- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 17-05-2022

Japan's Gross Domestic Product, released by the Cabinet Office, has been released as follows:

- Japanese GDP Annualised SA (QoQ) Q1 P: -1.0% (exp -1.8%; R previous 3.8%).

- GDP SA (QoQ) Q1 P: -0.2% (exp -0.4%; R previos 0.9%).

''The omicron outbreak and associated hit to consumption were anticipated to weigh heavily on GDP growth in Q1,'' analysts at Westpac said. ''Meanwhile, supply issues will continue to be a headwind to industrial production in March.''

USD/JPY is steady on the release around 129.50.

About the Gross Domestic Product

GDP is released by the Cabinet Office shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. GDP is a gross measure of market activity because it indicates the pace at which the Japanese economy is growing or decreasing. A high reading or a better than expected number is seen as positive for the JPY, while a low reading is negative

- AUD/USD struggles to extend three-day uptrend, grinds higher of late.

- Fed’s Evans pushes for an ‘expeditious’ rate hike to 2.25-2.50% neutral range.

- US dollar weakness, hawkish RBA Minutes and covid optimism in China previously favored bulls.

- Aussie Wage Price Index for Q1 2022 will be crucial considering RBA’s 40 bps talks.

AUD/USD seesaws around the weekly high, pausing a three-day rebound from the two-year low, as it takes rounds to 0.7030 during Wednesday’s Asian session.

The Aussie pair’s latest inaction could be linked to the lack of positive sentiment in the market, mainly triggered by the fresh fears of the US Fed’s faster rate hikes. Also challenging the AUD/USD buyers is the anxiety ahead of the quarterly Wage Price Index from Australia.

Recent comments from Chicago Fed President Charles Evans seem to have weighed on the market’s mood by renewing fears of a faster rate hike as the policymaker said, “(the Fed) Should raise rates to 2.25%-2.5% neutral range 'expeditiously'.” On Tuesday, Fed Chair Jerome Powell and a generally-hawkish St Louis Fed President James Bullard pushed for a 50 bps rate hike and weighed on the USD.

It’s worth noting that chatters of 40 basis points (bps) of a rate hike by the Reserve Bank of Australia (RBA), spread via the Minutes of the latest RBA meeting, underpinned the AUD/USD pair’s upside momentum the previous day. On the same line were headlines suggesting Shanghai’s nearness to reversing the covid-led activity restrictions. Also favoring the quote were headlines suggesting more investments from China and firmer prices of equities, as well as commodities.

That said, the Wall Street benchmarks closed positive even if the US 10-year Treasury yields rose nearly 10 bps to 2.99% at the latest. The S&P 500 Futures struggle, however, around 4,090 by the press time.

Moving on, Aussie Wage Price Index for Q1 2022, expected 0.8% QoQ versus 0.7% prior, will be important for immediate direction amid hawkish concerns over RBA. Following that, the US housing numbers and risk catalysts will be crucial for trading impetus.

Technical analysis

A clear upside break of the 10-DMA level of 0.6984, as well as lows marked during January 2022 surrounding 0.6965, directs AUD/USD buyers toward a monthly resistance line near 0.7080.

- GBP/USD is juggling in a 1.2484-1.2496 as investors await UK Inflation.

- The annual UK CPI is seen at 9.1% against the prior print of 7%.

- Pound bulls have strengthened on upbeat market mood and Employment data.

The GBP/USD pair is displaying back and forth moves in a narrow range of 1.2484-1.2496 in the Asian session as investors are on the sidelines ahead of the UK Consumer Price Index (CPI) figures on Wednesday. As per the market consensus, the annual inflation figure is eyeing the rooftop. The yearly CPI figure is seen at 9.1%, potentially higher than the prior print of 7%. While, the annual core CPI would jump to 6.2%, against the former figure of 5.7%.

A higher reading of the UK inflation is compelling for more rate hikes by the Bank of England (BOE) in the next monetary policy meetings. It would be justified to state that BOE Governor Andrew Bailey could feature a jumbo rate hike to contain the inflation mess. The inflation looks sky-rocketing in the UK zone and the BOE needs to take certain quantitative measures to safeguard the paychecks of the households.

Meanwhile, the jobless claims in the sterling area have reduced sharply by 56.9k, higher than the expectations of 38.8k. Also, the monthly ILO Unemployment Rate has been improved to 3.7% than the consensus and prior print of 3.8%.

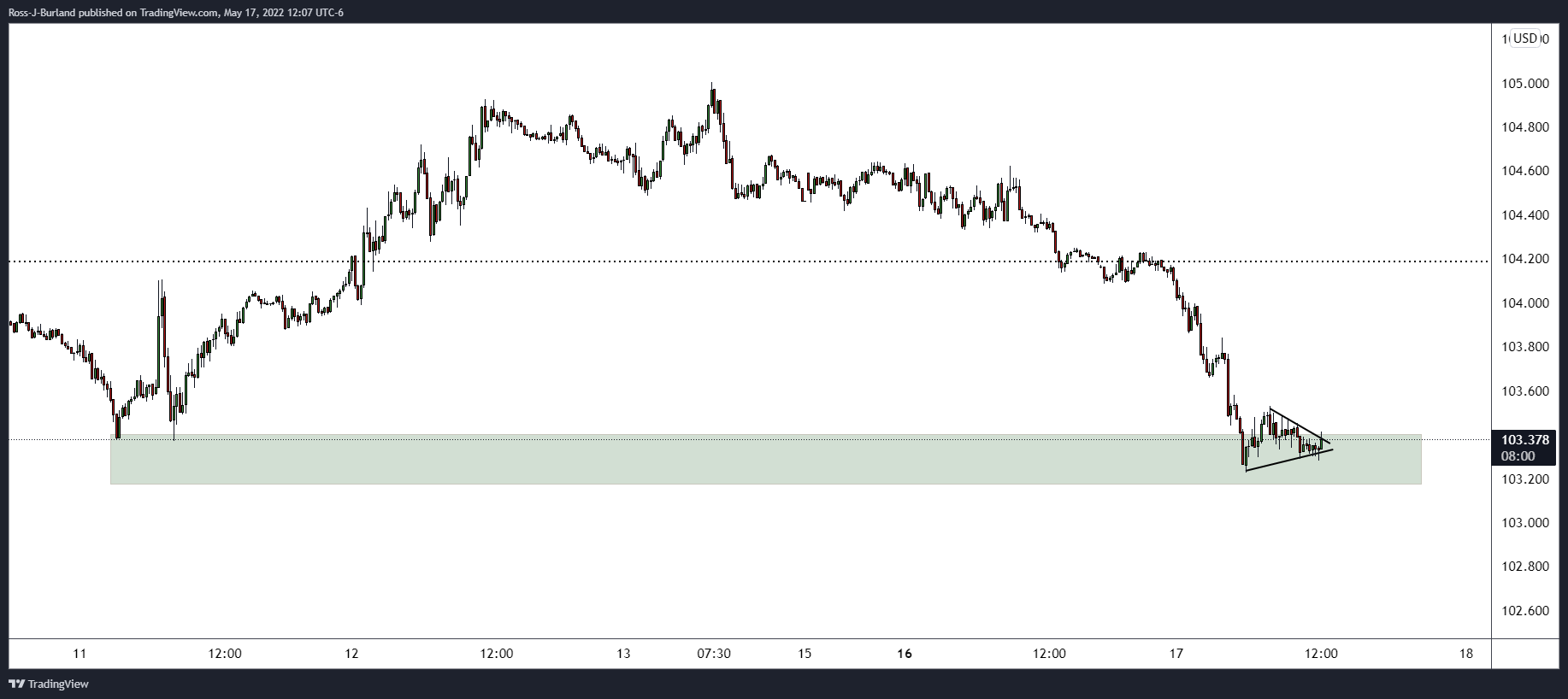

On the dollar front, the US dollar index (DXY) is hovering around 103.30 and is expected to scale lower amid an improvement in the risk appetite of the market participants. The odds of a jumbo rate hike by the Federal Reserve (Fed) in June are advancing sharply as the Fed is focusing to bring price stability sooner. Fed chair Jerome Powell has stated in Q&A at Wall Street Journal that inflation needs to get dropped in a ‘convincing’ way.

- NZD/USD struggles to extend three-day uptrend around weekly top.

- One-month-old descending resistance line, 100-SMA probe buyers, 50-SMA restricts immediate downside.

- RSI, MACD conditions signal firmer upside momentum of late.

NZD/USD takes rounds to 0.6360 as it battles with the short-term key hurdle during Wednesday’s Asian session, after a three-day rebound from the two-year low.

In doing so, the Kiwi pair jostles with a downward sloping resistance line from late April amid firmer RSI and MACD conditions.

It’s worth noting that the 100-SMA level of 0.6405 also challenges the NZD/USD buyers, even if they manage to successfully cross the 0.6360 hurdle.

Following that, a run-up towards the 0.6500 and then to the monthly high near 0.6570 can’t be ruled out.

Alternatively, the 50-SMA level surrounding 0.6315-10 restricts the short-term downside of the NZD/USD pair ahead of the monthly low near 0.6215.

In a case where the pair drops below 0.6215, a late 2019 bottom around 0.6200 will be crucial to watch.

NZD/USD: Four-hour chart

Trend: Further upside expected

- On Tuesday, the GBP/JPY gained around 1.58%, pushing the weekly gains to 2.04%.

- Sentiment improved as Shanghai is about to lift restrictions, helping to ease the supply chain constraints.

- GBP/JPY Price Forecast: Upward biased, but bulls would face solid resistance around 162.00.

The GBP/JPY rallied for the third straight day and reached a fresh weekly high around 161.85, recording minimal gains as the Asian Pacific session began. At the time of writing, the GBP/JPY is trading at 161.67, up 0.07%.

Sentiment-wise, Wall Street’s session was positive, as reflected by US equities. Asian futures point to a higher open, courtesy of the improvement in the Covid-19 outbreak in China, particularly Shanghai, the second largest industrial hub in China, which reported zero coronavirus cases for the third consecutive day.

“From June 1 to mid-and late June, as long as risks of a rebound in infections are controlled, we will fully implement epidemic prevention and control, normalise management and fully restore normal production and life in the city,” deputy mayor Zong Ming said.

Meanwhile, on Tuesday, the GBP/JPY opened near the day’s lows, around 158.70s, and then rallied 250-pips during the day, breaking several figures on its way north, until settling around 161.50.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY remains upward biased, as shown by the daily chart. However, traders need to be aware that a head-and-shoulders chart pattern is still in play, but a daily close above April 28 swing high at 164.25, would invalidate the chart pattern and would open the door for further gains.

Upwards, the GBP/JPY’s first resistance would be May 9, the daily high at 162.18. A breach of the latter would expose the 163.00 mark, followed by April 28 swing high at 164.25. On the other hand, the GBP/JPY first support would be the head-and-shoulders neckline around 160.00. Break below could send the pair aiming toward the 100-day moving average (DMA) at 158.09, followed by May 12 swing low at 155.58.

Key Technical Levels

Japanese manufacturers have become the least optimistic in more than a year about business conditions as firms struggled with rising import costs due to a weak yen and higher raw material prices, the Reuters Tankan poll for May showed on early Wednesday.

Additional findings

The Reuters Tankan sentiment index for manufacturers fell to 5 in May from 11 a month earlier, its lowest since February last year. The service index rose to 13 from 8, hitting its highest since February 2020.

The monthly poll, which tracks the Bank of Japan’s (BOJ) closely watched “tankan” quarterly survey, found confidence was likely to become less optimistic for both manufacturers and non-manufacturers over the coming three months.

The service-sector mood recovered to its most positive level since the start of the COVID-19 pandemic in early 2020 as the world’s third-largest economy shook off more of the drag from the coronavirus, which has made consumers cautious about spending.

The poll of 499 big and mid-sized companies conducted from April 26 to May 13, of which 236 responded, showed firms faced headwinds from persistently high raw material costs and Chinese coronavirus lockdown measures.

Market reaction

Following the news, USD/JPY picks up bids to renew intraday high around 129.50, following a sluggish daily performance.

Read: USD/JPY bulls stand their ground as US equities close higher

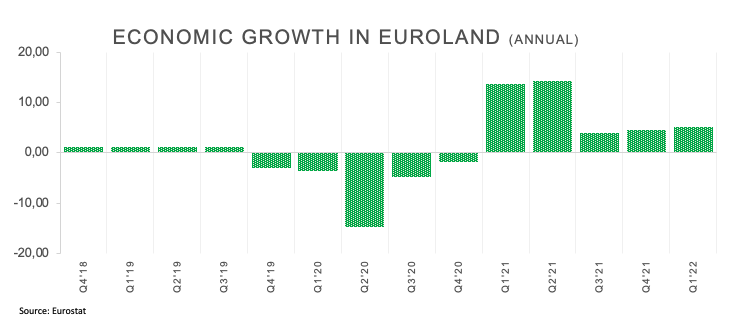

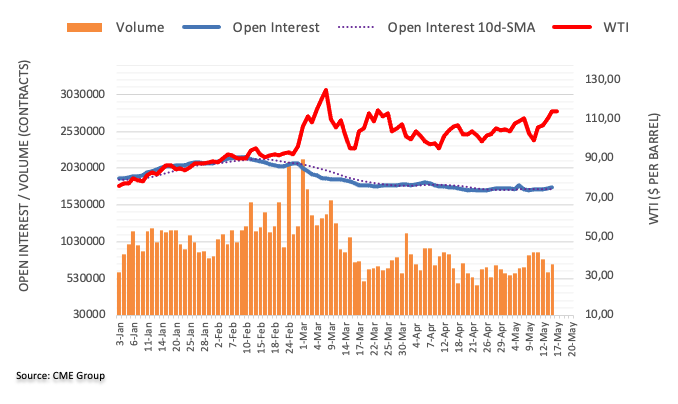

- WTI picks up bids to reverse pullback from seven-week top.

- API Weekly Crude Oil Stock registered surprise fall of 2.445M for the week ended May 13.

- Market sentiment improves as Fedspeak refrains from 75 bps idea, firmer macros, China news also favors buyers.

- Updates over European oil embargo on Russia, coronavirus and EIA stockpiles will be important for fresh directions.

WTI takes the bids to regain $111.00, paring the losses from a seven-week high flashed recently, as oil buyers cheer API inventories, as well as fears of more supply crunch, during Wednesday’s early Asian session.

That said, the weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data for the period ended on May 13 flashed a depletion of 2.445M barrels versus the previous addition of 1.618M.

Other than the API inventories, news from Reuters that the European Commission will on Wednesday unveil a 210 billion euro plan for how Europe can end its reliance on Russian fossil fuels by 2027 favored oil buyers of late. “To wean countries off those fuels, Brussels will propose a three-pronged plan: a switch to import more non-Russian gas, a faster rollout of renewable energy, and more effort to save energy, according to draft documents seen by Reuters,” said the news.

Elsewhere, China’s hopes of overcoming covid-led lockdowns in Shanghai and recently firmer data in the US and the Eurozone, coupled with the OPEC+ failures to meet the monthly target output, also favor the WTI crude oil buyers. Additionally, a softer USD offered an extra strength to the black gold prices.

Alternatively, inflation fears and hawkish comments from the key central bankers keep a tab on the energy prices. On the same line is global energy producers’ rejection to cut output.

Moving on, the official weekly oil inventory data from the Energy Information Administration (EIA), expected 1.533M versus 8.487M prior, will direct short-term oil prices. Also important are the risk catalysts including China's covid conditions, rate hike concerns and geopolitical woes.

Technical analysis

An upward sloping trend line from late March, around 111.40 by the press time, appears the key short-term hurdle for WTI buyers ahead of aiming for a late March swing high near $115.85. Meanwhile, sellers will wait for a clear break of the 10-DMA, around $106.80 by the press time.

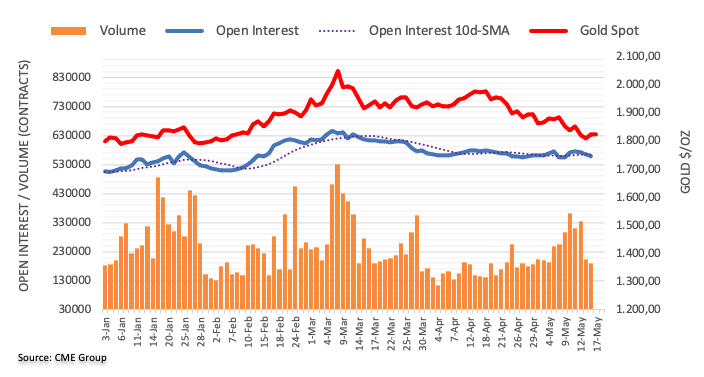

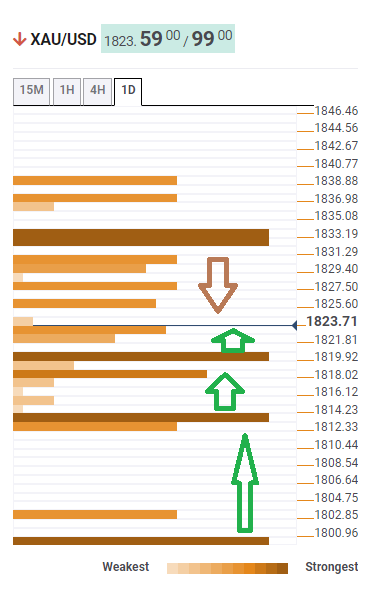

- Gold price is oscillating below $1,820.00, seeking a rally after a pullback.

- The Fed is focusing on bringing price stability to the economy.

- The precious metal is holding above 50% Fibo retracement.

Gold price (XAU/USD) is establishing below $1,820.00 after a modest fall from a high of $1,836.55 on Tuesday. The precious metal has failed to capitalize upon the diminishing safe-haven appeal of the US dollar index (DXY). The DXY has eased more than 1.5%, at the press time, from its recent 19-year high of 105.00 in the last two trading sessions. A balance in a range of 103.23-103.55 has been witnessed in the New York session, which is expected to get imbalanced sooner.

Fed Powell’s focus on bringing price stability

Federal Reserve (Fed) chair Jerome Powell has already announced two more jumbo rate hikes in the next two monetary policy meetings to curb the inflation mess, in an interview with Marketplace National Radio Station. Carry-forwarding his views in Q&A at Wall Street Journal, the focus of Fed’s Powell is to bring price stability to the economy. Fed’s Powell has also dictated that the central bank will keep with its tightening monetary policy until the inflation drops significantly.

This week, the light economic calendar will keep bringing topsy-turvy moves in the precious metal and investors will keep focusing on statements from Fed policymakers.

Gold technical analysis

On an hourly scale, XAU/USD is holding above the 50% Fibonacci retracement (placed from Monday’s low $1,786.94 to Tuesday’s high at $1,836.15) at $1,811.63. The precious metal has tumbled below the 50-period Exponential Moving Average (EMA) at $1,821.02. The Relative Strength Index (RSI) (14) is sensing support at 40.00 levels, which indicates the availability of responsive buying participants.

Gold hourly chart

-637884246721990384.png)

Chicago Fed President Charles Evans on Wednesday said, per Reuters, “(the Fed) Should raise rates to 2.25%-2.5% neutral range 'expeditiously'.”

Additional comments

Favors 'front-loaded' interest rate hikes.

After front-loading rate hikes, hopeful we can transition to more measured pace.

Measured pace would give time to monitor supply chains, evaluate impact of tighter policy.

May need to take policy 'somewhat' above neutral to achieve 2% inflation goal.

Inflation is clearly much too high.

Modestly restrictive stance will still be consistent with growing economy.

US. economic momentum 'strong,' labor market 'downright tight'.

Expect substantial deceleration of core inflation as pandemic-related price pressures ease.

Monetary policy has critical role in addressing broad-based runup in prices, keeping expectations in check.

Market reaction

EUR/USD remains unaffected by the news as it continues to grind higher around 1.0550 at the latest.

Read: EUR/USD seeks fresh clues around 1.0550 after the biggest daily gain in two months

The European Commission will on Wednesday unveil a 210 billion euro plan for how Europe can end its reliance on Russian fossil fuels by 2027, and use the pivot away from Moscow to quicken its shift to green energy, per Reuters.

Key quotes

To wean countries off those fuels, Brussels will propose a three-pronged plan: a switch to import more non-Russian gas, a faster rollout of renewable energy, and more effort to save energy, according to draft documents seen by Reuters.

The draft measures, which could change before they are published, include a mix of EU laws, non-binding schemes, and recommendations national governments could take up.

Taken together, Brussels expects them to require 210 billion euros in extra investments - which the EU plans to support by freeing up more money for the energy transition from its COVID-19 recovery fund, and which would ultimately reduce the billions of euros Europe spends on fossil fuel imports each year.

Market reaction

The news favors the WTI crude oil prices to regain $111.00 during otherwise quiet hours of early Asian session on Wednesday.

- EUR/USD steadies around weekly top following the heavy run-up.

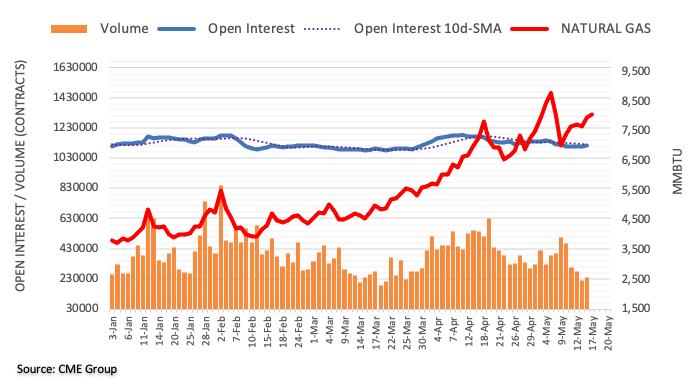

- Hawkish ECBspeak, EU GDP data favored Euro bulls amid market’s cautious optimism.

- US dollar stayed pressured despite firmer US statistics, upbeat yields.

- Second-tier data may entertain traders, risk catalysts are more important for fresh impulses.

EUR/USD bulls take a breather around mid-1.0500s, the weekly high, after positing the heaviest daily jump since early March. That said, the major currency pair has been trading inside a 30-pip range during the last hours of Tuesday, after a stellar rise, poking the range high surrounding 1.0550 as Asian traders brace for Wednesday’s work,

A fresh round of hawkish comments from the European Central Bank (ECB) policymakers has been the key support to the regional currency. Among them, Tuesday’s comments from European Central Bank (ECB) Governing Council member Klaas Knot was the most hawkish and fuelling the EUR/USD prices. ECB’s Knot told the Dutch TV that a 50 basis points (bps) rate hike should not be excluded if data in the next few months suggest that inflation is broadening and accumulating. On the same line were comments from European Central Bank Governing Council member Mario Centeno said on Tuesday that the normalization of monetary policy is desired and must happen, reported Reuters.

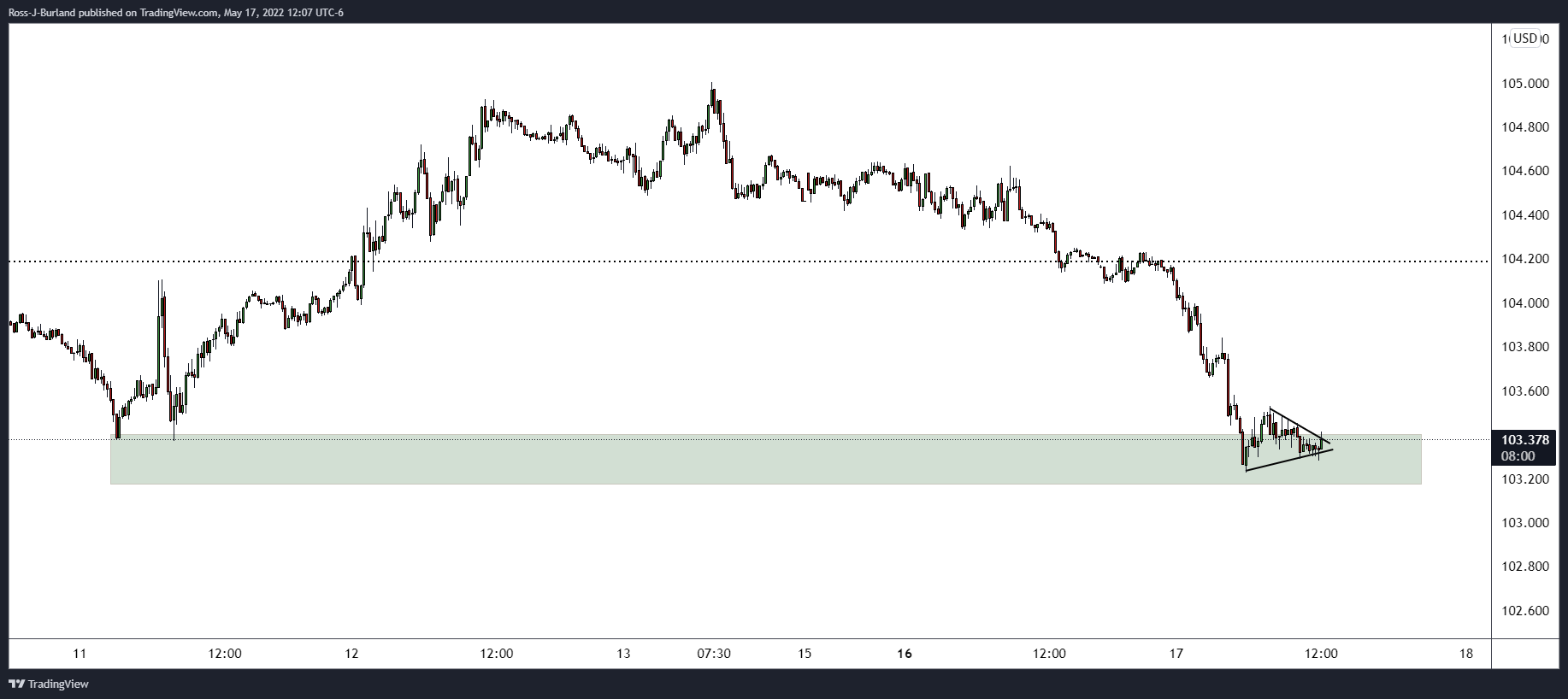

Additionally favoring the EUR/USD bulls was a slightly better-than-forecast reading of the preliminary Eurozone GDP for Q1 2022. The bloc’s GDP rose past 5.0% YoY to 5.1% while also rising above 0.2% QoQ expectations to 0.3%.

On the other hand, Fed Chairman Jerome Powell repeated his usual push for the 50 bps rate hike and didn’t surprise markets, despite pausing equity bulls. However, St Louis Fed President and outspoken hawkish FOMC member James Bullard’s preference for a 50 bps move, versus the previous support to the 75 bps action, seemed to have weighed on the US dollar. That said, the US Treasury yields remained firmer, up nearly 10 bps to 2.99% at the latest.

Talking about the US data, US Retail Sales rose at a pace of 0.9% MoM in April, slightly better than the expected pace of 0.7% but softer than the upwardly revised 1.4% growth (from 0.5%). US Retail Sales ex Autos, popularly known as Core Retail Sales, rose 0.6% MoM in April versus the 0.4% expected gain. It is worth noting that there was a big upward revision to the previous month’s Core Retail Sales figures, to 2.1% MoM versus the prior estimate of 1.1%.

Elsewhere, improvement in covid conditions in China previously spread optimism in Asia, backed by softer US data. However, fears emanating from the Russia-Ukraine tussles challenge the bulls.

Moving on, final readings of Eurozone HICP for April precedes the US housing numbers to entertain EUR/USD traders. However, major attention will be given to talks of rate hikes, inflation and growth, not to forget covid and geopolitics, for clear directions.

Technical analysis

A previous support line from late 2021 challenges immediate EUR/USD upside around 1.0550 ahead of the 21-DMA hurdle surrounding 1.0575. Meanwhile, a fresh downside can aim for April’s low of 1.0471.

- AUD/USD bears are looking for a discount at critical level.

- The bulls are testing bear's commitments at daily resistance.

As per the prior analysis, AUD/USD Price Analysis: Bulls are taking charge at critical daily resistance, the bulls have moved in to the target area on the daily chart as follows:

AUD/USD daioy chart, prior analysis

AUD/USD live charts

The price could now struggle at this juncture and if the bears commit at a diocount, then we coudl see a follow though into the weekly targt areas for the forseeible future:

AUD/USD weekly chart

The bears will be looking to the 0.68 figure to mitigate the price imbalance between 0.6776 and 0.6828 ahead of 0.6536.

- EUR/JPY may continue its three-day winning streak amid a rebound in the risk-on impulse.

- The odds of a rate hike by the ECB in July have risen strongly.

- In today’s session, Eurozone HICP and Japan’s GDP will remain in focus.

The EUR/JPY pair is hovering around 136.50 in the early Asian session after a bullish Tuesday. The cross witnessed some significant bets from the market participants as investors underpinned risk-on impulse in the global market. The asset has displayed a three-day winning streak and is likely to continue further amid a firmer market mood.

The shared currency bulls are performing strongly against the Japanese yen on strong Gross Domestic Product (GDP) numbers. The annual figure has landed at 5.1%, a little higher than the former figure of 5%. Apart from that, Employment Change in the eurozone failed to keep up with the forecasts. The Employment Change landed at 2.6%, lower than the estimates of 2.7%. Going forward, investors will keep an eye on the HICP number by the Eurostat. The yearly HICP figure is seen as stable at 7.5%.

The shared currency bulls got extra mileage on Tuesday amid rising hopes of a 25 basis point (bps) rate hike in July. European Central Bank (ECB) Governing Council member Klaas Knot, speaking on Dutch TV, claimed that mounting price pressures could open doors for a 50 bps rate hike, however, a quarter-to-a-percent seems more realistic.

Meanwhile, the yen bulls are awaiting the release of the GDP numbers on Wednesday. The annual GDP figure is expected to release at -1.8%, against the previous figure of 4.6%. While the quarterly figure may decline to -0.4% in comparison with the prior print of 1.1%.

- The AUD/JPY extended its gains for the third straight day, courtesy of a buoyant market mood.

- Improvement in the Covid-19 situation in China shifted sentiment positively, as reflected by global equities rallying.

- AUD/JPY Price Forecast: Neutral-upwards in both time-frames, though a bearish flag in the hourly chart could send the pair sliding towards 90.00.

The AUD/JPY advances as the North American session winds down, gaining 1.01%, courtesy of a positive market mood. Reports from China say that Shanghai has not reported Covid-19 cases for the third straight day, as the deputy major Zong Ming noted that Shanghai’s reopening would be carried out in stages. At the time of writing, the AUD/JPY is trading at 90.94.

Reflection of the above-mentioned is the behavior of US equities, finishing the session with gains. At the same time, Asian futures are pointing to a higher open, carrying on sentiment from Tuesday.

On Tuesday, the AUD/JPY opened around the 90.00 mark, and as China’s news crossed newswires, the risk barometer of the FX space rallied 120-pips, reaching a daily high at around 91.16, to finally retreat below the 91.00 threshold as the New York session came to an end.

AUD/JPY Price Forecast: Technical outlook

Daily chart

The AUD/JPY daily chart depicts the pair as neutral-upward biased, as the exchange rate is trapped between the 50 and the 100-day moving averages (DMAs), each at 91.19 and 86.97, respectively. MACD’s histogram shows that the distance between the MACD-line and the signal is reducing, suggesting that the former would crossover the latter, triggering a bullish signal that, if achieved, the cross-currency pair would face solid resistance at around 92.55-65.

Hourly chart

The AUD/JPY is also neutral-upward biased in this time frame, but it is close to the 200-hour simple moving average (SMA) at around 90.47. It is worth noting that the pair is moving within the boundaries of an ascending channel, meaning that a bearish flag is forming, suggesting the AUD/JPY might resume the previous downtrend unless it breaks above the top-trendline of the channel.

Upwards, the AUD/JPY first resistance would be the R1 daily pivot at 91.45. Break above would expose the confluence of the R2 pivot point and April 27, 2020, daily high at 91.98, followed by a downslope trendline, around 92.50-65.

On the other hand, the AUD/JPY first support would be the daily pivot point at around 90.66. Break below would expose the 200-hour SMA at 90.47, followed by the confluence of the 100-hour SMA and the S1 daily pivot at 90.07.

The Telegraph has reported that ''the EU will offer Britain new concessions on the Northern Ireland Protocol, but has threatened a trade war if Boris Johnson refuses to agree a compromise.''

The British pound has been vunerable this week on such angst surrounding Brexit, so this should come as a relief to investors of Uk assets. GBP/USd is trading at 1.2490, supported on the news as well as an improved risk sentiment in markets on Tuesday.

Meanwhie, the Telegraph wrrote that it ''understands that the European Commission will propose tweaking the bloc’s own laws to ease checks between mainland Britain and the province in order to end the long-running row over Brexit rules.''

According to sources, the Telegraph said, ''Maros Sefcovic, the EU’s chief negotiator, set out the olive branch in a call with Liz Truss after weeks of acrimony between the pair.''

''Details of their conversion emerged after the Foreign Secretary vowed on Tuesday to introduce new powers to tear up the post-Brexit solution and suspend border checks in the Irish Sea.

Despite the threat, insiders said that Mr Sefcovic was willing to agree significant compromises to virtually eliminate all customs and food safety checks between Great Britain and Northern Ireland, as he did with medicines.''

- USD/CAD is expecting more downside as DXY weakens significantly on a positive market mood.

- The Fed will keep a restricted policy until inflation comes down drastically.

- Canada’s annual CPI figure is seen unchanged at 6.7%

The USD/CAD pair is scaling lower after sensing rejection from its crucial resistance of 1.2850. The asset is oscillating around Tuesday’s low at 1.2807 and is expected to extend its losses after violating the same. A sheer downside move in the major after failing to sustain above the psychological support of 1.3000 intensified selling pressures, which resulted in a three-day losing streak.

A firmer rebound in the risk-on impulse has brought weakness in the US dollar index (DXY)’s safe-haven appeal. The DXY has tumbled to near 103.30 despite higher-than-expected US Retail Sales. The US Census Bureau reported the Retail Sales at 0.9%, higher than the consensus of 0.7%. The rebound in the positive market sentiment is so strong this time that a bearish reversal in the DXY looks likely. The DXY has eased more than 1.5% in the last three trading sessions after hitting a 19-year high of 105.00 last week.

Meanwhile, Federal Reserve (Fed) chair Jerome Powell in his Q&A with Wall Street Journal has emphasized on bring price stability to the economy. The Fed will continue with its tightening policy until the inflation drops in a convincing way.

On the loonie front, investors are focusing on the release of the Consumer Price Index (CPI) numbers. The core annual inflation figure that excludes food and energy is seen at 5.4%, a little lower than the prior print of 5.5%. While the wholesome annual figure is expected to remain stable at 6.7%. This will keep the odds of one more rate hike by the Bank of Canada (BOC) intact.

- USD/JPY held ground despite weakness in the US dollar and firmer risk appetite.

- The Fed chair failed to deliver anything new in his WSJ interview and risk appetite recovered on Wall Street.

At 129.34, USD/JPY is higher by some 0.18% into the close on Wall Street. Risk rallied on Tuesday as April industrial production and retail sales grew more than expected, indicating the strength of the economy which to some extent helped the US dollar vs the safe-haven yen.

As a consequence of the good mood, the S&P 500 and the Dow advanced 2.0% and 1.3%, respectively, while the tech-heavy Nasdaq jumped 2.8%. However, besides the yen, the dollar fell for a third straight day on Tuesday vs.s a basket of currencies. The greenback was pulling back from a two-decade high against a basket of major peers, as an uptick in investors' appetite for riskier bets diminished the US currency's appeal. The US 10-year yield jumped by 10.5 basis points to 2.98%.

The U.S. Dollar Currency Index (DXY), which tracks the greenback against six major currencies, was down 0.84% at 103.226, its lowest since May 6. The index hit a two-decade high last week supported by a hawkish Federal Reserve and worries over the global economic situation.

Fed Chair Jerome Powell, speaking at a Wall Street Journal event, vowed to "keep pushing" until it was clear the current inflationary wave is on the wane but this failed to keep risk down for long and equities rallied into the close for fresh highs.

As for data, Retail Sales and industrial output data provided a dose of optimism for market participants who fear the expected series of 50-basis-point interest rate hikes could drag the economy into recession.

Additionally, reports that authorities in China are preparing to relax COVID-19 restrictions allayed worries over the risks to supply chains and weakening Chinese demand that would be expected to continue weighing on the global outlook.

- The NZD/USD is advancing close to 0.80% on Tuesday, lifted by upbeat sentiment.

- China’s Covid-19 crisis seems to be under control as Shanghai is about to lift restrictions.

- Fed’s Powell reiterates that 50-bps in upcoming meetings remain “on the table.”

NZD/USD is surging for the third consecutive day and reclaims the 0.6300 mark for the first time in four days after a raft of risk-aversion struck risk-sensitive currencies, like the New Zealand dollar. At 0.6355, the NZD/USD reflects an improved market sentiment, courtesy of no new Covid-19 cases in Shanghai for the third straight day as the city prepares to lift restrictions.

Sentiment improvement boosts the NZD appeal amidst Fed speaking

US equities remain in positive territory as Wall Street prepares for the close. Meanwhile, US Treasury yields recovered some ground, led by the 10-year benchmark note, up to eight and a half basis points, sitting at 2.970%, while the greenback gave back some of its weekly gains and sat around 103.364, down 0.79%, as portrayed by the US Dollar Index, which tracks the buck’s value.

Late in the New York session, Federal Reserve Chair Jerome Powell crossed newswires at a Wall Street Journal event. Powell said that “what we need to see is inflation coming down in a clear and convincing way and we’re going to keep pushing until we see that.” He emphasized that “If that involves moving past broadly understood levels of neutral, we won’t hesitate at all to do that.”

Recapping the last Federal Reserve meeting, the US central bank hiked rates by 50-bps. Later in the press conference, Jerome Powell said that 50-bps increases are “on the table,” as market players have priced in a 100% odds of a 0.50% rate hike in the June meeting.

Also, earlier in the day, St. Louis Fed President James Bullard said that the continued strong growth trend for the US economy is the base case outlook for the next 18 months and added that household consumption is expected to hold up well through this year. He emphasized that the base case scenario for the Fed is 50-bps rate hikes at upcoming Fed meetings.

Furthermore, Minnesota Fed President Neik Kashkari said that the Fed has indicated it will get rates to at least neutral by the end of 2022. He added that the Fed needs to bring inflation down to its 2% target before a wage-price spiral takes off.

Earlier in the North American session, the US docket featured April’s US Retail Sales met expectations and rose by 0.9% m/m. Regarding the year-over-year reading, sales grew 8.2%, crushing the expectations of 4.2%, demonstrating the resilience of American consumers. Following the positive tone of US economic data, Industrial Production rose above the expectations, further cementing the Fed’s case of hiking rates aggressively to bring inflation as soon as possible.

Key Technical Levels

What you need to take care of on Wednesday, May 18:

The American dollar edged lower across the FX board as the currency extended the bearish corrective decline that began on Monday. Upbeat US data helped the case for a better market mood, with global indexes closing in the green.

Nevertheless, the underlying concerns remain the same. Tensions between Europe and Russia continued after the latter invaded Ukraine. Russian Deputy Foreign Minister Andrey Rudenko was on the wires and said that Ukraine has practically withdrawn from negotiations.

Federal Reserve chair Jerome Powell offered a speech. Powell failed to surprise investors, repeating that the central bank is comfortable with 50 bps rate hikes. He also mentioned that they could speed up or slow down the pace of hikes accordingly to the economic health. Speaking of which, Powell added that the underlying strength of the US economy is really good at the time being. US indexes retreated from their highs with his words but retained the green.

The EUR/USD pair surged to 1.0555, helped by ECB’s Governing Council member Klaas Knot, who said that a 50 bps rate hike should not be excluded if data suggest inflation keeps broadening and accumulating. He also added that a 25 bps hike in July would be realistic.

GBP/USD hit 1.2498 and finished the day nearby, with the pound underpinned by a stronger-than-expected UK jobs report. The ILO unemployment rate contracted to 3.7% in the three months to March, while the April Claimant Count Change fell to -56.9K. Market participants ignored mounting Brexit tensions. Foreign Secretary Liz Truss updated the House of Commons on the government's intention to introduce legislation to make changes to the Northern Ireland Protocol. The government would prefer a negotiated solution with the EU but will anyway work on changing the protocol.

The AUD/USD pair trades above the 0.7000 threshold, while the USD/CAD extended its slump and trades near the 1.2800 level. The better performance of equities underpinned commodity-linked currencies, despite softening gold and oil prices. The bright metal settled at $1,816 a troy ounce, while WTI is now changing hands at $109 per barrel.

The USD/JPY pair ended the day little changed at 129.35, while USD/CHF fell to 0.9938.

US Treasury yields ticked higher, with that on the 10-year note flirting with 3%.

Dogecoin price hints at one more fall towards $0.07

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bulls are taking control at a key area of resistance.

- If the bears do not come out of hibernation at this juncture, there are prospects of much higher levels.

As per the prior analysis, GBP/USD Price Analysis: Bears waiting to take a bite out of bullish correction, the price has rallied into the 61.8% Fibonacci ratio, extending the recovery from the lowest levels since May 2020.

GBP/USD prior analysis

GBP/USD live market

The price has pierced the golden ratio and bulls will be looking for a daily close above to confirm to the market that they are in control, opening prospects for higher territories for the foreseeable future:

The price is meeting resistance around the neckline of the M-formation which could lead to a correction back to test the prior highs that would be expected to offer some initial support. If bears do not come out of hibernation at this point, then a break of the early May highs at 1.2638 will likely lead to a grind back towards 1.30 the figure.

In a Wall Street Journal interview, Federal Reserve Chair Jerome Powell said on Tuesday that US central bank officials will keep tightening policy until inflation comes down in "a convincing way."

"There have been some promising signs you can point to," Powell said at a Wall Street Journal conference. But, he added, "There are some signs that are not so promising."

Risk assets were pressured during the event and the US dollar popped into a shorter bullish environment on the charts on hawkish rhetoric from the Fed chair who said that there is an overwhelming need to get inflation under control.

His uber hawkish rhetoric sent the S&P 500 back towards the lows of the day but the index has since recovered ground printing a high for the day as markets digest the chairman's comments, noting that the Fed will slow the pace of rate increases depending on how conditions evolve. Such decisions will be made on a meeting by meeting basis.

The US dollar has also fallen back to where it began at the start of the interview:

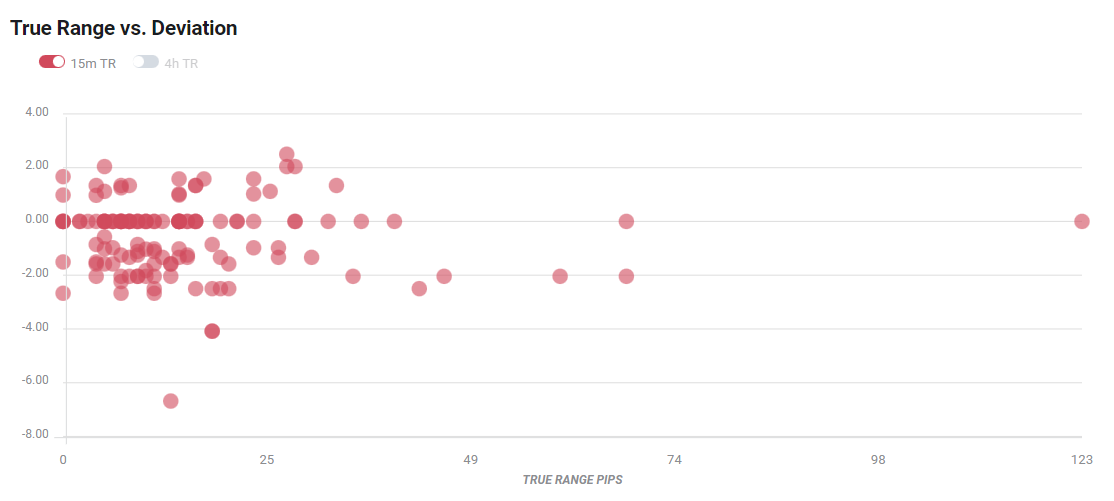

- Gold goes offered on a hawkish Powell as the US dollar rallies.

- The US dollar has popped out of a 15-min wedge formation to the upside.

The gold price was changing hands between the bulls and the bears during the Federal Reserve's chairman Jerome Powell's interview with the Wall Street Journal. At the time of writing, as the event concludes, XAU/USD is trading offered as the US dollar picks up a bid. The yellow metal is down some 0.48% at $1,815.50, falling from a high of $1,836.15 on the day printing a low of $1,813.74.

The US Dollar Currency Index (DXY), which tracks the greenback against six major currencies, was down 0.82% at 103.33, a touch away from the low of 103.226 ahead of the Powell event:

On hawkish rhetoric, the price has rallied out of the containment of the wedge formation as follows:

While well off the two-decade high made last week, which was made on the heels of strong inflation data and supported by a hawkish Federal Reserve, as well as worries over the global economic fallout from the Russia-Ukraine conflict, the bulls are stepping in again. As a consequence, the price of gold is suffering.

''A failure to confirm the early morning strength would see CTA selling resume course to a large net short position,'' analysts at TD Securities argued.

''With the Fed telegraphing their every move, Fedspeak will be increasingly important this week, particularly as bearish sentiment continues to undermine positioning. In turn, we continue to expect substantial selling flow to weigh on the yellow metal when liquidity is scarce.''

Gold technical analysis

The failure to close above a 61.8% ratio leaves the outlook bearish, in line with the broader bearish trend:

- The euro advanced 200-pips on Tuesday and recorded a fresh weekly high at around 136.69.

- ECB’s Knot expressed that a 25-bps rate hike is realistic, but he would not exclude a 50-bps.

- EUR/JPY Price Forecast: The bias shifted upwards, but a daily close below 136.00 or under the neckline would keep the head-and-shoulders pattern intact.

The common currency is rallying during the day, and it remains the gainer in the FX complex on Tuesday, to the detriment of safe-haven peers, which are getting battered by most of the G7 currencies, as market sentiment improved. At the time of writing, the EUR/JPY is trading at 136.24, above the head-and-shoulders neckline, threatening to invalidate the pattern.

The market mood in the New York session remains positive, carrying on the mood from the Asian and European sessions. US equities are recording gains between 1% and 2.67%. China’s improvement on its Covid-19 crisis, particularly in Shanghai, recording three consecutive days without cases, was cheered by investors to the detriment of the greenback and the Japanese yen.

In the overnight session, the EUR/JPY opened around 134.50 and rallied on ECB Klaus Knot’s comments, saying that a 25bp hike in July is realistic while adding that a 50bp rate hike should not be excluded if data in the next few months suggests that inflation is broadening and accumulating.

Following those remarks, the EUR/JPY rallied more than 200-pips, putting in danger the validity of the head-and-shoulders pattern, with the cross-currency exchange rate being above the neckline, which lies around the 135.25-35 range.

EUR/JPY Price Forecast: Technical outlook

On Tuesday, the EUR/JPY surged above the 50-day moving average and the head-and-shoulders neckline in the 134.95-135.25/35 area, threatening to invalidate the chart pattern. In the near term, the bias, which shifted to neutral-upwards, as of writing is upwards.

With that said, the EUR/JPY’s first resistance would be 137.00. Break above would expose 138.00, followed by May 9 swing high at 138.32. On the flip side, the EUR/JPY first support would be 136.00. A breach of the latter, the next  support would be the head-and-shoulders neckline around 135.25-35, followed by April’s 27 daily low at 134.77.

support would be the head-and-shoulders neckline around 135.25-35, followed by April’s 27 daily low at 134.77.

Key Technical Levels

The US dollar is crumbling, this week as investors survey the landscape of the global economy, not just in the US. The greenback has fallen victim to improved risk sentiment, helping the likes of the euro that has been extending its rebound from a five-year low touched last week, and putting more distance between the common currency and parity with the US dollar.

However, in what could throw the US dollar bulls a lifeline, the Federal Reserve Chairman Jerome Powell is taking the Wall Street Journal's questions on the US economic outlook and its implications for the labour market, inflation and central-bank policies.

Watch live

Key notes

- We know this is a time for fed to be tightly focused on getting inflation down.

- We have tools and resolve to get inflation back down.

- No on should doubt our resolve - wall street journal interview.

- We need to see inflation coming down in convincing way.

- Ongoing rate increases appropriate.

- Broad support on fomc for having on table 50 bps at next two meetings.

- That is short of a prediction though.

- That said, if economy performs as we expect will be on the table.

- Very difficult to think about giving forward guidance.

- Economy very uncertain, as are outside events.

- Markets are pricing in a series of rate hikes.

- We like to work through expectations.

- It's been good to see markets reacting to what we are saying.

- Financial conditions overall have tightened significantly.

- What we need is to see growth moving down from high levels.

- We need supply side to have chance to catch up.

- We need to see growth moving down to a level that's still positive.

- By standards of central bank practice, we moving as fast as we have in several decades.

- We need to see clear and convincing evidence inflation is coming down.

- If we don't see that, we'll have to move more aggressively.

- We need to see clear convincing evidence that inflation is coming down.

- If we do, can slow pace of hikes.

- Underlying strength of US economy is really good right now.

- Labor market extremely strong.

- Growth this year is still at very healthy leveles.

- Consumer balance sheets are healthy.

- It is well positioned to withstand tighter policy.

- We are raising rates expeditiously to more normal level.

- We'll probably reach that in Q4 this year.

- That's not a stopping point though.

- We are raising rates expeditiously to a more normal level, will reach in 4th quarter.

- We don't know where neutral is, or where tight is.

- We're going to be looking meeting by meeting at financial conditions, economic health.

- We are going to look meeting by meeting, data by data, at financial conditions and economy.

- We will be looking at our actions impact on the economy.

- We really need to see clear and convincing evidence inflation coming down.

- If we have to go past neutral, we won't hesitate.

- If need to move past neutral, we wont' hesitate.

- We will continue raising rates until we see inflation coming down.

- There will be no hesitation about that.

- We will go until we are at a place where financial conditions are appropriate, inflation is coming down.

- There will be no hesitation about that.

- We will go until we are at a place where financial conditions are appropriate, inflation is coming down.

- Financial conditions haven't tightened so quickly in a very long time.

- It would have been better to raise rates earlier with hindsight.

- Inflation is way too high.

- We need to bring it down.

US dollar chart

The US dollar was testing the resistance of the wedge formation on the 15-min chart ahead of the event.

The US dollar is now picking up a bid during the interview:

About Fed chair Powell

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

- Improvement in market sentiment benefits the Australian dollar.

- Despite better than expected US economic data, the greenback remains trading softer.

- Fed’s Bullard: The US central bank base case is 50-bps increases at upcoming meetings.

- AUD/USD Price Forecast: Remains downward biased, despite the 200-pip rally from YTD lows at around 0.6820s.

The Australian dollar marches forward but faces solid resistance around the 0.7040-50 area and retreats towards the 0.7010s, amidst a positive market sentiment session that weighed on the greenback, which remains soft on Tuesday, despite higher US Treasury yields. At the time of writing, the AUD/USD is trading at 0.7022.

Sentiment improves as China begins to control Shanghai Covid-19 crisis

Global equities remain on the right foot, trading in the green, while in the FX space, risk-sensitive currencies rise, while safe-haven peers are getting smashed by the improvement in the market sentiment, courtesy of progress in the Covid-19 crisis in China. That benefits the Aussie dollar, which remains buoyant in the session, as the Reserve Bank of Australia (RBA) last meeting minutes showed that the board discussed a 40-bps increase in its meeting, and at the same time, members agreed that further hikes would likely be required to ensure that inflation returns to its target.

Following the minutes, the AUD/USD jumped near the 0.7000 mark, but traders lifted the major until the European session, at the mid-point, between the R1 and R2 daily pivots, lying at 0.7010 and 0.7050, respectively.

US Retail Sales and Industrial Production came positive, as Fed speakers cross wires

Data-wise, the US docket featured Retail Sales for April, which came at 0.9% m/m, in line with estimations. However, the annual base reading rose by 8.2%, crushing the 4.2% expectations, illustrating the resilience of consumers in the US. Moreover, Industrial Production also printed positive numbers, beating monthly and yearly forecasts, further cementing the case of the Federal Reserve tightening monetary policy at the pace that began a couple of weeks ago.

Elsewhere, Fed speakers would dominate the headlines throughout the day. St. Louis Fed President James Bullard said that the continued strong growth trend for the US economy is the base case outlook for the next 18 months and added that household consumption is expected to hold up well through this year. He emphasized that the base case scenario for the Fed is 50-bps rate hikes at upcoming Fed meetings.

Later in the day, Minnesota Fed President Neik Kashkari said that the Fed has indicated it will get rates to at least neutral by the end of 2022. He added that the Fed needs to bring inflation down to its 2% target before a wage-price spiral takes off and stated that he does not know if Fed’s actions would trigger a recession.

In the week ahead, the Australian docket would feature the Wage Price Index on its quarterly and annual readings, expected at 0.8% and 2.5%, respectively. Meanwhile, the US docker would feature Building Permits and additional Fed speaking, led by Philadelphia Fed President Patrick Harker.

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains downward pressured, despite rallying from 0.6828 to 0.7040. As of writing, the Relative Strenght Index (RSI) is at 42.50, aiming higher, but remains in negative territory. Based on Tuesday’s price action, unless AUD/USD bulls lift prices above 0.7051, the major would be vulnerable to additional selling pressure.

If AUD/USD bulls achieve the above-mentioned, the pair’s first resistance would be 0.71000, followed by March 15 daily low-turned-resistance at 0.7165 and then 0.7200. However, if that scenario does not play out, the major’s first support would be 0.7000, followed by the January 28 daily low at 0.6967 and the YTD low at 0.6828.

- EUR/USD bulls in charge into the Fed Powell's comments.

- A close on a daily basis above the 61.8% ratio could be positive for the euro for the meanwhile.

At 1.0548, the euro is higher vs. the US dollar by some 1.13% at the time of writing after rallying on broard risk-on from 1.0428 to a high of 1.0555. The euro has extended the rebound from a five-year low touched last week while the US dollar is down against its major trading partners.

The single currency benefited at the start of the week due to the European Central bank policymaker Francois Villeroy de Galhau who said a weak euro could threaten price stability in the currency bloc. On Tuesday, Dutch central bank chief Klaas Knot told the Dutch TV programme College Tour that the ECB should raise its key interest rate by 25 basis points in July but should not yet rule out a bigger increase,

"The first interest rate hike is now being priced in for the monetary policy meeting of 21 July, and that seems realistic to me," Knot said. He argues that a 50 bps rate hike should not be excluded if data in the next few months suggests that inflation is broadening and accumulating.

The euro has also benefitted from an improved risk sentiment in markets this week that has weighed on the US dollar. Hopes that China might ease two key sets of restrictions had set a positive mood. Additionally, Shanghai achieved the long-awaited milestone of three straight days with no new COVID-19 cases outside quarantine zones, which could lead to the beginning of lifting the city's harsh lockdown as soon as June 1.

- Shanghai sets out plans for end of a painful Covid-19 lockdown

Meanwhile, the US Dollar Currency Index (DXY), which tracks the greenback against six major currencies, was down 0.82% at 103.33, a touch away from the low of 103.226. The index hit a two-decade high last week supported by a hawkish Federal Reserve and worries over the global economic fallout from the Russia-Ukraine conflict.

However, the US dollar even remained subdued after data showed US Retail Sales increased solidly in April as consumers bought motor vehicles amid an improvement in supply and frequented restaurants, showing no signs of demand letting up despite high inflation.

Markets will now tune in for comments from Federal Reserve's Chairman Jerome Powell at 1800 GMT, who is being closely watched for any clues about whether near-term rate expectations could become even more aggressive. Fed speak comes on the heels of a strong Consumer Price Inflation report, which has cemented the urgency to move quickly to a more neutral policy stance.

EUR/USD technical analysis

The pair has rallied to test the bearish commitments around a 61.8% / 78.6% ratios. A daily close above the 61.8% ratio could be positive for euro's outlook for the near term.

- As shown by the USD/CHF dropping below the parity, the Swiss franc recovers some ground vs. the greenback, gaining almost 0.90%.

- A positive market mood keeps the US dollar under pressure.

- USD/CHF Price Forecast: Drops on profit-taking but remains upward biased.

The USD/CHF plunged following the release of US Retail Sales, which came better than expected, though market players booked profits ahead of a later speech of Fed Chair Jerome Powell. At 0.9929, the USD/CHF is eyeing to re-test on March 23, 2020, daily low at around 0.9901.

Risk-on prevails as the market mood driver on Tuesday. Global equities are still trading in the green, while the greenback remains softer, despite better than expected US economic data. US Treasury yields remain elevated, with the 10-year Treasury yield rising seven and a half basis points, sitting at 2.960%, shy of the 3% threshold.

The US Dollar Index is getting hammered, influenced by a strong euro, losing 0.70%, currently at 103.409.

During the overnight session, the USD/CHF opened above the parity, though plummeted below the 50, 100, and 200-hour simple moving averages (SMAs), as some ECB speakers, led by Klaus Knot, who said that the ECB could hike 50-bps depending on data available.

USD/CHF Price Forecast: Technical outlook

The USD/CHF remains upward biased, despite retreating almost 1% on Tuesday. The daily moving averages (DMAs) reside well below the exchange rate. Also, the Relative Strenght Index (RSI), around 67.91, exited from overbought territory, opening the door for further upward pressure on the major.

That said, the USD/CHF first resistance level would be May 10 daily high at 0.9975. A breach of the latter would expose the parity at 1.000, followed by the YTD high at around 1.0064.

Key Technical Levels

Data released on Tuesday showed Industrial Production rose 1.1% in April. Analysts at Wells Fargo point out that US factories, mines and energy producers together called more capacity into service than at any other time since the start of the pandemic. They warn supply chains are not fixed and could worsen in the coming months.

Key Quotes:

“Supply chain issues, product shortages and difficulty finding labor are still key headwinds, but businesses are plodding ahead. In a rare event, every major category posted an increase in production in April; that was true whether broken out by industry group or market group.”

“Continued strength in production in the face of persistent supply issues is still encouraging and demonstrates increased activity amid an easing of some constraints. Our tracker of progress, the Pressure Gauge, continues to demonstrate a slow easing in constraints.”

“Price pressure remains elevated, but inventories have bottomed, unfilled orders are growing at a slower rate and delivery times, while still long by historic standards, have shortened.”

“Despite growing concern over the slowing of the broader economy amid a tighter policy environment, capital spending remains intact. Demand has not yet showed many signs of slowing as consumers' demand for goods has held up and businesses still need to replenish depleted inventory levels.”

Despite the recovery seen on Tuesday in the GBP/USD pair, the pound is not out of the woods. They consider risk appetite looks vulnerable and warn the pair could drop to 1.20 in a three-month perspective.

Key Quotes:

“The pound is the best performing G10 currency on a 1 day view as stronger than expected UK labour data raised the prospect that the BoE may have to go further with policy tightening to rein in inflationary pressures. While a strong labour market is a good reflection of economic health, it is not good news for everyone insofar as higher interest rates will compound the impact of the cost of living crisis for many lower income households.”

“GBP/USD has pushed to its best levels since May 5 today with its reprieve being underpinned by a broad-based pullback in the USD. The softer tone in the USD reflects a better tone in risk appetite today. That said, we continue to view the medium-term outlook for risk appetite as vulnerable and don’t view GBP/USD as being out of the woods.”

“In addition to tomorrow’s UK CPI inflation release, the week ahead is yet to bring April retail sales numbers. Surveys have already suggested that household balance sheets are being squeezed by higher prices. The market consensus for the April release stands at -0.3% m/m. A number in line with this is likely to be sufficient to take the wind out of GBP’s sails.”

“Under the weight of USD strength we see risk that GBP/USD could head as low at 1.20 on a 3 month view. We see the potential for EUR/GBP to move to 0.86 on a 3 month view.”

Despite rising interest rates, high inflation and product shortages, retail sales rose above expectations in April and upward revisions to the prior month suggests a better first quarter for consumer spending than first reported, explained analysts at Wells Fargo.

Key Quotes:

“Retail sales climbed 0.9% in April after an upwardly revised gain of 1.4% in March.”

“The main takeaway is that despite all the obvious reasons to expect otherwise, retail spending has continued to grow.”

“Believe it or not, there was some indication of a slight reprieve in consumer goods inflation for April. Prices did something they have not done in seventeen months—they boosted real retail sales. Last week we learned consumer prices rose 0.3% in April, but goods prices slid 0.3%. With the retail sales report mostly covering goods spending, the decline in prices suggests real retail sales rose a stronger 1.2% during the month.”

“For now, the 1.2% gain in overall real sales bodes well for second quarter consumption and suggests consumers continue to spend in the face of higher inflation. We have emphasized for sometime that consumers could rely on their balance sheets in the near-term to meet spending. Whether they are relying on credit, drawing down excess savings or simply saving less of their monthly income to fund purchases, the April data show little signs of an impending slowdown.”

- Mexican peso continues to rise versus the US dollar as markets recover.

- DXY extends bearish correction, and suffers the worst daily loss in months.

- The slide below 20.00, weakens further the USD/MXN pair.

The USD/MXN is falling on Tuesday for the sixth consecutive day. It bottomed at 19.92, the lowest level since April 19 and then rebounded toward 20.00.

The Mexican peso continues with its rally versus the US dollar for the sixth consecutive day. It reached the highest level in almost a month. The MXN has been among the top performers during the last five days, after a new rate hike from Banxico.

The improvement in risk appetite across financial markets seen during the last few days pushed USD/MXN further to the downside. Also weakened by higher crude oil and commodity prices. The US Dollar Index is falling for the third consecutive day, posting on Tuesday so far the worst decline in months. The greenback trimmed losses after the release of US economic data that came in above expectations.

April lows back on the radar

The consolidation below 20.00 could open the doors to a slide toward the next support area at 19.85 in USD/MXN. A slide below would expose the April low at 19.72. A weekly close clearly under 19.70 would strengthen the medium-term outlook for the Mexican peso.

If the dollar recovers above 20.00, it would alleviate the bearish pressure. Above the next resistance stands at 20.07, followed by 20.22. The critical resistance remains 20.45: a consolidation above would target the 20.70 zone.

USD/MXN daily chart

-637883997305387108.png)

Technical levels

- After snapping two days of consecutive losses on Monday, the yellow metal remains on the backfoot and is down 0.13% on Tuesday.

- The market mood remains positive, weighing on safe-haven peers and precious metals.

- Gold Price Forecast (XAU/USD): Remains defensive and failure to register a daily close above $1820-25, a re-test of the YTD lows around $1780s, is on the cards.

Gold spot (XAU/USD) modestly slides after facing a solid resistance near the trend-setter 200-day moving average (DMA) at around $1837.57, which held nicely and pushed XAU/USD price towards the two-year-old upslope trendline around $1820-25 area, amidst a positive market mood and high US Treasury yields. At the time of writing, XAU/USD is trading at $1820.76 in the North American session.

The Covid-19 situation in Shanghai improves, lifts the market mood

Sentiment has improved, as Shanghai reported no Covid-19 cases for the third consecutive day and would begin easing restrictions gradually. Portraying the aforementioned are global equities trading in the green, despite Fed Chair Jerome Powell hitting the wires at around 18:00 GMT. Regarding geopolitics linked to the Ukraine-Russia war, hostilities remain while the Russian Foreign Ministry Lavrov added that there are no talks with Ukraine.

In the meantime, the US Dollar Index, a measurement of the greenback’s value vs. a basket of rivals, remains soft in the day and drops to a two-week low, at 103.481, down some 0.68%, despite higher US Treasury yields, led by the 10-year benchmark note at 2.949%, gaining six basis points, a headwind for the yellow metal.

Before Wall Street opened, the US economic docket featured Retail Sales for April, which showed the resilience of consumers. The figures came at 0.9% m/m, in line with expectations. While the annual based number came at 8.2% y/y, smashing the 4.2% estimations. Also, Industrial Production posted good numbers, beating monthly and yearly forecasts, further cementing the case of the Federal Reserve tightening monetary policy at the pace that began a couple of weeks ago.

Additionally to macroeconomic data, Fed speakers would continue in the day. Earlier, St. Louis Fed President James Bullard said that the continued strong growth trend for the US economy is the base case outlook for the next 18 months at least, and added that household consumption is expected to hold up well through this year. He emphasized that the base case scenario for the Fed is 50-bps rate hikes at upcoming Fed meetings.

Also read:

- Fed’s Bullard: 50 bps rate increases at the coming meetings are a good base case for now

- Fed’s Bullard: Most pressing issue for Fed is inflation, labour market remains “super tight”

Gold Price Forecast (XAU/USD): Technical outlook

The price of gold remains downward pressured once XAU/USD broke below the 200-day moving average (DMA). Despite an earlier attempt to overcome the previously-mentioned DMA. Albeit XAU/USD remains defensive, it is trading around familiar ranges. However, faltering to record a daily close above the two-year-old upslope trendline around $1820-25 would open the door for further losses.

If gold bulls fail at $1820-25, XAU/USD’s first support would be $1800. Break below would expose the May 16 daily low at $1786.50, followed by the YTD low at $1780.18, and then December 15, 2021, daily low at $1752.35.

- US dollar recovers during the American session, DXY still down sharply.

- Canadian dollar among weakest currencies on Tuesday despite higher crude oil prices.

- USD/CAD finds support above 1.2800.

The USD/CAD bounced to the upside and eared losses on Tuesday after the greenback gained momentum during the American session. The pair printed a fresh daily high at 1.2854 and it is hovering around 1.2845. Earlier on Tuesday it bottomed at 1.2805, the lowest level since May 5.

The US dollar was falling sharply across the board amid risk appetite. During the last hours, the greenback recovered ground after US yields turned to the upside and as US stocks trimmed gains. The US 10-year yield rose from 2.90% to 2.97% and the 30-year yield from 3.11% to 3.16%. The Dow Jones is up by 0.55% or 165 points, down 200 points from the high.

Economic data from the US came in above expectations. Retail Sales rose 0.9% in April against the 0.7% of market consensus (March figures were revised higher). Industrial Production advanced 1.1%, above the 0.5% expected by analysts. The numbers helped the dollar.

The loonie is falling also versus the Australian and the New Zealand dollar, despite higher crude oil prices. The broad correction in markets boosted NZD/CAD and AUD/CAD.

Rebounding from the 20-day SMA

The slide of USD/CAD from the highest level in more than a year found support above the 1.2800 area. The rebound pushed the price back above the 20-day Simple Moving Average at 1.2835. A daily close below the line could open the doors to another test of 1.2800. The next support stands at 1.2770 and 1.2720.

If USD/CAD holds above the 20-day SMA, attention would turn to the next resistance at 1.2855 followed by 1.2870 and 1.2905.

Technical levels

- WTI has continued to rise on Tuesday, hitting the $115s, up around $17 versus last week’s sub-$100 lows.

- Easing China lockdown fears combined with ongoing Russia/OPEC+ production woes and risk-on flows is supporting prices on Tuesday.

- Bulls are eyeing a test of late-March highs in the $116s.

Oil prices have maintained and extended on recent upside momentum on Tuesday, with front-month WTI futures rallying into the $115s per barrel and eyeing a test of late-March highs in the $116s. Constructive updates regarding the Covid-19 situation in China, with Shanghai reporting no Covid-19 infections outside of quarantine for a third day, have boosted hopes for imminent lockdown easing. This, combined with a general more risk-on feel to global macro trade and a weaker US dollar amid hopes the Chinese tech crackdown will also ease, has injected the latest impetus into WTI.

The US benchmark for sweet light crude oil now trades around $17 higher versus last week’s sub-$100 lows. While an easing of China lockdown fears has been the latest bullish catalyst, analysts continue to cite numerous other factors as supportive of prices. Firstly, traders continue to bet that the EU will soon agree on some sort of embargo on Russian oil imports (even though Hungary continues to push back), with some flagging a 30-31 May EU summit as a potential date where agreement could be reached.

An embargo would be a devastating blow to the already shrinking Russian oil output. Since the West imposed harsh sanctions on the nation for its invasion of Ukraine, Russian output has been in decline as exporters struggle to find buyers. OPEC+ output missed the group’s target by 2.6M barrels per day (BPD) in April, a Reuters survey released on Tuesday showed. Half of this miss was due to Russian output falling and things are expected to have gotten worse this month. But the latest report also highlighted the struggles many smaller OPEC+ nations continue to have in lifting output in line with their OPEC+ target, despite sky-high oil prices.

Continued Russia/OPEC+ output woes combined with an easing of China lockdown fears have proven to be a bullish combination for oil markets in recent days. Should risk appetite in broad markets (like in equities) continue to improve, WTI may well be headed back above its late-March highs in the $116s in the near future. This would open the door to a run higher towards annual highs around $130. Should the bulls fatigue, support in the form of earlier monthly highs in the $111s should offer short-term support.

- DXY’s moderate retracement meets support near 103.20.

- US Retail Sales surprised to the upside in April.

- Chief Powell speaks later in the NA session.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main competitors, remains on the defensive well below the 104.00 mark on Tuesday.

US Dollar Index now looks to Powell

The index keeps the weekly decline well in place, although it manages to bounce off earlier lows in the 103.25/20 band, or 2-week lows.

The renewed downside in the dollar comes amidst further improvement in the risk complex as well as a technical retracement in light of the overbought condition of DXY seen in the last couple of sessions.

Positive results from the US docket helped the greenback to trim part of the daily drop after Retail Sales expanded at a monthly 0.9% in April, and 0.6% when it comes to sales excluding the Autos sector. In addition, Industrial Production expanded 1.1% and Capacity Utilization improved to 79.0%.

Later in the session, Chief Powell speaks at the Wall Street Journal Future of Everything Festival in New York. In addition, Philly Fed P.Harker (2023 voter, hawk) and Cleveland Fed L.Mester (voter, hawk) are also due to speak later.

What to look for around USD

The dollar met decent resistance in the 105.00 neighbourhood so far this month, sparking a moderate correction lower afterwards. Supporting the buck appears investors’ expectations of a tighter rate path by the Federal Reserve and its correlation to yields, the current elevated inflation narrative and the solid health of the labour market. On the negatives for the greenback turn up the incipient speculation of a “hard landing” of the US economy as a result of the Fed’s more aggressive normalization.

Key events in the US this week: Retail Sales, Industrial Production, Business Inventories, NAHB Index, Fed Powell (Tuesday) – MBA Mortgage Applications, Building Permits, Housing Starts (Wednesday) – Initial Claims, Philly Fed Manufacturing Index, Existing Home Sales, CB Leading Index (Thursday).

Eminent issues on the back boiler: Speculation of a “hard landing” of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is down 0.75% at 103.40 and faces the next support at 103.22 (weekly low May 17) followed by 102.35 (low May 5) and then 99.81 (weekly low April 21). On the other hand, the break above 105.00 (2022 high May 13) would open the door to 105.63 (high December 11 2002) and finally 106.00 (round level).

- A combination of supporting factors assisted USD/JPY to regain positive traction on Tuesday.

- Fading safe-haven demand weighed on the JPY and extended support amid rising US bond yields.

- Broad-based USD weakness held back bulls from placing aggressive bets and capped the upside.

- Sustained move beyond a descending trend-line resistance is needed to confirm a fresh breakout.

The USD/JPY pair edged higher during the early North American session and climbed to a three-day high in reaction to better-than-expected US Retail Sales figures. The pair was last seen trading around the 129.75 region, up 0.40% for the day, with bulls now looking to build on the momentum beyond the 200-period SMA on the 4-hour chart.

The risk-on impulse - as depicted by a strong rally in the equity markets - undermined the safe-haven Japanese yen and assisted the USD/JPY pair to regain traction on Tuesday. Apart from this, a goodish pickup in the US Treasury bond yields acted as a tailwind for spot prices, though broad-based US dollar weakness might cap gains.

From a technical perspective, the USD/JPY pair now seems to have confirmed a bullish breakout through a two-day-old trading range. Meanwhile, technical indicators on the daily chart are holding comfortably in the bullish territory and have again started gaining positive traction on hourly charts, adding credence to the constructive set-up.

Any subsequent move up, however, is likely to remain capped near a downward sloping trend-line. The said hurdle is pegged just ahead of the 130.00 psychological mark, which now coincides with the 61.8% Fibonacci retracement level of the 131.35-127.52 corrective slide and should act as a key pivotal point for short-term traders.

A convincing break through the aforementioned confluence barrier would set the stage for the resumption of the prior bullish trend. The USD/JPY pair might then surpass an intermediate hurdle near the mid-130.00s and reclaim the 131.00 mark. Bulls might eventually aim back to challenge a two-decade high, around the 131.35 area.

On the flip side, the 50% Fibo. level, near the 129.45-129.40 zone, now seems to protect the immediate downside ahead of the 129.15 area. This is closely followed by the 129.00 round figure and the daily low, around the 128.85 region, which if broken decisively would drag the USD/JPY pair towards the 129.00 mark, or the 38.2% Fibo. level.

The next relevant support is pegged near the lower end of the trading range, around the 128.70 region, which if broken would shift the bias in favour of bearish traders. The subsequent downfall would expose intermediate support near the 128.30-128.20 region before the USD/JPY pair break below the 128.00 mark and retest mid-127.00s (38.2% Fibo.).

USD/JPY 4-hour chart

-637883918883912891.png)

Key levels to watch

EUR/GBP is lower despite negative Brexit news but economists at BBH do not think sterling outperformance can be maintained.

Outlook for the UK economy is much worse than it is for the eurozone

“We continue to believe that if a trade war breaks out between the two, the UK stands to lose much more than the EU. The UK is already facing recession risks from other headwinds, but a trade war would likely turn a mild recession into a deep one. In addition, so-called equivalence for UK financial firms would be dead in the water.”

“If the UK does follow through with its threats, we would expect the euro to greatly outperform sterling. Even if the UK steps back from the brink, the outlook for the UK economy is much worse than it is for the eurozone. As such, we would fade this move lower in EUR/GBP as it approaches the May 2 low near 0.8376.”

Further gains in USD/IDR could extend to the 14,700 region in the short-term horizon, according to Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We highlighted last Monday (09 May, spot at 14,545) that ‘rapid increase in upward momentum is likely to lead to a break of the Jul 2021 high of 14,565’. We added, ‘the next resistance is at 14,620’.”

“Our view was not wrong as USD/IDR rose to a high of 14,625 on Friday (13 May) before extending its advance today. Upward momentum remains strong and USD/IDR could advance further to 14,680, possibly 14,700. Support is at 14,600 followed by 14,550.”

- EUR/USD keeps pushing higher and retakes 1.0500 and above.

- Immediately to the upside is now the weekly high at 1.0641.

EUR/USD picks up further pace and trespasses the key barrier at 1.0500 the figure on Tuesday.

Considering the pair’s ongoing price action, the continuation of the rebound appears likely in the very near term at least. Against that, the next hurdle emerges at the weekly high at 1.0641 (May 5) ahead of the temporary 55-day SMA, today at 1.0819.

Below the 3-month line around 1.0880, the pair is expected to remain under pressure and vulnerable to extra losses.

EUR/USD daily chart

Gold is trading back at the bull-market trendline near $1,830. The yellow metal could enjoy a temporary relief on a move above this level, economists at TD Securities report.

Failure to confirm early morning strength to see gold selling resume

“A convincing break north of the $1,830 level on the day could whipsaw momentum funds that have recently started selling the yellow. Nonetheless, with downside momentum firming and broad macro liquidations also weighing on gold, we think any relief will be fleeting.”

“A failure to confirm the early morning strength would see CTA selling resume course to a large net short position.”

- DXY sheds further ground and breaks below 104.00.

- The continuation of the corrective decline could revisit 102.30.

DXY breaches the 104.00 support and drops to new 2-week lows in the 103.20 region on Tuesday.

Against that, further retracements remain well on the cards and could now target the next support at 102.35 (May 5 low), where decent contention is expected to emerge.

The current bullish stance in the index remains supported by the 3-month line around 100.00, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 96.39.

DXY daily chart

- GBP/USD has rallied to the upper 1.2400s and is eyeing its 21DMA in the 1.2530s after strong UK jobs data.

- But the Fed’s relatively more hawkish stance versus the BoE and rising Brexit risks may make further upside difficult.

Recent concerning headlines highlighting the rising risk that a spat over the Northern Ireland border into a fully-fledged trade war between the UK and EU has failed to dent sterling optimism, with GBP/USD holding in the upper 1.2400s for now as traders digest the implications of a super strong UK labour market report released earlier in the session. The pair has also shrugged off a just-released, stronger than expected US Retail Sales report for April, perhaps as it continues to also find support from a more buoyant tone to risk appetite on Tuesday.

For reference, the latest UK labour data revealed the unemployment rate falling to its lowest since 1974 at 3.7% in the three months to March, below the expected 3.8%. Meanwhile, wages were up 7.0% YoY in March, well above the expected gain of 5.4%, which will ease some concerns about the vulnerability of consumers amid the ongoing cost-of-living squeeze. Analysts said the latest labour market data will encourage the BoE to continue lifting interest rates at upcoming meetings. Another 25 bps rate hike is expected from the bank in June.

At current levels in the 1.2480s, GBP/USD trades with gains of about 1.3% on Tuesday and is now over 2.5% higher versus last week’s multi-month sub-1.2200 lows. Bulls will now be eyeing a test of the pair’s 21-Day Moving Average in the 1.2530s, but it is notable that this level has offered significant resistance in recent weeks. Fed speakers continue to remind us (John Williams on Monday, James Bullard just now and plenty more later on Tuesday) to expect significant further Fed tightening in the quarters ahead as the bank races to tame inflation.