- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-12-2022

- WTI crude oil licks its wounds near the yearly low.

- Bearish MACD signals, key resistances challenge the black gold buyers.

- Three-week-old descending support line challenges further downside.

WTI crude oil picks up bids to pare weekly losses around the lowest levels in 2022 as bulls poke the $72.00 level during Friday’s Asian session. In doing so, the black gold prints the first daily gains in six while justifying a bullish divergence between the oil prices and the Relative Strength Index (RSI) line, placed at 14.

That said, the lower low of WTI contrasts with the higher low of the RSI line and teases the commodity buyers around the multi-day low.

However, the recovery moves need validation from the late November swing lows, around $73.70, to convince oil buyers.

Even so, a three-week-old horizontal region could challenge the quote’s further upside between $75.25 and $75.75.

Additionally, acting as an upside filter is the 200-HMA level surrounding $77.90 and the $78.00 threshold.

In a case where the energy benchmark rises past $78.00, the $80.00 could act as the last defense of bears.

Alternatively, a downward-sloping support line from late November, close to $70.80, acts as the immediate challenge for the WTI bears.

Following that, the $70.00 round figure and late December 2021 low near $66.00 could lure the commodity sellers.

WTI: Hourly chart

Trend: Limited recovery expected

- USD/CHF is likely to display weakness to near 0.9350 as a risk-on impulse has hogged the limelight.

- Volatility in the currency market is accelerating as the Fed is set to announce the last monetary policy of CY2022.

- Investors have ignored uncertainty over Fed’s interest rate peak.

The USD/CHF pair has failed to extend its recovery above 0.9380 in early Asia and is declining towards the 0.9350 cushion ahead. A significant drop in safe-haven appeal led by the mounting risk appetite theme has weighed on the US Dollar Index (DXY). Volatility in the currency market is accelerating as the Federal Reserve (Fed) is set to announce the last monetary policy of CY2022 next week.

The USD Index is looking to shift its auction profile below the critical resistance of 105.00 as investors are cheering expectations of a slowdown in the pace of the interest rate hike by the Fed. Meanwhile, S&P500 is focusing more on optimism derived from expectations over a deceleration in interest rate hike pace rather and has ignored recession fears.

Fed policymakers have been favoring a return to lower rate hike culture to avoid financing risks and to give some time to the economy to heal stubborn inflation itself. Analysts at Danske Bank see a further hike in interest rates by 50 basis points (bps) and a hawkish message from Fed chair Jerome Powell for CY2023. Also, the neutral rate is expected at 5.00-5.25%.

But before that, the release of the United States inflation data will be of utmost importance. The headline inflation is seen unchanged at 7.7% while the core inflation figure could move marginally higher to 6.4% from the former release of 6.3%.

On the Swiss Franc front, investors are shifting their focus toward the interest rate decision by the Swiss National Bank (SNB), which is scheduled for next week. SNB Chairman Thomas J. Jordan is expected to return to policy easing as the inflationary pressures are marginally above the desired rate.

- NZD/USD struggles to extend three-day uptrend, eyes to snap seven-week uptrend.

- New Zealand Manufacturing Sales improved in Q3, Electronic Card Retail Sales came in mixed for November.

- Anxiety ahead of the key data/events keeps traders on dicey floor, light macro also contributes to market’s inaction.

- China inflation, US Michigan Consumer Sentiment Index will entertain traders ahead of the busy next week.

NZD/USD makes rounds to 0.6380 during Friday’s Asian session, after rising in the last three consecutive days, as mixed data from New Zealand (NZ) probes the Kiwi pair traders. Also likely to have challenged the bulls is the cautious mood ahead of the key statistics from the US and China, as well as the pair’s first weekly loss in eight.

New Zealand’s Electronic Card Retail Sales rose more than 0.2% to 0.3% MoM in November, versus 1.0% prior, whereas the YoY figures eased to 7.1% from 12.9% market consensus and 16.6% previous readings. Further, the nation’s Manufacturing Sales for the third quarter (Q3) surprised markets with 3.1% growth compared to -2.4% forecasts and -4.1% prior.

Elsewhere, the US Dollar weakness joined the likely improvement in Sino-American relations and China’s gradual easing of the Zero-Covid policy to favor the bulls. However, the fears emanating from Russia and hopes that the US economic recovery could allow the Federal Reserve (Fed) to remain hawkish in the next week seem to probe the NZD/USD bulls.

US Dollar Index (DXY) dropped for the second consecutive day on Thursday, paring the first weekly gain in three, even as the benchmark United States 10-year Treasury bond yields recovered from the lowest levels since mid-September. That said, the greenback’s gauge versus the six major currencies remains pressured around 104.80 by the press time.

The DXY losses could be linked to the recently downbeat statistics from the world’s biggest economy. On Thursday, US Initial Jobless Claims matched 230K market consensus for the week ended on December 02, versus the upwardly revised 226K prior. Further, the four-week average also printed 230K figure compared to 229K previous readings. Earlier in the week, the US Goods and Services Trade Balance deteriorated to $-78.2 billion versus $-79.1 billion expected and $-73.28 billion prior. Further, the final readings of the Unit Labour for Q3 eased to 2.4% QoQ versus 3.5% first estimations.

Elsewhere, Shanghai City Authorities mentioned that they will stop requiring Covid test checks for restaurants or entertainment venues from this Friday. On the same line, the South China Morning Post (SCMP) states that Hong Kong is ‘to ease isolation rules’ for infected travelers, with a release on the fifth day.

Also, China Premier Li Keqiang said, “Growth will continue amid the implementation of optimized pandemic policies.” The policymaker also stated, “Will keep yuan exchange rate basically stable.”

Recently, US Treasury Secretary Janet Yellen said on Thursday that "Recession is not inevitable," while also declining to say whether the dollar had peaked against other currencies.

Amid these plays, S&P 500 Futures print mild gains while Wall Street closed positive on Thursday.

Moving on, the scheduled top-tier readings from China and the United States could entertain NZD/USD traders. That said, China Consumer Price Index (CPI) is expected to repeat 0.1% MoM figure in November but is likely to ease to 1.0% YoY versus 2.0% previous readings. Further, the Producer Price Index (PPI) could decline to -1.5% compared to -1.3% prior during the stated month. Additionally, the preliminary readings of the Michigan Consumer Sentiment Index for December, expected 53.3 versus 56.8 prior, will entertain Gold traders afterward. Also important to watch will be the University of Michigan’s (UoM) 5-year Consumer Inflation Expectations for the said month, 3.0% previous readings.

Technical analysis

NZD/USD pair’s rebound from 0.6300 enables it to again aim for the 0.6470-75 key hurdle, comprising tops marked in August and December.

“The Bank of England will add another 50 basis points to Bank Rate next week and take borrowing costs to 3.50%, despite the economy falling into recession, as it battles inflation running at more than five times its target,” stated the latest survey from Reuters.

Key findings

One of the first major central banks to start unwinding the ultra loose policy adopted globally during the pandemic, the BoE went for a 75 bp lift last month but was expected to add a more modest 50 on Dec. 15 according to all but two of the 54 economists surveyed Dec. 5-7.

Only two economists expected a 75 bp increase next week compared to 13 of 56 in the Nov. 23 poll.

The U.S. Federal Reserve is also expected to shift down to a 50 bp move this month after four consecutive 75 bp increases, a separate Reuters poll found.

After next week's move, the BoE will add another 50 bps in the first quarter and 25 bps in the second, with medians showing Bank Rate peaking at 4.25% then. Forecasts for the terminal rate ranged from 3.50% to 4.75%.

In last month's survey, Bank Rate was expected to peak at 4.25% next quarter and there was a big divide between economists in the latest survey as to when and where it would level out.

Quarterly forecasts suggest the economy shrank 0.2% last quarter and will do so by 0.4% in this one, meeting the technical definition of recession. It will then contract 0.4%, 0.4% and 0.2% in the first three quarters of next year.

A majority of respondents to another question said the recession would be long and shallow.

Those forecasts were little changed from last month but when asked about the risks to their GDP forecasts, 12 of 18 said it was to the downside. Across this year the economy was predicted to expand 4.4% but then contract 0.9% next year before returning to 0.9% growth in 2024.

Inflation was seen peaking at 10.9% this quarter, higher than the 10.7% estimate given last month before drifting down. However, it won't reach the Bank's 2.0% goal until the third quarter of 2024.

Also read: GBP/USD eyes more gains above 1.2250 amid upbeat market mood, UK GDP eyed

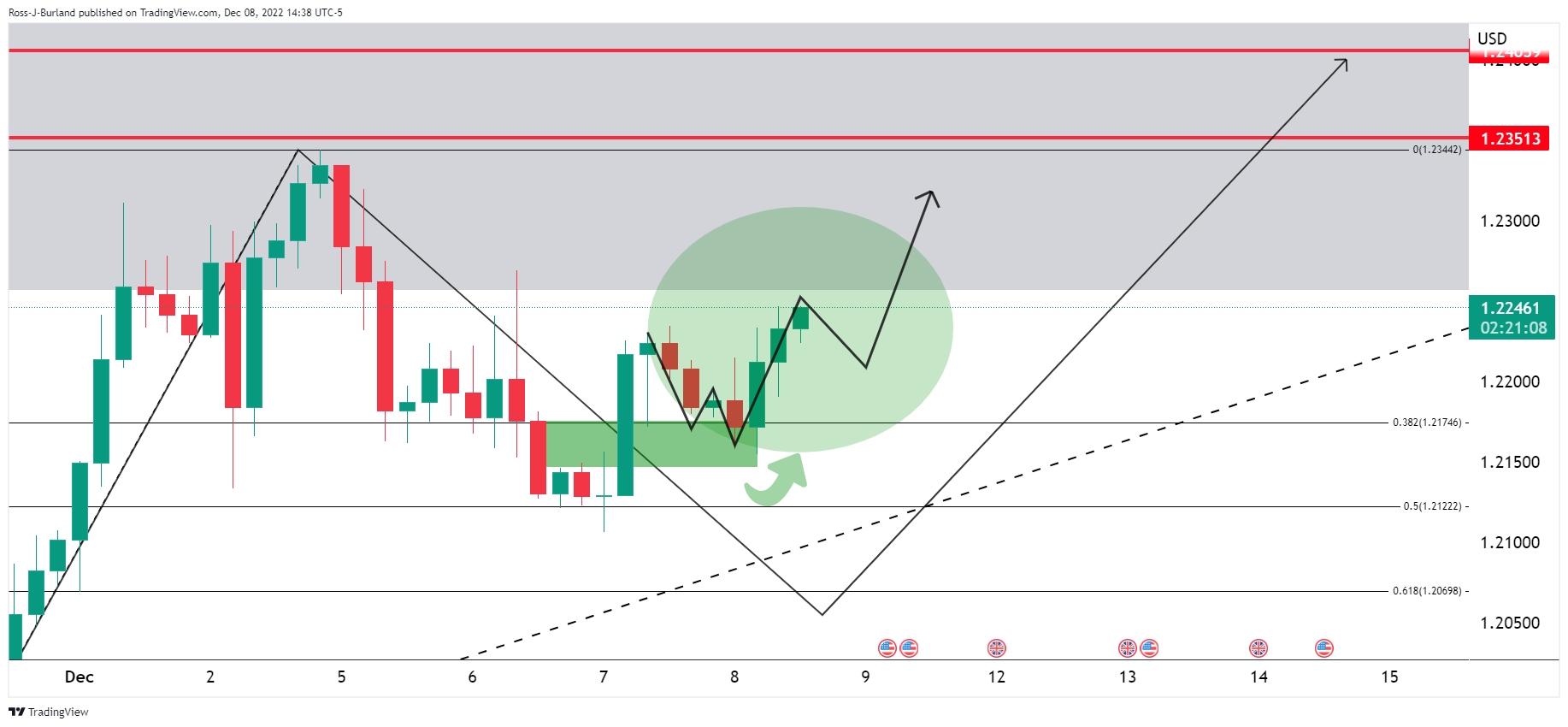

- GBP/USD is aiming to overstep the 1.2250 hurdle on expectations of slowdown in Fed’s rate hike pace.

- The BOE is set to hike rates further by 50 bps despite the economy falling into recession.

- S&P500 snapped a three-day losing streak as investors shrugged off recession fears.

The GBP/USD pair is gathering momentum to surpass the immediate hurdle of 1.2250 in the early Tokyo session. The Cable is displaying a sideways auction profile after sustaining above the round-kevel resistance of 1.2200. Positive market sentiment has tilted bias for more upside in the Cable ahead. The US Dollar Index (DXY) is expected to remain on the tenterhooks as investors are shifting their focus to the monetary policy meeting by the Federal Reserve (Fed), which is due next week.

S&P500 snapped a three-day losing streak and recovered firmly after investors shrugged off recession fears. The 10-year US Treasury yields followed optimism in US equities and escalated to 3.49%.

The Pound Sterling is likely to remain in action as investors are awaiting the release of the monthly Gross Domestic Product (GDP) data, which will release on Monday. As per the estimates, the United Kingdom GDP data will improve to 0.1% contraction vs. the prior 0.5% contraction. Apart from that, Industrial and Manufacturing Production figures will be of utmost importance.

Key trigger that will bring power-pack action in the Pound Sterling is the interest rate decision by the Bank of England (BOE). A poll on interest rate hike expectations by the BOE taken by Reuters speaks that the Bank of England will add another 50 basis points (bps) next week and take borrowing costs to 3.50%, despite the economy falling into recession.

On the United States front, rising expectations of a slowdown in an interest rate hike by the Federal Reserve (Fed) are weighing on the US Dollar. Fed chair Jerome Powell is expected to decelerate the current pace of interest rate hike and will announce a 50 bps addition in borrowing costs.

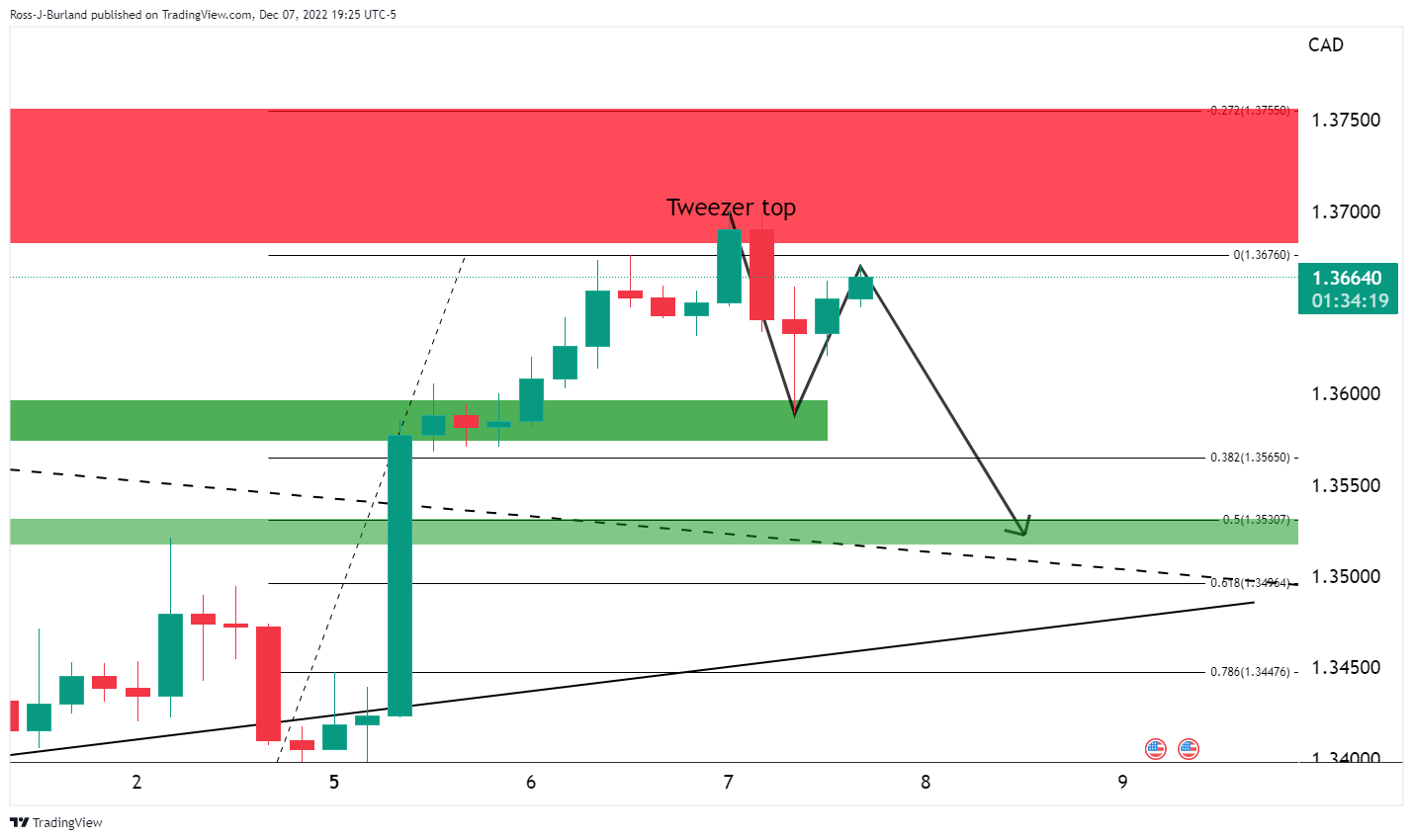

- USD/CAD licks its wounds after the biggest daily loss in over a week.

- 50-DMA restricts immediate downside but bearish Doji candlestick, seven-week-old resistance line probe bulls.

- Ascending trend line from mid-November puts a strong floor under the prices.

USD/CAD seesaws around 1.3600 as bearish take a breather during early Friday morning in Asia, after the heaviest slump in eight days.

The Loonie pair’s previous fall could be linked to the bearish Doji candlestick, as well as the U-turn from the seven-week-old downward-sloping resistance line.

However, the bullish MACD signals and the 50-DMA level surrounding 1.3560 challenge the quote’s immediate downside.

In a case where the USD/CAD bears manage to conquer the 50-DMA support, the 38.2% Fibonacci retracement level of the pair’s August-October upside, near 1.3500 threshold, will be on their radars.

Even so, the pair buyers remain hopeful unless witnessing a clear downside break of an ascending support line from the mid-November, at 1.3430 by the press time.

Meanwhile, recovery moves not only need to cross the aforementioned nearby resistance line figures of 1.3665 but also cross the stated Doji’s top of 1.3700 to convince USD/CAD buyers.

Following that, a quick run-up towards the previous monthly peak surrounding 1.3810 can’t be ruled out.

Though, multiple levels surrounding 1.3850 and 1.3900 can test the USD/CAD bulls afterward, before directing them to the yearly high marked in October near 1.3980.

USD/CAD: Daily chart

Trend: Limited downside expected

- AUD/USD is oscillating below 0.6800, more upside seems favored amid the risk appetite theme.

- The commentary from Janet Yellen that the US could avoid recession has supported bond yields.

- Lower inflation print could force PBOC to call for more policy easing ahead.

The AUD/USD pair is displaying back-and-forth moves below the critical hurdle of 0.6800 in the early Asian session. The Aussie asset has turned sideways as investors are awaiting the release of China’s Consumer Price Index (CPI) data. The Australian Dollar stretched its recovery firmly on Thursday after surpassing the critical resistance of 0.6740 as the risk-on impulse regained its glory.

Meanwhile, the US Dollar Index (DXY) is oscillating below the 105.00 support as investors shrugged off United States recession-inspired uncertainty that led to a decline in safe-haven’s appeal. A decent recovery in S&P500 on Thursday after a three-day weakness spell showed investors have discounted further interest rate hike by the Federal Reserve (Fed).

The 10-year US bond yields have accelerated to near 3.49% after a sell-off as commentary from US Treasury Secretary Janet Yellen trimmed recession risks. Yellen said the US can avoid recession, given that there is no wage-price spiral and supply chain bottlenecks are starting to ease, as reported by Reuters.

Going forward, investors are shifting their focus toward the United States CPI data, which will release on Tuesday. As per the consensus, the headline CPI is expected to remain steady at 7.7% while the core CPI that excludes food and oil prices could inch higher to 6.4% from the prior release of 6.3%. Recent jump in labor additions and upbeat demand in the service sector justify higher consensus for core inflation figure.

On the Australian front, the release of the China CPI will be keenly watched. As per the projections from economists at TD Securities, the annual inflation data could decline to 1.5% from the former release of 2.1%. This may force the People’s Bank of China (PBOC) to adopt an extreme dovish stance on interest rates. It is worth noting that Australia is a leading trading partner of China and the injection of liquidity into the Chinese economy will also support the Australian Dollar.

- Gold price extends three-day uptrend to reverse Monday’s heavy losses.

- Firmer sentiment, downbeat United States statistics weighed on the US Dollar.

- Optimism surrounding China Covid conditions adds strength to Gold price.

- China inflation numbers, US Michigan Consumer Sentiment Index and 5-year Consumer Inflation Expectations in focus.

Gold price (XAU/USD) grinds higher towards $1,800 as broad US Dollar weakness and optimism surrounding China favors the metal buyers ahead of the key data from Beijing and the United States. Even so, the bullion remains on the way to printing the first weekly loss in three as it seesaws around $1,790 during the early hours of Friday’s Asian session.

US Dollar fails to trace United States Treasury bond yields and favor Gold buyers

US Dollar Index (DXY) dropped for the second consecutive day on Thursday, paring the first weekly gain in three, even as the benchmark United States 10-year Treasury bond yields recovered from the lowest levels since mid-September. That said, the greenback’s gauge versus the six major currencies remains pressured around 104.80 by the press time.

The DXY losses could be linked to the recently downbeat statistics from the world’s biggest economy. On Thursday, US Initial Jobless Claims matched 230K market consensus for the week ended on December 02, versus upwardly revised 226K prior. Further, the four-week average also printed 230K figure compared to 229K previous readings. Earlier in the week, the US Goods and Services Trade Balance deteriorated to $-78.2 billion versus $-79.1 billion expected and $-73.28 billion prior. Further, the final readings of the Unit Labour for Q3 eased to 2.4% QoQ versus 3.5% first estimations.

Even so, US Treasury Secretary Janet Yellen said on Thursday that "Recession is not inevitable," while also declining to say whether the dollar had peaked against other currencies.

Optimism surrounding China also propels XAU/USD

China runs down on its Zero-Covid policy and propels the Gold price due to its status as one of the world’s key Gold consumers. On Thursday, Shanghai City Authorities mentioned that they will stop requiring Covid test checks for restaurants or entertainment venues from this Friday. On the same line, the South China Morning Post (SCMP) states that Hong Kong is ‘to ease isolation rules’ for infected travelers, with a release on the fifth day.

Following the announcements, China Premier Li Keqiang said, “Growth will continue amid implementation of optimized pandemic policies.” The policymaker also stated, “Will keep yuan exchange rate basically stable.”

An active day before the key week

After witnessing a few days of inaction and mixed clues, mainly due to a light calendar, Friday could entertain Gold traders with the scheduled top-tier readings from China and the United States.

Firstly, China Consumer Price Index (CPI) is expected to repeat 0.1% MoM figure in November but is likely to ease to 1.0% YoY versus 2.0% previous readings. Further, the Producer Price Index (PPI) could decline to -1.5% compared to -1.3% prior during the stated month.

That said, the preliminary readings of the Michigan Consumer Sentiment Index for December, expected 53.3 versus 56.8 prior, will entertain Gold traders afterward. Also important to watch will be the University of Michigan’s (UoM) 5-year Consumer Inflation Expectations for the said month, 3.0% previous readings.

It should be noted that the geopolitical fears emanating from Russia and the latest passage of the bill to help Taiwan with weapons by the US Congress seem to challenge the XAU/USD traders ahead of the key week comprising multiple central bank meetings.

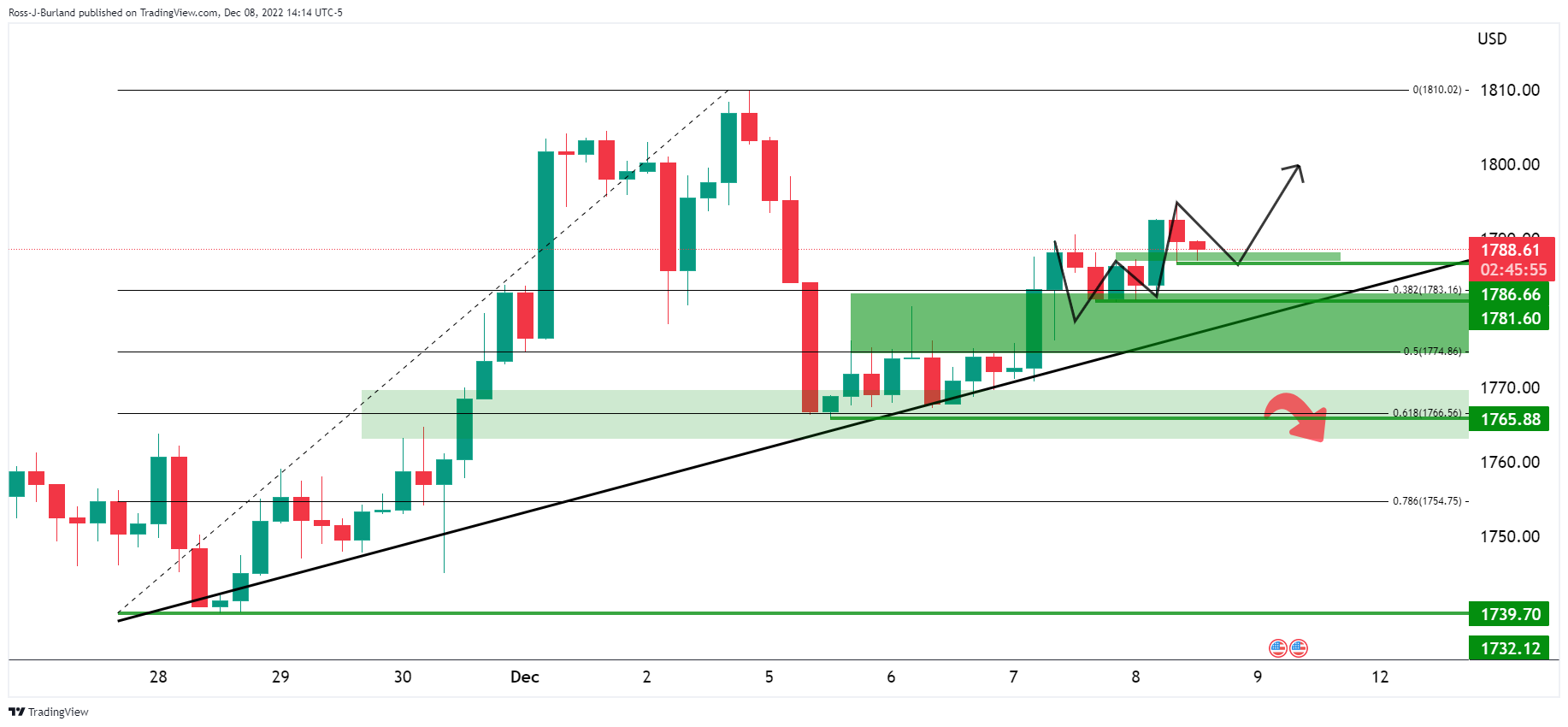

Gold price technical analysis

Gold price portrays a rising wedge bearish chart formation on the four-hour play. However, the firmer Relative Strength Index (RSI) line, placed at 14, as well as bullish signals from the Moving Average Convergence and Divergence (MACD) indicator, keeps the XAU/USD buyers hopeful.

That said, the $1,800 threshold and the weekly high, as well as the monthly peak, surrounding $1,810 appear as the immediate levels that lure the Gold buyers. Though, the upper line of the stated wedge, close to $1,816 at the latest, could question the metal’s further advances.

In a case where the quote rises past $1,816, the odds of witnessing a run-up toward the mid-June high near $1,858 can’t be ruled out.

On the flip side, a convergence of the 50-Exponential Moving Average (EMA) and lower line of the wedge, around $1,777, appears the key support to watch during the fresh declines of the Gold price.

Also acting as an important support is the horizontal area comprising October’s high and late November swing low, close to $1,730-32.

Overall, Gold price grinds higher inside a bearish chart pattern.

Gold price: Four-hour chart

Trend: Limited upside expected

- EUR/USD is eying more upside towards a weekly high at 1.0600 amid a cheerful market mood.

- The US Treasury yields have extended their gains to near 3.49% as the Fed is set to hike the interest rate further.

- The ECB is looking to hike interest rates by 50 bps next week.

The EUR/USD pair climbed above the psychological hurdle of 1.0500 in the New York session and is aiming to sustain above the same ahead. The major currency pair is expected to kiss a weekly high around 1.0600 amid a significant improvement in the risk appetite of the market participants.

Meanwhile, the US Dollar Index (DXY) has slipped below the round-level cushion of 105.00 as investors have shrugged off uncertainty about a recession situation in the United States economy. S&P500 recovered sharply on Thursday after three consecutive bearish trading sessions, portraying a recovery in the risk-on profile. The 10-year US Treasury yields have extended their gains to near 3.49% as the Federal Reserve (Fed) is set to hike the interest rate next week.

As the inflation rate is extremely far from the desired rate of 2% and the Fed has yet not reached the neutral rate, continuation of policy tightening is highly expected. Analysts at Danske Bank see a further hike in interest rates by 50 basis points (bps) and a hawkish message from Fed chair Jerome Powell for CY2023. Also, the neutral rate is expected at 5.00-5.25%.

On Friday, investors will focus on the release of the five-year Consumer Inflation Expectation data. A de-anchored inflation data could accelerate recession fears in the US economy as it will force Fed policymakers to look more at a higher interest rate peak than current projections.

Meanwhile, Eurozone investors are shifting their focus toward the interest rate decision by the European Central Bank (ECB), which will be announced next week. Analysts at Rabobank think that the ECB is likely to raise the policy rate by 50 basis points in December but note that they are not fully discounting the possibility of a 75 bps hike. They have forecasted a terminal rate at 3%.

Reuters reports that the US Treasury Secretary Janet Yellen on Thursday said the Biden administration was listening to concerns raised by European allies over the US Inflation Reduction Act, a $430 billion green energy subsidy package.

Many European Union countries fear their companies will be unfairly disadvantaged by the subsidies contained in the new law.

"We will look at what is legal and what is feasible," Yellen told reporters.

Yellen said the US can avoid recession, given that there is no wage-price spiral and supply chain bottlenecks are starting to ease.

"Recession is not inevitable," Yellen told reporters. She declined to say whether the dollar had peaked against other currencies.

- NZD/USD bulls stay in charge on the softness in the US Dollar.

- USD data will be key in the build-up to the Fed next week.

NZD/USD is up on the day as the US Dollar bulls fold ahead of key data in the build-up to the Federal Reserve (Fed) meeting next week. The Kiwi has rallied from a low of 0.6326 and reached a high of 0.6388 with the US Dollar touching its lowest level since Monday as per the DXY index.

The index eased to a low of 104.724 while investors positioned themselves ahead of key US inflation data on Friday and next week. The slide in the greenback comes at the same time a rise in weekly jobless claims suggested that the labour market is slowing down. Weekly jobless claims rose to 230K, as expected. Continuing claims rose to 1.671M, topping the forecast of 1.6M and the data comes ahead of next week's Federal Reserve meeting.

The data falls ahead of Friday's Producer Price Index (PPI) and the University of Michigan's consumer sentiment survey and then next week's November Consumer Price Index will be due. Investors w look for any signs that the Federal Reserve is getting ready to pause its hikes.

Domestically, local data today will give a final steer on how third quarter Gross Domestic Product GDP (due next week) is shaping up, but analysts at ANZ Bank said it is unlikely to perturb FX markets much. As with most of the year, the focus is offshore, they said.

''In that regard, tonight’s US PPI data will be interesting, as it’ll highlight any upstream pressures in CPI, due out next week – which, recall, was the main catalyst for the turn in the USD last month. We thus continue to brace for volatility, especially with US 10yr bond yields now 1% below where we expect the fed funds rate to be after next week’s decision as markets all but ignore hawkish elements of Fed rhetoric. Buckle up!''

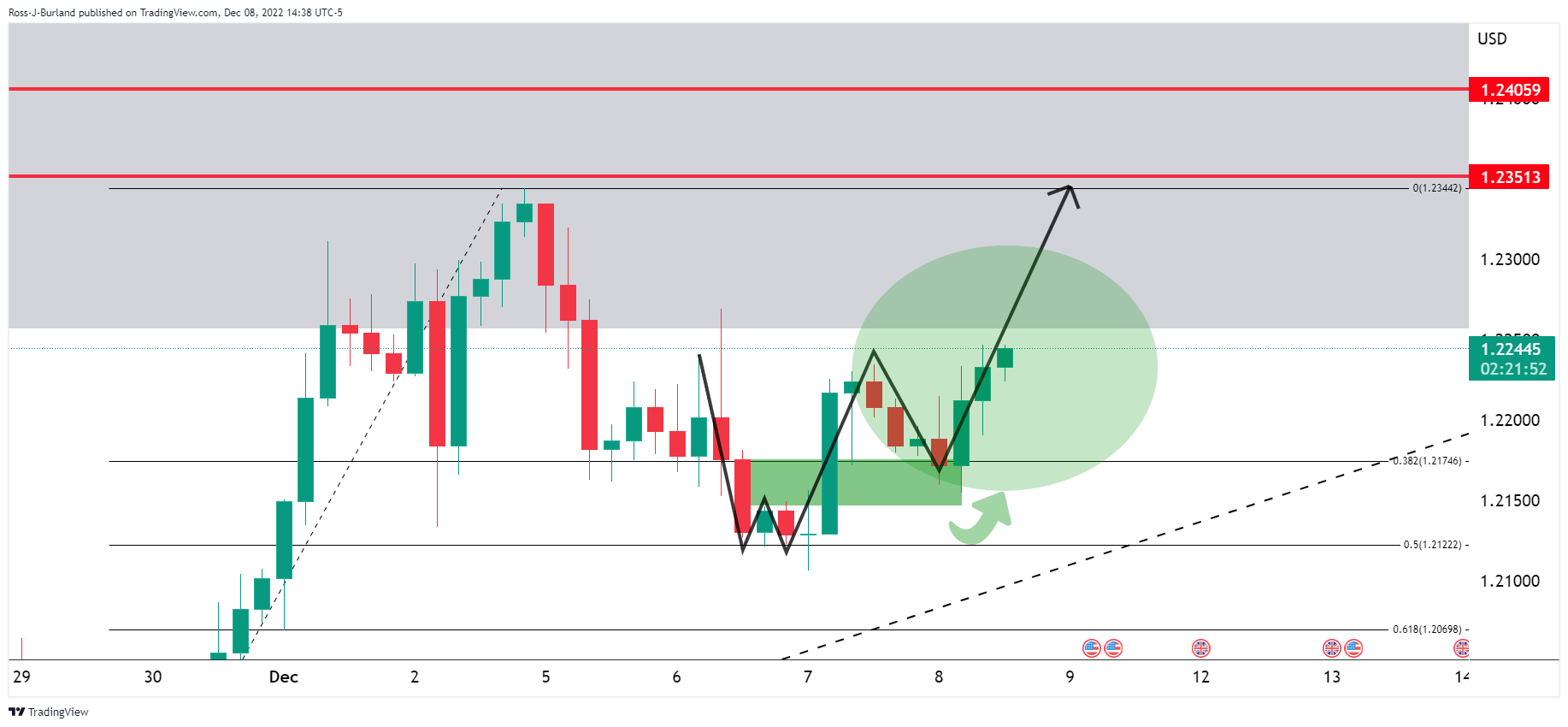

- GBP/USD's combination of harmonic patterns is a bearish feature.

- A trip into the Fibonacci scale could be on the cards for the remainder of the week with 1.22 eyed.

In the prior analysis, GBP/USD Price Analysis: Bulls in control and eye 1.2350, it was explained that the bulls took out a key resistance and so long as 1.2150 holds, there would be prospects of a rally towards 1.2350 and then 1.2450 for the days ahead:

GBP/USD prior analysis

GBP/USD update

The price respected the support area and subsequently moved higher. However, another W-formation has formed which could see the Gold price move into the neckline prior to the next bullish impulse:

GBP/USD M10 chart

The combination of the harmonic patterns is a bearish feature for the near term and a trip into the Fibonacci scale could be on the cards for the remainder of the week with 1.22 eyed.

What you need to take care of on Friday, December 9:

The better tone of US stocks weighed on the American Dollar. The USD finished the day with losses against most of its major rivals, shedding most ground early in the US session, and spending the rest of it in consolidation mode.

Volatility decreased amid the absence of first-tier figures and ahead of central banks’ decisions next week, as speculative interest lacks certainties about their next moves on monetary policy. The US Federal Reserve, the European Central Bank, the Switzerland National Bank and the Bank of England will provide monetary policy updates next week.

The EUR/USD pair trades at around 1.0540, while GBP/USD is up to 1.2235. AUD/USD advanced for a second consecutive day and hovers around 06760.

Bank of Canada Deputy Governor Sharon Kozicki said the bank will study the latest economic data to gauge whether or not to raise interest rates, adding it would move forcefully if necessary. The Canadian Dollar strengthened, with USD/CAD down to 1.3580.

The USD/JPY saw little action and finished the day little changed at around 136.70. The USD/CHF is down to 0.9360.

Gold posted a modest intraday advance and trades around $1,787 a troy ounce. Crude oil prices, on the other hand, kept falling with WTI trading at $71.60 a barrel.

Friday will start with China publishing the November Consumer Price Index and the Producer Price Index. Later in the day, it will be the turn of the US to unveil wholesale inflation. The US PPI is expected to have risen by 7.4% YoY in November, down from 8% in the previous month.

Like this article? Help us with some feedback by answering this survey:

- Gold bulls eye a run towards $1,800 from W-formation neckline support.

- All eyes will be on the Federal Reserve next week and key data before then.

Gold price is up on the day by some 0.22% after rising from a low of $1,781 to a high of $1,794.88 so far on Thursday. Markets have been relatively quiet on the day with little data released and the Federal Reserve in a blackout. Nevertheless, The US dollar eased, while investors positioned themselves ahead of key US inflation data and the Federal Reserve's policy meeting due next week.

The US Dollar index, as measured by the DXY index, fell 0.4% from a high of 105.433 to a low of 104.724, making gold less expensive for other currency holders. The dip came at the same time a rise in weekly jobless claims suggested that the labour market is slowing down. Weekly jobless claims rose to 230K, as expected. Continuing claims rose to 1.671M, topping the forecast of 1.6M and the data comes ahead of next week's Federal Reserve meeting.

There will be more key data events coming up before the Federal Reserve December 14 meeting. The Producer Price Index and the University of Michigan's consumer sentiment survey on Friday as well as November's Consumer Price Index are due. Investors will be on the watch for any signs that the Federal Reserve is getting ready to pause its hikes.

Fed expectations

Meanwhile, money markets show there is a 91% chance that the policy-setting Federal Open Market Committee (FOMC) will raise rates by half a point next week, and just a 9% chance there will be another 75 basis point increase with the rates peaking in May 2023 at 4.92%. The US Federal Reserve has already raised its policy rate by 375 basis points this year in the fastest hikes since the 1980s.

Meanwhile, supportive of the Gold price, safe haven assets were in strong demand amid growing recessionary fears this week as seen in the thirty-year Treasuries that dropped more than 10bp to a three-month low while yields on the 10-year were also lower. The yield curve between the 2-year and 10-year Treasury notes US 10-year has also widened in recent days.

Gold technical analysis

The daily charts above show the Gold price correcting in the harmonic formation although it has started to decelerate below the key $1,800s. On the 4-hour chart below, the Gold price is attempting to move higher and so long as the W-formation's neckline holds, there will be prospects of an upside continuation:

Deputy Governor Sharon Kozicki said in a speech in Montreal that the Bank of Canada will in study the latest economic data to gauge whether or not to raise interest rates, adding it would move forcefully if necessary.

Key Quotes

"We expect our decisions will be more data-dependent," Deputy Governor Sharon Kozicki said in a speech in Montreal, adding the bank is still prepared to be "forceful" with rates.

"We are moving from how much to raise interest rates to whether to raise interest rates."

"With the labor market still tight and businesses still finding it easy to raise their prices, Governing Council agreed that the economy still needs a more sustained moderation of demand," Kozicki said.

USD/CAD update

At the time of writing. USD/CAD is trading at 1.3581 and down by over 0.5%. The Canadian Dollar has been tracking oil higher this week and has been boosted by the central bank lifting rates at a record pace of 400 basis points in nine months to 4.25% - a level that was last seen in January 2008. However, the BoC also signalled this week that its unprecedented tightening campaign was near an end, dropping language that said they would have to rise further.

- EUR/USD bulls rally on Federal Reserve and European Central Bank prospects.

- United States economic data weighed on the US Dollar with more to come before the Federal Reserve,

- EUR/USD bulls are firming from near 1.0480 support and are taking on resistance around 1.0570.

EUR/USD is firmly higher on Thursday due to diminishing expectations for the Federal Reserve (Fed) to keep raising interest rates at the same aggressive pace. A rise in weekly jobless claims suggests that the labour market is slowing down. EUR/USD is currently 0.38% higher having rallied from a low of 1.0489 to a high of 1.0564 on the day so far.

Federal Reserve expectations

Weekly jobless claims rose to 230K, as expected. Continuing claims rose to 1.671M, topping the forecast of 1.6M and the data comes ahead of next week's Federal Reserve meeting. Money markets show there is a 91% chance that the policy-setting Federal Open Market Committee (FOMC) will raise rates by half a point next week, and just a 9% chance there will be another 75 basis point increase.

There will be more key data events coming up before the Federal Reserve December 14 meeting. The Producer Price Index and the University of Michigan's consumer sentiment survey on Friday as well as November's Consumer Price Index are due. Investors will be on the watch for any signs that the Fed is getting ready to pause its hikes.

Noting the shift in market sentiment following last Friday's Nonfarm Payrolls (NFP) and this week's ISM Services data, analysts at Danske Bank said ''we acknowledge that our earlier call of a 75bp hike next week appears unlikely, but do not think the need to tighten monetary policy further has disappeared. We adjust our Federal Reserve call, and now expect a 50 basis points (bp) hike next week, followed by 50bp in February and 25bp in March. Thus, we maintain our call for a terminal rate of 5.00-5.25% unchanged.''

European Central Bank in focus

The European Central Bank (ECB) and the Bank of England (BoE) are also set to announce interest rate decisions next week and are expected to act in order to thwart stubbornly high inflation.

''At next week's meeting, we expect the European Central Bank to deliver a 50bp rate hike with a hawkish twist,'' analysts at Danske Bank said. ''Specifically, we expect the European Central Bank to present key principles of the end to reinvestments under the Asset Purchase Programme (APP) process (in which reinvestments will almost come to a full stop) and an open-ended wording for more rate hikes to come. This will be a compromise, which we believe will be palatable to both hawks and doves.''

''We currently expect European Central Bank rate hikes into Q1 next year, with the deposit rate peaking at 2.75%, but with risks skewed for more hikes,'' the analysts added.

EUR/USD technical analysis

While on the front side of the daily trendline, EUR/USD bulls are firming from near 1.0480 support and are taking on resistance around 1.0570. A break there opens the risk of a move in EUR/USD beyond 1.0600:

A move in EUR/USD below the trendline, however, will expose supports near 1.0490 and 1.0440 and open prospects of a deeper correction towards 1.0400.

Commenting on Brexit negotiations, German Foreign Minister Annalena Baerbock said on Thursday that they are "100% in line" with the European Commission and Ireland on the Northern Ireland Protocol, as reported by Reuters.

"We should use and seize the window of opportunity on Northern Ireland Protocol talks," Baerbock added.

Market reaction

These comments don't seem to be having a significant impact on Pound Sterling's performance against its rivals. As of writing, GBP/USD was trading at 1.2230, where it was up 0.28% on a daily basis.

Next week, the European Central Bank will have its monetary policy meeting. Analysts at Danske Bank see the central bank raising rates by 50 basis points and to continue rising rates into the first quarter of next year. They see the deposit rate peaking at 2.75%, but with risks skewed for more hikes.

Key Quotes:

“At next week’s meeting, we expect the ECB to deliver a 50bp rate hike with a hawkish twist. Specifically, we expect the ECB to present key principles of the end to reinvestments under the APP process (in which reinvestments will almost come to a full stop) and an open-ended wording for more rate hikes to come. This will be a compromise, which we believe will be palatable to both hawks and doves.”

“For EUR/USD, the ECB meeting will conclude a busy week that also includes US CPI and the FOMC meeting. Overall, we do not expect a ‘hawkish 50bp hike’ will leave a big impact on EUR/USD, but it depends on the momentum heading into the meeting. The market may feed off a hawkish ECB, if US CPI inflation drops again and the Fed comes across as dovish and sends EUR/USD to new highs. Vice versa, higher US CPI inflation may turn around momentum in EUR/USD, send it back down and leave the ECB meeting less relevant.”

According to analysts at Wells Fargo, the US Dollar will remain strong early next year, followed by a depreciation during the second half of 2023. As market participants begin to anticipate eventual policy easing in the US, they believe the greenback will start to trend lower beginning in mid-2023.

Key Quotes:

“The over-arching theme for most of 2022 was that of U.S. dollar strength. In fact, the Federal Reserve's trade-weighted dollar index is up nearly 6% on balance since the beginning of 2022. We expect this theme of U.S. dollar strength to persist in early 2023 as U.S. economic trends remain resilient relative to other major developed economies, and as the Federal Reserve pursues a more aggressive pace of monetary tightening compared to other major central banks. With the Fed set to deliver rate hikes through March 2023, and most other central banks seen finishing their tightening cycles at a similar time, we believe the U.S. dollar index could gain a further 4%-5% by the end of Q1-2023.”

“But as the Fed ends its tightening cycle and U.S. economic trends worsen, we believe the greenback will enter a period of cyclical depreciation and weaken against most foreign currencies for the remainder of next year. We anticipate that dollar weakness will be broad enough such that most G10, as well as emerging market currencies, can strengthen vis-à-vis the greenback over the course of 2023.”

“In that sense, we believe 2023 could be ripe for emerging market currencies to not only recover against the U.S. dollar, but also outperform relative to G10 currencies.”

Next week, the FOMC will have its two-day meeting. Market participants expect a 50 basis points rate hike. Analysts at Danske Bank continue to expect a hawkish message regarding the policy stance in 2023. They think the recent easing in financial conditions is premature, and further hikes will be needed.

Key Quotes:

“US economy remains on a path of modest growth in Q4, and Fed needs to force a moderate recession next year to avoid prolonging inflation from here. Getting demand lower requires broad financial conditions to retighten again, which likely includes a combination of more rate hikes in Q1, still elevated longer real yields and stronger USD.”

“We acknowledge that our earlier call of a 75bp hike next week appears unlikely, but do not think the need to tighten monetary policy further has disappeared. We adjust our Fed call, and now expect 50bp hike next week, followed by 50bp in February and 25bp in March. Thus, we maintain our call for a terminal rate of 5.00-5.25% unchanged.”

- Wall Street adds to gains while US Treasury yields remain steady.

- Japanese up versus US Dollar, steady versus other rivals.

- USD/JPY down for the second day in a row, still above 136.00.

The USD/JPY is falling on Thursday but still holds above the 136.00/30 support area. The pair peaked on Asian hours at 137.25 and then turned to the downside. It is hovering around 136.45, down for the second day in a row.

The US Dollar Index (DXY) is down by 0.28% despite modestly higher US Treasury yields and on the back of risk appetite. The biggest gainers on Thursday are commodity prices as gold and silver rise sharply.

The Japanese yen is up versus the US Dollar despite yields and higher equity prices. The Dow Jones is up by 0.74% and the Nasdaq gains more than 1%. Economic data released in the US came in below expectations with Initial Jobless Claims rising to 230K in the week ended December 3 while Continuing Claims increased by 62K in the week of November 26 to 1.671 million, the highest level since early February.

Key data to be released on Friday includes the Chinese Consumer Price Index, US Producer Price Index and the University of Michigan’s Consumer Sentiment.

USD/JPY weak but above 136.00/30

The intraday bias in USD/JPY point to the downside but losses seems limited while above 136.00/30. A break below would open the doors an extension of the decline.

On the upside, immediate resistance is seen at 136.70, followed by 137.00 and then 137.40. A firm break of 137.70 could change the short-term outlook from negative to neutral.

Technical levels

Analysts at Rabobank said they expect AUD/NZD to rise to the 1.08 area on a six-month view.

Scope for NZD/USD to drop back in coming months

"The RBNZ is forecasting a temporary contraction of 1% in GDP in 2023. The view is that this is necessary to bring demand back in line with supply and to stamp inflation out of the system. This GDP forecast contrasts with that from the RBA which projects no recession."

"The optimism assessment is that a short downturn this will put the NZ domestic economy on a better path to sustainable growth over the medium-term with this year’s input from tourism already providing a solid base for export growth. That said, the outlook fares poorly in relation to Australia where the economy is likely to continue to draw protection from energy production (though its terms of trade fell back sharply in Q3, driving by weak iron ore prices)."

"We expect AUD/NZD to creep higher to 1.08 on a 6 month view. We see scope for NZD/USD to drop back in the coming months as global growth slows and demand for safe haven increases but look for NZD/USD to move higher again on a 6 to 9 month view."

- US Dollar falls while commodity currencies outperform.

- Equity prices rise in Wall Street, head for a slide in Europe.

- GBP/USD with positive momentum, tests relevant resistance.

The GBP/USD is up on Thursday for the second day in a row but the upside remains limited by the 1.2230 area. Risk appetite and a weaker dollar are supporting the pair.

In Wall Street, the Dow Jones is up by 0.72% while the Nasdaq gains by 1.10%. European indexes are in negative, with the FTSE 100 down by 0.07%. The US Dollar Index is falling by 0.25%. The best performers in FX are commodity currencies as Gold, Silver and oil rise sharply.

Economic data released on Thursday showed US Initial Jobless Claims rose as expected to 230K in the week ended December 3 while Continuing Claims increased by 62K in the week of November 26 to 1.671 million, above the 1.575 million of market consensus, hitting the highest level since early February.

On Friday, China will report the Consumer Price Index for November that is expected to show an increase of 1% (annual). The Bank of England will release the Consumer Inflation Expectations report. In the US are due the Producer Price Index and the University of Michigan Consumer Sentiment report.

GBP/USD short-term outlook

The GBP/USD pair is trading at daily highs, challenging the 1.2230 zone. If it consolidates above, the positive momentum will favor more gains, targeting 1.2260. Above, attention would turn to 1.2290/1.2300.

A failure to break 1.2230 would keep the pair sideways between that area and 1.2150. A slide below would expose the weekly low at 1.2104.

Technical levels

- US Dollar falls across the board on Thursday, amid risk appetite.

- AUD/USD strengthens after breaking 0.6750, trims weekly losses.

- US Initial Jobless Claims rise to 230K and Continuing Claims hit fresh monthly highs.

A slide of the US Dollar across the board boosted the AUD/USD pair that broke above 0.6745. It hit three-day highs at 0.6769 following US economic data and then pulled back to 0.6755/60.

The US Dollar is falling modestly while commodity currencies are rising strongly. Gold, silver and crude oil are all up. The DXY is down just 0.05% at 105.10. US Treasury yields hold steady, marginally higher.

Regarding economic data, US Initial Jobless Claims rose as expected to 230K in the week ended December 3 while Continuing Claims increased by 62K to 1.671 million in the week ended November 26, above the 1.575 million of market consensus, hitting the highest level since early February. On Friday, China will report the Consumer Price Index for November which is expected to show an increase of 1.5% (annual).

Positive short-term outlook for AUD above 0.6750

The AUD/USD gained momentum after breaking the 0.6740/50 area that capped the upside during the previous two trading days. While above this level, the outlook is bullish of the Aussie in the very short-term. The next resistance is seen at 0.6780 followed by 0.6795.

A slide back under 0.6740 would weaken the pair, exposing the next support area at 0.6710. Below, the next one stands at 0.6680.

Technical levels

- SUD/CAD comes under heavy selling pressure and is weighed down by a combination of factors.

- A solid recovery in oil prices underpins the Loonie and exerts pressure amid a softer greenback.

- Rebounding US bond yields, recession fears should limit the USD losses and lend some support.

The USD/CAD pair continues with its struggle to make it through the 1.3700 mark and attracts aggressive selling on Thursday. The sharp intraday decline drags spot prices below the 1.3600 round figure during the early North American session and is sponsored by a combination of factors.

As investors look past a dovish 50 bps rate hike by the Bank of Canada (BoC), a solid recovery in crude oil prices underpins the commodity-linked Loonie. Hopes that the easing of COVID-19 curbs in China will revive fuel demand assist the black liquid to snap a four-day losing streak to a fresh YTD low. Apart from this, a modest US Dollar weakness exerts downward pressure on the USD/CAD pair and contributes to the sharp intraday fall of around 100 pips.

As investors seek clarity on the Fed's rate-hike path, a mildly positive tone around the equity markets is seen weighing on the safe-haven greenback. That said, rebounding US Treasury bond yields, along with growing recession fears, should help limit losses for the USD. Traders might also refrain from placing aggressive bets and prefer to wait for next week's release of the US consumer inflation figures and the highly-anticipated FOMC monetary policy meeting.

The crucial US CPI report, along with the Fed decision will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the USD/CAD pair. This makes it prudent to wait for strong follow-through selling before confirming that the recent positive move witnessed over the past week or so has run out of steam. That said, bulls need to wait for a sustained move beyond the 1.3700 mark before positioning for additional gains.

Technical levels to watch

- Initial Jobless Claims in the US increased by 4,000 in the week ending December 3.

- US Dollar Index stays in negative territory near 105.00.

There were 230,000 initial jobless claims in the week ending December 3, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 226,000 (revised from 225,000) and came in line with the market expectation.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 230,000, an increase of 1,000 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending November 26 was 1,671,000, an increase of 62,000 from the previous week's revised level," the DOL noted in its publication.

Market reaction

The US Dollar Index edged slightly lower after this report and was last seen losing 0.18% on the day at 104.98.

- Gold price struggles to capitalize on its gains recorded over the past two trading sessions.

- Rebounding US Treasury bond yields revives US Dollar demand and acts as a headwind.

- Traders also seem reluctant amid uncertainty over the Federal Reserve’s rate hike path.

Gold price reverses an intraday dip to the $1,780 area and climbs to the top end of its daily trading range heading into the North American session. The XAU/USD is currently placed just above the $1,785 level, though lacks bullish conviction and remains below a technically significant 200-day Simple Moving Average (SMA).

Traders wait for clarity about the Federal Reserve’s rate hike path

The sideways consolidative move comes amid the uncertainty over the Federal Reserve's rate-hike path, which tends to drive the non-yielding Gold price. The current market pricing indicates over a 90% chance of a relatively smaller 50 bps rate hike move by the US central bank in December. That said, the recent positive macro data from the United States backed the case for further policy tightening and fueled speculations that the Fed may lift interest rates more than projected.

Focus remains on next week’s key data/event risk from the United States

Hence, the focus will remain glued on the upcoming Federal Open Market Committee (FOMC) monetary policy meeting on December 13-14. Heading into the key central bank event risk, investors will take cues from the release of the latest consumer inflation figures from the United States. The crucial CPI report plays a key role in influencing the Federal Reserve's policy outlook. This, in turn, should determine the near-term trajectory for Gold price, which is also seen as a hedge against inflation.

Rebounding US Treasury bond yields seems to cap Gold price

In the meantime, a goodish rebound in the US Treasury bond yields is seen acting as a tailwind for the US Dollar and keeping a lid on the Dollar-denominated Gold price. Apart from this, a generally positive risk tone, bolstered by the optimism over the easing of COVID-19 curbs in China, contributes to capping the upside for the safe-haven XAU/USD. The aforementioned factors might hold back traders from placing aggressive bets and supports prospects for an extension of the range-bound price action.

Gold price technical outlook

From a technical perspective, the 200-day SMA, currently around the $1,792-$1,793 area, is likely to act as an immediate hurdle ahead of the $1,800 psychological mark. The next relevant hurdle is pegged near the $1,810 area, or the multi-month top touched on Monday, above which Gold price could appreciate further towards the $1,830 hurdle. The momentum could eventually lift the XAU/USD to the $1,843-$1,845 supply zone.

On the flip side, the $1,775-$1,774 region could protect the immediate downside ahead of the weekly low, around the $1,765-$1,764 area. Some follow-through selling, leading to a subsequent break below the $1,761-$1,760 horizontal resistance breakpoint, will negate any near-term positive outlook and shift the bias in favour of bearish traders. Gold price might then turn vulnerable to accelerate the fall towards the $1,738-$1,737 area en route to the $1,725 level.

Key levels to watch

Analysts at Rabobank think that the European Central Bank (ECB) is likely to raise the policy rate by 50 basis points in December but note that they are not fully discounting the possibility of a 75 bps hike.

We maintain our forecast of a 3% terminal rate

"Despite a first easing of headline inflation, core inflation is still high and will slow the convergence of inflation back to target. The new staff projections will include a 2025 forecast, but given recent forecast errors the ECB should err on the side of caution as long as upside inflation risks remain."

"A slower rate path does not mean a lower terminal rate. Conveying this message will be a key challenge for President Lagarde. Details on quantitative tightening may steal the limelight.

"We maintain our forecast of a 3% terminal rate. As such, we have extended our policy expectations with a final 25bp hike in April. We could see quantitative tightening run at a monthly pace of €25-30bn, and we have pencilled in a Q2 start date."

- EUR/USD struggles to gain any meaningful traction and oscillates in a narrow trading band.

- Rebounding US bond yields, recession fears revive the USD demand and act as a headwind.

- The uncertainty about the Fed’s rate-hike path caps the greenback and offers some support.

The EUR/USD pair struggles to capitalize on the overnight bounce from the 1.0440 area, or the lower end of its weekly range and oscillates in a narrow trading band on Thursday. The pair is currently placed around the 1.0500 psychological mark, nearly unchanged for the day.

Following the previous day's pullback, the US Dollar regains some positive traction and turns out to be a key factor acting as a headwind for the EUR/USD pair. The recent positive US economic data fueled speculations that the Fed might lift rates more than recently projected. This, in turn, pushes the US Treasury bond yields, which, along with growing recession fears, revive demand for the safe-haven buck.

The shared currency, on the other hand, is undermined by diminishing odds for more aggressive rate hikes by the European Central Bank (ECB). Apart from this, worries about economic headwinds stemming from the protracted Russia-Ukraine conflict further contribute to capping the upside for the EUR/USD pair. The downside, however, remains cushioned amid rising bets for a 50 bps Fed rate hike in December.

Firming expectations that the US central bank will slow the pace of its policy tightening is holding back the USD bulls from placing fresh bets and lending some support to the EUR/USD pair. Hence, the focus remains glued to the highly-anticipated FOMC policy meeting on December 13-14. The ECB is also scheduled to announce its decision on Thursday, which should provide a fresh directional impetus to the major.

In the meantime, traders on Thursday will take cues from the release of the Weekly Initial Jobless Claims data from the US, due later during the early North American session. This, along with the US bond yields and the broader risk sentiment, might influence the USD price dynamics and allow traders to grab short-term opportunities around the EUR/USD pair.

Technical levels to watch

Economists at Nordea expect the European Central Bank (ECB) to raise key rates by 75 basis points for the third time in a row in December in a nod to the more hawkish voices in the Governing Council.

ECB to set broad guidelines for QT

"We think the ECB will postpone the decision on the starting date for reducing the huge bond holdings, or set the date for late Q2 or early Q3 2023, in a nod to the more dovish voices in the Governing Council."

"We think the ECB will set the broad guidelines for the reduction in bond holdings, or quantitative tightening (QT), including setting cap values for the amount of bonds allowed to mature each month, with the monthly cap initially set at EUR 10 to 20bn per month."

"We think the ECB will signal that while the central bank remains in a data-dependent mode, further hikes look likely and their magnitude is likely to moderate going forward."

Economists at TD Securities said they expect the Consumer Price Index in China to decline to 1.5% on a yearly basis in November from 2.1%.

November PPI to remain in deflationary territory

"Pork prices fell in November after several months of gains, contributing to a likely overall drop in food prices, while a higher base is also likely to result in a lower year-on-year CPI reading. Fuel prices have also added upward pressure on inflation over past months, but we expect this to have moderated in November too."

"Taken together, with weak demand side pressures, it all points to a subdued CPI outcome. Separately, we expect November PPI to remain in deflationary territory, with a print of -1.2% y/y likely (cons. -1.4%, last -1.3%)."

"While industrial metals and bulks recovered some ground over the month this was mitigated by a fall in oil prices. Additionally, despite rising Covid cases, there appears to be little sign of any build-up of supply constraints and any feed through into producer prices at present, with PMI input prices falling further."

Analysts at TD Securities noted that the Bank of Canada's (BoC) decision to hike the policy rate by 50 basis points to 4.25% was a mild hawkish surprise relative to market pricing and the analyst community.

Statement was more balanced than previous months

"The larger surprise was the Bank's signal that it may be finished with rate hikes as it softened its forward guidance, implying that 4.25% will be the Bank's terminal rate."

"The statement itself was more balanced than previous months, with the Bank citing evidence that interest rates are working to slow demand and that inflation momentum is softening. The Bank's new guidance suggests a more data-dependent approach going forward, and we look for the Bank to keep rates unchanged in January."

- Silver reverses an intraday dip to the $22.55 area and climbs back closer to the overnight swing high.

- The technical setup favours bullish traders and supports prospects for a further appreciating move.

- Any meaningful pullback might attract some di-buyers and remains limited near the $22.00 mark.

Silver attracts fresh buyers near the $22.55 region on Thursday and steadily climbs back closer to the overnight swing high during the first half of the European session. The white metal is currently placed around the $22.70-$22.75 area and seems poised to build on its intraday ascent.

This week's repeated failures to break through the $22.00 mark and the overnight goodish rebound from the vicinity of the 200-hour SMA favours bullish traders. Moreover, positive technical indicators on daily/hourly charts are still away from being in the overbought zone and add credence to the constructive outlook for the XAG/USD.

This, in turn, supports prospects for a move back towards reclaiming the $23.00 round-figure mark. The momentum could further get extended and allow the XAG/USD to challenge the multi-month peak, around the $23.50-$23.55 zone touched earlier this week. Some follow-through buying should pave the way for an extension of the upward trajectory.

On the flip side, the daily swing low, around the $22.55 region, should protect the immediate downside. Any subsequent fall might continue to find decent support near the 200-hour SMA, currently around the $22.15-$22.10 zone. This is followed by the $22.00 mark, which if broken will negate the positive outlook for the XAG/USD.

The next relevant support is pegged near the $21.40 region ahead of the technical significant 200-day SMA, around the $21.25 area, and the $21.00 mark. The latter should act as a strong base for spot prices. A convincing break below will shift the bias in favour of bearish traders and prompt aggressive technical selling around the XAG/USD.

Silver 1-hour chart

Key levels to watch

- AUD/USD remains confined in a range and is influenced by a combination of diverging forces.

- The subdued USD demand offers some support, though recession fears seem to cap the Aussie.

- Traders also prefer to wait on the sidelines ahead of the key FOMC policy meeting next week.

The AUD/USD pair struggles to capitalize on the overnight bounce from the 0.6670-0.6665 area, or a one-week low and seesaws between tepid gains/minor losses on Thursday. The pair holds steady above the 0.6700 mark through the early part of the European session, awaiting a fresh catalyst before the next leg of a directional move.

The downside for the AUD/USD pair, meanwhile, remains cushioned amid subdued US Dollar demand and optimism over the easing of COVID-19 restrictions in China. That said, growing worries about a deeper global economic downturn act as a headwind for the risk-sentiment Aussie. Traders also seem reluctant to place aggressive directional bets amid the uncertainty over the Fed's rate hike path.

It is worth mentioning that the markets have been pricing in a greater chance of a relatively smaller 50 bps Fed rate hike move in December. The incoming positive US macro data, however, suggested that the economy remained resilient and fueled speculations that the Fed might lift rates more than projected. This leads to a goodish rebound in the US Treasury bonds yields and offers support to the USD.

Hence, the focus will remain glued to the highly-anticipated FOMC monetary policy meeting on December 13-14. In the meantime, the mixed fundamental backdrop warrants some caution before positioning for a firm near-term direction. This, in turn, supports prospects for an extension of the range-bound price action around the AUD/USD pair as traders look to the US Initial Jobless Claims for some impetus.

Technical levels to watch

FX option expiries for Dec 8 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0400-05 306m

- 1.0420-30 567m

- 1.0450 810m

- USD/JPY: USD amounts

- 136.35-45 420m

- 137.00 741m

- AUD/USD: AUD amounts

- 0.6665 201m

- 0.6700 526m

- 0.6800-10 1.02b

- USD/CAD: USD amounts

- 1.3490-00 881m

- 1.3550 500m

- 1.3650 785m

- USD/JPY oscillates in a narrow trading band amid subdued trading action on Thursday.

- A combination of factors undermines the JPY and extends some support to the major.

- Bets for less aggressive Fed rate hikes keep the USD bulls on the defensive and cap gains.

The USD/JPY pair lacks any firm directional bias and seesaws between tepid gains/minor losses through the early European session on Thursday. The pair, however, manages to hold its neck above the daily low and is currently placed around the 136.65-136.70 area, nearly unchanged for the day.

The Japanese Yen is weighed down by the weaker domestic data, showing an unexpected current account deficit and an economic contraction during the third quarter. Apart from this, a goodish rebound in the US Treasury bond yields widens the US-Japan rate differential and further contributes to driving flows away from the JPY. This, in turn, assists the USD/JPY pair to attract some buying near the 136.25 region.

The intraday uptick, however, lacks bullish conviction and runs out of steam near the 137.25 zone amid subdued US Dollar demand. Expectations that the Fed will slow the pace of its policy tightening cycle keeps the USD bulls on the defensive and caps the upside for the USD/JPY pair. That said, the incoming positive US macro data has been fueling speculations that the Fed might lift rates more than recently projected.

This, in turn, holds back traders from placing aggressive bets around the USD/JPY pair and leads to a range-bound price action. Hence, the focus will remain glued to the upcoming FOMC policy meeting on December 13-14. Heading into the key central bank event risk, investors will confront the release of the latest US consumer inflation figures, which should influence the Fed's policy outlook and drive the USD demand.

This, in turn, will help determine the next leg of a directional move for the USD/JPY pair. In the meantime, traders on Thursday will take cues from the release of the usual Weekly Initial Jobless Claims data from the US, due later during the early North American session. This, along with the US bond yields and the broader market risk sentiment, will be looked upon for short-term trading opportunities around the USD/JPY pair.

Technical levels to watch

Here is what you need to know on Thursday, December 8:

Financial markets remain choppy in the second half of the week amid a lack of fundamental drivers and high-tier data releases. Participants stay on the sidelines ahead of next week's key central bank announcements and major currency pairs struggle to make a decisive move in either direction. Following Wednesday's pullback on falling US Treasury bond yields, the US Dollar Index stays calm near 105.00. The US economic docket will feature the weekly Initial Jobless Claims on Thursday and investors will keep a close eye on mews surrounding China's zero-Covid policy.

Shanghai city authorities announced earlier in the day that they will not be requiring Covid test checks for restaurants and entertainment venues from Friday. Meanwhile, Hong Kong said that they will ease isolation rules for infected travellers. Hong Kong's Hang Seng Index looks to close more than 3% higher but Shanghai Composite Index trades flat following these developments.

Meanwhile, the data from the US revealed on Wednesday that Unit Labor Costs rose by 2.4% in the third quarter. With this print missing the market expectation of 3.2% by a wide margin, the benchmark 10-year US Treasury bond yield turned south and dropped below 3.5%, weighing on the US Dollar.

Following the December policy meeting, the Bank of Canada decided to raise its policy rate by 50 basis points to 4.25% as expected. Regarding future policy action, the BoC noted in its policy statement that it will be considering whether the interest rate needs to rise further. "Inflation is still too high and short-term inflation expectations remain elevated," the BOC further noted. After having closed flat at 1.3650 on Wednesday, USD/CAD continues to fluctuate near that level early Thursday.

EUR/USD snapped a two-day losing streak and closed slightly above 1.0500 on Wednesday. The pair trades in a narrow channel in the European morning. European Central Bank (ECB) President Christine Lagarde is scheduled to deliver a speech at 1200 GMT.

GBP/USD managed to register modest daily gains on Thursday and went into a consolidation phase at around 1.2200 on Thursday.

Earlier in the day, the data from Japan revealed that the Gross Domestic Product shrank at an annual rate of 0.8% in the third quarter. This reading came in slightly better than the market expectation for a contraction of 1.1%. USD/JPY showed no immediate reaction to this data and was last seen fluctuating below 137.00.

Gold Price benefited from falling US T-bond yields and posted strong daily gains on Wednesday. XAU/USD was last seen consolidating its gains above $1,780.

Bitcoin continues to move up and down in a narrow channel at around $17,000 on Thursday. Following Wednesday's 3% decline, Ethereum stays quiet slightly above $1,200.

- GBP/USD lacks any firm direction and oscillates in a narrow trading range on Thursday.

- Subdued USD demand lends some support, though recession fears seem to cap the pair.

- Traders also seem reluctant ahead of the crucial FOMC/BoE policy meetings next week.

The GBP/USD pair struggles to capitalize on the overnight recovery from the 1.2100 neighbourhood, or the weekly low and oscillates in a range through the early European session on Thursday. The pair is currently trading around the 1.2200 round-figure mark, nearly unchanged for the day.

The latest optimism over the easing of COVID-19 curbs in China is seen undermining the safe-haven US Dollar, which, in turn, offers some support to the GBP/USD pair. That said, rebounding US Treasury bond yields, along with growing recession fears, should act as a tailwind for the greenback. Traders might also refrain from placing aggressive bets amid the uncertainty over the Fed's rate-hike path.

Market participants seem convinced that the US central bank will slow the pace of its policy tightening and have been pricing in a greater chance of a smaller 50 bps rate hike in December. That said, the incoming positive US macro data suggested that the economy remained resilient despite rising borrowing costs and fueled speculations that the Fed might lift rates more than recently projected.

Hence, the focus will remain glued to the FOMC monetary policy meeting on December 13-14, which will be followed by the Bank of England (BoE) meeting on Thursday. The UK central bank is expected to hike rates by 50 bps, though some analysts anticipate a larger 75 bps move. Nevertheless, the crucial central bank decisions should provide a fresh directional impetus to the GBP/USD pair.

In the meantime, a bleak outlook for the UK economy might hold back bulls from placing aggressive bets around the British pound amid absent relevant domestic macro data. The US economic docket, meanwhile, features the release of the usual Weekly Initial Jobless Claims. This, along with the US bond yields and the broader risk sentiment, will drive the USD and influence the GBP/USD pair.

Technical levels to watch

- USD/CAD pulls back from intraday high to pare daily gains.

- Weekly support line holds the key for bear’s entry.

- Buyers need validation from November’s peak to keep the reins.

USD/CAD registers another failure to cross the one-month-old resistance line as it drops to 1.3655 amid the initial hour of Thursday’s European trading session.

The Loonie pair’s latest declines also take clues from the impending bear cross on the MACD, as well as RSI (14) pullback from the overbought territory.

Although the intraday bears are having an upper hand by the press time, an upward-sloping support line from Monday, close to 1.3650, restricts the USD/CAD pair’s immediate downside.

Following that, a southward trajectory towards the 200-Simple Moving Average (SMA) level surrounding 1.3480 can’t be ruled out.

However, a three-week-old ascending trend line near 1.3420 appears crucial for the USD/CAD seller’s further dominance as a break of which won’t hesitate to poke the previous monthly low of 1.3226.

Alternatively, an upside clearance of the monthly resistance line near 1.3685 will need validation from the 1.3700 threshold and November’s peak of 1.3808 to convince the USD/CAD bulls.

In that case, the 1.3855-60 and the 1.3900 level could also probe the Loonie pair’s further upside before highlighting the 1.4000 psychological magnet.

USD/CAD: Four-hour chart

Trend: Limited downside expected

- Gold price picks up bids to pare the first daily loss in three.

- Risk-positive headlines from China, Hong Kong appear to favor the latest XAU/USD rebound.

- Gold bears remain hopeful as firmer US Dollar, Treasury bond yields keep recession fears on the table.

- Headlines surrounding Russia also probe bullion buyers ahead of next week’s key Fed meeting.

Gold price (XAU/USD) bounces off intraday low to $1,785 during the initial hour of Thursday’s Asian session as the market players lick their wounds after a negative start.

The latest easing in the risk-off mood, which initially helped the US Dollar to brace for weekly gains, could be linked to the headlines from China. Recently, Shanghai City Authorities mentioned that they will stop requiring Covid test checks for restaurants or entertainment venues from this Friday. On the same line, the South China Morning Post (SCMP) states that Hong Kong is ‘to ease isolation rules’ for infected travelers, with a release on the fifth day.

Even so, the looming fears of economic slowdown, as well as Russia’s usage of nuclear weapons in its war with Ukraine, seemed to weigh on the XAU/USD price. Furthermore, Bloomberg came out with the news suggesting more tension between the US and China due to the latest bills the US Congress is up for passing, which in turn challenges the Gold buyers. “The US is set to pass legislation revamping US policy toward Taiwan and restricting government use of Chinese semiconductors, moves that appear certain to antagonize Beijing even as President Joe Biden seeks to ease tensions,” said Bloomberg.

Amid these plays, the S&P 500 Futures reverse the initial losses while recovering from the three-week low to around 3,935 by the press time. Further, the US 10-year Treasury yields stay inactive near 3.45% while paring the previous day’s losses near the lowest levels since early September.

Looking forward, the Gold price may witness lackluster days ahead of the next week’s Federal Open Market Committee (FOMC) meeting. However, today’s weekly US Initial Jobless Claims, as well as Friday’s preliminary prints of the Michigan Consumer Sentiment Index and 5-year Consumer Inflation Expectations may entertain traders.

Gold price technical analysis

Gold price stays defensive above the 200-Hour Moving Average (HMA) level surrounding $1,773. In doing so, the yellow metal remains inside an immediate rising wedge bearish chart pattern, currently between $1,782 and $1,795.

It’s worth noting that a two-week-old ascending trend line holds the key to XAU/USD bear’s entry, around $1,771 at the latest.

That said, bearish MACD signals and recently firmer RSI keeps sellers hopeful as the metal portrays the rising wedge chart pattern on the hourly play. However, a clear upside break of the $1,782 hurdle won’t hesitate to refresh the monthly peak surrounding $1,810.

Gold price: Hourly chart

Trend: Limited recovery expected

- NZD/USD retreats towards 50-HMA, snaps two-day winning streak.

- Bearish MACD signals, weekly resistance line keep sellers hopeful

- Convergence of 200-HMA, ascending trend line from late November challenge further downside.

- Bulls need validation from 0.6470-75 to refresh yearly top.

NZD/USD remains mildly offered around 0.6350 heading into Thursday’s European session.

In doing so, the Kiwi pair struggles to extend the day-start bounce off the 50-Hour Moving Average (HMA) while defending the one-week-old bearish trend, as shown by the descending trend line. Also supporting the downside bias are the bearish MACD signals.

That said, a clear downside break of the 50-HMA, around 0.6335 by the press time, holds the key to the NZD/USD pair’s short-term downside.

Even so, the 200-HMA and an upward-sloping trend line from November 28, close to 0.6300, appears a tough nut to crack for the Kiwi pair sellers.

Following that, a slump towards the late November swing low near 0.6155 can’t be ruled out.

Meanwhile, recovery moves need not only cross the weekly resistance line, around 0.6365 at the latest, but should also cross the monthly high surrounding 0.6475 to lure the NZD/USD bulls.

It’s worth noting that the August month’s peak near 0.6470 adds strength to the 0.6470-75 resistance area.

During the quote's sustained trading beyond 0.6475, the 61.8% Fibonacci Expansion (FE) of the pair's moves from November 28 to December 05, close to 0.6510, will be on the NZD/USD buyer's radar.

Overall, NZD/USD is likely to remain weak for the short term and the sellers can regain control on a successful break of 0.6300.

NZD/USD: Hourly chart

Trend: Limited downside expected

- Silver price is juggling around $22.60 amid a quiet market mood.

- The US Dollar Index (DXY) is struggling to cross the critical hurdle of 105.40.

- The 200-EM is aiming higher which indicates that the upside trend is intact.

Silver price (XAG/USD) is displaying a sideways auction profile around the immediate hurdle of $22.60 in the early European session. The white metal has turned balance after correcting from the critical resistance of $22.80. The market mood is extremely quiet as investors are awaiting a potential trigger for fresh impetus.

Meanwhile, the US Dollar Index (DXY) is struggling to cross the critical hurdle of 105.40. S&P500 futures are displaying a subdued performance following Wednesday’s choppy movement.

On an hourly scale, Silver price recovered firmly after testing the horizontal support placed from November 15 high at $22.25. The precious metal is testing the 20-period Exponential Moving Average (EMA) around $22.60 after a sheer recovery. Meanwhile, the 200-EMA at $22.20 is aiming higher, which indicates that the long-term trend is bullish.

The Relative Strength Index (RSI) (14) is aiming to reclaim the bullish range of 60.00-80.00 for a decisive rally.

Should the Silver price break above Friday’s high at $22.82, bulls will drive the asset toward the round-level resistance at $23.00, followed by Monday’s high at $23.52.

On the flip side, Silver price will witness a steep fall if its surrenders the 200-EMA at $22.20. An occurrence of the same will drag the asset toward November 24 high at $21.67. A breakdown of $21.67 support will expose the asset for more downside toward November 28 low of around $21.00.

Silver hourly chart

-638060762462721399.png)

AUD/USD defends bears around 0.6715 heading into Thursday’s European session. In doing so, the Aussie pair braces for the weekly loss while parting ways from the previous fortnight’s optimism.

While the risk-aversion and fears of downbeat economics from Australia, as well as China, keeps the AUD/USD bears hopeful, the options market disagrees with the bearish bias.

That said, the one-month risk reversal (RR) for the AUD/USD pair, the ratio between call and put premiums, prints the biggest daily gains in three by flashing 0.120 numbers at the latest, per options data from Reuters. In doing so, the weekly RR also remains firmer and prints the winning streak for the third consecutive time, 0.160 by the press time.

It’s worth noting that the market’s latest moves could also be linked to the preparations ahead of the next week’s Federal Open Market Committee (FOMC) meeting.

Also read: AUD/USD remains depressed below 0.6750 after Australia Trade Balance, RBA Bulletin

- EUR/USD is oscillating around 1.0500 as investors await a speech from European Central Bank’s Lagarde.

- Uncertainty over the Federal Reserve policy outlook has muddled investors’ sentiment.

- The speech from Christine Lagarde will trim obscurity over interest rate policy.

- EUR/USD is expected to continue its sideways auction profile amid a quiet market mood.

EUR/USD is failing to sustain above the psychological support of 1.0500 in the Tokyo session. The major currency pair is struggling to hold its reins amid a cautious market mood. Rising fears of a recession in the United States economy are compelling investors to safeguard themselves behind the US Dollar.

Meanwhile, the shared currency bulls are getting anxious ahead of the speech from European Central Bank (ECB) President Christine Lagarde, which is scheduled for Thursday. At the time of writing, the US Dollar Index (DXY) extended its recovery to near the bewildering resistance at 105.40. S&P500 futures continue to remain sideways as the upside has been restricted by soaring recession fears.