- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-03-2023

- US Dollar Index remains depressed after posting the biggest daily loss in a week.

- Cautious mood ahead of the US data, downbeat early signals for NFP weigh on DXY.

- Pullback in US Treasury bond yields, sluggish markets add strength to the US Dollar Index retreat.

- US employment report for February appears the key amid challenges for Fed hawks.

US Dollar Index (DXY) stays dicey around 105.30 amid the initial trading hours of the all-important Friday comprising the US jobs report for February. That said, the greenback’s gauge versus the six major currencies dropped the most in a week the previous day after mixed US data joined a pullback in the US Treasury bond yields. However, risk-off mood and challenges to sentiment put a floor under the prices.

On Thursday, US Initial Jobless Claims rose the most since January, to 211K for the week ended on March 03 versus 195K expected and 190K prior. Additionally, the Challenger Job Cuts were down and the Continuing Jobless Claims were up. Previously, the US ADP Employment Change rose to 242K in February versus 200K market forecasts and 119K prior (revised). Further, January JOLTS job openings were 10.8M, compared to an upwardly revised 11.2M prior and 10.6M market forecast.

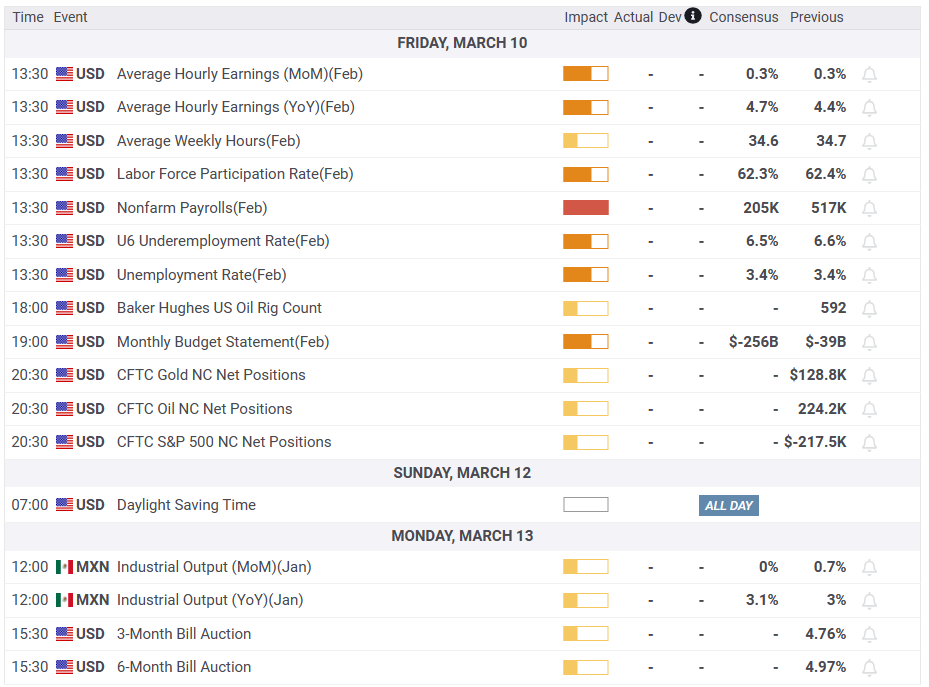

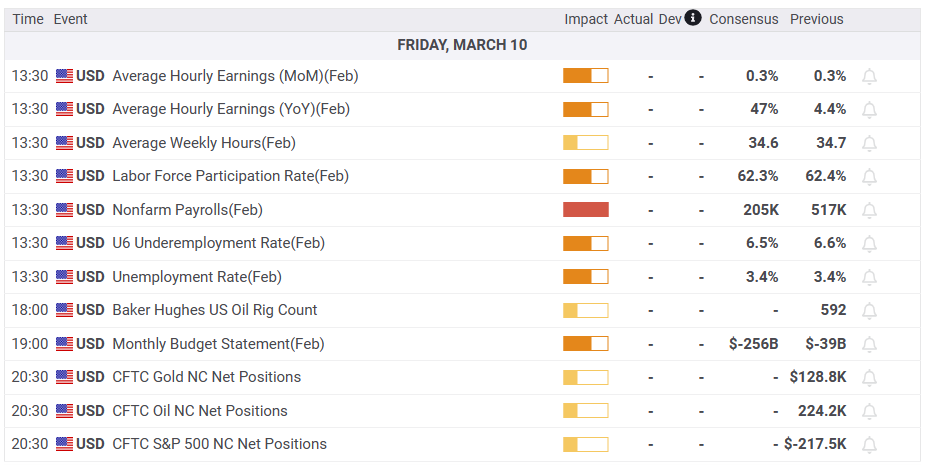

With this, the early signals for Friday’s Nonfarm Payrolls (NFP) appear mixed and challenge the market’s push for 0.50% Fed rate hike in March, as backed by Federal Reserve Chairman Jerome Powell’s latest signals.

On the same line, the US 10-year and two-year Treasury bond yields eased to 3.92% and 4.87% versus 5.08% and 4.01% daily open respectively on Thursday. With this, the 10-year coupons marked the biggest daily loss in a week while the two-year counterpart flashed the heaviest fall in two months. As a result, Wall Street benchmarks closed with more than 1.5% daily losses each, with S&P 500 Futures printing mild losses by the press time.

Elsewhere, disappointment from China’s monthly Consumer Price Index (CPI) and Producer Price Index (PPI) data for February dims the prospects of recovery in the world’s second-largest economy, which in turn weigh on sentiment and allow DXY bears to take a breather. On the same line could be the fears of higher taxes in the world’s biggest economy, the US, as well as the political chaos relating to it as US President Joe Biden proposes raising corporation tax to cut $3 trillion from the fiscal deficit over the next decade.

Looking ahead, market forecasts suggest an overall easing in the US employment report for February. The same contrasts with the hawkish Fed bias to highlight the odds of a strong market move in favor of the US Dollar Index in case of a positive surprise.

Also read: Nonfarm Payrolls Preview: Five scenarios for the Fed, USD and stocks reactions, with probabilities

Technical analysis

Despite the latest pullback, the 100-DMA level surrounding 105.15 challenges the US Dollar Index bears.

- NZD/USD's resistance between 0.6120 and 0.6150 could lead to a downside extension in failures below the area.

- All eyes are on the US NFP event.

NZD/USD is gliding bid ahead of key US Nonfarm Payroll data tonight while the USD DXY has turned soft ahead of the event putting some wind under the Bird's wings. The following illustrates a corrective bias ahead of the event but bearish overall.

NZD/USD daily charts

The daily chart's inverse head and shoulders are compelling, but the price remains on the front side of the dominant bear trend still and there are bearish under tones while below 0.6270.

In the meanwhile, there are prospects of a fuller test of the dynamic resistance in line with the 200-DMA and neckline of the M-formation.

With that being said, 0.6150 near the 38.2% Fibonacci that meets the dynamic resistance could prove a tough nut to crack.

NZD/USD H1 chart

On the lower time frames, such as the hourly, the 0.6120s could prove to be resilient also and lead to a downside extension in failures below the level.

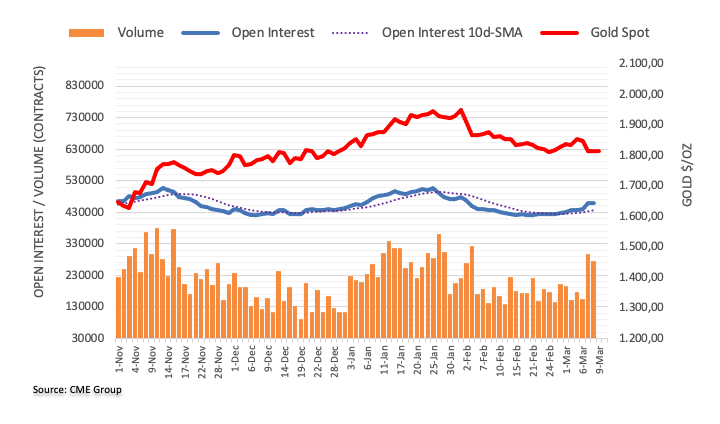

- Gold price pares weekly losses by grinding higher, sidelined of late.

- United States Treasury bond yields retreat amid mixed clues for Nonfarm Payrolls (NFP) and challenge XAU/USD traders of late.

- Fears emanating from China, US President Biden’s budget proposal cap Gold prices amid pre-data anxiety.

- Downbeat NFP forecasts tease positive surprise and XAU/USD decline despite likely comparative deterioration in the actual figures.

Gold price (XAU/USD) portrays the typical pre-data caution as it seesaws around the $1,830 resistance confluence during early Friday, following the biggest daily run-up in a week. Apart from the XAU/USD trader’s anxiety ahead of the United States employment data for February, challenges to sentiment and doubts on the latest retreat in the US Treasury bond yields also probe the bullion buyers of late.

Gold price recovers as sluggish United States employment clues weigh on yields

Gold price cheered mixed prints of the second-tier United States employment data and a pullback in the US Treasury bond yields to print the biggest daily jump in a week that pokes the short-term key resistance around $1,831.

On Wednesday, the US ADP Employment Change rose to 242K in February versus 200K market forecasts and 119K prior (revised). Further, January JOLTS job openings were 10.8M, compared to an upwardly revised 11.2M prior and 10.6M market forecast.

On the same line, US Initial Jobless Claims rose to 211K for the week ended on March 03 versus 195K expected and 190K prior. Additionally, the Challenger Job Cuts were down and the Continuing Jobless Claims were up.

Overall, the early signals for Friday’s Nonfarm Payrolls (NFP) appear mixed. However, analysts’ estimations for the Nonfarm Payrolls (NFP) appear too low at 203K, versus 517K prior, which in turn raises expectations of a positive surprise. The same may help the Gold bears to return to the table if details surrounding the wage growth and Unemployment Rate also refrain from the pessimistic outcome.

Also read: US February Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

It should be noted that the US 10-year and two-year Treasury bond yields eased to 3.92% and 4.87% versus 5.08% and 4.01% daily open respectively on Thursday. With this, the 10-year coupons marked the biggest daily loss in a week while the two-year counterpart flashed the heaviest fall in two months. As a result, Wall Street benchmarks closed with more than 1.5% daily losses each whereas the US Dollar Index (DXY) managed to pare some of the daily losses by the end of Thursday but failed to ignore the biggest daily fall in a week.

Hawkish Fed bets keep XAU/USD sellers hopeful

Despite the latest lack of clarity in the markets due to the mixed United States data, the market’s bets on the Federal Reserve (Fed) remain hawkish, which in turn challenges the Gold buyers ahead of the key US data. On Wednesday, Federal Reserve Chairman Jerome Powell highlighted the data dependency while also signaling that they have underestimated the resilience of growth and inflation. The news defends the hawkish Fed bias as market players expected a 50 bps rate hike in March, versus 0.25% expected in the last week.

Fears from China, US President Biden tax proposal prod Gold bears

Apart from the United States data and Federal Reserve concerns, geopolitical headlines also challenge the Gold price recovery.

That said, disappointment from China’s monthly Consumer Price Index (CPI) and Producer Price Index (PPI) data for February dims the prospects of recovery in the world’s second-largest economy, as well as one of the biggest XAU/USD users.

On the same line could be the fears of higher taxes in the world’s biggest economy, the US, as well as the political chaos relating to it as US President Joe Biden proposes raising corporation tax to cut $3 trillion from the fiscal deficit over the next decade.

Gold price technical analysis

Gold price extends the mid-week rebound from a fortnight-old ascending support line as the bulls poke a convergence of 100 and 50 Simple Moving Averages (SMAs), around $1,831 by the press time.

Adding strength to the recovery movement is the Relative Strength Index (RSI) line, placed at 14, as it gradually rises from the oversold territory. Furthermore, the looming bull cross of the Moving Average Convergence and Divergence (MACD) indicator also keeps the XAU/USD buyers hopeful of overcoming the immediate $1,832 resistance confluence.

However, a downward-sloping trend line from early February, near $1,852 at the latest, acts as the key upside barrier for the Gold buyers to knock to retake control.

Meanwhile, a downside break of the aforementioned two-week-old support line, near $1,810 at the latest, puts a floor under the XAU/USD price.

Ina case where the Gold bears manage to conquer the stated key support trend line, the $1,800 threshold may test the fall targeting the 61.8% Fibonacci Expansion (FE) of the metal’s moves between early February and March 06, close to $1,787.

To sum up, Gold price appears picking up strength but the bulls are far from winning the driver’s seat.

Gold price: Four-hour chart

Trend: Limited upside expected

- GBP/JPY has sensed some buying interest near 162.00 ahead of the BoJ policy.

- Last BoJ Kuroda’s meeting might come with an unchanged stance, however, a power-pack action cannot be ruled out.

- In times when UK CPI is still in the double-digit figure, a steady policy stance could dampen BoE’s efforts.

The GBP/JPY pair attempted a rebound to near 162.00 in the early Asian session. The cross is expected to display extremely volatile moves ahead as investors are awaiting the release of the United Kingdom’s monthly Gross Domestic Product (GDP) and Manufacturing sector data, and the interest rate decision by the Bank of Japan (BoJ).

Mounting expectations of the coming pause in the policy-tightening spell by the Bank of England (BoE) is impacting the Pound Sterling. BoE policymaker Swati Dhingra warned against further interest rate increases by citing “Overtightening poses a more material risk at this point.” She further added, “Many tightening effects are yet to fully take hold.”

In times when the UK headline Consumer Price Index (CPI) is still in double-digit figure despite pushing rates to 4%, a steady policy stance could dampen the efforts yet made by BoE Governor Andrew Bailey and his teammates.

On the economic front, Monthly Manufacturing production (Jan) is expected to contract by 0.1% and the Industrial Production is seen contracting by 0.2% in the same period. The consensus shows monthly GDP has expanded by 0.1% vs. December’s contraction of 0.5%.

Meanwhile, the Japanese Yen is likely to display a power-pack action as March’s monetary policy will be the last for BoJ Governor Haruhiko Kuroda. Analysts at Danske Bank are of the view that “The BoJ will tweak its yield curve control in the short-term. It is not likely to happen this week, but we also were surprised the last time they did it in December. Either way, we think it is a matter of time and could happen during Q2.”

- USD/CHF might continue its downside momentum to near 0.9300 amid signs of deceleration in the US labor market.

- Higher planned lay-off and an 11% jump in initial claims indicate that the US labor market is not tight enough.

- The theme of higher rates for a longer time might keep USD Index firmer in the coming months.

The USD/CHF pair has displayed a sheer downside to near 0.9320 as investors have ignored risks associated with bigger rates announcements and higher terminal rates as endorsed by Federal Reserve (Fed) chair Jerome Powell in his testimony before Congress. The Swiss Franc asset is expected to continue its downside move to near the round-level support of 0.9300 amid an absence of loss in the downside momentum.

S&P500 futures faced immense selling pressure on Thursday as the characteristics of reducing a deficit of nearly $3 trillion by the next decade and a big stretch in taxes on corporations, billionaires, and rich investors discouraged investors. The US Dollar Index (DXY) also witnessed pressure and corrected gradually to 105.25 as an expression of fiscal deficit will also restrict inflation from flexing its muscles.

Apart from that, an 11% jump in the number of individuals filing for jobless claims for the very first time conveyed that the United States labor market is not as upbeat as it appears. Also, planned lay-off for February jumped four-fold on an annual basis, as reported by Reuters.

Signs of deceleration in the US labor market supported demand for US government bonds, which trimmed the 10-year US Treasury yields heavily to 3.90%.

Economists at Rabobank see the risks as being titled towards a firmer for longer USD in the coming months. “In the near term, the releases of US payrolls and Consumer Price Index (CPI) data are likely to be instrumental in guiding the direction of the USD Index. However, the risks that inflation could prove sticky suggest that the higher for longer interest rate theme could persist for months.”

On the Swiss Franc front, investors will focus on next week’s Producers and Import Prices data. A contraction of 0.1% is expected on a monthly basis. The annual data could improve to 3.4% from the former release of 3.3%. A monthly decline could delight the Swiss National Bank (SNB), which has already confronted that Swiss’ inflationary pressures are getting beyond its control.

- Risk aversion bolstered the USD/MXN toward new weekly highs above $18.30.

- USD/MXN Price Analysis: The daily close above the 20-day EMA opened the door toward $18.60.

The Mexican Peso (MXN) is under pressure on Thursday; after reaching new 5-year lows at 17.8967, the USD/MXN has risen back towards the 18.0800 area. At around the Wall Street close, risk aversion pushed US equities lower, while the Mexican Peso depreciated the most since February 6, 2023. At the time of writing, the USD/MXN is gaining 2.07%, or 3700 pips, at 18.3323.

Also read: USD/MXN advances above the 18.00 figure as traders rush to safety

USD/MXN Price action

The USD/MXN stages a recovery after trading below the $18.00 barrier during the last few days. Earlier in the day, I wrote, “Nevertheless, USD/MXN bulls are far ahead of declaring victory. They must reclaim the weekly high at 18.1788, followed by the 20-day Exponential Moving Average (EMA) at 18.2898.” Later in the session, USD/MXN bulls reclaimed those levels as the exchange rate rests comfortably above the 20-day EMA. Additionally, Thursday’s close for the USD/MXN was 18.3483, which has opened the door for further upside.

That said, the USD/MXN first resistance would be the new weekly high of 18.4391. A breach of the latter will expose the $18.50 barrier, closely followed by the 50-day EMA at 18.6410 and the 100-day EMA at 19.0105.

On the flip side, the USD/MXN first support would e the 20-day EMA at 18.3169. Once cleared, and the USD/MXN pair will dive towards the March 7 high turned support at 18.1788, followed by the $18.00 psychological level.

USD/MXN Daily chart

USD/MXN Technical levels

- USD/CAD pares the biggest weekly gains since late September, snaps four-day uptrend with mild losses.

- BoC’s Rogers terms the latest rate hike pause as conditional but failed to impress Loonie buyers amid downbeat Oil price.

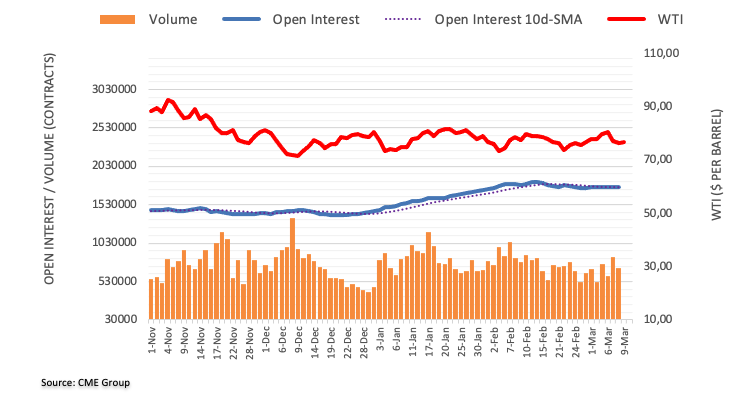

- WTI remains sidelined around a fortnight low after declining in the last three consecutive days.

- US NFP, Canada Employment Change for February will be crucial amid BoC vs. Fed tussle.

USD/CAD dribbles around 1.3830-20 as bulls catch a break around the highest levels since late October 2022 after a four-day uptrend. In doing so, the Loonie pair portrays the market’s anxiety ahead of the key employment data from the US and Canada while also justifying a pause in the WTI crude oil’s fall, due to Ottawa’s reliance on Oil as the key export item.

The Loonie pair rose in the last four consecutive days as the monetary policy divergence between the Bank of Canada (BoC) and the Federal Reserve (Fed) joins downbeat Oil price. Adding strength to the pair’s upside momentum could be the broad US Dollar strength, ignoring the latest retreat, during the uncertain times.

On Thursday, Bank of Canada Senior Deputy Governor Carolyn Rogers signaled that the Canadian central bank’s latest pause in the interest rate hikes is a conditional one. The policymaker added, “If economic developments unfold as we projected and inflation comes down as quickly as we forecast in the January Monetary Policy Report (MPR), then we shouldn’t need to raise rates further. But if evidence accumulates suggesting inflation may not decline in line with our forecast, we’re prepared to do more.”

Elsewhere, mixed employment clues from the US probed the US Dollar bulls ahead of the key jobs report. That said, US Initial Jobless Claims marked the biggest jump since January by rising to 211K for the week ended on March 03 versus 195K expected and 190K prior. Additionally, the Challenger Job Cuts were down and the Continuing Jobless Claims were up.

It should be noted that fears emanating from softer China inflation data and US President Joe Biden’s proposed tax hike exert downside pressure on the market sentiment and the Oil price. With this, the WTI crude oil dropped to a two-week low during the three-day losing streak, before making rounds to $75.70.

Amid these plays, Wall Street benchmarks closed with more than 1.5% daily losses each but the US 10-year and two-year Treasury bond yields eased to 3.92% and 4.87% versus 5.08% and 4.01% daily open respectively. Though, the US Dollar Index (DXY) pared some of the daily losses by the end of Thursday but failed to ignore the biggest daily fall in a week.

To sum up, the USD/CAD pair appears indecisive but the bears are likely firming their grips with hopes of witnessing negative surprises from the US data. However, market consensus for the Canadian jobs report for February also appears less optimistic and hence the Loonie pair traders should remain cautious ahead of the all-important releases.

Also read: Nonfarm Payrolls Preview: Five scenarios for the Fed, USD and stocks reactions, with probabilities

Technical analysis

A daily closing beyond the 1.3800 hurdle, encompassing multiple levels marked during late September-October 2022, keeps the USD/CAD buyers hopeful of challenging the previous yearly top surrounding .3980.

- EUR/USD is facing selling pressure in extending its recovery above the supply zone placed in a range of 1.0577-1.0589.

- An absence of strength in the recovery move from EUR/USD has kept the room open for bears.

- The RSI (14) is struggling to sustain in the bullish range of 60.00-80.00.

The EUR/USD pair has scaled above 1.0580 in the early Tokyo session despite a lack of strength in the recovery move. It seems that investors are putting less focus on building positions as the release of the United States Nonfarm payrolls (NFP) (Feb) data will provide more clarity on further guidance.

According to the estimates, the United States economy has added fresh 205K jobs, lower than the mega addition of 514K payrolls in January. The Unemployment Rate is expected to remain steady at 3.4%. The catalyst that might grab major attention is the Average Hourly Earnings data. Firms are offering higher payouts to hire fresh talent amid an extreme shortage of labor. And higher payouts are forcing households to stretch their spending, which is ultimately fueling the US Consumer Price Index (CPI). The economic data is seen higher at 4.7% vs. the former release of 4.4%.

The US Dollar Index (DXY) is oscillating above 105.20 after a gradual correction. A release of an upbeat US NFP gamut might strengthen US Dollar bulls further.

EUR/USD is facing selling pressure in extending its recovery above the supply zone in a range of 1.0577-1.0589 on an hourly scale. The 100-period Exponential Moving Average (EMA) at 1.0585 also acts as a barricade for the Euro.

Meanwhile, the Relative Strength Index (RSI) (14) is struggling to sustain in the bullish range of 60.00-80.00. An absence of strength in the RSI (14) could result in exhaustion in the uptrend.

A break below March 01 low at 1.0565 might drag the major currency pair toward March 08 low at 1.0524. A slippage below the same will drag the asset further toward the psychological support at 1.0500.

On the flip side, a decisive move above the round-level resistance at 1.0600 will drive the asset toward February 28 high at 1.0645. A breach above the latter will expose the asset to March 01 high at 1.0691.

EUR/USD hourly chart

- GBP/USD seesaws within a choppy range after two-day rebound from the lowest levels since late November 2022.

- Hopes of no recession in the UK, upbeat efforts to lure more stock market listings help Cable buyer.

- Mixed US data, pullback in yields weigh on US Dollar ahead of the key US jobs report.

- UK’s monthly GDP for January will be crucial to watch amid economic slowdown chatters but US NFP is the key.

GBP/USD makes rounds to 1.1930-20 during early Friday morning in Asia as bulls take a breather after the biggest daily jump in more than a week ahead of the key statistics from the UK and the US.

That said, the risk-off mood failed to extend the US Dollar’s run-up on Thursday amid US data, which in turn joined a retreat in the key US Treasury bond yields to weigh on the greenback. While portraying the mood, Wall Street benchmarks closed with more than 1.5% daily losses each but the US 10-year and two-year Treasury bond yields eased to 3.92% and 4.87% versus 5.08% and 4.01% daily open respectively. It should be noted that the US Dollar Index (DXY) managed to pare some of the daily losses by the end of Thursday but failed to ignore the biggest daily fall in a week.

At home, hopes of economic recovery and more stock market listings seem to help the Cable pair amid a light calendar during the week.

“The country's economy is on track to shrink less than expected this year and avoid the two quarters of negative growth which mark a technical recession,” the British Chambers of Commerce (BCC) forecast on Wednesday per Reuters.

Britain’s finance ministry said on Wednesday it will launch a review into how investor research on companies could be improved to attract more listings, a step that follows a decision by UK chip designer Arm Ltd to only list in New York, reported Reuters.

On the same line, Britain's revamped financial market rules will largely be aligned with U.S. and European Union regulations to minimise disruption to global companies, its financial services minister Andrew Griffith said on Thursday per Reuters.

It’s worth observing, however, that BoE policy maker Swati Dhingra warned against interest rate hikes on Wednesday while saying that overtightening poses a more material risk at this point. On the contrary, Fed Chairman Jerome Powell keeps his hawkish bias intact.

Technical analysis

GBP/USD managed to regain its place above the 200-DMA level of 1.1900, after a two-day absence, which in turn keeps buyers hopeful.

- AUD/USD fails to recover from four-month trough, holds lower ground of late.

- Global markets remained vulnerable on mixed US data amid cautious mood ahead of NFP.

- Downbeat China inflation, US President Biden’s budget proposal also strengthens risk-off mood.

- Equities drop but a retreat in yields weigh on US Dollar despite sour sentiment.

AUD/USD justifies its risk-barometer status while revisiting the sub-0.6600 area early Friday, after a failed attempt to recover from the four-month low. In doing so, the Aussie pair traces the downbeat equities and fears emanating from China, as well as failing to cheer the retreat in the US Treasury bond yield and the US Dollar, amid the market’s cautious mood ahead of the all-important US employment data.

Wall Street benchmarks closed with more than 1.5% daily losses each but the US 10-year and two-year Treasury bond yields eased to 3.92% and 4.87% versus 5.08% and 4.01% daily open respectively. It should be noted that the US Dollar Index (DXY) managed to pare some of the daily losses by the end of Thursday but failed to ignore the biggest daily fall in a week.

While tracing the key catalysts mixed employment clues from the US gain major attention. That said, US Initial Jobless Claims marked the biggest jump since January by rising to 211K for the week ended on March 03 versus 195K expected and 190K prior. Additionally, the Challenger Job Cuts were down and the Continuing Jobless Claims were up.

Elsewhere, disappointment from China’s monthly Consumer Price Index (CPI) and Producer Price Index (PPI) data for February also dims the prospects of recovery in the world’s second-largest economy and weighs on the risk profile. On the same line could be the fears of higher taxes in the world’s biggest economy, the US, as well as the political chaos relating to it as US President Joe Biden proposes raising corporation tax from 21% to 28% in his latest budget guide ahead of Friday’s release.

Above all, hawkish comments from Fed Chair Jerome Powell join dovish rhetoric from Reserve Bank of Australia (RBA) Governor Philip Lowe to keep the AUD/USD bears hopeful as traders await the key US Nonfarm Payrolls, expected 205K versus 517K prior.

Given the mixed early clues and the strong prints in the last, fewer odds favor the positive surprise from the US jobs report and hence the AUD/USD pair may witness a corrective bounce. The hopes of recovery also take clues from the quote’s repeated failure to drop below 0.6550.

Technical analysis

AUD/USD dribbles inside a 100-pip trading range between 0.6640 and 0.6540 comprising levels marked during late October and November 2022.

- Silver remains firm at around $20.00 a troy ounce, ahead of essential US data.

- XAG/USD Price Analysis: Despite consolidating around $20.00, the bias is still downwards.

Silver price continues to trade sideways on Thursday, amidst the lack of a catalyst, ahead of the release of crucial US economic data. The US Nonfarm Payrolls report for February looming keeps investors risk averse, as shown by US equities and emerging market currencies, with the Mexican Peso (MXN) weakening. At the time of writing, the XAG/USD is trading at $20.05, up 0.19%.

XAG/USD Price action

XAG/USD remained firm during the day, unable to crack the top/bottom of the $19.98-$20.28 range. Nevertheless, traders should know Silver stumbled below the 200-day Exponential Moving Average (EMA) at $21.80, so the white metal is downward biased. Notable, the 50-day EMA is closing to the 200-day EMA, and once it crosses below the latter, a death cross would exacerbate a fall toward the November 3 daily low at $18.84.

But firstly, XAG/USD needs to clear the YTD low at $19.92. A breach of the latter will expose the $19.00 psychological level, followed by the November 3 daily low at $18.84.

As an alternate scenario, the XAG/USD first resistance would be the daily high of $20.06. Once cleared, the next resistance level would be the February 28 daily low-turned resistance at $20.43, followed by the November 28 daily low-turned resistance at $20.87.

XAG/USD Daily chart

XAG/USD Technical levels

- USD/JPY is expected to witness more losses below 136.00 as investors have ignored Fed’s bigger rate hike fears.

- The proposal of higher taxes by US Biden has spooked the interest of investors towards US equities.

- An unchanged monetary policy is expected from BoJ Kuroda.

The USD/JPY pair is delivering a sideways performance above 136.00 in the early Asian session. The asset looks vulnerable above 136.00 and is expected to deliver a break below the same as investors have shrugged-off fears associated with expectations of bigger rates from the Federal Reserve (Fed).

Thursday’s Initial Jobless Claims data reported an 11% jump in the number of candidates claiming for the very first time. This was the highest jump in the past five months, which conveyed that the United States labor market is not tight enough as it appears to the market participants. The street believes that a mega jump in initial claims was the outcome of the mid-winter school break in New York. So it is a one-time blip and can be ignored.

The US Dollar Index (DXY) is juggling above 105.25 after a gradual correction from Wednesday’s high at 105.86. S&P500 futures witnessed an intense sell-off on Thursday as investors got distressed by high taxes proposed by US President Joe Biden on billionaires and rich investors. Citing the Budget as a blue-collar blueprint, more taxes on riches will be utilized for medical claims of retired individuals.

Squeezing fears for Fed’s blunt statement on using higher rates to bring down inflation also supported the demand for US government bonds. The alpha generated on 10-year US Treasury bonds dropped firmly to near 3.90%.

On the Japanese Yen front, investors are awaiting the interest rate decision by the Bank of Japan (BoJ) for fresh impetus. Analysts at TD Securities are of the view that “It is unlikely that the BoJ will rock the boat at this meeting even as CPI inflation hit a 41-year high. Governor Kuroda at his last meeting will likely keep policy unchanged, with further changes having to wait for incoming governor Ueda starting in April. We think the BoJ could shift the top end of the YCC band again in the months ahead, potentially as early as April.”

- Gold price bulls are moving in to test a 38.2% Fibonacci retracement.

- Gold price bears are lurking and eye a break of $1,804 to then test the 200 DMA.

- All eyes are on the Nonfarm Payrolls event and next week's US Consumer Price Index.

Gold price is up some 0.9% and has traveled from a low of $1,812.02 and moved higher sharply to test $1,835.64 as the US Dollar shed some more points in the DXY index, moving from a three-month high set earlier in the week.

A risk on appetite came about in early trade on Wall Street which benefitted the Gold price as United States of America economic data has proven that there are signs of cracks in a tight US jobs market. This occurred a day before Friday's US Nonfarm Payrolls event and is in contrast to how the markets were starting to position following Federal Reserve's Chair Jerome Powell's hawkish rhetoric to Congress earlier in the week. However, US stocks have come undone buyt the Gold price remains bid nevertheless.

US Jobless Claims moved higher by 11% last week. This was the largest increase in five months. At the same time, planned layoffs for February quadrupled year-on-year. This data might be indicating that the Federal Reserve's hiking cycle has been playing out as intended and negates the need to hike aggressively. Consequently, the Gold price shot higher with US Treasury yields easing which is a bullish sign for Gold price since the metal offers no interest. The US 10-year note was last seen paying 3.927%, down from the highs of 4.019%.

The rise in the Gold price comes following another red day for the US Dollar index, DXY, which is losing around 0.33% at the time of writing after falling from a high of 105.729 and after making a low for the day of 105.153. The US Dollar surged earlier in the week following hawkish Congressional testimony by Federal Reserve chair Jerome Powell. Fed's Powell explained to lawmakers that the central bank will raise rates higher and faster after a series of strong economic reports showed the economy continues to run hot. Consequently, market expectations for a 50 basis point rate hike from the Federal Reserve shot higher.

As noted by analysts at Brown Brothers Harriman, WIRP now suggests nearly 70% odds of a 50 bp hike at the March 21-22 Federal Open Market Committee meeting:

''Looking ahead, 25 bp hikes in May and June are priced in that would take Fed Funds to 5.50-5.75%, with over 30% odds of a last 25 bp hike in Q3 that would move the range up to 5.75-6.0%.''

''After all this repricing, an easing cycle is still expected to begin in the fourth quarter, albeit at much lower odds. Eventually, it should be totally and unequivocally priced out into 2024 during the next stage of Fed repricing,'' the analysts added and said, ''for now, we believe the uptrends in US yields and the US Dollar remain intact.''

US Nonfarm Payrolls and US Consumer Price Index headwinds

As for the Nonfarm Payrolls, this event will be part of a duo that is going to be instrumental in guiding market expectations regarding the policy guidance likely to be offered by the FOMC at the March meeting.

''We look for payroll gains to mean-revert to 230k in February following the gangbuster report that saw job creation surge to 517k in January,'' analysts at TD Securities said. ''We also expect the Unemployment Rate to remain unchanged at a historically low level; while average hourly earnings likely accelerated to a 0.4% m/m gain, lifting the YoY measure to a still-elevated 4.8%.'' The analysts added, ''we think the hurdle is rather high to see USD weakness prevail; data would have to materially surprise to the downside.''

We then have the US Consumer Price Index next week and analysts see this increase by 0.4% MoM and headline CPI to rise by 0.5% in February.

''Price pressures were intense and broad-based in January, more so than in previous months. A potential sign that inflation pressures are intensifying again,'' analysts at ANZ Bank said. ''Annual revisions to the CPI seasonal factors by the BLS show inflation over the course of H2 2022 did not ease as much as initially reported. This means the Fed is facing a more persistent sticky inflation battle than it thought earlier this year,'' the analysts argued.

''Recent activity and inflation data portray a resilient economy suggesting the Fed still has more work to do to slow demand, particularly in the labor market. We expect there will be upward revisions to the terminal fed funds rate (FFR) forecast at the March FOMC meeting,'' the analysts at ANZ added leaving scope for a headwind for the Gold price bugs for the imminent future.

Gold price technical analysis

Gold price crossed back above the $1,825 mark in the pursuit of the neckline of M-formation's neckline. We have Gold price support at $1,804 and resistance above $1,850 with territories between the move into the 38.2% and 78.6% Fibonacci scale open to a test. Should the bears commit, then there will be prospects of a move to test the Gold price 200 DMA in the coming days with the $1,1770s eyed in that regard.

Here is what you need to know on Friday, March 10:

US stocks dropped sharply on Thursday and US Treasuries rose ahead of Friday’s Nonfarm Payrolls report. Initial Jobless Claims unexpectedly climbed to the highest level in ten weeks, taking some bets for a 50 basis points Fed rate hike off the table.

US yields moved further to the downside during the American session. The US 2-year yield fell to 4.95% and the 10-year to 3.92%. The slide in yields weighed on the US Dollar. The DXY pulled back for the second day in a row, falling to 105.20. The retreat of the Greenback is still a correction from Tuesday’s rally, which was boosted by Federal Reserve Chair Powell's hawkish remarks.

US February Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

The US employment report will be released on Friday, with traders seemingly on the sidelines ahead of payrolls. The numbers could be critical for Fed rate expectations as the odds of a 50 basis points rate hike jumped during the current week.

EUR/USD rose for the second day but was unable to retake 1.0600. Voices against the guidance of “significant rate hikes ahead” emerged at the European Central Bank (ECB), with Bank of Italy Governor Ignazio Vizco criticizing his colleagues. GBP/USD had the best day of the week so far, peaking at 1.1937, the highest in two days. EUR/GBP pulled back below 0.8900.

The Bank of Japan will announce its monetary policy decision (no change expected) at Governor Kuroda’s last policy meeting. His term expires on April 8, after a ten-year tenure. Japan’s Lower House of Parliament approved Kazuo Ueda to become the next governor and two deputy governors (Ryozo Himino and Shinichi Uchida). The Upper House will vote on the nominees Friday. USD/JPY lost more than a hundred pips on Thursday, going all the way back to 136.00.

The US Dollar posted mixed results awaiting key data. Commodity and emerging market currencies were hit late on Thursday as Wall Street plunged. USD/MXN rebounded 2.5% from fresh multi-year lows.

AUD/USD and NZD/USD turned negative hit by risk aversion, falling to 0.6580 and 0.6100, respectively. The weak Canadian Dollar extended losses; USD/CAD rose for the fourth consecutive day, reaching the highest level since mid-October, above 1.3830.

Gold climbed above $1,830/oz, boosted by lower yields and unaffected by the risk-off tone. Silver failed to hold to gains and pulled back to $20.00. Bitcoin broke below $21,000 to the lowest since January 20. Crude oil prices fell by more than 1%.

Like this article? Help us with some feedback by answering this survey:

- The S&P 500, the Nasdaq 100, and the Dow Jones dropped as traders prepared for US NFP.

- The latest round of US economic data spurred a hawkish shift in the Federal Reserve.

- US President Joe Biden presented his budget for 2024.

Wall Street maintains a downbeat mode late in the New York session, with US equities registering substantial losses. Sentiment shifted sour, with traders expecting additional labor market data and next week’s inflationary figures as the Federal Reserve (Fed) prepares for the upcoming meeting.

At the time of typing, the S&P 500 is falling 1.43%, at 3,925.50. Following suit is the heavy-tech Nasdaq 100, down 1.58% at 11,390.53, while the Dow Jones drops 1.31%, at 32,367.39.

US equity indices, the US Dollar, and UST bond yields are down, ahead of US NFP

The latest economic data from the United States (US) shifted the US Federal Reserve (Fed), notably the Fed Chair Jerome Powell, more hawkish than expected. February’s 500K plus jobs added to the economy, inflation cooling but above estimates, ISM Manufacturing and Services PMIs improving, and financial conditions loosening sounded the alarms at the Fed.

On Tuesday, Jerome Powell began his two-day testimony before the US Senate and the House of Representatives. Powell said that the Federal Funds Rate (FFR) would peak higher than estimates, and if upcoming data warranted a larger hike, the Fed has the tools to do it. When asked about the March 21-22 meeting, he said, “We have not made any decision,” leaving the door open for a 50 or 25 bps lift.

Powell’s words rattled the financial markets, with the S&P 500 plunging from around 4,056.90 to 3,927.00 for a 3.22% fall. The greenback advanced, as shown by the US Dollar Index, which went up 1.50% and printed a weekly high of 105.883. US Treasury bond yields skyrocketed, with 2s and 10s peaking at 5.084% and 4.019%, respectively. Consequently, the US bond yield curve inverted the most since the 1980s, at over 100 bps. The US 2s-10s yield curve has functioned as a forecast indicator of recessions within a 12-month period.

Thursday’s data in the US economic docket alleviated the tightness of the labor market, with unemployment claims rising above estimates. Traders’ focus is on Friday’s US Nonfarm Payrolls report and next week’s US Consumer Price Index.

An upbeat labor market data and higher inflation could reinforce the Fed’s hawkish shift of late. Otherwise, it could pave the way for 25 bps increases. The CME FedWatch Tool has fully priced in a 25 bps rate increase, and odds for a 50 bps lie at 62.4%.

US President Joe Biden filled his budget for the 2024 fiscal year, which includes a plan to cut $3 trillion from the deficit over the next decade. Some of the highlights are:

- Taxes on wealthy people and large corporations.

- Increase of corporate tax rate to 28%.

- Hiking taxes on oil and gas companies.

Of late, Bitcoin is plummeting 4.52%, at 20,705 a coin, in what appears to be traders squaring off positions ahead of volatile US economic data.

S&P 500 Daily chart

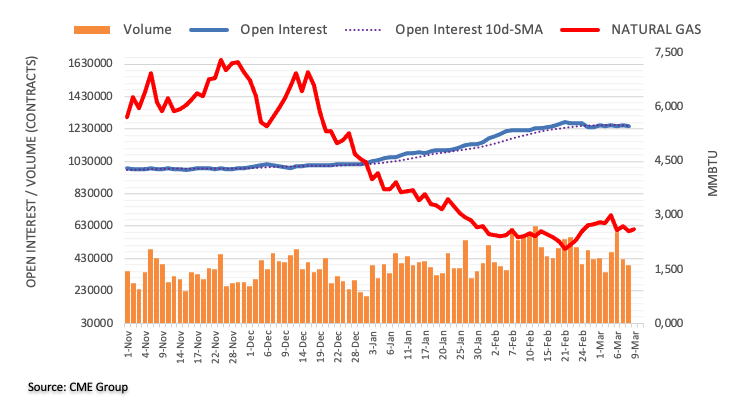

- WTI bears are in the market as the countdown to NFP is underway.

- WTI dropped around 1% on the third day of losses.

West Texas Intermediate is down by some 1% on the day in late Wall Street trade. The black gold fell from a high of $78.01bbls to a low of $75.63 despite a softer US Dollar ahead of Friday's main event for the week in the US Nonfarm Payrolls.

The US Dollar index was last seen down 0.4 points to 105.17 yet oil remains heavily offered. ''Trend signals in WTI crude have been bolstered by Chair Powell's hawkish rhetoric during his Congressional testimony. With downside momentum signals firing on all cylinders, CTAs have bolstered sufficient dry-powder to raise the risk of yet another round of short covering,'' analysts at TD Securities argued. ''This has been typical behavior over the last few months, in line with range-bound price action in energy markets.''

Oil is also pressured this week due to recession worries as the Federal Reserve turned hawkish. A series of data releases have been showing the US economy continues to run hot. However, data released on Thursday took some of the sting out of Fed Chairman Jerome Powell's hawkish tone.

US jobless claims leaped by 11% last week. This was the heaviest move up in five months. Planned layoffs for February quadrupled year-on-year. This data might be indicating that the Federal Reserve's hiking cycle has been playing out as intended and negates the need to hike aggressively. Consequently, all three major US stock indexes were up and the US Dollar has drifted lower in a correction from a three-month high near 105.90 printed at the start of the week.

US Nonfarm Payrolls eyed

Next up, Friday's Nonfarm Payrolls and next week's Consumer Price Index will be instrumental in guiding market expectations regarding the policy guidance likely to be offered by the FOMC at the March meeting.

''We look for payroll gains to mean-revert to 230k in February following the gangbuster report that saw job creation surge to 517k in January,'' analysts at TD Securities said. ''We also expect the Unemployment Rate to remain unchanged at a historically low level; while average hourly earnings likely accelerated to a 0.4% m/m gain, lifting the YoY measure to a still-elevated 4.8%.'' The analysts added, ''we think the hurdle is rather high to see USD weakness prevail; data would have to materially surprise to the downside.''

Bank of Canada Senior Deputy Governor Carolyn Rogers said on Thursday they are looking for more evidence that the current interest rate levels are high enough. In a prepared speech to be delivered at the Manitoba Chambers of Commerce approximately at 18:55 GMT, she talks “about the factors behind high inflation and how we know inflation is falling.”

Key takeaways

“Yesterday, we decided to leave the policy rate at its current level of 4.50%. We also continued our policy of quantitative tightening.”

“It’s a conditional pause, though. If economic developments unfold as we projected and inflation comes down as quickly as we forecast in the January Monetary Policy Report (MPR), then we shouldn’t need to raise rates further. But if evidence accumulates suggesting inflation may not decline in line with our forecast, we’re prepared to do more.”

“We’ll need to see more evidence to fully assess whether monetary policy is restrictive enough to return inflation to 2%. For now, let me unpack recent developments and share some insight into what we discussed and how we’ll be thinking about things going forward.”

“And with inflation still well above our target, we’re still more worried about upside risks.”

“Major economies around the world are highly interconnected—but while we’re always thinking globally, we have to act locally. We must tailor our policy to Canadian circumstances. And monetary policy needs to be forward-looking.”

“We’re watching closely to see how things unfold. And we are committed to getting inflation all the way back to 2% so Canadians can once again count on low, stable and predictable inflation with sustainable economic growth.”

Market reaction

The USD/CAD erased gains during the American session and is approaching the 1.3800 zone. The Canadian Dollar is among the worst G10 performers on Thursday.

- AUD/USD bears eye a breakout to the downside.

- AUD/USD daily chart's 38.2% Fibonacci is yet to be tested higher up near 0.6650.

As per the prior analysis, AUD/USD Price Analysis: Bears eye a break to 0.6520, and AUD/USD falls heavily as bears move in towards the 0.6580s target area, AUD/USD moved in on the target and is now folding with a bearish bias still ahead of the US Nonfarm Payrolls this Friday.

AUD/USD prior analysis

''AUD/USD has already made a recovery that came in close contact with the 38.2% ratio which leaves prospects of a move to the downside with 0.6520 eyed.''

AUD/USD update

The price is carving out a geometrical box, an ascending triangle, in a downtrend which is considered a bearish chart pattern. Two-way price action can be expected from here with a bearish bias while on the front side of the bear trend and below the 200 DMA. 0.6520 is key in this regard as it guards a move towards 0.6380:

With all that being said, the daily chart's 38.2% Fibonacci is yet to be tested higher up near 0.6650.

- USD/CHF plunges below the 100-day EMA, with sellers eyeing the 50-day EMA at 0.9310s.

- Oscillators remain in negative territory, warranting further downside in the USD/CHF pair.

- USD/CHF Price Analysis: Sellers reclaiming the 20-day EMA would pave the way to 0.9300.

The USD/CHF reverses its upward course and trims some of its weekly gains after the pair was shy of testing the 200-day Exponential Moving Average (EMA) at 0.9448. Consequently, sellers stepped in and tumbled the USD/CHF pair below 0.9400. At the time of typing, the USD/CHF is trading at 0.9357, down 0.59%.

USD/CHF Price action

During Thursday’s session, the USD/CHF retreated below 0.9400, with sellers reclaiming the 100-day EMA at 0.9384. Even though the USD/CHF is falling, it’s facing solid support around 0.93500, which, once cleared, could pave the USD/CHF’s way toward the 20-day EMA at 0.9333. A breach of the latter and the USD/CHF could fall to the 50-day EMA at 0.9316.

Oscillators like the Relative Strength Index (RSI) favor sellers, while the Rate of Change (RoC), portrays buyers losing momentum. Therefore, the USD/CHF could test the 0.9300 figure in the near term.

As an alternate scenario, the USD/CHF first resistance would be the 0.9400 figure. Once broken, the USD/CHF could test the YTD low at 0.9440 before reaching the 200-day EMA at 0.9448.

USD/CHF Daily chart

USD/CHF Technical levels

- EUR/USD bears are monitoring the price action and are on the lookout for opposing structures to align with.

- A break above the 78.6% may deter bears from getting heavily involved but the 1.0470s area eyed.

- Counting down to the Nonfarm Payrolls and US CPI.

EUR/USD is under making ground on Thursday and has moved up from a low of 1.0536 to score a corrective high of 1.0586 so far in the New York session ahead of the key US Nonfarm Payrolls on Friday. European stocks were held back by higher-for-longer interest rate worries but Treasury yields have eased on Wall Street supporting risk appetite.

US economic data has proven that there are signs of cracks in a tight US jobs market which is in contrast to how the markets were starting to position following Federal Reserve's Chair Jerome Powell's hawkish rhetoric to Congress earlier in the week.

Data released on Thursday took some of the sting out of Fed Chairman Jerome Powell's hawkish tone and has shown US jobless claims leaped by 11% last week. This was the biggest increase in five months. At the same time, planned layoffs for February quadrupled year-on-year. This data might be indicating that the Federal Reserve's hiking cycle has been playing out as intended and negates the need to hike aggressively.

Consequently, all three major US stock indexes were up and the US Dollar has drifted lower in a correction from a three-month high near 105.90 printed at the start of the week. The benchmark US Treasury yields have pulled back 0.8% and printed a low of 3.94% from 4.019%. In turn, the Euro is higher. However, Friday's Nonfarm Payrolls and next week's Consumer Price Index will be instrumental in guiding market expectations regarding the policy guidance likely to be offered by the FOMC at the March meeting.

Looking to tomorrow's event, the earlier ADP report pointed to another solid jobs report. It’s worth noting that NFP has beaten ADP for seven straight months. Will this streak continue in February? The ADP headline reading came in at 242k vs. 200k expected and a revised 119k (which was 106k) in January. ''The print adds to the sense that the economy is still humming along in February,'' analysts at Brown Brothers Harriman explained.

''Of course, recall that ADP missed big in January even after the revision and so the predictive power of ADP leaves a lot to be desired. That said, the consensus for Friday's NFP has edged higher to 225k vs. 517k in January. The unemployment rate is seen steady at 3.4% and average hourly earnings picking up to 4.7% y/y vs. 4.4% in January. Obviously, one big question is whether January NFP gets revised significantly in either direction,'' the analysts explained further. When giving their outlook for EURUSd, they said that they believe it remains on track to test 2023 low near $1.0485.

Meanwhile, ING analyst Chris Turner said in a webinar that ''the euro may struggle to recover until the third quarter when the US Dollar is likely to fall in tandem with the short-end of the U.S. Treasury yield curve.''

"Our baseline view for the second quarter had been a 1.05-1.10 range and clearly we are more towards the lower end of that and I suspect that the 1.05 area is going to be more pressured and more vulnerable during that period," Turner says, adding:

''However, the European Central Bank has been pretty hawkish about the prospect of further interest rate rises which may prevent EUR/USD from falling below the 1.05 support level even as the U.S. Federal Reserve signals higher rates.''

EUR/USD daily charts

In prior analysis, it was shown that an M-formation was forming on the daily chart as follows:

''The price has carved out an M-formation which is a pattern that tends to see a retest of the neckline near a 50% mean reversion in this particular case. 1.0520 guards 1.0480 while bulls will need to get above 1.06 to open risk to 1.0700.''

EUR/USD update

From the hourly chart, we can see how the M-formation has played out with the price moving up into the neckline area's resistance approaching the 38.2% Fibonacci retracement level.

At this juncture, bears will be monitoring the price action and on the lookout for opposing structures to align their shorts positions with. A break above the 78.6% Fibo may deter bears from getting heavily involved but the 1.0470s area is eyed as a downside target for a test of critical support on the way to the 200 DMA as per the daily chart:

- USD/MXN turned positive after buyers stepped in and dragged prices above 18.00.

- US Initial Jobless Claims aimed higher, suggesting that the Fed could increase rates gradually.

- Inflation in Mexico cooled down, with analysts speculating that Banxico could rise in 25 bps increments.

The Mexican Peso (MXN) is under pressure on Thursday; after reaching new 5-year lows at 17.8967, the UXD/MXN has risen back towards the 18.0800 area. Traders seeking safety ahead of important US economic data to be released, with the US Nonfarm Payrolls and next week’s CP, bought the US Dollar (USD). Hence, the USD/MXN climbs 0.60%, trading at around 18.0860.

Unemployment claims rose, though bolstered the USD vs. the MXN

Market mood has deteriorated, as shown by Wall Street, retracing its earlier gains. The Bureau of Labor Statistics (BLS) revealed the Initial Jobless Claims for the week ending on March 4 were 211K higher than expected at 195K. Although claims rose, the ADP Employment Change data, and job openings, continued to portray a tight labor market, justifying the Federal Reserve’s Chair Jerome Powell’s hawkishness at his appearance before the US Congress.

The US Dollar Index (DXY) is losing 0.38%, down at 105.250, putting a lid on the USD/MXN recovery towards the weekly highs at around 18.1788.

On the Mexican front, inflation slumped in the headline and core readings. The Consumer Price Index for February came at 7.62% YoY, below estimates of 7.68% and the previous month’s readings of 7.91%. Core CPI rose by 8.29% YoY, above the consensus but beneath January’s 8.45%.

“Today’s (inflation) print reduces the odds that (the Mexican central bank) chooses to go ahead with a 50 bps hike, though incoming data as well as the outlook for the Fed remain key influences on the bank’s decision,” Scotiabank economists said in a note.

Following the Mexican inflation release, the USD/MXN climbed above the $18.00 figure, extending its gains ahead of a busy US economic calendar. Nevertheless, the bias is downwards, but it could shift to neutral if buyers reclaim 18.3000.

USD/MXN Price action

The USD/MXN stages a recovery after trading below the $18.00 barrier during the last few days. Nevertheless, USD/MXN bulls are far ahead of declaring victory, as they need to reclaim the weekly high at 18.1788, followed by the 20-day Exponential Moving Average (EMA) at 18.2898. Once done, the USD/MXN could consolidate around the 18.1800-18.3000 area before testing the 50-day EMA at 18.6430. Otherwise, the USD/MXN is at the brisk of falling below 18.0000, which could pave the way for a new YTD low print.

What to watch?

US President Joe Biden presented his budget for the fiscal year 2024. It includes a plan to cut $3 trillion from the fiscal deficit over the next decade and higher taxes on wealthy people and large corporations.

More revenue would come from an increase in the corporate tax rate to 28%, hiking taxes on oil and gas companies and allowing Medicare to negotiate drug prices. The 2024 budget totals $6.8 trillion in spending, slightly above the current year.

The budget sets the stage for a battle between Democrats and Republicans, that control the House of Representatives. Still, Congress has to pass an increase to the debt ceiling. Republicans oppose raising taxes and their leaders said they won’t seek reductions to Social Security or Medicare.

The budget’s blueprint projects an annual deficit of more than $1 trillion each year through 2033 (deficits between 4.6% and 6.8% of GDP), with the debt-to-GDP ratio reaching 109% by that year. It assumes an annual growth of 1.5%.

- GBP/USD is on track to finish Thursday’s session with gains of 0.70%.

- Unemployment claims in the US take off some pressure from the Federal Reserve as the labor market cools down.

- GBP/USD Price Analysis: To remain downward bias unless bulls reclaim 1.2000.

GBP/USD bounces off the YTD lows of 1.1802 and rises above 1.1900, following Powell’s two-day appearance at the US Congress. Although Powell’s stance turned hawkish, US Thursday’s data might help the Fed to gradually increase rates, though further confirmation is needed on Friday’s Nonfarm Payrolls. At the time of writing, the GBP/USD is trading at 1.1905 after hitting a low of 1.1828.

Rising unemployment claims improved market sentiment, so the GBP rises

Data revealed by the BLS, Jobless Claims for the week ending on March 4 were 211K higher than expected at 195K. Despite a strong ADP report on Wednesday and more job openings than anticipated, rising unemployment claims could ease the tightness of the labor market. A downbeat US Nonfarm Payrolls report, coupled with high unemployment claims, could reduce the Federal Reserve’s (Fed) needs to tighten conditions at a faster pace.

The US Dollar Index (DXY) edges down by 0.40%, at 105.225, a tailwind for the previously battered Pound Sterling (GBP). In addition, US Treasury bond yields are easing ahead of an essential jobs report and next Tuesday’s inflation data.

On the UK front, an employment report will be released on March 14. Furthermore, the Chancellor of the Exchequer, Jeremy Hunt, will announce the spring budget. Aside from this, money market futures are pricing in a 91% chance that the Bank of England (BoE) will increase rates by 25 bps on the BoE’s next meeting on March 23.

GBP/USD Technical analysis

After the GBP/USD fell to fresh YTD lows at 1.1802, the pair recovered some ground but clashed on an upslope trendline; previous support turned resistance around 1.1930s. The daily Exponential Moving Averages (EMAs) reinforced the downtrend following the formation of a death cross that happened on February 3, which exacerbated the GBP/USD’s fall. Also, for a bullish continuation, the GBP/USD must conquer 1.2000. Contrarily, the GBP/USD first support would be 1.1900, which, once cleared, could pave the way to retest the YTD lows and 1.1800.

Economists at Rabobank have revised their economic forecasts for the Eurozone. They have significantly upgraded projections for the Eurozone in 2023 from -0.5% to 0.3%.

Good news, but with a disclaimer

“Lower energy prices, generous government subsidies and overall economic resilience will boost economic growth in the short run. As a consequence, we expect inflation to stay elevated for longer, just as interest rates. Combined with the fact that in most countries there is no more pandemic-related pent-up demand to be expected, this makes us forecast lackluster growth in the medium run.”

“We have quite substantially upgraded our forecast for 2023; we expect the economy to grow by 0.3% rather than contract with -0.5%. At the same time, we have slightly downgraded our forecast for 2024 from 1.2% to 0.9%.”

- Gold price jumps off the week’s lows, around $1810s, despite Fed’s Powell hawkish remarks.

- US Initial Jobless Claims rose above estimates, signaling that the labor market is cooling.

- XAU/USD Price Analysis: Neutral upwards, but downside risks remain.

Gold price climbs sharply in the North American session after dropping more than 1.70% on Tuesday. Hawkish remarks by the US Federal Reserve (Fed) Chair Jerome Powell at his appearance at the US Congress bolstered the US Dollar (USD). However, the US employment and inflation figures on Friday and the next week could influence the Fed’s path on interest rates. At the time of writing, the XAU/USD is trading at $1831.87 after hitting a low of $1812.09.

A fall in US jobless claims, a prelude of Friday’s NFP?

XAU/USD jumped sharply on the release of US economic data. The Bureau of Labor Statistics (BLS) revealed that Initial Jobless Claims for the week ending on March 4 rose by 211K above estimates of 195K. Even though Wednesday’s ADP report was solid, job openings exceeded forecasts; increasing unemployment claims could alleviate the labor market’s tightness. A solid US Nonfarm Payrolls report on Friday would pressure the Federal Reserve to deliver price stability. Hence, further tightening would be needed.

The US Dollar softened, and US Real Yields dropped from around 1.68%

In the meantime, the greenback is on the back foot, with traders booking profit ahead of tomorrow’s US jobs report. The US Dollar Index (DXY), which tracks the buck’s value against a basket of peers, retraces 0.46% at 105.172, a tailwind for the yellow metal prices.

US Treasury bond yields have come off the highs, with the 10-year rate at 3.944%, down five bps. The 10-yeas US TIPS, a proxy for Real Yields, are down from 1.686% to 1.614%, giving XAU/USD buyers a respite.

XAU/USD Technical analysis

XAU/USD jumped from around $1810, shy of testing the 200-day Exponential Moving Average (EMA) At $1805.56. On its way north, the XAU/USD reclaimed the 100-day EMA at $1821.94 and reduced the gap of the 20-day EMA, resting at $1839.43. For a bullish resumption, XAU/USD must reclaim the confluence of the 20 and 50-day EMAs at around $1844. Once cleared, it will expose the $1850 area. On the flip side, if XAU/USD tumbled back below the 100-day EMA, the path toward the 200-day EMA would be open.

What to watch?

The Fed has more to do. At some point, it is going to hurt, Kit Juckes, Chief Global FX Strategist at Société Générale reports.

Fed still closer to the end of its hiking cycle than either the ECB or the BoJ

“The Fed is still closer to the end of its hiking cycle than either the ECB or the BoJ, even if that cycle has further to go. Hence the inversion and the fear that the harder the inflation nut will be to crack, the more damage will be done to the economy its sitting on. That adds up to a slightly stronger Dollar but not dramatically stronger – it’s retraced a third of the fall from its end-September peak. This is set to grind on until the weight of forward-looking recession indicators (the curve, leading indicators, profits, the real estate sector, t name a few) becomes too heavy to ignore.”

“In the meantime, we watch investors move to the relative safety of credit markets, which appeals to boomers and is fine until it really isn’t. At which point, we’re in a recession.”

The Bank of Japan (BoJ) will announce its monetary policy decision on Friday, March 10 at 03:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of six major banks.

This will be the last one under current Governor Kuroda, as Kazuo Ueda has been appointed to succeed Kuroda from April on. No changes are expected in this March meeting. A policy shift by Kuroda in his last meeting would be a shocker.

Danske Bank

“The current BoJ Governor, Kuroda, has his last monetary policy meeting. We still think BoJ will tweak its yield curve control in the short-term. It is not likely to happen this week, but we also were surprised last time they did it in December. Either way, we think it is a matter of time and could happen during Q2.”

TDS

“It is unlikely that the BoJ will rock the boat at this meeting even as CPI inflation hit a 41-year high. Governor Kuroda at his last meeting will likely keep policy unchanged, with further changes having to wait for incoming governor Ueda starting in April. We think the BoJ could shift the top end of the YCC band again in the months ahead, potentially as early as April.”

SocGen

“We expect the BoJ to maintain its main monetary policy, i.e. YCC and ETF purchases. The BoJ is likely to want to see the results of this year’s spring wage negotiations, or the shunto in Japanese. Going forward, the BoJ is also likely to keep its policies unchanged in April, at the first meeting under the governor nominee, Kazuo Ueda. However, we expect that the BoJ will widen the range of fluctuation permitted on 10-year JGB yields from ±50 bps to ±100 bps at the June monetary policy meeting. In addition, the BoJ could make it clear that it will hold the current range or YCC until further progress is made in prices and wages. We continue to expect that the YCC will not be abolished in June.”

Deutsche Bank

“We expect the BoJ to adhere to its present monetary policy, with YCC removal seen unlikely, although you can't rule it out given December's surprise. This will also be the last monetary policy meeting for Governor Kuroda.”

Citibank

“BoJ will hold a policy meeting on March 9-10, the last one for Governor Kuroda. We expect to see the policy status quo maintained.”

BofA

“We expect no change in the BoJ's key policy targets, including the +/-50 bps band around the zero% 10yr JGB long rate target. We summarize expected market reactions to tail risks: No change: the market to await Ueda (USD/JPY 137). Shortening target from 10yr to 5yr: It could eventually be bearish for JPY if Ueda confirms dovish stance on the front-end as a 5yr ceiling can work as forward guidance (USD/JPY 134-136). Raising 10yr target band ceiling to 1% from 0.5%: Policy uncertainty to remain high (USD/JPY 132-134). YCC removal: Market may price in earlier and faster rate hikes on the front-end (USD/JPY 128-130).”

Gold price edges higher on Thursday. Bets for rate hikes by the Federal Reserve have failed to cap the yellow metal, strategists at TD Securities report.

More substantial CTA buying activity is unlikely below the $1,920 mark

“Gold prices are failing to print new lows ahead of this week's jobs report, and instead, have traded incredibly resiliently given rates markets pricing for the terminal rate rising sharply to 5.65% with 43 bps of hikes priced for March (72% chance of a 50 bps hike). This continues to underscore that substantial physical inflows into Gold markets have more than offset investor outflows in recent months.”

“In response to the resilient price action, CTA trend followers could already be set to marginally add to their Gold length this session, but more substantial CTA buying activity is unlikely below the $1,920 mark. Still, substantial selling flows are equally unlikely until prices break below the $1,710 mark, suggesting that CTA flows may take a backseat in the yellow metal for the time being.”

- EUR/USD manages to regain some poise and revisits 1.0580.

- Further losses could see the YTD low near 1.0480 retested.

EUR/USD regains some buying interest and advances to the 1.0580/85 band following two daily drops in a row.

The continuation of the downtrend seems favoured for the time being. Against that, the pair could dispute the 2023 low at 1.0481 (January 6) once the March low at 1.0524 (March 8) is cleared. Further losses are expected to retest the minor support at 1.0443 (weekly low December 7 2022).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0324.

EUR/USD daily chart

USD/CAD pushed higher and touched its strongest level since October at 1.3817. Economists at MUFG Bank expect the Loonie to remain under pressure.

Clear policy divergence lifting USD/CAD

“While we expect the US economy to slow more as well in response to higher rates it is happening with more of a lag that is opening up a widening policy divergence between the BoC and Fed in the near-term.”

“Short-term yield spreads between the US and Canada have hit fresh highs this week taking out the highs from late last year, and are placing further upward pressure on USD/CAD that has jumped from around 1.3600 to 1.3800.”

- USD/JPY comes under heavy selling pressure amid a sharp USD pullback from a multi-month top.

- The Fed-BoJ policy divergence supports prospects for the emergence of dip-buying at lower levels.

- The overnight failure to find acceptance above the 200-day SMA warrants some caution for bulls.

The USD/JPY pair meets with a fresh supply on Thursday and extends the previous day's modest pullback from the vicinity of the 138.00 mark, or its highest level since mid-December. The intraday selling picks up pace during the early North American session and momentarily drags spot prices below the 136.00 mark in the last hour.

The US Dollar (USD) bulls opt to take some profits off the table following the recent strong rally to over a three-month peak and turn out to be a key factor exerting pressure on the USD/JPY pair. Apart from this, the downfall could further be attributed to some repositioning trade ahead of the Bank of Japan (BoJ) monetary policy decision, scheduled to be announced during the Asian session on Friday.

The downside for the USD, however, is more likely to remain cushioned amid rising bets for a jumbo 50 bps lift-off at the March FOMC meeting. In contrast, the BoJ is expected to stick to its ultra-easy policy settings to support the fragile domestic economy. The divergent policy stance adopted by the two major central banks supports prospects for the emergence of some dip-buying around the USD/JPY pair.

From a technical perspective, the overnight failure to find acceptance above the very important 200-day Simple Moving Average (SMA) warrants caution for bullish traders. This makes it prudent to wait for a sustained move beyond the overnight swing high, around the 137.90 area, before positioning for any further gains. The USD/JPY pair might then climb to the 138.50 intermediate barrier en route to the 139.00 round figure.

On the flip side, any further decline is more likely to attract fresh buyers near the 135.35 horizontal support zone. That said, a convincing breakthrough, leading to a subsequent weakness below the 135.00 psychological mark, might shift the near-term bias in favour of bearish traders. Spot prices might then accelerate the fall towards the 134.75-134.70 area before eventually dropping to the 134.25 area and the 134.00 round figure.

USD/JPY daily chart

Key levels to watch

- Initial Jobless Claims in the US increased by 21,000 in the week ending March 4.

- US Dollar Index stays in negative territory below 105.50.

There were 211,000 initial jobless claims in the week ending March 4, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 190,000 and came in worse than the market expectation of 195,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 197,000, an increase of 4,000 from the previous week's unrevised average.

"The advance number for seasonally adjusted insured unemployment during the week ending February 25 was 1,718,000, an increase of 69,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar Index extended its downward correction after this data and was last seen losing 0.35% on the day at 105.28.

- USD/CAD climbs to its highest level since October and seems poised to appreciate further.

- A slightly overbought RSI on the daily chart might hold back bulls from placing fresh bets.

- Any meaningful corrective slide could be seen as a buying opportunity and remain limited.

The USD/CAD pair attracts some dip-buying near the 1.3785 region and climbs to a fresh high since October 21 during the early North American session on Thursday. The pair currently trades just above the 1.3800 mark and seems poised to extend its recent upward trajectory witnessed over the past three weeks or so.

Crude Oil prices languish near the weekly low amid concerns that a deeper global economic downturn will dent fuel demand and fading optimism over a strong recovery in China. This, in turn, is seen undermining the commodity-linked Loonie and acting as a tailwind for the USD/CAD pair. Bulls, meanwhile, seem rather unaffected by a modest US Dollar pullback from over a three-month peak.

The downside for the USD, however, remains cushioned amid bets for a 50 bps lift-off at the upcoming FOMC policy meeting on March 21-22. Moreover, looming recession risks should benefit the safe-haven buck. This, along with the fact that the Bank of Canada (BoC) became the first major central bank to pause its rate-hiking cycle on Wednesday, validates the positive outlook for the USD/CAD pair.

From a technical perspective, a sustained move beyond the 1.3700 horizontal barrier on Tuesday was seen as a fresh trigger for bullish traders. The subsequent move up validates the breakout and supports prospects for a further near-term appreciating move. That said, Relative Strength Index (RSI) on the daily chart is flashing slightly overbought conditions and warrants caution before placing fresh bets.

Nevertheless, the USD/CAD pair remains on track to climb further towards an intermediate hurdle near the 1.3870-1.3880 region en route to the 1.3900 round-figure mark. The positive momentum could get extended further, which should allow bulls to challenge the 2022 swing high, around the 1.3975-1.3980 zone, and then aim to reclaim the 1.4000 psychological mark.

On the flip side, any meaningful corrective decline now seems to find some support near the 1.3750-1.3745 area. Any further decline is more likely to attract fresh buyers near the 1.3700 horizontal resistance breakpoint. The latter should act as a pivotal point, which if broken might prompt some technical selling and drag the USD/CAD pair back towards the 1.3600 mark en route to the 1.3560 support zone.

USD/CAD daily chart

Key levels to watch

- DXY comes under some selling pressure following new YTD highs.

- Extra upside continues to target the 200-day SMA.

DXY gives away part of recent gains to the vicinity of the 106.00 mark, or new 2023 peaks.

The continuation of the rebound in the dollar seems like for the time being. The breakout of the round level at 106.00 should put the index en route to a probable test of the key 200-day SMA, today at 106.60.

A convincing move beyond the latter should shift the outlook to constructive in the short-term horizon and allow for the continuation of the uptrend.

DXY daily chart

Economists at Rabobank see the risks as being titled towards a firmer for longer USD in the coming months.

King Dollar (again)?

“In the near-term, the releases of US payrolls and CPI inflation data are likely to be instrumental in guiding the direction of the USD. However, the risks that inflation could prove sticky suggests that the higher for longer interest rate theme could persist for months.”

“We maintain our three-month forecast of EUR/USD 1.05 and continue to see risk of a dip to EUR/USD 1.03 on a six-month view.”

“We see risk of Cable moving to 1.16 on a six-month view.”

“We are forecasting AUD/USD holding close to 0.66 in the coming months with downside risk to this view.”

- Silver enters a bearish consolidation phase and oscillates in a narrow range around the $20.00 mark.

- The technical setup supports prospects for an extension of the recent well-established downtrend.

- A slightly oversold RSI on the daily chart is holding back bearish traders from placing fresh bets.

Silver struggles to gain any meaningful traction and extends its sideways consolidative price move around the $20.00 psychological mark through the mid-European session on Thursday. The white metal, meanwhile, remains well within the striking distance of over a four-month low touched on Wednesday and seems vulnerable to prolonging its downward trajectory witnessed since early February.

The recent breakdown through a technically significant 200-day Exponential Moving Average (EMA) was seen as a fresh trigger for bearish traders. Furthermore, this week's sustained weakness below the $20.50-$20.40 horizontal support, which coincided with the previous YTD low, adds credence to the negative outlook. This, in turn, suggests that the path of least resistance for the XAG/USD is to the downside.

That said, Relative Strength Index (RSI) on the daily chart is hovering in the oversold territory. Moreover, repeated failures to find acceptance below the $20.00 psychological mark make it prudent to wait for near-term consolidation before placing fresh bets around the XAG/USD. Nevertheless, the metal's inability to attract any buyers suggests that the near-term descending trend is still far from being over.

Hence, a subsequent slide towards testing the $19.60 intermediate support, en route to the $19.00 round-figure mark, looks like a distinct possibility. Some follow-through selling should pave the way for a slide towards the next relevant support near the $18.80-$18.75 region before the XAG/USD eventually drops to $18.30-$18.25 horizontal zone and the $18.00 level, which should offer strong support.

On the flip side, the $20.40-$20.50 support breakpoint now seems to act as an immediate barrier. Any further recovery is likely to attract fresh sellers and remains capped near the 200-day Simple Moving Average (SMA), currently pegged just ahead of the $21.00 mark. The latter should act as a pivotal point, which if cleared decisively could lift the XAG/USD to the mid-$21.00s. Bulls

might then aim to reclaim the $22.00 mark.

Silver daily chart

Key levels to watch

EUR/USD failed to make a decisive move in either direction on Wednesday. Economists at OCBC Bank expect the pair to trade within a 1.0520-1.0580 range today.

Await outcome of the US NFP on Friday

“Day ahead, expect EUR to consolidate around 1.0520-1.0580 range within wider perimeters of 1.0460-1.0680 range as we await outcome of the US NFP event risk tomorrow.”

“Resistance at 1.0640 (21-Day Moving Average), 1.0680 (23.6% fibo) and 1.0720 (50 DMA).”

“Support at 1.0520 (100 DMA), 1.0460 (38.2% fibo retracement of Sep low.”

- EUR/JPY accelerate losses and drops to the sub-144.00 region.

- There is an interim support at the 100-day SMA just above 143.00.

EUR/JPY fades Wednesday’s small advance and drops to new multi-day lows below the 144.00 level on Thursday.

While further side-lined trading seems likely for the time being, the cross could face bouts of selling pressure and confront the provisional 100-day SMA at 143.09. The loss of the latter could spark a deeper move to the weekly low at 142.14 (February 24).

In the meantime, while above the 200-day SMA, today at 141.75, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

The UK growth numbers are slated for release on Friday, March 10 at 07:00 GMT as we get closer to the release time, here are forecasts from economists and researchers of three major banks regarding the upcoming Gross Domestic Product (GDP) data.

January GDP is expected at 0.1% month-on-month vs. -0.5% in December.

ING