- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-01-2012

Oil prices on trading on Monday after growing up in lower Friday on rumors of the intention of the international agency Standard & Poor's to lower the ratings of the eurozone countries. Oil price increase is largely due to technical purchases of oil futures, which trade over the past week, noticeably down in value because of the appreciated dollar and because of an unexpected increase in U.S. commercial inventories of crude oil and petroleum products.

Dollar since the beginning of the day slightly decreased against the euro and other currencies, further ensuring the conditions for speculative purchases of oil and other commodity assets whose prices are set in U.S. currency. Thus, the dollar index for the six major world currencies fell slightly below the 81.5 points after the day on January 13th 2012. This figure peaked in September 2010. - 81.515 points.

Price of Brent crude on Monday morning growing up more actively than the price of crude oil WTI, which is due to the forthcoming completion of the contract period for the futures Brent for February delivery while maintaining the fears of supply disruptions of oil from the Persian Gulf if Iran will make the blockade of the Strait of Hormuz.

The February futures contract for WTI crude oil during today's trading rose to 99.80 dollars a barrel.

Gold has somewhat compensated for losses incurred on Friday due to the lowering of the rating agency Standard & Poor's ratings of nine of the 17 eurozone countries, which deprived France and Austria the highest ratings.

Demand for gold jewelry in India - one of the world's largest gold markets - rose by 5-7 percent in 2011 and will grow by 10-15 percent this year due to lower gold prices, said the head of one of the largest retail companies in India sales of jewelry.

In Italy, Europe's largest exporter of gold jewelry, sales fell sharply in 2011 and remain low in 2012, so as to affect demand for the debt crisis and government measures to strengthen the economy, according to senior industry representatives.

Gold for February deliveries in today's trading increased to $1648.0 per ounce.

Resistance 3: 1297 (Jan 12 high)

Resistance 2: 1294 (Jan 13 high)

Resistance 1: 1291 (Jan 10 high)

Current price: 1287,25

Support 1:1286 (61,8 % FIBO of Jan 13 ’s falling)

Support 2 :1283 (50,0 % FIBO of Jan 13 ’s falling)

Support 3 : 1280 (38.2 % FIBO of Jan 13 ’s falling, intraday low)EUR/USD $1.2500, $1.2550, $1.2600, $1.2700, $1.2800

USD/JPY Y77.00, Y76.80, Y76.50

GBP/USD $1.5250, $1.5350, $1.5450

EUR/CHF Chf1.2100

AUD/USD $1.0150, $1.0200, $1.0350

- France receives total EUR17.036b bids for treasury bills

- France 10-year OAT spread is 3bps tighter at +127bps.

France ready for a potential increase in interest rates

Negotiations on Greece is not stopped, just take a break

Comments S & P needed in the future

08:15 Switzerland Producer & Import Prices, m/m December -0.8% -0.4% +0.3%

08:15 Switzerland Producer & Import Prices, y/y December -2.4% -2.8% -2.3%

The euro is still under pressure as France prepared to sell bills after Standard & Poor’s stripped the nation of its top credit rating and cut eight other euro-region nations.

Europe’s shared currency briefly pared declines after the European Central Bank was said to buy Italian and Spanish debt to cap yield increases.

The euro dropped on Fraday amid reports of imminent ratings cuts before S&P lowered the top grades of France and Austria one level to AA+, with “negative” outlooks. The company affirmed the ratings of countries including Germany, Belgium and the Netherlands and downgraded Italy, Portugal, Spain and Cyprus by two steps and Malta, Slovakia and Slovenia by one level.

EUR/USD: during european session the pair was limited $1.2620-$ 1,2680.

Resistance 3: Y77.60 (61.8 % FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0 % FIBO Y78.20-Y76.60)

Resistance 1: Y77.00/05 (session high, Jan 11 high)

Current price: Y76.78

Support 1:Y76.65 (Jan 12-13 lows)

Support 2:Y76.55 (lows of November and January)

Support 3:Y75.60 (Oct 31 loiw)

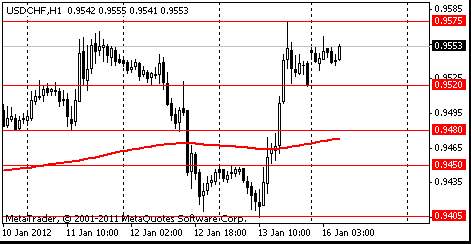

Resistance 3: Chf0.9780 (Feb'2011 high)

Resistance 2: Chf0.9595 (Jan 9 high)

Resistance 1: Chf0.9570 (area of session high and Jan 11 and 13 highs)

Current price: Chf0.9545

Support 1: Chf0.9510 (38,2 % FIBO of Friday's growth)

Support 2: Chf0.9490 (50,0 % FIBO of Friday's growth, МА (200) for Н1)

Support 3: Chf0.9470 (61,8 % FIBO of Friday's growth)

Resistance 3 : $1.5410 (Jan 13 high)

Resistance 2 : $1.5350 (resistance line from Jan 11)

Resistance 1 : $1.5330 (session high)

Current price: $1.5304

Support 1 : $1.5280 (session low)

Support 2 : $1.5230 (Jan 13 low)

Support 3 : $1.5200 (psychological level)

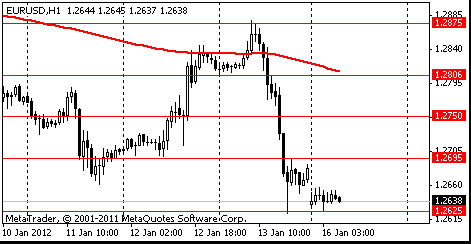

Resistance 3 : $1.2750 (50,0 % FIBO of Friday's falling)

Resistance 2 : $1.2720 (38,2 % FIBO of Friday's falling)

Resistance 1 : $1.2680 (session high)

Current price: $1.2670

Support 1 : $1.2620 (session low, Jan 13 high)

Support 2 : $1.2590 (Aug'2010 low)

Support 3 : $1.2520 (Jul 13'2010 low)

EUR/USD $1.2500, $1.2550, $1.2600, $1.2700, $1.2800

USD/JPY Y77.00, Y76.80, Y76.50

GBP/USD $1.5250, $1.5350, $1.5450

EUR/CHF Chf1.2100

AUD/USD $1.0150, $1.0200, $1.0350

19 Jan:

Bank of America (BAC), EPS cons. $0.21

Intel Corp (INTC), EPS cons. $0.61

Microsoft Corp (MSFT), EPS cons. $0.77

EUR/USD

Offers $1.2820, $1.2800, $1.2780/85, $1.2750/55, $1.2720/30, $1.2680/700

Bids $1.2625/00, $1.2590, $1.2550

Asian stocks fell ahead of a debt sale today by France after Standard & Poor’s stripped the country of its top credit rating and cut eight other European nations on concern the region hasn’t done enough to contain its debt crisis.

Nikkei 225 8,378 -121.66 -1.43%

Hang Seng 19,012 -192.22 -1.00%

S&P/ASX 200 4,147 -48.65 -1.16%

Shanghai Composite 2,206 -38.39 -1.71%

Financial companies contributed the most to the decline in the MSCI Asia Pacific Index. Mitsubishi UFJ Financial Group Inc. (8306), Japan’s biggest lender, fell 2.7 percent to 325 yen. HSBC Holdings Plc (HSBA), Europe’s biggest lender, lost 0.7 percent to HK$59.75. Hutchison Whampoa Ltd. (13), an operator of retail chains and ports that gets 53 percent of its revenue in Europe, slid 1.5 percent to HK$67.20.

On Monday the euro rose to a 16-month low against the dollar after meeting, German Chancellor Angela Merkel and French President Nicolas Sarkozy, specify a new set of rules of financial discipline discussed at the summit on December 9.

It became known of the resignation of the head of the Swiss National Bank Philipp Hildebrand. The resignation is related to the recent scandal of illegal operations with the use of insider information. Frank has become stronger after reports of the resignation of the head of the Swiss central bank.

On Tuesday the dollar declined as US stocks advanced, damping demand for safer investments. The euro’s gains were tempered before Spain and Italy sell debt this week amid concern the nations will struggle to meet funding needs. Spain will auction as much as 5 billion euros of bonds due in 2015 and 2016 on Jan. 12, and Italy will sell 12 billion euros of bills the same day.

On Wednesday the euro weakened to a 16-month low versus the dollar and dropped for the first time in three days against the yen amid speculation France’s credit rating may be downgraded and Europe’s sovereign debt crisis will worsen. The shared currency declined against 14 of its 16 most- traded peers even after French Finance Minister Francois Baroin denied having been notified by a ratings company that the nation’s top rating will be cut. The euro extended losses as leading members of the European Parliament objected to a planned German-led euro fiscal treaty.

On Thursday the euro rose to a one-week high versus the dollar after European Central Bank President Mario Draghi said he saw signs of stabilization in the economy and Spain sold almost twice its maximum target at a note auction.

The shared currency appreciated versus 14 of its 16 most- traded peers as Italian borrowing costs dropped at a bill auction. The ECB left its benchmark interest rate unchanged. The dollar fell the yen after data showed U.S. retail sales increased less than economists forecast.

On Friday the euro dropped amid speculation Standard & Poor’s may downgrade the credit ratings of several countries in the 17-nation currency region. The shared currency amid reports talks between Greece and its creditor banks were put on hold. The Dollar Index climbed as U.S. stocks fell after JPMorgan Chase & Co. said profit declined. The dollar climbed as risk appetite faded and investors sought refuge.

Germany, Europe’s biggest economy, will retain its AAA rating in a review of euro-area countries’ credit grades by S&P, a European government official said. France is among several euro-area countries facing downgrades by S&P in the review, which is due 20:0 GMT, the official said on condition of anonymity because the announcement has yet to be made. Austria will probably lose its AAA rating on concern about bad debts at the country’s banks, according to a person familiar with the matter.

Japanese shares rose after lower Italian and Spanish borrowing costs signaled that European policy makers are getting a handle on the debt crisis.

The Nikkei rose 1.4% to 8,500.02 on Fraiday, climbing 1.3% on the week.

Canon Inc., a camera maker that gets a third of its revenue in Europe, rose 3.1% after the yen fell against the euro yesterday.

Inpex Corp. climbed 1.2% after Japan’s biggest energy explorer said it would proceed with a $34 billion liquefied natural gas project in Australia.

Pacific Metals added 4.5%, while Bridgestone Corp. gained 1.4%. Iron and steel companies had the second-largest advance in the Topix’s 33 industry groups.

Goldman Sachs said Pacific Metals and Bridgestone are among the Japanese stocks that will advance the most this year as the market recovers from its worst slide since 2008.

European stocks rose as declining borrowing costs at sales of Italian and Spanish debt outweighed worse-than-forecast data on U.S. jobs and retail sales.

Spain auctioned 10 billion euros ($12.7 billion) of bonds maturing in 2015 and 2016 yesterday, twice the maximum target set for the sale. The yield on the three-year notes was 3.384 percent, compared with 5.187 percent when the nation sold similar securities in December.

Italy issued 12 billion euros of Treasury bills, meeting its target as its borrowing costs plunged. The Rome-based Treasury auctioned 8.5 billion euros one-year bills at a rate of 2.735 percent, down from 5.952 percent at the last auction.

Royal Bank of Scotland Group Plc climbed the most in two years, leading gains in financial shares. UniCredit SpA, Italy’s biggest bank, advanced 11%. ING Groep NV, the largest Dutch financial-services company, rallied 11%.

Commerzbank surged 16%. Germany’s second-largest lender plans to raise capital to levels required by the European Banking Authority without asking taxpayers for aid, said two people with knowledge of the matter.

U.S. stocks retreated as euro- region governments braced for credit downgrades by S&P and after JPMorgan Chase & Co.’s profit slumped.

After the market close, S&P said France lost its AAA rating. All 10 groups in the S&P 500 fell as financial and industrial gauges slid at least 0.7%.

JPMorgan, the largest U.S. bank by assets, dropped 2.5%. Bank of America Corp. (BAC), Intel Corp. (INTC) and Alcoa Inc. (AA) lost more than 1.3%.

Germany, Belgium, Estonia, Finland, Ireland, Luxembourg and the Netherlands had their ratings affirmed by S&P as France lost its AAA rating. France was cut to AA+ and the rating has a negative outlook, S&P said in a statement. Cyprus, Italy, Portugal and Spain were cut by two notches S&P said. The long- term ratings on Austria, Malta, Slovakia and Slovenia were cut one notch.

Concern about potential downgrades overshadowed data showing that confidence among U.S. consumers rose more than forecast in January to the highest level in eight months, a sign household spending may hold up early this year. Separate figures showed that the U.S. trade deficit widened more than forecast in November as American exports declined and companies stepped up imports of crude oil and automobiles.

Resistance 3: Chf0.9650 (Feb 9 high)

Resistance 2: Chf0.9595 (Jan 9 high)

Resistance 1: Chf0.9575 (Jan 13 high)

The current price: Chf0.9553

Support 1: Chf0.9520 (low of the American session on Jan 13)

Support 2: Chf0.9480 (MA (233) H1)

Support 3: Chf0.9450 (Jan 4 high)

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5405 (Jan 13 high)

Resistance 1 : $1.5365 (Jan 12 high)

The current price: $1.5302

Support 1 : $1.5275 (Jan 12 low, session low)

Support 2 : $1.5230 (Jan 13 low)

Support 3 : $1.5200 (a psychological level)

Resistance 3 : $1.2805 (MA (233) H1)

Resistance 2 : $1.2750 (50.0% FIBO $1.2625-$1.2875)

Resistance 1 : $1.2695 (high of the American session on Jan 13)

The current price: $1.2638

Support 1 : $1.2625 (session low)

Support 2 : $1.2590 (Aug 24 low)

Support 3 : $1.2530 (138.2% FIBO $1.2625-$1.2875)

00:00 U.S. Martin Luther King Day 0

00:01 United Kingdom Rightmove House Price Index (MoM) January -2.7%

00:01 United Kingdom Rightmove House Price Index (YoY) January +1.5%

00:30 Australia ANZ Job Advertisements (MoM) December 0.0%

00:30 Australia Home Loans November +0.7% +1.1%

05:00 Japan Consumer Confidence December 38.1 38.9

08:15 Switzerland Producer & Import Prices, m/m December -0.8% -0.4%

08:15 Switzerland Producer & Import Prices, y/y December -2.4% -2.8%

18:00 Eurozone ECB President Mario Draghi Speaks 0

21:00 New Zealand NZIER Business Confidence IV quarter 25

23:50 Japan Tertiary Industry Index November +0.6% -0.3%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.