- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 29-04-2015

(raw materials / closing price /% change)

Oil 58.58 +2.66%

Gold 1,204.10 -0.49%

(index / closing price / change items /% change)

Hang Seng 28,400.34 -42.41 -0.15 %

S&P/ASX 200 5,838.6 -109.96 -1.85 %

Shanghai Composite 4,476.62 +0.41 +0.01 %

FTSE 100 6,946.28 -84.25 -1.20 %

CAC 40 5,039.39 -133.99 -2.59 %

Xetra DAX 11,432.72 -378.94 -3.21 %

S&P 500 2,106.85 -7.91 -0.37 %

NASDAQ Composite 5,023.64 -31.78 -0.63 %

Dow Jones 18,035.53 -74.61 -0.41 %

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1116 +1,27%

GBP/USD $1,5428 +0,59%

USD/CHF Chf0,9402 -1,60%

USD/JPY Y119,09 +0,21%

EUR/JPY Y132,39 +1,48%

GBP/JPY Y183,73 +0,81%

AUD/USD $0,7992 -0,36%

NZD/USD $0,7604 -1,67%

USD/CAD C$1,2015 -0,10%

(time / country / index / period / previous value / forecast)

01:30 Australia Import Price Index, q/q Quarter I 0.9%

01:30 Australia Export Price Index, q/q Quarter I 0.0%

01:30 Australia Private Sector Credit, y/y March 6.2%

01:30 Australia Private Sector Credit, m/m March 0.5% 0.59%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275

05:00 Japan Housing Starts, y/y March -3.1% 3.66%

05:00 Japan Construction Orders, y/y March 1.0% -1.04%

06:00 Germany Retail sales, real unadjusted, y/y March 3.6% 1.89%

06:00 Germany Retail sales, real adjusted March -0.5% 0.7%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

06:45 France Consumer spending March 0.1% -0.5%

06:45 France Consumer spending, y/y March 3.0%

07:00 Switzerland KOF Leading Indicator April 0.5 0.7

07:55 Germany Unemployment Change April -15 -13

07:55 Germany Unemployment Rate s.a. April 6.4% 6.4%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) April -0.1% 0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) April 0.6% 0.68%

09:00 Eurozone Unemployment Rate March 11.3% 11.3%

12:30 Canada GDP (m/m) February -0.1%

12:30 U.S. Continuing Jobless Claims April 2325 2406

12:30 U.S. Initial Jobless Claims April 295 300

12:30 U.S. Personal spending March 0.1% 0.27%

12:30 U.S. Personal Income, m/m March 0.4% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y March 1.4%

12:30 U.S. PCE price index ex food, energy, m/m March 0.1%

13:45 U.S. Chicago Purchasing Managers' Index April 46.3

14:30 Canada BOC Gov Stephen Poloz Speaks

23:30 Australia AIG Manufacturing Index April 46.3

23:30 Japan Unemployment Rate March 3.5% 3.5%

23:30 Japan Household spending Y/Y March -2.9% -11.7%

23:30 Japan Tokyo Consumer Price Index, y/y April 2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April 2.2%

23:30 Japan National Consumer Price Index, y/y March 2.2%

23:30 Japan National CPI Ex-Fresh Food, y/y March 2.0% 2.0%

U.S. stocks declined after the economy barely grew in the first quarter and investors weighed the timing for a possible interest-rate increase as the Federal Reserve said part of the weakness was transitory.

The Standard & Poor's 500 Index slipped 0.4 percent to 2,106.80 at 4 p.m. in New York, after earlier falling as much as 0.8 percent.

"It confirms people's view that the Fed won't raise interest rates in June - that's certainly driven home today by GDP growth," said Kristina Hooper, a U.S. investment strategist at Allianz Global Investors in New York. The firm oversees $499 billion. "But there is still some question mark because the Fed is blaming part of downturn in the first quarter on transitory factors."

Fed officials have said they expect to raise rates this year for the first time since 2006 as the economy nears full employment, and that their decision will be guided by the latest data. They had said last month that they would be unlikely to raise rates at their April meeting.

A run of disappointing economic data has cast doubt on how quickly the Fed can meet its goals for full employment and stable prices.

"Economic growth slowed during the winter months, in part reflecting transitory factors," the Federal Open Market Committee said in a statement Wednesday. "The pace of job gains moderated," it said, and "underutilization of labor resources was little changed."

A report earlier Wednesday showed growth almost ground to a halt in the first quarter, held back by severe winter weather and slumping business spending and exports.

Gross domestic product, the volume of all goods and services produced, rose at a 0.2 percent annualized rate after advancing 2.2 percent the prior quarter. The median forecast of 86 economists surveyed by Bloomberg called for a 1 percent gain.

"If they had taken out the word 'transitory,' you probably would have had the equity market turn positive," said Quincy Krosby, a market strategist at Prudential Financial Inc., in Newark, New Jersey. Prudential oversees more than $1 trillion in assets. "Just having that in there shows the Fed does believe it was, in fact, transitory i.e. we are going to be pushing into a rebound soon."

The S&P 500 has risen 1.9 percent this month, rebounding from a drop in March, after earnings from companies including Merck & Co. and Microsoft Corp. beat analysts' estimates. About 74 percent of the S&P 500 companies that have reported earnings this season have beaten analysts' profit projections, while 48 percent topped sales estimates.

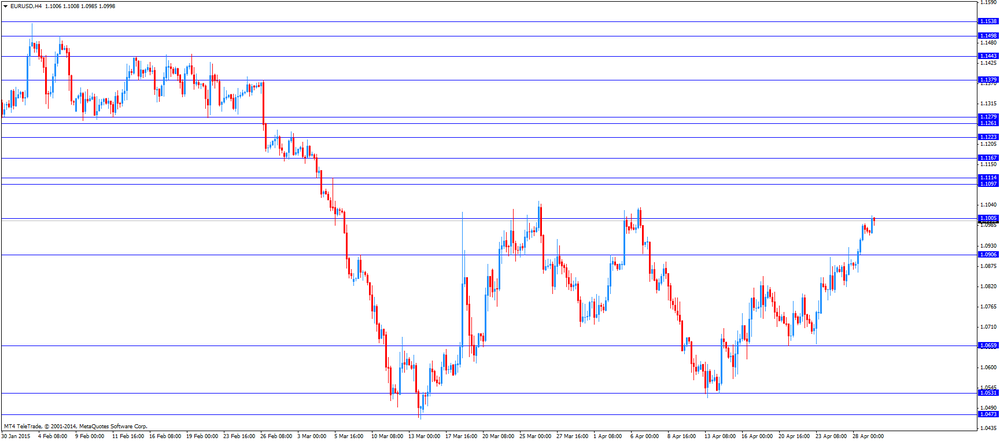

Shared currency on track to record its largest single-day gains against dollar, yen since March 18

The euro recorded strong gains against both the dollar and the yen Wednesday after a surprisingly weak reading on U.S. economic growth fueled more speculation that the Federal Reserve won't be in a hurry to raise interest rates.

The euro has risen about 1.4% against the dollar, and 1.5% against the yen so far, putting the shared currency on track to record its largest single-day percentage gain against both currencies since March 18.

The shared currency shot to session highs of (EURUSD)$1.1163 and (USDJPY) Yen132.64 after the weak U.S data. It traded at $1.0972 and Yen130.36 Tuesday afternoon.

The euro has now risen more than 6% against the dollar since it fell below $1.05 in mid-March, a time when many expected the Federal Reserve to raise rates as soon as June. Investors now expect the move to come later, most likely in September.

Investors will be looking for clues about the Fed's intentions when policy makers issue an updated monetary policy statement, expected at 2 p.m. Eastern.

U.S. gross domestic product expanded at an annual rate of 0.2% in the first quarter, according to a preliminary report from the Labor Department, far below the consensus forecast for 1.1% growth based on a poll of economists conducted by MarketWatch. A marked slowdown in business investment and exports were largely to blame for the slowdown. That contrasts with growth of 2.2% in last quarter of 2014.

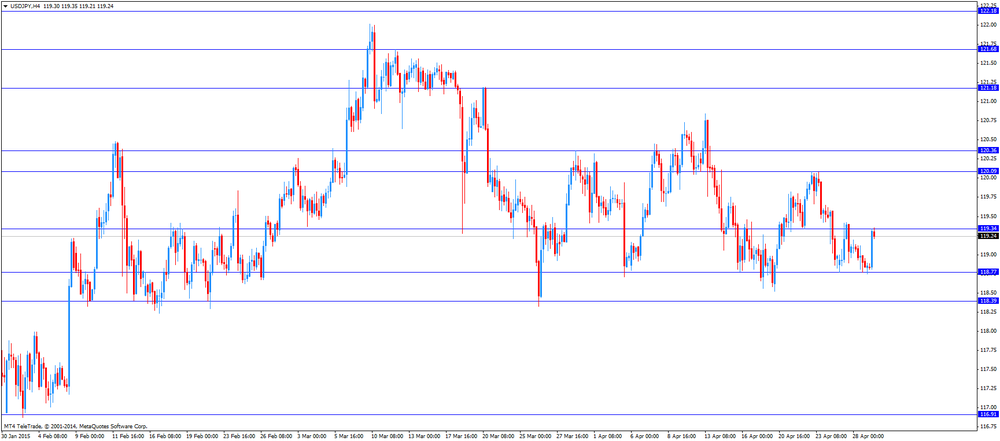

Colin Cieszynski, chief markets strategist at CMC Markets, said the euro's gains against the yen were a combination of a spillover from its strength against the dollar, and yen weakness ahead of a monetary policy update from the Bank of Japan, expected Thursday morning, local time.

"[The euro] seems that it's surging more against the yen than against the U.S. dollar, which I find intriguing," Cieszynski said.

The euro's gains against the yen show that investors expect Japan's central bank to maintain its program of asset purchases, Cieszynski said. The shared currency fell to its lowest level against the yen since June 2013 two weeks ago, but has since moved higher.

Meanwhile, the dollar was little changed against the Japanese currency.

One dollar (USDJPY) was worth Yen119.24 in recent trade, compared with Yen118.82 late Tuesday. One pound was worth $ 1.5334 Tuesday.

The dollar has traded in a range between Yen118.33 and Yen120.86 since late March.

In other currency trading, the pound (GBPUSD) rose to a session high of $1.5490, its highest level since late February.

Stock indices closed lower on a stronger euro. The euro rose against the U.S. dollar as the U.S. GDP was weaker than expected. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

U.S. consumers spending slowed in the first quarter due to cold weather. Energy companies in the U.S. cut spending due to lower low prices.

A strong U.S. dollar also weighed on GDP.

Investors are awaiting the results of the Fed's monetary policy meeting later in the day. They are awaiting signs when the Fed will start to hike its interest rate. It is unlikely that the Fed will start to raise its interest rate in June as the recently released U.S. economic data was weaker than expected.

The Greek debt focus remains in focus. Greek Finance Minister Yanis Varoufakis denied in an interview to the German newspaper Die Zeit on Wednesday that he was sidelined from debt talks between Greece and its creditors.

Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index declined to 103.7 in April from 103.9 in March, missing expectations for a rise to 104.1. It was the first decline in five months.

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 4.6% in March from last year, exceeding expectations for a 4.2% gain, after a 4 % increase in February.

On a yearly basis, M3 money supply in the Eurozone climbed to 4.1% from 3.8% in the period from December to February.

Loans to the private sector in the Eurozone increased 0.1% in March from the last year, in line with expectations, after a 0.1% decline in February. It was the first increase since March 2012.

The rise was driven by ECB's quantitative easing.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,946.28 -84.25 -1.20 %

DAX 11,432.72 -378.94 -3.21 %

CAC 40 5,039.39 -133.99 -2.59 %

Crude oil prices increased on lower U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) said on Wednesday that U.S. commercial crude inventories rose by 1.9 million barrels last week. Analysts had expected a gain of 2.3 million barrels.

The EIA also said that crude oil inventories at the oil hub at Cushing, Oklahoma, fell for the first time since November 28, 2014.

These figures may indicate that an oil glut starts to ease.

WTI crude oil for June delivery increased to $58.55 a barrel on the New York Mercantile Exchange. Brent crude oil for June climbed to $65.14 a barrel on ICE Futures Europe.

Gold price rose on the weaker-than-expected U.S. GDP data. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

Consumers spending slowed in the first quarter due to cold weather. Energy companies cut spending due to lower low prices.

A strong U.S. dollar also weighed on GDP.

Consumer spending grew 1.9% in the first quarter, after a 4.4% increase in the fourth quarter. The harsh weather weighed on the consumer spending.

The personal consumption expenditures (PCE) price index dropped at an annual rate of 2.0% in the first quarter. That was the weakest reading since the first quarter of 2009.

The personal consumption expenditures (PCE) price index excluding food and energy increased 0.9%.

Investors are awaiting the results of the Fed's monetary policy meeting later in the day. It is likely that the Fed will delay its first interest rate hike due to the recently released soft U.S. economic data.

June futures for gold on the COMEX today increased to 1213.50 dollars per ounce.

Major U.S. stock-indexes fell on Wednesday after data showed that economic growth braked more sharply than expected in the first quarter. U.S. gross domestic product grew at only 0.2% annual rate in the quarter as harsh weather dampened consumer spending and energy companies struggling with low prices cut spending.

Most of the Dow stocks are trading in negative area (23 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -2.87%). Top gainer - Visa Inc. (V, +1.32%).

All S&P index sectors in negative area. Top looser - Utilities (-0.8%).

At the moment:

Dow 18000.00 -58.00 -0.32%

S&P 500 2102.25 -9.75 -0.46%

Nasdaq 100 4493.00 -23.00 -0.51%

10-year yield 2.06% +0.09

Oil 58.43 +1.37 +2.40%

Gold 1209.60 -4.30 -0.35%

Greek Finance Minister Yanis Varoufakis denied in an interview to the German newspaper Die Zeit on Wednesday that he was sidelined from debt talks between Greece and its creditors.

"Yes, I'm in charge. I'm still responsible for the talks with the Eurogroup," Varoufakis said.

Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

The Confederation of British Industry released its retail sales balance data on Wednesday. The CBI retail sales balance was down to +12% in April from +18% in March.

"With shopping habits changing so dramatically in the last few years underlying consumer confidence is hard to read, but both retailers and wholesalers are optimistic there will be a spring in their customers' steps, and therefore their sales, in the near future," the CBI survey chairman and Asda's Chief Customer Officer Barry Williams said.

Sales expectations for next month jumped to +40% in April from +21% in March.

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Wednesday. Pending home sales in the U.S. rose 1.1% in March, after a 3.6% gain in February. February's figure was revised up from a 3.1% rise.

The NAR's chief economist Lawrence Yun said that the activity this year was driven by more long-term homeowners.

"Demand appears to be stronger in several parts of the country, especially in metro areas that have seen solid job gains and firmer economic growth over the past year," he noted.

EUR/USD: $1.0900(E314mn), $1.0920-25(E340mn), $1.1000(E414mn)*$1.1000 E2.3bn Apr30*

USD/JPY: Y119.50-60($600mn)

GBP/USD: $1.5430(Gbp200mn)

USD/CHF: Chf0.9540($340mn), Chf0.9565($380mn)

USD/CAD: C$1.2100($350mn), C$1.2200($420mn), C$1.2245($205mn)

Destatis released its consumer price data for Germany on Wednesday. German consumer prices fell 0.1% in April, missing expectations for a 0.4% rise, after a 0.5% gain in March.

On a yearly basis, German consumer price inflation climbed to 0.4% in April from a 0.3% gain in March, but missing expectations for a 0.5% increase. It was the fastest pace since November 2014.

The U.S. Commerce Department released gross domestic product data on Wednesday. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

Consumers spending slowed in the first quarter due to cold weather. Energy companies cut spending due to lower low prices.

A strong U.S. dollar also weighed on GDP.

Consumer spending grew 1.9% in the first quarter, after a 4.4% increase in the fourth quarter. The harsh weather weighed on the consumer spending.

The personal consumption expenditures (PCE) price index dropped at an annual rate of 2.0% in the first quarter. That was the weakest reading since the first quarter of 2009.

The personal consumption expenditures (PCE) price index excluding food and energy increased 0.9%.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation.

U.S. stock-index futures maintained losses as data showed the economy barely grew in the first quarter and investors awaited the Federal Reserve's policy decision.

Global markets:

Nikkei 20,058.95 +75.63 +0.38%

Hang Seng 28,400.34 -42.41 -0.15%

Shanghai Composite 4,476.62 +0.41 +0.01%

FTSE 6,981.95 -48.58 -0.69%

CAC 5,108.13 -65.25 -1.26%

DAX 11,644.4 -167.26 -1.42%

Crude oil $56.85 (-0.40%)

Gold $1211.20 (-0.21%)

(company / ticker / price / change, % / volume)

| Exxon Mobil Corp | XOM | 87.86 | +0.07% | 2.2K |

| McDonald's Corp | MCD | 96.94 | +0.11% | 0.1K |

| Boeing Co | BA | 147.75 | +0.16% | 0.7K |

| Apple Inc. | AAPL | 130.85 | +0.22% | 415.6K |

| Visa | V | 67.12 | +0.52% | 2.7K |

| E. I. du Pont de Nemours and Co | DD | 75.26 | +0.59% | 0.1K |

| Yandex N.V., NASDAQ | YNDX | 19.40 | +1.04% | 4.1K |

| UnitedHealth Group Inc | UNH | 117.58 | -0.01% | 0.1K |

| Ford Motor Co. | F | 15.90 | -0.06% | 86.2K |

| AMERICAN INTERNATIONAL GROUP | AIG | 56.75 | -0.09% | 0.4K |

| Chevron Corp | CVX | 111.00 | -0.11% | 0.2K |

| Home Depot Inc | HD | 110.45 | -0.12% | 4.5K |

| Wal-Mart Stores Inc | WMT | 79.00 | -0.13% | 9.4K |

| Barrick Gold Corporation, NYSE | ABX | 13.28 | -0.15% | 47.2K |

| General Electric Co | GE | 27.06 | -0.22% | 3.6K |

| Starbucks Corporation, NASDAQ | SBUX | 50.50 | -0.22% | 11.6K |

| Johnson & Johnson | JNJ | 100.50 | -0.24% | 1.5K |

| International Business Machines Co... | IBM | 173.45 | -0.27% | 0.5K |

| The Coca-Cola Co | KO | 40.66 | -0.27% | 3.8K |

| ALCOA INC. | AA | 13.44 | -0.30% | 27.0K |

| Nike | NKE | 99.54 | -0.32% | 10.7K |

| Citigroup Inc., NYSE | C | 52.85 | -0.32% | 11.6K |

| General Motors Company, NYSE | GM | 35.60 | -0.34% | 0.2K |

| American Express Co | AXP | 77.22 | -0.35% | 0.9K |

| Procter & Gamble Co | PG | 80.14 | -0.35% | 9.4K |

| Walt Disney Co | DIS | 109.52 | -0.36% | 5.5K |

| Google Inc. | GOOG | 551.69 | -0.36% | 0.2K |

| JPMorgan Chase and Co | JPM | 62.50 | -0.41% | 5.9K |

| Intel Corp | INTC | 32.88 | -0.42% | 5.0K |

| Amazon.com Inc., NASDAQ | AMZN | 427.50 | -0.42% | 0.3K |

| Verizon Communications Inc | VZ | 50.32 | -0.45% | 4.7K |

| AT&T Inc | T | 34.70 | -0.46% | 15.5K |

| 3M Co | MMM | 157.56 | -0.49% | 1.0K |

| Cisco Systems Inc | CSCO | 29.17 | -0.51% | 28.1K |

| Facebook, Inc. | FB | 80.24 | -0.55% | 112.4K |

| Microsoft Corp | MSFT | 48.88 | -0.56% | 44.5K |

| Caterpillar Inc | CAT | 85.68 | -0.60% | 0.7K |

| Merck & Co Inc | MRK | 59.54 | -0.73% | 0.7K |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.78 | -0.74% | 10.3K |

| Pfizer Inc | PFE | 34.21 | -0.78% | 49.8K |

| Yahoo! Inc., NASDAQ | YHOO | 43.88 | -1.04% | 6.6K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 22.43 | -1.10% | 9.8K |

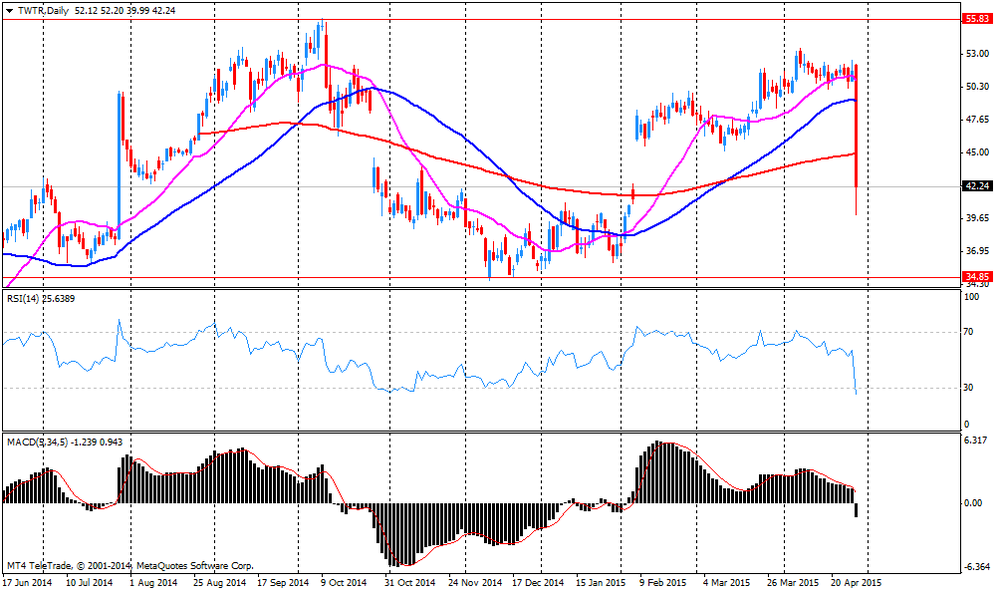

| Twitter, Inc., NYSE | TWTR | 41.17 | -2.60% | 2.0M |

Upgrades:

Downgrades:

Twitter (TWTR) downgraded to Neutral from Buy at Janney, target lowered to $44 from $53

Twitter (TWTR) downgraded to Equal Weight from Overweight at Barclays, target lowered to $44 from $60

Other:

Twitter (TWTR) target lowered to $55 from $61 at Brean Capital, to $47 from $54 at RBC Capital Mkts, to $50 from $62 at Cantor Fitzgerald

Statistics Canada released its industrial product and raw materials price indexes on Wednesday. The Industrial Product Price Index (IPPI) rose 0.3% in March, after a 1.8% increase in February. January's figure was revised up from a 0.4% decline.

The increase was driven by higher prices for energy and petroleum products. Energy and petroleum products gained 1.8% in March.

11 of the 21 commodity groups rose, 7 decreased and 3 were unchanged.

The Raw Materials Price Index (RMPI) fell 0.9% in March, missing expectations for a 4.5% rise, after a 5.9% gain in February. February's figure was revised down from a 6.1% increase.

The decline was driven by lower prices for crude energy products. Crude energy products were down 2.8% in March.

4 of the 6 commodity groups rose, 1 decreased and 1 were unchanged.

Company reported Q1 earnings of $0.07 per share versus $0.04 consensus. Revenues rose 74.0% year/year to $435.9 mln versus $456.55 mln consensus.

Company lowered FY15 revenue guidance to $2.17-$2.27 bln from $2.3-$2.35 bln versus $2.38 bln consensus and EBITDA guidance to $510-$535 mln from $550-$575 mln.

TWTR fell to $41.24 (-2.44%) on the premarket.

The European Central Bank (ECB) on Wednesday raised the amount the Greek central bank can lend its banks to €76.9 billion from €75.5 billion the previous week, according to news sources. The ECB declined to comment.

The ECB's data showed that deposit outflow from Greek banks slowed in March. Greek banks' deposits declined to 145 billion in March from 147.5 billion euros in February.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:00 New Zealand ANZ Business Confidence April 35.8 22.09 30.2

06:00 United Kingdom Nationwide house price index April 0.1% 0.2% 1.0%

06:00 United Kingdom Nationwide house price index, y/y April 5.1% 4.1% 5.2%

06:00 Switzerland UBS Consumption Indicator March 1.21 Revised From 1.19 1.35

08:00 Eurozone M3 money supply, adjusted y/y March 4% 4.2% 4.6%

08:00 Eurozone Private Loans, Y/Y March -0.1% 0.1% 0.1%

09:00 Eurozone Consumer Confidence (Finally) April -3.7 -4.3 -4.6

09:00 Eurozone Industrial confidence April -2.9 -1.2 -3.0

09:00 Eurozone Business climate indicator April 0.23 0.12 0.32

09:00 Eurozone Economic sentiment index April 103.9 104.1 103.7

11:00 U.S. MBA Mortgage Applications April 2.3% 9.88% -2.3%

12:00 Germany CPI, m/m (Preliminary) April 0.5% 0.4% -0.1%

12:00 Germany CPI, y/y (Preliminary) April 0.3% 0.5% 0.4%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. GDP data. The U.S. preliminary gross domestic product is expected to rise at an annual rate of 1.3% in the first quarter, after a 2.2% gain in the fourth quarter.

The personal consumption expenditures (PCE) price index excluding food and energy is expected to increase 1.0% in the first quarter.

The euro traded higher against the U.S. dollar after the mixed economic data from the Eurozone. German preliminary consumer price index fell 0.1% in April, missing expectations for a 0.4% increase, after a 0.5% gain in March.

On a yearly basis, German preliminary consumer price index increased to 0.4% in April from 0.3% in March, missing expectations for a 0.5% gain.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index declined to 103.7 in April from 103.9 in March, missing expectations for a rise to 104.1. It was the first decline in five months.

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 4.6% in March from last year, exceeding expectations for a 4.2% gain, after a 4 % increase in February.

On a yearly basis, M3 money supply in the Eurozone climbed to 4.1% from 3.8% in the period from December to February.

Loans to the private sector in the Eurozone increased 0.1% in March from the last year, in line with expectations, after a 0.1% decline in February. It was the first increase since March 2012.

The rise was driven by ECB's quantitative easing.

The Greek debt focus remains in focus. Greek Prime Minister Alexis Tsipras said on Tuesday that he expects an agreement between Greece and its creditors could be reached within two weeks. He also said that he would could a referendum if creditors insisted on demands deemed unacceptable by his government.

Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

The British pound traded mixed against the U.S. dollar after the better-than-expected economic U.K. Nationwide house price index. The U.K. Nationwide house price index increased 1.0% in April, exceeding expectations for 0.2% gain, after a 0.1% rise in March.

On a yearly basis, the U.K. Nationwide house price inflation was up to 5.2% in April from 5.2% in March. Analysts had expected the index to drop to 4.1%.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian raw materials purchase price index. Canada's raw materials purchase price index is expected to rise 4.5% in March, after a 6.1% gain in February.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected UBS consumption index. The UBS consumption index for Switzerland increased to 1.35 in March from 1.21 in February. February's figure was revised up from 1.19.

The increase was driven by a rise in new car registrations. New car registrations jumped 24.0% in March.

EUR/USD: the currency pair increased to $1.1013

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y119.35

The most important news that are expected (GMT0):

12:30 Canada Raw Material Price Index March 6.1% 4.5%

12:30 U.S. PCE price index, q/q Quarter I -0.4%

12:30 U.S. PCE price index ex food, energy, q/q Quarter I 1.1% 1.0%

12:30 U.S. GDP, q/q (Preliminary) Quarter I 2.2% 1.27%

14:00 U.S. Pending Home Sales (MoM) March 3.1%

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

21:00 New Zealand RBNZ Interest Rate Decision 3.5% 3.25%

21:00 New Zealand RBNZ Rate Statement

22:45 New Zealand Building Permits, m/m March -6.3%

23:50 Japan Industrial Production (MoM) (Preliminary) March -3.1% -3.4%

23:50 Japan Industrial Production (YoY) (Preliminary) March -2.0%

EUR/USD

Offers 1.1000 1.1030 1.1050 1.1080 1.1100 1.1120 1.1150

Bids 1.0960 1.0940 1.0925 1.0900 1.0880 1.0860 1.0830 1.0815-20 1.0800

GBP/USD

Offers 1.5400 1.5415 1.5440 1.5455 1.5470 1.5500 1.5525

Bids 1.5350 1.5330 1.5300 1.5280 1.5250 1.5220 1.5200 1.5175-80 15150

EUR/JPY

Offers 131.40 131.80 132.00 132.50 133.00

Bids 130.60 130.25 130.00 129.80 129.20 129.00

USD/JPY

Offers 119.00 119.20 119.40 119.60 119.75-80 120.00 120.20 120.50

Bids 118.75-80 118.65 118.50 (stops below) 118.25-30 118.00

EUR/GBP

Offers 0.7155-60 0.7180 0.7200 0.7220-25 0.7235 0.7250

Bids 0.7125-30 0.7100-10 0.7085 0.7065 0.7050

AUD/USD

Offers 0.8025 0.8100 0.8135 0.8200 0.8230

Bids 0.7935 0.7900 0.7840 0.7765 0.7700

Stock indices traded little changed as investors are awaiting the results of the Fed's monetary policy meeting. Investors are awaiting signs when the Fed will start to hike its interest rate. It is unlikely that the Fed will start to raise its interest rate in June as the recently released U.S. economic data was weaker than expected.

The Greek debt focus remains in focus. Greek Prime Minister Alexis Tsipras said on Tuesday that he expects an agreement between Greece and its creditors could be reached within two weeks. He also said that he would could a referendum if creditors insisted on demands deemed unacceptable by his government.

Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index declined to 103.7 in April from 103.9 in March, missing expectations for a rise to 104.1. It was the first decline in five months.

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 4.6% in March from last year, exceeding expectations for a 4.2% gain, after a 4 % increase in February.

On a yearly basis, M3 money supply in the Eurozone climbed to 4.1% from 3.8% in the period from December to February.

Loans to the private sector in the Eurozone increased 0.1% in March from the last year, in line with expectations, after a 0.1% decline in February. It was the first increase since March 2012.

The rise was driven by ECB's quantitative easing.

Current figures:

Name Price Change Change %

FTSE 100 7,034.78 +4.25 +0.06 %

DAX 11,808.8 -2.86 -0.02 %

CAC 40 5,166.85 -6.53 -0.13 %

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index declined to 103.7 in April from 103.9 in March, missing expectations for a rise to 104.1.

It was the first decline in five months.

The consumer confidence index dropped to -4.6 in April from -3.7 in March due to faltering optimism about the level of future unemployment and the future general economic situation index.

The industrial confidence index decreased to -3.2 in April from -2.9 the previous month as production expectations declined.

The services sentiment index climbed to 6.7 in April from 6.1 in March.

The construction confidence index fell to -25.6 in April from -24.2 in March due to the weaker employment expectations.

The business climate index increased to 0.32 in April from 0.23 in March, exceeding forecasts of a drop to 0.12. It was the highest level since May 2014.

EUR/USD: $1.0900(E314mn), $1.0920-25(E340mn), $1.1000(E414mn)*$1.1000 E2.3bn Apr30*

USD/JPY: Y119.50-60($600mn)

GBP/USD: $1.5430(Gbp200mn)

USD/CHF: Chf0.9540($340mn), Chf0.9565($380mn)

USD/CAD: C$1.2100($350mn), C$1.2200($420mn), C$1.2245($205mn)

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.35 in March from 1.21 in February.

February's figure was revised up from 1.19.

The increase was driven by a rise in new car registrations. New car registrations jumped 24.0% in March.

The retailer sentiment index dropped to -13 in March from -3 in the previous month, the lowest level since the end of 2011.

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 4.6% in March from last year, exceeding expectations for a 4.2% gain, after a 4 % increase in February.

On a yearly basis, M3 money supply in the Eurozone climbed to 4.1% from 3.8% in the period from December to February.

Loans to the private sector in the Eurozone increased 0.1% in March from the last year, in line with expectations, after a 0.1% decline in February.

It was the first increase since March 2012.

The rise was driven by ECB's quantitative easing.

HANG SENG 28,324.09 -118.66 -0.42%

S&P/ASX 200 5,838.6 -109.94 -1.85%

TOPIX closed

SHANGHAI COMP 4,474.09 -2.12 -0.05%The European Central Bank (ECB) Executive Board Member and Bundesbank President Jens Weidmann said on Tuesday that the situation in Greece is precarious. He added that Greece's debt continued to increase despite the haircut in 2012 and was now more than 170% of GDP.

Weidmann pointed out that the Eurozone is better prepared to fight off contagion from a Greek exit from the Eurozone than in previous years. But the Bundesbank president warned against underestimating the risks of such a scenario.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1086 (5086)

$1.1062 (3446)

$1.1016 (3397)

Price at time of writing this review: $1.0971

Support levels (open interest**, contracts):

$1.0938 (811)

$1.0899 (1112)

$1.0842 (1918)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 61722 contracts, with the maximum number of contracts with strike price $1,1200 (6517);

- Overall open interest on the PUT options with the expiration date May, 8 is 76693 contracts, with the maximum number of contracts with strike price $1,0000 (9281);

- The ratio of PUT/CALL was 1.24 versus 1.22 from the previous trading day according to data from April, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.5504 (987)

$1.5407 (1234)

$1.5310 (871)

Price at time of writing this review: $1.5346

Support levels (open interest**, contracts):

$1.5288 (421)

$1.5191 (964)

$1.5094 (1058)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 24713 contracts, with the maximum number of contracts with strike price $1,5000 (2747);

- Overall open interest on the PUT options with the expiration date May, 8 is 34884 contracts, with the maximum number of contracts with strike price $1,4700 (2869);

- The ratio of PUT/CALL was 1.41 versus 1.43 from the previous trading day according to data from April, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.