- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 18-01-2012

The euro gained for a second day versus the dollar and yen as the International Monetary Fund proposed raising its lending capacity by as much as $500 billion to protect the global economy amid Europe’s debt turmoil. The 17-nation currency rallied against most of its major peers as Greek officials resumed negotiations with bondholders. The euro rallied versus the dollar and yen as an IMF spokesman said in a statement that the Washington-based lender wants to increase its resources after identifying a potential need for $1 trillion in coming years. The IMF is studying options and will not comment further until it has consulted its members, the fund said.

The dollar fell against the euro on reduced demand for a refuge as U.S. data showed a rebound in industrial production. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, fell 0.7 percent to 80.522.

Most European stocks rose as the International Monetary Fund said it plans to raise as much as $500 billion to expand its lending resources and Greece neared a debt deal with its private creditors.

The IMF aims to increase its resources to safeguard the global economy after identifying a potential need for $1 trillion in financing in coming years, an IMF spokesman said in a statement. The IMF will not comment further until it has consulted its members, the fund said.

Greece is close to a deal with private creditors that would give them cash and securities with a market value of about 32 cents per euro of government debt, according to Bruce Richards, who is on the creditors’ committee and chief executive officer for Marathon Asset Management LP.

The World Bank cut its global growth forecast by the most in three years today, saying that a recession in the euro region threatens to exacerbate a slowdown in emerging markets such as India and Mexico.

The world economy will grow 2.5 percent this year, down from a June estimate of 3.6 percent, the Washington-based institution said. The euro area may contract 0.3 percent, compared with a previous estimate of a 1.8 percent gain. The World Bank cut its outlook for U.S. growth to 2.2 percent from 2.9 percent.

The German government trimmed its forecast for 2012 growth in Europe’s biggest economy to 0.7 percent from a previous 1 percent estimate.

Germany sold two-year notes at a record-low yield today after euro-area ratings downgrades by Standard & Poor’s on Jan. 13. Portugal auctioned its targeted amount of 2.5 billion euros ($3.2 billion) of securities at a sale of three-, six- and 11- month treasury bills.

Accor SA advanced 4.3 percent to 21.97 euros. The French hotelier, which generated 73 percent of its sales from Europe in 2010, said revenue rose 2.5 percent in 2011 and reiterated its forecast for full-year earnings before interest and taxes.

Man Group Plc jumped 6.8 percent to 114.4 pence. The world’s largest publicly traded hedge fund said it will reduce pay and eliminate jobs in a plan to reduce costs by about 10 percent as market turmoil prompted clients to withdraw money.

Commerzbank fell 1.7 percent to 1.41 euros as Moody’s cut Commerzbank’s financial-strength rating to D+ from C-. The rating represents Moody’s opinion of a lender’s intrinsic safety and soundness and doesn’t address the probability of timely repayment of debt, according to the company’s definitions.

Tullow Oil Plc declined 4.2 percent to 1,394 pence, its biggest retreat since Nov. 9. The London-based oil explorer with the highest number of licenses in Africa dropped after delaying full production from its Jubilee field in Ghana by at least a year.

U.S. stocks rose, sending the Standard & Poor’s 500 Index toward its highest level since July, as technology and financial shares rallied amid data showing that confidence among homebuilders exceeded forecasts.

Stocks rose as a gauge of confidence among U.S. homebuilders rose in January to the highest level in more than four years as sales and buyer traffic improved. U.S. industrial production rebounded in December, reflecting gains in demand for business equipment, automobiles and construction materials. The International Monetary Fund is proposing to raise its lending capacity by as much as $500 billion to insulate the global economy against any worsening of Europe’s debt crisis.

Dow 12,558.10 +76.03 +0.61%, Nasdaq 2,760.66 +32.58 +1.19%, S&P 500 1,304.10 +10.43 +0.81%

Goldman Sachs rose 5.9 percent to $103.48. Chief Executive Officer Lloyd C. Blankfein, 57, is cutting costs and focusing on international growth to help offset a slowdown in trading, which contributes most of the firm’s revenue. He has said he wants to prepare for a market rebound, even as he eliminates jobs and adapts to new rules that limit the bank’s ability to invest its own money and make trades for Goldman Sachs’s own account.

Yahoo climbed 2.6 percent to $15.83. Now that co-founder and one-time chief executive officer Yang has cut his leadership ties to Yahoo, newly appointed CEO Scott Thompson has freer rein to unwind the company’s part-ownership of Alibaba Group Holding Ltd. and Yahoo Japan Corp. He may also do a better job mounting a credible threat to Google Inc. and Facebook Inc. in online advertising, said Clayton Moran, an analyst at Benchmark Co.

PulteGroup Inc. and Lennar Corp. added at least 3.7 percent, pacing an advance in homebuilders.

Linear Technology Corp. jumped 9.9 percent to $32.83. The maker of integrated circuits said third-quarter revenue was as much as $317.8 million, compared with the average analyst estimate of $302.5 million.

Oil fell in New York as U.S. industrial output rebounded in December amid increasing tension between Iran and Saudi Arabia, OPEC’s two leading producers.

Futures advanced as much as 1.3 percent and equities rebounded after Federal Reserve figures showed that production at factories, mines and utilities rose 0.4 percent last month. Iran called on Saudi Arabia to be “more wise and responsible” after the kingdom said it could make up for any supply loss resulting from a European ban on Iranian imports.

The World Bank cut its global growth forecast by the most in three years, saying a recession in the euro region may exacerbate a slowdown in emerging markets. The global economy will expand 2.5 percent this year, down from a June estimate of 3.6 percent, according to the World Bank in Washington. Turmoil in Europe has the potential to trigger a financial crisis reminiscent of 2008, it said.

Crude oil for February delivery fell to $99.84 a barrel on the New York Mercantile Exchange. Earlier prices climbed to $102.06, the highest level since Jan. 12.

Brent oil for March settlement declined 17 cents to $111.36 a barrel on the London-based ICE Futures Europe exchange.

Some hsg mkts are overvalued.

Corp bal sheets are in good shape, biz investment seen as strong ahead despite uncertainties.

Euro lenders to contain their crisis, China is slowing to a more sustainable growth pace, and sees US recovery slowing.

Gold prices stable amid uncertainty surrounding the negotiations on the reduction of Greece's debt, and on media reports that the International Monetary Fund plans to increase financial resources.

China has reduced purchases of gold before the New Year by the lunar calendar, and traders in India do not make new orders after the increase of import duties of up to 2percent with a solid rate of 300 rupees per 10 grams.

Gold mining company, African Barrick Gold has not fulfilled the plan for mining in the past year because of power outages at the mine Buzwagi.

Cost of the February gold futures on the COMEX is trading today in the range of $1642.1 - $1659.7 per ounce.

Resistance 3:1310 (August'2010 high)

Resistance 2:1300 (psychological level)

Resistance 1:12997 (area of Jan 12-13 higfs)

Current price: 1294,00

Resistance 1:1286 (session low)

Resistance 2:1280 (session low)

Support 3 : 1272 (Jan 13 low)

EUR/USD $1.2600, $1.2650, $1.2675, $1.2700, $1.2900, $1.2915

USD/JPY Y76.50, Y76.70

EUR/CHF Chf1.2100

AUD/USD $1.0300, $1.0420, $1.0500

GBP/USD $1.5400, $1.5550

USD/CHF Chf0.9450, Chf0.9500

AUD/NZD NZ$1.3000

Data:

09:30 UK Claimant count December 3.0 8.2 1.2

09:30 UK Claimant Count Rate December 5.0% 5.0% 5.0%

09:30 UK ILO Unemployment Rate December 8.3% 8.3% 8.4%

09:30 UK Average Earnings, 3m/y November +2.0% +2.0% +1.9%

09:30 UK Average earnings ex bonuses, 3 m/y November +1.8% +1.9% +1.9%

The euro advanced as the International Monetary Fund was said to seek a $500 billion expansion of its lending resources to safeguard the global economy.

The common currency strengthened before Greek Prime Minister Lucas Papademos resumes negotiations with bondholders over proposed losses today.

The dollar weakened before U.S. reports that economists said will show industrial production and confidence among homebuilders increased, damping demand for the safety of the greenback.

The pound fell against the euro as a report showed the British unemployment rate rose to a 16-year high.

EUR/USD: the pair has shown high in $1,2845 area, but returned back below $1,2800 later.

GBP/USD: during european session the pair was limited $1,5320-$ 1,5385.

USD/JPY: the pair has returned to area of session high Y76.80.

US data starts at 13:30 GMT with PPI data. At 1400GMT, US TICS data is due, followed at 1415GMT by US industrial production, which is expected to rise 0.5% in December after falling 0.2% in November. At 1430GMT, Federal Reserve Governor Daniel Tarullo testifies to a House Financial Services Subcommittee on the Volcker Rule. The US NAHB Housing Market Index is then due at 1500GMT.

GBP/USD

Offers $1.5490/500, $1.5445/55, $1.5410/25, $1.5400/05

Bids $1.5300, $1.5270, $1.5250

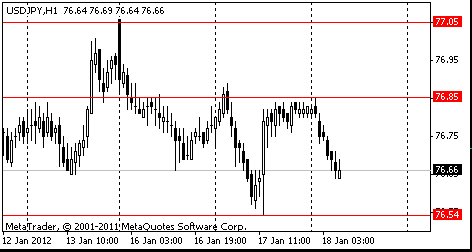

Resistance 3: Y77.35/40 (Jan 6 high, 50.0 % FIBO Y78.20-Y76.60)

Resistance 2: Y77.00/05 (Jan 11 and 16 high)

Resistance 1: Y77.90 (Jan 17 high)

Current price: Y76.81

Support 1:Y76.55 (Jan 17 and November lows)

Support 2:Y75.60 (Oct 31 low)

Support 3:Y75.00 (psychological level)

Resistance 3: Chf0.9600 (area of high of January)

Resistance 2: Chf0.9575 (area of session high and Jan 13 high)

Resistance 1: Chf0.9510 (МА (200) for Н1)

Current price: Chf0.9457

Support 1: Chf0.9410/00 (area of Jan 12-13 lows)

Support 2: Chf0.9390 (МА (200) for Н4)

Support 3: Chf0.9300 (Jan 3 low)

Resistance 3 : $1.5500 (area of Jan 10 high)

Resistance 2 : $1.5410 (Jan 13 and 17 highs)

Resistance 1 : $1.5385 (area of session high and МА (200) for Н1)

Current price: $1.5362

Support 1 : $1.5300 (area of session low and low of american session on Jan 17)

Support 2 : $1.5280 (Jan 16 low and resistance line from Jan 11 broken before)

Support 3 : $1.5230 (Jan 13 low)

Resistance 3 : $1.3000 (psychological level, МА (200) for Н1)

Resistance 2 : $1.2870/80 (area of Jan 13 high, Dec 29 low and support line from Nov 8)

Resistance 1 : $1.2845 (session high)

Current price: $1.2813

Support 1 : $1.2780 (support line from Jan 17)

Support 2 : $1.2730 (session low)

Support 3 : $1.2710 (low of american session on Jan 17)

E496mln of 3-month T-bill;avg yield 4.346% (4.346%), cover 4.1 (2.4);

- E754mln of 6-month T-bill;avg yield 4.74%, cover 3.0;

- E1.25bln of 11-month T-bill;avg yield 4.986%, cover 2.1.

EUR/USD $1.2600, $1.2650, $1.2675, $1.2700, $1.2900, $1.2915

USD/JPY Y76.50, Y76.70

EUR/CHF Chf1.2100

AUD/USD $1.0300, $1.0420, $1.0500

GBP/USD $1.5400, $1.5550

USD/CHF Chf0.9450, Chf0.9500

AUD/NZD NZ$1.3000

Asian stocks rose, with a regional benchmark index set for the highest close in six weeks, as economic reports in the U.S. and Germany beat estimates and oil prices gained.

Nikkei 225 8,551 +84.18 +0.99%

Hang Seng 19,668 +40.24 +0.21%

S&P/ASX 200 4,218 +2.25 +0.05%

Shanghai Composite 2,266 -31.99 -1.39%

Fanuc Corp. (6954), a Japanese maker of factory automation systems that gets 75 percent of its sales abroad, rose 4.2 percent.

Inpex Corp. (1605), Japan’s biggest energy explorer, advanced 1.8 percent.

BHP Billiton Ltd. (BHP), Australia’s No. 1 oil and gas producer, gained 0.8 percent after reporting plans to boost exploration spending.

Tokyo Electric Power Co. surged 7.8 percent after the utility said it will raise power prices.

04:30 JPY Industrial Production (MoM) November -2.6% -2.6% -2.7%

04:30 JPY Industrial Production (YoY) November -4.0% -4.0% -4.2%

The dollar fell against most of its major counterparts before U.S. data today forecast to show industrial production rose and confidence among homebuilders increased, reducing demand for safer assets.

The euro gained versus the greenback for a second day after a hedge-fund manager on a creditors’ committee for Greece said yesterday the country is nearing a deal on its debt. Greek Prime Minister Lucas Papademos will resume negotiations with private bondholders today. Australia’s dollar traded near the highest level in 11 weeks before a report tomorrow that may show the country’s employers added jobs in December. The Australian dollar advanced for a second day before government data forecast to show the number of people employed in Australia rose by 10,000 last month after a decline of 6,300 in November. The jobless rate is projected to remain unchanged at 5.3 percent, according to the median of economists’ estimates in a Bloomberg survey.

EUR/USD: during the Asian session the pair has grown on a floor of a figure.

GBP/USD: during the Asian session the pair grew.

USD/JPY: during the Asian session the pair fell.

European events for Wednesday start at 0830GMT when ECB Governing Council member Jens Weidmann is due to attend a meeting of the German government Cabinet, in Berlin. UK data includes the labour market data at 0930GMT. Unemployment is on the rise in the UK. US data starts at 1200GMT with the weekly MBA Weekly Mortgage Applications, which is followed by the weekly ICSC-Goldman Weekly mall sales at 1245GMT and then PPI data at 1330GMT. At 1400GMT, US TICS data is due, followed at 1415GMT by US industrial production, which is expected to rise 0.5% in December after falling 0.2% in November. At 1430GMT, Federal Reserve Governor Daniel Tarullo testifies to a House Financial Services Subcommittee on the Volcker Rule. The US NAHB Housing Market Index is then due at 1500GMT.

Yesterday the euro rose for the first time in three days against the dollar and the yen after a successful auction of bonds of Belgium and the European Foundation for financial stability, as well as record growth of German economic sentiment index. Data were published by the German institute ZEW, whose index value improved to Germany and the EU as a whole, breaking the expectations (for Germany in December, the index was -21.6 points at the forecast of -49.5 and -53.8 value for November , for the EU as a whole in December the index was -32.5 points at the forecast of -48.7 and -51.1 value for November). Markets have also provided support for the outcome of the auction on government bonds of Belgium, which showed a decrease in the average return over the same previous release. Belgium has attracted 2.96 billion of funds under objective 3.0 billion euros. Positive was also an auction of bonds of the European Financial Stability Fund (EFSF), which attracted 1.501 billion euros at 1.5 billion euros target. Funds held for 6 months, the average yield was 0.2664%, covering 3.1.

The yen fell against the euro Tuesday on data from a larger-than-expected growth of China's GDP in the fourth quarter of 2011. China's economy, according to published official figures on Tuesday, grew up in the IV quarter 2011 by 8.9% over the same period in 2010, down from the third quarter (9.1%) but higher than market expectations, constituting an average of of 8.7%.

EUR/USD: yesterday the pair has grown, showed a new week’s high.

GBP/USD: yesterday the pair has grown.

USD/JPY: yesterday the pair showed a month’s low, however has receded later.

European events for Wednesday start at 0830GMT when ECB Governing Council member Jens Weidmann is due to attend a meeting of the German government Cabinet, in Berlin. UK data includes the labour market data at 0930GMT. Unemployment is on the rise in the UK. US data starts at 1200GMT with the weekly MBA Weekly Mortgage Applications, which is followed by the weekly ICSC-Goldman Weekly mall sales at 1245GMT and then PPI data at 1330GMT. At 1400GMT, US TICS data is due, followed at 1415GMT by US industrial production, which is expected to rise 0.5% in December after falling 0.2% in November. At 1430GMT, Federal Reserve Governor Daniel Tarullo testifies to a House Financial Services Subcommittee on the Volcker Rule. The US NAHB Housing Market Index is then due at 1500GMT.

Asian stocks rose, with the regional benchmark index heading for the highest close in almost six weeks, after French borrowing costs fell and the slowest Chinese growth since 2009 added to speculation policy makers will ease lending curbs in the world’s No. 2 economy.

Financial companies contributed the most to gains on the MSCI Asia Pacific Index amid optimism Europe’s debt crisis won’t throw the global financial system into disarray. HSBC rose 3.3 percent to HK$61.60.Westpac Banking Corp. (WBC), Australia’s No. 2 lender by market value, advanced 1.4 percent to A$20.66.

Chinese developers rose in Hong Kong. Agile Property added 9 percent to HK$8.39, while Country Garden Holdings Co. (2007) climbed 4.2 percent to HK$3.26.

Paladin Energy surged after reporting a 24 percent gain in output and forecasting a price increase for nuclear fuel. The shares advanced 12 percent to A$1.71.European stocks climbed, with the Stoxx Europe 600 Index extending a five-month high, amid speculation that China’s slowest economic growth in more than two years will lead to easier monetary policy.

Gross domestic product in China, the world’s second-biggest economy, increased 8.9 percent in the fourth quarter from a year earlier, the statistics bureau said in Beijing. The economy expanded at the slowest pace in 10 quarters, increasing pressure on Premier Wen Jiabao to ease monetary policy.

The European Financial Stability Facility, the euro area’s bailout fund, lost its top credit rating yesterday at Standard & Poor’s following downgrades of France and Austria on Jan. 13.

A report today showed that German investor confidence jumped the most on record in January. The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which aims to predict economic developments six months in advance, surged to minus 21.6 from minus 53.8 in December, the biggest gain since the index started in December 1991.

National benchmark indexes climbed in every western- European market except Luxembourg and Iceland. The U.K.’s FTSE 100 Index rose 0.7 percent, Germany’s DAX Index advanced 1.8 percent and France’s CAC 40 Index jumped 1.4 percent.

Carmakers led gains among the 19 industry groups on the Stoxx 600. Daimler rose 3.8 percent to 40.85 euros and Renault SA jumped 2.6 percent to 31.68 euros.

Rio Tinto advanced 2.9 percent to 3,694 pence after saying that fourth-quarter iron ore production rose to 51.2 million metric tons in the three months ended Dec. 31 from 50.1 million tons a year earlier

Afren Plc surged 13 percent to 130.5 pence. The company said it discovered oil and gas at the Okoro East exploration well off southeast Nigeria.

U.S. stocks advanced, sending the Dow Jones Industrial Average to the highest level since July, after reports bolstered optimism in the American and German economies and Spain’s borrowing costs decreased at an auction.

Stocks gained as manufacturing in the New York region expanded in January at the fastest pace in nine months. German investor confidence rose the most on record in January. Spanish borrowing costs fell at an auction as investors ignored S&P downgrades last week. China’s economy expanded at the slowest pace in 10 quarters, sustaining pressure on Premier Wen Jiabao to ease monetary policy.

Equities pared gains as financial shares slumped, with Citigroup Inc. losing 8.2 percent amid an unexpected drop in earnings.

Wells Fargo & Co., the largest U.S. bank by market value, gained 0.7 percent amid record profit. Sears Holdings Corp. surged 9.5 percent, the most in the Standard & Poor’s 500 Index, on speculation that the company may seek to go private.

Carnival Corp. tumbled 14 percent after the Costa Concordia cruise ship ran aground off the coast of Italy on Jan. 13.

Kraft Foods Inc. (KFT) added 1 percent to $38.13. The food company said it will realign its U.S. sales organization and cut 1,600 jobs in North America throughout 2012 as part of its move to divide its snacks and grocery businesses.

Resistance 3: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 2: Y77.05 (Jan 11-16 high)

Resistance 1: Y76.85 (session high)

The current price: Y76.66

Support 1:Y76.54 (Jan 17 low)

Support 2:Y76.10 (Sep 22 low)

Support 3:Y75.60 (Oct 31 low)

Resistance 3: Chf0.9595 (Jan 9 high)

Resistance 2: Chf0.9575 (Jan 13-17 high)

Resistance 1: Chf0.9525 (high of the American session on Jan 17)

The current price: Chf0.9471

Support 1: Chf0.9445 (Jan 17 low)

Support 2: Chf0.9405 (Jan 13 low)

Support 3: Chf0.9340 (Dec 30 low)

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5440 (38.2% FIBO $1.5230-$1.5770)

Resistance 1 : $1.5400 (Jan 17 high, MA (233) H1)

The current price: $1.5341

Support 1 : $1.5320 (low of the American session on Jan 17)

Support 2 : $1.5275 (Jan 16 low)

Support 3 : $1.5230 (Jan 13 low)

Resistance 3 : $1.2875 (Jan 13 high)

Resistance 2 : $1.2810 (Jan 17 high)

Resistance 1 : $1.2790 (session high)

The current price: $1.2765

Support 1 : $1.2735 (session low)

Support 2 : $1.2710 (low of the American session on Jan 17)

Support 3 : $1.2650 (Jan 17 low)

Change % Change Last

Oil $100.81 +0.10 +0.10%

Gold $1,652.80 -2.80 -0.17%

Change % Change Last

Nikkei 225 8,466 +88.04 +1.05%

Hang Seng 19,628 +615.55 +3.24%

S&P/ASX 200 4,216 +68.40 +1.65%

Shanghai Composite 2,298 +92.18 +4.18%

FTSE 100 5,694 +36.51 +0.65%CAC 40 3,270 +44.99 +1.40%

DAX 6,333 +112.92 +1.82%

Dow 12,482.07 +60.01 +0.48%

Nasdaq 2,728.08 +17.41 +0.64%

S&P 500 1,293.67 +4.58 +0.36%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2736 +0,55%

GBP/USD $1,5332 +0,06%

USD/CHF Chf0,9493 -0,50%

USD/JPY Y76,83 +0,07%

EUR/JPY Y97,84 +0,61%

GBP/JPY Y117,78 +0,13%

AUD/USD $1,0374 +0,59%

NZD/USD $0,8000 +0,81%

USD/CAD C$1,0150 -0,28%

04:30 JPY Industrial Production (MoM) November -2.6% -2.6%

04:30 JPY Industrial Production (YoY) November -4.0% -4.0%

09:30 GBP Claimant count December 3.0 8.2

09:30 GBP Claimant Count Rate December 5.0% 5.0%

09:30 GBP ILO Unemployment Rate December 8.3% 8.3%

09:30 GBP Average Earnings, 3m/y November +2.0% +2.0%

09:30 GBP Average earnings ex bonuses, 3 m/y November +1.8% +1.9%

13:30 USD PPI, m/m December +0.3% +0.1%

13:30 USD PPI, y/y December +5.7% +5.1%

13:30 USD PPI excluding food and energy, m/m December +0.1% +0.1%

13:30 USD PPI excluding food and energy, Y/Y December +2.9% +2.8%

14:00 USD Total Net TIC Flows November -48.8 50.0

14:00 USD Net Long-term TIC Flows November 4.8 27.3

14:15 USD Industrial Production (MoM) December -0.2% +0.5%

14:15 USD Capacity Utilization December 77.8% 78.2%

14:30 USD FOMC Member Tarullo Speaks 0

15:00 USD NAHB Housing Market Index January 21 22

15:30 USD EIA Crude Oil Stocks change 13.01.12 +5.0

15:30 CAD Bank of Canada Monetary Policy Report Quarter I

21:45 NZD CPI, q/q IV quarter +0.4% +0.4%

21:45 NZD CPI, y/y IV quarter +4.6% +2.6%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.