- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-12-2022

- USD/JPY bias remains bearish and a fade on rallies could be in store.

- Bulls eye a move towards 137.50 and then a break of 138.00.

As per the prior analysis, USD/JPY Price Analysis: Bears eye a break of key support structures, USD/JPY sank into the proposed area of support as the following will illustrate:

USD/JPY prior analysis

USD/JPY was trading on the back side of the daily trend lines which exposed 135.80 on the downside and below.

The bears were embarking on an equal low as seen more easily on the following zoomed-in chart:

It was stated that there would be liquidity in here that could lead to a move back into the horizontal resistance. However, it was stated, that so long as the 139 area held, the emphasis would remain on the downside. A break of 135.80 opened risk to the lower end of the 133 area:

USD/JPY update

Bulls now eye 137.50:

The price could now be embarking on a move beyond 138.00 but resistance needs to give. While on the front side of the micro trendlines, the bias remains bearish and a fade on rallies could be in store.

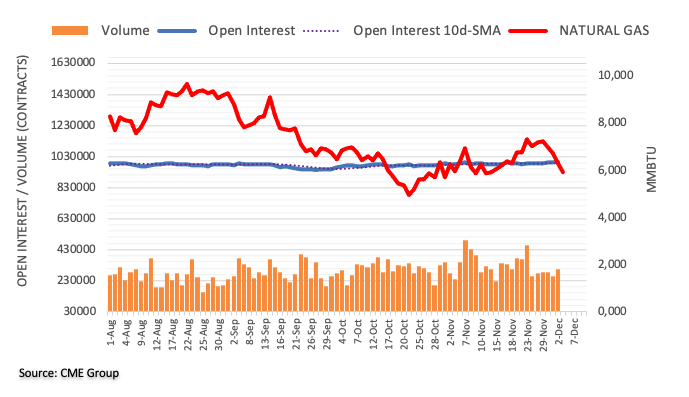

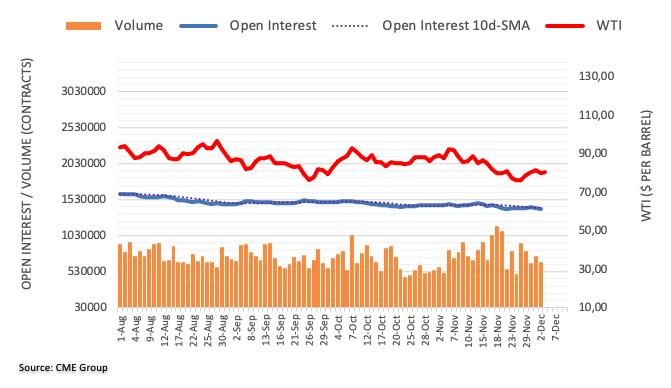

- WTI remains defensive after posting the biggest daily loss in two weeks.

- Ukrainian drones renew fresh geopolitical fears by attacking deep inside Russia.

- Moscow rejects supplying Oil under the G7 price.

- Firmer US Dollar adds strength to the bearish bias, China-linked optimism favor commodity bulls.

WTI crude oil consolidates the biggest daily loss in two weeks by making rounds to $77.50 early Wednesday. In doing so, the black gold also justifies the optimism surrounding China and supply-crunch fears emanating from China.

Recently, the New York Times (NYT) released a piece of news suggesting Ukrainian drones attacked military bases hundreds of miles inside Russia and escalated war. The same renews the geopolitical tension which previously propelled the black gold.

On the same line, Reuters mentioned that the Group of Seven (G7) price cap on Russian seaborne oil came into force on Monday as the West tries to limit Moscow's ability to finance its war in Ukraine, but Russia has said it will not abide by the measure even if it has to cut production.

It should be noted that firmer US data renewed hawkish expectations from the US Federal Reserve (Fed) and challenged the commodity buyers. That said, US ISM Services PMI rose to 56.5 in November versus 53.1 market forecast and 54.4 previous readings whereas the Factory Orders also registered 1.0% growth compared to 0.7% expected and 0.3% prior. Further, S&P Global Composite PMI improved to 46.4 versus 46.3 initial estimations while the Services counterpart rose to 46.2 compared to 46.1 flash forecasts. On Friday, the US Nonfarm Payrolls (NFP) surprised markets by rising to 263K versus 200K expected and an upwardly revised prior of 284K while the Unemployment Rate matched market forecasts and prior readings of 3.7% for November.

Alternatively, optimism surrounding China’s economic growth, due to the latest easing of virus woes and re-opening appears to keep the WTI crude oil buyers hopeful. Reuters reported on Monday that China is on course to downgrade its management of COVID-19 from a top-level Category A infectious disease to a less strict Category B disease as early as January. The news came after Chinese President XI Jinping termed the previous jump in the virus cases as Omicron and mostly of mild nature. Furthermore, the OPEC+ verdict to defend the supply cuts also keeps the oil buyers positive.

Moving on, Oil traders should pay close attention to the geopolitical and Covid-linked headlines for clear directions. Also important will be the private inventory data from the American Petroleum Institute (API) for the week ended on December 02, prior 61.3.

Technical analysis

A U-turn from the 21-DMA hurdle, currently around $81.45, directs WTI bears toward April’s low near $76.10. However, further downside appears limited considering the quote’s latest bounce off $73.66.

- Gold price has shifted its business below $1,770.00 as US Dollar Index sensed bumper demand on soured market sentiment.

- The tight labor market and solid United States service sector have triggered signs of a rebound in inflation.

- Federal Reserve might decelerate the interest rate hike pace but will escalate guidance on interest rate peak.

- Gold price is declining towards the lower portion of the Rising Channel chart pattern around $1,760.00.

Gold price (XAU/USD) has shifted its auction profile below the critical support of $1,770.0 in the early Asian session. The precious metal has been dragged below the cushion of $1,770.0 after surrendering the $1,780.00 support on Monday. Failing to climb above the ultimate resistance of $1,810.00 brought significant selling pressure on Gold price.

Soured market mood after the release of the stronger-than-projected US ISM Services PMI data triggered a sell-off in the risk-perceived currencies. Gold price faced immense pressure as upbeat service demand in the United States economy cemented expectations of a rebound in inflation. The risk aversion theme improved safe-haven’s appeal vigorously. The US Dollar Index (DXY) drove to 105.40 after registering a fresh five-month low at 104.10.

The risk aversion theme underpinned by the solid US service sector brought a stellar recovery in the returns from US Treasury bonds. The 10-YEAR us Treasury yields rebounded to near 3.59% after days of ignorance by the market participants.

Solid US service sector refreshes higher inflation expectations fears

Last week, upbeat US Nonfarm Payrolls (NFP) data cleared that labor demand is stellar led by strong demand from households. However, the market ignored the surprise rise in employment data and supported Gold price further. But now, the tight labor market in the United States economy has been followed by robust demand for the service sector. It is worth noting that a tight labor market and firmer service demand are catalysts that de-anchor short-term inflation expectations and carry the potential of ruining the recent drawdown in the October inflation report.

The US Services PMI has accelerated to 56.5, higher than the projections of 53.1 and the prior release of 54.4. Higher services PMI eventually demands more labor to augment the operations, which could incentivize firms to continue escalating prices for end use ahead.

Robust demand drives Federal Reserve’s bigger rate hike fears

Federal Reserve (Fed) chair Jerome Powell is putting his blood and sweat into triggering a slowdown in the United States economy to phase out extra inflation apart from the targeted one. The Federal Reserve has already announced four consecutive 75 basis points (bps) rate hikes to achieve price stability as early as possible. This time, the Federal Reserve policymakers were planning to decelerate the interest rate hike pace as their agenda is to trim inflation without crashing the economy.

No doubt, additional requirements for labor to augment overall robust demand will delight the Federal Reserve in hiking interest rates but rates have reached sufficiently higher to curtail inflation. Therefore, the novel robust demand has created havoc for the Federal Reserve policymakers.

Expectations for a higher interest rate peak by the Federal Reserve soared

The minutes from Federal Open Market Committee (FOMC) indicated that Federal Reserve policymakers favored a slowdown in the current pace adopted for an interest rate hike from December monetary policy meeting. The reasoning behind the small rate hike was to reduce financial risks and to observe the progress made from efforts by Federal Reserve in bringing price stability. A fresh increment in overall demand has renewed fears of hawkish Federal Reserve bets but various policymakers still favor a higher interest rate peak rather than calling a recession by passing a bigger rate hike judgment.

Chicago Fed President Charles Evans said on Friday, "We are probably going to have a slightly higher peak to Fed policy rate even as we slow pace of rate hikes," as reported by Reuters.

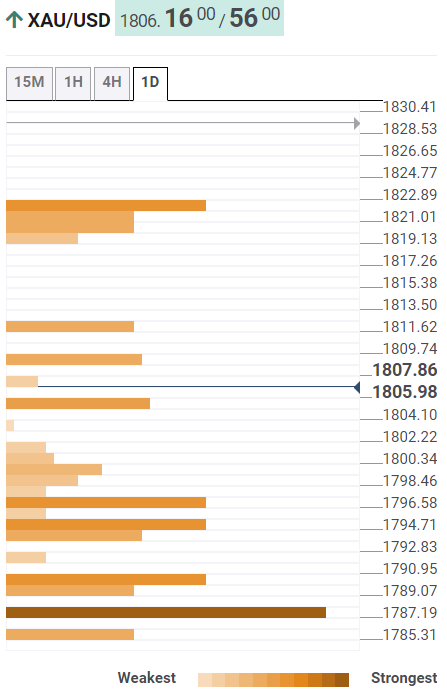

Gold price technical outlook

Gold price is declining towards the lower portion of the Rising Channel chart pattern plotted on an hourly scale. A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at $1,791.25, adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

- USD/CHF probes two-day rebound with mild losses, struggles of late.

- Resistance-turned-support line challenges bears even as 200-HMA restricts immediate upside.

- Bullish MACD signals, sustained break of 50-HMA adding strength to upside bias.

USD/CHF snaps a two-day rebound from the eight-month low as it prints mild losses near 0.9425 during Tuesday’s Asian session.

Even so, the Swiss Franc (CHF) pair defends the previous day’s upside break of a downward-sloping resistance line from December 01, now support. Also keeping the USD/CHF pair buyers hopeful is the quote’s successful trading above the 50-HMA and bullish MACD signals.

That said, the quote’s recovery moves need validation from the 200-HMA hurdle surrounding 0.9440, to keep the USD/CHF buyers hopeful.

Following that, the 50% and the 61.8% Fibonacci retracement levels of the pair’s November 21 to December 02 downside, close to 0.9465 and 0.9495, as well as the 0.9500 threshold, could challenge the USD/CHF bulls.

In a case where the pair remains firmer past 0.9500, multiple hurdles around 0.9500 can test the pair’s further upside.

Alternatively, pullback moves need to break the resistance-turned-support line, close to 0.9410, to tease the USD/CHF bears.

However, the 50-HMA level of 0.9375 and the latest trough surrounding 0.9325, also the lowest levels since April, could challenge the pair’s additional weakness before directing sellers toward the 0.9300 round figure.

USD/CHF: Hourly chart

Trend: Further upside expected

- The GBP/JPY hurdled the 100, 50, and 20-day EMAs on Monday and gained 170 pips.

- GBP/JPY Price Analysis: Short term, the pair might pull back before resuming the uptrend.

The GBP/JPY snaps two days of consecutive losses and breaches the 100, 50, and 20-day Exponential Moving Averages (EMAs), rallying more than 170 pips on Monday. In the meantime, the GBP/JPY is trading at 166.68 as the Asian Pacific session begins, registering minuscule losses of 0.07%.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY is neutral-upward biased, testing the 20-day EMA at 166.61 after bouncing from daily lows around the 100-day EMA at 164.83. Nevertheless, as the daily EMAs remain almost flat and the Relative Strength Index (RSI) and the Rate of Change (RoC) are practically horizontal, it suggests that the pair might consolidate.

Short term, the GBP/JPY 1-hour chart illustrates the pair as upward biased. Albeit price action is registering successive series of higher highs/lows, the RSI and the ROC are doing the opposite, portraying a negative divergence.

Hence, the GBP/JPY could fall further before resuming its uptrend. Therefore, the GBP/JPY first support would be the daily pivot at 166.15, followed by the S1 pivot level at 165.49. Break below will expose the December 5 low of 164.85.

US inflation expectations as per the 10-year and 5-year breakeven inflation rates per the St. Louis Federal Reserve (FRED) data, challenge the recently hawkish bias over the US Federal Reserve (Fed). The inflation precursors might have taken clues from the Fed policymakers’ dovish comments, including those from Chairman Jerome Powell, to challenge the US Dollar bulls. However, the previous day’s strong US data joins fresh fears from Ukraine to test the market’s optimism.

That said, the latest prints of the 5-year and 10-year inflation expectations portray a pullback from the one-month high to 2.46% and 2.39% respectively.

On Monday, US ISM Services PMI rose to 56.5 in November versus 53.1 market forecast and 54.4 previous readings whereas the Factory Orders also registered 1.0% growth compared to 0.7% expected and 0.3% prior. Further, S&P Global Composite PMI improved to 46.4 versus 46.3 initial estimations while the Services counterpart rose to 46.2 compared to 46.1 flash forecasts.

It should be noted that Friday’s US Nonfarm Payrolls (NFP) surprised markets by rising to 263K versus 200K expected and an upwardly revised prior of 284K while the Unemployment Rate matched market forecasts and prior readings of 3.7% for November. Following the upbeat data, Chicago Fed President Charles Evans said, "We are probably going to have a slightly higher peak to Fed policy rate even as we slow pace of rate hikes.”

Recently, the New York Times (NYT) released a piece of news suggesting Ukrainian drones attacked military bases hundreds of miles inside Russia and escalated war.

Amid these plays, the S&P 500 Futures print mild gains and US Treasury yields stay unchanged after the week-start fall in the prices of shares and bonds.

Also read: Forex Today: US Dollar’s comeback in the making?

- NZD/USD holds lower ground after reversing from six-month high.

- Bearish chart formation, impending bear cross on the MACD challenge recovery moves.

- 200-DMA, monthly support line restrict immediate downside, bulls need validation from 0.6480.

NZD/USD retreats from an intraday high of 0.6323 as it fades the corrective bounce after a two-day downtrend amid Tuesday’s Asian session.

Given the looming bearish cross on the MACD indicator, coupled with the last week’s failure to stay beyond the August month’s high near 0.6470, the Kiwi pair is likely to remain bearish.

That said, a one-month-old ascending support line near 0.6280 and the 50% Fibonacci retracement level of the pair’s April-October downside, close to 0.6275, could restrict short-term declines of the NZD/USD pair.

However, the 200-DMA and an upward-sloping trend line from October’s low, respectively near 0.6225 and 0.6080, appear tough nuts to crack for the NZD/USD bears afterward.

On the flip side, the 61.8% Fibonacci retracement level of 0.6452, also known as the golden ratio, challenges the intraday pair buyers ahead of the double tops marked near 0.6470-75.

It’s worth noting that highs marked in May and June, around 0.6570-75, act as the last defense of the NZD/USD bears.

Overall, NZD/USD remains on the bear’s radar despite the recent hesitance to break the 0.6300 threshold.

NZD/USD: Daily chart

Trend: Further downside expected

The New York Times has said that Ukraine executed its most brazen attack into Russian territory targeting two military bases hundreds of miles inside the country, using unmanned drones, according to the Russian Defense Ministry and a senior Ukrainian official.

''The drones were launched from Ukrainian territory, and at least one of the strikes was made with the help of special forces close to the base who helped guide the drones to the target, said the official, speaking on condition of anonymity to convey sensitive information.''

Market implications

A risk-off tone has struck markets at the start of the week and this news will likely embolden the US Dollar bulls.

-

US Dollar comes up for air and eyes 106.00

US data has encouraged a flight to safety after an injection of investor enthusiasm over signs of possible loosening in COVID restrictions in China faded. Renewed speculation that the Federal Reserve may not be able to pivot as soon as December is driving the forex board at the start of this week.

- USD/CAD grinds near one-week high after breaking the key hurdles to the north.

- Firmer US data triggered US Dollar run-up but pre-BOC woes test the bulls.

- 50-DMA, previous resistance line from October 13 restricts immediate downside.

- Previous weekly top restricts nearby advances, monthly resistance line adds to the upside filters.

USD/CAD seesaws around a one-week high as bulls flirt with the 1.3600 threshold following a strong run-up to cross the previous key resistances. That said, the Loonie pair’s latest moves appear less lucrative for sellers as the quote stays beyond important resistance-turned-support and the US Dollar bulls are back to the table early Tuesday.

The Loonie pair began the week on the negative side amid the market amid hopes of a faster recovery in China as multiple states from the Dragon nation announced an easing of the Covid-led activity restrictions. However, strong US data raised doubts over the Fed’s easy rate hike trajectory and underpinned the USD/CAD run-up.

Also favoring the quote’s upside moves were the weaker prices of Canada’s key export WTI crude oil. WTI crude oil dropped to a one-week low while marking over 3.5% daily slump for Monday. The energy benchmark’s latest declines could be linked to the strong USD while the Covid hopes and OPEC+ inaction, as well as chatters over the Group of Seven Nations’ (G7) price cap on Russian Oil exports, test the bears.

Elsewhere, Canadian Building Permits recovered in October with -1.4% figure versus -2.0% expected and a revised down -18.2% MoM prior.

On the other hand, US ISM Services PMI rose to 56.5 in November versus 53.1 market forecast and 54.4 previous readings whereas the Factory Orders also registered 1.0% growth compared to 0.7% expected and 0.3% prior. Further, S&P Global Composite PMI improved to 46.4 versus 46.3 initial estimations while the Services counterpart rose to 46.2 compared to 46.1 flash forecasts. On Friday, the US Nonfarm Payrolls (NFP) surprised markets by rising to 263K versus 200K expected and an upwardly revised prior of 284K while the Unemployment Rate matched market forecasts and prior readings of 3.7% for November. Following the upbeat data, Chicago Fed President Charles Evans said, "We are probably going to have a slightly higher peak to Fed policy rate even as we slow pace of rate hikes.”

Amid these plays, Wall Street closed in the red while the US 10-year Treasury yields rose eight basis points to 3.58% by the end of Monday’s North American session.

Looking forward, the market’s cautious mood ahead of the Bank of Canada’s (BOC) monetary policy meeting could restrict immediate USD/CAD moves. However, the dovish hopes from the Canadian central bank challenge the pair sellers despite hopes of 0.50% rate increase.

Technical analysis

Among the key immediate supports, the 50-DMA level surrounding 1.3570 could gain the intraday seller’s attention before the previous resistance line from October 13, close to 1.3535 at the latest.

In a case where the USD/CAD price drops below 1.3535, the odds of witnessing a slump to the 21-DMA support near 1.3415 can’t be ruled out.

Even so, the 100-DMA level around 1.3300 will be a tough nut to crack for the USD/CAD bears before taking control.

Alternatively, last week’s top of 1.3645 restricts the nearby upside of the USD/CAD pair before directing the buyers towards a one-month-old upward-sloping trend line, close to 1.3675 by the press time.

USD/CAD: Daily chart

Trend: Further upside expected

- The US Dollar is testing prior lows and there is room to go.

- A retest of 106.00 could be in order in the meantime.

- The greenback is on the back side of the daily trendline and the downside is favoured while below 108.00.

The US Dollar is up after data showed that the US Services industry activity unexpectedly rose in Novemberederal Reserve may lift interest rates more than recently projected. DXY, an index that measures the US Dollar vs. the greenback is back into the 105 area following a rise from the lows of the November bearish cycle of 104.11.

The data helped to encourage a flight to safety after an injection of investor enthusiasm over signs of possible loosening in COVID restrictions in China faded. Renewed speculation that the Federal Reserve may not be able to pivot as soon as December is driving the forex board at the start of this week.

US major indexes ended in the red which is a bearish setup for Tokyo today due to the concerns that the US Federal Reserve might continue on its aggressive policy tightening path despite fears of a recession next year. The Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates. The data beat forecast the Non-manufacturing PMI would fall to 53.1.

When combined with the end of last week's data and the surprisingly strong Nonfarm Payrolls, wage growth and consumer spending that had accelerated in October, the US Dollar is set to benefit. Before the Nonfarm Payrolls report, the market pricing of the terminal rate was seen topping out at 4.75%-5%. However, the Fed is now seen raising its policy rate, currently in the 3.75%-4% range, to 4.92% by March of next year and more likely than not into the 5%-5.25% range by May, based on futures contract prices and the CME Fed watch tool.

With all that being said, however, Fed Chair Jerome Powell said last week that the US central bank could scale back the pace of its rate increases "as soon as December." Futures contracts tied to the Fed policy rate still imply a 70% chance that central bankers will slow the pace of rate hikes when they meet Dec. 13-14, rather than adding to a string of 75-basis-point rate hikes over the past four meetings.

US Dollar bears will be keeping an eye out for any follow-through in risk appetite on the back of several cities easing their COVID restrictions in China in what appears to be a shift toward gradual reopening as the country nears entering the fourth year of the pandemic. However, despite the partial relaxation, many restrictions remain in place. In some parts of China, new lockdowns and travel restrictions are still being imposed.

US Dollar technical analysis

The Greenback is on the back side of the daily trendline and the downside is favoured while below 108.00. A retest of 106.00 could be in order in the meantime, however.

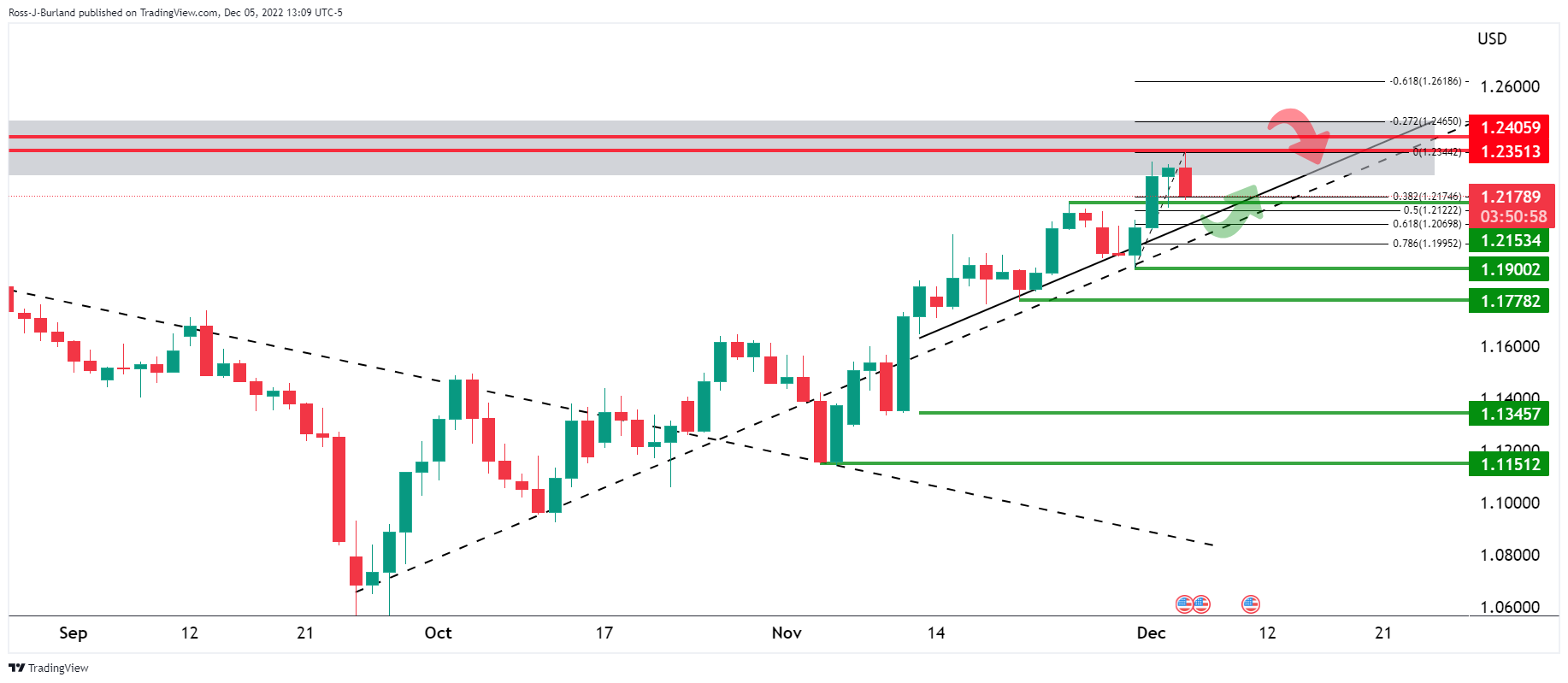

- Sour market sentiment has dragged the Cable below 1.2200.

- An oscillation in the bullish range by the RSI (14) indicates that the bullish momentum is still solid.

- A mean reversion to the 20-EMA around 1.1970 is highly expected.

The GBP/USD pair has sensed barricades around the immediate hurdle of 1.2200 in the early Tokyo session. The three-day winning streak of the Cable ended on Monday after it failed to extend its rally above 1.2340. A cautious market mood hammered the Pound Sterling and sent it to lower below the round-level cushion of 1.2200.

Meanwhile, the US Dollar Index (DXY) has witnessed a significant buying interest and has advanced to near 105.40 after refreshing its fresh- foe-month low at 104.10.

On a daily scale, Cable has faced selling pressure after testing the supply zone placed in a narrow range of 1.2292-1.2351. The gap between the Cable and the 20-period Exponential Moving Average (EMA) has escalated, therefore, a mean reversion cannot be ruled out. The Cable is still holding the 200-EMA at 1.2108, which indicates that the long-term trend is still bullish.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which indicates that the bullish momentum is still active.

Going forward, a decline below Friday’s low at 1.2134 will drag the Cable toward the psychological resistance at 1.2000, followed by the 20-EMA around 1.1971.

On the flip side, a break above Monday’s high at 1.2345 will drive the Cable toward June 16 high of around 1.2400. A breach of the latter will send the major toward June 1 low at 1.2460.

GBP/USD daily chart

- EUR/USD tanks below the 1.0500 figure as buying pressure fades.

- EUR/USD Price Analysis: The 200-DMA at sight if the pair tumbles below 1.0400.

On Monday, the EUR/USD stumbled from around 1.0594 due to some factors, including positive economic data from the United States (US), and high US Treasury yields, amidst China’s easing Covid restrictions. At the time of writing, as the Asian Pacific session begins, the EUR/USD is trading at 1.0488.

EUR/USD Price Analysis: Technical outlook

From a daily chart perspective, the EUR/USD is upward biased once it cleared the 200-day Exponential Moving Average (EMA) on November 30, extending its gains to three consecutive days. However, Monday’s story is different, after US economic data revealed that the US Federal Reserve (Fed) would need to keep increasing rates. Therefore, the EUR/USD dropped and eyes a test of the December 2 daily low of 1.0392.

Albeit in bullish territory, the Relative Strength Index (RSI) aims downwards, while the Rate of Change (RoC) depicts buyer pressure is fading.

All that said, the EUR/USD path of least resistance is downward biased. Therefore, the EUR/USD first support would be the December 2 daily low of 1.0392. A breach of the latter will expose the 200-day EMA at 1.0388, followed by the 50-day EMA at 1.0173

.

- AUD/JPY struggles to defend the bounce off seven-week low.

- Sour sentiment ahead of the key RBA event challenge the pair’s rebound.

- RBA is expected to unveil 0.25% rate hike, future tightening of monetary policy will be in focus.

- Easing Covid woes, talks of BOJ’s exit from ultra-easy monetary policy act as additional catalysts.

AUD/JPY justifies its risk-barometer status as it fades the previous day’s rebound from a nearly four-month low, taking rounds to 91.60 during early Tuesday morning in Asia.

The cross-currency pair began the week on a firmer footing amid hopes of a faster recovery in China as multiple states from the Dragon nation announced an easing of the Covid-led activity restrictions. However, challenges for the Bank of Japan’s (BOJ) easy monetary policy appeared to have weighed on the pair afterward. It’s worth noting that the Reserve Bank of Australia (RBA) is up for announcing its latest monetary policy decision at 03:30 AM GMT on Tuesday and hence the AUD/JPY price remains sidelined ahead of the key event.

That said, Reuters reported on Monday that China is on course to downgrade its management of COVID-19 from a top-level Category A infectious disease to a less strict Category B disease as early as January. The news came after Chinese President XI Jinping termed the previous jump in the virus cases as Omicron and mostly of mild nature.

Additionally, doves at the Bank of Japan (BOJ) appear losing their previous status as talks of altering the inflation target and a gradual exit from the easy-money policies are taking rounds of late. The last week, Japanese media Asahi quotes Bank of Japan (BOJ) Board Member Naoki Tamura as saying, “The Bank of Japan should conduct a review of its monetary policy framework and the feasibility of its 2% inflation target.” However, BOJ Governor defended the policy status while saying, “A global economic slowdown has been observed, and Japan's inflation is expected to decelerate from 2023.”

Talking about the data, there wasn’t much from Japan but Australia’s AiG Performance of Construction Index for November rose to 48.2 versus 43.3 whereas S&P Global Services PMI rose more than 47.2 initial forecasts to 47.6 while the Composite PMI also improved to 48.0 versus 47.7 prior. Further, TD Securities Inflation for November jumped to 5.9% YoY and 1.0% MoM compared to 5.2% and 0.4% respective priors.

Additionally, China Caixin/S&P Global Services Purchasing Managers' Index (PMI) fell to 46.7 from 48.4, marking the third monthly contraction in a row. In doing so, the private services gauge also dropped lowest levels in six months.

It should be noted that the doubts over the Fed’s easy rate hike trajectory also recently challenged the market sentiment and weighed on the AUD/JPY prices.

That said, Wall Street closed in the red while the US 10-year Treasury yields rose eight basis points to 3.58% by the end of Monday’s North American session.

Looking forward, AUD/JPY may witness inaction ahead of the RBA’s verdict as traders doubt the latest hopes of witnessing an easy rate hike hopes from the Aussie central bank amid firmer data. It should be observed the that RBA is expected to announce a 25 basis point rate increase to 3.10% but the Monetary Policy Statement will be more important to watch for clear directions.

Technical analysis

Although a four-month-old ascending support line, around 91.00 by the press time, restricts immediate AUD/JPY downside, the pair buyers remain off the table unless witnessing a clear break of the 200-DMA hurdle, close to 93.00 at the latest.

- AUD/USD has plunged below 0.6700 as the market mood has soured on upbeat US Services PMI data.

- A tight labor market and solid demand for services in the US indicate that short-term inflation is still de-anchored.

- The RBA is expected to announce a third consecutive 25 bps rate hike ahead.

The AUD/USD pair has witnessed an intense sell-off after refreshing its 11-week high at 0.6851 on Monday. The Aussie asset has plunged below the round-level support of 0.6700 in the early Asian session and is expected to remain on tenterhooks ahead of the interest rate decision by the Reserve Bank of Australia (RBA).

The risk profile turned extremely bearish on Monday after the US economy reported better-than-projected US ISM Services PMI data. This has renewed fears of a bigger rate hike announcement by the Federal Reserve (Fed) in its December monetary policy meeting.

The sour market mood improved safe-haven’s appeal dramatically. The US Dollar Index (DXY) recovered sharply to near 105.40 after registering a fresh five-month low near 104.10. S&P500 witnessed extreme selling pressure amid the risk aversion theme. Meanwhile, the 10-year US Treasury yields have recovered firmly to near 3.59%.

The US ISM Services PMI soared to 56.5, higher than the projections of 53.1 and the prior release of 54.4. Also, Friday’s Nonfarm Payrolls (NFP) were extremely stronger than projections, which indicated that the overall demand is robust and short-term inflation expectations are still de-anchored. This could ruin the plan of deceleration of interest rate hike pace by the Fed as expected for the monetary policy meeting scheduled for next week.

On the Australian front, investors are keeping an eye on RBA’s interest rate decision. RBA Governor Philip Lowe is expected to continue its 25 basis points (bps) rate hike culture for the third time consecutively despite signs of exhaustion in the inflationary pressures. This may push RBA’s Official Cash Rate (OCR) to 3.10%.

- Silver price plunges 3.74%, on high US Treasury yields, back below $22.30.

- Silver Price Analysis: A daily close below $22.24 would exacerbate a fall further; otherwise, a re-test of $23.00 is possible.

Silver price collapsed from around $23.51 daily high down to $22.23, spurred by high US Treasury yields caused by upbeat US economic data justifying the Federal Reserve’s (Fed) need to continue increasing borrowing costs. Therefore, the XAG/USD drops 3.90%, trading at $22.25.

Silver Price Analysis: XAG/USD Technical Outlook

The XAG/USD daily chart portrays the white metal as upward biased, despite falling from multi-month highs. Should be noted that XAG/USD is testing the November 15 daily high of 22.24, which, once cleared, would exacerbate a deeper correction toward the $22.00 psychological mark, followed by the 200-day Exponential Moving Average (EMA) at $21.02.

The Relative Strength Index (RSI) exited from overbought conditions, triggering a sell signal that caused Monday’s dive, while the Rate of Change (RoC) depicts buyers losing momentum.

Therefore, the XAG/USD might be headed for a pullback. However, if XAG/USD holds its reins above $22.24, that could open the door for consolidation. Hence, the XAG/USD first resistance would be the $22.50 mark, followed by the $23.00 figure. Break above will expose the multi-month high of $23.50.

Silver Key Technical Levels

- Gold bears have charged in and the price is now at a fresh layer of support.

- Gold price is now on the backside of the micro trend, testing the daily W-formations' neckline support.

- A bullish correction could be on the cards with $1,780 eyed.

Gold price was smashed lower at the start of the week and is ending the North American session lower by some 1.65%. XAU/USD printed a low of $1,765.91 and fell from a high of $1,810.01 in a move that was forecasted in this week's pre-market analysis: Gold, Chart of the Week: XAU/USD bears eye a typical corrective opportunity below critical resistance

While there was a technical bias to the downside for the start of the week, the fundamentals drove the move as investors fretted that better-than-expected service-sector activity could point to the Federal Reserve hiking interest rates for longer.

US data switch flipped

The Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates.

The data beat forecast the Non-manufacturing PMI would fall to 53.1. This data combined with Friday's surprisingly strong Nonfarm Payrolls and wage growth data in November as well as news that consumer spending had accelerated in October gives has raised optimism that a recession could be avoided in 2023.

The switch has flipped since the recently weaker Consumer Price Index, prior ISM data and dovish Federal Reserve chairman Jerome Powell's comments that combined had started to weigh on the market's pricing of the terminal rate that had declined to below 5%. The rate was seen topping out at 4.75%-5% before the series of bullish data.

However, the Fed is now seen raising its policy rate, currently in the 3.75%-4% range, to 4.92% by March of next year and more likely than not into the 5%-5.25% range by May, based on futures contract prices and the CME Fed watch tool. However, futures contracts tied to the Fed policy rate still imply an 89% chance that the US central bank will increase interest rates by 50 basis points next week to 4.25%-4.50%, with the rates peaking at 4.984% in May 2023.

Nevertheless, US bond yields are still rising, bearish for gold since it offers no interest. The yield on the US 10-year note was last seen up 3.4% to 3.605%. The Federal Open Market Committee (FOMC) meets on Dec. 13-14.

Gold technical analysis

Prior analysis:

As per this week's pre-open analysis, it was stated that the price was on the back side of the trend, which is overall bullish as per the harmonic pattern while above the W-formation's lows near $1,730.

Zooming in ...

There were prospects of a correction towards the neckline of the W-formation as illustrated above and below, down on the hourly chart:

With the price potentially basing, for the meantime, in the $1,790s, a move into test into the $1,800s was expected to ''draw in the sellers again for the opening sessions with a move into the dynamic support that meets the daily 38.2% Fibonacci and a 50% mean reversion below that.''

Gold update:

The price action has followed the projection to the tee as illustrated above.

While the price is now on the backside of the micro trend, testing the daily W-formations's neckline support, a bullish correction could be on the cards with $1,780 eyed.

What you need to take care of on Tuesday, December 6:

The American dollar finished Monday with substantial gains after starting the day on the back foot. The Greenback initially fell on the back of news coming from China, as different districts are easing their restrictive COVID-19 measures, while market talks pointed at further loosening in January.

Markets changed course following the release of upbeat US data, with the US Dollar accelerating its advance ahead of Wall Street’s close. The official ISM Services PMI for November improved by more than anticipated, surging to 56.5 from 54.4 and beating the 53.1 expected. Additionally, Factory Orders rose by 1% MoM in October, better than the 0.7% advance expected, while S&P Global upwardly revised its November Services PMI to 46.2 from a preliminary estimate of 46.1.

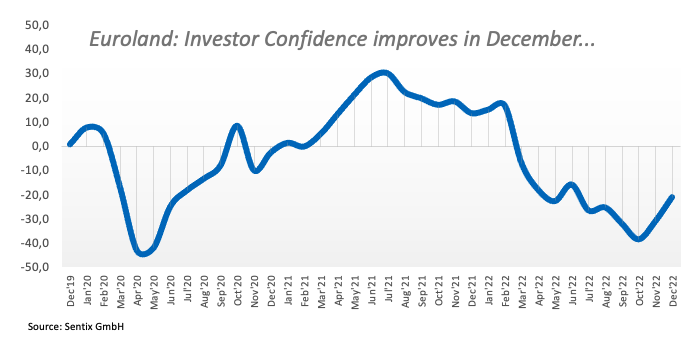

Ahead of the December central bank’s meeting, European Central Bank (ECB) policymaker Gabriel Makhlouf said that a 50 bps rate hike is the minimum necessary, adding that he would not rule out a 75 bps hike. The ECB and the US Federal Reserve (Fed) will announce their decisions on December 15 and 14, respectively, and policymakers will enter their blackout period next Thursday.

EUR/USD trades around 1.0480, while GBP/USD plunged to the 1.2160 price zone. Commodity-linked currencies were also under strong selling pressure, with AUD/USD now struggling around 0.6670 and USD/CAD nearing 1.3600.

Crude oil prices surged at the beginning of the day amid Chinese news, which means steady demand, and as OPEC+ announced its decision to maintain its decision of reducing oil production by 2 million barrels per day. Another factor weighing on oil prices was the latest EU decision to put a cap on oil prices. Moscow said it will not recognize the price cap and is preparing a decision. The black gold turned south early in the US afternoon and posted sharp losses amid the broad USD strength. WTI settled at $77.20 a barrel.

Gold surged to $1,810 a troy ounce at the beginning of the day but plunged amid renewed USD demand and ends the day around $1,766 troy ounce.

The greenback surged also vs safe-haven currencies, with USD/JPY recovering towards the 136.70 price zone.

The Reserve Bank of Australia will announce its decision on monetary policy first thing Tuesday.

Cryptocurrencies collapsed with the resurgent US demand. BTC/USD trades around $16,900, down over $1,000 on the day

Like this article? Help us with some feedback by answering this survey:

- US ISM Non-Manufacturing PMI surprised to the upside, weighing on the NZD/USD.

- An absent New Zealand docket would keep the NZD leaning on investors’ mood.

- NZD/USD Price Analysis: Upward biased, but a pullback to the 200-DMA is on the cards.

The New Zealand Dollar (NZD) tumbles from three-month highs around 0.6442 vs. the US Dollar (USD) after the release of positive US economic data, despite last week’s dovish speech by the Federal Reserve Chair, Jerome Powell. Therefore, the NZD/USD is trading at 0.6317, below its opening price by 1.33%.

Sentiment remains sour, following goodish US data

US equities remain depressed due to sentiment turning sour. The Institute for Supply Management (ISM) reported that the ISM Non-Manufacturing PMI for November smashed expectations e 53.3 estimates, coming at 56.5 while showing that the price index subcomponent added to inflationary pressures in the US. At the same time, the US Factor Orders for November jumped 1%, vs. the 0.7% consensus, above September’s data.

Elsewhere, the Federal Reserve (Fed) Chair Jerome Powell, in last week’s speech saying that moderating interest rate hikes could happen as soon as December, plunged the USD. Nevertheless, last Friday’s US Nonfarm Payrolls report cemented the case for additional action by the Federal Reserve. The US economy added 263K new jobs to the economy, beating the consensus of 200K, while the Average Hourly Earnings jumped by 5.1% YoY, above 4.9% forecasts.

On the New Zealand front, the lack of economic data revealed during the week, with only the release of the Electronic Retail Card Spending and Manufacturing Sales, would lean on the dynamics of the US Dollar and market sentiment.

NZD/USD Price Analysis: Technical outlook

The NZD/USD daily chart depicts the major as upward biased as long as it stays above the 200-day Exponential Moving Average (EMA) at 0.6234.OF note, price action is registering a series of successive higher highs, while the Rate of Change (RoC) didn’t, opening the door for a correction. At the same time the Relative Strength Index (RSI) exited from overbought conditions, suggesting that buying pressure is fading.

The NZD/USD key support levels lie at 0.6300, followed by the 200-day EMA at 0.6234 and the 0.6200 figure. On the flip side, the NZD/USD first resistance would be the 0.6400 mark, followed by 0.6442, ahead of the 0.6300 psychological level.

- WTI price is on the back side of the channel, so that is longer-term bullish.

- WTI H4 M-formation is bullish and a break of the neckline will likely put the bias back in favour.

- Break below $76.40 will be putting on some serious heat on the committed bulls.

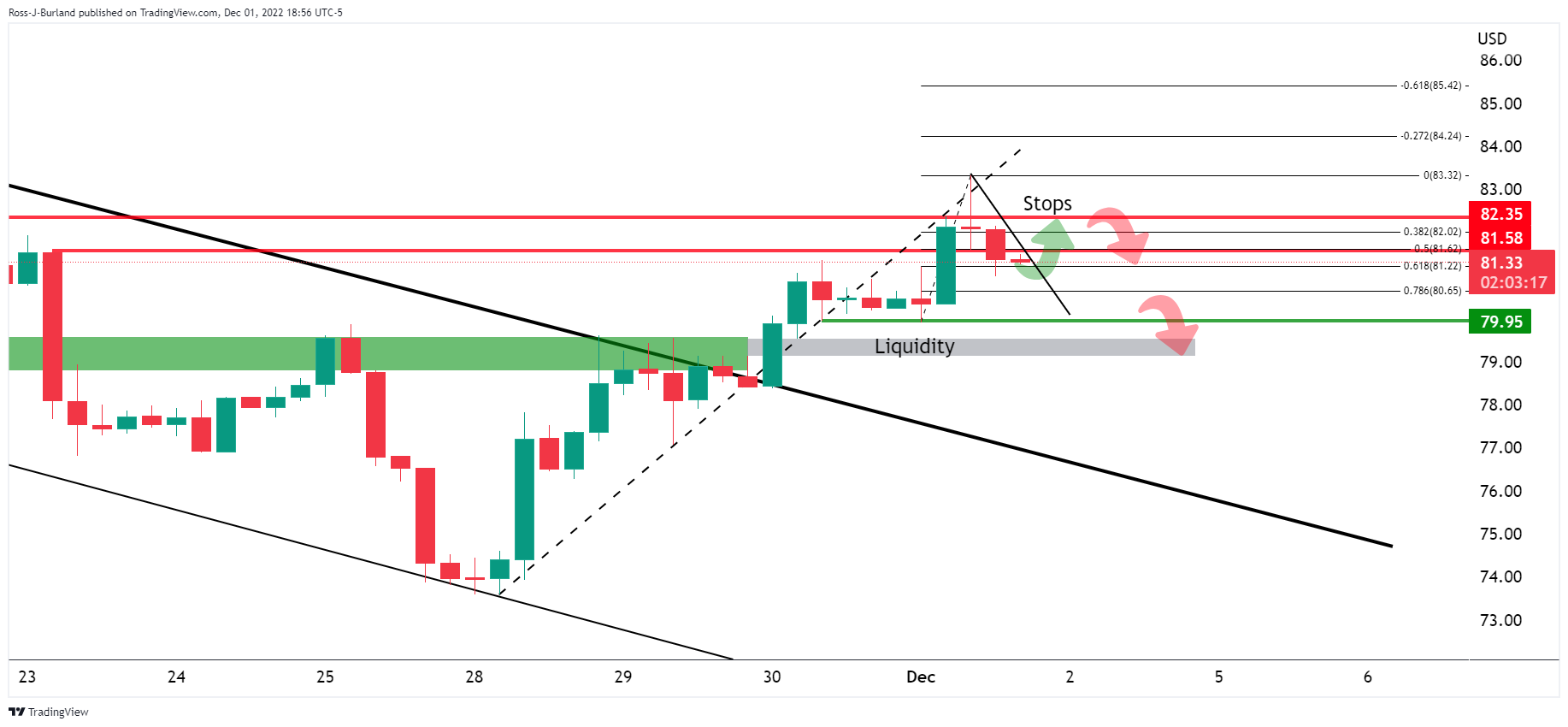

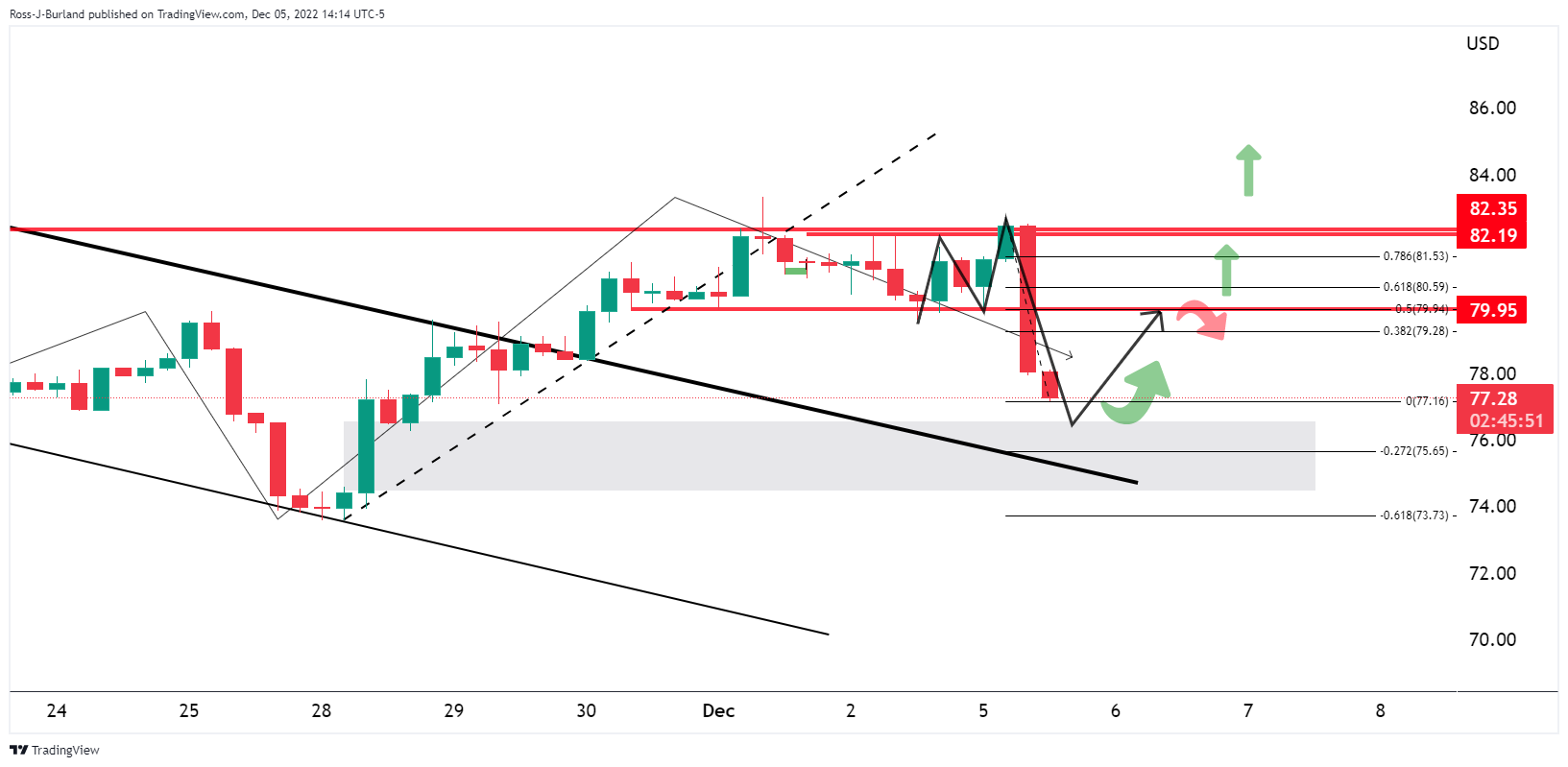

As per the prior analysis, the price has been in a phase of distribution for the month of December, so far, following a break of a major bear channel as the following analysis will illustrate:

WTI prior analysis

In the above daily charts, it was shown that WTI was seen moving into prior highs and this had swept liquidity where a schematic of distribution was being printed:

A move towards where WTI short position stops were likely located was anticipated as per the above hourly chart.

A continuation of the downside in Oil to target liquidity below $78.00 was expected eventually while below $81.50:

WTI update

The W-formation on the daily chart has seen the price move to test the neckline.

On the 4-hour chart, the M-formation is bullish and a break of the neckline, or a 50% mean reversion, will likely put the bias back in favour of the bull for a continuation higher. After all, the price is on the back side of the channel, so that is longer-term bullish. However, a break below $76.40 will be putting on some serious heat on the committed bulls as per the following daily and 4-hour charts:

- A risk-off impulse bolstered the US Dollar to the detriment of the Canadian Dollar.

- November US ISM Services PMI was better than expected, spurring a 120 pip jump on the release.

- The Bank of Canada is expected to hike rates by 25 bps on Wednesday.

- USD/CAD Price Analysis:

The Canadian Dollar (CAD) weakens against the US Dollar (USD), while the USD/CAD reclaims the 1.3500 figure, spurred by positive economic data from the United States (US) revealed on Monday and a solid November employment report last Friday. Hence, the USD/CAD is trading at 1.3576 after hitting a daily low of 1.3384.

Sour sentiment and upbeat US ISM Services PMI underpinned the USD

Risk aversion is the name of the game. The Institute for Supply Management (ISM) reported that the Services Index for November grew at a faster pace than the 53.3 estimated, at 56.5, while showing that the price index subcomponent added to inflationary pressures in the US. Meanwhile, the US Factor Orders for November jumped 1% vs. expectations of a 0.7% increase, above September’s data.

The USD/CAD reacted upwards, rallying more than 120 pips in three hours, from 1.3400 to 1.3520. Of late, the major extended its rally towards fresh daily highs of 1.3581.

Aside from this, last week’s dovish speech by the Federal Reserve (Fed) Chair Jerome Powell, saying that moderating interest rate hikes could happen as soon as December, plunged the USD. Nevertheless, last Friday’s US Nonfarm Payrolls report cemented the case for additional rate hikes. November figures came at 263K beating the consensus of 200K, while the Average Hourly Earnings jumped by 5.1% YoY, above 4.9% forecasts.

In the meantime, the last week’s Canadian docket featured Q3’s Gross Domestic Product (GDP) surprisingly jumped 2.9% QoQ, while employment data showed the economy added 10.1K jobs, aligned with the consensuses.

Ahead into the week, the Bank of Canada (BoC) Wednesday’s monetary policy looms, with analysts split between a 25 or 50 bps rate hike. Analysts at TD Securities expect a 25 bps rate hike, taking rates to the 4.00% threshold. Later in the week, the BoC’s Deputy Governor Kozicki will cross newswires, followed by the Balance of Trade and Building Permits for October.

USD/CAD Price Analysis: Technical outlook

The daily chart shows that the USD/CAD is upward biased, breaking above a three-month-old downslope resistance trendline drawn from October highs. Traders should be aware that a daily close above the latter would expose the November 29 daily high of 1.3645. Nevertheless, on its way north, the USD/CAD needs to clear the psychological 1.3600 figure, followed by the former, and then the 1.3700 mark.

- GBP/USD slides in a risk-off environment at start of week US session.

- The British Pound is vulnerable to soured UK politics and economy.

- The US Dollar bulls are moving in on the face of stronger US economic data.

- Federal Reserve terminal rate is the driver for the US Dollar.

The British Pound is under pressure in the North American session as risk appetite drops on Wall Street. US major indexes have fallen following better-than-expected service-sector activity that has added to jitters that the US Federal Reserve might continue on its aggressive policy tightening path despite fears of a recession next year.

At the time of writing, GBP/USD is down 0.78% after falling from a high of 1.2344 to a low of 1.2162 so far. The US Dollar is climbing in a risk-off environment as an initial boost of investor enthusiasm over signs of possible loosening in COVID restrictions in China faded and on some speculation that the Federal Reserve may not be able to pivot as soon as December.

US economic data improves outlook for US Dollar

The Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates. The data beat forecast the Non-manufacturing PMI would fall to 53.1. This data combined with Friday's surprisingly strong Nonfarm Payrolls and wage growth data in November as well as news that consumer spending had accelerated in October gives has raised optimism that a recession could be avoided in 2023.

Eyes on the Federal Reserve

The data comes in contrast to a recently weaker Consumer Price Index, prior ISM data and dovish Federal Reserve chairman Jerome Powell's comments that combined had started to weigh on the market's pricing of the terminal rate that had declined to below 5%. Before the Nonfarm Payrolls report, the rate was seen topping out at 4.75%-5% before the report. However, the Fed is now seen raising its policy rate, currently in the 3.75%-4% range, to 4.92% by March of next year and more likely than not into the 5%-5.25% range by May, based on futures contract prices and the CME Fed watch tool.

Nevertheless, in the near term, Fed Chair Jerome Powell said last week that the US central bank could scale back the pace of its rate increases "as soon as December." Futures contracts tied to the Fed policy rate still imply a 70% chance that central bankers will slow the pace of rate hikes when they meet Dec. 13-14, rather than adding to a string of 75-basis-point rate hikes over the past four meetings.

GBP/USD positioning remains bearish

According to the latest weekly data from the Commodity Futures Trading Commission (CFTC), Money managers are still bearish towards the British Pound.

A net short position is, however, reducing and is now more than 50% smaller than the depths seen earlier this year but that is largely due to the US Dollar being trimmed in the improved risk environment. Nevertheless, while there might be less room for strong rallies in GBP, a reversal in risk appetite could leave the currency exposed to a sharp move lower.

''In the spot market the pound has recovered a significant amount of ground vs. the softer USD,'' analysts at Rabobank said.

UK politics in the spotlight

''While the UK political backdrop has retained a calmer air since the start of PM Rishi Sunak’s premiership, neither the economy nor this own party is proving easy to manage,'' the analysts argued.

''Recessionary conditions appear to be taking root, strike action is on the rise and a slew of Tories has already indicated they will throw in the towel at the general election rather than face the possibility that the party could be in opposition for some years,'' the analysts added.

Prime Minister Rishi Sunak, in power for just over a month, faces a raft of problems in the run-up to an election that opinion polls suggest the Conservatives will lose which could ultimately spell more weakness for the pound.

GBP/USD technical analysis

GBP/USD is potentially moving into a phase of distribution below 1.2350, 1,2400 areas on the daily chart as illustrated above. However, the British Pound's bullish trend is still intact while structures 1.2150 and 1.1900 are yet to be broken:

This leaves the focus on the upside in GBP/USD while above 1.1900. A move into test below 1.2150 could result in a deeper correction through the Fibonacci scale with eyes on a 50% mean reversion at 1.2120 and then a 61.8% ratio confluence with the upper quarter of the 1.20 area near 1.2070.

- The Euro is falling against the US Dollar after hitting a six-month high nearby 1.0600.

- US ISM Non-Manufacturing activity surprisingly jumped in the United States.

- Eurozone data was mixed, though tilted negative as Retail Sales dropped.

- EUR/USD Price Analysis: Upward biased, but could pull back to 1.0400 before testing 1.0600.

The Euro (EUR) is almost unchanged against the US Dollar (USD) following the release of an upbeat US ISM Services PMI that underpinned the USD, while last week’s solid November US employment report shows the labor market remains tight. At the time of writing, the EUR/USD is trading at 1.0494, down by 0.40%.

US ISM Services was better than expected, weighed on the Euro

Sentiment remains deteriorated, even though China is beginning to ease Covid-19 measures. The US ISM Non-Manufacturing Index for November rose by 56.5, above estimates of 53.3, crushing October’s 54.4. According to Bloomberg, “The service sector expanded at a faster pace in November, with the holiday season bolstering business activity.” It should be noted that the price index subcomponent confirmed that inflationary pressure is skewed to the upside.

On the economic data release, the EUR/USD dived from around 1.0550 to 1.0503.

At the same time, US Factory Orders grew by 1% in November against expectations of a 0.7% increase and also smashed September’s data of 0.3%. “New orders for manufactured durable goods in October, up seven of the last eight months, increased $3.0 billion or 1.1%to $277.4 billion, up from the previously published 1% increase,” the publication further read.

Aside from this, last week’s employment report, November’s Nonfarm Payrolls (NFP) rose by 263K, beating the 200K estimates, while the Unemployment Rate, at 3.7%, remained unchanged. Average Hourly Earnings increased by 5.1%, vs. 4.9% forecasts, which would keep the US Federal Reserve (Fed) lifting rates, even if it means at 50 bps increases, as the Federal Reserve (Fed) Chair Jerome Powell said last Wednesday.

In the meantime, across the pond, S&P Global PMIs Services and Composite indices across the Eurozone remained unchanged, while the Euro area Retail Sales came worse than expected, at -1.8% MoM vs. -1.7% foreseen and -2.7% YoY, below -2.6% estimated. Additionally, several European Central Bank (ECB) officials, Villeroy and Makhlouf, backed a 50 bps rate hike in the December meeting.

EUR/USD Price Analysis: Technical outlook

From a technical perspective, the EUR/USD daily chart is neutral-upward biased after breaking above the 200-day Exponential Moving Average (EMA) at 1.0388. As the EUR/USD rose to six-month highs at 1.0594, registering successive series of higher highs, oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) did not, so a negative divergence between price action/oscillators, emerged.

Therefore, the EUR/USD first support would be the 1.0500 figure, followed by the December 2 daily low at 1.0428 and the 1.0400 psychological figure.

The ISM Service sector PMI rose above expectations in November to 56.5 from 54.4 in October. Analysts at Wells Fargo point out employment crossed back into expansion territory, wait times shortened and prices came down slightly. As a negative, they see a drop in orders sullied, an otherwise encouraging report for the service sector.

Key Quotes:

“A surge in business activity lifted ISM services to a consensus-defying print of 56.5 in November. Employment crossed back into expansion territory, wait times shortened and prices came down slightly. Only a drop in orders sullied an otherwise encouraging report for the service sector.”

“The ISM suggests service-sector activity is holding up better than manufacturing, but the gain in the headline number does not mean that all categories are improving. The better-than-expected gain was due almost entirely to a 9.0 point gain in the business activity index, which marks the largest one-month gain since March 2021. This component is also now at its highest reading in almost a year, signaling current activity remained widespread through November. Only one industry, finance and insurance, reported a decrease in business activity last month.”

“The only headline-feeding decline was in the new orders component, though this should not be glossed over. This key leading indicator slid for the fourth-consecutive month to 56.0. This still marks expansion but is consistent with lost momentum and could foreshadow a more significant slowdown is yet to come.”

- US Dollar gains momentum across the board, DXY turns positive.

- Economic data from the US shows numbers above market consensus.

- USD/JPY with a bullish outlook in the very short-term.

The USD/JPY broke above 135.50 and jumped above 136.00 extending the recovery from multi-month lows. The US Dollar is rising across the board supported by better-than-expected economic data and higher Treasury bond yields.

Dollar strengthens further after US data

US economic data surpassed expectations on Monday, helping the US Dollar. The S&P Global Composite PMI was revised from the 46.3 preliminary reading to 46.4 in November. Factory Orders in October rose 1% surpassing expectations of a 0.7% increase. The ISM Service PMI in November rose from 54.4 to 56.5. The Price Paid Index fell from 70.7 to 70.

The US Dollar Index (DXY) is up 0.40% after hitting earlier on Monday at 104.11, the lowest level since June. The more positive tone around the Greenback helped the USD/JPY move further to the upside.

The pair broke above 135.50 and climbed to 136.40, reaching the highest level since Thursday. It remains near the high, with the bullish momentum intact. The next resistance area is seen around 136.60 followed by 137.00.

The 136.00 level has become the immediate support followed by 135.50/55. The recovery of the Dollar is being supported by indicators in the 4-hour chart with the RSI moving north, breaking the 30 level and Momentum turning also to the upside. According to indicators, more gains seem likely before a new leg lower.

Technical levels

The US Dollar Index is now trading 8% off its early November high. Economists at ING suspect that the Dollar correction may have run its course, and several factors should allow for some re-appreciation into year-end.

Fed to remain hawkish

“Our suspicion is that the Fed will maintain its hawkish narrative for longer, implicitly or explicitly protesting against the recent drop in yields. After all, endorsing the market’s dovish narrative may be premature and risky for the Fed whose plan should be to let markets do the heavy lifting in tightening – and we are bearish on Treasuries in the near term. A still highly inflationary global environment may struggle to live with sub-3.50% 10-year yields.”

China's optimism being misplaced

“USD/CNY is trading below 7.00 for the first time since September, with the Yuan following Chinese risk assets higher after the government announced an easing of Covid rules. The government’s move appears to be a direct consequence of recent demonstrations against its Covid policy, but a further untightening of restrictions may prove complicated. At the same time, the real estate and export sectors remain a key concern for the medium outlook in China, and one that may prevent the Yuan from appreciating much further.”

Energy prices rising again

“With Russia rejecting the cap on oil prices at $60/bbl and threatening output cuts, along with a projected drop in temperatures in many parts of Europe, the energy crisis may return and we see ample room for gas and oil prices to climb back. That would be a positive development for the Dollar.”

The US Dollar stumbled again last week. But in the view of economists at TD Securities the Greenback should consolidate ahead of November Consumer Price Index (CPI) data and the December Fed meeting.

USD/JPY to retest 140 before year-end

“A shift in momentum signals could keep the USD on the back foot in the very short-term. Yet, USD downside looks contained ahead of November CPI and the Fed meeting.”

“We like fading the rally in GBP/USD and see USD/JPY retesting 140 before year-end.”

“We also see dovish risks for RBA and BoC this week and like USD/NOK topside, especially if risk sentiment peaks.”

NZD/USD is stabilizing its gains above the 200-Day Moving Average of 0.6285. Analysts at Credit Suisse look for an eventual move above 0.6468/87.

Immediate support is seen at 0.6351

“Whilst we stay cautious of daily RSI’s overbought condition, the medium-term momentum remains supportive and with the recent key break in the USD space also in place, we think that a move above 0.6468/87 is likely.”

“A sustained break above key resistance at the 50% retracement of the whole 2021/22 decline and the August high at 0.6468/87 would mark another major break of technical resistance to confirm further sustained medium-term upside, with resistance above here next seen at 0.6568/76, which is the June high and then 0.6591.”

“Immediate support is seen at 0.6351 and next at 0.6326/10, though only quick move back below the 200DMA at 0.6285 would raise suspicion of a brief consolidation phase.”

- US Dollar soars across the board after US data.

- Aussie under pressure versus the Dollar ahead of the RBA.

- AUD/USD drops more than a hundred pips from monthly highs to the lowest since Wednesdays.

The AUD/USD dropped further after breaking under 0.6800 and recently it reach its lowest since Wednesday at 0.6740. The pair remains near the low, under pressure amid a stronger US Dollar across the board following US economic data.

Good US data bad news for Wall Street

Economic data from the US came in above expectations on Monday, helping the US Dollar. The S&P Global Composite PMI for November was revised from the 46.3 preliminary reading to 46.4. Factory Orders in October rose 1% surpassing expectations of a 0.7% increase. The ISM Service PMI in November rose from 54.4 to 56.5. The Price Paid Index fell from 70.7 to 70.

Following the latest reports, the US Dollar gained momentum across the board and hit fresh daily highs. Metals extended the decline and US stocks hit fresh lows.

RBA next

On Tuesday, the Reserve Bank of Australia (RBA) will announce its decision on monetary policy. The consensus is for a 25 basis points rate hike. The decision and the guidance offered in the statement will likely have a large impact on the Aussie.

“The Statement would read dovish if the Bank states it will assess the data over the holiday break to determine its next cash rate move. Alternatively, the Bank explicitly stating 300 bps of cumulative hikes would also be dovish (the RBA assumed 300 bps by Jul '23)”, explained analysts at TD Securites.

Short-term technical outlook

The AUD/USD has reversed sharply and the outlook has deteriorated significantly for the bulls. A recovery back above 0.6800 would shift the momentum back to the Aussie. Above the next resistance stands at 0.6820. If the pair holds above 0.6840, a new test of the recent high at 0.6850 seems likely.

On the flip side, a support area emerges around 0.6720. A break lower would put attention on 0.6700 with the next barrier seen at 0.6665.

Technical levels

- Robust United States Nonfarm Payrolls data to keep the Federal Reserve tightening policy.

- US Treasury bond yields remain elevated, weighing on Gold prices.

- China’s eases testing measures as Beijing shifts to new “optimized and adjusted measures.”

- Gold Price Forecast: To consolidate around $1770-$1800, as oscillators aim downwards.

Gold price retraces after hitting a multi-month high at $1810, spurred by high US Treasury yields and a risk-off impulse. Factors like the latest employment report in the United States (US) cementing the tightness of the labor market caused a jump in US bond yields. China’s easing Covid-19 restrictions kept the yellow metal from appreciating. At the time of writing, the XAU/USD is trading at $1776., down 1.30%.

Gold capped by a solid US employment report

US stocks are set to open lower, as depicted by equity futures. Last week’s employment report, November’s Nonfarm Payrolls (NFP) jumped 263K, above 200K estimates, while the Unemployment Rate, at 3.7%, remained unchanged. Average Hourly Earnings rose by 5.1%, vs. 4.9% forecasts, which would keep the US Federal Reserve (Fed) liftin rates, even if it means at 50 bps increases. In his Wednesday speech, Fed Chairman Jerome Powell said, “the principal wage measures that we look at, I would say that you’re one and half or two percent above that (which is consistent with two percent inflation over time).”

US yields rise on Monday, stalling Gold’s rally

Aside from this, the US 10-year Treasury bond yield is rising nine bps, from 3.502% to 3.597%, while US Real Yields, which reflect the interest of the nominal yield minus inflation expectations, remain at 1.16% as of Friday, a headwind for Gold. XAU/USD remains heavy, falling more than 1%, as Wall Street opened.

China’s progresses towards easing Covid-19 restrictions

Over the weekend, Chinese authorities are beginning to relax testing requirements across major cities, as Beijing shifts from Covid-19 zero-tolerance measures, amid elevated reports of the virus contagion. Chinese Vice Premier Sun Chunlan said last week that the country’s pandemic control had entered a new phase. Confronted with evolving challenges and tasks, the government will take small, consistent steps to optimize Covid measures.

Gold Price Forecast: XAU/USD Technical Outlook

The XAU/USD daily chart suggests Gold is still upward biased but could consolidate soon. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) portray negative divergence with price action, which exacerbated the fall beneath $1800. Nevertheless, if XAU/USD price remains above the Exponential Moving Averages (EMAs), that could keep the non-yielding metal uptrend intact.

Hence, the XAU/USD first resistance would be the psychological $1800. Break above will expose December’s 5 high of $1810, followed by the June 17 high of $1857.20, followed by June’s 13 daily high at $1879.45. On the other hand, the XAU/USD first support would be $1778.68, followed by December’s low at $1767.70 and the 200-day EMA at $1759.92.

India’s Monetary Policy Committee (MPC) is scheduled to announce its Interest Rate Decision on Wednesday, December 7 at 04:30 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of five major banks for the upcoming central bank's meeting.

The Reserve Bank of India (RBI) is expected to hike the repo rate by 35 basis points to 6.25%. At the last policy meeting on September 30, the bank hiked the repo rate by 50 bps to 5.90%.

ANZ

“We expect a 35 bps hike in the policy repo rate to 6.25%, reflecting the need to tame high inflation amid persistent domestic demand strength, as also shown in the Q3 GDP print. However, going forward, the pace of rate hikes will be tempered as external headwinds have eased considerably after the recent sell-off in the Dollar, oil prices, and the US Fed’s expected pivot to smaller rate hikes. The RBI’s FX reserves, too, have also risen on the back of revaluation gains. The wording of the monetary policy committee’s stance will have to be scrutinised as both nominal and real policy rates arenow entering growth restrictive territory.”

Standard Chartered

“We expect it to hike the repo rate by 35 bps to 6.25%. The likely smaller rake hike compared to the three previous 50 bps hikes may be driven by (1) softening domestic inflation (with the October print at 6.77% versus an average of 7.2% in H1-FY23) on base effects, easing commodity prices and lower prices of perishables, (2) the need to assess the impact of rate increases so far (190bps since May 2022) on inflation and economic activity in the face of global headwinds, and (3) a slowing pace of rate increases globally. We see inflation slipping back below the 4+/-2% target band only by March/April 2023, after staying above an average of 6% on a quarterly basis since Q1- 2022. We, therefore, expect the MPC to stay vigilant on inflation risks and maintain its guidance of ‘withdrawal of accommodation’ with no change in stance. We see the terminal repo rate reaching 6.50% with an additional 25 bps rate hike in Q1-2023.”

ING

“Inflation remains higher than it would like but is showing some signs of peaking, while rates have already been raised a lot. It is not inconceivable that it will hike by only 25 bps, less than the 35 bps expected by the market.”

TDS

“We think the RBI can afford to step down the pace of its tightening. The worst of inflation is probably over after CPI inflation hit a high of 7.4% YoY in Sep and has since fallen to 6.8% YoY in Oct. Looking ahead, inflation pressures should moderate further. Sep MPC Minutes also indicated a preference among some members for a tapering of the tightening cycle going ahead. Thus, we expect the RBI to hike by 35 bps to 6.25%.”

SocGen

“The lower October inflation print (6.8% YoY vs 7.4% in September) will soon give way to inflation perking up as the high statistical base effect reverses from December, and we believe the RBI will hike the policy rate twice more, for a cumulative rate hike of 60 bps, of which we expect a 35 bps rate hike in the meeting this week. This will likely be followed by a final hike of 25 bps in February 2023, which would take the terminal rate to 6.5%. We also believe that sustained disinflation would be visible from 2Q23 onward, which would result in India’s real policy rate eventually turning positive after a rather prolonged period of remaining in the negative zone.”

- Factory Orders in the US rose more than expected in October.

- US Dollar Index stays in positive territory at around 104.90.

The data published by the US Census Bureau revealed on Monday that new orders for manufactured goods, Factory Orders, increased $5.8 billion, or by 1%, in October to $556.6 billion. This print followed September's growth of 0.3% and came in better than the market expectation for an increase of 0.7%.

"New orders for manufactured durable goods in October, up seven of the last eight months, increased $3.0 billion or 1.1%to $277.4 billion, up from the previously published 1% increase," the publication further read.

Market reaction

Combined with the better-than-expected ISM Services PMI report, the data helps the US Dollar continue to outperform its rivals in the second half of the day on Monday. As of writing, the US Dollar Index was up 0.4% on the day at 104.90.

USD/CHF has breached the bottom of the key support zone at 0.9355, which in the view of analysts at Credit Suisse, indicates further weakness is likely over the next month.

Further sustained downside

“USD/CHF broke the bottom of the key support zone at 0.9355 on Friday. This move paired with the DXY breaking its 200-Day Moving Average in our eyes signals that further gradual downside is likely to unfold, and we thus look for further weakness to develop over the next month.”

“Support is seen at 0.9325/12 and then at 0.9287/84, below which would solidify the current weakness and clear way to the late March low at 0.9193.”

“A quick move back above the 13-Day Exponential Average at 0.9460/68 would see scope for a near-term pause to unfold, though only above the recent highs at 0.9546/98 would raise the prospect of a firmer correction.”

- US ISM Services PMI rose modestly in November.

- US Dollar Index gained traction after the data and climbed to the 105.00 area.

The business activity in the US service sector continued to expand at an accelerating pace in November with the ISM Services PMI rising to 56.5 in November from 54.4 in October. This reading came in better than the market expectation of 53.1.

The inflation component of the survey, the Prices Paid Index, declined to 70 from 70.7, compared to analysts' estimate of 73.6. The Employment Index rose to 51.1 from 49.1 and the New Orders Index edged lower to 56 from 56.5.

Commenting on the data, "based on comments from Business Survey Committee respondents, increased capacity and shorter lead times have resulted in a continued improvement in supply chain and logistics performance," said Anthony Nieves, Chair of the Institute for Supply Management Services Business Survey Committee. "A new fiscal period and the holiday season have contributed to stronger business activity and increased employment."

Market reaction

The US Dollar gathered strength against its rivals with the initial reaction and the US Dollar Index was last seen rising 0.46% on the day at 105.00.

Gold’s rally has started to show signs of exhaustion. An epic bull-trap could be developing in XAU/USD, economists at TD Securities report.

Macro headwinds are unlikely to relent in coming months

“We see signs of buying exhaustion in Gold, but a notable consolidation in prices will be needed before CTA trend followers spark renewed outflows.”

“At this juncture, positioning risks are no longer tilted to the upside, as a rally north $1,830 only points to marginal CTA buying from current positioning levels. This suggests that the pain trade in precious metals may finally be running out of steam, setting the stage for an epic bull-trap in precious metals, as the recently strong price action attracts discretionary interest in the complex, whereas macro headwinds are unlikely to relent in coming months.”

The Russian Rouble has been one of only a handful of EM currencies that has outperformed the US Dollar this year. Economists at MUFG Bank expect the exceptionally strong gains for the RUB to reverse in the year ahead.

Scope for further weakness USD in the year ahead

“Even after the recent correction lower, the US Dollar remains at significantly overvalued levels against other major currencies leaving scope for further weakness in the year ahead. At the same time, we expect the Rouble to weaken in the year ahead following the sharp gains between March and June of this year.”

“We expect the exceptionally strong gains for the Rouble this year to reverse in the year ahead driven in part by curtailed energy export revenues (sanctions + lower prices) and a further easing of capital controls.”

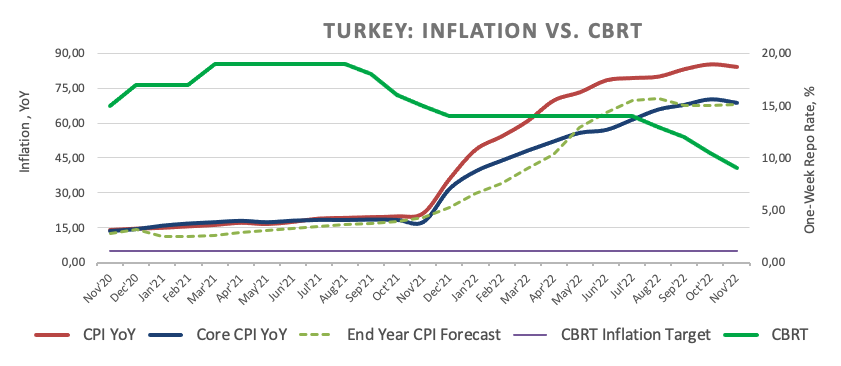

- USD/TRY extends the range bound theme above 18.6000.

- Turkish inflation seems to have peaked in recent months.

- Turkish CPI rose less than expected in November.

The Turkish lira starts the week on the defensive and motivates USD/TRY to resume the upside above 18.6300 on Monday.

USD/TRY looks bid post-CPI

USD/TRY fades Friday’s downtick and manages to gather some upside traction at the end of the new week, although the broader side-lined theme remains largely unchanged for the time being.

The selling bias in the lira picks up pace on Monday after Türkiye’s inflation figures measured by the CPI rose a tad below consensus at 84.39% in the year to November, while the Core CPI gained 68.91% over the last twelve months and Producer Prices increased 136.02% from a year earlier.

What to look for around TRY

USD/TRY remains side-lined above/around the 18.6000 region amidst omnipresent intervention in the FX markets.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating and real interest rates remain entrenched well in the negative territory.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth via transforming the current account deficit into surplus, always following a lower-interest-rate recipe.

Key events in Türkiye this week: Inflation Rate (Monday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 2023.

USD/TRY key levels

So far, the pair is gaining 0.15% at 18.6247 and faces the next hurdle at 18.6664 (all-time high December 2) followed by 19.00 (round level). On the downside, a break below 18.5339 (55-day SMA) would expose 18.3642 (monthly low November 7) and finally 18.2967 (100-day SMA).

The Reserve Bank of Australia (RBA) will announce its next monetary policy decision on Tuesday, December 6 at 03:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming central bank's decision.

The RBA is set to hike the Official Cash Rate (OCR) by 25 bps from 2.85% to 3.10%, summing up to a total of 300 bps in rate increases in eight months.

ANZ

“We do think a December pause will be considered, but with the RBA not meeting again until February and the recent wages and employment data being robust we expect the cash rate target to be lifted 25 bps to 3.10%.”

Westpac

“We anticipate that the RBA will lift the cash rate by 25 bps, to 3.10%. Inflation is still too high and more work needs to be done in our view. Annual headline inflation is expected to hit the 8% mark in the December quarter and to still be above the 2-3 target band at the end of 2023 (at about 4%, we expect).”

Standard Chartered

“We expect the RBA to hike the cash rate by 25 bps to 3.10% from 2.85% previously. At the November meeting, the central bank reiterated its view that monetary policy operates with a lag and recent rate hikes are yet to be reflected in mortgage payments. In addition, latest data shows that housing prices are already falling on a YoY basis. However, inflation levels remain elevated. The labour market remains very tight and wage pressures remain. As such, we think the RBA may have to continue hiking, but at 25 bps increments instead of 50 bps.”

UOB

“We are penciling in another 25 bps hike, which will take the OCR to 3.10%. Thereafter, we look for a hold.”

ING

“We have decided that the central bank is no longer particularly concerned with the flow of data, and will hike rates another 25 bps despite recent softer-than-expected inflation.”

Danske Bank

“We expect a 25 bps hike.”

TDS

“We expect a 25 bps increase in the target rate to 3.10%, but all eyes will be on any shift in the language suggesting the RBA will pause in early 2023. We don't expect the RBA to shut the door to further rate hikes in 2023 but given the Bank has raised the cash rate 300 bps, 7 months ahead of assumptions, a dovish tweak cannot be ruled out.”

SocGen

“We expect the RBA to increase its cash rate target from 2.85% to 3.10%. While policymakers continue to say that they have not ruled out returning to 50 bps hike if necessary, we don’t think that the current environment justifies returning to a 50 bps hike. We reiterate our recently revised terminal policy rate forecast of 3.85%, which matches our forecast of the terminal Fed Funds rate at 5.25% (upper bound).”

Citibank

“The final meeting of the year will likely see the RBA hike for the eighth consecutive month. Citi analysts keep their quarterly inflation forecast unchanged at 1.7% and still expect a terminal rate next year unchanged at 3.35% with another 25 bps hike in February to be the last in the cycle, though risks are still tilted to the upside.”

NAB

“We expect a 25 bps increase. High inflation, a tight labour market and accelerating inflation mean it is too early for the RBA to pause, even as they prioritise keeping the economy on an ‘even keel’. As for the post-Meeting Statement, this could equivocate a little further on the guidance that the Board expects further interest rate hikes in the period ahead.”

US ISM Services PMI Overview

The Institute of Supply Management (ISM) will release the Non-Manufacturing Purchasing Managers' Index (PMI) - also known as the ISM Services PMI – at 15:00 GMT this Monday. The gauge is expected to edge down to 53.1 in November from 54.4 in the previous month. Given that the Fed looks more at inflation than growth, investors will keep a close eye on the Prices Paid sub-component, which is anticipated to rise from 70.7 in October to 73.6 during the reported month.

How Could it Affect EUR/USD?