- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 26-01-2012

The dollar weakened versus all its 16 most-traded counterparts as the Federal Reserve’s pledge to keep interest rates at a record low for longer than originally forecast spurred investors to seek higher yields.

The U.S. currency touched a five-week low against the euro after policy makers said yesterday the benchmark interest rate would stay low until at least late 2014 from mid-2013 and as Italian yields fell to a six-week low. The euro rallied earlier as Italian 10-year yields fell below 6 percent for the first time since Dec. 8. The nation sold its maximum target at an auction of zero-coupon and inflation- linked debt today.

The Canadian dollar strengthened to parity with the greenback for the first time since November. Goldman Sachs Group Inc. yesterday recommended its clients buy the Canadian dollar versus the greenback, saying the Fed’s pledge to keep rates low reaffirms a dollar “weakening trend.”

The Australian dollar climbed for a second day versus the greenback after Alexei Ulyukayev, first deputy chairman of Russia’s central bank, said his nation may start buying the Aussie as a reserve currency as soon as early February.

European stocks advanced, climbing 20 percent from the September low and entering a bull market, after the U.S. Federal Reserve signaled it may keep interest rates low through 2014 and a report said Greece’s creditors will make a new offer for a debt-swap deal.

U.S. policy makers are “prepared to provide further monetary accommodation if employment is not making sufficient progress towards our assessment of its maximum level, or if inflation shows signs of moving further below its mandate- consistent rate,” Bernanke said yesterday after European markets closed. Bond buying is “an option that’s certainly on the table,” he added. The Fed also extended its pledge to keep interest rates low through at least late 2014.

Orders for U.S durable goods rose 3 percent in December, exceeding the 2 percent growth estimate in a Bloomberg News survey of economists. Orders advanced for a third month boosted by demand for aircraft, autos and business equipment.

In Greece, private creditors will submit a new offer with an average interest rate of 3.75 percent on bonds issued as part of a debt restructure, Kathimerini reported, without saying where it got the information.

FTSE 100 5,795 +72.20 +1.26%, CAC 40 3,363 +50.75 +1.53%, DAX 6,540 +118.00 +1.84%

BHP Billiton, the world’s largest mining company, advanced 3.3 percent to 2,199.5 pence. Rio Tinto Group, the third biggest, rose 4.9 percent to 3,893 pence. Anglo American Plc, the third-largest copper producer, climbed 3.1 percent to 2,737 pence after saying iron-ore output increased 5 percent in the fourth quarter, while copper volumes jumped 10 percent.

European steelmakers rallied. ThyssenKrupp AG gained 4.5 percent to 22.14 euros. ArcelorMittal added 3.8 percent to 16.72 euros. Salzgitter AG advanced 6.8 percent to 48.67 euros.

Nokia climbed 2.7 percent to 4.17 euros after selling more smartphones last quarter than projected. Nokia sold 19.6 million smartphones that can handle tasks such as video calls and showing movies, the Espoo, Finland-based company said today. Analysts had predicted sales of 18.5 million smartphones.

U.S. stocks reversed gains, after the Dow Jones Industrial Average rose to its highest level on a closing basis since May 2008, as a report showed that sales of new homes unexpectedly fell in December.

The S&P 500 reversed gains after a report showed that sales of new U.S. homes unexpectedly declined in December for the first time in four months, capping the slowest year on record for builders. An index of U.S. leading indicators rose in December for a third month, indicating the world’s largest economy will keep growing in early 2012. Orders for U.S. durable goods advanced more than forecast in December.

Dow 12,787.04 +30.08 +0.24%, Nasdaq 2,814.09 -4.22 -0.15%, S&P 500 1,323.55 -2.51 -0.19%

AT&T fell 2.2 percent to $29.55. The largest U.S. phone company predicted 2012 earnings that trailed analysts’ estimates as record demand for smartphones such as the iPhone drive up subsidy costs.

Caterpillar jumped 2.7 percent to $111.97 for the biggest advance in the Dow. Producers of coal, copper and iron ore are increasing investment to meet rising demand from emerging economies. Capital spending at major mining companies is expected to climb 25 percent this year, according to data compiled by Bloomberg Industries.

Senate votes 52-44 to defeat resolution to block debt ceiling increase

Oil rose after the Federal Reserve announced it plans to keep U.S. interest rates near a record low through 2014 and a report showed durable goods orders in the world’s biggest crude-consuming country increased.

Futures advanced above $100 a barrel as Fed Chairman Ben S. Bernanke said yesterday that policy makers are considering more bond purchases to boost growth after extending the pledge to maintain interest rates. Bookings for goods meant to last at least three years climbed 3 percent in December, data from the Commerce Department showed today.

The Federal Open Market Committee had previously said the benchmark rate would stay low through mid-2013. Fed officials also lowered their projections for economic expansion and inflation for this year and next.

Crude oil for March delivery rose to $101.59 a barrel on the New York Mercantile Exchange. Brent oil for March settlement climbed $1.53, or 1.4 percent, to $111.34 a barrel on the ICE Futures Europe exchange in London.

Gold prices rose to a maximum of 6.5 weeks on the background of the rally in stock markets, commodities and the euro after reports the U.S. Federal Reserve plans to maintain low interest rates for several years. Post Fed the possibility of maintaining interest rates at current low levels until the end of 2014 pleased investors who buy gold,because increase in rates leads to an increase in the dollar and loss of profits from investments in gold. Euro rose to a maximum of five weeks against the dollar because of the willingness to take risks after the Fed statement and rumors of a breakthrough in negotiations with private creditors in Greece.

From a technical perspective gold has strengthened the position after exceeding the100-day moving average at $ 1.684, although in the short term correction is possible.

Activity in the physical market is reduced, since China and other major Asian markets closed for New Year celebrations of the lunar calendar.

Cost of the February gold futures on the COMEX today rose to 1731.5 dollars per ounce.

EUR/USD $1.3150, $1.3050, $1.3000

USD/JPY Y77.50, Y78.00

AUD/USD $1.0500

EUR/CHF Chf1.2100, Chf1.2050, Chf1.2000

GBP/USD $1.5600, $1.5500, $1.5430

USD/CHF Chf0.9335, Chf0.9450

U.S. stock futures advanced after earnings at companies including Caterpillar Inc. exceeded analysts’ projections.

Caterpillar, the largest construction and mining-equipment maker, rallied 3,6% after its full-year profit forecast also beat estimates amid higher demand for shovels and trucks.

Benchmark gauges rose yesterday, sending the Dow to the highest level since May, as the Federal Reserve signaled low rates through at least late 2014 and didn’t rule out bond purchases to bolster the economy.

Orders for U.S. durable goods rose more than forecast in December, led by demand for aircraft, autos and business equipment that signals further manufacturing gains. Claims for U.S. jobless benefits rose last week, another report showed, reflecting the usual volatility around holidays that has masked an improvement in the labor market.

Gobal stocks:

Nikkei 8,849 -34.22 -0.39%

FTSE 5,804 +80.82 +1.41%

CAC 3,362 +49.29 +1.49%

DAX 6,541 +119.16 +1.86%

Crude oil: $101.16 (+1,8%).

Gold: $1725.40 (+1,5%).

Data:

07:00 Germany Gfk Consumer Confidence Survey February 5.6 5.6 5.9

07:45 France Consumer confidence January 80 80 81

11:00 United Kingdom CBI retail sales volume balance January 9 1 -22

The dollar fell on speculation the Federal Reserve will seek to bring down unemployment by introducing another round of bond purchases, debasing the currency.

The U.S. currency declined after policy makers said yesterday the benchmark interest rate would stay low until at least late 2014, pushing back a previous date of mid-2013.

The central bank lowered its forecast for economic growth this year to a range of 2.2% to 2.7%, from a projection of 2.5% to 2.9% in November. It predicted an expansion next year of 2.8% to 3.2%, versus a previous forecast of 3% to 3.5%.

EUR/USD: the pair has grown, showed high in $1,3170 area. The rate receded in $1,3150 area later.

GBP/USD: the pair has shown high above $1,5700, but receded later.

USD/JPY: during european session the pair was limited Y77.40-Y77.70.

The weekly EIA Natural Gas Stocks data is then due at 1530GMT, followed at 1600GMT by Kansas City Fed Production data and later, at 2130GMT by M2 Money Supply data.

EUR/USD

Offers $1.3240/60, $1.3220, $1.3200, $1.3190, $1.3175/80

Bids $1.3030, $1.3100, $1.3080/70, $1.3050/30, $1.3010/00, $1.2980

Resistance 3: Y79.00 (high of November)

Resistance 2: Y78.20/30 (area of Jan 25 high, high of December and МА (200) for D1)

Resistance 1: Y77.85 (session high)

Current price: Y77.61

Support 1:Y77.30 (Jan 19-20 high)

Support 2:Y76.85 (Jan 23 low)

Support 3:Y76.55 (Jan 17 low)

Resistance 3: Chf0.9290 (resistance line from Jan 17)

Resistance 2: Chf0.9230 (session high and Jan 24 low)

Resistance 1: Chf0.9200 (area of low of asian session and Jan 25 low)

Current price: Chf0.9179

Support 1: Chf0.9160 (session low)

Support 2: Chf0.9060 (low of December)

Support 3: Chf0.8960 (61,8 % FIBO Chf0,8570-Chf0,9600)

Resistance 3 : $1.5890 (Nov 18 high)

Resistance 2 : $1.5780 (high of December)

Resistance 1 : $1.5720 (session high)

Current price: $1.5678

Support 1 : $1.5650 (session low)

Support 2 : $1.5620 (Jan 24 high)

Support 3 : $1.5590 (support line from Jan 13)

Resistance 3 : $1.3260 (support line from January'2011 broken earlier)

Resistance 2 : $1.3200 (Dec 21 high)

Resistance 1 : $1.3175 (session high)

Current price: $1.3146

Support 1 : $1.3130 (high of asian session)

Support 2 : $1.3090 (session low)

Support 3 : $1.3040 (hourly low on Jan 25, earlier resistance)

Sold E4.5bln vs target E3.5bln-E4.5bln. E4.5bln of new Jan 2014 CTZ; avg yield 3.763% (4.833%), cover 1.714 (2.24)

EUR/USD $1.3150, $1.3050, $1.3000(large)

USD/JPY Y77.50, Y78.00

AUD/USD $1.0500

EUR/CHF Chf1.2100, Chf1.2050, Chf1.2000

GBP/USD $1.5600(decent size), $1.5500, $1.5430

USD/CHF Chf0.9335, Chf0.9450

Asian stocks rose, with the regional benchmark index set for the highest close in almost three months, after the yen fell and Apple Inc. reported quarterly profit more than doubled, boosting the earnings outlook for Asian exporters.

Nikkei 225 8,849 -34.22 -0.39%

Hang Seng 20,439 +328.77 +1.63%

S&P/ASX 200 Closed

Shanghai Composite Closed

Li & Fung Ltd., a supplier of toys and clothes to Wal-Mart Stores Inc., advanced 3.4 percent in Hong Kong.

Cnooc Ltd. (883) and other energy companies advanced after oil and metal prices climbed.

Franshion Properties China Ltd. (817) led gains among Chinese developers on speculation the mainland will ease lending.

Tokyo Electric Power Co. rose 5.4 percent after a report the company will accept public funds to avoid bankruptcy.

00:00 China Bank holiday 0

00:00 Australia Bank holiday 0

The dollar traded 0.1 percent from the least in five weeks against the euro after the Federal Reserve extended its pledge to keep interest rates low until late 2014. Economic conditions will likely “warrant exceptionally low levels for the federal funds rate at least through late 2014,” the Federal Open Market Committee said in a statement released in Washington yesterday. The Fed had previously pledged to keep its rate target in place until mid-2013. The central bank also lowered its forecast for economic growth this year to a range of 2.2 percent to 2.7 percent, down from a projection of 2.5 percent to 2.9 percent in November. U.S. gross domestic product increased at a 3 percent annual rate in the fourth quarter, according to the median forecast of economists in a Bloomberg News survey before the Commerce Department’s releases the data tomorrow. That compares with a 1.8 percent advance in the previous three-month period.

New Zealand’s dollar maintained a four-day gain even after the nation’s central bank held its key interest rate at a record low.

Reserve Bank of New Zealand Governor Alan Bollard said today it is “prudent” for the central bank to keep interest rates at record low 2.5 percent.

Demand for the 17-nation euro was limited before talks on a Greek debt swap resume.

EUR/USD: during the Asian session the pair was in a range $1.3090-$1.3010.

GBP/USD: during the Asian session the pair was in a range $1.5650-$1.5660.

USD/JPY: during the Asian session the pair continued yesterday's decrease.

On Thursday European data starts at 0710GMT with the GfK consumer confidence data from Germany, while France data at 0745GMT includes consumer confidence and also the quarterly industry survey. At 0800GMT, World Trade Organization Director General Pascal Lamy becomes the first main speaker out of Davos for Thursday, followed at 1030GMT by UK Prime Minister David Cameron. At 1300GMT,

German Chancellor Angela Merkel and Spanish Prime Minister Mariano Rajoy give a joint press conference after their meeting in Berlin. UK

data at 1100GMT sees the CBI Distributive Trades Survey. US data starts at 1330GMT with both the weekly Jobless Claims and also Durable Goods orders. The weekly EIA Natural Gas Stocks data is then due at 1530GMT, followed at 1600GMT by Kansas City Fed Production data and later, at 2130GMT by M2 Money Supply data.

Yesterday the dollar fell to the weakest level in a month against the euro after the Federal Reserve extended its pledge to hold its target for the federal funds rate low until late 2014 amid a “highly accommodative” monetary policy. The central bank had previously pledged to keep its rate target in place until mid-2013. Nine of 17 Federal Reserve officials expect borrowing costs will remain below 1 percent at the end of 2014, with six officials expecting zero rates to remain into 2015. The projections by Federal Open Market Committee participants, released for the first time today in Washington, provide an unprecedented look at policy makers’ plans for the path of the benchmark interest rate, which has remained near zero since December 2008. An increase in 2014 would mark the first rise in the fed funds rate since June 2006. Policy makers also lowered their estimates for growth and inflation in 2012, a move consistent with their statement earlier today that interest rates will remain “exceptionally low” through at least late 2014.

The yen fell against most its major counterparts after the Ministry of Finance said Japan’s exports dropped 8 percent in December from a year earlier. The median estimate of 27 economists surveyed by Bloomberg News was for a 7.4 percent decline. The Japanese currency is viewed as a safe haven because the nation’s trade surplus makes the currency attractive because it means the nation doesn’t have to rely on overseas lenders.

EUR/USD: yesterday the pair rose, showed new month's high.

GBP/USD: yesterday the pair rose, showed new month's high.

USD/JPY: yesterday the pair gain and showed new high of 2012, but could not be kept above Y78.00.

On Thursday European data starts at 0710GMT with the GfK consumer confidence data from Germany, while France data at 0745GMT includes consumer confidence and also the quarterly industry survey. At 0800GMT, World Trade Organization Director General Pascal Lamy becomes the first main speaker out of Davos for Thursday, followed at 1030GMT by UK Prime Minister David Cameron. At 1300GMT,

German Chancellor Angela Merkel and Spanish Prime Minister Mariano Rajoy give a joint press conference after their meeting in Berlin. UK

data at 1100GMT sees the CBI Distributive Trades Survey. US data starts at 1330GMT with both the weekly Jobless Claims and also Durable Goods orders. The weekly EIA Natural Gas Stocks data is then due at 1530GMT, followed at 1600GMT by Kansas City Fed Production data and later, at 2130GMT by M2 Money Supply data.

Asian stocks rose, with the regional benchmark index set for the highest close in almost three months, after the yen fell and Apple Inc. reported quarterly profit more than doubled, boosting the earnings outlook for Asian exporters.

Sony Corp. (6758), Japan’s No. 1 exporter of consumer electronics, advanced 4.8 percent. Hynix Semiconductor Inc. (000660) paced gains among suppliers to Apple after the world’s largest technology company gained in after-hours trading. Lynas Corp., an Australian rare- earths miner, rose 5.1 percent after selling a $225 million convertible bond to help fund a delayed refinery.

European stocks fell for a second day after Ericsson AB and Novartis AG posted earnings that missed analysts’ estimates. The U.K. economy shrank in the fourth quarter more than economists had forecast as manufacturers cut output and services stagnated, leaving Britain on the brink of another recession. Bank of England policy makers voted unanimously this month to keep their target for bond purchases unchanged, with some officials saying more stimulus is “likely” to be needed after the current program is complete.

The Federal Reserve will release rate forecasts for the first time today. Business and political leaders gathered in Davos, Switzerland, for the start of the World Economic Forum’s annual meeting.

National benchmark indexes fell in 12 of the 18 western- European markets today. The U.K.’s FTSE 100 Index slid 0.5 percent, France’s CAC 40 Index declined 0.3 percent and Germany’s DAX Index added less than 0.1 percent.

Ericsson, the world’s largest maker of wireless networks, plunged 14 percent after reporting fourth-quarter net income that missed analysts’ estimates.

Novartis, Europe’s biggest drugmaker by sales, declined 2.5 percent.

ARM Holdings Plc climbed 3 percent after Apple Inc. posted quarterly profit that more than doubled. ARM is the U.K. owner of chip technology used in Apple’s iPhone and iPad.

U.S. stocks rose, sending the Dow Jones Industrial Average to the highest level since May, as the Federal Reserve signaled low rates through at least late 2014 and didn’t rule out bond purchases to bolster the economy.

Benchmark gauges reversed losses as the Fed extended its previous pledge to keep rates low at least until the middle of 2013 as more than two years of economic growth have failed to push unemployment below 8.5 percent. Fed Chairman Ben S. Bernanke said central bankers are still debating additional asset purchases.

Gold producers rallied as the metal climbed to a six-week high. Newmont Mining Corp., the largest U.S. gold producer, jumped 4.8 percent to $60.25. Freeport-McMoRan Copper & Gold Inc., the world’s largest publicly traded copper producer, climbed 4.8 percent to $46.08.

Apple rallied 6.2 percent, the most since May 2010, to $446.66. The company sold 37 million iPhones in the period ended Dec. 31, with customers snapping up the new 4S model that went on sale in October, a week after the death of co-founder Steve Jobs. Record revenue vaulted Apple ahead of Hewlett-Packard Co. (HPQ) as the world’s biggest computer maker by sales and quelled concern that the company’s allure may dim as it embarks on a new era with Chief Executive Officer Tim Cook at the helm.

Textron surged 15 percent, the most in the S&P 500, to $24.76. Chief Executive Officer Scott Donnelly is working to leverage the company’s businesses with measures such as having Cessna and Bell share overseas service centers and sales forces. Textron is winding down its finance unit, which struggled during the recession.

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.30/45 (area of Nov 1-29 high)

The current price: Y77.62

Support 1:Y77.55 (Jan 25 low)

Support 2:Y77.30 (Jan 20 low)

Support 3:Y76.85 (Nov 22 low)

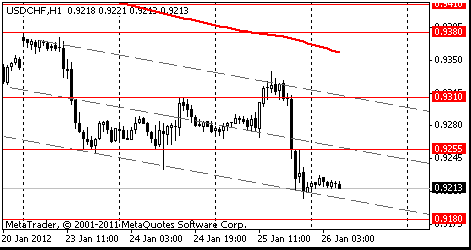

Resistance 3: Chf0.9380 (Jan 23 high, MA (233) H1)

Resistance 2: Chf0.9310 (Jan 24 high)

Resistance 1: Chf0.9255 (middle line from Jan 23)

The current price: Chf0.9213

Support 1: Chf0.9180 (Dec 9 low)

Support 2: Chf0.9140 (Nov 29 low)

Support 3: Chf0.9110 (Nov 29 low)

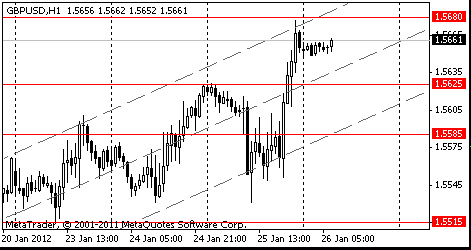

Resistance 3 : $1.5770 (Dec 21 high)

Resistance 2 : $1.5725 (Dec 22 high)

Resistance 1 : $1.5680 (Jan 25 high)

The current price: $1.5661

Support 1 : $1.5625 (middle line from Jan 20)

Support 2 : $1.5585 (support line from Jan 20)

Support 3 : $1.5515 (Jan 23 low)

Resistance 3 : $1.3235 (Dec 13 high)

Resistance 2 : $1.3200 (Dec 21 high)

Resistance 1 : $1.3130 (Dec 20 high)

The current price: $1.3112

Support 1 : $1.3045 (middle line from Jan 23)

Support 2 : $1.2970 (support line from Jan 23)

Support 3 : $1.2875/85 (area of Jan 20-23 low)

Change % Change Last

Oil $99.76 +0.36 +0.36%

Gold $1,710.90 +10.80 +0.64%

Change % Change Last

Nikkei 225 8,884 +98.36 +1.12%

Hang Seng Closed

S&P/ASX 200 4,271 +47.11 +1.12%

Shanghai Composite Closed

FTSE 100 5,752 -30.66 -0.53%CAC 40 3,323 -15.77 -0.47%

DAX 6,419 -17.40 -0.27%

Dow 12,758.85 +83.10 +0.66%

Nasdaq 2,818.31 +31.67 +1.14%

S&P 500 1,326.06 +11.41 +0.87%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3105 +0,53%

GBP/USD $1,5677 +0,34%

USD/CHF Chf0,9214 -0,65%

USD/JPY Y77,78 +0,17%

EUR/JPY Y101,92 +0,67%

GBP/JPY Y121,76 +0,34%

AUD/USD $1,0596 +0,97%

NZD/USD $0,8166 +0,59%

USD/CAD C$1,0043 -0,44%

00:00 China Bank holiday

00:00 Australia Bank holiday

07:00 Germany Gfk Consumer Confidence Survey February 5.6 5.6

07:45 France Consumer confidence January 80 80

09:00 Switzerland World Economic Forum Annual Meetings

11:00 United Kingdom CBI retail sales volume balance January 9 1

13:30 U.S. Initial Jobless Claims 21/01/12 352 395

13:30 U.S. Durable Goods Orders December +3.8% +2.0%

13:30 U.S. Durable Goods Orders ex Transportation December +0.3% +0.9%

13:30 U.S. Durable goods orders ex defense December +3.7% +5.4%

15:00 U.S. New Home Sales December 315 322

15:00 U.S. Leading Indicators December +0.5% +0.7%

21:45 New Zealand Trade Balance December -308 -47

23:30 Japan National Consumer Price Index, y/y December -0.5% -0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y December -0.2% -0.1%

23:30 Japan Tokyo Consumer Price Index, y/y January -0.4% -0.4%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January -0.3% -0.3%

23:50 Japan Retail sales, y/y December -2.3% +2.0%

23:50 Japan Monetary Policy Meeting Minutes

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.