- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-04-2012

The U.S. economy is facing difficulties, the situation in the housing market is unfavorable

Tensions in the European markets creates downside risks

It is expected that over the next few years, inflation will be close to 2%

Banks should decide, taking into account their long-term interests

The euro touched the lowest level against the yen since February as Spanish bond yields touched a 2012 high after a minister called on the European Central Bank to do more to stem debt-market turmoil. The euro slid against the yen after the cost of insuring Spain’s debt reached a record and Jaime Garcia-Legaz, the nation’s deputy economy minister, said in an interview on April 13 that the ECB should “step up purchases of bonds.”

The dollar rose earlier versus most major counterparts as data showed U.S. consumer purchases rose last month, damping speculation the Federal Reserve will add to monetary easing. Retail sales increased 0.8 percent, following a revised 1 percent advance in February, Commerce Department figures showed today in Washington.

China’s yuan tumbled against the dollar as the central bank doubled the daily trading band, reflecting declines in emerging- market currencies. Effective today the People’s Bank of China is allowing 1 percent moves from its daily fixing, after keeping the limit at 0.5 percent since May 2007.

European stocks rebounded from their longest stretch of weekly losses since August as companies from International Power Plc to Royal KPN NV rallied amid an increase in takeover activity.

The benchmark Stoxx 600 has risen 4 percent this year as the European Central Bank disbursed more than 1 trillion euros ($1.3 trillion) to the region’s lenders and as U.S. economic reports topped forecasts. The number of shares changing hands on gauge today was 4.8 percent greater than the average over 30 days.

National benchmark indexes climbed in 12 of the 17 western- European markets that were open today. The U.K.’s FTSE 100 advanced 0.3 percent and Germany’s DAX rose 0.6 percent. France’s CAC 40 increased 0.5 percent. Greece’s stock market was closed for the Orthodox Easter holiday.

International Power added 3.2 percent to 416.8 pence after GDF Suez agreed to buy the 30 percent stake at a revised price of 418 pence a share. That’s 7 percent more than an earlier offer of 390 pence that the U.K. utility rejected as too low. GDF increased 5 percent to 18.86 euros as Europe’s biggest utility by market value confirmed that it will raise its 2012 targets if the deal goes through.

KPN rose 0.9 percent to 7.12 euros after the Netherlands’ largest phone company said it has started a review of Belgian mobile-phone unit, BASE. The business will probably attract interest from private-equity firms such as Apax Partners LLP, according to people familiar with the situation. BASE may fetch 1.8 billion euros in a sale.

Vestas Wind Systems A/S surged 13 percent to 55.55 kroner for the biggest gain on the Stoxx 600. Jyllands-Posten reported that Sinovel Wind Group Co. and Xinjiang Goldwind Science & Technology Co. are considering bidding for the Danish company.

The Standard & Poor’s 500 Index was little changed, after its biggest weekly loss in 2012, as a drop in Apple Inc. tempered optimism about a stronger-than-forecast increase in retail sales for the world’s largest economy.

Earlier gains in the S&P 500 were driven by data showing that retail sales gained 0.8 percent in March, almost three times as much as projected. Investors also watched corporate earnings data. Profits per share at S&P 500 companies rose 1.7 percent in the first quarter and will grow 8.6 percent this year, according to analysts’ estimates.

Dow 12,934.77 +85.18 +0.66%, Nasdaq 2,986.96 -24.37 -0.81%, S&P 500 1,369.85 -0.41 -0.03%

Apple, which soared 45 percent in 2012, dropped 3 percent to $587.27 today. Verizon Wireless, a U.S. partner of Apple, said last week that it will begin charging customers $30 to upgrade to a new phone. The move suggests mobile-phone service providers may take other steps, including trimming subsidies, to keep sales of the iPhone from eating into their margins, said Walter Piecyk, an analyst at BTIG LLC in New York.

Gannett slumped 9.1 percent to $13.67. Revenue from the publishing division, the largest unit, decreased 6 percent as advertising and circulation fell. Chief Executive Officer Gracia Martore, who took over in October, is struggling to revive revenue growth as the newspaper industry as a whole continues to lose ad business to Internet companies.

Mattel dropped 8.5 percent to $31.22. Its largest retail partners were cautious on orders and reduced inventories at mid- to high-single-digit percentage rates, Chief Executive Officer Bryan Stockton said. Gross sales of Barbie products, which fell 6 percent globally in the quarter, were particularly affected by the retailers’ inventory restrictions, Stockton said.

Google Inc. slid 2.4 percent to $609.33. The world’s most popular search engine “impeded” and “delayed” a U.S. inquiry into its data collection, according to the latest in a series of regulatory probes of the company’s privacy practices. Google said it wasn’t “found to have violated any laws” in the investigation by the U.S. Federal Communications Commission.

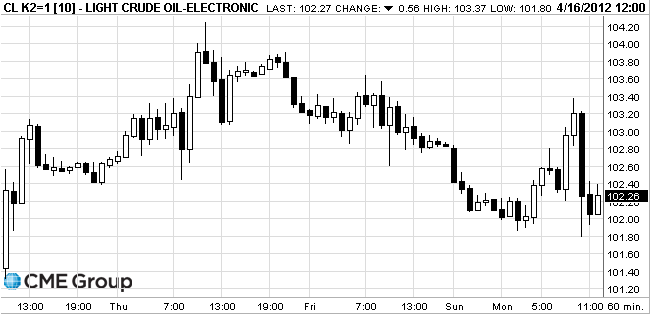

Oil fell for a second day after the first international talks in 15 months on Iran’s nuclear program yielded an agreement for the parties to reconvene.

Crude dropped as much as 1 percent after April 14 negotiations in Istanbul were called “constructive” by both Catherine Ashton, the European Union’s foreign policy chief, and Iran’s lead negotiator, Saeed Jalili.

The United Nations’ five permanent Security Council members plus Germany will meet Iranian delegates in Baghdad on May 23, Ashton said yesterday. The Istanbul talks lasted 10 hours.

Israeli Prime Minister Benjamin Netanyahu criticized the outcome as giving Iran more time to continue enriching uranium, the process capable of producing fuel for a nuclear bomb.

Crude for May delivery fell to $101.80 a barrel on the New York Mercantile Exchange. Prices are up 3.5 percent this year.

Brent oil for June settlement dropped $2.27, or 1.9 percent, to $118.94 a barrel on the ICE Futures Europe exchange.

Gold prices are falling, because the fear of the financial condition of Spain, investors get rid of riskier assets.

Concerns regarding the bidders to overcome the debt crisis in the euro area increased after the ten-year government bond yields in Spain on Monday exceeded the psychologically important level of 6%. This growth began last Friday, after it became known that the amount of borrowing by credit institutions of the country at the ECB in March increased about two times.

In addition, investor interest in safe assets, supported by analysts were worse than expected GDP data of China, which in the first quarter of 2012 increased by 8.1% compared with January-March 2011. The analysts expect the growth rate of 8.4%.

Trading volume is still lower than last year. According to the bank UBS, the average daily turnover on the Comex Exchange in April was only 61 percent of the March.

May futures on the COMEX gold fell today to $ 1641.4 an ounce.

Resistance 3:1388 (Apr 13 high)

Resistance 2:1380 (МА (200) for Н1, resistance line from Apr 2)

Resistance 1:1370 (resistance line from Apr 13)

Current price: 1360,87

Support 1:1360 (session low)

Support 2:1356/52 (support line from Mar 6, Apr 10 low)

Support 3:1338 (low of March)

EUR/USD $1.3025, $1.3100, $1.3115, $1.3110, $1.3120

USD/JPY Y80.00

EUR/CHF Chf1.2000

GBP/USD $1.5850

USD/CHF Chf0.9200

AUD/USD $1.0280, $1.0350

EUR/AUD A$1.2650

USD/CAD C$1.0000

U.S. stock futures rose as a stronger-than-forecast increase in retail sales last month bolstered optimism about the world’s largest economy.

Global Stocks:

Nikkei 9,470.64 -167.35 -1.74%

Hang Seng 20,610.64 -90.40 -0.44%

Shanghai Composite 2,357.03 -2.13 -0.09%

FTSE 5,706.24 +54.45 +0.96%

CAC 3,241.12 +52.03 +1.63%

DAX 6,658.75 +74.85 +1.14%

Crude oil: $102.98 (+0.15%).

Gold: $1652.80 (-0,45%).

Caterpillar (CAT) was upgraded to a Buy from Neutral at Bank of AmericaMerrill.

Home Depot (HD) was upgraded to Overweight from Neutral at Piper Jaffray.

EUR/USD

Offers $1.3140/50, $1.3120, $1.3090, $1.3060

Bids $1.2990/70, $1.2955/50, $1.2925/20, $1.2900

GBP/USD

Offers $1.5930/35, $1.5890/910, $1.5880, $1.5860/65

Bids $1.5810/00, $1.5780/70, $1.5750/40

USD/JPY

Offers Y81.60/65, Y81.45/50, Y81.25, Y80.85/00

Bids Y80.40/30, Y80.10/00, Y79.80/75, Y79.50, Y79.40/35

AUD/USD

Offers $1.0490/00, $1.0460/65, $1.0450/55, $1.0425/30, $1.0400/10, $1.0385/90

Bids $1.0300, $1.0275/70, $1.0255/50, $1.0225, $1.0200

EUR/JPY

Offers Y106.95/00, Y106.20/30, Y106.00, Y105.40/45

Bids Y104.65/60, Y104.00, Y103.60/50

EUR/GBP

Offers stg0.8320/25, stg0.8300, stg0.8275/80, stg0.8265/70

Bids stg0.8200, stg0.8180/75

Resistance 3: Y81.90 (Apr 10 high)

Resistance 2: Y81.55 (МА (200) for Н1, the top border of down channel from Apr 2)

Resistance 1: Y81.20 (Apr 13 high)

Current price: Y80.79

Support 1: Y80.45 (session low)

Support 1: Y80.20 (Feb 29 low)

Support 3: Y80.00 (Feb 28 low, border of down channel from Apr 2)

Resistance 3 : $1.5960 (resistance line from Apr 2)

Resistance 2 : $1.5880 (МА(200) for Н1)

Resistance 1 : $1.5850 (session high)

Current price: $1.5841

Support 1 : $1.5820 (session low, support line from Ap 5)

Support 2 : $1.5800 (Mar 26 low)

Support 3 : $1.5770 (Apr 22 low)

Комментарии: пара торгуется в области линии поддержки от 13 января, закрепление ниже которой откроет дорогу в область мартовских минимумов $1,5600.

Resistance 3 : $1.3170 (resistance line from Apr 3)

Resistance 2 : $1.3100 (support line from Apr 9 broken earlier, МА (200) for Н1)

Resistance 1 : $1.3050 (Apr 10 low)

Current price: $1.3036

Support 1 : $1.3000 (session low, low of March, psychological level)

Support 2 : $1.2975 (low of February)

Support 3 : $1.2930 (Jan 25 low)

EUR/USD $1.3025, $1.3100, $1.3115, $1.3110, $1.3120

USD/JPY Y80.00

EUR/CHF Chf1.2000

GBP/USD $1.5850

USD/CHF Chf0.9200

AUD/USD $1.0280, $1.0350

EUR/AUD A$1.2650

USD/CAD C$1.0000

Asian stocks fell, with a regional benchmark index headed for its biggest drop in almost two weeks, after the cost of insuring against a Spanish default climbed and U.S. consumer confidence dropped, clouding the earnings outlook for Asia’s exporters.

Nikkei 225 9,470.64 -167.35 -1.74%

Hang Seng 20,600.46 -100.58 -0.49%

S&P/ASX 200 4,302.3 -21.01 -0.49%

Shanghai Composite 2,357.03 -2.13 -0.09%

Nintendo Co. a manufacturer of game consoles that gets a third of its sales in Europe, fell 3.2 percent in Osaka.

James Hardie Industries SE, an Australian supplier of building materials that gets more than half of its sales from the U.S., dropped 1.2 percent in Sydney. Industrial & Commercial Bank of China Ltd. declined 1 percent in Hong Kong after Goldman Sachs Group Inc. was said to sell a $2.5 billion stake at a discount.

23:01 United Kingdom Rightmove House Price Index (MoM) April +1.6% +2.9%

23:01 United Kingdom Rightmove House Price Index (YoY) April +2.2% +3.4%

The euro declined to a one-month low against the dollar before Spain auctions bills and bonds amid concern Europe’s debt crisis will continue. Spain will sell 12-month and 18-month bills tomorrow, followed by April 19 auctions of debt due in 2014 and 2022. Yields on the nation’s 10-year notes soared as much as 18 basis points to 6 percent on April 13, edging toward the 7 percent level that pushed Greece, Ireland and Portugal into rescues. The 17-nation currency slid to its weakest versus the British pound since September 2010 after the cost of protecting Spain’s debt from nonpayment climbed to a record.

For the first time in seven months, traders are testing the Swiss National Bank’s determination to limit the franc’s strength against the euro as Europe’s resurgent debt crisis drives up demand for safer assets. The franc breached the central bank’s cap of 1.20 to the euro on April 5 and April 9, and options investors are predicting even more appreciation. It jumped 1.1 percent versus nine peers in a basket of currencies in March, the biggest gain since July, and is up 1.9 percent from a nine-month low on Jan. 11, according to data compiled by Bloomberg. Demand for Swiss assets is so strong that investors accepted negative yields at an auction of six-month government bills last week as Spain’s borrowing costs rose toward levels that prompted bailouts for Greece, Ireland and Portugal. The franc is climbing against its peers even after the central bank repeated a commitment to prevent increases that threaten to bring about deflation and hurt exports.

The Australian dollar fell for a second day as Asian stocks extended a global rout, reducing demand for higher-yielding assets.

EUR/USD: during the Asian session the pair continued Friday’s falling.

GBP/USD: during the Asian session the pair fell, continued decrease in Friday.

USD/JPY: during the Asian session the pair lowered below Y80.50.

European data starts at 0630GMT with the France BoF retail survey. The European data calendar then rounds off at 0900GMT with the

EMU trade balance for February. UK data at 0830GMT includes CML Mortgage Approvals data. US data starts at 1230GMT when retail sales are expected to rise 0.3% in March after a solid increase in February. At 1400GMT, US business inventories are forecast to rise 0.6% in February. Factory inventories were already reported up 0.4%, while wholesale inventories rose 0.9% in February. The annual revisions to the wholesale data released March 30 will be included in February business inventory data.

On Monday the euro rose against the U.S. dollar against the announcement of the fact that Spain will cut costs further E10 billion in the focus of market participants are data on the trade balance of Germany, which will be published. The data may show a fall in exports in February. According to a preliminary survey of economists, exports from the eurozone's largest economy, Germany is likely to decline by 1.2% in February compared with the previous month, when the index grew by 2.4%. The Canadian dollar rose against its U.S. counterpart after the Bank of Canada said that the spring survey of business sector reflects the optimism. The yen rose against all of its major peers as data showing Japan returned to a current-account surplus and tensions over a North Korean rocket launch bolstered the allure of the currency as an investment haven.

On Tuesday the yen rose for a fifth day versus the dollar and the euro after Federal Reserve Chairman Ben S. Bernanke said the U.S. recovery is far from complete, spurring demand for haven amid bets the central bank will add stimulus. The euro fell to the lowest level in a month against the yen before Italy auctions bonds this week amid concern the region’s debt crisis is spreading. Italy will sell 11 billion euros ($14.4 billion) of bills, followed by an offering of debt due from 2015 to 2023.

On Wednesday the euro strengthened from a seven- week low against the yen as Spain’s bonds climbed after a board member of the European Central Bank indicated it may buy the nation’s debt to reduce borrowing costs. The yen weakened against all but one of its 16 most-traded peers amid speculation the Bank of Japan will add to monetary easing later this month. Britain’s pound strengthened after a report showed U.K. retail sales rose in March. It advanced 0.3 percent to $1.5903, and climbed as much as 0.5 percent, the most since March 30. Retail sales at U.K. stores open at least 12 months, measured by value, gained 1.3 percent from a year earlier, after sliding 0.3 percent in February, the London-based British Retail Consortium said.

On Thursday the dollar fell versus most major counterparts as data showed the most Americans since January filed for jobless benefits last week, supporting the argument that monetary policy should stay stimulative to spur growth. The euro strengthened versus the dollar as Italy’s 10-year bonds rose for a second day, pushing yields down from an almost two-month high of 5.73 percent reached. The yen dropped versus major peers as Bank of Japan Governor Masaaki Shirakawa said policy makers will “pursue powerful easing”. The pound fell as a result of published data on the trade balance. Sharp fall in exports to countries outside the EU in February, partly because of falling car exports in January increased the trade deficit.

On Friday the euro dropped against most of its major counterparts amid bets the European Central Bank won’t restart its government bond-purchase program even as Spanish credit-default swaps rose to a record. Euro slid after a report showed China’s economy expanded less than analysts forecast, adding to bets global growth is slowing. The British pound fell against the dollar after a report showed that producer prices in Britain rose again in March, confirming the stability of the inflationary pressures in the economy. Prices of output rose 0.6% m / m, exceeding the average forecast of 0.5%.Prices rose at the entrance of 1.9%, exceeding the forecast of 1.4%.

Asian stocks rose for a second day after a North Korean rocket launch failed minutes after liftoff and China’s bank lending surged. Shares pared gains after the Chinese economy grew less than estimated.

Nikkei 225 9,637.99 +113.20 +1.19%

Hang Seng 20,701.04 +373.72 +1.84%

S&P/ASX 200 4,323.31 +42.67 +1.00%

Shanghai Composite 2,359.16 +8.30 +0.35%

Fanuc Corp., a Japanese supplier of automation equipment to mainland factories, trimmed gains after China said its economy grew at the slowest pace since 2009.

Li & Fung Ltd., a supplier to Wal-Mart Stores Inc., rose 1.9 percent in Hong Kong after Federal Reserve policy makers signaled U.S. interest rates will stay low.

Victek Co. led declines among South Korean defense contractors after a North Korean rocket launched in defiance of international pressure broke up and fell into the sea.

European stocks fell, for the longest streak of weekly losses since August, as concern resurfaced about the euro-area’s debt crisis and China’s economic growth slowed last quarter more than forecast.

The cost of insuring against a Spanish default jumped to a record as Prime Minister Mariano Rajoy struggles to prevent the nation from becoming the fourth euro-region member to need a bailout.

Growth in China’s economy, the world’s second biggest, slowed more than forecast last quarter to the least in almost three years. Gross domestic product rose 8.1 percent from a year earlier following an 8.9 percent increase in the fourth quarter, the National Bureau of Statistics in Beijing said today.

National benchmark indexes fell in every western-European market. France’s CAC 40 slid 2.5 percent, while the U.K.’s FTSE 100 decreased 1 percent and Germany’s DAX slipped 2.4 percent. Spain’s IBEX 35 dropped 3.6 percent to its lowest level since March 2009, while Italy’s FTSE MIB sank 3.4 percent. Greece was closed for a holiday.

Italian banks led a gauge of European lenders lower, with UniCredit, the nation’s biggest bank, dropping 6 percent to 3.03 euros, and Popolare di Milano retreating 8.2 percent to 34.6 euro cents. Intesa Sanpaolo SpA sank 4.8 percent to 1.16 euros. BNP Paribas SA slid 5.2 percent to 30.40 euros, while Banco Santander declined 3.2 percent to 4.86 euros.

Cap Gemini, France’s biggest computer-services company, slipped 5.1 percent to 29.92 euros after peer Infosys Ltd. plunged the most in almost three years in Mumbai trading after forecasting sales lower than analysts had estimated.

STMicroelectronics NV, Europe’s largest semiconductor maker, dropped 5.1 percent to 5.21 euros.

Sage Group Plc, the U.K.’s largest software maker, slipped 2.6 percent to 287.7 pence. Milan Radia, an analyst at Jefferies Group Inc., cut the stock to hold from buy.

L’Oreal climbed 1.2 percent to 92.14 euros after it reported first-quarter sales that exceeded analysts’ estimates and said trends are favorable for all its brands.

Stallergenes SA, the French pharmaceutical company that makes allergy treatments, increased 3.3 percent to 42.66 euros as first-quarter sales rose to 75.7 million euros from 70.9 million euros a year earlier.

U.S. stocks fell, giving the Standard & Poor’s 500 Index its biggest weekly decline in 2012, as consumer confidence dropped, China’s growth slowed and the cost of insuring against a Spanish default rose to a record.

Stocks fell as confidence among U.S. consumers cooled in April from a one-year high. China’s growth slowed to the least in almost three years. Credit-default swaps on Spain surged as Prime Minister Mariano Rajoy struggles to prevent the nation from becoming the fourth euro-region member to need a bailout.

Dow 12,849.59 -136.99 -1.05%, Nasdaq 3,011.33 -44.22 -1.45%, S&P 500 1,370.26 -17.31 -1.25%

Concern about the global financial system drove banks lower even after JPMorgan and Wells Fargo & Co. reported earnings that beat estimates. Bank of America (ВАС) sank 5.3 percent, the most in the Dow, to $8.68. JPMorgan (JPM) lost 3.6 percent to $43.21. Wells Fargo dropped 3.5 percent to $32.84.

Google tumbled 4.1 percent to $624.60 even as earnings beat estimates. The bid to preserve control for founders Larry Page and Sergey Brin raised concern among corporate-governance watchdogs. Google unveiled a plan that lets the company issue new shares without diluting the founders’ voting power.

Dow Chemical Co. advanced 1.6 percent to $33.20. The largest U.S. chemicals producer increased its quarterly dividend to 32 cents a share from 25 cents.

Johnson Controls Inc. added 2.3 percent to $32.57. The largest U.S. auto supplier was boosted to buy from hold at Deutsche Bank AG.

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y81.85 (Apr 10 high)

Resistance 1: Y81.20 (Apr 13 high)

The current price: Y80.85

Support 1: Y80.55 (Apr 11 low)

Support 2: Y80.00 (Feb 28 low)

Support 3: Y79.35 (Feb 20 low)

Resistance 3: Chf0.9335 (Mar 15 high)

Resistance 2: Chf0.9300 (Feb 16 high)

Resistance 1: Chf0.9255 (Mar 16 high)

The current price: Chf0.9129

Support 1: Chf0.9220 (Apr 5 high)

Support 2: Chf0.9185 (Apr 11 high)

Support 3: Chf0.9145 (Apr 10 high)

Resistance 3 : $1.5965 (Nov 13 high)

Resistance 2 : $1.5910 (low of the European session on Apr 13)

Resistance 1 : $1.5855 (session high)

The current price: $1.5825

Support 1 : $1.5800/05 (area of Apr 5-10 lows)

Support 2 : $1.5770 (Mar 22 low)

Support 3 : $1.5695 (Mar 16 low)

Resistance 3 : $1.3100 (Apr 12 low)

Resistance 2 : $1.3070 (Apr 13 low)

Resistance 1 : $1.3030 (Apr 9 low)

The current price: $1.3020

Support 1 : $1.3005 (Mar 15 low)

Support 2 : $1.2975 (Feb 16 low)

Support 3 : $1.2930 (Jan 25 low)

07:15 Switzerland Producer & Import Prices, m/m March +0.8% +0.5%

07:15 Switzerland Producer & Import Prices, y/y March -1.9% -1.8%

09:00 Eurozone Trade Balance s.a. February 5.9 4.3

12:30 Canada Foreign investment in Canadian securities February -4.2 7.2

12:30 U.S. Retail sales March +1.1% +0.4%

12:30 U.S. Retail sales excluding auto March +0.9% +0.6%

12:30 U.S. NY Fed Empire State manufacturing index April 20.21 18.2

13:00 U.S. Net Long-term TIC Flows February 101.0 43.1

13:00 U.S. Total Net TIC Flows February 18.8

14:00 U.S. Business inventories February +0.7% +0.7%

14:00 U.S. NAHB Housing Market Index April 28 28

16:30 U.S. FOMC Member Pianalto Speaks -

23:01 United Kingdom Nationwide Consumer Confidence March 44 42

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.