- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 12-01-2012

The euro rose to a one-week high versus the dollar after European Central Bank President Mario Draghi said he saw signs of stabilization in the economy and Spain sold almost twice its maximum target at a note auction.

The shared currency appreciated versus 14 of its 16 most- traded peers as Italian borrowing costs dropped at a bill auction. The ECB left its benchmark interest rate unchanged.

The dollar fell the yen after data showed U.S. retail sales increased less than economists forecast.

The dollar fell bafter the Commerce Department said U.S. retail sales gained 0.1 percent last month, following a revised 0.4 percent increase in November. Economists in a Bloomberg survey forecast a 0.3 percent advance in December.

The Australian dollar erased gains versus its U.S. counterpart as stocks declined after the sales report and after more Americans than forecast filed claims for jobless benefits last week.

Can See Signs Of UK Economy Turning The Corner

- I Believe The Euro Will Survive

- Inflation Will Fall In 2012

Can See Signs Of UK Economy Turning The Corner

I Believe The Euro Will Survive

Inflation Will Fall In 2012

European stocks declined after reports that showed U.S. retail sales and initial jobless claims missed economists’ forecasts outweighed lower borrowing costs at Spanish and Italian debt auctions. The Stoxx Europe 600 Index fell 0.2 percent to 249.50 at the close in London. The gauge had earlier advanced as much as 0.9 percent after Spain and Italy sold debt, raising their targeted amounts at lower yields. Tesco Plc dropped 16 percent, leading retail shares lower, after the U.K.’s largest supermarket chain said it was “disappointed” with holiday sales.

FTSE 100 5,662 -8.40 -0.15%, CAC 40 3,200 -4.85 -0.15%, Xetra DAX 6,179 +26.87 +0.44%

UniCredit (UCG) SpA climbed 14 percent to 2.90 euros. The stock was raised to “buy” from “neutral” at Citigroup Inc., which said the stock would suit a high-risk investment strategy as it offers significant “upside potential.”

Sulzer jumped 5.1 percent to 112.50 Swiss francs. The company said 2011 orders rose 14 percent, or 8.4 percent nominally, to 3.6 billion francs ($3.8 billion).

Petroplus Holdings AG surged 16 percent to 1.39 francs, the most since November 2006. Europe’s largest independent refiner has reached a temporary agreement with lenders to renegotiate its debts and maintain operations at its Coryton and Ingolstadt refineries.

Solar shares gained after a government body said China plans to double solar capacity this year. The head of China’s National Energy Administration, Liu Tienan, said yesterday that the country will install 3 gigawatts in 2012.

Wacker Chemie AG (WCH), the second-biggest maker of solar-grade silicon, advanced 6 percent to 78 euros. Solarworld AG (SWV), Germany’s largest solar-panel maker, rose 10.4 percent to 3.96 euros.

S&P 500 1,292 -0.72 -0.06%, NASDAQ 2,715 +4.38 +0.16%, Dow 12,432 -17.48 -0.14%

Stocks fell as data showed that more Americans than forecast filed applications for unemployment benefits last week, raising the possibility that a greater-than-usual increase in temporary holiday hiring boosted December payrolls. Sales at U.S. retailers in December rose less than forecast, restrained by cheaper fuel prices and holiday discounting that helped hold down the value of goods sold.Chevron Corp. (CVX) slid 2.5 percent after oil-refining profit at the energy company slumped. Bank of America Corp. (BAC) reversed an earlier rally as a 2.3 percent decline helped drag financial shares lower. Sears Holdings (SHLD) Corp. sank 4.2 percent after vendor loans are said to be halted by CIT Group Inc. Dow Chemical Co. rose 2.4 percent as the European Union removed tariffs against the U.S. on a chemical used in paints and paper coatings.

With the start of this busy session, gold gained some momentum and extended the gains recorded in the previous session, where investors are demanding more gold as a hedge against uncertainty ahead of the major events awaited today. Yesterday, gold advanced and extended the gains recorded this week, where the metal was able to hold onto the gains despite the strengthening U.S. dollar, which forced downside pressures on other metals, commodities and currencies. Gold futures rose for a third consecutive day on Thursday, nearing a one-month high as the euro's sharp rise after a pair of successful euro-zone debt auctions and low interest rates in the currency union drew buyers to precious metals.

The most actively traded gold contract, for February delivery, recently rose $19, or 1.2%, to $1,658.60 a troy ounce on the Comex division of the New York Mercantile Exchange. The contract climbed as high as $1,660.90 a troy ounce, the highest intraday price since Dec. 13.

Debt auctions in Italy and Spain on Thursday were considered to be successful, easing worries about the financial stability of two of the currency union's more debt-laden members. The euro rose against the dollar in response, lifting demand for precious metals as alternative assets.

A falling dollar can increase interest in dollar-denominated gold futures by making them appear cheaper for buyers using other currencies. Some investors buy gold to shield their wealth against weakness in the currency.

Gold was also fueled by the view that low interest rates in Europe and the U.S. are here to stay. The European Central Bank Thursday said it would leave its benchmark rate unchanged, but in a press conference, ECB chief Mario Draghi kept the door open to future cuts. Uncertainty, he said, remains high and "we stand ready to act."

Oil climbed on concern that a strike in Nigeria will curb supplies and European Central Bank President Mario Draghi said there are some signs the euro-area economy is stabilizing.

Currently Light Sweet Crude Oil futeres are trading at $102,11 per barrel (+1,2%).

Resistance 3:1310 (Aug'2010 high)

Resistance 2:1300 (psychological level)

Resistance 1:1297 (session high)

Current price: 1283,75

Resistance 1:1283 (support line from Dec 28)

Resistance 2:1279 (area of Jan 6 high, Jan 11 low)

Support 3 : 1267 (Jan 6-9 lows)

EUR/USD $1.2550, $1.2600, $1.2750, $1.2800, $1.2810, $1.2820

USD/JPY Y76.30, Y77.00, Y77.20, Y77.35, Y77.50

AUD/USD $1.0300, $1.0450

GBP/USD $1.5400, $1.5470

EUR/JPY Y100.00

USD/JPY Chf0.9500, Chf0.9300

U.S. stock futures trimmed gains after government data showed retail sales trailed projections and jobless claims increased more than forecast, damping optimism in the economic outlook.

Jobless claims climbed to 399К in the week ended Jan. 7. The median forecast of economists projected 375,000. Retail sales climbed 0.1% in December. Economists forecast a 0.3%.

U.S. futures followed European shares higher earlier today as Spain sold 10 billion euros ($13 billion) of bonds, twice the target for the sale, while Italy sold 12 billion euros of bills, easing concerns the countries would struggle to finance their debts. The European Central Bank held interest rates steady after two straight cuts as signs of respite from the sovereign debt crisis gave it scope to pause.

Global Stocks:

Nikkei 8,386 -62.29 -0.74%

Hang Seng 19,095 -56.56 -0.30%

Shanghai Composite 2,275 -1.04 -0.05%

FTSE 5,669 -2.21 -0.04%

CAC 3,225 +20.20 +0.63%

DAX 6,209 +56.37 +0.92%

Crude oil: $101.48 (+0,6%).

Gold: $1654.70 (+0,9%).

- never comment on exchange rates, stick to G7- communique;

- we reaffirmed strong interest in stable glob fin system.

- never comment on exchange rates, stick to G7- communique;

- we reaffirmed strong interest in stable glob fin system.

- global econ,protectionism, imbalances also among risks;

- 3-yr refi shows providing support to banks;

- all nonstandard measures are temporary in nature;

- infl has been elevated since end-2010, mainly due energy;

- risks to inflation as broadly balanced in medium term.

- global econ,protectionism, imbalances also among risks;

- 3-yr refi shows providing support to banks;

- all nonstandard measures are temporary in nature;

- infl has been elevated since end-2010, mainly due energy;

- risks to inflation as broadly balanced in medium term.

- infl to stay above 2% several months, then decline;

- fin tensions still dampen econ activity;

- tentative signs of stabilization of activity;

- high uncertainty, substantial downside risks.

- infl to stay above 2% several months, then decline;

- fin tensions still dampen econ activity;

- tentative signs of stabilization of activity;

- high uncertainty, substantial downside risks.

Bids $1.5500, $1.5450, $1.5400/10, $1.5380/85

Offers $1.5270, $1.5225/20, $1.5200/190

06:30 France CPI, m/m December +0.3% +0.2% +0.4%

06:30 France CPI, y/y December +2.5% +2.3% +2.7%

07:00 Germany CPI, m/m December +0.7% +0.7% +0.7%

07:00 Germany CPI, y/y December +2.1% +2.1% +2.1%

09:30 United Kingdom Industrial Production (MoM) November -0.7% +0.1% -0.6%

09:30 United Kingdom Industrial Production (YoY) November -1.7% -2.2% -3.1%

09:30 United Kingdom Manufacturing Production (MoM) November -0.7% +0.1% -0.2%

09:30 United Kingdom Manufacturing Production (YoY) November +0.3% -0.5% -0.6%

10:00 Eurozone Industrial production, (MoM) November -0.1% -0.2% -0.1%

10:00 Eurozone Industrial Production (YoY) November +1.3% +0.3% -0.3%

12:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50% 0.50%

12:45 Eurozone ECB Interest Rate Decision 0 1.00% 1.00% 1.00%

The euro strengthened after Spain sold almost twice its maximum target of debt at an auction today, boosting demand for the region’s assets.

The euro rose as Italian borrowing costs dropped at a bill sale, spurring optimism the sovereign-debt crisis is easing.

European Central Bank policy makers meeting today leave their benchmark interest rate of 1.00%.

The euro extended gains after a government report showed industrial production in the region declined by less than economists forecast.

The pound stayed lower against the euro after the Bank of England kept borrowing costs at a record low.

The pound weakened as the Bank of England’s Monetary Policy Committee held its key interest rate at 0.5 percent, in line with the forecast of analysts. The central bank maintained its bond-buying target at 275 billion pounds.

The Dollar Index declined for the third time in four days before a U.S. report that economists said will show retail sales increased in December, damping demand for the relative safety of the U.S. currency.

EUR/USD: during european session the pair grown, showed high in $1,2770 area.

US data starts at 1330GMT with both initial jobless benefit claims and retail sales data. At 1500GMT, US business inventories are expected to rise 0.5% in November after the 0.8% increase in October. Factory inventories were already reported up 0.5%. Late US data sees the 2130GMT release of Money Supply.

EUR/USD

Offers $1.2840/60, $1.2820/30, $1.2800, $1.2790/800, $1.2780

Bids $1.2730/20, $1.2650, $1.2640, $1.2625/20, $1.2600

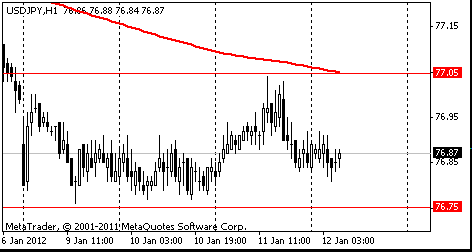

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.35/40 (Jan 6 high, 50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.05 (Jan 11 high)

Current price: Y76.85

Support 1:Y76.80 (session low, support line from Jan 4)

Support 2:Y76.55 (lows of November and January)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9600 (area of Jan 9 high)

Resistance 2: Chf0.9565 (Jan 11 high)

Resistance 1: Chf0.9520 (low of asian session)

Current price: Chf0.9494

Support 1: Chf0.9480 (session low, Jan 11 low)

Support 2: Chf0.9465/50 (area of Dec 29 and Jan 4 high, МА (200) for Н1 and Jan 10 low)

Support 3: Chf0.9410 (Jan 5 low)

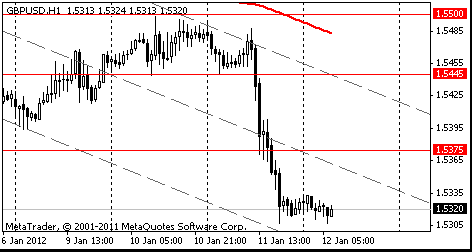

Resistance 3 : $1.5410 (61.8 % FIBO $1.5500-$ 1.5275)

Resistance 2 : $1.5390 (50.0 % FIBO $1.5500-$ 1.5275)

Resistance 1 : $1.5360 (38,2 % FIBO $1.5500-$ 1.5275)

Current price: $1.5351

Support 1 : $1.5310/00 (area of Jan 11 low and low of asian session)

Support 2 : $1.5275/70 (session low and low of 2011)

Support 3 : $1.5200 (psychological level)

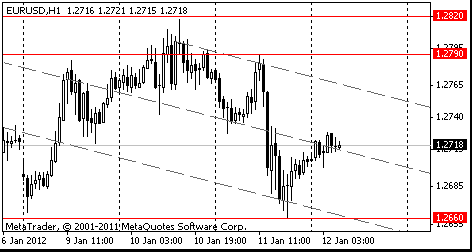

Resistance 3: $ 1.2860/70 (50,0 % $1,3080-$ 1,2660, Dec 29 low)

Resistance 2: $ 1.2810/20 (38,2 % $1,3080-$ 1,2660, Jan 6 and 10 highs)

Resistance 1: $ 1.2770 (low of asian session)

Current price: $1.2749

Support 1 : $1.2700 (session low)

Support 2 : $1.2660 (Jan 9 and 11 lows)

Support 3 : $1.2590 (low of August’2010)

sold E8.5bln 12-mont; average yield 2.735% (5.952%), cover 1.47 (1.92);

sold E3.5bln 3-month "flexi" BOT; average yield 1.644%, cover 1.853.

EUR/USD $1.2550, $1.2600, $1.2750, $1.2800, $1.2810, $1.2820

USD/JPY Y76.30, Y77.00, Y77.20, Y77.35, Y77.50

AUD/USD $1.0300, $1.0450

GBP/USD $1.5400, $1.5470

EUR/JPY Y100.00

USD/JPY Chf0.9500, Chf0.9300

Asian stock markets were mostly lower Thursday, amid inflation data in China that failed to meet expectations and fears of a possible recession in Europe. Data released Thursday showed China's inflation eased slightly in December to 4.1 percent, from November's 4.2 percent. But analysts had hoped to see more improvement.

Nikkei 225 8,386 -62.29 -0.74%

Hang Seng 19,087 -64.96 -0.34%

S&P/ASX 200 4,181 -6.53 -0.16%

Shanghai Composite 2,275 -1.04 -0.05%

Olympus rose 2.27 per cent to 1,258 yen following an Asahi Shimbun report that it was planning a capital tie-up with firms that could include Panasonic, Sony, Fujifilm and South Korea's Samsung Electronics.

The company said no decision has been made. The report was seen as positive for Olympus's share price as such a tie-up meant the company was more likely to be able to remain listed, said an analyst at a Japanese brokerage.

Panasonic Corp., a maker of home appliances, slid 2.5 percent to 628 yen. A Panasonic official said on Thursday: "We are not considering a capital tie-up at this point." Panasonic's comment has failed to extinguish talk in Japan that it might yet take a stake in Olympus, once the disgraced firm has finally put the accounting scandal behind it. Panasonic President Fumio Ohtsubo, also speaking at the Las Vegas event earlier this week, had said: "The situation is unclear, so we aren't doing anything at this time."

01:30 China PPI y/y December +2.7% +1.6% +1.7%

05:00 Japan Eco Watchers Survey: Current December 45.0 46.3 47.0

05:00 Japan Eco Watchers Survey: Outlook December 44.7 45.0 44.4

06:00 Japan Prelim Machine Tool Orders, y/y December +15.8% +17.4%

The euro was 0.5 percent from a 16- month low against the dollar on speculation European Central Bank policy makers won’t take steps today to support growth even as reports signal the euro-area economy is struggling.

The 17-nation currency held a drop from yesterday versus the yen before figures estimated to show European output shrank in November. Demand for the euro was limited before Spain and Italy sell debt today, amid concern the nations will struggle to meet funding needs. Spain will auction as much as 5 billion euros ($6.4 billion) of bonds due 2015 and 2016 today, while Italy is scheduled to sell 12 billion euros of bills. The ECB will probably keep its key interest rate at 1 percent at a policy meeting today, the median estimate of economists surveyed by Bloomberg News showed.

New Zealand’s dollar touched a two- month high against the greenback as a report showed China’s inflation cooled for the fifth straight month in December, increasing speculation the Asian nation will provide more monetary stimulus.

The so-called kiwi also rose to its strongest level since November versus the yen before data that may show U.S. retail sales grew, supporting demand for riskier assets. China’s consumer prices rose 4.1 percent from a year earlier, the National Bureau of Statistics said in Beijing today. That compares with the median estimate of 4 percent in a Bloomberg News survey and 4.2 percent in November.

The People’s Bank of China in November cut the amount of cash that lenders need to set aside as reserves, the first reduction since 2008. China is Australia’s biggest trading partner and New Zealand’s second-largest export market.

Sales at U.S. retailers probably climbed 0.3 percent in December, following a 0.2 percent gain in November, according to the median forecast in a Bloomberg survey of economists before the Commerce Department issues the figure today.

EUR/USD: on Asian session the pair traded in range $1.2700-$1.2730.

GBP/USD: on Asian session the pair traded in range $1.5305-$1.5330.

USD/JPY: on Asian session the pair traded in range Y76.80-Y76.90.

European data starts at 0630GMT with France HICP, which is followed by German final HICP at 0700GMT and then France balance of

payments and central government deficit data at 0745GMT. At 0900GMT, ECB Governing Council member Jens Weidmann, German Finance Minister Wolfgang Schaeuble and German Chancellor Angela Merkel all attend a New Year's reception of the German President, in Berlin. EMU data at includes industrial output at 1000GMT and the OECD leading indicator at 1100GMT. UK data at 0930GMT sees the Index of Production as well as Industrial Production and Manufacturing Output data. Manufacturing output plunged on the month in October, and unless there is a sharp rebound in November and December the sector will end up making a negative contribution to Q4 GDP. US data starts at 1330GMT with both initial jobless benefit claims and retail sales data. At 1500GMT, US business inventories are expected to rise 0.5% in November after the 0.8% increase in October. Factory inventories were already reported up 0.5%. Late US data sees the 2130GMT release of Money Supply.

Yesterday the euro weakened to a 16-month low versus the dollar and dropped for the first time in three days against the yen amid speculation France’s credit rating may be downgraded and Europe’s sovereign debt crisis will worsen. The shared currency declined against 14 of its 16 most- traded peers even after French Finance Minister Francois Baroin denied having been notified by a ratings company that the nation’s top rating will be cut. The euro extended losses as leading members of the European Parliament objected to a planned German-led euro fiscal treaty.

Sterling was the worst performer against the dollar after data showed the U.K. trade deficit increased more than forecast. British retail-store inflation also slowed to the least in 16 months, fueling bets the Bank of England will need to add stimulus to aid the economy.

The pound dropped 1 percent to $1.5303 and fell 0.3 percent to 82.76 pence per euro.

The U.S. currency rose against most of its major peers as investors sought the safety of Treasuries. Yields on 10-year notes dropped to the lowest level in two days, 1.92 percent.

The Dollar Index (DXY), which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, gained as much as 0.7 percent to 81.493, approaching Jan. 9’s 81.503, the highest since September 2010.

EUR/USD: yesterday the pair fell and has updated a monthly’s low.

GBP/USD: yesterday the pair has lost one and a half figure.

USD/JPY: yesterday the pair has a little grown.

European data starts at 0630GMT with France HICP, which is followed by German final HICP at 0700GMT and then France balance of

payments and central government deficit data at 0745GMT. At 0900GMT, ECB Governing Council member Jens Weidmann, German Finance Minister Wolfgang Schaeuble and German Chancellor Angela Merkel all attend a New Year's reception of the German President, in Berlin. EMU data at includes industrial output at 1000GMT and the OECD leading indicator at 1100GMT. UK data at 0930GMT sees the Index of Production as well as Industrial Production and Manufacturing Output data. Manufacturing output plunged on the month in October, and unless there is a sharp rebound in November and December the sector will end up making a negative contribution to Q4 GDP. US data starts at 1330GMT with both initial jobless benefit claims and retail sales data. At 1500GMT, US business inventories are expected to rise 0.5% in November after the 0.8% increase in October. Factory inventories were already reported up 0.5%. Late US data sees the 2130GMT release of Money Supply.

Japanese stocks advanced as increased U.S. hiring boosted the earnings outlook for exporters. Gains were limited before reports expected to show Europe may be edging toward recession.

Sony Corp., which depends on the U.S. for 20 percent of its sales, rose 0.5%.

Nomura Holdings Inc. climbed 3.2% on speculation the resignation of its wholesale banking chief will allow the brokerage to revamp after overseas losses.

Tokyo Electric Power Co., which operates the crippled Fukushima Dai-Ichi nuclear plant, fell 6.1% after soaring as much as 29% yesterday on speculation it will avoid delisting.

European stocks fell from a one-week high as Fitch Ratings said the European Central Bank must do more to prevent debt crisis from spreading and a report indicated the German economy is shrinking.

Metro AG, Germany’s largest retailer, declined 3.3% after Benjamin Peters, an analyst at UBS AG, cut the stock to “sell” from “neutral.” The shares “will come under increasing pressure from earnings downgrades,” Peters wrote in a report.

Nestle SA, the world’s biggest food company, fell 1.7% after Bank of America Corp. downgraded the stock to “neutral” from “buy.”

Aryzta AG, a Swiss supplier of bakery products to supermarkets and restaurants, tumbled 6.8% after it sold 4.25 million new shares at 41 francs each. That was the largest drop since April 2009 and the worst performance in the Stoxx 600 today.

Italian banks advanced today, with Banca Popolare di Milano Scarl jumping 9.4%. Banca Monte dei Paschi di Siena SpA increased 8.1%. UniCredit SpA gained 5.5% as the shares were raised to “outperform” from “underperform” by Sanford C. Bernstein & Co. analysts, who cited the stock’s “now attractive” valuation. The bank was also upgraded to “neutral” from “reduce” by WestLB.

U.S. stocks rose as gains in banking and technology shares helped the market recover from an early slump spurred by growing signs Europe may slip into a recession.

Citigroup Inc. (+4,23%) led banks higher after analyst Dick Bove said the shares could “easily” triple in five years.

Germany’s Federal Statistics Office said the economy probably shrank in the fourth quarter from the third and three research institutes forecast in a joint report that the euro-area economy contracted in the fourth quarter and will continue to decline in the first three months of 2012. The Federal Reserve said that the U.S. economy improved last month across most of the country even as hiring was limited and housing remained stagnant.

Microsoft (MSFT) Corp. (-0,43%) recovered from earlier losses triggered after the world’s largest software maker said industrywide sales of personal computers will probably be lower than analysts projected in the fourth quarter because supply was hurt by flooding in Thailand.

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.05 (Jan 11 high, MA(233) H1)

The current price: Y76.91

Support 1:Y76.75 (Jan 9 low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9650 (Feb 9 high)

Resistance 2: Chf0.9595 (Jan 9 high)

Resistance 1: Chf0.9565 (Jan 11 high)

The current price: Chf0.9525

Support 1: Chf0.9465 (Jan 10 low, MA (233) H1)

Support 2: Chf0.9415 (61.8% FIBO Chf0.9595-Chf0.9305)

Support 3: Chf0.9395 (Dec 29 low)

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5445 (resistance line from Jan 4)

Resistance 1 : $1.5375 (middle line from Jan 4)

The current price: $1.5320

Support 1 : $1.5270 (Oct 6 low)

Support 2 : $1.5200 (psychological level)

Support 3 : $1.5125 (Jul 21 low)

Resistance 3: $ 1.2870 (50.0% FIBO $1.2665-$1.3075)

Resistance 2: $ 1.2820 (Jan 10 high)

Resistance 1: $ 1.2790 (Jan 11 high)

The current price: $1.2718

Support 1 : $1.2660 (Jan 11 low)

Support 2 : $1.2625 (Aug 31 low)

Support 3 : $1.2590 (Aug 24 low)

Change % Change Last

Oil $101.07 +0.20 +0.20%

Gold $1,643.60 +4.00 +0.24%

Change % Change Last

Nikkei 8,448 +25.62 +0.30%

Hang Seng 19,152 +147.66 +0.78%

Shanghai Composite 2,276 -9.70 -0.42%

FTSE 5,671 -25.88 -0.45%

CAC 3,205 -5.96 -0.19%

DAX 6,152 -10.64 -0.17%

Dow 12,456.27 -6.20 -0.05%

Nasdaq 2,712.49 +9.99 +0.37%

S&P 500 1,293.16 +1.08 +0.08%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2705 -0,56%

GBP/USD $1,5326 -1,02%

USD/CHF Chf0,9539 +0,51%

USD/JPY Y76,85 +0,01%

EUR/JPY Y97,64 -0,56%

GBP/JPY Y117,78 -1,00%

AUD/USD $1,0308 -0,04%

NZD/USD $0,7968 +0,33%

USD/CAD C$1,0195 +0,40%

01:30 China CPI y/y December +4.2% +4.0%

01:30 China PPI y/y December +2.7% +1.6%

05:00 Japan Eco Watchers Survey: Current December 45.0 46.3

05:00 Japan Eco Watchers Survey: Outlook December 44.7

06:00 Japan Prelim Machine Tool Orders, y/y December +15.8%

06:30 France CPI, m/m December +0.3% +0.2%

06:30 France CPI, y/y December +2.5% +2.3%

07:00 Germany CPI, m/m December +0.7% +0.7%

07:00 Germany CPI, y/y December +2.1% +2.1%

09:30 United Kingdom Industrial Production (MoM) November -0.7% +0.1%

09:30 United Kingdom Industrial Production (YoY) November -1.7% -2.2%

09:30 United Kingdom Manufacturing Production (MoM) November -0.7% +0.1%

09:30 United Kingdom Manufacturing Production (YoY) November +0.3% -0.5%

10:00 Eurozone Industrial production, (MoM) November -0.1% -0.2%

10:00 Eurozone Industrial Production (YoY) November +1.3% +0.3%

12:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50%

12:45 Eurozone ECB Interest Rate Decision 0 1.00% 1.00%

13:30 Eurozone ECB Press Conference 0

13:30 Canada New Housing Price Index November +0.2% +0.3%

13:30 U.S. Initial Jobless Claims 07.01.2012 372 370

13:30 U.S. Retail sales December +0.2% +0.3%

13:30 U.S. Retail sales excluding auto December +0.2% +0.3%

15:00 United Kingdom NIESR GDP Estimate December +0.3%

15:00 U.S. Business inventories November +0.8% +0.4%

19:00 U.S. Federal budget December -137.3 -79.0

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.