- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 27-05-2022

- The shared currency is about to finish the week with 1.66%.

- US Core PCE rose by 4.9% YoY, lower than March’s 5.1% reading; will the Fed diminish the speed of rate hikes?

- EUR/USD Price Forecast: Its long-term bias remains bearish, but a rally towards 1.0800 in the near term is on the cards.

The EUR/USD reached a fresh four-week high, around 1.0765, but in the last hour, retreated some 30 pips, as the New York session wanes, on an upbeat trading session, courtesy of positive US data. At 1.0735, the EUR/USD is set to record weekly gains of 1.66% amidst a week full of ECB officials’ hawkish commentary and mixed US economic data.

US inflation eases some, and further ECB hawkish commentary lifts the EUR/USD

On Friday, the US Commerce Department unveiled inflation figures for the country. The Fed’s favorite gauge, the Core PCE for April, increased by 4.9% YoY, aligned with forecasts but lower than the March reading. That easied investors’ worries regarding an aggressive US central bank, with some of its members, like St. Louis Fed President James Bullard, expecting rates to finish in the 3.25-3.50% range.

In fact, during the week, Atlanta’s Fed President Raphael Bostic, usually a hawk, commented that once the Fed is done with 50 bps increases in the June and July meeting, it might pause as they assess the economy’s reaction.

In the meantime, the EUR/USD jumped on the release, towards 1.0750, though retraced the move, dipping towards 1.0700. However, in the middle of the North American session, the EUR/USD recovered some ground and settled above April’s 2020 lows of 1.0727.

Meanwhile, during the European session, the Bundesbank President and ECB member Joachim Nagel said that he believes the first-rate raise move should come in July, with more to follow in the second half of 2022. He added that inflation would not fall overnight, and it could take some time.

Next week, the Eurozone macroeconomic docket will feature Headline Inflation for Germany and the Euro area. Both headline figures are expected to rise to new highs, but core EU inflation is foreseen to fall to 3.4%. Another event triggering EUR/USD traders’ reaction would be the EU Council Meeting.

On the US front, the docket will reveal the May ISM Manufacturing and the Business related PMIs, Fed speakers, and employment data on the US front.

EUR/USD Price Forecast: Technical outlook

The EUR/USD advanced in the day and pierced the 50-day moving average (DMA) at 1.0746, pushing towards 1.0765 (new weekly highs). However, EUR/USD bulls’ failure to sustain the rally dragged spot prices below the abovementioned. However, they could remain hopeful as the Relative Strength Index (RSI) at 56 persists in bullish territory, aiming higher.

That said, the EUR/USD’s first resistance would be the 50-DMA. A break above would expose the March 7 low-turned-resistance at 1.0805, followed by April’s 21 high at 1.0936.

- The Australian dollar extends its weekly rally to two straight weeks, up 1.68%.

- The AUD/USD rises on positive Australian and US economic data as recession fears wane and expectations for a non-aggressive US Fed.

- Next week, the US economic docket will be busy and will feature releases of ISM PMIs, Fed speakers, and employment data to digest.

The Australian dollar reclaims the 0.7100 mark and records a fresh three-week high, up 0.83%. At 0.7159, the AUD/USD reflects the upbeat market sentiment amid the release of high US inflation, though ticking down from the March reading.

Investors cheered that US inflation is back below 5%, and US equities climb

Before Wall Street opened, the US Department of Commerce revealed that inflationary pressures in the US are still high but lower than in March. The Core Personal Consumption Expenditure (PCE), the Fed’s favorite inflation gauge, rose by 4.9% YoY, higher than the recorded in March of 5.1%. The market reacted positively to the news, turning towards riskier assets, as they discount that the Fed might pause or slow the pace of tightening conditions.

In the same release, consumer spending increased by 0.9% in April and beat the street’s forecast as consumers boosted purchases of goods and services, a sign that could underpin US economic growth in the Q2 amid increasing worries of a recession.

Elsewhere, during the Asian session, Australian Retail Sales for April rose by 0.9% as expected, marking a rise for four consecutive months, depicting the resilience of consumers, albeit a higher inflation reading, around 5.1% in the Q1.

The release of upbeat economic data for Australia and the US helped risk appetite. That triggered the so-awaited upside break on the AUD/USD, clearing the previous weekly high at 0.7126. As the North American session winds down, the AUD/USD settled in the mid-range of the 0.7100-0.7200 area.

In the week ahead, the Australian docket will feature the Real GDP for Q1. TD Securities analysts expect them to rise by 1.2%, higher than expected. They added that “Growth momentum probably slowed in Q1 as economic activity was interrupted by the Omicron wave and floods in Queensland and NSW. However, we think these shocks are temporary as domestic demand should be relatively resilient, as reflected in the strong Q1 retail sales outturn. We expect the RBA to make a bolder policy move in June as the economy is on a strong footing.”.

On the US front, the docket will reveal the May ISM Manufacturing and the Business related PMIs, Fed speakers, and employment data.

Key Technical Levels

- The Canadian dollar is recording goodish gains in the week of 0.85%.

- A positive market sentiment boosted the appetite for high-beta currencies, like the CAD.

- USD/CAD Price Forecast: To face solid support around 1.2694-1.2700.

The USD/CAD edges lower in the North American session, extending its weekly losses for the third consecutive week as investors shrugged off an “aggressive” US Federal Reserve, as Core PCE rose to 4.9% but ticked down from 5.1% YoY. At the time of writing, the USD/CAD is trading at 1.2727.

US equities remain positive, reflecting a risk-on mood. The S&P 500 is about to erase its May losses, as the US Commerce Department informed that inflation increased at a slower pace than in March. Will the Fed slow the pace of hiking rates after reaching the 2% threshold?

Although inflation is heading lower, ING analysts noted that some factors lurk in the economic environment. First, the geopolitical backdrop keeps pushing energy prices higher. Second, China’s zero-covid policy slowed down the improvement in the supply chains, and thirdly, the tight labor market needs to mitigate a wage-price spiral.

Elsewhere, the USD/CAD on Friday began trading near the day’s highs at 1.2784 but slid towards three-week new lows around the 1.2720 area.

USD/CAD Price Forecast: Technical outlook

USD/CAD remains upward biased, though its two-week downtrend will face a solid support area in the 50 and the 100-day moving averages (DMAs), around the 1.2704-1.2693 area. Nevertheless, USD/CAD bulls need to be careful and not overconfident that the aforementioned level would hold. Why? The Relative Strength Index (RSI) at 44.29 is aiming lower, well within bearish territory, and with enough space before reaching oversold conditions.

If the USD/CAD two-week downtrend extends, the major’s first support would be the 1.2693-1.2704 area. Break below would expose the 200-DMA at 1.2658, followed by the April 22 low at 1.2566. On the flip side, the USD/CAD first resistance would be 1.2800. Once cleared, the following supply region would be the 20-DMA at 1-2862, followed by the March 8 high at.1.2901.

Key Technical Levels

- The USD/CHF is registering losses of 1.68% as the weekend looms.

- A risk-on market mood capped the USD/CHF fall as safe-haven appetite decreased.

- USD/CHF Price Forecast: If bulls are to regain control, a daily close above 0.9600 is needed.

The Swiss franc is set to finish for the second consecutive week with hefty gains, as shown by the USD/CHF losing 1.68%. On Friday, in the North American session, the USD/CHF ticked down some 0.07%, trading at 0.9583 at the time of writing.

Sentiment remains upbeat, once the Fed’s favorite measure of inflation, although it came near 40-year highs, easied from the 5% threshold to 4.9% YoY. US equities are climbing during the day. Even the S&P 500 has almost pared its monthly gains in what seems to be a relief rally, as investors backpedaled from an “aggressive” Fed tightening cycle.

In the meantime, the US Dollar Index, a gauge of the greenback’s value, post-minimal gains of 0.05%, is sitting at 101.812. Contrarily US Treasury yields remain flat, led by the 10-year benchmark note, stationary at 2.749%.

USD/CHF Price Forecast: Technical outlook

Friday’s price action pushed the USD/CHF towards fresh five-week lows, near 0.9545 but bounced from under the 50-day moving average (DMA) around 0.9567, as USD/CHF bulls get ready to launch an assault towards 0.9600, so they can keep the uptrend intact. However, to their detriment, oscillators remain in bearish territory through directionless, opening the door for a consolidation.

Upwards, the USD/CHF first resistance would be 0.9600. Break above would open the door for additional supply zones. Firstly the May 26 daily high at 0.9632, followed by the June 5, 2020, high at0.9652. On the other hand, the USD/CHF first support would be the 50-DMA at 0.9567. Latter’s breach would expose the Bollinger’s band bottom band, at 0.9511, followed by a re-test of the 0.9500 figure.

Key Technical Levels

The USD/INR is about to end the week modestly lower, pulling back from record levels. The chart shows the primary trend is bullish and strong. According to analysts at Wells Fargo, the rupee will continue to decline versus the US dollar, at a gradual pace.

Key Quotes:

“The Indian rupee recently hit an all-time record low against the dollar, and going forward, we expect the currency to continue making new lows against the greenback. We believe the rupee will continue to weaken as the Reserve Bank of India (RBI) is likely behind the curve in tightening monetary policy.”

“While we forecast the RBI to lift interest rates again in June, we doubt RBI policymakers will be able to keep pace with the Federal Reserve.”

“As the Fed raises interest rates and shrinks its balance sheet, the U.S. dollar should rally against most emerging market currencies, including the rupee.”

“While we expect the rupee to consistently hit new lows, we believe the pace of depreciation will be gradual in nature. The RBI maintains a hefty stockpile of foreign exchange reserves and uses these asset buffers to limit rupee volatility. Recently, RBI FX intervention contained currency volatility, and going forward, we expect intervention efforts to continue to keep rupee depreciation orderly.”

- US dollar continues to pullback across the board.

- Yen loses momentum in the market amid risk appetite.

- USD/JPY fails to benefit from the rally in Wall Street.

The USD/JPY is about to end the week trading around 127.00. The pair bottomed on Tuesday at 126.35, the lowest level in five weeks and then rebounded finding resistance below 127.50. It is about to post the third weekly decline in a row.

The US dollar remains weak, and keeps correcting lower versus G10 currencies from multi-year highs. The improvement in risk sentiment boosted the retreat that was also driven by steady US yields.

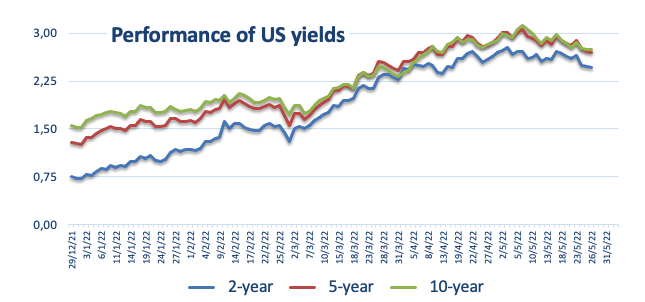

The demand for Treasuries remained firm despite the rally in Wall Street. The S&P 500 is heading to a weekly gain of more than 5%. US yields edged lower during the week. The US 10-year yield stands at 2.74%, far from the 3.20% (May 9).

“In March, USD/JPY broke through 117 and moved sharply higher. IMM data shows Leveraged Funds’ short JPY position expanded over the following four weeks at the fastest pace in five years. Interestingly, despite the rally in risk this week USD/JPY has failed to rally and hit a new low on Tuesday. We continue to see downside risks over the coming weeks”, wrote analysts at MUFG Bank.

In the short-term, the bias in USD/JPY is tilted to the downside. A break under 126.50 should open the doors to more losses, targeting 126.20 and then 125.75. On the upside a recovery above 127.50 (horizontal resistance and downtrend line from recent top) should remove the negative bias.

Technical levels

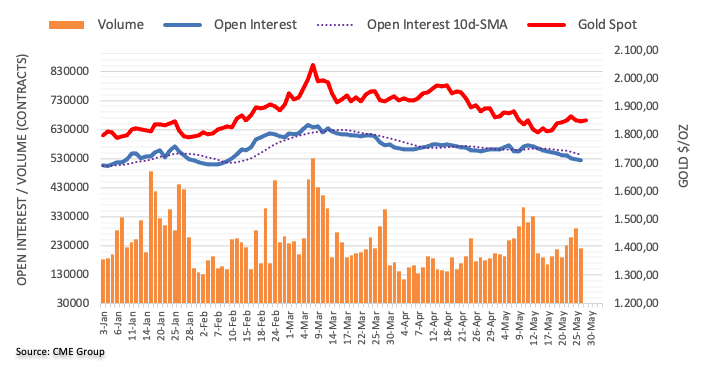

- Gold aims to finish the week with decent gains of 0.37%.

- US Core PCE eases from 5.1% YoY, though remains at forty-year highs; will the Fed pause?

- Gold Price Analysis (XAU/USD): If Gold bulls reclaim $1870, a push towards $1900 is on the cards.

Gold spot (XAU/USD) climbs during the New York session but is still unable to challenge the weekly highs and remains glued to the 20-day moving average (DMA) near the $1848.48 area. At the time of writing, XAU/USD is trading at $1852.28 a troy ounce.

US Core PCE came aligned with expectations but lower than March’s reading

European and US equities continued rising amidst an upbeat market mood. The US Commerce Department released the Core Personal Consumption Expenditure (PCE), the Fed’s favorite inflation reading. Numbers came better than expected, showing that prices are still elevated but off the 5.1% highs, at 4.9% YoY.

Now that inflation appears to be easing from forty-years highs, will the Fed tighten conditions at a slower pace? Meanwhile, the Fed’s May minutes showed that all its members agreed to hike rates by 50 bps in each of the two-consecutive monetary policy meetings.

In the meantime, the US Dollar Index, a measure of the buck’s value vs. its peers, pares some early-day losses and is gaining some 0.07%, sitting at 101.827. Failure to reclaim above 102.500 would open the door for a re-test of the April 24 low at 99.818.

Contrarily to the USD gains, US Treasury yields showed that investors are scaling back from overpricing the US central bank rate hikes expectations. The US 10-year Treasury yield is almost flat in the day, posting minimal losses, down at 2.743%, a tailwind for the non-yielding metal, which benefits from lower yields.

Elsewhere, the US economic docket revealed additional data. Consumer spending rose 0.9% last month and beat estimations as consumers boosted purchases of goods and services, a sign that could underpin US economic growth in the Q2 amid increasing worries of a recession.

Gold Price Analysis (XAU/USD): Technical outlook

On Friday’s price action, Gold has reclaimed the 20-day moving average (DMA) at $1848.42, sitting above the $1850 mark. It’s worth noting that XAU/USD bears could not push prices below the 200-DMA, signaling that selling pressure might be easing, as shown by oscillators. The Relative Strenght Index (RSI) at 45.56 begins to aim higher. Even though it remains in bearish territory, an upslope keeps Gold bulls hopeful of lifting prices towards $1900.

That said, the XAU/USD first resistance would be $1869.61. Break above would send the spot towards the confluence of the Bollinger’s band top band and the March lows at around the $1889.91-1891.08 area. Once cleared, the next stop would be $1900.

Analysts at Wells Fargo forecast the AUD/USD pair at 0.7100 by the end of the second quarter, at 0.6900 by year-end and at 0.6800 by the first quarter of next year. They warn risks are tilted to the upside.

Key Quotes:

“After a steady rebound in growth in Q4-2021, labor market and activity trends during 2022 suggest solid economic fundamentals for Australia's economy amid building inflationary pressures.”

“The RBA raised its Cash Rate by 25 bps to 0.35% at its May monetary policy meeting, citing a resilient economy with inflation that has risen faster and higher than previously expected, as well as progress toward full employment and wage growth. The move surprised many market participants, given the consensus forecast for a hike of only 15 bps (…) The minutes indicated the RBA will review the size of its rate hikes again based on new information each month.”

“Our base case is for the Australian dollar to weaken moderately in the quarters ahead. However, we believe the risks are tilted to the upside, and it is possible that there will be a smaller decline in the currency than our base case forecast suggests.”

“More persistently elevated underlying inflation could prompt the Reserve Bank of Australia to raise rates faster than currently expected, which would be supportive of the currency.”

“In this more favorable scenario, the AUD/USD exchange rate might soften only moderately, perhaps not weakening much below the $0.6900 level.”

The EUR/USD is about to post end higher for the second weekly in a row, “notable gains” according to analysts at MUFG Bank. They point out that the bounce in the pair is very notable and is becoming more difficult to simply dismiss out of hand as just a temporary reversal.

Key Quotes:

“EUR/USD is heading for a second week of gains for the first time since April 2021. The percentage increase over the two-week period is close to 3%, which if we exclude the very volatile period during the period of covid, would be the largest two-week gain since February 2016 when the US dollar reversed course on the back of Fed communications suggesting a slower pace of monetary tightening in response to the financial crisis in China at that time.”

“Our current FX forecasts shows a low-point of 1.0400 in Q2 before a gradual increase through the second half of the year. The price action of late reinforces our view that the scope for notable further US dollar strength from here is becoming more limited.”

“There are risks that this current bounce in EUR/USD could fade and we could correct lower as financial conditions tighten again, risk aversion becomes more pronounced and there is a renewed flight to the dollar. We are mindful though that if those conditions do not materialise relatively soon, EUR/USD could rally further.”

“There are reasons for us to believe that US dollar strength could emerge again. While EUR/USD could drift lower again there are factors to suggest better support for EUR/USD is emerging. We remain sceptical of parity being hit.”

- Cable is about to post back-to-back weekly gains, up by 0.94%.

- The Fed’s favorite inflation gauge eases from above the 5% threshold, showing signs that elevated prices could be peaking soon.

- UK’s PM Boris Johnson said that the UK might avoid a recession.

- GBP/USD Price Forecast: If bulls fail to reclaim 1.2700, expect selling pressure to mount and send the pair towards a YTD low re-test.

The British pound marches firmly during the last week’s trading day, gaining some 0.45% after the Commerce Department reported that the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (PCE), rose by 4.9%, in line with estimations, but lower than 5.2% in March. At 1.2614, the GBP/USD keeps extending its gains during the North American session.

Global equities reflect a positive mood, climbing on Friday. Investors begin to shrug off worries that inflation will keep rising. Also, the pullback in core inflation could deter the Fed from hiking rates as aggressively as previously priced in by market players, which lifted the yield on the 10-year benchmark note to its YTD high at 3.20% earlier this month.

Before Wall Street opened, additional data was revealed. Consumer spending rose 0.9% last month and beat estimations as consumers boosted purchases of goods and services, a sign that could underpin US economic growth in the Q2 amid increasing worries of a recession.

Analyst of ING wrote in a note that the inflation reading is encouraging, though reiterated that bringing it back to its target will take a while. “We believe we need to see three conditions to get inflation to drop meaningfully quickly. Firstly, an improved geopolitical backdrop to get energy prices lower, which seems unlikely given Russia’s actions. Secondly, an improved supply chain environment, which also seems unlikely given China’s zero-Covid policy and the potential for strike action at US ports. Then thirdly, we would need to see a big increase in labor supply to mitigate surging labor costs, which again doesn’t seem on the cards just yet,” ING analysts added.

In the meantime, UK’s Prime Minister Boris Johnson commented that the UK could avoid a recession in the months ahead, despite UK’s last inflation report, popping up 9% at forty years high. Even the Bank of England is expecting a contraction in growth late in the year and a prolonged stagnation scenario.

Elsewhere, the US Dollar Index, a gauge of the greenback’s value vs. its peers, bounces off weekly lows and grinds higher by 0.10%, sitting at 101.850.

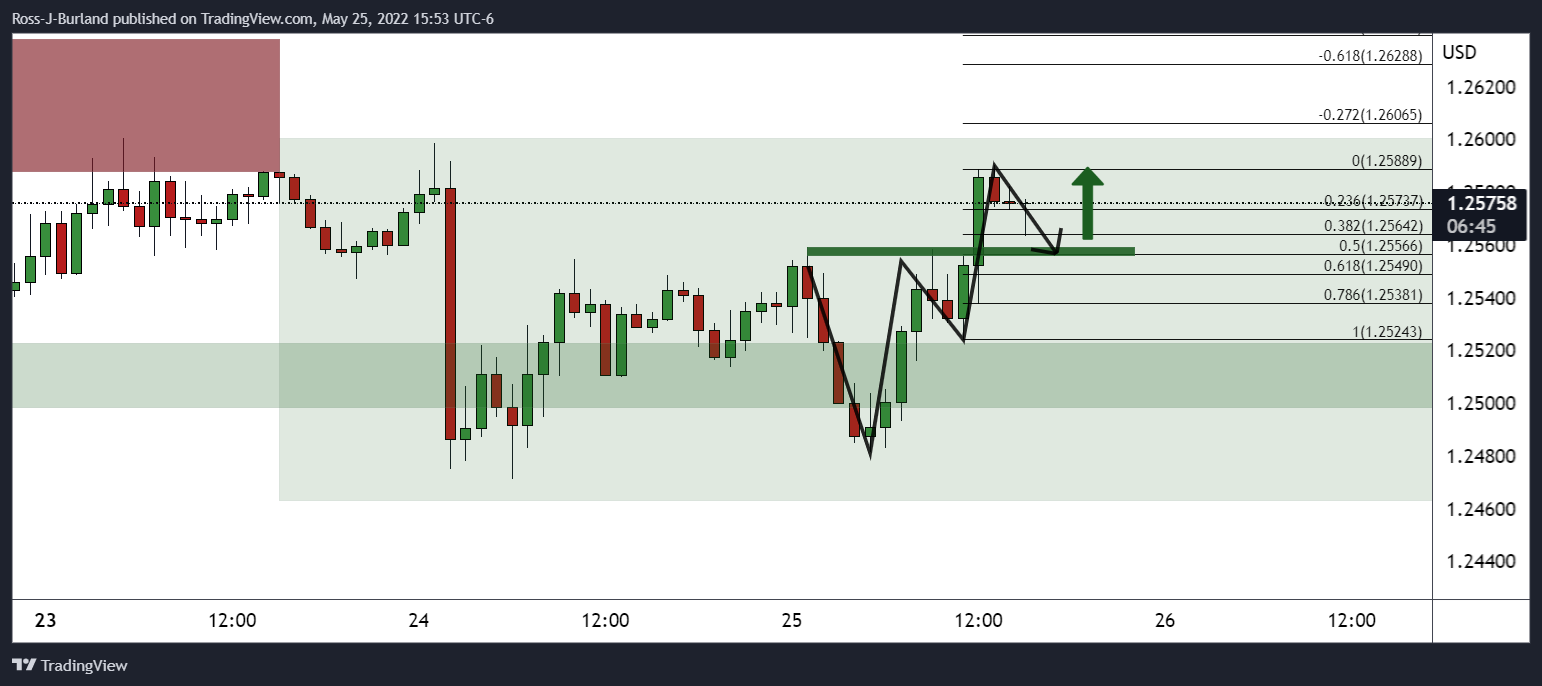

GBP/USD Price Forecast: Technical outlook

From a daily chart perspective, the GBP/USD remains downward biased. During the day, the major failed to break above the May 4 daily high at 1.2638 and pulled back towards 1.2610s, well below the daily moving averages (DMAs). However, the RSI shows some signs of turning bullish, but the GBP/USD bulls need to reclaim 1.2700 to shift the bias to neutral-upwards.

Failure to the above-mentioned would keep the pair vulnerable, sending the pair towards the May 20 daily low at 1.2436, followed by the May 17 lows at 1.2315, and the YTD low at 1.2155.

Key Technical Levels

Data released on Friday showed Persona Spending rose in April 0.9%, surpassing expectations. Analysts at Wells Fargo point out that for the first time since October 2021 income outpaced inflation. They forecast consumer spending will downshift over the next quarters.

Key Quotes:

“On the day after revised GDP numbers showed an even faster pace of consumer spending in the first quarter, fresh data today for April showed that momentum continued into the second quarter. Personal spending shot up 0.9% in the month and, after adjusting for inflation, real spending still added 0.7%; that comes on the heels of revisions that more than doubled March's real spending gain from 0.2% to 0.5%.

“Personal income rose 0.4% in April, with another solid gain in wages & salaries which are now over 15% above their pre-pandemic level. Once removing transfers and adjusting for inflation, real disposable personal income rose 0.02%. With this marking the first time in five months that income outpaced inflation, as expected the level of real disposable income looks to have bottomed in March.”

“We forecast consumer spending will downshift over the next several quarters, particularly as rate hikes begin to ratchet up the cost of credit. Even though we expect consumer spending to remain below trend throughout the forecast period, we do not look for sustained declines in outlays.”

- Mexican peso among top performers on Friday.

- USD/MXN trades at the lowest level since January 2021.

- Risk appetite, a weak dollar and a hawkish Banxico supports MXN's rally.

The USD/MXN is falling sharply on Friday, with the Mexican peso leading across the board. The pair tumbled to 19.56, reaching the lowest intraday level since January 2021.

The combination of technical factors, a weaker dollar, steady US yields, and risk appetite pushed USD/MXN further to the downside. It is headed toward the lowest weekly close since March 2020.

The break below the support area around 19.70 added weighed to the downside. The next critical support is seen at the 19.50 zone followed by 19.30. To alleviate the bearish pressure, the dollar needs to rise back above 19.90.

Equity markets are rising again on Friday. In Wall Street, the S&P 500 gains 1.64% and is up by more than 5% for the week. Main indices are about to post the first gain after falling for seven weeks in a row. The improvement in market sentiment boosted the demand for emerging market currencies.

The weaker dollar and steady yields also contribute to the slide in USD/MXN. The DXY is falling 0.15%, about to post the lowest daily close since April 25. At the same time, US yields remain steady, not reacting to risk appetite. The US 10-year stands at 2.72%, slightly above the weekly low.

Another positive factor for the Mexican peso was the “hawkish” minutes from Banxico’s latest meeting when it rose rates by 50 bp to 7%. “The minutes show that more policymakers were open to a larger move as another said it would reinforce the bank’s autonomy and have more impact on long-term inflation expectations,” explained analysts at Brown Brothers Harriman. The next board meeting is on June 23.

USD/MXN weekly chart

-637892607857292532.png)

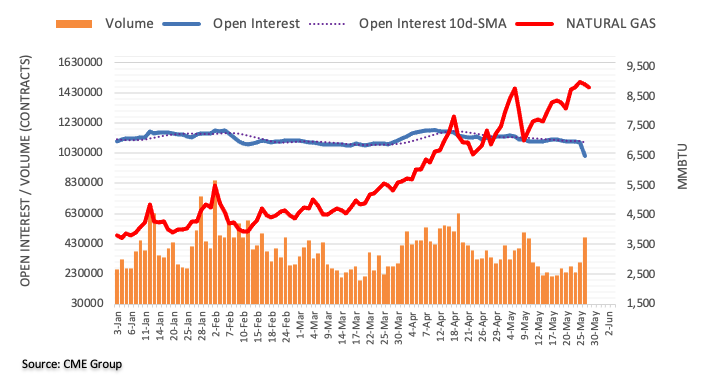

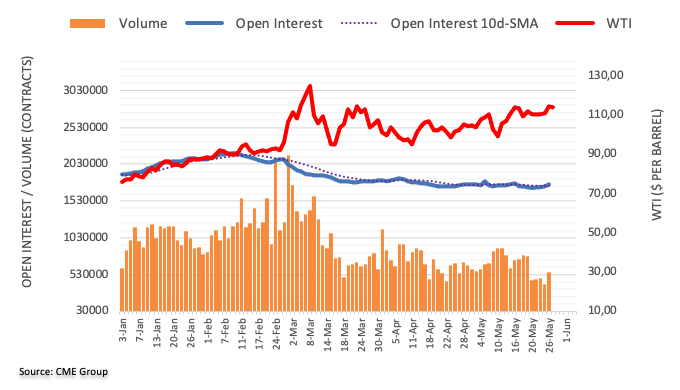

- WTI has stabilised just below monthly highs near the $114 level, as bulls eye a push towards $120.

- Familiar themes of strong US demand, EU/Russia oil sanctions, OPEC+ output struggles and easing Chinese lockdowns are supporting prices.

- WTI looks set to end the week around $3.50 higher.

Oil prices have stabilised close to monthly highs on Friday, supported amid a strong end to the week for global risk assets and commodity markets, and with familiar supportive themes in focus. Front-month WTI futures were last trading ever so slightly in the red near the $114 per barrel mark, on course to post a weekly gain of just shy of $3.50. For now, earlier monthly highs in the $115s and late-March highs in the $116s are offering resistance.

Traders continue to cite expectations for strong US fuel demand as peak driving season there approaches and as US gasoline inventories continue to decline (weekly EIA data released on Wednesday showed another drop) as supportive to the price action. The EU’s plans to sanction Russian oil imports have also been in the headlines. The bloc is now reportedly working on a deal that would ban seaborne imports, but allow pipeline imports to continue in a bid to placate land-locked Hungary, the nation that has held things up until now.

EU officials reportedly think a deal on this could be reached by next week’s EU Council Summit meeting of EU 27 leaders. Commodity analysts expect fresh EU sanctions would be a major hit to Russian production, which has already dropped substantially since the start of its invasion of Ukraine back in February. Indeed, Russia accounted for around half of OPEC+’s 2.6M barrel per day (BPD) miss on its output target for April, a recent Reuters survey showed.

OPEC+ production woes are another factor being cited as supportive of crude oil prices by analysts at the moment. Aside from Russia, plenty of other smaller (mostly African) producers have struggled to keep up with output quota hikes in recent months. Only Saudi Arabia and the UAE really have any spare capacity to rapidly increase output and, despite Western pressures, they don’t seem to want to. Indeed, OPEC+ sources told Reuters earlier this week that the group would stick with its policy of lifting output quotas at a gradual, 432K BPD each month when they meet next week.

Elsewhere, the situation in China is less of a concern as of late. Though Beijing remains in lockdown, restrictions in Shanghai are soon set to be lifted and further improvement could provide further tailwinds for crude oil prices next week. Looking at WTI from a technical perspective, the commodity appears to have formed an ascending triangle below resistance in the $115-$116ish area.

Typically, these chart patterns precede a bullish breakout. Bullish fundamental developments in the form of an EU deal on Russian oil sanctions plus an improving demand outlook could combine with technical buying upon a break of resistance to send WTI towards $120 next week.

GBP/USD has tested key resistance at 1.2633/51. Analysts at Credit Suisse now look for a turn back lower from here.

Close above 1.2633/51 to trigger a deeper correction

“GBP/USD is still stalling around key resistance at the May high and 23.6% retracement of the entire fall from 2021 at 1.2633/51. Given both our bullish USD and bearish GBP view, we have a high level of conviction that the market will fail here and see an eventual resumption of the core downtrend.”

“Support is seen at 1.2482/39 initially, below which would confirm a small intraday top to turn the short-term risks back lower, with next support at 1.2338/29. Below here open up next support at 1.2218 and more importantly at 1.2167/57.”

“A close above 1.2633/59 would in contrast trigger an even deeper correction, with next resistance at the 38.2% retracement of the 2022 at 1.2766, then the crucial 55-day average at 1.2805, where we would have greater confidence in a ceiling if reached for a resumption of the broader downtrend.”

The University of Michigan's final estimate of US Consumer Sentiment fell to 58.4 in May from 65.2 in April, below the flash estimate released earlier this month of 59.1, data released on Friday revealed. Meanwhile, the Consumer Expectations index was revised lower to 55.2 from the flash estimate of 56.3, after coming in at 62.5 last month and the Current Conditions index was revised lower to 63.3 from 63.6, having printed 69.4 in April.

The 1-year measure of inflation expectations was also revised lower to 5.3% from the flash estimate and last month's reading of 5.4%.

Market Reaction

The data hasn't triggered a market reaction, but the revision lower to inflation expectations could weigh on the dollar a tad, as it further bolsters the "peak inflation" narrative that is in focus after Core PCE data showed an easing of US price pressures in April earlier in the day.

- USD/TRY comes under selling pressure, still above 16.00.

- Investors continue to digest the latest CBRT event.

- Focus now shifts to next weeks GDP and CPI figures.

USD/TRY now looks consolidative in the upper end of the recent range and trades close to recent yearly peaks near 16.50.

USD/TRY now looks to upcoming key data

The beleaguered Turkish currency manages to regain some buying interest and forces USD/TRY to recede to the negative territory for the first time after five consecutive daily advances on Friday. It is worth mentioning that the lira is down around 23% vs. the greenback so far this year.

Market participants, in the meantime, continue to assess Thursday’s reluctance to act on rates by the Turkish central bank despite inflation in the country is running at around 2-decades high (as per April figures).

Moving forward, investors are expected to shift their attention to next week’s release of Q1 GDP results (May 31) and inflation figures gauged by the CPI (June 3).

What to look for around TRY

USD/TRY keeps the upside bias well and sound and looks to consolidate the recent surpass of the 16.00 yardstick for the first time since late December 2021.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is losing 0.50% at 16.2508 and a breach of 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29). On the upside, the initial hurdle lines up at 16.4554 (2022 high May 26) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level).

S&P 500 pushed sharply higher yesterday. The 4091/4128 zone is key, as a break above here would similarly signal a deeper corrective recovery, economists at Credit Suisse report.

Risk of an eventual breakdown below 3855/15 stays elevated

“Key now going into the weekly close and month-end is the price high and gap at 4091/4128. Only a closing break above here would confirm a short-term base to signal a more profound recovery, which we would be inclined at this point to view as a ‘bear market rally’. If a base is confirmed, we would expect the market to extend the recovery to the 63-day average at 4277/4314.

“We would be inclined to view any recovery as corrective, as the medium-term technical picture is not particularly constructive. Therefore, the risk of an eventual breakdown below 3855/15 stays seen as elevated, with first near-term support seen at 3932/25, below which would remove the recent upward pressure.”

- NZD/USD is finishing a strong week positively and was last trading in the 0.6530s, up 0.9% on the day.

- The pair has rallied around 5.0% from monthly lows two weeks ago and is eyeing monthly highs in the 0.6560s.

- US inflation data on Friday supported the idea that US inflation is easing, weighing on the buck.

NZD/USD is on the front foot on Friday amid a strong end to what has, for the most part, been a strong week for risk assets and global commodity markets. The pair was last trading in the 0.6530s, up around 0.9% on the day, taking its gains on the week to around 2.0%, reflective of the fact that the kiwi has been one of this week’s best performing G10 currencies. The pair is eyeing a test of monthly highs in the 0.6560s.

Lifting the mood in recent trade and also somewhat weighing on the US dollar was US Core PCE inflation data for April that lent support to the idea that price pressures in the US have peaked, thus reducing the pressure on the Fed to tighten monetary policy quite so aggressively. But the kiwi has also derived support from domestic New Zealand factors this week, which go some way in explaining its outperformance versus most of the rest of its non-US dollar G10 peers.

The RBNZ raised interest rates by 50 bps to 2.0% as expected on Wednesday, but signaled a much more hawkish than expected path for interest rates in the quarters ahead, with the bank expecting to have lifted rates to nearly 4.0% in 2023. At this point, the RBNZ is comfortably the most hawkish central bank in the G10 and this has helped NZD/USD rebound around 5.0% in the last two weeks from earlier monthly lows in the low 0.6200s.

- A combination of supporting factors lifted AUD/USD to a fresh multi-week high on Friday.

- The technical set-up favours bullish traders and supports prospects for additional gains.

- Sustained break below the 0.7100 mark is needed to negate the constructive outlook.

The AUD/USD pair gained strong positive traction on the last day of the week and shot to over a three-week high, around mid-0.7100s during the early North American session.

Expectations that the US central could pause the current rate hike cycle later this year dragged the US Treasury bond yields to a multi-week low. This, along with a generally positive risk tone, undermined the safe-haven US dollar. This, in turn, benefitted the risk-sensitive aussie, which drew additional support from the Reserve Bank of Australia's hawkish signal earlier this week.

From a technical perspective, the recent recovery move from the YTD low along an upward sloping channel points to a well established short-term bullish trend. A subsequent move beyond the 38.2% Fibonacci retracement level of the 0.7662-0.6829 downfall, which coincided with the 200-period SMA on the 4-hour chart, favours bullish traders and supports prospects for additional gains.

The AUD/USD pair now seems all set to extend the momentum towards the 0.7200 round-figure mark en-route the 0.7235-0.7245 confluence hurdle. The latter comprises the 100-day SMA and the 50% Fibo. level. This is closely followed by the very important 200-day SMA, currently around the 0.7260 area, which if cleared decisively will set the stage for an extension of the appreciating move.

On the flip side, any meaningful pullback now seems to find decent support near the 0.7125 zone ahead of the 7100 round figure. A convincing break below might prompt aggressive technical selling and make the AUD/USD pair vulnerable. Spot prices could then test the 23.6% Fibo., around the 0.7030-0.7025 region before eventually dropping to the 0.7000 psychological mark.

Failure to defend the aforementioned support levels will shift the bias back in favour of bearish traders. The subsequent decline could drag the AUD/USD pair to the 0.6940 intermediate support en-route the 0.6900 mark and the YTD low, around the 0.6830-0.6825 region touched earlier this month.

AUD/USD 4-hour chart

-637892556315858985.png)

Key levels to watch

GBP/USD fluctuates in a relatively tight channel above 1.26 on Friday. Economists at Scotiatbank believe that cable is unlikely to see a push higher towards the 1.30 level.

The 1.26 figure zone is acting as solid support

“The 1.26 figure zone is acting as solid support ahead of yesterday’s low of ~1.2550.”

“Cable gains past the mid-1.26s face limited resistance until the next big figure with the 50-day MA of ~1.2775 following.”

“The UK macroeconomic backdrop and the global risk tone still mean a GBP return to 1.30 is unlikely.”

EUR sellers emerge in mid-1.07s. However, economists at Scotiabank expect the pair to inch higher towards the 1.08 figure.

Support aligns at 1.0700/10

“The EUR is still struggling somewhat to make a firm and sustained push above the mid-1.07s as it settles in a consolidation band of ~1.0650-1.0750 since Tuesday. But the higher highs, higher lows price action suggests gains extending towards 1.08 shortly once the mid-figure zone gives way”

“Around 1.08, the EUR faces key trendline resistance measured from mid-Feb.”

“Support is 1.0700/10 followed by 1.0660/65.”

“We spot resistance after the mid-1.07s at the daily high of 1.0765 and the 1.08 figure area.”

EURUSD is now very close to a series of retracement resistances around 1.0787/0822. Economists at Credit Suisse we look for a turn back lower from here, for a move to 1.0608/0599 initially, then 1.0350/41.

Resistance at 1.0839 expected to cap

“EUR/USD has now seen the anticipated recovery to the 38.2% retracement of the fall from February, the 55-day average and the mid-April lows at 1.0758/87. We expect a much tougher barrier here and for the medium-term downtrend to reassert itself from here and we therefore now turn tactically bearish again.”

“We note that there is further important resistance just above at 1.0822/39, which includes the back of the broken uptrend from 2017, where we look for a solid cap.”

“Support moves to 1.0642, then 1.0608/0599, below which would confirm that the risks have turned lower again for a retest of 1.0350/41.”

“Above 1.0822/39 is not our base case, however it would trigger a deeper-than-expected recovery, with the next level at 1.0923/37.”

- Gold is around 0.5% higher in the $1860 area in wake of US Core PCE data.

- The data lent support to the idea that inflation is easing, which may remove pressure on the Fed to tighten.

Spot gold (XAU/USD) prices saw a mixed, fairly subdued reaction to the latest US inflation data for April that supported the idea that price pressures might have peaked at the end of Q1. The US dollar and US yields weren't much changed after the Core PCE Price Index showed the rate of inflation falling to 4.9% YoY in April from 5.2% in March and the MoM rate of price gain remaining unchanged versus last month at 0.3% MoM. Thus, the precious metal didn’t get any cross-asset impulses to drive volatility.

At present, XAU/USD is trading around the $1860 level, up around 0.5% on the day, as the pair continues to derive support from the 21 and 200-Day Moving Averages at $1851 and $1839, as well as from US yields and the buck, both of which are close to/at monthly lows. Gold is currently on course to post a weekly gain of about 0.7%, and has rebounded by about 4.0% from last week’s multi-month lows under $1790.

The latest US inflation data will come as a relief to the Fed and takes away some of the pressure to raise interest rates back to neutral (around 2.5%) quite so rapidly. Though markets still expect 50 bps rate moves at the next two meetings (June and July), the argument for what would be a fourth successive 50 bps hike in September is somewhat diminished.

Meanwhile, if inflation continues to ease back from current levels in the months ahead, the Fed will feel more at ease in pausing rate hikes once it gets back to neutral and reassessing the need for further tightening. If the idea that the Fed won’t need to lift interest rates much beyond neutral starts gaining more traction, this is a downside risk for long-term US yields and also the US dollar, meaning an upside risk for gold.

These will be key themes in the weeks ahead. In the more immediate future, spot gold is likely to remain fairly well supported and may have another run at earlier weekly highs in the $1860s. The upcoming preliminary release of the May University of Michigan Consumer Sentiment survey at 1400GMT will be worth watching for a timely read on how well the US consumer is holding up.

- EUR/USD fades the earlier spike to the 1.0770 zone.

- US headline/Core PCE failed to surprise markets in April.

- US final Consumer Sentiment next of note in the calendar.

EUR/USD wobbles around the 1.0700 neighbourhood amidst mixed risk appetite trends at the end of the week.

EUR/USD looks well supported around 1.0700

EUR/USD came under some moderate selling pressure soon after printing fresh monthly highs near 1.0770 earlier in the session.

Indeed, the pair now exchanges gains with losses amidst the equally lack of a clear direction in the greenback, which managed to bounce off new monthly lows near 101.40 when tracked by the US Dollar Index (DXY).

No meaningful reaction in the pair to US inflation figures after the headline PCE rose 6.3% in the year to April and 4.9% YoY when it comes to the Core print. Further April data saw the trade deficit shrink to $105.94B, Personal Income expand 0.4% MoM and Personal Spending rise 0.9% inter-month. Later in the NA session, the final U-Mich Index will close the weekly calendar.

What to look for around EUR

The intense selling bias in the dollar puts EUR/USD on track to challenge the 1.0800 region in the short-term horizon.

Despite the pair’s upside impulse, the broader outlook for the single currency remains negative for the time being. As usual, price action in spot should reflect dollar dynamics, geopolitical concerns and the Fed-ECB divergence.

Occasional pockets of strength in the single currency, however, should appear reinforced by speculation the ECB could raise rates at some point in the summer, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro area. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is losing 0.03% at 1.0718 and a breach of 1.0459 (low May 18) would target 1.0348 (2022 low May 13) en route to 1.0340 (2017 low January 3 2017). On the other hand, the immediate hurdle aligns at 1.0765 (monthly high May 24) followed by 1.0771 (55-day SMA) and finally 1.0936 (weekly high April 21).

- USD/CAD continued losing ground for the second straight day amid sustained USD selling.

- Softer-than-expected US PCE Price Index data for April did little to impress the USD bulls.

- Even modest pullback in oil prices also did little to undermine the loonie or lend support.

The USD/CAD pair maintained its offered tone below mid-1.2700s, or over a three-week low through the early North American session and moved little post-US macro data.

The headline US Personal Consumption Expenditure (PCE) Price Index decelerated to a 6.3% YoY rate in April as against consensus estimates pointing to a steady reading of 6.6%. The Core PCE Price Index - the Fed's primary inflation measure - fell from 5.2% in March to 4.9% during the reported month, though was in line with market expectations.

The data indicated that inflationary pressures in the US might be easing and reaffirmed the idea that the US central could pause the current rate hike cycle later this year. This was evident from the recent slump in the US Treasury bond yields to a multi-week low, which, along with the risk-on impulse, weighed on the safe-haven US dollar.

The prevalent selling bias surrounding the greenback turned out to be a key factor that dragged the USD/CAD pair lower for the second successive day, back closer to the monthly swing low. Bulls seemed rather unimpressed and largely shrugged off modest pullback in crude oil prices, which tend to undermine the commodity-linked loonie.

With the USD price dynamics turning out to be an exclusive driver of the USD/CAD pair's ongoing downward trajectory, traders now look forward to the revised Michigan US Consumer Sentiment Index. This, along with the US bond yields and the broader market risk sentiment, will influence the USD and provide some impetus to the USD/CAD pair.

Technical levels to watch

- Core PCE inflation rose at a pace of 4.9% YoY in April, in line with expectations.

- MoM, prices were up 0.3%, also in line with forecasts.

- Markets didn't react to the data, which was broadly in line with expectations.

The annual pace of inflation in the US according to the Core PCE Price Index fell to 4.9% in April, in line with the median economist forecast for an inflation rate of 4.9%, according to newswire polling. That comes after the Core PCE Price Index had prices rising at a pace of 5.2% YoY in March. The MoM pace of inflation according to the index came in at 0.3% in April, also in line with the median economist forecast for an inflation rate of 0.3%, according to newswire polling.

According to the PCE Price Index, the YoY rate of price gain in April was 6.3%, down from 6.6% in March, while the MoM pace of price gain was 0.2%, down from 0.9% in March. Elsewhere, Personal Incomes rose at a pace of 0.4% MoM in April, a little below the expected gain of 0.5% and down from last month's 0.5% growth rate. Personal Spending, meanwhile, grew at a pace of 0.9% MoM, above the expected drop to 0.7% from a 1.4% growth rate in March.

Market Reaction

The broadly in line with expectations inflation data has not triggered much of a market reaction just yet.

US President Joe Biden's administration is reportedly planning to cancel $10,000 in student debt per borrower, reported the Washington Post citing sources on Friday. Biden had reportedly hoped to make the announcement as soon as this weekend, though this has been delayed in light of the recent massacre in Texas.

Reducing student debt by $10,000 of per borrower could cost as much as $230 billion, a nonpartisan think tank called the Committee for a Responsible Federal Budget has said. The timing of the relief isn't clear, but would mark a massive fiscal injection that critics might argue could make the Fed's inflation-fighting job harder.

- Silver is on the front foot pre-US Core PCE data as the buck and US yields hover at monthly lows.

- Upcoming inflation data at 1230GMT will be viewed in the context of how it impacts Fed tightening expectations.

- A downside surprise could lift silver towards $23.00 while an upside surprise could send it back under $22.00.

Spot silver (XAG/USD) prices have rallied to nearly three-week highs in the mid-$22.00s per troy ounce on Friday ahead of the release of key US Core PCE inflation figures for April, boosted as the US dollar and US bond yields probe monthly lows. A weaker buck helps USD-denominated commodities attract demand from foreign investors, while a fall in bond yields represents a lower “opportunity cost” of holding non-yielding assets (such as precious metals).

At current levels in the $22.30s, XAG/USD is trading higher by more than 1.5% on Friday, thus extending its weekly gains to about 2.8%, and its gains from earlier monthly lows to closer to 9.0%. For reference, since spot-silver posted multi-month lows in the mid-$20.00s on 13 May, the DXY has dropped about 3% and the US 10-year by about 17bps.

Upcoming US Core PCE inflation data at 1230GMT will, as usual, be closely scrutinised and could trigger a choppy market reaction. Analysts increasingly believe that inflation in the US might have now peaked, and might well ease back over the remainder of the year, thus allowing the Fed to pause its rate hikes once it gets back to neutral (around 2.5%). The upcoming data will thus be viewed in the context of whether it supports or pushes back against this narrative.

The MoM price gain according to the Core PCE Price Index will be the most closely watched number. If prints in line with consensus forecasts and last month’s number at 0.3%, or if it comes in lower, recent USD weakness/US yield downside might well extend. In this scenario, XAG/USD might be in with a shot of reclaiming a $23 handle. If it surprises to the upside, a quick drop back into the $21.00s might be on the cards.

- USD/CHF dropped to a one-month low on Friday amid the prevalent USD selling bias.

- Signs that the Fed could pause the rate hike cycle later this year weighed on the USD.

- The risk-on impulse undermined the safe-haven CHF and helped limit deeper losses.

The USD/CHF pair remained on the defensive heading into the North American session and was seen trading around the 0.9570 region, or a fresh one-month low.

Minutes from the May 3-4 FOMC meeting released on Wednesday suggested that the Fed could pause the rate hike cycle after two 50 bps hikes each in June and July amid the worsening economic outlook. The speculations were reinforced by the recent slump in the US Treasury bond yields to a multi-week low, which, in turn, weighed on the US dollar and exerted downward pressure on the USD/CHF pair.

That said, the risk-on impulse - as depicted by a generally positive tone around the equity markets - undermine the safe-haven Swiss franc and held back traders from placing aggressive bearish bets around the USD/CHF pair. Apart from this, a modest USD rebound from a fresh monthly low helped limit any further losses, at least for the time being, though any meaningful recovery still seems elusive.

Market participants now look forward to the release of the US April Core PCE Price Index - the Fed's preferred inflation gauge. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the USD/CHF pair. Traders will further take cues from the broader market risk sentiment to grab short-term opportunities on the last day of the week.

Technical levels to watch

European Union nations are reportedly working on a Russia oil sanction deal that could be signed at next week's EU Council Summit that would exclude oil delivered into the EU via pipelines, two EU officials told Reuters. Bloomberg had reported something similar earlier in the day.

The exclusion of oil delivered by pipelines is designed to win over the approval of landlocked nations such as Hungary, who have thus far pushed back against plans for a broad EU ban on Russian oil imports. Leaders of EU 27 nations will be meeting on 30-31 May and any EU sanction plan must get unanimous approval from all nations.

- GBP/USD has pared back from earlier highs but remains in the green and supported above 1.2600 pre-US Core PCE data.

- The pair was nonetheless able to hit monthly highs earlier in the day, with some citing UK fiscal stimulus optimism.

Though the pair has now handed back most of the gains it made during the Asia Pacific session, GBP/USD continues to trade slightly in the green and supported to the north of the 1.2600 level on Friday. FX market conditions have been fairly subdued in recent hours ahead of the release of key US Core PCE inflation data for April that, if it shows an easing of price pressures, could contribute to a continuation of recent USD weakening if it contributes to the “inflation has peaked” narrative and thus triggers a further paring back on Fed tightening bets.

Indeed, USD weakness (the DXY is on course for a second successive weekly loss, the worst losing streak since December 2021) has been the key driver behind cable’s more than 3.5% rally from earlier monthly lows in the mid-1.2100s to fresh monthly highs this Friday. But analysts have also attributed a few domestic UK factors as lending support to the rebound. Firstly, last week’s UK labour market data was strong, while the April inflation figures showed price pressures at their worst in four decades, giving a marginal boost to BoE tightening bets at the time.

Meanwhile, the UK government surprised markets on Thursday with a new, larger than expected fiscal aid package of £15 billion, aimed at helping low-income households cope with the current cost-of-living squeeze. Some analysts said that this larger than expected injection of fiscal stimulus (which will be spread over the summer and autumn) might encourage the BoE to revise higher its very pessimistic UK growth forecasts for this year and next.

A less pessimistic growth outlook means that the BoE might feel more confident that it can get away with slightly more monetary tightening in order to ensure inflation expectations don’t de-anchor. Still, FX strategists continue to warn that the UK growth outlook remains far weaker than in the US, meaning the outlook for BoE policy is far less hawkish than the outlook at the Fed. That mean, in the medium-longer term, a sustained rebound for GBP/USD doesn’t look likely. If Brexit tensions surrounding the Northern Ireland Protocol further worsen, that only could the pair’s outlook.

US PCE Price Index Overview

Friday's US economic docket highlights the release of the April Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 12:30 GMT. The headline gauge is expected to hold steady at a 6.6% YoY rate during the reported month. The core reading, however, is anticipated to have eased to 4.9% YoY in April from 5.2% previous and rose 0.3% on a monthly basis.

How Could it Affect EUR/USD?

According to Yohay Elam, Analyst FXStreet: “The dollar has been whipsawed in recent days, but when it comes to data, the greenback seems to have been in a win-win situation. A better figure means more rate hikes and a stronger dollar, while a weak figure implies the global economy is weakening – sending investors to the safety of the world's reserve currency.”

This, along with the EUR/USD pair's inability to make it through the 50-day SMA, suggest that the path of least resistance for spot prices is to the downside. Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the major: “The near-term technical outlook shows that the bullish bias remains intact for the time being. EUR/USD holds above the ascending trend line coming from mid-May and the Relative Strength Index (RSI) indicator on the four-hour chart holds comfortably above 50.”

Eren also outlined important technical levels to trade the EUR/USD pair: “On the upside, static resistance seems to have formed at 1.0760. 1.0800 (psychological level) aligns as the next hurdle. Initial support is located at 1.0700 (psychological level, 20-period SMA) before 1.0660 (ascending trend line, static level) and 1.0630 (200-period SMA). As long as the pair manages to end the week above 1.0700, sellers are likely to remain on the sidelines.”

Key Notes

• US Core PCE Preview: Why there is room for a dollar-lifting upside surprise

• EUR/USD Forecast: A weekly close above 1.0700 could be a bullish sign

• EUR/USD invades 1.0760 ahead of US PCE, DXY renews monthly lows

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

- EUR/USD advances to fresh monthly peaks near 1.0770.

- Extra gains now target the resistance line near 1.0820.

EUR/USD comes under pressure soon after clinching new highs in the vicinity of 1.0770 on Friday.

Considering the pair’s current price action, the continuation of the rebound looks likely in the very near term at least. That said, the next up barrier now appears at the 55-day SMA, today at 1.0770 prior to the 3-month resistance line near 1.0820.

The breakout of this area should mitigate the selling pressure and allow for a probable move to the weekly high at 1.0936 (April 21).

EUR/USD daily chart

Bundesbank President and European Central Bank (ECB) Governing Council member Joachim Nagel said in an interview with Der Spiegel on Friday that the ECB should raise interest rates in July, followed by more rate hikes in the second half of the year, Reuters reported.

"In our June meeting we must send a clear signal where we're going," Nagel told the German paper, adding that "from my current perspective, we must then make the first rates move in July and have others follow in the second half of the year". Nagel warned that it may take some time for inflation to fall in the Eurozone.

Earlier this week, ECB President Christine Lagarde outlined new interest rate guidance in a blog post, where she indicated taking Eurozone interest rates back into positive territory by the end of the third quarter. Thus Nagel's views seem to be well aligned with Lagarde's.

- DXY made a U-turn soon after hitting new lows near 101.40.

- The support line near 100.60 underpins the constructive view.

The index reverses course after bottoming out in the 101.40 region earlier on Friday.

The breakdown of the May low at 101.43 (May 27) should expose another pullback to the interim 55-day SMA at 101.47 ahead of the support line around 100.60, which is expected to offer decent contention. While above this area, further gains in the very near term in the dollar should remain well on the table.

The longer-term positive outlook for the index is seen constructive while above the 200-day SMA at 96.76.

DXY daily chart

- EUR/JPY falters once again around the 136.70 region.

- Extra gains look likely while above the 134.50 zone.

EUR/JPY corrects lower after failing once again to extend the recovery further north of the 136.70 area on Friday.

The succession of higher lows since mid-May leaves the prospects for further upside well on the table for the time being. That said, while above the 2-month support line near 134.50, further upside appears likely with the next target at recent peaks in the 136.80 region ahead of the May high at 138.31 (May 9).

In the meantime, while above the 200-day SMA at 131.36, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- Gold Price is heading back towards $1900 amid mixed markets.

- US dollar recovers ground but the correction doesn’t seem to be over yet.

- XAUUSD’s path of least resistance appears to the upside, for now.

Gold Price is staging a solid comeback after finding strong support near the $1,840 region over the past two trading days. The bright metal is looking to retest the two-week highs on the road to recovery, as the US dollar is struggling to recover further ground amid mixed market sentiment and subdued Treasury yields. Dismal US GDP, Markit Manufacturing PMI and Pending Home Sales point to signs of US economic slowdown, cooling off the aggressive Fed tightening expectations and keeping the dollar broadly undermined. This week’s turnaround in global stocks is also weighing on the greenback’s safe-haven appeal, benefiting the USD-priced gold.

Also read: Gold Price Forecast: Key $1,838 support could be at risk ahead of US GDP

Gold Price: Key levels to watch

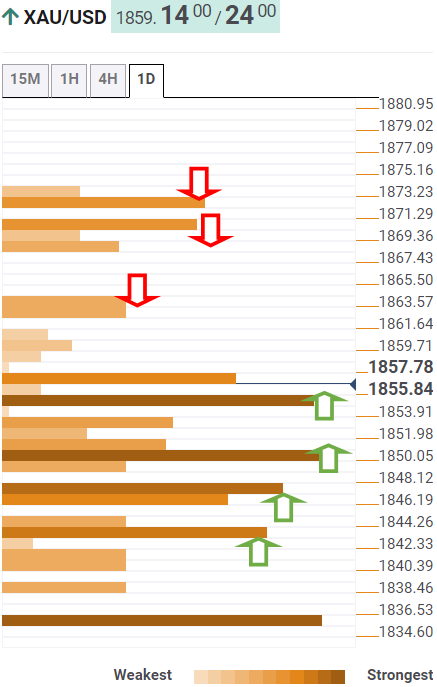

The Technical Confluences Detector shows that the Gold Price is fast approaching strong resistance at $1,863, as the renewed upside gathers steam.

That level is the convergence of the Fibonacci 161.8% one-day and the pivot point one-day R2.

The next significant upside barrier awaits at the confluence of the pivot point one-day R3, pivot point one-week R1 and the two-week highs at $1,870.

The previous month’s low of $1,872 will be a tough nut to crack for gold bulls.

Alternatively, the immediate downside will be capped by $1,855, which is the meeting point of the SMA5 one-day and the previous day’s high.

Failure to defend the latter will threaten the $1,850 demand area, where the previous week’s high and the Fibonacci 61.8% one-day merge.

Gold sellers will then target the intersection of the SMA100 four-hour, pivot point one-month S1 and the Fibonacci 38.2% one-day at $1,847.

The last relevant support is pegged at the pivot point one-day S1 at $1,844.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

UK Prime Minister Boris Johnson voices his concern over the country’s economic outlook, in an interview with Bloomberg TV on Friday.

Key quotes

“See a difficult period ahead for the economy.”

“The UK can avoid a recession.”

“Do not want to see a return to 1970's 'wage-price' spiral.”

Market reaction

GBP/USD is trading around 1.2600, having hit a daily low of 1.2587 in the last hour. The spot is still up 0.07% on the day.

- NZD/USD gained strong positive traction on Friday and climbed to a three-week high.

- The technical set-up favours bullish traders and supports prospects for further gains.

- Sustained break below the 0.6400 mark is needed to negate the constructive outlook.

The NZD/USD pair caught aggressive bids on the last day of the week and rallied to over a three-week top during the first half of the European session. Bulls are now looking to build on the momentum beyond the 0.6525-0.6530 confluence, comprising 200-period SMA on the 4-hour chart and the 38.2% Fibonacci retracement level of the 0.7035-0.6217 fall.

Signs that the Fed could pause the rate hike cycle after two 50 bps hikes each in June and July amid the worsening economic outlook, along with the risk-on impulse continued weighing on the safe-haven US dollar. Apart from this, the Reserve Bank of New Zealand's hit at even higher rates going forward further benefitted the risk-sensitive kiwi.

Looking at the broader technical picture, the recent recovery from the YTD low has been along an upward sloping channel. This points to a well-established short-term bullish trend and supports prospects for additional gains. Some follow-through buying beyond the aforementioned 0.6525-30 confluence hurdle will reaffirm the near-term positive outlook for the NZD/USD pair.

Bullish traders might then lift the NZD/USD pair beyond the 0.6600 round-figure mark, towards the 50% Fibo. level resistance near the 0.6625 region. The momentum could further get extended towards the next relevant hurdle near the 0.6655 area, or the 50-day SMA, spot prices could aim to challenge the very important 200-day SMA, currently around the 0.6700 mark.

On the flip side, any meaningful pullback below the 0.6500 psychological mark now seems to find decent support near the lower end of the ascending channel, around the 0.6470-0.6465 region. This is followed by the 23.6% Fibo. level, just ahead of the 0.6400 mark, which if broken will negate the positive bias and prompt aggressive selling around the NZD/USD pair.

NZD/USD 4-hour chart

-637892415867968569.png)

Key levels to watch

EUR/USD remains on track to close the second straight week in positive territory. A weekly close above 1.07 could be a bullish sign, FXStreet’s Eren Sengezer reports.

Static resistance seems to have formed at 1.0760

“On the upside, static resistance seems to have formed at 1.0760. 1.08 (psychological level) aligns as the next hurdle.”

“Initial support is located at 1.07 (psychological level, 20-period SMA) before 1.0660 (ascending trend line, static level) and 1.0630 (200-period SMA).”

“As long as the pair manages to end the week above 1.07, sellers are likely to remain on the sidelines.”

- A combination of factors dragged USD/CAD to a fresh multi-week low on Friday.

- Bullish oil prices underpinned the loonie and exerted pressure amid a weaker USD.

- Signs that the Fed might pause later this year continued weighing on the greenback.

The USD/CAD pair weakened further below mid-1.2700s through the first half of the European session and dropped to a fresh three-month low in the last hour.

A combination of factors dragged the USD/CAD pair lower for the second successive day on Friday, taking along some trading stops near the previous weekly low support near the 1.2765-1.2760 region. Crude oil prices held steady near a two-month high and continued underpinning the commodity-linked loonie. Apart from this, the prevalent bearish sentiment surrounding the US dollar exerted downward pressure on the major.

Despite worries about softening global economic growth, expectations of demand recovery in China and the impending European Union embargo on Russian oil imports extended support to the black liquid. Furthermore, OPEC+ is expected to stick to last year's oil production deal at its June 2 meeting and raise July output targets by 432K barrels per day. This added to supply concerns and acted as a tailwind for oil.

On the other hand, the USD was pressured by speculations that the Fed could pause the rate hike cycle later this year amid the worsening economic outlook. Doubt over the Fed's ability to bring inflation under control without sinking the economy into recession dragged the yield on the benchmark 10-year US government bond fell to a six-week low. This, along with the risk-on impulse, weighed on the safe-haven greenback.

The fundamental backdrop seems tilted in favour of bearish traders and a break below the weekly low supports prospects for a further near-term depreciating move for the USD/CAD pair. Hence, some follow-through decline, towards testing the 100-day SMA, currently around the 1.2700-1.2695 region, remains a distinct possibility.

Technical levels to watch

UOB Group’s Barnabas Gan comments on the GDP figures in Singapore.

Key Takeaways

“Singapore has revised its 1Q22 GDP growth higher to 3.7% y/y, from the preliminary estimate of 3.4% y/y released in Apr. From a quarter-on-quarter perspective, 1Q22 GDP rose 0.7% as compared to the advance estimates for an expansion of 0.4%. The upward revision is in line with our call for GDP to grow at 3.6% y/y (+0.6% q/q sa).”

“The official estimate for Singapore’s full-year growth has been maintained at 3 – 5% in 2022. However, authorities are now expecting GDP growth ‘likely to come in at the lower half of the forecast range.’ This is also in line with our expectations for full-year GDP to average 3.5% this year.”

“Singapore’s overall economic prognosis remains optimistic on the back of trade and manufacturing momentum. However, exogenous factors including rising inflation, China’s slowdown and the monetary policy tightening in advanced economies could weaken Singapore’s economic outlook in the year ahead.”

- USD/JPY reverses losses in tandem with the US dollar.

- The market mood remains upbeat, Treasury yields recover losses.

- The pair defends 50-DMA once again but not for long.

USD/JPY is trading on the defensive around the 127.00 level, licking its wound after the drop to 126.68 lows in Asian trading.

The spot is off the lows, tracking the recovery in the US dollar across its main peers. The downside in the major also appears capped amid a minor bounce in the US Treasury yields and positive European equities.

Markets also assess the latest comment from the Japanese PM Fumio Kishida and BOJ Governor Haruhiko Kuroda, as both leaders expressed their take on the country’s growth and inflation outlook.

All eyes now remain on the US PCE Price Index data for fresh dollar valuations, eventually affecting the pair. Note that the latest slew of US macro data has not been very encouraging and has collaborated with the downside in the buck.

Technically, USD/JPY’s daily chart shows that the price is moving lower while within a falling wedge formation after peaking out at 131.34 earlier this month.

Bears are now testing the lower range of the wedge, although the bullish 50-Daily Moving Average (DMA) at 126.55 has been guarding the downside over the past four trading days.

If the latter gives way on a sustained basis, then a test of the wedge lower boundary at 125.90 will be inevitable.

The 14-day Relative Strength Index (RSI) is inching lower below the midline, suggesting that there is scope for additional weakness going forward.

USD/JPY: Daily chart

However, the major could find fresh bids near the wedge support, which may prompt a rebound towards the wedge’s upper boundary, now pegged at 127.83.

Daily closing above that hurdle will confirm a falling wedge breakout, recalling buyers for a fresh run towards the downward-pointing 21-DMA at 128.90.

Ahead of that upside target, the 128.50 psychological barrier could test the bearish commitments.

USD/JPY: Additional levels to consider

- AUD/USD gained strong positive traction on Friday and climbed to a fresh multi-week high.

- The RBA’s hawkish signal acted as a tailwind for the aussie amid sustained USD selling bias.

- Signs that the Fed could pause the rate hike cycle, the risk-on mood weighed on the buck.

The AUD/USD pair maintained its bid tone through the first half of the European session and was last seen trading near a three-week high, just below mid-0.7100s.

A combination of supporting factors assisted the AUD/USD pair to gain strong positive traction on Friday and breakout through a multi-day-old trading range. The Australian dollar continued drawing support from the Reserve Bank of Australia's hawkish signal that a bigger interest rate hike is still possible in June amid the upside risks to inflation. Apart from this, the prevalent US dollar selling bias provided an additional boost to the major and contributed to the ongoing bullish move.

The FOMC meeting minutes released on Wednesday suggested that the Fed could pause the rate hike cycle after two 50 bps hikes each in June and July amid the worsening economic outlook. The speculations were fueled by Thursday's release of the Prelim US GDP report, which showed that the economy contracted by a 1.5% annualized pace in Q1. This, in turn, dragged the yield on the benchmark 10-year US government bond fell to a six-week low, which, along with the risk-on impulse, weighed heavily on the buck.

Meanwhile, the intraday move up pushed spot prices beyond the 0.7125 supply zone and might have already set the stage for additional gains. Hence, a subsequent strength, towards reclaiming the 0.7200 round-figure mark, now looks like a distinct possibility. The momentum could further get extended to the 100-day SMA, around the 0.7230-0.7235 region. Traders now look to the US Core PCE Price Index - the Fed's preferred inflation gauge - for a fresh impetus later during the early North American session.

Technical levels to watch

Gold is trending sideways. Economists at Commerzbank note that the yellow metal is not attracting the attention of investors with risk flows dominating the financial markets.

Somewhat weaker US dollar is lending virtually no support

“In the current market environment, which is characterised once again by higher risk appetite among market participants, gold is not in much demand.”

“The somewhat weaker US dollar is lending virtually no support this morning.”

“The past two days saw outflows from the gold ETFs again, meaning that gold is lacking any impetus from financial investors.”

- GBP/USD climbed to a fresh monthly low and was supported by the prevalent USD selling bias.

- Speculations that the Fed could pause the rate hike cycle, the risk-on mood weighed on the buck.

- Doubts over any further BoE rate hikes, Brexit woes held back bulls from placing aggressive bets.

The GBP/USD pair trimmed a part of its intraday gains to a one-month low and was seen trading near the 1.2625-1.2620 area, up 0.25% during the early European session.

The pair gained positive traction for the third successive day on Friday - also marking the sixth day of a positive move in the previous seven - and confirmed a bullish breakout through the 1.2600 mark. The momentum pushed spot prices to the highest level since April 26 and was sponsored by the prevalent US dollar selling bias.

The FOMC meeting minutes released on Wednesday suggested that the Fed could pause the rate hike cycle after two 50 bps hikes each in June and July amid the worsening economic outlook. The speculations were fueled by Thursday's release of the Prelim US GDP report, which showed that the economy contracted by a 1.5% annualized pace in Q1.

Doubt over the Fed's ability to bring inflation under control without sinking the economy into recession led to an extension of the recent decline in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond fell to a six-week low, which, along with the risk-on impulse, dragged the USD to a fresh one month low.

That said, diminishing odds for any further interest rate hikes by the Bank of England and the UK-EU impasse over Northern Ireland acted as a headwind for the British pound. This was seen as the only factor that held back bulls from placing aggressive bets and behind the GBP/USD pair's intraday pullback of around 40 pips from the daily high.

In the absence of any major market-moving economic releases from the UK, the USD price dynamics will continue to play a key role in influencing the GBP/USD pair. Later during the early North American session, the release of the US Core PCE Price Index - the Fed's preferred inflation gauge - could allow traders to grab short-term opportunities.

Technical levels to watch

Here is what you need to know on Friday, May 27:

With risk flows dominating the financial markets on Thursday, Wall Street's main indexes registered impressive gains and the dollar continued to lose interest. Although the market mood seems to have turned cautious early Friday, the US Dollar Index trades at its lowest level in a month near the mid-101.00s. The US Personal Consumption Expenditures (PCE) Price Index data, the Fed's preferred gauge of inflation, will be published later in the day. The US Bureau of Economic Analysis will also release the Personal Income and Personal Spending data for April alongside the University of Michigan's Consumer Sentiment Index for May.

US Core PCE Preview: Why there is room for a dollar-lifting upside surprise.

Crude oil prices rose sharply on Thursday amid renewed supply concerns and the barrel of West Texas Intermediate (WTI) climbed to its highest level in ten days near $115. Earlier in the day, Russian Deputy Prime Minister Alexander Novak said they were expecting Russia's oil production to decline to 480-500 million tonnes this year from 524 million tonnes in 2021.

Bloomberg reported on Friday that Chinese Premier Li Keqiang warned of dire consequences if they fail to prevent the economy from sliding further and noted that a contraction in the second quarter must be avoided. Meanwhile, the US and Taiwan are reportedly planning to announce economic talks to deepen their ties, which could be seen as a factor that could cause US-China geopolitical tensions to escalate.

EUR/USD took advantage of the selling pressure surrounding the dollar and advanced to its highest level in a month at 1.0765 before going into a consolidation phase. The pair remains on track to close the second straight week in positive territory.

GBP/USD registered small gains on Thursday and fluctuates in a relatively tight channel above 1.2600 on Friday. British Finance Minister announced on Thursday that they will be sending one-off £650 payments to around 8 million of the country's lowest-income households.

Following a three-day consolidation, AUD/USD gained traction during the Asian trading hours and climbed above 0.7100. The data from Australia showed that Retail Sales rose by 0.9% on a monthly basis in April, matching the market expectation.

USD/JPY stays on the back foot and trades near 127.00 early Friday. Bank of Japan Governor Haruhiko Kuroda noted on Friday that they are not expecting prices to rise sustainably unless accompanied by wage hikes.

Gold struggled to gather bullish momentum on Thursday as the benchmark 10-year US Treasury bond yield continued to move up and down near 2.75%. XAU/USD stays calm on Friday and moves sideways slightly above $1,850.

Bitcoin dropped to a two-week low of $28,000 on Thursday. Although BTC/USD managed to erase a small portion of its losses ahead of the weekend, it continues to trade below the key $30,000 level. Ethereum suffered heavy losses in the second half of the week and lost nearly 8% on Thursday. At the time of press, ETH/USD was down 1% on the day at $1,770.

- Sustained USD selling bias assisted gold to gain some positive traction on Friday.