COMEX fell to 1774.2 dollars per ounce.

Oil dropped, erasing earlier gains, on concern that new leadership in Italy may not contain the European debt crisis and China’s demand for crude may weaken.

West Texas Intermediate fell as much as 1.3 percent after rising earlier to $99.69 a barrel, the highest since July 26. Italy’s president offered Mario Monti, a former European Union competition commissioner, the post of prime minister yesterday. The International Monetary Fund’s Deputy Managing Director Zhu Min said yesterday the world’s second-largest economy was heading for a “soft landing” as growth slows.

The euro weakened as much as 0.8 percent to $1.3636 after Italy sold 3 billion euros ($4 billion) of five-year bonds, the maximum target, at the highest yield in more than 14 years.

Crude for December delivery was at $98.17 a barrel, down 82 cents, in electronic trading on the New York Mercantile Exchange. Prices rose 5 percent last week and have increased for six consecutive weeks, the longest run of gains since April 2009.

Brent oil for December settlement declined 83 cents to $113.33 a barrel on the London-based ICE Futures Europe exchange. The more-active January contract was 59 cents lower at $112.34. December futures, which expire tomorrow, traded at a premium of $15.21 to New York crude, compared with a record $27.88 on Oct. 14. The spread narrowed 14 percent last week.

EUR/JPY

Offers Y106.45/50, Y106.15/20, Y105.75/80, Y105.55/60

Bids Y104.75/70, Y104.25/20, Y104.10/00, Y103.90/85, Y103.55/50

US GDP seen 2.6% in Q4, unchanged from prior forecast Unemployment rate seen 9.0; unchanged payroll growth seen avg 115k per month versus prior forecast of 149k.

EUR/USD $1.3500, $1.3600, $1.3650, $1.3700, $1.3750, $1.3800, $1.3980, $1.3985

USD/JPY Y77.25, Y77.40AUD/USD $1.0200, $1.0240, $1.0265, $1.0270, $1.0300, $1.0500

USD/CHF Chf0.9170, Chf0.8800

GBP/USD $1.6030, $1.6000

EUR/JPY Y108.75

EUR/GBP stg0.8575

Italy sold 3 billion euros ($4 billion) of five-year bonds, the maximum target, at the highest yield in more than 14 years as Mario Monti seeks to form a new government to restore investor confidence in public finances.

World markets: Nikkei +1.05%, Hang Seng +1.94%, Shanghai Composite +1.92%, FTSE -0.17%, CAC -0.77%, DAX -0.42%.

GS raises the stock's 12-month price target to $118/share from $111. Shares of CAT +1.1% at $97.21 premarket.

Emirates airline has ordered 50 Boeing (BA) 777 jets at the Dubai Air Show for $18B and taken an option for another 20, with the whole deal worth up to $26B. The booking is the biggest in the history of Boeing, which forecasts Middle East demand of 2,520 jets worth $450B over the next 20 years.

Shares of BA +2.73% premarket to $68.75.

Data:

10:00 EU(17) Industrial production (September) -2.0%

10:00 EU(17) Industrial production (September) Y/Y 2.2%

The euro fell as Italy’s borrowing costs rose after the nation sold 3 billion euros ($4.1 billion) of bonds at the highest yield since 1997.

The shared currency dropped as Italy sold the five-year securities to yield 6.29 percent, up from 5.32 percent at the previous auction and the highest since June 1997.

Italy’s Treasury auctioned 3 billion euros of September 2016 notes, the maximum target. Demand rose to 1.47 times the amount on offer, from 1.34 times last month. Italy’s 10-year bond yields surged above 7 percent last week. The Italian five- year yield jumped 11 basis points today, reversing gains that pushed it down by as much as 12 basis points.

The euro also declined today after Spiegel magazine reported that German lawmakers are preparing for Greece’s departure from the currency in case the new government doesn’t commit to carry forward reforms that have already been agreed.

EUR/USD: the pair fell in $1.3630 area.

GBP/USD: the pair fell in $1.5930 area .

USD/JPY: the pair showed low in Y76,80 area. Later the rate restored above mark Y77,00.

Next support seen at $1.3610/00 ($1.3610 61.8% $1.3484/1.3815, $1.3602 Nov11 intraday low).

EUR/USD

Offers $1.3775/80, $1.3750/55, $1.3720/30

Bids $1.3655/50, $1.3610/00, $1.3585/80, $1.3555/45

Resistance 3: Y77.90 (resistance line from Nov 2)

Resistance 2: Y77.70 (Nov 11 high)

Resistance 1: Y77.25 (session high)

Current price: Y76.93

Support 1:Y76.80 (session low)

Support 2:Y76.30 (area of Nov 25-26 high)

Support 3:Y75.60 (area of historic low)

Resistance 3: Chf0.9150 (Oct 10 high)

Resistance 2: Chf0.9080 (Nov 11 high)

Resistance 1: Chf0.9050 (session high)

Current price: Chf0.9029

Support 1: Chf0.8960 (area of Nov 11 low and session low)

Support 2: Chf0.8920 (Nov 8-9 low, 38,2 % FIBO Chf0,8570-Chf0,9150)

Support 3: Chf0.8860 (50,0 % FIBO Chf0,8760-Chf0,9150)

Resistance 3: $ 1.6165 (Oct 31 high)

Resistance 2: $ 1.6090 (Nov 11 high, session high)

Resistance 1: $ 1.6000 (МА (200) for Н1)

Current price: $1.5942

Support 1 : $1.5920 (session high)

Support 2 : $1.5970 (Nov 3 and 11 lows)

Support 3 : $1.5850 (area of Oct 14, 17th and 19 highs)

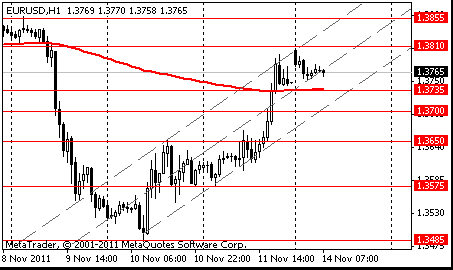

Resistance 3: $ 1.3850 (38,2 % FIBO $1,4240-$ 1,3610, area of Nov 3, 4, 8 and 9 highs)

Resistance 2: $ 1.3800 (area of session high)

Resistance 1: $ 1.3720 (МА (200) for Н1)

Current price: $1.3673

Support 1 : $1.3650 (area of 50,0 % FIBO $1,3480-$ 1,3800)

Support 2 : $1.3610 (61,8 % FIBO $1,3480-$ 1,3800)

Support 3 : $1.3580 (Nov 11 low)

EUR/USD $1.3500, $1.3600, $1.3650, $1.3700, $1.3750, $1.3800, $1.3980, $1.3985

USD/JPY Y77.25, Y77.40AUD/USD $1.0200, $1.0240, $1.0265, $1.0270, $1.0300, $1.0500

USD/CHF Chf0.9170, Chf0.8800

GBP/USD $1.6030, $1.6000

EUR/JPY Y108.75

EUR/GBP stg0.8575

Nikkei 225 8,604 +89.23 +1.05%

Hang Seng 19,508 +371.01 +1.94%

S&P/ASX 4,305 +8.06 +0.19%

Shanghai Composite 2,529 +47.63 +1.92%

The 17-nation currency was supported after Greece’s finance minister said his priority is to ensure the country gets a sixth loan under an EU-led bailout after Prime Minister Lucas Papademos took charge.

The New Zealand dollar climbed for a second day after a government report showed retail sales increased by the most since 2006, adding to signs the domestic economy remains resilient.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair continues falling.

On Monday EMU data rounds off at 1000GMT with EMU industrial output. At 1000GMT, German Chancellor Angela Merkel delivers a speech at a convention of her CDU party, in Leipzig. The OECD leading indicator data for September is then due, at 1100GMT. At 1300GMT, German Economics Minister Philipp Roesler delivers a speech at a conference on EU matters, in Berlin. At the Riksbank and ECB Conference on Bank Resolution, in Stockholm, at 1530GMT ECB Executive Board member Peter Praet is due to participate in a panel discussion, while at 1800GMT, ECB Vice President Vitor Constancio is due to give a dinner keynote speech.

On Monday the euro fell versus the yen and dollar as Italian Prime Minister Silvio Berlusconi faces a budget vote amid pressure to resign, stoking concern the region’s third-largest economy will struggle to manage its debt. Yields on Italy’s 10-year bonds jumped to as high as 6.68 percent, approaching the 7 percent level that drove Greece, Ireland and Portugal to seek bailouts. The rise in Italian yields pushed the spread with the German securities to 491 basis points, also a euro-era record. The franc fell after Swiss National Bank President Philipp Hildebrand said the central bank expects the currency to weaken further. Swiss inflation unexpectedly slowed to a negative rate in October, data yesterday showed.

On Tuesday the euro pared its advance versus the dollar after Italian Prime Minister Silvio Berlusconi won a vote today in parliament on last year’s budget report without an absolute majority, fueling more calls for him to quit. Italy’s 630-seat Chamber of Deputies approved the routine budget report with 308 votes, Speaker Gianfranco Fini said in Rome. Berlusconi’s failure to muster an absolute majority spurred further calls for his resignation as Italy struggles to convince investors it can fund itself. The chamber had failed to pass the report in an initial ballot last month, prompting a confidence motion won by Berlusconi on Oct. 14 with 316 votes. Since then he has faced defections that reduced his majority.

On Wednesday the dollar rose as U.S. 10-year note yields declined the most in a week as demand for refuge surged. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners climbed 1.3 percent to 77.630. The yen strengthened against most of its major peers as traders sought a haven. The Japanese currency and yen- denominated bonds were the most-sought assets, according to Bank of New York Mellon Corp. The yen tends to gain because Japan’s export-reliant economy doesn’t need foreign capital to balance current accounts the broadest measure of trade while the greenback tends to strengthen during periods of financial stress due to its status as the world’s reserve currency.

On Thursday the euro advanced from a one-month low versus the dollar after Standard & Poor’s clarified that France’s credit rating remains AAA, easing concern that a crisis was imminent in the region’s second-largest economy.

The 17-nation currency advanced earlier versus most major peers after Italy drew double the bids for the amount on offer at a bill sale, damping bets the nation will face a challenge funding itself. Greece chose an interim prime minister. Europe’s shared currency rallied from little-changed as S&P said a message was erroneously sent to some of its subscribers suggesting France’s top-notch credit rating had been lowered. It affirmed the country’s AAA rating. Lucas Papademos, a former vice president of the ECB, was chosen to lead a new Greek unity government, paving the way for a coalition charged with securing additional financing to avert the country’s economic collapse. Papademos, 64, steered the country into the euro region as central bank governor more than a decade ago. He has never held elective office.

On Friday the euro gained the most in two weeks against the dollar as renewed optimism European leaders are taking steps to contain the region’s sovereign-debt crisis spurred appetite for risk. The 17-nation currency rose as former European Central Bank Vice President Lucas Papademos was sworn in as prime minster of Greece and as Italy’s Senate approved a debt-cutting bill. Italy’s Chamber of Deputies will give final approval to the austerity legislation tomorrow and Prime Minister Silvio Berlusconi will resign “a minute later,” Chamber Speaker Gianfranco Fini said. The new government may be led by former European Union Competition Commissioner Mario Monti. Greek Finance Minister Evangelos Venizelos will remain in his post in the new coalition government headed by Papademos, which is charged with the immediate task of securing funds to avert an economic collapse. Venizelos will also be deputy premier, according to an e-mailed statement today from the press ministry in Athens.

Asian stocks rose, rebounding from the biggest decline in seven weeks yesterday, as U.S. jobless claims fell and the selection of a new Greek premier tempered concern Europe’s debt crisis won’t be contained. The MSCI Asia Pacific Index is poised to decline for a second week as Europe’s sovereign-debt crisis stirred political turmoil across the region, with Italian Prime Minister Silvio Berlusconi and Greek Prime Minister George Papandreou both offering to step down.

Australia’s S&P/ASX 200 rose 1.2 percent and South Korea’s Kospi Index jumped 2.8 percent. Hong Kong’s Hang Seng Index advanced 0.9 percent, while China’s Shanghai Composite Index gained 0.1 percent. Japan’s Nikkei 225 (NKY) Stock Average added 0.2 percent, erasing losses of as much as 0.2 percent.

Exporters advanced. Sony, Japan’s biggest exporter of consumer electronics, the maker of PlayStation game consoles and Bravia televisions, climbed 2.4 percent to 1,354 yen in Tokyo. Canon Inc., the world’s biggest camera maker, gained 2.1 percent to 3,435 yen. LG Electronics Inc., Asia’s second-largest maker of mobile phones by sales, jumped 6.4 percent to 64,600 won in Seoul.

China Petroleum & Chemical Corp., Asia’s biggest refiner, rose 3.1 percent in Hong Kong. Sinopec, as the Chinese oil refiner is known, gained after parent China Petrochemical Corp. agreed to pay $3.54 billion for a 30 percent stake in Galp Energia’s Brazilian unit, giving it access to the biggest oil discovery in the western hemisphere since 1976.

Esprit Holdings Ltd., the Hong Kong-based clothier that gets most of its sales from Europe, jumped 4.7 percent to HK$9.95 after Chief Executive Officer Ronald Van Der Vis bought 300,000 shares of Esprit at an average price of HK$10.632 on Nov. 7. The stock tumbled 74 percent this year through yesterday as earnings slumped.

Genting Singapore Plc slumped 5.9 percent after Citigroup Inc. lowered its rating to “sell” as the casino-resort operator posted sales and profit that missed analysts’ estimates.

Macau casino operators also declined on concern gambling spending in Asia may be slowing. Galaxy Entertainment Group Ltd., the gaming company founded by billionaire Lui Che-Woo, slumped 6.9 percent to HK$14.40. Wynn Macau Ltd. declined 5.6 percent to HK$20.25. Sands China Ltd., Asia’s biggest gambling company by revenue, fell 4.5 percent to HK$22.10.

European stocks advanced, recouping this week’s losses, after the Italian Senate approved an austerity package, raising optimism that the euro area’s second- most indebted country will contain the debt crisis.

The Senate in Rome voted 156 to 12 to pass the package of measures promised to the European Union in a bid to boost growth and cut Italy’s debt of 1.9 trillion euros ($2.6 trillion), the world’s fourth biggest. Opposition lawmakers did not take part in the vote, allowing the bill to pass.

In Greece, a new unity government led by Lucas Papademos was sworn in today with a mandate to implement budget measures and decisions related to a 130 billion-euro bailout agreed on an Oct. 26. Elections may take place on Feb. 19. The new government said Evangelos Venizelos will remain the country’s finance minister and deputy prime minister.

National benchmark indexes advanced in 15 of the 18 western European markets today. France’s CAC 40 rose 2.8 percent and the U.K.’s FTSE 100 gained 1.9 percent. Germany’s DAX rose 3.2 percent, while Italy’s FTSE MIB jumped 3.7 percent.

Telecom Italia SpA gained 5.3 percent after third-quarter net income surged 33 percent to 807 million euros, beating analysts’ estimates for 708.5 million euros.

Banks and insurers paced gains. BNP Paribas surged 5.7 percent to 32.24 euros. National Bank of Greece SA gained 2.5 percent to 2.09 euros and Alpha Bank SA added 2.9 percent to 1.08 euros.

Allianz SE, Europe’s biggest insurer, rose 5.6 percent to 76.25 euros after saying it is “ready to take a closer look” at assets such as mortgages that some troubled banks may sell. The company posted a bigger-than-estimated 84 percent drop in third-quarter profit after writing down Greek government debt and investments in financial companies.

Vivendi jumped 2.6 percent to 15.87 euros after its Universal Music Group unit agreed to buy the recorded-music assets of EMI Group from Citigroup Inc. in a deal valued at 1.2 billion pounds ($1.9 billion).

Aker Solutions ASA, Norway’s biggest oil rig maker, rallied 8.5 percent to 71.50 kroner after the company signed a contract with Lundin Petroleum AB to build a 700 million kroner ($124 million) subsea production system for the Brynhild project on the Norwegian continental shelf. The contract is valued at 700 million kroner. Lundin Petroleum gained 5.5 percent to 176.20 kroner.

Galp Energia SGPS, Portugal’s largest oil company, slumped 11 percent to 13.25 euros, its biggest decline in three months, after an agreement to sell a 30 percent stake in its Brazil unit to China’s Sinopec Group for $3.54 billion.

U.S. stocks rallied, preventing a second straight weekly drop in benchmark indexes, as American consumer confidence topped estimates and Italy’s approval of debt-reduction plans eased concern about Europe’s debt crisis. Earlier gains were driven by a drop in Italian bond yields as the nation’s Senate approved budget measures in a bid to allow for a new government. In Greece, Lucas Papademos, a former vice president of the European Central Bank, was sworn in as premier of a unity government. Stocks extended their rally as the Thomson Reuters/University of Michigan preliminary index of consumer sentiment rose to 64.2 this month, the highest since June. The median estimate of economists surveyed called for 61.5.

Dow 12,153.68 +259.89 +2.19%, Nasdaq 2,678.75 +53.60 +2.04%, S&P 500 1,263.85 +24.15 +1.95%

All 10 groups in the Standard & Poor’s 500 Index rose as 487 stocks gained. Bank of America Corp. (BAC) and Citigroup Inc. increased at least 2.4 percent as financial shares advanced. Caterpillar Inc. (CAT) and Alcoa Inc. (AA) climbed more than 3.4 percent to pace gains among the biggest companies.

Walt Disney Co. (DIS) jumped 6 percent as the largest theme-park operator reported a 30 percent gain in profit, beating analysts’ projections. Higher fees from pay-TV operators, advertising gains and improved results at resorts drove revenue and profit growth. Disney resorts benefited from higher ticket prices and a new ship.

E*Trade Financial Corp. fell 4.1 percent, the most in the S&P 500, to $9.09. The board of the online brokerage rejected putting the company up for sale. Before today, the shares dropped 41 percent in 2011, more than its bigger rivals Charles Schwab Corp. and TD Ameritrade Holding Corp.

Resistance 3: Y77.90 (Nov 9-10 high)

Resistance 2: Y77.55 (MA (233) H1)

Resistance 1: Y77.25 (session high)

The current price: Y77.13

Support 1: Y77.05 (Nov 11 low)

Support 2: Y76.65 (area of Oct 17-20 low)

Support 3: Y76.30 (Oct 12 low)

Comments: the pair is on downtrend. In focus support Y77.05.

Resistance 3: Chf0.9080 (Nov 11 high)

Resistance 2: Chf0.9045 (resistance line from Nov 10)

Resistance 1: Chf0.9015 (session high)

The current price: Chf0.9003

Support 1: Chf0.8955 (MA (233) H1, Nov 11 low)

Support 2: Chf0.8920 (Nov 8-9 low)

Support 3: Chf0.8865 (Nov 7 low)

Comments: the pair is on downtrend. In focus support Chf0.8955.

Resistance 3 : $1.6165 (Oct 31 high)

Resistance 2 : $1.6130 (Nov 8 high)

Resistance 1 : $1.6090 (session high)

The current price: $1.6046

Support 1 : $1.6040 (session low)

Support 2 : $1.6005 (38.2% FIBO $1.6090-$1.5870)

Support 3 : $1.5980 (50.0% FIBO $1.6090-$1.5870)

Comments: the pair is corrected but remains in uptrend. In focus support $1.6050.

Resistance 3: $1.3900 (a psychological mark)

Resistance 2: $1.3855 (Nov 9 high)

Resistance 1: $1.3810 (session high)

The current price: $1.3765

Support 1 : $1.3735 (MA (233) H1)

Support 2 : $1.3700 (support line from Nov 10)

Support 3 : $1.3650 (50.0% FIBO $1.3485-$1.3810)

Comments: the pair is on uptrend. In focus support $1.3735.

04:30 Japan Industrial output final September -4.0% -3.7%

04:30 Japan Industrial output final Y/Y September -4.0%

08:15 Switzerland Producer & Import Prices, m/m October -0.1% -0.3%

08:15 Switzerland Producer & Import Prices, y/y October -2.0% -1.9%

10:00 Eurozone Industrial production, (MoM) September +1.2% -2.1%

10:00 Eurozone Industrial Production (YoY) September +5.3% +3.6%

18:00 Canada BOC Gov Carney Speaks 0

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.