- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-12-2022

- EUR/JPY is oscillating below 143.40 ahead of ECB Lagarde’s speech.

- ECB policymakers believe that current interest rates are near to neutral rate.

- The BOJ may look for more easing to accelerate the economy’s growth in times of lower inflation.

The EUR/JPY pair is displaying a lackluster performance in early Asia as investors are awaiting the speech from European Central Bank (ECB) President Christine Lagarde for fresh impetus. The cross is hovering around the critical hurdle of 143.40 and is likely to remain sideways amid the unavailability of a fresh trigger.

The speech from ECB President is going to provide fresh cues about the likely monetary policy action. Meanwhile, ECB policymakers delivered similar responses on interest rate guidance on Tuesday. ECB Chief Economist Phillip Lane is dubious about the inflation peak as it has been achieved or is still to come next year. He further added that he expects more rate hikes ahead but "a lot has been done already".

While, Constantinos Herodotou, Governor of the Central Bank of Cyprus said that “There will be another hike in rates, but we are very near neutral rate.”

On the Japanese yen front, Bank of Japan (BOJ) Governor Haruhiko Kuroda is not ready to call for a termination of policy easing till wag inflation reaches around 3% to push inflation sustainably to the 2% target, as reported by Reuters. The BOJ is bound to keep flushing liquidity into the economy until the economy gets strengthened as desired.

For further guidance, the release of Japan’s Gross Domestic Product (GDP) data will provide significant cues. As per the projections, Japan’s GDP is expected to contract by 1.1% against the prior contraction of 1.2%. While the quarterly data is likely to contract by 0.3%, similar to the prior release. A contraction in Japan’s GDP in times when the economy is struggling to push inflation higher may force more policy easing measures by the BOJ.

Australian GDP overview

Reserve Bank of Australia’s (RBA) readiness for further increases in interest rates and expectations of solid economic recovery highlights Australia’s third-quarter (Q3) Gross Domestic Product (GDP) figures, up for publishing at 00:30 GMT on Wednesday, for the AUD/USD pair traders.

The recent data from Australia portray a mixed picture as downbeat housing market data and labor participation rate contrasts with upbeat export growth and consumer spending. Even with these statistics in mind, the Aussie Q3 GDP is likely to print slightly better figures.

That said, forecasts suggest the annualized pace of economic growth to come in at 6.3%, above the previous period's 3.6%, while the quarter-on-quarter (QoQ) numbers could mark the 0.7% growth figures versus 0.9% prior.

Ahead of the outcome, Westpac said,

The economic rebound should continue at a robust pace, supported by the reopening from COVID-19 and tailwinds from earlier policy stimulus. Hence, consumer spending and business investment should grow solidly in the quarter, though housing is expected to be flat on lower renovation work. After the various partial surveys released this week, Westpac’s forecast remains 0.8%qtr, 6.4%yr, with the median forecast on Bloomberg 0.7% quarterly.

How could it affect the AUD/USD?

AUD/USD remains pressured around the 0.6700 round figure, making rounds to the 100-DMA support, as a lack of major data/events joins the pre-GDP anxiety to challenge the pair traders.

That said, Australia’s Q3 GDP is likely to carry less importance for the pair traders, considering the present focus on the risk-aversion and hawkish Fed bets. Also likely to dilute the importance of the data is the latest Reserve Bank of Australia (RBA) monetary policy meeting that stated household spending is expected to slow over the period ahead while also confirming that the Australian economy is continuing to grow solidly.

Hence, positive data from Australia might offer a knee-jerk rebound in the AUD/USD prices but not affect the overall bearish trend. On the contrary, downbeat figures won’t hesitate to please bears with a fresh multi-month low.

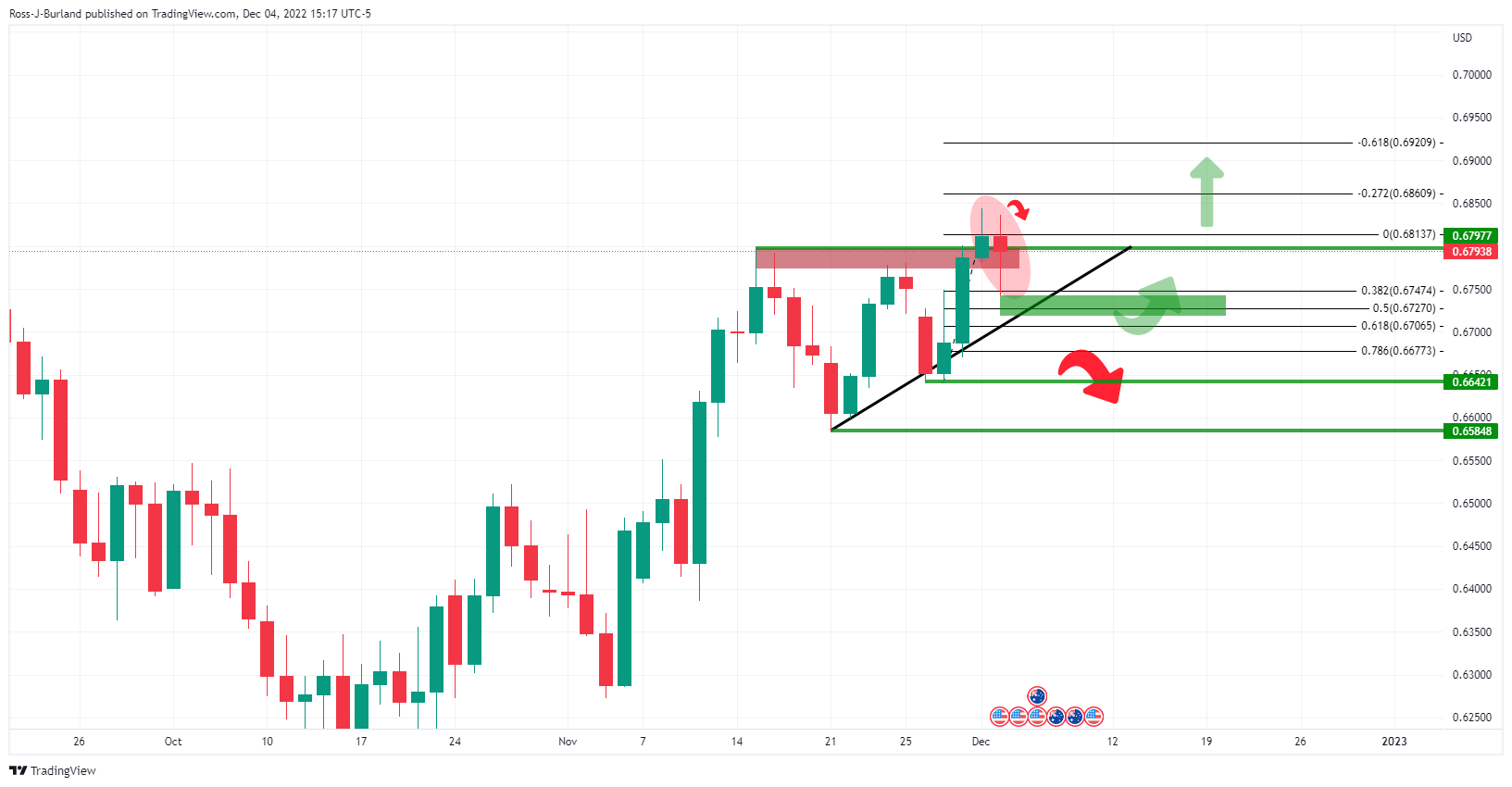

Technically, failure to cross the 61.8% Fibonacci retracement level of the June-October downside, near 0.6855, joins bearish MACD signals and steady RSI to favor AUD/USD bears. However, a clear break of the 100-DMA support near 0.6690 becomes necessary for the sellers to aim for a late November swing low near 0.6585.

Key notes

AUD/USD floats above 100-DMA support ahead of Australia GDP

AUD/USD Forecast: Bears gearing up for a test of 0.6500

About the Aussie GDP release

The Gross Domestic Product released by the Australian Bureau of Statistics is a measure of the total value of all goods and services produced by Australia. The GDP is considered a broad measure of economic activity and health. A rising trend has a positive effect on the AUD, while a falling trend is seen as negative (or bearish) for the AUD.

The media is reporting that Chinese authorities are considering downgrading Covid-19. This could be a positive for risk appetite for the day ahead in markets that have otherwise been on the back foot.

Global stocks posted a third straight day of losses on Tuesday as investors fret over how long the Federal Reserve will maintain interest rates as so restrictive to the US economy.

However, China downgrading Covid-19 from the top class of infectious diseases would allow it to be managed more flexibly in a move that would relieve local governments of the legal obligations to introduce strong controls such as lockdowns, freeing up the economy once again. It would likely be welcomed news amongst an otherwise pessimistic outlook on the global economy and looming recessions. MSCI's all-country world index, a gauge of stock performance in 47 countries, dropped 1.26% to mark its third down day in a row after hitting a three-month high last week.

''While China’s emergence from almost three years of pandemic isolation is paved with uncertainty, technical charts signal Chinese stocks may enjoy some smooth gains as the economy reopens,'' Bloomberg wrote.

''The incremental easing of Covid restrictions in cities from Beijing to Hangzhou has brightened the outlook for Chinese stocks, and both onshore and offshore gauges may rise toward levels reached earlier this year when optimism over an end to lockdowns and an economic recovery drove gains.''

- WTI crude oil prices dribble around weekly low after three-day downtrend.

- U-turn from 21-DMA, bearish MACD signals favor sellers.

- 10-week-old descending trend line lures bears, monthly resistance line adds to the upside filters.

WTI crude oil bears await more clues as they pause around $74.80, the lowest level in a week, during Wednesday’s sluggish Asian session. In doing so, the commodity price pauses the three-day downtrend.

That said, the black gold’s sustained U-turn from the 21-DMA and bearish MACD signals keep the sellers hopeful. However, a downward-sloping trend line from late September, around $73.20 appears a tough nut to crack for the bears. Adding strength to the $73.20 support is the nearly oversold RSI line, placed at 14.

It should be noted that the previous monthly low and Tuesday’s bottom, respectively around $73.65 and $73.55, may act as immediate supports for the energy benchmark.

In a case where the quote drops below $73.20, the $73.00 round figure might act as an intermediate halt before dragging the $70.00 psychological magnet and then to the late December 2021 low near $66.15.

Alternatively, the $80.00 threshold could restrict the WTI’s recovery moves ahead of the 21-DMA hurdle surrounding $80.70.

Following that, a downward-sloping trend line from early November, near $81.70, acts as an extra filter to the north.

Overall, WTI crude oil remains on the bear’s radar but the downside room appears limited.

WTI: Daily chart

Trend: Limited downside expected

- USD/CAD is making moves to the upside, but bears are lurking.

- Bulls eye a longer-term target beyond 1.4000.

We have seen USD/CAD break out of a symmetrical triangle on the daily chart and the focus is on the upside while the price continues to ride weekly trendline support.,

A correction at this juncture into prior highs near 1.3580, could act as support offering a discount to the bulls seeking a run on liquidity towards 1.3800/25 stops in a continuation of the short squeeze.

USD/CAD weekly charts

USD/CAD is in an uptrend with eyes on a break of 1.4000. However, there is a long way to go until the bulls are out of the woods as the following charts will illustrate:

There are conflicting patterns on the weekly chart, as we zoom in.

We have a W formation, on the chart above, and an M pattern on the chart below.

Given the price has rallied towards the neckline of the M-formation, the path of least resistance could now be to the downside for the near term.

USD/CAD daily chart

We have seen USD/CAD break out of the triangle meeting the 1.3650s. A correction at this juncture into prior highs near 1.3580, could act as support offering a discount to the bulls seeking a run on liquidity towards 1.3800/25 stops in a continuation of the short squeeze.

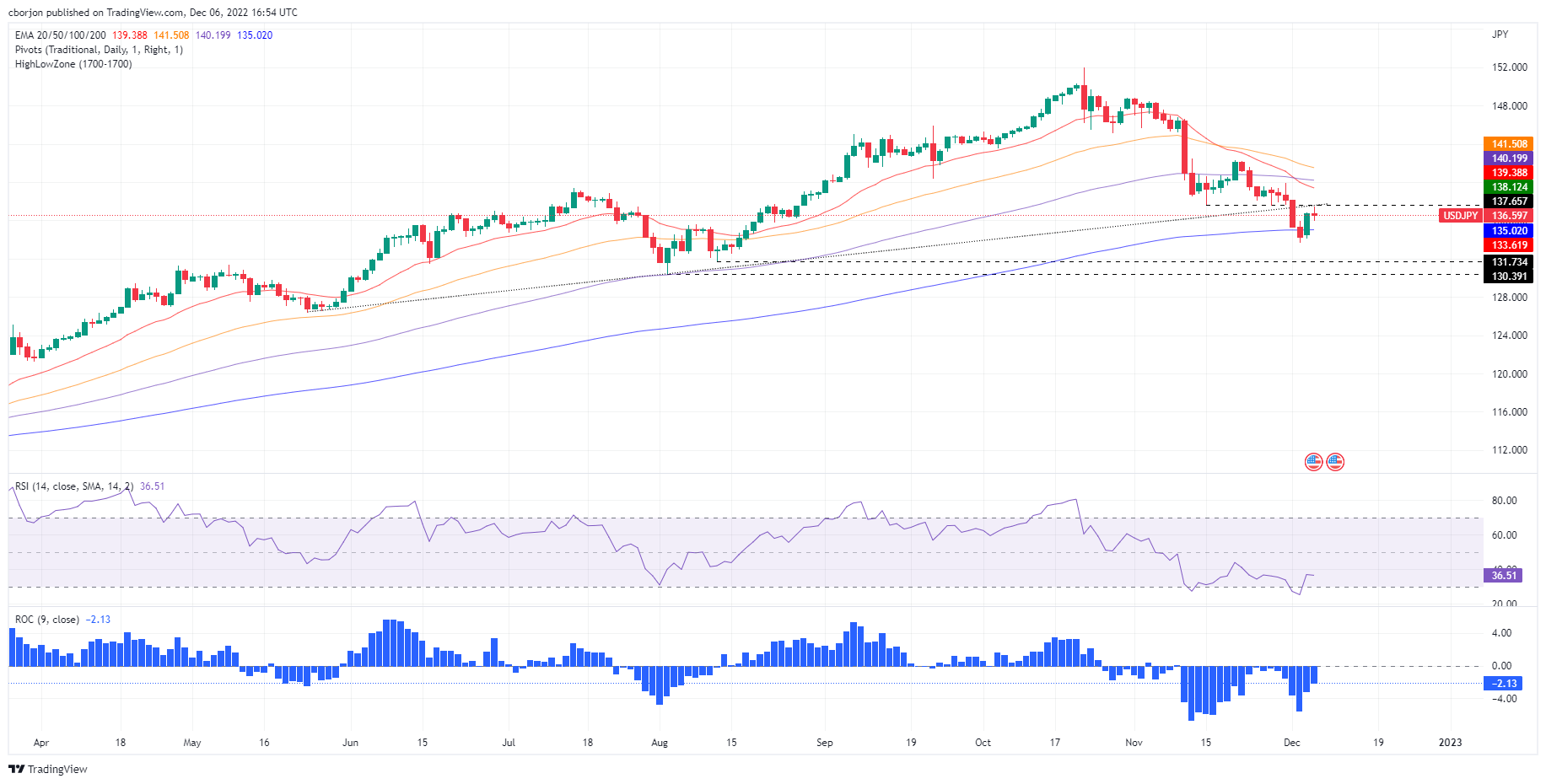

- Doji, in the USD/JPY daily chart, would it mean consolidation around 136.00-137.00?

- USD/JPY Price Analysis: Positive divergence would exacerbate a rally, but a doji clouds the USD rally.

The USD/JPY struck a seven-month-old upslope previous support trendline turned resistance around 137.60, retraced towards its Tuesday daily close at 137.02 for a minuscule 0.02% gain. As the Asian Pacific session begins, the USD/JPY is trading at 136.90, below its opening price by 0.09%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY is neutral-to-upward biased, though a doji emerging in the daily chart suggests the uptrend might halt, or perhaps the USD/JPY might consolidate, around the 136.00-137.00 area. Since mid-November, the USD/JPY registered successive series of lower lows, while the Relative Strength Index (RSI) did the opposite, suggesting that a positive divergence emerged. Furthermore, the Rate of Change (RoC) edges toward zero, implying that selling pressure is fading.

If the USD/JPY clears the weekly high above 137.42, that will invalidate the doji mentioned above and exacerbate a rally toward the 20-day Exponential Moving Average (EMA) at 139.18. Once that resistance level is breached, the next resistance would be the 100-day EMA at 140.14

On the flip side, the USD/JPY first support would be the December 6 daily low of 135.96. A breach of the latter will expose the 200-day EMA at 135.04, followed by the December 2 swing low at 133.61.

- Solid risk aversion theme is propelling the US Dollar for more upside.

- The kiwi asset has not challenged the 200-EMA around 0.6300 yet.

- A slippage inside the bearish range of 20.00-40.00 by the RSI (14) will trigger a bearish momentum.

The NZD/USD pair is struggling to climb above the immediate hurdle of 0.6320 in the early Tokyo session. The kiwi asset is facing immense pressure from the risk aversion theme. Meanwhile, investors are parking their funds in the US Dollar to dodge volatility in the global markets.

The US Dollar Index (DXY) is aiming to extend its gains above the immediate hurdle of 105.60. Meanwhile, the 10-year US Treasury yields have dropped to near 3.53% after a decent recovery.

On an hourly scale, the kiwi asset is displaying back-and-forth moves in a range of 0.6300-0.6350 after dropping from the critical hurdle above 0.6450. The major has yet not surrendered the 200-period Exponential Moving Average (EMA) marginally below 0.6300, which indicates that the long-term trend is still intact but with caution. Meanwhile, the 20-EMA at 0.6326 is acting as a major barricade for the asset.

The Relative Strength Index (RSI) (14) is hovering around 40.00. A slippage inside the bearish range of 20.00-40.00 will trigger a bearish momentum.

Going forward, a downside move below the round-level cushion of 0.6300 will explode volatility contraction and will drag the kiwi asset toward November 29 high around 0.6250, followed by November 29 low below 0.6200.

On the contrary, a breakout of the consolidation by overstepping Monday’s high at 0.6350 will drive the major towards the round-level resistance at 0.6400. A breach of the latter will expose the major to retest the previous week’s high at 0.6477.

NZD/USD hourly chart

- AUD/USD pokes 100-DMA after failing to defend RBA-led gains.

- Risk-aversion wave, pre-data anxiety weighs on prices amid a quiet session.

- Australia’s Q3 GDP is likely to deteriorate on QoQ and improve on YoY basis.

- China trade numbers for October, risk catalysts are also important for clear directions.

AUD/USD remains pressured around 0.6690, after reversing the Reserve Bank of Australia-led (RBA) gains as traders await the Aussie Gross Domestic Product (GDP) data on early Wednesday. That said, the market’s indecision amid a light calendar and mixed clues also challenge the pair traders.

The warnings of grim economic conditions from multiple US banks and downbeat earnings weighed on the market sentiment during late Tuesday. Among them were the United States Heads of Goldman Sachs, Bank of America Corp and JPMorgan Chase. Additionally, Bloomberg Economics also forecasted the lowest economic growth since 1993, to 2.4% for 2023.

However, downbeat prints of the US trade numbers and the inflation expectations join the optimism surrounding China to challenge the AUD/USD bears.

That said, US Goods and Services Trade Balance deteriorated to $-78.2 billion versus $-79.1 billion expected and $-73.28 billion prior. Further, US inflation expectations, as per the 10-year and 5-year breakeven inflation rates per the St. Louis Federal Reserve (FRED) data, extend the previous retreat from a one-month high by printing the second day of downside. The latest prints of the 5-year and 10-year inflation expectations are 2.38% and 2.43% respectively.

It should be noted that China, Australia’s biggest customer, is up for conveying more easing to its three-year-old Zero-Covid policy on Wednesday, per Reuters. Beijing’s latest move could be linked to the receding virus infections from the record high, as well as multiple announcements suggesting more unlocking of the virus-hit economy that’s the second biggest in the world.

Additionally, the RBA’s hawkish hike of 0.25%, with hints of more rate increases, allowed the AUD/USD to remain firmer during early Tuesday. However, the details of the RBA Rate Statement raise concerns over the Aussie economic growth, which in turn highlights today’s Australian GDP for the third quarter (Q3), expected 0.7% QoQ versus 0.9% prior, as well as 6.3% YoY versus 3.6% previous readouts. Following the Australian GDP outcome, China’s trade numbers for November will also entertain the AUD/USD pair traders.

Technical analysis

Failure to cross the 61.8% Fibonacci retracement level of the June-October downside, near 0.6855, joins bearish MACD signals and steady RSI to favor AUD/USD bears. However, a clear break of the 100-DMA support near 0.6690 becomes necessary for the sellers to aim for a late November swing low near 0.6585.

Gold price remains pressured amid inactive markets, recent sour sentiment underpins US Dollar.

Headlines surrounding global economic growth, Russia portray contrast with China’s Covid-linked optimism.

Mixed concerns surrounding Federal Reserve’s next move also weigh on the XAU/USD prices.

Equities drop, United States Treasury bond yields remain sluggish to challenge Gold price moves amid a light calendar.

Gold price (XAU/USD) remains pressured around $1,770, struggling with short-term key support during the early Asian session on Wednesday. The metal’s latest weakness could be linked to the market’s sour sentiment that underpinned the US Dollar’s rebound, as well as the Covid-linked optimism in China. It’s worth noting, however, that a light calendar and mixed updates surrounding the US Federal Reserve (Fed) seemed to have challenged the XAU/USD moves.

Risk-off mood weighs on the Gold price

Following an upbeat start to Tuesday’s trading, Gold price witnessed downside pressure as risk appetite soured after multiple warnings of grim economic conditions from multiple US banks and downbeat earnings. Among them were the United States Heads of Goldman Sachs, Bank of America Corp and JPMorgan Chase. Additionally, Bloomberg Economics also forecasted the lowest economic growth since 1993, to 2.4% for 2023.

It’s worth noting that escalating tension between European Union (EU) and Russia, as well as between Kyiv and Moscow, also exerts downside pressure on the Gold price by favoring the rush to risk safety. That said, the Oil price cap and Ukraine’s drone attack in Russia are the key catalysts fueling the risk-aversion of late.

Concerns over Federal Reserve keep XAU/USD bears hopeful

Officials from the Federal Reserve (Fed) are on the pre-Federal Open Market Committee (FOMC) blackout and hence the Fed talks are absent. However, the last dossier from the policymakers wasn’t confirming the previous bearish bias due to the strong United States employment report for November.

That said, the US Nonfarm Payrolls (NFP) surprised markets by rising to 263K versus 200K expected and an upwardly revised prior of 284K while the Unemployment Rate matched market forecasts and prior readings of 3.7% for November. Following the upbeat data, Chicago Fed President Charles Evans said, "We are probably going to have a slightly higher peak to Fed policy rate even as we slow pace of rate hikes.”

Following that, Monday’s strong prints of the United States ISM Services PMI also bolstered the hawkish hopes of the Fed. That said, the private services gauge rose to 56.5 in November versus 53.1 market forecast and 54.4 previous readings whereas the Factory Orders also registered 1.0% growth compared to 0.7% expected and 0.3% prior. Further, S&P Global Composite PMI improved to 46.4 versus 46.3 initial estimations.

On Tuesday, US Goods and Services Trade Balance deteriorated to $-78.2 billion versus $-79.1 billion expected and $-73.28 billion prior.

It should, however, be noted that the recent downside in the US inflation expectations challenges the hawkish concerns surrounding the Federal Reserve’s (Fed) next move and hence challenge the Gold sellers. US inflation expectations, as per the 10-year and 5-year breakeven inflation rates per the St. Louis Federal Reserve (FRED) data, extend the previous retreat from a one-month high by printing the second day of downside. The latest prints of the 5-year and 10-year inflation expectations are 2.38% and 2.43% respectively.

China defends Gold buyers

Being one of the biggest Gold consumers an increase in optimism surrounding China challenges the Gold sellers. That said, the dragon nation is up for conveying more easing to its three-year-old Zero-Covid policy on Wednesday, per Reuters. Beijing’s latest move could be linked to the receding virus infections from the record high, as well as multiple announcements suggesting more unlocking of the virus-hit economy that’s the second biggest in the world.

To sum up, Gold price struggles for clear directions amid mixed clues but remains on the bear’s radar as sentiment sours.

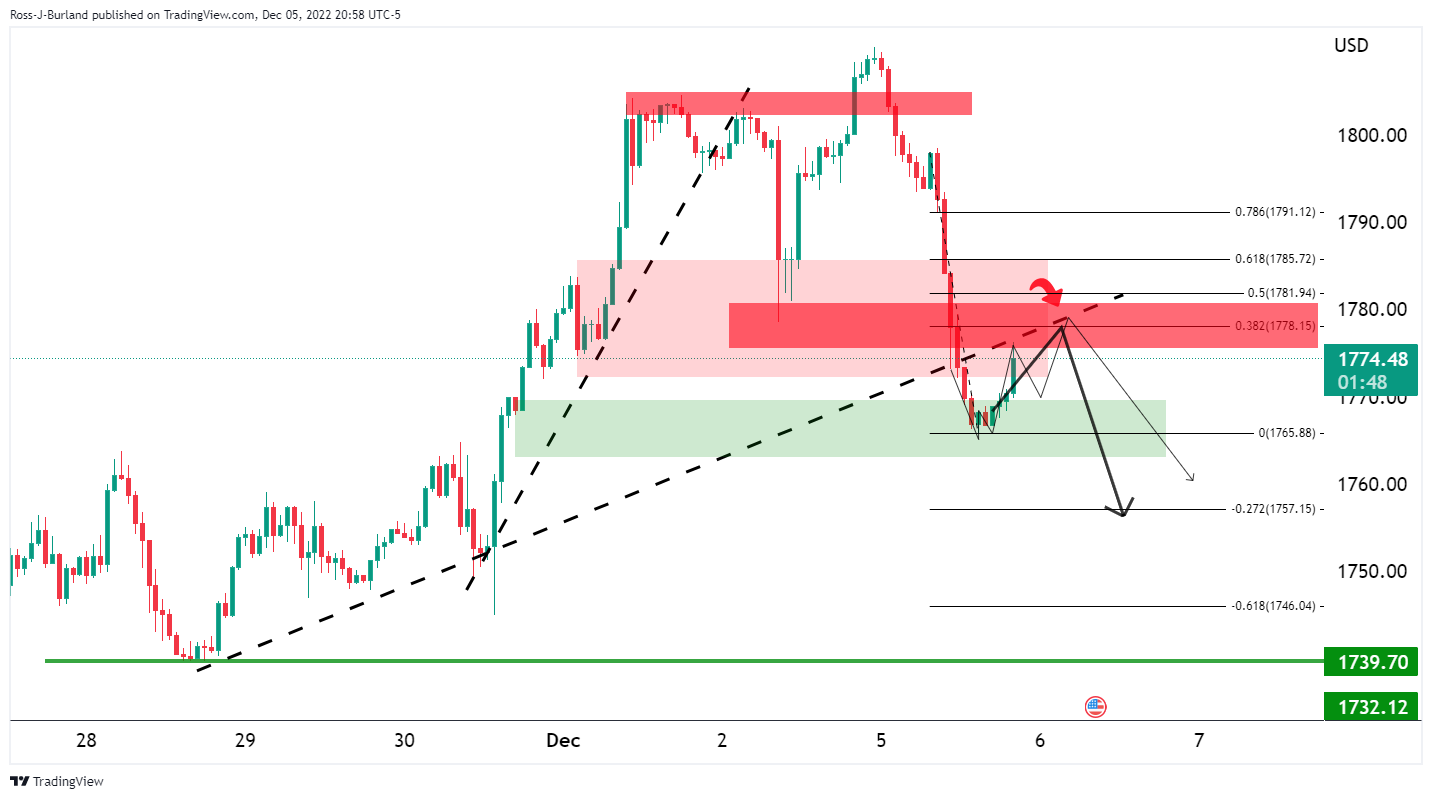

Gold price technical analysis

Having failed to cross a two-month-old ascending resistance line, the Gold price dropped to the 100-bar Simple Moving Average (SMA).

However, a failure to stay much beyond the key SMA level joins the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator and the normal conditions of the Relative Strength Index (RSI) line, placed at 14, to suggest a further extension of the downbeat moves.

That said, a convergence of the 100-SMA and upward-sloping support line from November 08 highlights $1,765 as the short-term key support to watch for the Gold price traders.

In a case where the XAU/USD bears manage to smash the said support confluence near $1,765, a horizontal area comprising multiple levels marked since October 04, close to $1,730, should gain major attention.

Meanwhile, Gold price recovery could aim for the $1,780 and the mid-November swing high surrounding $1,786 before targeting the $1,800 threshold.

Following that, the monthly high near $1,810 and the previously mentioned multi-day-old resistance line around $1,813 might challenge the XAU/USD bulls.

Overall, the Gold price remains pressured around the short-term key support with a preferred move on the downside.

Gold price: Four-hour chart

Trend: Further weakness expected

- GBP/USD is expected to decline to near 1.2100 as the Fed is set to escalate the interest rate peak target.

- United States wage inflation has triggered the risk of higher consumer spending ahead.

- United Kingdom’s food supply crisis has escalated led by skyrocketing costs and labor shortages.

The GBP/USD pair has shifted its business below the crucial support of 1.2150 in the early Asian session. The Cable is declining towards the immediate cushion of 1.2100 as the risk aversion theme is gaining more traction. The major is expected to remain on tenterhooks as the US Dollar is looking to add more gains amid a significant improvement in safe-haven’s appeal.

The US Dollar Index (DXY) has climbed to near Friday’s high around 105.60 and is expected to deliver more gains as the Federal Reserve (Fed) is expected to continue severe policy tightening measures to safeguard the economy from wage inflation fears.

Meanwhile, S&P500 futures witnessed a sell-off consecutively on Tuesday as a higher interest rate peak by the Fed triggered recession fears. The US Treasury yields have failed to keep up the bullish momentum and have declined despite renewed fears of a rebound in inflation.

A tight labor market and robust demand in the US service sector are going to keep wages reported on a firmer note ahead. Higher wages to households will allow them more purchases of durable goods and robust consumer spending will keep inflation comfortably in a strong position. Fresh evidence of a rebound in inflationary pressures has forced market participants to presume a higher interest rate peak ahead.

Going forward, investors will look for five-year consumer inflation expectations for further guidance. Long-term inflation expectations are still anchored as the Fed has already accelerated its interest rates dramatically.

On the United Kingdom front, risks of a food supply crisis have escalated led by skyrocketing costs and labor shortages. Minette Batters, president of the National Farmers Union said “We need government and the wider supply chain to act now. Tomorrow could well be too late.” as reported by Financial Times.

This week, investors will focus on annual consumer inflation expectations, which will release on Friday. The forward inflation indicator is expected to remain solid as the retail demand is firmer in the UK economy. UK’s Like-For-Like Retail Sales reported by the British Retail Consortium (BRC) escalated to 4.1% from the prior release of 1.2% in November on an annual basis. Households’ robust demand indicates a higher price rise index ahead.

- The Australian Dollar appreciates against the Japanese Yen, though it drops below 92.00 after hitting a new weekly high.

- AUD/JPY Price Analysis: Would fall to 90.00 once it clears December’s low at 91.08.

The Australian Dollar (AUD) rose against the Japanese Yen (JPY), though it gave back some of its earlier gains after hitting a daily high of 92.33. The 200-day Exponential Moving Average (EMA) at 91.97 was the main reason for the AUD/JPY to retrace from three-day highs, and at the time of writing, the AUD/JPY trades at 91.63, below its opening price by 0.12%.

AUD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the cross-currency pair is neutral to downward biased, as it should be remembered that a break below the 200-day EMA is used as a barometer for long-term trends. Additionally to the 200-day EMA capping the rally, the bottom-trendline of a descending channel that intersects with the 200-EMA are two technical signals that would keep the AUD/JPY downward biased. Both oscillators lack direction, with the Relative Strength Index (RSI) almost flat at bearish territory and the Rate of Change (RoC) unchanged.

If the AUD/JPY breaks below December’s 5 daily low at 91.08, that will pave the way for substantial losses. The following support would be the October 13 swing low at 90.83, followed by the August 2 daily low at 90.52. A decisive break would expose the 90.00 psychological level.

On the upside, the AUD/JPY first resistance would be the 200-day EMA at 91.97. Breach above will clear the way to the 20-day EMA at 92.88, followed by the 93.00 figure.

- EUR/USD is eyeing more weakness towards 1.0440 as investors have underpinned the risk aversion theme.

- Expectations for a higher interest rate peak have triggered recession fears in the United States economy.

- Investors are awaiting ECB Lagarde’s speech for fresh impetus.

The EUR/USD pair has turned sideways after dropping vertically to near 1.0465 in the early Tokyo session. The major currency pair has extended its losses after dropping below the critical support of 1.0480 and is expected to deliver more weakness to near 1.0440 as the risk-off impulse has escalated amid a firmer US Dollar.

The US Dollar Index (DXY) is hovering around Friday’s high at 105.60 after overstepping the critical hurdle of 105.50. The US Dollar is expected to witness more demand as investors have underpinned safe-haven assets amid the risk-aversion theme. Meanwhile, S&P500 witnessed a sell-off on Tuesday as a higher interest rate peak by the Federal Reserve (Fed) could trigger a recession in the United States.

The returns on US Treasury bonds failed to keep the upside momentum and dropped as expectations of a decline in interest rate hike pace by the Fed are extremely solid. The 10-year US Treasury yields have declined to near 3.53%.

Surprise rise in the US service sector and November’s employment report have cleared that inflation is here to stay for a while as demand has not slowed down yet. The road to 2% inflation is far from over, therefore, the Fed is bound to hike the interest rate further but with less velocity this time.

On the Eurozone front, investors are keeping an eye on the speech from European Central Bank (ECB) President Christine Lagarde, which is scheduled for Thursday. The speech from ECB President will provide cues about the likely monetary policy action in December. Meanwhile, a surprise rise in Factory Orders in Germany has indicated that demand is returning despite accelerating interest rates.

- USD/CHF consolidates around 0.9380-9450s amidst the lack of a catalyst.

- USD/CHF Price Analysis: Break above the 200-EMA could pave the way towards 0.9550.

The USD/CHF hit a fresh three-day high at 0.9455 but shifted downwards as US Treasury bond yields weakened the US Dollar (USD) against the Swiss Franc (CHF). At the time of writing, the USD/CHF is trading at 0.9419., below its opening price by a minuscule 0.07%.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF is downward biased, though it’s forming a falling wedge that suggests prices would break to the upside. Of note, the USD/CHF registered a new 8-month low of around 0.9326 last Friday, and so far, the USD/CHF has remained subdued around 0.9320-0.9455.

Oscillators like the Relative Strength Index (RSI) is almost flat at bearish territory, while the Rate of Change (RoC) suggests that selling pressure is fading. If the USD/CHF breaks above 0.9455, that could open the door toward 0.9500.

Short term, the USD/CHF 1-hour chart depicts the pair as neutral-upward biased. The EMAs are almost flat, around the spot price, though the 200-EMA at 0.9436 has been acting as solid resistance as prices tumbled around that area. Break above the latter could open the door towards the 0.9500 figure, followed by the November 30 daily high at 0.9547. As an alternate scenario, the USD/CHF first support would be the intersection of the 20 and 50-EMAs around 0.9411-13, followed by the 100- EMA at 0.9405 and the 0.9400 mark.

- AUD/USD dropped to test a key technical area on the daily chart.

- AUD/USD bears eye a test below the trendline and a move below 0.6640/50 could be significant.

AUD/USD was under pressure and down by some 0.14% into the close on Wall Street following the prior day's Reserve Bank of Australia, RBA, meeting within a risk-off environment in financial markets.

The RBA delivered a 25bps hike as expected but stopped short of signalling a pause as some forecasters were anticipating. The RBA said it was not on a preset course to tighten policy but said inflation was still high. The Bank reaffirmed its tightening bias, noting a further increase in inflation and wages. Meanwhile, today’s Gross Domestic Product (GDP) data for Australia is expected to show growth of 0.7% QoQ with annual GDP growth expected to increase to 6.3%.

As for the greenback, it was nearly unchanged on Tuesday after strong gains the day before, in a risk-off environment. Data this week showed that the Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates.

This data combined with Friday's surprisingly strong Nonfarm Payrolls and wage growth data in November as well as news that consumer spending had accelerated in October raised optimism that a recession could be avoided in 2023. Consequently, traders currently expect a half-point hike from the Fed next week and they expect a terminal rate of just above 5% in May.

AUD/USD technical analysis

As per the prior analysis, AUD/USD Price Analysis: Eyes are on critical daily dynamic support, where a 50% mean reversion area was eyed in the lower quarter of the 0.6700s, bears have moved in as follows:

Prior analysis:

AUD/USD update

Should the supporting trendline be broken now, a move below 0.6640/50 could be a significant bearish development ahead of the critical remaining calendar events for the year.

What you need to take care of on Wednesday, December 7:

Financial markets remained risk-averse, helping the US Dollar to advance on Tuesday. The American currency shed some ground throughout the first half of the day, but gathered momentum after Wall Street’s opening as US indexes fell for a fourth consecutive session.

The American Dollar finished the day at fresh weekly highs, particularly against its high-yielding rivals. The EUR/USD pair hovers around 1.460, while GBP/USD trades in the 1.2140 price zone.

Financial markets reflect increased uncertainty about the US Federal Reserve’s future actions. The central bank has hinted at an easing pace of quantitative tightening starting as soon as this month, despite economic resilience and signs of easing inflation. Both, policymakers and investors fear the aggressive pace of tightening will result in a long-lasting recession.

Meanwhile, European Central Bank Governing Council member Constantinos Herodotou said the central bank would hike rates again but warned they are near the neutral rate

Tensions between Europe and Russia escalate, as the latter is considering reducing oil production while setting a floor for oil sales in response to the G-7 decision to cap prices.

Crude oil prices were sharply down, with the barrel of WTI currently changing hands at $74 per barrel. The USD/CAD pair surged towards the 1.3660 price zone, where it currently trades.

The AUD/USD pair ended the day around 0.6680, following the lead of stocks and despite a hawkish RBA. Safe-haven CHF and JPY trimmed early gains vs the dollar and the pair ended the day pretty much unchanged.

Spot gold attempted to recover ground but closed Tuesday unchanged at around $1,770 a troy ounce.

Australia will publish its Q3 Gross Domestic Product early on Wednesday, and the economy is expected to have grown at an annualized pace of 6.3%.

Like this article? Help us with some feedback by answering this survey:

- NZD/USD bulls could be throwing in the towel here.

- Bears eye a move to test the trendline support.

NZD/USD is trading around flat on the day, sitting near 0.6320 having stuck to a tight range of 0.6303 and 0.6354. There has been little in the way of a catalyst this week so far, instead the bird has been inching away from the recent highs in what has been a fragile risk environment for financial markets so far, weighing on the high beta currencies such as NZD.

Friday's Nonfarm Payrolls data combined with the start of the week's US Services PMIs have surfaced the prospects of a hawkish Federal Reserve interest rate decision at next week's meeting. In turn, the stock markets and commodity complex have been pressured at the start of the week.

Analysts at ANZ Bank think that the meeting will be tricky to interpret. ''A smaller hike is all but assured, leaving the focus on the terminal rate, which will have to strike the right balance: high enough to credibly bring down inflation, but not so high that it stokes recession fears. We still think it speaks mostly of US dollar volatility into year-end, with a good chance of a correction higher, but let’s see,'' the analysts explained.

''Next week’s HYEFU is also important for the NZD. It’s unlikely to be bond friendly, but potentially higher bond yields and the need for offshore buyers may translate to NZD buy flows,'' the analysts added.

NZD/USD technical analysis

If the bulls commit at this juncture, then there could be the case being made for another rejection at resistance as the bull cycle begins to decelerate and teeter out in the 0.6400s.

However, should there be a significant correction into liquidity near 0.6250, then if the bulls were to re-engage, then there could be a build-up for momentum to run the bird through resistance in the coming days/weeks.

- Gold price registers a minimal advance, even though the US Dollar is rising.

- Solid economic data from the United States would keep the Federal Reserve pressured.

- Gold Price Forecast: A break below $1760 will exacerbate a fall to $1725; otherwise, a rally to $1786 is on the cards.

Gold price turns positive after diving to new weekly lows around $1766.90 and grinds higher amidst a buoyant US Dollar (USD), even though US Treasury yields are weakening, amidst a risk-off impulse spurred by increasing recessionary jitters. That said, the XAU/USD is trading at $1769.48, almost flat, at the time of typing.

US data put the Federal Reserve in the spotlight

Since last Friday, US economic data revealed had increased likelihood of additional Federal Reserve tightening. The US Nonfarm Payrolls report showed that the economy added 263K new jobs, above estimates, and depicted that workers are looking for higher wages. Why? Because the Average Hourly Earnings on a YoY comparison jumped from 4.9% to 5.1%.

Monday’s data further cemented the case for a hotter-than-expected US economy. Even though last week’s ISM Manufacturing PMI dropped to contractionary territory, the services component rose 56.6, above 53.3 forecasts. According to Bloomberg, “The service sector expanded faster in November, with the holiday season bolstering business activity. The price subindex confirmed the inflationary impulse in services is still strong despite more widespread disinflation in goods sectors.”

Earlier, the US Department of Commerce (DoC) revealed that Trade Balance in the United States widened to $-78.2B compared to September’s $-74.1B, beneath estimates of $-80B. Although the trade deficit expanded, data was mainly ignored as investors assessed the US economy.

Given the backdrop mentioned above, the next week’s Federal Reserve Open Market Committee (FOMC) meeting would be crucial, albeit the Federal Reserve Chair Jerome Powell gave the green light on 50 bps rate hikes. However, with US data looming, like the Producer Price Index, the University of Michigan (UoM), and the following week’s Consumer Price Index (CPI), it would shed some cues about inflation elevating or easing.

Gold Price Forecast: XAU/USD Technical Outlook

From a technical perspective, Gold remains upward biased. However, after breaching the $1800 figure last Friday, the yellow metal failed to capitalize on broad US Dollar weakness, as XAU/USD tumbled below the $1800 mark. Gold buyers’ lack of strength is well portrayed by the Relative Strength Index (RSI), registering a series of lower peaks, while price action is aimed upwards. Also, the Rate of Change (RoC) confirms buying momentum is fading.

If XAU/USD drops below the 200-day Exponential Moving Average (EMA) at $1759.79, that could pave the way for further losses. Otherwise, if XAU/USD buyers reclaim the November 15 daily high of $1786.53, that could exacerbate a re-test of the $1800 psychological level.

- WTI bulls could be on the verge of moving on following as strong down move.

- US recession concerns are playing into financial markets creating a risk-off mood.

West Texas Intermediate crude is down over 4% on the day so far, falling back into the bearish trend once again and on the front side of what was momentary a counter-trendline. At the time of writing, WTI is trading at $73.80 near the lows of the day having fallen from $77.86.

Recession worries have reared their ugly head again as traders about a risk-off mood following the start of the week's US data that fanned the flames of the Federal Reserve's hawkish narrative in financial markets. On Monday, the Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates. The data beat forecasts that the Non-manufacturing PMI would fall to 53.1.

This has been raising concern the Federal Open Market Committee will potentially stick to the 75 basis point hiking tact when its two-day meeting wraps up on Dec.14, over-shadowing developments that could tighten the market. Concerns about a steep increase in borrowing costs have boosted the US Dollar this year, pressing negatively on US equities and bond markets, with the S&P 500 down 17.5%.

Meanwhile, the Energy Information Administration lifted its forecast for 2023 global oil inventories in its December Short-Term Energy Outlook (STEO), raising its outlook by 0.2-million barrels after expecting a drop of 0.3-million barrels in its November release. The EIA also trimmed its forecast for the average price of Brent crude oil next year to US$92.00, down from its November estimate of US$95.00 on the expectation of a recession in the US.

Meanwhile, the agency took into account the European Union's ban on seaborne Russian oil imports and the US$60 price cap on Russian crude that came into effect at the start of this week following a decision made on Friday. The cap is expected to tighten supply as Russia looks for alternative buyers.

WTI technical analysis

A prior analysis, that favoured the upside of the market so long as the price remained on the back side of the counter trendline, acknowledged a break below $76.40 that would be putting on some serious heat on the committed bulls as per the following daily and 4-hour charts:

Meanwhile, there are prospects for a correction at this juncture:

- Silver price stumbles beneath $22.14 amidst overall USD strength.

- Silver Price Analysis: Break below $22.00 would exacerbate a test of a symmetrical triangle break around $21.80.

Silver price dropped from daily highs hit at 22.59, testing the current week's lows of 22.14, due to speculations that the Federal Reserve (Fed) would continue to tighten monetary conditions, even though recessionary risks are skewed to the upside. Therefore, the US Dolla (USD) got bolstered by safe-haven flows, to the detriment of precious metals. At the time of writing, the XAG/USD is trading at 22.19.

Silver Price Analysis: XAG/USD Technical Outlook

Since tumbling more than 3.80% on Monday, the XAGU/USD remains downward pressured, registering fresh two-day lows beneath $22.17, which would exacerbate a fall towards the top trendline of a symmetrical triangle broken last Thursday. Of note, the Relative Strength Index (RSI) and the Rate of Change (RoC), depict the white metal buying pressure fading, and unless buyers step in around $22.00, further downward action is warranted.

Therefore, the XAG/USD first support would be the $22.00 figure. Break below will expose the 20-day Exponential Moving Average (EMA) at 22.21.53, followed by the trend-setter 200*day EMA at $21.03. On the flip side, the XAG/USD first resistance would be the $23.00 psychological level. A breach of the latter will expose the December 5 swing high at $23.51, followed by the $24.00 mark.

Silver Key Technical Levels

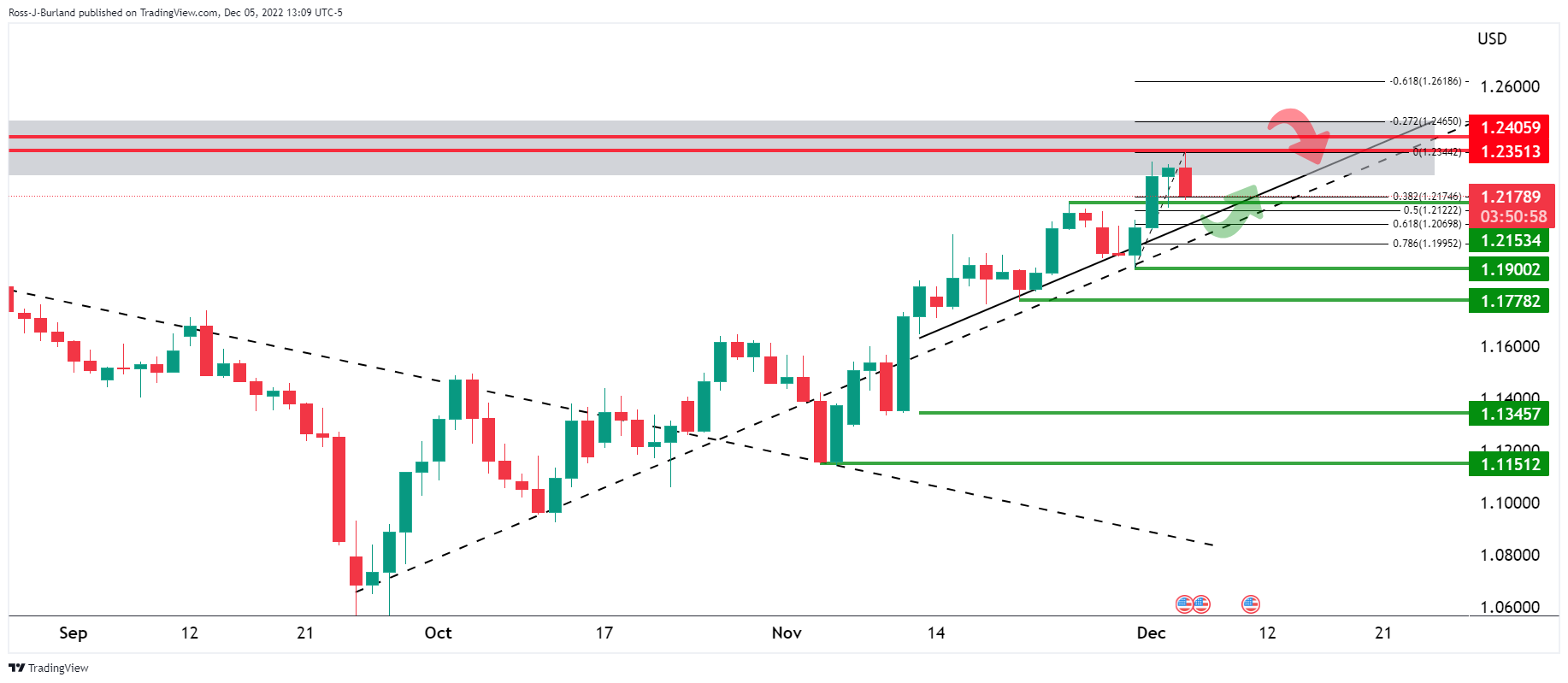

- In the 4-hour chart, we can see that the price is forming a head & shoulders pattern.

- A break of structure in the 1.2150s is required for a move into testing the trendline support and commitments at 1.2100.

- If the bulls were to commit, then the case for a higher bull cycle high would be on the cards with 1.2450 eyed.

As per the prior analysis, GBP/USD bears step up the pace, eye break of 1.2150s, the British Pound remains within the bullish trend but is testing the commitments below 1.2200 and at 1.2150. The low of the week so far has been 1.2152 and the following illustrates the prospects of a deeper correction should the bears stay the course.

GBP/USD prior analysis

It was stated that GBP/USD has been potentially starting to move into a phase of distribution below the 1.2350, 1.2400 areas on the daily chart as illustrated above.

However, the British Pound's bullish trend would still be intact while structures 1.2150 and 1.1900 are yet to be broken:

A move below 1.2150 could, however, result in a deeper correction through the Fibonacci scale with eyes on a 50% mean reversion at 1.2120 and then a 61.8% ratio confluence with the upper quarter of the 1.20 area near 1.2070.

GBP/USD update, H4 chart

In the 4-hour chart, we can see that the price is forming a head & shoulders pattern with lower highs in the right-hand shoulder. This gives rise to the prospects of a break of structure in the 1.2150s for a move into testing the trendline support and commitments at 1.21 the figure for other sessions ahead.

If the bulls were to commit around the dynamic support of the trendline, then the case for a higher bull cycle high would be on the cards with 1.2450 eyed.

- The US Dollar fails to capitalize on a risk-off mood, blamed on falling US bond yields.

- Recently released US economic data would keep the Federal Reserve tightening monetary policy.

- USD/JPY Price Analysis: Upward biased, but might consolidate around 135.00/136.00.

The USD/JPY remains pressured in the North American session, spurred by dented risk appetite produced by the last three days’ economic data from the United States (US) suggesting further tightening needs by the Federal Reserve (Fed). Nonetheless, the USD/JPY edges lower, trading at 136.61, partly due to falling US Treasury yields.

Before Wall Street opened, the US Department of Commerce (DoC) revealed that Trade Balance in the United States widened to $-78.2B compared to September’s $-74.1B, beneath estimates of $-80B. Delving into the data, the Exports rose by $256.6B below September’s data, while Imports jumped $334.8B above the previous month’s $332.6B.

Meanwhile, data revealed since last Friday portrays that the labor market in the US remains tight, while Average Hourly Earnings jimping 5.1% YoY added to inflationary pressures. Aside from employment data, the US Institute for Supply Management (ISM) revealed that the Service PMI Index rose 56.6, better than the 53.3 expected.

Elsewhere, investors’ sentiment has dampened since the beginning of the week due to their assessment of the Federal Reserve’s (Fed) reaction to data. Wednesday’s speech by the Federal Reserve Chair Jerome Powell, pivoting towards less aggressive rate hikes in the 50 bps size, spurred a rally in risk-perceived assets. However, last week’s data put Powell at a crossroads, with the Producer Price Index (PPI) to be released on Thursday, followed by the University of Michigan (UoM) Consumer Sentiment and next week’s Consumer Price Index (CPI) before December’s meeting. Any hints that inflation remains high could put an aggressive 75 bps hike back into play.

Hence, the USD/JPY failed to sustain the rally on Tuesday due to the US bond yields falling. The US 10-year Treasury yield creeps down two and a half bps, at 3.550%.

USD/JPY Price Analysis: Technical outlook

From the daily chart perspective, the USD/JPY is neutral-upward biased. Since last Friday’s breach of the 200-day Exponential Moving Average (EMA), the major recovered some ground, though it’s testing the bottom trendline of a previous upslope support trendline at around 137.40s. The USD/JPY key support levels lie at 136.00, followed by the December 2 daily high of 135.98, followed by the 200-day EMA at 135.01. On the other hand, the USD/JPY first resistance would be the psychological 137.00 mark. Break above will expose the upslope trendline drawn since August 2022 at around 137.40, followed by the December 1 daily high of 138.12.

Data released on Tuesday showed the US trade deficit widened in October. Analysts at Wells Fargo point out exports were held back by a decline in natural gas specifically, but there were signs of slower growth beginning to bite, which they expect to remain a headwind for exports into next year. They warn net exports now look to be a considerable drag on fourth-quarter growth.

Key Quotes:

“The U.S. trade deficit widened for the second straight month to -$78.2 billion in October as import growth (+$2.2 billion) outpaced exports (-$1.9 billion). Despite the sharp widening the past two months, the deficit still sits smaller in October than the average that prevailed over the past 12 months.”

“The October data thus position net exports to be a considerable drag on fourth quarter growth. Exports will remain under pressure as there is a clear sign of economic deceleration abroad and a stronger U.S. dollar is making U.S. goods more expensive and less competitive in global markets. At the same time, imports should remain supported into next year amid further normalization in supply chains and continued domestic demand for end product.”

“These dynamics will likely cause net exports to remain a drag on headline growth for a few quarters. But as the economy falls into a mild recession by the second half of next year, net exports are set to boost growth as demand for imports dries up.”

- Bank of Canada to announce monetary policy on Wednesday.

- The Loonie is the worst G10 performer on Tuesday.

- USD/CAD up for the fourth day in a row, heads for highest close in a month.

The USD/CAD rose further during the American session amid risk aversion and a decline in crude oil prices, ahead of the Bank of Canada decision. The pair climbed to 1.3670, hitting the highest level since November 4 and then pulled back toward 1.3620.

A weak Loonie boosts USD/CAD

As of writing, USD/CAD is hovering around 1.3645, about to post the fourth consecutive gain and the highest daily close in a month. The Canadian dollar is on Tuesday the worst performer among the G10 space.

The decline in crude oil prices (WTI down 1.80%, at fresh weekly lows) and in equity price weighs on the Canadian Dollar. The Dow Jones is falling by 0.53% and the Nasdaq drops by 1.58%. Crude and equity indexes are adding to yesterday’s losses.

On Wednesday, the Bank of Canada will announce its decision on monetary policy. A 50 basis points rate hike to 4.25% is expected. Some analysts see a smaller rate hike. Volatility around the decision is expected to increase significantly on CAD’s crosses.

“The BOC is unlikely to offer much to move the needle for CAD. CAD underperformance on crosses has occurred quickly and looks tactically stretched. A case for a reversal can be made, but we will look to fade that strategically given idiosyncratic drags”, said analysts at TD Securities.

Technical levels

- Trade Balance in the United States shows the deficit widening, a headwind for the US Dollar.

- Factory Orders in Germany kept the Euro buoyant amid a gloomy outlook.

- Federal Reserve and European Central Bank December meetings to keep the pair in familiar ranges.

- EUR/USD Price Analysis: Upward biased, but a pullback towards 1.0400 is on the cards.

The Euro (EUR) is extending some of its Monday losses against the US Dollar (USD), stuck below the 1.0500 figure amidst a risk-off impulse, as data released in the United States (US) did not bolster the USD. Factory Orders in Germany surprisingly exceeded estimates, underpinning the Euro. Therefore, the EUR/USD is trading at 1.0487 after hitting a daily low of 1.0475.

US Trade Balance deficit widened and could weigh on Q4 GDP

Wall Street is set to open lower, portraying a dismal mood. The Department of Commerce (DoC) in the United States revealed the October Trade Balance, which showed the deficit widening for two-consecutive months, as figures came at $-78.2B exceeding estimates of $-80B, though trailed by September’s $-74.1B. Delving into the data, the Exports rose by $256.6B below September’s data, while Imports jumped $334.8B above the previous month’s $332.6B.

Germany Factory Orders boosted the Euro

In the Euro area, Germany revealed its October Factory Orders, which rose above estimates of 0.1% and smashed September’s figures. Worth noting that orders grew for the first time since July. Compared to October 2021, orders fell at an adjusted 3.2%. The report added that companies still have difficulties fulfilling their orders as supply chains are interrupted, blamed on the war in Ukraine and distortions spurred by the Covid-19 crisis.

US jobs data and robust ISM Services PMI keep the USD buoyant

Elsewhere, the EUR/USD has not been able to rally back toward multi-month highs at 1.0594 due to last week’s solid US Nonfarm Payrolls (NFP) data for November, with companies hiring more than 263K jobs, exceeding 200K estimates. Also, Average Hourly Earnings jumped to 5.1% YoY, and Monday’s release of an upbeat US Institute for Supply Management (ISM) Non-Manufacturing PMI at 56.5 vs. 53.3 estimated will keep the US Dollar bid.

Meetings of the Federal Reserve and the European Central Bank loom

Given the backdrop, investors are assessing that the US Federal Reserve (Fed) would keep tightening monetary conditions. Money market futures odds for a 50 bps increase in the Federal Funds rate (FFR) at the December meeting are at 79.4%, while odds for a 75 bps are at 20.6%. Regarding the European Central Bank (ECB), some policymakers like Villeroy, Makhlouf, and Herodotou, expressed their support for a 50 bps rate hike, contrary to Knots and Holtzman, which backed an aggressive 75 bps.

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart suggests the pair remains upward biased but losing some momentum, as Monday’s candlestick printed an inverted hammer, which usually appears at the end of an uptrend/downtrend. Since Monday, the Relative Strength Index (RSI) has been aiming downward, while the Rate of Change (RoC) proves sellers are losing momentum. Therefore, the EUR/USD might pull back before resuming its uptrend.

The EUR/USD first support would be the 1.0480 December 5 low, followed by the 1.0400 figure and the 200-day Exponential Moving Average (EMA) at 1.0388.

Analysts at TD Securities noted that they expect the Bank of Canada (BoC) to raise the policy rate by 25 basis points in December but noted that this was admittedly a "close call."

Terminal rate at 4.25%

"We see the BoC's terminal rate at 4.25%, and as such expect the BoC to signal that it expects to lift rates further."

"The BOC is unlikely to offer much to move the needle for CAD. CAD underperformance on crosses has occurred quickly and looks tactically stretched. A case for a reversal can be made, but we will look to fade that strategically given idiosyncratic drags."

- AUD/USD trims gains as the US dollar turns positive on risk aversion.

- RBA raises rates by 25 bps as expected.

- Australia to report Q3 GDP growth on Wednesday.

The AUD/USD is rising only modestly on Tuesday, recovering a small portion of Monday’s losses. The recovery from under 0.6700 found resistance below 0.6750. The US Dollar is posting mixed results as Wall Street drops again.

After RBA, attention turns to data

On Tuesday, the Reserve Bank of Australia (RBA) raised the key interest rate by 25 basis points as expected. The central bank said it expected further increases. “Size and timing of future increases determined by data and outlook for inflation and labour market”, the RBA said in the monetary policy statement. The Aussie gained ground modestly after the decision.

Growth data is due in Australia on Wednesday, with Q3 figures. Market consensus is for a GDP increase of 0.7% with the annual rate rising from 3.6% to 6.3%.

The AUD/USD failed to benefit and remains pressured amid global risk aversion on Tuesday. The Dow Jones is falling by 0.43%, adding to Monday’s losses. Crude oil prices are down 0.40%, approaching 2022 lows and gold is erasing daily gains.

“We think the reopening in China and the uptick in Australia's commodity export prices could provide AUD some relative support against other cyclical currencies, even if we expect AUD/USD to decline modestly amid tightening financial conditions and broad USD strength”, said Danske Bank analysts.

The AUD/USD is approaching 0.6700 again. A consolidation below would further weaken the short-term outlook, suggesting a test of the next support seen around 0.6660/65. On the upside, the immediate resistance is located at 0.6745/50. A recovery above 0.6775 would strengthen the Aussie.

Technical levels

- Gold price catches fresh bids amid the emergence of some selling around US Dollar.

- Sliding US Treasury bond yields weighs on USD and benefits the non-yielding metal.

- The upside seems capped amid uncertainty over future rate hikes by Federal Reserve.

Gold price regains positive traction on Tuesday and reverses a part of the previous day's retracement slide from a five-month peak. The steady intraday ascent extends through the early North American session and lifts the XAU/USD to a fresh daily high, around the $1,780-$1,781 region in the last hour.

Weaker US Dollar lends support to Gold price

The US Dollar struggles to capitalize on the overnight solid rebound from its lowest level since late June and attracts some sellers near a technically significant 200-day Simple Moving Average (SMA). As investors seek clarity on the Federal Reserve's rate-hike path, a fresh leg down in the US Treasury bond yields weighs on the Greenback. This, in turn, is seen as a key factor driving flows towards the Dollar-denominated Gold price.

Against the backdrop of Friday's upbeat monthly jobs report from the United States, the better-than-expected ISM Services PMI released on Monday pointed to a resilient economy. The incoming positive US macro data raises fears that the Federal Reserve might lift rates more than projected. Investors, however, seem convinced that the US central bank will slow the pace of its policy-tightening cycle and anticipate a 50 bps rate hike in December.

Focus remains on next week’s key data/event risks

Hence, the market focus will remain glued to the Federal Open Market Committee (FOMC) policy meeting on December 13-14. Heading into the key event risk, investors will confront the release of the latest US consumer inflation figures for November, which might influence the Federal Reserve's near-term policy outlook. This, in turn, will play a key role in driving the non-yielding Gold price and help determine the next leg of a directional move.

Recession fears further underpin safe-haven XAU/USD

In the meantime, growing worries about a deeper global economic downturn overshadow the optimism led by the easing of COVID-19 restrictions in China. This is evident from the prevalent cautious mood around the equity markets and should continue to lend some support to the safe haven Gold price. Traders, however, might refrain from placing aggressive bets and prefer to move to the sidelines in the absence of any major market-moving US macro data.

Gold price technical outlook

From a technical perspective, repeated failures to find acceptance or build on the momentum beyond the very important 200-day SMA favours the XAU/USD bears. That said, the emergence of fresh buying on Tuesday warrants some caution before confirming a near-term top for Gold price and positioning for a deeper corrective pullback.

Meanwhile, a subsequent move back above the $1,782-$1,783 horizontal resistance could lift Gold price back to the 200 DMA, closer to the $1,800 mark. The next relevant hurdle is pegged near the $1,810 area, or the multi-month top touched on Monday, above which Gold price seems poised to appreciate further. The momentum could then accelerate towards the $1,830 intermediate hurdle en route to the $1,843-$1,845 supply zone.

On the flip side, the overnight swing low, around the $1,769-$1,768 region, now becomes immediate support to defend ahead of the $1,761-$1,760 horizontal resistance breakpoint. A convincing break below will negate any near-term positive outlook and shift the bias in favour of bearish traders. Gold price might then turn vulnerable to accelerate the fall further towards the $1,738-$1,737 area before dropping to the $1,725 level.

Gold price key levels to watch

- US October Goods and Services Trade Balance came in at -$78.2 billion in October.

- US Dollar Index stays in negative territory at around 105.00.

The United States (US) international goods and services deficit rose by $4 billion to $78.2 billion in October, the data published jointly by the US Census Bureau and the US Bureau of Economic Analysis revealed on Tuesday. This reading came in slightly lower than the market expectation for a deficit of $79.1 billion.

"October exports were $256.6 billion, $1.9 billion less than September exports," the publication further read. "October imports were $334.8 billion, $2.2 billion more than September imports."

Market reaction

This report doesn't seem to be having a noticeable impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was down 0.24% on the day at 105.05.

Economists at Brown Brothers Harriman & Co. (BBH) suggest that the recent dovish turn by the Federal Reserve might continue to weigh on the US Dollar, though the fundamental backdrop favours bulls.

Key Quotes:

“DXY is trading near 105.15 but has held on to the bulk of yesterday’s gains. While we still believe the fundamental outlook favors the dollar, we acknowledge that near-term dollar weakness is likely to continue after Powell’s unexpected dovish turn. If the U.S. data continue to come in firm like ISM services, that dovish Fed narrative could start to crack.”

“After Powell’s speech last week, the narrative swung towards dovish. After AHE and services PMI, that narrative is swinging back to hawkish. We imagine there will be some whispers about 75 bp from the Fed next week but we think it will depend in large part on the CPI data out the day before the decision. “

“That said, we think it was a mistake for Powell to take 75 bp off the table last week. WIRP still suggests that a 50 bp hike on December 14 is fully priced in, with only 5% odds of a larger 75 bp move. The swaps market is pricing in a peak policy rate of 5.0% but odds of a higher 5.25% peak have crept back in.”

“Both AHE and core PCE have flat-lined near 5% for most of this year despite falling CPI and PPI readings. We believe that getting core PCE back down to the Fed’s target of 2% will be much more difficult than markets are pricing in. We don't think two more 50 bp hikes will do it, not when the labor market remains so firm and consumption is holding up.”

- EUR/USD regains positive traction amid the emergence of fresh USD selling on Tuesday.

- Expectations for a 50 bps Fed rate hike in December act as a headwind for the greenback.

- The upbeat German Factory Orders data underpin the Euro and offer additional support.

The EUR/USD pair attracts fresh buying on Tuesday and for now, seems to have stalled the previous day's retracement slide from the vicinity of the 1.0600 mark, or its highest level since late June. The pair extends its steady ascent heading into the North American session and hits a fresh daily high, around the 1.0525-1.0530 area in the last hour.

The US Dollar recovery from over a five-month low touched on Monday runs out of steam ahead of the very important 200-day SMA, which, in turn, is seen offering some support to the EUR/USD pair. Rising bets for a relatively smaller 50 bps rate hike in December, to a larger extent, overshadow speculations that the Fed may raise interest rates more than projected. This keeps the US Treasury bond yields depressed, which, along with signs of stability in the equity markets, undermine the safe-haven greenback.

The shared currency, on the other hand, draws additional support from better-than-expected German data, showing that Factory Orders rose 0.8% in October against the 0.2% fall estimated. That said, worries about a deeper economic downturn and diminishing odds for a more aggressive policy tightening by the European Central Bank (ECB) could act as a headwind for the EUR/USD pair. In the absence of any major market-moving economic data, this warrants some caution before placing aggressive bullish bets.

The emergence of some dip-buying on Tuesday, meanwhile, adds credence to the recent breakout through a technically significant 200-day SMA. This, in turn, supports prospects for the resumption of the recent positive trend, which should allow the EUR/USD pair to make a fresh attempt to conquer the 1.0600 mark. Investors, however, might prefer to move to the sidelines ahead of next week's key data/event risks - the US consumer inflation figures, the FOMC decision and the ECB monetary policy meeting.

Technical levels to watch

Dr. Ralph Solveen, Senior Economist at Commerzbank, offer a brief analysis of the upbeat German data releases earlier this Tuesday, which showed that Factory Orders increased by 0.8% in October.

Key Quotes:

“The trend in orders continues to point downwards despite the increase in October. This is also supported by the results of the Ifo survey, in which companies revised their assessment of the demand trend downwards until recently. Obviously, the noticeable interest rate increases by many central banks are increasingly dampening demand for German industrial products.”

“As many companies continue to have a very high order backlog, weaker demand is unlikely to impact production as strongly this time as in previous cycles. However, the trend is still likely to be downward in the coming months, partly because production in the energy-intensive sectors is likely to be cut further due to the sharp rise in energy prices. As a result, manufacturing is likely to contribute to the German economy contracting in the first half of the coming year, even if the risk of a slump triggered by gas rationing has been noticeably reduced.”

Analysts at TD Securities (TDS) offer a brief preview of the Australian GDP report, due on Wednesday, and forecast a 0.7% growth during the third quarter.

Key Quotes:

“TD forecasts Q3 GDP to have grown 0.7% q/q and 6.3% y/y. In terms of the breakdown, we are looking at domestic demand to have ticked up 0.9% q/q, for net exports to subtract 0.5ppts and for inventories to add 0.3ppts. We will watch the savings rate as a guide to see how much more buffer households have to spur future consumption with the long term average hovering around 6% vs 8.7% as of June.”

- GBP/USD attracts some buying near the 200-day SMA, though lacks follow-through.

- The overnight failure near the trend-channel resistance warrants caution for bulls.

- A sustained break below the 1.2100 mark should pave the way for deeper losses.

The GBP/USD pair finds some support near the very important 200-day SMA and stalls the previous day's retracement slide from its highest level since June 17. Spot prices, however, struggle to gain any meaningful traction and seesaw between tepid gains/minor losses around the 1.2200 mark through the mid-European session.

The US Dollar struggles to capitalize on the overnight solid recovery move from over a five-month low and turns out to be a key factor lending support to the GBP/USD pair. That said, expectations that the Fed may raise interest rates more than projected act as a tailwind for the buck. This, along with a bleak outlook for the UK economy, keeps a lid on any meaningful upside for spot prices.

From a technical perspective, the overnight failure near a resistance marked by the top end of over a two-month-old ascending channel could be seen as the first sign of bullish exhaustion. The lack of follow-through selling, however, warrants some caution before confirming that the GBP/USD pair might have formed a near-term top and positioning for any meaningful corrective downfall.

In the meantime, the daily swing low, around the 1.2160-1.2155 area, could act as immediate support ahead of the 200 DMA, currently around the 1.2135 region. This is followed by the 1.2100 mark, which if broken decisively will make the GBP/USD pair vulnerable to weaken further to the 1.2000 psychological mark. The downward trajectory could get extended to the 1.1935-1.1930 horizontal support.

On the flip side, any meaningful intraday positive move might confront hurdle near the 1.2250-1.2255 zone, above which the GBP/USD pair could reclaim the 1.2300 mark. Some follow-through buying should allow bulls to aim back to the multi-month peak, around the 1.2345 area touched on Monday. Spot prices could eventually climb to the trend-channel barrier, currently around the 1.2400 mark.

GBP/USD daily chart

Key levels to watch

Analysts at Westpac provide their first impressions of New Zealand’s construction sector activity report for the third quarter.

Key quotes

“Construction activity has continued to charge higher, with the amount of building work put in place rising by 3.8% in the September quarter.”

“Underlying September’s rise was a 3.1% lift in residential work and a 4.9% increase in non-residential construction.”

“The result was above our forecast for a 1.1% rise, and was also stronger than the average analyst forecast for only 0.8% growth.”

- AUD/USD regains some positive traction and draws support from a combination of factors.

- The easing of COVID-19 curbs in China and the hawkish RBA lifts the risk-sensitive Aussie.

- Bets that the Fed will continue to hike interest rates underpin the USD and cap the upside.

The AUD/USD pair attracts some buying near the 100-day SMA support on Tuesday and stalls the overnight sharp pullback from its highest level since September 13. The pair maintains its bid tone through the first half of the European session and is currently placed around the 0.6715-0.6720 region, just a few pips below the daily peak.

The latest optimism over the easing of strict COVID-19 curbs in China leads to a modest recovery in the risk sentiment and benefits the risk-sensitive Aussie. Furthermore, the Reserve Bank of Australia (RBA) decided to hike the Official Cash Rate (OCR) by 25 bps and indicated further rate increases over the period ahead. The combination of aforementioned factors offers some support to the AUD/USD pair, though some follow-through US Dollar buying keeps a lid on any further gains.

Against the backdrop of Friday's upbeat US monthly jobs report, the stronger US ISM Services PMI print on Monday suggested that the economy remained resilient despite rising borrowing costs. This, in turn, fuels speculations that the Fed may lift interest rates more than projected and is seen acting as a tailwind for the greenback. That said, firming expectations for a relatively smaller 50 bps Fed rate hike move in December seem to cap the buck, at least for the time being.

Nevertheless, the mixed fundamental backdrop warrants some caution for aggressive traders and before positioning for a firm intraday direction amid a relatively thin US economic docket, featuring the release of Trade Balance data That said, the broader market risk sentiment might still influence the safe-haven USD and produce short-term trading opportunities around the AUD/USD pair.

Technical levels to watch

Constantinos Herodotou, Governor of the Central Bank of Cyprus and member of the European Central Bank (ECB) Governing Council, touched upon the topics of inflation and interest rates in his speech on Tuesday.

Key quotes

“There will be another hike in rates, but we are very near neutral rate.”

“Don't see a "hard landing" in Eurozone economy.”

“No material de-anchoring of inflation expectations. “

Market reaction

These above comments have little to no impact on the Euro, as EUR/USD remains stuck in a narrow range near 1.0500 so far this Tuesday.

Russian Deputy Prime Minister Alexander Novak said on Tuesday, “Russia might reduce oil production, but not by much.”

Additional quotes

“Oil production in Russia in December 2022 will remain at the November level.”

“Introduction of the oil price cap will affect companies, but oil will be in demand on the market.”

“Russia is changing logistics chains for oil, does not see this as a tragedy.”

“Russian mechanism of banning sales of oil subject to the Western price cap should start working before the end of the year.”

Market reaction

WTI was last seen trading flat at $77.50, consolidating the rebound from near $76.75 levels.

Analysts at TD Securities noted that the Reserve Bank of Australia hiked its policy rate by 25 basis points as expected but refrained from signalling a pause in rate increases as anticipated by some forecasts.

RBA views the risks to the upside

"Today's statement offered no suggestion the Bank was considering a pause just yet. It reiterated its forward guidance as it has since the October meeting that "The Board expects to increase interest rates further over the period ahead...."."

"The RBA's decision to retain this segment of its forward guidance was the right course of action. Pre-empting the Q4'22 inflation print and signalling a potential pause in today's Statement would not have stacked up as prudent 'risk management' in our view."

"In today's Statement the Bank removed reference to its Central CPI forecast for 2023. It also removed reference to its central unemployment rate forecast over coming months. In contrast, it reiterated its GDP forecasts for 2023 and 2024."

"The way we are reading these omissions is that a clear source of uncertainty for the RBA comes from the strong labour market and the upside risk to inflation it poses to its 2023 forecasts. For sometime the RBA has telegraphed that Australian wages growth "....remains lower than in many other advanced economies". However this was absent from today's Statement and suggests the RBA views the risks to the upside."

- Gold price licks its wounds around below $1,800 as the US Dollar holds firm.

- Robust US economic data revive hawkish Federal Reserve tightening bets.

- Downside appears more compelling for Gold price after rejection above $1,800.

Gold price is consolidating a two-day downtrend below the $1,800 threshold, as bears gather strength before initiating a fresh leg lower. A quiet calendar is also contributing to the listless performance of Gold price. Meanwhile, investors turn cautious and help underpin the safe-haven demand for the US Dollar, in turn, capping the recovery attempts in the bright metal. The US Dollar continues to capitalize on the recent strong US ISM Services PMI and Factory Orders data, which have renewed expectations of more rate increases from the Federal Reserve (Fed), extending into the next year. However, stalled upside in the US Treasury yields across the curve is allowing Gold price stage a modest comeback. Amid a lack of top-tier US economic data and the Fed’s ‘blackout period’, the broad market sentiment and the Fed rate hike expectations will continue to play a pivotal role in influencing the USD-denominated Gold price.

Also read: Gold Price Forecast: XAU/USD risks further downside on renewed hawkish Federal Reserve view

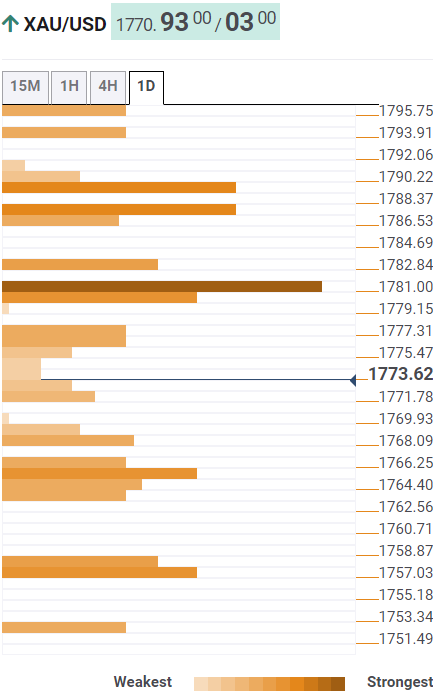

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is eyeing a big break to the downside, targeting the initial support at the SMA50 four-hour at $1,768.

The next strong cushion is seen at around $1,765, the convergence of the Fibonacci 61.8% one-week, the previous day’s low and the SMA100 four-hour.

A sharp drop toward the pivot point one-week S1 at $1,758 cannot be ruled out if the abovementioned support fails to hold.

Alternatively, Gold buyers need to find a strong foothold above the confluence of the Fibonacci 23.6% one-day and SMA5 one-day at $1,777.

Further upside will open beyond a break of the Fibonacci 38.2% one-week at $1,781. The next stop for bulls is envisioned at the intersection of the Fibonacci 38.2% one-day and SMA100 one-hour at around $1,783.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- USD/JPY touches a three-day high on Tuesday, albeit lacks follow-through or bullish conviction.

- Bets for further policy tightening by the Fed underpin the USD and lends support to the pair.

- BoJ Governor Kuroda's comments on exiting the ultra-loose monetary policy cap the upside.

The USD/JPY pair struggles to capitalize on its modest intraday gains and attracts some sellers in the vicinity of mid-137.00s, or a three-day high touched this Tuesday. Spot prices retreat below the 137.00 mark during the first half of the European session, though the downside seems cushioned amid a modest US Dollar strength.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies, is looking to build on the previous day's solid bounce from over a five-month low and acting as a tailwind for the USD/JPY pair. The incoming strong US macro data suggests that the economy remains resilient despite rising borrowing costs and fuel speculations that the Fed may lift interest rates more than projected. This, in turn, is seen as a key factor lending some support to the greenback.

The Japanese Yen, on the other hand, is undermined by dismal domestic data, showing that Japan's real wage posted its biggest fall in more than seven years in October. That said, Bank of Japan (BoJ) Governor Haruhiko Kuroda's comments on exiting the ultra-loose monetary policy helped limit losses for the JPY. Kuroda also acknowledged the upside risk to inflationary pressures, which, in turn, holds back bulls from placing aggressive bets and caps the USD/JPY pair, at least for the time being.

The aforementioned fundamental factors make it prudent to wait for strong follow-through buying before confirming that spot prices have formed a near-term bottom and positioning for any further gains. In the absence of any major market-moving economic releases from the US, traders will take cues from the USD price dynamics. Apart from this, the broader risk sentiment will influence demand for the safe-haven JPY and further contribute to producing short-term opportunities around the USD/JPY pair.

Technical level to watch

You-Na Park-Heger, an Analyst at Commerzbank, offers his afterthoughts on the Reserve Bank of Australia (RBA) interest rate decision and its impact on the Australian Dollar (AUD).

Key quotes

“The Reserve Bank of Australia (RBA) today raised its key interest rate by 25 bp to 3.1%, as widely expected. It also signaled that further tightening of monetary policy is likely to be forthcoming. Expectations that the RBA would signal a pause were thus not met. In this respect, the decision was somewhat more hawkish than expected.”

“However, the AUD could not really benefit. This is because the accompanying statement supports the basic assessment on the market that the RBA will soon take a break. Whether this comes a tad later than thought should not make too much of a difference for the currency market. In this respect, Australia's monetary policy should continue not to offer much support for the AUD.”

Analysts at Australia and New Zealand (ANZ) Banking Group offer a sneak peek at what to expect from Wednesday’s Australian thrid quarter Gross Domestic Product (GDP) release.

Key quotes

“Key partial indicators released over the past two days have largely netted out, and we are leaving our expectation for Q3 GDP growth unchanged at 0.7% QoQ.”

“Annual GDP growth is forecast to jump up to 6.3%, reflecting the very weak result for Q3 2021 when much of the economy was subject to lockdown. This is a solid result and suggests the economy had quite a bit of momentum in the September quarter in the early stages of monetary policy tightening.”