- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 15-11-2011

Can meet 2012 deficit goal even with only 0.5% growth

No objection if parliament pushes further fiscal consolidation

The euro fell to a one-month low against the yen as European bond yields surged at auctions and Mario Monti, Italy’s premier-in-waiting, faced resistance to forming a cabinet. The 17-nation currency slid below $1.35 as Italy’s 10-year yields surpassed the 7 percent threshold that prompted other nations to seek bailouts. Italian 10-year yields climbed as high as 7.07 percent after rising to a euro-era record of 7.48 percent on Nov. 9. The extra yield investors demand to hold the 10-year debt of Spain, France, Austria and Belgium instead of German bunds widened to the most since the euro was introduced in 1999. The ZEW Center for European Economic Research said its index of German investor and analyst expectations, which aims to predict developments six months in advance, decreased to minus 55.2 this month, the lowest since October 2008.

The Swiss franc dropped versus the dollar after the central bank’s Vice Chairman Thomas Jordan said the currency remains “very strong.” Hans Hess, president of the country’s industry group Swissmem, told reporters today in Bern that the central bank should raise the ceiling. Fair value, the measure for currencies using prices for similar goods and services in two countries, is 1.35 to 1.40 francs per euro.

The dollar got a boost as Federal Reserve Bank of Dallas President Richard Fisher said he sees decreasing odds the central bank will need to ease policy further on signs the U.S. economy is poised for growth. U.S. retail sales rose in October more than forecast, and manufacturing in the New York region unexpectedly expanded this month, reports showed today.

- Fed has provided certainty, Congress has created uncertainty

European stocks declined as Italy’s premier in waiting Mario Monti struggled to get political parties to help form his new Cabinet and the country’s biggest defense company forecast an unexpected loss. Monti, a former European Union competition commissioner, struggled to get political parties to agree to participate in his so-called technical Cabinet during talks in Rome yesterday and today. A government lacking political representation will find it harder to muster support from the parties in parliament to pass unpopular laws.

The euro area’s inability to contain its sovereign-debt crisis has led to a surge in Italian borrowing costs with yields on the country’s benchmark 10-year bonds climbing above 7 percent today. Monti will try to reassure investors that Italy can cut its 1.9 trillion-euro debt and spur economic growth that has lagged behind the euro-region average for more than a decade.

A report today showed German investor confidence fell to a three-year low in November. The ZEW Center for European Economic Research in Mannheim, Germany, said its index of investor and analyst expectations, which aims to predict developments six months in advance, declined to minus 55.2 from minus 48.3 in October. That’s the lowest since October 2008.

A separate report showed the euro area’s economic expansion failed to accelerate in the third quarter. Gross domestic product increased 0.2 percent from the previous three months, when it rose at the same pace, the European Union’s statistics office in Luxembourg said.

European stocks pared their losses after a U.S. Commerce Department report showed that retail sales climbed more in October than predicted as Americans bought iPhones and cars. A separate report showed manufacturing in the New York region unexpectedly expanded in November. The Federal Reserve Bank of New York’s general economic index rose to 0.6 from minus 8.5 in October.

National benchmark indexes fell in 14 of the 18 western- European markets today. France’s CAC 40 Index lost 1.9 percent, the U.K.’s FTSE 100 Index slipped less than 0.1 percent and Germany’s DAX Index dropped 0.9 percent.

Finmeccanica slumped 20 percent to 3.57 euros, its lowest price in 15 years. The company forecast an adjusted loss before interest, taxes, amortization and restructuring of 200 million euros. The maker of helicopters and plane parts booked writedowns of 753 million euros.

Europe’s banking shares slid 2 percent as a group, extending yesterday’s drop. National Bank of Greece SA retreated 12 percent to 1.86 euros and Alpha Bank SA plummeted 11 percent to 96 euro cents. UniCredit, Italy’s biggest bank, lost 4.5 percent to 73.95 euro cents.

Vienna Insurance Group AG sank 4.5 percent to 26.74 euros. The insurer said third-quarter net income rose 3.9 percent to 98.2 million euros. That missed the average estimate of 102.8 million euros in a Bloomberg survey of six analysts. The insurer wrote down its Italian government bonds by 10 percent.

Cable & Wireless Worldwide plunged 26 percent to 22.31 pence, its largest drop since March 2010 and the biggest retreat on the Stoxx 600. The company, which provides telecommunications services to the U.K. police force, will pay an interim dividend of 0.75 pence per share in January 2012 and then suspend future dividend payments to “improve balance-sheet strength and to enable investment in the business,” it said.

Electrolux AB lost 6.3 percent to 113.40 kronor as the world’s second-biggest appliance maker said it will close factories in Europe and North America to cut costs amid weak demand.

Kabel Deutschland AG slipped 3.2 percent to 40.79 euros as Germany’s largest cable operator predicted sales growth in 2011 at the lower end of its forecast range of 6.25 percent to 6.75 percent.

Can not afford to provoke ratings increased volatility in the markets

Necessary to reduce excessive reliance on ratings

Rating agencies must be accountable for their mistakes

It is necessary to increase the competitiveness of the rating agencies

U.S. stocks declined, sending the Standard & Poor’s 500 Index down for a second straight day, as Italian, Spanish and French credit-default swaps surged to records amid concern Europe’s debt crisis is worsening. Italy’s 10-year yield climbed above 7 percent as prime minister-in-waiting Mario Monti faced resistance on forming a cabinet for his new government. The rate on German two-year notes dropped below 0.3 percent for the first time, while the extra yield investors demand to hold 10-year bonds from France, Belgium, Spain and Austria instead of benchmark bunds all increased to euro-era records.

Earlier today, futures trimmed losses as a Commerce Department report showed U.S. retail sales increased 0.5 percent in October, topping economists’ estimates, and the Federal Reserve Bank of New York’s general economic index unexpectedly rose to 0.6, the first positive reading since May.

Dow 12,052.34 -26.64 -0.22%, Nasdaq 2,660.73 +3.51 +0.13%, S&P 500 1,250.09 -1.69 -0.14%

Financial shares had the biggest decline in the S&P 500 among 10 industries, falling 0.8 percent as a group.

Bank of America Corp. (BAC) rallied 1.8 percent as credit-card writeoffs declined in October.

Wal-Mart Stores Inc. (WMT) retreated 2.6 percent as profit at the world’s largest retailer trailed forecasts. Net income for the quarter ended Oct. 31 declined 2.9 percent to $3.34 billion from $3.44 billion a year earlier. Profit excluding some items was 97 cents a share. Analysts projected 98 cents, on average.

LinkedIn Corp., a professional-networking website, slid 7.1 percent after saying Bain Capital Ventures will sell all of its shares in a secondary stock offering. The company plans to offer as many as 9.2 million shares for as much as $703 million, up from the $500 million sale previously announced. Current holders including Bain expect to sell 6.73 million of those shares. Bain’s stake may be worth as much as $283.2 million in the sale, based on a proposed maximum offering price of $76.44.

Gold declined for a second day in New York as a stronger dollar curbed demand for the metal as an alternative asset.

The euro fell versus the dollar for a second day after Italy’s borrowing costs surged to the highest level since 1997 at a note auction and Mario Monti, the nation’s premier-in- waiting, faced resistance to forming a Cabinet.

Gold for December delivery fell to $1,760.90 an ounce on the Comex in New York. Immediate-delivery gold was 0.6 percent lower at $1,769.88 in London.

Bullion is in the 11th year of a bull market and futures reached a record $1,923.70 an ounce on Sept. 6 as investors sought to diversify away from equities and some currencies. Holdings in gold-backed exchange-traded products reached a record 2,330 metric tons on Aug. 18 and were at 2,312.3 tons yesterday, little changed from Nov. 11.

Oil rose after U.S. retail sales increased more than projected in October, bolstering optimism that the economy of the largest crude-consuming country will expand this quarter.

Futures climbed as much as 1.2 percent after the Commerce Department said sales gained 0.5 percent last month following a 1.1 percent increase in September. The median forecast of 81 economists surveyed by Bloomberg News was a rise of 0.3 percent. Other reports showed wholesale prices dropped in October and manufacturing in the New York region expanded in November.

Crude for December delivery rose to $99.34 a barrel on the New York Mercantile Exchange. The contract dropped to $97.51 earlier today.

The Brent contract for December settlement, which expires today, gained 90 cents, or 0.8 percent, to $112.79 a barrel on the London-based ICE Futures Europe exchange. The January contract climbed 68 cents, or 0.6 percent, to $111.96.

Futures trimmed losses today after a Commerce Department report showed U.S. retail sales increased 0.5 percent in October, topping economists’ estimates, and the Federal Reserve Bank of New York’s general economic index unexpectedly rose to 0.6, the first positive reading since May.

The yield on French 10-year bonds climbed today to a euro- era record relative to benchmark German bunds, as did Belgium’s and Spain’s. Mario Monti, Italy’s premier-in-waiting, faced political resistance on forming a Cabinet during talks in Rome yesterday. Economic growth in Europe failed to accelerate in the third quarter, the European Union’s statistics office said.

Crude oil: $97.84 (-0,3%).

Gold: $1771,40 (-0,4%).

EUR/USD

Offers $1.3640/50, $1.3600/10, $1.3580/85, $1.3560/70

Bids $1.3500, $1.3485/80, $1.3465/60, $1.3440, $1.3410/00

Data:

06:30 France GDP (Q3) preliminary 0.4%

06:30 France GDP (Q3) preliminary Y/Y 1.6%

07:00 Germany GDP (Q3) flash 0.5%

07:00 Germany GDP (Q3) flash Y/Y 2.6%

09:30 UK HICP (October) 0.1%

09:30 UK HICP (October) Y/Y 5.0%

09:30 UK HICP ex EFAT (October) Y/Y 3.4%

09:30 UK Retail prices (October) 0.0%

09:30 UK Retail prices (October) Y/Y 5.4%

09:30 UK RPI-X (October) Y/Y 5.6%

10:00 Germany ZEW economic expectations index (November) -55.2

10:00 EU(17) GDP (Q3) flash 0.2%

10:00 EU(17) GDP (Q3) flash Y/Y 1.4%

10:00 EU(17) Trade balance (September) unadjusted, bln 2.9

10:00 EU(17) Trade balance (September) adjusted, bln 2.1

The euro slumped for a second day as European bond yields surged at auctions and Italy’s premier-in- waiting Mario Monti faced resistance to forming a Cabinet, fueling concern efforts to solve the debt crisis are faltering.

The euro dropped to a one-month low against the yen as Italy’s 10-year yield surpassed the 7 percent threshold that prompted Greece, Ireland and Portugal to seek bailouts.

Spain raised 3.16 billion euros from selling 12- and 18- month bills today, less than its maximum target of 3.5 billion euros. The average yield on the one-year securities climbed to 5.022 percent from 3.608 percent at the previous sale Oct. 18. Greek and Belgian borrowing costs also rose at auctions today.

The ZEW Center for European Economic Research said its index of investor and analyst expectations, which aims to predict developments six months in advance, declined to minus 55.2 this month, the lowest since October 2008.

EUR/USD: the pair fell in $1.3530 area.

GBP/USD: the pair fell in $1.5850 area.

USD/JPY: the pair decreased in Y77,00 area.

- unemployment rate will go down to 6% but slowly;

- inflation rate goal is 2%.

- unemployment rate will go down to 6% but slowly;

- inflation rate goal is 2%.

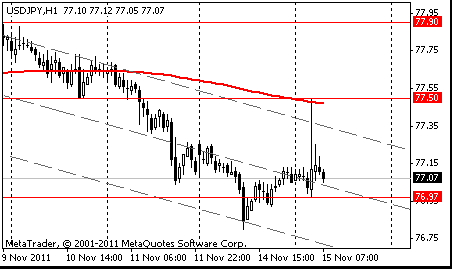

Resistance 3: Y77.90 (resistance line from Nov 2)

Resistance 2: Y77.70 (Nov 11 high, MA(200) for H1)

Resistance 1: Y77.50 (session high)

Current price: Y76.99

Support 1:Y76.80 (Npv 14 low)

Support 2:Y76.30 (area of Nov 25-26 high)

Support 3:Y75.60 (area of historic low)

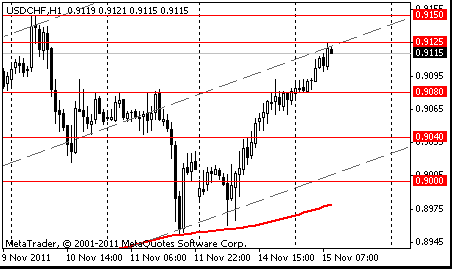

Resistance 3: Chf0.9310 (high of October)

Resistance 2: Chf0.9270 (Oct 10 high)

Resistance 1: Chf0.9175 (session high)

Current price: Chf0.9161

Support 1: Chf0.9150 (Nov 10 high)

Support 2: Chf0.9090 (38,2 % FIBO of growth from Chf0,8960)

Support 3: Chf0.9070 (50,0 % FIBO of growth from Chf0,8960)

Resistance 3: $ 1.6040 (support line from Octo 12)

Resistance 2: $ 1.5990 (МА(200) for Н1)

Resistance 1: $ 1.5930 (session high)

Current price: $1.5880

Support 1 : $1.5820 (session low, 38,2 % FIBO $1,5270-$ 1,6170)

Support 2 : $1.5750 (Oct 21 low)

Support 3 : $1.5720 (50,0 % FIBO $1,5270-$ 1,6170)

Resistance 3: $ 1.3660 (50.0 % FIBO $1,3800-$ 1,3510)

Resistance 2: $ 1.3640 (area of session high)

Resistance 1: $ 1.3620 (38,2 % FIBO $1,3800-$ 1,3510)

Current price: $1.3532

Support 1 : $1.3510 (session low)

Support 2 : $1.3480 (Nov 10 low)

Support 3 : $1.3370 (area of Oct 7-10 lows)

Nikkei 225 8,542 -61.77 -0.72%

Hang Seng 19,356 -152.02 -0.78%

S&P/ASX 4,286 -18.93 -0.44%

Shanghai Composite 2,530 +1.05 +0.04%

Economic Situation Still Relatively Good In Germany

Crisis Risks Could Further Harm German Economy

Econ Expectations Were Last Lower In October

Euro-Zone, US Debt Problems Weigh On Business Activity

The euro declined for a second day before a report forecast to show German investor confidence fell to a three-year low as Europe’s debt crisis threatens to curb economic growth.

The 17-nation currency dropped against 10 of its 16 major counterparts as Spain prepares to sell up to 4 billion euros ($5.4 billion) of bonds on Nov. 17 after Italy’s borrowing costs surged to the highest level since 1997 at a note auction.

The New Zealand and Australian currencies declined for a second day as concern Europe will struggle to contain its sovereign-debt crisis sapped demand for riskier assets.

The so-called kiwi and Aussie dollars weakened versus most of their major counterparts as Asian stocks slid. Losses in Australia’s dollar were limited after the Reserve Bank said in minutes of its Nov. 1 meeting there was a case for keeping interest rates unchanged.

The Canadian currency dropped as crude oil, Canada’s biggest export, fell.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair updated a week’s high, however has lost the positions later.

European data for Tuesday sees flash Q3 GDP data including France at 0630GMT, which is expected to come in at 0.4% q/q, while Germany at 0700GMT is expected to rise 0.5%. At 0915GMT, ECB Executive Board member Juergen Stark is due to give a speech entitled "Prospects of monetary policy in the euro area," in Luxembourg. EMU data continues at 1000GMT when the Q3 flash GDP is expected to rise 0.2% q/q. Trade data for September is also due at the same time. Also at 1000GMT, the German ZEW data is due. The current conditions measure is expected to slip to a reading of 32.0, while the economic sentiment measure is also expected to decline to a reading of -52.5. UK data at 0930GMT sees CPI. October was, undoubtedly, another month of very high inflation in the UK with the impact of hikes in domestic energy tariffs still coming through. US events start at 1230GMT when St. Louis Fed President James Bullard is due to deliver a speech on the economy outlook to the CFA Society of St. Louis. US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data. Also at 1300GMT, Chicago Fed President Charles Evans is due to deliver a speech to the Council on Foreign Relations in New York. US data continues at 1330GMT with Retail & Food Sales, PPI and also the NY Fed Empire State Survey.The weekly Redbook Average is then due at 1355GMT.

The euro dropped more than 1 percent versus the dollar and yen as Italy’s borrowing costs increased at a five-year note sale, stoking concern its new government will struggle to contain debt turmoil. Italy’s Treasury auctioned 3 billion euros ($4.1 billion) of September 2016 notes, the maximum target. The yield was 6.29 percent, up from 5.32 percent at the previous auction and the highest since June 1997. Demand rose to 1.47 times the amount on offer, from 1.34 times last month. Former European Union Competition Commissioner Mario Monti will head a new government as Italy reaches outside the political arena for a leader to restore confidence in its ability to cut the euro region’s second-biggest debt. Italy’s President Giorgio Napolitano offered the position of premier to Monti after the resignation of Silvio Berlusconi.

Yields on Spanish 10-year bonds rose above 6 percent today for the first time since Aug. 5. The European Central Bank was said to resume its purchases of government debt, including buying Spanish and Italian securities, on Aug. 8.

The franc snapped a two-day gain versus the dollar, sliding to 90.86 centimes versus the dollar, after the Federal Statistics Office said producer and import prices decreased 1.8 percent last month from a year earlier. Swiss National Bank President Philipp Hildebrand is proving intervention in foreign-exchange markets can succeed as speculators bow to his decision to cap the franc against the euro as he seeks to stave off the threat of deflation. The currency has depreciated 10 percent against the euro and 13 percent versus the dollar since Sept. 5, the day before the central bank imposed a ceiling at 1.20 per euro.

Sterling fell to $1.5899 after the Chartered Institute of Personnel and Development said its gauge of U.K. hiring fell to minus 3 in the fourth quarter from minus 1 in the previous three months.

EUR/USD: yesterday the pair fell and lost two figures.

GBP/USD: yesterday the pair fell and lost two figures.

USD/JPY: yesterday the pair continued decrease.

European data for Tuesday sees flash Q3 GDP data including France at 0630GMT, which is expected to come in at 0.4% q/q, while Germany at 0700GMT is expected to rise 0.5%. At 0915GMT, ECB Executive Board member Juergen Stark is due to give a speech entitled "Prospects of monetary policy in the euro area," in Luxembourg. EMU data continues at 1000GMT when the Q3 flash GDP is expected to rise 0.2% q/q. Trade data for September is also due at the same time. Also at 1000GMT, the German ZEW data is due. The current conditions measure is expected to slip to a reading of 32.0, while the economic sentiment measure is also expected to decline to a reading of -52.5. UK data at 0930GMT sees CPI. October was, undoubtedly, another month of very high inflation in the UK with the impact of hikes in domestic energy tariffs still coming through. US events start at 1230GMT when St. Louis Fed President James Bullard is due to deliver a speech on the economy outlook to the CFA Society of St. Louis. US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data. Also at 1300GMT, Chicago Fed President Charles Evans is due to deliver a speech to the Council on Foreign Relations in New York. US data continues at 1330GMT with Retail & Food Sales, PPI and also the NY Fed Empire State Survey.The weekly Redbook Average is then due at 1355GMT.

Asian stocks rose, paring two weeks of losses, amid optimism new governments in Greece and Italy will help contain Europe’s debt crisis and after top economists said China will have a “soft landing.”

Mario Monti, former European Union competition commissioner, was asked to become Italy’s new prime minister over the weekend after the region’s debt crisis led to the unraveling of a coalition led by Prime Minister Silvio Berlusconi.

Greek Prime Minister Lucas Papademos, who was sworn in on Nov. 11, said the country’s new government must implement agreements from last month’s European summit to receive more loans and avoid default.

Japan’s Nikkei 225 (NKY) Stock Average added 1.1 percent after the government said gross domestic product grew at an annualized 6 percent in the three months ending Sept. 30, the fastest pace in a year and a half. Australia’s S&P/ASX 200 rose 0.2 percent. Hong Kong’s Hang Seng Index advanced 1.9 percent and Shanghai’s Composite Index increased 1.9 percent.

Japan’s exporters rose, with Nissan advancing 2 percent to 719 yen. Fanuc Corp., a maker of factory robots that gets 75 percent of its sales abroad, rose 3.6 percent to 12,810 yen. Nissan Motor Co., Japan’s third-largest carmaker by market value, increased 2 percent after the nation’s economy expanded for the first time in four quarters.

Stocks advanced in Hong Kong after two of China’s best- known economists said the world’s second-largest economy was heading for a “soft landing.” Zhu Min, deputy managing director at the International Monetary Fund, and Fan Gang, director at the National Economic Research Institute, spoke yesterday at the Asia-Pacific Economic Cooperation forum in Honolulu, hosted by U.S. President Barack Obama. Chinese President Hu Jintao on Nov. 12 pushed for increased imports as a means to balance the economy and foster global growth.

China Overseas Land & Investment Ltd. advanced 6.2 percent after two of China’s best- known economists said the economy was responding to policies to reduce lending, slow inflation and curb property prices. Bank of Communications Co., a provider of commercial banking services, rose 1.4 percent to HK$5.73 in Hong Kong. Komatsu Ltd., a Japanese machinery maker that gets 23 percent of its sales in China, climbed 3.8 percent to 1,978 yen.

Want Want China Holdings Ltd., the country’s biggest producer of rice cakes, surged 6.1 percent to HK$7.44 after Hang Seng Indexes Co. said the company will be added to Hong Kong’s benchmark index.

Hynix Semiconductor Inc. gained in Seoul after its shareholders accepted SK Telecom Co.’s bid to buy 20 percent of the chipmaker. The world’s second-largest maker of computer- memory chips added 3.5 percent to 22,300 won.

European stocks dropped as Italy’s borrowing costs rose after the nation sold 3 billion euros ($4.1 billion) of bonds at the highest yield since 1997. Stocks initially climbed after Mario Monti, a former European Union competition commissioner, was appointed Italy’s new prime minister, as the country tackles the euro region’s second-biggest debt. Silvio Berlusconi resigned after defections ended his parliamentary majority and the country’s 10-year bond yield surged over the 7 percent threshold that prompted Greece, Ireland and Portugal to seek EU bailouts.

Italy sold 3 billion euros of five-year bonds, the maximum target for the auction, as borrowing costs climbed. The Rome- based Treasury sold the bonds to yield 6.29 percent, the highest since June 1997 and up from 5.32 percent at the last auction on Oct. 13. The yield on five-year Italian notes rose 17 basis points to 6.63 percent following the auction.

In Greece, the nation’s finance minister, Evangelos Venizelos, said his priority is to ensure the country gets a sixth loan under an EU-led bailout after Prime Minister Lucas Papademos took charge of a new interim government.

Spiegel magazine reported that German lawmakers are preparing for Greece’s departure from the euro if the debt- strapped country’s new government doesn’t commit to reforms. The magazine did not say where it got the information.

National benchmark indexes fell in 13 of the 18 western- European markets today. France’s CAC 40 Index lost 1.3 percent, the U.K.’s FTSE 100 Index slid 0.5 percent and Germany’s DAX Index dropped 1.2 percent.

UniCredit sank 6.2 percent to 77.4 euro cents after the board approved a share sale to boost capital. The Italian lender also reported a 10.6 billion-euro loss for the third quarter, following almost 10 billion euros in goodwill impairments and writedowns, and said it won’t pay a dividend for 2011.

Spain’s government securities also slid, pushing the 10- year yield to 6.11 percent, surpassing 6 percent for the first time since the European Central Bank was said to resume buying the nation’s debt on Aug. 8. ECB Governing Council member Jens Weidmann suggested policy makers should end their support of the region’s most indebted nations. Banco Bilbao Vizcaya Argentaria, Spain’s second-biggest bank, dropped 3.2 percent to 5.97 euros and Banco Santander SA, Spain’s largest lender, slid 2.7 percent to 5.65 euros and Bankinter SA slipped 2.3 percent to 4.15 euros.

Hochtief declined 11 percent to 45.55 euros for the biggest drop on the Stoxx 600 after Germany’s largest construction company said that the “macroeconomic situation” has delayed the sale of its airport-operating unit. The company predicted it will post a net loss if the sale isn’t concluded this year.

Q-Cells SE slumped 27 percent to 85 euro cents after the German solar cell and module maker posted a third-quarter loss before interest and taxes of 47.3 million euros, wider than analysts had estimated. Q-Cells also announced the resignation of its chief financial officer Marion Helmes.

U.S. stocks declined, snapping a two-day advance in the Standard & Poor’s 500 Index, as an increase in Italian borrowing costs deepened concern Europe will struggle to contain its sovereign debt crisis. Stocks fell as the yield on the Italian five-year bond rose following an auction and Spanish 10-year rates surged to a euro- era record above German yields. The S&P 500 extended its decline after German Finance Minister Wolfgang Schaeuble said Europe’s permanent bailout fund may not be implemented before 2013. The equity index also dropped after German Chancellor Angela Merkel’s Christian Democratic Union party voted to offer euro states a “voluntary” means of leaving the currency area.

Bank of America slid 2.6 percent to $6.05. The second- biggest U.S. lender by assets will sell 10.4 billion CCB shares this month to a group of investors in private transactions for an after-tax gain of about $1.8 billion, the bank said today. After the closing, the company will own about 1 percent of the common shares of CCB, the U.S. lender said.

Bank of New York Mellon slumped 4.5 percent to $20.55. The bank plans to save as much as $700 million before taxes by 2015, through operational improvements such as consolidating applications, insourcing software development and consolidating locations. BNY Mellon is cutting expenses as lawsuits over the pricing of foreign exchange transactions are pushing up legal costs and interest rates near zero erode revenue.

Boeing rallied 1.5 percent, the most in the Dow, to $67.94. The company signed an agreement with Emirates at the Dubai Air show for 50 of its 777-300ER jets and an option for 20 more, in a deal valued at $26 billion. The accord extends their relationship in the wide-body market, with Emirates operating more than 90 of the 777s for the industry’s biggest such fleet.

Lowe’s Cos. advanced 1.7 percent to $23.50. The second- largest U.S. home-improvement retailer reported third-quarter profit that exceeded analysts’ estimates, helped by sales at older stores.

International Business Machines Corp. (IBM) lost less than 0.1 percent to $187.35, after rallying as much as 1.3 percent. Warren Buffett’s Berkshire Hathaway Inc. bought a 5.5 percent stake in the computer-services provider as the billionaire chairman accelerated stock purchases. Buffett, who spent more than $10 billion on IBM stock, paid near-record prices for the shares, recalling his winning 1988 investment in Coca-Cola Co.

Resistance 3: Y78.25 (Nov 4 high)

Resistance 2: Y77.90 (Nov 9-10 high)

Resistance 1: Y77.50 (session high)

The current price: Y77.08

Support 1: Y76.95 (session low)

Support 2: Y76.65 (area of Oct 17-20 low)

Support 3: Y76.30 (Oct 12 low)

Comments: the pair is on downtrend. In focus support Y76.95.

Resistance 3: Chf0.9235 (resistance line from Nov 4)

Resistance 2: Chf0.9150 (Nov 10 high)

Resistance 1: Chf0.9125 (session high)

The current price: Chf0.9115

Support 1: Chf0.9080 (session low)

Support 2: Chf0.9040 (50.0% FIBO Chf0.9115-Chf0.8960)

Support 3: Chf0.9000 (support line from Nov 4)

Comments: the pair is on uptrend. In focus resistance Chf0.9115.

Resistance 3: $1.3805 (Nov 14 high)

Resistance 2: $1.3720 (MA (233) H1)

Resistance 1: $1.3640 (session high)

The current price: $1.3611

Support 1 : $1.3590 (session low)

Support 2 : $1.3550 (low of the American session on Nov 10)

Support 3 : $1.3485 (Nov 10 low)

Comments: the pair decreases. In focus support $1.3590.

Change % Change Last

Nikkei 225 8,604 +89.23 +1.05%

Hang Seng 19,508 +371.01 +1.94%

S&P/ASX 200 4,305 +8.06 +0.19%

Shanghai Composite 2,529 +47.63 +1.92%

FTSE 100 5,519 -26.34 -0.47%

CAC 40 3,109 -40.43 -1.28%

DAX 5,985 -72.01 -1.19%

Dow 12,078.98 -74.70 -0.61%

Nasdaq 2,657.22 -21.53 -0.80%

S&P 500 1,251.78 -12.07 -0.96%

10 Year Yield 2.04% -0.01 --

Oil $98.23 +0.09 +0.09%

Gold $1,781.20 +2.80 +0.16%

00:01 United Kingdom Nationwide Consumer Confidence October 45

00:30 Australia Australia RBA Meeting's Minutes

06:30 France GDP, q/q Quarter III 0.0% +0.3%

06:30 France GDP, Y/Y Quarter III +1.7% +1.6%

07:00 Germany GDP (QoQ) Quarter III +0.1% +0.5%

07:00 Germany GDP (wda) (YoY) Quarter III +2.8% +2.4%

09:30 United Kingdom HICP, Y/Y October +5.2% +5.1%

09:30 United Kingdom HICP ex EFAT, Y/Y October +3.3% +3.3%

09:30 United Kingdom HICP, m/m October +0.6% +0.2%

10:00 Germany ZEW Survey - Economic Sentiment November -48.3 -51.7

10:00 Eurozone ZEW Economic Sentiment November -51.2 -52.7

10:00 Eurozone GDP (QoQ) Quarter III +0.2% +0.2%

10:00 Eurozone GDP (YoY) Quarter III +1.6% +1.4%

10:00 Eurozone Trade Balance s.a. September -1.0 -0.8

13:00 U.S. FOMC Member Charles Evans Speaks

13:30 Canada Bank of Canada Monetary Policy Report September +1.4% +1.1%

13:30 U.S. Retail sales October +1.1% +0.3%

13:30 U.S. Retail sales excluding auto October +0.6% +0.2%

13:30 U.S. PPI, m/m October +0.8% -0.1%

13:30 U.S. PPI, y/y October +6.9%

13:30 U.S. PPI excluding food and energy, m/m October +0.1% +0.2%

13:30 U.S. PPI excluding food and energy, Y/Y October +2.5%

13:30 U.S. FOMC Member James Bullard Speaks

15:00 U.S. Business inventories September +0.5% +0.2%

17:30 U.S. FOMC Member Richard Fisher Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.