- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 11-01-2012

The euro weakened to a 16-month low versus the dollar and dropped for the first time in three days against the yen amid speculation France’s credit rating may be downgraded and Europe’s sovereign debt crisis will worsen. The shared currency declined against 14 of its 16 most- traded peers even after French Finance Minister Francois Baroin denied having been notified by a ratings company that the nation’s top rating will be cut. The euro extended losses as leading members of the European Parliament objected to a planned German-led euro fiscal treaty.

Sterling was the worst performer against the dollar after data showed the U.K. trade deficit increased more than forecast. British retail-store inflation also slowed to the least in 16 months, fueling bets the Bank of England will need to add stimulus to aid the economy.

The pound dropped 1 percent to $1.5329 and fell 0.3 percent to 82.76 pence per euro.

The U.S. currency rose against most of its major peers as investors sought the safety of Treasuries. Yields on 10-year notes dropped to the lowest level in two days, 1.92 percent.

The Dollar Index (DXY), which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, gained as much as 0.7 percent to 81.493, approaching Jan. 9’s 81.503, the highest since September 2010.

European stocks fell from a one-week high as Fitch Ratings said the European Central Bank must do more to prevent debt crisis from spreading and a report indicated the German economy is shrinking.

The Stoxx Europe 600 Index dropped 0.4 percent to 249.93 at the close of trading, after earlier climbing as much as 0.3 percent. The gauge has still advanced 2.2 percent this year as economic reports around the world added to optimism the global economy can withstand the euro area’s debt crisis.

S&P 500 1,290 -2.26 -0.17%, NASDAQ 2,706 +3.69 +0.14%, Dow 12,428 -34.06 -0.27%

Metro AG (MEO), Germany’s largest retailer, declined 3.3 percent to 28.36 euros after Benjamin Peters, an analyst at UBS AG, cut the stock to “sell” from “neutral.” The shares “will come under increasing pressure from earnings downgrades,” Peters wrote in a report.

Nestle SA, the world’s biggest food company, fell 1.7 percent to 53.85 Swiss francs after Bank of America Corp. downgraded the stock to “neutral” from “buy.”

Aryzta AG (ARYN), a Swiss supplier of bakery products to supermarkets and restaurants, tumbled 6.8 percent to 42.8 francs after it sold 4.25 million new shares at 41 francs each. That was the largest drop since April 2009 and the worst performance in the Stoxx 600 today.

Italian banks advanced today, with Banca Popolare di Milano Scarl (PMI) jumping 9.4 percent to 29.4 euro cents. Banca Monte dei Paschi di Siena SpA (BMPS) increased 8.1 percent to 21.3 euro cents. UniCredit SpA (UCG) gained 5.5 percent to 2.56 euros as the shares were raised to “outperform” from “underperform” by Sanford C. Bernstein & Co. analysts, who cited the stock’s “now attractive” valuation. The bank was also upgraded to “neutral” from “reduce” by WestLB

U.S. stocks fell, snapping a two-day advance for the Standard & Poor’s 500 Index, amid concern that Europe’s debt crisis will stifle global economic growth.

S&P 500 1,290 -2.26 -0.17%

NASDAQ 2,706 +3.69 +0.14%

Dow 12,428 -34.06 -0.27%

Leading the Dow's decliners were energy and consumer-staple stocks. Coca-Cola dropped 2.1% and Chevron lost 1%. Telecommunications and materials limited some of the losses. Verizon Communications rose 1% and AT&T added 0.5%.In corporate news, Urban Outfitters plunged 18% after the apparel retailer said its chief executive officer, Glen Senk, has resigned to pursue another opportunity. He will be succeeded as CEO by Richard Hayne, currently the company's chairman.

Supervalu sank 11% after the supermarket operator's third-quarter loss widened on larger writedowns and weaker sales. Revenue fell short of expectations and the company cut its sales view for the current year.

Lennar jumped 8% after the homebuilder reported better-than-expected revenue, offsetting earnings that fell shy of estimates.

Spot gold holds at $1635.50/oz, after trading in a $1631.30 to $1646.90 range. The precious metal broke above its 200-day moving average Tuesday (at 1635 currently) and then earlier Wednesday took out the twin peaks from Dec 14/Dec 21 around $1641-1641.50, but saw little followthrough so far. CitiFX technicals say a close above the 200-day "would add to the bullish bias and open the way for the trend resistance at 1698 in the near term, followed by $1802.(Nov 8 high at $1802.60). They maintain their longer-term view that gold will move to new trend highs "over time and ultimately towards the $2400 target later this year."

Crude oil futures extended declines after a U.S. government report showed inventories increased almost five times as much as expected.

Inventories of crude oil gained 4.96 million barrels to 334.6 million, the department said.

Currently Feb NYMEX crude oil futures are trading at $100,74 per barrel (-1,47%).

Resistance 2:1300 (psychological level)

Resistance 2:1290/92 (area of October and Jan 10 highs)

Resistance 1:1287 (session high)

Current price: 1285,25

Resistance 1:1279 (area of Jan 6 high, session low and support line from Dec 28)

Support 2 : 1267 (Jan 6-9 low)

Support 3 : 1260 (Jan 5 low)

EUR/USD $1.2500, $1.2825, $1.2850, $1.2875, $1.2920

USD/JPY Y76.00

AUD/USD $1.0400, $1.0175, $1.0150

GBP/USD $1.5620

U.S. stock futures fell as Microsoft Corp. (MSFT) declined and amid concern that Europe’s debt crisis will stifle global economic growth.

Shares of MSFT fell after saying that industrywide sales of personal computers will probably be lower than analysts projected.

Global stocks:

Nikkei 8,448 +25.62 +0.30%

Hang Seng 19,152 +147.66 +0.78%

Shanghai Composite 2,276 -9.70 -0.42%

FTSE 5,664 -32.92 -0.58%

CAC 3,202 -9.06 -0.28%

DAX 6,151 -11.80 -0.19%

Crude oil: $101.47 (-0,8%).

Gold: $1640.40 (+0,6%).

09:30 United Kingdom Trade in goods November -7.6 -8.2 -8.6

The euro weakened as Fitch Ratings added to concern the region’s debt crisis will spread, reducing demand for the 17-nation currency.

The euro declined against after Fitch’s head of sovereign ratings David Riley said the European Central Bank should boost bond purchases to combat the debt crisis and prevent a collapse of the shared currency. The euro also depreciated after a German report showed the region’s largest economy may be on the brink of recession.

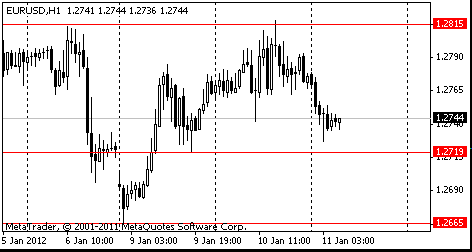

EUR/USD: the pair decreased, showed low below $1,2700.

At 1340GMT, Chicago Fed President Charles Evans speaks to the Rotary Club of Lake Forest and Lake Bluff, while at 1400GMT, Atlanta Fed President Dennis Lockhart delivers a speech on the economic outlook to the Georgia Center for Nonprofits in Atlanta.

EUR/USD

Offers $1.2800, $1.2750, $1.2720/25

Bids $1.2675/65, $1.2650, $1.2640, $1.2625/20, $1.2600, $1.2580

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.35/40 (Jan 6 high, 50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.05 (session high)

Current price: Y76.93

Support 1:Y76.80 (support line from Jan 4)

Support 2:Y76.55 (lows of November and January)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9780 (high of 2011)

Resistance 2: Chf0.9600 (area of Jan 9 high)

Resistance 1: Chf0.9560 (session high)

Current price: Chf0.9537

Support 1: Chf0.9520 (area of asian session high)

Support 2: Chf0.9480 (session low)

Support 3: Chf0.9465/50 (area of Dec 29, Jan 4 highs, МА (200) for Н1 and Jan 10 low)

- Hungary's deficit cutting measures are insufficient;

- to recommend new deficit cutting moves for Hungary;

- will pronounce on hungary's central bank law Jan 17;

- hope Hungary will reconsider central bank law;

- expect Spain to tackle labour market problems.

Resistance 2 : $1.5445 (low of asian session)

Resistance 1 : $1.5420 (earlier resistance, area of Jan 9 american session low)

Current price: $1.5390

Support 1 : $1.5375/60 (area of December and Jan 6 lows and session low)

Support 2 : $1.5300 (psychological level)

Support 3 : $1.5270 (low of 2011)

Resistance 3: $ 1.2810/20 (38,2 % $1,3080-$ 1,2660, Jan 6 and 10 highs)

Resistance 2: $ 1.2790 (session high)

Resistance 1: $ 1.2730 (low of asian session)

Current price: $1.2705

Support 1 : $1.2700/690 (area of session low)

Support 2 : $1.2660 (Jan 9 low)

Support 3 : $1.2590 (low of Aug'2010)

EUR/USD $1.2500, $1.2825, $1.2850, $1.2875, $1.2920

USD/JPY Y76.00

AUD/USD $1.0400, $1.0175, $1.0150

GBP/USD $1.5620

- Jan 11 German Merkel & Italy Monti to meet in Berlin at 1200GMT

- Jan 11 EU report on 'Excessive Deficit' for Belgium, Cyprus, Malta, Poland and Hungary

- Jan 12 Italy PM Monti addresses lower house on economy, EU

- Jan 12 Spain sells new 2015, 3.25% 2016 & 4.25% 2016 Bono upto E5bln

- Jan 12 ECB Governing Council meeting, press conference with Draghi

- Jan 12 Italy sells new 12-month-/3-month T-bills for up to E12.0bln

- Jan 13 Greek T-bill redemption for E2.0bln

- Jan 13 Italy sells medium-long bonds

- Jan 16 Italy T-bill redemption for E7.7bln

- Jan 17 Spain to sell 12-/18-month T-bills

Asian stock markets were mixed Wednesday, with resources plays rising sharply in Sydney on strong copper imports from China, though exporters in Seoul and Tokyo pulled back as sentiment remained fragile amid continued caution over the euro-zone debt crisis.

Nikkei 225 8,448 +25.62 +0.30%

Hang Seng 19,158 +154.16 +0.81%

S&P/ASX 200 4,188 +35.29 +0.85%

Shanghai Composite 2,276 -9.70 -0.42%

James Hardie Industries SE (JHX), a maker of building materials that gets most of its sales in the U.S., climbed 3 percent in Sydney. AU Optronics Corp. (2409), a supplier of liquid-crystal displays to Nokia Oyj and Dell Inc., gained 4.4 percent in Taipei. China Unicom (Hong Kong) Ltd. fell 3.7 percent amid concern competition will increase among mainland telecoms.

James Hardie rose 3 percent to A$7.12 in Sydney. LG Display Co. (034220), the world’s second-largest LCD maker by sales, gained 2.7 percent to 26,800 won in Seoul.

05:00 Japan Leading Economic Index November 92.0 92.9 92.9

05:00 Japan Coincident Index November 91.4 90.3 90.3

The euro dropped versus the dollar before a report that may signal Europe’s sovereign-debt crisis is hurting the region’s prospects for economic growth.

The 17-nation currency slid against most of its major peers before Spain and Italy sell securities this week amid concern the nations will struggle to meet funding needs. Industrial production in the euro region is forecast to have shrunk for a third month in November, according to a Bloomberg News survey of economists before the European Union’s statistics office in Luxembourg releases the data tomorrow. The median estimate is for a 0.3 percent contraction.

The European Central Bank will keep its key interest rate at 1 percent at a policy meeting tomorrow, the median estimate in a separate Bloomberg poll showed. That would follow quarter- point rate reductions at each of the bank’s last two meetings.

Gains in the dollar were limited before a report tomorrow forecast to show inflation is slowing in China, spurring speculation the Asian nation’s central bank will have more scope to support growth in the world’s second-biggest economy.

China’s consumer prices probably rose 4 percent in December from a year earlier, according to median estimate of economists surveyed by Bloomberg News before the statistics bureau releases its figures tomorrow. That would be the lowest inflation rate since September 2010.

The world’s second-largest economy is experiencing a slowdown in trade, with import growth falling to a two-year low in December, according to a Chinese government report published yesterday. The data also showed a deceleration in export growth.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair dropped.

USD/JPY: on Asian session the pair gain.

European events for Wednesday start at 0700GMT with German GDP for 2011, while UK data at 0930GMT sees trade data as well as BoE quoted rates data. US data starts at 1200GMT with the weekly MBA Mortgage Applications Index. At 1340GMT, Chicago Fed President Charles Evans speaks to the Rotary Club of Lake Forest and Lake Bluff, while at 1400GMT, Atlanta Fed President Dennis Lockhart

delivers a speech on the economic outlook to the Georgia Center for Nonprofits in Atlanta. European events continue at 1500GMT, when the Eurozone Insee, IFO, ISAE institutes give their Q1 economic outlook.

Yesterday the dollar declined as US stocks advanced, damping demand for safer investments.

The euro’s gains were tempered before Spain and Italy sell debt this week amid concern the nations will struggle to meet funding needs. Spain will auction as much as 5 billion euros of bonds due in 2015 and 2016 on Jan. 12, and Italy will sell 12 billion euros of bills the same day.

The dollar and yen weakened against higher-yielding currencies before Germany’s chancellor meets with the International Monetary Fund’s managing director amid signs European leaders are taking steps to end the debt crisis.

EUR/USD: yesterday the pair has slightly grown.

GBP/USD: yesterday the pair has slightly grown.

USD/JPY: yesterday the pair traded in range Y76.77-Y76.90.

European events for Wednesday start at 0700GMT with German GDP for 2011, while UK data at 0930GMT sees trade data as well as BoE quoted rates data. US data starts at 1200GMT with the weekly MBA Mortgage Applications Index. At 1340GMT, Chicago Fed President Charles Evans speaks to the Rotary Club of Lake Forest and Lake Bluff, while at 1400GMT, Atlanta Fed President Dennis Lockhart

delivers a speech on the economic outlook to the Georgia Center for Nonprofits in Atlanta. European events continue at 1500GMT, when the Eurozone Insee, IFO, ISAE institutes give their Q1 economic outlook.

Asian stocks rose on stronger U.S. economic reports.

Exporters rose as consumer borrowing in the U.S. surged by the most in 10 years, indicating households are optimistic enough to take on debt and banks are more willing to lend.

Honda increased 1.4%. Hyundai Motor Co., South Korea’s largest automaker, advanced 2.3%. Samsung Electronics Co., the world’s second-biggest maker of mobile phones by sales, added 1%.

Olympus Corp. surged 20% after the Nikkei reported the scandal-hit camera maker will likely retain its listing on the Tokyo Stock Exchange and as the company took legal action against executives over a $1.7 billion accounting fraud.

European stocks rose as mining companies rallied after Alcoa Inc. (AA) kicked off the U.S. earnings season with results that met analysts estimates.

BHP Billiton Ltd. (BHP) climbed more than 3% as copper rebounded from a one-week low on record monthly imports of the metal in China.

European stocks retreated yesterday, trimming three weeks of gains for the Stoxx 600, as a meeting between German Chancellor Angela Merkel and French President Nicolas Sarkozy failed to ease concern that euro-leaders will fail to do enough to resolve the sovereign-debt crisis.

The European stocks gained before Merkel and the International Monetary Fund’s managing director Christine Lagarde meet in Berlin.

A gauge of bank shares rose 3.6%. Commerzbank AG surged 4.8%, UniCredit SpA soared 6%.

US stocks rose amid bets that China may act to spur economic growth.

Stocks rose as a drop in China’s import growth bolstered forecasts for monetary easing. German Chancellor Angela Merkel and International Monetary Fund Managing Director Christine Lagarde were scheduled to meet in Berlin as pressure grows to complete a Greek debt swap needed to put a rescue plan in place.

US stocks pared gains as Alcoa Inc. (AA), the largest U.S. aluminum producer, tumbled from today’s peak.

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.00 (Jan 9 high)

The current price: Y76.91

Support 1:Y76.75 (Jan 9 low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9650 (Feb 9 high)

Resistance 2: Chf0.9595 (Jan 9 high)

Resistance 1: Chf0.9540 (high of the American session on Jan 9)

The current price: Chf0.9514

Support 1: Chf0.9465 (Jan 10 low)

Support 2: Chf0.9415 (61.8% FIBO Chf0.9595-Chf0.9305)

Support 3: Chf0.9395 (Dec 29 low)

Resistance 3 : $1.5560 (61.8% FIBO $1.5670-$1.5375)

Resistance 2 : $1.5525 (50.0% FIBO $1.5670-$1.5375, Jan 6 high)

Resistance 1 : $1.5500 (Jan 10 high)

The current price: $1.5454

Support 1 : $1.5445 (Jan 10 low)

Support 2 : $1.5420 (low of the American session on Jan 9)

Support 3 : $1.5375/60 (area of Dec low and Jan 6 low)

Resistance 3: $1.2920 (61.8% FIBO $1.2665-$1.3075)

Resistance 2: $1.2870 (50.0% FIBO $1.2665-$1.3075, MA (233) H1)

Resistance 1: $1.2815 (Jan 6-10 high)

The current price: $1.2737

Support 1 : $1.2720 (low of the American session on Jan 9)

Support 2 : $1.2665 (Jan 9 low)

Support 3 : $1.2625 (Aug 31 low)

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2776 +0,10%

GBP/USD $1,5482 +0,17%

USD/CHF Chf0,9490 -0,04%

USD/JPY Y76,84 +0,01%

EUR/JPY Y98,19 +0,12%

GBP/JPY Y118,96 +0,19%

AUD/USD $1,0312 +0,72%

NZD/USD $0,7942 +0,91%

USD/CAD C$1,0154 -0,78%

Change % Change Last

Oil $102.20 +0.90 +0.89%

Gold $1,632.00 +24.00 +1.49%

Change % Change Last

Nikkei 8,422 +31.91 +0.38%

Hang Seng 19,004 +138.56 +0.73%

Shanghai Composite 2,286 +59.85 +2.69%

FTSE 5,697 +84.44 +1.50%CAC 3,211 +83.10 +2.66%

DAX 6,163 +145.75 +2.42%

Dow 12,460.13 +67.44 +0.54%

Nasdaq 2,702.50 +25.94 +0.97%

S&P 500 1,292.08 +11.38 +0.89%

05:00 Japan Leading Economic Index November 92.0 92.9

05:00 Japan Coincident Index November 91.4 90.3

09:30 United Kingdom Trade in goods November -7.6 -8.2

13:40 U.S. FOMC Member Charles Evans Speaks 0

14:00 U.S. FOMC Member Dennis Lockhart Speaks 0

15:30 U.S. EIA Crude Oil Stocks change 06.01.2012 +2.2

17:30 U.S. FOMC Member Charles Plosser Speaks 0

19:00 U.S. Fed's Beige Book January

23:50 Japan Current Account Total, bln November 562.4 246.8

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.