- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 23-05-2022

- AUD/NZD is hovering around 1.0990 on underperformance from Aussie PMI numbers.

- The NZ Retail Sales have turned negative, which may bring a sell-off in kiwi.

- This week, the major event will be the monetary policy announcement by the RBNZ.

The AUD/NZD pair has witnessed a lack of follow-up buying action in the early Tokyo session after Statistics New Zealand reported negative quarterly Retail Sales. The cross attempted to overstep the psychological resistance of 1.1000 as the quarterly Retail Sales landed at -0.5%, extremely lower than the former figure of 8.3%. However, it failed to do the same amid a lack of follow-up buying.

The cross didn’t find a cumulative buying action as downbeat Aussie's Purchase Managers Index (PMI) numbers by the IHS Markit hammered the aussie bulls. The IHS Markit reported the S&P Global Composite PMI at 52.5, significantly lower than the prior print of 55.9. In a detailed manner, the Manufacturing PMI tumbles to 55.3, against the consensus of 57.8 and the previous figure of 58.8. While the Services PMI edged higher to 53 from the estimates of 52.2 but remained lower than the last recorded figure of 56.6.

On the kiwi front, the interest rate decision by the Reserve Bank of New Zealand (RBNZ) will keep investors on the edge. The RBNZ will announce its interest rate decision n Wednesday and is expected to further elevate its Official Cash Rate (OCR) by 50 basis points (bps). Rising price pressures in the kiwi zone are demanding a spree of rate hikes and an ending of quantitative easing. An interest rate elevation by half a percent will push the OCR to 2%.

- Silver extends pullback from a two-week top, pressured around intraday low of late.

- Confirmation of a bearish chart pattern, downbeat MACD signals favor sellers.

- 50-SMA, monthly act as intermediate halts during the theoretical slump towards $20.00.

Silver (XAG/USD) remains on the back foot around the daily bottom, keeping the pullback from a fortnight high, as sellers flirt with $21.75-70 during Tuesday’s Asian session.

In doing so, the silver prices tease bears by confirming the one-week-old rising wedge bearish chart pattern. Bearish MACD signals also back the rising wedge confirmation and add strength to the downside hopes.

That said, the 50-SMA level of $21.48 and the $21.00 threshold may entertain silver sellers ahead of directing them to the monthly low of $20.45.

It’s worth noting that the XAG/USD weakness past $20.45 will aim for the stated wedge confirmation’s theoretical target surrounding $20.00.

On the flip side, corrective pullback needs to cross the 61.8% Fibonacci retracement of May 05-13 downside, around $22.20, to restore the silver buyer’s confidence.

Following that, the upside momentum will aim for the monthly high near $23.30.

Silver: Four-hour chart

Trend: Further downside expected

Reuters reports that Kansas City Federal Reserve Bank President Esther George on Monday said she expects the US central bank to lift its target interest rate to about 2% by August, with further action dependent on how both supply and demand are affecting inflation.

"Fed policymakers have emphasized a commitment to act expeditiously to restore price stability, and I expect that further rate increases could put the federal funds rate in the neighborhood of 2% by August, a significant pace of change in policy settings" George said in remarks prepared for delivery to an agricultural symposium put on by the Kansas City Fed.

"Evidence that inflation is clearly decelerating will inform judgments about further tightening."

."The central bank’s job is to prevent persistent imbalances from feeding into inflation and unmooring inflation expectations," George said.

''The Fed's interest rate hikes can only reduce demand and cannot influence supply factors that are also heavily impacting inflation,'' she said.

"The evolution of its efforts alongside other factors will affect the course of monetary policy, requiring continuous and careful monitoring."

US dollar under pressure

Meanwhile, the European Central Bank is getting attention which is resulting in a bid in the euro, weighing on the US dollar. The dollar index, DXY, fell on Monday while the euro rallied after the European Central Bank indicated a move from negative interest rates.

- AUD/USD consolidates recent gains around multi-day top, renews intraday low of late.

- Australia’s S&P Global Manufacturing PMI for May came in softer but Services PMIs rose past market consensus.

- Risk-on mood, hopes from new government previously favored bulls.

- US activity data, Fed’s Powell and headlines from Quad, as well as concerning China, will be important for fresh impulse.

AUD/USD holds lower ground near the intraday low after downbeat Australia activity data allowed the bulls to take a breather after refreshing two-week top. That said, the Aussie pair remains pressured around 0.7090 by the press time of the initial Asian session on Tuesday.

That said, Australia’s preliminary readings of the S&P Global Manufacturing PMI for May dropped to 55.3, versus 57.8 expected and 58.8 prior, whereas the Services counterpart improved from 52.2 forecast to 53.0, compared to 56.6 prior (revised). As a result, the Composite PMI also eased to 52.5 from 55.9 prior.

Also allowing the quote to pare recent gains is the downbeat prints of the S&P 500 Futures, printing 0.65% intraday losses by the press time, despite the Wall Street benchmarks’ gains.

Comments from San Francisco Federal Reserve Bank President Mary Daly seem to have triggered the latest risk-off mood. “I think that we can weather this storm, get the interest rate up...price stability restored and still leave Americans with jobs aplentiful and with growth expanding as we expect it to," said the policymaker during an interview with Fox News on Monday.

Previously, the risk-on mood joined a lack of bullish bias to drag the US Dollar Index (DXY) to a two-week low. In doing so, the US Dollar Index (DXY) extended the first weekly loss in seven as mixed covid signals from China, mostly positive, join the repeated Fedspeak around a 50 bps rate-hike, contrary to the recently hawkish comments from the ECB policymakers. Also weighing on the greenback were the headlines from Japan where US President Joe Biden mentioned that he is considering reducing tariffs on China. In addition to the softer USD, hopes from the Labour Party, as they retake control in Australia after nine years, also favored AUD/USD buyers earlier.

Moving on, risk catalysts like headlines from Quad Summit in Tokyo and covid updates from China can entertain AUD/USD traders ahead of the US preliminary readings of the S&P Global Manufacturing and Services PMIs for May. . Also, Fed’s Powell is always crucial to move the markets and can do so if refrained from the usual support for a 50 bps rate hike trajectory.

Technical analysis

A daily closing beyond a seven-week-old descending trend line, around 0.7070 by the press time, keeps AUD/USD buyers hopeful of challenging the monthly high surrounding 0.7265.

- The AUD/JPY begins the week on the right foot and is gaining some 0.64%.

- In the FX space, the market mood is mixed as safe-haven peers get buoyant and risk-sensitive currencies stalled.

- AUD/JPY Price Forecast: Bullish above 90.76 and bearish below the aforementioned, as it would open the door for a re-test of 87.30.

The AUD/JPY records minimal losses of 0.18% as the Asian session begins. On Monday, the cross recorded gains close to 0.90%, on a positive market mood, following a dismal week, particularly for US equities. At the time of writing, the AUD/JPY is trading at 90.63.

Sentiment shifted from positive to mix as Asian equity futures fluctuated post-Wall Street close. On Monday, the mood was positive due to some reports which stated that the US could consider lifting some trade tariffs on China, which was cheered by investors. That, along with increasing concerns that the US could be hit by a recession and optimism about global economic growth, kept market players shifting toward riskier assets.

On Monday, the AUD/JPY opened near the day's lows at around 90.18. Later, the cross soared and reached a daily high above the 91.00 mark but retreated somewhat and settled at approximately at 90.76.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is trading around crucial support recorded on March 31 at 90.76. From the market structure perspective, failure at the previously mentioned level would open the door towards a re-test of the March 31 swing low at 87.30. Furthermore, the Relative Strength Index (RSI) slope shifted horizontally beneath the 50-midline, meaning that sellers could be exerting downward pressure on the pair.

Therefore, the AUD/JPY bias is neutral-downwards, and its first support would be the 90.00 mark. Break below would expose the May 19 swing low at 88.99, which, once cleared, would send the AUD/JPY aiming towards the confluence of the March 31 swing low and the 100-day moving average (DMA) at around 87.23-30.

Nevertheless, if AUD/JPY traders reclaim 90.76, that would open the door for a test of a downslope trendline. That said, the cross-currency pair's first resistance would be the March 31 swing low-turned-resistance at 90.76. A breach of the latter would send the AUD/JPY to 91.00, followed by the 50-DMA at 91.57 and the downslope trendline around the 92.00 area.

Key Technical Levels

- The DXY is consolidating around 102.00 and seeks more losses on a positive market tone.

- Fed’s Powell is expected to dictate the interest rate elevation in his speech.

- A softer US PMI is the outcome of rising interest rates.

The US dollar index (DXY) is moving sharply lower as positive market sentiment has underpinned the risk-perceived currencies and safe-haven assets are losing traction. The asset has surrendered around 2.80% after hitting a 19-year high of 105.00 on May 13. The asset has tumbled below its crucial support of 102.35 and is expected to extend its losses after violating the round-level support of 102.00.

US PMI

On Tuesday, investors will keep an eye on the release of the S&P Global Composite PMI, which is seen at 55.5, a tad lower than the prior print of 56. In a detailed manner, Manufacturing and Services PMI are expected to land at 57.9 and 55.4 respectively. A little underperformance is expected by the market participants as higher interest rates by the Federal Reserve (Fed) have trimmed the scale of economic activities in the US economy. Due to the unavailability of dirt-cheap money, corporate are channelizing their funds into more filtered investments and projects, which is dampening the manufacturing and services sector.

Fed Powell’s speech

The speech from Fed chair Jerome Powell on Tuesday will fade the obscurity over the interest rate decision by the Fed in its upcoming June monetary policy. As per the market consensus, a rate hike announcement by 50 basis points (bps) looks possible to contain the soaring inflation. Also, the status of balance sheet reduction will be keenly watched.

Key events this week: S&P Global PMI, New Home Sales, Durable Goods Orders, FOMC minutes, Initial Jobless Claims, Gross Domestic Product (GDP), Core Personal Consumption Expenditure (PCE), and Michigan Consumer Sentiment Index (CSI).

Major Events this week: Fed Powell’s speech, European Central Bank (ECB)’s Christine Lagarde’s speech, Reserve Bank of New Zealand (RBNZ) interest rate decision.

- NZD/USD takes offers to renew intraday low, consolidates recent gains around 13-day top.

- New Zealand Q1 Retail Sales flashed -0.50% figures versus 8.3% prior growth.

- Firmer sentiment, repeated Fedspeak keeps US dollar on the back foot.

- First readings of S&P Global PMIs for May, speech from Fed Chairman Powell can entertain traders ahead of RBNZ.

NZD/USD stands on slippery grounds, snapping a three-day uptrend at a fortnight top, as New Zealand’s (NZ) Q1 2022 Retail Sales disappoints Kiwi bulls ahead of Wednesday’s key RBNZ. That said, the quote renews a daily low of around 0.6450 during the initial hour of Tuesday’s Asian session.

New Zealand’s first quarter (Q1) 2022 Retail Sales surprised kiwi bulls with a -0.5% QoQ figure versus the downwardly revised previous readings of 8.3% QoQ (from 8.6%). That said, Retail Sales ex Autos also dropped to 0.0% from 6.8% prior during the stated period.

The downbeat numbers raise allow NZD/USD bulls to better prepare for the Reserve Bank of New Zealand’s (RBNZ) widely anticipated rate hike of 50 basis points (bps).

It’s worth noting that a negative start of the day by the S&P 500 Futures, despite firmer closing of the Wall Street benchmarks, also weigh on the Kiwi prices of late.

On Monday, the NZD/USD rallied to a three-week high amid broad US dollar weakness, as well as optimism in the market during a light calendar. In doing so, the US Dollar Index (DXY) extended the first weekly loss in seven as mixed covid signals from China, mostly positive, join the repeated Fedspeak around a 50 bps rate-hike, contrary to the recently hawkish comments from the ECB policymakers. Also weighing on the greenback were the headlines from Japan where US President Joe Biden mentioned that he is considering reducing tariffs on China.

Looking forward, the preliminary readings of the S&P Global Manufacturing and Services PMIs for May will be crucial amid hopes of stabilization in the market’s confidence. Also, Fed’s Powell is always the key catalyst to move the markets and can do so if refrained from the usual support for a “normal” rate hike trajectory. Additionally, headlines from the Quad Summit in Tokyo and concerning the covid will also be important for NZD/USD traders to watch for fresh impulse.

Above all, tomorrow’s RBNZ Interest Rate Decision will be crucial as markets do expect a 50 bps move but data from New Zealand has been mixed of late.

Technical analysis

NZD/USD trades above the 21-DMA, around 0.6400 at the latest, for the first time in seven weeks. The weekly recovery move from a two-year low also gains support from the MACD and RSI (14) to direct buyers towards January’s low surrounding 0.6530.

Reuters reported that San Francisco Federal Reserve Bank President Mary Daly on Monday said the US economy has a lot of momentum and said the central bank can raise interest rates to where they are no longer stimulating economic growth without starting a recession.

"We really have a strong economy," Daly said in an interview on Fox News."I think that we can weather this storm, get the interest rate up...price stability restored and still leave Americans with jobs aplentiful and with growth expanding as we expect it to."

US dollar sinking

Meanwhile, the European Central Bank is getting attention which is resulting in a bid in the euro, weighing on the US dollar. The dollar index, DXY, fell on Monday while the euro rallied after the European Central Bank indicated a move from negative interest rates.

- GBP/USD bulls are in charge and looking for a break of key daily resistance.

- The weekly chart is being corrected with 1.2650 eyed.

The price is making it's way higher within the correction of the weekly chart's bearish impulse. Having already mitigated some of the price imbalance in a 38.2% Fibonacci retracement so far, the bulls are staying with the course which leaves 1.2650 vulnerable in a 50% mean reversion. Thereafter, the golden 61.8% ratio will be eyed.

GBP/USD weekly chart

On the daily chart, the bulls have broken the first layer of resistance that would now be expected to act as a support on a retest. If the bulls commit, then a break of 1.2650 would expose the void of bids between there and the 1.30s.

GBP/USD daily chart

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, snapped a two-day downtrend with a U-turn from the lowest level since late February.

That said, the inflation gauge rose from 2.55% to 2.60% by the end of Monday’s North American trading session.

A drop in the US inflation expectations also joins the US dollar’s south-run, amid repeated chatters of a 50 bps rate hike from the Fed, keeping the greenback bulls away from the table.

The US Dollar Index (DXY) extends the first weekly loss in seven as mixed covid signals from China, mostly positive, join the repeated Fedspeak around a 50 bps rate-hike, contrary to the recently hawkish comments from the ECB policymakers. Also weighing on the greenback were the headlines from Japan where US President Joe Biden mentioned that he is considering reducing tariffs on China.

Amid these plays, Wall Street ended Monday on a positive note and the US Treasury yields also rose as traders turn cautiously optimistic prior to the key data/events.

Also read: Forex Today: Dollar continues to shed ground

- USD/CHF holds lower grounds after refreshing multi-day low.

- Risk-on mood, softer US dollar keep sellers hopeful ahead of a busy day.

- ECB vs. Fed drama, US President Biden’s jest to remove Trump-era tariffs on China underpin firmer sentiment.

- Preliminary readings of S&P Global PMIs for May, speech from Fed Chairman Powell will be crucial for immediate direction.

USD/CHF refreshed its monthly low to 0.9627, before consolidating losses near 0.9658, as the US dollar extends the previous week’s losses amid firmer sentiment. However, the Swiss currency (CHF) pair recently turned sidelined amid cautious sentiment ahead of the key US PMIs for May and a speech from Federal Reserve (Fed) Chairman Jerome Powell.

The US Dollar Index (DXY) extends the first weekly loss in seven as mixed covid signals from China, mostly positive, join the repeated Fedspeak around a 50 bps rate-hike, contrary to the recently hawkish comments from the ECB policymakers. Also weighing on the greenback were the headlines from Japan where US President Joe Biden mentioned that he is considering reducing tariffs on China.

That said, firmer prints of the US Chicago National Activity Index for April, to 0.47 versus 0.36 flashed in March, also eased the market’s pessimism and back sentiment suggesting no surprise rate hike from the Fed than already conveyed. On the contrary, the European Central Bank (ECB) President Christine Lagarde signaled an end to the negative rates by Q3, suggesting a lift in the benchmark rate in July, which in turn propelled the bloc’s currency and shortened the ECB vs. Fed divergence that drowned the greenback.

Amid these plays, Wall Street ended Monday on a positive note and the US Treasury yields also rose as traders turn cautiously optimistic prior to the key data/events.

That said, the preliminary readings of the S&P Global Manufacturing and Services PMIs for May will be crucial amid hopes of stabilization in the market’s confidence. Also, Fed’s Powell is always the key catalyst to move the markets and can do so if refrained from the usual support for a “normal” rate hike trajectory. Additionally, headlines from the Quad Summit in Tokyo and concerning the covid will also be important for USD/CFH traders to watch for fresh impulse.

Technical analysis

50-day EMA joins the 50% Fibonacci retracement of March-May upside, around 0.9615-05, to put a short-term floor under the USD/CHF prices. Meanwhile, recovery remains elusive until witnessing a clear break of the 21-day EMA level surrounding 0.9770.

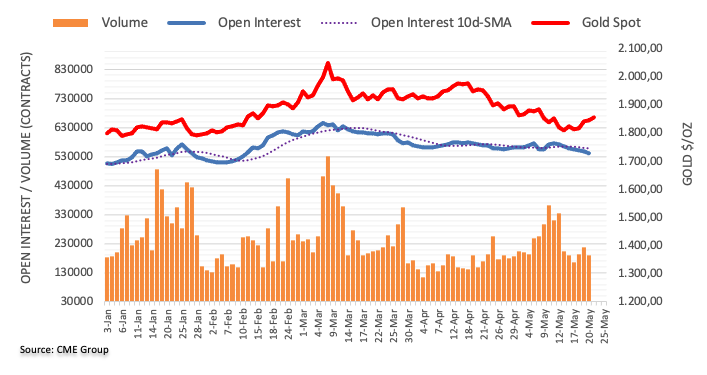

- Gold price may witness a pullback towards $1,840.00 ahead of Fed Powell.

- The soaring market mood is responsible for the weakness in the DXY.

- To corner the galloping inflation, a jumbo rate hike in June looks likely.

Gold price (XAU/USD) has delivered a four-day winning streak after displaying a bullish reversal at around $1,800.00 last week. The precious metal is expected to turn sideways after a firmer responsive buying action as more market participants will connect with bulls for further upside.

A softer US dollar index (DXY) is the real catalyst behind the $40+ rally in gold prices. The DXY has eased around 2.80% after hitting a high of 105.00 despite rising odds of a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed) in June. Mounting inflationary pressures in the US economy are compelling for one more rate hike by the Federal Reserve (Fed) in June. Also, the speech from Fed chair Jerome Powell on Tuesday may provide some insights into the likely monetary policy action in June.

The upbeat market tone is responsible for a sheer downside move in the DXY. Risk-sensitive currencies are gaining traction as DXY’s safe-haven appeal diminishes.

Gold technical analysis

On an hourly scale, XAU/USD is holding above 23.6% Fibonacci retracement (placed from April 18 high at $1,998.43 to May’s low at $1,804.90) at $1,837.60. Gold bulls are firmer above the 200-period Exponential Moving Average (EMA) at $1,840.40. The trendline placed from May’s low at $1,804.90 will act as major support for the counter. A pullback move is expected towards the above-mentioned trendline after a bullish reversal to near $1,840.00. The Relative Strength Index (RSI) (14) has shifted lower from the bullish range of 60.00-80.00 but is expected to find support at 40.00.

Gold hourly chart

-637889414450819091.png)

- USD/CAD is balancing below 1.2800 amid carnage in the DXY.

- An underperformance is expected from US PMI numbers in all aspects.

- Fed’s Powell may dictate a hawkish tone for the likely monetary policy action in June.

The USD/CAD pair is falling gradually lower after facing multiple failed attempts while attacking the round-level barricade of 1.2800 on Monday. The asset is expected to tumble further towards May 5 low at 1.2722 as the US dollar index (DXY) is eyeing an establishment below 102.00 ahead of the US Purchase Managers Index (PMI) numbers and speech from Federal Reserve (Fed) chair Jerome Powell on Tuesday.

The DXY extended its losses on Monday after slipping below the crucial support of 102.35. A downside move of almost 2.80% has been recorded by the DXY from its 19-year high of 105.00. Going forward, investors’ focus will remain on the US PMI numbers.

The S&P Global Composite PMI is seen at 55.5, lower than the prior print of 56. While the Manufacturing and Services PMI are expected to land at 57.9 and 55.4 respectively. A little underperformance is expected by the market participants as higher interest rates are signaling lower economic activities due to liquidity squeeze from the market, which could bring more weakness in the greenback.

Also, the speech from Fed chair Jerome Powell will remain on the investor’s radar. The major discussion could be interest rate guidance for the upcoming monetary policies, especially in June, which is expected to be highly hawkish amid stable inflationary pressures at elevated levels.

On the loonie front, the monthly Retail Sales numbers will be on the investor’s radar, which is due on Thursday. The monthly Retail Sales are expected to climb sharply higher to 1.4% against the prior print of 0.1%. However, the monthly Retail Sales that exclude auto sales are seen at 2%, a little lower than the former figure of 2.1%.

- AUD/USD bulls testing critical resistance within a bearish territory.

- The bears have not thrown in the towel just yet.

The price is breaking out of the downward trend in a rising wedge formation. While this is typically regarded as a bearish continuation chart pattern, the Aussie has a habit of defying gravity when correcting the trend and a break of the current resistance would be a significant development. There is a void between there and the 0.73 figure and the price imbalance could well be mitigated.

AUD/USD H4 charts

On the other hand, the bears are moving in and repeated failures at this resistance level would be expected to leave the ball in their court. A subsequent break of the next term support would be expected to encourage the bears back to the table and a snowball effect gathering momentum could result in a downside continuation and restest of the counter trendline:

A break of the trendline and a run on sell stops would be expected to result in supply that could push the bulls back to the edge of an abyss at 0.6950:

AUD/USD daily chart

- NZD/USD begins the week with gains of almost 1%.

- The greenback remains under pressure on growing concerns that an aggressive Fed would cause a recession in the US.

- NZD/USD Price Forecast: Failure to reclaim 0.6500, and the RSI shifting downwards to tumble the major towards 0.6300.

The New Zealand dollar advances for the third straight day and begins the week on a higher tone, benefitted by a positive market mood, reflected by global equities finishing Monday’s session with gains. At the time of writing, the NZD/USD is trading at 0.6459.

Sentiment remains upbeat; the US dollar edges down

Wall Street finished Monday’s session with gains, further confirming risk appetite. The greenback trades softer, with the US Dollar Index tumbling close to 1% in the day and hovering around 102.074, a tailwind for the NZD/USD. Nevertheless, rising US Treasury yields, led by the 10-year benchmark note up 7.5 basis points, sitting at 2.860%, caped the rise of the NZD.

The buck remains on the defensive, on growing concerns that a further aggressive Federal Reserve could trigger a recession in the US. The US central bank struggles to drag inflation from around 8% to its 2% target. Reports that the US may consider lifting some trade tariffs on China was a piece of news cheered by traders, which turned to equities and lifted the major global indices.

Aside from this, the NZD/USD opened near the daily pivot point at 0.6390 and never looked back, rallying close to 1%, reaching a daily high at 0.6491 on Monday. Nevertheless, the major retreated afterward around the 20-hour simple moving average (SMA) at 0.6465.

An absent New Zealand economic docket left NZD/USD traders focused on market sentiment and US macroeconomic data. The US docket featured the Chicago Fed National Activity Index for April, which rose by 0.47, higher than the 0.36 of the previous reading.

Of late, Atlanta’s Federal Reserve President Raphael Bostic said that the quick response in financial markets to tighten monetary policy offers hope that other parts of the economy may adjust more quickly.

In the week ahead, the New Zealand economic docket will feature Retail Sales for the first quarter, followed by the Reserve Bank of New Zealand (RBNZ) Interest Rate Decision and Business and Consumer Sentiment surveys.

On the US front, S&P PMIs, New Home Sales for April, and the Federal Reserve Chair Jerome Powell would be featured.

NZD/USD Price Forecast: Technical outlook

The NZD/USD is still downward biased, albeit starting the week with an almost 1% gain. The majority of the daily moving averages (DMAs) reside above the exchange rate, except for the 20-DMA at 0.6390, which tracks the trend in the near term. It’s worth noting that the Relative Strength Index (RSI) slope turned horizontally below the 50-midline at 49.19, which leaves the pair vulnerable to further selling pressure.

Therefore, the major could resume the downtrend before the RBNZ monetary policy meeting.

That said, the NZD/USD first support would be the 20-DMA at 0.6390. Break below would expose the May 20 daily low at 0.6363, followed by the May 19 daily low at 0.6290.

- EUR/USD bulls staying the course as the greenback slides.

- Bulls are taking the hawkish comments from ECB governor and running with them.

At 1.0687, the single currency is 1.2% higher on the day, rising from a 1.0556 low to a fresh corrective high of 1.0697. EUR/USD bulls have stayed the course as the US dollar continues to melt away from the highs made in its breakneck 10% surge.

The flight to safety that has been one of the many factors that have been supporting the greenback has been pulled from under the bulls in recent days. After rising in all but two of the last 14 weeks, the dollar index made a 1.6% weekly fall on Friday and the bears have firmed in the opening sessions this week.

Investors had been turning hopeful that loosening lockdowns in China can help global growth and exporters' currencies. Additionally, an unexpectedly big rate cut in China last week has been taken as a signal that authorities are going to provide continued support which has reassured investors.

Meanwhile, domestically, the European Central Bank president said the bank was likely to lift the euro area deposit rate out of the negative territory by end-September and could raise it further if it saw inflation stabilising at 2%.

''This supports current market pricing for liftoff July 21 with a 25 bp hike, followed by another 25 bp September 8 that results in a zero deposit rate,'' analysts at Brown Brothers Harriman explained.

''Follow-up hikes on October 27 and December 15 are fully priced in that would take the deposit rate to 0.5% by year-end. To be clear, market pricing for the ECB has not shifted after Lagarde’s remarks and yet the euro got another leg higher. At some point, the subdued ECB outlook should weigh on the euro but for now, the FX market is happy to take the dollar lower.''

EUR/USD technical analysis

On the charts, this has transpired into the potential for more downside in the greenback to follow shortly/ The DXY index has fallen below support at the start of this week:

The price is moving into a void of support on the daily chart which could lead to a move lower to test the prior highs near 101.00.

As for the euro, this points to higher highs for the days ahead:

What you need to take care of on Tuesday, May 24:

The greenback weakened on the first trading day of the week, amid a better market mood. US President Joe Biden said to be studying cutting tariffs on Chinese imports, which could save up to $80 billion in taxes for the country. Biden also called on OPEC to raise oil production, in the hopes it would help to cool down inflationary pressures. His comments helped to keep stocks afloat throughout the day, despite persistent inflation and growth-related concerns.

The EUR/USD pair flirts with 1.0700, helped by European Central Bank President Christine Lagarde. She said she expects the facilities program to end “very early” in the third quarter of the year, leaving policymakers in a position to exit negative interest rates by the end of the quarter. Also, this would allow a rate hike to take place in July, in line with forward guidance, according to Lagarde.

GBP/USD trades around 1.2580, also holding on to intraday gains, despite worrisome Brexit news. The UK has been long supporting the case to modify the Northern Ireland Protocol amid the barriers it creates in Northern Ireland and aims to legislate against it within the upcoming weeks.

Commodity-linked currencies benefited from the better tone of equities. AUD/USD trades around 0.7100, while USD/CAD is in the 1.2780 region.

The Swiss Franc appreciated against the greenback, with the pair now at around 0.9660, while USD/JPY is pretty much unchanged on a daily basis, trading at around 127.80.

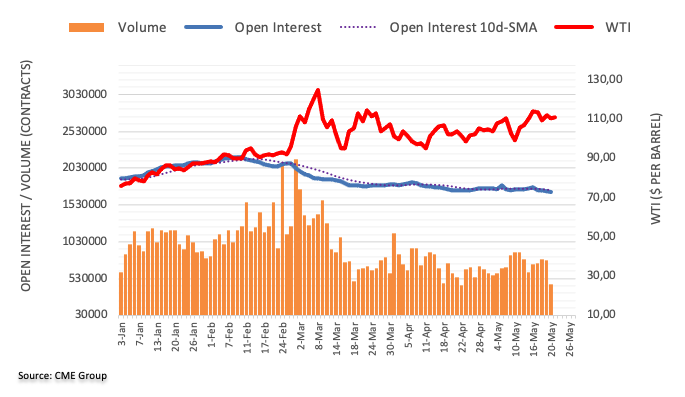

Gold posted a modest advance and finished the day at $1,854 a troy ounce. Crude oil prices edged marginally lower, with WTI changing hands at $110.30 a barrel.

May preliminary S&P Global PMIs for major economies are due on Tuesday.

XRP price prompts fear amongst investors as technicals signal another sell-off

Like this article? Help us with some feedback by answering this survey:

- Gold (XAU/USD) begins the week on the right foot, up 0.54% in the week.

- A softer buck and concerns of the US falling into a recession courtesy of an aggressive Fed lifts the prospects of the yellow metal.

- Gold Price Forecast (XAU/USD): Bulls need to reclaim the 20-DMA, if not a re-test of the 200-DMA is on the cards

Gold spot (XAU/USD) advances for the fourth-straight trading day and begins the week with an upbeat tone but retreats at the 20-day moving average (DMA) at $1856.45. At $1854.78, XAU/USD reflects the weak appetite for the greenback, albeit higher US Treasury yields, which are pairing last Friday’s losses.

The market sentiment remains upbeat, one of the factors that weighed on the US Dollar, which is trading at four-week lows. The US Dollar Index is plunging almost 1% and clings to the 102.000 mark, a tailwind for Gold prices. The buck’s weakness is courtesy of growing concerns of a US economic slowdown that could trigger a recession, as the Federal Reserve hikes rates aggressively to bring inflation down from above 8%. Investors’ focus would be on Friday’s Personal Consumption Expenditure (PCE), the US Fed’s favorite gauge of inflation

In the meantime, US equities are higher as the New York session begins to wind down, though they remain at risk of resuming the ongoing bear market correction. That would carry on towards the Asian session, which could witness the second straight session with a positive appetite. Reports that the US may consider lifting some trade tariffs on China was a piece of news cheered by traders, which turned to equities and lifted the major global indices.

Elsewhere, Atlanta’s Federal Reserve President Raphael Bostic said that the quick response in financial markets to tighten monetary policy offers hope that other parts of the economy may adjust more quickly.

On Monday, XAU/USD began its week of trading, just shy of the R1 daily pivot around $1858, and rallied towards the daily high at $1865.34, $25 short from testing March lows at around $1889.91. Furthermore worth noting that once the daily high was reached, the yellow metal retreated below the 20-day moving average (DMA), and it is settling around the $1850 area.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD is neutral biased once traders lifted the non-yielding metal above the 200-DMA at $1838.97, opening the door for further gains. However, although Gold is rallying for the fourth consecutive day, it remains exposed to further selling pressure. At the time of writing, the daily chart shows that XAU/USD bulls failed to reclaim the 20-DMA at $1856.46, a level that, once conquered, could open the door for a re-test of March’s low at around $1889.91.

If that scenario plays out, XAU/USD’s first resistance would be the 100-DMA at $1886.33. Break above would expose March’s low at $1889.91, followed by the $1900. Mark. On the flip side, XAU/USD’s first support would be the 200-DMA at 1838.97. Once cleared, the next support would be $1800, followed by the YTD low at $1780.18.

- The USD/JPY is almost flat in the day, down a minimal 0.01%.

- An upbeat market mood and higher US Treasury yields put a lid on the USD/JPY fall.

- USD/JPY Price Forecast: The bias is neutral-upwards, but a break below 126.90, could open the door for further losses.

The USD/JPY edges lower and records minimal losses of 0.01% in the North American session, courtesy of a positive mood and a weaker greenback. At the time of writing, the USD/JPY is trading at 127.84.

Sentiment remains upbeat, as US equities gain between 1.27% and 1.90%. The US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, is down 0.87% and clings to the 102.000 mark, a headwind for the USD/JPY. However, rising US Treasury yields put a lid on the fall, as the 10-year Treasury yield is rising almost seven basis points, sitting at 2.853%.

In the FX space, the risk appetite keeps safe-haven peers downward pressured and risk-sensitive currencies like the AUD, the NZD, and the GBP, up.

On Monday, in the Asian session, the USD/JPY opened near the daily pivot point at 127.90. However, the pair dipped below the S1 pivot at 127.31, towards the daily lows at around 127.15. Nevertheless, the major bounced off the lows during the European session and printed the daily high at 127.85.

USD/JPY Price Forecast: Technical outlook

The USD/JPY remains neutral-upward biased from a daily chart perspective, albeit approaching April’s 26 swing lows at around 126.94, was unable to break support. Nevertheless, the pair could shift its bias to neutral if USD/JPY bulls fail to break the 20-DMA at 129.23, exposing the major to selling pressure.

The USD/JPY 1-hour chart shows that the pair is trapped between the 50 and 100-hour simple moving averages (SMAs) at 127.98 and 128.19, respectively, but it is upwards. Why? The 20-hour SMA resides below the exchange rate, while the Relative Strength Index (RSI) shifted bullish above the 50-midline. Therefore, the USD/JPY bias is upwards.

The USD/JPY’s first resistance would be the daily pivot at 127.90. Latter’s breach would send the pair above the 128.00 mark and aim towards the 100-hour SMA at 128.19. Once cleared, the next resistance would be the R1 pivot point at 128.28, followed by the confluence of the 200-hour SMA and the R2 pivot point at 128.67.

Key Technical Levels

The UK has been long supporting the case to modify the Northern Ireland Protocol amid the barriers it creates in Northern Ireland. Another issue comes from delay and prices rises amid checks requirements.

Last week, UK Foreign Secretary Liz Truss updated the local parliament, noting that their preference is to reach a negotiated solution with the EU.

However, the Union has refused to reopen the treaty and has threatened to use “all the measures at its disposal” is the UK takes unilateral action to override the Brexit deal.

The GBP/USD pair was unaltered by the news.

- The shared currency is extending its rally to two consecutive weeks and reached a new MTD high at 1.0691

- A hawkish ECB’s President Lagarde and risk appetite boost the EUR/USD.

- EUR/USD Price Forecast: Failure at 1.0700 would open the door for EUR/USD’s further downward pressure.

The EUR/USD is soaring and is closing to the 1.0700 mark, courtesy of the greenback trading in a softer tone, an upbeat market sentiment, and an additional “hawkish” boost provided by the European Central Bank (ECB) President Lagarde, saying that a rate hike on July, it’s possible. At the time of writing, the EUR/USD is trading at 1.0673.

Risk appetite and a hawkish ECB’s Lagarde lift the EUR/USD

As abovementioned, sentiment remains positive, as European bourses are closing with gains, while US equities lick their wounds and pare some of last Friday’s losses. China’s coronavirus crisis intensified during the weekend in Beijing, while conditions in Shanghai improved though it reported 570 new asymptomatic cases and 52 symptomatic.

The EUR/USD got a boost due to a weaker greenback. The US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, is falling almost 0.80%, sitting at 102.218, a tailwind for the EUR/USD. On the contrary, US Treasury yields are rising, led by the 10-year benchmark note at 2.859%, gaining seven and a half basis points.

The ECB President Christine Lagarde crossed the wires, and she said that the ECB is likely to be in a position to exit negative interest rates by the end of the Q3 but pushed against 50-bps increases. She added that she expects net purchases to end early in the third quarter, allowing the ECB to hike rates at the July meeting.

During the day, other ECB policymakers spoke to the media. ECB’s Villeroy said that the Eurozone growth is resilient and stated that the ECB’s main focus would be to bring inflation back to 2%. According to Bloomberg, some ECB sources said that ECB President Lagarde’s plan to raise rates bothered some hawkish policymakers at the ECB who want a faster option.

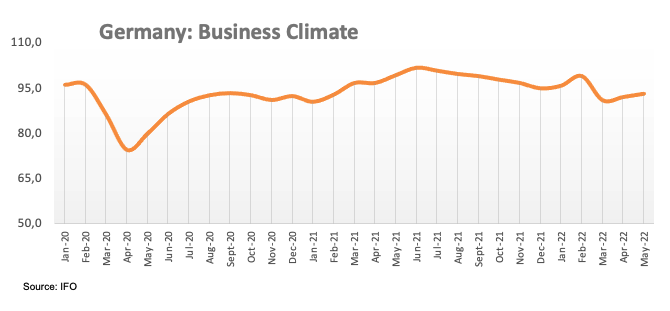

During the European session, the EU docket featured IFO May Surveys on its different indexes, which unexpectedly rose more than expected, demonstrating the upbeat morale of German businesses, though maintaining investors’ spirits higher.

Meanwhile, the US economic docket featured the Chicago Fed National Activity Index for April, which rose by 0.47, higher than the 0.36 of the previous reading, and further, Fed speaking, with Atlanta’s Fed President, Raphael Bostic, crossing the wires.

EUR/USD Price Forecast: Technical outlook

The EUR/USD daily chart depicts the pair as downward biased, despite reclaiming the 20-day moving average (DMA), which currently sits at 1.0530. Nevertheless, the rally appears to be overextended, as it is above the top band of the Bollinger’s band indicator at 1.0673, but the Relative Strength Index (RSI) above the 50-midline is aiming higher, with enough room before reaching overbought conditions.

Upwards, the EUR/USD’s first resistance would be the 1.0700 mark. Break above would expose the 50-DMA at 1.0772, followed by 1.0800. On the other hand, the major’s first support would be the 1.0600 figure. A breach of the latter would expose the 20-DMA at 1.0529, followed by the 1.0500 mark.

- Mexican peso rises versus the US dollar for the ninth time out of the last ten days.

- USD/MXN stays bearish, about to test critical support at 2022 lows.

- The 19.90 area is not the immediate resistance.

The USD/MXN continued its decline on Monday and dropped to 19.77, reaching the lowest level since April 19. The outlook points to a test of the year-to-day low at 19.72. A daily close below 19.70 would point to the next strong support around 19.50.

Despite falling constantly during the last two weeks, technical indicators in the daily chart favor the downside, with the RSI pointing south and above 30. Momentum is firm in negative territory. The Mexican peso has in front the 19.70 area that could be hard to break. If it fails to break lower a rebound seems likely.

In the short-term, USD/MXN could likely moved sideways between 19.90 and 19.70. The 19.90 zone has become the immediate resistance. Above the next level to watch is 20.05. If the dollar rises above the 20-day Simple Moving Average, today at 20.19, the bearish outlook would be negated.

USD/MXN daily chart

-637889198822316928.png)

- Swiss franc remains among the top performers in the currency market.

- ECB open doors to positive interest rates by end of Q3.

- USD/CHF keeps looking for support, bearish outlook.

After a short-lived recovery on Friday, the USD/CHF resumed the downside on Monday. Recently it printed a fresh monthly low at 0.9626. It is hovering around 0.9650, about to post the sixth daily loss out of the last eight days.

A broad-based correction of the US dollar triggered the slide of USD/CHF last week. The negative momentum intensify further with recent comments from Swiss National Bank officials warning about inflation.

On Monday, Andrea Meachler, a board member of the SNB said the central bank won't hesitate to raise interest rates if inflation remains outside of the target. Also on Monday, Christine Lagarde, president of the European Central Bank and other governing council members, suggested a possibility of positive interest rates by the end of the third quarter.

The dollar weakened further amid an improvement in market sentiment at the beginning of the week. The DXY is falling 0.87%, trading at 102.10, the lowest level since April 26.

The USD/CHF continues to look for support. Below 0.9625, the next barrier might be seen at 0.9595 and then 0.9525. Now the immediate resistance is located at 0.9695, followed by 0.9735.

More levels

- The GBP/USD snaps three days of consecutive weekly losses and begins with gains for the second straight week.

- Sterling rallies on risk appetite, a weaker greenback, and a more “hawkish” than expected BoE Governor Bailey.

- GBP/USD Price Forecast: Failure at 1.2600 to leave the major exposed to further selling pressure.

The British pound is extending its recovery after posting its first weekly gain in five and begins the beginning week on the right foot on Monday. At 1.2578, the GBP/USD reflects the upbeat market mood as European and North American investors shrug off concerns of an economic slowdown, as shown by equities edging up amidst a busy week with central bankers taking center stage.

The GBP/USD rallies in a favorable mood, and a soft US dollar

Additionally, as shown by its US Dollar Index, the greenback remains defensive, falling 0.82% and sitting at around 102.173, breaking below analysts’ so-called strong 103.000 level, a tailwind for the GBP/USD. Contrarily, US Treasury yields grind higher four basis points, sitting at 2.828%, regaining some strength after last week’s 4.69% fall.

Meanwhile, the GBP/USD opened the week near the 1.2470s area and, due to favorable market sentiment, rallied 100-pips, reclaiming the 1.2500 mark and closing at the 1.2600 price level, last seen on May 5.

An absent UK economic docket left the Bank of England’s (BoE) Governor Andrew Bailey as the catalyst for the day and sounded very “hawkish” aligned to most MPC members. He said that the central bank is ready to hike rates if needed and added that policymakers can and “must” take actions needed to return inflation to target over a period that avoids unnecessary volatility

Bailey said he rejected the argument that the BoE’s response let demand out of hand, thus stoking inflation.

Elsewhere, on the US front, the economic docket features the Chicago Fed National Activity Index for April, which rose by 0.47, higher than the 0.36 of the previous reading, and further, Fed speaking, with Atlanta’s Fed President, Raphael Bostic, crossing the wires.

GBP/USD Price Forecast: Technical outlook

According to the daily chart, the GBP/USD remains under downward pressure, despite recovering some 400-plus pips after reaching a year-to-date low at 1.2155. On Monday, the major attempted a break above 1.2600 but failed. Also, the Relative Strength Index (RSI) at 50.58, its slope is beginning to aim horizontal, signaling that the upward move is fading.

Upwards, the GBP/USD first resistance would be 1.2600. Break above would expose May 4 daily high at 1.2638, followed by the April 26 daily high at 1.2772. On the other hand, the major first support would be 1.2500. Latter’s breach would send the pair tumbling towards 1.2400, followed by the May 17 daily low at 1.2315 and the YTD low at 1.2155.

Some of the more hawkish European Central Bank policymakers are annoyed at the rate-hike timeline outlined by central bank President Christine Lagarde, Bloomberg reported on Monday citing sources, given some had preferred a faster option. Lagarde effectively signalled in a blog post on Monday that the bank would bring rates out of negative territory by the end of September, which the irked hawkish ECB policymakers have taken to imply two 25 bps rate hikes, effectively ruling out the option of a 50 bps rate hike in July.

- EUR/JPY is above 136.00 and eyeing last week’s highs following hawkish ECB commentary.

- The pair has formed a pennant and could break higher towards 140.00 should Eurozone yields kick on.

Hawkish interest rate guidance from European Central Bank President Christine Lagarde, who signaled that the bank is likely to have lifted interest rates out of negative territory by the end of September, boosted the euro against most of its G10 peers on Monday. That helped lift EUR/JPY to above 136.00 level, where it is now probing its 21-Day Moving Average, whilst bulls eye a test of last week’s highs in the upper 136.00s.

At current levels, around 136.10, the pair is trading with on-the-day gains of about 0.9%, with robust May German IFO survey data released earlier in the day likely contributing to the euro’s robust start to the week. Looking ahead, Eurozone business survey data remains in focus with the release of flash May Markit PMI survey data out on Tuesday. Survey data is being closely scrutinised at the moment with traders wanting to guage how the Eurozone economy is holding up amid the ongoing Russo-Ukraine war.

For now, ECB policymakers deem the Eurozone economy as still holding up well, with Bank of France head and European Central Bank governing council member Francois Villeroy de Galhau on Monday characterised growth as “resilient”, before saying that the deal on near-term rate hikes is probably done. Aside from Tuesday’s survey data, focus this week will remain on the various ECB and BoJ policymakers scheduled to speak. Given the policy divergence between the two, risks arguably remain tilted to the upside for EUR/JPY.

The pair is at present trapped within a pennant structure that has been in play since late April. A bullish breakout could see EUR/USD rally back towards annual highs in the 140.00 area, though such a move would likely need to be driven by further upside in Eurozone yields to drive the Eurozone/Japan rate differential higher.

Bank of France head and European Central Bank governing council member Francois Villeroy de Galhau said on Monday that a deal on rate hikes in the near term is probably done, reported Reuters. His remarks come after ECB President Christine Lagarde said in a Monday blog post that the ECB would likely lift rates out of negative territory by the end of September.

Villeroy added that Eurozone growth remains resilient, with the main short-term problem being inflation. Because of a broadening of inflationary pressures, he continued, the ECB must normalise monetary policy to get inflation back to 2.0%. The ECB is set to normalise policy, he emphasised, not tighten it.

Earlier in the day, the May German IFO survey came in stronger than expected.

- Oil prices are a little lower on Monday despite the weaker US dollar and stronger global equity markets.

- WTI remains within recent ranges near $110 as traders mull China Covid-19 and EU Russian oil embargo developments plus demand.

Oil prices stabilized within recent ranges on Monday amid a fairly quiet start to the week so far as crude oil relevant newsflow is concerned, with benchmarks broadly failing to benefit from a rally in global equities and a decline in the US dollar. As a risk-sensitive asset, strength in equities tends to help oil prices, while a weaker US dollar increases demand for USD-denominated commodities (like oil), as it makes it cheaper for the holders of international currency.

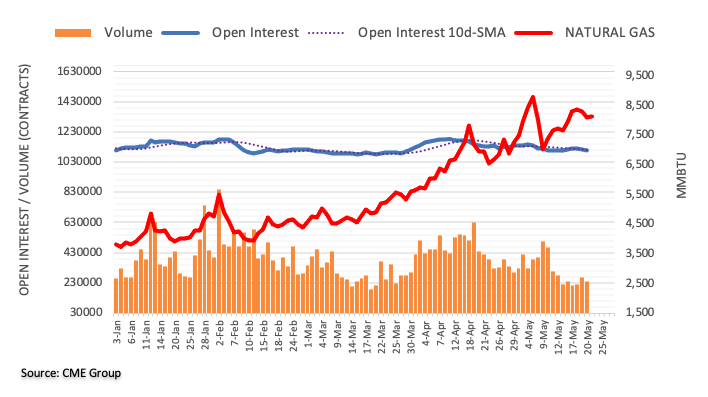

Front-month WTI futures were last pivoting on either side of the $110 level, midway between last week’s highs in the $115 area and lows in the $105 area. At current levels near $109.50, WTI is down about $1.0 on the day, which is a small intra-day move by WTI standards. Oil traders remain focused on familiar themes, including the Covid-19 lockdown situation in China. According to China’s NHC, the overall situation in the country is improving, though Beijing reported a record number of infections on Sunday. Lockdowns across many of the country’s largest cities, including Shanghai and Beijing, have dented Chinese crude oil demand in recent weeks, a tailwind for crude oil prices.

Elsewhere, analysts also noted strength in the US market for gasoline as the nation approaches its peak driving season, as reflected by US refineries ramping up output, as supportive for crude oil prices on Monday. According to analysts at Reuters, the peak driving season in the US lasts from the end of May (Memorial Day weekend) until September (Labor Day).

Whilst there have been fears that the surge in gasoline prices since the 2021 peak driving season might dent demand this year, analysts have over the last few weeks been citing high-frequency US mobility data as showing that this has thus far not been the case. A report from the Federal Highways Agency last week showed that vehicle miles traveled hit a record high for April this year, and high-frequency data from TomTom and Google show traffic climbing over the last few weeks.

Looking ahead, analysts will remain on the lookout for any headlines about whether the EU is getting any closer to a deal on ending Russian oil imports. The latest reports from Bloomberg suggest this isn't the case. That could act as another headwind making it more difficult for WTI to return to/break above last week’s $115ish highs. For now, though, robust demand (outside of China) and weak supply (as output from Russia/smaller OPEC nations struggles) should keep prices underpinned above last week’s $105ish lows, with the 21 and 50-Day Moving Averages in the mid-$100s also lending support.

Bank of England (BoE) governor Andrew Bailey said on Monday that the central bank is prepared to raise interest rates again in order to bring inflation down, reported Reuters. Policymakers can and must take the actions needed to return inflation to target over a period that avoids unnecessary volatility, he added.

The UK is facing a very big negative impact on real incomes caused by the rise in prices of imports, Bailey continued. Bailey added that he rejects the argument that the government's response to the Covid-19 pandemic and BoE's monetary policy let demand get out of hand and thus stoked inflation.

Deadlocked talks between European Union (EU) nations aimed at reaching an agreement on an embargo of Russian oil imports could extend into June, Hungary has signaled according to Bloomberg sources. Hungary is at present the main roadblock to a deal that would see the EU phase out most of its Russian oil imports within the next few months, as it continues to prioritize domestic energy security.

Analysts had previously touted an EU council summit meeting on 30-31 May as a god opportunity for leaders to come to an agreement on the embargo. The latest signals from Hungary will dampen expectations for a month-end breakthrough.

- USD/CAD dropped to over a two-week low on Monday amid heavy USD selling bias.

- Modest pullback in oil prices undermined the loonie and helped limit the downside.

- Recovery beyond the 1.2800 mark might confront resistance near the 38.2% Fibo.

The USD/CAD pair came under some renewed selling pressure on Monday and dropped to over a two-week low, around the 1.2770 region amid broad-based US dollar weakness. That said, a modest intraday pullback in crude oil prices undermined the commodity-linked loonie and helped limit any further losses, at least for the time being.

The USD/CAD pair was last seen trading just a few pips below the 1.2800 round-figure mark, still down nearly 0.40% for the day and remains at the mercy of the USD price dynamics.

From a technical perspective, bulls, so far, have managed to defend the 50% Fibonacci retracement level of the 1.2459-1.3077 strong move up. The said support should now act as a pivotal point, which, if broken decisively, will set the stage for an extension of the recent sharp pullback from the highest level since November 2020.

The USD/CAD pair might then accelerate the downfall towards testing intermediate support near the 1.2720-1.2715 region before eventually dropping to sub-1.2700 levels, or the 61.8% Fibo. level. The latter coincides with the 100-day SMA and is followed by the very important 200-day SMA, around the 1.2660-1.2665 zone.

Some follow-through selling would suggest that the USD/CAD pair has topped out in the near-term and prompt fresh technical selling. The subsequent decline has the potential to drag spot prices further towards the 1.2600 mark en-route the next relevant support near the 1.2560 horizontal zone.

On the flip side, attempted recovery back above the 1.2800 mark might now confront stiff resistance near the 38.2% Fibo. level, around the 1.2835-1.2840 region. Sustained strength beyond might trigger a short-covering bounce and allow bulls to reclaim the 1.2900 mark, though any further positive move seems elusive.

USD/CAD daily chart

-637889100657865221.png)

Key levels to watch

- USD/TRY trades on the defensive below the 16.00 mark.

- Turkey Capacity Utilization improved to 78.0% in May.

- Turkey End Year CPI Forecast now seen at 57.92%.

USD/TRY trades in quite a volatile fashion always below the 16.00 mark at the beginning of the week.

USD/TRY shifts its focus to the CBRT

USD/TRY extends the choppy activity seen as of late, while further upside and a break above the key 16.00 barrier still remaining elusive for bulls.

The lira managed to regain traction and drag spot lower on the back of the generalized selling bias in the greenback and the consequent renewed inflows into the risk complex and the EM FX space.

In the domestic calendar, Turkey’s Capacity Utilization rose to 78.0% in May, while the

End Year CPI Forecast is now expected at 57.92% (from 46.44%). Additional data saw the Manufacturing Confidence down a little to 109.4 (from 109.7) in May.

In the meantime, the pair is expected to continue within the current consolidative theme ahead of the CBRT event on Thursday, where market consensus still expects the central bank to keep rates unchanged despite the rampant inflation.

What to look for around TRY

USD/TRY keeps the upside bias well and sound and trades at shouting distance from the 16.00 mark.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Capacity Utilization, End Year CPI, Manufacturing Confidence (Monday) – Economic Confidence Index, CBRT Interest Rate Decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is losing 0.13% at 15.8395 and a drop below 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29). On the upside, the next barrier aligns at 15.9815 (2022 high May 20) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level).

NZD/USD continues its strong upward advance, threatening to reach the May high at 0.6556/68. However, while below here, economists at Credit Suisse stay bearish as this region ideally holds further near-term strength.

Only a sustained break above o.6556/68 would signal a false breakout

“We stay with our bearish medium-term view whilst below 0.6556/68, with only a sustained move above here threatening to negate the broader NZD/USD weakness.”

“Immediate support is thus seen at 0.6417/15 and then further below at the price low at 0.6310/.6288, a break below which is needed to weaken correction and put the market on track to retest the YTD low at 0.6227/13.”

“A stable close above the May high at 0.6556/68 would indicate a false breakout and see scope for sustained upside, with next notable resistance then seen at the 55-day moving average at 0.6684/90.”

- Gold is trading in the $1850s, up about 0.4% though lower versus early session highs in the $1860s.

- XAU/USD is trading over 3.5% higher versus last week’s lows amid a pullback in the US dollar.

- Key Fed events and US economic data present two-sided risks to the precious metal this week.

Spot gold (XAU/USD) has pulled back from earlier session highs in the $1860s per troy ounce after probing the 21-Day Moving Average at $1858, though prices are still higher by about 0.4% on the day (around $8.0) amid a soft start to the week for the US dollar. At present, XAU/USD is trading in the $1850s and is still in a bullish trend since its bounce from multi-month sub-$1790 lows printed this time last week. At current levels, gold is over 3.5% higher versus these lows.

The main driver of this recovery over the past week has been a weakening of the US Dollar Index (DXY), which has pulled sharply lower from multi-decade highs printed above 105.00 earlier in the month. Since these highs set ten days ago on 13 May, the DXY has dropped more than 2.5% to the low-102.00s. This drop came despite Fed policymakers sounding exceedingly hawkish last week in their intent to continue pressing ahead with rate hikes to tame rampant inflation, even in the face of a weakening economy/stock markets.

Given the Fed’s role as a key driver of upside in the buck over the last few months, analysts are not unsurprisingly questioning how much further this dollar pullback has to run. Surely dip-buyers will come back in at some point, they question. If there is a dollar recovery this week, that would be bad for XAU/USD.

This week's economic events arguably present two-sided risks for XAU/USD. On the one hand, there will be plenty of Fed speak as well as the release of the May meeting minutes and the tone is expected to be as hawkish as ever. On the other hand, US (and global) flash May PMIs on Tuesday plus Thursday’s second estimate of Q1 US GDP growth may combine to trigger fresh concerns about US (and global growth), which could offer silver some safe-haven support, especially if it is deemed as dampening long-term Fed tightening prospects.

S&P 500 posted a late bullish “hammer” reversal into the close on Friday to hold above the key 3855/15 support cluster. This reasserts the potential for further short-term consolidation over the next few days, but the broader risk is still biased lower, in the view of analysts at Credit Suisse.

Eventual break under 3855/15 can see support at 3505/00

“S&P 500 has resultantly formed a bullish ‘hammer’ candlestick reversal and with a short-term bullish momentum divergence now in place, and with US Bond Yields and the USD stabilizing, all this reasserts the potential for a short-term phase of consolidation.”

“Key resistance is seen at the falling 13- day exponential average, now at 4002. Whilst below this level, this will just stay seen as a low-level consolidation, with medium-term downside momentum staying strong. Therefore, the risk of an eventual breakdown stays seen as elevated, with the next key support level at the cluster of price lows around 3723/3694 and eventually down to 3505/00.

“Key resistance stays at the aforementioned 4002 13-day exponential moving average. A break above here would open up a deeper corrective recovery, with resistance then seen at 4091/4128.”

- NZD/USD gained strong positive traction on Monday and shot to over a two-week high.

- The risk-on impulse undermined the safe-haven USD and extended support to the kiwi.

- Expectations for an additional 50 bps rate hike by the RBNZ provided an additional lift.

The NZD/USD pair prolonged its recent strong recovery from a nearly two-year low touched earlier this month and gained traction for the third successive day on Monday. This also marked the sixth day of a positive move in the previous seven and lifted spot prices to over a two-week high during the mid-European session.

As China prepares to reopen at the beginning of June after a two-month lockdown, investors turned optimistic amid hopes that loosening COVID-19 restrictions would boost the global economy. This was evident from a generally positive tone around the equity markets, which dragged the safe-haven US dollar to a fresh monthly low and benefitted the risk-sensitive New Zealand dollar.

The kiwi was further underpinned by expectations that the Reserve Bank of New Zealand would increase the Official Cash Rate by an additional 50 bps on Wednesday. The central bank is also anticipated to provide a clear signal that further tightening is forthcoming. The combination of factors pushed the NZD/USD pair further beyond last week's swing high, around the 0.6415-0.6420 region.

Hence, the momentum could also be attributed to some technical buying, though stalled just ahead of the 0.6500 psychological mark. The said handle should now act as a pivotal point ahead of the key central bank event risk and the release of minutes of the latest FOMC meeting on Wednesday. This will play an important role in determining the next leg of a directional move for the NZD/USD pair.

The markets already seem to have fully priced in at least 50 bps Fed rate hike move over the next two policy meetings. Investors, however, will look for clues about the possibility of a jumbo 75 bps rate hike in June. Apart from this, important US macro data scheduled during the latter part of the week will influence the USD and further provide some meaningful impetus to the NZD/USD pair.

In the meantime, a goodish pickup in the US Treasury bond yields could lend some support to the buck. Moreover, absent relevant market moving economic releases from the US warrants some caution before placing fresh bullish bets around the NZD/USD pair. This makes it prudent to wait for sustained strength beyond the 0.6500 mark before positioning for any further appreciating move.

Technical levels to watch

- Silver has pulled back to the $22.00 area from an earlier failed test of the 21DMA at $22.20.

- XAG/USD is still up over 1% on the day and more than 7.5% versus recent lows in the mid-$20.00s.

- Dollar weakness is driving the ongoing rebound, though there could be a recovery this week amid more expected Fed hawkishness.

Spot silver (XAG/USD) has pulled back from earlier session highs in the $22.20 per troy ounce area after failing a test of the 21-Day Moving Average, though continues to trade with gains of about 1.2% on the day (over 25 cents) amid a continued weakening of the US dollar at the start of the week. For now, XAG/USD is holding onto the $22.00 level and the uptrend that has been in play over the past ten days that has seen the precious metal bounce more than 7.5% from multi-month lows in the mid-$20.00s remains intact.

The main driver of this recent recovery has been the US Dollar Index’s (DXY) sharp pullback from the multi-decade highs it printed above 105.00 earlier in the month. Since 13 May, the DXY has dropped more than 2.5% from these highs to the low-102.00s, despite Fed policymakers sounding exceedingly hawkish last week in their intent to continue pressing ahead with rate hikes to tame rampant inflation, even in the face of a weakening economy/stock markets.

Given the Fed’s role as a key driver of upside in the buck over the last few months, analysts are not unsurprisingly questioning how much further this dollar pullback has to run. Surely dip-buyers will come back in at some point, they question. If there is a dollar recovery this week, that would be bad for XAG/USD. Its failure to get above its 21DMA may prove pivotal (failure at a major moving average is often seen by technicians as a bearish sign.

This week's economic events arguably present two-sided risks for XAG/USD. On the one hand, there will be plenty of Fed speak as well as the release of the May meeting minutes and the tone is expected to be as hawkish as ever. On the other hand, US (and global) flash May PMIs on Tuesday plus Thursday’s second estimate of Q1 US GDP growth may combine to trigger fresh concerns about US (and global growth), which could offer silver some safe-haven support, especially if it is deemed as dampening long-term Fed tightening prospects.

- EUR/USD advances further north and flirts with 1.0700.

- Further up now aligns the 55-day SMA at 1.0788.

EUR/USD pushes higher and prints new May peaks just ahead of the 1.0700 mark on Monday.

Considering the pair’s ongoing price action, the continuation of the rebound appears likely in the very near term at least. That said, the next up barrier now appears at the 55-day SMA, today at 1.0788 before the 3-month resistance line around 1.0860.

The breakout of this area should mitigate the selling pressure and allow for a probable move to the weekly high at 1.0936 (April 21).

EUR/USD daily chart

- The Chicago Fed's National Activity Index rose to 0.47 in April from 0.36 in March.

- It has remained stable in the mid-0.0s since the start of the year.

- There was no market reaction to the latest Chicago Fed data.

The US National Activity Index rose to 0.47 in April from 0.36 in March, data released by the Federal Reserve Bank of Chicago revealed on Monday. The National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. The index has been relatively stable in the mid-0.0s since the start of the year, suggesting a modest but consistent growth rate.

Market Reaction

There was no market reaction to the latest Chicago Fed data.

Over the past five days, the New Zealand dollar is the second-best performing G10 currency after the Swiss franc. The guidance from the Reserve Bank of New Zealand (RBNZ) this week will be key. In the opinion of economists at Rabobank, the kiwi is vulnerable to lower rates.

The peak in RBNZ rates could be lower than previously expected

“If the RBNZ starts to signal the peak in rates is likely to be lower and come sooner, the NZD could be vulnerable.”

“Despite the improved tone of NZD/USD in recent sessions, we expect further upside may be difficult on a 1-to-3-month view.”

“We see the potential for further safe-haven demand to boost the USD in the month ahead. This view stems from concerns over the pace of global growth.”

“We see risk of another dip to the NZD/USD 0.63 area in the weeks ahead with a moderate recovery in the currency pair on a 6-month view dependent on a broad-based softening in the value of the USD.”

EUR/USD has held key support at 1.0341 and daily MACD has turned higher. Furthermore, the break above 1.0642 confirms a base and analysts at Credit Suisse look for a move to 1.0758/90.

EUR/USD looks likely to confirm a near-term base

“This morning’s break above the 23.6% retracement of the fall from February and May high at 1.0620/42 should confirm a near-term base and provide the platform for a deeper recovery to the 38.2% retracement, 55-day average and mid-April lows at 1.0758/90.

“We expect a much tougher barrier at 1.0758/90 and for the medium-term downtrend to reassert itself from here, with medium-term momentum ultimately still very strong.”

“Support moves to this morning’s breakout point at 1.0608/0599, with 1.0532 now needing to hold to maintain an immediate upside bias. A break below here and then 1.0460 can clear the way for a retest of 1.0350/41.”

Swiss National Bank governing board member Andrea Maechler said in an interview published in Swiss newspaper Bilan on Monday that the central bank won't hesitate to raise interest rates if inflation remains outside of target.

"If the inflation we expect does not come down in the medium term to a range between 0% and 2%, we will not hesitate to tighten policy," Maechler said.

The headline rate of annual Consumer Price Inflation (CPI) rose to 2.5% in April in Switzerland, data released earlier this month showed, above the bank's zero to 2.0% target range. The fact that the European Central Bank has announced to take its policy rate out of negative territory this year removes some pressure on the SNB to maintain rates at their present -0.75% level.

EUR/CHF’s decline has paused around the 55-day moving average (DMA) at 1.0278. Nevertheless, analysts at Credit Suisse stay oriented lower and expect a test of 1.0189/69 in due course.

Resistance at 1.0360 set to hold to maintain the strong downward pressure

“With daily MACD turning lower and with the recent sharp drop in mind, we maintain our long-held bearish view and see scope for further downside, with support seen at 1.0263/53 initially, and then further below at the late April lows at 1.0189/69.

“A closing break below the late April lows at 1.0189/69 would look to promote further weakness to 1.0133, ahead of the April low at 1.0086.”

“Resistance remains at 1.0360, which ideally holds to maintain the strong downward pressure. Whilst a break above here would likely look to test 1.0403 as well, only a move above the 200-DMA and recent high at 1.0480/0515 would threaten the medium-term downtrend, though our base case is that this level will continue to hold if reached.”

GBP/USD looks likely to see a deeper corrective recovery. Nonetheless, the broader view of the Credit Suisse analyst team stays bearish, with key resistance at 1.2633/51.

Support is seen at 1.2338/29

“Although our broader outlook stays negative, with daily MACD momentum having turned higher we continue to look for a corrective recovery/consolidation phase to emerge. “

“Beyond the next key resistance at the May high and 23.6% retracement of the entire fall from 2021 at 1.2633/51 would trigger an even deeper correction, with the next resistance at the 38.2% retracement of the 2022 at 1.2766, then the crucial 55-day average at 1.2843, where we would have greater confidence in a ceiling for a resumption of the broader downtrend.”

“Support is seen at 1.2447/39 initially, with 1.2338/29 now needing to hold to maintain an immediate upside bias. A break would end the corrective recovery phase, with support seen next at 1.2218 and more importantly at 1.2167/57.”

EUR/USD is trading at the highest since April 26 near 1.0680. Economists at BBH expect the pair to test the April 21 high near 1.0935 on a break past 1.0710.

Lagarde signals interest rate turnaround

“A break above 1.0710 would set up a test of the April 21 high near 1.0935.”

“European Central Bank President Christine Lagarde said the ECB is likely to exit negative rates by the end of Q3. This supports current market pricing for liftoff on July 21 with a 25 bp hike, followed by another 25 bp on September 8 which results in a zero deposit rate. Follow-up hikes on October 27 and December 15 are fully priced in that would take the deposit rate to 0.5% by year-end.”

“To be clear, market pricing for the ECB has not shifted after Lagarde’s remarks and yet the euro got another leg higher. At some point, the subdued ECB outlook should weigh on the euro but for now, the FX market is happy to take the dollar lower.”

The US Dollar Index (DXY) is trading near 102.144, the lowest since April 26. A break under 101.08 would open up additional losses below 100 but the dollar is set to resume its uptrend eventually, economists at BBH report.

Pendulum of market sentiment is likely to swing back in the dollar’s favor

“Key level to watch is 101.80 as a break below would set up a test of the April 21 low near 99.818.”

“We still view this as a correction within the longer-term dollar rally but confess surprise at how far the dollar has fallen from the early May peak.”

“At some point, the pendulum of market sentiment is likely to swing back in the dollar’s favor but for now, the market is seeing very little resistance as it takes the dollar lower.”

“We believe that as the US outlook improves, yields will resume rising and that should help the dollar get some traction in the coming days.”

- USD/JPY edged lower on the first day of the week amid broad-based USD weakness.

- The risk-on impulse undermined the safe-haven JPY and helped limit further losses.

- The Fed-BoJ policy divergence also held back traders from placing fresh bearish bets.

The USD/JPY pair witnessed some selling on the first day of a new week, though managed to find some support ahead of the monthly low, around the 127.00 mark touched last Thursday. The pair remained on the defensive through the mid-European session and was last seen trading just a few pips above mid-127.00s.

The US dollar added to last week's heavy losses and dropped to its lowest level since April 26 amid a strong pickup in demand for the shared currency. Moreover, a 50 bps Fed rate hike move over the next two policy meetings is fully priced in the markets. The combination of factors dragged the USD Index to its lowest level since April 26, which, in turn, exerted some downward pressure on the USD/JPY pair. That said, a combination of factors acted as a headwind for the Japanese yen and helped limit any deeper losses, at least for the time being.

Investors turned optimistic amid hopes that loosening COVID-19 lockdowns in China would boost the global economy. This was evident from a generally positive tone around the equity markets, which tends to undermine the safe-haven Japanese yen. The risk-on flow was reinforced by a goodish pickup in the US Treasury bond yields. This, along with a big divergence in the monetary policy stance adopted by the Bank of Japan and the Fed, acted as a tailwind for spot prices. This, in turn, warrants caution before placing fresh bearish bets around the USD/JPY pair.

It is worth recalling that the BoJ has vowed to keep its existing ultra-loose policy settings and promised to conduct unlimited bond purchase operations to defend its near-zero target for 10-year yields. In contrast, the US central bank is anticipated to take more drastic action to bring inflation under control. Hence, the focus will remain on the minutes of the latest FOMC monetary policy meeting, due for release on Wednesday. This, along with key US macro data scheduled during the latter part of the week, would provide a fresh directional impetus to the USD/JPY pair.

In the meantime, the USD price dynamics might continue to play a key role in influencing spot prices amid absent relevant market moving economic releases from the US. Traders might further take cues from the broader market risk sentiment and the US bond yields to grab short-term opportunities around the USD/JPY pair.

Technical levels to watch

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest decision by the PBoC to lower the 5-year LPR.

Key Takeaways

“The People’s Bank of China (PBoC)’s benchmark 5Y Loan Prime Rate (LPR) was fixed lower by a record 15 bps to 4.45% today (Bloomberg est: 4.55%), signaling stronger support for the real estate market. The rate was last cut by 5 bps in Jan. This could be followed by further measures to ease property market curbs.”

“The 1Y rate was unchanged at 3.70% (Bloomberg est: 3.65%), following decision by the PBoC to keep the 1Y medium-term lending facility (MLF) rate steady at 2.85% on Mon (16 May).”