- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 24-05-2022

- The soaring market mood has underpinned pound against the greenback.

- GBP/USD is aiming to recover Tuesday’s losses ahead of the FOMC minutes.

- The US Manufacturing PMI remained at par while Services PMI tumbled sharply.

The GBP/USD pair has rebounded gradually from a low of 1.2475 as positive market sentiment has underpinned the risk-sensitive currencies. The cable witnessed a steep fall on Tuesday after failing to overstep the round level resistance of 1.2600. The asset was offered on Tuesday amid poor S&P Global Purchase Managers Index (PMI) numbers. A severe underperformance was displayed on the economic data front by the UK as the Services PMI landed at 51.8 vs. 57.3 as expected while the Manufacturing PMI was recorded lower at 54.6 vs. 55.1 forecasts.

Meanwhile, the US dollar index (DXY) is oscillating in a minor range of 101.74-101.79 in early Tokyo after a two-day losing streak. The asset has displayed a bearish reversal after establishing below the crucial support of 102.35. Failing to sustain at 19-year high levels of 105.00, the asset has surrendered more than 3% gains in the past eight trading sessions. The IHS Markit reported an at par performance by the US on the PMI data front. The Manufacturing PMI landed at 57.5, in line with the forecasts while the Services PMI remained lower at 53.5.

Now, investors are focusing on the release of the Federal Open Market Committee (FOMC) minutes, which will dictate the strategic development behind the announcement of the 50 basis points (bps) interest rate decision by the Federal Reserve (Fed).

- Silver remains on the front foot around 12-day high, up for the third consecutive day.

- Clear break of 21-DMA, bullish MACD signals direct buyers towards one-month-old resistance line.

- Bears need a downside break of $21.00 to retake control.

Silver (XAG/USD) pierces the 21-DMA while extending the previous day’s run-up to a fortnight high during Wednesday’s Asian session. That said, the bright metal rises to $22.15 at the latest.

Not only a break of the short-term key moving average but bullish MACD signals also underpin the upside bias for the commodity prices.

That said, a descending trend line from April 29, around $22.40, appears immediate key resistance for the quote to cross.

Following that, a run-up towards the $23.00 threshold and late April swing high close to $23.60 can’t be ruled out.

However, an area comprising the 50-DMA and the 100-DMA around $23.70-80, appears a tough nut to crack for the XAG/USD bulls afterward.

On the contrary, pullback moves may have to defy the DMA breakout, around $22.00 by the press time, to direct silver prices towards a two-week-long horizontal rea near $21.20-10.

In a case where the metal remains weak past $21.10, also conquers the $21.00 threshold, it can plummet to the $20.00 psychological magnet.

Silver: Daily chart

Trend: Further upside expected

New Zealand (NZ) markets remain cautious ahead of the key Reserve Bank of New Zealand (RBNZ) Interest Rate Decision, up for publishing at 02:00 AM GMT on Wednesday.

While portraying the mood, the benchmark 10-year Treasury yields drop to the lowest level since April 18, down 0.30% around 3.443% at the latest. On the same line is New Zealand’s key equity index NZX 50 which extends the previous day’s losses, down 0.11% intraday by the press time.

The reason for the latest pessimism in the market, despite the widely anticipated rate hike of 50 basis points (bps) to the Official Cash Rate (OCR) of 1.5%, could be linked to the recently downbeat NZ Q1 2022 Retail Sales.

It’s worth noting that the mostly priced-in rate hike gives rise to a view that any disappointment, either via softer rate action or from the Rate Statement, will have larger repercussions.

Read: Reserve Bank of New Zealand Preview: Will they step up their tightening game?

- USD/CAD holds onto the previous day’s rebound from three-week low, sidelined of late.

- 200-SMA, monthly support line and 50% Fibonacci retracement constitute strong support, 100-SMA guards recovery moves.

- Steady RSI suggests further grinding towards the south.

USD/CAD defends the bounce off the 1.2770 key support, taking rounds to 1.2815-20 during Wednesday’s Asian session. In doing so, the Loonie pair seesaws between the 100-SMA and 200-SMA amid steady RSI conditions.

Hence, the quote is likely to remain sidelined until either breaking the 100-SMA level of 1.2880 or the 1.2770 support confluence including the 200-SMA, together with the one-month-old ascending trend line and 50% Fibonacci retracement of April 21 to May 12 upside.

Even if the USD/CAD prices manage to cross the 110-pip trading range, a three-week-old horizontal area and 61.8% Fibo. will challenge the momentum around 1.2920 and 1.2685 in that order.

It’s worth noting that the quote’s moves past the aforementioned range are likely to create havoc.

That said, the nearly two-week-long consolidation of gains and the recent US dollar weakness suggest short-term favor to the bears. However, a clear downside break of the 1.2685 support seems less likely.

On the contrary, an upside break of the 1.2920 hurdle won’t hesitate to renew the monthly peak, around 1.3080 by the press time.

USD/CAD: Four-hour chart

Trend: Sideways

- A breakdown of an H&S formation at 127.00 has weakened the greenback bulls.

- The 50- and 200-EMAs have displayed a Death Cross formation, which adds to the downside filters.

- RSI’s bearish range shift is compelling for more downside going forward.

The USD/JPY pair is attempting a pullback towards the round-level resistance of 127.00 after a vertical downside move to a low of 126.48 on Tuesday. The pair witnessed a steep fall on Tuesday after slipping below a two-day low of 127.09. An imbalance move from the previous auction area of 127.09-128.32 has dampened the demand for the greenback.

A breakdown of the Head and Shoulder chart pattern on an hourly scale is underpinning the Japanese yen against the greenback. The breakdown of an H&S pattern denotes a prolonged inventory distribution from institutional investors to retain participants. A decisive slippage below the round level support of 127.00 has marked the trigger of the H&S breakdown.

The death cross, represented by the 50- and 200-period Exponential Moving Averages (EMAs) at 130.00 is signaling a confirmed bearish bias in the counter.

Meanwhile, a range shift has been displayed by the Relative Strength Index (RSI) (14) from 40.00-60.00 to the bearish range of 20.00-40.00 which advocates more downside.

Investors should attempt shorts after a pullback towards the 50-EMA at 127.38 for a downside move to Tuesday’s Low at 126.48, followed by the round-level support at 125.00.

Alternatively, the greenback bulls could regain strength if the asset oversteps Thursday’s high at 128.95, which will drive the asset towards May 17 high at 129.78. A breach of the latter will expose the asset to recapture its multi-year high at 131.28.

USD/JPY hourly chart

Early Wednesday morning in Asia, Reuters conveyed three ballistic missile launches from North Korea after US President Joe Biden left the region following a trip in which he agreed to boost measures to deter the nuclear-armed state. “South Korea's Joint Chiefs of Staff said the three ballistic missile launches were fired in the space of less than an hour from the Sunan area of the North's capital Pyongyang,” the news adds.

The North Korean act was in direct violation of the US and South Korea's warning to the hermit kingdom as the news mentioned, “US and South Korean officials had warned that North Korea appeared ready for a weapons test, possibly during Biden's visit.”

However, US Military said, per Reuters, “We aware of multiple North Korean missile launches, but they are not a direct threat to US soldiers, territory, or allies.”

On the contrary, Japan's Defense Minister Nobuo Kishi stated that North Korean missile launches are unacceptable.

Market reaction

Although the geopolitical threats from North Korea are less important for now, considering the Russia-Ukraine crisis and growth fears, S&P 500 Futures paused the day-start advance around 3,960, up 0.40% intraday, following the news.

- The Swiss franc continues its two-week rally vs. the greenback, surging almost 1.50% in two days.

- A weaker US Dollar and a dismal mood increased appetite for the CHF, so the USD/CHF falls.

- USD/CHF Price Forecast: After falling close to 500-pips, bulls find the 0.9550 as a solid demand zone to step in, capping the ongoing pullback.

The USD/CHF continues its free-fall, courtesy of a softer greenback amidst investors’ negative mood, which caused global equities to fall and the buck to lose the 102.000 mark. At the time of writing, the USD/CHF is trading at 0.9605, recording minimal gains of 0.13% as the Asian session begins.

On Tuesday, the market sentiment remained sour throughout the day. US equities finished with losses, except for the Dow Jones. The US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, edged lower, recording a fresh four-week low at around 101.768, down so far in the week almost 1.30%.

USD/CHF Price Forecast: Technical outlook

Tuesday’s session left the USD/CHF trading above the 50-day moving average (DMA) at 0.9558. It’s worth noting that the confluence of Bollinger’s band lower band with the previously-mentioned moving average is a zone that could find some buyers stepping in as the greenback remains in an uptrend. Nevertheless, the two-week pullback weighed on the USD/CHF, which has fallen almost 500 pips from the YTD high at the parity; however, the RSI, albeit in bearish territory, begins to aim higher, meaning the major might consolidate before resuming upwards/downwards.

Upwards, the USD/CHF first resistance would be the 0.9700 mark. If USD/CHF bulls reclaim the aforementioned, a re-test of the 20-DMA at 0.9823 is on the cards, but firstly, a break above the 0.9800 mark is needed before extending the pair’s rally.

On the flip side, the USD/CHF first support would be 0.9600. Break below would expose the confluence of the 50-DMA and Bollinger’s band lower band around 0.9558. Once cleared, the next demand zone would be March 16, 0.9533 daily high.

Key Technical Levels

- AUD/NZD grinds higher after bouncing off two-week low.

- Market’s risk-aversion takes a pause amid quiet start of the key day.

- RBNZ’s likely 50 bps rate hike seems already priced-in and hence a disappointment will be more interesting to watch.

AUD/NZD renews intraday high around 1.01015 as it battles the key hurdle after bouncing off a fortnight low the previous day. That said, the cross-currency pair cheers mildly optimistic market sentiment ahead of the Reserve Bank of New Zealand (RBNZ) Interest Rate Decision.

Global markets began the week on firmer footing before portraying a risk-off day on Tuesday, recently picking pace again, as traders seek confirmations of mixed signals from the major central banks amid inflation growth fears. Even so, softer yields and the US dollar seem to underpin the run-up in Antipodeans. It’s worth noting that the New Zealand Dollar (NZD) seems to have been weighed down of late, despite hawkish expectations from today’s RBNZ, as the widely anticipated 50 bps rate hike is likely already priced-in.

Also weighing on the AUD/NZD prices could be the recent comments from China suggesting more stimulus and efforts tame covid as the nation struggles to justify growth potential. Additionally, a more disappointing outcome of the New Zealand Q1 Retail Sales, -0.5% QoQ versus 8.3% prior, compared to the slightly softer Aussie PMIs also weighs on the quote.

Against this backdrop, the S&P 500 Futures rise half a percent after mixed closing on the Wall Street whereas the US 10-year Treasury yields dropped the most in a week to refresh a one-month low of around 2.717%.

Looking forward, comments from RBA Assistant Governor (Economic) Luci Ellis could offer intermediate clues to the AUD/NZD traders ahead of the key RBNZ.

Read: Reserve Bank of New Zealand Preview: Will they step up their tightening game?

Technical analysis

AUD/NZD bounces off a 10-week-old ascending trend line, around 1.0985, to challenge the weekly resistance line and the 21-DMA near 1.1015.

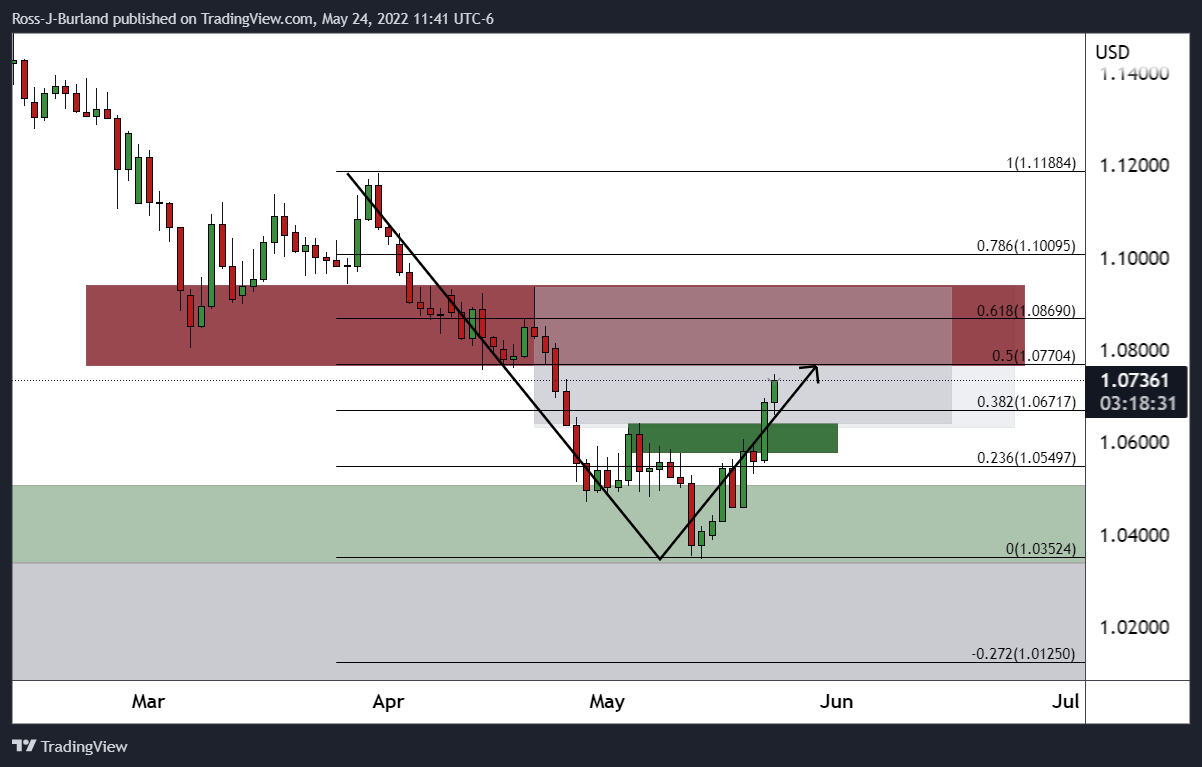

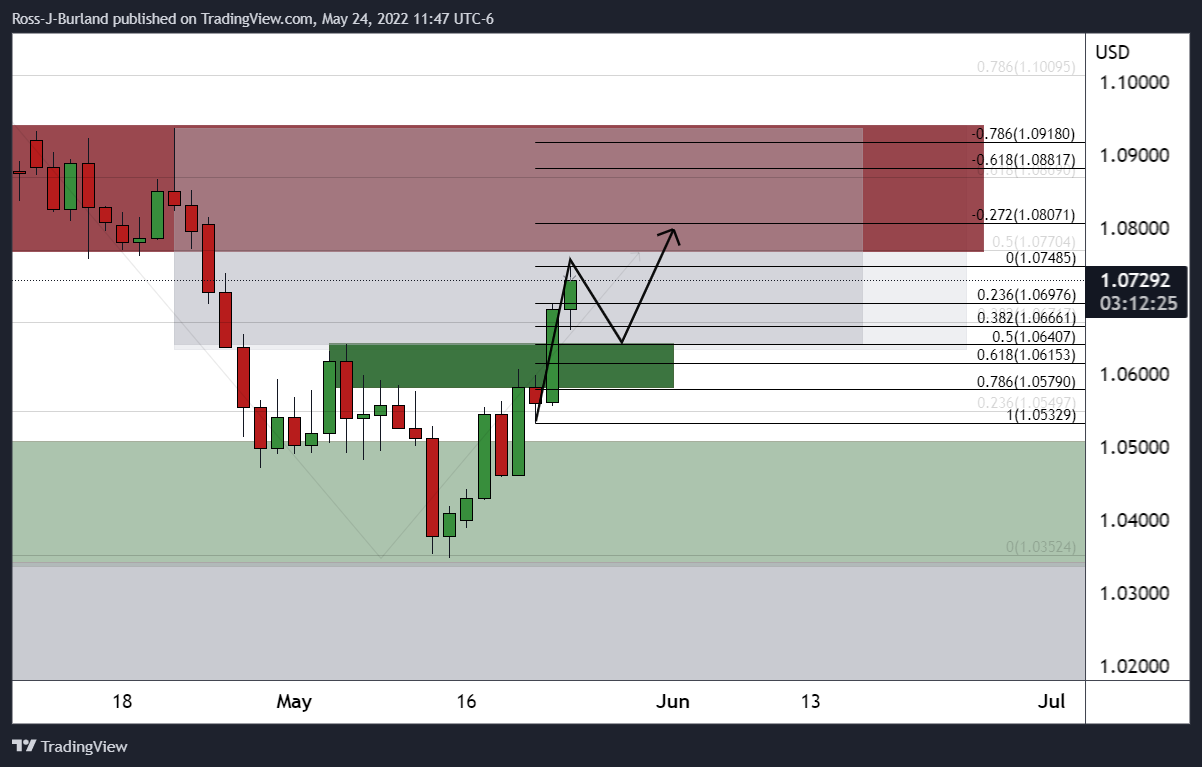

- EUR/USD bulls take a breather after rising to one-month high during a two-day uptrend.

- Hawkish ECB speak, mixed US data and repeated Fed comments underpin the run-up.

- Risk-aversion failed to propel the US dollar amid doubts over growth, inflation.

- US Durable Goods Orders for April, German data and risk catalysts are extra burden on the market watchers.

EUR/USD dribbles around a one-month high, after rising for the last two consecutive days to Wednesday’s Asian morning, as the US dollar selling pauses ahead of the key catalyst, as well as amid a risk-off mood. That said, the major currency pair seesaws around 1.0730-35 by the press time.

Fears of slowing housing growth and hawkish comments from the European Central Bank (ECB) officials could be termed as the key factors that recently propelled the EUR/USD prices. On the same line were the repetitive Fedspeak and an absence of impressive data from elsewhere. It’s worth noting that the risk-aversion couldn’t lift the US dollar on downbeat Treasury yields ahead of today’s Minutes of the latest Federal Open Market Committee (FOMC).

US New Home Sales for April marked the biggest monthly fall in nine years with 16.6% MoM figures and sparked concerns over the growth of the world’s largest economy, especially at the time when inflation fears are mounting. The same weighed down the US Treasury yields and the US Dollar Index (DXY) as Fed policymakers keep repeating the 50 bps rate hike concerns. It’s worth noting that the US preliminary activity numbers for May also came in softer and exerted additional downside pressure on the greenback.

That said, the US 10-year Treasury yields dropped the most in a week to refresh a one-month low around 2.717% while the DXY extended the week-start fall towards late April bottom near 101.70. Elsewhere, the Wall Street benchmarks closed mixed, after an initially downbeat performance.

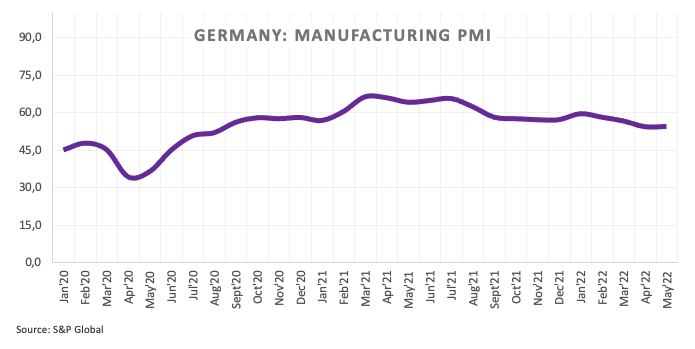

Not only the USD weakness but the economic optimism among the European policymakers and upbeat data from Germany also weighed on the EUR/USD prices. On Tuesday, the European Central Bank (ECB) President Christine Lagarde joined Vice President of the European Commission Valdis Dombrovskis to portray the economic resilience of the bloc. Further, German PMI was firmer for May while the Eurozone numbers were softer-than-expected. It should be noted that some of the ECB policymakers have recently spread direct comments on the 50 bps rate hike in July and offered notable strength to the Euro.

That said, the EUR/USD traders may pay attention to the qualitative catalysts ahead of the European morning and hence a risk-off mood may consolidate some of the pair’s latest gains. However, German GfK sentiment figures, GDP data and a speech from ECB President Lagarde will be crucial to watch afterward. Following that, the US Durable Goods Orders for April and FOMC minutes will be important. Should the US data keep coming softer, the EUR/USD pair will justify the technical breakout to please buyers.

Read: FOMC May Minutes Preview: Will the Fed have to sell MBS?

Technical analysis

A daily closing beyond the previous support line from early March, around 1.0710, directs EUR/USD prices towards the 50-SMA hurdle surrounding 1.0765 ahead of challenging a downward sloping resistance line from February, near 1.0845.

- AUD/USD is looking to recapture a fortnight high at 0.7127 as investors await FOMC minutes.

- A likely underperformance from US Durable Goods Orders may diminish the appeal of the greenback.

- The Manufacturing PMI data of aussie remained vulnerable while in line numbers are displayed by the US.

The AUD/USD pair has surpassed 0.7110 as investors are awaiting the release of the Federal Open Market Committee (FOMC) minutes on Wednesday. The pair struggled to surpass 0.7120 on Tuesday and is attempting to elevate itself above the fortnight high at 0.7127.

The asset prices on Tuesday were mostly dictated by the global Purchase Manager Index (PMI) numbers. The antipodean reported the Manufacturing PMI at 55.3, significantly lower than the estimates of 57.8 and the prior print of 58.8 while Services PMI landed at 53, higher than the forecasts of 52.2 but lower than the prior release of 53.5.

While the US Manufacturing PMI remained in line with the estimates of 57.5 and Service PMI tumbled to 53.5 against the expectation of 55.2.

Going forward, the market participants will focus on the release of the FOMC minutes. The FOMC minutes will dictate the ideology of Federal Reserve (Fed) policymakers behind the announcement of 50 basis points (bps) interest rate hike. Also, the guidance on the upcoming monetary policy meetings will be meaningful to watch.

Apart from the FOMC minutes, the US Durable Goods data hold significant importance. The US Census Bureau is expected to report the monthly Durable Goods Orders at 0.6% against the prior print of 1.1%. Also, the core Durable Goods Orders that exclude defense goods are expected to land at 0% vs. 1.4% reported earlier.

- The GBP/JPY paired Monday’s gains and some more, down 1.31%.

- Sentiment remains negative as Wednesday’s Asian session begins.

- GBP/JPY Price Forecast: To further extend its current losses towards 157.99 and beyond.

Risk-aversion is back for the second consecutive trading day in the week and weighs on the GBP/JPY, which plummets 200 pips as the North American session winds down. At the time of writing, the GBP/JPY is trading at 159.03.

Sentiment remains sour due to US Federal Reserve tightening monetary conditions as the central bank scrambles to bring inflation down. US S&P Global PMIs showed mixed readings, but investors’ concerns about a difficult US economic scenario cloud the outlook. Meanwhile, market players sought safe-haven protection and sold off assets that had the risk word attached to them.

On Tuesday, the GBP/JPY opened near the daily highs at 160.98 and tumbled shy of a solid supply zone around 160.01-41. Initially, the cross stabilized around the 160.30-60 area. However, once it broke below an upslope trendline near 160.50, it exerted further downward pressure until it broke below 160.02, accelerating the downtrend and reaching a fresh weekly low at 157.99.

GBP/JPY Price Forecast: Technical outlook

Once Tuesday’s trading session is in the rearview mirror, the GBP/JPY shifted neutral-downward biased, as shown by the daily chart. Despite the long-term daily moving averages (DMAs) residing below the exchange rate, price action in the 1-hour chart depicts a successive series of lower highs (LH) and lower lows (LL). Hence, a downward move towards the previously tested 157.99 weekly low is on the cards.

That said, the GBP/JPY first support would be May 19 swing low at 158.75. Break below would expose the May 24 daily low at 157.99, followed by the May 16 swing low at 157.42.

Hourly chart

Key Technical Levels

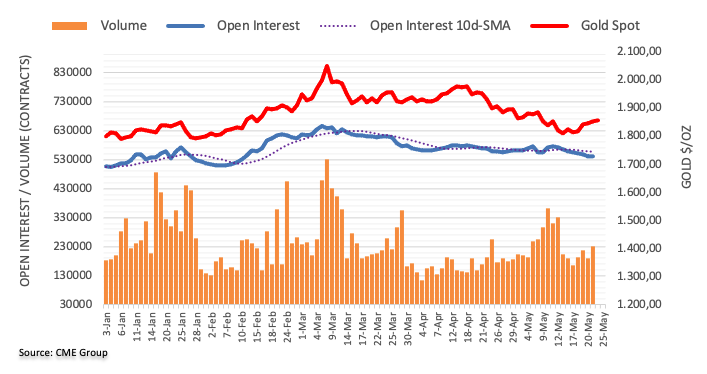

- Gold is making headway into key daily resistance.

- Risk sentiment is sour and supportive of the yellow metal.

The gold price has been moving higher on Tuesday as the US dollar gave way to the bears yet again, sliding to a one-month low following hawkish rhetoric from the European Central Bank President Christine Lagarde. The governor said the eurozone interest rates will likely be in positive territory by the end of the third quarter. Consequently, the markets moved out of the greenback and spread the demand across its rivals.

Against a basket of other major currencies (DXY), the dollar was down 0.362% at 101.646, its lowest since April 25. The greenback also weakened further after data showed US business activity slowed moderately in May. S&P Global said its flash US Composite PMI Output Index, which tracks the manufacturing and services sectors, showed the pace of growth was the slowest in four months. US New-Home Sales also slowed to a 591,000 annual rate in April from a downwardly revised 709,000 rate in March, below the 749,000-rate expected.

Additionally, negativity returned to risk markets and major equity market indexes ended mixed Tuesday as Snap (SNAP) said it expects second-quarter revenue to miss its own guidance. The Dow Jones Industrial Average managed to end 0.2% higher at 31,928.62. The S&P 500 declined 0.8% to 3,941.48 while the tech-heavy Nasdaq Composite fell by 2.4% to 11,264.45. Investors moved into bonds instead and this sent the US 10-year yield lower by 10.1 basis points to 2.76% after reaching its lowest intraday level since mid-April earlier in the session.

Gold supported on growing economic concern

''Gold traders are increasingly questioning the Fed's willingness to hike into a recession, as growing economic concern is breathing life into the gold market. Upside flow from CTAs along with renewed growth in ETFs have supported the recovery,'' analysts at TD Securities argued.

''In turn, the improving momentum has seen the nearest trigger within trend-following models flip toward further upside should prices break north of $1900/oz, rather than a whipsaw lower. Nonetheless, the recovery in the yellow metal is still on shaky ground as Fed Chair Powell signalled a willingness to sacrifice some economic growth in an effort to tame inflation, suggesting the Fed is comfortable with more pain before taking the foot off the break, which should ultimately still weigh on precious metals.''

Gold technical analysis

Gold is trapped between daily support and resistance still but is making headway. However, the W-formation is a reversion pattern that could leave the price trapped in the sideways channel for the days ahead. If, however, there is a break one way or the other, of the current support and resistance, then the price imbalances to $1,883 on the upside and $1,780 to the downside could be mitigated.

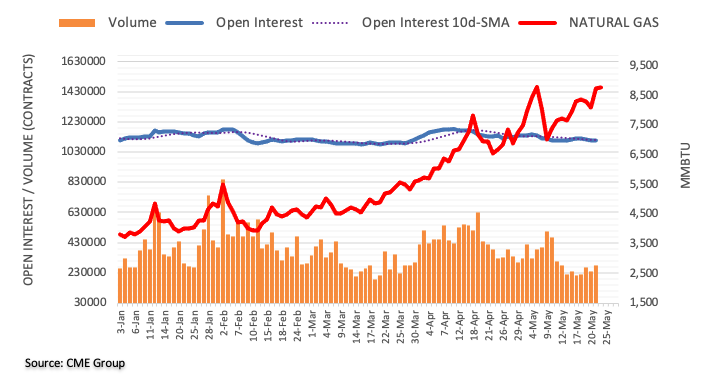

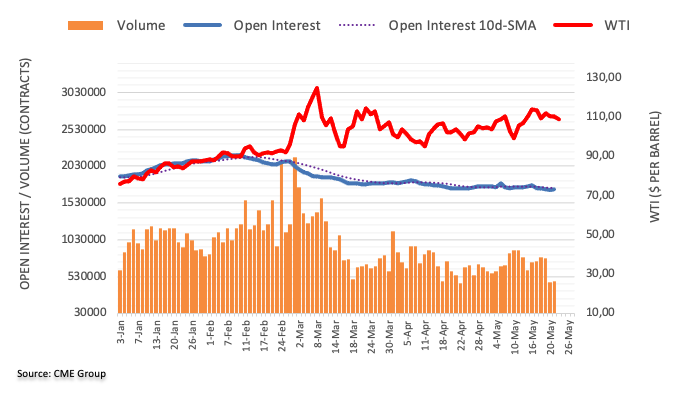

- Oil prices are trading directionless as an underperformance from Global PMI numbers renews demand worries.

- The US PMI remained in line with estimates while Europe and the UK PMI displayed subdued performance.

- Re-opening of Shanghai after severe lockdown measures will spurt the oil demand.

West Texas Intermediate, futures on NYMEX, is oscillating in a narrow range of $109.00-109.72 in the Asian session after an unexpected jump in oil inventories reported by the American Petroleum Institute (API). The weekly oil stockpiles rose to 0.567 million barrels against the previous figure of -2.445 million barrels.

A general underperformance reported in the global Purchase Managers Index (PMI) economic data by various nations has raised concerns over the demand of oil on a broad basis. The US Manufacturing PMI remained similar to consensus at 57.5 but lower than the previous release. Europe’s Manufacturing PMI landed lower at 54.4 than estimates and prior print. Also, the UK’s Manufacturing PMI remained lower at 54.6 than forecasts and former figures. Therefore, a general underperformance in the economic activities by developed nations has showcased a plunge in the aggregate demand and henceforth the demand for fossil fuels.

Going forward, oil bulls may get a sigh of relief as Shanghai is reopening after two-month severe lockdown restrictions to contain the spread of Covid-19. It is worth noting that China is the leading importer of oil and the reopening of Shanghai may spurt the oil demand going forward. Apart from that, the upcoming US summer season is expected to increase the demand of fossil fuels.

Meanwhile, Europe has not reached any meaningful decision regarding the embargo on Russian oil imports as Hungary is continuously opposing the sudden Russian oil ban to safeguard itself against the prompt supply shock.

- It is RBNZ day in the Asian session and the kiwi is quiet ahead of the event.

- The MPS will be held against a backdrop of fragile global markets.

NZD/USD is down some 0.12% into the close on Wall Street in what has been a day of little activity for the pair, bounded by support and resistance, changing hands between 0.6423 and 0.6468 ahead of the Reserve Bank of New Zealand.

''Equities and bond yields are also lower in the US, and general market volatility remains high, and as with last time, the MPS will be held against a backdrop of fragile global markets,'' analysts at ANZ Bank explained.

''That does mean it has to compete with other factors for impact, but with fears of a hard landing at the core of what’s eating away at risk sentiment, as we’ve been saying for a while, if the RBNZ can strike the right balance between “we’ve got this” on inflation while signalling that it is cognisant of recession risks (not an easy job) while also preserving optionality, that’d likely be positive for the Kiwi.''

As for the greenback, the US dollar index has been on the backfoot and it hit nearly a one-month low while European Central Bank President Christine Lagarde said eurozone interest rates will likely be in positive territory by the end of the third quarter. The markets are starting to price in a higher interest rate regime around other central banks which is stripping the greenback of some demand. Against a basket of other major currencies (DXY), the dollar was down to 101.646, its lowest level since April 25.

Reuters reports that the greenback weakened further after data showed US business activity slowed in May as higher prices cooled demand for services while renewed supply constraints because of COVID-19 lockdowns in China and the war in Ukraine hampered production at factories.

''S&P Global said its flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, showed the pace of growth was the slowest in four months.''

- Despite retreating from weekly highs, the EUR/JPY is gaining 0.92% in the week,

- A negative market sentiment keeps safe-haven peers in the FX space buoyant.

- EUR/JPY Price Forecast: Rising wedge in the daily chart might lead the pair to tumble towards 132.00 unless EUR/JPY bulls reclaim 137.00.

The EUR/JPY edges lower after reaching fresh weekly highs at around 136.79 and daily lows just below the 50-DMA at 135.64, blamed on a dampened market sentiment that increased appetite for safe-haven peers. At the time of writing, the EUR/JPY cross-currency pair is trading at 136.16.

Dismal sentiment keeps the euro on the defensive

Risk aversion continued for the second consecutive day in the week. Global equities are trading lower on expectations that the US Federal Reserve will not achieve a soft landing as it tightens monetary conditions, aiming to tackle high inflation around quadruple its target. Furthermore, China’s coronavirus crisis, which spurred factory halts in April, particularly in Shanghai, clouds the economic outlook.

Elsewhere, the EUR/JPY pair opened near the daily high and tumbled as sentiment turned sour, aiming towards the 50-hour simple moving average (SMA) at 135.95, breaking on its way south, support levels like the daily pivot point at 136.05. However, the cross-currency is back above the central daily pivot point, though down in the day by some 0.37%.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY daily chart depicts the pair as upward biased. However, the cross advances steadily and will face a solid supply area around the 137.00 mark, which EUR/JPY bulls have been unable to conquer.

It’s worth noting that a rising wedge is forming, which, once broken, might open the door for further losses. That said, the EUR/JPY’s first support would be the 50-day moving average (DMA) at 135.64. A breach of the latter would open the door for a re-test of the rising wedge bottom trendline, around 134.80-135.10. Once cleared, the following demand zone would be the rising wedge target at 132.00, followed by the 200-DMA at 131.24.

What you need to take care of on Wednesday, May 25:

The American dollar remained weak on Tuesday, despite the market mood being sour. The EUR/USD pair rallied beyond 1.0700 as more ECB officials vowed for a 50 bps rate hike. The GBP/USD pair, however, fell following softer-than-anticipated local data to end the day in the 1.2520 price zone.

S&P Global released the preliminary estimates of its May PMIs. Most European manufacturing and services indexes came in below the market’s expectation, except for the German ones, which were slightly better than April ones. The EU services PMI came down to 56.3 from 57.7 in the previous month, while the manufacturing index printed at 54.4, below the 54.9 expected.

UK figures were also disappointing, as business activity slowed down to its weakest since early 2021, according to the official report. Finally, the company reported that the US manufacturing index slid to 57.5 as expected, while the services index contracted to 53.5 in the same period.

Meanwhile, inflation did not recede while the coronavirus-related lockdown in China exacerbated supply chain issues. In fact, JP Morgan downgraded China’s growth forecast to 3.7% from 4.3% in 2022, while other research institutes followed suit.

The AUD/USD pair trades just below the 0.7100 level, while USD/CAD holds above 1.2800. Safe-haven currencies were sharply up, with USD/JPY down to 126.80.

Gold price trades near its weekly high at $1,869.71 a troy ounce, while crude oil prices posted modest gains. WTI is now changing hands at around $110.00 a barrel.

Asian and European indexes closed in the red. Wall Street spent most of the day in negative territory but managed to recover ground in the final hour of trading. The DJIA settled in positive territory, but its counterparts remained in the red.

Demand for safety boosted government bonds, with yields down to fresh weekly lows.

The Reserve Bank of New Zealand will announce its monetary policy decision and is expected to hike the main rate by 50 bps to 2%.

This is how low Bitcoin can go

Like this article? Help us with some feedback by answering this survey:

- USD/CAD is losing some bids into the close on Wall Street but the loonie remains out of favour.

- Oil and shares have been on the backfoot while investors remain concerned over China's economy.

At 1.2824, USD/CAD is higher on the day so far as the commodity sector wobbles as fears about weak earnings and slowing economic growth punctured the recent mini-rally. Shares have been on the backfoot while investors remain concerned over China's economy.

At the start of the week, traders favoured the pledges of more stimulus from China's government but are now more concerned over the prospects of a prolonged lockdown in various regions of the nation that still struggle with the pandemic. "The government's dynamic zero-COVID policy will remain in place through 2022, preventing a return to normalcy and limiting the effectiveness of new fiscal and monetary stimulus measures," warned S&P Global. "Thus, real GDP growth will likely slow from 8.1% in 2021 to 4.3% in 2022." "New geopolitical, financial, or supply-side shocks could tip the world economy into recession."

Additionally, the price of oil is lower over the worries of not only a possible global recession but also China's COVID-19 curbs that have balanced tight global supply and US summer driving season demand. US crude prices have eased to $108.63 a barrel. Subsequently, the Canadian dollar has edged lower against its US counterpart on Tuesday.

As for data, Canadian factory sales rose 1.6% in April from March, largely driven by higher sales of petroleum and coal products, Statistics Canada said in a flash estimate. A separate flash estimate for the same month showed that wholesale trade rose 0.2%.

Overall, CAD could be in a better position compared to other growth currencies such as the antipodeans due to solid growth, commodity exposure, and domestic monetary tightening. However, ''markets are shifting into data-watching mode, and how this evolves will be relevant for broad USD dynamics over the tactical horizon, analysts at TD Securities argued and said that ''this is not a great setup for the CAD.''

- Silver (XAG/USD) modestly advances but faces strong resistance around $22.00; so far is up 1.25% in the week.

- Risk-aversion keeps precious metals buoyant while the greenback and US Treasury yields fall.

- Silver Price Forecast (XAG/USD): A daily close above $22.00 would open the door for further gains; otherwise, the downtrend would resume.

Silver (XAG/USD) registers gains but appears to be glued to the $22.00 mark, as XAG/USD bulls failed to record a daily close above the $22.00 area for four consecutive days, albeit a dampened market mood. At the time of writing, the XAG/USD is trading at $22.05.

Precious metals climb on the US weaker economic outlook

US equities keep illustrating a dampened market mood in tone with the Asian and European sessions. S&P Global PMIs revealed that Europe and the US presented mixed results, increasing investors’ concerns that Europe and the US might suffer a possible economic slowdown. The supply chain issues continue, and higher costs from raw materials would keep inflationary pressures elevated.

Given the backdrop that the Federal Reserve is tightening monetary conditions in the US and is about to hike 50-bps in the June and July meetings, concerns about the US central bank achieving a soft or “softish landing,” as Fed Chair Powell said, look far to be done. That’s why market players keep the US stock market downward pressured and the US dollar softer.

The US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, slides 0.24% and is down at 101.850. Failure to reclaim the 102.000 mark would open the door for a retest of April 21 swing low at 99.818. On the same note, the 10-year US Treasury yield grinds lower and loses almost ten basis points (bps), sitting at 2.761%, a tailwind for Silver prices.

Elsewhere, Atlanta’s Fed President Raphael Bostic crossed the wires, though he sounded less “hawkish” than usually. Bostic said that rate hikes won’t cause a recession and that the central bank can hike rates to deal with overly high inflation without sending the US economy into recession. He stated that the US central bank could pause rate increases in September to review how the economy performs.

Macroeconomic-wise, the US docket featured the US S&P Global PMIs for May, which illustrated mixed results, with the Services and Composite Indexes missing expectations while the Manufacturing PMI was unchanged. Furthermore, Richmond’s Fed Manufacturing Index plunged to -14 vs. 15 foreseen, adding to the Fed regional manufacturing reports showing deceleration or contraction.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD is still downward biased, despite recording gains for the third day out of the last four. However, it’s important that XAG/USD traders, need to be aware that Silver has struggled at the $22.00 mark. Failure at the previously mentioned would resume the downtrend and open the door for further losses.

If that scenario plays out, the XAG/USD’s first support would be the May 19 pivot low at $21.28. Break below would expose the May 16 daily low at $20.84, followed by the YTD low at $20.45. However, if XAG/USD’s bulls accomplish a daily close above the $22.00 mark, that could allow further gains. The XAG/USD first resistance would be the psychological $23.00 mark. Once cleared, the next supply zones would be the May 5 swing high at $23.28, followed by a test of the 200-DMA at $23.57.

- EUR/USD staying the course, so far, towards a 50% mean reversion target area.

- However, the bearish head and shoulders are a topping pattern that currently features in the 15-min time frame.

As per the start of the week's analysis, EUR/USD Price Analysis: Bulls are taking over through key daily resistance, the price has continued higher as the bulls hunt down key weekly resistance structure.

Breaking daily resistance in the opening sessions on Monday, EUR/USD breached the 38.2% Fibonacci of the weekly bearish impulse on Monday and has subsequently moved higher into the 1.07 areas with eyes on mid-late April daily swing lows near 1.0770. The following illustrates the bullish bias over a series of time frames.

EUR/USD weekly/daily charts, prior analysis

It was stated that ''the bulls are already penetrating the 38.2% Fibonacci and on the way to 1.07 the figure. A move towards the 50% and 61.8% ratios could be on the cards for the foreseeable future.''

As for the daily chart, the analysis noted ''the price imbalance on the daily chart leaves the aforementioned weekly ratios on the Fibonacci scale exposed towards 1.0770 and 1.0936.''

EUR/USD live market

The price is moving in on the aforementioned weekly supply zone and prior daily swing lows:

However, at this juncture, the weekly W-formation should be noted:

This is a reversion pattern and the price would be expected to revisit the neckline in due course. In the meantime, the daily impulse could be due for a meanwhile correction also:

EUR/USD M15 chart

The bearish head and shoulders are a topping pattern that currently features in the 15-min time frame. A break of the neckline near 1.0725 could spell trouble for the committed bulls. A break of 1.0705 will likely open the way for further supply to mitigate the price imbalance towards a 38.2% Fibonacci retracement of the daily bullish breakout impulse near 1.0665 that guards a 50% mean reversion to 1.0640.

- Cable pares some of Monday’s gains and retraces towards the 1.2530s region.

- Risk-aversion and weaker than the expected UK PMIs weighed on the GBP/USD.

- GBP/USD Price Forecast: A daily close below 1.2600 to leave exposed the major to additional selling pressure.

The British pound shifted to the defensive as sentiment shifted sour and weighed by weaker than expected UK PMIs, which dragged the major from weekly highs at around 1.2600 towards the 1.2530s area. At 1.2536, the GBP/USD is trimming some of Monday’s gains and is down 0.40%.

The mood remains dampened, spurred by concerns about the US economy falling into a recession. The Federal Reserve is on a hiking cycle, tightening its monetary policy, which according to money market futures, would see the Fed hiking towards the 2.75-3% area by the end of the year.

Another factor that is weighing on is China’s Covid-19 crisis. Reports over the weekend illustrated that Beijing is struggling to cap the spread. Meanwhile, Shanghai, which was about to lift restrictions, witnessed another outbreak, though not as at the beginning of the last episode.

Elsewhere, the GBP/USD opened near the daily high around 1.2600 but fell and broke below the central and S1 daily pivot points, near the 1.2480s. Nevertheless, towards the end of the European session, the major is treading water and is aiming towards the 50-hour simple moving average (SMA) at 1.2542.

GBP/USD Price Forecast Technical outlook

From a technical perspective, the GBP/USD remains downward biased, despite bouncing 300 pips from the YTD low to current levels. The 1.2600 mark probes to be a solid resistance, as the GBP/USD bulls struggled twice to reclaim the figure, which would have opened the door for an upward move towards the May 4 swing high at 1.2638. However, a daily close below 1.2600 would leave the pair vulnerable to additional selling pressure, further validated by the RSI at 48.69, within the negative territory and aiming lower.

That said, the GBP/USD first support would be the psychological 1.2500 figure. A breach of the latter would expose July 2020 lows near 1.2479, followed by the May 17 daily low at 1.2313 and the YTD low at 1.2155.

Key Technical Levels

- AUD/USD is on the back foot despite a bruised US dollar.

- Investors remain concerned over China's economy and COVID lockdowns.

At 0.7085, AUD/USD is trading down some 0.31%, sliding from a high of 0.7107 to a low of 0.7056.

The Australian dollar eased on Tuesday as global stocks underperformed while investors remain concerned over China's economy and COVID lockdowns. At the start of the week, traders favoured the pledges of more stimulus from China's government over the prospects of a prolonged lockdown in various regions of the nation that still struggles with the pandemic.

"The government's dynamic zero-COVID policy will remain in place through 2022, preventing a return to normalcy and limiting the effectiveness of new fiscal and monetary stimulus measures," warned S&P Global. "Thus, real GDP growth will likely slow from 8.1% in 2021 to 4.3% in 2022." "New geopolitical, financial, or supply-side shocks could tip the world economy into recession."

Meanwhile, with central banks in the picture, the US dollar's appeal has been hit due to other central bankers speaking out and carrying hawkish rhetoric. The DXY index, which measures a basket of currencies vs. the US dollar printed a fresh one-month low on Tuesday after European Central Bank President Christine Lagarde said eurozone interest rates will likely be in positive territory by the end of the third quarter. This supported the euro in a correction higher and weighed on the greenback.

RBA in focus

As for the Reserve Bank of Australia, consumer spending seems to have held up well to the Reserve Bank of Australia's (RBA) first hike in interest rates earlier this month. However, some of the data of late may not have met the mark.

''The Wage Price Index (WPI) came in below expectations in the first quarter at a low 0.7% QoQ (0.65%), the same rate as in the fourth quarter 2021,'' analysts at ANZ Bank explained, adding that ''this suggests the RBA is likely to hike the cash rate another 25bp in June, rather than a larger 40 or 50bp hike.''

''The wage and employment data hasn’t, in our view, met Governor Lowe’s threshold of there needing to be “a very strong argument” for the RBA to “deviate” from moves of 25bp in coming months.''

''Especially when the minutes from the May meeting highlighted that the Board meets monthly, so has the opportunity to review the setting of interest rates again within a relatively short period of time.''

Meanwhile, markets are priced for quarter-point rises in the 0.35% cash rate in both June and July, and a half-point hike in August following what is likely to be another alarming inflation report.

Looking ahead, the RBA Assistant Governor Luci Ellis is due to speak and could expand on the central bank's own outlook for policy.

- The yellow metal is rallying in the week, gaining 1.07%.

- Gold advance is courtesy of a dismal sentiment, broad US dollar weakness, and falling US Treasury yields.

- Gold Price Forecast (XAU/USD): To hit a substantial resistance area around $1886-90, which once cleared would open the door for further gains; otherwise, Gold would tumble towards the 200-DMA.

Gold spot (XAU/USD) records solid gains and stays above the 20-day moving average (DMA), which lies at $1854.50, amidst a dismal market sentiment, falling US Treasury yields, and a weaker US dollar. At $1867.22, XAU/USD eyes to re-test the March 31 swing low-turned-resistance at around $1889.91.

Gold advances boosted by a softer greenback

Risk-aversion keeps riskier assets under pressure. Global equities are recording losses, while the non-yielding metal has seen an increase in flows towards its safe-haven status, while the greenback keeps tumbling, a tailwind for Gold prices. The US Dollar Index, a gauge of the buck’s value vs. a basket of peers, is falling 0.36%, down at 101.717.

Investors’ concerns that the US Federal Reserve would trigger a recession in favor of bringing inflation down weighed on the market mood. Additionally, China’s ongoing coronavirus crisis keeps the global economic outlook cloudy. According to the Global Times, Shanghai will allow convenience stores and drugstores to resume operations with a maximum occupancy of 50% before May 31 and 75% after June 1.

In the meantime, US Treasuries keep plunging, led by the 10-year Treasury yield, down 11 bps, sitting at 2.743%.

At the time of writing, Atlanta’s Fed President Raphael Bostic hit the wires. Bostic said he supports expeditious rate hikes to neutral but done “with intention and without recklessness.” Further added that he does not see clear signs of a wage-price spiral.

The US economic docket featured the US S&P Global PMIs for May, which illustrated mixed results, with the Services and Composite Indexes missing expectations while the Manufacturing PMI was unchanged. Furthermore, Richmond’s Fed Manufacturing Index plunged to -14 vs. 15 foreseen, adding to the Fed regional manufacturing reports showing deceleration or contraction.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD remains neutral biased, despite exchanging hands above the 20 and the 200-day moving averages (DMAs), each at $1854.41 and $1839.36, respectively. The four-consecutive day rally continued, but the non-yielding metal will face substantial resistance levels around the 100-DMA and March’s 31 swing lows. If XAU/USD fails to reclaim the previously mentioned levels, Gold would aim south and re-test the 200-DMA.

Upwards, the XAU/USD’s first resistance would be the 100-DMA at 1886.84. Break above would immediately expose the March 31 swing low-turned-resistance at 1889.91, followed by the 1900 mark. On the flip side, the XAU/USD’s first support would be the 20-DMA at $1854.41, followed by the 200-DMA at $1839.36, and then the $1800 figure.

Federal Reserve's Raphael Bostic said rate hikes won’t cause a recession and that the central bank can hike rates to deal with overly high inflation without sending the US economy into recession.

He repeats that the Fed rates hikes can take some pause arguing that the Fed might need to pause rate increases in September to take stock of how the economy is performing.

Key comments

Will proceed 'with intention, without recklessness'.

Monetary policymakers must be mindful of uncertainties, proceed carefully in tightening policy.

US dollar remains pressured

The bruised US dollar was sold off to a fresh one-month low on Tuesday. Against a basket of its rivals (DXY), the dollar fell to 101.646, its lowest level since April 25.

- Demand for bonds is on the rise amid a deterioration in the global economic outlook.

- US stocks drop on Tuesday boosting further the yen.

- USD/JPY breaks range and extends retreat from multi-year highs.

The USD/JPY ended with days of consolidation with a sharp decline on Tuesday. The pair broke under 127.00 and tumbled to 126.34, the lowest level in a month. It remains near the lows, under pressure amid risk aversion.

The decline of USD/JPY gained momentum on the back of a weaker US dollar, lower yields and as stocks in Wall Street turned red. The Dow Jones is falling 0.83% and the Nasdaq drops by 2.78%. The US 10-year yield stands at 2.73%, a four-week low while the 30-year is back under 3%.

Economic data from the US came in below expectations (PMIs and New Home Sales) and weighed on the greenback. The DXY is falling 0.37%, trading at 101.70, the lowest in almost a month.

Analysts at MUFG Bank, see the USD/JPY pair with a bearish bias, moving in the range 122.00/129.50 during the next weeks. “The main risk to our bearish outlook for USD/JPY would be if global growth concerns eased in the month ahead. A pick-up in China growth could be one potential trigger. The upward impact on global yields, commodity prices and a potential stabilization for global equity markets should encourage a higher USD/JPY even if the USD weakens more broadly. Yen weakness would be more evident though against high beta commodity currencies.”

If the USD/JPY extends the decline, below the 126.30 support line, 126.00 is the next target followed by 125.75 (April 11, 12 high). A recovery now would face an immediate resistance at the 127.00/05 area. Above the next one might be seen at 127.60 and then comes a downtrend line at 128.30.

Technical levels

A break lower in the EUR/USD pair to new lows remains plausible in a scenario of tighter financial conditions, explain analysts at MUFG Bank. They point out the scale of the sell-off of the dollar does highlight the limits to the bull-run from here and with so much Federal Reserve tightening priced, they still expect the US dollar to weaken more notably later in the year.

Key Quotes:

“We are sticking to our neutral bias for EUR/USD in the month ahead. The ECB’s recent hawkish policy shift has helped to provide some much-needed support for the EUR after it briefly tested and held support from the low in early 2017 at 1.0340. The EUR has since staged a relief rally moving back into the middle of our forecast range. The turnaround for the EUR has been reinforced by hawkish comments from President Lagarde signalling clearly that the ECB plans to speed up the pace of policy tightening in response to upside inflation risks.”

“The removal of negative rate policy should provide more support for the EUR going forward given that it has proved effective at helping to keep the EUR weak by encouraging record capital outflows into foreign bond markets while it has been in place. It was more normal for EUR/USD to trade above the 1.2000-level in the decade prior to the introduction of negative rates.”

“The EUR’s ability to extend its recent advance much further on the back of the normalization of ECB policy remains constrained by ongoing downside risks from the Ukraine conflict. It appears increasingly likely now that the conflict will prove more prolonged than initially hoped and thereby increases the risk of a longer period of disruption for the euro-zone economy that will both dampen growth and keep inflation higher for longer.”

- Canadian dollar among worst performers of the American session.

- US and Canadian bonds rise sharply.

- USD/CAD rises to the highest level since last Wednesday.

The USD/CAD broke to the upside after moving in a small range for hours and jumped to 1.2872, reaching the highest level since last Thursday. The pair remains near the highs, with the bullish momentum intact.

Weaker loonie, USD/CAD rebounds from weekly lows

The loonie dropped across the board during the American session amid risk aversion. It also lost ground versus AUD and NZD. The Dow Jones is falling 1.40% and the Nasdaq 3.40%. US and Canadian yields are falling, currently at multi-day lows.

The slide in equity prices offered some support to the dollar that was affected by weaker than expected US economic data. The S&P Global PMI came in below expectations. The S&P Global Composite dropped in May to the lowest in five months according to preliminary data at 53.8, down from 56 and below the 55.5 of market consensus. New home Sales fell 16.6% in April, worse than expectations. On Wednesday, the FOMC minutes will be released. In Canada, the next important economic report is due on Thursday with retail sales.

Resistance ahead at 1.2890

The USD/CAD is turning to the upside, bouncing from the lowest in two weeks. The pair found support above 1.2760 and now is looking to test the 1.2890 area. A consolidation above 1.2900 should strengthen the outlook for the dollar.

On the flip side, 1.2815/20 is the key support. If USD/CAD falls below, the recent low at 1.2764 would be exposed. Below the next support stands at 1.2714 (May 5 low).

Technical levels

- The common currency records gains in the week of 1.57%.

- Overall US Dollar’s weakness on concerns that the Fed would trigger a recession, a tailwind for the EUR/USD.

- EUR/USD Price Forecast: Failure to reclaim the 50-DMA at around 1.0767 would expose the major to selling pressure.

EUR/USD bulls are reclaiming the 1.0700 mark on Tuesday, courtesy of ECB policymakers expressing the need for the central bank to exit from negative rates by the third quarter of 2022, further emphasized on Monday by ECB President Christine Lagarde. At 1.0732, the EUR/USD gains for the second straight day.

US Dollar weakness extend for two days on investors’ concerns of a “possible” US recession

The greenback remains soft for the second day of the week and is trading below 102.000 the lowest level since April 26, on growing concerns that the Federal Reserve would not achieve a soft landing and trigger a recession. Meanwhile, May’s US S&P Global PMIs showed mixed results, with the Services and Composite Index missing expectations while the Manufacturing PMI came unchanged.

Later, Richmond’s Fed Manufacturing Index plunged to -14 vs. 15 foreseen, adding to the list of Fed regional manufacturing reports showing deceleration or contraction. Late at around 16:20, the Fed Chair Jerome Powell would cross the wires.

In the meantime, the US 10-year benchmark note follows the buck’s footsteps and is also down 13 bps, sitting at 2.726%.

During the Eurozone session, the EU docket witnessed the release of S&P Global PMIs, which showed mixed results. The EU Manufacturing and Services PMI missed expectations, though downtick minimally. The German Manufacturing PMI beat expectations, carrying on the support from Monday’s German IFO readings, which showed the resilience of businesses and consumers.

Further ECB speaking crossed the wires on Tuesday. ECB’s President Lagarde said, “I don’t think that we’re in a situation of surging demand at the moment. It’s definitely an inflation that is fueled by the supply side of the economy. In that situation, we have to move in the right direction, obviously, but we don’t have to rush and we don’t have to panic.” In the meantime, ECB’s Francois Villeroy added that “A 50 bp hike is not part of the consensus at this point, I am clear. Interest rate hikes will be gradual.”

Albeit Lagarde and Villeroy’s efforts to push back, additional ECB “hawks” crossed wires. ECB’s Holzmann said a 50 bps hike in July would be appropriate. Furthermore, ECB’s Kazakhs added to that list and commented that the central bank should not rule out 50 bps rate rises and look for hikes in July and September, and possibly another in Q4.

In the week ahead, the EU docket is packed and will feature German Gfk Consumer Confidence, German GDP, and France’s Consumer Confidence. On the US front, Durable Goods Orders, May’s FOMC Minutes, US GDP Growth Estimates, and the Fed’s favorite gauge of inflation, the Personal Consumption Expenditure (PCE).

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains downward biased, despite the last couple of weeks’ price action, which formed a bottom after dropping from 2021 tops at around 1.2349. Nevertheless, the shared currency is still hovering around the April 2020 lows near 1.0727, which means that a daily close above the previously mentioned would open the door for further gains. Otherwise, the EUR/USD rally to the 1.0720s area would be seen as an opportunity for EUR/USD bears to add to their positions and aim for a re-test of the YTD lows at 1.0348.

Upwards, the EUR/USD’s first resistance would be the 50-day moving average (DMA) at 1.0767. Break above would expose the March 7 daily low at 1.0805, followed by the 1.0900 mark. On the flip side, the major’s first support would be 1.0700. A breach of the latter would expose April 2017 daily low at 1.0635, followed by the 20-DMA at 1.0535.

- A sharp drop in UK (and global) yields following weak UK and US PMI data has weighed heavily on GBP/JPY.

- The pair was last trading in the low 158.00s and eyeing a breakout to fresh monthly lows around 156.00.

UK government bond yields had already been on the back foot in the lead up to the start of the US trading session in wake of much weaker than expected UK PMI data for May released earlier in the day which triggered renewed fears about the UK’s increasingly fragile, inflation plagued economy, but that move lower accelerated in tandem with a drop in global yields after disappointing US Service PMI numbers, which triggered fears about a slowdown in the world’s most important/largest economy.

UK 10-year yields were last trading lower by more than 10 bps on the day, with similar drops seen in the US and, to a lesser extent owing to hawkish ECB commentary, the Eurozone. As a result, UK (and global)/Japan yields differentials have narrowed significantly on the day, weighing heavily on G10/JPY pairs owing to the yen’s sensitivity to rate differentials.

GBP/JPY was last trading close to one-week lows under the 158.50 mark, down about 1.6% or over 250 pips on the day and eyeing a break lower towards monthly lows in the 156.00 area. Technicians will note how the 21-Day Moving Average (at 160.40) has once again proven a solid level of resistance, as has been the case since late April. As global growth fears largely subsume fears about central bank tightening, thus sending yields lower, G10/JPY pairs like GBP/JPY remain at risk of further losses. Traders will likely be targetting a test of the 200DMA in the mid-155.00s in the coming weeks.

European Central Bank policymaker Martins Kazaks said on Tuesday that the bank should not rule out a 50 bps rate hike, and that he sees possible rate hikes in July, September and potentially one more in Q4, reported Reuters.

His remarks come after fellow ECB policymaker Robert Holzmann called for a 50 bps move in July,, ECB's Francois Villeroy de Galhau said a 50 bps rate hike isn't yet consensus at the bank and ECB President Christine Lagarde reiterated that the bank will take rates out of negative territory in Q3.

- NZD/USD has pared some intra-day losses after weak US Service PMI data, but is still lower in the 0.6450 area.

- NZD was weighed by softer than expected New Zealand Retail Sales growth figures, which come ahead of Wednesday’s RBNZ meeting.

Softer than expected Q1 New Zealand Retail Sales growth figures have contributed to a weakening of the kiwi on Tuesday, with NZD/USD eroding much of the gains it made on Monday as a result. Worries about global growth as scores of major institutions revised down their growth estimates for the Chinese economy and more US companies warned about a worsening economic environment also weighed. The pair is currently trading near the 0.6450 level, down about 0.3% on the day, after reaching as high as 0.6490 at the start of the week. Just released US Services PMI data for May was worse than expected and has helped the kiwi pair some of its intra-day losses versus the buck, with NZD/USD having been as low as the 0.6420s earlier in the day.

Back to the New Zealand data; real Retail Sales growth came in at -0.5% QoQ in the first quarter of this year, below expectations for a solid pace of increase. Analysts at Westpac said the data “signals downside risk to our forecasts for a 0.6% rise in March quarter GDP”. “The rise in consumer prices is squeezing households' spending power,” they added, “while the rise in mortgage rates and related debt servicing costs will add to the pressures on discretionary incomes”.

Still, the RBNZ is nonetheless expected to press ahead with a 50 bps rate hike during the upcoming Wednesday Asia Pacific session. Kiwi traders will be closely scrutinising the bank’s guidance for future rate hikes and NZD could be choppy as a result. Ahead of the upcoming RBNZ announcement, NZD/USD traders will also have to keep an eye on commentary from Fed Chair Jerome Powell from 1620GMT, where he will likely reiterate the bank’s stance that it is ready to lift interest rates above neutral without hesitation if needed to tame inflation.

New Home Sales in the US in April slumped 16.6% MoM, according to the latest data from the US Census Bureau released on Tuesday. That comes after a 10.5% slump in March, reflecting the ongoing impact of the recent sharp rise in mortgage rates. New Homes Sales came in at 591K over the past 12 months to April, well below expectations for 750K and down from March's 709K.

Market Reaction

FX markets do not seem to have reacted to the latest US housing figures, concerning for the US economy though they were. Focus instead has seemingly remained on weak US Service PMI data released a few minutes before, which knocked the DXY back to session lows.

- A combination of factors dragged USD/CHF to a nearly one-month low on Tuesday.

- The risk-off mood underpinned the safe-haven CHF and exerted downward pressure.

- Broad-based USD weakness further contributed to the selling bias and the downfall.

The USD/CHF pair dropped to a nearly one-month low during the early North American session and is now looking to extend the downward trajectory below the 0.9600 round-figure mark.

The pair prolonged its recent sharp retracement slide from a two-year peak, around the 1.0065 region touched earlier this month and witnessed some follow-through selling on Tuesday. This marked the second successive day of a downfall - also the fifth in the previous six - and was sponsored by a combination of factors.

The worsening global economic outlook continued weighing on investors' sentiment, which was evident from a fresh wave of the risk-aversion trade. This, in turn, boosted demand for the traditional safe-haven Swiss franc and dragged the USD/CHF pair lower amid the emergence of heavy selling around the US dollar.

The anti-risk flow was reinforced by a fresh leg down in the US Treasury bond yields. Apart from this, strong pickup in the shared currency - bolstered by hawkish comments by the ECB policymakers - dragged the USD Index to a fresh monthly low. This was seen as another factor that contributed to the USD/CHF pair's decline.

On the economic data front, the US PMIs indicated a deceleration of growth in both - the manufacturing and services sector - and did little to provide any respite to the USD bulls. Tuesday's US economic docket also features New Home Sales and Richmond Manufacturing Index, though the focus remains on Fed Chair Jerome Powell's speech.

Technical levels to watch

- USD/TRY prints new 2022 highs north of 16.00 on Tuesday.

- Turkey 10y bond yields rose to the boundaries of 25.00%.

- The CBRT is expected to leave the policy rate unchanged.

Further weakness in the Turkish currency lifts USD/TRY to new YTD highs past the 16.00 barrier on Tuesday.

USD/TRY weaker ahead of CBRT

USD/TRY advances for the third session in a row and finally manages to leave behind the 16.00 hurdle on Tuesday despite the persistent offered stance in the greenback.

The lira, in the meantime, continues to suffer the omnipresent geopolitical tensions stemming from the war in Ukraine and its associated energy crisis, while rising speculation of a global slowdown seems to have already started to weigh on the currency.

In addition, inflation concerns appear unabated and were particularly exacerbated after the monthly survey by the Turkish central bank (CBRT) on Monday now sees inflation around 58% by year end.

Investors’ attention, in the meantime, slowly shifts to the CBRT’s event on Thursday and whether the bank will finally start hiking rates to tame the rampant inflation.

What to look for around TRY

USD/TRY keeps the upside bias well and sound and trades beyond the 16.00 yardstick for the first time since late December 2021.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Economic Confidence Index, CBRT Interest Rate Decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 0.80% at 16.0484 and is expected to meet the next hurdle at 16.1533 (2022 high May 24) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other and, a breach of 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29).

How should investors position for stagflation? Economists at Deutsche Bank can already see similar patterns between how different assets performed in the 1970s and how they have been doing today. Commodities are the only asset class to see relatively consistent gains.

Traditional assets need inflation back towards target

“The main takeaway should be that if inflation stays high for many years, then both history and today's high starting valuations suggest it will be very difficult to generate positive real returns in most traditional financial asset classes. Nominal returns will also likely underperform their long-term trend.”

“Commodities could be the exception although the run-up in prices in the last few quarters leaves the asset class much more expensive than it was.”

“Traditional assets will need inflation to return back towards target in order to get back to long-term positive real returns. If not, then prepare for a decade of real wealth destruction after four decades of huge real wealth accumulation.”

- The flash US Manufacturing PMI was in line with expectations, but the Services PMI was weaker.

- The US dollar is weakening as a result, with the DXY dropping to fresh session lows in the 101.70s.

The flash estimate for May of IHS Markit's headline US Manufacturing PMI came in at 57.5, in line with expectations, data released on Tuesday showed. That was a slight decline from 59.2 last month.

However, the flash estimate for May of IHS Markit's headline US Services PMI came in at 53.5, below expectations for a reading of 55.2 and below last month's 55.6. That meant that the flash estimate of IHS Markit's US Composite PMI fell to 53.8 in May from 55.6 in April.

Market Reaction

The US dollar has been under selling pressure in recent trade in wake of the downbeat US Service PMI numbers, which come at a time when recent earnings announcements (from Snap Inc. on Tuesday but also lots of big US retailers last week) have been warning about a worsening consumer environment. The DXY recently fell to fresh session lows under the 101.75 level, and is now down about 0.4% on the day.

- GBP/USD has slid back below 1.2500 on Tuesday after weak UK PMI data and amid risk-off flows.

- The pair is eyeing a test of its 21DMA around 1.2425 as US PMIs, remarks from Fed Chair Powell loom.

The sterling bears regained control on Tuesday and pushed GBP/USD back below the 1.2500 level, a roughly 100 pip turnaround from earlier session highs just shy of the 1.2600 level after UK PMI data released earlier in the day reignited fears about a possible recession later this year. The flash estimate of May’s headline Services PMI fell to 51.8, well below the expected drop to 56.9 from 58.9 in April. A reading below 50 suggests negative growth.

The latest data has been interpreted as dampening the prospect for further BoE monetary tightening, given that bank had already been worried about UK growth as the country experiences its worst cost-of-living crisis in decades. The PMI data comes on the heels of last week’s UK Consumer Price Inflation reading that showed headline prices pressures rising at a four-decade high pace of 9.0% YoY in April and jobs data that showed the UK labour market remains tight at the start of Q2/end of Q1.

In wake of aftermarket earnings on Monday from Snap that alluded to a weakening macro environment, which comes on the heels of big US retailers last week essentially pointing to the same thing, risk appetite has soured a little on Tuesday, with this also weighing on GBP/USD. As focus turns to the upcoming release of US PMI data at 1345GMT and then a speech from Fed Chair Jerome Powell at 1620GMT, GBP/USD bears are eyeing a retest of the 21-Day Moving Average, which currently resides close to 1.2425.

- AUD/USD witnessed some selling on Tuesday and eroded a part of the previous day’s strong gains.

- Recession fears weighed on investors’ sentiment and drove flows away from risk-sensitive aussie.

- Sustained weakness below mid-0.7000s is needed to confirm that spot prices have topped out.

The AUD/USD pair came under some selling pressure on Tuesday and moved further away from over a two-week high, around the 0.7125 region touched the previous day. The pair remained depressed through the early North American session and was last seen trading around the 0.7075-0.7080 region, just a few pips above the daily low.

The worsening global economic outlook continued weighing on investors' sentiment and triggered a fresh wave of the risk-aversion trade. This was evident from a generally weaker tone around the equity markets, which, in turn, undermined the perceived riskier aussie, though modest US dollar weakness helped limit deeper losses.

From a technical perspective, the AUD/USD pair, so far, has managed to hold its neck above the 23.6% Fibonacci retracement of the 0.6829-0.7128 recent recovery move. This is closely followed by a confluence comprising an upward sloping trend-line extending from the YTD low touched earlier this month and 100-hour SMA.

The technical set-up warrants some caution before confirming that the recent positive move witnessed over the past two weeks or so has run out of steam and before placing bearish bets. Moreover, neutral oscillators on hourly/daily charts haven't been supportive of any firm near-term direction, warranting caution for aggressive traders.

Hence, sustained weakness below the aforementioned confluence, around mid-0.7000s, is needed to support prospects for any further losses. The AUD/USD pair might then accelerate the slide towards the 38.2% Fibo. level, around the 0.7015 region, en-route the 0.7000 psychological mark and the 50% Fibo. level support near the 0.6980 area.

On the flip side, the 0.7100 round-figure mark now seems to act as an immediate hurdle ahead of the overnight swing high, around the 0.7125 region. Some follow-through buying would be seen as a fresh trigger for bulls and pave the way for a move towards the 0.7200 round figure, with some intermediate resistance near the 0.7170 region.

AUD/USD 1-hour chart

-637889954066972114.png)

Key levels to watch

Gold remains underpinned near $1,860 as growing economic concern is breathing life into the gold market. As economists at TD Securities note, gold traders are increasingly questioning the Fed's willingness to hike into a recession.

Gold traders focused on remarks from Fed Chair Jerome Powell

“Upside flow from CTAs along with renewed growth in ETFs have supported the recovery. In turn, the improving momentum has seen the nearest trigger within trend following models flip toward further upside should prices break north of $1,900/oz, rather than a whipsaw lower.

“The recovery in the yellow metal is still on shaky ground as Fed Chair Powell signalled a willingness to sacrifice some economic growth in an effort to tame inflation, suggesting the Fed is comfortable with more pain before taking the foot off the brake, which should ultimately still weigh on precious metals.”

- EUR/USD surpasses the 1.0700 hurdle and reaches 4-week highs.

- Immediately to the upside now comes the 55-day SMA.

EUR/USD sees its upside accelerated above the 1.0700 yardstick on turnaround Tuesday.

Considering the pair’s ongoing price action, the continuation of the recovery appears likely in the very near term at least. That said, the next up barrier now appears at the 55-day SMA, today at 1.0785 before the 3-month resistance line around 1.0840.

The breakout of this area should mitigate the selling pressure and allow for a probable move to the weekly high at 1.0936 (April 21).

The daily RSI around 55 also indicates that extra upside could still be in store for the pair until it reaches the overbought territory (>70).

EUR/USD daily chart

- The global flight to safety boosted the JPY and prompted some selling around USD/JPY.

- Retreating US bond yields turned out to be another factor that exerted downward pressure.

- The emergence of USD buying helped limit losses amid the Fed-BoJ policy divergence.

The USD/JPY pair maintained its offered tone through the early North American session, albeit has managed to rebound a few pips from the daily low. The pair was last seen trading around the 127.40-127.35 region, still down over 0.40% for the day.

The worsening global economic outlook continued weighing on investors' sentiment and triggered a fresh wave of the risk-aversion trade. This, in turn, boosted demand for traditional safe-haven currencies, including the Japanese yen, and exerted downward pressure on the USD/JPY pair. The anti-risk flow was reinforced by a fresh leg down in the US Treasury bond yields, which further inspired bearish traders and dragged spot prices back closer to the monthly low.

The downside, however, remains cushioned, at least for the time being, amid the emergence of some US dollar buying at lower levels. Apart from this, a big divergence in the monetary policy stance adopted by the Bank of Japan (dovish) and the Fed (hawkish) assisted the USD/JPY pair to find some support ahead of the 127.00 round-figure mark. This, in turn, makes it prudent to wait for strong follow-through selling before positioning for any further depreciating move.

Market participants now look forward to the US economic docket - featuring the releases of the flash PMI prints for May, New Home Sales and Richmond Manufacturing Index. This, along with Fed Chair Jerome Powell's speech and the US bond yields, will influence the USD price dynamics and provide some impetus to the USD/JPY pair. Traders will further take cues from the broader market risk sentiment to grab short-term opportunities.

Technical levels to watch

The economy of the European Union is resilient, but economic growth will be slower said Vice President of the European Commission Valdis Dombrovskis said on Tuesday according to Reuters.

- Gold is a little higher on Tuesday as it benefits from weaker equities, lower yields and a softer dollar.

- XAU/USD was last trading just above its 21DMA and near $1860, more than $50 higher versus earlier weekly lows.

- Gold traders are focused on upcoming US PMI data and more remarks from Fed Chair Jerome Powell.

Spot gold (XAU/USD) is unsurprisingly trading with an upside bias just above its 21-Day Moving Average at $1856.70 and near the $1860 mark amid a favourable macro backdrop that sees long-term US yields hovering close to monthly lows, US equities reversing Monday’s gains in pre-market trade and the DXY falling to fresh four-week lows under 102. The precious metal was last trading with gains of about 0.2%, boosted amid safe-haven flows from equities, by falling yields lowering the “opportunity cost” of holding non-yielding assets like gold, and as a the weaker US dollar makes the purchase of USD-denominated commodities like gold cheaper for international buyers, thus boosting its demand.

Focus turns to upcoming US flash PMI survey data for May scheduled for release at 1345GMT, as investors fret about the strength of the US economy. Recent indications from major US companies (most recently Snap’s guidance on Monday, but before that from major retailers last week) is that conditions are worsening, though other indicators haven't been quite so downbeat. Tuesday’s PMIs are expected to fall in the latter camp, but traders should monitor the data in case it triggers any cross-asset volatility.

Thereafter, Fed Chair Jerome Powell is scheduled to deliver some pre-recorded remarks at an event from 1620GMT. There is much less confusion/uncertainty about the Fed than there is about the current strength of the US economy. They are unequivocally hawkish, with Powell last week reiterating the bank’s desire to get rates to neutral by the end of the year (meaning a few more 50 bps hikes at upcoming meetings) and saying the bank wouldn’t hesitate to raise rates beyond neutral if needed to tame inflation, which remains far too high. Other Fed policymakers have all been reading off of the same script and the takeaway is clear, interest rates are moving higher.

The big question for markets is just how much higher. Gold traders should beware that while the US dollar’s recent pullback from multi-decade highs printed earlier in the month has given the precious metal some short-term respite (its currently more than $50 higher versus earlier monthly lows), this may prove short-lived if inflation fails to moderate as fast as the Fed wants in the coming months, and if markets subsequently start betting on a higher Fed terminal rate. This would push long-term yields and the US dollar higher, which would make a return to sub-$1800 levels likely.

- EUR/USD has pushed above 1.0700 on Tuesday amid more tailwinds from hawkish ECB commentary.

- The pair is now trading 1.5% higher on the week, despite flash May PMIs printing a little weaker than forecast.

- Focus turns to US PMIs and remarks from Fed’s Powell later in the day as strategists warn about USD dip-buying.

Weaker than forecast Eurozone flash PMI survey data for May has not deterred euro bulls on Tuesday, given that it (unlike the UK data) still indicated solid underlying growth despite continued high inflationary pressures. Indeed, EUR/USD has been able to reclaim the 1.0700 level with the pair getting tailwinds from hawkish ECB commentary thus far on the week. At current levels between 1.0710-20, the pair is trading with gains of about 0.25% on the day, taking its gains on the week to around 1.5%.