- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 09-01-2012

The euro rose to a 16-month low against the dollar after today's meeting, German Chancellor Angela Merkel and French President Nicolas Sarkozy, specify a new set of rules of financial discipline discussed at the summit on December 9. As per the last meeting, German Chancellor Angela Merkel said that negotiations on the fiscal pact are good. Merkel also noted the need for a fiscal pact included measures to stimulate economic growth. In turn, French President Nicolas Sarkozy pledged that France's budget deficit in 2011 will be lower than expected.

It became known today of the resignation of the head of the Swiss National Bank Philipp Hildebrand. The resignation is related to the recent scandal of illegal operations with the use of insider information. Frank has become stronger after reports of the resignation of the head of the Swiss central bank.

U.S. stocks were little changed, following last week’s advance in the Standard & Poor’s 500 Index, as leaders discussed shoring up the euro and investors awaited the start of the fourth-quarter earnings season.

Dow 12,384.71 +24.79 +0.20%, Nasdaq 2,677.67 +3.45 +0.13%, S&P 500 1,280.10 +2.29 +0.18%

Alcoa Inc. (AA) increased 2.4 percent as it becomes the first company in the Dow Jones Industrial Average to report quarterly results after the market close.

Broadcom Corp. rallied 2.8 percent after Deutsche Bank AG said soft fourth-quarter results for chipmakers create a buying opportunity for the shares.

Costco Wholesale Corp. lost 2.5 percent after Sanford C. Bernstein & Co. cut its rating for the warehouse-club chain.

Now is not a time to lock into a rigid (mon-policy) position

He expects more US econ progress in '12 but says growth is slow

Gold prices are stable, as traders remained cautious ahead of a meeting of leaders of France and Germany on the problems of the eurozone. It was expected that at today's meeting, German Chancellor Angela Merkel and French President Nicolas Sarkozy,specify a new set of rules of financial discipline discussed at the summit on December 9. As per the last meeting, German Chancellor Angela Merkel said that negotiations on the fiscal pact. Merkel also noted the need for a fiscal pact included measures to stimulate economic growth. In turn, French President Nicolas Sarkozy pledged that France's budget deficit in 2011 will be lower than expected.

Although gold has fallen in price by 10 percent in December, a record-low interest rate sand concerns about the level of debt and economic growth are supporting prices.

February gold in electronic trading on the New York Stock Exchange on Comex fell to1605.7 dollars per troy ounce.

Oil dropped a third day as German industrial output declined, signaling that growth in Europe’s largest economy may have stalled, and as concern eased that Iran will block crude shipments from the Persian Gulf.

Futures fell as much as 1 percent after German production fell 0.6 percent in November, the Economy Ministry in Berlin said today. Oil climbed to a seven-month high as manufacturing in the U.S. improved.

Oil for February delivery fell 85 cents, or 0.8 percent, to $100.71 a barrel at 10:07 a.m. on the New York Mercantile Exchange. The price fell as low as $100.44. Futures are up 13 percent from a year earlier.

Brent oil for February settlement decreased 48 cents, or 0.4 percent, to $112.58 a barrel on the London-based ICE Futures Europe exchange.

Resistance 3:1300 (psychological level)

Resistance 2:1289 (high of October)

Resistance 1:1281 (Jan 6 high)

Current price: 1273,50

Support 1 : 1267 (session low, Jan 6 low)

Support 2 : 1260 (Jan 5 low)

Support 3 : 1253 (area of Dec 30 - Jan 1 lows, МА (200) for D1)

EUR/USD $1.2600, $1.2700, $1.2750, $1.2800

USD/JPY Y76.00, Y76.50, Y77.50, Y78.00

AUD/USD $1.0150, $1.0200, $1.0250

GBP/USD $1.5700

GBP/JPY Y120.00

EUR/CHF Chf1.2000, Chf1.2200, Chf1.2300

U.S. stock futures rose as European leaders discussed plans to shore up the region’s currency.

German Chancellor Angela Merkel and French President Nicolas Sarkozy sought to craft a plan for rescuing the euro over the next three months. At a joint press conference after a meeting today, both Sarkozy and Merkel said they support a financial-transaction tax. Merkel said she isn’t intimidated by the risk of a credit-rating downgrade for euro-area governments.

World markets:

Hang Seng 18,866 +272.66 +1.47%

Shanghai Composite 2,226 +62.49 +2.89%

FTSE 5,643 -6.75 -0.12%

CAC 3,151 +14.04 +0.45%

DAX 6,058 -0.09 0.00%

Crude Oil: $101.61 (+0,1%).

Gold: $1621.50 (+0,3%).

06:45 Switzerland Unemployment Rate December 3.1% 3.1% 3.3%

07:00 Germany Trade Balance November 12.6 12.6 15.0

07:45 France Trade Balance, bln November -6.2 -5.8 -4.4

08:15 Switzerland Retail Sales Y/Y November -0.2% +0.6% +1.8%

09:30 Eurozone Sentix Investor Confidence January -24.0 -23.5 -21.1

11:00 Germany Industrial Production s.a. (MoM) November +0.8% -0.4% -0.6%

11:00 Germany Industrial Production (YoY) November +4.1% -0.5% +3.6%

The euro rose before the leaders of Germany and France met to craft a plan for rescuing the 17-nation common currency.

German Chancellor Angela Merkel and French President Nicolas Sarkozy held talks in Berlin today to flesh out a new rulebook for fiscal discipline negotiated at a Dec. 9 summit that seeks to create a “fiscal compact” for the euro area. Futures traders’ bets that the euro will decline against the dollar reached a record.

Merkel welcomed progress on talks on the fiscal pact at a joint press conference with Sarkozy after their meeting and said there was “very close agreement” between their two countries.

The euro pared gains as a report showed industrial production in Germany, Europe’s biggest economy, declined in November.

German industrial production dropped 0.6% after an 0.8% increase the previous month.

EUR/USD: the pair has shown high in $1,2780 area then receded.

GBP/USD: the pair has grown in $1,5460 area.

USD/JPY: the pair was limited Y76,75-Y77,00.

GBP/USD

Offers $1.5580, $1.5550, $1.5520/30, $1.5490/500, $1.5470

Bids $1.5360/50, $1.5330/20, $1.5270

EUR/USD

Offers $1.2830/40, $1.2810/00

Bids $1.2740, $1.2725/20, $1.2710/695, $1.2660/50, $1.2640, $1.2625/20, $1.2600

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.35/40 (Jan 6 high, 50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.00 (session high)

Current price: Y76.85

Support 1:Y76.75 (session low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.00 (psychological level)

Resistance 3: Chf0.9780 (high of 2011)

Resistance 2: Chf0.9600 (area of session high)

Resistance 1: Chf0.9540 (intraday high)

Current price: Chf0.9517

Support 1: Chf0.9500 (area of session low and Jan 6 low)

Support 2: Chf0.9470 (Dec 29 high)

Support 3: Chf0.9450 (Jan 4 high)

Resistance 3: $ 1.2860/70 (Dec 29 low, 50,0 % $1,3080-$ 1,2660)

Resistance 2: $ 1.2810/20 (38,2 % $1,3080-$ 1,2660, Jan 6 high)

Resistance 1: $ 1.2790 (session high)

Current price: $1.2752

Support 1 : $1.2700 (psychological mark)

Support 2 : $1.2660 (session low)

Support 3 : $1.2590 (low of 2011)

EUR/USD $1.2600, $1.2700, $1.2750, $1.2800

USD/JPY Y76.00, Y76.50, Y77.50, Y78.00

AUD/USD $1.0150, $1.0200, $1.0250

GBP/USD $1.5700

GBP/JPY Y120.00

EUR/CHF Chf1.2000, Chf1.2200, Chf1.2300

Asian stock markets were mostly lower on Monday as continued concerns over the outlook for Europe overshadowed better-than-expected US jobs data on Friday, and pushed the euro to fresh lows against the US dollar and the Japanese yen. Concerns abound about the ability of European leaders to find a comprehensive solution to the eurozone's ongoing sovereign-debt and banking crisis amid growing worries over the outlook for Greece, Italy and Spain. Monday brings a meeting between French President Nicolas Sarkozy and German Chancellor Angela Merkel. The uncertainty eclipsed positive US economic data on Friday, which showed a drop in the US unemployment rate to its lowest level since February 2009.

Nikkei 225 closed

Hang Seng 18,866 +272.66 +1.47%

S&P/ASX 200 4,105 -3.07 -0.07%

Shanghai Composite 2,226 +62.49 +2.89%

00:30 Australia Retail sales (MoM) November +0.2% +0.4% 0.0%

00:30 Australia Retail Sales Y/Y November +2.8% +3.1%

The euro touched an 11-year low against the yen before the German and French leaders meet amid signs Europe’s sovereign-debt crisis is damping the region’s prospects for growth.

The 17-nation euro traded 0.4 percent from the least in nearly 16 months versus the dollar ahead of a report today forecast to show industrial production in Germany, Europe’s biggest economy, declined in November. German Chancellor Angela Merkel and French President Nicolas Sarkozy meet in Berlin today to flesh out a new rulebook for fiscal discipline negotiated at a Dec. 9 summit that seeks to create a “fiscal compact” for the 17-member euro area. The talks will be followed by a joint press conference.

Spain is scheduled to sell bonds due in 2015 and 2016 on Jan. 12. Italy will auction securities on the same day and on Jan. 13. Spain’s 10-year bond yield (GSPG10YR) climbed seven basis points, or 0.07 percentage point, to 5.71 percent on Jan. 6, while the rate on similar-maturity Italian debt (GBTPGR10) gained four basis points to 7.13 percent, above the 7 percent threshold that led Greece, Portugal and Ireland to seek bailouts.

The Australian dollar weakened against all of its 16 major peers.

The so-called Aussie fell for a fourth day after data showed the South Pacific nation’s retail sales unexpectedly stagnated in November and Pacific Investment Management Co. said the Reserve Bank will need to ease monetary policy. New Zealand’s dollar, nicknamed the kiwi, maintained a three-day drop after a report showed the nation’s trade deficit widened. Australia’s retail sales (AURSTSA) were unchanged in November, a report from the statistics bureau showed today, compared with the 0.4 percent gain estimated by economists in a Bloomberg News survey.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair traded in range $1.5390-$1.5440.

USD/JPY: on Asian session the pair traded in range Y76.80-Y77.00.

European events start at 0700GMT with Germany foreign trade data, which is followed by France foreign trade at 0745GMT.

Core-European data also includes the 1100GMT release of German industrial output data. At 1230GMT German Chancellor Angela Merkel and French President Nicolas Sarkozy are due to meet and hold a joint press conference, in Berlin. US data starts at 1430GMT with the weekly Capital Goods Index, which is followed at 1500GMT by the Employment Trends Index and then at 1530GMT by the weekly Retail Trade Index. Back in Europe at 1530GMT, German Chancellor Angela Merkel delivers a speech at a conference of the DBB trade union, in Cologne.

On Tuesday the dollar fell the most more than a month against the euro as signs manufacturing is expanding in the U.S. and China damped the appeal of safer assets. The euro advanced after German unemployment fell more than forecast. The euro extended gains after the Nuremberg-based Federal Labor Agency said German unemployment fell in December more than economists forecast. The number of people out of work slid a seasonally adjusted 22,000 to 2.89 million, the agency said. Australia’s and New Zealand’s dollars rose to the strongest since November.

On Wednesday the dollar rose against most traded currencies of the partner against the background of the declining interest in risky assets. Support the dollar had released statistical data showing that in November, orders for U.S. manufactured goods increased the maximum for the last 4 months of growth. As shown by the Department of Commerce, factory orders rose 1.8% against the previous value of the revised -0.2%. Increased demand for aircraft, automobiles and metals offset the decline in orders for computers and electronics. Euro fell against major currencies against the weak auction results for German government bonds, which resulted in the 4,057 billion euros drawn on 10 years with plans to 5.0 billion euros.

On Thursday the euro fell to an 11-year low against the yen and the weakest level in 15 months versus the dollar on concern Europe’s debt crisis is worsening and as reports showed the U.S. labor market is strengthening. The 17-nation currency weakened against most major peers after France’s borrowing costs rose at a bond sale as credit-rating companies threaten to cut the nation’s top AAA ranking.

The dollar extended gains versus the euro after ADP Employer Services reported U.S. companies added 325,000 workers in December, beating the highest projection in a Bloomberg News survey and following a revised 204,000 gain the prior month.

On Friday the dollar gained to a 15-month high versus the euro as U.S. employers added more jobs than forecast and investors speculated Europe’s debt crisis is worsening. The greenback headed for its fifth weekly advance versus the euro in what would be its longest winning streak since February 2010 amid optimism the U.S. economic recovery is gaining momentum. The 17-nation European currency fell to an 11- year low against the yen. It’s the worst week for Europe’s common currency in four months. Europe’s shared currency lost 5.1 percent versus the dollar over the past month and dropped 5.9 percent against the yen as investors sought refuge amid Europe’s sovereign-debt turmoil.

Asian stocks fell and the regional benchmark index pared weekly gains as higher borrowing costs in a French bond auction stoked concern Europe’s debt crisis is deepening, overshadowing improving economic data in the U.S.

Nikkei 225 8,489 -71.40 -0.83%

Hang Seng 18,813 +86.10 +0.46%

S&P/ASX 200 4,143 -45.16 -1.08%

Shanghai Composite 2,148 -20.94 -0.97%

Companies that do businesses in Europe declined. HSBC fell 2.1 percent to HK$59.40 in Hong Kong. Esprit Holdings Ltd. (330), a clothier that counts Europe as its biggest market, slipped 1.8 percent to HK$10.08. Sony Corp. (6758), which depends on the market for a fifth of its sales, lost 2 percent to 1,345 yen.

Makers of computer memory chips dropped after Nomura cut its forecast for 2012 growth in global shipments of dynamic random access memory to 2.7 percent from 3.7 percent.

Elpida sank 5.4 percent to 331 yen in Tokyo. Powerchip Technology Corp. (5346), a Taiwanese producer of memory chips, slumped 6.7 percent to 97 Taiwanese cents.

Samsung Electronics Co., Asia’s biggest maker of computer memory chips by sales, slipped 1.4 percent to 1.04 million won in Seoul even as the company posted fourth-quarter earnings that beat analyst estimates.

European stocks closed little changed as a report showed U.S. employers added more jobs than economists had predicted.

U.S. employers added 200,000 jobs last month, following a revised 100,000 gain in November that was smaller than initially estimated, Labor Department figures showed. The unemployment rate unexpectedly fell to 8.5 percent, the lowest since February 2009, while hours worked and earnings climbed.

Euro-area consumer confidence fell to the lowest in more than two years and unemployment remained at a 13-year high, according to data released today.

National benchmark indexes declined in 12 of the 14 western European markets open today. Germany’s DAX Index slipped 0.6 percent and France’s CAC 40 retreated 0.2 percent. The U.K.’s FTSE 100 Index rose 0.5 percent. Markets were closed in Greece, Finland, Sweden and Austria for a holiday.

BMW and Daimler each slid 1.1 percent respectively. Automakers fell 0.7 percent, among the largest drop of 19 industry groups in the Stoxx 600.

UniCredit tumbled 11 percent, the lowest level since 1992, after Italy’s biggest bank priced a 7.5 billion-euro ($9.6 billion) rights offer at a discount on Jan. 4. The Italian market regulator, Consob, said yesterday that it’s investigating the share move to verify whether its ban on short selling in financial stocks has been respected.

Man Group Plc fell 8.4 percent, the lowest in 11 years, after analysts cut their earnings estimates on the world’s biggest publicly traded hedge-fund manager.

Vodafone Group Plc, the world’s largest mobile-phone operator, climbed 1.2 percent to 179.5 pence after Goldman Sachs Group Inc. upgraded the shares to “buy” from “neutral,” saying a merger between the British company and Verizon Communications Inc. may be “attractive.”

U.S. stocks fell as better-than- forecast jobs growth and a drop in the unemployment rate failed to extend a weekly rally and lift the Standard & Poor’s 500 Index above its October high.

U.S. employers added 200,000 workers to payrolls in December, Labor Department figures showed in Washington, more than the 155,000 gain projected in a Bloomberg News survey. The unemployment rate unexpectedly fell to 8.5 percent, the lowest since February 2009. The growth in payrolls did not beat estimates by as wide a margin as data from ADP Employer Services yesterday that helped trigger gains in equities.

Equities also dropped earlier as German factory orders fell 4.8 percent, the biggest decline in almost three years, fueling concern that Europe was heading into a recession.

Dow 12,359.92 -55.78 -0.45%, Nasdaq 2,674.22 +4.36 +0.16%, S&P 500 1,277.81 -3.25 -0.25%

Bank of America Corp. (BAC) lost 2.1 percent after surging 8.6 percent yesterday.

Alcoa Inc. (АА), due to start the earnings season on Jan. 9, slid 2.1 percent after saying it will close 12 percent of its global smelting capacity.

Family Dollar Stores Inc. fell 7.5 percent to $53.63 for the biggest retreat in the S&P 500. The discount retailer reported fiscal first-quarter revenue of $2.15 billion, missing the average analyst estimate of $2.17 billion. Comparable store sales increased 4.1 percent, compared with the average analyst estimate of 4.9 percent.

J.C. Penney advanced 3.5 percent to $34.96 after being raised to “outperform” from “neutral” at Macquarie Group Ltd. The third-largest department-store chain lost 2.7 percent yesterday after cutting its fourth-quarter profit forecast, citing declining sales and deeper discounts than anticipated during the holiday season.

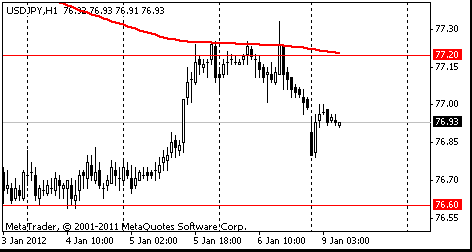

Resistance 3: Y77.88 (high of the European session on Dec 29)

Resistance 2: Y77.55 (Dec 28 low)

Resistance 1: Y77.20 (MA (233) H1)

The current price: Y76.93

Support 1:Y76.60 (Jan 3-4 low)

Support 2:Y76.10 (Sep 22 low)

Support 3:Y75.60 (Oct 31 low)

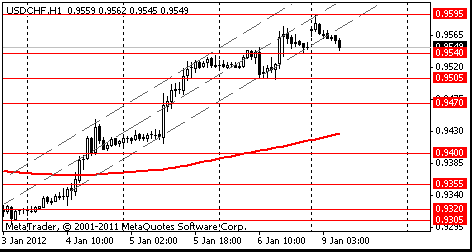

Resistance 3: Chf0.9700 (Feb 10 high)

Resistance 2: Chf0.9650 (Feb 9 high)

Resistance 1: Chf0.9595 (session high)

The current price: Chf0.9550

Support 1: Chf0.9540 (low of the American session on Jan 6)

Support 2: Chf0.9505 (Jan 6 low)

Support 3: Chf0.9470 (Dec 29 high)

Resistance 3 : $1.5580 (Jan 4 low)

Resistance 2 : $1.5525 (Jan 6 high)

Resistance 1 : $1.5465 (Jan 5 low)

The current price: $1.5423

Support 1 : $1.5360/75 (Dec 29 low and Jan 6 low)

Support 2 : $1.5335 (Oct 4 low)

Support 3 : $1.5270 (Oct 6 low)

Resistance 3: $1.2810 (Jan 6 high)

Resistance 2: $1.2760 (low of the Asian session on Jan 6)

Resistance 1: $1.2730 (resistance line from Jan 4)

The current price: $1.2697

Support 1 : $1.2665 (session low)

Support 2 : $1.2625 (100% FE $1.2943-$1.2769 from $1.2798)

Support 3 : $1.2590 (support line from Jan 4)

00:00 Australia HIA New Home Sales, m/m November +5.5%

00:30 Australia Retail sales (MoM) November +0.2% +0.4%

00:30 Australia Retail Sales Y/Y November +2.8%

06:45 Switzerland Unemployment Rate December 3.0% 3.1%

07:00 Germany Trade Balance November 12.6 12.6

07:45 France Trade Balance, bln November -6.2 -5.8

08:15 Switzerland Retail Sales Y/Y November -0.2% +0.6%

09:30 Eurozone Sentix Investor Confidence January -24.0 -23.5

11:00 Germany Industrial Production s.a. (MoM) November +0.8% -0.4%

11:00 Germany Industrial Production (YoY) November +4.1% -0.5%

13:30 Canada Building Permits (MoM) November +11.9% -3.1%

15:30 Canada Bank of Canada Senior Loan Officer IV quarter -26.9

15:30 Canada Bank of Canada business outlook future sales IV quarter 6.0 10.0

17:40 U.S. FOMC Member Dennis Lockhart Speaks 0

20:00 U.S. Consumer Credit November 7.6 7.2

21:45 New Zealand Building Permits, m/m November +11.2% +3.3%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.