- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 06-01-2012

The dollar gained to a 15-month high versus the euro as U.S. employers added more jobs than forecast and investors speculated Europe’s debt crisis is worsening. The greenback headed for its fifth weekly advance versus the euro in what would be its longest winning streak since February 2010 amid optimism the U.S. economic recovery is gaining momentum. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, rose 0.4 percent to 81.228. U.S. nonfarm payrolls increased by 200,000 jobs last month, following a revised 100,000 gain in November that was smaller than initially estimated, Labor Department figures showed in Washington. The unemployment rate unexpectedly fell to 8.5 percent, the lowest since February 2009, from 8.7 percent.

The 17-nation European currency fell to an 11- year low against the yen. It’s the worst week for Europe’s common currency in four months. Europe’s shared currency lost 5.1 percent versus the dollar over the past month and dropped 5.9 percent against the yen as investors sought refuge amid Europe’s sovereign-debt turmoil.

The yen erased losses versus the dollar after Federal Reserve Bank of New York President William Dudley called on the U.S. government to try new programs to revive the housing market and said the central bank may still consider ways to spur growth. The Fed purchased $2.3 trillion of Treasury and mortgage- related bonds from 2008 through June 2011 in two rounds of quantitative easing to support the economy.

U.S. stocks were little changed, recovering from an earlier slump, as investors dissected better- than-forecast employment data and prospects for profit growth before the start of earnings season next week.

U.S. employers added 200,000 workers to payrolls in December, Labor Department figures showed in Washington, more than the 155,000 gain projected in a Bloomberg News survey. The unemployment rate unexpectedly fell to 8.5 percent, the lowest since February 2009. However, the growth in payrolls did not beat estimates by as wide a margin as data from ADP Employer Services yesterday that helped trigger gains in equities.

Equities also dropped earlier as German factory orders fell 4.8 percent, the biggest decline in almost three years, fueling concern that Europe was heading into a recession.

Most U.S. stocks rose yesterday as banks rallied and payrolls climbed, offsetting reduced profit forecasts at companies including Target Corp. and J.C. Penney Co.

Financial companies pared steeper losses. Bank of America Corp. (BAC) retreated 0.2 percent after dropping 5 percent earlier.

General Electric Co. (GE) and Microsoft Corp. (MSFT) climbed at least 1 percent to lead gains among the largest companies.

Alcoa Inc. (AA), due to start the earnings season on Jan. 9, slid 2.1 percent after saying it will close 12 percent of its smelting capacity.

European stocks closed little changed as a report showed U.S. employers added more jobs than economists had predicted.

U.S. employers added 200,000 jobs last month, following a revised 100,000 gain in November that was smaller than initially estimated, Labor Department figures showed. The unemployment rate unexpectedly fell to 8.5 percent, the lowest since February 2009, while hours worked and earnings climbed.

Euro-area consumer confidence fell to the lowest in more than two years and unemployment remained at a 13-year high, according to data released today.

National benchmark indexes declined in 12 of the 14 western European markets open today. Germany’s DAX Index slipped 0.6 percent and France’s CAC 40 retreated 0.2 percent. The U.K.’s FTSE 100 Index rose 0.5 percent. Markets were closed in Greece, Finland, Sweden and Austria for a holiday.

BMW and Daimler each slid 1.1 percent respectively. Automakers fell 0.7 percent, among the largest drop of 19 industry groups in the Stoxx 600.

UniCredit tumbled 11 percent, the lowest level since 1992, after Italy’s biggest bank priced a 7.5 billion-euro ($9.6 billion) rights offer at a discount on Jan. 4. The Italian market regulator, Consob, said yesterday that it’s investigating the share move to verify whether its ban on short selling in financial stocks has been respected.

Man Group Plc fell 8.4 percent, the lowest in 11 years, after analysts cut their earnings estimates on the world’s biggest publicly traded hedge-fund manager.

Vodafone Group Plc, the world’s largest mobile-phone operator, climbed 1.2 percent to 179.5 pence after Goldman Sachs Group Inc. upgraded the shares to “buy” from “neutral,” saying a merger between the British company and Verizon Communications Inc. may be “attractive.”

US will "most likely continue on a path of gradual recovery in 2012" but hsg market is a drag on recovery

Credit headwinds are subsiding but EZ global strains are a downside risk

Mentions Fed white paper on hsg without endorsing a solution

Gold fell slightly against the dollar growth, sustained by the data on the U.S. labor market, which were better than expected. It was registered a decline in the unemployment rate to the level of 8.5% while the forecast growth of 8.7%. Also, the data recorded that by the endof December in the non-agricultural sectors of the economy was created 200K jobs, the forecast of 153K.

The cost of the February futures on the COMEX today declined to 1609.0 dollars per ounce.

Oil slipped for a second day as European confidence in the economic outlook fell to a two-year low and the euro declined.

Futures decreased as much as 0.9 percent as the common currency dropped to the lowest level versus the dollar since September 2010. Crude surged to the highest price in almost eight months this week as Iran threatened to block the Strait of Hormuz and European ministers discussed an embargo on oil imports from the country.

Crude oil for February delivery fell 75 cents, or 0.7 percent, to $101.06 a barrel at 10:30 a.m. on the New York Mercantile Exchange. The contract is headed for a 2.3 percent gain this week. Prices advanced 8.2 percent in 2011.

Brent oil for February settlement declined 46 cents, or 0.4 percent, to $112.28 a barrel on the London-based ICE Futures Europe exchange.

He endorsed additional purchases of MBS to speed hsg recovery

Sees infl below 2% in next several yrs and says jobs improvement should be very gradual - calls labor demand "too weak"

Resistance 3:1300 (psychological level)

Resistance 2:1289 (high of October)

Resistance 1:1281 (session high)

Current price: 1271,00

Support 1 : 1267 (session low)

Support 2 : 1260 (Jan 5 low)

Support 3 : 1253 (area of Dec 30, Jan 1 lows)

EUR/USD $1.2800, $1.2900, $1.2950-55

USD/JPY Y77.00, Y77.30, Y77.90

AUD/USD $1.0150, $1.0250, $1.0275, $1.0300

USD/CAD C$1.0130

U.S. stock futures rose as better-than-forecast jobs growth and a drop in the unemployment rate bolstered optimism in the world’s largest economy. Equity futures extended gains as U.S. employers added more workers to payrolls than forecast in December. The 200,000 increase followed a revised 100,000 gain in November that was smaller than initially estimated, Labor Department figures showed in Washington. The median forecast was 155,000. The unemployment rate unexpectedly fell to 8.5 percent, the lowest since February 2009, while hours worked and earnings climbed.

World markets:

Nikkei 8,390 -98.36 -1.16%Hang Seng 18,593 -220.35 -1.17%

Shanghai Composite 2,163 +14.94 +0.70%

FTSE 5,678 +53.87 +0.96%

CAC 3,177 +32.45 +1.03%

DAX 6,130 +33.83 +0.55%

Crude oil: $102.34 (+0,52%).

Gold: $1623.40 (+0,20%).

08:00 Switzerland Foreign Currency Reserves December 229.3 254.24

08:00 United Kingdom Halifax house price index December -0.9% -0.9%

08:00 United Kingdom Halifax house price index 3m Y/Y December -1.0% -1.3%

08:15 Switzerland Consumer Price Index (MoM) December -0.2% -0.1% -0.2%

08:15 Switzerland Consumer Price Index (YoY) December -0.5% -0.6% -0.7%

10:00 Eurozone Retail Sales (MoM) November +0.4% -0.2% -0.8%

10:00 Eurozone Retail Sales (YoY) November -0.4% -0.9% -2.5%

10:00 Eurozone Unemployment Rate November 10.3% 10.3% 10.3%

10:00 Eurozone Business climate indicator December -0.44 -0.46 -0.13

10:00 Eurozone Economic sentiment index December 93.7 93.2 93.3

10:00 Eurozone Industrial confidence December -7.3 -7.5 -7.7

11:00 Germany Factory Orders s.a. (MoM) November +5.0% -1.6% -4.8%

11:00 Germany Factory Orders n.s.a. (YoY) November +5.2% -1.2% -4.3%

The euro is under pressure after reports showed confidence in the European economic outlook fell to a two-year low and German factory orders dropped by the most in almost three years.

The dollar was little changed before a U.S. report forecast to show employers added the most jobs in three months, adding to signs the world’s largest economy is gaining momentum.

U.S. employers hired 153K workers last month, after adding 120K in November. The jobless rate rose to 8.7% from 8.6%. U.S. companies added 325K workers in December, the most in records going back to 2001, ADP Employer Services said yesterday.

EUR/USD: the pair was limited $1,2760-$ 1,2810.

GBP/USD: the pair was limited $1,5470-$ 1,5500.

US data starts with the labor market data at 1330GMT where non-farm payrolls are forecast to rise 150,000 in December, continuing a trend of moderate payrolls gain. The unemployment rate is forecast to rebound slightly to 8.7% after falling 0.4 to 8.6% in November. Hourly earnings are expected to rise 0.2% after the 0.1% November decline, while the average workweek is forecast to hold steady at 34.3 hours. At 1430GMT, New York Fed President William Dudley speaks to the New Jersey Bankers Association in Iselin, N.J.

GBP/USD

Offers $1.5590/600, $1.5580, $1.5550/55, $1.5530/35

Bids

$1.5445/35, $1.5410/00

EUR/USD

Offers

$1.2900/10, $1.2880/85, $1.2850/65, $1.2820

Bids $1.2760/50, $1.2730, $1.2720, $1.2710/00

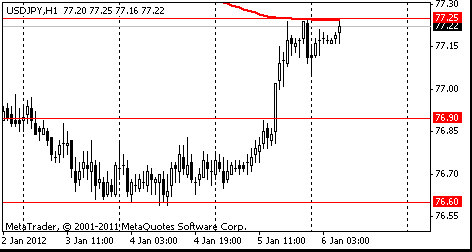

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.40 (50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.25 (session high, Jan 5 high)

Current price: Y77.14

Support 1:Y77.00 (session low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.00 (psychological level)

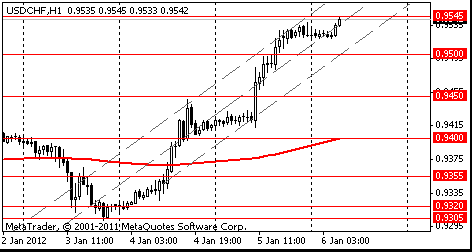

Resistance 3: Chf0.9780 (high of 2011)

Resistance 2: Chf0.9600 (psychological mark)

Resistance 1: Chf0.9550 (session high, Dec 15 high)

Current price: Chf0.9517

Support 1: Chf0.9500 (area of session low)

Support 2: Chf0.9470 (Dec 29 high)

Support 3: Chf0.9450 (Jan 4 high)

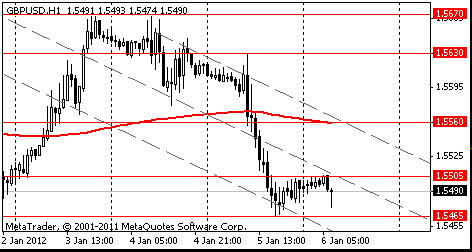

Resistance 3 : $1.5630 (Jan 5 high)

Resistance 2 : $1.5540 (МА (200) for Н1)

Resistance 1 : $1.5515 (session high)

Current price: $1.5498

Support 1 : $1.5480/70 (61,8 % FIBO $1,5360-$ 1,5670, Jan 2 low)

Support 2 : $1.5400 (Dec 30 low)

Support 3 : $1.5360 (low of December)

Resistance 2: $ 1.2880 (38,2 % FIBO $1,3080-$ 1,2760)

Resistance 2: $ 1.2860 (Dec 29 low)

Resistance 1: $ 1.2820 (session high)

Current price: $1.2784

Support 1 : $1.2760 (session low)

Support 2 : $1.2700 (psychological mark)

Support 3 : $1.2590 (low of 2011)

EUR/USD $1.2800, $1.2900, $1.2950-55

USD/JPY Y77.00, Y77.30, Y77.90

AUD/USD $1.0150, $1.0250, $1.0275, $1.0300

USD/CAD C$1.0130

Low Borrowing Costs Are Best Stimulus We Can Give To Econ

- Rebalancing Of Economy Not Going Far, Fast Enough

Asian stocks fell and the regional benchmark index pared weekly gains as higher borrowing costs in a French bond auction stoked concern Europe’s debt crisis is deepening, overshadowing improving economic data in the U.S.

Nikkei 225 8,489 -71.40 -0.83%

Hang Seng 18,813 +86.10 +0.46%

S&P/ASX 200 4,143 -45.16 -1.08%

Shanghai Composite 2,148 -20.94 -0.97%

Companies that do businesses in Europe declined. HSBC fell 2.1 percent to HK$59.40 in Hong Kong. Esprit Holdings Ltd. (330), a clothier that counts Europe as its biggest market, slipped 1.8 percent to HK$10.08. Sony Corp. (6758), which depends on the market for a fifth of its sales, lost 2 percent to 1,345 yen.

Makers of computer memory chips dropped after Nomura cut its forecast for 2012 growth in global shipments of dynamic random access memory to 2.7 percent from 3.7 percent.

Elpida sank 5.4 percent to 331 yen in Tokyo. Powerchip Technology Corp. (5346), a Taiwanese producer of memory chips, slumped 6.7 percent to 97 Taiwanese cents.

Samsung Electronics Co., Asia’s biggest maker of computer memory chips by sales, slipped 1.4 percent to 1.04 million won in Seoul even as the company posted fourth-quarter earnings that beat analyst estimates.

The euro fell to a 15-month low versus the dollar on speculation declining consumer confidence and spending will make it harder for European leaders to contain the region’s sovereign-debt crisis. The 17-nation currency was 0.2 percent from its weakest level in 11 years against the yen as Spain and Italy prepare to sell debt next week after France’s borrowing costs rose at an auction yesterday. The dollar is set for a weekly gain versus the yen and euro before a U.S. report forecast to show employers added the most jobs in three months in December. The Dollar Index (DXY) reached a one-year high.

The Australian and New Zealand dollars declined for a third day on concern Europe’s debt crisis is deepening, sapping demand for higher-yielding assets. The so-called Aussie fell against 15 of its 16 major counterparts before European countries, including Germany, Greece, Spain and Italy, sell bonds next week. New Zealand’s dollar was set for a weekly advance against the majority of its most-traded peers before a U.S. report that economists say will show hiring increased last month in the world’s largest economy. Australia’s dollar fell 0.6 percent to $1.0208 as of 4:08 p.m. in Sydney from the close in New York yesterday. Payrolls in the U.S. climbed by 155,000 workers in December after rising 120,000 the previous month, according to the median estimate of economists in a Bloomberg News survey before Labor Department data today.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased, however was restored later.

USD/JPY: on Asian session the pair gain.

On Friday EMU data sees retail trade, unemployment data and also the business climate indicator/economic sentiment survey all at 1000GMT, where retail trade is expected to decline by a reading of -0.5% m/m, -0.8% y/y and the unemployment rate is expected to have edged up to 10.4%. At 1100GMT, Germany manufacturing orders are expected to decline after the previous month's strong gain. Events start at 0800GMT with the latest UK house price index from the Halifax. US data starts with the labor market data at 1330GMT where non-farm payrolls are forecast to rise 150,000 in December, continuing a trend of moderate payrolls gain. The unemployment rate is forecast to rebound slightly to 8.7% after falling 0.4 to 8.6% in November. Hourly earnings are expected to rise 0.2% after the 0.1% November decline, while the average workweek is forecast to hold steady at 34.3 hours. At 1430GMT, New York Fed President William Dudley speaks to the New Jersey Bankers Association in Iselin, N.J.

Yesterday the euro fell to an 11-year low against the yen and the weakest level in 15 months versus the dollar on concern Europe’s debt crisis is worsening and as reports showed the U.S. labor market is strengthening. The 17-nation currency weakened against most major peers after France’s borrowing costs rose at a bond sale as credit-rating companies threaten to cut the nation’s top AAA ranking.

The dollar extended gains versus the euro after ADP Employer Services reported U.S. companies added 325,000 workers in December, beating the highest projection in a Bloomberg News survey and following a revised 204,000 gain the prior month. The median estimate was for a gain of 178,000. A government report tomorrow will show U.S. nonfarm payrolls swelled by 150,000 positions last month, compared with 120,000 in November, according to another Bloomberg survey.

The Australian dollar fell against its U.S. counterpart after a report showed the nation’s trade surplus (AUITGSB) unexpectedly narrowed in November as shipments abroad of resources slowed.

Canada’s dollar slid to a one-week low versus its U.S. counterpart as crude oil fell and rising bond yields in France, Spain and Italy signaled renewed concern some euro-area nations may struggle to fund themselves.

The Canadian currency fell as much as 1 percent as North American equities dropped, making higher-yielding assets less attractive to investors. The nation’s employers added 20,000 jobs in December after net losses in the previous two months, according to economists before tomorrow’s jobs report.

EUR / USD on results of yesterday's session, the pair has fallen on one and a half figure.

GBP / USD on results of yesterday's session, the pair has lost more figures.

USD / JPY on results of yesterday's session the pair was fixed above Y77,00.

On Friday EMU data sees retail trade, unemployment data and also the business climate indicator/economic sentiment survey all at 1000GMT, where retail trade is expected to decline by a reading of -0.5% m/m, -0.8% y/y and the unemployment rate is expected to have edged up to 10.4%. At 1100GMT, Germany manufacturing orders are expected to decline after the previous month's strong gain. Events start at 0800GMT with the latest UK house price index from the Halifax. US data starts with the labor market data at 1330GMT where non-farm payrolls are forecast to rise 150,000 in December, continuing a trend of moderate payrolls gain. The unemployment rate is forecast to rebound slightly to 8.7% after falling 0.4 to 8.6% in November. Hourly earnings are expected to rise 0.2% after the 0.1% November decline, while the average workweek is forecast to hold steady at 34.3 hours. At 1430GMT, New York Fed President William Dudley speaks to the New Jersey Bankers Association in Iselin, N.J.

Asian stocks retreated, snapping a two-day rally, after Australia’s services industry shrank and the euro weakened ahead of France’s plans to sells as much as 8 billion euros ($10.4 billion) of debt. France plans to sell as much as 8 billion euros of debt today in the country’s first test this year of investor appetite for its bonds amid threats of a downgrade of its AAA rating by credit companies. Luxembourg Prime Minister Jean-Claude Juncker said the European Union is facing a recession of unknown scope.

Asian exporters declined as the euro dropped toward an 11- year low against the yen and fell to a four-month low against the won. A weaker euro cuts the value of European income at Japanese and South Korean companies when repatriated.

Sony Corp., a Japanese electronics maker that gets 21 percent of its sales from Europe, fell 2.2 percent as a weaker euro cut the earnings outlook for exporters.

Canon Inc., a camera maker that depends on Europe for almost a third of its sales, lost 1.2 percent to 3,390 yen.

Samsung Electronics Co., the world’s second-largest maker of mobile phones by sales, sank 2.3 percent to 1.055 million won in Seoul.

European stocks (SXXP) declined for a second day as concern that the region’s banks will have to raise capital overshadowed a report showing that U.S. companies added more workers to their payrolls than economists had predicted.

UniCredit SpA, which announced a rights offer at a 43 percent discount yesterday, slumped to a 19-year low. Societe Generale SA dropped 5.4 percent after announcing it will cut corporate- and investment-banking staff. In the U.S., private employers added 325,000 workers to payrolls in December, according to a report from Roseland, New Jersey-based ADP Employer Services. That was the biggest increase in records going back to 2001. The median projection in the survey called for an advance of 178,000.Societe Generale, France’s second-largest lender, retreated 5.4 percent to 16.08 euros after saying it will cut about 1,580 jobs at its corporate and investment bank, about 10 percent of the unit’s total staff.

Nokia Oyj rose 7.1 percent to 4.16 euros after Credit Suisse Group AG raised its recommendation to “outperform” from “underperform.” The company considers Risto Siilasmaa, the founder of security software maker F-Secure Oyj, as the frontrunner to become its next chairman, a person familiar with the matter said.

Petrofac Ltd. (PFC), the U.K. oilfield-services provider, advanced 1.9 percent to 1,493 pence after agreeing with Schlumberger Ltd. (SLB) to cooperate on production projects.

Brenntag AG (BNR) fell 1.2 percent to 71.40 euros, its biggest drop in four weeks. Brachem Acquisition SCA sold an 8.7 percent stake in the chemical distributor to institutional investors for about 315 million euros.

CRH Plc (CRH) and HeidelbergCement AG (HEI) fell 2.7 percent to 15.06 euros and 2.8 percent to 33.61 euros, respectively. Credit Suisse lowered its recommendation on both companies to “underperform” and said volumes, prices and margins in the building-materials business will remain “challenged.”

U.S. stocks rose as banks rallied and employment data bolstered optimism in the economy, helping to erase earlier losses triggered by reduced profit forecasts at companies including Target Corp. and J.C. Penney Co.

Bank of America Corp. (BAC), JPMorgan Chase & Co. (JPM) and SunTrust Banks Inc. rose at least 2.5 percent after Deutsche Bank AG saw “encouraging signs” for banks’ fourth-quarter earnings. LSI Corp. rallied 6.8 percent after the chipmaker was raised to “outperform” from “neutral” at Wedbush Securities. Target and J.C. Penney each lost more than 3 percent.

S&P 500 1,281 +3.34 +0.26%, NASDAQ 2,668 +19.69 +0.74%, Dow 12,415 -3.74 -0.03%

Target (TGT) and J.C. Penney cut their earnings forecasts as retailers (S5RETL) reported mixed December same-store sales results. Gap Inc., Target and Kohl’s Corp. reported sales that trailed analysts’ estimates after mistiming promotions or running out of inventory during a projected record holiday shopping season.

J.C. Penney dropped 3.2 percent to $33.81. The retailer forecast fourth-quarter earnings of 65 cents to 70 cents a share, less than the average analyst estimate of $1.08 a share. Target lost 3 percent to $48.49. The second-largest U.S. discount retailer cut its fourth-quarter profit forecast to no more than $1.43 a share, below the average analyst estimate of $1.48, according to a Bloomberg survey.

Gap fell 3.3 percent to $18.27, while Kohl’s slipped 1 percent to $46.88.

Macy’s Inc. added 3.7 percent to $33.87. The Cincinnati- based retailer reported a 6.2 percent increase in same-store sales, topping the 4.6 percent estimate.

Alcoa Inc. is scheduled to mark the unofficial start of the fourth-quarter earnings season on Jan. 9. Profit at S&P 500 companies rose 6.2 percent during the September-December period, according to analyst estimates compiled by Bloomberg, which would mark the slowest growth since the third quarter of 2009.

Resistance 3: Y77.88 (high of the European session on Dec 29)

Resistance 2: Y77.55 (Dec 28 low)

Resistance 1: Y77.25 (session high, MA (233) H1)

The current price: Y77.21

Support 1:Y76.90 (Dec 30 low)

Support 2:Y76.60 (Jan 3-4 low)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9645 (100% FE Chf0.9413-Chf0.9537 from Chf0.9519)

Resistance 2: Chf0.9595 (resistance line from Jan 4)

Resistance 1: Chf0.9545 (session high)

The current price: Chf0.9338

Support 1: Chf0.9500 (support line from Jan 4)

Support 2: Chf0.9450 (Jan 4 high)

Support 3: Chf0.9400 (MA (233) H1)

Resistance 3 : $1.5630 (Jan 5 high)

Resistance 2 : $1.5560 (MA (233) H1)

Resistance 1 : $1.5505 (session high)

The current price: $1.5489

Support 1 : $1.5465 (Jan 5 low)

Support 2 : $1.5405 (61.8% FE $1.5629-$1.5465 from $1.5506)

Support 3 : $1.5360 (Dec 29 low)

Resistance 3: $1.2915 (50.0 % FIBO $1.2760-$1.3075)

Resistance 2: $1.2860 (Dec 29 low)

Resistance 1: $1.2800 (session high)

The current price: $1.2775

Support 1 : $1.2760 (session low)

Support 2 : $1.2690 (61.8% FE $1.2943-$1.2769 from $1.2798)

Support 3 : $1.2625 (100% FE $1.2943-$1.2769 from $1.2798)

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2783 -1,24%

GBP/USD $1,5486 -0,85%USD/CHF Chf0,9530 1,20%

USD/JPY Y77,18 0,61%

EUR/JPY Y98,67 -0,61%

GBP/JPY Y119,54 -0,23%

AUD/USD $1,0250 -1,15%

NZD/USD $0,7804 -0,91%

USD/CAD C$1,0194 0,68%

Change % Change Last

Oil $101.74 -0.07 -0.07%

Gold $1,621.70 +1.60 +0.10%

Change % Change Last

Nikkei 225 8,489 -71.40 -0.83%

Hang Seng 18,813 +86.10 +0.46%

S&P/ASX 200 4,143 -45.16 -1.08%

Shanghai Composite 2,148 -20.94 -0.97%

FTSE 5,624 -44.07 -0.78%

CAC 3,150 -43.29 -1.36%

DAX 6,100 -11.86 -0.19%

S&P 500 1,281 +3.34 +0.26%NASDAQ 2,668 +19.69 +0.74%

Dow 12,415 -3.74 -0.03%

10 Year Yield 1.99% -0.0020 --

08:00 Switzerland Foreign Currency Reserves December 229.3

08:00 United Kingdom Halifax house price index December -0.9%

08:00 United Kingdom Halifax house price index 3m Y/Y December -1.0%

08:15 Switzerland Consumer Price Index (MoM) December -0.2% -0.1%

08:15 Switzerland Consumer Price Index (YoY) December -0.5% -0.6%

10:00 Eurozone Retail Sales (MoM) November +0.4% -0.2%

10:00 Eurozone Retail Sales (YoY) November -0.4% -0.9%

10:00 Eurozone Unemployment Rate November 10.3% 10.3%

10:00 Eurozone Business climate indicator December -0.44 -0.46

10:00 Eurozone Economic sentiment index December 93.7 93.2

10:00 Eurozone Industrial confidence December -7.3 -7.5

11:00 Germany Factory Orders s.a. (MoM) November +5.2% -1.6%

11:00 Germany Factory Orders n.s.a. (YoY) November +5.4% -1.2%

12:00 Canada Employment December -18.6 +15.3

12:00 Canada Unemployment rate December 7.4% 7.4%

13:03 U.S. Average hourly earnings December -0.1% +0.2%

13:30 U.S. Nonfarm Payrolls December 120 153

13:30 U.S. Unemployment Rate December 8.6% 8.7%

13:30 U.S. Average workweek December 34.3 34.3

15:20 U.S. FOMC Member Rosengren Speaks 0

17:40 U.S. FOMC Member Elizabeth Duke Speaks 0

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.