- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-04-2012

European stocks fell, for the longest streak of weekly losses since August, as concern resurfaced about the euro-area’s debt crisis and China’s economic growth slowed last quarter more than forecast.

The cost of insuring against a Spanish default jumped to a record as Prime Minister Mariano Rajoy struggles to prevent the nation from becoming the fourth euro-region member to need a bailout.

Growth in China’s economy, the world’s second biggest, slowed more than forecast last quarter to the least in almost three years. Gross domestic product rose 8.1 percent from a year earlier following an 8.9 percent increase in the fourth quarter, the National Bureau of Statistics in Beijing said today.

National benchmark indexes fell in every western-European market. France’s CAC 40 slid 2.5 percent, while the U.K.’s FTSE 100 decreased 1 percent and Germany’s DAX slipped 2.4 percent. Spain’s IBEX 35 dropped 3.6 percent to its lowest level since March 2009, while Italy’s FTSE MIB sank 3.4 percent. Greece was closed for a holiday.

Italian banks led a gauge of European lenders lower, with UniCredit, the nation’s biggest bank, dropping 6 percent to 3.03 euros, and Popolare di Milano retreating 8.2 percent to 34.6 euro cents. Intesa Sanpaolo SpA sank 4.8 percent to 1.16 euros. BNP Paribas SA slid 5.2 percent to 30.40 euros, while Banco Santander declined 3.2 percent to 4.86 euros.

Cap Gemini, France’s biggest computer-services company, slipped 5.1 percent to 29.92 euros after peer Infosys Ltd. plunged the most in almost three years in Mumbai trading after forecasting sales lower than analysts had estimated.

STMicroelectronics NV, Europe’s largest semiconductor maker, dropped 5.1 percent to 5.21 euros.

Sage Group Plc, the U.K.’s largest software maker, slipped 2.6 percent to 287.7 pence. Milan Radia, an analyst at Jefferies Group Inc., cut the stock to hold from buy.

L’Oreal climbed 1.2 percent to 92.14 euros after it reported first-quarter sales that exceeded analysts’ estimates and said trends are favorable for all its brands.

Stallergenes SA, the French pharmaceutical company that makes allergy treatments, increased 3.3 percent to 42.66 euros as first-quarter sales rose to 75.7 million euros from 70.9 million euros a year earlier.

The euro dropped against most of its major counterparts amid bets the European Central Bank won’t restart its government bond-purchase program even as Spanish credit-default swaps rose to a record. The cost of insuring against a Spanish government default rose to a record 498 basis points, according to CMA prices. A basis point on a credit-default swap protecting 10 million euros ($13.1 million) of debt for five years is equivalent to 1,000 euros a year. Swaps pay the buyer face value in exchange for the underlying securities or the cash equivalent if a borrower fails to adhere to its debt agreements. Europe’s shared currency headed for a second weekly decline against the yen and dollar after Klaas Knot, a member of the ECB governing council, said he didn’t see a “good reason” to buy Spanish securities. Euro slid after a report showed China’s economy expanded less than analysts forecast, adding to bets global growth is slowing.

The Dollar Index rose as U.S. consumer confidence cooled, damping risk appetite. Thomson Reuters/University of Michigan preliminary index of consumer sentiment for April unexpectedly fell to 75.7.

The British pound fell against the dollar after a report showed that producer prices in Britain rose again in March, confirming the stability of the inflationary pressures in the economy. Prices of output rose 0.6% m / m, exceeding the average forecast of 0.5%.Prices rose at the entrance of 1.9%, exceeding the forecast of 1.4%. Producer prices rose the third consecutive month, registering a growth of 6 out of 10 categories. The highest growth was recorded for prices of petrol, tobacco and alcohol. In annual terms, producer prices have increased output by 3.6% in March against 4.1% in February.

Вefore the crisis, private companies have been too much borrowing

Before the crisis, private companies are too dependent on short-term financing

Companies are not adequately monitored the risk before the crisis

Before the crisis, regulators have paid too little attention to the system as a whole

Gaps in regulation led to the fact that the system became unstable

Lending by the Fed helped to stabilize the system

TARP program and the FDIC to resolve the crisis contributed to the

Stress tests in 2009 helped restore confidence in banks

The Fed as a whole was struggling with the crisis by "classical instruments"

U.S. stocks fell, sending the Standard & Poor’s 500 Index toward the worst weekly decline in 2012, as consumer confidence dropped, China’s growth slowed and the cost of insuring against a Spanish default rose to a record.

Equities slumped as confidence among U.S. consumers cooled in April from a one-year high. China said gross domestic product rose 8.1 percent in the first quarter, less than the 8.4 percent growth predicted. Credit-default swaps on Spain surged to an all-time high, signaling a deterioration in investor perceptions of credit quality.

Dow 12,916.04 -70.54 -0.54%, Nasdaq 3,021.98 -33.57 -1.10%, S&P 500 1,376.96 -10.61 -0.76%

Concern about the global financial system helped drive bank shares lower even after JPMorgan and Wells Fargo & Co. reported earnings that beat analysts’ estimates. JPMorgan (JPM) lost 2.1 percent to $43.92, while Wells Fargo dropped 2 percent to $33.33.

Bank of America (ВАС) dropped 3.5 percent to $8.85. Hewlett-Packard (HPQ) slid 2.2 percent to $24.55. GE declined 1.6 percent to $19.

Google fell 3.1 percent to $630.75 after its latest bid to preserve control for founders Larry Page and Sergey Brin raised concern among corporate-governance watchdogs. Google unveiled a plan that lets the company issue new shares without diluting the founders’ voting power. The stock change would create a new class of nonvoting shares that will be distributed to existing shareholders in what is effectively a 2-for-1 stock split.

Dow Chemical Co. (DOW) advanced 2.3 percent to $33.42. The largest U.S. chemicals producer increased its quarterly dividend to 32 cents a share from 25 cents.

Gold drops for the first time in five days against the dollar strengthening. Top of the negative dynamics of precious metal was laid on the data slowing growth in China. In I quarter of 2012. China's GDP growth slowed to 8.1% versus 8.9% for the previous quarter. In the I quarter of 2012. China's GDP growth forecast was worse than economists had forecast slowing to 8.3% and was lowest after the II quarter of 2009.

Support the dollar also had strong statements of U.S. investment banks JP Morgan and Wells Fargo for the first quarter of this year, as well as data on inflation in the U.S. in March. On Friday the U.S. Labor Department reported a slowdown in consumer price growth in annual terms in March, up 2.7% from 2.9% in February. In monthly terms, inflation in March slowed to 0.3% from 0.4% in February. These coincided with the forecasts of analysts.

In addition, investors were pleased with corporate reporting Wells Fargo, according to which the Bank's net profit in terms of one common share for the last quarter was $ 0.75 versus $ 0.67 for the first quarter of 2011 with the forecast of 0.73 dollars. A similar index of JP Morgan Chase was 1.31 dollar against 1.28 dollar in January-March 2011. Analysts had expected a figure with 1.18 dollars per share.

At the same time, a sharp drop in prices of precious metals interfere with the preliminary data on consumer sentiment index for April, University of Michigan, who unexpectedly fell to 75.7 points from 76.2 points in March. Analysts had expected growth to 76.5 index points.

May futures on the COMEX gold fell today to $ 1661.6 an ounce.

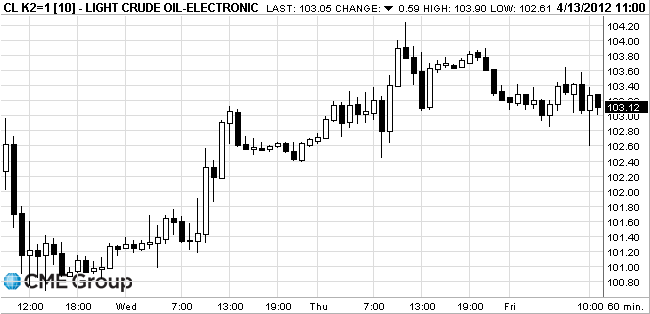

Crude fell for the first time in three days as China’s economic growth slowed to the least in almost three years.

Futures dropped as much as 1 percent after the National Bureau of Statistics said gross domestic product in the world’s second-biggest oil-consuming country expanded 8.1 percent in the first quarter from a year earlier.

Growth in China, which ranks behind only the U.S. in terms of oil consumption, trailed forecasts by the most since the third quarter of 2008. The median estimate was for an 8.4 percent first-quarter expansion. The economy expanded by 8.9 percent in the fourth quarter.

China cut daily crude processing by 3 percent in March from a month earlier as refineries started maintenance, according to data also released by the National Bureau of Statistics today.

Crude for May delivery fell to $102.61 a barrel on the New York Mercantile Exchange. Prices are down 0.5 percent this week and up 4 percent this year.

Brent oil for May settlement slipped 84 cents, or 0.7 percent, to $120.87 a barrel on the London-based ICE Futures Europe exchange. Front-month Brent futures expire today. The more-actively traded June contract was 94 cents lower at $120.58.

Resistance 3:1420 (4 years high)

Resistance 2:1397/00 (area of Apr 5 high)

Resistance 1:1385 (МА (200) for Н1)

Current price: 1370,00

Support 1:1366 (the line of resistance from Apr 9 broken yesterday)

Support 2:1362 (Apr 12 low)

Support 3:1352 (Apr 10 low, support line from Mar 6)

EUR/USD $1.3105, $1.3110, $1.3120, $1.3150, $1.3170, $1.3175

USD/JPY Y80.15, Y80.50, Y82.35, Y82.40

EUR/GBP stg0.8225

EUR/CHF Chf1.2075

GBP/USD $1.5950

USD/CHF Chf0.9160

AUD/USD $1.0380, $1.0400

AUD/NZD NZ$1.2520

Data:

06:00 Germany CPI, m/m (finally) March +0.7% +0.3% +0.4%

06:00 Germany CPI, y/y (finally) March +2.3% +2.1% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) March +2.1% +1.3% +1.9%

08:30 United Kingdom Producer Price Index - Input (YoY) March +7.3% +4.8% +5.8%

08:30 United Kingdom Producer Price Index - Output (MoM) March +0.6% +0.5% +0.6%

08:30 United Kingdom Producer Price Index - Output (YoY) March +4.1% +3.5% +3.6%

The euro fell against the dollar amid speculation the European Central Bank will need to restart its government bond purchase program as the sovereign debt crisis intensifies.

Europe’s shared currency headed for a second weekly decline against the yen as data showed Spanish banks’ borrowing from the ECB jumped by almost 50 percent in March.

Average net borrowings by Spanish banks climbed to 227.6 billion euros last month from 152.4 billion euros in February, the Bank of Spain said. Lenders in the whole euro system took 361.7 billion euros, the data showed.

EUR/USD: the pair decreased in $1,3140 area.

GBP/USD: the pair showed low in $1,5910 area then slightly restored.

USD/JPY: the pair was limited Y80,80-Y81,20.

EUR/USD

Offers $1.3280, $1.3240/50, $1.3220

Bids $1.3135/25, $1.3115/00, $1.3095/90, $1.3080, $1.3060/50

USD/JPY

Offers Y82.00, Y81.85/90, Y81.60/65, Y81.45/50, Y81.25

Bids Y80.75, Y80.50, Y80.30/25, Y80.10/00, Y79.80/75

AUD/USD

Offers $1.0545/50, $1.0530/35, $1.0490/00, $1.0460/65, $1.0450/55, $1.0415/20

Bids $1.0355/50, $1.0325/20, $1.0305/00, $1.0255/45, $1.0225, $1.0200

EUR/JPY

Offers Y107.45/50, Y107.15/20, Y106.95/00

Bids Y106.30/25, Y106.00, Y105.50/40, Y105.00, Y104.75/70

EUR/GBP

Offers stg0.8320/25, stg0.8300, stg0.8275/80

Bids stg0.8250/40, stg0.8225/20, stg0.8200, stg0.8180/75

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y81.90 (Apr 10 high, МА (200) for Н1, border of the down channel from Apr 2)

Resistance 1: Y81.20 (session high)

Current price: Y80.99

Support 1: Y80.60 (Apr 11 low, low of March)

Support 1: Y80.20 (Feb 29 low, border of the down channel from Apr 2)

Support 3: Y80.00 (Feb 28 low)

Resistance 3: Chf0.9250 (Mar 16 high)

Resistance 2: Chf0.9210/20 (area of Apr 5, 9-10 highs)

Resistance 1: Chf0.9150/60 (resistance line from Apr 10, МА (200) for Н1)

Current price: Chf0.9127

Support 1: Chf0.9090 (Apr 12 low, Mar 29 high, 61,8 %% FIBO Chf0,9000-Chf0,9220)

Support 2: Chf0.9000 (Apr 2-3 lows)

Support 3: Chf0.8930 (Feb 24 and 29 lows)

Resistance 3 : $1.6060 (Apr 2 high)

Resistance 2 : $1.6020 (the top border of up channel from Apr 10)

Resistance 1 : $1.5980 (Apr 12 high)

Current price: $1.5955

Support 1 : $1.5930 (the bottom border of up channel from Apr 10)

Support 2 : $1.5910/00 (session low, МА (200) for Н1)

Support 3 : $1.5850 (Apr 11 low)

Resistance 3 : $1.3390 (high of March)

Resistance 2 : $1.3250 (61,8 % FIBO $1,3390-$ 1,3030)

Resistance 1 : $1.3210/20 (area of Apr 12 high, МА (200) for Н4, 50,0 % FIBO $1,3390-$ 1,3030)

Current price: $1.3170

Support 1 : $1.3140 (support line from Apr 10, МА (200) for Н1, session low)

Support 2 : $1.3100 (support line from Apr 9, Apr 12 low)

Support 3 : $1.3030 (Apr 5 and 9 lows)

EUR/USD $1.3105, $1.3110, $1.3120, $1.3150, $1.3170, $1.3175

USD/JPY Y80.15, Y80.50, Y82.35, Y82.40

EUR/GBP stg0.8225

EUR/CHF Chf1.2075

GBP/USD $1.5950

USD/CHF Chf0.9160

AUD/USD $1.0380, $1.0400

AUD/NZD NZ$1.2520

Asian stocks rose for a second day after a North Korean rocket launch failed minutes after liftoff and China’s bank lending surged. Shares pared gains after the Chinese economy grew less than estimated.

Nikkei 225 9,637.99 +113.20 +1.19%

Hang Seng 20,701.04 +373.72 +1.84%

S&P/ASX 200 4,323.31 +42.67 +1.00%

Shanghai Composite 2,359.16 +8.30 +0.35%

Fanuc Corp., a Japanese supplier of automation equipment to mainland factories, trimmed gains after China said its economy grew at the slowest pace since 2009.

Li & Fung Ltd., a supplier to Wal-Mart Stores Inc., rose 1.9 percent in Hong Kong after Federal Reserve policy makers signaled U.S. interest rates will stay low.

Victek Co. led declines among South Korean defense contractors after a North Korean rocket launched in defiance of international pressure broke up and fell into the sea.

02:00 China GDP y/y Quarter I +8.9% +8.4% +8.1%

02:00 China Industrial Production y/y March +11.4% +11.5% +11.9%

02:00 China Retail Sales y/y March +14.7% +15.1% +15.2%

The yen remained lower after a two- day decline against the dollar and the euro before Japanese ministers discuss measures against deflation today amid speculation the central bank will add to monetary easing. Japan’s Economic and Fiscal Policy Minister Motohisa Furukawa said ministers will discuss deflation later today, after BOJ Governor Masaaki Shirakawa said yesterday defeating price declines and achieving sustained growth are extremely important tasks for the central bank.

Australia’s dollar, known as the Aussie, slid against all of its 16 major counterparts after China said gross domestic product grew 8.1 percent year-on-year in the first quarter. That’s the slowest expansion in almost three years and compared with the 8.4 percent gain estimated by economists in a Bloomberg News survey. The Australian dollar fell 0.4 percent to $1.0392. China is Australia’s largest trading partner.

The dollar was headed for a weekly loss versus the majority of its peers before U.S. data projected to show U.S. inflation slowed. U.S. consumer prices probably rose 0.3 percent last month after climbing 0.4 percent in February, according to the median estimate of a Bloomberg survey before the Labor Department releases the figure. That would follow a report last week that showed nonfarm payrolls increased by 120,000 in March, the smallest gain in five months.

Fed Bank of New York President William C. Dudley said yesterday that it’s “too soon to conclude that we are out of the woods, as underlined by the March labor-market release,” adding he still supports holding rates close to zero through late 2014. Speeches are scheduled today from Dudley and Fed Chairman Ben S. Bernanke.

EUR/USD: during the Asian session the pair is corrected after yesterday's growth.

GBP/USD: during the Asian session the pair fell, receded from yesterday's highs.

USD/JPY: during the Asian session the pair rose to Y81.20.

European data starts at 0600GMT with final HICP data from Germany where the preliminary reading was 0.4% m/m, 2.3% y/y. UK data at 0830 includes the Producer Price Index and also Construction Output data. US events start at 1200GMT when New York Fed President William Dudley speaks to the Buffalo Niagara Partnership's Movers & Shakers Breakfast and will answer questions from the audience. In the afternoon he will visit the Roswell Park Cancer Institute. US data starts at 1230GMT when consumer prices are forecast to rise 0.3% in March following the energy-driven jump in February. Then, at 1700GMT, Federal Reserve Chairmman Ben Bernanke will speak to the Russell Sage Foundation and The Century Foundation on "Rethinking Finance".

Yesterday the dollar fell versus most major counterparts as data showed the most Americans since January filed for jobless benefits last week, supporting the argument that monetary policy should stay stimulative to spur growth.

The euro strengthened versus the dollar as Italy’s 10-year bonds rose for a second day, pushing yields down from an almost two-month high of 5.73 percent reached. The nation sold 4.88 euros ($6.4 billion) of securities, close to its 5 billion-euro maximum target for the sale.

The yen dropped versus major peers as Bank of Japan Governor Masaaki Shirakawa said policy makers will “pursue powerful easing.” Defeating deflation and achieving sustained growth are important tasks for the central bank, Shirakawa said in Tokyo.

The pound fell as a result of published data on the trade balance. Sharp fall in exports to countries outside the EU in February, partly because of falling car exports in January increased the trade deficit. Merchandise trade deficit widened to 8.772 billion pounds in February to 7.883 billion pounds in January, far more than analysts had expected.

EUR/USD: yesterday the pair gain, touched level $1.3200.

GBP/USD: yesterday the pair gain on a floor of a figure, showed a new week’s high.

USD/JPY: yesterday the pair traded in range Y80.70-Y81.10.

European data starts at 0600GMT with final HICP data from Germany where the preliminary reading was 0.4% m/m, 2.3% y/y. UK data at 0830 includes the Producer Price Index and also Construction Output data. US events start at 1200GMT when New York Fed President William Dudley speaks to the Buffalo Niagara Partnership's Movers & Shakers Breakfast and will answer questions from the audience. In the afternoon he will visit the Roswell Park Cancer Institute. US data starts at 1230GMT when consumer prices are forecast to rise 0.3% in March following the energy-driven jump in February. Then, at 1700GMT, Federal Reserve Chairmman Ben Bernanke will speak to the Russell Sage Foundation and The Century Foundation on "Rethinking Finance".

Most Asian stocks rose, with the regional benchmark index climbing from its lowest level in more than two months, as materials producers and traders increased on higher commodity prices and Citigroup Inc. recommended buying global industrial shares.

Nikkei 225 9,524.79 +66.05 +0.70%

Hang Seng 20,281.37 +140.70 +0.70%

S&P/ASX 200 4,280.64 +34.52 +0.81%

Shanghai Composite 2,350.86 +41.94 +1.82%

Alumina Ltd., partner in the world’s biggest producer of the material used to make alumina, added 1.1 percent in Sydney after Alcoa Inc., the largest U.S. aluminum producer, reported an unexpected first-quarter profit. Fanuc Corp., a maker of production automation systems, advanced 1.6 percent after Citigroup maintained a buy rating on the Japanese company. Australian banks increased after the country’s payrolls rose almost seven times as much as economists estimated.

European stocks climbed the most in more than a week, led by a rally in mining companies, after the Federal Reserve signaled U.S. interest rates will remain low to support economic growth.

Fed Vice Chairman Janet Yellen endorsed the central bank’s view that borrowing costs are likely to stay low through 2014 as the central bank misses its goal for full employment and inflation remains in check.

National benchmark indexes advanced in 15 of the 18 western European markets. The U.K.’s FTSE 100 rallied 1.3 percent, while Germany’s DAX and France’s CAC 40 (CAC) increased 1 percent. Spain’s IBEX 35 slipped 0.8 percent.

Rio Tinto, the world’s third-largest mining company, climbed 4.5 percent to 3,487 pence. BHP, the biggest, gained 2.8 percent to 1,906.5 pence and Xstrata Plc increased 2.5 percent to 1,105.5 pence.

China, the world’s largest consumer of copper, will publish its first-quarter GDP data tomorrow. The report is forecast to show the economy expanded 8.4 percent from a year earlier, slowing from the fourth quarter’s 8.9 percent increase, according to a survey of economists.

Hays rallied 8.9 percent to 88.5 pence after the U.K. recruitment company forecast full-year operating profit will “be towards the top of the current range of market estimates.”

Gerresheimer AG climbed 10 percent to 35.35 euros, the largest gain in three years, as the German maker of glass and plastic products for the health-care industry raised its forecast for the year.

Nokia Oyj dropped 7.2 percent to 3.04 euros, extending yesterday’s 14 percent selloff, as brokers reduced their recommendations on the shares. Societe Generale SA downgraded the biggest maker of mobile handsets by volume to hold from buy, while Morgan Stanley trimmed its price estimate by 32 percent to 2.60 euros after the company cut its profit forecasts yesterday.

U.S. stocks rose, giving the Standard & Poor’s 500 Index its biggest two-day rally in 2012, on policymakers’ signals that interest rates will remain low.

Equities rose today as Federal Reserve Vice Chairman Janet Yellen and New York Fed President William C. Dudley endorsed the central bank’s view that borrowing costs are likely to stay low through 2014. Those comments overshadowed investors’ disappointment after a report showed that more Americans than forecast filed claims for jobless benefits last week.

Dow 12,986.58 +181.19 +1.41%, Nasdaq 3,055.55 +39.09 +1.30%, S&P 500 1,387.57 +18.86 +1.38%

Caterpillar Inc. (CAT) advanced 4.6 percent to $106.44. Alcoa Inc. (AA), which this week reported an unexpected profit, rallied 2.7 percent to $10.17. JPMorgan Chase & Co. (JPM) climbed 1.9 percent to $44.84.

Hewlett-Packard (HPQ) jumped 7.2 percent, the most in the Dow, to $25.10. The company accounted for 17.2 percent of worldwide PC shipments, Stamford, Connecticut-based Gartner said yesterday. Total global PC shipments climbed 1.9 percent to 89 million units, after predictions of a 1.2 percent drop, according to Gartner. Another research firm, IDC, also reported a surprise increase for the quarter.

Google rallied 2.4 percent to $651.01. After the close of regular trading, the shares rose 1.8 percent to $662.60. First- quarter profit before certain costs was $10.08 a share. Analysts had projected $9.64 on average, according to data compiled by Bloomberg.

AT&T Inc. (T) gained 1.3 percent to $30.84 after the company’s shares were raised to the equivalent of buy at JPMorgan. The 9- month share-price estimate is $33.

$31.6 Billion

McKesson Corp. jumped 3.9 percent to $91.34. The largest U.S. drug distributor based on revenue rose to its highest level since 1998 after the company won a $31.6 billion contract from the Department of Veterans Affairs.

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y81.85 (Apr 10 high)

Resistance 1: Y81.20 (session high)

The current price: Y80.85

Support 1: Y80.55 (Apr 11 low)

Support 2: Y80.00 (Feb 28 low)

Support 3: Y79.35 (Feb 20 low)

Resistance 3: Chf0.9220 (Apr 5 high)

Resistance 2: Chf0.9185 (high of the American session on Apr 11)

Resistance 1: Chf0.9145 (Apr 10 low)

The current price: Chf0.9125

Support 1: Chf0.9090 (Apr 12 low)

Support 2: Chf0.9070 (Apr 2 high)

Support 3: Chf0.9000 (Apr 2-3 low)

Resistance 3 : $1.6090 (Nov 11-14 high)

Resistance 2 : $1.6045 (Apr 3 high)

Resistance 1 : $1.5985 (Apr 12 high)

The current price: $1.5940

Support 1 : $1.5930 (low of the American session on Apr 12)

Support 2 : $1.5885 (low of the American session on Apr 11)

Support 3 : $1.5850 (Apr 11 low)

Resistance 3 : $1.3300 (psychological level)

Resistance 2 : $1.3250 (Mar 29 low)

Resistance 1 : $1.3210 (Apr 12 high)

The current price: $1.3168

Support 1 : $1.3155 (Apr 11 high)

Support 2 : $1.3100 (Apr 12 low)

Support 3 : $1.3065 (Apr 11 low)

Change % Change Last

Oil $103.60 -0.04 -0.04%

Gold $1,677.70 -2.90 -0.17%

Change % Change Last

Nikkei 225 9,458.74 -79.28 -0.83%

Hang Seng 20,121.71 -234.53 -1.15%

S&P/ASX 200 4,246.13 -46.14 -1.07%

Shanghai Composite 2,308.92 +3.06 +0.13%

FTSE 100 5,710.46 +75.72 +1.34%

CAC 40 3,269.79 +32.10 +0.99%

DAX 6,743.24 +68.51 +1.03%

Dow 12,986.58 +181.19 +1.41%

Nasdaq 3,055.55 +39.09 +1.30%

S&P 500 1,387.57 +18.86 +1.38%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3186 +0,58%

GBP/USD $1,5957 +0,31%

USD/CHF Chf0,9110 -0,70%

USD/JPY Y80,86 -0,01%

EUR/JPY Y106,64 +0,60%

GBP/JPY Y129,03 +0,31%

AUD/USD $1,0437 +1,28%

NZD/USD $0,8274 +1,10%

USD/CAD C$0,9945 -0,92%

02:00 China GDP y/y Quarter I +8.9% +8.4%

02:00 China Industrial Production y/y March +11.4% +11.5%

02:00 China Retail Sales y/y March +14.7% +15.1%

06:00 Germany CPI, m/m (finally) March +0.7% +0.3%

06:00 Germany CPI, y/y (finally) March +2.3% +2.1%

08:30 United Kingdom Producer Price Index - Input (MoM) March +2.1% +1.3%

08:30 United Kingdom Producer Price Index - Input (YoY) March +7.3% +4.8%

08:30 United Kingdom Producer Price Index - Output (MoM) March +0.6% +0.5%

08:30 United Kingdom Producer Price Index - Output (YoY) March +4.1% +3.5%

12:00 U.S. FOMC Member Dudley Speak -

12:30 U.S. CPI, m/m March +0.4% +0.2%

12:30 U.S. CPI, Y/Y March +2.9% +2.6%

12:30 U.S. CPI excluding food and energy, m/m March +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y March +2.2% +2.2%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (preliminary) April 76.2 76.5

17:00 U.S. Fed Chairman Bernanke Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.