- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 27-04-2015

(raw materials / closing price /% change)

Oil 56.99 -0.28%

Gold 1,201.20 -0.17%

(index / closing price / change items /% change)

HANG SENG 28,572.9 +511.92 +1.82%

TOPIX 1,619.07 +0.23 +0.01%

SHANGHAI COMP 4,523.69 +130.00 +2.96%

FTSE 100 7,103.98 +33.28 +0.47 %

CAC 40 5,268.91 +67.46 +1.30 %

Xetra DAX 12,039.16 +228.31 +1.93 %

S&P 500 2,108.92 -8.77 -0.41 %

NASDAQ Composite 5,060.25 -31.84 -0.63 %

Dow Jones 18,037.97 -42.17 -0.23 %

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0883 +0,11%

GBP/USD $1,5228 +0,26%

USD/CHF Chf0,9553 +0,21%

USD/JPY Y119,09 +0,09%

EUR/JPY Y129,61 +0,25%

GBP/JPY Y181,36 +0,40%

AUD/USD $0,7846 +0,31%

NZD/USD $0,7634 +0,46%

USD/CAD C$1,2089 -0,69%

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence April 93 91.15

08:30 United Kingdom BBA Mortgage Approvals March 37.3K

08:30 United Kingdom GDP, q/q (Preliminary) Quarter I 0.6% 0.7%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter I 3.0% 2.82%

12:45 Canada BOC Gov Stephen Poloz Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y February 4.6%

14:00 U.S. Richmond Fed Manufacturing Index April -8

14:00 U.S. Consumer confidence April 101.3

22:45 New Zealand Trade Balance, mln March 50 78.9

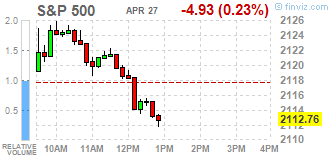

Major U.S. stock indexes rose on Monday morning of Apple's (AAPL.O) results after the close, but after 10AM went down. Investors this week will be closely watching the results of the two-day U.S. Federal Reserve meeting, starting Tuesday, for clues on when interest rates could be hiked.

Most of the Dow stocks are trading in negative area (18 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -1.74%). Top gainer -E. I. du Pont de Nemours and Company (DD, +4.29%).

S&P index sectors are moving mixed. Top gainer - Basic materials (+0,8%). Top looser- Healthcare (-1.3%).

At the moment:

Dow 17985.00 -32.00 -0.18%

S&P 500 2107.25 -4.50 -0.21%

Nasdaq 100 4525.50 -3.75 -0.08%

10-year yield 1.93% +0.01

Oil 57.11 -0.04 -0.07%

Gold 1205.20 +30.20 +2.57%

Stock indices closed higher on news that the Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

Friday's Eurogroup meeting ended without any results as widely expected. Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

The Prime Minister Alexis Tsipras held phone calls with German Chancellor Angela Merkel and Dijsselbloem on Sunday to discuss speeding up the negotiations. According to the Greek government, Greece will resume talks with its creditors today.

German Finance Minister Wolfgang Schaeuble hinted on Saturday that Germany was preparing for a possible Greek default.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,103.98 +33.28 +0.47 %

DAX 12,039.16 +228.31 +1.93 %

CAC 40 5,268.91 +67.46 +1.30 %

Brent crude traded higher on concerns over a disruption to oil supplies support due to fights in Yemen, while WTI crude oil declined.

Saudi Arabia continued airstrikes against the Iran-allied Houthi rebels in Yemen.

Analysts expect that the U.S. oil production will decline. The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 31 rigs to 703 last week, the lowest weekly level since October 2010. Combined oil and gas rigs fell by 22 to 932, the lowest level since July 2009.

WTI crude oil for June delivery declined to $56.71 a barrel on the New York Mercantile Exchange. Brent crude oil for June rose to $65.31 a barrel on ICE Futures Europe.

Gold price rose on the Greek debt problem and the soft U.S. economic data. Friday's Eurogroup meeting ended without any results as widely expected. Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

The Prime Minister Alexis Tsipras held phone calls with German Chancellor Angela Merkel and Dijsselbloem on Sunday to discuss speeding up the negotiations. According to the Greek government, Greece will resume talks with its creditors today.

German Finance Minister Wolfgang Schaeuble hinted on Saturday that Germany was preparing for a possible Greek default.

The recently released soft U.S. economic data also supported gold price ahead of the Fed's monetary policy meeting. The U.S. preliminary services purchasing managers' index (PMI) declined to 57.8 in April from 59.2 in March, beating expectations for a decrease to 57.4. The decline was driven by a decrease in new business growth.

It is likely that the Fed will delay its first interest rate hike.

June futures for gold on the COMEX today climbed to 1203.90 dollars per ounce.

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary services purchasing managers' index (PMI) declined to 57.8 in April from 59.2 in March, beating expectations for a decrease to 57.4.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a decrease in new business growth.

The Markit Chief Economist Chris Williamson said that "he economy as a whole picking up speed again after a temporary soft patch at the start of the year".

The preliminary employment at service companies climbed to 55.4 in April from 54.0 in March.

German IW economic institute released its growth forecast for Germany on Monday. Germany's economy is expected to expand at around 2.25% in 2015.

The growth will be driven by "numerous positive special effects" such as low oil prices, low interest rates and a weaker euro.

The director of the IW economic institute Michael Huether noted that these "positive special effects" are short-lived.

The German government expects the economy to grow 1.8%.

EUR/USD: $1.0800(E848mn), $1.0900 (E1.3bn)

USD/JPY: Y119.00($768mn), Y120.00($1.7bn)

GBP/USD: $1.5080-90(Gbp420mn), $1.5200(Gbp264mn)

AUD/USD: $0.7780-90(A$560mn)

NZD/USD: $0.7575(NZ$283mn)

USD/CAD: C$1.2000($700mn), C$1.2035-50($700mn), C$1.2165($869mn), C$1.2200($710mn)

Stock futures were moving higher on Monday, extending a record run for the S&P 500 and Nasdaq, as markets awaited a busy week of earnings and a meeting of the Federal Reserve.

Global markets:

Nikkei 19,983.32 -36.72 -0.18%

Hang Seng 28,433.59 +372.61 +1.33%

Shanghai Composite 4,528.1 +134.42 +3.06%

FTSE 7,119.34 +48.64 +0.69%

CAC 5,262.02 +60.57 +1.16%

DAX 12,016.39 +205.54 +1.74%

Crude oil $56.86 (-0.49%)

Gold $1185.90 (+0.92%)

(company / ticker / price / change, % / volume)

| Yandex N.V., NASDAQ | YNDX | 20.68 | +0.05% | 8.6K |

| Boeing Co | BA | 148.61 | +0.14% | 0.3K |

| General Electric Co | GE | 26.84 | +0.15% | 33.9K |

| Google Inc. | GOOG | 566.05 | +0.18% | 59.0K |

| Citigroup Inc., NYSE | C | 53.00 | +0.19% | 4.4K |

| ALCOA INC. | AA | 13.25 | +0.23% | 0.2K |

| JPMorgan Chase and Co | JPM | 62.75 | +0.24% | 1.2K |

| International Paper Company | IP | 53.81 | +0.26% | 0.7K |

| Goldman Sachs | GS | 198.53 | +0.27% | 0.4K |

| The Coca-Cola Co | KO | 41.00 | +0.27% | 0.4K |

| E. I. du Pont de Nemours and Co | DD | 71.72 | +0.28% | 0.7K |

| Cisco Systems Inc | CSCO | 28.91 | +0.31% | 16.5K |

| Intel Corp | INTC | 32.18 | +0.31% | 2.5K |

| Ford Motor Co. | F | 15.82 | +0.32% | 6.5K |

| General Motors Company, NYSE | GM | 35.74 | +0.42% | 8.7K |

| UnitedHealth Group Inc | UNH | 119.20 | +0.43% | 0.9K |

| Pfizer Inc | PFE | 35.44 | +0.48% | 3.2K |

| Yahoo! Inc., NASDAQ | YHOO | 44.87 | +0.79% | 7.2K |

| Merck & Co Inc | MRK | 58.06 | +0.80% | 0.5K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 21.00 | +0.86% | 4.3K |

| Tesla Motors, Inc., NASDAQ | TSLA | 220.45 | +0.93% | 15.4K |

| Walt Disney Co | DIS | 111.00 | +1.34% | 13.5K |

| Apple Inc. | AAPL | 132.27 | +1.53% | 1.3M |

| Barrick Gold Corporation, NYSE | ABX | 12.72 | +1.60% | 17.0K |

| AT&T Inc | T | 34.01 | 0.00% | 21.8K |

| Visa | V | 67.48 | 0.00% | 1.9K |

| Caterpillar Inc | CAT | 84.60 | 0.00% | 11.5K |

| Chevron Corp | CVX | 109.87 | 0.00% | 5.0K |

| Exxon Mobil Corp | XOM | 86.97 | 0.00% | 6.5K |

| Home Depot Inc | HD | 113.70 | 0.00% | 3.3K |

| International Business Machines Co... | IBM | 169.78 | 0.00% | 0.6K |

| Johnson & Johnson | JNJ | 101.08 | 0.00% | 0.6K |

| Wal-Mart Stores Inc | WMT | 79.84 | 0.00% | 0.2K |

| Deere & Company, NYSE | DE | 88.39 | 0.00% | 0.1K |

| Facebook, Inc. | FB | 81.53 | 0.00% | 95.1K |

| Hewlett-Packard Co. | HPQ | 33.25 | -0.03% | 0.1K |

| Verizon Communications Inc | VZ | 49.95 | -0.16% | 1.8K |

| Twitter, Inc., NYSE | TWTR | 50.73 | -0.18% | 232.1K |

| Amazon.com Inc., NASDAQ | AMZN | 444.20 | -0.20% | 32.0K |

| Procter & Gamble Co | PG | 80.77 | -0.28% | 9.9K |

| American Express Co | AXP | 77.70 | -0.37% | 7.5K |

| Starbucks Corporation, NASDAQ | SBUX | 51.65 | -0.37% | 14.1K |

| Microsoft Corp | MSFT | 47.57 | -0.63% | 85.2K |

Destatis released its import prices data for Germany on Monday. German import prices declined by 1.4% in March from last year, after a 3% fall in February.

Import prices decline since January 2013.

On a monthly base, import prices increased 1% in March, after a 1.4% in February.

On a monthly base, import prices excluding crude oil and mineral oil products climbed by 1% in March.

Export prices climbed to 1.4% year-on-year in March from 0.7% in February.

On a monthly base, export prices rose 0.6% in March.

Upgrades:

Downgrades:

Procter & Gamble (PG) downgraded from Outperform to Underperform at Credit Agricole

Amazon (AMZN) downgraded from Buy to Hold at Argus

American Express (AXP) downgraded from Buy to Neutral at Nomura

Twitter (TWTR) downgraded from Buy to Neutral at Sun Trust Rbsn Humphrey, target lowered from $58 to $50

Other:

Apple (AAPL) initiated at Buy at Brean Capital, target $160

Walt Disney (DIS) reiterated at Buy at Citigroup, target raised $110 to $125

April 27

After the Close:

Apple (AAPL. Consensus EPS $2.16, Consensus Revenue $56102.92 mln.

Barrick Gold (ABX). Consensus EPS $0.09, Consensus Revenue $2348.49 mln.

April 28

Before the Open:

Ford Motor (F). Consensus EPS $0.26, Consensus Revenue $33896.16 mln.

Pfizer (PFE). Consensus EPS $0.49, Consensus Revenue $10712.47 mln.

Merck (MRK). Consensus EPS $0.75, Consensus Revenue $9056.97 mln.

April 29

After the Close:

Baidu.com (BIDU). Consensus EPS $1.13, Consensus Revenue $2076.18 mln.

April 30

Before the Open:

Exxon Mobil (XOM). Consensus EPS $0.84, Consensus Revenue $62681.42 mln.

After the Close:

American Intl (AIG). Consensus EPS $1.19, Consensus Revenue $5228.00 mln.

Visa (V). Consensus EPS $0.62, Consensus Revenue $3338.69 mln.

May 1

Before the Open:

Chevron (CVX). Cредний прогноз: EPS $0.80, Consensus Revenue $33965.01 mln.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand Bank holiday

10:00 United Kingdom CBI industrial order books balance April 0 1

The U.S. dollar traded higher against the most major currencies ahead of the U.S. preliminary services purchasing managers' index (PMI). The U.S. preliminary services PMI is expected to decline to 57.4 in April from 59.2 in March.

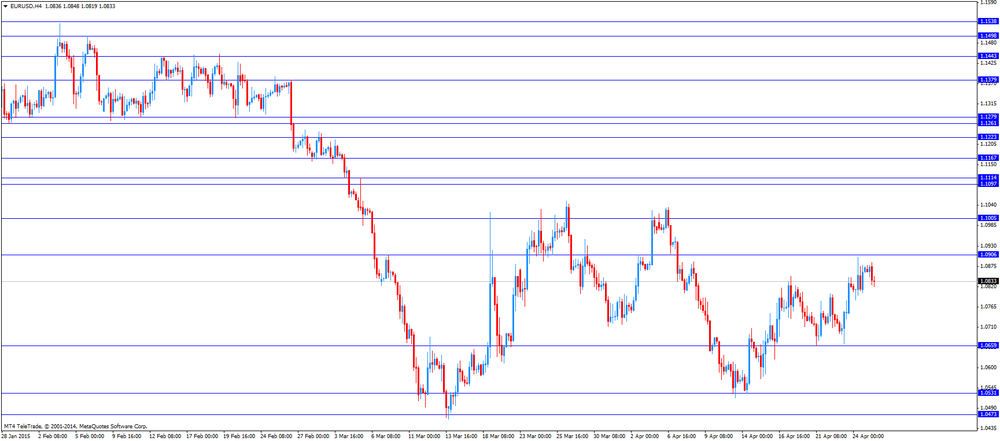

The euro traded lower against the U.S. dollar as the Greek debt crisis continues to weigh on the euro. Friday's Eurogroup meeting ended without any results as widely expected. Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

The Prime Minister Alexis Tsipras held phone calls with German Chancellor Angela Merkel and Dijsselbloem on Sunday to discuss speeding up the negotiations. According to the Greek government, Greece will resume talks with its creditors today.

German Finance Minister Wolfgang Schaeuble hinted on Saturday that Germany was preparing for a possible Greek default.

The British pound traded lower against the U.S. dollar after the CBI industrial order books balance data from the U.K. The CBI industrial order books balance rose to +1% in April from +0% in March.

The increase was driven by a higher output and new orders expectation.

In the first quarter of 2015, the balance of firms reporting a rise in order books was at 13%.

EUR/USD: the currency pair decreased to $1.0819

GBP/USD: the currency pair fell to $1.5106

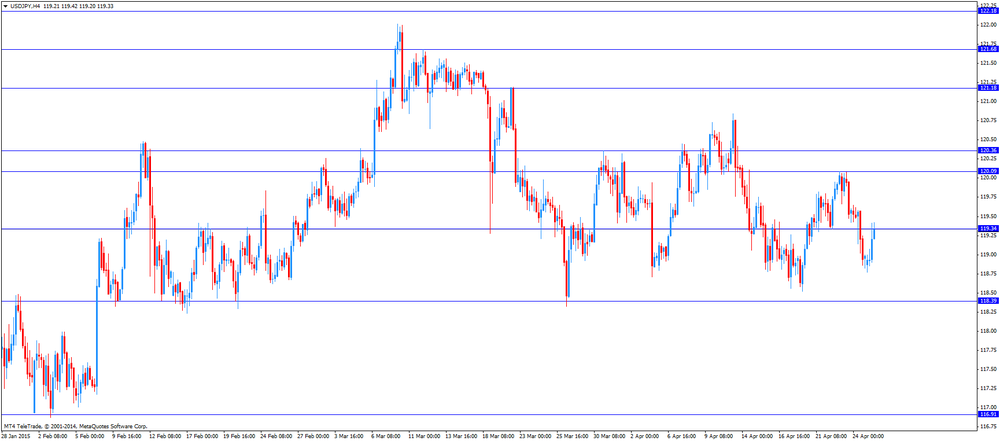

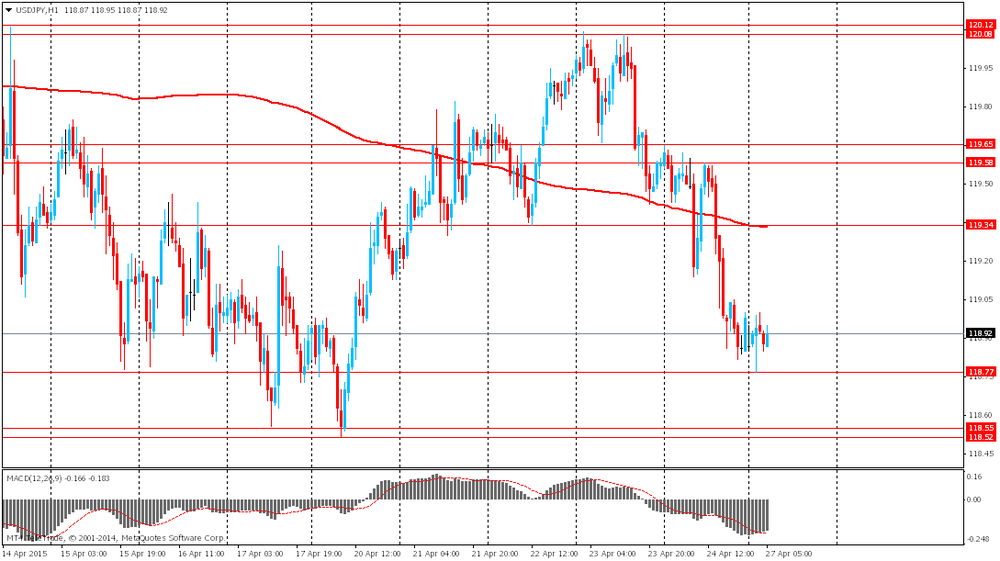

USD/JPY: the currency pair rose to Y119.42

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) April 59.2 57.37

22:40 Australia RBA's Governor Glenn Stevens Speech

EUR/USD

Offers 1.0880-85 1.0900 1.0920 1.0950 1.0980 1.1000

Bids 1.0830 1.0815-20 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.5185 1.5200 1.5220 1.5250 1.5280 1.5300 1.5325-30

Bids 1.5130 1.5100-10 1.5080 1.5065 1.5050 1.5030 1.5000 1.4980 1.4960

EUR/JPY

Offers 129.80 130.00 130.30 130.80 131.00 131.30 131.50

Bids 129.20 129.00 128.80 128.40 128.00

USD/JPY

Offers 119.40 119.60 119.75-80 120.00 120.20 120.50 120.80 121.00

Bids 119.00 118.80-85 118.65 118.50 118.25-30 118.00

EUR/GBP

Offers 0.7180 0.7200 0.7220-25 0.7235 0.7250 0.7265

Bids 0.7150 0.7125-30 0.7100-10 0.7085

AUD/USD

Offers 0.7830 0.7850-60 0.7875 0.7900 0.7925-30

Bids 0.7800 0.7780-85 0.7760 0.7725 0.7700 0.7675-80 0.7650

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to +1% in April from +0% in March.

The increase was driven by a higher output and new orders expectation.

In the first quarter of 2015, the balance of firms reporting a rise in order books was at 13%.

The CBI Deputy Director-General Katja Hall said that manufacturers in the U.K. expect the growth to continue.

"Exports keep dragging at the heels of growth: firms are finding the recent rise in the Pound against the Euro challenging, making them less competitive in Europe, while the unravelling situation in Greece is creating uncertainty," Hall said.

Stock indices traded lower on the Greek debt crisis. Friday's Eurogroup meeting ended without any results as widely expected. Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

The Prime Minister Alexis Tsipras held phone calls with German Chancellor Angela Merkel and Dijsselbloem on Sunday to discuss speeding up the negotiations. According to the Greek government, Greece will resume talks with its creditors today.

German Finance Minister Wolfgang Schaeuble hinted on Saturday that Germany was preparing for a possible Greek default.

Current figures:

Name Price Change Change %

FTSE 100 7,049.51 -21.19 -0.30 %

DAX 11,785.1 -25.75 -0.22 %

CAC 40 5,154.25 -47.20 -0.91 %

Fitch Ratings has downgraded Japan's rating to 'A' from 'A+' on Monday. The outlook is stable.

The downgrade was driven by the lack of "sufficient structural fiscal measures" in the Japanese government's budget for the fiscal year ending March 31, 2016 (FY15) "to replace a deferred consumption tax increase".

Fitch placed Japan's rating on negative as the Japanese government had decided to delay the scheduled consumption tax rise.

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

The Prime Minister Alexis Tsipras held phone calls with German Chancellor Angela Merkel and Dijsselbloem on Sunday to discuss speeding up the negotiations. According to the Greek government, Greece will resume talks with its creditors today.

EUR/USD: $1.0800(E848mn), $1.0900 (E1.3bn)

USD/JPY: Y119.00($768mn), Y120.00($1.7bn)

GBP/USD: $1.5080-90(Gbp420mn), $1.5200(Gbp264mn)

AUD/USD: $0.7780-90(A$560mn)

NZD/USD: $0.7575(NZ$283mn)

USD/CAD: C$1.2000($700mn), C$1.2035-50($700mn), C$1.2165($869mn), C$1.2200($710mn)

China's National Bureau of Statistics released its industrial profits data for China on Monday. Industrial profits in China fell 2.7% year-over-year in the first quarter of 2015 to 1.25 trillion yuan.

Industrial profits declined 0.4% from a year ago to 508.61 billion yuan.

Mining profits plunged 61% in the first quarter of 2015 from a year earlier, while manufacturing profits rose by 4.9%.

HANG SENG 28,572.9 +511.92 +1.82%

S&P CNX NIFTY 8,248.7 -56.55 -0.68%

S&P/ASX 200 5,982.7 +49.41 +0.83%

TOPIX 1,619.07 +0.23 +0.01%

SHANGHAI COMP 4,523.69 +130.00 +2.96%

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 31 rigs to 703 last week, the lowest weekly level since October 2010.

Combined oil and gas rigs fell by 22 to 932, the lowest level since July 2009.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand Bank holiday

The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 major peers, was little changed at 1,180.62, after sliding 0.4 percent last week as orders of durable goods, manufacturing, and new home sales all came in weaker-than-projected.

Federal Reserve officials will decide on monetary policy on April 29, the same day a report is projected to show economic growth slowed. The Federal Open Market Committee was split at its meeting in March on when to begin raising rates, which have been held in a range of zero to 0.25 percent since 2008 to support the economy.

Japan's currency is set to resume its descent in the coming months as the BOJ will probably add to stimulus as early as July, said Ray Attrill, global co-head of currency strategy at National Australia Bank Ltd. in Sydney. Twenty-two of 34 economists in a Bloomberg survey conducted March 31 to April 3 forecast the BOJ will expand easing by the end of October. Three estimate the central bank will make a move on April 30.

EUR / USD: during the Asian session, the pair was trading around $1.0860

GBP / USD: during the Asian session the pair traded in the range of $1.5160-85

USD / JPY: during the Asian session the pair traded in the range of Y119.00

EUR / USD

Resistance levels (open interest**, contracts)

$1.0979 (2467)

$1.0940 (2530)

$1.0903 (2996)

Price at time of writing this review: $1.0871

Support levels (open interest**, contracts):

$1.0812 (1106)

$1.0772 (1644)

$1.0717 (3119)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 62546 contracts, with the maximum number of contracts with strike price $1,1200 (6845);

- Overall open interest on the PUT options with the expiration date May, 8 is 77313 contracts, with the maximum number of contracts with strike price $1,0000 (9281);

- The ratio of PUT/CALL was 1.24 versus 1.23 from the previous trading day according to data from April, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5504 (977)

$1.5406 (924)

$1.5309 (1001)

Price at time of writing this review: $1.5171

Support levels (open interest**, contracts):

$1.5088 (883)

$1.4992 (1932)

$1.4894 (1686)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 23948 contracts, with the maximum number of contracts with strike price $1,5000 (2801);

- Overall open interest on the PUT options with the expiration date May, 8 is 33233 contracts, with the maximum number of contracts with strike price $1,4700 (2713);

- The ratio of PUT/CALL was 1.39 versus 1.37 from the previous trading day according to data from April, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.