- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 27-07-2022

- Bulls' failure in establishment above 200-EMA resulted in a bearish reversal.

- A rising channel breakdown along with rejection has dragged the asset significantly lower.

- The RSI (14) has slipped below 40.00, which adds to the downside filters.

The USD/JPY pair is falling like a house of cards after surrendering the crucial support of 136.40 in the early Tokyo session. The pair has eased more than 0.2% in the initial session and is likely to display more losses ahead as the US dollar index (DXY) is heavily dumped by the market participants.

A downside break of the rising channel chart pattern on an hourly scale has weakened the greenback bulls. The upper and lower portion of the above-mentioned chart pattern is plotted from July 25 high and low at 136.79 and 135.89 respectively. Also, a rejection of the breakdown test has bolstered the yen bulls.

The downside move in the asset was initiated after the pair failed to sustain above the 200-period Exponential Moving Average (EMA) at 137.18, which created a base for a bearish reversal.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped below 40.00, which has infused fresh blood into the yen bulls.

A minor recovery towards the 5-period EMA at 136.45 will be a bargain sell for the market participants. This will drag the asset towards July 25 low at 135.89, followed by the psychological support at 135.00.

On the flip side, the greenback bulls could wonder if the asset oversteps July 25 high at 136.79. An occurrence of the same will send the asset towards the 200-EMA at 137.12. A breach of the 200-EMA will push the asset towards Wednesday’s high at 137.46.

USD/JPY hourly chart

-637945629430980820.png)

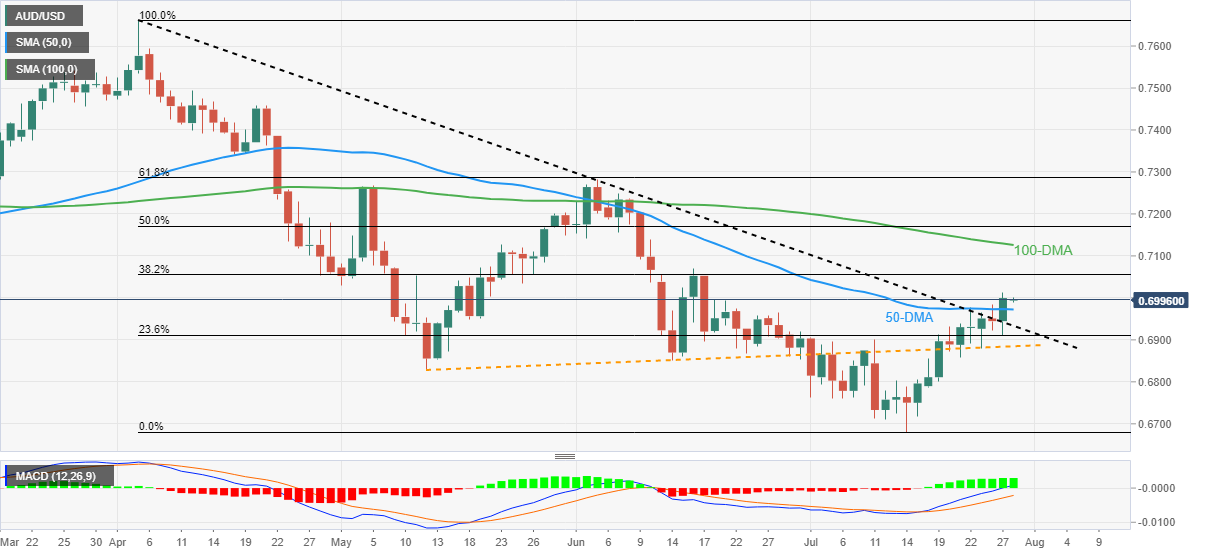

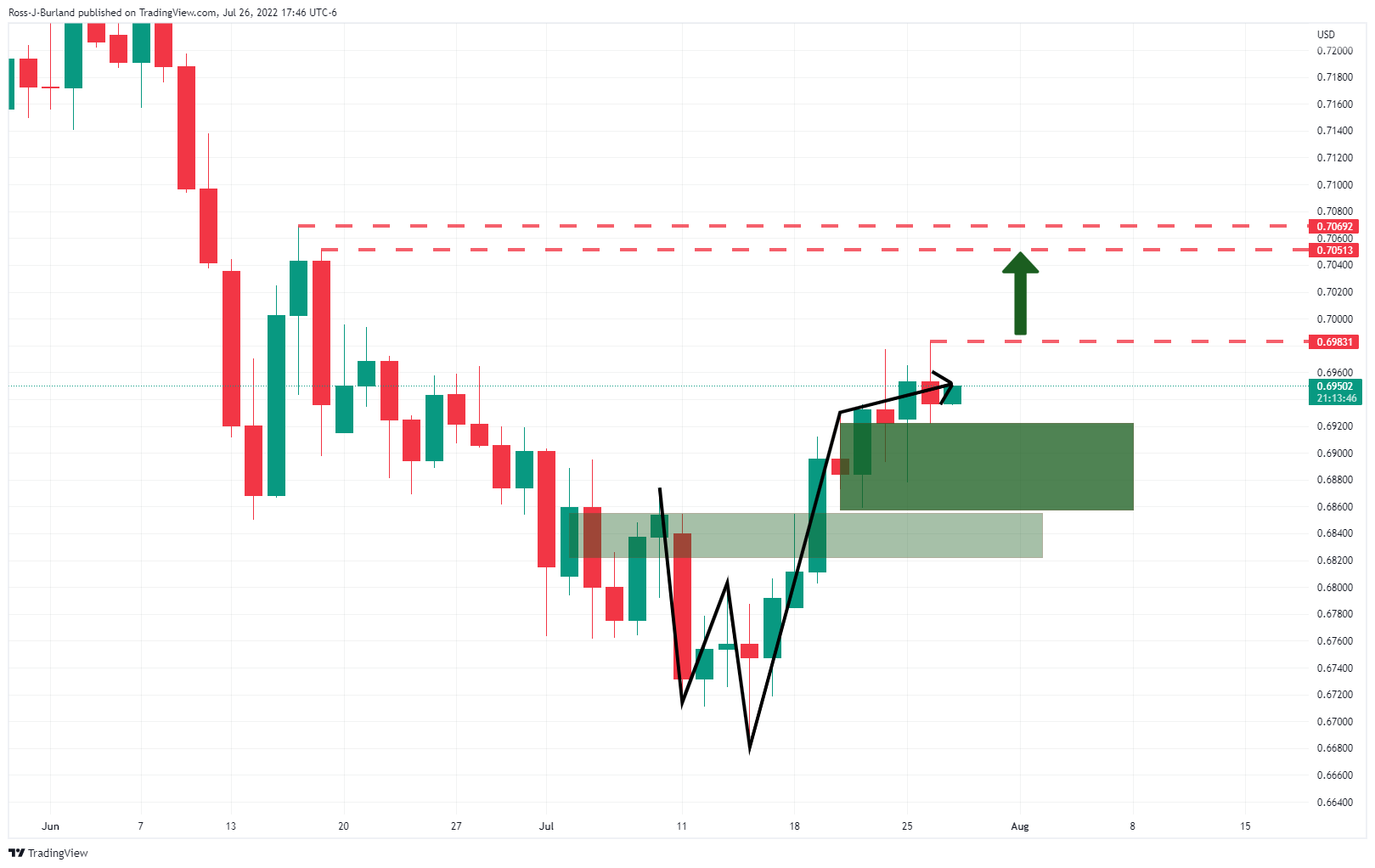

- AUD/USD remains sidelined after refreshing multi-day high, crossing the key hurdles.

- Bullish MACD signals back the technical breakouts to direct buyers towards mid-June high.

- 50-DMA restricts immediate downside, 100-DMA challenges buyers past 0.7070.

AUD/USD buyers flirt with the 0.7000 threshold, after refreshing the six-week high the previous day, as traders await Australia’s Q2 Import Price Index and Retail Sales for June during Thursday’s Asian session.

Even so, a successful upside break of the previous resistance line from April and the 50-DMA, as well as the bullish MACD signals, hint at the AUD/USD pair’s further upside.

That said, the 38.2% Fibonacci retracement of the April-July downside, also nearing the mid-June swing high around 0.7070, appears to be the immediate resistance for the pair.

Following that, the 100-DMA level near 0.7125 could challenge the AUD/USD bulls/

Alternatively, pullback moves may initially aim for the 50-DMA level of 0.6972 before testing the previous resistance line near 0.6930.

However, the AUD/USD bears remain cautious until the quote stays beyond an upward sloping support line from May 12, close to 0.6885 by the press time.

Overall, AUD/USD remains on the bull’s radar ahead of the key Aussie data.

AUD/USD: Daily chart

Trend: Further upside expected

Silver (XAG/USD) prices remain firmer around a two-week high near $19.65 during Thursday’s Asian session. In doing so, the bright metal justifies the upbeat signals from the options markets after the US Federal Reserve (Fed) favored commodities and Antipodeans.

That said, Fed matched market forecasts by announcing a 75-bps rate increase. The underlying reason for the pair’s weakness could be attributed to Fed Chairman Jerome Powell’s speech as it signaled that the hawks are running out of fuel. Key comments from the Fed’s Powell were that the rates had reached neutrality, so there won't be any more forward guidance, as well as rates will be decided meeting by meeting.

It’s worth noting that the one-month XAG/USD risk reversal (RR), a gauge of the spread between call options and put options, rallied to the four-day high by the end of Wednesday’s North American session, to +0.040 at the latest. In doing so, the options market barometer justifies the commodity traders’ optimism favored by the Fed’s latest actions.

Given the recent Fed-inspired run-up and the firmer RR, silver prices are likely to keep the post-Fed advances ahead of the US Q2 Gross Domestic Product (GDP) Annualized, expected 0.4% versus -1.6% prior.

Also read: US Gross Domestic Product Preview: Would the US avoid a technical recession?

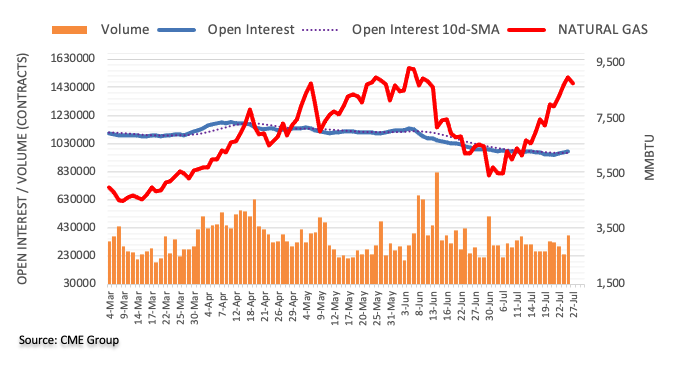

- NZD/USD bulls take back control but are yet to break into blue skies.

- The bird's wings are clipped below the hourly structure and below the counter trendline resistance.

Following the Federal Reserve's dovish outcome, NZD/USD has rallied, correcting what was a break of trendline support on the hourly time frame and has moved in on a key resistance area. The price is now bound by support and resistance as the following illustrates.

NZD/USD H1 chart

The price will need to break the counter-trendline resistance as well as the horizontal resistance as illustrated on the chart above. Meanwhile, a correction could be on the cards to the downside with the key Fibonaccis marked in red that aligns with market structures. If they were to give out to the bears, then the final hurdles, marked by green dashed support lines, will need to be taken out if the prioce is to revisit a potential demand zone between 0.6100 and 0.6120.

- USD/CAD remains pressured around six-week low, keeps Fed-inspired bearish bias despite oil’s pullback.

- Fears of US recession also recently poked bears even as Fed’s Powell favored sellers.

- FOMC matched market’s forecast of 0.75% rate hike, Fed Chair Powell signaled lesser aggression.

- Advance readings of US Q2 GDP will be important, risk catalysts should be watched too.

USD/CAD bears approach 1.2800 while extending the post-Fed losses during Thursday’s Asian session. In doing so, the Loonie pair ignores a pullback in prices of Canada’s key export item, namely WTI crude oil, as well as the easing of the risk-on mood.

That said, the intact fears of the US economic slowdown as portrayed by the US Treasury yield curve, conveyed by Reuters, appeared to have recently probed the optimists and challenged the USD/CAD bears. The analysis mentions that the US government bond market is sending a fresh batch of signals that investors are increasingly convinced the Federal Reserve's aggressive actions to tame inflation will result in recession. “Some of those moves reversed slightly on Wednesday, with rates at the short end of the curve turning lower on expectations of the Fed being less likely to continue with super-sized hikes,” adds Reuters.

The US 10-year Treasury yields dropped nearly four basis points (bps) to 2.78% while the 2-year bond coupons slumped by 2.58% to 2.98% after the Fed’s 0.75% rate hike. Even so, the gap between the key US bond coupons remains the widest since 2000 and in turn hints at the US recession woes.

It’s worth noting that the USD/CAD prices slumped to the lowest levels since June 13 after the US Federal Reserve (Fed) matched market forecasts by announcing a 75-bps rate increase. The underlying reason for the pair’s weakness could be attributed to Fed Chairman Jerome Powell’s speech as it signaled that the hawks are running out of fuel. Key comments from the Fed’s Powell were that the rates had reached neutrality, so there won't be any more forward guidance, as well as rates will be decided meeting by meeting.

Elsewhere, US Durable Goods Orders rose by 1.9% MoM versus expectations of -0.4% and the revised prior of 0.8%. Further, the Nondefense Capital Goods Orders excluding Aircraft also increased by 0.5% compared to 0.2% market consensus and 0.6% prior. Additionally, the US Pending Home Sales dropped by 8.6% MoM in June, compared to the market expectation for a decrease of 2% and following May's growth of 0.4%.

It should be observed that the WTI crude oil prices pare the biggest daily jump in over a week around 97.25 while the S&P 500 Futures drop 0.10% intraday at the latest.

Moving on, USD/CAD traders should pay attention to the risk catalysts for fresh impulse ahead of the first readings of the US Q2 Gross Domestic Product (GDP) Annualized, expected 0.4% versus -1.6% prior.

Also read: US GDP Preview: Win-win for the dollar? Economy's flirt with recession to boost the buck

Technical analysis

The first daily closing below the 50-DMA since early June keeps USD/CAD sellers hopeful of keeping the reins until the quote rises back beyond the stated moving average surrounding 1.2855.

- USD/CHF has surrendered the critical support of 0.9580 amid weakness in the DXY.

- A tad lower hawkish guidance and softening commentary on retail demand have weakened the greenback.

- For further guidance, investors may rely on US GDP data.

The USD/CHF pair displayed a modest rebound after hitting a low of 0.9586 in the late New York session. However, the greenback bulls have dragged the asset below Wednesday’s low at 0.9586 as investors have initiated short positions after considering the rebound a bargain sell.

The asset is prepared to deliver a fresh bearish impulsive wave as the US dollar index (DXY) has shifted into a negative trajectory after the rate hike announcement by the Federal Reserve (Fed).

It’s not the 75 basis points (bps) rate hike by the Fed, which is responsible for the plummeting DXY but its mild hawkish guidance and concerns for retail demand have forced investors to dump the safe haven. The Fed is expecting interest rate elevation to 3.5% by the end of 2022. However, positive commentary on the labor market has eased some concerns for the economy.

In today’s session, the entire focus of investors will shift to the US Gross Domestic Product (GDP) numbers. As per the market consensus, the US GDP data will shift lower to 8% against the prior release of 8.3% on a quarterly basis. While the annualized figure will significantly improve to 0.4% vs. -1.6% in the prior release.

On the Swiss franc front, investors will keep an eye on Real Retail Sales data. The economic data landed at -1.6%. The economic catalyst is expected to remain higher as soaring energy bills and prices of food products will elevate Real Retail Sales. However, a slippage in the economic data will indicate a major slump in the overall demand. This may weaken the Swiss franc bulls ahead.

- EUR/JPY trims its weekly gains but remains up around 0.17%.

- Investors cheered the US Fed’s dovish commentary, though Thursday’s US GDP would give traders clues about the Fed’s next move.

- EUR/JPY Price Analysis: Downward biased; a break below 139.00 would pave the way for further losses.

On Wednesday, EUR/JPY climbed towards the intersection of the 20 and 50-day EMAs as the US Fed hiked rates by 75 bps, aligned to market expectations. The EUR/JPY reacted upwards, following the lead of the EUR/USD, which rallied sharply, as the greenback, instead of strengthening, weakened. A slight change in the Fed monetary policy statement, acknowledging that the US economy is “softening,” was cheered by bulls. The EUR/JPY is trading at 139.15, slightly down 0.03% as the Asian session begins.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart is neutral-to-downward biased. Wednesday’s jump faced solid resistance around the 20-day EMA at 139.34, though the EUR/JPY hit a daily high at 139.50, retraced below the former, so EUR/JPY sellers remain in charge. Further, the Relative Strength Index (RSI) stayed in negative territory and is still below the 7-day RSI’s SMA. Therefore, the EUR/JPY is subject to additional selling pressure.

EUR/JPY 1-hour chart

The EUR/JPY hourly chart and the daily chart are downward biased. As the Asian session began, the EUR/JPY slipped below the 100-hour EMA at 139.28, paving the way toward 139.00. It’s worth noting that below the latter, the intersection of the 20 and 50-hour EMAs around 138.96 would be difficult support to overcome. If EUR/JPY sellers reclaim the latter, the next support would be the S1 daily pivot point at 138.61. Once cleared, the EUR/JPY’s next support would be the July 26 low at 138.16, followed by the S3 pivot at 137.52.

EUR/JPY Key Technical Levels

“I strongly urge the Senate to act on this bill as soon as possible, and the house to do the same,” Said US President Joe Biden in support of the latest move by US Senate Majority Leader Chuck Schumer and Senator Joe Manchin.

US President Biden announced his support to the recent deal between the key US Senators during early Thursday in Asia.

“Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.V., on Wednesday announced that they have struck a long-awaited deal on legislation that aims to reform the tax code, fight climate change and cut health-care costs,” said CNBC news. "The reconciliation bill would invest more than $400 billion over 10 years, to be fully paid for by closing tax loopholes on the richest Americans and corporations, the senators said in a joint statement. It would reduce deficits by $300 billion over that decade, the senators said, citing estimates from nonpartisan congressional tax and budget offices," adds the news.

Market reaction

The news failed to impress buyers as fears of the US recession remains on the table and tames the Fed-inspired optimism. While portraying the same, the S&P 500 Futures drop 0.15% intraday by the press time.

- GBP/USD eases from one-month high but holds onto post-Fed breakout of the key technical hurdles.

- Bullish MACD signals also favor buyers to aim for 50-DMA.

- Previous resistance line holds the key to seller’s entry.

GBP/USD bulls take a breather around a one-month high during Thursday’s Asian session, paring the Fed-inspired rally to 1.2186 by easing to 1.2150.

Even so, the Cable pair buyers keep the reins as it holds onto the previous day’s upside break of the key resistance line from April, now support around 1.2070.

Also favoring the bulls is the pair’s sustained trading above 21-DMA and a two-week-old support line, as well as firmer signals from the MACD.

It’s worth noting that the quote’s weakness below the resistance-turned-support line, around 1.2070, won’t be considered a welcome sign for the bears as a convergence of the 21-DMA and a fortnight-old support line, near 1.2000, will be a tough nut to crack for the GBP/USD sellers.

If the quote remains weak past 1.2000, the odds of witnessing a gradual south-run toward the yearly low near 1.1760 can’t be ruled out.

Alternatively, the 50-DMA level near 1.2230 guards the quote’s immediate upside ahead of a descending resistance line from late March, close to 1.2410 at the latest.

In a case where the GBP/USD bulls keep reins past 1.2410, it can reverse the four-month-old downtrend while targeting May’s peak of 1.2666 as the next hurdle.

GBP/USD: Daily chart

Trend: Further upside expected

- AUD/JPY is juggling in a minute range, upside looks likely as odds of RBA-BOJ policy divergence soars.

- The release of higher Australian Inflation print has accelerated RBA’s rate hike expectations.

- This week, the entire focus will remain on Japan’s labor market data.

The AUD/JPY pair is displaying back and forth moves in a narrow range of 95.40-95.57 in the early Tokyo session. The asset has witnessed a mild correction after attempting a break above 95.70. However, the cross has managed to establish comfortably above the crucial hurdle of 95.35 amid a soaring market mood.

The risk barometer is looking to extend its gains as investors are expecting an escalation in the Reserve Bank of Australia (RBA)-Bank of Japan (BOJ) policy divergence. A higher inflation print posted by the Australian Bureau of Statistics on Wednesday has paddled up the odds of one more new normal 50 basis points (bps) rate hike announcement by the RBA.

The Australian Bureau of Statistics reported the overall inflation rate for the second quarter of CY2022 at 6.1%, minutely lower than the estimates of 6.2% but remained extremely higher than the prior release of 5.1%. Also, the trimmed CPI has increased to 4.9%, higher than the expectations and the prior release of 4.7% and 3.7% respectively.

There is no denying the fact that RBA Governor Philip Lowe will go for more policy tightening measures in August monetary policy to contain the inflationary pressures. However, the Bank of Japan (BOJ) will carry forward its ultra-loose monetary policy as pre-pandemic levels are yet to be achieved.

Going forward, investors’ focus will remain on Japan’s employment data. The jobless rate may trim to 2.5% vs. the prior release of 2.6%. Also, the Jobs/Applicants ratio may increase to 1.25 from the former figure of 1.24. An occurrence of the same will strengthen the yen bulls.

- AUD/USD bulls take a breather after rising the most in a week, around 1.5-month high.

- Growth fears from Australia, recession woes in the US probe bulls.

- Fed announced 0.75% rate hike to match market forecasts, Chairman Jerome Powell tried to renew optimism and succeeded.

- Australia’s Retail Sales for June, US preliminary Q2 GDP will be important for fresh impulse.

AUD/USD seesaws near the 0.7000 threshold, after the Fed-inspired rally to the six-week high, as traders await the key data from Australia and the US during early Thursday morning in Asia. In doing so, the Aussie pair justifies the market’s cautious mood amid recently mixed concerns over the US recession and also relating to Aussie GDP, inflation and interest rates.

The Aussie pair’s latest inaction could be linked to the statements from excerpts of an economic statement to be delivered to parliament Thursday by Aussie Treasurer Jim Chalmers, as reported by Bloomberg, which cuts the nation’s GDP growth outlook. “The economy expanded 3.75% in the 12 months ended June 30, compared with the previous government’s estimate of 4.25% ahead of a May election,” said the news.

Also weighing on the pair could be the intact fears of the US economic slowdown as portrayed by the US Treasury yield curve, as conveyed by Reuters. The analysis mentions that the US government bond market is sending a fresh batch of signals that investors are increasingly convinced the Federal Reserve's aggressive actions to tame inflation will result in recession. “Some of those moves reversed slightly on Wednesday, with rates at the short end of the curve turning lower on expectations of the Fed being less likely to continue with super-sized hikes,” adds Reuters.

It’s worth noting that the US 10-year Treasury yields dropped nearly four basis points (bps) to 2.78% while the 2-year bond coupons slumped by 2.58% to 2.98% after the Fed’s 0.75% rate hike. Even so, the gap between the key US bond coupons remains the widest since 2000 and in turn hints at the US recession woes.

On Wednesday, the US Federal Reserve (Fed) matched market forecasts by announcing a 75-bps rate increase. However, the risk appetite improved after the rate lift as Chairman Powell’s speech spurred speculations that the hawks are running out of fuel. Key comments from the Fed’s Powell were that the rates had reached neutrality, so there won't be any more forward guidance, as well as rates will be decided meeting by meeting. The Fed meeting spurred the market’s risk-on mood, before the latest cautious sentiment and fueled the AUD/USD prices.

Before that, Australia’s downbeat Q2 Consumer Price Index (CPI) and mixed US data joined the pre-Fed anxiety to weigh on the AUD/USD prices. Australia’s headline Consumer Price Index (CPI) matches 1.8% QoQ forecasts, versus 2.1% prior whereas the YoY release eased below 6.2% expectations to 6.1%. On the other hand, US Durable Goods Orders rose by 1.9% MoM versus expectations of -0.4% and the revised prior of 0.8%. Further, the Nondefense Capital Goods Orders excluding Aircraft also increased by 0.5% compared to 0.2% market consensus and 0.6% prior. Additionally, the US Pending Home Sales dropped by 8.6% MoM in June, compared to the market expectation for a decrease of 2% and following May's growth of 0.4%.

Amid these plays, the Wall Street benchmarks rallied post-Fed and closed with gains while the US Treasury yields eased. However, the S&P 500 Futures print mild losses by the press time.

Moving on, Australia’s Q2 Import Price Index and Retail Sales for June may offer immediate directions ahead of the initial readings of the US Q2 Gross Domestic Product (GDP).

Read: US Gross Domestic Product Preview: Would the US avoid a technical recession?

Technical analysis

AUD/USD lands on a bull’s table on marking a successful break of an downward sloping trend line from April 05, near 0.6935 now. Also acting as a short-term key support is the 50-DMA level surrounding 0.6975. With this, the buyers are on their way to the mid-June high near 0.7070 wherein the 0.7000 psychological magnet acts as the immediate hurdle.

- GBP/JPY advanced sharply as the US Fed tilted dovish on its monetary policy statement.

- Sentiment is positive once the US central bank conceded that the US economy is softening.

- GBP/JPY Price Analysis: Upward biased and might test 167.00 soon.

The GBP/JPY rallies towards the 166.00 figure amidst a risk-on impulse due to the US Federal Reserve hiking 75 bps the Federal funds rate (FFR) while also acknowledging that the US economy is slowing and conceding that they are in neutral territory. At the time of writing, the GBP/JPY is trading at 165.96.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart is upward biased. On Wednesday, unexpectedly, the pair jumped 133 pips and reclaimed the 166.00 mark, courtesy of the GBP/USD bounce after the Fed decision. That said, the GBP/JPY broke a two-month-old downslope trendline, which helped sellers to spot fresh entries in the pair, but once cleared, that would pave the way for further gains.

Therefore, the GBP/JPY's first resistance would be the June 28 daily high at 166.94, followed by the June 22 swing high at 167.85.

GBP/JPY 1-hour chart

The GBP/JPY hourly chart also depicts the pair as upward biased. Nevertheless, GBP/JPY buyers should know that the exchange rate is facing a solid resistance of around 166.00. If the GBP/JPY breaks decisively above the previously mentioned, the next resistance would be the R1 daily pivot at 166.65. Once cleared, the next ceiling will be the R2 pivot at 167.37, followed by the June 22 high at 167.85.

GBP/JPY Key Technical Levels

“The US government bond market is sending a fresh batch of signals that investors are increasingly convinced the Federal Reserve's aggressive actions to tame inflation will result in recession,” per Reuters analysis published early Thursday morning in Asia.

Key quotes

While Fed Chair Jerome Powell on Wednesday said that he does not see the economy currently in a recession, spreads between different pairings of Treasury securities - and derivatives tied to them - have in past weeks moved into or toward an "inversion" when the shorter dated of the pair yields more than the longer one.

These join another widely followed yield spread relationship - between 2- and 10-year notes - that has been in inversion for most of this month.

Some of those moves reversed slightly on Wednesday, with rates at the short end of the curve turning lower on expectations of the Fed being less likely to continue with super-sized hikes.

The curve is indicating that the Fed will have to start cutting rates after hiking.

The part of the U.S. Treasury yield curve that compares yields on two-year Treasuries with yields on 10-year government bonds has been inverted for most of the past month and is around the most negative its been since 2000 on a closing price basis.

Fed economists have said that near-term forward yield spreads - namely the differential between the three-month Treasury yield and what the market expects that yield to be in 18 months - are more reliable predictors of a recession than the differential between long-maturity Treasury yields and their short-maturity counterparts.

Futures contracts tied to the Fed's policy rate showed this week that benchmark U.S. interest rates will peak in January 2023, earlier than the February reading they gave last week.

FX reaction

The analysis questions the market’s risk-on mood after the Fed’s 0.75% rate hike, which in turn weighs on the S&P 500 Futures despite the upbeat performance of the Wall Street benchmarks.

- EUR/USD is expected to deliver more gains after overstepping the immediate hurdle of 1.0220.

- Fed’s mild hawkish guidance and concerns for softening retail demand have dragged the DXY.

- A vulnerable Eurozone GDP figure may weaken the shared currency bulls.

The EUR/USD pair is spinning around the critical figure of 1.0200 after picking offers around 1.0220 in the late New York Session. The pair has turned sideways after a sheer upside and is likely to extend its gains if the asset oversteps Wednesday’s high at 1.0220.

Well, it’s not the fundamentals of shared currency which has driven the asset higher but the plummeting US dollar index (DXY), which is responsible for the upside auction. The DXY witnessed a steep fall after the Federal Reserve (Fed) escalated its interest rates to 2.25-2.50%.

The option of a 1% rate hike was not viable as retail demand has been softer last month and an extreme policy tightening measure could dampen the catalyst further.

As per the commentary from Fed chair Jerome Powell, the labor market is rock solid and the Fed is seeing interest rates near 3.5% by the end of CY2022. Therefore, room for more rate hikes is less and the market participants may see normalcy in interest rate hikes in September monetary policy meeting.

On the eurozone front, fears of an energy crisis have escalated after the commentary from the German gas regulator that energy prices could accelerate further dramatically. The gas supply cut off from the main pipeline from Russia has created havoc in eurozone as the Winter season is coming, which is known for higher gas demand.

This week, the eurozone will report the Gross Domestic Product (GDP) data on Friday, which will provide further guidance to investors. The economic data is seen lower at 3.4% than the prior release of 5.4% on an annual basis. A vulnerable GDP figure may weaken the shared currency bulls.

“Australia downgraded its economic growth outlook by a half-percentage point for this fiscal year and next due to accelerating inflation, higher interest rates and a slowing global economy,” reported Bloomberg early Thursday morning in Asia.

The news quotes excerpts of an economic statement to be delivered to parliament Thursday by Aussie Treasurer Jim Chalmers while mentioning, “The economy expanded 3.75% in the 12 months ended June 30, compared with the previous government’s estimate of 4.25% ahead of a May election.”

“The economy is forecast to decelerate further this fiscal year to 3% from a prior expectation of 3.5% and then 2% in fiscal 2024 from 2.5% seen before,” adds Bloomberg.

Additional quotes

The Australian economy is growing -- but so are the challenges. Some are home-grown, others come from around the world.

The headwinds our economy is facing -- higher inflation at the top of that list, along with slowing global growth -- are now reflected in the revised economic outcomes and forecasts.

AUD/USD grinds higher

The news fails to impress the AUD/USD buyers as the quote seesaws around a six-week high near 0.7000 of late. In doing so, the Aussie pair holds onto the post-Fed gains while waiting for Australia’s Retail Sales for June and the US preliminary Q2 GDP.

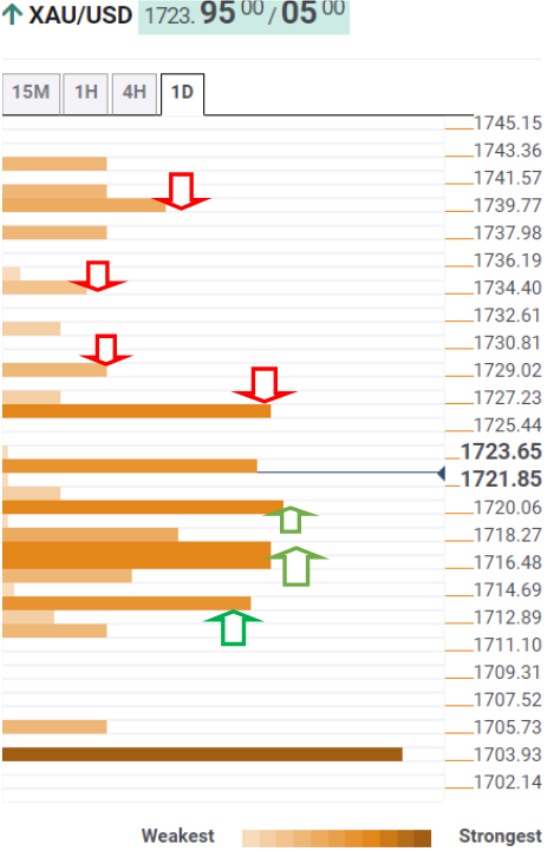

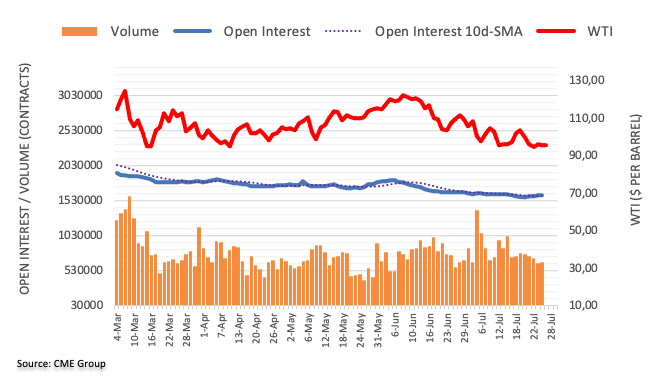

- Gold price is oscillating in a $1,733.12-1,736.00 range after facing feeble barricades at around $1,740.00.

- Fed’s mild hawkish commentary has resulted in an upbeat market mood.

- The DXY has shifted into negative territory after less hawkish guidance from the Fed.

Gold price (XAU/USD) has turned into a consolidating trajectory after a mild correction while attempting to surpass the critical hurdle of $1,740.00. Earlier, the precious metal displayed a juggernaut rally from a low of $1,720.00 after the Federal Reserve (Fed) announced an interest rate hike by a consecutive 75 basis points (bps).

Taking into consideration the soaring price pressures and softening retail demand, Fed chair Jerome Powell decided to maintain the status quo and elevated the interest rates to 2.25-2.50%. Apart from that, the guidance doesn’t seem extremely hawkish as Fed policymakers are seeing interest rates near 3.5% by the end of CY2022.

A mild hawkish commentary from the Fed has turned out to be music to the ears for the gold bulls. This has also underpinned the risk-on market mood as the market participants are joyful that Fed has at least a decent target for this year. Also, the Fed stated that the labor market is extremely solid and the unemployment rate is low, which has supported the Fed to announce rate hikes unhesitatingly.

Meanwhile, the US dollar index (DXY) has plunged below the cushion of 107.00 significantly. The DXY is expected to extend its losses after a downside move below 106.20.

Gold technical analysis

On an hourly scale, the gold price has given an upside break of a descending triangle pattern whose downward-sloping trendline is placed from July 22 high at $1,739.37. While the horizontal support is placed from July 22 low at $1,712.94.

A meaningful bull cross represented by the 20-and 50-period Exponential Moving Averages (EMAs) at $1,719.36, adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which advocates a sheer upside momentum ahead.

Gold hourly chart

- NZD/USD is ending the day on the bid following a dovish tilt at Fed.

- There is more data to come from the US that could tip the balance further.

NZD/USD is some 0.6% higher on the day with the pair moving up from a low of 0.6191 to a high of 0.6277 on the day that the Federal Reserve confirmed the market's dovish sentiment. The event comes ahead of more key US data today and at the end of the week, so the Fed is not the be-all and end-all. However, the Fed has set a precedent for the day ahead which is a softer US dollar, risk-on, and a positive environment for the kiwi.

The FOMC raised the fed funds rate 75bp to a 2.25-2.5% target range, as widely expected. The decision was unanimous. During the press conference, Powell noted that further outsized hikes would be conditional on data, and that there will be less “clear guidance” on rate hikes from here, with slower hikes appropriate “at some point”.

Main takeaways from the Fed statement

- The Fed says recent indicators of spending and production have softened.

- Fed says job gains have been robust, the unemployment rate has remained low.

- Fed says inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, and broader price pressures.

The Fed funds rate futures forecast 3.4% in December after a 75 basis point hike. That leaves 107 basis points of tightening for the remainder of 2022 and thus, the market are pricing for a more dovish outcome for the September meeting as the Fed turns data-dependent.

Meanwhile, Jerome Powell, the Fed's chairman's presser concluded in recent trade and following a cautiously optimistic tone over the US economy. With the chair's warning of a softer labour market, the US dollar was down to the lows of the day at 106.279, losing 0.69% as per the DXY index into the close of the North American forex session ahead of the roll-over.

Meanwhile, in the bigger picture, analysts at ANZ bank said that the USD steamroller continues, as highlighted by the Economist’s Big Mac Index, which suggests the NZD is 14% undervalued but has no shortage of company.

More to come from the US calendar

Meanwhile, traders will now look to the US Gross Domestic Product data tomorrow and inflation readings on Friday. On the one hand, a positive reading for growth in Q2 following the -1.6% QoQ saar plunge in the first quarter could support the greenback as it might ''quash talk of recession, at least for the H1'', analysts at Rabobank argued. ''That said, speculation will remain as to the size and extent of any potential downturn in 2023.'' On the other hand, a negative outcome will be potentially bearish for the greenback. On Friday, the Fed’s favoured PCE deflator numbers will also be key.

What you need to take care of on Thursday, July 28:

The American dollar plunged on Wednesday following the US Federal Reserve monetary policy decision. The central bank delivered as expected and hiked the main benchmark rate by 75 bps.

Financial markets reacted to chief Jerome Powell's words, as he shed quite some light on the future of monetary policy. Firstly, he said that rates had reached neutrality, so there won't be any more forward guidance. Rates will be decided meeting by meeting.

For most of the press conference, Powell tried to cool down recession fears, and he clearly succeeded. He noted that nothing works without price stability, somehow saying that keeping inflation under control is more relevant than any potential economic bump in the road.

Wall Street soared. The DJIA added 1.43%, while the S&P500 added 2.91%. The Nasdaq Composite was the best performer, soaring 4.12%.

The US Treasury yield curve shrank a bit, with the 10-year note now yielding 2.80% and the 2-year note 3%. A bit of progress there, reflecting temporarily easing recession concerns.

The EUR/USD pair jumped above 1.0200. Market temporarily put aside EU turmoil, which may soon make it back to the headlines. GBP/USD trades at 1.2160 at the end of the day, while commodity-linked currencies were the best performers. AUD/USD trades around the 0.7000 threshold, while USD/CAD fell towards 1.2800.

Safe-haven assets also beat the dollar. USD/CHF is down to 0.9590, while USD/JPY slid to trade at 136.50.

Spot gold is up, now trading at $1,733 a troy ounce, while crude oil prices also benefited from the risk-on sentiment. WTI trades around $98.05 a barrel.

The US will release the preliminary estimate of its Q2 Gross Domestic Product on Thursday, another volatile event that would bring action to financial markets.

Like this article? Help us with some feedback by answering this survey:

- GBP/USD rises after the Fed “dovish” 75 bps rate hike.

- Fed Powell opened the door for “another exceptionally” rate hike in following meetings.

- GBP/USD rallied more than 160 pips and hit a daily high at 1.2185 before easing to current price levels.

The British pound extended its gains on Wednesday, post-Fed back-to-back 75 bps rate hike, which lifted the Federal funds rate (FFR) to 2.50%. The central bank conceded that production and spending slowed down, perceived by investors as a slightly “dovish” tilt, without mentioning the “recession” word. At the time of writing, the GBP/USD is trading at 1.2166, up by 1.12%.

Some remarks from Fed Chair Powell's press conference

At his press conference, Fed Chair Jerome Powell said that although commodity prices have eased, there is still upward inflation pressure. He added that “another exceptionally” rate hike may be appropriate while saying that “we are looking for compelling evidence for inflation falling” in the following months.

Jerome Powell added that the central bank would decide monetary policy “meeting by meeting basis” and would not provide forward guidance as before. Powell said that the FOMC sees rate increases in 2023 while adding that the board has not decided when to slow rate hikes.

Summary of the FOMC monetary policy statement

In its monetary policy statement, Fed officials mentioned that spending and production have “softened” but simultaneously said that the labor market is robust. The US central bank noted that inflation remains elevated and has broadened further, emphasizing that the Fed is “strongly committed to returning inflation to its 2 percent objective.”

Meanwhile, policymakers anticipated that additional rate hikes would be “appropriate” and added that the balance sheet reduction would continue as planned in the Plans for Reducing the Size of the Fed’s Balance Sheet, issued in May.

GBP/USD Market’s reaction

The GBP/USD seesawed around 1.2029-88 but rallied once Federal Reserve Chief Jerome Powell took the stand. The GBP/USD rallied from 1.2029 to 1.2185 for a 160 pip upward move of the major, which it is approaching the 50-day EMA around 1.2232.

GBP/USD Key Technical Levels

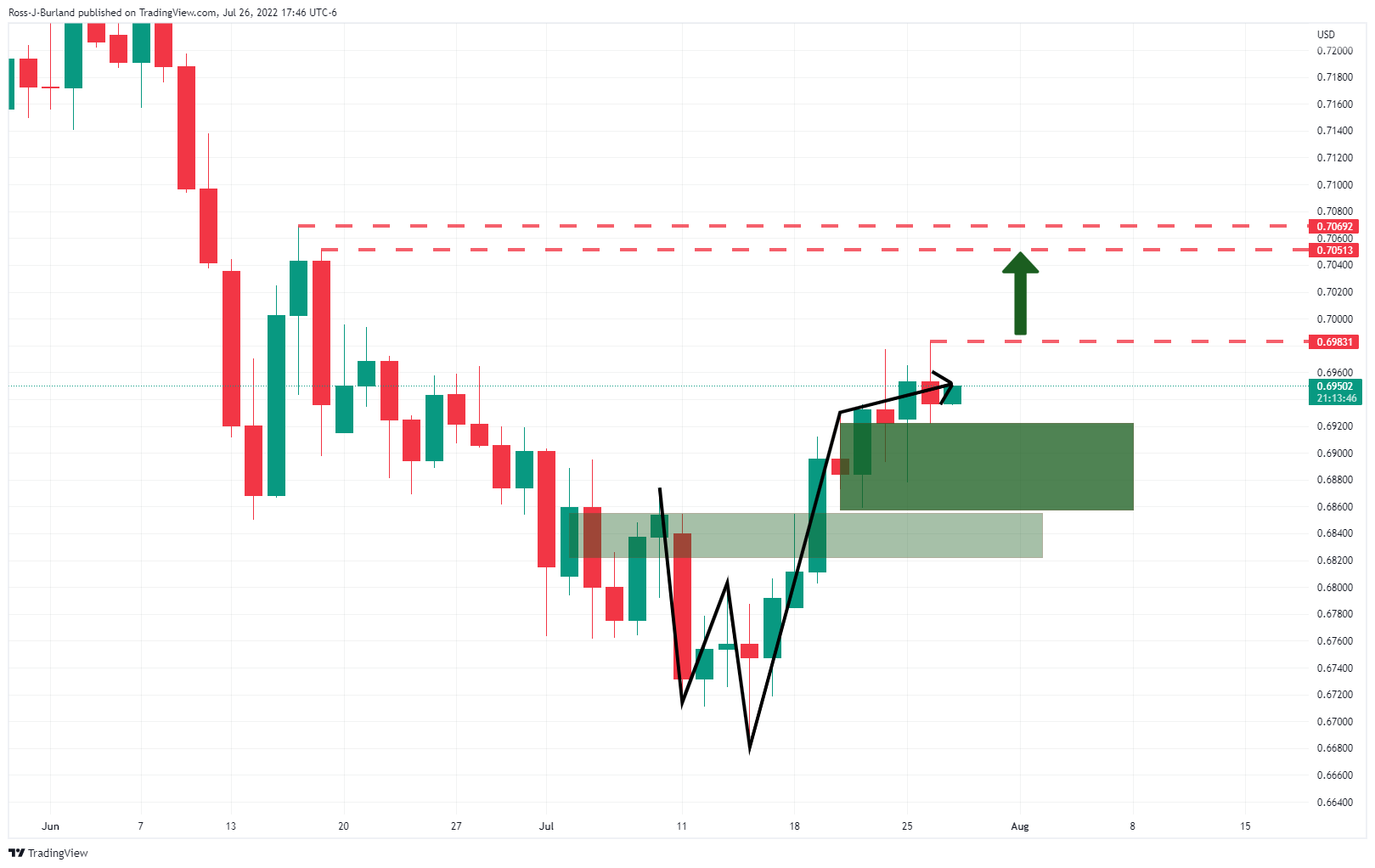

- AUD/USD bulls move in on a dovish tilt at the Fed.

- The bulls have broken a key daily resistance level and eye space in the 0.7000s ahead of the RBA.

AUD/USD is moving through a critical level on the daily chart (see below) and has reached a high of 0.7000 following a dovish outcome at the Federal Reserve. AUD/USD has climbed by over 0.8% on the day so far from a low of 0.6911 to a high of 0.7000.

The US dollar has come under pressure along with US yields which have given a lifeline to the commodities sector and US stocks following a dovish tilt at the Federal Reserve that raised rates by the expected 75bps, but lower than the 100 bps that in part had been anticipated in the face of rising inflation. However, the Fed's acknowledgement of the risks to the US economy and a moderation in the labour market going forward has put the breaks on big interest rate hike expectations among investors.

Main takeaways from the Fed statement

- The Fed says recent indicators of spending and production have softened.

- Fed says job gains have been robust, the unemployment rate has remained low.

- Fed says inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, and broader price pressures.

The Fed funds rate futures forecast 3.4% in December after a 75 basis point hike. That leaves 107 basis points of tightening for the remainder of 2022.

Traders are pricing for a more dovish outcome for the September meeting as the Fed turns data-dependent. The Fed's chairman's presser concluded in recent trade and following a cautiously optimistic tone over the US economy, with Jerome Powell warning of a softer labour market, the US dollar is down to the lows of the day at 106.279, losing 0.86% as per the DXY index.

Fed Powell key takeaways,

-

Powell speech: We want to get to 3% to 3.5% by end-2022

-

Powell speech: Time to go to a meeting-by-meeting basis

-

Powell speech: Another unusually large increase could be appropriate at next meeting

-

Powell speech: Labor market is extremely tight

-

Powell speech: Growth in consumer spending has slowed significantly

-

Powell speech: Another unusually large increase could be appropriate at next meeting

- Powell speech: Time to go to a meeting-by-meeting basis

-

Powell speech: We want to get to 3% to 3.5% by end-2022

-

Powell speech: Want to see demand running below potential for sustained period

- Powell speech: Balance sheet reduction will be picking up steam

- Powell speech: Households are in very strong shape

More to come from the US calendar

Meanwhile, traders will now look to the US growth data tomorrow and inflation readings on Friday. A positive reading for growth in Q2 following the -1.6% QoQ saar plunge in the first quarter could support the greenback as it might ''quash talk of recession, at least for the H1'', analysts at Rabobank argued. ''That said, speculation will remain as to the size and extent of any potential downturn in 2023.'' On Friday, the Fed’s favoured PCE deflator numbers will also be key.

RBA in focus

Domestically, AUD was choppy ahead of the Fed following the inflation data in the Asian session and in anticipation of an interest rate hike at next week's Reserve Bank of Australia meeting. ''We had forecast a 75bps RBA hike at next week's meeting. We now expect the Bank to hike 50bps at the meeting,'' analysts at TD Securities argued following the inflation data.

''With Q2 Aus Headline inflation underwhelming ours and street forecasts and the Fed unlikely to deliver a 100bps hike tomorrow, a 75bps RBA hike is difficult to justify. Headline inflation above 6% YoY and trimmed mean inflation at 4.9% YoY, the highest since 2003, keeps 50bps RBA hikes on the map.''

The analysis said that aside from amending their Augustcall, their rate hike path remains unchanged in 2022 - Sep +50bps, with 25bps hikes in Oct, Nov, Dec taking the year-end cash rate at 3.10%. ''Our terminal rate forecast remains unchanged at 3.35%, but is now reached in Feb'23, not Dec'22, as per our prior forecast.''

AUD/USD technical analysis

As per the prior analysis, AUD/USD Price Analysis: Bulls eye a break of 0.6980 or face a move lower, the bulls have indeed moved through the resistance and now can target higher.

AUD/USD, daily chart, prior analysis:

From a 4-hour perspective, below, the price has almost completely mitigated the price imbalance between 0.7003 and 0.7013 which now leaves the scope for a bearish correction in the immediate future, prior to the next bullish impulse.

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"Going forward, we have seen a slowing in spending, beginnings of perhaps slight lessening in tightness of labor market."

"We understand goal of soft landing is very challenging, has become more so in recent months."

"I am gratified that markets have been orderly."

"From financial stability perspective, we have a well-capitalized banking system."

"Households are in very strong shape."

"So from that standpoint on financial stability, you have a decent picture."

"That's not to say, lower income households are not suffering."

"We're seeing real declines in food consumption."

"It is our job, unconditionally, to provide price stabilty."

"There will likely be some softening in labor market conditions ahead."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"No one can be sure on whether we can achieve a soft landing."

"Balance sheet reduction is working fine, markets have accepted it, and should be able to absorb it."

"Balance sheet reduction will be picking up steam."

"Getting down to new balance sheet equilibrium could take 2 - 2.5 years."

"Markets seem to have confidence in the Fed's commitment to 2% inflation."

"Broader financial conditions have tightened a good bit."

"We're going to get our policy rate to level where we are confident inflation will come down to 2%."

"We'll be watching financial conditions to see they are appropriately tight."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- USD/CAD is under pressure on the back of a dovish tilt at the Fed.

- The Fed's chairman, Powell, is taking questions over the economy which has weighed on yields and the US dollar.

USD/CAD is under pressure over the Federal Reserve event. The greenback has been sold off and commodities are rising as risk appetite flows through the markets. US stocks and oil have rallied as the Fed is expected to slow its pace of tightening in anticipation of slower jobs creation and softening in labour market conditions. At the time of writing, USD/CAD is trading at 1.2832, down some 0.4% on the day falling from a high of 1.2911 to a low of 1.2829 so far.

Main takeaways from the statement

- The Fed says recent indicators of spending and production have softened.

- Fed says job gains have been robust, the unemployment rate has remained low.

- Fed says inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, and broader price pressures.

The Fed funds rate futures forecast 3.4% in December after a 75 basis point hike. That leaves 107 basis points of tightening for the remainder of 2022.

Traders are pricing for a more dovish outcome for the September meeting as the Fed turns data-dependent. Investors are monitoring the Fed's chairman's presser who is coming across as cautiously optimistic for the US economy but is warning of a softer labour market. He sees a slowing in demand going forward in the economy.

Fed Powell key takeaways, so far

-

Powell speech: We want to get to 3% to 3.5% by end-2022

-

Powell speech: Time to go to a meeting-by-meeting basis

-

Powell speech: Another unusually large increase could be appropriate at next meeting

-

Powell speech: Labor market is extremely tight

-

Powell speech: Growth in consumer spending has slowed significantly

-

Powell speech: Another unusually large increase could be appropriate at next meeting

- Powell speech: Time to go to a meeting-by-meeting basis

-

Powell speech: We want to get to 3% to 3.5% by end-2022

- Powell speech: Want to see demand running below potential for sustained period

The week has just got going

This all comes ahead of tomorrow's second quarter Gross Domestic Product which could turn the screw on the US dollar is it comes in lower than expected. ''We look for US output to have contracted for a second consecutive quarter following Q1's 1.6% AR retreat,'' analysts at TD Securities. ''We expect Q2 growth to be particularly impacted by a large drag from the inventories component. Despite likely registering a second consecutive decline, we don't think the US economy is in a recession. We also look for the ECI to post a 1.1% QoQ gain, a tad lower from Q1.''

On the other hand, a positive reading for growth in Q2 following the -1.6% QoQ saar plunge in Q1 would quash talk of recession, at least for the H1, analysts at Rabobank argued. ''That said, speculation will remain as to the size and extent of any potential downturn in 2023.''

On Friday, the Fed’s favoured PCE deflator numbers will also be key.

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"We will watch both CPI and PCE, but we think PCE is the best measure of inflation."

"There is a slowing in demand in Q2."

"At same time, there is a tight labor market."

"We think demand is moderating, but not sure yet by how much."

"Money still on household balance sheets, labor market still robust."

"We want to see demand running below potential for a sustained period."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"Our thinking is that we want to get to a moderately restrictive level by end of this year."

"That means 3% to 3.5%."

"Last inflation report was worse than expected."

"My view of terminal rate, as for all participants, has evolved."

"By September, we'll have more inflation data in hand."

"Very hard to say with any confidence what the economy will be like in 6-12 months."

"So, can't predict monetary policy rate range for next year."

"There is significantly more uncertainty now than usual."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- The US Federal Reserve hiked rates by 75 bps.

- The central bank acknowledged that spending and production “softened.”

- USD/JPY: Tumbled to 136.80s as a reaction to the headline, but remains volatile, just below the 20-day EMA.

The USD/JPY slumped during the North American session after the Federal Reserve increased the Federal funds rate (FFR) by 75 bps in line with expectations. The Fed slightly tilted dovish as Powell and Co. acknowledged that spending and production softened while opening the door for further tightening. At the time of writing, the USD/JPY trades volatile in the 136.50-137.30 range.

Summary of the FOMC monetary policy statement

In the FOMC statement, policymakers conceded that production and spending had softened while the labor market remained tight. The statement’s first paragraph was perceived as dovish, as the USD/JPY slightly moved upwards while US bond yields edged lower.

Concerning inflation, Fed officials noted that inflation remains high and broadened further. The central bank expressed that the Russia-Ukraine war created further upward pressures on the already high inflation, while the central bank “strongly committed” to returning inflation to its 2 percent objective.

In the meantime, the Fed will continue reducing its balance, as planned in the Plans for Reducing the Size of the Fed’s Balance Sheet, issued in May.

USD/JPY Market’s reaction

The USD/JPY dipped below 137.00, and hit 136.83 before rallying towards 137.46. However, since then, the USD/JPY has been tumbling towards 136.60s as Fed Chair Jerome Powell has begun the Q&A session so traders might prepare for volatile swings until the end of the press conference.

Press conference here: Fed Press Conference: Chairman Jerome Powell speech live stream – July 27

USD/JPY Key Technical Levels

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"75 bps was right call in light of the data."

"But we wouldn't hesitate to make a larger move if appropriate."

"Very broad support for move at this meeting."

"Inflation has continued to disappoint."

"We've moved expeditiously to get to neutral."

"Our focus is going to continue to be on getting supply and demand in better balance."

"We will be looking at incoming data, including are we seeing a slowdown in economic activity we think we need."

"Some evidence we are seeing that now."

"We will be looking closely at inflation."

"Our mandate is for headline inflation, but we look at core as a better read."

"Will be asking if stance of policy is sufficiently restrictive to bring inflation back down to target."

"Likely full effect of rate increases has not been felt yet."

"Committee broadly feels we need to get to a moderately restrictive level."

"For September, will make decision based on data."

"Time to go to a meeting by meeting basis, not provide clear guide as before."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"Reducing balance sheet plays important role."

"Over coming months looking for compelling evidence of inflation coming down."

"We are looking for compelling evidence inflation coming down over next few months."

"Pace of increases depends on incoming data, outlook for economy."

"Another unusually large increase could be appropriate at next meeting."

"We will communicate our thinking as clearly as possible."

"Likely will be appropriate to slow pace of increases as rates get more restrictive."

"Economy often evolves in unexpected ways."

"Further surprises could be in store."

"We will strive to avoid adding to uncertainty."

"We expect a period of below-trend economic growth."

"Such outcomes necessary to achieve price stability."

"Process is likely to involve period of lower growth, softening labor market

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"Fixed investment looks to have declined in Q2."

"Labor market is extremely tight."

"Wage growth is elevated."

"Job growth is slower, but still robust."

"Labor demand is very strong, supply remains subdued."

"Inflation well above the goal."

"Overall labor market suggests underlying aggregate demand remains solid."

"Price pressures are broad."

"Although prices for some commodities have eased, there is still additional upward pressure on inflation."

"Acutely aware of significant hardship of high inflation."

"We are highly attentive to risks of inflation."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

FOMC Chairman Jerome Powell is commenting on the policy outlook following the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 2.25-2.5%.

Key quotes

"We are moving expeditiously to bring inflation down."

"We have resolve to do it."

"Economy is resilient."

"Essential we bring inflation down."

"Labor market is extremely tight, inflation much too high."

"We are continuing process of significantly reducing our balance sheet."

"Growth in consumer spending has slowed significantly."

"Some of that reflects tighter financial conditions."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- The US Federal Reserve hiked rates by 75 bps.

- The central bank acknowledged that spending and production “softened.”

- EUR/USD: Initially reacted to the downside but is seesawing around 1.0120-50.

The EUR/USD edges higher after the US Federal Reserve decided to hike rates by 75 bps, lifting the Federal funds rate (FFR) to the 2.25-2.50% range, as the US central bank acknowledged that production and spending “have softened.” At the time of writing, the EUR/USD is seesawing around the 1.0120-50 range.

Summary of the FOMC monetary policy statement

Fed officials, in their statement, acknowledged that the labor market is robust. Nevertheless, they mentioned that production and spending had taken their toll due to higher rates, which was perceived as slightly dovish per traders’ reaction.

Regarding inflation, the central bank said that inflation remains elevated and had broadened further while blaming the Russia-Ukraine war created additional upward pressures on inflation. So in reaction to that, the Federal Reserve hiked rates and anticipated that “ongoing increases in the target range will be appropriate.” Additionally, the Fed reiterated that it is “strongly committed to returning inflation to its 2 percent objective.”

In the meantime, the Fed will continue reducing its balance, as planned in the Plans for Reducing the Size of the Fed’s Balance Sheet, issued in May.

EUR/USD Market’s reaction

The EUR/USD reacted downwards to 1.0120, before rallying towards 1.0150, before settling around current price levels as Chair’s Powell press conference is about to begin.

Press conference here: Fed Press Conference: Chairman Jerome Powell speech live stream – July 27

EUR/USD Key Technical Levels

- Gold price is on the bid following a slightly dovish tilt in the Fed's statement.

- The Fed chairman's presser will likely cause greater volatility as investors seek clarity.

The gold price has rallied on the back of the Federal Reserve's interest rate decision which has weighed on the greenback and has left US yields in limbo, slightly lower now after 20 minutes post the statement's release in the 2 and 10-year yields.

XAU/USD popped to a session high of $1,727.09 from a low of $1,711.56 as the central bank downgrades the economy but remains focussed on inflation risks, as per the statement, repeating that it is `highly attentive' to inflation risks.

Main takeaways from the statement

- The Fed says recent indicators of spending and production have softened.

- Fed says job gains have been robust, unemployment rate has remained low.

- Fed says inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, and broader price pressures.

The Fed funds rate futures forecast 3.4% in December after a 75 basis point hike. That leaves 107 basis points of tightening for the remainder of 2022.

Overall, the outcome is somewhat dovish for the September meeting. The fact that the Fed is acknowledging risks to spending and production, the markets will be tuned in to the Fed's chairman's presser at the bottom of the hour for further insight and what the implications are for the labour sector.

If Powell confirms the market's lowering of rate hike expectations for later this year and early next year, that would likely cement the bearish sentiment around US yields and potentially weigh on the US dollar, lifting risk assets and commodities, including gold. With that being said, the US dollar can benefit from safe-haven flows as well in the face of a global slowdown.

''Barring a dovish scenario, we expect participants to return their attention to the massive and complacent position held by prop traders, which still hold the title as the dominant speculative force in gold,'' analysts at TD Securities said with respect to today's Fed outcome.

'' We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and that the recent rally will ultimately fade when faced with a wall of offers.''

Watch Fed Powell Live

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Fed, looking forward

''In terms of the Fed policy outlook, we don't anticipate inflation will offer any respite in the short term, keeping the Fed in check regarding expectations for additional rate hikes this year,'' analysts at TD Securities argued.

''As Fed officials have repeatedly underscored, policymakers are looking for compelling evidence that inflation is abating before pausing its ongoing tightening process. If our forecast proves correct, this can happen at the end of Q4/beginning of 2023 at the earliest.''

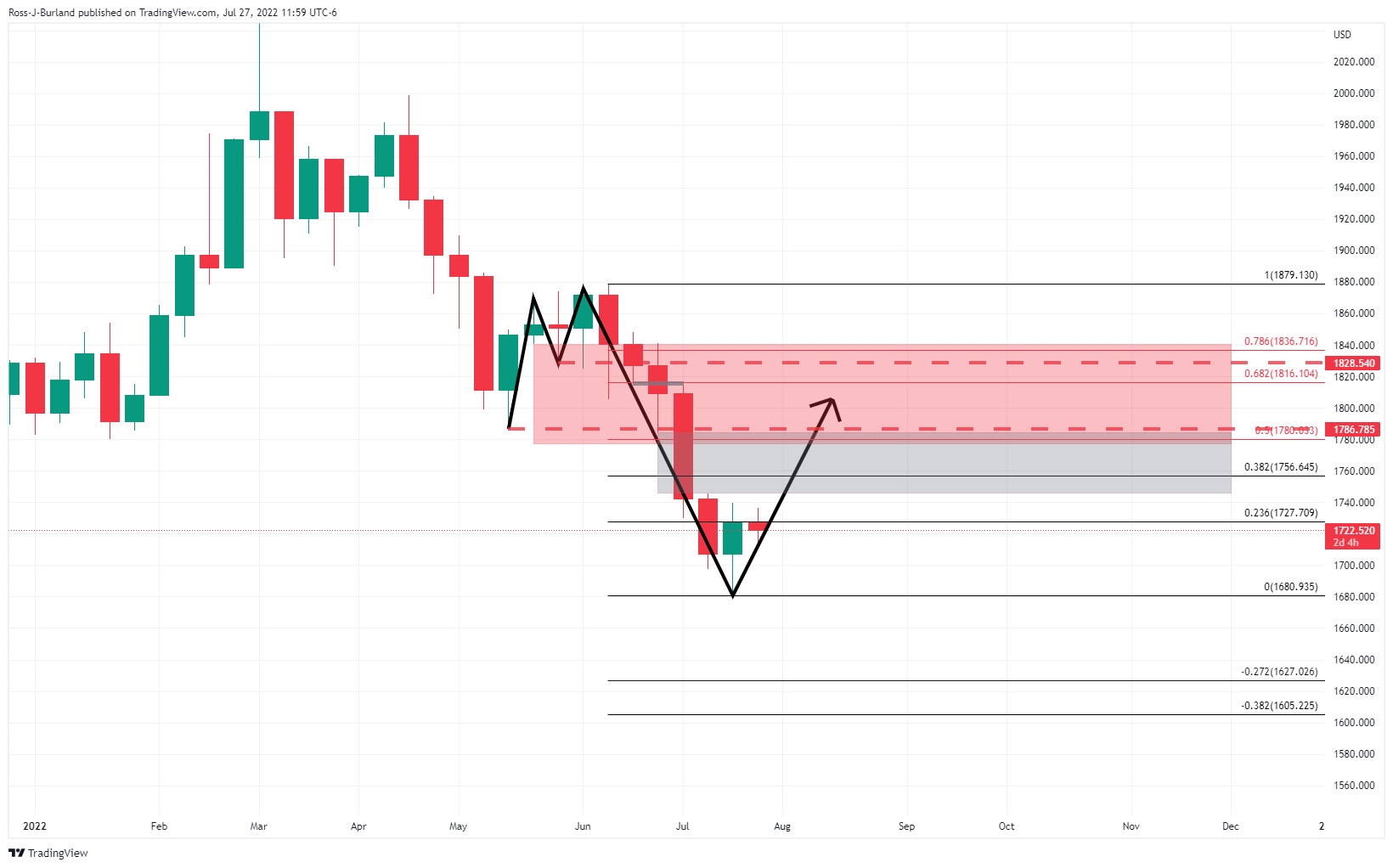

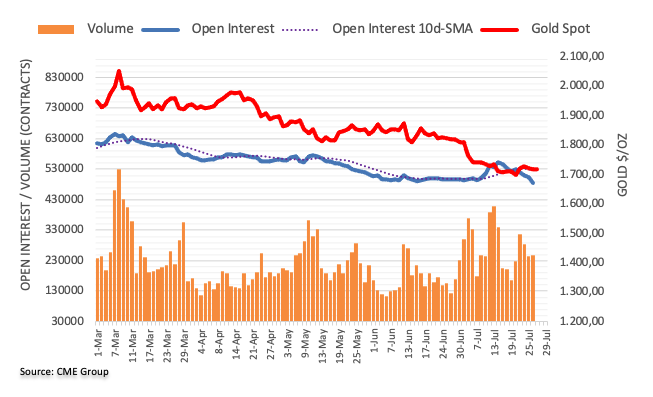

Gold, technical analysis

From a weekly perspective, the bulls are hunting down a critical area of resistance as marked out below:

The greyed areas are price imbalances that will be mitigated at some stage while the Fibonaccis align with the prior pivots.

The US Federal Reserve on Wednesday announced that it had lifted the policy rate, federal funds rate, by 75 bps to the range of 2.25-2.5%. This decision came in line with the market expectation.

In its policy statement, the Fed noted that it anticipates that ongoing increases in the policy rate will be appropriate.

Market reaction

With the immediate reaction, the dollar came under modest pressure and the US Dollar Index fell below 107.00.

Developing story...

Follow our live coverage of the Fed's policy announcements and the market reaction.

Key takeaways from policy statement via Reuters

"Recent indicators of spending and production have softened."

"Job gains have been robust, the unemployment rate has remained low."

"Inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, broader price pressures."

"Balance sheet reduction will accelerate in sept as planned, with monthly caps on runoff rising to $35 bln for MBS and $60 bln for treasuries."

"War in Ukraine creating additional upward pressure on inflation, weighing on global economic activity."

"Highly attentive to inflation risks."

"Strongly committed to returning inflation to 2% goal."

"Prepared to adjust policy as appropriate."

"Fed vote in favor of policy was unanimous."

- AUD/USD remains heavy as Fed’s decision approaches, around 0.6920s.

- Sentiment remains positive, but volatility is expected, so caution is warranted.

- ANZ Analysts expect a 50 bps rate hike by the RBA at its next meeting.

The AUD/USD slumps ahead of the FOMC monetary policy decision after hitting a daily high at 0.6957, but solid resistance ahead, with the 50-day EMA and a four-month-old downslope trendline lurking around 0.6960-68 area, sent the major down, below the July 26 low at 0.6921. At the time of writing, the AUD/USD is trading at 0.6927.

AUD/USD is heavy as traders prepare for the Fed

Traders’ mood is still positive ahead of the FOMC’s decision. US equities are trading in the green, while the greenback begins to erase its early gains and is almost flat. The US Dollar Index is at 107.220, 0.03% up. Meanwhile, the short-end of the yield curve, namely the 2-year bond yields, trims its earlier gains and sits at 3.056%, higher than the 10-year bond coupon, which sits at 2.761%, a signal that implies recession.

Earlier in the North American session, US data was released and gave mixed signals. The Department of Commerce unveiled June’s Durable Good Orders, which rose more than estimated, while the Trade Balance showed that the deficit shrank, illustrating the resilience of the US economy. Nevertheless, housing data continues to show deterioration, as May’s Pending Home Sales tumbled the most since April 2020, shrinking by 20% YoY, vs. the 13.8 contraction in the previous month.

In the meantime, during the Asian session, Australia’s Q2 CPI rose below expectations, with headline numbers at 6.1% YoY and trimmed mean at 4.9% YoY. Expectations of a Reserve Bank of Australia (RBA) 75 bps rate hike were lowered, as most market participants have fully priced in a 50 bps increase.

In a note, analysts at ANZ bank wrote, “This doesn’t change our view on the RBA’s near-term meetings, where we expect 50bp hikes. The target cash rate is still well below the RBA’s estimates of neutral, and we expect the labor market to continue tightening. This will prompt the RBA to take the cash rate above the lower bound of what it deems the neutral range. As such, we maintain our 3.35% year-end forecast.”

AUD/USD Key Technical Levels

- GBP/USD sits tight ahead of the Federal Reserve interest rate decision.

- Technically, the price is on a bullish path with a focus on the 1.22 area, but bears will be motivated by a break of 1.1963 lows.

At 1.2053, GBP/USD is higher by 0.22% and has climbed from within a range of 1.2016 and 1.2087 on the day so far in the count down to the Federal Reserve interest rate decision.

The US dollar has been [rushed and pulled this week in the build-up to the Fed outcome, juggled between the bears and bulls depending on risk sentiment. On Tuesday, it benefitted from gas woes in Europe and poor business sentiment from Germany on Monday as well as an overall gloomy outlook for world growth as forecasted by the International Monetary fund.

However, it is all about the Fed today and DXY has been trading between a low of 106.781 and 107.436 the high so far. Analysts widely expect a further 75-basis-point increase in the federal funds rate which has been priced in by the markets. The focus will be on any forward guidance on the path of monetary policy going forward, particularly in the absence of an updated Summary of Economic Projections. Federal Reserve Chairman Jerome Powell speaks at 2:30 pm ET in the presser.

Meanwhile, the bond market is already pricing in a looming recession, as seen in the inversion of two- and 10-year Treasury note yields. The short-end of the yield curve has been higher than the long end nearly all month, with the gap widening in the build-up to the Fed. Nevertheless, US stocks on Wall Street are firmer, being led by upbeat earnings and recovering from the negative sentiment surrounding profit warnings from Walmart the prior day.

Domestically, there has been no UK data but investors are second-guessing the Bank of England's next move when it meets next on August 4. Markets are pricing got The Old Lady to continue its tightening cycle with the possibility of a larger 50-bp increase.

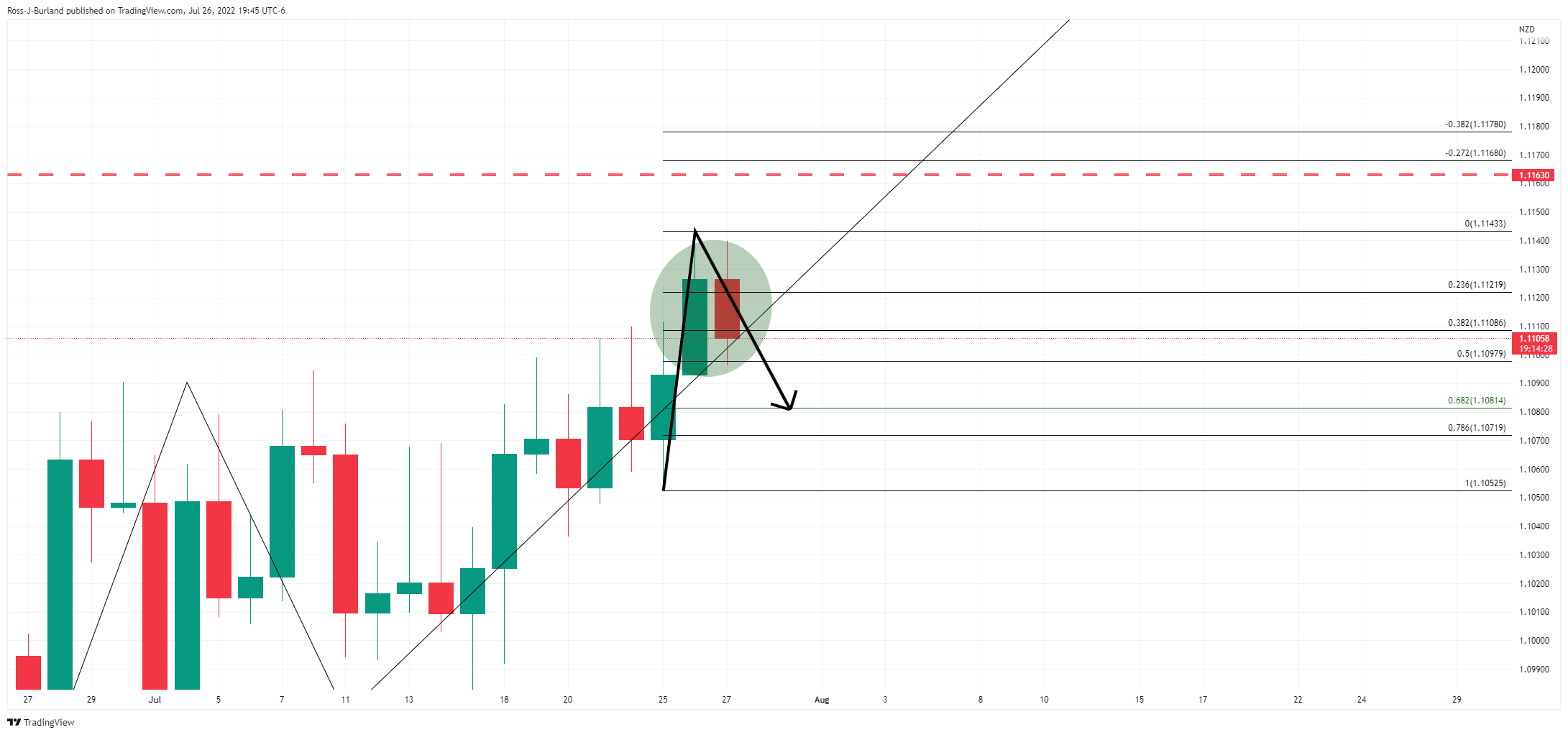

GBP/USD technical analysis

From a daily perspective, the bears will be seeking a break below 1.1963 while the bull's eye a continuation beyond 1.2090 to target the price imbalance between 1.2212 and 1.2238 which aligns with a 78.6% weekly retracement of the weekly bearish impulse:

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- EUR/GBP is losing in the week more than 1%.

- US equities are still rising, but the sentiment will turn cautious as the FOMC decision looms.

- EUR/GBP Price Analysis: In the long and near term, shifted downward biased.

The EUR/GBP tumbles for four straight days and, on its way south, breaks below the 100 and 200-day EMAs, shifting the pair bias downwards as it tests the July 13 swing low at 0.8403 amidst a positive market mood. At the time of writing, the EUR/GBP is trading at 0.8403.

Market players’ mood still hangs positive ahead of the US FOMC decision. Despite a gloomy scenario with high inflation, recession fears, although calmed but still lingering around traders’ minds, and slower economic growth, US equities are rising. In the case of the EUR/GBP, a worsening EU energy crisis has propelled the pound.

EUR/GBP Price Analysis: Technical outlook

From a daily chart perspective, the EUR/GBP pair shifted downward biased once it tumbled below the 50 and 200-day EMAs. Additionally, the Relative Strength Index (RSI) plunging within bearish territory motivated sellers to increase their positions, which piled around the weekly highs at 0.8500, sending the cross sliding 100 pips. Unless EUR/GBP buyers reclaim the 200-day EMA at 0.8439, sellers are in charge. Therefore, the EUR/GBP first support would be the 0.8400 figure. Once cleared, the cross might tumble towards the May 17 low at 0.8394, followed by May 2 daily low at 0.8367.

EUR/GBP 1-hour chart

The EUR/GBP 1-hour chart illustrates that the pair consolidates around the 0.8400-20 range, but the bias is downwards. Further reinforcing the trend is that the exchange rate is below the hourly EMAs, alongside the Relative Strength Index (RSI) below its 7-period SMA, so sellers are in control. Hence, the EUR/GBP first support would be the 0.8400 figure. Break below will expose the May 17 low at 0.8394, followed by the S1 daily pivot at 0.8378, followed by the May 2 swing low at 0.8367.

EUR/GBP Key Technical Levels

- USD/CAD extends its weekly rally to two-straight days of gains, but it is below July’s 26 high at 1.2901.

- An upbeat market mood put a lid on the USD/CAD rise as Investors prepare for the FOMC’s decision.

- US Durable Good Orders and a narrower Trade Balance, to boost the US Q2 GDP Advance on Thursday.

The USD/CAD is almost flat during Wednesday’s North American session as investors prepare for the Federal Reserve Open Market Committee (FOMC) decision. The US central bank is expected to hike rates by 75 bps, fully reflected by the rise in US 2-year Treasury yield at 3.075%. Even though a tailwind for the Loonie, the Canadian dollar stays firm due to high crude oil prices. At the time of writing, the USD/CAD is trading at 1.2886.

USD/CAD trimmed its losses despite upbeat sentiment, lifted by positive US growth-linked data

Global equities are trading with gains, reflecting an upbeat sentiment. US corporate earnings cheered by investors keep stocks higher, but as the Fed decision time looms, the mood could turn sour as traders prepare for the Fed decision. in the meantime, the greenback is firm, gaining 0.12%, as shown by the US Dollar Index at 107.320.

US economic data revealed that the Q2 Advance GDP figure might save from printing a contractionary reading. The US Commerce Department reported that Durable Good Orders for June rose more than estimations, while the Trade Balance deficit narrowed for the third straight month. It is also worth noting that inventories are keeping pace despite increasing concerns of a recession.

However, not everything was positive, with June’s Pending Home Sales tumbling by 20%, vs. -13.8% YoY, resulting from higher interest rates. Fed officials already expressed that they were expecting the housing market to slow down, as mortgage rates have doubled since the beginning of 2022, as the Fed started its tightening cycle.

On Wednesday, the USD/CAD began trading around the daily highs at 1.2884 but tumbled as oil prices increased. However, as the Fed’s decision time approaches, USD/CAD traders have begun to reduce their exposure and prepare to assess the US central bank decision.

What to watch

The Canadian economic docket is empty. Meanwhile, on the US front, the Fed’s monetary policy decision will be unveiled around 18:00 GMT, followed by Fed Chair Jerome Powell’s press conference. On Thursday, the Q2 Advance GDP will confirm if the US entered a technical recession, though market players expect a jump from Q1 -1.5% figure to 0.5% expansion.

USD/CAD Key Technical Levels

- US dollar prints fresh highs across the board before the Fed.

- FOMC expected to raise rates by 75 basis points.

- US yields await steady, near the recent lows.

A stronger US dollar on Wednesday, ahead of the critical Fed decision, boosted the USD/JPY to 137.36, the highest level since Friday. The dollar holds a positive momentum, but the next move depends on Powell and his friends.

The current bullish short-term bias will be challenged in a few minutes with the FOMC statement that will trigger volatility across financial markets. If USD/JPY remains above 137.00, it would be positive for the dollar, while below, a test of 136.20 seems granted. More losses should open the doors to a stepper correction of the long rally to test 135.55 (July 22 low).

Eyes on the Fed

The Federal Reserve is expected to hike its key interest rate by 75 basis points to 2.50% on Wednesday amid high inflation. The statement (due at 18:00 GMT), particularly hints about the next steps, will be critical for market reaction. Jerome Powell’s press conference will begin at 18:30 GMT.

US economic data released on Wednesday showed ongoing signs of economic slowdown. On Thursday is due the first estimate of Q2 GDP, that could should the second consecutive contraction.

Treasury yields await the outcome of the meeting near the recent lows. The US 10-year yield stands at 2.77%, far from the 3.07% peak of last week. If the demand for bonds strengthens after the FOMC, the USD/JPY will likely suffer. On the contrary, a rebound in yields would add fuel to the rally.

Technical levels

Data released on Wednesday included the preliminary June Durable Goods Orders report. Analsyts at Wells Fargo point out data suggest manufacturing continues to defy expectations for a slowdown in activity, “But stripping away defense orders and adjusting for inflation suggests activity is cooling.” According to them, “an ugly end to the quarter for core capital goods shipments positions a weaker Q2 for equipment spending than we anticipated, but advanced data on inventories should offset some of that weakness in tomorrow's Q2 GDP report.”

Key Quotes:

“Durable goods data continue to defy expectations for signs of a slowdown in manufacturing. That's true at least at first glance. Fresh orders for durable goods rose 1.9% in June, marking the fastest monthly change in six months. That was despite the consensus expectation for a 0.4% decline.”

“But the details on orders suggest strength can largely be tied to defense aircraft orders, which tend to be pretty volatile. Defense aircraft orders rose 80.6% during the month. Stripping that away and zooming in on private-sector activity, nondefense capital goods orders excluding aircraft were up a more muted 0.5%. Inflation chips away at that even further—a back of the hand adjustment for the 0.7% increase in producer prices for private capital equipment last month suggests the real gain in core capital goods orders was modestly negative.”

“We're becoming a bit more cautious in terms of the medium-to-long-term outlook for capex spending. We've long held the view that a more sustainable growth trajectory for manufacturing may be warranted today as producers chip away at record amounts of backlog. But the recent downward revisions to manufacturing data make that a tougher story to tell, as does the slowdown in core order backlogs.”

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to contract by 1.2% in the second quarter, up from the July 19 forecast of -1.6%.