- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-12-2022

- USD/JPY holds lower ground after reversing from weekly top the previous day.

- Final readings of Japan’s Q3 GDP improved to -0.2% QoQ.

- US Treasury yields slumped on recession fears, downbeat US data.

USD/JPY remains on the back foot around 136.40 after witnessing downbeat data from Japan during early Thursday in Tokyo. Even so, the Yen pair remains mostly sidelined, maybe due to the initial hours of trading, after reversing from the one-week high on Wednesday.

Japan’s final readings of the third quarter (Q3) Gross Domestic Product (GDP) came in better than initial forecasts as the QoQ figures improved to -0.2% versus -0.3% while the GDP Annualized came in -0.8% versus -1.1% expected and -1.2% prior.

In addition to the firmer Japan data, downbeat US Treasury yields and softer US data also weigh on the USD/JPY prices.

That said, the benchmark 10-year Treasury bond yields dropped to the lowest levels since early September by losing 3.30% on Wednesday, close to 3.43% level at the latest. Further, the two-year counterpart dropped 2.54%, near the 4.26% mark by the press time. With this, the US Treasury bond yield curve, the difference between the long-dated and the short-term bond yields, inverted the most in over forty years.

On the other hand, the US Goods and Services Trade Balance deteriorated to $-78.2 billion versus $-79.1 billion expected and $-73.28 billion prior. Further, the final readings of the Unit Labour for Q3 eased to 2.4% QoQ versus 3.5% first estimations.

On a different page, the latest fears emanating from China and Russia seem to also exert downside pressure on the USD/JPY prices.

Technical analysis

A 12-day-old descending resistance line near 137.50 restricts immediate USD/JPY upside, which in turn joins downbeat MACD and RSI (14) to direct sellers towards the 200-DMA re-test, around 134.95 by the press time.

Japan's Gross Domestic Product has been released as follows:

- Japan GDP SA QoQ Q3F: -0.2% (est -0.3%, prev -0.3%).

- Japan GDP Annualised Q3F: -0.8% (est -1.0%, prev -1.2%).

- Japan GDP Nominal SA Q/Q Q3F: -0.7% (est -0.4%, prev -0.5%).

Japan's economy shrank at an annualised 0.8% in the July-September quarter, slower than the initial estimate of a 1.2% contraction, revised government data showed on Thursday.

The revised figure for gross domestic product (GDP) released by the Cabinet Office compared with economists' median forecast for a 1.1% decline in a Reuters poll.

On a quarter-on-quarter basis, GDP contracted 0.2%.

USD/JPY update

The bears are moving in from a key area of resistance and a break of 132.50 opens prospects of amove into 130.00.

About Japan GDP

The Gross Domestic Product released by the Cabinet Office shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. GDP is a gross measure of market activity because it indicates the pace at which the Japanese economy is growing or decreasing. A high reading or a better-than-expected number is seen as positive for the JPY, while a low reading is negative.

- EUR/USD treads water after snapping two-day downtrend, stays defensive of late.

- Downbeat US Treasury yields, softer US data favor broad-based US Dollar weakness.

- Firmer EU statistics, hawkish ECB survey underpin bullish bias amid sluggish session.

EUR/USD struggles to defend the previous day’s corrective bounce around 1.0510-15 during Thursday’s Asian session. In doing so, the major currency pair portrays the market’s inaction amid a light calendar and mixed sentiment. However, the scheduled speech from European Central Bank (ECB) President Christine Lagarde and weekly prints of the US Initial Jobless Claims will be important for near-term clear directions for the pair traders.

Final prints of the Eurozone Gross Domestic Product (GDP) for the third quarter (Q3) improved to 0.3% QoQ versus 0.2% previous estimations. On the same line was the YoY number of 2.3% and the upward revision of the yearly prior figures to 4.2% versus 2.1% flash estimations. Further, German Industrial Production also improved to -0.1% MoM versus -0.5% expected and 0.6% prior while Eurozone Employment Change rose to 1.8% YoY during the Q3 2022 against 1.7% expected and previous readings. Additionally, strong prints of the ECB survey of consumer expectations for inflation also favor the Euro.

On the other hand, US Dollar Index (DXY) dropped 0.37% to 105.17 by the end of Wednesday’s North American session. The DXY weakness could also be linked to the softer US data, namely the trade balance and Unit Labour Costs for the third quarter (Q3). It should be noted that the US Goods and Services Trade Balance deteriorated to $-78.2 billion versus $-79.1 billion expected and $-73.28 billion prior. Further, the final readings of the Unit Labour for Q3 eased to 2.4% QoQ versus 3.5% first estimations.

Also exerting downside pressure on the DXY could be the weaker US Treasury bond yields. That said, the benchmark 10-year Treasury bond yields dropped to the lowest levels since early September by losing 3.30% in a day to 3.42% level at the latest. Further, the two-year counterpart dropped 2.54% to the 4.26% mark. With this, the US Treasury bond yield curve, the difference between the long-dated and the short-term bond yields, inverted the most in over forty years.

Elsewhere, China announced multiple measures to ease the three-year-long Zero-Covid policy and bolstered the market sentiment before the risk appetite weakened. The dragon nation’s downbeat prints of the Trade Balance, Imports and Exports seemed to have probed the positive vibes. On the other hand, Russian President Vladimir Putin teased a nuclear war by saying that nuclear weapons could be used to defend itself and its allies.

Moving on, a speech from ECB President Lagarde and the weekly prints of the US Jobless Claims will be important for the EUR/USD traders.

Technical analysis

A one-month-old rising wedge bearish chart formation keeps EUR/USD sellers hopeful unless the quote crosses the 1.0625 hurdle. Alternatively, 1.0435 acts as the trigger for the pair’s theoretical downward trajectory backed by the rising wedge confirmation.

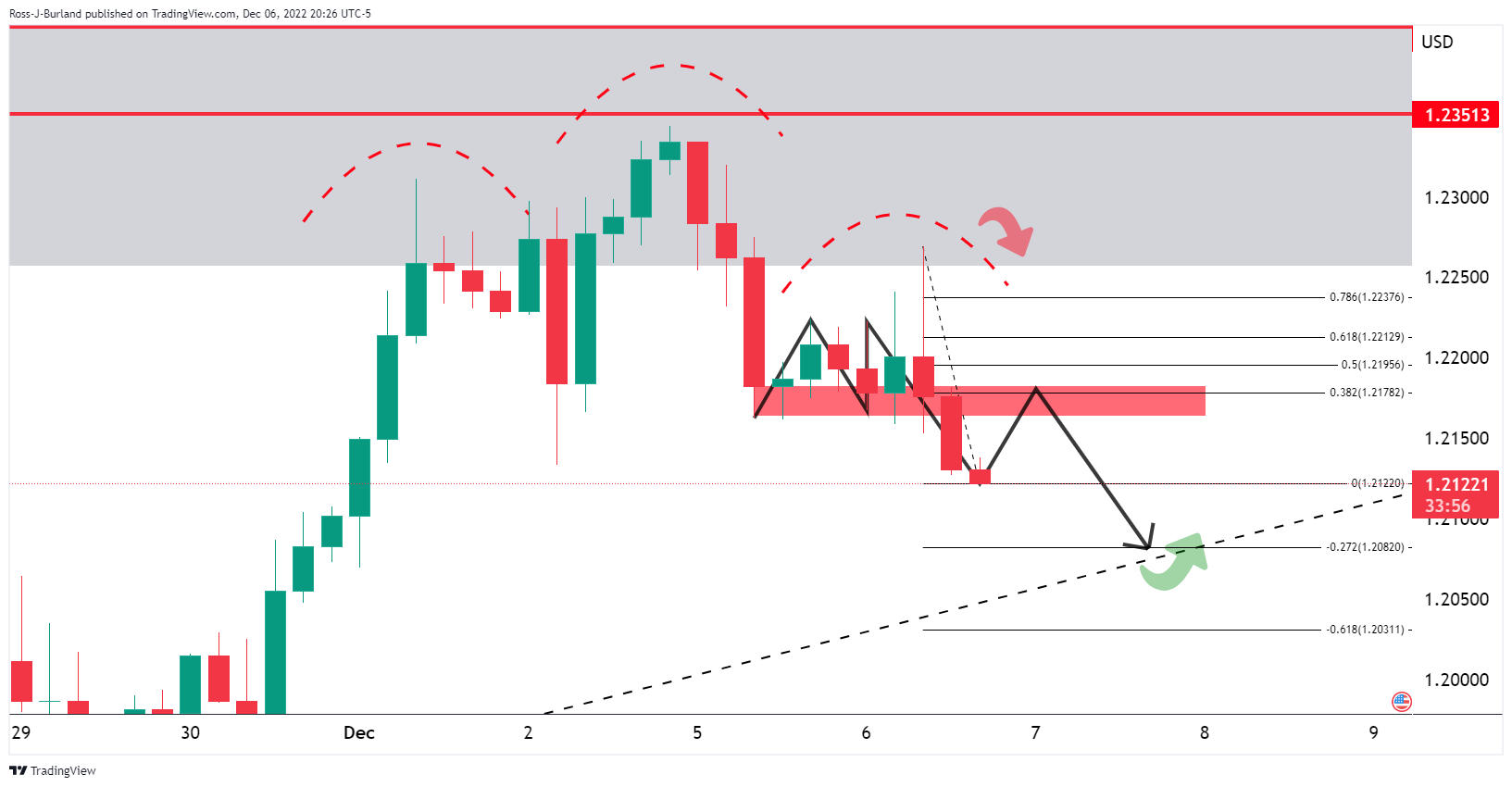

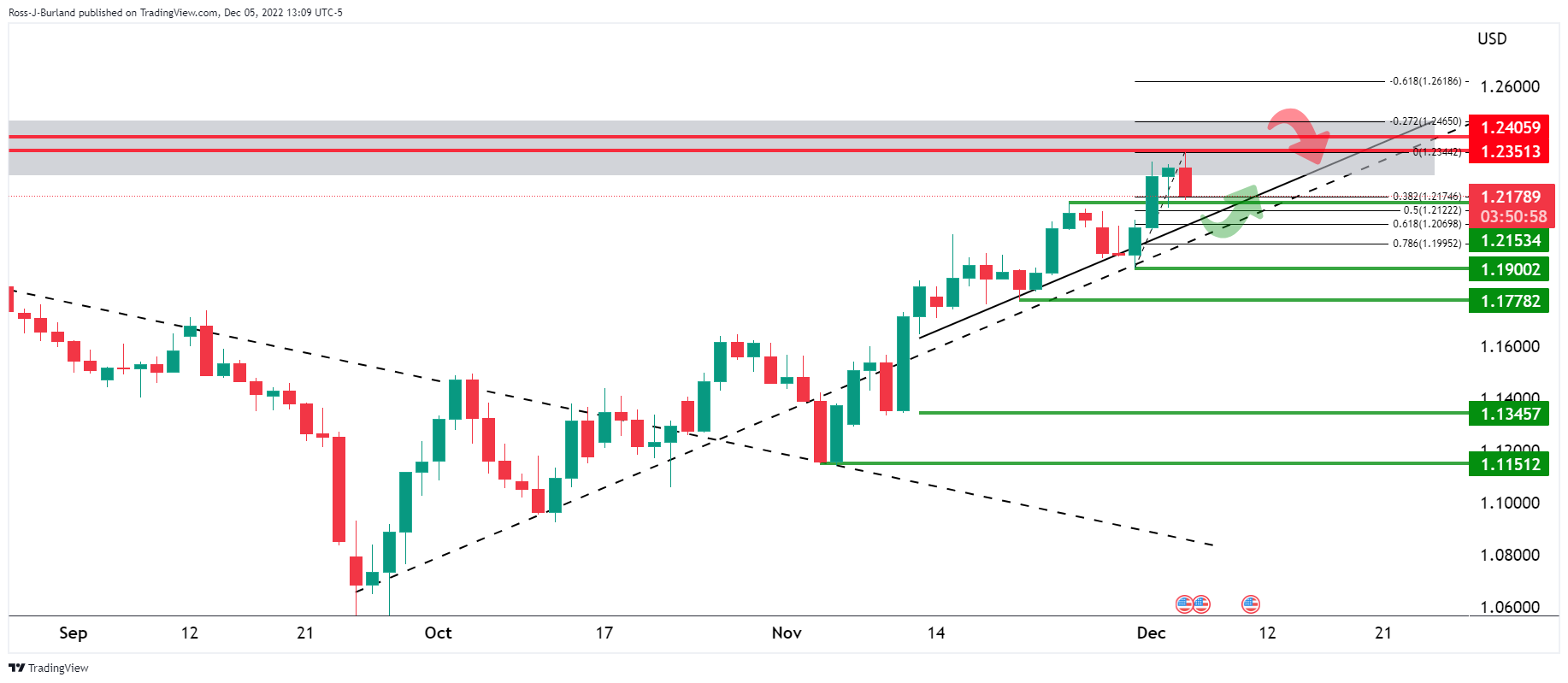

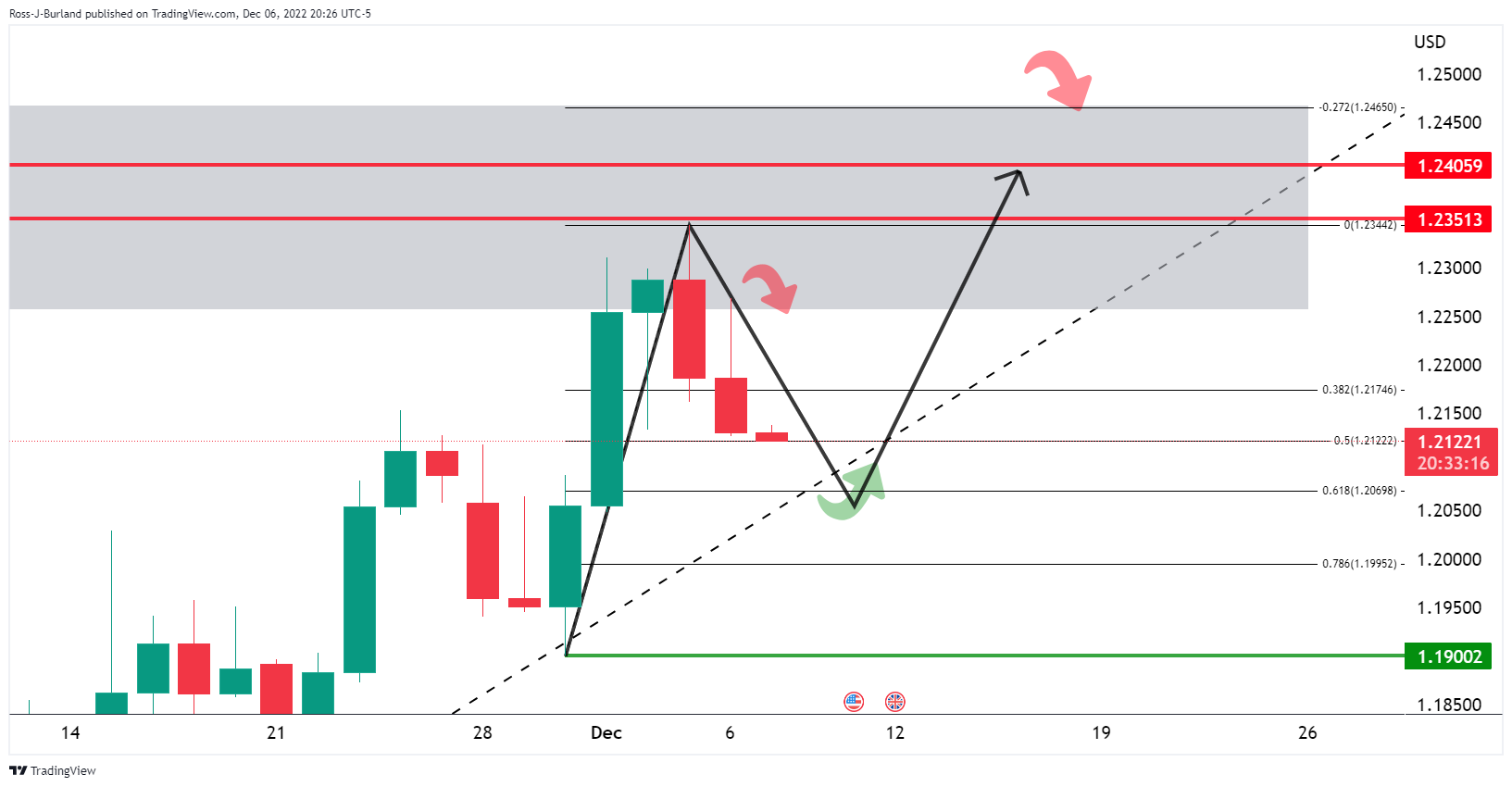

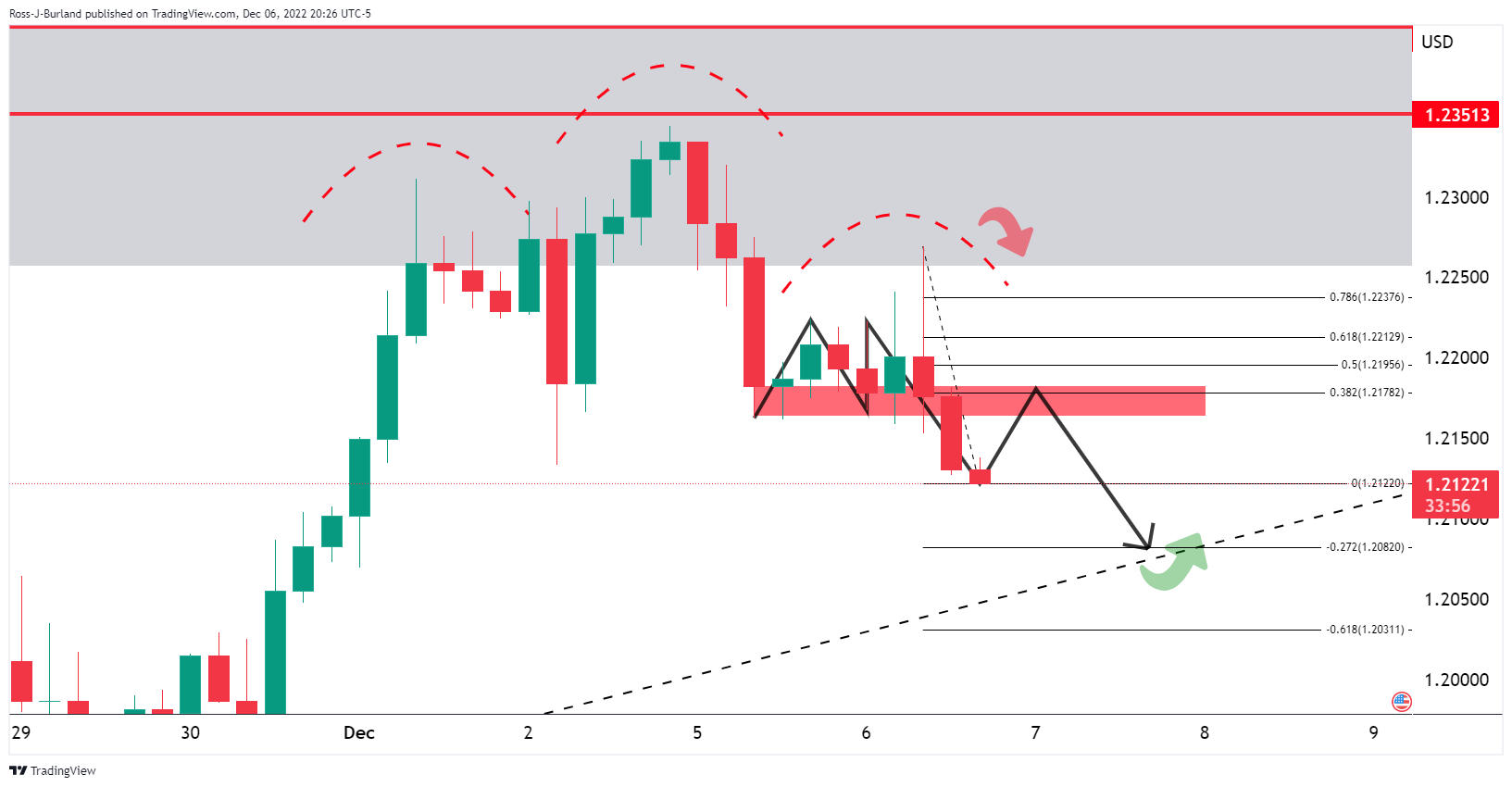

- GBP/USD bulls move and take out key 4-hour resistance.

- A bullish structure is being formed and eyes are on 1.2350.

As per the prior analyses, GBP/USD Price Analysis: Bears stay the course and eye trendline support, the British Pound has managed to find its feet and is now forming a bullish structure as the following will illustrate.

GBP/USD prior analysis

On the 4-hour chart, the H&S pattern was playing out as follows:

Zoomed in...

GBP/USD update

It was explained that the M-formation is a reversion pattern so a return to the neckline was a strong possibility prior to further declines towards the trendline support. However, the bulls took out the resistance and so long as 1.2150 holds, there will be prospects of a rally towards 1.2350 and then 1.2450 for the days ahead:

- AUD/NZD struggles to defend the bounce off yearly low.

- Oversold RSI conditions, Wednesday’s Doji candlestick signal further recovery.

- Ascending trend line from March 2020 appears to be the key support.

AUD/NZD remains sidelined around 1.0585 during Thursday’s Asian session, after bouncing off the yearly low the previous day. In doing so, the quote justifies Wednesday’s Doji candlestick, as well as oversold conditions of the Relative Strength Index (RSI) line, placed at 14.

AUD/NZD: Daily chart

A closer look at the chart shows that the recovery needs validation from a horizontal resistance line comprising October 2020 top and March 2022 low surrounding 1.0610-15.

Even so, downward-sloping resistance lines from November 11 and September 28, respectively near 1.0710 and 1.0780, challenge the AUD/NZD pair’s further upside.

It’s worth noting, however, that the pair’s successful break of 1.0780 enables the AUD/NZD bulls to retake control.

AUD/NZD: Daily chart

Alternatively, an ascending trend line from March 2020, around 1.0500, appears the key support for the AUD/NZD pair bears to watch during the quote’s further downside.

Following that, the quote’s gradual downside towards the lows marked in November and September of 2021, close to 1.0325 and 1.0280 in that order, can’t be ruled out.

Overall, AUD/NZD is likely to witness a corrective bounce but the recovery has a long way to go before convincing the buyers.

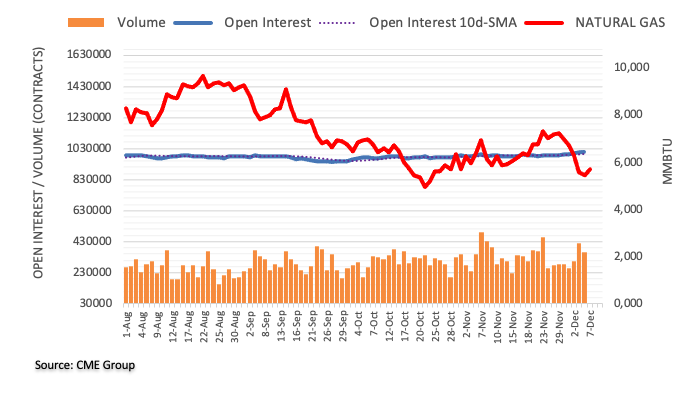

- West Texas Intermediate falls to the lowest in nearly a year.

- Traders fret over recession fears and the Federal Reserve that looks to raise interest rates again.

West Texas Intermediate (WTI ) crude fell to the lowest in nearly a year on Wednesday despite the good news in China's steps to move down from the zero-Covid policies. Instead, analysts fret over a weakening economic backdrop and low liquidity across markets. At the time of writing, Oil is down some 2.8%, sliding from a high of $75.36 to a low of $71.77.

China has moved to relax the zero-Covid policies that had slashed economic growth and oil demand. However, the nation announced that frequent testing and health passes will no longer be needed for travel in the country. The easing of restrictions would be expected to aid recovery in the economy o the country is the world's No.1 oil importer. Additionally, a European Union embargo against maritime shipments of crude oil from Russia went into effect Monday, along with a price cap agreed to by the Group of Seven leading industrialized economies and Australia.

However, ahead of the Federal Reserve that looks to raise interest rates again when its policy committee meets next week, prospects of a recession in the US are weighing on Oil.

''Despite European sanctions on Russian oil beginning this week, the market has refocused on the economic backdrop amid tighter monetary policies from central banks,'' analysts at ANZ Bank said.

''The relatively high price cap also eased concerns of additional supply disruptions to Russian crude oil. Recent softness in the physical markets has also weighed on futures. Distillate inventories in the US rose by more than 6mbbl last week, according to Energy Information Administration data.''

- A successful test of the consolidation breakout will trigger a buying opportunity for the market participants.

- The 50-EMA is acting as major support for the New Zealand Dollar.

- The US Dollar lost strength as investors shrugged off uncertainty and channelized funds into risky assets.

The NZD/USD pair has picked demand after correcting below the crucial support of 0.6350 in early Asia. The Kiwi asset displayed a rebound on Wednesday after the US Dollar lost strength as investors shrugged off uncertainty and propelled reversal in risk-sensitive assets.

At the time of writing, the US Dollar Index (DXY) is facing barricades around 105.20. S&P500 remained choppy on Wednesday as accelerating recession fears capped the upside. The 10-year US Treasury yields have dropped to near 3.42%.

On an hourly scale, the kiwi pair is testing the breakout of the consolidation that placed in a range of 0.6300-0.6355. The 50-period Exponential Moving Average (EMA) at 0.6344 is acting as major support for the counter.

Meanwhile, the Relative Strength Index (RSI) (14) has dropped into the 40.00-60.00 range but that doesn’t resemble a reversal. The oscillator has lost upside momentum for now but may achieve this after stepping into the bullish range of 60.00-80.00.

Going forward, a break above Thursday’s high at 0.6372 will drive the kiwi asset towards Monday’s high at 0.6444, followed by December 1 high at 0.6477.

On the flip side, a break below the round-level resistance of 0.6300 will drag the asset towards November 29 high at 0.6254 and November 30 low at 0.6190.

NZD/USD hourly chart

-638060511555675363.png)

- The EUR/JPY is subdued around 143.40s due to a risk-off impulse.

- The 20 and 50-day Exponential Moving Averages capped the EUR/JPY rally towards 144.00.

- EUR/JPY: Once it clears 143.80, a test of the MTD high of 144.85 is on the cards.

The EUR/JPY edged higher after hitting a daily low of 143.16 and traveling all the way towards its daily high if 144.58 amidst a deteriorated market mood that keeps safe-haven peers, like the Japanese Yen (JPY), on the defensive. As the Asian Pacific session begins, the EUR/JPY is trading at 143.50, registering minuscule gains of 0.01%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY remains neutral-to-upward biased, trading within the boundaries of a descending channel formed since the beginning of November. The EUR/JPY soared towards 144.50s, but the intersection of the 20 and 50-day Exponential Moving Averages (EMAs), around 143.80/95, capped the rally. With oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) flashing signs, the selling pressure is fading, which could open the door for further gains.

The EUR/JPY key resistance levels are the 143.80/95 area. A breach of the latter and the 144.00 psychological price level would be up for grabs, followed by November’s monthly high of 144.85.

As an alternate scenario, a EUR/JPY break below December’s 6 daily low of 143.09 could lay the ground for further downside pressure. Once cleared, the following support would be the 100-day EMA at 142.43, followed by the December 5 daily low of 141.49, followed by December’s MTD low at 140.76.

EUR/JPY Key Technical Levels

- AUD/USD stays defensive after bouncing off one-week low.

- Headlines from Russia, pre-data anxiety challenge Aussie pair buyers.

- Optimism surrounding China contrasts with downbeat data to also test upside momentum.

- Light calendar elsewhere, Fed policymakers’ blackout could allow AUD/USD bulls to keep the reins even if Aussie data disappoints.

AUD/USD struggles to defend the latest bullish impulse around 0.6725-30, after bouncing off a one-week low the previous day, as traders await updates/data from Australia during early Thursday. Also likely to have challenged the Aussie pair buyers could be the latest swing in the market’s sentiment, mainly due to Russian President Vladimir Putin’s comments and headlines from the US Congress.

Russian President Putin teased a nuclear war by saying that nuclear weapons could be used to defend itself and its allies. On the other hand, Bloomberg came out with the news suggesting more tension between the US and China due to the latest bills the US Congress is up for passing. “The US is set to pass legislation revamping US policy toward Taiwan and restricting government use of Chinese semiconductors, moves that appear certain to antagonize Beijing even as President Joe Biden seeks to ease tensions,” said Bloomberg.

Previously, the US Dollar traced downbeat Treasury bond yields to snap a two-day uptrend and favor the AUD/USD bulls. That said, the benchmark 10-year Treasury bond yields dropped to the lowest levels since early September by losing 3.30% in a day to 3.42% level at the latest. Further, the two-year counterpart dropped 2.54% to the 4.26% mark. With this, the US Treasury bond yield curve, the difference between the long-dated and the short-term bond yields, inverted the most in over forty years.

The US Dollar Index (DXY), on the other hand, dropped 0.37% to 105.17 by the end of Wednesday’s North American session. The DXY weakness could also be linked to the softer US data, namely the trade balance and Unit Labour Costs for the third quarter (Q3).

It should be noted that China’s easing of the three-year-long Zero-Covid policy and readiness for more monetary and fiscal measures to stimulate the economy also helped the AUD/USD bulls.

Alternatively, downbeat prints of Australia’s Q3 Gross Domestic Product (GDP) and China's Trade Balance for November could be noted as the key upside barriers.

Looking forward, AUD/USD traders may witness further hardships in extending the latest upside. However, the Reserve Bank of Australia (RBA) Bulletin and Aussie Trade Balance for October could help the bulls in case of positive outcomes. Following that, US weekly jobless claims and risk catalysts will be crucial for clear directions.

Technical analysis

A clear rebound from the 100-DMA, around 0.6680 by the press time, keeps AUD/USD buyers hopeful. However, a convergence of the two-week-old ascending trend line and the 61.8% Fibonacci retracement level of the June-October downside, near 0.6860, appears a tough nut to crack for the bulls.

- USD/CAD is oscillating around 1.3650 as BOC’s interest rate peak and weak oil prices have capped the upside.

- The downside in the Canadian Dollar is being supported by investors' improved risk appetite.

- Growing signs of recession in the United States have impacted oil prices.

The USD/CAD pair is displaying back-and-forth moves in a narrow range of around 1.3650 in the early Tokyo session. The Loonie asset rebounded in the New York session after sensing strength near the round-level support of 1.3600. The move was against the risk-appetite theme in the global market but the ‘less-hawkish’ sound adopted by Bank of Canada (BOC) Governor Tiff Macklem justified the same.

Meanwhile, the US Dollar Index (DXY) is displaying signs of volatility contraction and is oscillating in a 105.00-105.10 range. S&P500 remained sideways as the upside was capped by soaring recession fears and the downside was restricted after the risk-on impulse resurfaced. The US Treasury bonds witnessed a sheer demand from the market participants as a higher interest rate peak by the Federal Reserve (Fed) alarmed recession fears. The 10-year US Treasury yields have plunged to near 3.42%.

Meanwhile, Loonie investors are not capitalizing on the risk-appetite theme as interest rates by the BOC have reached near their peak. On Wednesday, the Canadian central bank announced a 50 basis points (bps) rate hike consecutively for the second time to 4.25%, the highest since 2008. The move was in line with the expectations of the street.

The absence of a statement dictating ‘more hikes are needed further’ indicated that the bigger rate hike regime by the BOC is over and interest rates have reached near neutral one. It is high time that the central bank will evaluate the efforts made by BOC policymakers.

On the oil front, fresh annual lows by West Texas Intermediate (WTI) at $72.00 led by growing signs of recession in the United States have impacted the Canadian Dollar. It is worth noting that Canada is a leading exporter of oil to the US and weaker oil prices impact Canada’s fiscal budget.

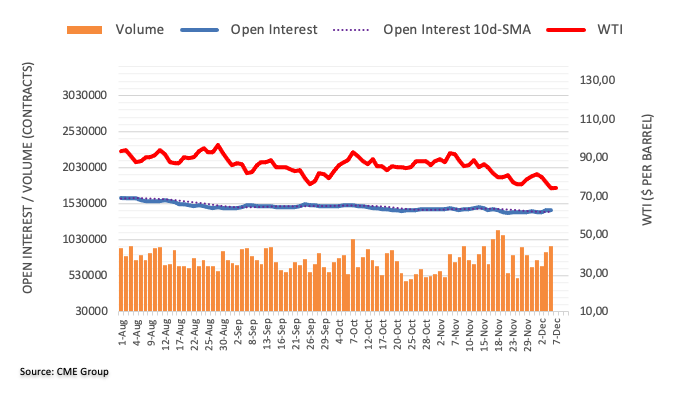

- Gold price grinds higher after the two-day winning streak.

- United States 10-year Treasury bond yields dropped to the lowest in three months and drowned the US Dollar.

- Optimism surrounding China adds strength to Gold price but headlines from Russia tests XAU/USD bulls.

- Light calendar, softer US data could offer another mixed trading session.

Gold price (XAU/USD) seesaws around $1,785, after posting the biggest daily gains in a week, as buyers seek more clues to approach the five-month top marked earlier in the week.

The yellow metal’s latest run-up could be linked to the downbeat performance of the United States Treasury bond yields, as well as the US Dollar weakness. In doing so, the Gold price also cheered upbeat headlines from China. It should be noted that the latest pause in the XAU/USD run-up could be linked to fears emanating from Russia.

Gold price trace United States Treasury bonds

A rush towards risk safety could easily be witnessed as the United States Treasury bond prices rallied, together with the Gold price, which in turn drowned the bond yields and the US Dollar. That said, the benchmark 10-year Treasury bond yields dropped to the lowest levels since early September by loosing 3.30% in a day to 3.42% level at the latest. Further, the two-year counterpart dropped 2.54% to 4.26% mark. With this, the US Treasury bond yield curve, the difference between the long-dated and the short-term bond yields, inverted the most in over forty years.

While checking the underlying reasons, the fears of global economic slowdown and the Federal Reserve’s (Fed) readiness to go easy on the interest rate hikes gain the major attention.

In addition to this, the recently softer prints of the United States second-tier data, namely the trade balance and Unit Labour Costs for the third quarter (Q3), become additional catalysts to weigh on the US Dollar and propel the Gold price.

Mixed headlines from China, Russia confuse XAU/USD bulls

China announced multiple measures to ease the three-year-long Zero-Covid policy and bolstered the market sentiment before the risk appetite weakened. The dragon nation’s downbeat prints of the Trade Balance, Imports and Exports seemed to have probed the positive vibes. On the other hand, Russian President Vladimir Putin teased a nuclear war by saying that nuclear weapons could be used to defend itself and its allies.

Light calendar to tease gold traders

Although the softer United States Treasury bond yields and US Dollar keep the Gold buyers hopeful, a lack of major data/events could test the metal’s short-term upside. Even so, the weekly prints of the US Jobless Claims may gain attention after the recent disappointment from the Unit Labour Costs for Q3, which in turn could please the XAU/USD buyers in case of downbeat outcome.

Gold price technical analysis

Gold price flirts with a three-week-old horizontal resistance area surrounding $1,785, after multiple bounces off the 100-bar Simple Moving Average (SMA), close to $1,764 by the press time.

The XAU/USD recovery also takes clues from the firmer Relative Strength Index (RSI) line, placed at 14. Additionally keeping buyers hopeful is the impending bull cross on the Moving Average Convergence and Divergence (MACD) indicator.

That said, the Gold price appears all set to cross the $1,800 threshold. However, an upward-sloping resistance line from early October, around $1,815 at the latest, could challenge the XAU/USD buyers afterward.

Alternatively, pullback remains elusive unless the quote stays beyond the 100-SMA level near $1,764.

Even if the Gold bears manage to conquer the key SMA support, a broad horizontal area comprising levels marked since October 04, close to $1,730-32, will be in focus.

Gold price: Four-hour chart

Trend: Further upside expected

- Silver price rallies more than 2.40% on Wednesday due to falling US T-bond yields.

- XAG/USD: Break above $23.00 could open the door for a re-test of an 8-month high.

Silver price bounces off the daily low at $22.10, and prints a fresh two-day high around $22.81, due to broad US Dollar (USD) weakness and falling US Treasury bond yields, as investors seeking safety and pricing in a recession bought US Treasuries. Therefore, the XAG/USD is rallying, trading at $22.72, gaining some 2.49%.

Silver Price Analysis: XAG/USD Technical Outlook

The daily chart shows that the XAG/USD uptrend remains intact. Tuesday’s price action formed an inverted hammer following Monday’s collapse of 3.85%, and even though it closed below near-term support of the December 5 low of $22.17, it climbed sharply on Wednesday.

Like the Relative Strength Index (RSI) and the Rate of Change (RoC), oscillators depict that buyers are gathering momentum. Hence that could prepare the territory for a re-test of the eight-month high at around $23.51.

Therefore, the XAG/USD first resistance would be the psychological $23.00 figure. Above it lies the December 5 swing high of $23.51 (also the 8-month high), which, once broken, could send XAG/USD rallying toward the psychological $24.00.

As an alternate scenario, the XAG/USD first support would be the December 6 swing low of $22.03, followed by the 20-day Exponential Moving Average (EMA) at $21.74, followed by the 200-day EMA at $21.06.

Silver Key Technical Levels

- GBP/USD is looking to shift its business above 1.2200 amid an improvement in investors’ risk appetite.

- The US Dollar will witness a prolonged decline after a policy change by the FOMC from Q1CY2023.

- Concerns over recession due to Fed’s higher interest rate peak guidance have sidelined S&P500.

The GBP/USD pair is aiming to shift its auction profile above the round-level hurdle of 1.2200 in the early Asian session. Earlier, the Cable displayed a firmer recovery after dropping to near 1.2100 on Wednesday. A responsive buying action from the market participants pushed the Cable significantly higher. Investors shrugged off United States data-inspired volatility and cheered the easing Covid-19 lockdown measures in China.

Stellar recovery in the risk appetite theme terminated a two-day recovery in the US Dollar index (DXY). The USD Index sensed extreme selling pressure while attempting to reclaim the critical resistance of 106.00. S&P500 remained sideways but signs of a rebound are available. Meanwhile, the 10-year US Treasury yields witnessed an intense sell-off and dropped to near 3.42%.

Concerns over higher borrowing costs expectations due to fresh strength in the United States economy led by firmer Nonfarm Payrolls (NFP) data and solid demand for the service sector are muddling investors. The market participants are in a fix on whether to cheer strength in the US economy or turn anxious over rising expectations for recession due to higher interest rate peak guidance by the Federal Reserve (Fed) policymakers.

Meanwhile, Economists at the National Bank of Canada believe that the greenback could recover some ground in the near term before sustaining a prolonged decline next year. But for the long term, a stage of prolonged decline will take place after a policy change from the Federal Open Market Committee (FOMC) in the first quarter of CY2023.

Going forward, investors will keep an eye on US five-year Consumer Inflation Expectations, which will release on Friday. Long-term inflation expectations are still anchored as the Fed has already accelerated its interest rates vigorously.

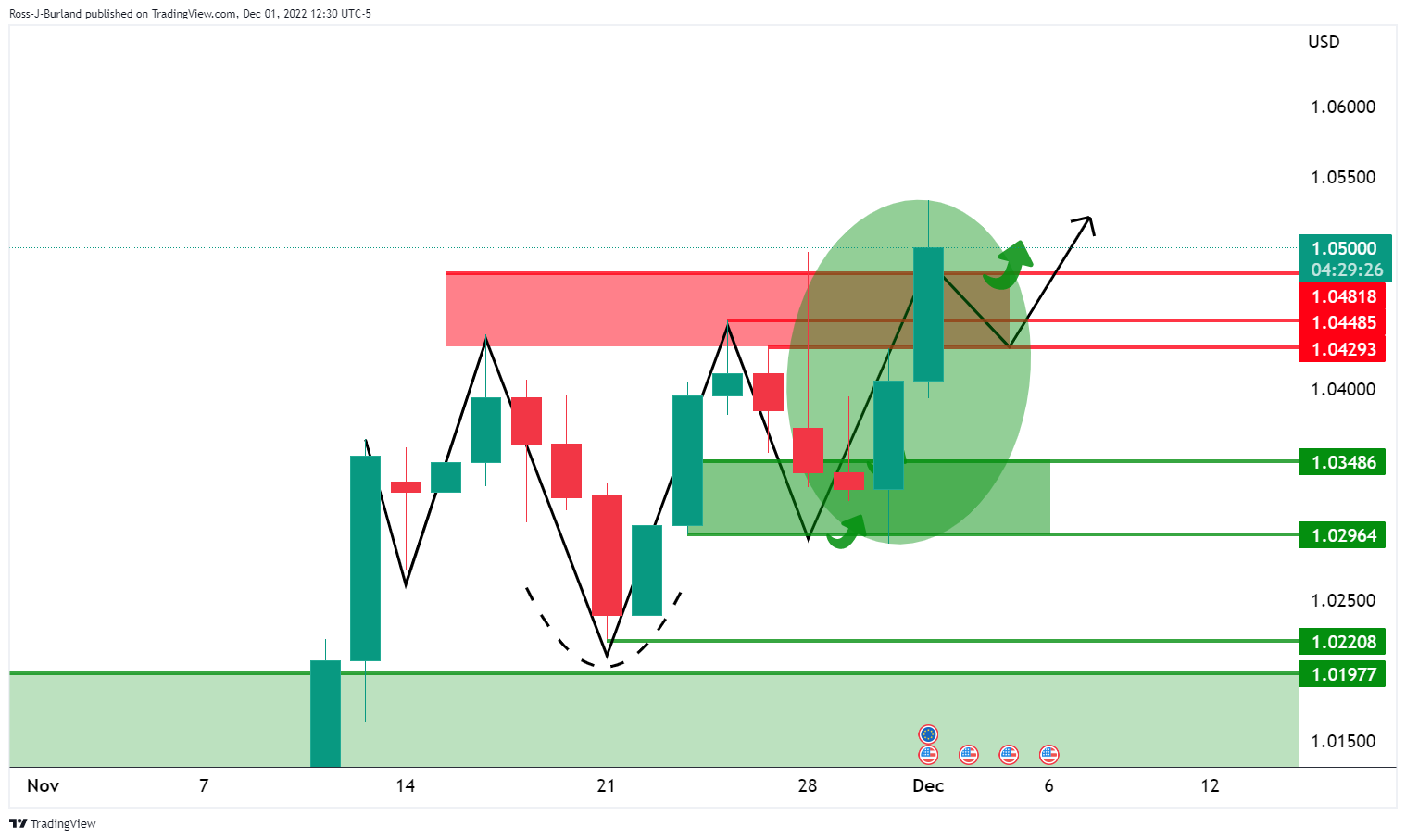

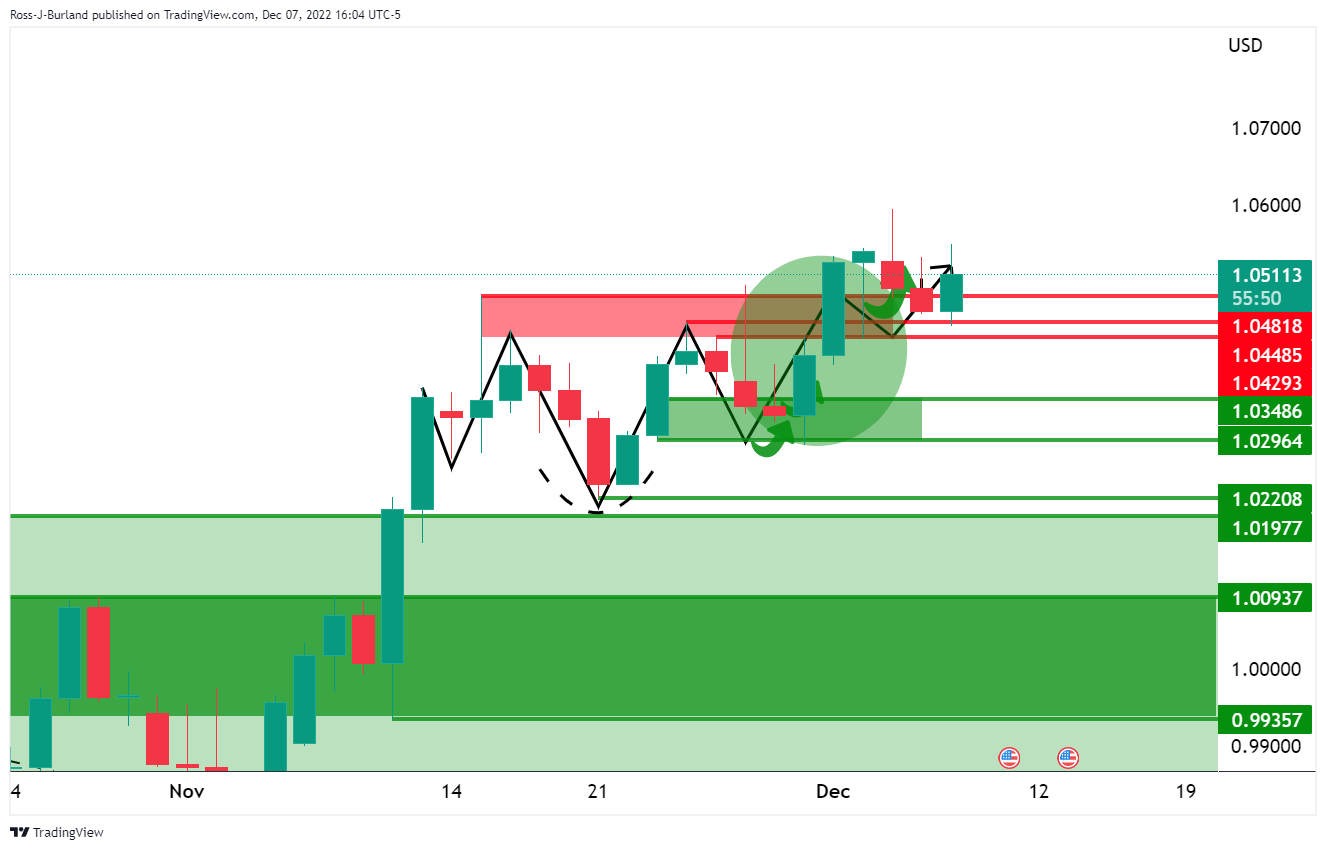

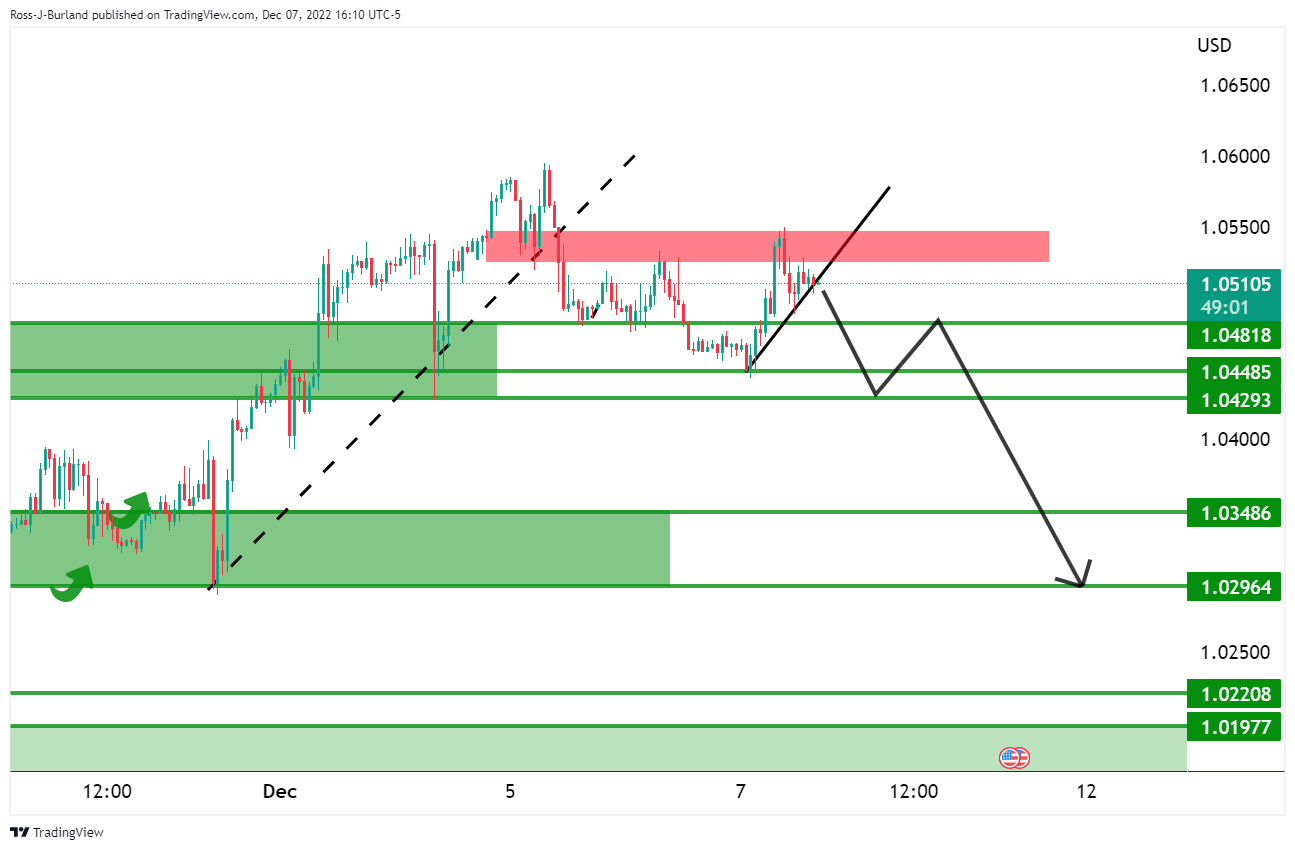

- 1.0550 is capping the bulls that look for space above 1.0600.

- EUR/USD bears eye a break of the micro trendline and below 1.0480 for a downside bias.

As per the prior analysis, EUR/USD Price Analysis: Bulls eye higher highs in the 1.05 area, whereby an inverse head & shoulders was identified on the daily chart, the price has stayed with the bullish course as follows:

EUR/USD prior analysis

EUR/USD update

The price moved in on the support zone and has found buyers again. The bulls eye an upside continuation with 1.0600 on the radar on a break of the bull cycle highs. A break of the 1.0450s, however, will put the bullish bias into jeopardy and open risk to 1.0350/00 for the foreseeable future as per the hourly chart below:

Bears eye a break of the micro trendline and below 1.0480 for a downside bias.

- USD/JPY drops weighed by falling US 10-year bond yields and a soft US Dollar.

- Weaker than expected, China’s data triggered risk aversion, despite easing Covid-19 restrictions.

- US economic data revealed since last Friday suggests the Federal Reserve has work to do.

USD/JPY tumbles as Wall Street closes after hitting a daily high of 137.85 and a low of 136.21, weighed by broad US Dollar (USD) weakness, as China’s economic data threatens to derail the global economic recovery amidst relaxing Covid-19 restrictions. Those factors amongst demand for US Treasuries sent yields tumbling, undermining the USD/JPY. At the time of writing, the USD/JPY is trading at 136.32.

Risk aversion keeps US equities trading with losses. The US Dollar remains soft in the session, blamed on falling US Treasury yields, with the US 10-year benchmark rate plummeting 11 bps to 3.422%. Meanwhile, the US 10s-2s yield curve inverted the most in 40 years, down at -0.842%, a signal of a possible upcoming recession in the United States.

Aside from this, China reported the Balance of Trade for November, which missed expectations, while Exports plunged 8.7% YoY vs. a 3.5% contraction estimated. Concerning the Covid-19 restrictions, Chinese authorities announced that people with Covid can isolate at home if they have mild or no symptoms. Additionally, PCR tests are no longer needed when visiting most venues.

In the meantime, the last two weeks economic data from the United States (US) has proved the economy’s resilience. An upbeat US employment data, wages rising above the 5% threshold, and The US ISM Services PMI exceeding estimates further cemented the case for the 50 bps rate hike by the Federal Reserve. Also, ahead of the Fed’s decision, inflation data from the US would give USD/JPY traders clues regarding the size of the rate hike.

In the Japanese front, the economic docket will feature GDP Growth Rate for Q3, expected to contract 0.3% MoM, while the annual reading is expected to drop 1.1%. Furthermore, the Current Account Balance is estimated to be ¥623.4B

USD/JPY Key Technical Levels

- NZD/USD firms up on US Dollar weakness as focus switched to the Fed next week.

- China lifted sentiment with the nation announcing some easing in its zero-COVID strategy.

NZD/USD is higher by some 0.75% in the day so far having climbed from a low of 0.6309 to a high of 0.6384 while the US Dollar gives up the prior day's gains as the DXY moves into a key level of resistance ahead of the 106 level.

The greenback is under pressure as news from China lifted sentiment with the nation announcing some easing in its zero-COVID strategy. There were reports that people with Covid can now isolate at home rather than in state facilities if they have mild or no symptoms. They also no longer need to show tests for most venues and can travel more giving risk sentiment a lift mid-week.

Meanwhile, weaker US unit labour costs may have weighed on Wednesday leading to a move in both US bond yields and the greenback. ''The focus remains global, and while we are somewhat sceptical about the sustainability of lower US bond yields given Fed rhetoric, markets clearly want to move onto the next cycle and are fading end-of-cycle factors and hawkish Fed overtones,'' analysts at ANZ Bank said. ''That speaks to volatility going into and in the wake of next week’s Fed meeting; that seems the key takeaway.''

Looking ahead to next week's meeting, Federal Reserve's Chair Jerome Powell most recently said that the US central bank could scale back the pace of its rate increases "as soon as December." Futures contracts tied to the Fed policy rate still imply a 70% chance that central bankers will slow the pace of rate hikes when they meet Dec. 13-14.

The Fed's chair Powell's comments have prompted the market to price in a lower peak interest rate, which Fed funds futures showed on Wednesday was 4.933%, down from a recent high of 5.1%. Markets are now rethinking this to a 5%-5.25% range by May, as per the futures contract prices and the CME Fed watch tool.

Meanwhile, noting that the USD has stopped appreciating and is now in full retreat, analysts at ANZ Bank argued that ''even if the USD has peaked and further depreciation occurs (strengthening the NZD), volatility has picked up and it could be a bumpy ride.''

What you need to take care of on Thursday, December 8:

The US Dollar finishes Wednesday with losses against most of its major rivals, despite a dismal market mood. The decline was contained, but it’s clear that the American currency

Earlier in the day, China announced a series of measures relaxing coronavirus restrictions, moving away from the zero-Covid policy. However, macroeconomic figures were discouraging. The November Trade Balance posted a surplus of $69.84 billion, as exports fell by 8.7%, while imports were down 1.1%. The poor figures exacerbated concerns about global economic progress.

Another risk-off factor came from Moscow, mid-US session. Russian President Vladimir Putin warned t the threat of a nuclear war is rising, adding that nuclear weapons could be used to defend itself and its allies.

The US Treasury yield curve inverted the most in over forty years, amid concerns related to the global economic growth and uncertainty ahead of the looming US Federal Reserve monetary policy decision. Yields finished the day in the red, as demand for government bonds resurged following news coming from Russia. The 10-year note currently yields 3.43%, while the 2-year note pays 4.26%.

The Euro Area Gross Domestic Product came in better than anticipated in the third quarter of the year, posting an annualized growth of 2.3%. The quarterly gain was o 0.3%, better than the 0.2% anticipated. EUR/USD battles the 1.0500 level, trading a handful of pips above it.

The Bank of Canada hiked its benchmark interest rate by 50 basis points to 4.25% as expected. Policymakers noted that there is growing evidence that the tighter monetary policy is training domestic demand while acknowledging inflation remains elevated. The central ban will be considering whether the policy rate needs to rise further. USD/CAD seesawed between gains and losses, ending the day at around 1.3640.

GBP/USD trades just above 1.2200, while AUD/USD hovers around 0.6730. The USD/JPY pair is down to 136.30, while USD/CHF settled at around 0.9400.

Gold benefited from the broad dollar weakness and trades at around $1,787 a troy ounce, while crude oil prices remained under selling pressure. WTI trades at $72.10 a barrel, its lowest since December 2021

Like this article? Help us with some feedback by answering this survey:

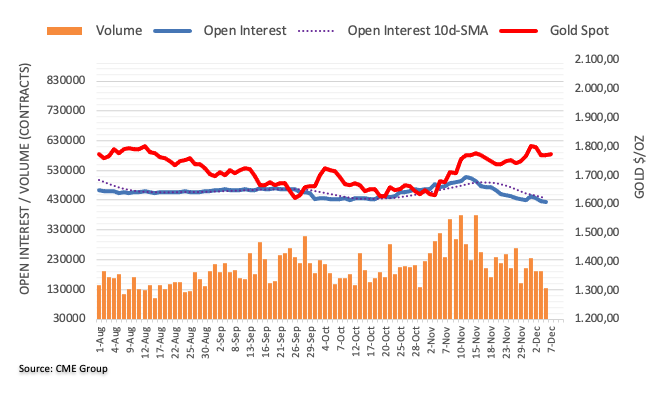

- Gold has broken the bullish trendline but is now coming up to test the bearish commitments.

- Bulls eye a move beyond $1,790 on a strong correction that threatens a continuation to the upside.

Gold price is higher on the day having climbed from a low of $1,768.82 and reaching a high of $1,789.05 so far as the US Dollar tails off in the mid-afternoon session in the US.

At the time of writing, XAU/USD is 1% higher at $1,789 as the greenback slides while China announces some easing in its zero-COVID strategy. People with Covid can now isolate at home rather than in state facilities if they have mild or no symptoms. They also no longer need to show tests for most venues and can travel more giving risk sentiment a lift mid-week.

Nevertheless, US equities have struggled for direction as investors digest the recent data of late within the US Federal Reserve officials in the blackout ahead of next week’s meeting. At the start of this week, the Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates. Additionally, last Friday's surprisingly strong Nonfarm Payrolls data in November has raised optimism that a recession could be avoided in 2023.

Meanwhile, the Fed Chair Jerome Powell said last week that the US central bank could scale back the pace of its rate increases "as soon as December," and futures contracts tied to the Fed policy rate still imply a 70% chance that central bankers will slow the pace of rate hikes when they meet Dec. 13-14.

The Fed's chair Powell's comments have prompted the market to price in a lower peak interest rate, which Fed funds futures showed on Wednesday was 4.933%, down from a recent high of 5.1%. Markets are now rethinking this to a 5%-5.25% range by May, as per the futures contract prices and the CME Fed watch tool.

Gold technical analysis

Gold has broken the bullish trendline but is now coming up to test the bearish commitments near $1,790 on a strong correction that threatens a continuation to the upside.

- Broad US Dollar weakness across the board, a headwind for the USD/CHF.

- A falling wedge in the USD/CHF daily chart suggests the pair might break upwards

- USD/CHF: A break below 0.9326 might pave the way to 0.9300; otherwise, a rally to 0.9400 is on the cards.

The USD/CHF extends its losses for two consecutive trading sessions, down by a minuscule 0.22%, after hitting a daily high of 0.9437. At the time of writing, the USD/CHF is trading at 0.9396, as the US Dollar Index (DXY) plunges 0.51%.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF daily chart suggests the pair is downward biased. Since mid-November, the USD/CHF has formed a falling wedge, a bullish continuation chart pattern, which appeared, following the massive swing from around 2022 highs of 1.0147, towards the last week’s 0.9326 low. Therefore, the USD/CHF might consolidate between the wedge boundaries before breaking upwards/downwards.

Oscillators give mixed signals, with the Relative Strength Index (RSI) aiming downwards, while the Rate of Change (RoC) portrays selling pressure fading. Unless the USD/CHF breaks below 0.9326 and poses a challenge to break the wedge on the downside, that could lay the ground for a test of the 0.9300 figure.

As an alternate scenario, the USD/CHF first resistance would be the 0.9400 figure, followed by the September 13 daily low-turned-resistance at 0.9479, followed by the wedge’s top-trendline at 0.9505, and the 20-day Exponential Moving Average (EMA) At 0.9510.

USD/CHF Key Technical Levels

- AUD/USD holds on positive grounds despite risk-off mood.

- The Australian economy expanded less than expected in the third quarter, eyes stay on data.

AUD/USD is higher on the day having climbed from a low of 0.6668 and reaching a high of 0.6734 so far. News that authorities have loosened some of the country's zero-COVID rules sparked a risk on mood in Asia that followed through into North American markets on Wednesday. The greenback has weakened amid concerns that rising interest rates could push the US economy into recession.

Investors have cheered the news that China is preparing its people to live with the disease, although there are still fears that the US central bank might stick to a longer rate-hike cycle which is weighing on US equities on Wednesday.

At the start of this week, the Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates.

The data beat forecast the Non-manufacturing PMI would fall to 53.1. While the data combined with last Friday's surprisingly strong Nonfarm Payrolls data in November had raised optimism that a recession could be avoided in 2023, investors are concerned that the Fed will subsequently hike rates by 75 Bps again at the December meeting.

Last Friday's surprisingly strong Nonfarm Payrolls data in November had also raised optimism that a recession could be avoided in 2023, yet investors are concerned that the Fed will subsequently hike rates by 75 Bps again at the December meeting which is a weight on high beta currencies such as the Aussie. More economic data, including weekly jobless claims, the Producer Price Index and the University of Michigan's Consumer Sentiment survey are due this week that will be watched for clues on what to expect from the Fed on Dec. 14.

Meanwhile, the Australian Dollar was facing some pressure overnight after data showed that the Australian economy expanded less than expected in the third quarter as persistent inflation and rising interest rates dampened consumption. The data follows the comments from the Reserve Bank of Australias Governor Philip Lowe who said that “the size and timing of future interest rate increases will continue to be determined by incoming data.”

- Weaker-than-expected economic data in China threatens to derail economic growth and trigger risk aversion.

- Federal Reserve pressured by Solid US economic data released since last Friday and US inflation data looming.

- GBP/USD: Remains upward biased, could test Tuesday’s high of 1.2269 ahead of 1.2300.

The British Pound (GBP) turned positive despite overall risk aversion triggered by China’s exports weakening. Additionally, the latest headlines involving Russian President Vladimir Putin, saying that “the threat of nuclear war is increasing,” bolstered the US Dollar (USD), giving another leg-down to the GBP/USD pair. Nevertheless, the Sterling has recovered, and the GBP/USD is trading at 1.2215, above its opening price, after reaching a high of 1.2226.

Exports in China plunged, sparking global recession fears

Sentiment remains deteriorated after China’s Trade Balance data weakened, showing that Exports plunged 8.7% YoY, below estimates of 0.3% contraction. Economic data since the second half of the last week from the United States (US) showed that the labor market remains tight and that wages are rising, a signal that is not going to be liked by Federal Reserve (Fed) Chair Jerome Powell. Given that Powell’s speech last Wednesday gave the green light to lower interest rate hikes, further inflation data to be revealed this Thursday with the Producer Price Index (PPI) and next week’s Consumer Price Index (CPI) would be crucial to assess the following week’s rate hike by the Federal Reserve.

The lack of economic data on the United Kingdom (UK) front keeps the Pound Sterling adrift to US Dollar dynamics. However, it appears that the political drama spurred during the premiership of Lizz Truss has abated so far, due to a fiscally responsible budget, by the new Prime Minister Rishi Sunak. Nevertheless, it should be said that the UK economy is “likely” already in recession, and a gloomy outlook with labor shortages, wage inflation, Brexit jitters, and weak investment, could hurt the prospects for higher GBP/USD spot prices.

In the next week, the Federal Reserve and the Bank of England are expected to raise rates by 50 bps, leaving interest rates differentials unchanged. What could rock the boat is the Summary of Economic Projections (SEP) released by the Fed, which will update Fed officials’ projections for the Federal Fund rates (FFR). A higher peak for the FFR would be hawkish and could spur US Dollar strength towards the end of 2022.

GBP/USD Price Analysis: Technical outlook

The GBP/USD daily chart suggests the pair remains upward-biased after bouncing off the 200-day Exponential Moving Average (EMA) at 1.2104. Geopolitical headlines linked to Putin and nuclear war issues spurred a flight to safety, but nerviosism faded as the GBP/USD approaches Tuesday’s high of 1.2269. Therefore, the GBP/USD next resistance level would be 1.2269, followed by the psychological 1.2300. As an alternate scenario, the GBP/USD first support would be 1.2200, followed by the 200-day EMA at 1.2104 and the 20-day EMA at 1.2048.

On Wednesday, the Bank of Canada (BoC) raised its key interest rate by 50 bases points to 4.25%, in line with market consensus. Analysts at CIBC, point out the BoC sounded more cautious. They see the central bank plateauing at the 4.25% level.

Key Quotes:

“The Bank of Canada flashed a yellow card on its rate hiking team by sounding more cautious about its willingness to press on to even higher interest rates in 2023, even as it tightened today. As we expected, the Bank lifted the overnight rate by 50 basis points to 4.25%, but having previously concluded these messages by saying that rates “will need to rise further,” it now says only that it will “be considering whether the policy interest rate needs to rise further”.

“We see the overnight rate plateauing at this 4.25% level, but unlike what financial markets have been presuming in the last couple of weeks as bond yields tumbled, we expect the Bank of Canada to keep the overnight rate there through 2023, and ease only gradually in 2024.”

“We expect to see enough further evidence that demand growth is slowing to keep the Bank on hold in Q1, but even then, the Bank might want to leave the door ajar for a later hike by retaining the wording it used today. Indeed, it might not be until the spring of 2023, when we've put a couple of quarters of negligible growth behind us and have clearer signs of economic slack, when the language of these statements changes to indicate that the Bank is no longer "considering" further hikes.”

“We see the Fed pressing on to higher rates than the Bank of Canada, so a strengthening in the loonie awaits a general turn to a weaker US dollar globally, something we expect to see as we get to the end of the Fed's hiking cycle in Q1 2023.”

- The Loonie appreciates against the US Dollar following the Bank of Canada 50 bps rate hike.

- The Bank of Canada expects further tightening as core CPI persists at 5%.

- After the BoC’s decision, the USD/CAD tumbled from around 1.3660 to its daily low of 1.3588.

The USD/CAD tumbled during the North American session after the Bank of Canada (BoC) lifted rates by 50 bps, from 3.75% to 4.25%, in line with analysts’ expectations, triggering a fall from around 1.3700 to 1.3505. At the time of writing, the USD/CAD remains volatile, trading around 1.3600-1.3615.

Bank of Canada remarks of its monetary policy statement

The Bank of Canada mentioned that inflation worldwide remains high and broadly based. Even though growth is slowing, the BoC said that the US economy is proving to be resilient, with consumption rising and the labor market “overheated.” They commented that supply bottlenecks are easing, though geopolitical events could disrupt it.

The BoC acknowledged that the labor market is tight, and the Q3 GDP was stronger than expected and commented that “there is growing evidence that tighter monetary policy is restraining domestic demand, consumption moderated in the third quarter, and housing market activity continues to decline.”

The Governing Council noted that inflation remains too high, and short-term inflation expectations remain elevated. Traders should know that CPI is at 6.9%, while core CPI is around 5%.

The BoC finished its statement by saying that further rate hikes would be needed to bring supply and demand into balance, adding that Quantitative Tightening (QT) “is complementing increases in the policy rate.”

USD/CAD Reaction to the Bank of Canada decision

The USD/CAD 5-minute chart portrayed the pair as seesawing around the daily pivot point at 1.3630 and the 1.366 area before the decision crossed newswires. After the headline, the USD/CAD tumbled towards its daily low of 1.3587 before stabilizing in the 1.3600-1.3620 range, below the 20-Exponential Moving Average (EMA) at 1.3623.

- Russian President Putin warns of increased nuclear war risks.

- Market sentiment deteriorates briefly after comments, then rebounds.

- EUR/USD up for the day but off highs.

The EUR/USD dropped below 1.0500 following comments from Russian President Putin. The Euro is among the weakest currencies of the American session. Earlier it peaked at 1.0549, the highest level in two days.

A choppy session

Market sentiment deteriorated briefly after Russian President Vladimir Putin said the threat of nuclear war is on the rise. He added they have the most advanced weapons but they don’t want to use them. He considers it possible using nukes as a response to an attack.

Wall Street is moving between gains and losses. The S&P 500 is up 0.28%, after falling during the previous four trading days. Crude oil prices are back in negative territory. The US Dollar is mixed, with the DXY down 0.35%, off lows.

Unclear signs

The Euro is rising versus the US Dollar after two consecutive daily losses, recovering from the three-day lows. The main trend remains bullish with a focus on the 1.0600 area which is the critical resistance for the moment. On the flip side, the key area is seen around the 1.0400 area; before that level support levels are seen at 1.0480 and then 1.0440.

As of writing, EUR/USD is hovering around 1.0500, up for the day but off highs. The 20-hour Simple Moving Average stands at 1.0480 and a slide below would change the intraday bias to bearish.

Technical levels

Gold showed an extremely positive performance in the month of November. However, economists at Commerzbank do not expect the yellow metal to hold its gains.

Fragile recovery of Gold price

“The potential for further gains is likely to gradually diminish. Even though the rate hike cycle will end in the foreseeable future, interest rates will probably remain at the elevated level they will then have reached for quite some time after.”

“Rate cuts would presumably require inflation to fall significantly and lastingly and to approach the Fed’s inflation target of 2% again. Powell says that this will necessitate a restrictive interest rate level for a prolonged period. If interest rate expectations increase any further following the upcoming Fed meeting because the Fed believes a higher rate level to be necessary, Gold could come under pressure.”

“The same would happen if the USD were to appreciate again. A foretaste of this came following the publication of a much more buoyant ISM Non-Manufacturing Index than anticipated. It caused the Gold price to slide by around $40.”

The trade-weighted US Dollar index has suffered its worst monthly depreciation since 2009. Economists at the National Bank of Canada believe that the greenback could recover some ground in the near term before sustaining a prolonged decline next year.

US Dollar appears oversold

“The US Dollar appears oversold and we would expect a partial retracement in the coming weeks.”

“Looking ahead to next year, we still anticipate a policy change from the FOMC in the first quarter of 2023, which would set the stage for a more prolonged decline in the greenback.”

Russian President Vladimir Putin said on Wednesday that the threat of a nuclear war is on the rise, as reported by Reuters.

Key takeaways

"Russia will defend its allies with all available means."

"Russia does not have tactical nuclear weapons in other countries unlike the United States."

"We didn't speak about usage of nuclear weapons."

"Russia has not gone mad."

"We have most advanced weapons, but do not want to wave them around."

"Russia considers such weapons as deterrent."

Market reaction

These comments don't seem to be having a significant impact on risk perception. As of writing, the S&P 500 Index was virtually unchanged on the day at 3,940.

Measured since the middle of November the Pound is the second best performing G10 currency after the NZD. Going forward, the question is whether these gains are sustainable? Economists at Rabobank expect GBP/USD to turn back lower in 2023.

Potential for further sharp dips in Cable next year

“We expect choppy conditions in Cable and for near-term activity to be mostly guided by movement in the USD.”

“While we are not expecting to see Cable re-visit it post mini-budget low in the coming months, we do see the potential for further sharp dips in Cable next year. This assumes another wave of concerns regarding heightened energy costs for Europe looking ahead to winter 2023 which would pressure European currencies vs. the greenback.”

“We continue to view GBP as vulnerable as see strong risk that Cable will spend much of next year below 1.20.”

- Japanese Yen rises across the board on American hours as stocks slide and bonds rise.

- DXY turns negative and extends losses toward 105.00.

- USD/JPY retreats after hitting weekly highs.

The USD/JPY broke below the 137.55 area and fell to 136.39, printing a fresh daily low. The pair is retreating from weekly highs amid a weaker US Dollar. It is trading modestly lower for the day, after rising for two consecutive days.

Data released on Wednesday, showed an increase in Unit Labor Cost in the US during the third quarter of 2.4%, below the 3.2% of markets consensus. Nonfarm Productivity rose by 0.8% surpassing expectations of an increase of 0.5%. On Thursday, Jobless Claims data is due and on Friday, the Producer Price Index. Next week, on Tuesday, is the Consumer Prices Index and on Wednesday the FOMC decision.

Equity prices in Wall Street are falling modestly, with the S&P 500 down 0.25%, on its way to the fifth decline in a row. At the same time, US yields are also lower. The 10-year Treasury bond yield stands at 3.44%, the lowest since mid-September.

The rally in Treasuries and the decline in equity prices are boosting the Japanese Yen which is among the top performers of the American session. On the contrary, the US Dollar is falling across the board. The DXY is down by 0.43%, approaching 105.00.

USD/JPY downside contained so far by 136.30

The decline in USD/JPY found support around 136.30, a relevant support. Below the 20-Simple Moving Average in four-hour charts emerges at 136.15. So a confirmation under 136.15 would point to more losses for the pair targeting initially 135.55.

The US Dollar needs to break and hold above 137.70/80 in order to open the doors to 138.00 and more.

Technical levels

- Sentiment shifted negatively on weaker Exports from China as recession fears increased.

- Economic data revealed in the United States warrants further Federal Reserve tightening.

- Gold Price Forecast: Reclaiming $1780, put in play a test to $1800.

Gold price climbs back above $1770 amidst a risk-off impulse due to negative data from China increasing concerns of a global recession, while worldwide central banks continue to raise borrowing costs. The last rounds of economic data released in the United States (US), depicting a resilient economy, add pressure on the Federal Reserve (Fed) to act. Nevertheless, the US Dollar (USD) edges lower, a tailwind for the yellow metal. At the time o typing, the XAU/USD is trading at $1783., after hitting a low of $1768.

China’s exports tumbled, spurring recession woes

US equities fall, depicting a risk-off mood. Data released in the Asian session that China’s exports plunged 8.7% YoY in November, well beneath the 3.5% contraction expected, triggered pessimism that the economy would further slow down, despite Chinese authorities relaxing Covid-19 restrictions.

Economy in the United States remains resilient, pressures the Federal Reserve

Recent data from the United States had shown that the Federal Reserve would need to continue to tighten monetary policy. The US economy adding 263K new jobs, as demonstrated by November’s Nonfarm Payrolls (NFP) report, showed the tightness of the labor market. Additionally, Average Hourly Earnings jumped by 5.1% YoY vs. 4.9%, adding to inflationary pressures.

In the meantime, the ISM Non-Manufacturing PMI grew by 56.6, exceeding forecasts of 53.3, bolstered by the holiday season. According to Bloomberg analysts, “the price subindex confirmed the inflationary impulse in services is still strong despite more widespread disinflation in goods sectors.”

Federal Reserve to diggest PPI, Consumer Sentiment, and next week’s CPI

Given the backdrop mentioned above, the next week’s Federal Reserve Open Market Committee (FOMC) meeting would be crucial, albeit the Federal Reserve Chair Jerome Powell gave the green light on 50 bps rate hikes. However, with US data looming, like the Producer Price Index, the University of Michigan (UoM), and the following week’s Consumer Price Index (CPI), it would shed some cues about inflation elevating or easing.

Gold Price Forecast: XAU/USD Technical Outlook

From a technical perspective, Gold remains upward biased. However, after breaching the $1800 figure last Friday, the yellow metal failed to capitalize on broad US Dollar weakness, as XAU/USD tumbled below the $1800 mark. Gold buyers’ lack of strength is well portrayed by the Relative Strength Index (RSI), registering a series of lower peaks, while price action is aimed upwards. Also, the Rate of Change (RoC) confirms buying momentum is fading.

Nevertheless, Gold’ was capped around $1766, and XAU/USD is back above $1780, eyeing a break of the November 15 swing high at $1786.53. If XAU/USD breaches the latter, the next resistance will be the $1800 figure. The break above will expose the June 17 daily high at $1857.20, followed by the June 13 pivot high at $1879.45.

The Bank of Canada (BoC) announce that it hiked its benchmark interest rate by 50 basis points to 4.25% following the December policy meeting. This decision came in line with the market expectation. In its policy statement, the BoC said that it will be considering whether the policy rate needs to rise further.

Market reaction

With the initial reaction, USD/CAD edged lower and was last seen losing 0.3% on the day at 1.3610.

Key takeaways from policy statement

"There is growing evidence that tighter monetary policy is restraining domestic demand."

"Three-month rates of change in core inflation have come down in an early indicator that price pressures may be losing momentum."

"Inflation is still too high and short-term inflation expectations remain elevated."

"Data since October monetary policy report support the bank's outlook that growth will essentially stall through the middle of 2023."

"Inflation around the world remains high and broadly based."

"Global economic growth is slowing, although it is proving more resilient than predicted in October Monetary Policy Report."

"Gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events."

"Q3 Canada GDP was stronger than expected, the economy continues to operate in excess demand; labor market remains tight."

Although it has recovered from some of its recent losses, the Loonie has performed disappointingly over the past month. Looking ahead, economists at the National Bank of Canada expect the CAD to outperform the USD in 2023.

Imminent pause by the Bank of Canada

“The improvement in inflationary trends sets the stage for an imminent pause by the BoC to assess the impact of previous rate hikes. Such a pause would certainly help allay fears of a recession and a prolonged period of house price deflation.”

“We sill see the possibility of a significant appreciation of the CAD against the greenback in 2023.”

S&P 500 is starting to turn more decisively lower. Analysts at Credit Suisse now look for a closing break below 3938 to complete a short-term top.

Initial resistance seen at 3984

“We look for a sustained move below 3938 to confirm that a top is in place to clear the way for further weakness to 3868/58 initially, which is the 38.2% retracement of the October/December rally. Whilst we would look for this to hold at first, below in due course should see the 63-day average at 3835 next, with the ‘measured top objective’ seen at 3775.

“Big picture, we maintain our base case the October/December has been a bear market rally only.”

“Resistance is seen at 3984 initially, with 3999/4015 now ideally capping. Above can see a recovery back to 4042/52.”

Since the end of August through to now, the Pound is the top performing G10 currency, having advanced 4.9%. However, economists at MUFG Bank expect GBP underperformance from here.

Underperformance set to re-emerge

“It is the imminent economic disruption from strikes that could soon start to undermine sentiment once again. We are not convinced market participants have priced appropriately the disruptions that are coming and if these strikes materialise as scheduled, the hit to confidence and growth could be notable. Train operators, Royal Mail, nurses in the NHS, ambulance technicians, bus drivers, road maintenance workers, Heathrow ground handlers, the Eurostar, and civil servants are all scheduled to strike in December and announced strikes of nearly 50 days have so far been confirmed with more yet to be announced.”

“The global risk-on that has been evident since mid-October looks to be coming to an end while domestic specific factors here in the UK will likely undermine confidence further with December kicking off the winter with severe disruptions and with more to come.”

- The index keeps the bearish noted unchanged near 105.00.

- The favourable risk-on mood continues to weigh on the dollar.

- US yields add to Tuesday’s decline across the curve.

The greenback, when measured by the USD Index (DXY), remains under pressure and near the 105.00 neighbourhood on Wednesday.

USD Index weaker on stronger risk appetite

The index probes the area of 2-day lows in the 104.90/85 band midweek, as investors’ preference for the risk complex seems to have gathered extra pace in response to further re-opening in China.

In line with the daily retracement in the dollar, US yields accelerate the decline to new multi-week lows in the belly and the long end of the curve, while the short end trade in 3-session lows so far.

In the calendar, MBA Mortgage Applications contracted 1.9% in the week to December 2, while Consumer Credit Change is due later in the NA session.

What to look for around USD

The dollar remains offered as investors seem to have digested the recent hawkish messages from some Fed’s policy makers as well as above-expectations results from some US fundamentals.

While hawkish Fedspeak maintains the Fed’s pivot narrative in the freezer, upcoming results in US fundamentals would likely play a key role in determining the chances of a slower pace of the Fed’s normalization process in the short term.

Key events in the US this week: MBA Mortgage Applications, Consumer Credit Change (Wednesday) – Initial Jobless Claims (Thursday) – Producer Prices, Advanced Michigan Consumer Sentiment, Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.47% at 105.06 and the breakdown of 104.11 (monthly low December 5) would open the door to 103.41 (weekly low June 16) and finally 101.29 (monthly low May 30). On the other hand, the next hurdle comes at 105.82 (weekly high December 7) seconded by 107.19 (weekly high November 30) and then 107.99 (weekly high November 21).

Gold continues to fluctuate in a narrow range near $1,770. The yellow metal needs a weekly close above the 200-Day Moving Average (DMA) at $1,796 to see further gains, strategists at Credit Suisse report.

Move below support at $1,729 to ease the immediate upward bias

“Gold remains capped by the crucial 200DMA, currently seen at $1,796 and we expect a consolidation to emerge from here. Below support at $1,729 though is needed to ease the immediate upward bias in the range with support seen next at the 55DMA at $1,698.”

“A weekly close above $1,796 would be seen to open the door to a more meaningful recovery for a rise to the 50% retracement of the 2022 fall at $1,843 next, then the $1,877 June high.”

Alvin Liew, Senior Economist at UOB Group, comments on the latest results from Retail Sales in Singapore.

Key Takeaways

“Singapore’s retail sales continued to rise in Oct but by a more subdued 0.1% m/m SA, 10.4% y/y (from 3.2% m/m, 11.3% y/y in Sep), but it was still the seventh consecutive month of double-digit on-year growth. Excluding motor vehicle sales, the m/m increase was more pronounced at +0.8%, (but still a significant slowdown from 4.1% in Sep), translating to a 14.3% y/y increase (from 16.9% y/y in Sep).”

“Delving into the details of the latest retail sales growth, five of the 14 main segments recorded m/m decreases in Oct, up from four in Sep. As for the Oct y/y increase, it was due to larger growth in some retail sales segments including wearing apparel & footwear, food & alcohol, department stores and watches & jewellery. The estimated total retail sales value rose further to S$4.0 bn (from a decent S$3.8bn for Sep) and continued to signal an improving domestic retail and F&B environment in tandem with a tighter labour market, pent-up demand from the re-opening and more importantly, a return of tourist demand.”

“Outlook – Year-to-date, retail sales grew by 11.3% y/y. We continue to expect domestic retailers to enjoy domestic and external support, complemented by the return of major events such as various sports, concerts and BTMICE activities (Business Travel and Meetings, Incentive Travel, Conventions and Exhibitions) attracting tourist arrivals, while the tight domestic labour market will also contribute to domestic consumption demand. End-year festive demand is another positive. Importantly, households will likely front-load big ticket item purchases in Nov and Dec ahead of the GST hike from 7% to 8% on 01 Jan 2023."

"The key downside is elevated inflation pressures that may increasingly curb discretionary spending of households. The low base effect is also likely to fade going into 4Q 22, rendering less uplift. Barring the re-emergence of fresh COVID19 or other health-related risks in Singapore and around the region (leading to re-imposition of social and travel restrictions, which is not our base case), we continue to project retail sales to expand by 10% in 2022 which implies a more moderate forecast of around 6.0% retail sales growth in 4Q22. That will help support our projected 2.5% y/y services growth for 4Q 22. We have conservatively penciled in a 2.3% retail sales growth for 2023."

GBP/USD finds firm support in low 1.21 region. Economists at Scotiabank expect the pair to continue trading on a solid foot.

Intraday support is 1.2085/95

“Fundamental news is thin on the ground and what little there is is not that encouraging (lower house prices, more strikes on the way), suggesting gains are perhaps more technically inspired than anything else today, at least.”

“The underlying trend in the Pound looks constructive – higher highs and higher lows on the daily chart – with Pound also supported by constructive trend momentum signals.”

“Intraday support is 1.2085/95. Resistance is 1.2220.”

- EUR/USD rises to 2-day highs and revisits the 1.0550 zone.

- Further upside is expected to meet the next barrier at 1.0614.

EUR/USD reverses the weekly leg lower and reclaims the 1.0500 barrier and above on Wednesday.

Further upside in the pair is now likely to pick up pace following the recent surpass of the 200-day SMA and the 10-month resistance line. Against that, there are no resistance levels of note until the June high at 1.0614 (June 27).

Further upside in EUR/USD remains on the cards while above the 200-day SMA, today at 1.0355.

EUR/USD daily chart

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 15:00 GMT. The Canadian central bank is widely expected to lift its benchmark rate by 50 bps to 4.25% at the end of the November meeting amid elevated inflation, robust economic activity and a super-tight jobs market. Investors will take cues from the accompanying monetary policy statement in the absence of the post-meeting press conference.

Analysts at ING offer a brief preview of the central bank event and write: “Both markets and economists are split down the middle on whether it will be a 25 bps or 50 bps hike. We favour the latter given a robust 3Q GDP outcome, the tight jobs market and the ongoing elevated inflation readings. But we acknowledge there are signs of softening in the economy. The housing market is looking vulnerable and Canadian households are more exposed to higher rates than elsewhere due to high borrowing levels so we recognise this is a very close call. We are getting very close to the peak though, which we think will be 4.5% in 1Q 2023.”

How Could it Affect USD/CAD?

Ahead of the key risk, the USD/CAD pair touches a fresh one-month high, albeit struggles to capitalize on the move beyond the 1.3700 round-figure mark. A modest US Dollar pullback from the weekly top acts as a headwind for spot prices. Furthermore, an intraday recovery in crude oil prices from the YTD low offers some support to the commodity-linked Loonie and caps the upside for the major.

The BoC is unlikely to hint towards a more aggressive tightening. Moreover, any dovish signals by the Canadian central bank will be enough to exert additional downward pressure on the domestic currency. This, in turn, suggests that the path of least resistance for the USD/CAD pair is to the upside. Spot prices seem poised to surpass the 1.3700 mark and test the next relevant hurdle near the 1.3740 zone. The momentum could get extended towards reclaiming the 1.3800 round figure.

Key Notes

• Bank of Canada Preview: The end of the tightening cycle is around the corner

• BoC Preview: Forecasts from nine major banks, very close call

• USD/CAD Forecast: Move beyond 1.3700 remains on the cards, BoC decision awaited

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

- Unit Labor Costs in the US rose less than expected in the third quarter.

- US Dollar Index stays in negative territory near 105.00.

Unit Labor Costs in the nonfarm business sector rose by 2.4% in the third quarter of 2022, the US Bureau of Labor Statistics (BLS) reported on Wednesday. This reading came in lower than the market expectation for an increase of 3.2%.

Further details of the publication revealed that Nonfarm Productivity rose by 0.8% in the same period, compared to the market expectation of 0.5%.

Market reaction

These figures don't seem to be having a significant impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was down 0.4% on the day at 105.15.

USD/CAD has broken trend resistance at 1.3585. Therefore, economists at Scotiabank expect the pair to advance well above the 1.38 level.

Weakness back below needed to temper gains

“Spot gains above short-term trend resistance off the Oct high (1.3585) leave the USD with a clearer path to retest 1.38+ from here.”

“Resistance is 1.3805 and 1.3970/75.”

“Support is 1.3645 and 1.3585; weakness back below here is needed to temper USD gains.”

USD/JPY preserves its bullish momentum and climbs above 137.00. Economists at BBH note that the pair could test last week’s high near 140.

BoJ Board Member Nakamura remains dovish

“USD/JPY is trading at the highest level since December 1 near 137.65 and a clean break above 137.50 sets up a test of last week’s high near 140.”

“Bank of Japan Board Member Nakamura said the bank needs to continue with monetary easing as the economy is still recovering from the pandemic. He warned that tightening monetary policy could bring back deflation as the economy still has a negative output gap. Lastly, Nakamura said that is not yet time for a BoJ policy review. These comments are consistent with Kuroda’s earlier this week and support our view that the BoJ is on hold for the time being.”

- NZD/USD gains some positive traction amid a modest USD pullback from the weekly high.

- Hawkish Fed expectations, rising US bond yields should help limit losses for the greenback.

- Recession fears weigh on investors’ sentiment and might cap gains for the risk-sensitive Kiwi.

The NZD/USD pair edges higher for the second straight day on Wednesday, albeit struggles to capitalize on the move and remains confined within the previous day's trading range. Nevertheless, the pair sticks to its intraday gains through the early North American session and is currently placed near the daily top, just below mid-0.6300s.

Having failed to find acceptance above the very important 200-day SMA, the US Dollar retreats from a multi-day peak touched earlier today and offers some support to the NZD/USD pair. The USD, for now, seems to have stalled this week's goodish recovery move from over a five-month low, though hawkish Fed expectations should help limit the downside.

The recent upbeat US macro data suggests that the economy remains resilient despite rising borrowing costs and fuel speculations that the Fed may lift rates more than projected. This, in turn, pushes the US Treasury bond yields higher, which, along with a generally weaker tone around the equity markets, should offer support to the safe-haven buck.

Despite the latest optimism over the easing of COVID-19 restrictions in China, worries about a deeper global economic downturn continue to weigh on investors' sentiment. The fundamental backdrop favours the USD bulls and warrants some caution before placing aggressive bullish bets around the NZD/USD pair amid the absence of any relevant market-moving economic data.

Traders might also prefer to move to the sidelines and wait for next week's key US data/even risk - the release of the US consumer inflation figures and the highly-anticipated FOMC policy meeting. Market participants will look for fresh clues about the Fed's rate-hike path, which will influence the USD and provide a fresh directional impetus to the NZD/USD pair.

Technical levels to watch

EUR/USD regains 1.05 area. Economists at Scotiabank to extend its stretch higher above the 1.0525 zone.

Underlying trend signals are tilting bullish

“Relatively resilient growth and stubborn inflation expectations (the ECB’s Oct survey showed a rise in 12m inflation expectations to 5.4%, from 5.1%) will keep policy makers in tightening mode (50 bps priced in for the Dec 15th meeting), underpinning the EUR.”

“Underlying trend signals are tilting bullish, which is helping limited EUR drawdowns and bolster support on weakness.”

“Support is 1.0430/35. Resistance above 1.0525 is 1.0595/00.”

The Bank of Canada (BoC) is expected to raise its policy rate by 50 basis points to 4.25%. Such a decision could spark knee-jerk buying in the Loonie, economists at Société Générale report.

BoC rate decision is a toss-up between 25 bps and 50 bps

“The BoC rate decision is a toss-up between 25 bps and 50 bps today but we suspect the bank may opt for the latter after GDP growth surpassed expectations in 3Q thanks in part to strong exports.”

“Money markets are pricing in about 33 bps today so 50 bps to 4.25% or 125 bps above 2-3% neutral rate band would be a surprise and could spark knee-jerk buying in the Loonie.”

See – BoC Preview: Forecasts from nine major banks, very close call

- The index comes under pressure after faltering in the 105.80 region.

- A breakout of the 200-day SMA is needed to allow for extra recovery.

DXY now looks offered after two daily drops in a row and following an unsuccessful attempt to retest the 1.0600 region earlier in the session on Wednesday.

A sustainable close above the 200-day SMA at 105.67 should provide extra legs to the index and the possibility to extend the recovery to, initially, the weekly high at 107.19 (November 30).

Below the 200-day SMA, the dollar’s outlook should remain negative.

DXY daily chart

- EUR/JPY looks firm and advances to multi-day highs past 144.00.

- Further upside now looks at the weekly high past 146.00.

EUR/JPY rapidly leaves behind Tuesday’s pullback and advances north of the 144.00 hurdle to clinch fresh multi-session peaks on Wednesday.

Further upside now appears on the cards and the cross could now challenge the weekly high at 146.13 (November 23) in the relatively short term.

The outlook for EUR/JPY is expected to remain positive while above the 200-day SMA, today at 139.31.

EUR/JPY daily chart

EUR/USD rose to the highest levels since June, at around 1.0595, by the start of this week. Still, economists at Credit Suisse stick to their 1.0130-1.0610 range set for the rest of 2022.

Not yet minded to try to fade range extremes

“As things stand, we are not yet minded to try to fade the topside of our anticipated EUR/USD 1.0130-1.0610 range, even if this week’s highs get re-tested.”

“As well as positioning, lower oil prices, an improved China story and possible strong euro area wage data are near-term risks.”

- Silver finds support near $22.00 and stalls this week’s pullback from a multi-month high.

- The technical set-up favours bullish traders and supports prospects for additional gains.

- A sustained break below $21.00 will negate the near-term positive bias for the XAG/USD.

Silver attracts fresh buyers on Wednesday and steadily climbs back closer to the mid-$22.00s during the mid-European session.

Looking at the broader picture, this week's sharp retracement slide from the highest level since late April stalls near the $22.00 round-figure mark. The said handle coincides with the 200-hour SMA and should act as a pivotal point, which if broken decisively will set the stage for a deeper corrective decline.

The XAG/USD might then accelerate the fall towards the $21.40 support zone. This is closely followed by the very important 200-day SMA, around the $21.30-$21.25 region, and the $21.00 mark. The latter should act as a strong base for spot prices, which if broken decisively will negate the near-term positive outlook.

That said, oscillators on the daily chart are holding comfortably in the bullish territory and have again started gaining positive traction on hourly charts. This, in turn, supports prospects for the emergence of some dip-buying at lower levels, which should help limit any meaningful near-term fall for the XAG/USD.

Meanwhile, any subsequent move up beyond the overnight swing high, around the $22.60 area, is likely to confront stiff resistance near the $23.00 mark. A sustained strength beyond should lift the XAG/USD to the multi-month peak, around the $23.50-$23.55 zone. Some follow-through buying should pave the way for additional gains.