- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-01-2012

Downgrades Portugal to BB from BBB-, outlook negative.

Affirms Ireland at BBB+, outlook revised to negative.

Downgrades Spain to A from AA-, outlook negative.

Downgrades Italy to BBB+ from A, outlook negative.

Affirms Germany rating at AAA, outlook revised to stable.

Downgrades France to AA+ from AAA, outlook negative.

The euro dropped amid speculation Standard & Poor’s may downgrade the credit ratings of several countries in the 17-nation currency region today.

The shared currency amid reports talks between Greece and its creditor banks were put on hold. The Dollar Index climbed as U.S. stocks fell after JPMorgan Chase & Co. said profit declined.

The dollar climbed as risk appetite faded and investors sought refuge.

Germany, Europe’s biggest economy, will retain its AAA rating in a review of euro-area countries’ credit grades by S&P, a European government official said.

France is among several euro-area countries facing downgrades by S&P in the review, which is due 20:0 GMT, the official said on condition of anonymity because the announcement has yet to be made. Austria will probably lose its AAA rating on concern about bad debts at the country’s banks, according to a person familiar with the matter.

Stocks tumbled as a European government official said France is among several euro-area countries facing downgrades by S&P in the review, which is due at 20:00 GMT. Germany, Europe’s biggest economy, will retain its AAA rating in a review of euro-area countries’ credit grades by S&P, the official said on condition of anonymity because the announcement has yet to be made.

Concern about potential downgrades overshadowed data showing that confidence among U.S. consumers rose more than forecast in January to the highest level in eight months, a sign household spending may hold up early this year. Separate figures showed that the U.S. trade deficit widened more than forecast in November as American exports declined and companies stepped up imports of crude oil and automobiles.

All groups in the S&P 500 declined as financial, industrial and commodity gauges slid at least 1%. JPMorgan, the largest U.S. bank by assets, fell 3.8%. Bank of America Corp. (BAC), Morgan Stanley and Citigroup Inc. retreated at least 2.%.

Oil fell after two European Union officials said an embargo on Iranian crude imports may be postponed for six months.

Crude oil for February delivery fell 0.44% to $98.66 per barrel on the New York Mercantile Exchange. Session low reached at $97.70 per barrel.

“There is mounting evidence that China will avoid a hard landing, and US data have similarly taken a more upbeat tone. European data continue to point to falling activity."

Resistance 3:1286 (61,8 % FIBO of today's falling)

Resistance 2:1283 (50,0 % FIBO of today's falling)

Resistance 1:1280 (38.2 % FIBO of today's falling, Jan 12 low)

Current price: 1276,50

Support 1:1272 (session low)

Support 2 : 1267 (Jan 6-9 lows)

Support 3 : 1260 (Jan 5 low)

EUR/USD $1.2700, $1.2720, $1.2750, $1.2800, $1.2850, $1.2900, $1.2970, $1.3000

USD/JPY Y76.00, Y76.50, Y77.00, Y77.20, Y77.35, Y77.75

AUD/USD $1.0255, $1.0275, $1.0300, $1.0310, $1.0320, $1.0405, $1.0500

GBP/USD $1.5200

EUR/JPY Y101.00

EUR/GBP stg0.8350, stg0.8330

USD/CHF Chf0.9400, Chf0.9510

EUR/CHF Chf1.2100

AUD/NZD NZ$1.3105

AUD/CHF Chf0.9800

The trade deficit in the U.S. widened in November for the first time in five months as oil imports rose.

Separately, the Thomson Reuters-University of Michigan preliminary index of consumer sentiment in January increased to 71.5 from 69.9 at the end of December, according to the median forecast before the report at 14:55 GMT.

Global stocks:

Nikkei 8,500 +114.43 +1.36%Hang Seng 19,204 +109.04 +0.57%

Shanghai Composite 2,245 -30.43 -1.34%

FTSE 5,641 -21.51 -0.38%

CAC 3,223 +22.67 +0.71%

DAX 6,187 +8.02 +0.13%

Crude oil: $98.71 (-0,4%).

Gold: $1639.00 (-0,5%).

Italy sold 3 billion euros of notes due in November 2014 today at an average yield of 4.83 percent, down from 5.62 percent at a previous auction on Dec. 29. It also sold debt due in July 2014 and August 2018. Yesterday, the nation sold one- year bills at 2.735 percent, more than half of the 5.952 percent yield at the prior sale on Dec. 12. “Expectations were built up quite significantly following yesterday’s auction,” said Ian Stannard, head of European currency strategy at Morgan Stanley in London. “Any rebound we see in euro-dollar is going to remain limited, and we remain bearish over the medium term.”

The 17-nation currency dropped against all but two of its 16 major counterparts as concern recent measures by European leaders may still fail to resolve the region’s debt crisis.

The Dollar Index headed for a weekly decline before a U.S. report that economists said will show consumer confidence improved this month, reducing demand for the U.S. currency as a haven.

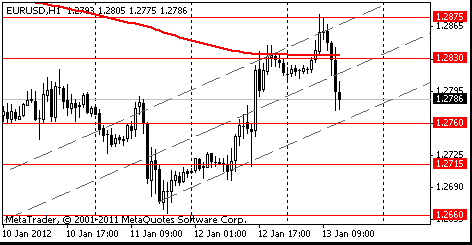

EUR/USD: during european session the pair fell to $1.2765.

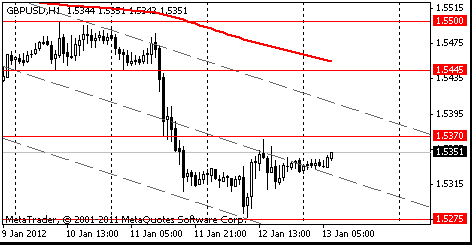

GBP/USD: during european session the pair updated session low.

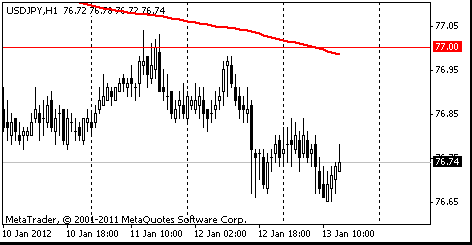

USD/JPY: the pair has traded nearby Y76.75.

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.00 (MA (233) H1)

The current price: Y76.75

Support 1:Y76.55 (Nov 18 low)

Support 2:Y76.10 (Sep 22 low)

Support 3:Y75.60 (Oct 31 low)

Resistance 3: Chf0.9595 (high on Jan 9)

Resistance 2: Chf0.9565 (Jan 11 high)

Resistance 1: Chf0.9525 (high of the American session on Jan 12)

The current price: Chf0.9469

Support 1: Chf0.9450 (middle line from Jan 11)

Support 2: Chf0.9405 (session low)

Support 3: Chf0.9340 (Dec 30 low)

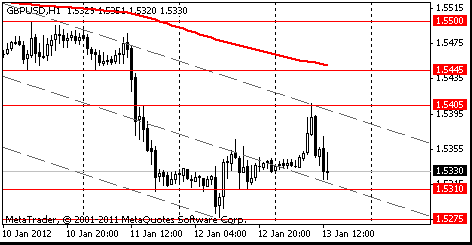

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5445 (MA (233) H1)

Resistance 1 : $1.5405 (session high)

The current price: $1.5330

Support 1 : $1.5310 (low of the American session on Jan 12)

Support 2 : $1.5275 (Jan 12 low)

Support 3 : $1.5200 (a psychological level)

Resistance 3 : $1.2920 (61.8% FIBO $1.2665-$1.3075)

Resistance 2 : $1.2875 (session high)

Resistance 1 : $1.2830 (MA (233) H1)

The current price: $1.2786

Support 1 : $1.2760 (support line from Jan 11)

Support 2 : $1.2715 (low of the American session on Jan 12)

Support 3 : $1.2660 (Jan 11 low)

Italy sold E4.75bln vs target E4.75bln

E3.0bln of 6% 2014 BTP, avg yield 4.83% (5.62%), cover 1.2 (1.364)

E779mln of 4.25% July 2014 BTP, avg yield 4.29%, cover 1.2

E971mln of 4.50% Aug 2018 BTP, avg yield 5.75%, cover 1.6

European (SXXP) stocks climbed, with the benchmark Stoxx Europe 600 Index headed for its fourth weekly advance, as Italy prepares to sell more debt. U.S. index futures were little changed, while Asian shares rose.

FTSE 100 5,693 +30.19 +0.53%

CAC 40 3,240 +40.01 +1.25%

Xetra DAX 6,233 +54.11 +0.88%

Commerzbank jumped 6.1 percent after German newspaper Handelsblatt reported that the lender will raise its capital levels without seeking government aid. GN Store Nord A/S (GN), a Danish maker of hearing aids and headsets, rallied 13 percent after one of its units won a settlement from Telekomunikacja Polska SA (TPS) over a dispute in Poland. Invensys Plc (ISYS) slumped the most in almost nine years after revealing 60 million pounds ($92 million) in additional costs.

EUR/USD $1.2700, $1.2720, $1.2750, $1.2800, $1.2850, $1.2900, $1.2970, $1.3000

USD/JPY Y76.00, Y76.50, Y77.00, Y77.20, Y77.35, Y77.75

AUD/USD $1.0255, $1.0275, $1.0300, $1.0310, $1.0320, $1.0405, $1.0500

GBP/USD $1.5200

EUR/JPY Y101.00

EUR/GBP stg0.8350, stg0.8330

USD/CHF Chf0.9400, Chf0.9510

EUR/CHF Chf1.2100

AUD/NZD NZ$1.3105

AUD/CHF Chf0.9800

Asian stocks rose, with a regional benchmark index poised for its longest streak of weekly advances in a year, as lower Italian and Spanish borrowing costs added to optimism Europe’s debt crisis may be contained.

Nikkei 225 8,500 +114.43 +1.36%

Hang Seng 19,177 +81.39 +0.43%

S&P/ASX 200 4,196 +14.89 +0.36%

Shanghai Composite 2,245 -30.43 -1.34%

Canon Inc. (7751), a camera maker that gets a third of its sales in Europe, climbed 3.1 percent in Tokyo. JGC Corp. (1963), Japan’s biggest building of industrial facilities by sales, jumped 3.9 percent after its venture won a $15 billion contract to build a liquefied natural gas facility in Australia. Belle International Holdings Ltd., China’s biggest shoe retailer, plunged 7.6 percent after reporting slower sales growth.

The euro was set to halt a five-week drop against the dollar as Italy prepared to sell bonds and after European Central Bank President Mario Draghi said policy makers have averted a credit shortage.

The 17-nation euro rose yesterday after Spain sold twice the maximum target at a note auction.

Italy will sell bonds due in 2014 and 2018 today. The nation’s Treasury raised 12 billion euros ($15.4 billion) from a bill auction yesterday. Italy’s 10-year yield fell 35 basis points, 0.35 percentage point, to 6.63 percent.

Spain raised 9.98 billion euros from yesterday’s note auction. The rate on the country’s 10-year debt dropped 19 basis points to 5.13 percent.

The greenback slid versus 15 of 16 major peers this week before a report that may show confidence among U.S. consumers gained, damping demand for the currency as a haven.

The Australian and New Zealand dollars fell against most of their 16 major peers amid concern U.S. economic growth may be weaker than forecast, sapping demand for riskier assets.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair fell.

Core-European data is limited to the 1000GMT release of the EMU trade balance. UK data comes at 0930GMT with PPI and also construction output. Producer prices have ended their long ascent and are coming back down.

Yesterday the euro rose to a one-week high versus the dollar after European Central Bank President Mario Draghi said he saw signs of stabilization in the economy and Spain sold almost twice its maximum target at a note auction.

The shared currency appreciated versus 14 of its 16 most- traded peers as Italian borrowing costs dropped at a bill auction. The ECB left its benchmark interest rate unchanged.

The dollar fell the yen after data showed U.S. retail sales increased less than economists forecast.

The dollar fell bafter the Commerce Department said U.S. retail sales gained 0.1 percent last month, following a revised 0.4 percent increase in November. Economists in a Bloomberg survey forecast a 0.3 percent advance in December.

The Australian dollar erased gains versus its U.S. counterpart as stocks declined after the sales report and after more Americans than forecast filed claims for jobless benefits last week.

EUR/USD: yesterday the pair has grown on a figure.

GBP/USD: yesterday the pair traded about a level $1.5330.

USD/JPY: yesterday the pair has fallen.

Core-European data is limited to the 1000GMT release of the EMU trade balance. UK data comes at 0930GMT with PPI and also construction output. Producer prices have ended their long ascent and are coming back down.

Japanese stocks fell as weaker exports and a shrinking German economy added to concern the global economy is slowing.

Germany’s gross domestic product contracted about 0.25 percent in the fourth quarter from the previous three months, the government said yesterday, adding to signs Europe’s largest economy may be on the brink of recession.

Canon Inc., a camera maker that gets a third of its revenue in Europe, fell 0.9% after a report Japan’s trade surplus narrowed on a stronger yen and weak overseas demand.

Brokerages led declines after Nomura Holdings Inc. said individual investors are buying fewer stocks.

Komatsu Ltd., a construction machinery maker that relies on China for 23% of its sales, rose 2.7% after slowing mainland inflation raised expectations the government will take action to encourage growth.

European stocks declined after reports that showed U.S. retail sales and initial jobless claims missed economists’ forecasts outweighed lower borrowing costs at Spanish and Italian debt auctions.

Spain auctioned 9.98 billion euros ($12.7 billion) of bonds maturing in 2015 and 2016, including a new three-year benchmark security, twice the maximum target of 5 billion euros set for the sale. The yield on the three-year notes was 3.384 percent, compared with 5.187 percent when the nation sold similar notes in December.

Italy sold 12 billion euros of Treasury bills, meeting its target, and its borrowing costs plunged. The Rome-based Treasury sold 8.5 billion euros one-year bills at a rate of 2.735 percent, down from 5.952 percent at the last auction.

The European Central Bank kept the benchmark interest rate at a record low of 1%, as predicted.

Tesco Plc dropped 16%, leading retail shares lower, after the U.K.’s largest supermarket chain said it was “disappointed” with holiday sales.

Delhaize dropped 11%. The owner of Food Lion supermarkets plans to cut about 5,000 positions and expects a 2.4 percent drop in revenue as it closes stores in the U.S. and Europe. Costs related to the closures will hurt earnings by about 205 million euros starting in the first quarter, the Brussels-based company said.

Vestas lost 7.1%. The biggest wind- turbine maker said it’s cutting 2,335 jobs worldwide and a further 1,600 posts are at risk in the U.S. this year as a tax credit expires.

RBS advanced 5.6%. Britain’s biggest government-owned lender will cut 3,500 jobs at its investment bank over the next three years as it exits its unprofitable cash equities and mergers advisory operations.

UniCredit (UCG) SpA climbed 14%. The stock was raised to “buy” from “neutral” at Citigroup Inc., which said the stock would suit a high-risk investment strategy as it offers significant “upside potential.”

U.S. stocks rose as a drop in borrowing costs at debt auctions in Europe overshadowed disappointing data on American jobless claims and retail sales.

Stocks rose as Spain sold 10 billion euros ($13 billion) of bonds, twice the target for the sale, while Italy sold 12 billion euros of bills, easing concerns the countries would struggle to finance their debts. European Central Bank President Mario Draghi said the bank has averted a serious credit shortage and there are signs the economy is stabilizing.

Stocks fell earlier as jobless claims climbed by 24,000 to 399,000 in the week ended Jan. 7, compared with a median estimate of 370,000. U.S. retail sales rose 0.1% in December cs cons. +0.3%.

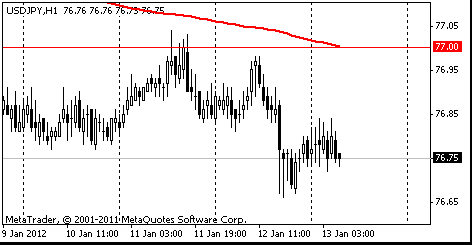

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.00 (MA (233) H1)

The current price: Y76.75

Support 1:Y76.55 (Nov 18 low)

Support 2:Y76.10 (Sep 22 low)

Support 3:Y75.60 (Oct 31 low)

Resistance 3: Chf0.9565 (Jan 11 low)

Resistance 2: Chf0.9525 (high of the American session on Jan 12)

Resistance 1: Chf0.9465 (MA (233) H1)

The current price: Chf0.9435

Support 1: Chf0.9410 (Jan 12 low)

Support 2: Chf0.9395 (Dec 29 low)

Support 3: Chf0.9340 (Dec 30 low)

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5445 (MA (233) H1)

Resistance 1 : $1.5370 (Jan 12 high)

The current price: $1.5351

Support 1 : $1.5275 (Jan 12 low)

Support 2 : $1.5200 (psychological level)

Support 3 : $1.5125 (Jul 21 low)

Resistance 3 : $1.2920 (61.8% FIBO $1.2665-$1.3075)

Resistance 2 : $1.2870 (50.0% FIBO $1.2660-$1.3075)

Resistance 1 : $1.2845 (Jan 12 high)

The current price: $1.2828

Support 1 : $1.2790 (Jan 11 low)

Support 2 : $1.2715 (low of the American session on Jan 12)

Support 3 : $1.2660 (Jan 11 low)

Change % Change Last

Oil $98.92 -0.18 -0.18%

Gold $1,650.50 +2.80 +0.17%

Change % Change Last

Nikkei 8,386 -62.29 -0.74%

Hang Seng 19,095 -56.56 -0.30%

Shanghai Composite 2,275 -1.04 -0.05%

FTSE 5,662 -8.40 -0.15%

CAC 3,200 -4.85 -0.15%

DAX 6,179 +26.87 +0.44%

Dow 12,471.02 +21.57 +0.17%

Nasdaq 2,724.70 +13.94 +0.51%

S&P 500 1,295.50 +3.02 +0.23%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2815 +0,86%

GBP/USD $1,5303 -0,15%

USD/CHF Chf0,9444 -1,01%

USD/JPY Y76,75 -0,13%

EUR/JPY Y98,37 +0,74%

GBP/JPY Y117,65 -0,11%

AUD/USD $1,0332 +0,23%

NZD/USD $0,7936 -0,40%

USD/CAD C$1,0190 -0,05%

09:30 United Kingdom Producer Price Index - Input (MoM) December +0.1% +0.1%

09:30 United Kingdom Producer Price Index - Input (YoY) December +13.4% +9.1%

09:30 United Kingdom Producer Price Index - Output (MoM) December 0.0% 0.0%

09:30 United Kingdom Producer Price Index - Output (YoY) December +5.4% +5.0%

10:00 Eurozone Trade Balance s.a. November 0.3 0.7

13:30 Canada Trade balance, billions November -0.9 -0.4

13:30 U.S. International trade, bln November -43.5 -44.6

13:30 U.S. Import Price Index December +0.7% 0.0%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index (Prelim) January 69.9 70.8

16:10 U.S. FOMC Member Elizabeth Duke Speaks

17:45 U.S. FOMC Member Laker Speaks

18:00 U.S. FOMC Member Charles Evans Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.