- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-12-2022

- USD/CAD is oscillating around 1.3470 as investors are awaiting BOC’s monetary policy.

- Loonie’s downside has been restricted by sluggish oil prices while the weak US Dollar has capped its upside.

- Unchanged Canada’s October inflation is expected to continue BOC’s policy tightening measures.

The USD/CAD pair is displaying back-and-forth moves around 1.3470 in the early Asian session. The loonie pair has turned sideways as investors are shifting their focus toward the interest rate decision by the Bank of Canada (BOC), which is due on Wednesday.

Meanwhile, the risk-appetite theme is supporting the Canadian Dollar as the solid United States labor market failed to propel the chances of the current policy restriction pace by the Federal Reserve (Fed). The US Dollar Index (DXY) is highly expected to test Friday’s low around 104.40 amid higher appeal for risk-perceived assets.

S&P500 futures have displayed subdued performance as the upside has been capped by upbeat US Nonfarm Payrolls (NFP) data while the downside is supported by solid risk appetite.

For further guidance, market participants are keeping an eye on US ISM Services PMI data, which is seen higher at 55.6 vs. the prior release of 54.4. Also, the Services New Orders Index data, which is expected to land higher at 58.5, will hog the limelight. This might fetch US Dollar’s lost ground as robust demand could accelerate inflation guidance from the Fed and its policymakers.

On the Canadian Dollar front, the interest rate decision by the BOC will be of significant importance. Analysts at CIBC point out that the report supports their view that the Bank of Canada will increase rates by 50 bps next week, before pausing in 2023. Canada’s inflation remained unchanged at 6.9% in October. Therefore, the absence of exhaustion signals in inflation supports further policy tightening from BOC Governor Tiff Macklem.

On the oil front, OPEC has decided of sticking to a two million barrels per day production cut till November 2023. The absence of extended production cuts as expected by the market participants has dragged the oil prices dramatically to near $80.00. Meanwhile, easing Covid-19 curbs in China has strengthened oil demand projections. A sell-off in oil prices to near $80.00 has impacted the Canadian Dollar, being a leading exporter of oil to the United States.

- The Cable is facing barricades while attempting to break above 1.2300.

- Advancing 20-and 50-EMAs signifies more upside ahead.

- A range shift by the RSI (14) into the 60.00-80.00 area will strengthen Pound Sterling.

The GBP/USD pair has witnessed marginal selling pressure after failing to cross the 1.2300 hurdle in the early Tokyo session. The Cable recovered sharply on Friday after a sheer correction to near 1.2150 on the release of robust United States Employment data.

Meanwhile, the risk impulse is extremely bullish as the Federal Reserve (Fed) is still looking to trim the interest rate hike pace. The US Dollar Index (DXY) is declining toward Friday’s low of around 104.40.

On an hourly scale, Cable witnessed a significant buying interest after dropping to near November 24 high of around 1.2150 on Friday. The recovery was full of strength and it pushed Cable near the critical resistance of 1.2300.

Advancing 20-and 50-period Exponential Moving Averages (EMAs) at 1.2260 and 1.2210 add to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has recovered after dropping to near 40.00. A break inside the bullish range of 60.00-80.00 would trigger a bullish momentum.

For further upside, a decisive break above Friday’s high at 1.2311 will drive Cable toward June 16 high at 1.2406, followed by the round-level resistance at 1.2500.

Alternatively, a decisive drop below Wednesday’s low at 1.1900 will drag the Cable toward November 22 low at 1.1825. A slippage below the latter will drag the pair to near November 21 low at 1.1779.

GBP/USD hourly chart

- Gold price is hovering around $1,800.00 as investors await US ISM Services PMI data.

- The upbeat US NFP data has failed to fade the odds of the Fed’s rate hike slowdown.

- Solid United States Services New Orders could drive inflation expectations higher.

Gold price (XAU/USD) is facing immense pressure in conquering the round-level resistance of $1,800.00 in the early Tokyo session. The precious metal is highly expected to display more gains ahead and may extend towards a fresh three-month high at $1,824.63 as the upbeat US Nonfarm Payrolls (NFP) failed to fade the risk appetite theme.

The US Dollar Index (DXY) is looking to re-test the previous week’s low around 104.40 as the market participants are of the view that solid employment generation in November is unable to fade expectations of a slowdown in interest rate hike pace by the Federal Reserve (Fed). Also, the 10-year US Treasury yields have dropped further below 3.50% and are not getting any intermediate cushion.

The economic catalyst that investors are awaiting for further guidance is the United States ISM Services data, which will release on Monday. The economic data is seen higher at 55.6 vs. the prior release of 54.4. Apart from that, the catalyst which will impact Gold prices is the ISM Services New Orders Index data. The economic data is expected to land higher at 58.5, which indicates robust demand by households that may provide a cushion to inflation ahead.

Gold technical analysis

On an hourly scale, the Gold price has picked up decent demand after a correction to near November 15 high at $1,777.32. The yellow metal is aiming to reclaim a three-months high at around $1,805.00. The Gold price has scaled above the 20-period Exponential Moving Average (EMA) at $1,795.90 after sensing support from the 50-EMA around $1,790.00, which indicates that the short-term trend has tilted north.

Gold hourly chart

- EUR/USD is looking to conquer 1.0550 as the focus has shifted to Eurozone Retail Sales data.

- The USD Index failed to extend recovery despite solid additions in the labor market.

- A solid Eurozone retail demand is going to strengthen inflation expectations ahead.

The EUR/USD pair is hovering around a fresh five-month high at 1.0545 in the early Asian session. The major currency pair is expected to extend its rally to near 1.0550 ahead amid an upbeat market mood. Expectations of a decline in interest rate hike extent ahead by the Federal Reserve (Fed) have underpinned the risk appetite theme for a longer period.

The US Dollar Index (DXY) is expected to test the previous week’s low around 104.40 as the recovery move banked on stronger-than-projected United States Nonfarm Payrolls (NFP) data faded after failing to extend the rebound move above 105.60. S&P500 ended on a subdued note on Friday as upbeat labor additions acted as a double-edged sword for the market.

The 10-year US Treasury yields continued their downside journey and dropped below 3.50% as the Fed is highly expected to decelerate its rate hike pace.

The US NFP data rose to 263K, significantly higher than the projections of 200K. Demand for labor remained extremely solid in November despite accelerating interest rates by the Fed. This implies robust retail demand by the households, which could be a barrier to the declining inflation desire. Apart from that, Average Hourly Earnings rose to 5.1% respecting solid labor demand, which is going to support inflation as households will have higher money at their disposal.

On the Eurozone front, investors are awaiting the release of the Retail Sales data, which will release on Monday. The economic data is expected to improve dramatically by 2.7% against a contraction of 0.6% on an annual basis. A solid retail demand is going to strengthen inflation expectations ahead as it is not providing any incentive to factory owners to offer lower prices for products and services.

Speaking to a Russian TV station on Sunday, accusing the Western countries of violating the rules of the World Trade Organization, Russian Deputy Prime Minister and Minister of Energy Alexander V. Novak said his country would not export its oil under the price cap recently set by Western countries despite potentially needing to cut its oil production.

Novak said that Russia will continue to sell oil to countries that follow the free market rules. Novak explained that Russia is working on measures to impose ban on oil exports to the countries that might follow the Western price cap.

This follows Friday's news that EU member countries, as well as the United State, the United Kingdom, Canada and Australia, have agreed to set the price of Russian oil exports at USD 60 per barrel as from this Monday.

-

ECB's Villeroy: In favour of 50 bp rate hike on Dec. 15

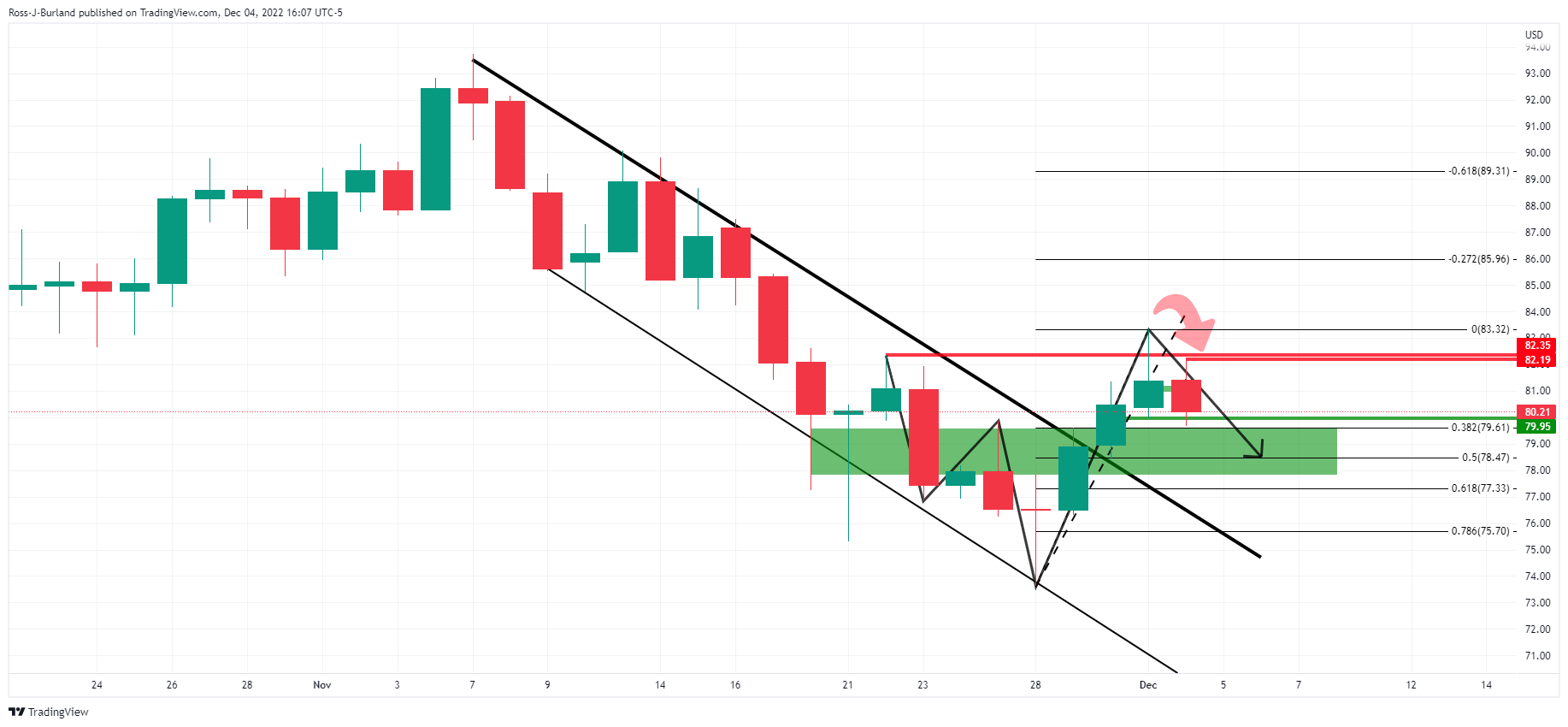

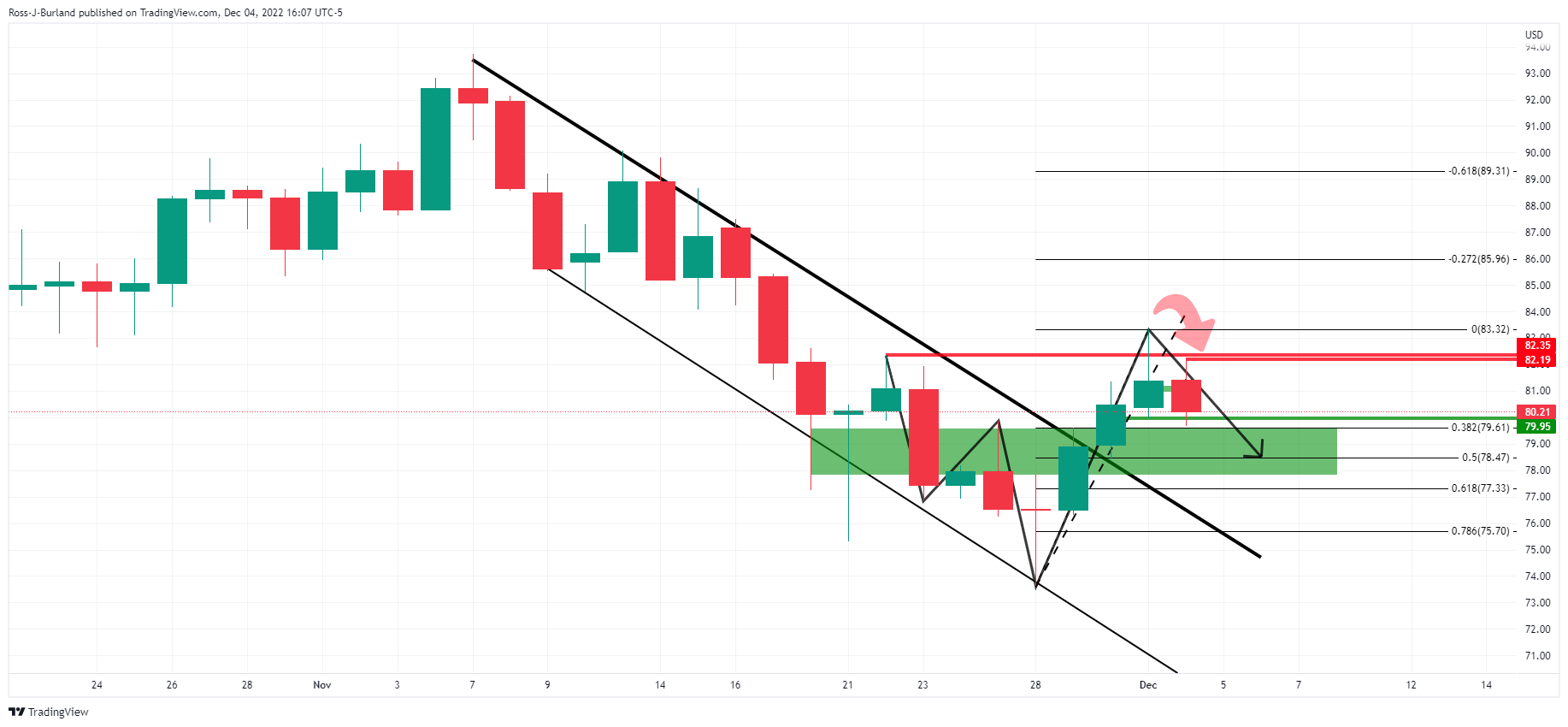

WTI technical analysis

Meanwhile, West Texas Intermediate (WTI) is correcting into the Fibonacci scale drawn on the prior bullish leg as follows:

As per the daily chart analysis above, the W-formation is a reversion pattern and the price would be expected to be drawn towards the neckline in which this case has a confluence with the 50% mean reversion area near $78.50bbls.

Reuters reports that Europen Central Bank board member François Villeroy de Galhau said on Sunday that he is in favour of a 50 basis point hike to 2% of the European Central Bank's main rate at its board meeting on Dec. 15.

The central banker also said in an interview with LCI television that he expects inflation will peak in the first half of next year.

Key notes

ECB's Villeroy says inflation should peak in first half next year.

ECB's Villeroy says he personally favours 50 bp hike at rate meeting on Dec 15.

ECB's Villeroy says rate hikes will continue after Dec 15, cannot say when they will stop.

ECB's Villeroy says thinks France and Europe will escape hard landing of economy.

ECB's Villeroy says recession next year is unlikely.

ECB's Villeroy says expects to beat inflation by 2024-2025.

EUR/USD update

Meanwhile, the Euro fell to below 1.05 vs. the US Dollar on Friday, following a hotter-than-expected jobs report for the US. However, EUR/USD recovered back towards the highs of the day ending around 1.0540 on dovish rhetoric from Federal Reserve speakers. As for the ECB, analysts stay divided on whether the central bank will hike borrowing costs by a 75bps for the third time when it meets in December or will opt for a smaller 50bps increase.

Oil traders will note the weekend news that OPEC and its allied producers (OPEC+) have agreed to maintain their current oil-output targets despite a recent decline in energy prices.

Sunday's meeting was an important one for the oil industry given the recent moves in the oil price into fresh bearish cycle lows for the end of the year. West Texas Intermediate has been pressured of late given a deteriorating demand outlook from China and Europe recently agreeing to a price cap for Russian oil that is set to take effect this Monday.

At the meeting on Sunday, OPEC+ has agreed to sustain the 2 million-barrels-per-day cut that was announced in October that had drawn criticism from the Biden administration that regards the cut as a blatant display of siding with Moscow.

Meanwhile, in response to the Ukraine invasion, G7 nations, the European Union and Australia agreed at the end of last week to cap the price of Russian seaborne oil at $60 per barrel starting on Dec. 5. The Kremlin said this weekend that it would not comply with the price cap.

WTI technical analysis

Meanwhile, WTI is correcting into the Fibonacci scale drawn on the prior bullish leg as follows:

The W-formation is a reversion pattern that tends to see the price drawn towards the neckline in which this case has a confluence with the 50% mean reversion area near $78.50bbls.

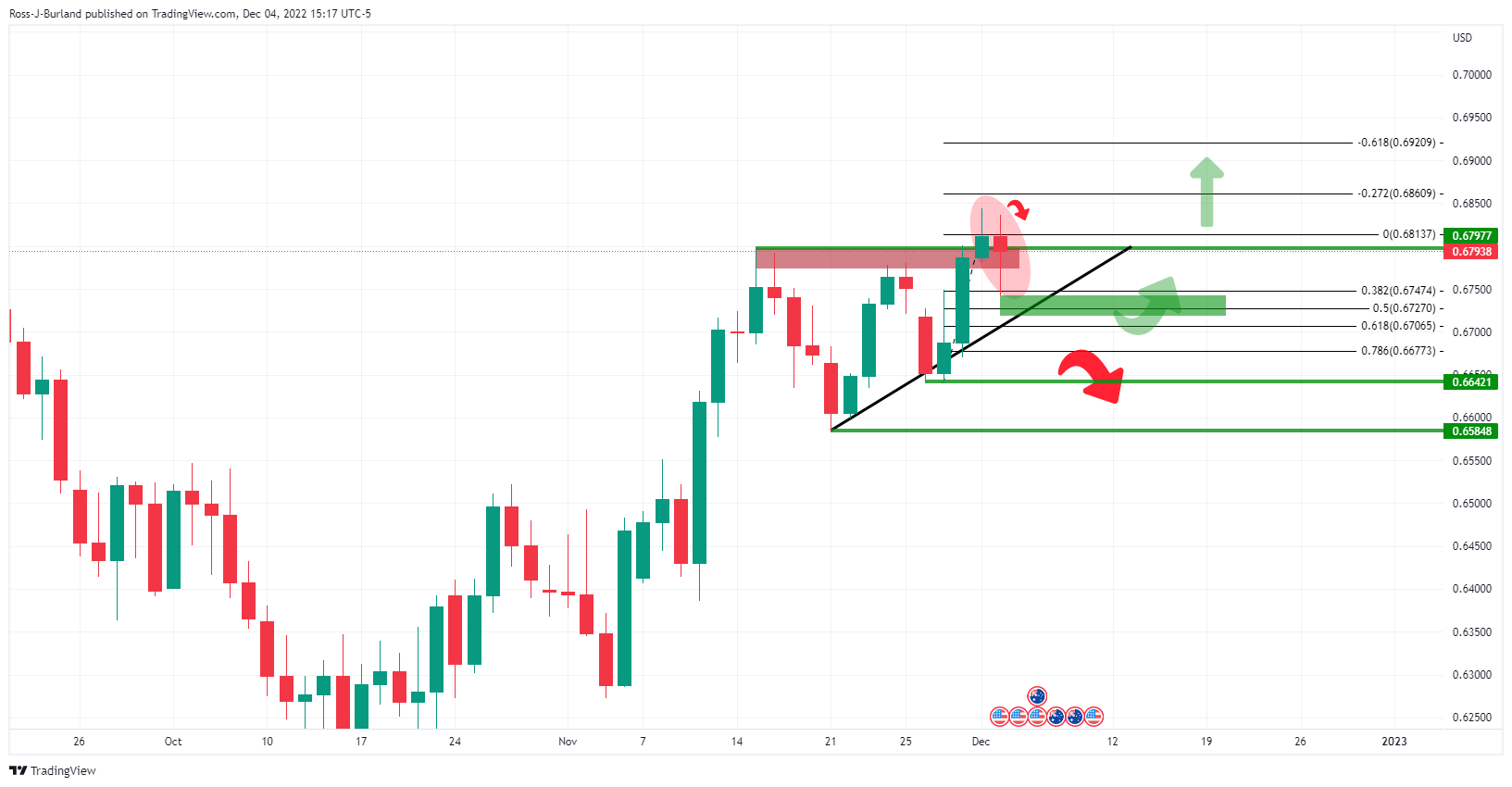

- AUD/USD bears eye a 50% mean reversion in the lower quarter of the 0.6700s.

- A break of the supporting trendline and subsequent test of 0.6640/50 could be a significant bearish development.

As per the prior analysis, AUD/USD Price Analysis: Bulls eye 0.6850 while bears look to 0.6650, AUD/USD remains within familiar ranges, struggling to get beyond 0.6800 as the following illustrates:

AUD/USD prior analysis

The price has reached through the resistance area but has subsequently moved in on the length taking on the midpoint of the prior bullish impulse as follows:

AUD/USD H4 chart update

The engulfment came in a strong move to the downside that leaves the bias bearish for the opening sessions at the start of the week with the dynamic trendline support eyed.

AUD/USD daily chart

On the daily time frame, support is expected in the 50% mean reversion area and lower quarter of the 0.6700s. Should the supporting trendline be broken, a move below 0.6640/50 could be a significant bearish development ahead of the critical remaining calendar events for the year.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.