- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 23-01-2012

The euro strengthened to an almost three-week high against the dollar as French Finance Minister Francois Baroin said negotiations between Greece and its private creditors are making “tangible progress.”

The 17-nation currency gained versus 13 of its 16 major counterparts tracked by Bloomberg as European Union finance ministers gather in Brussels to discuss a Greek debt swap, budget rules and a financial firewall to protect indebted nations.

Bondholders negotiating a debt swap with Greece have made their “maximum” offer, leaving it to the EU and International Monetary Fund to decide whether to accept the deal, said Charles Dallara, managing director of the Washington-based Institute of International Finance, who’s representing private creditors in the talks.

The pound fell 0.7 percent to 83.61 pence per euro after profit alerts increased by more than 70 percent in the final quarter of 2011 at U.K.-listed companies, the biggest jump since the first three months of 2001, according to Ernst & Young LLP.

European stocks climbed to a five- month high, led by a rally in banks, as Greece bargained with bondholders over debt relief and Germany floated the idea of combining Europe’s two rescue funds.

European Union finance chiefs started discussing the region’s rescue funds, Greece’s latest offer to bondholders, a German-inspired deficit-control treaty and nominees to the European Central Bank’s board today.

National benchmark indexes rose in 15 of the 18 western European markets today.

FTSE 100 5,783 +54.01 +0.94%, CAC 40 3,338 +16.92 +0.51%, DAX 6,437 +32.23 +0.50%

UniCredit, Italy’s biggest bank, rallied 10 percent to 3.66 euros while Banca Monte dei Paschi di Siena SpA, the nation’s third-biggest, surged 14 percent to 26.23 euro cents and Intesa Sanpaolo SpA climbed 5.4 percent to 1.46 euros.

Elsewhere, Commerzbank gained 13 percent to 1.95 euros in Frankfurt trading. Societe Generale SA climbed 8.6 percent to 22.80 euros in Paris, a tenth day of gains for the longest winning streak since March 2009.

Outokumpu jumped 18 percent to 7.97 euros as ThyssenKrupp said it’s in talks to merge its Inoxum stainless steel unit with the Finnish company. All options for the unit are still open, including an initial public offering, spinoff or a sale to an investor, ThyssenKrupp said.

ThyssenKrupp, Germany’s largest steelmaker, rallied 2.6 percent to 21.26 euros.

There is a limit to how far monpol can stimulate the economy

He doesn't worry about low UK productivity growth, hasn't seen slowdown in UK trend productivity

Most MPC thing growth will get back to trend

U.S. stocks fell, after the Dow Jones Industrial Average climbed to the highest closing level since May, as investors weighed developments in Europe’s efforts to tame its debt crisis.

European officials will forge ahead today with crafting a plan to tackle the debt crisis, as banking and government negotiators continue trying to reach a deal that will lighten Greece’s debt burden. Bondholders negotiating a debt swap with Greece have made their “maximum” offer, leaving it to the European Union and International Monetary Fund to decide whether to accept the deal, the negotiator for private creditors said.

Dow 12,676.28 -44.20 -0.35%, Nasdaq 2,777.37 -9.33 -0.33%, S&P 500 1,312.38 -3.00 -0.23%

Halliburton slumped 3.9 percent to $34.79. The company posted a decline in its fourth-quarter operating margin in North America as companies cut natural-gas drilling. It reported a profit margin of 27.2 percent for the region, its largest, down from 29 percent in the past two quarters, according to a statement today.

Research In Motion tumbled 6.5 percent to $15.90. The BlackBerry maker replaced co-Chief Executive Officers Jim Balsillie and Mike Lazaridis with an insider who said he sees no need for radical change as the company struggles to compete with Apple Inc. (AAPL) Thorsten Heins, a chief operating officer who joined RIM four years ago from Siemens AG, will replace the pair in the CEO post effective immediately, RIM said.

Among financial companies, Bank of America Corp. rose 1.3 percent to $7.17, after rallying 4.2 percent earlier.

Chesapeake Energy gained 3.9 percent to $21.77. Gross production at wells it operates will be cut by as much as 1 billion cubic feet a day and the Oklahoma City-based company will defer gas-well completions wherever possible. Planned spending on gas wells will fall 70 percent from 2011 levels, to $900 million.

We are ready to accelerate the payment of ESM

Greece does not require intermediate credit

We will not support an increase in EFSF, ESM

To stimulate growth, you can use EU funds supporting

Oil rose for the first time in four days

after the European Union agreed to ban crude imports from Iran, raising concern that retaliation from the Islamic Republic may disrupt oil supply from the Middle East.

Futures gained as much as 1.5 percent as the 27-nation bloc said it would implement the crude embargo starting July 1 to pressure the country over its nuclear program. Iran has threatened to close the Strait of Hormuz, the transit point for about a fifth of global oil, if its exports are banned.

Oil for March delivery gained to $99.80 a barrel on the New York Mercantile Exchange. Prices have increased 11 percent in the past year.

Brent oil for March settlement advanced 59 cents, or 0.5 percent, to $110.45 a barrel on the London-based ICE Futures Europe exchange.

Gold prices reached a peak of six weeks due to the strengthening of the euro against the dollar and the rise in other commodity markets.

The euro is rising against the dollar, although the market is uncertain due to ongoing negotiations on debt restructuring of Greece. Private lenders have already decided on what losses they are prepared in the course of restructuring, and now such a decision should take the finance ministers of the eurozone. Greece must pay 14.5 billion euros to creditors on March 20.

On the physical gold market in India, demand is growing due to appreciation of the rupee against the dollar. Other major Asian markets - China, Singapore, Malaysia and Indonesia- are closed to celebrate the New Year by the lunar calendar.

Cost of the February gold futures on the COMEX today rose to 1679.7 dollars per ounce.

EUR/USD $1.2800, $1.2900, $1.2910

USD/JPY Y76.75, Y76.80, Y76.85, Y77.00, Y77.45

AUD/USD $1.0300, $1.0450, $1.0360, $1.0350

GBP/USD $1.5500

EUR/JPY Y99.00, Y98.50

EUR/AUD A$1.2425

NZD/USD $0.7840

U.S. stock futures were little changed as finance ministers gathered in Brussels to discuss new budget rules and a Greek debt swap.

European officials will forge ahead today with crafting a long-term plan to tackle the region’s debt crisis, as banking and government negotiators continue trying to reach an agreement that will lighten Greece debt burden. Bondholders negotiating a debt swap with Greece have made their “maximum” offer, leaving it to the European Union and International Monetary Fund to decide whether to accept the deal, the negotiator for private creditors said.

Global stocks:

Nikkei 8,766 -0.46 -0.01%

FTSE 5,767 +38.59 +0.67%

CAC 3,335 +13.83 +0.42%

DAX 6,431 +26.61 +0.42%

Crude oil: $99.31 (+1,0%).

Gold: $1667.40 (+0,2%).

The euro strengthened on speculation European officials meeting today in Brussels will advance plans to tackle the region’s debt crisis.

The common currency gained as French Finance Minister Francois Baroin said negotiations between Greece and its private creditors are making “tangible progress.”

European Union finance ministers are gathering in Brussels to discuss a Greek debt swap, new budget rules and a financial firewall to protect indebted states.

The German government is considering proposals to run the temporary and permanent European rescue funds in parallel if needed, potentially creating a bigger firewall against the region’s debt crisis, according to Steffen Seibert, the government’s chief spokesman.

EUR/USD: the pair has grown above $1,3000.

GBP/USD: the pair become stronger, but not managed to overcome $1,5580.

USD/JPY: the pair receded below Y77.00.

Jan 24

McDonald's Corp (MCD). Cons. EPS $1.30.

Verizon Communications (VZ). Cons. EPS $0.53.

Johnson & Johnson (JNJ). Cons. EPS $1.09.

EUR/USD

Offers $1.3100, $1.3075/85, $1.3050, $1.3020/25

Bids $1.2980, $1.2950, $1.2890/80, $1.2840, $1.2820, $1.2800

Resistance 3: Y77.60 (61,8 % FIBO Y78.20-Y76.60, Dec 28 low)

Resistance 2: Y77.35/40 (area of session high, Jan 6 high, 50.0 % FIBO Y78.20-Y76.60)

Resistance 1: Y77.10 (area of session high)

Current price: Y76.91

Support 1:Y79.85 (session low, МА (200) for Н1)

Support 2:Y76.55 (Jan 17 low and low of November)

Support 3:Y75.60 (historical low)

Resistance 2: Chf0.9320 (low of american session on Jan 20)

Resistance 1: Chf0.9300 (Jan 20 low)

Current price: Chf0.9281

Support 1: Chf0.9280 (session low)

Support 2: Chf0.9240 (Dec 21 low)

Support 3: Chf0.9180 (Dec 8-9 lows)

Resistance 2 : $1.5670 (high of January)

Resistance 1 : $1.5580 (session high)

Current price: $1.5569

Support 1 : $1.5560 (high of asian session)

Support 2 : $1.5515 (area of session low)

Support 3 : $1.5450 (Jan 20 low, 38,2 % FIBO $1,5230-$ 1,5580)

Resistance 3 : $1.3120 (Dec 22 high)

Resistance 2 : $1.3080 (high of January and Dec 26-28, the top border of the upchannel from Jan 16)

Resistance 1 : $1.3000 (psychological level)

Current price: $1.2996

Support 1 : $1.2950 (high of american session on Jan 20)

Support 2 : $1.2920 (the bottom border of the upchannel from Jan 16)

Support 3 : $1.2880 (session low, Jan 20 low)

EUR/USD $1.2800, $1.2900, $1.2910

USD/JPY Y76.75, Y76.80, Y76.85, Y77.00, Y77.45

AUD/USD $1.0300, $1.0450, $1.0360, $1.0350

GBP/USD $1.5500

EUR/JPY Y99.00, Y98.50

EUR/AUD A$1.2425

NZD/USD $0.7840

Asian stocks swung between gains and losses as increasing home sales in the U.S. added to signs the world’s biggest economy is recovering, outweighing uncertainties over continuing debt negotiations in Greece.

Nikkei 225 8,766 -0.46 -0.01%

Hang Seng Closed

S&P/ASX 200 4,225 -14.53 -0.34%

Shanghai Composite Closed

Canon Inc. (7751), the Japanese camera maker that gets a third of its sales from Europe, fell 1 percent in Tokyo.

Reliance Industries (RIL) Ltd., India’s biggest company by market value, sank 2.9 percent in Mumbai after earnings dropped for the first time in two years.

Olympus Corp. (7733), the world’s No. 1 maker of endoscopes, jumped 8.2 percent after it was allowed to keep its stock market listing following an accounting fraud that cut the company’s market value by about $4 billion.

USD/CHF likely to reach 0.9595 near term – Commerzbank. The cross is resuming the negative sentiment that prevailed last week along with a weaker greenback, trading on Monday well below the 0.9400 level. K.Jones, analyst at Commerzbank, remarks that a breach of 0.9295 (close to 2012 low at 0.9306) could leave the pair well exposed for further downside eyeing levels at 0.9250-02 and then 0.9080-66

Although risk-on trade has been sharpening since last week, any disappointing news from the euro zone could suddenly shift the investors’ appetite towards safe havens, and in that case she affirms that “rallies will need to regain 0.9410-50 intraday in order to alleviate immediate downside pressure and signal a retest of the 0.9595 recent high”.

00:00 China Bank holiday

00:30 Australia Producer price index, q / q IV quarter +0.6% +0.5% +0.3%

00:30 Australia Producer price index, y/y IV quarter +2.7% +3.0% +2.9%

The euro fell for a second day on concern that Greece will struggle to reach an agreement with creditors to ease its debt burden.

The 17-nation currency weakened before European Union finance ministers meet in Brussels today to discuss a Greek debt swap, new budget rules and a financial firewall to protect indebted states.

Bondholders negotiating a debt swap with Greece have made their “maximum” offer, leaving it to the EU and International Monetary Fund to decide whether to accept the deal, said Charles Dallara, who’s representing private creditors in the talks.

Financial markets in China, Hong Kong, Singapore, South Korea, Taiwan, Indonesia and Malaysia are shut for the Lunar New Year holiday today.

The Australian dollar rose against most of its 16 major counterparts before reports that may show the U.S. economy is accelerating, supporting demand for the riskier assets.

The Australian dollar traded near the highest level in almost 12 weeks as Asian stocks extended a week-long rally in global equities. Demand for the South Pacific nations’ currencies was limited on concern Greece will struggle to reach agreement with its creditors on a deal that will lighten the country’s debt burden.

Australian dollar demand was also limited after a report showed wholesale cost pressures are easing, providing scope for the Reserve Bank of Australia to implement a third consecutive interest-rate cut.

The producer price index (MXAP) advanced 0.3 percent in the October-to-December period from the prior quarter, when it gained 0.6 percent, the Bureau of Statistics said in Sydney today. The median estimate of economists surveyed by Bloomberg News was for a 0.4 percent increase.

A Credit Suisse Group AG index based on swaps indicates an 82 percent chance that the RBA will lower rates by 25 basis points, or 0.25 percentage point, when policy makers gather on Feb. 7. The benchmark rate is currently 4.25 percent following quarter-point reductions at each of the central bank’s two most recent meetings.

EUR/USD: during the Asian session the pair was restored to $1.2900.

GBP/USD: during the Asian session the pair has receded from week’s highs.

USD/JPY: during the Asian session the pair has a little grown.

Main European data is a little thin on Monday with just the Manufacturing and Services sentiment data for January for France. At 1130GMT, International Monetary Fund Managing Director Christine Lagarde speaks on "the economic challenges of 2012 and restoring confidence and growth" in Berlin before the German Council on Foreign Relations. At 1430GMT, the EIA publishes its early Annual Energy Outlook. US data for Monday starts at 1430GMT with the weekly Capital Goods Index, which is followed at 1530GMT by the weekly Retail Trade index.

On Monday the euro was under pressure as France prepared to sell bills after Standard & Poor’s stripped the nation of its top credit rating and cut eight other euro-region nations.

Europe’s shared currency briefly pared declines after the European Central Bank was said to buy Italian and Spanish debt to cap yield increases. The euro dropped on Friday amid reports of imminent ratings cuts before S&P lowered the top grades of France and Austria one level to AA+, with “negative” outlooks. The company affirmed the ratings of countries including Germany, Belgium and the Netherlands and downgraded Italy, Portugal, Spain and Cyprus by two steps and Malta, Slovakia and Slovenia by one level.

On Tuesday the euro rose for the first time in three days against the dollar and the yen after a successful auction of bonds of Belgium and the European Foundation for financial stability, as well as record growth of German economic sentiment index. Markets have also provided support for the outcome of the auction on government bonds of Belgium, which showed a decrease in the average return over the same previous release. Belgium has attracted 2.96 billion of funds under objective 3.0 billion euros. Positive was also an auction of bonds of the European Financial Stability Fund (EFSF), which attracted 1.501 billion euros at 1.5 billion euros target. Funds held for 6 months, the average yield was 0.2664%, covering 3.1.

On Wednesday the euro gained for a second day versus the dollar and yen as the International Monetary Fund proposed raising its lending capacity by as much as $500 billion to protect the global economy amid Europe’s debt turmoil. The 17-nation currency rallied against most of its major peers as Greek officials resumed negotiations with bondholders. The euro rallied versus the dollar and yen as an IMF spokesman said in a statement that the Washington-based lender wants to increase its resources after identifying a potential need for $1 trillion in coming years. The IMF is studying options and will not comment further until it has consulted its members, the fund said.

On Thursday the euro strengthened to a two-week high against the dollar and the yen as Spain raised more than its maximum target at a debt sale, boosting optimism the region’s sovereign-debt crisis is being contained. Spain sold 6.61 billion euros ($8.5 billion) of debt due in 2016, 2019 and 2022, exceeding the maximum target of 4.5 billion euros set for the auctions. Investors bid for 3.2 times the amount of 2016 notes allotted, versus 1.7 times last week. Demand for the 2022 bond was 2.2 times the amount sold, from 1.5 in November. French borrowing costs declined as the nation sold 7.97 billion euros of medium and long-term securities.

On Friday the euro dropped from a two-week high against the dollar as European stocks fell and Greek officials held debt-swap talks for a third day, damping investor demand for the shared currency. European officials and Greece’s private bondholders agreed in October to carry out a 50 percent cut in the face value of the nation’s debt by voluntarily exchanging outstanding bonds for new securities, with a goal of reducing the country’s borrowings to 120 percent of gross domestic product by 2020. An accord with bondholders is essential to a second financing package for Greece, which faces a 14.5 billion-euro ($18.7 billion) bond payment on March 20.

Asian stocks rose, with a regional benchmark index heading for its fifth straight weekly advance, as fewer Americans than forecast filed claims for jobless benefits and after Spain and France sold bonds at lower yields.

Toyota Motor Corp. (7203), a Japanese carmaker that gets about 70 percent of its sales overseas, climbed 4.1 percent in Tokyo.

Japanese lenders rallied after the central bank said it will postpone the sale of shares purchased from financial institutions. HSBC Holdings Plc. (HSBA), Europe’s biggest bank by market value, advanced 3.4 percent in Hong Kong.

Li Ning Co., China’s No. 1 sportswear company, surged 7.1 percent after selling 750 million yuan ($119 million) of convertible bonds.

European stocks retreated from a five-month high as U.S. home sales rose less than forecast, adding to concern that gains in equities have outpaced the outlook for economic growth.

Greek officials and private creditors met for a third day to seek agreement on a debt swap. European officials and bondholders agreed in October to implement a 50 percent cut in the face value of Greek debt by voluntarily exchanging outstanding bonds for new securities, with a goal of reducing borrowings to 120 percent of gross domestic product by 2020.

The government and creditors reached an initial agreement for a voluntary swap of Greek debt, Proto Thema reported on its website, without saying how it got the information. The parties agreed that new bonds to replace existing Greek debt would be of a 30-year maturity and carry a coupon beginning at 3.1 percent, reach 3.9 percent and go as high as 4.75 percent, the Athens- based newspaper said.

National benchmark indexes fell in 12 of the 18 western European markets today. France’s CAC 40, the U.K.’s FTSE 100 and Germany’s DAX Index all slid 0.2 percent. Greece’s ASE rallied 2.7 percent to a two-month high.

Cie. de Saint-Gobain, Europe’s largest building-materials supplier, led construction shares lower, falling 2 percent.

BP, the U.K.’s second-largest oil company, dropped 3.1 percent to 467.45 pence as crude declined for a third day in New York trading.

Petrofac Ltd. fell 4.3 percent to 1,440 pence, dropping for a sixth day, as JPMorgan Chase & Co. downgraded the shares.

Meyer Burger Technology AG, the biggest maker of solar- panel manufacturing equipment, sank 6.6 percent to 17.8 Swiss francs as Germany said it will increase the frequency of cuts to solar subsidies. Solarworld AG (SWV) slid 6.5 percent to 4.04 euros in Frankfurt trading.

Most U.S. stocks rose, erasing a loss for the Standard & Poor’s 500 Index in the final minutes of trading, as banks gained and results from International Business Machines Corp. (IBM) to Intel Corp. (INTC) boosted technology shares.

Sales of previously owned U.S. homes rose for a third month in December to the highest level since January 2011, a sign the housing market ended last year with momentum. Greek officials and private creditors entered a third day of negotiations on a debt swap deal that’s crucial to lowering the country’s borrowings and freeing up a second round of international aid.

IBM gained 4.4 percent to $188.52 after forecasting 2012 earnings that beat analysts’ estimates as fourth-quarter profit rose 4.4 percent because of rising software demand.

Intel increased 2.9 percent to $26.38. The chipmaker predicted first-quarter revenue that may top analysts’ estimates, signaling that the shortage of disk drives that throttled personal computer production may be ending.

Microsoft added 5.7 percent to $29.71. The company’s Xbox business got a boost from Christmas shoppers, who snapped up its video-game consoles and Kinect sensor controllers, and signed up for the Xbox Live online service.

GE (GE) closed unchanged at $19.15. Profit topped estimates after the company’s industrial order backlog rose to a record $200 billion even as weaker demand in Europe hindered sales in health care.

Google tumbled 8.4 percent to $585.99. Chief Executive Officer Larry Page is moving into new markets to ignite growth outside Google’s traditional search-based business. That effort contributed to an 8 percent drop in the average price Google gets when users click an ad, because it charges less for ads on mobile devices and in emerging markets, said Herman Leung, an analyst at Susquehanna Financial Group.

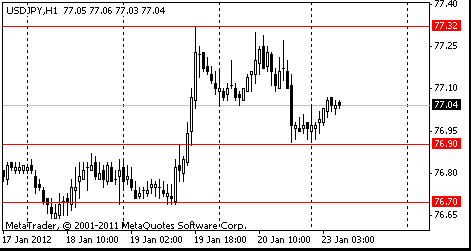

Resistance 3: Y78.30 (Nov 29 high)

Resistance 2: Y77.90 (Dec 29 high)

Resistance 1: Y77.30/40 (area of Jan 6 and 19 highs)

The current price: Y77.04

Support 1:Y76.90 (session low)

Support 2:Y76.70 (Jan 19 low)

Support 3:Y76.55 (Jan 17 low)

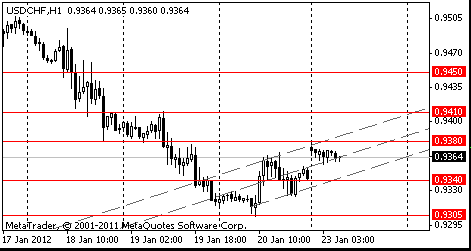

Resistance 3: Chf0.9450 (high of the Asian session on Jan 13)

Resistance 2: Chf0.9410 (Jan 19 high)

Resistance 1: Chf0.9380 (high of the American session on Jan 19, session high)

The current price: Chf0.9364

Support 1: Chf0.9340 (support line from Jan 20)

Support 2: Chf0.9305 (Jan 20 low)

Support 3: Chf0.9270 (Dec 20 low)

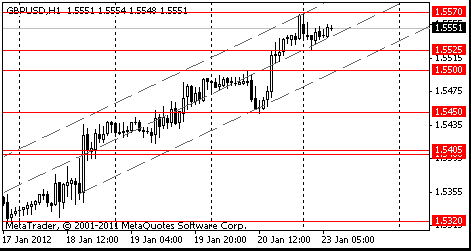

Resistance 3 : $1.5670 (Jan 3 high)

Resistance 2 : $1.5630 (Jan 5 high)

Resistance 1 : $1.5570 (session high)

The current price: $1.5551

Support 1 : $1.5525 (session low)

Support 2 : $1.5500 (support line from Jan 18)

Support 3 : $1.5450 (Jan 20 low)

Resistance 3 : $1.2985 (Jan 20 high)

Resistance 2 : $1.2950 (high of the American session on Jan 20)

Resistance 1 : $1.2920 (resistance line from Jan 20)

The current price: $1.2898

Support 1 : $1.2870 (session low)

Support 2 : $1.2840 (Jan 19 low)

Support 3 : $1.2810 (low of the Asian session on Jan 13)

00:00 China Bank holiday 0

00:30 Australia Producer price index, q / q IV quarter +0.6% +0.5%

00:30 Australia Producer price index, y/y IV quarter +2.7% +3.0%

13:30 Canada Leading Indicators, m/m December +0.8% +0.6%

15:00 Eurozone Consumer Confidence January -21.1 -21.4

18:00 United Kingdom MPC Member Posen Speaks 0

23:00 Australia Conference Board Australia Leading Index November +0.6%

● Added the description of economic indicators* and their history in a graphical presentation ** (two asterisks in the “Actual” column)

● Changed the way of reviewing the calendar records. Currently, in order to review the previous calendar records, one must select the necessary date in the calendar which is displayed by clicking “ Select date in calendar “***

● Changed the index or event importance notation where one exclamation mark indicates news of little importance, two for highly important news, and three for extremely important news.

●The actual indicator value varies depending on the forecasted value (or the previous value in case the forecast is not available): red – below the forecast, green – above the forecast, black – neutral;

● Speeded up the actual values report

We hope that the changes provided will assist in your prompt and objective assessment of international trading floors situations for maximally effective funds investments.TeleTRADE team continues to develop its Analytics section in an effort to make it maximally convenient for our clients. Any new changes are advised. Please follow the news!

* The description contains the index information, its market influence and its source.

** To view the index information and its diagram, please click the corresponding button. (You may also simultaneously review either the index information or its diagram). In order to hide the index information or its diagram, please click the corresponding button once again.

As a rule, the economic indicator diagram displays two indexes, the forecast (if it is available, green column) and actual (dark red column).

The simultaneous display of both values allows determining the degree of the reported index influence on the corresponding instrument. For instance: Having noticed a significant difference between the actual and forecasted values over a certain period in the past, you may review the corresponding financial instrument price changes at MetaTrader-Teletrade terminal. It offers more objective plotting of expectations regarding the market reaction towards the future index report.

There is a possibility of reviewing just one of the values – either forecasted or the actual one. To do that you need to remove the unnecessary value by clicking the corresponding heading in the upper right corner of the diagram (double clicking the heading will bring back the index value onto the diagram)

By moving the cursor over a certain area of the diagram you will see the pop-up menu displaying the report date with the forecasted and actual values of the date selected.

*** The calendar provides the possibility of choosing not just a particular date but also a week. To do that you need to press and hold the Shift button while making the choice.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.