- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 20-05-2022

- The Canadian dollar gained 0.47% vs. the greenback in the week, which was soft throughout the whole week.

- The US Dollar Index reclaimed the 103.000 mark but ended the week with losses of 1.38%.

- USD/CAD Price Forecast: A daily close above the 20-DMA could pave the way for a move towards 1.3000.

The USD/CAD is seesawing during the North American session and is recording minimal gains of 0.06% on Friday, after reaching a daily low below 1.2800, later reclaimed by USD/CAD bulls that struggled at the 20-DMA at around 1.2868. At the time of writing, the USD/CAD is trading at 1.2836.

The major benefitted from overall greenback strength, as the US Dollar Index, a measure of the greenback, rose more than 0.23% and is sitting at 103.060, a tailwind for the USD/CAD. Also, a dampened market mood increased appetite for safe-haven peers in the FX space, particularly the buck, while the JPY is the weakest on the week’s last trading day.

Reflection of the above-mentioned are the US equities plunging between 1.51% and 2.49%, reaching fresh 52-week lows. That despite investors’ cheered rate cut of 0.15% by the People Bank of China (PBoC), aimed to stimulate the Chinese economy, which is going to another Covid-19 outbreak that triggered more than one-month lockdowns in Shanghai.

Meanwhile, mixed economic data on the Canadian docket boosted the prospects of the Loonie, which gained 0.47% in the week. Canada’s inflation rate rose by 6.8%, hitting a 31-year high. Furthermore, on Thursday, Statistics Canada reported that prices paid by producers, also known as PPI, came in line with expectations, but Raw Materials skyrocketed to 38.4% y/y, higher than the 31% estimations.

Analysts at TD Securities wrote in a note that the report might keep the Bank of Canada under pressure to bring policy to neutral. They added that although “The Bank has already acknowledged that additional 50bp hikes are likely, today’s report is unlikely to tip the scales towards a 75bp hike.”

“We continue to look for the Bank to hike by 50bps in June and July to bring the overnight rate to 2.00%, before switching to 25bp hikes from Sept-Jan,” TD Securities analysts noted.

USD/CAD Price Forecast: Technical outlook

Friday’s price action shows that the USD/CAD tumbled below the 20-day moving average (DMA) at 1.2869, and albeit being positive in the session, USD/CAD buyers have been unable to reclaim the level. Still, it’s worth noting that the Relative Strenght Index (RSI), although it fell off the cliff from around 80 readings to 51.49, turned bullish, and is aiming higher, a signal that USD/CAD bulls remain in charge.

That said, the USD/CAD first resistance would be the 20-DMA at 1.2869. Break above would expose the 1.2900 mark, followed by the May 16 daily high at 1.2981, then the figure at 1.3000. On the flip side, the USD/CAD first support would be 1.2800. Once cleared, the next demand zone would be the April 29 daily low at 1.2718, followed by the confluence of the 50 and 100-DMA at 1.2695 and 1.2690, respectively.

Key Technical Levels

- The USD/JPY loses for the second straight week, 1.10%.

- The greenback remained strong in the session, boosted by a dampened market mood, as US equities reached fresh 52-week lows.

- USD/JPY Price Forecast: Range-bound lacking a catalyst that can rock the boat.

The USD/JPY continues sliding for the third straight day, though the downtrend capped at April’s 27 daily low at 126.94, keeping the major’s uptrend intact amidst a downbeat market mood on the last trading day of the week, as the Wall Street close looms. At 127.82, the USD/JPY records minimal gains of 0.04%.

US equities are plunging between 1.51% and 2.49%. The Dow Jones and the Nasdaq reached a 52-week low, despite efforts from the People Bank of China (PBoC) to stimulate the Chinese economy when it cut rates in the 5-year Loan Prime Rate (LPR) by 0.15%. Although the decision was cheered by investors in the Asian and European sessions, it was ignored in the New York session, as options expiring tied to equities and ETFs increased volatility.

In the meantime, the US Dollar Index, a measurement of the greenback’s value against its peers, recovers some 0.23% in the day and sits at 103.102. Contrarily, US Treasury yields, led by the 10-year benchmark note, is down from a 3% high in the week to 2.774%, a headwind for the USD/JPY due to its tight positive correlation.

USD/JPY Price Forecast: Technical outlook

USD/JPY’s price action pushed the exchange rate towards the Bollinger’s band bottom line, at around 127.12, where some USD/JPY buyers lifted the price towards current price levels. It is worth noting that the USD/JPY shifted from upward biased to neutral due to the major staying trading in the 127.00-129.78 range, unable to trade beyond those boundaries, amid a lack of a fresh impetus that could rock the pair towards new weekly/yearly lows/highs, respectively.

Upwards, the USD/JPY first resistance would be 128.00. A breach of the latter would expose essential resistance levels. Firstly, May’s 18 daily high at 129.53, followed by the 130.00 mark, and the YTD high at 131.34. On the flip side, the USD/JPY’s first support would be May 19 daily low at 127.02. Break below would expose April’s 27 swing low at 126.94, followed by the 50-DMA at 125.66.

Key Technical Levels

- The Swiss franc gained more than 2.50% vs. the greenback.

- A dampened market mood and a strong US dollar capped the USD/CHF nosedive in the week.

- USD/CHF Price Forecast: Although the major held a massive loss in the week, it remains upward biased unless USD/CHF bears push the pair below the 0.9700 mark.

The USD/CHF is trimming some of its losses, bouncing off the weekly lows at around 0.9700 and pushing to reclaim 0.9750, amidst a dismal sentiment portrayed by US equities recording losses. Also, broad US dollar strength is a tailwind for the pair, despite hefty losses in the 10-year US Treasury yield, which fell from 3% to 2.785%, near weekly lows. At 0.9762, the USD/CHF is gaining 0.35% and eyes to pierce the 20-DMA at around 0.9827.

From a technical perspective, the USD/CHF tumbled in total 250-pips after reaching parity on May 12. USD/CHF traders would need to be aware that Friday’s uptick spurred a reaction in the Relative Strength Index (RSI), which plunged from overbought levels to the 50-midline, and as of writing, it is aiming up at 51.28.

USD/CHF Price Forecast: Technical outlook

That said, the USD/CHF remains upward biased, as the daily moving averages (DMAs) are still below the spot price. The USD/CHF first resistance would be the figure at 0.9800. A breach of the latter would expose the 20-DMA at 0.9827, followed by March 23, 2020, a daily high at 0.9901, and then the parity.

On the flip side, the USD/CHF first support would be 0.9700. Break below would expose the 0.9600 mark, closely followed by the 50-DMA at 0.9545.

Key Technical Levels

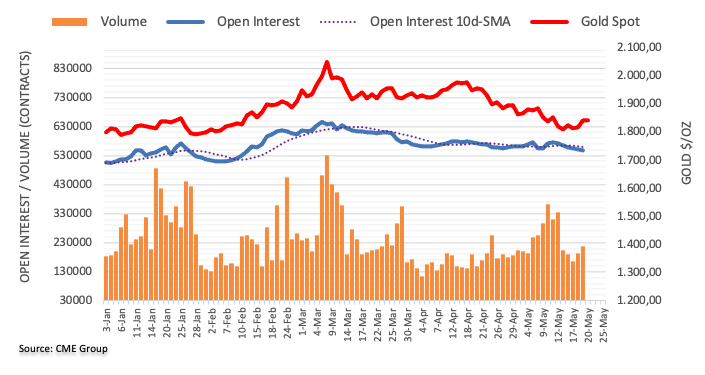

- Gold prepares to finish the week on a higher note, up some 1.76%.

- Risk-aversion fails to boost Gold prospects, and also a buoyant greenback is weighing on XAU/USD prices.

- Gold Price Forecast (XAU/USD): Failure at the 20-DMA leaves the precious metal vulnerable to further selling pressure.

Gold spot (XAU/USD) is almost flat on the day, in a choppy trading session on Friday, as market players’ sentiment shifted negatively, as reflected by US equities tumbling between 0.67% and 1.76%, while the greenback recovers some ground, after falling from YTD highs at around 105.00. At $1843.03, XAU/USD is set to finish the week with decent gains, snapping four straight weeks of losses.

Sentiment remains negative due to the option expiring

Early in the North American session, a buoyant market mood courtesy of the People’s Bank of China (PBoC) 15-bps rate cut to its 5-year LPR was cheered by investors as Asian and European equities finished with gains. Nevertheless, in the mid-New York session, the mood turned sour. Analysts attribute the shift to options expiring on equities and ETFs, which triggered high volatility, and sent the Dow Jones Industrial and the Nasdaq to fresh 52-week lows.

Gold remains to trade in familiar ranges amidst the lack of a catalyst. Fed policymakers throughout the week have emphasized the need to bring inflation down, and the majority of them telegraphed its stance about hiking rates by 50-bps at least in the June and July meetings. Others like Philadelphia Fed’s Patrick Harker added that he is less worried about a deep recession and is not forecasting it. Meanwhile, Minnesota Fed’s Neil Kashkari said he sees evidence of a long-term high inflation regime and expressed that the central bank needs to be more aggressive.

In the week ahead, the US economic docket will feature S&P Global PMIs, the release of the last Fed’s FOMC meeting minutes, Jobless Claims, and the Fed’s favorite gauge for inflation, the Personal Consumption Expenditure (PCE) for April.

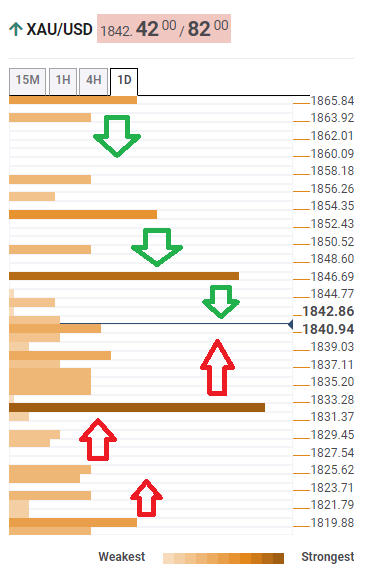

Gold Price Forecast (XAU/USD): Technical outlook

Although it is above the 200-DMA, which lies at $1838.61, Friday’s Gold price action is still vulnerable to further selling pressure. XAU/USD’s bulls, to ease the downward pressure, need to reclaim the 20-DMA at $1858.41, a level that would leave Gold comfortably trading in the $1838-58 range, before finding a fresh impetus to continue its climb towards the 100-DMA at $1885.75.

Nevertheless, until the above scenario plays out, Gold’s path of least resistance is neutral-downwards. XAU/USD’s first support would be the 200-DMA at $1838.62. Break below would expose the two-year-old upslope trendline around $1820-30, followed by the bottom band of the Bollinger’s band indicator at $1798.05, immediately followed by the YTD low at $1780.18.

- Despite falling on Friday, the AUD/USD is up in the week by 1.34%.

- Sentiment fluctuated negatively in the last hour, dragging the AUD/USD lower.

- AUD/USD Price Forecast: A daily close below the 20-DMA could pave the way towards the YTD low below 0.6850.

The Aussie dollar is struggling at the 20-day moving average (DMA) and is losing the battle as the AUD/USD looks forward to resuming the prevailing downtrend, as the 50-DMA crosses below the 100-DMA, further confirming the bias. At 0.7030, the AUD/USD reflects the greenback’s strength as sentiment turned sour.

Sentiment fluctuated negatively in the last hour, dragging the AUD/USD lower

Earlier in the day, Wall Street opened higher, influenced by the positive mood carried on from the Asian and European sessions. The People’s Bank of China (PBoC) rate cut to the 5-year Loan Prime Rate (LPR) from 4.60% to 4.45% was cheered by investors, a signal that Chinese authorities would keep supporting the economy, despite zero-tolerance Covid-19 restrictions. Nevertheless, the mood shifted in the last hour.

During the week, the Australian dollar benefitted from positive employment data, despite that the Wage Price Index (WPI) rose lower than estimations. However, the Full-time employment crushed expectations, and the Unemployment Rate down ticked, lifting the AUD/USD above 0.7070s, weekly highs.

On Friday, the story is different, as risk-aversion, which kicked in since Thursday’s though was ignored by FX market players, is taking a toll on the AUD/USD, sending the major tumbling below the 20-DMA and threatening to open the door for a move towards 0.7000.

On the US front, an absent economic docket, which witnessed earlier in the week a parade of Fed speakers, is not doing much for the greenback, which is strengthening in the session as reflected by the US Dollar Index up 0.26%, back above the 103.000 mark.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is still downward biased, despite Thursday’s rally, which lifted the pair from below 0.7000s towards weekly highs. A Friday’s daily close below the 20-DMA at 0.7039 would expose the major to selling pressure.

Therefore, the major’s path of least resistance continues downwards. The AUD/USD first support would be 0.7000. Break below would expose the 0.6900 mark, followed by the bottom band of the Bollinger band’s indicator at 0.6850 and then the YTD low at 0.6828.

Next week the Reserve Bank of New Zealand will have its monetary policy meeting. According to analysts at Wells Fargo, high inflation and a hawkish central bank outlook sets the stage for another 50 bps hike in May to 2.00%. They expect the rate to end the year at 3.00%.

Key Quotes:

“The Reserve Bank of New Zealand (RBNZ) will hold its May monetary policy meeting next week against a backdrop of elevated inflation.”

“The RBNZ surprised markets with a 50 bps rate hike in April. The central bank expects CPI to peak around 7% in the first half of this year, although it believes the risk of persistent and high inflation expectations have increased. Notably, the RBNZ has asserted that the "path of least regret" is moving to a neutral policy rate sooner, which should reduce the risks of rising inflation expectations and provide more policy flexibility amid an uncertain global economic environment.”

“High inflation and a hawkish RBNZ sets the stage for another 50 bps hike in May, which would bring the Official Cash Rate to 2.00%. We then expect additional 25 bps rate hikes in July, August, October, and November, which would bring the OCR to 3.00% at the end of 2022.”

- Dollar ends a positive weekly streak across the board, even as risk aversion prevails.

- Pound offers signs of life, rebounds more than 200 pips.

- GBP/USD could correct further, considering magnitude of recent slide.

The GBP/USD is moving sideways on Friday, consolidating slightly below 1.2500. The pair remained steady even as stocks in Wall Street turned negative. Risk aversion is offering no boost to the dollar.

The pound is rising versus the US dollar for the first time in five weeks as it recovers from the lowest level in almost two years and following a 900 pips slide. The main trend is still bearish for GBP/USD. The pair moved off YTD lows giving signs of an interim bottom. The recovery appears to have room to go, particularly is financial tensions across global markets ease.

Technical outlook

The GBP/USD pair tested the 1.2540 resistance, where the Fibonacci 23.6% retracement of the downtrend that started in late March is located, before going into a consolidation phase on Friday, noted Dwani Mehta, analysts at FXStreet. “On a bullish note, the pair managed to close above the 21 DMA for the first time since March 22 and the Relative Strength Index (RSI) indicator on the daily chart rose to 50.”

According to Mehta, in case 1.2450 holds as support in the near term, GBP/USD could test 1.2540 and eye 1.2630 as its next bullish target. “A daily close above the latter could attract buyers and open the door for additional gains toward 1.2750 (Fibonacci 38.2% retracement).”

Technical levels

- The EUR/USD records gains in the week of some 1.30%.

- The US Dollar is trimming Thursday’s losses and remains buoyant on Friday amidst a positive sentiment.

- ECB Governing Council members continued expressing the need to tackle inflation.

- EUR/USD Price Forecast: Threatening to break below the 20-DMA, and once cleared, a move towards 1.0500 is on the cards.

The shared currency retreats from weekly highs though remain above the 20-day moving average (DMA), lying at 1.0531, amidst an upbeat sentiment session courtesy of additional stimulus by the People’s Bank of China (PBoC), which cut rates in the 5-year LPR from 4.6% to 4.45%, as concerns of a global recession grow amongst financial analysts. At the time of writing, the EUR/USD is trading at 1.0552.

Buoyant US dollar weighs on the EUR, despite ECB's hawkish pivot

The greenback is recovering some ground on Friday and caught a bid as US equities rallied. US Treasury yields are under pressure, though the 10-year clings to the 2.80% threshold, while the 10-year German bund hovers near the 1% threshold, a level last reached in June 2015.

The Eurozone economic docket featured the German Producer Price Index (PPI) for April, which came hotter than expected. The monthly reading rose by 2.8%, higher than 1.4% foreseen, while annually based expanded by 33.5%, higher than 31.5% estimated. The data does not alter the hawkish pivot by some ECB board members, which expressed that the central bank needs to get above 0%.

The EUR/USD got a lift in the week on the back of further ECB hawkish expressions by the Governing Council (GC) members. On Friday, the ECB GC member Ignazio Visco commented that the ECB can move out of negative rate territory, and a June hike is “certainly” out of the question. Later in the day, he added that he foresees a moderate recession if Rusian gas is shut off.

In the meantime, the Bundesbank President and ECB board member Nagel said that rate hikes could follow in short succession and noted that negative rates are a thing of the past. Of late, ECB’s Francois Villeroy commented that the ECB’s priority in the short time is fighting inflation and will deliver.

EUR/USD Price Forecast: Technical outlook

Friday’s price action leaves the EUR/USD exposed to selling pressure if EUR bears achieve a break below the 20-DMA. Further reinforcing the aforementioned is the RSI, which shifted from pointing upwards, and is aiming downwards at 46.10 in negative territory as the week is about to end.

That said, the path of least resistance for the major is downwards. The EUR/USD first support would be the 20-DMA at 1.0531. Break below would expose the February 2017 lows at around 1.0494, followed by the bottom of the Bollinger bands at 1.0381 and the YTD low at 1.0353.

Key Technical Levels

- Mexican peso holds onto weekly gains versus the US dollar.

- Emerging market currencies resist the wave of risk aversion well.

- USD/MXN heads for the third weekly decline in a row.

The USD/MXN dropped further on Friday and bottomed at 19.84, the lowest level in a month. It then trimmed losses and climbed toward 19.90 as Wall Street turned negative.

Emerging market currencies resisted the wave of risk aversion so far but the negative tone across financial markets remains a great risk. More tensions could hit not only emerging markets' assets but also their currencies.

Wall Street indices opened positive on Friday and then changed their course. The Dow Jones is falling by 0.71% and the S&P 500 drops by 0.63%. The move pushed USD/MXN back to the 19.90 area.

A daily close below should keep the negative momentum intact, with scope for a test of the next support at 19.80. The next level to watch is seen at the April low at 19.72.

If the US dollar manages to recover above 19.90 it would alleviate the bearish bias. The next critical resistance stands at 20.05. If USD/MXN rises above the 20-day Simple Moving Simple at 20.20, it would negate the bearish short-term outlook.

-637886567367582187.png)

- USD/CAD is back to trading flat in the 1.2830 area after hitting more than two-week lows earlier in the session.

- The pair is on course to end the week lower by about 0.5% amid USD weakness and hot Canadian CPI.

USD/CAD hit its lowest level in more than two weeks on Friday in the 1.2770s, though was unable to muster a sustained break below earlier weekly lows in the 1.2780 area or even the 1.2800 level. At current levels close to 1.2830, the pair is trading broadly flat on the day and is on course to drop about 0.5% on the week, which would be the biggest weekly drop since March, with the pair now trading about 2.0% below last week’s multi-month highs in the upper-1.3000s.

An improvement in global risk appetite on the last day of the week after China’s PBoC eased financial conditions in the country with a surprise cut to its benchmark 5-year interest rate (called the Loan Prime Rate) helped keep the pair trading with a negative bias. But the pair has also been weighed this week by a combination of a weakening US dollar and strong Canadian economic data.

Regarding the former, despite Fed policymakers sounding hawkish throughout the week, the buck seems to be suffering from profit-taking, with some also citing weak Philly Fed manufacturing data on Thursday as sparking fears about the state of the US economy. Meanwhile, the YoY rate of Consumer Price Inflation in Canada was revealed on Wednesday to have unexpectedly risen to fresh multi-decade highs at 6.8%, pumping expectations for further rapid tightening from the BoC and boosting the loonie at the time.

Next week, Canadian April Retail Sales data on Thursday will be closely scrutinized as an update as to the state of health of the Canadian consumer, but the main drivers of the USD/CAD pair will likely continue to come from risk appetite, commodity prices and US economic events. May flash US PMIs will be released on Tuesday, the minutes of the last Fed meeting will be out on Wednesday, and the second estimate of US Q1 GDP growth will be out on Thursday followed by the April Core PCE inflation report on Friday.

- Having failed to break above its 21DMA at 0.6413, NZD/USD has since fallen back to consolidate around 0.6400.

- The pair is on course for its first positive week in seven as traders prepared for next week’s RBNZ meeting.

Though risk assets broadly look set to end the week on a stronger footing, most have pulled back from earlier session highs since the open of US trade, with the kiwi no exception. NZD/USD was able to rally above the 0.6400 level earlier in the day, but ran into resistance at its 21-Day Moving Average at 0.6413 and has since dropped back to trade near 0.6400. That still leaves the pair trading with gains of about 0.3% on the day and around 1.75% on the week. That would mark NZD/USD’s first positive week in seven.

The main driver of this week’s gains has been a broad weakening of the US dollar, which seems to have been positioning more than fundamental related, given US economic data was mixed (April Retail Sales was strong but May Philly Fed Manufacturing survey was weak) and Fed commentary was hawkish. But the kiwi has also derived some support from domestic themes.

A spike in QoQ Producer Price Inflation rates, as revealed by data released on Thursday, has bolstered expectations for the RBNZ to hike interest rates by 50 bps next Wednesday. Meanwhile, Q1 Retail Sales data out on Tuesday ought to point to a robust New Zealand economy. This combo could keep the kiwi support next week, but broader risk appetite will also remain key.

Global equity markets were choppy this week, buffeted on the one hand by concerns about Fed tightening and weakening global growth, but then also lifted by constructive China updates (more monetary/fiscal stimulus and hopes for lockdown easing). If stocks continue to drop next week this could offer the buck some safe-haven support, while it may also benefit from any hawkish vibes from the Fed minutes out on Wednesday.

Eurozone Consumer Confidence Index rose from -22.0 in April to -21.1 in May, according to the latest data release from the European Commission. That was slightly better than the small expected rise to -21.5, but still left the index close to multi-year lows, as EU consumers struggle amid surging energy-driven inflation, a slowing economy and uncertainty with war raging close to its borders in Ukraine.

Despite economic weakness, ECB policymakers continue to signal intentions to start lifting interest rates in July, with inflation still running at multi-decade highs in the Eurozone. A consensus at the bank seems to have built that it is time to end the negative interest rate experiment.

- USD/CHF stage modest recovery from a fresh monthly low touched earlier this Friday.

- The risk-on impulse undermined the safe-haven CHF and acted as a tailwind to the pair.

- Rebounding US bond yields helped revive the USD demand and remained supportive.

- Recession fears held back bulls from placing aggressive bets and might cap the upside.

The USD/CHF pair traded with a mild positive bias through the early North American session and was last seen hovering near the daily peak, around the 0.9740-0.9745 region.

Having shown some resilience below the 0.9700 mark, the USD/CHF pair staged modest bounce from a fresh monthly low touched earlier this Friday amid the risk-on impulse. The market sentiment got a boost after the People’s Bank of China (PBOC) cut its five-year loan prime rate by 15 basis points to counter an economic slowdown. This was evident from the strong recovery in the equity markets, which undermined the safe-haven Swiss franc and acted as a tailwind for the major.

On the other hand, the US dollar drew some support from rebounding US Treasury bond yields and the prospects for a more aggressive policy tightening by the Fed. This was seen as another factor that contributed to the USD/CHF pair's intraday recovery of over 50 pips. That said, concerns about softening global economic growth kept a lid on the optimism and held back bulls from placing aggressive bets amid absent relevant market-moving economic release from the US.

The markets remain worried that a more aggressive move by major central banks to constrain inflation could pose challenges to global economic growth. Apart from this, the Russia-Ukraine war and extended COVID-19 lockdowns in China have been fueling recession fears. This might continue to drive some haven flows, making it prudent to wait for strong follow-through buying before confirming that the USD/CHF pair has formed a near-term bottom and positioning for any further gains.

Technical levels to watch

Bank of Japan Governor Haruhiko Kuroda on Friday explained at the G7 that the BoJ will patiently continue with powerful monetary easing, reported Reuters. Kuroda continued that he doesn't see inflation pressure rising in Japan more than what we projected in the April quarterly report. There has been absolutely no change to the BoJ's view that it's appropriate to maintain the current policies of yield curve control and negative interest rates.

Japanese Finance Minister Shun'ichi Suzuki reaffirmed his commitment to the G7 on currency markets, including the stance that excess volatility and disorderly forex moves are undesirable. Suzuki earlier explained recent forex moves to the G7, saying that Japan will respond appropriately to forex moves based on the G7 agreement.

- DXY hovers around the 103.00 neighbourhood on Friday.

- US yields keep the range bound theme intact so far.

- US equities reverse part of recent losses after PBoC’s rate cut.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main rival currencies, alternates gains with losses around the 103.00 zone on Friday.

US Dollar Index within a tight range amidst risk-on trade

Following Thursday’s deep decline, the index keeps the familiar range around the 103.00 region in an uneventful session at the end of the week.

The risk appetite, however, seems to be leaning towards the riskier assets, as noted after a positive start of the US stock markets, all following the earlier rate cut by the PBoC. Indeed, the Chinese central bank pumped extra stimulus into the markets after it reduced the 5y Loan Prime Rate by 15 bps to 4.45%.

Nothing scheduled in the US docket on Friday should leave investors assessing the weekly slew of Fed-speakers – all favouring 50 bps rate hike at the June meeting – along with rising concerns over the probability of a global economic slowdown as well as a “hard landing” of the US economy in response to the Fed’s tighter stance.

What to look for around USD

The dollar attempts a mild rebound to the 103.00 neighbourhood following the multi-session drop recorded on Thursday. In the meantime, and supporting the buck, appears investors’ expectations of a tighter rate path by the Federal Reserve and its correlation to yields, the current elevated inflation narrative and the solid health of the labour market. On the negatives for the greenback turn up the incipient speculation of a “hard landing” of the US economy as a result of the Fed’s more aggressive normalization.

Eminent issues on the back boiler: Speculation of a “hard landing” of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is gaining 0.12% at 102.99 and the breakout of 105.00 (2022 high May 13) would open the door to 105.63 (high December 11 2002) and finally 106.00 (round level). On the other hand, the next support lines up at 102.65 (weekly low May 19) followed by 102.35 (low May 5) and then 99.81 (weekly low April 21).

Weaker economic data has provided a much-needed jolt to the yellow metal. Nevertheless, strategists at TD Securities still expect gold to struggle to post further gains.

The path of least resistance for gold is still lower

“Yesterday's economic data disappointments have seen the yellow metal hold north of levels that could see CTA funds' recently acquired net-short positions end up being short-lived.”

“The bounce in prices has brought an end to ETF outflows, ending the streak at ten straight days. But, with downside momentum and the prevailing negative sentiment across precious metals more firmly entrenched, gold may face a high bar to maintain this recovery.”

“Fed Chair Powell signalled a willingness to sacrifice some economic growth in an effort to tame inflation, suggesting the path of least resistance for gold is still lower.”

European Central Bank (ECB) governing council member Ignazio Visco said on Friday that the Eurozone might be facing a moderate recession, which could get worse depending on the circumstances, reported Reuters. Europe is still in a negative supply shock, Visco noted.

Earlier in the day, Bank of France governor and fellow ECB governing council member Francois Villeroy de Galhau said on Friday that the ECB's short-term priority is fighting and mastering inflation, reported Reuters. The ECB will deliver in its fight against inflation, he continued.

USD/TRY climbed about 4% last week, breaking above the 15 handle for the first time since December. Economists at TD Securities expect the pair to hit the 19 level by the end of the quarter.

Risks align for further upside moves in USD/TRY

“Risks seem to be aligning for further upside moves in USD/TRY.”

“We continue to forecast 19.00 by end-Q2, suggesting hikes may be approaching.”

- Gold is trading in the $1840s, above its 200DMA but still below resistance in the $1850 area.

- A break above $1850 could signal a breakout from the bearish trend XAU/USD has been stuck in since mid-April.

- Focus next week will be on Fed minutes and US Q1 GDP and April Core PCE inflation data.

After managing to break back above its 200-Day Moving Average on Thursday as the US dollar and US yields waned, spot gold (XAU/USD) prices have failed to push above resistance at the $1850 mark. At present, the precious metal is trading flat on the day just above $1840, with buying ahead of the 200DMA at $1837 offering support for the time being.

Gold has been surprisingly resilient this week despite multiple Fed policymakers, including Fed Chair Jerome Powell, emphasizing the central bank’s focus on inflation fighting above all else and signaling the intention to continue with aggressive rate hikes. In recent weeks/months, hawkish Fed vibes have been a positive for the buck, which last week hit multi-decade highs, and have lifted US yields, which earlier this month hit multi-year highs.

But that has not been the case this week, with both yields and the buck moving lower (with weakness in the US dollar particularly surprising given this week’s torrid conditions in the global equity space). Technicians think that if XAU/USD can muster a break above the 200DMA and the $1850 level, this would snap a bearish trend that has been weighing on gold since mid-April when it nearly hit $2,000.

Friday looks likely to be a quiet session amid slow newsflow and no major US data releases of Fed speakers scheduled. That means such a break may have to wait until next week. But then again, with focus returning to the theme of Fed tightening next week (Fed minutes are released on Wednesday), maybe the recent moves lower in USD and US yields will prove short-lived.

Some have highlighted next week’s US GDP and inflation data as more important. The first estimate of Q1 GDP growth showed a surprise contraction in US output and traders will be looking for any revisions from the second estimate. Meanwhile, traders will be eyeing the April Core PCE Inflation report for any fresh signs that inflation may have peaked. Weak data could be supportive of gold if it 1) lessens the pressure on the Fed to be so aggressive or 2) weighs on risk appetite/the US dollar.

UK PM Boris Johnson on Friday said that in the months ahead, the UK is going to have to use its fiscal firepower to mitigate the cost-of-living squeeze, reported Reuters. "In the months ahead we are going to have to do what we did before, we're going to use our fiscal firepower that we built up, that we have, to help," said Johnson during a speech in Wales. "We're going to put our arms around the British people again as we did during COVID," he added.

Data this week showed the headline rate of Consumer Price Inflation (CPI) hit a new multi-decade high at 9.0% YoY. The Bank of England expects the annual headline CPI rate to hit 10% by the end of the year.

- GBP/USD edged higher on the last day of the week, though the uptick lacked bullish conviction.

- The recent range-bound price action points to indecision over the next leg of a directional move.

- Bulls need to conquer the 1.2500 mark before positioning for an extension of the recent recovery.

The GBP/USD pair attracted some dip-buying on Friday, albeit struggled to capitalize on the move and remained below the 1.2500 psychological mark through the early North American session.

Better-than-expected UK macro data turned out to be a key factor that provided modest lift to the British pound, though stagflation fears and Brexit woes acted as a headwind. Apart from this, a goodish pickup in the US dollar demand kept a lid on any meaningful upside for the GBP/USD pair.

Looking at the broader picture, spot prices have been oscillating in a broader trading range held over the past four trading sessions. This points to indecision over the next leg of a directional move for the GBP/USD pair and warrants caution amid mixed technical indicators on hourly/daily charts.

Oscillators on hourly charts are holding in the positive territory but are yet to confirm a bullish bias on the daily chart. Moreover, the GBP/USD pair, so far, has struggled to find acceptance above the 1.2500 mark, which coincides with the 38.2% Fibonacci retracement level of the 1.3090-1.2156 fall.

This makes it prudent to wait for strong follow-through buying beyond the aforementioned barrier before placing aggressive bullish bets. The GBP/USD pair might then climb to the 1.2570-1.2575 region en-route the 1.2600 round figure and the 50% Fibo. level, around the 1.2630-1.2635 zone.

On the flip side, the daily swing low, around the 1.2440-1.2435 area, should now protect the immediate downside ahead of the 1.2400 mark. This is followed by support near the 1.2380-1.2375 region, or the 23.6% Fibo. level, which if broken will shift the bias back in favour of bearish traders.

The next relevant support is pegged near the lower boundary of a multi-day-old trading range, around the 1.2330 region. A convincing break through the latter would make the GBP/USD pair vulnerable to weakening further below the 1.2300 handle, towards testing the 1.2270-1.2260 support zone.

GBP/USD 4-hour chart

-637886481377209787.png)

Key levels to watch

Bundesbank head and European Central Bank (ECB) governing council member Joachim Nagel said on Friday that negative interest rates are a thing of the past, reported Reuters. In response to a question about whether the ECB might entertain a 50 bps rate hike in July, Nagel said that it is important to raise rates, with the rest to be discussed by the governing council.

Separately, Bank of France governor and fellow ECB governing council member Francois Villeroy de Galhau said on Friday that the ECB's short-term priority is fighting and mastering inflation, reported Reuters. The ECB will deliver in its fight against inflation, he continued.

Bank of France governor and European Central Bank (ECB) governing council member Francois Villeroy de Galhau said on Friday that the ECB's short-term priority is fighting and mastering inflation, reported Reuters. The ECB will deliver in its fight against inflation, he continued.

Separately, Bundesbank head and fellow ECB governing council member Joachim Nagel said on Friday that negative interest rates are a thing of the past, reported Reuters. In response to a question about whether the ECB might entertain a 50 bps rate hike in July, Nagel said that it is important to raise rates, with the rest to be discussed by the governing council.

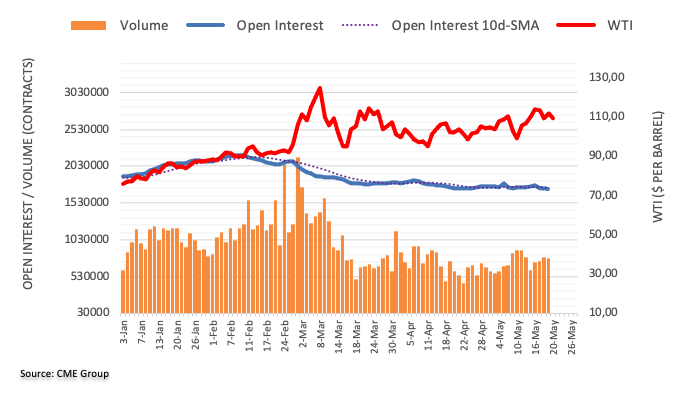

- WTI is stable in the $110 area, a little lower on the day, though close to flat on the week.

- WTI is trading in the middle of its $105-$115ish weekly range as traders continue to mull various themes.

Oil prices are a little lower on Friday, though remain comfortably within recent ranges and aren’t really trading with much conviction. Front-month WTI futures were last trading near the $110 per barrel mark, down just under $2.0 on the day, though still trading nearly $5.0 higher versus Thursday’s lows around $105. WTI looks likely to close out the week nearly bang on flat, having failed to test late-March highs in the $116s in the first part of the week before coming under pressure amid a sharp deterioration in global equity market sentiment on Wednesday.

A lack of major new crude oil-relevant fundamental developments this week means it's not too surprising to see WTI at the middle of this week’s $105-115ish ranges. Firstly, there hasn’t been much to update on regarding the proposed EU ban on Russian oil imports. The proposal still hasn’t secured the unanimous agreement amongst EU member nations needed to go into force, with Hungary still holding out, though analysts expect an agreement could be reached at an EU council summit at the end of this month.

This lack of progress combined with this week’s downturn in global equities as investors fret about aggressive central bank (Fed) tightening amid sky-high inflation despite slowing global growth kept WTI from surpassing the mid-$110s. But further evidence of OPEC+ output struggles (as smaller nations continue to underproduce relative to their output target and Russian output drops), easing China lockdowns and the continued lack of any progress towards oil export sanction relief on Iran or Venezuela plus a weaker US dollar helped WTI find plenty of buyers as it dipped back into the mid-$100s.

Meanwhile, data this week showed that despite recent fuel (and general) price inflation, US consumer spending is holding up. April Retail Sales data out on Tuesday was better than expected, while weekly US inventory data out on Wednesday showed a further decline in crude oil stocks and US refiners running at full capacity. Moreover, data from the Federal Highway Administration on Friday showed that vehicle miles in the US continue to rise, indicative of there not being substantial demand destruction just yet.

EUR/USD has reinforced its defense of key support from the 1.0341 low of 2017. With daily MACD holding having turned higher, analysts at Credit Suisse remain of the view a near-term base is forming, with a break above 1.0642 needed to confirm.

1.0465/60 needs to hold to maintain an immediate upside bias

“With daily MACD momentum holding a bullish divergence and having turned higher, we remain of the view a near-term base is forming.”

“Near-term resistance is seen at the accelerated downtrend at 1.0608 ahead of the 23.6% retracement of the fall from February and May high at 1.0620/42. Above here is needed to confirm a near-term base has been completed to provide the platform for a deeper recovery to the 38.2% retracement, 55-day average and mid-April lows at 1.0758/94. We expect a much tougher barrier here if tested.”

“Support is seen at 1.0508 initially, with 1.0465/60 now needing to hold to maintain an immediate upside bias. A break can clear the way for a retest of 1.0350/41.”

- USD/JPY attracted buying on Friday and recovered further from the monthly low touched on Thursday.

- The risk-on impulse undermined the safe-haven JPY and extended support amid modest USD strength.

- Recession fears held back bulls from placing aggressive bets and kept a lid on any meaningful gains.

The USD/JPY pair held on to its modest intraday gains and was seen trading near the daily peak, just above the 128.00 mark heading into the North American session.

A combination of supporting factors assisted the USD/JPY pair to attract some buying near the 127.50 region on Friday and build on the overnight bounce from the 127.00 mark, or the monthly low. The People’s Bank of China (PBOC) cut its five-year loan prime rate by 15 basis points to counter an economic slowdown and boosted investors' confidence. This was evident from a solid recovery in the equity markets and undermined the safe-haven Japanese yen. This, along with a goodish pickup in the US dollar demand, acted as a tailwind for the major.

Against the backdrop of expectations for a more aggressive policy tightening by the Fed, the risk-on flow led to modest recovery in the US Treasury bond yields and extended support to the buck. Apart from this, a big divergence in the monetary policy stance adopted by the US central bank and the Bank of Japan offered additional support to the USD/JPY pair. It is worth mentioning that the Bank of Japan has vowed to keep its existing ultra-loose policy settings and promised to conduct unlimited bond purchase operations to defend its near-zero target for 10-year yields.

The fundamental backdrop seems tilted in favour of bullish traders, though the gloomy global economic outlook kept a lid on any meaningful upside for the USD/JPY pair, at least for now. Investors remain concerned that a more aggressive move by major central banks to constrain inflation would pose challenges to the global economy. Adding to this, extended COVID-19 lockdowns in China and the Russia-Ukraine war have been fueling recession fears. This makes it prudent to wait for strong follow-through buying before confirming that the recent corrective slide has run its course.

In the absence of any major market-moving economic releases from the US, the US bond yields will continue to play a key role in influencing the USD price dynamics. Apart from this, traders will further take cues from the broader market risk sentiment to grab short-term opportunities around the USD/JPY pair.

Technical levels to watch

German Finance Minister Christian Lindner on Friday said that Germany rejects further EU "next-generation" funds, reported Reuters. Germany takes inflation very seriously, Lindner continued, adding that the EU must end expansive fiscal policy. Euro depreciation is a risk, he added.

Lindner noted that discussion regarding central banks at the G7 were very open, whilst also respecting their independence and that Germany welcomes the prospect of interest rate rises. "We must bring inflation back towards 2.0% quickly," Lindner said, emphasising the G7's determination to stop inflation.

Seperately, Bundesbank head and ECB governing council member Joachim Nagel said that more rate hikes could follow in quick succession and that most companies plan price increases. ECB policymakers have in recent weeks been priming markets for an end to QE in by the end of Q2 and a start to rate hikes in July.

- AUD/USD has bounced from an earlier test of 0.7000 and is probing its 21DMA around 0.7050.

- The Aussie is getting tailwinds from global equity and commodity markets plus yuan strength after a surprise PBoC rate cut.

- AUD remains vulnerable if risk appetite sours/USD turns higher again, with Fed minutes and key US data out next week.

A rebound in global equity combined with rising industrial metal prices in wake of the latest move by China’s PBoC to lower its 5-year Loan Prime Rate, which should boost the country’s struggling property sector and, incidentally, has put the yuan on course for its best week this year, is benefitting the Australian dollar on Friday.

AUD/USD found decent support earlier in the session when it dipped back towards the psychologically important 0.7000 level and is now back to consolidating close to its 21-Day Moving Average in the 0.7050 area, up about 0.15% on the day. The 21DMA has been a key level of resistance in recent weeks and a break above it could set the stage for a push above 0.7100 and even on to the next key area of resistance in the upper 0.7200s (the 50 and 200DMAs plus this month’s high).

If sentiment about the Chinese economy continues to improve next week, a bullish break higher is certainly a possibility (be that from bets on more PBoC easing, lockdown easing or both). But a push higher in AUD/USD would likely also rely on continued US dollar weakness, as has been seen over the past few days.

While the DXY has pulled back over 2.0% from last week’s highs above 105.00 and is in the upper 102.00s, dips have consistently been good buying opportunities in recent weeks amid the Fed’s hawkish shift and ongoing evidence of high inflation and a tight labour market. This has not only supported the buck but also hurt risk appetite, dampening sentiment towards the risk-sensitive Aussie.

While AUD/USD is trading more than 3.0% above earlier monthly lows in the low-0.6800s, the pair is still down around 8.0% versus its early April highs. Fed tightening will remain in focus next week with more Fed policymakers speaking and the release of the minutes of the Fed’s meeting earlier this month (where they lifted rates by 50 bps and signaled more 50 bps moves likely ahead) on Wednesday.

US data in the form of the second estimate of Q1 GDP growth (recall the first estimate showed a surprise contraction in output) on Thursday and April Core PCE inflation figures on Friday will also be in focus. The data might underpin recent fears about stagflation that could further dampen risk appetite and weigh on the risk-sensitive Aussie.

- EUR/USD falters once again just ahead of 1.0600.

- Extra recovery should target the monthly top at 1.0641.

EUR/USD alternates gains with losses in the area below the 1.0600 yardstick on Friday.

Considering the pair’s ongoing price action, the continuation of the rebound appears likely in the very near term at least. That said, the next up barrier emerges at the May high at 1.0641 (May 5) ahead of the interim hurdle at the 55-day SMA, today at 1.0792.

Below the 3-month line near 1.0860, the pair is expected to remain under pressure and vulnerable to extra losses.

EUR/USD daily charts

- DXY remains under pressure below the 103.00 mark.

- Further downside could see the 102.30 region revisited.

DXY keeps the bearish note so far unchanged in the sub-103.00 region at the end of the week.

The index remains under scrutiny and therefore extra losses should not be ruled out for the time being. Against that, a probable retracement to the May low at 102.35 (May 5 low) remains on the cards in the not-so-distant future.

Looking at the broader picture, the current bullish stance in the index remains supported by the 3-month line around 100.30, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 96.54.

DXY daily chart

- EUR/JPY adds to Thursday’s uptick and retests 135.80.

- Extra recovery should target the weekly high at 136.70.

EUR/JPY picks up further upside traction and revisits the 135.80 region at the end of the week.

The continuation of the ongoing bounce should initially target the weekly high at 136.69 (May 17). Further gains from here are expected to put the May high at 138.31 (May 9) back on the radar ahead of the 2022 peak at 140.00 (April 21).

In the meantime, while above the 200-day SMA at 131.16, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Finnish state-owned gas wholesaler Gasum announced in a statement on Friday that Russian gas flow to Finland will be halted on May 21 at 0400 GMT, as reported by Reuters.

"On the afternoon of Friday, May 20, Gazprom export informed Gasum that natural gas supplies to Finland under Gasum’s supply contract will be cut," the statement read.

The company said during the upcoming summer season, it will supply natural gas to its customers from other sources through the BalticConnector pipeline.

Market reaction

Thie headline doesn't seem to be having a significant impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was up 0.1% on the day at 1.0595.

- Silver gained positive traction for the second straight day and climbed to a near two-week high.

- Acceptance above the 23.6% Fibo. level supports prospects for an extension of the bullish move.

- Mixed technical indicators on hourly/daily charts warrant caution before placing aggressive bets.

Silver built on the overnight strong intraday rally of over 3% and gained some follow-through traction for the second successive day on Friday. The momentum pushed the white metal to a nearly two-week high, beyond the $22.00 round-figure mark during the first half of the European session.

From a technical perspective, sustained move and acceptance above the 23.6% Fibonacci retracement level of the $28.22-$20.46 fall could be seen as a fresh trigger for bullish traders. Oscillators on hourly charts have been gaining traction and add credence to the constructive outlook.

That said, technical indicators on the daily chart - though have been recovering from the negative territory - are yet to confirm a bullish bias. This makes it prudent to wait for a subsequent strength beyond the 100-period SMA on the 4-hour chart before positioning for any further gains.

The XAG/USD might then surpass an intermediate hurdle near the $22.30 area and accelerate the momentum towards testing the next relevant hurdle near the $22.65 zone. The latter coincides with the 38.2% Fibo. level, which if cleared would suggest that spot prices have bottomed out.

On the flip side, the 23.6% Fibo. level resistance breakpoint, around the $21.80 region, now seems to protect the immediate downside. Any further pullback is more likely to find decent support near the $21.25-$21.20 area, which should act as a strong near-term base for the XAG/USD.

A convincing break below would negate prospects for any further positive move and prompt aggressive technical selling. The XAG/USD would then turn vulnerable to weaken further below the $21.00 round-figure mark and aim to challenge the YTD low, around the $20.45 area touched last week.

Silver 4-hour chart

-637886389425195275.png)

Key levels to watch

- USD/CAD prolonged its recent bearish trend and dropped to a fresh two-week low on Friday.

- The tight supply outlook acted as a tailwind for crude oil prices, which underpinned the loonie.

- Subdued USD price action did little to impress bullish traders or lend any support to the pair.

The USD/CAD pair added to the previous day's losses and witnessed some follow-through selling for the second successive day on Friday. This also marked the fifth day of a negative move in the previous six and dragged spot prices to a fresh two-week low, around the 1.2780-1.2775 region during the first half of the European session.

Despite concerns that weakening global economic growth could curb a recovery in fuel demand, a tight supply outlook acted as a tailwind for crude oil prices. Apart from this, strong domestic consumer inflation figures released on Wednesday underpinned the commodity-linked loonie and exerted some downward pressure on the USD/CAD pair.

On the other hand, the US dollar languished near its lowest level since May 5 and was pressured by the recent sharp pullback in the US Treasury bond yields. Apart from this, the risk-on impulse in the markets was seen as another factor that weighed on the safe-haven greenback and contributed to offered toe surrounding the USD/CAD pair.

with the latest leg down, spot prices now seem to have found acceptance below the 1.2800 round-figure mark. This could be seen as a fresh trigger for bearish traders and supports prospects for additional losses. That said, expectations for a more aggressive policy tightening by the Fed might act as a tailwind for the buck and the USD/CAD pair.

There isn't any major market-moving economic data due for release on Friday, either from the US or Canada. Hence, the USD remains at the mercy of the US bond yields and the broader market risk sentiment. Apart from this, traders will take cues from oil price dynamics to grab short-term opportunities around the USD/CAD pair.

Technical levels to watch

- GBP/USD gained some positive traction on Friday, albeit lacked bullish conviction.

- Upbeat UK Retail Sales data turned out to be a key factor that extended support.

- Stagflation fears, Brexit woes and modest USD strength capped any further gains.

The GBP/USD pair traded with a mild positive bias through the first half of the European session and was last seen hovering around the 1.2475-1.2480 region, up 0.15% for the day.

Following the previous day's modest pullback from a two-week high, the GBP/USD pair attracted some buying on Friday and was supported by better-than-expected UK macro data. The UK Office for National Statistics reported that Retail Sales unexpectedly rose by 1.4% in April as against consensus estimates pointing to a drop of 0.2%.

Adding to this, the Bank of England (BoE) Chief Economist Huw Pill said that they still have some way to go in policy tightening as MPC sees an upside skew in the risks around the inflation. That said, a combination of factors held back bulls from placing aggressive bets and kept a lid on any further gains for the GBP/USD pair.

Against the backdrop of a surprise economic contraction in March, the UK inflation data released on Wednesday fueled stagflation fears. Moreover, rising wages threaten to exacerbate inflationary pressures and hurt consumer spending. This, along with the BoE's gloomy economic outlook and Brexit jitters, should act as a headwind for sterling.

On the other hand, the recent US dollar pullback from a two-decade high, for now, seems to have stalled amid expectations for a more aggressive policy tightening by the Fed. This further contributed to keeping a lid on any meaningful upside for the GBP/USD pair. That said, the risk-on impulse undermined the safe-haven USD and extended support to spot prices.

There isn't any major market-moving economic data due for release on Friday, either from the UK or the US. That said, the US bond yields and the broader market risk sentiment might influence the USD price dynamics. This, in turn, should provide some impetus to the GBP/USD pair and allow traders to grab short-term opportunities on the last day of the week.

Technical levels to watch

In opinion of Economist at UOB Group Lee Sue Ann, the Bank of Korea (BoK) could lift the policy rate to 2.00% by end of 2022.

Key Quotes

“Given our expectation that the headline inflation will stay above 4% through 2Q22-3Q22, we have raised our average full-year 2022 forecast to 3.9% from 3.3% previously (2021: 2.5%).”

“We now see a further 50bps rate hike by the BOK this year, with 25bps each in May/Jul and Aug/Oct. This will bring the benchmark rate to 2.00% by end-2022.”

- EUR/USD falters just ahead of the 1.0600 mark on Friday.

- German 10y Bund yields approach the 1.00% mark.

- Flash EMU Consumer Confidence next on tap later in the session.

EUR/USD regains some composure and retargets the 1.0600 region following an earlier drop to the mid-1.0500s at the end of the week.

EUR/USD remains focused on 1.0641

EUR/USD comes under some mild selling pressure following Thursday’s sharp rebound. The abrupt move higher was triggered exclusively by another bout of dollar weakness, although a close above the key 1.0600 mark still remains elusive for EUR-bulls.

In the meantime, German 10y Bund yields look to regain the psychological 1.00% mark following two consecutive sessions with losses, while US yields so far trade with marginal gains along the curve.

In the euro docket, the only release of note will be the flash Consumer Confidence gauged by the European Commission for the month of May (-22.0 prev.). There are no scheduled publications or events across the pond on Friday.

What to look for around EUR

The weekly recovery in EUR/USD has so far met strong resistance around 1.0600. Despite the pair removed some downside pressure, the broader outlook for the single currency remains entrenched in the negative territory for the time being. As usual, price action in spot should reflect dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by firmer speculation the ECB could raise rates at some point in the summer, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: EMU Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro area. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is losing 0.04% at 1.0577 and a breach of 1.0348 (2022 low May 13) would target 1.0340 (2017 low January 3 2017) en route to 1.0300 (round level). On the upside, the initial hurdle aligns at 1.0607 (weekly high May 19) seconded by 1.0641 (weekly high May 5) and finally 1.0936 (weekly high April 21).

Gold Price recovered significantly yesterday. Weaker US dollar lends buoyancy to the yellow metal, which is set to end the week up again for the first time in four weeks, economists at Commerzbank report.

Robust recovery of gold

“The upswing is continuing, meaning that gold may end the week up again for the first time in four weeks.”

“The fact that the US dollar has been noticeably weaker since yesterday is lending tailwind.”

“What is more, a countermovement was overdue following the pronounced phase of weakness since the end of April. The Relative Strength Index (RSI) for example had been trading close to oversold territory for around a week before the price began climbing yesterday.”

EUR/USD has climbed to a fresh two-week high. As FXStreet’s Eren Sengezer notes, the technical outlook suggests that additional gains could be witnessed in case 1.06 is confirmed as support.

Next bullish target aligns at 1.0660

“On the upside, 1.06 aligns as first resistance. If that level is confirmed as support, the pair could target 1.0640 (static level) and 1.0660 (200-period SMA) afterwards.”

“On the flip side, 1.0550 (former resistance, static level) could be seen as first support. With a four-hour close below that level, buyers could start booking their profits and cause the pair to retreat toward 1.0520 (ascending trend line, 50-period SMA) and 1.05 (psychological level).”

- NZD/USD edged higher for the second straight session and inched back closer to a two-week high.

- A positive risk tone benefitted the perceived riskier kiwi and remained supportive of the uptick.

- Modest USD strength, recession fears held back bulls from placing fresh bets and capped gains.

The NZD/USD pair maintained its bid tone through the early European session and was last seen trading near the daily high, around the 0.6400 round-figure mark.

The pair gained traction for the second successive day on Friday - also marking the fifth day of a positive move in the previous six - and inched back closer to a two-week high touched overnight. The People’s Bank of China (PBOC) cut its five-year loan prime rate by 15 basis points to counter an economic slowdown and boosted investors' confidence. This was evident from a solid recovery in the equity markets, which, in turn, was seen as a key factor that benefitted the perceived riskier kiwi.

That said, recession fears might keep a lid on any optimistic moves in the markets. Investors seem worried that a more aggressive move by major central banks to constrain inflation, the Russia-Ukraine war and extended COVID-19 lockdowns in China would hurt the global economic growth. Apart from this, modest US dollar strength failed to assist the NZD/USD pair to capitalize on the intraday uptick beyond the 0.6400 mark. This warrants caution for aggressive traders and before placing fresh bullish bets.

The markets seem convinced that the Fed would need to take more drastic action to bring inflation under control. The bets were reinforced by Fed Chair Jerome Powell's remarks at a Wall Street Journal event, saying that he will back interest rate increases until prices start falling back toward a healthy level. This, along with an uptick in the US Treasury bond yields, extended some support to the greenback, which, in turn, should cap the NZD/USD pair amid absent relevant economic data from the US.

Technical levels to watch

European Central Bank (ECB) Governing Council member Ignazio Visco told Bloomberg TV on Friday that a rate hike in June was out of the question but added that July could be the time to start raising rates, as reported by Reuters.

Visco further noted that they could move out of the negative rate territory.

Market reaction

EUR/USD continues to consolidate its weekly gains during the European trading hours. The pair was last seen trading at 1.0565, where it was down 0.2% on a daily basis.

FX option expiries for May 20 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.03450-50 506m

- 1.0395 510m

- 1.0415 1.1b

- 1.0475 715m

- 1.0500-10 660m

- 1.0540-50 814m

- 1.0575 670m

- 1.0600 430m

- 1.0625 219m

- GBP/USD: GBP amounts

- 1.2300 313m

- 1.2355 305m

- 1.2405 360m

- 1.2490-00 270m

- 1.2650 295m

- EUR/GBP: EUR amounts

- 0.8400 200m

- 0.8430 300m

- AUD/USD: AUD amounts

- 0.7050 545m

- USD/CAD: USD amounts

- 1.2730 2.63b

- 1.2775 450m

- 1.2800 510m

- 1.2850-55 610m

- 1.3000 1.08b

Bank of England (BOE) Chief Economist Huw Pill said on Friday that they still have some way to go in policy tightening, as reported by Reuters.

Additional takeaways

"Supported by the independence accorded to the MPC, we are able to take the sometimes tough decisions to bring inflation back to 2%."

"Tightening still has further to run."

"Inflation forecast to rise into double digits."

"MPC has not yet taken a decision about whether to commence gilt sales."

"If market dysfunction were to take hold, asset sales could, if necessary, be paused."

"Asset sales have the potential to tighten monetary and financial conditions; I would expect them to do so."

"Impact of gilt sales will be – indeed, already may be – ‘priced into’ financial prices, notably gilt yields."

"MPC sees an upside skew in the risks around the inflation baseline in the latter part of the forecast period."

"MPC needs to ensure that domestic price-setting does not achieve a self-sustaining, expectationally-driven momentum."

Market reaction

GBP/USD stays in the positive territory and trades within a touching distance of 1.2500 after these comments.

- Gold climbed to a one-week high on Friday amid a softer tone surrounding the USD.

- Recession fears further underpinned the safe-haven metal and remained supportive.

- A goodish recovery in the equity markets, Fed rate hike bets capped any further gains.

Gold built on the overnight strong move back above the very important 200-day SMA and gained some follow-through traction on the last day of the week. The XAUUSD maintained its bid tone through the early European session and was last seen trading near the $1,850 region, or over a one-week high.

The US dollar languished near a two-week low touched the previous day amid the recent sharp pullback in the US Treasury bond yields. This, in turn, was seen as a key factor that extended some support to the dollar-denominated gold. Apart from this, concerns about softening global economic growth acted as a tailwind for the safe-haven XAUUSD and assisted spot prices to recover further from the multi-month low touched earlier this week.

The markets remain worried that a more aggressive move by major central banks to constrain inflation could pose challenges to global economic growth. Apart from this, the Russia-Ukraine war and extended COVID-19 lockdowns in China have been fueling recession fears. That said, a combination of factors might hold back traders from placing aggressive bullish bets around gold and keep a lid on any meaningful upside, at least for now.

The global risk sentiment recovered a bit after the People’s Bank of China (PBOC) cut its five-year loan prime rate by 15 basis points to counter an economic slowdown. Apart from this, expectations that the Fed would stick to its monetary policy tightening path over the next few months to bring inflation under control should cap gains for the non-yielding yellow metal. Nevertheless, gold remains on track to snap a four-week losing streak.

In the absence of any major market-moving economic releases from the US, the US bond yields will continue to play a key role in influencing the USD price dynamics. Apart from this, traders will take cues from the broader market risk sentiment to grab short-term opportunities around gold.

Technical levels to watch

European Central Bank (ECB) policymaker Madis Muller said Friday that the focus needs to be on fighting high inflation.

Earlier on, his colleague Martins Kazaks said he “hopes that first rate hike will take place in July.”

Market reaction

EUR/USD is holding the lower ground, having failed to recapture 1.0600, as the US dollar sustains the renewed upside.

The spot was last seen trading at 1.0568, down 0.17% on the day.

Gold has had a 6.9% drop in May so far. XAU/USD now trades under a prior triangle breakout and is testing the 200-day moving average (DMA) at $1,838, indicating that the technical posture is not favourable, Benjamin Wong, Strategist at DBS Bank reports.

Inability to stage a bounce

“Posting declines under 200-DMA $1,838 forces a relook that this corrective decline of the broader mid-term ranges. Negativity is reinforced as gold prices stay under the Ichimoku cloud amidst the persistence of a negative moving average convergence divergence (MACD) signal.”

“Gold’s negative performance of late is drawing momentum from both the unabated rise in US 10 years real yields and a plunge in gold exchange-traded funds holdings. US real yields is the one to watch out for, as gold being a noninterest-bearing asset thrives only in negative rates environment.”

“Intermediate resistance points at $1,836 and an interim channel resistance at $1,842 as first levels to break to restore flagging confidence. 100-DMA at $1,885 is equally robust.”

“A sustained break lower contours into the 38.2% Fibonacci retracement of $1,160-$2,075 at $1,726 as the first visible target.”

- AUD/USD reversed an early slide to the 0.7000 mark and climbed back closer to the daily high.

- A goodish recovery in the equity markets undermined the safe-haven USD and extended support.

- Recession fears should keep a lid on any optimistic move in the markets and cap gains for the pair.

The AUD/USD pair recovered its early lost ground and was last seen trading near the higher end of its daily range, just below mid-0.7000s during the early European session.

The pair attracted some dip-buying near the 0.7000 psychological mark on Friday and has now moved well within the striking distance of a two-week high touched the previous day. The global risk sentiment recovered a bit after the People’s Bank of China (PBOC) cut its five-year loan prime rate by 15 basis points to counter an economic slowdown. This, in turn, failed to assist the safe-haven US dollar to capitalize on its modest intraday gains and extended some support to the China-proxy aussie.

The Australian dollar was further underpinned by the Reserve Bank of Australia's hawkish signal that a bigger interest rate hike is still possible in June amid the upside risks to inflation. The market expectations were reinforced by domestic employment data released on Thursday, which showed that the jobless rate fell to the lowest level in almost 50 years. That said, the gloomy global economic outlook should keep a lid on any optimistic move in the markets and the growth-sensitive AUD/USD pair.

The markets remain worried that a more aggressive move by major central banks to constrain inflation could pose challenges to global economic growth. Apart from this, the Russia-Ukraine war and extended COVID-19 lockdowns in China have been fueling recession fears. This makes it prudent to wait for strong follow-through buying before traders start positioning for an extension of the AUD/USD pair's recent bounce from the YTD low, around the 0.6830-0.6825 region touched last week.

In the absence of any major market-moving economic releases from the US, the broader market risk sentiment will continue to play a key role in influencing the USD price dynamics. This, in turn, should provide some impetus to the AUD/USD pair and allow traders to grab short-term opportunities on the last day of the week.

Technical levels to watch

Some support measures for the Chinese economy and some stability in the Chinese renminbi have helped usher in a period of consolidation in FX markets. Nonetheless, economists at ING believe that USD/CNY is unlikely to move back lower towards the 6.50 area.

PBoC lowered the 5-year LPR

“The overnight 15bp cut in the 5-year Loan Prime Rate – aimed at supporting the property sector – has instilled a little more confidence in Chinese assets markets.”

“We cannot see USD/CNY heading straight back to 6.50. Instead, a 6.65-6.80 trading range may be developing after the recent CNY devaluation.”

- USD/JPY struggles for clear directions after the two-day downtrend refreshed monthly low.

- Bearish bias takes clues from the recently softer USD, multi-month high Japan inflation data.

- Chatters over monetary policy divergence and China act as additional catalysts for fresh impetus.

USD/JPY dribbles between gains and losses around 127.80, mostly unchanged on a day, as European traders brace for Friday’s task. The yen pair’s latest inaction could be linked to the mixed concerns in the market and a lack of major catalysts. Even so, the quote eyes the second consecutive weekly loss amid a softer US dollar and fears of inflation, as well as growth.

That said, Japan’s National Consumer Price Index (CPI) for April rose to the highest levels since 2014, to 2.5% YoY versus 1.5% expected and 1.2% prior. On the same line were the numbers for National CPI ex Food, Energy that reversed the -0.7% prior and crossed the -0.9% forecast to 0.8% YoY.

On a different page, International Monetary Fund (IMF) Deputy Managing Director Kenji Okamura recently followed Managing Director Kristalina Georgieva’s signal for tighter monetary policy and urged Asian policymakers to be cautious. “IMF’s Okamura said, “Asian economies must be mindful of spillover risks as a decade of unconventional easing policies by major central banks is withdrawn faster than expected.”

It’s worth noting that the People’s Bank of China’s (PBOC) rate cut and softer covid numbers from the dragon nation, not to forget Shanghai’s gradual unlock, seems to underpin cautious optimism in Asia.

While the mildly positive sentiment favors stocks futures and the Asia-Pacific stocks, softer yields exert additional downside pressure on the US Dollar Index (DXY) and weigh on the USD/JPY prices.

Looking forward, a lack of major data/events keeps the USD/JPY pair at the mercy of risk catalysts. However, the monetary policy divergence between the Bank of Japan (BOJ) and the US Federal Reserve (Fed) could keep the buyers hopeful.

Technical analysis

A three-week-old ascending trend line defends USD/JPY buyers around 127.80. Also acting as a downside filter is the late April swing low near 126.95. Meanwhile, recovery moves need to cross a two-week-old descending trend line, close to 129.00, to retake control.

The dollar is now about 2% off its highs seen late last week. Economists at ING consider this a pause not a reversal in the dollar's bull trend.

Dollar rally pauses for breath

“The emerging market environment still looks challenged given that the stronger dollar is effectively exporting tighter Fed policy around the world.”

“DXY could correct a little lower to 102.30, but we see this as bull market consolidation, rather than top-building activity.”

“Not until the Fed pours cold water on tightening expectations should the dollar build a top.”

EUR/USD stays in a consolidation phase slightly below 1.06 early Friday. Economists at ING expect the world’s most popular currency pair to advance towards the 1.0650/70 area in the next few days.

EUR/USD seen getting close to parity in 3Q22

“The market now prices a 31/32bp ECB rate hike at the 21 July ECB meeting – pricing which has plenty of scope to bounce between +25bp and +50bp over the next two months. This could drag EUR/USD back to the 1.0650/70 area over the coming days – helped by brief periods of calm in the external environment – but we would see this as a bear market bounce.”

“Our core EUR/USD view for 2H22 is one of heightened volatility and probably EUR/USD getting close to parity in 3Q22 when expectations of the Fed tightening cycle could be at their zenith.”

The UK Retail Sales came in at 1.4% MoM in April, an upside surprise. GBP/USD closes in on 1.2500 on the upbeat data. However, economists at ING believe that cable is unlikely to see further gains.

April retail sales provide a reprieve

“UK retail sales have come in a little better than expected and break/suspend the narrative that the cost of living squeeze is large enough to derail the Bank of England tightening cycle. We would not get carried away with the sterling recovery, however.

“Sterling is showing a high correlation with risk assets – trading as a growth currency – and the outlook for risk assets will remain challenging for the next three to six months probably.”

“Cable may struggle to breach the 1.2500/2550 area and 1.20 levels are very possible over the coming months.”

“New-found hawkishness at the ECB means that EUR/GBP may struggle to sustain a move below 0.8450 before returning to 0.8600.”

USD/IDR rose sharply by 2.7% over a span of 4 weeks. The pair could revisit 14,900 near-term on USD strength, economists at TD Securities report.

BI to intervene more actively to cap a further rise beyond 15,000

“Given the hawkish Fed rhetoric and softer risk sentiment, which may prop up the USD further, USD/IDR may test 14,900 – the high in September 2020. However, we think a peak in the USD is likely to come some time this quarter.”

“USD/IDR rarely stays above the 15,000 level for a prolonged period based on a 10-year horizon window, and we anticipate BI to intervene more actively to cap a further rise in USD/IDR beyond 15,000.”

NZD/USD is back up around 0.64. Markets remain very volatile but having broken out its six-week downtrend channel, the kiwi has improved its technical picture, economists at ANZ Bank report.

Markets debate odds of a hard landing in New Zealand

“Market sentiment is extremely fragile and convoluted at the moment – while there is an acknowledgment that rate hikes are needed, that has naturally stoked fears of a hard landing/slower growth, and bond markets are wavering, as is the USD, which has broadly tracked bond yields.”

“Next week’s MPS will be key for the NZD as markets debate odds of a hard landing here too. There’s a lot priced in locally, and if some of that is priced out, it’ll lower interest rates, but it’ll also lessen the perceived odds of a hard landing, so it’s complicated.”

“Technically, the NZD has broken out of its six-week downtrend channel; that’s positive.”

The South African central bank (SARB) raised its key rate by 50bp to 4.75% on Thursday. The rand was able to benefit from yesterday’s decision even though a larger rate step had been largely anticipated. However, economists at Commerzbank expect ZAR to struggle to post further gains.

SARB intensifies its approach

“The decision was not unanimous nor was it tight: only one of the five council members favoured a smaller rate step.”

“The hawkish statement is likely to have strengthened the market’s expectation that the SARB is very decisive in its fight against inflation despite weak growth.”

“In the current environment and with the prospect of a global rise in interest rates the rand is likely to increasingly struggle. We expect it to trend weaker medium-term, even though confidence of ZAR investors in the SARB’s stability-orientated approach is likely to remain an important support for the rand.”

- GBP/JPY refreshes intraday high after better-than-forecast UK data.

- UK Retail Sales rose past forecasts, prior on MoM, improved on YoY during April.

- 200-EMA tests buyers, sellers need to smash weekly support line to retake control.