- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-12-2022

- USD/CAD struggles for clear directions after two-day downtrend.

- 100-HMA approaches 50-HMA from below, suggesting short-term downside.

- Four-day-old resistance line adds to the upside filters.

- Bears need validation from a two-week-old ascending support line.

USD/CAD treads water around 1.3430 during the early Friday in Asia, following a two-day losing streak. The Loonie pair’s latest inaction could be linked to the trader’s cautious mood ahead of the key employment data from the US and Canada.

Even so, a looming bear cross between the 100-HMA and 50-HMA keeps the USD/CAD sellers hopeful. It’s worth noting that the 100-HMA has to successfully pierce the 50-HMA to confirm the bearish bias.

That said, the bullish MACD signals challenge the quote’s downside after the latest fall, which in turn suggests a corrective bounce toward the HMA convergence area near 1.3475.

Also acting as an upside filter is a downward-sloping resistance line from Tuesday, close to 1.3490, as well as the 1.3500 threshold.

Hence, the USD/CAD pair remains on the bear’s radar unless crossing the 1.3500 mark, a break of which could direct the buyers toward the weekly top surrounding 1.3645.

On the flip side, an ascending trend line from November 16, close to 1.3380 at the latest, restricts the short-term downside of the Loonie pair.

Following that, the 1.3315 level may probe the USD/CAD bears before directing them to the monthly low near 1.3225.

USD/CAD: Hourly chart

Trend: Further downside expected

- Gold price grind near the key hurdle after refreshing four-month high.

- Hopes of slower Federal Reserve rate hikes drowned the United States Treasury bond yields, US Dollar and favored XAU/USD.

- Optimism surrounding China also allowed Gold buyers to keep the reins.

- United States Nonfarm Payrolls will be crucial amid talks of Fed’s 50 bps rate hike in December.

Gold price (XAU/USD) refreshed a four-month high above $1,800 before taking rounds to $1,805-07 during early Friday morning in Asia. In doing so, the yellow metal portrays the market’s cautious mood ahead of the key catalysts. Also likely to have probed the Gold buyers could be the recently mixed updates from the Fed, as well as the data from the United States.

Dovish Federal Reserve drowns the United States Treasury bond yields, US Dollar and Gold Price

The dovish bias of the Federal Reserve (Fed) Chairman Jerome Powell, as well as downbeat comments from US Treasury Secretary Janet Yellen, initially raised hopes of easy rate hikes.

Recently, Federal Reserve (Fed) Governor Michelle Bowman stated that (It is) appropriate for us to slow the pace of increases. Before him, Fed Governor Jerome Powell also teased the slowing of a rate hike while US Treasury Secretary Yellen also advocated for a soft landing. Further, Vice Chair of supervision, Michael Barr, also said, “We may shift to a slower pace of rate increases at the next meeting.” It’s worth noting that the recent comments from New York Fed’s John Williams seemed to have tested the US Dollar bears as the policymakers stated that the Fed has a ways to go with rate rises.

The comments favoring a 50 bps Fed rate hike in December allowed the US Treasury bond yields to refresh a four-month low amid receding market pessimism and a rush toward the riskier assets.

It’s worth noting, however, that the Bank of Japan’s (BOJ) hints of adjusting the easy money policies seemed to have challenged the bond yields of late amid fears of less demand from the biggest customer in Asia.

That said, the benchmark US 10-year Treasury bond yields slumped to 3.50% while the two-year counterpart printed 4.23% while poking the lowest levels since October by the press time.

With this, US Dollar Index (DXY) slumped to the lowest levels in four months, pressured around 104.70 at the latest.

China’s Covid conditions, mostly downbeat United States data also weigh on XAU/USD

The consecutive three days of the downtrend of Chinese daily Covid infections from a record high allowed the policymakers to tease the “next stage” in battling the virus while announcing multiple easing of the activity-control measures.

Elsewhere, US Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, matched 5.0% market forecasts on YoY but eased to 0.2% MoM versus 0.3% expected. Further, US ISM Manufacturing PMI for November eased to 49.0 versus 49.7 expected and 50.2 prior.

US Nonfarm Payrolls are the key for Gold buyers

While the aforementioned catalysts are well in place to weigh on the Gold price, it’s the market’s anxiety ahead of the US employment report for November that probes XAU/USD bulls of late, especially when the Fed is dovish.

Forecasts suggest that the headlines Nonfarm Payrolls (NFP) is likely to ease with a 200K print versus 261K prior while the Unemployment Rate could remain unchanged at 3.7%. It should be noted that a likely easing in the Average Hourly Earnings for the stated month could also weigh on the Gold price.

Hence, a downbeat US jobs report may allow the XAU/USD buyers to keep the reins. However, the historical analysis suggests fading of NFP-led moves within four hours and hence any surprises might not harm the latest moves of the yellow metal.

Also read: US November Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

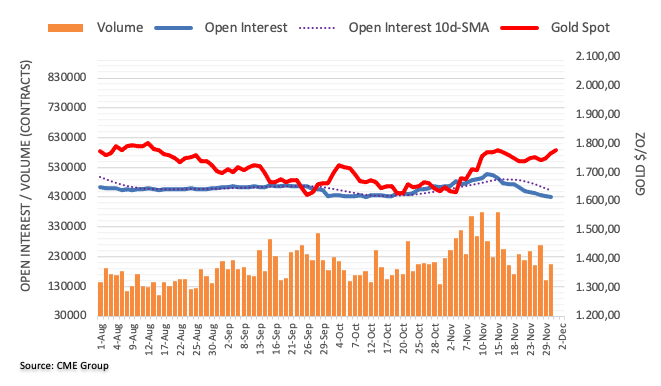

Gold price technical analysis

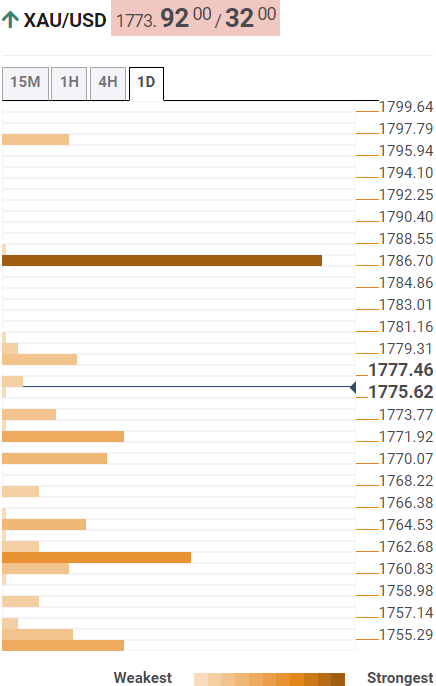

Gold buyers take a breather at the highest levels since early August amid the overbought conditions of the Relative Strength Index (RSI) line, placed at 14. Also challenging the metal buyers is the horizontal area surrounding $1,805-07 comprising multiple levels marked since mid-June.

That said, the Moving Average Convergence and Divergence (MACD) indicator’s bullish signals join the previous day’s upside break of the 200-Day Moving Average (DMA) and a downward-sloping trend line from August to keep the Gold price on the bull’s radar.

Hence, a clear upside break of the $1,807 appears necessary for the bullion to let the buyers sit in the driver’s seat. Following that, a run-up toward a mid-June high of $1,858 and then to June’s peak surrounding $1,880 can’t be ruled out.

Alternatively, pullback moves remain elusive unless the quote stays beyond the 200-DMA level near $1,796, a break of which could quickly drag the Gold price towards the resistance-turned-support line from early August, close to $1,782 at the latest.

In a case where the XAU/USD remains weak past $1,782, a one-month-old ascending support line near $1,758 will be crucial for the Gold traders to watch as it holds the key to the bear’s entry.

Gold price: Daily chart

Trend: Further upside expected

- Risk aversion weighed on the Australian Dollar, bolstering the safe-haven status of the Japanese Yen.

- AUD/JPY Price Analysis: Break below the 200-day EMA to exacerbate a fall towards 90.00.

The Australian Dollar (AUD) losses ground against the Japanese Yen (JPY) amid a risk-off impulse as the prospects for a recession in the United States (US) increased, blamed on a worst-than-expected US ISM PMI, and flashed manufacturing activity is deteriorating. At the time of writing, the AUD/JPY is trading at 92.16.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart portrays the pair trading within a descending channel, with the 20, 50, and 100-day Exponential Moving Averages (EMAs) sitting above the exchange rate, further confirming the downtrend. Additionally, the AUD/JPY Thursday close below the former weekly low of 92.14, has paved the way for additional losses.

Oscillators with the Relative Strength Index (RSI) at bearish territory, and the 9-day Rate of Change (RoC) aiming downwards, suggests bears are gathering momentum. Therefore, the AUD/JPY path of least resistance is downwards.

The AUD/JPY key support levels are the 200-day EMA at 91.99, followed by the October 13 swing low of 90.83, followed by the August 2 pivot low of 90.52, ahead of the 90.00 figure.

As an alternate scenario, the AUD/JPY first resistance would be the 93.00 figure. Break above will open the AUD/JPY path to the confluence of the 20 and 100-day EMA at 93.40/60, ahead of the 50-day EMA at 93.78

AUD/JPY Key Technical Levels

- EUR/USD remains sidelined after refreshing multi-day high, probes three-day uptrend.

- Hopes of slower Fed rate hike drowned the US Treasury bond yields, US Dollar.

- Mixed data from Eurozone, United States, failed to tame the bulls.

- ECB’s Lagarde should remain hawkish to defend buyers, US NFP may print softer outcome for November.

EUR/USD cheered the broad-based US Dollar weakness to march towards the highest levels since late June, before recently taking rounds to 1.0520-30 during the generally quiet early Asian session. It’s worth noting that the cautious mood ahead of the speech from European Central Bank (ECB) President Christine Lagarde and monthly employment data from the United States seems to probe the pair buyers of late.

Even so, dovish bias about the Federal Reserve’s (Fed) next move joins optimism surrounding China’s Covid conditions and record Unemployment Rate from Eurozone seemed to have drowned the EUR/USD prices.

Having witnessed comments favoring easy rate hikes from the Fed and safe passage for the soft landing, the second-tier Fed officials also confirmed the need to go slow on the rates during their latest speeches.

Recently, Federal Reserve (Fed) Governor Michelle Bowman stated that (It is) appropriate for us to slow the pace of increases. Before him, Fed Governor Jerome Powell also teased the slowing of a rate hike while US Treasury Secretary Yellen also advocated for a soft landing. Further, Vice Chair of supervision, Michael Barr, also said, “We may shift to a slower pace of rate increases at the next meeting.”

It’s worth noting that the recent comments from New York Fed’s John Williams seemed to have tested the US Dollar bears as the policymakers stated that the Fed has a ways to go with rate rises.

Elsewhere, the consecutive three days of the downtrend of Chinese daily Covid infections from a record high allowed the policymakers to tease the “next stage” in battling the virus while announcing multiple easing of the activity-control measures.

Talking about the data, US Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, matched 5.0% market forecasts on YoY but eased to 0.2% MoM versus 0.3% expected. Further, US ISM Manufacturing PMI for November eased to 49.0 versus 49.7 expected and 50.2 prior.

At home, Eurozone Unemployment Rate refreshed a record low of 6.5% in October versus 6.6% expected and prior while the final prints of November’s S&P Global/CIPS Manufacturing PMI dropped to 47.1 versus 47.3 initial forecast. Further, Germany’s Retail Sales growth shrank by 5.0% YoY in October, the biggest drop since June, versus -2.8% expected and -0.9% previous readings. Also, the final prints of German S&P Global/CIPS Manufacturing PMI for November declined to 46.2 compared to 46.7 flash estimations.

Against this backdrop, Wall Street closed mixed but the US 10-year Treasury bond yields plummeted to a four-month low, which in turn drowned the US Dollar Index, pressured around 104.70 by the press time.

Looking forward, likely hawkish comments from ECB President Lagarde during a panel discussion on growth and inflation at the Bank of Thailand might help the EUR/USD to remain firmer. However, the anxiety ahead of the US Nonfarm Payrolls (NFP), expected to ease to 200K versus 261K prior, might restrict the pair’s immediate moves.

Also: Nonfarm Payrolls Preview: Dollar selling opportunity? Low expectations to trigger temporary bounce

Technical analysis

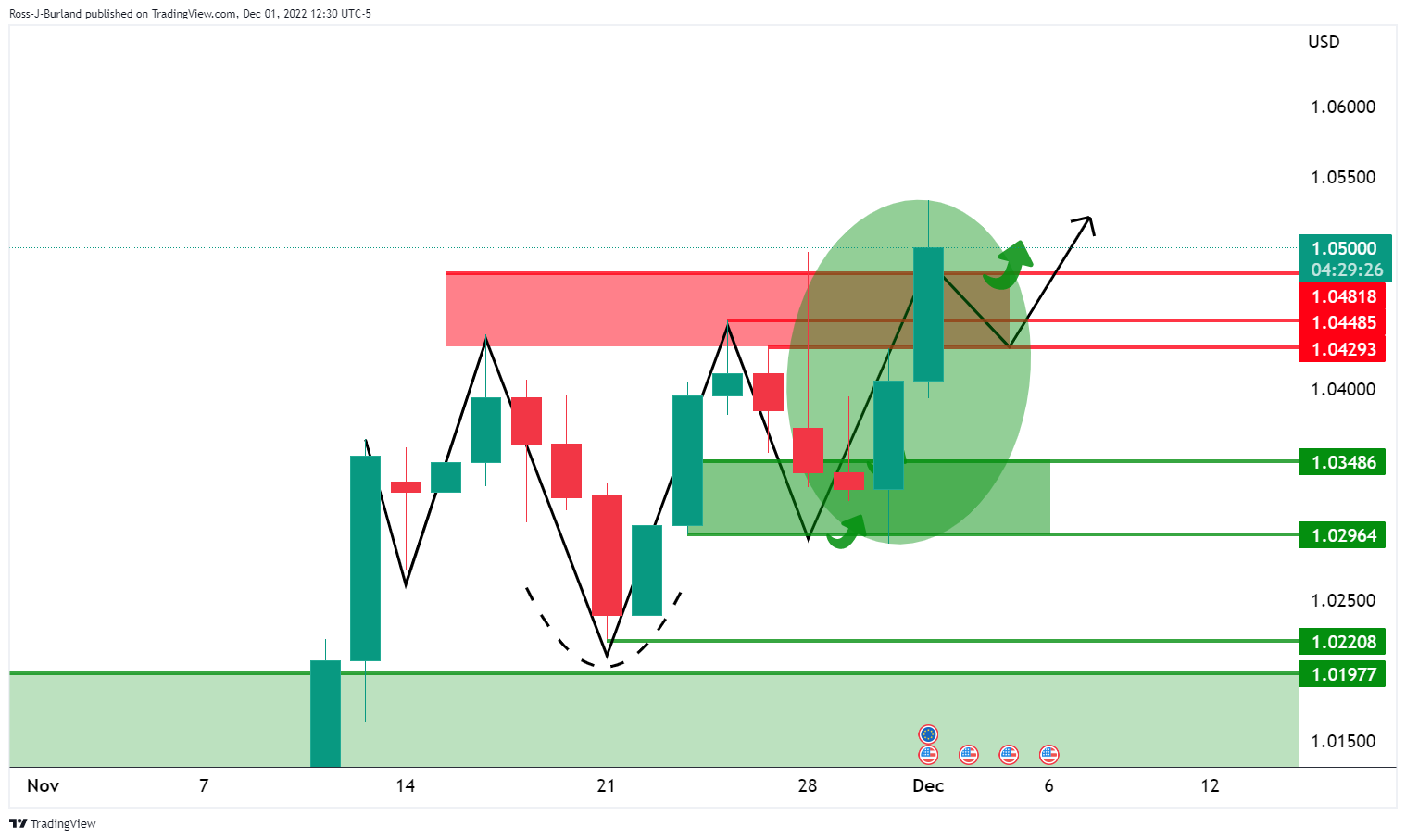

A clear upside break of the four-month-old ascending resistance line, now support near 1.0500, keeps EUR/USD bulls hopeful of poking the late June swing high near 1.0615.

Early Friday morning in Asia, Reuters quoted an Official from the Group of Seven Nations (G7) Price Cap Coalition to convey the update over the Russian Oil export price cap.

Key comments

Expected agreement calls for maintaining price cap at 5% below market price for Russian crude.

There is some discretion, flexibility in determining market price for Russian crude for price cap.

Oil markets seem pretty comfortable with cap mechanism on Russian Oil prices.

Not sure how Russia will react to $60 price cap but Russia has no good options.

Price cap will limit Russia's ability to fight the war against Ukraine.

Price caps will be adjusted on a range of considerations including market prices, could go up or down.

Optimistic about agreeing on refined products price cap by February 5.

Oil buyers take a breather, for now

The news is yet to shake the WTI crude oil prices as the quote seesaws near $81.35 after rising to the fresh high in two weeks the previous day.

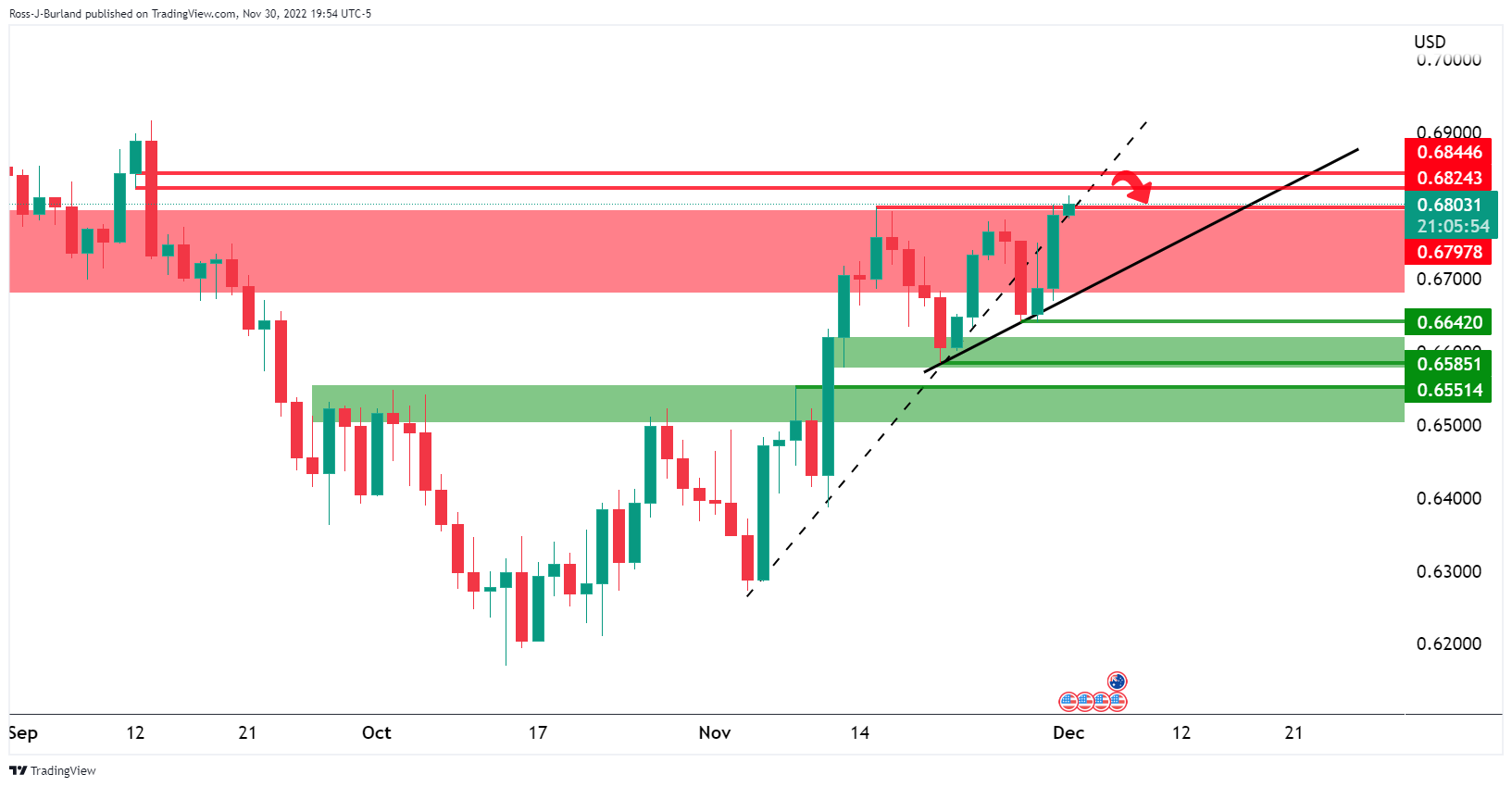

- AUD/USD grinds at the highest levels in 11 weeks after refreshing the top.

- Dovish Fed, China-linked optimism and downbeat US data weighed on the US Dollar.

- Mixed performance of equities, Aussie data probed bulls ahead of the key catalysts.

- Likely dovish tone from RBA’s Lowe, softer US jobs report may favor bulls.

AUD/USD portrays the typical pre-data/event anxiety as it seesaws near 0.6800 during the early Asian session on Friday, after refreshing the 11-week high the previous day. That said, the Aussie pair rose during the last three consecutive days amid broad US Dollar weakness and the market’s optimism surrounding China’s Covid conditions, adding strength to the run-up could be the downbeat US data.

US Dollar Index (DXY) slumped to the lowest levels in four months, pressured around 104.70 by the press time, as the dovish bias of the Federal Reserve (Fed) policymakers, as well as downbeat comments from US Treasury Secretary Janet Yellen, raised hopes of easy rate hikes.

Recently, Federal Reserve (Fed) Governor Michelle Bowman stated that (It is) appropriate for us to slow the pace of increases. Before him, Fed Governor Jerome Powell also teased the slowing of a rate hike while US Treasury Secretary Yellen also advocated for a soft landing. Further, Vice Chair of supervision, Michael Barr, also said, “We may shift to a slower pace of rate increases at the next meeting.” It’s worth noting that the recent comments from New York Fed’s John Williams seemed to have tested the US Dollar bears as the policymakers stated that the Fed has a ways to go with rate rises.

Not only the Fedspeak but the mostly downbeat US data also drowned the US Dollar. That said, the US Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, matched 5.0% market forecasts on YoY but eased to 0.2% MoM versus 0.3% expected. Further, US ISM Manufacturing PMI for November eased to 49.0 versus 49.7 expected and 50.2 prior.

Furthermore, the consecutive three days of the downtrend of Chinese daily Covid infections from the record high allowed the policymakers to tease the “next stage” in battling the virus while announcing multiple easing of the activity-control measures. Given the Aussie-China ties, positives for Beijing often get cheered by the AUD/USD buyers.

At home, Australia’s Private Capital Expenditure dropped to -0.6% for the third quarter (Q3) versus 1.5% expected and -0.3% prior. Further, downbeat prints of Australia’s AiG Performance of Mfg Index and S&P Global Manufacturing PMI for November also appeared to have probed the AUD/USD bulls at the multi-day high.

It should be observed that the mixed performance of Wall Street and multi-month low US Treasury yields seemed to also have probed the AUD/USD bulls ahead of a speech from Reserve Bank of Australia (RBA) Governor Philip Lowe. The policymaker has already teased easy rates during his speech earlier in the week and hence the bull’s fears are justified. Also challenging the prices could be the cautious mood ahead of the key US jobs report for November, the earlier signals for which have been downbeat and may favor the Aussie buyers if matching forecasts.

Also: Nonfarm Payrolls Preview: Dollar selling opportunity? Low expectations to trigger temporary bounce

Technical analysis

Although August month’s low near 0.6855 joins nearly overbought RSI to challenge the immediate AUD/USD upside, a clear break of the previous key resistance line from September 13, now support near 0.6765, directs the Aussie pair towards September’s peak of 0.6916.

- Fundamental news in the United States debilitated the US Dollar and boosted the Swiss Franc.

- Oscillators like RSI and the Rate of Change suggests sellers are gathering momentum.

- USD/CHF Price Analysis: Break below 0.9300 will exacerbate a fall to 0.9200.

The USD/CHF extended its losses for two-straight days, courtesy of a gloomy economic outlook in the United States (US), as manufacturing activity shrank while the US Federal Reserve (Fed) tightened monetary conditions. Therefore, the US Dollar (USD) weakened, contrarily to the Swiss Franc (CHF). At the time of writing, the USD/CHF is trading at 0.9366, beneath its opening price by 0.92%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is dropping sharply, as shown in the daily chart. The 170-pip fall spurred by the Federal Reserve, slowing the speed of rate hikes, exacerbated the fall from around 0.9530s. Even though the USD/CHF dived sharply, oscillators, like the 9-period Rate of Change (ROC) and the Relative Strength Index (RSI) showed that sellers are gathering momentum, cementing the case for a bearish bias.

Therefore, the USD/CHF first support would be the November 15 daily low at 0.9356. A breach of the latter will expose the 0.9300 figure, followed by the April 12 daily low at 0.9286, ahead of the March 31 swing low of 0.9194.

As an alternate scenario, the USD/CHF first resistance would be 0.9400. Break above will pave the way towards the 20-day Exponential Movin Average (EMA) at 0.9545, but on its way up, the major needs to surpass the psychological 0.9500.

USD/CHF Key Technical Levels

Early Friday morning in Asia, Japanese media Asahi quotes Bank of Japan Board Member Naoki Tamura as saying, “The Bank of Japan should conduct a review of its monetary policy framework and the feasibility of its 2% inflation target.”

The policymaker also added, “Whether the BOJ needs to tweak its (ultra-easy) monetary policy will depend on the outcome of the review."

Additional comments

Timing of review could come soon or somewhat later, which will depend on price, wage, economic outlook.

BOJ should consider 2% price target as flexible goal as that level may have been excessively high for Japan.

Market implications

Chatters surrounding the Bank of Japan’s (BOJ) monetary policy tightening allowed the USD/JPY to refresh the multi-month low the previous and are exerting downside pressure on the Yen pair of late.

Also read: USD/JPY Price Analysis: Plunges 200-pips after sellers stepped in eyeing the 200-DMA around 135.00

- The USD/JPY breaks a five-month-old trendline, eyeing the 200-day EMA around 134.99.

- Oscillators in bearish territory cement the downtrend, but overbought RSI might refrain USD/JPY short traders.

- USD/JPY: After reclaiming the 200-DMA, a fall toward 131.70 is on the cards.

The USD/JPY plunges below 136.00, extending its losses towards the 135.20s area, spurred by a risk-off impulse and manufacturing activity weakening in the United States (US), posing a recession risk. Therefore, USD/JPY sellers stepped in, below Wednesday's low, of 137.64, and sent the pair tumbling more than 250 pips. At the time of writing, the USD/JPY is trading at 135.34.

USD/JPY Price Analysis: Technical outlook

The USD/JPY shifted neutral-to-downward biased once it cleared the confluence of the 20, and 100-day EMA around 140.46/50. OF note, the 9-period Rate of Change (ROC) is gathering momentum, meaning sellers are in charge. Still, the Relative Strength Index (RSI) entered oversold conditions, meaning that the USD/JPY might consolidate around the 200-day Exponential Moving Average (EMA) at 134.99 before continuing to the downside.

Additionally, the USD/JPY tumbled below a 5-month-old upslope trendline draw from June lows, which exacerbated the downfall. To conclude, the USD/JPY is downward biased in the near term.

Hence, the USD/JPY first support would be 200-day EMA at 134.99. Break below will expose crucial psychological levels like the 134.00 and 133.00 figures, followed by the August 11 low at 131.73.

USD/JPY Key Technical Levels

- The Pound Sterling has reached fresh bull cycle highs on US Dollar weakness.

- GBP/USD bulls could be throwing in the towel below 1.2300, although 1.250 is also a near-term prospect.

The US Dollar weakened to three-month-lows against the Pound Sterling on Thursday, after comments by Federal Reserve Chair Jerome Powell that US rate hikes could be scaled back "as soon as December". GBP/USD took on 1.2300 and is showing signs of exhaustion on the charts as the following illustrates:

GBP/USD daily charts

The price has moved sharply away from the trendline support and has swept the liquidity, to some degree, above the early August highs. However, that is not to say that this rally is over and there are prospects of a move into the 1.2400 area of which would be expected to hold on initial tests and potentially cap the rally.

GBP/USD H1 charts

However, at this juncture, there are prospects of a deep correction of the current bullish impulse towards 1.2150. On one hand, we could see a correction that moves progressively lower into the trendline support or price action that more resembles something like the following schematic:

The Federal Reserve’s vice chair of supervision, Michael Barr, inflation is far too high.

Key comments

Fed is quite focused on bringing inflation down to 2%.

We've moved quickly this year to restrictive territory.

We are now at a point where we can pay more attention to the rate we are getting to, less on pace.

We may shift to slower pace of rate increases at next meeting.

It's 'smart' to modulate on rate hike pace.

Current fed policy is restrictive.

Broadly the view of colleagues that fed policy is in restrictive territory now.

The question is how much more restrictive do we need to be to bring down inflation.

We have some work still to do.

We have more work to do on rates later this year and next year.

US Dollar update

The price of DXY is headed to a test into the mid-range of the 104 area that guards a slide into the 103s and 101s.

- NZD/USD advances towards a test of 0.6400 and has eyes on the 0.6450s.

- 0.6450 comes as a confluence between Aug high and the 61.8% retracement of the whole 2022 move.

NZD/USD is stalling below 0.6400 as the US Dollar attempts to correct what has been a significant move to the downside in the currency markets this week. At the time of writing, NZD/USD is down by over 1% and has fallen from a high of 105.896 to a low of 104.664 so far.

The move in the greenback has been driven by dovish remarks from the Federal Reserve's chair, Jerome Powell, or at least the comments that the market prefers to listen to. Fed's Powell gave a speech on Wednesday indicating that the Fed would ease the historically-high pace of interest rate rises at its next policy meeting in December.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in remarks at the Brookings Institution. Consequently, the US Dollar dropped, US yields eased and stocks rose. The S&P 500 ended its three-day losing streak and closed up 2.7% while the Dow officially entered a bull market.

However, Powell’s admission that “the path ahead for inflation remains highly uncertain” and when he said “by any standard, inflation remains much too high,” and “it will take substantially more evidence to give comfort that inflation is actually declining,'' likely means the Fed will keep hiking well into 2023. Additionally, earlier on in the week, St. Louis Federal Reserve President James Bullard warned that the stock market is underpricing the risk of a continually aggressive Fed. On Thursday, the New York Fed’s John Williams who recently said that he predicts a time, “probably 2024”, when the Fed will lower the federal funds rate, said on Fox News that the Fed has a ways to go on rate hikes.

Nevertheless, the market is running with the dovish comments from a speech that had something for both hawks and doves and that has seen the Kiwi rally strongly over the past 24 hrs through the resistance at 0.6325 (the 76.4% Fibo of the Aug-Oct sell-off) as the following technical analysis will show:

NZD/USD technical analysis

The above series of charts, weekly, daily and H4, illustrate the prospects of a move into the 0.6450s. Analysts at ANZ Bank argued that the ''price action looks extremely solid, and technically, the next major target level is 0.6450 (marking both the Aug high and the 61.8% retracement of the whole 2022 move).''

What you need to take care of on Friday, December 2:

The US Dollar extended its decline to multi-month lows against most of its major rivals amid persistent optimism and tepid US data, supportive of the Federal Reserve’s monetary policy pivot.

At the beginning of the day, the Greenback was hit by the BOJ. Bank of Japan board member Asahi Noguchi surprised investors by saying the central bank is ready to withdraw stimulus if inflation numbers appear too strong. “BOJ could withdraw stimulus preemptively if underlying inflation perks up higher than expected,” said the policymaker. USD/JPY trades in the 135.40 price zone.

Meanwhile, some Chinese cities announced they are easing their testing and control coronavirus-related policies. The country has entered a new stage in fighting the virus, according to one top zero-Covid enforcer. The relief news pushed Asian and European equities higher, which in turn, undermined demand for the Greenback.

The US Personal Consumption Expenditures (PCE) Price Index rose by 6% YoY in October, easing from 6.3%. Core PCE inflation came in at 5% in the same period, down from 5.2% in September. Also, the ISM Manufacturing PMI fell to 49 in November, down from the previous 50.2, being the first time the indicator signals contraction since May 2020.

EUR/USD regained the 1.0500 threshold and trades above it despite softer Euro Area growth figures. GBP/USD hovers around 1.2250 ahead of the US close. The AUD/USD pair trades around 0.6810, while the worst performer was the Canadian Dollar, as USD/CAD ended the day in the 1.3430 price zone.

Gold soared and settled at $1,802 a troy ounce, its highest since August. Crude oil prices were also up, with WTI changing hands at $81.30 a barrel.

On Friday, the US will publish the Nonfarm Payrolls report, while Canada will also publish its monthly employment report.

Bitcoin price witnesses 44% increase of deposits to all exchanges in November

Like this article? Help us with some feedback by answering this survey:

- US Dollar remains on the defensive, spurred by the ISM manufacturing PMI dropping to the contractionary territory.

- Inflation in the United States remained unchanged, while unemployment claims fell.

- The Australian Dollar got bolstered by a weaker US Dollar as traders eye RBA’s Governor Lowe.

- AUD/USD Price Analysis: Could test 0.7000 if the AUD/USD clears the 200-DMA.

The Australian Dollar (AUD) advances in the New York session but retraces after hitting a new two-month high around 0.6840s as sentiment shifted sour. United States (US) economic data portrays a gloomy economic outlook while increasing borrowing costs by the Federal Reserve (Fed) would keep the economy under pressure. That said, the US Dollar (USD) remains on the defensive, undermined by falling US Treasury yields. At the time of writing, the AUD/USD clings above the 0.6800 figure.

US Dollar weakened as the ISM Manufacturing PMI shrank

US equities are trading with losses. The Institute for Supply Management (ISM) for November revealed that the Manufacturing PMI dropped below the expansionary/contractionary 50 levels, down to 49.0 from 49.2 estimated by analysts. Timothy R. Fiore, Chair of the ISM, commented that US manufacturing activity dived into a contraction, with the PMI reaching its lowest level since the pandemic began. The report “reflects companies’ preparing for lower output.” Following the report, the AUD/USD dropped from the day’s high of 0.6845 to 0.6810.

Tightness in the labor market pressures the Federal Reserve

Before Wall Street opened, the Department of Labor revealed that Initial Jobless Claims for the last week increased by 225K, a decrease of 16K compared to the previous week’s and below the expected 235K by analysts. Continuing claims jumped from 1.57M to 1.603M, showing that the labor market remains tighter than Federal Reserve officials’ expectations.

US Core PCE rose by 5%, but failed to bolster the US Dollar

At the same time, the US Department of Commerce (DoC) revealed the Federal Reserve preferred measure of inflation, the US Core Personal Consumption Expenditure (PCE), which rose by 5% YoY, beneath October’s 5.2%. Even though the report flashes that inflation is beginning to ease, it remains too high. Although prices stabilized in the last couple of months, Federal Reserve Chair Jerome Powell commented that he needs “substantial evidence” that inflation is cooling.

What to watch

Aside from this, in Australia, the calendar will feature October Retail Sales, Housing data, and the Reserve Bank of Australia (RBA) Governor Philip Lowe, which will cross wires. On the US front, the US Nonfarm Payrolls report for November would update the labor market situation, while Fes speakers, ahead of the blackout period, will cross wires.

AUD/USD Price Analysis: Technical outlook

Although the AUD/USD failed to break the 200-day Exponential Moving Average (EMA) around 0.6840, its bias remains upward, further cemented by the Relative Strength Index (RSI) at bullish territory aiming upwards. However, the AUD/USD needs to hold above Wednesday’s high of 0.6801, so the pair could consolidate within the 0.6800-0.6850 area if buyers would like to push prices higher. If that scenario plays out, the AUD/USD first resistance would be the 0.6900 figure, followed by the August 26 high of 0.7000. As an alternate scenario, the AUD/USD first support would be 0.6800, followed by the November 29 high at 0.6748, above the 0.6700 figure.

- US Dollar bears head toward the mid-range of the 104 area that guards a slide into the 103s and 101s.

- Are investors putting the cart before the horse?

The US Dollar is falling to test a 16-week low in the DXY, an index that measures the greenback vs. a basket of currencies. The August 11 low was made at 104.64 and today's low reached 104.66 so far. The index has fallen from a high of 105.89 and has been pressured on the back of Wednesday's dovish remarks from the Federal Reserve's chair, Jerome Powell.

Fed's Powell gave a speech on Wednesday while strongly indicating that the Fed would ease the historically-high pace of interest rate rises at its next policy meeting in December. “The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in remarks at the Brookings Institution, his last public appearance before the central bank enters a blackout period ahead of its December 13-14 policymaking meeting. Consequently, the US Dollar dropped, US yields eased and stocks rose. The S&P 500 ended its three-day losing streak and closed up 2.7% while the Dow officially entered a bull market.

Meanwhile, on Thursday, easing inflation supported the Fed chair's indication that rate hikes could slow. Data has shown that in the 12 months through October, the personal consumption expenditures (PCE) price index increased 6.0% after advancing 6.3% in September compared with the Fed's 2% target.

In current trade, Benchmark 10-year yields are down 1.5% to 3.5565 and the more Fed sentiment-sensitive 2-year note yields are down 0.6% to 4.287%. Fed funds futures are pricing that the Fed’s benchmark rate will peak at 4.91% in May, up from 3.83% now. The traders had priced for a top of over 5% before Powell’s remarks on Wednesday.

However, investors who are expecting a full pivot may be putting the cart before the horse. Prior to Powell's speech, St. Louis Federal Reserve President James Bullard warned that the stock market is underpricing the risk of a continually aggressive Fed. Powell’s admission that “the path ahead for inflation remains highly uncertain” leaves prospects on the table for a protracted period of rate hikes. Additionally, the US dollar tends to perform around the sentiment of a US recession. Powell said on Wednesday that there is still a chance the economy avoids recession but the odds are slim. “To the extent we need to keep rates higher longer, that’s going to narrow the path to a soft landing,” Powell warned. US PMIs on Thursday were testimony to such rhetoric.

The bottom line is that “by any standard, inflation remains much too high,” and “it will take substantially more evidence to give comfort that inflation is actually declining,” as per Powell's comments on Wednesday. However, for now, despite such hawkish jaw-boning, and signals that the Fed will keep hiking well into 2023, for now, investors don't mind and that is weighing on the greenback.

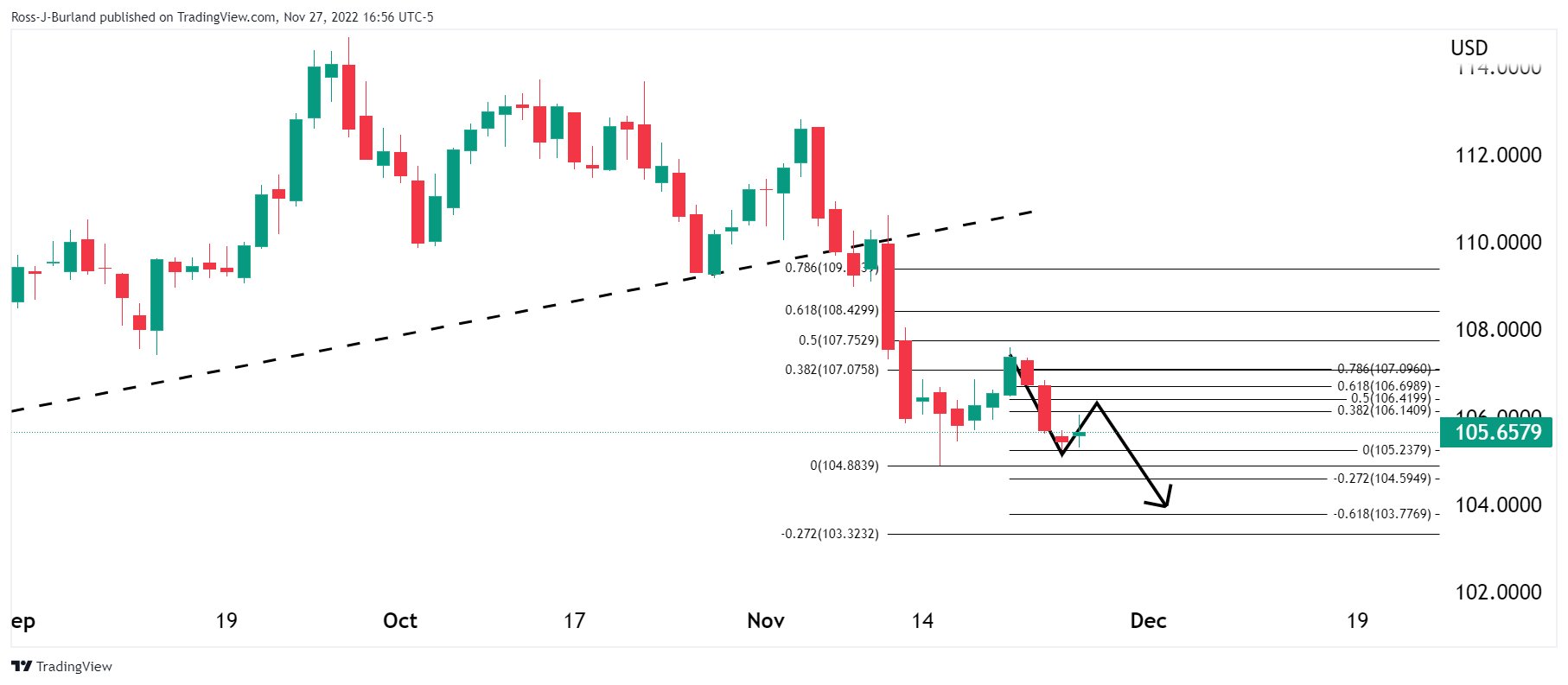

US Dollar and yields technical analysis

The 2-year yield has carved out an H&S topping pattern and is on the verge of a break of the long-term trendline as seen on the weekly chart above and the 4-hour chart below

US Dollar daily chart

As per prior analysis, US Dollar is firm in a risk-off start to the week, whereby the US Dollar was expected to correct higher before the next slide, the greenback is following a bearish trajectory below the prior bullish trend"

Prior analysis:

Update:

The price is headed to a test into the mid-range of the 104 area that guards a slide into the 103s and 101s.

The New York Fed’s John Williams who recently said that he predicts a time, “probably 2024”, when the Fed will lower the federal funds rate, has today said on Fox News that the Fed has a ways to go on rate hikes.

Key comments

Inflation still far too high.

Will take a couple of years for inflation to ease to target.

High inflation not yet embedded in economy.

Fed job is to balance demand with supply.

Seeing signs of welcome ebbing in inflation, but unsure if its peaked.

Doesn't believe there is a wage price spiral happening.

Demand still far exceeding available supply in us economy.

Tighter monetary policy needed to restore economic balance.

Fiscal stance not a big factor right now in driving inflation.

Fed has a ways to go with rate rises.

Fed rate rise resting place depends on economy.

More to come ...

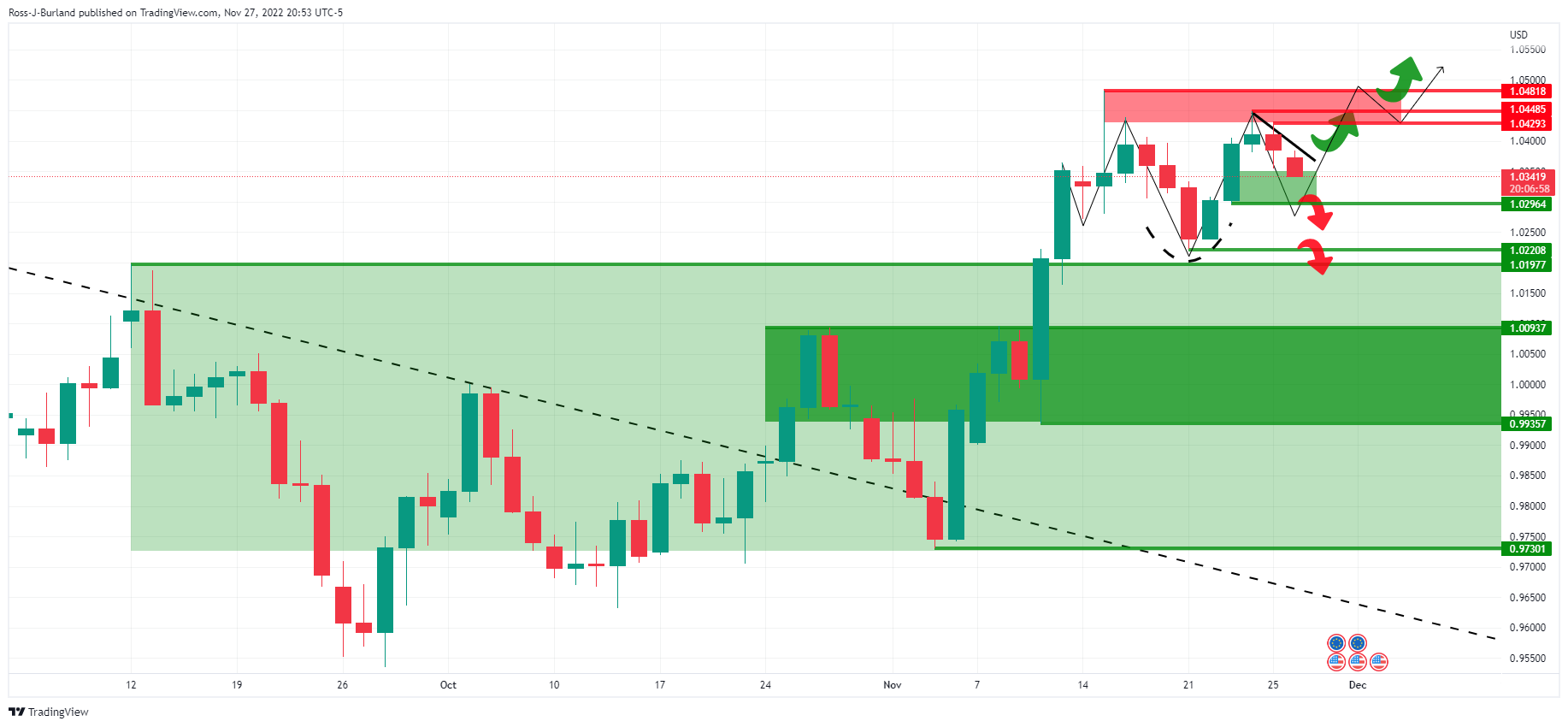

- EUR/USD H1 W-formation has seen a correction into the 50% mean reversion area.

- The bulls are in control on the front side of the trendline support.

As per the prior analysis, EUR/USD Price Analysis: Bears move in and eye a break towards key 1.0300 support, whereby an inverse head & shoulders was identified on the daily chart, the price has rallied into the 1.05 area as follows:

EUR/USD prior analysis

It was stated that an inverse head & shoulders could be in the making at this juncture. ''Bullish commitments around 1.0300/50 would be forming the right-hand shoulder of the bullish pattern.''

Update:

EUR/USD H1 charts

At this juncture, the W-formation has seen a correction into the 50% mean reversion area and support. The bulls are in control on the front side of the trendline support and eye higher highs before the week is out.

- The USD/CAD halted its fall as US data showed signs of further deterioration in the economy of the United States.

- Risk aversion spurred by weaker-than-expected US ISM Manufacturing PMI.

- Fed’s Bowman said there’s work to do by the US central bank.

The USD/CAD trims some of Wednesday’s losses spurred by a weak ISM Manufacturing activity report which threatens to tap the economy of the United States (US) into a recession. However, dovish commentary by the Federal Reserve (Fed) Chair Jerome Powell capped the USD/CAD gains. At the time of writing, the USD/CAD is trading at 1.3420.

Sentiment shifted negatively as US ISM Manufacturing PMI flashes a recession

Investors’ mood deteriorated after the Institute for Supply Management (ISM), released the Manufacturing PMI report for November, which dropped to the contractionary territory at 49.0, beneath 49.2 expectations, and trailed October’s 50.2. Timothy Fiore, the ISM’s Manufacturing Business Survey Committee chair, said the report “reflects companies’ preparing for lower output.” Additionally, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the last week increased by 225K, below the expected 235K by analysts and less than the previous week’s reading.

Earlier, the US Department of Commerce (Doc) revealed that the Fed’s preferred inflation gauge, the US Core Personal Consumption Expenditure (PCE), rose by 5% YoY, below the previous month’s 5.2% reading, and aligned with consensus.

Elsewhere, the US Federal Reserve Chair Jerome Powell gave the green light to slow rate hikes. He said moderation could happen as soon as the December meeting, though he emphasized the Fed’s commitment to tackle inflation. Echoing some of his comments was Fed Governor Michell Bowman, saying,” We still have a lot of work to do to bring our policy rate to a level that is sufficiently restrictive to bring down inflation over time.”

Aside from this, the Canadian economic calendar, which featured November’s S&P Global PMI Manufacturing report, persisted in contractionary territory for the fourth consecutive month, rising by 49.6 above October’s 48.8. Paul Smith, economics director at S&P Global Market Intelligence, said, “Both output and new orders continued to fall, although perhaps of some comfort is that the degrees of decline were softer than in October.”

All that said, the USD/CAD daily chart showed the major found support at around 1.3400, though it failed to crack the confluence of the 20 and 50-day Exponential Moving Averages (EMAs) around 1.3440/45. That could pave the way for a break under 1.3400, sending the pair sliding toward the 100-day EMA at 1.3321. Otherwise, the USD/CAD might consolidate around the 1.3400-1.3440 area.

What to watch

The US and Canadian economic dockets will feature employment figures, which could shed some clues about the current economic status.

USD/CAD Key Technical Levels

- Silver price rose more than 1%, spurred by Federal Reserve Jerome Powell’s dovish speech.

- Soft US Dollar and US Treasury bond yields plummeting, a tailwind for XAG/USD.

- Silver Price Analysis: Once it cleared $22.00, a rally above $23.00 is on the cards.

Silver price soars more than 2% following a “dovish” perceived speech by the Federal Reserve (Fed) Chair Jerome Powell, who laid the ground for lower rate hikes Wednesday. The United States (US) economic docker revealed mixed data, undermining the US Dollar (USD), as shown by the rise of precious metals and most FX peers. At the time of writing, the XAG/USD is trading at $22.55.

Upbeat sentiment, dovish Fed, and mixed US data weighed on the US Dollar

Traders’ mood remains upbeat after Powell’s speech. The Federal Reserve Chair said that “the time for moderating the pace of rate increases may come as soon as the December meeting,” spurring US Dollar weakness and sending Silver prices up. He added that most Fed policymakers would not want to “overtighten,” stating that he does not want to cut rates soon.

Data-wise, the Institute for Supply Management (ISM) revealed that manufacturing activity in the United States fell to 49.0 below 49.2 estimates and trailed October’s 50.2 reading, the lowest since May 2020. Usually, when the ISM Manufacturing PMI drops below 50, activity is in contractionary territory. However, lower readings would help to tame inflation, though it opens the door for a recession.

Earlier, the US Department of Commerce (Doc) revealed that the Fed’s preferred inflation gauge, the US Core Personal Consumption Expenditure (PCE), rose by 5% YoY, below the previous month’s 5.2% reading, and aligned with consensus. At the same time, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the week ending on November 26 rose by 225K, below the expected 235K by analysts and less than the previous week’s reading.

Silver Price Analysis: Technical outlook

From a daily chart perspective, the XAG/USD is upward biased, trading above the daily Exponential Moving Averages (EMAs). After bottoming around the year-to-date (YTD) lows of around $17.56, the white metal followed an upward trajectory, which initially failed to clear the October 4 swing high of $21.23. Still, once cleared, XAG/USD hurdle the $22.00 psychological level. That said, the Silver price path of least resistance is upwards.

The XAG/USD first resistance is the June 6 high of $22.51, followed by the $23.00 figure, ahead of the May 5 high of $23.27.

Data released on Thursday, showed Persona Spending rose by 0.8% in October while Personal Income increased by 0.7%. Analysts at Wells Fargo, point out that the rising cost of goods and services means that nominal spending would increase even if the volume of goods and services consumed were flat. In other words, consumers are increasing their spending even after adjusting for inflation.

Key Quotes:

“Yet even as prices grow faster than paychecks, consumers are still buying more even in volume terms. This is a real pickle for inflation fighters at the Federal Reserve because firms who find that they can pass along price increases without a concomitant decline in demand have no financial incentive to lower prices.”

“The monthly change in the PCE deflator was unchanged at 0.3%, but due to base effects, the year-over-year rate did cool to 6.0% in October from an upwardly revised 6.3% in the prior month. The year-over-year rate of core inflation also came down slightly to 5.0% in October.”

“Monetary policy acts with a lag, and while it still may be early days, consumers' relentless spending suggests they remain unfazed by high inflation and the rate hikes intended to get prices under control.”

“The staying power of the consumer has been uncanny thus far, but consumers are no exception to the same macro headwinds that have plagued the rest of the economy.”

- Broad based decline of the US Dollar triggers volatility across financial markets.

- USD/MXN gives up Wednesday’s rally showing Mexican Peso still in command.

- Another test of 19.00/05 should not be ruled out.

The USD/MXN is falling sharply on Thursday, after a wild Wednesday. Yesterday, the pair jumped, rising not only above 19.30 but also to 19.46. It respected a downtrend line and resume the downside, amid a broad slide of the US Dollar.

On Wednesday, USD/MXN peaked at 19.46, trading momentarily above the 20-day Simple Moving Average. The upside was capped by a downtrend line and closed the day below 19.30: a sign that the Greenback is not ready yet for a sustainable rebound.

All the positive developments for the Dollar, have been reversed during the last 24 hours. The bearish trend and momentum have been reaffirmed. While under 19.30, the Mexican Peso could likely test again the 19.00/05 psychological area. A break lower would target 18.85.

USDMXN daily chart

-638055071892970358.png)

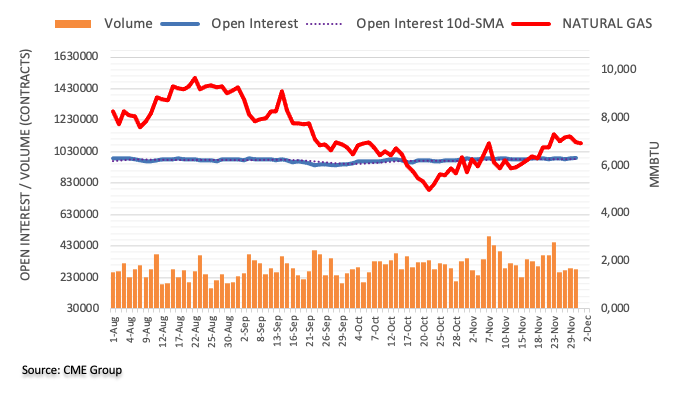

With US inflation forecast by economists at Société Générale to decrease from 8.0% in 2022 to 4.3% in 2023, the impact on Gold via real rates should continue to be extremely bearish.

Headwinds gathering

“In 2023, we expect a Fed pivot toward more dovish policies, and the 10-year rate should gradually decrease. By itself, this is bullish for Gold. But we expect inflation to drop faster than rates from an average headline CPI of 8.0% in 2022 to 4.2% in 2023 As a result, we expect real rates to surge, driving down Gold prices sharply.”

“After Q3-23, Gold’s fortunes should reverse, as we expect a mild US recession in early 2024 and sluggish EU and China growth. Investors are likely to hedge such risks by transferring part of their allocations to Gold. At this point, we would expect the Fed to turn dovish again, with inflation somewhat under control, albeit higher than before COVID.”

- US Dollar Index is down by 0.90%, at lowest in almost four months.

- Pound also rises sharply versus the Euro on Thursday.

- GBP/USD heads for the first close above the 200-day SMA since September 2021.

The GBP/USD is having the best day in weeks, boosted by a weaker US Dollar across the board. The pound is also rising versus the Euro. Cable peaked at 1.2310, the highest since June and then pulled back to 1.2260.

During the last hours, the US Dollar trimmed losses but it is still sharply lower, after extending the slide that started on Wednesday following Fed Chair Jerome Powell's speech. Fed officials sign that at the December meeting rates will be raised again but at a slower pace.

Expectations about a less hawkish are pushing the Dollar sharply lower. Economic data released on Thursday showed easing inflation signs (declines in the Core PCE and the Prices Paid Index of the ISM Manufacturing) and weakening conditions in the Manufacturing sector (ISM Manufacturing fell in November to 49).

Beyond the Dollar's weakness, the Pound is also rising versus the Euro. The EUR/GBP broke below the 0.8570 critical support, and fell so far to 0.8552, the lowest since August 30.

Above the 200-day SMA

The GBP/USD is on its way to the first close above the 200-day Simple Moving Average (today at 1.2150) another positive technical development for the bulls. So far, spot price has been unable to consolidate above 1.2300 that is the resistance level to break; if it manages to do it would open the doors to more gains.

Technical levels

EUR/USD has moved back above the 1.05 level. But energy issues are set to weigh on the Euro, dragging the pair down to parity in 2023, economists at Rabobank report.

Re-opening of China will increase the competition for global LNG supplies

“While the EUR has been lifted by a decline in gas prices from their highs and hopes that Germany may face less bad recessionary risks, this respite may be short-lived.”

“In spring and summer 2023 Europe could be struggling to refill its gas storage facilities at today’s prices. A re-opening of China will increase the competition for global LNG supplies.”

“While we have lifted our one and three-month EUR/USD forecasts to reflect the recent improvement in risk appetite, we continue to see risk of the EUR dropping back through parity next year as the next wave of the gas price crisis hits.”

- ISM Manufacturing PMI dropped into contraction territory below 50 in November.

- US Dollar Index continues to push lower, losing more than 1% on the day.

The economic activity in the United States manufacturing sector contracted in November with the ISM Manufacturing PMI declining to 49 from 50.2 in October. This reading came in below the market expectation of 49.8.

Further details of the publication showed that the Prices Paid Index component dropped to 43 from 46.6, the Employment Index edged lower to 48.4 from 50 and the New Orders Index declined to 47.2 from 49.2.

Assessing the data, "with Business Survey Committee panellists reporting softening new order rates over the previous six months, the November composite index reading reflects companies' preparing for future lower output," said Timothy R. Fiore, Chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

Market reaction

The US Dollar stays under constant selling pressure following this report and the US Dollar Index was last seen losing 1.1% on the day at 104.70.

- Gold price climbs above $1800 for the first time since August 2022.

- Dovish speech by the Federal Reserve Chair Jerome Powell weakened the US Dollar.

- The US Dollar Index tumbles below the 105.000 mark, while US T-bond yields plunge to 3.60%.

Gold price rallies and hits a fresh three-month high following a more “dovish” than expected message from US Federal Reserve (Fed) Chairman Jerome Powell. Another factor denting demand for the US Dollar (USD) is that the Federal Reserve preferred gauge for inflation was unchanged, while unemployment claims were lower than expected. At the time of writing, the XAU/USD is trading above the $1800 mark for the first time since August.

Gold soars on dovish remarks by Fed Chair Powell as US bond yields plummet

XAU/USD remains in the driver’s seat after hitting a daily low of $1767, Wednesday’s high, towards $1803.40, following dovish remarks from Jerome Powell on Wednesday. Powell said that “moderating the pace of rate increases may come as soon as the December meeting,” cementing expectations that the Fed will move away from the 75 bps hikes they’ve pursued at the last four meetings in favor of a slower 50 bps pace. In the Q&A after the speech, he said that “my colleagues and I do not want to overtighten,” referring to monetary policy.

Data-wise, the economic docket for the United States (US) did not help the US Dollar, which remains on the back foot following Powell’s speech. The US Core Personal Consumption Expenditure (PCE), the Fed gauge for inflation, rose by 5% YoY, below the previous month’s 5.2% reading, and aligned with consensus, Commerce Department data revealed Thursday.

In the meantime, initial Jobless Claims for the week ending in the last week on November 26 rose by 225K, below the expected 235K by analysts and less than the previous week’s reading.

Elsewhere as the US Dollar Index (DXY) drops below the 105.000 mark, extending its daily losses to 1%, US Treasury bond yields are plunging, with the US 10-year Treasury bond yield reaching 3.600%, while Gold prices extended its gains.

Gold 1-hour Chart

Gold Key Technical Levels

Economists at the Bank of America Global Research expect the US Dollar to remain on a solid foot at the beginning of 2023 but to drift lower as the year unfolds.

Positive USD forces remain, but will fade gradually

“For now, the forces that have supported the USD this year remain valid, despite the recent correction lower.”

“In our baseline, the USD remains strong early next year and starts a more sustained downward path after the Fed pauses.”

“We forecast EUR/USD at parity and USD/JPY at 146 by 1Q23. However, in our baseline the USD gradually weakens starting in Q2, to 1.10 for EUR/USD and to 135 for USD/JPY by end-2023, with our EUR/USD forecast above the consensus.”

- Japanese Yen among top performers as the US Dollar remains under pressure.

- Greenback resumes slide after United States’ economic reports.

- USD/JPY down more than 200 pips, but no signs of stabilization seen so far.

The USD/JPY printed a fresh three-month during Thursday’s American session, following the release of US economic data at 135.73. It then bounced modestly toward the 136.00 zone. It remains under pressure, with the US Dollar down across the board.

Easing inflation in the US hits the Dollar

On Wednesday, Federal Reserve Chairman Jerome Powell pointed toward a slowdown in rate hikes, as soon as December. His comments were no surprise but triggered a rally in stocks and in Treasuries. The US Dollar began a decline that is still going on.

Inflation data released on Thursday showed a slowdown, although still at elevated levels with the Core PCE at 5% (annual) in October down from the 5.2% of September. Personal income and Spiting rose 0.7% and 0.8% respectably. Continuing Jobless Claims rose for the seventh week in a row to the highest level since March.

The numbers did not help the Dollar and US yields held near monthly lows, supporting the Japanese Yen. Not even higher equity prices in Wall Street are offsetting the strength of the yen.

Oversold?

The USD/JPY is on its way to the lowest daily close since mid-August, falling for the fourth consecutive day. The pair is challenging the 136.00 area and below the next support emerges at 135.50. Below a horizontal line is seen around 134.60 and then appears the 200-day Simple Moving Average at 134.40.

No signs of consolidation are seen at the moment. Despite oversold reading in many technical indicators, the Momentum remains extremely negative. A rebound back above 137.00 could alleviate the bearish pressure. Above 137.70 the outlook for the Dollar could improve (or become less negative).

Technical levels

Federal Reserve (Fed) Governor Michelle Bowman noted on Thursday that the headline and core inflation have slowed slightly but added that they are still unacceptably high, as reported by Reuters.

Additional takeaways

"I expect ongoing increases in rate hikes at coming meetings."

"We still have a lot of work to do but it is appropriate for us to slow the pace of increases."

"That will allow us to more fully assess the impact of our actions."

"My views on size and pace of rate hikes will be guided by incoming data."

"Looking for signs inflation has peaked and is on a downward path."

"Policy will have to remain restrictive for some time to get inflation down."

"I'll continue to watch labor market to assess the impact of our actions there."

"We are not seeing a significant impact on reducing inflation."

"They are still at high levels and I need to see our actions have an impact."

"Until then, I expect we will have a slightly higher terminal rate than I had anticipated at sept meeting."

"Balance sheet not creating issues at this point, we need to continue to monitor."

Market reaction

The US Dollar stays under heavy bearish pressure following these comments and the US Dollar Index was last seen losing 0.92% on the day at 104.90.

- EUR/USD extends the upside momentum above 1.0500.

- The June high past 1.0600 now emerges as the next target.

EUR/USD trades on a firm foot and manages to surpass the 1.0500 barrier to clinch fresh multi-month tops on Thursday.

Gains in the pair are now likely to pick up pace following the breakout of the 200-day SMA and the 10-month resistance line. Against that, there are no resistance levels of note until the June high at 1.0614 (June 27).

Further upside in EUR/USD remains on the cards while above the 200-day SMA, today at 1.0369.

EUR/USD daily chart

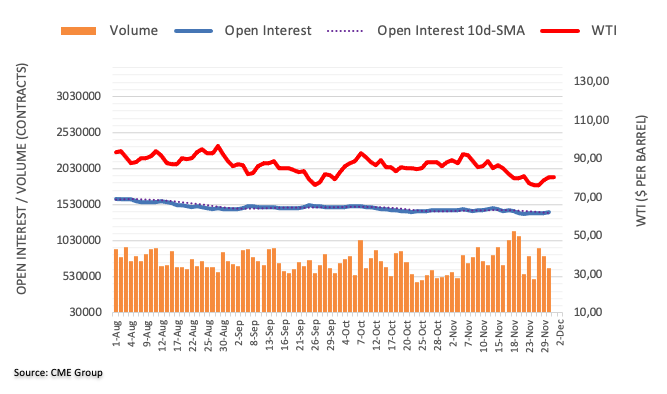

Strategists at Société Générale update their Crude Oil price forecasts. They expect the black gold to remain elevated in the first half of next year before declining towards $93.50 in the last quarter of 2023.

Oil market looks set to remain in deficit every quarter until the end of Q4 '23

“According to our models, the market looks set to remain in deficit every quarter until the end of Q4 '23, pulling yet more Oil from inventories.”

“We forecast Oil prices to average $98/bbl in Q1 '23 and $108/bbl in Q2 '23, with the China reopening/Russian sanctions kicking in. For the second half of 2023, we forecast a decline in Oil prices, implying an average of $93.5/bbl in Q4 '23. This view assumes fading risk premium due to Russian sanctions, a slowdown in economic activity due to a recession in the US and China reopening proving choppy and probably gradual.”

“In 2024 and 2025, we expect prices to rise back toward $100/bbl and $110/bbl respectively, as inventories would still be very low and significant backwardation re-emerges.”

- EUR/USD gathers extra steam and surpasses the 1.0500 mark.

- The dollar remains offered and trades in multi-week lows.

- US ISM Manufacturing comes next in the calendar.

EUR/USD extends the upside momentum to new multi-month peaks north of the 1.0500 barrier on Thursday.

EUR/USD now looks to US ISM

EUR/USD looks strong and extends the recent brewakout of the key 200-day SMA as well as the 10-month resistance line, opening the door at the same time to the continuation of the uptrend, at least in the near term.

The renewed and pronounced selling pressure in the greenback lent further wings to the rebound in spot so far, all after Chief Powell reinforced the idea that the Fed could slow the pace of the upcoming interest rate hikes in the next months at his speech on Wednesday.

Following the above, the probability of a half-point rate raise at the Fed’s 14 December meeting is now at almost 80% according to CME Group’s FedWatch Tool.

Earlier in the euro area, German Retail Sales contracted 2.8% MoM in October and 5.0% over the last twelve months, while the final Manufacturing PMI rose to 46.2 in November (from 45.1). In the broader Euroland, the Unemployment Rate improved to 6.5% in October, while the final Manufacturing PMI also advanced to 47.1 (from 46.4).

In the US, the headline PCE rose 6.0% YoY in October and 5.0% when comes to the Core PCE. In addition, weekly Claims rose by 225K in the week to November 26 and Personal Income and Personal Spending expanded at a monthly 0.7% and 0.8%, respectively, in October.

Later in the session, the US ISM Manufacturing is expected to grab all the attention ahead of speeches by Fed’s Logan, Bowman and Barr.

What to look for around EUR

EUR/USD sees its upside bias renewed on Thursday in response to the continuation of the downside bias in the dollar.

In the meantime, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy remains the exclusive driver of the pair’s price action for the time being.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Retail Sales, ECB General Council Meeting, Germany/EMU Final Manufacturing PMI, EMU Unemployment Rate (Thursday) - ECB Lagarde, Germany Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.95% at 1.0505 and faces the next up barrier at 1.0513 (weekly high December 1) ahead of 1.0614 (weekly high June 27) and finally 1.0773 (monthly high June 9). On the flip side, a breach of 1.0330 (weekly low November 28) would target 1.0222 (weekly low November 21) en route to 1.0042 (100-day SMA).

The Rand has sold off aggressively today, with USD/ZAR rising over 4%. The pair could extend its rally if South Africa President Cyril Ramaphosa resigns today, economists at TD Securities report.

Ramaphosa likely to announce his resignation

“President Ramaphosa will make an announcement soon, likely resigning from his post. Speculation started to spread earlier today, and all eyes are on the 3:00 PM London time press conference. At the time of writing, we think the odds that Ramaphosa resigns today have exceeded 50%.”

“We think that USD/ZAR has room to extend the upside move to over 5% today, and possibly more in the coming days. This is predicated on Ramaphosa's resignation today, which would start a succession crisis within the ANC and bring about political confusion to South Africa.”

Eurozone inflation for November surprised to the downside but data was unable to move EUR/USD significantly. Economists at Commerzbank expect the pair to remain at current levels for now.

ECB is likely to continue moving in sync with the Fed

“Inflation data is likely to be sufficient to give the doves on the ECB board the upper hand at the December meeting. Even though yesterday’s data did not provide a convincing picture of falling inflation pressure due to the heavy fluctuation of energy prices. But for now, it is quite possible that inflation might have peaked in the euro zone too. That means the ECB is likely to continue moving in sync with the Fed and also reduce the speed of its rate hikes.”

“If the hawks amongst the Fed and ECB do not manage to influence market expectations significantly again there is a lot to suggest that EUR/USD will trade around current levels for now.”

- The index remains well on the defensive and breaks below 105.00.

- The continuation of the downside could drop to the August low.

DXY extends the leg lower to the area below the 105.00 level for the first time since mid-August.

The continuation of the selling pressure could motivate the dollar to shed further ground and challenge the August low at 104.63 (August 10) in the short-term horizon.

Below the 200-day SMA at 105.51, the dollar’s outlook should remain negative.

DXY daily chart

- Initial Jobless Claims in the US declined by 16,000 in the week ending November 26.

- US Dollar Index stays deep in negative territory near 105.00.

There were 225,000 initial jobless claims in the week ending November 26, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 241,000 (revised from 240,000) and came in better than the market expectation of 235,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.1% and the 4-week moving average was 228,750, an increase of 1,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending November 19 was 1,608,000, an increase of 57,000 from the previous week's unrevised level of 1,551,000," the DOL noted in its publication.

Market reaction

The US Dollar stays under heavy selling pressure and the US Dollar Index was last seen losing 0.8% on the day at 105.00.

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI for October at 15:00 GMT this Thursday. The index is expected to show a contraction in the manufacturing sector activity during November and fall below the 50 mark for the first time since June 2020. Given that the Fed looks more at inflation than growth, investors will keep a close eye on the Prices Paid sub-component, which is anticipated to edge higher from 46.6 in October to 47.5 during the reported month.

How could it affect EUR/USD?

Ahead of the key release, the US Dollar drops to a nearly four-month low on Thursday in the wake of the overnight dovish remarks by Fed Chair Jerome Powell. A weaker-than-expected ISM Manufacturing PMI will be seen as another sign of a slowdown in the US economy and exert additional downward pressure on the greenback. This, in turn, should assist the EUR/USD pair to capitalize on its intraday positive move beyond the very important 200-day SMA.

Conversely, a stronger print is unlikely to provide any respite to the USD bulls amid rising bets for a less aggressive policy tightening by the Fed. This, in turn, suggests that the path of least resistance for the USD is to the downside and supports prospects for a further near-term appreciating move for the EUR/USD pair.

Valeria Bednarik, Chief Analyst at FXStreet, offers a brief technical overview and outlines important technical levels to trade the major: “The EUR/USD pair daily chart shows that the pair has advanced above its 200 Simple Moving Average (SMA), while the 20 SMA accelerated north below the longer one, reflecting increased buying interest. The Momentum indicator keeps heading lower within positive territory amid a weak daily opening, while the Relative Strength Index (RSI) consolidates at around 64. Overall, the risk is skewed to the upside, although the pair needs to clear its recent high at 1.0496 to confirm a sustainable rally.”

“The 4-hour chart favors another leg higher, although additional confirmations are needed. The pair is developing above all of its moving averages, with the 20 SMA picking up above bullish longer ones. Technical indicators, however, have lost their directional strength and stand pat within positive levels. Whether EUR/USD can storm through 1.0500 will depend on the upcoming US first-tier figures,” Valeria adds further.

Key Notes

• EUR/USD: Break above 1.05 could open the door to an extended rebound up toward 1.08 – MUFG

• EUR/USD outlook: The Euro keeps firm tone on weaker dollar, improved economic data

• EUR/USD: High volatility still in play

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, declined to 6% on a yearly basis in October from 6.3% in September, the US Bureau of Economic Analysis announced on Thursday. This reading came in below the market expectation of 6.2%.

The annual Core PCE Price Index, the Federal Reserve's preferred gauge of inflation, declined to 5% from 5.2% as expected.

Further details of the publication revealed that Personal Spending and Personal Income rose by 0.8% and 0.7%, respectively, on a monthly basis in October.

Market reaction

The US Dollar continued to weaken against its rivals and the US Dollar Index was last seen losing 0.75% on the day at 105.05.

The US Dollar has continued to trade at weaker levels after falling sharply following a keynote speech from Fed Chair Powell. A strong Nonfarm Payrolls report is needed to reverse the Greenback’s decline, economists at MUFG Bank report.

Financial conditions continue to ease

“The lack of strong pushback against loosening of financial conditions has given market participants the green light to continue chasing recent risk-on trends including a weaker US Dollar.”

“The latest US economic data releases yesterday were also unfavourable for the USD showing a further loss of growth momentum in the labour market and a worrying drop in business confidence.”

“The developments leave the US Dollar in desperate need of a solid NFP report tomorrow to stem further losses.”

- EUR/JPY accelerates the decline below the 142.00 mark.

- Further losses could revisit the October low in the sub-141.00 area.

EUR/JPY looks well offered and drops to new 2-month lows in the 141.00 region on Thursday.

The sharp pullback below the 4-month support line opens the door to a deeper retracement in the short term, with the immediate target at the October low at 140.89 (October 10).

Below the latter emerges the key 200-day SMA, today at 139.02. The outlook for the cross is expected to remain positive while above this region.

EUR/JPY daily chart

- GBP/USD rallies to a fresh multi-month high on Thursday amid the prevalent USD selling bias.

- Powell’s dovish remarks on Wednesday drags US bond yields lower and weigh on the buck.

- The technical set-up favours bullish traders and supports prospects for further near-term gains.

The GBP/USD pair builds on the overnight solid bounce from the 1.1900 mark, or the weekly low and gains strong follow-through traction for the second successive day on Thursday. The positive momentum remains uninterrupted through the early North American session and lifts spot prices to the 1.2200 mark, or the highest level since August 12.

The US Dollar struggles to gain any meaningful traction and remains depressed near a multi-month low, which, in turn, acts as a tailwind for the GBP/USD pair. Fed Chair Jerome Powell sent a clear message on Wednesday that the US central bank could soon slow the pace of its policy tightening as soon as in December. This leads to a further decline in the US Treasury bond yields and continues to weigh on the Greenback.

Apart from this, a generally positive tone around the equity markets is seen as another factor exerting downward pressure on the safe-haven buck and benefiting the high beta British Pound. The aforementioned supporting factors help offset the overnight dovish remarks by Bank of England (BoE) Chief Economist Huw Pill. Even a bleak outlook for the UK economy fails to dent the bullish sentiment surrounding the GBP/USD pair.

With the latest leg up, spot prices move back above a technically significant 200-day Simple Moving Average (SMA) for the first time in 2022. This could be seen as a fresh trigger for bullish traders and might have already set the stage for a further near-term appreciating move. Traders now look to the US economic docket, featuring the Personal Consumption Expenditures Price Index (the Fed's preferred inflation gauge) and the ISM Manufacturing PMI.

The data, along with the US bond yields and the broader risk sentiment, will influence the USD price dynamics and provide some impetus to the GBP/USD pair. The focus will then shift to the release of the closely-watched US monthly jobs report - popularly known as NFP. Nevertheless, the technical set-up seems tilted in favour of bullish traders and suggests that the path of least resistance for the pair is to the upside.

Technical levels to watch

GBP/USD extends gains through the mid-1.21 area. Economists at Scotiabank expect the pair to test the 1.24/25 area in the next few weeks.

More upward pressure on Cable in the short and medium term

“Marginal new highs for the GBP through 1.2150 suggest more upward pressure on Cable in the short and medium term.”

“GBP/USD is breaking out bullishly from a downward sloping channel (bull flag) that has developed over the past week, implying the resumption of short-term trend gains, while sustained strength through 1.2060 on the week (50% retracement of the 2022 decline) pave the way for the pair to push on to the 1.24/1.25 zone (61.8% Fib at 1.2458) in the next few weeks.”

“Support is 1.2055/60 intraday.”

- Gold price rallies back closer to a three-month high amid sustained US Dollar selling.

- Federal Reserve Chair Powell’s dovish comments continue to weigh on Greenback.

- Sliding US Treasury bond yields further contribute to driving flows toward XAU/USD.

- Traders now await the Fed’s preferred inflation gauge for some meaningful impetus.

Gold price gains traction for the third successive day on Thursday and climbs to over a two-week high during the mid-European session. The XAU/USD is currently placed just above the $1,780 level, with bulls eyeing a move beyond the three-month high touched in November.

Powell’s dovish remarks weigh on US Dollar and benefit Gold price

The US Dollar languished near a technically significant 200-day Simple Moving Average (SMA) in the wake of the overnight dovish remarks by Federal Reserve Chair Jerome Powell. A weaker Greenback turns out to be a key factor acting as a tailwind for the Dollar-denominated Gold price. Powell sent a clear message that the US central bank will soften its stance and said that it was time to moderate the pace of interest rate hikes.

Declining US Treasury bond yields provides an additional lift to XAU/USD

The prospects for a less aggressive policy tightening by the Federal Reserve contribute to an extension of the recent decline in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US Treasury note drops to a nearly two-month low, which continues to weigh on the US Dollar and further benefits the non-yielding Gold price. That said, uncertainty over peak interest rates in the United States might cap the XAU/USD.

US Personal Consumption Expenditures Price Index eyed for fresh impetus

In fact, Powell warned on Wednesday that interest rates could continue to rise to even higher levels than previously expected, largely due to stubbornly high inflation. Hence, the market focus shifts to the US Personal Consumption Expenditures (PCE) Price Index for November. The Federal Reserve's preferred inflation is expected to remain well above the 2% target, though signs of easing price pressures could dent the US Dollar and boost Gold price.

Thursday's US economic docket also features the release of ISM Manufacturing PMI. This, along with the US bond yields, might influence the USD price dynamics. Apart from this, the broader market risk sentiment should allow traders to grab short-term opportunities around Gold price ahead of the closely-watched US monthly jobs (NFP) on Friday.

Gold price technical outlook

From a technical perspective, momentum beyond the $1,785-$1,786 region should allow Gold price to reclaim the $1,800 psychological mark. The latter coincides with the very important 200-day SMA, which if cleared will be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move. The XAU/USD might then climb to the $1,807-$1,808 region before eventually rallying to the next relevant hurdle near the $1,820 area.

On the flip side, a meaningful slide back below the $1,775 level is likely to find decent support near the $1,762-$1,760 horizontal zone. Any further decline is more likely to attract fresh buyers around the $1,740 region. The latter should act as a strong base for Gold price, which if broken decisively will negate the positive outlook and shift the near-term bias in favour of bearish traders.

Key levels to watch

Economists at Nordea expect more short-term pain for the Norwegian Krone and the Swedish Krona before they strengthen.

Stronger scandi currencies in the long run

“In the short-term, we have kept our forecast for EUR/NOK and EUR/SEK still looking for a weaker EUR/NOK and the EUR/SEK to remain weak as risk-sentiment is likely to deteriorate.”

“Longer out, we see a Chinese reopening and central banks pausing their rate hikes after the historic rate hiking cycle in 2022 as supportive for both the NOK and SEK.”

EUR/USD holds yesterday’s gains and looks poised to test levels above 1.05, economists at Scotiabank report.

“Peak Fed” pricing will exert more pressure on the USD

“We think solid returns in European stocks relative to US markets will help keep the EUR underpinned in the short run while ‘peak Fed’ pricing will exert more pressure on the USD in the longer term, paving the way for additional, if modest, EUR gains into 2023.”

“EUR/USD is holding this week’s consolidation range below 1.05 and just under retracement resistance at 1.0517 (50% Fibonacci retracement of the 2022 decline).”

“Solid (technically bullish) gains overall yesterday will offset the bearish price action in the EUR we saw at the start of the week to some extent but new highs are needed to give the EUR a more obvious and sustained lift.”

“Support is 1.0390/00 and 1.0300/20.”

UOB Group’s Economist Ho Woei Chen reviews the latest PMIs results in the Chinese economy.

Key Takeaways

“China’s official manufacturing and non-manufacturing PMIs slumped further in Nov amid a worsening COVID-19 outbreak and anti-lockdown protests. This is the second straight month that both PMIs are concurrently in contraction (defined as a reading <50).”

“Both PMI readings were below Bloomberg’s consensus expectation as they fell to their lowest since Apr which marked the start of a 2-month lockdown in Shanghai.”

“Due to the more challenging environment including rising recession risks in the developed economies, we have lowered our forecast for 4Q22 GDP to 3.9% y/y from earlier 4.5% y/y. For 2022 GDP, our forecast remains at 3.3%, after incorporating the stronger than expected 3Q22 data. We are also maintaining our 2023 GDP forecast for China at 4.8%.”

In light of the recent price action, USD/CNH could extend the decline to the 7.0200 region in the short term, note Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “The sharp plunge in USD yesterday came as a surprise (we were expecting sideways trading). The decline appears to be overdone but USD could test the 7.0200 first before the risk of rebound increases. The next support at 7.0000 is unlikely to come under threat today. Resistance is at 7.0800, followed by 7.1000.”

Next 1-3 weeks: “USD fell sharply the second straight day. The outsized drop is likely to extend to 7.0200, as low as 7.0000. The downside risk is intact as long USD does not move above 7.1450.”

Gold gained after Fed Chair Jerome Powell indicated the Fed will slow the pace of interest rate increases next month. Nevertheless, strategists at TD Securities expect the yellow metal to drift lower into the first quarter of next year.

Still considerable risks that policy keeps on tightening

“Fed Chair Powell signaled the Federal Reserve will slow the pace of interest-rate increases next month, but this does not mean rates will not go past 5%. However, market pricing of the terminal rate is now just under 5%.”

“The confirmation of a slower pace of tightening prompted the market to go bid for Gold. Still, given that inflation will be a problem for some time suggests that even though the rate of tightening may moderate, there are still considerable risks that policy keeps on tightening.”

“Current price action may be the result of the last short positions being covered. We still expect Gold will trend lower into Q1-23.”

See – Gold Price Forecast: Miles to go before XAU/USD shows a sustained shine – TDS

- EUR/GBP drifts lower for the second straight session and challenges the 0.8575-0.8570 support.