- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-10-2021

- EUR/USD bears are looking for a downside continuation to test weekly targets.

- At resistance, the hourly chart is riping for a downside continuation following a significant correction.

EUR/USD has seen a tremendous sell-off throughout Sep to date. The price has fallen from a fractal weekly high of 1.1909 to fresh lows at 1.1524 and into territory not traded in since July 2020. At this juncture, the price is not far off from the weekly 9 March candle's high of 1.1496 and then 1.1425 as being the 8 June weekly candle high. These are target levels for the bravest of bears who are still in anticipation of immediate lower levels.

The path of least resistance could well be to the upside at this juncture, given the weekly drop is expected to correct. However, according to the daily chart and momentum indicators, as well as the aforementioned weekly targets, there could still be some juice left to be squeezed out of this weekly move for day traders.

The following illustrates both the bullish and bearish bias in a top-down analysis, usually starting first with the monthly chart, then moving all the way into the 15-min chart. However, for the sake of the order of priority, we will look at the hourly and 15-min conditions that could offer a potential trade opportunity for day trades over the coming sessions.

EUR/USD 1-hour chart

The hourly chart has seen the price fall in a bearish impulse and a correction to a significant level on the Fibonacci scale. The correction is stalling and the deceleration would be expected to lead to a downside continuation towards hourly, daily Fibo, or even, weekly structure targets as illustrated above.

EUR/USD, 15-min chart

The 15 min time frame from where to execute the break of a support structure is showing an engulfing bearish test of the trendline support. A break there will likely engage the bears and potentially trigger a break of horizontal support near 1.1530 as being the prior day's closing price.

The market is bearish below there and traders can engage for a run to the hourly -272% Fibonacci retracement of the correction's range at 1.1522. However, given the quiet Asian session, the process could be slow but the Tokyo open and subsequent trade could add some life to an otherwise sleepy market.

More to come on the longer-term analysis...

- USD/JPY continue to accelerate gains for the third straight session on Wednesday.

- US dollar at fresh yearly high above 94.50 boosting prospects for USD/JPY.

- US Inflation, hawkish Fed members, and FOMC minutes steal the spotlight.

USD/JPY prints fresh daily gains on Wednesday in the early Asian trading session. The pair started higher this Monday and the momentum is still carried on the back of a firmer US dollar At the time of writing, USD/JPY is trading at 113.58, up 0.02% for the day.

The hawkish comments from Fed’s officials strengthen the US Fed’s stance on November tapering although recent economic data tell a different story. St. Louis Fed President James Bullard said he support November tapering along with Atlanta Fed President Raphael Bostic. The greenback remains supported at the higher level, pushing USD/JPY toward fresh 2021 highs.

The US Consumer Inflation Expectations came at 5.3% in September, rising for the 11th straight month whereas the number of job openings fell more than expected in August. Furthermore, the International Monetary Fund (IMF) downgraded the growth in the US economy from 7% in July to 6%. The US benchmark T-bond yields trade lower at 1.57% in response to the factors, but the US dollar remained unfazed.

On the other hand, the Japanese yen remained on the backfoot after the recent data revealed a drop in Japan’s Business Mood. The Reuters Tankan sentiment index for manufactures fell to 16 in October from 18 in the previous month.

As for now, traders are waiting for Japan’s Machine Orders, US Core Inflation Rate, and FOMC Minutes to gauge the market sentiment.

USD/JPY additional levels

- AUD/JPY reaches a fresh three-month high around the 83.80 range.

- AUD/JPY: A Doji in the daily chart depicts that the pair might correct lower before resuming the uptrend, supported by momentum indicators.

The AUD/JPY is trading unchanged as the Asian session begins and is trading at 83.48, barely down 0.01%, during the day at the time of writing. The market sentiment is mixed, as depicted by Asian equity futures, seesawing between gainers and losers.

AUD/JPY Price Forecast: Technical outlook

Daily chart

On Tuesday, the AUD/JPY reached 83.80 above the middle of the Andrew Pitchfork channel, but strong seeling pressure capped the move, retreating the cross-currency to 83.50. A breach of the latter could accelerate an upside move towards the July 6 high at 84.19, but oversold levels at the Relative Strength Index (RSI) at 73, suggests the pair could be headed for a correction towards the 200-day moving average (DMA) at 82.37, before resuming a move towards higher prices. Nevertheless, in case of a push below the 200-DMA, the September 3 high at 82.02 will be the next support before reaching the 100-DMA at 81.83.

Worth notice: the October 12 price action portrayed a Doji in the middle of the Pitchfork channel, meaning the pair could reverse the upward trend.

1-hour chart

The AUD/JPY is trading within a narrow range between 83.50-83.80. A break beyond the upside level could open the way towards 84.00. However, the Relative Strength Index at 53, suggesting that an upside move might be on the cards. Failure to an upside break could signal that consolidation or a correction could lie ahead for the AUD/JPY in the near term.

On the flip side, a break beneath the bottom level will find the daily pivot at 83.41 as the first support level, followed by the 83.00 psychological level. A breach beneath the latter would exert downward pressure on the pair towards the confluence of the 50-simple moving average (SMA) and the S1 pivot level around the 83.12-83.22 area.

US Treasury Secretary Janet Yellen reiterates view high us inflation transitory and said that she sees an 'isolated' shortages of goods in coming months.

Last week, Yellen said that the various issues that have colluded to push up prices likely will pass though she’s not sure how long that will take. “Supply bottlenecks have developed that have caused inflation,” she said. ''I believe that they’re transitory, but that doesn’t mean they’ll go away over the next several months.”

Meanwhile, the carry trade currencies are up where rate hikes are being priced in from the likes of the Bank of England this year and the Federal Reserve next year. The US dollar is third to the CAD and AUD so far this week as investors seek shelter in commodity prices as a hedge against inflation.

DXY, an index that measures the US dollar vs a basket of major rivals, has been trading through 93.50 and is at the highest level since Sep 2020.

- NZD/USD treads water on Wednesday as it fails to capitalize on the previous session’s gains.

- US Dollar Index near one-year high above 94.50 with fresh 0.22% gains.

- Kiwi remains under pressure on mixed economic data, renewed COVID-19 outbreak, China data eyed.

NZD/USD continues to grind lower on Wednesday in the Asian session. The buying pressure in the US dollar keeps NZD/USD edgy. At the time of writing, NZD/USD is trading at 0.6933, down 0.01% for the day,

The US Dollar Index (DXY), which measures the greenback performance against its six major rivals, trades at 94.50 near its highest since September 2020. The greenback attracts the capital flows on its safe-haven appeal amid risk on sentiment and hawkish Fed member’s.

Fed Vice Chair Richard Clarida said that gradual taper concluding mid-2022 may soon be warranted as the economy has made substantial progress. In the same tune, both Atlanta Fed President Raphael Bostic and St. Louis Fed President James Bullard endorsed a November start.

On the other hand, Kiwi lost its momentum on reduced risk appetite among investors in the wake of the renewed COVID-19 restrictions and mixed economic data. In the latest development, the outlook for Auckland remains grim with the number of active new coronavirus cases jumping five-fold since a week ago.

On the economic data side, Food Inflation in New Zealand jumped 4% in September on yearly basis from 2.8 in the previous month.

As for now, all eyes are on the Chinese Export data, US Core Inflation data, and FOMC minutes to take fresh trading impetus.

NZD/USD additional levels

- The market sentiment is a mixed bag on the back of inflationary pressures.

- Higher Iron ore prices failed to boost the Australian dollar.

- Investors remain sidelined, awaiting crucial US CPI data due on Wednesday.

- AUD/USD: From a technical perspective, the pair is in a downward trend.

The AUD/USD is beginning the Asian session on the wrong foot, is down 0.04%, trading at 0.7347 during the day at the time of writing.

The market sentiment is mixed, as witnessed with US stock indices closed with losses between 0.24% and 0.35%. Meanwhile, Asian equity future indices seesaw between gains and losses. Factors like the energy crunch and inflationary pressures keep investors uncomfortable to open new positions on the AUD/USD pair.

Iron ore prices are up 11.21%, trading at $129.00 per metric tonne, but the Australian dollar has not followed its footprints.

On the macroeconomic front, the Australian docket will feature the Westpac Consumer Confidence for October, expected at 2.4%, more than the September reading at 2%.

Data-wise, the September CPI data is due on Wednesday in the US, and the market is expecting 5.3% YoY and 4.0% YoY, respectively, on headline and core.

AUD/USD Price Forecast: Technical outlook

Daily chart

The AUD/USD pair trades between the 50 and the 100-day moving averages (DMA’s) that lie at 0.7302 and 0.7416, respectively. The 200-DMA is located above the current spot price, meaning that the pair is in a downtrend.

To resume the downward trend for AUD/USD sellers, they will need a daily close below the October 12 low at 0.7330. in that outcome, sellers could push the price towards the confluence of the 50-DMA and the figure at 0.7300. This level is crucial, as a break underneath could open the door for the September 30 low at 0.7169.

Momentum indicator like the Relative Strength Index (RSI) is at 57, edging lower, indicating that downward pressure is waning, suggesting that the pair might consolidate before resuming the downside bias.

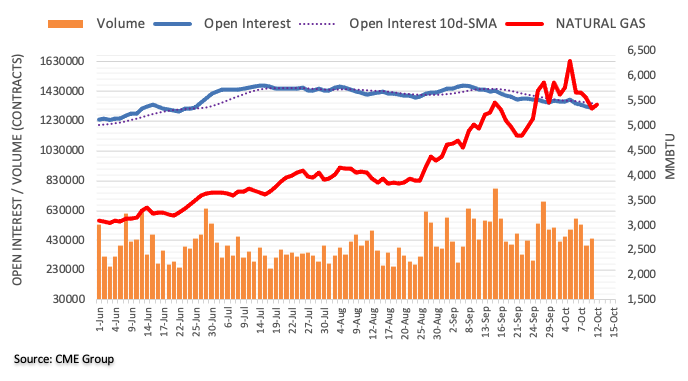

- Gold is in the balance of the market's forecasts for stagflation.

- Gold is at the mercy of the Fed, inflation risks and US jobs and other critical data this week.

The price of gold is higher by some 0.38% around the close of Wall Street as US equities plummet. The Dow fell more than 100 points as stocks end lower ahead of bank earnings, inflation data. The S&P 500 was 0.25% lower and the Nasdaq ended down 0.14%.

Meanwhile, the carry trade and commodity currencies are taking up the top leader boards, where rate hikes are now being priced in. The US dollar DXY, an index that measures the US dollar vs a basket of major rivals, is trading through 93.50 and is at the highest level since Sep 2020 as the market prices in the Federal reserve's tapering and rate hike expectations in 2021 and 2022 respectively.

Inflation and stagflation risks weighed

Risk markets have stabilised as inflation uncertainty continued to creep higher despite a dismal Nonfarm payrolls headline last week. However, investors will now look to the next key US data releases in September Consumer Price Index and Retail Sales which will be important in the current stagflation debate for which gold is akin.

''Looking beyond Fed pricing, higher wages and no rise in the participation rate, along with the ongoing energy crisis, will keep the stagflation theme alive,'' analysts at TD Securities explained. ''As such, gold could be an ideal hedge against these rising stagflationary winds, while a positioning slate that is skewed short also suggests that a further rout on the yellow metal is unlikely.''

Indeed, recent Fedspeak and inflation expectations data have indicated that confidence in the transitory inflation story is continuing to fade. This makes for September's CPI data that are due Wednesday important. The market is expecting 5.3% YoY and 4.0% YoY respectively on headline and core.

Meanwhile, as the global energy crisis intensifies, impacting the production of goods across the world and supply chains across Europe and Asia, reasons to own the yellow metal are growing more compelling, analysts at TD Securities argued.

''Indeed, as these issues fuel concerns of slowing demand and rising inflation, price action across rates in recent trading sessions suggest that global macro is just starting to price in implications of the energy crisis,'' the analysts pointed pout. ''After all,'' they say, ''the Post-Fed move higher in rates was led by real rates, whereas it is now being led by breakevens, suggesting the market is pricing in higher inflation due to the spike in energy, but acknowledging that this is a supply-shock which impacts growth negatively.''

''In turn, with positioning in the yellow metal increasingly short, including CTAs, potential strength in gold due to this growing stagflationary narrative could spark aggressive short covering on the horizon.''

Gold positioning

From a positioning standpoint, speculators have opted to add back some along following the breakout in Treasury yields that have been weighing on momentum, eventually sending the yellow metal to the lows. Still, short covering did not last long as investors look to the Fed for the November taper. Looking forward, however, there is plenty of dry powder on the sidelines which could help drive gold higher as investors look for traditional hedges vs stagflationary themes.

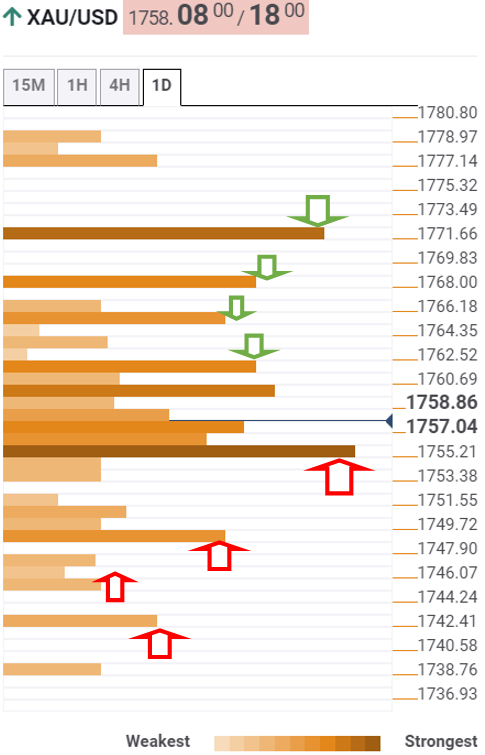

Gold technical analysis

In the Chart of the Week: XAU/USD bulls step in, the 4-hour support was noted as follows:

Gold 4-hour chart, prior analysis

It was stated at the start of the week's analysis that, ''from a 4-hour perspective, gold bulls would be prudent to see the price make a move in the direction of the target to break the near term resistance around $1,770. In engaging above this area, there is a higher probability of a bullish continuation for gold this week.'

However, the bears have been testing the grit of the bulls and the price has moved sideways along horizontal support and pushing dynamic support further out along the trend as follows:

Should the price break the dynamic resistance that has formed and test into the 1,770 resistance area, then there are prospects of the bullish breakout. On the other hand, a break below the 1,750 would likely lead to a downside continuation from a daily perspective towards 1,720 and void the daily upside target towards the 200 MA near 1,800:

In a CNBC interview, Federal Reserve's James Bullard has stated that he supports starting a taper in November.

Key comments

Says he wants to finish the taper in Q1 of 2022 to be in place to react to higher inflation.

Says the pandemic will come under better and better control with pills, booster shots, shots for kids.

Says still in great shape economy-wise despite the delta setback in Q3.

Says by next spring could see the unemployment rate back to pre-pandemic level.

Says 'reasonable' to think inflation could come down on its own, but there's some risk it could go higher.

Says want to be in a position to raise rates if needed in spring or summer of 2022.

Says the probability of recession is exceptionally low at this point.

Meanwhile, the carry trade currencies, where rate hikes are being priced in, are higher. The US dollar is taking up the top spot behind CAD and AUD on Tuesday.

DXY, the index that measures the US dollar vs a basket of major rivals, is trading through 93.50 and is at the highest level since Sep 2020.

- USD/CAD break below 1.2500 amid higher energy prices.

- The market sentiment is downbeat, weighs on the USD/CAD pair.

- USD/CAD: The pair has another leg-down before momentum indicators reach oversold levels from a technical perspective.

The USD/CAD pair slides during the New York session is trading at 1.2462, down 0.18% at the time of writing.

The market sentiment is downbeat, portrayed by US stock indices posting losses between 0.25% and 0.34%. Factors like the energy crunch in Europe and Asia, the Chinese Evergrande’s real-estate spillover in the sector, inflationary pressures, and rising energy prices have kept investors at bay.

That said, rising oil prices are boosting the Canadian dollar. Western Texas Intermediate (WTI) crude oil is barely unchanged at $79.90, below the $80.00 threshold for the first time in two days.

Meanwhile, the US Dollar Index that measures the greenback’s performance against a basket of six peers is advancing 0.12%, currently at 94.48, whereas the US T-bond 10-year benchmark note rate is declining three basis points (bps), down to 1.566%, for the first time since the last week.

USD/CAD Price Forecast: Technical outlook

Daily chart

The USD/CAD is trading below the daily moving averages (DMA’s), suggesting the pair is in a downtrend. Momentum indicators, like the Relative Strength Index (RSI) at 36, edging lower, means another leg down could be on the cards.

To accelerate the downward trend, USD/CAD sellers need a daily close below 1.2445. In that outcome, the first support level would be 1.2421. A breach beneath the latter can push the pair towards the July 16 low at 1.2302.

On the flip side, a daily close above the 200-DMA at 1.2510 could pave the way for further gains. The first resistance would be 1.2600, immediately followed by the 50-DMA at 1.2622.

KEY ADDITIONAL LEVELS TO WATCH

- EUR/JPY bearish confluences point to an imminent downside correction.

- EUR/JPY bears are looking for an optimal entry point.

EUR/JPY has rallied as the Yen takes up the last position according to the CSI indicators. The market is getting behind the inflation theme which is seeing flows driven towards the commodity complex and higher-yielding currencies. This leaves the euro vulnerable and the yen is potentially due for a positive correction making EUR/JPY's recent rally a potential shorting opportunity. The following illustrates the bearish confluence on both the weekly and daily time frames with prospects of a 1-hour trade set-up.

Weekly chart

From a weekly perspective, the price is firmly bid and it can easily move higher. However, when examining the price action on the lower time frames, it makes the W-formation on both the weekly and daily charts compelling.

The W and M harmonic patterns are reversion patterns by nature and have a high completion rate. Therefore, the price would be expected to retrace some of the recent bids in due course. Examining the daily chart, that reversion could be imminent.

Daily chart

As illustrated, the daily chart is meeting resistance and the price is well above the 200-day moving average and a cluster of the 10, 21, and 50 MAs. Additionally, by measuring the peaks of Aug to current highs and comparing them to no fresh highs in RSI over the same time period, this is a bearish divergence.

However, it is a relatively weak divergence considering RSI is flat between the peaks. We would want to see a lower current high to that of Aug's peak for stronger divergence. Nonetheless, the confluence of factors points to a downside correction. A target to the prior daily highs near the 38.2% Fibonacci retracement level is a compelling zone between and near 130.50 and 130.20.

EUR/JPY, 1-hour chart

The 1-hour time frame is a suitable chart to monitor for an optimal entry point for a swing towards the daily target near the 130.20/50 zone. Bears would be prudent to wait for a break of dynamic trendline support and then to expect a restest of the structure as a counter-trendline. Then, the horizontal support near 130.80, if broken, would be expected to act as resistance on any restest. This would likely lead to a deterioration of bids equating to a significant downside correction as per the daily chart's forecast above.

What you need to know on Wednesday, October 13:

Market participants kept struggling for a catalyst as the macroeconomic calendar remained scarce. Overall, risk-aversion dominates the scene amid Chinese headwinds related to financial stability and the ongoing energy crisis.

Furthermore, the International Monetary Fund lowered its global growth forecast amid "seeing major supply disruptions around the world that are also feeding inflationary pressures, which are quite high and financial risk taking also is increasing, which poses an additional risk to the outlook."

The American dollar gathered momentum during US trading hours, helped by comments from US Federal Reserve officials aligned with soon-to-come tapering. Vice-Chair Richard Clarida said, "I myself believe that the 'substantial further progress' standard has more than been met with regard to our price-stability mandate and has all but been met with regard to our employment mandate," adding that gradual tapering of assets purchases could conclude mid-2022.

Federal Reserve Raphael Bostic noted that inflation is well above Fed's 2% goal, noting that persistent supply chain issues will probably last longer than initially anticipated. Hence, policymakers need to watch carefully to ensure that pandemic-induced pressures do not cause long-term inflation expectations to become unanchored.

Across the pond, dismal German data undermined demand for the shared currency. The EUR/USD pair fell to a fresh 2021 low of 1.1524, holding nearby as the day ended.

The GBP/USD pair hovers around 1.3590, undermined by the dollar's demand, and despite speculation the Bank of England could raise interest rates before year-end to counter inflationary pressures.

The AUD/USD pair held on to gains near 0.7350, although the sour tone of equities prevented it from advancing further. USD/CAD fell to 1.2433, a fresh 2-month low as crude oil prices held at multi-year highs. WTI settled at $80.60 a barrel.

Gold attempted to rally but changed course in the US afternoon, ending the day with modest gains around $1,760 a troy ounce.

Solana bound for further losses as SOL eyes $125

Like this article? Help us with some feedback by answering this survey:

- The euro returns to 0.8480 area after failure at 0.8520.

- BoE rate hike expectations are supporting the pound.

- EUR/GBP is trading above a key support area at 0.8471/49 – Commerzbank.

The euro has found support at 0.8480 area following a reversal from 0.8520 earlier today. Broadly speaking, the pair is licking its wounds, clinging right below 0.8500 after having lost nearly 2% over the previous two weeks.

BoE tightening expectations are supporting the GBP

The British pound has remained fairly firm in October, supported by expectations that the Bank of England will lead the rest of the major central banks in raising interest rates after the COVID-19 crisis. Some market sources are anticipating an interest rate hike early next year, with other hikes to follow, in an attempt to tackle inflationary pressures.

Furthermore, the euro remains on the defensive on rising concerns about inflationary pressures and supply bottlenecks thwarting the post-pandemic recovery. The macroeconomic docket has supported those fears on Tuesday, with the German ZEW economic sentiment index deteriorating for the fifth consecutive month.

EUR/GBP: Above important support at 0.8449 – Commerzbank

According to Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, breach of 0.8471/49 support would renew bearish pressure: “EUR/GBP is under pressure near term following last week’s failure just ahead of .8671, the July 2021 high. The market has reacted back to key support at .8505/00, the lows from mid-July, and these are exposed and failure here will target key support is .8471/49, the recent low and lows since 2019. We again look for these to hold the downside.”

Technical levels to watch

- High energy prices, supply shortages amid other factors dampened the market sentiment, thus weighing on the NZD.

- Fed’s Clarida commented that he would like the QE’s reduction to conclude by the first half of 2022.

- Among other policymakers, Atlanta’s Fed President Bostic is ready to begin the bond tapering in November.

The NZD/USD pair falls during the New York session, trading at 0.6933, down 0.12% at the time of writing.

High energy prices, supply shortages, and the ongoing energy crisis, among other factors, weigh on the market sentiment, as witnessed by US stocks falling between 0.02% and 0.09%. Also, some Federal Reserve Members crossed the wires, reinforcing the possibility of the start of the bond tapering process by the Federal Open Market Committee on November’s meeting

In the meantime, the US Dollar Index that measures the US dollar performance against a basket of six peers is aiming higher, almost 0.20%, sits at 94.50.

In the absence of any New Zealand fundamental catalyst, the US economic docket featured the JOLTS Job Openings for September, which decreased to 10.439M lower than the 10.925M foreseen by economists.

Fed’s Clarida would like to conclude the QE’s reduction by the first half of 2022

Fed speakers have crossed the wires during the New York session. The Federal Reserve Vice-Chairman Richard Clarida said that the bar for taper has all but met concerning the labor market. Moreover added, “if recovery remains on track, gradual tapering of asset purchases concluding middle of next year may soon be warranted.”

Meanwhile, Raphael Bostic, President of the Federal Reserve in Atlanta, said that the slowdown in the US labor market should not derail the Fed’s taper timeline. He said, “[he] would be comfortable starting tapering of asset purchase program in November.”

On the macroeconomic front, on Wednesday, the New Zealand economic docket will feature the REINZ House Price Index (MoM) and the Food Price Index (MoM), both for September.

On the US front, the Consumer Price Index and the last Federal Open Market Committee minutes could offer a fresh catalyst for NZD/USD traders.

NZD/USD Price Forecast: Technical outlook

Daily chart

The NZD/USD spot price is well below the daily moving averages (DMA’s), supporting the downward trend. In the last four days, the pair has unsuccessfully tested the 0.6960 level, retreating on heavy selling pressure, each of the moves below 0.6940. A daily break below 0.6900 could push the pair towards the confluence of a rising slope trendline and the October 6 low at 0.6875. A breach of that level could expose the 2021 lows at 0.6805.

The Relative Strength Index (RSI) is at 44, flattish, suggesting that the pair might consolidate before resuming another leg down, towards 0.6805.

- The US dollar extends gains to 10-day highs above 0.9300.

- The Swiss franc loses ground against a stronger dollar.

- USD/CHF: Above 0.9300, the next target is a 6-months high at 0.9380.

The US dollar is pushing higher on the afternoon US trading session, exploring levels above 0.9300 for the first time over the last ten days. The pair has pierced the top of the recent trading range, inching up towards multi-month highs at 0.9380.

The dollar firms up across the board

The greenback has bounced up after a soft opening on Tuesday, as investors' concerns about inflationary pressures curtailing economic recovery have dented the US dollar’s strength.

The greenback, however, has managed to bounce up, boosted by a rebound on US Treasury yields, with the 10-year note reaching 1.60% for the first time since June. Market expectations of QE tapering by the Federal Reserve are underpinning the US dollar’s rally.

In absence of relevant macroeconomic figures, the focus is on September’s US Consumer Prices Index data and the minutes of the last FOMC meeting, which could offer a fresh impulse to the USD.

USD/CHF: Above 0.9300, next resistance is 0.9380

On the upside, if the pair manages to confirm above 0.9300 (Oct. 6, 8 highs) the pair might attempt another attack to multi-month high 0.9380 (Sept. 30 high, 78,6% Fib. Retracement of the March-June decline) and 0.9435 (Apr. 5 high).

On the downside, immediate support lies at 0.9270 (61,8% Fib. Retracement of the March-June decline) then 0.9250 (Oct 7, 11 low, trendline support) and below here, 0.9220 (Sept. 23 lows).

Technical levels to watch

- GBP/JPY rallied on Tuesday to the highest levels since 21 June.

- UK jobs data keeps expectations for future rate rises from the Bank of England intact.

GBP/JPY soared as investors get on the carry trades and behind the pound following UK jobs data that met expectations and left sentiment in place for future rate rises from the Bank of England intact. The currencies that are expected to offer higher yields or track commodities due to inflation risks are performing the best. The risks of inflation have also kicked in on a week where plenty of Fed speakers are likely to advocate for action sooner than later.

BoE rate hike expectations lift GBP

Firstly, UK data that the Unemployment Rate edged down to 4.5% in the three months to August, in line with economists' forecasts in a Reuters poll. Additionally, British employers expanded their payrolls to a record high in September. This leaves scopes for the Bank of England to raise interest rates as risks of stagflation are limited so long as the jobs market is improving. Money market pricing shows around an 8 basis point rate hike from the BoE priced in as early as the Bank's November meeting.

At the start of the week, GBP/USD printed a two-week high on hawkish weekend comments from BoE governor Andrew Bailey and fellow policymaker Michael Saunders, who both advocated for rate hikes. Saunders, in particular, said households must brace for "significantly earlier" interest rate rises. Bailey stressed the need to prevent inflation. This leaves GBP vulnerable to the upside as investors back the carry trades, seeking yield from nations of whole economic are emerging from the COVID-19 lockdowns and being the first to hike rates since the start of the global COVID-19 pandemic.

GBP downside risks, (Brexit)

On the other hand, there are risks relating to Brexit woes and the UK's energy crisis. As analysts at Brown Brothers Harriman explained, ''a hike before year-end is now fully priced in, as are three more hikes to follow in 2022.''

''Despite the heightened BOE tightening expectations, we believe the fundamental backdrop for sterling remains negative,'' the analysts argued. ''For cable, a break below $1.3510 is needed to set up a test of the September 29 cycle low near $1.3410.''

The UK's Brexit Minister Frost made a speech today with a plea to the European Union to allow for "significant change" to post-Brexit rules governing trade with Northern Ireland.

A day before the EU is expected to present its proposals to solve a standoff over part of the Brexit divorce deal, Frost again warned Brussels London could unilaterally waive some of the terms of its agreement if the bloc failed to budge.

"With some effort of will, we could still, despite all the problems, be in a position where the poison is drawn from this issue entirely and it is removed from the diplomatic top table once and for all."

The European Commission has said it will not comment immediately on Frost's speech before it outlines its proposals. However, the EU has repeatedly said it will not renegotiate the protocol. Analysts at Brown Brothers Harriman are of the mind that this is going in circles. ''For the hundredth time, we must point out that there is simply no way for the UK to square the circle,'' the analysts said in a note today.

''That is, after the UK left the EU, there is no way to avoid a hard border somewhere between Ireland and Britain. A hard border in the Irish Sea would not be acceptable to loyalists in Northern Ireland, while one between Northern Ireland and the rest of Ireland would bring back bad memories of the Troubles.''

"For the EU now to say that the protocol drawn up in extreme haste in a time of great uncertainty can never be improved upon would be a historic misjudgement," Frost said. "So I repeat, to conclude- let us both be ambitious and agree a better way forward."

Meanwhile, on Monday, Irish Foreign Minister Simon Coveney said Britain knew full well Brussels could not move on the ECJ. "At some point the EU will say enough, we cannot compromise more and I think we're very close to that point now," he said

The risks are an outright trade war that would be expected to harm both sides. The EU has said it would try to find a cooperative solution but has also threatened sanctions if the U.K. were to take unilateral action.

''A costly trade war is probably the last thing Europe needs right now,'' analysts at Brown Brothers Harriman said. ''However, such a development would most likely hurt the smaller country the most. To put it bluntly, the UK needs the EU more than the EU needs the UK. And let’s not forget that the UK is still pushing the EU for so-called equivalence for British financial firms.''

Reuters reported on Atlanta Fed Bank President Raphael Bostic comments from a little earlier today.

Bostic was noted saying that US inflation is elevated but it is not at the point where it would affect the Federal Reserve's stance on interest rates.

He added that he still expects it will be more than a year before the central bank raises rates from near-zero levels.

"I'm not seeing signs that this elevated inflation is doing the kind of harm to the economy which would really call into question our policy stance in terms of interest rates," Bostic said during a virtual event with the Peterson Institute of International Economics.

Meanwhile, the carry trade currencies, where rate hikes are being priced in, are soaring with the US dollar taking up the top spot on Tuesday.

DXY, an index that measures the US dollar vs a basket of major rivals, is trading through 93.50 and is at the highest level since Sep 2020.

- Silver prices whipsaw between $22.35 and $22.75 before returning to previous ranges.

- Precious metals' upside attempts remain limited by US dollar strength

- XAG/USD treading water around $23.50.

Silver futures have whipsawed between $22.35 and $22.75 on Tuesday, to consolidate near $22.60 during the US trading session. On the daily chart, the precious metal remains practically unchanged with upside attempts weighed by US dollar strength

Silver prices pull back as the US dollar bounces up

Silver and other precious metals appreciated earlier on Tuesday, fueled by a moderate risk aversion on rising concerns about the economic consequences of surging inflation. Beyond that, the negative opening of US Treasury bonds weighed on the US dollar, driving silver prices somewhat higher.

The precious metal’s rally, however, has been short-lived. The US dollar has bounced up, with US T-Bond yields regaining lost ground, with the market anticipating the market pricing the upcoming announcement of QE tapering by the Federal Reserve. The US Dollar Index has bounced up above $94.25 earlier today to extend towards year-to-date highs beyond 94.50.

XAG/USD: treading water between $22.20 and $23.15

From a technical perspective, the pair remains moving within a horizontal range. On the upside, September 22, October 8 highs, at $23.15 remain the main obstacle to extend gains towards 14, 16 September highs, at $24.00, and of September 3 high at $24.87.

On the downside, immediate support lies at $22.15 (October 6 low) and below here, $21.37 (September 29 low) and 20.75 (50% Fibonacci retracement of the March-August 2020 rally.

Technical levels to watch

- EUR/USD slides for the second day in a row, on the back of Us dollar strength.

- The US dollar index is trading at one and ½ year highs above 94.50, weigh on the EUR/USD pair.

- The market sentiment is downbeat, attributed to inflationary pressures and slower growth.

- Fed’s Bostic and Clarida support the start of the bond tapering by November.

The EUR/USD is sliding during the New York session, downward pressured 0.23%, trading at 1.1526 at the time of writing. The single currency is trading near the 2021 year lows.

The market sentiment stills in a risk-off environment, portrayed by US stock indices falling between 0.15% and 0.34%. However, safe-haven currencies like the Japanese yen and the Swiss franc are losing against most G8 currencies, probably on the back of the carry trade. In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, advances 0.18%, is at 94.54, reaching a new one and ½ yearly high.

Factors like Inflationary pressures mainly spurred by high energy prices, supply shortages, and a drop in consumer confidence keep investors at bay.

Germany ZEW of Economic Sentiment was worse than expected

On the macroeconomic front, Germany featured the ZEW Survey Economic Sentiment and Current Situation for October. The German Economic Sentiment rose to 22.3 lower than the 24 foreseen, whereas the Current Situation reading rose to 21.6, worse than the 29.5 expected, and trailed the September 31.9.

Across the pond, the JOLTS Job Openings for August dropped to 10.439M, less than the 10.925M estimated.

Fed’s Bostic and Clarida support the start of the bond tapering by the November meeting

Fed speakers have crossed the wires during the session. Raphael Bostic, President of the Federal Reserve in Atlanta, said that the slowdown in the US labor market should not derail the Fed’s taper timeline. He added, “would be comfortable starting tapering of asset purchase program in November.”

Meanwhile, the Federal Reserve Vice-Chairman Richard Clarida said that the bar for taper has all but met concerning the labor market. Further added, “if recovery remains on track, gradual tapering of asset purchases concluding middle of next year may soon be warranted.”

KEY ADDITIONAL LEVELS TO WATCH

- The Australian dollar retreats from 0.7385 high: returns to 0.7360 area.

- The aussie remains firm, boosted by higher commodity prices.

- AUD/USD's rally might be capped at 0.7365 – Credit Suisse.

The Australian dollar has pulled back on Tuesday’s US session, returning to 0.7360 area after having reached fresh one-month highs at 0.7385. The pair, however, is showing strength despite the rising concerns about surging inflation pressures and has rallied about 2.5% in October so far.

Higher commodity prices are boosting AUD’s rally

The Aussie seems unaffected by the US dollar’s strength and has maintained its positive tone this week. The increasing commodity prices, with iron ore, one of Australia’s main exports surging amid higher demand from China, is driving the AUD higher across the board.

Beyond that, the relaxation of COVID-19 restrictions in Sydney, the country’s most populated city, which has gone through a four-month lockdown, has increased optimism about a post-pandemic recovery while the authorities accelerate the pace of vaccination.

AUD/USD resistance at 0.7365 might cap the upside trend – Credit Suisse

The FX analysis team at Credit Suisse, however, warns about a key resistance area at 0.7365, that could halt the current rally: “AUD/USD has broken out resistance at 0.7312/17, which suggests a short-term correction higher to the 2021 downtrend at 0.7365, which we then expect to cap the market. Thereafter, support is seen at 0.7291/87 initially, below which would confirm a turn back lower and retest of 0.7179/70 lows.”

Technical levels to watch

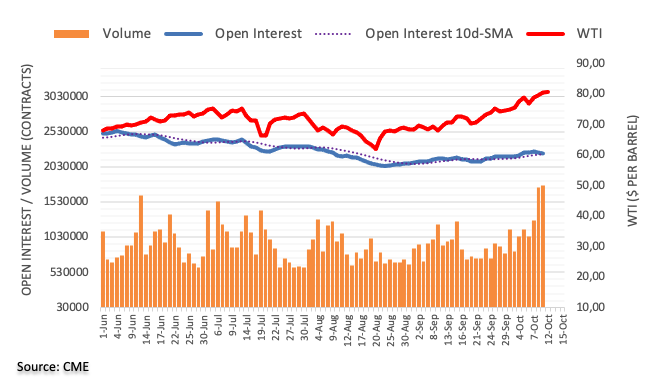

- WTI keeps trading above $80.00 as other energy resources advance.

- The market sentiment is downbeat on the back of higher energy prices, threatening to derail economic growth.

- WTI: The 1-hour chart depicts a possible consolidation before resuming the upward trend from a technical perspective.

Western Texas Intermediate (WTI) is advancing for the fourth consecutive day, is trading at $80.10, climbs 0.14% during the New York session at the time of writing. Market sentiment is a mixed bag, as US stocks seesaw around the green and red, while European stocks are recording losses between 0.07% and 0.44%, except for the Spanish IBEX 35, which increased 0.43%.

The ongoing energy crisis threatens to keep oil prices higher. Shortages of energy in Asia have pushed China to allow coal-fired power plants to pass on the high costs of generation to some end users. Further, India has asked energy producers to import up to 10% of their coal needs, despite being the world’s second-largest coal producer. However, a steep surge in power demand that has exceeded pre-pandemic levels in Asia means that coal India’s supplies are no longer sufficient.

Meanwhile, the US Dollar Index that tracks the greenback’s performance against a basket of six peers and influences commodity prices is up 0.09%, sitting at 94.45 near one and half year highs, putting a lid on WTI price.

WTI Price Forecast: Technical outlook

1-hour chart

WTI is hovering around the 50-simple moving average (SMA) at 80.02. A breach above $81.00 could pave the way for further gains. The first supply zone would be $82.00, a level tested on Monday unsuccessfully, with the move retreating to $79.00. A break above the latter would expose a move towards $84.00.

On the flip side, a break below the 50-SMA could exert downward pressure on WTI, pushing the price towards the 100-SMA at $78.84. In that outcome, the following demand zones would be the $78.00 and then the 200-SMA at $77.70.

The Relative Strenght Index (RSI) is at 49, suggesting that WTI could be headed towards consolidation or a correction lower before resuming the upward trend.

- Gold's upside attempt fails at $1,770.

- Bullion rally loses steam with the USD picking up.

- XAU/USD remains trading without a clear bias.

Gold futures’ appreciated on Tuesday, as inflation concerns hurt risk appetite, and the pair reached session highs at $1,770 before pulling back to $1,760 with the USD bouncing up as the US bond yields pare losses. The XAU/USD remains positive in the daily chart, yet still trapped within the last weeks’ horizontal range between $1,745 and $1,770/80.

Gold bulls lose steam as the USD picks up

Bullion is giving away ground on the afternoon US session, weighed by renewed USD strength. The greenback remains firm, fuelled by the firm advance on US treasury yields. The 10-year US T-Bond note has returned to levels past 1.60% after a weak opening, with the investors pricing that the Federal Reserve will soon announce the end of the Quantitative Easing era.

The US dollar index, which measures the value of the USD against a basket of the most traded currencies, remains firm, after bouncing from session lows at 94.25, to reach levels only a few pips shy of year-to-date highs at 94.50.

In the absence of first-tier macroeconomic releases, the market is focusing on September’s US Consumer Prices Index figures and the minutes of the FOMC, due on Wednesday, which could have a significant impact on the US dollar.

XAU/USD remains moving without a clear direction

From a technical perspective, gold prices remain trapped within a consolidative range, with upside attempts limited below $1,770 (October 5 high) and $1,780 (October 8 high) above here, bulls might gain confidence and push the pair towards $1,807 (September 14 and 15 highs).

On the downside, immediate support lies at $1,750 (October 10, 11, and 12 lows), $1,745 (October 6 low), and below here, a key support area at $1,725 (September 29, 30 low).

Technical levels to watch

- US dollar's reversal from three-year highs at 113.75.

- The treasury yield differential is crushing the Japanese yen.

- USD/JPY's rally is targeting 114.20 – UOB.

US dollar’s pullback from fresh three-year highs at 113.75 hit earlier on Tuesday has found support at 113.45. The pair has bounced up again returning to 113.65 so far.

The yes dives on higher US Treasury yields

The greenback keeps marching higher against the Japanese yen, boosted by surging US Treasury yields on expectations the Federal Reserve will soon announce the end of its bond-buying program. The US Treasury yields have appreciated again on Tuesday, with the benchmark 10-year note reaching five-month highs above 1.60%.

Furthermore, Japanese Prime Minister Kishida’s comments this weekend confirming that there is no plan to revise the country’s tax on capital gains and dividends, which has triggered concerns about capital flows from the stock markets, might have increased negative pressure on the JPY.

All in all, the widening yield gap between the US and Japan, with the BoJ maintaining the 10-year yield near zero through a yield curve control policy, is crushing the JPY. The USD has appreciated about 4% over the last 15 days.

USD/JPY: Next target seen at 114.20 – UOB

From a technical perspective, the FX Analysis team at UOB expects the current upside trend to extend towards 114.20: “The impulsive surge suggests that further USD strength would not be surprising. The next resistance is at 114.20. The USD strength is deemed intact as long as it does not breach 112.40 (‘strong support’ level is markedly higher from yesterday’s level of 111.50).”

Technical levels to watch

"I myself believe that the 'substantial further progress' standard has more than been met with regard to our price-stability mandate and has all but been met with regard to our employment mandate," Fed Vice Chair Richard Clarida said on Tuesday, per Reuters.

Additional takeaways

"If recovery remains on track, gradual tapering of asset purchases concluding middle of next year may soon be warranted."

"Decision on pace of asset purchases won't be intended to carry signal about the timing of the interest-rate hike."

"US GDP growth this year could be the fastest since 1983."

"Labor market progress has been notable."

"Course of the labour market, economy, continues to depend on the virus."

"Inflation running 'well above' moderate overshoot of 2% goal."

"Underlying inflation close to 2% goal; this year's unwelcome surge will be largely transitory."

"Risks to inflation are to the upside."

"If inflation expectations moved up to run persistently high, the Fed would react; that is not the case at present."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen rising 0.08% on the day at 94.43.

- The British pound seesaws around 1.3600 amid risk-off sentiment.

- Supply shortages and high energy prices dampen the market sentiment.

- The US Dollar Index reaches a one and ½ year high, around 94.50.

The GBP/USD is barely unchanged 0.01% during the New York session, trading at 1.3595 at the time of writing. A negative tone surrounds the market sentiment, with European stock indices losing between 0.13% and 0.56%, except for the IBEX 35, which is in the green, up 0.20%. Meanwhile, US indices seesaw between loses and gains, without clear direction, with the Dow Jones Industrial up 0.15%, while the S&P 500 and the Nasdaq are down 0.02% and 0.20%, respectively.

Supply shortages and the ongoing energy crisis across Europe and Asia are factors that keep investors sidelined. The “buy the dip” narrative has remained shut-in, thus hurting the market sentiment, as traders scramble towards safe-haven assets, like the greenback.

The US Dollar Index reached a one and a half year high at 94.52

Meanwhile, the US Dollar Index that measures the buck’s performance against a basket of six peers is barely up 0.04%, at 94.40, trimming earlier losses, that saw the index dip to 94.22, putting a lid on the GBP/USD pair.

In the UK economic docket, the Claimant Count Change (MoM) for September rose to -51.1K better than the August reading at -58.6K. At the same time, the ILO Unemployment Rate dropped to 4.5%, versus a previous reading of 4.6%, in line with expectations.

Across the pond, the US JOLTS Job Openings fell to 10.439M versus 10.925M expected. The quit rate increased to a record 2.9% as more people left their jobs, underscoring how wage increases, sign-on incentives, and many job vacancies fuel the turnover.

The market reaction was muted, leaving the GBP/USD pair influenced mainly by market sentiment, the Federal Reserve bond taper announcement, and the possibility of the Bank of England hiking interest rates.

KEY ADDITIONAL LEVELS TO WATCH

Atlanta Federal Reserve President Raphael Bostic told the Financial Times on Tuesday that the slowdown in the US labour market should not detail the Fed's taper timeline, as reported by Reuters.

Additional takeaways

"Labour market had made sufficient gains to allow the central bank to reduce, or taper, its $120 billion a month asset purchase programme."

"Would be comfortable starting tapering of asset purchase programme in November."

"Progress has been made to start winding down asset purchases."

"There is significant uncertainty about how long inflationary pressures will last."

Market reaction

The US Dollar Index preserves its bullish momentum following these comments and was last seen trading at a fresh 12-month high of 94.51.

David Frost, the British minister responsible for implementing the Brexit deal, said on Tuesday that "it takes two" to fix the UK's relationship with the EU, as reported by Reuters.

"Despite the Indo-Pacific tilt, hard business of European defence remains vital," Frost added and noted that they will always look for constructive relations with France.

Market reaction

The GBP/USD pair remains on the back foot following these comments and was last seen trading at 1.3578, where it was down 0.12% on a daily basis.

- US JOLTS Job Openings declined modestly in August.

- US Dollar Index stays in the positive territory near 94.50.

The number of job openings on the last business day of August declined to 10.4, the US Bureau of Labor Statistics announced in its latest Job Openings and Labor Turnover Summary (JOLTS) on Tuesday. This reading came in lower than the market expectation of 10.9 million.

"Hires decreased to 6.3 million while total separations were little changed at 6.0 million," the publication further revealed. "Job openings decreased in several industries with the largest decreases in health care and social assistance (-224,000)."

Market reaction

This report doesn't seem to be having a significant impact on the greenback's performance against its rivals. As of writing, the US Dollar Index was up 0.1% on the day at 90.45.

- Wall Street's main indexes push higher following Monday's decline.

- Energy Index trades in the negative territory after the opening bell.

After failing to gather bullish momentum and closing in the negative territory on Monday, major equity indexes in the US managed to open modestly higher on Tuesday. As of writing, the S&P 500 was up 0.2% on the day at 4,368, the Dow Jones Industrial Average was rising 0.1% at 34,515 and the Nasdaq Composite was rising 0.4% at 14,543.

Among the 11 major S&P 500 sectors, the Energy Index is down 0.5% as the biggest decline in early trade. On the other hand, the Consumer Discretionary Index is rising 0.85%.

Earlier in the day, the data from the US showed that the NFIB Business Optimism Index declined to 99.1 in September from 100.1 in August but this reading received little to no market reaction.

Wake Up Wall Street (SPY) (QQQ): Markets cornered by rising yields and surging energy costs.

S&P 500 chart (daily)

- EUR/USD remains under pressure in the mid-1.1500s.

- The outlook for the pair stays fragile and appears vulnerable.

EUR/USD extends the consolidative trade range for yet another session and always around the 1.1550 zone on Tuesday.

Another visit to the 2021 low at 1.1529 remains well on the table in the near future amidst the ongoing bearish context. A deeper pullback from here should trigger a relatively quick test of the 1.1500 neighbourhood, where the March 2020 high sits.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1939.

EUR/USD daily chart

In its World Economic Outlook published on Tuesday, the International Monetary Fund said that it lowered its 2021 global growth forecast to 5.9% from 6% in July due to supply disruptions in advanced economies, per Reuters.

Additional takeaways

"2022 global growth forecast unchanged at 4.9%."

"US 2021 growth forecast cut by 1 percentage point from July forecast; German growth cut by 0.5 points, Japan's growth cut by 0.4 points."

"China's 2021 growth forecast cut to 8.0% from 8.1% in July due to faster scaleback of public investment."

"2021 outlook for some low-income developing countries cut due to worsening COVID-19 dynamics; some commodity exporters upgraded on higher prices."

"Growth risks tilted to the downside, including possible emergence of new coronavirus variants, more persistent supply-demand mismatches, inflation pressures."

"Price pressures could prompt faster monetary policy normalization and tighter financial conditions, hurting emerging markets."

Market reaction

This publication doesn't seem to be having a significant impact on risk sentiment. As of writing, the S&P Futures were up 0.16% on the day.

- DXY briefly surpassed 94.50 to clinch new 2021 highs.

- Further up comes the 94.74/76 region.

DXY adds to Monday’s gains and manages to re-visit the 94.50 region on turnaround Tuesday.

The ongoing price action allows the index to extend the leg lower to the area above 94.50 in the short-term horizon. That said, the next target is seen at the September 2020 high at 94.74 followed by the 200-week SMA, today at 94.76. Further north should come the round level at 95.00, also in the not-so-distant future.

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.72.

DXY daily chart

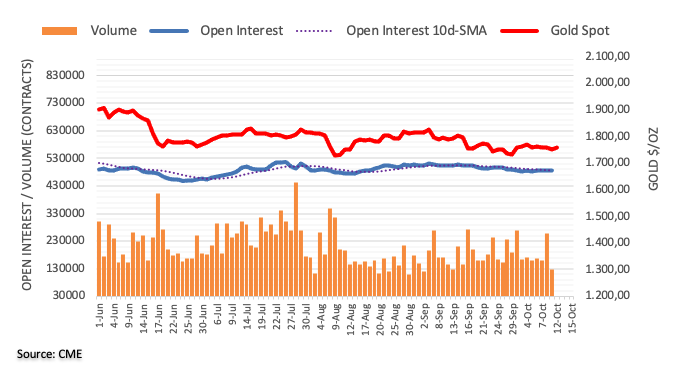

- Gold advanced beyond $1,760 following Monday's choppy action.

- 10-year US Treasury bond yield is down more than 1% on Tuesday.

- XAU/USD needs to break out of $1,750-70 range to determine next direction.

The XAU/USD pair extended its sideways grind above $1,750 during the Asian session on Tuesday but managed to gather bullish momentum in the European trading hours. After rising to a daily high of $1,765, however, gold lost its traction and erased its daily gains. As of writing, the pair was trading virtually unchanged on the day at $1,754.

Following the three-day weekend, the US bond markets returned to action on Tuesday and the 2% decline witnessed in the benchmark 10-year US T-bond yield helped XAU/USD turn north. Although the 10-year yield managed to pull away from daily lows, it's still down 1.5% on a daily basis while holding above the key 1.6% mark.

Meanwhile, the US Dollar Index is trading at its highest level in more than a year at 94.51, not allowing XAU/USD to stage a convincing recovery.

The only data from the US showed on Tuesday that the NFIB Business Optimism Index edged lower to 99.1 in September from 100.1 in August. Later in the session, August JOLTS Job Openings data will be looked upon for fresh impetus.

Gold technical outlook

Despite the recent decline, the XAU/USD pair continues to trade within the two-week-old $1,750-70 range. Only a daily close outside of that channel could trigger a decisive move.

In the meantime, the Relative Strength Index indicator on the four-hour chart continues to fluctuate between 40 and 60, confirming the view that XAU/USD is having a difficult time finding direction.

With a break below $1,750, gold could target $1,735 (static level) as the next target on the downside ahead of $1,725 (static level). On the other hand, the 200-period SMA forms significant resistance at $1,780.

Additional levels to watch for

European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Tuesday risk remains that they fall short of the 2023 inflation target rather than exceed it, as reported by Reuters.

"This calls for continued accommodative monetary policy," Villeroy added and noted that exiting from the Pandemic Emergency Purchase Program would not signal the end of the ECB's very accommodative monetary policy.

Market reaction

The EUR/USD pair showed no immediate reaction to these remarks and was last seen trading flat on the day at 1.1554.

- EUR/USD is having a tough time making a decisive move in either direction.

- US Dollar Index goes into consolidation after posting gains on Monday.

- Wall Street's main indexes look to open modestly higher.

The EUR/USD pair advanced to a session high of 1.1570 during the European trading hours but failed to preserve its bullish momentum. As of writing, the pair was virtually unchanged on a daily basis at 1.1552.

Markets remain calm ahead of Wednesday's key events

In the absence of significant fundamental drivers, major pairs are fluctuating in tight ranges. Moreover, investors seem to be opting out to stay on the sidelines while waiting for Wednesday's Consumer Price Index (CPI) data from the US and the FOMC's Meeting Minutes.

FOMC Minutes Preview: Fed to reiterate taper message, sending the dollar up, stocks down

Meanwhile, US stock index futures are up between 0.1% and 0.35% ahead of the opening bell. In case risk flows start to dominate financial markets in the second half of the day, the greenback could have a tough time finding demand. Currently, the US Dollar Index is posting small daily losses at 94.31. Nevertheless, EUR/USD is unlikely to break out of the horizontal channel that seems to have formed between 1.1550 and 1.1600.

Earlier in the day, the data from the US showed that the NFIB Business Optimism Index edged lower to 99.1 in September from 100.1 in August but investors showed little to no attention to this reading.

On the other hand, European Central Bank (ECB) Governing Council member and Bank of France Head Francois Villeroy de Galhau said on Tuesday that the uncertainty in the eurozone shifted from growth outlook to inflation outlook.

Technical levels to watch for

European Central Bank (ECB) top supervisor Andrea Enria said on Tuesday that the banking sector in Europe is comfortable in terms of capital, as reported by Reuters.

However, Enria further noted that forborne loans in the euro area warrant caution.

Market reaction

These comments don't seem to be having a noticeable impact on market sentiment. As of writing, the Euro Stoxx 50 Index was down 0.35% on the day at 4,058. Meanwhile, the EUR/USD pair continues to fluctuate in a tight range and was last seen trading unchanged on a daily basis at 1.1551.

- USD/CAD stays under modest bearish pressure on Tuesday.

- US Dollar Index continues to move sideways above 94.00.

- WTI holds above $80 after climbing to multi-year highs on Monday.

The USD/CAD pair spent the Asian session fluctuating in a tight range but started to edge lower ahead of the American session with the commodity-sensitive loonie gathering strength on rising crude oil prices.

Oil weakness remains short-lived

Supported by reports suggesting that OPEC+ is not looking to increase its output despite rising energy prices, the barrel of West Texas Intermediate reached its highest level in nearly seven years at $82.15 on Monday. Although WTI staged a correction and briefly dipped below $80 on Tuesday, it's currently up 0.5% on the day at $80.85.

On the other hand, the negative shift witnessed in risk sentiment helped the greenback gather strength in the late American session on Monday and allowed USD/CAD to limit its losses. The US Dollar Index, which reached a six-day high of 94.43 earlier in the day, is now flat around 94.30.

There won't be any high-tier macroeconomic data releases in the remainder of the day and the risk perception is likely to continue to impact the USD's market valuation. Currently, US stock index futures are little changed on a daily basis.

The Consumer Price Index (CPI) data from the US on Wednesday will be the next significant data that could ramp up the market volatility.

Technical levels to watch for

Economist at UOB Group Barnabas Gan reviews the latest interest rate decision by the RBI.

Key Takeaways

“The Reserve Bank of India (RBI) kept its policy repo rate and reverse repo rate unchanged at 4.00% and 3.35% respectively in its October’s monetary policy meeting, in line with market expectations. The monetary policy committee voted unanimously to keep the rates unchanged.”

“Similar to RBI’s August meeting, the MPC voted 5-1 majority to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis, while keeping inflation within target.”

“RBI’s tone seen in the monetary policy statement continued to stay positive, similar to the previous August’s policy meeting.”

“Given the improving economic prognosis and ebbing COVID-19 infections in India, it is evident that RBI will likely floor its policy-rate at 4.0% for the rest of this year.”

- EUR/JPY extends the recovery further north of 131.00.

- The next target is located at the Fibo level at 131.75.

EUR/JPY pushes higher and surpasses the 131.00 mark, reaching fresh 3-month peaks at the same time on Tuesday.

The cross keeps the recent breakout of the 200-day SMA well and sound, allowing for extra gains in the very near term. That said, there is an interim hurdle at 131.75, where another Fibo level sits ahead of 132.69 (high June 23).

In the broader scenario, while above the 200-day SMA at 129.81, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- USD/CHF attracted some dip-buying near 0.9255 area, though lacked follow-through.

- A recovery in equity markets undermined the safe-haven CHF and remained supportive.

- A subdued USD demand held bulls from placing aggressive bets and capped the upside.

The USD/CHF pair reversed an intraday dip to the 0.9255 area and was last seen hovering near the top end of its daily trading range, around the 0.9270-75 region.

A goodish rebound in the US equity futures undermined the safe-haven Swiss franc and was seen as a key factor that acted as a tailwind for the USD/CHF pair. However, a subdued US dollar demand held bulls from placing aggressive bets and kept a lid on any meaningful gains for the major, at least for the time being.

A softer tone surrounding the US Treasury bond yields failed to assist the USD to capitalize on the previous day's positive move back closer to one-year tops. That said, prospects for an early policy tightening by the Fed should assist the greenback to attract some dip-buying and lend some support to the USD/CHF pair.

Despite Friday's weaker headline NFP print, investors seem convinced that the Fed remains on track to begin tapering its bond purchases by the end of 2021. The markets have also started pricing in the possibility of an interest rate hike in 2022 amid worries that the recent surge in oil/energy prices will stoke inflation.

Hence, the market focus now shifts to the release of the US consumer inflation figures on Wednesday, which will be followed by the FOMC meeting minutes. Apart from this, the US monthly Retail Sales figures, due on Friday, will influence the USD price dynamics and provide a fresh directional impetus to the USD/CHF pair.

In the meantime, traders might take cues from Tuesday's release of JOLTS Job Openings data for some impetus later during the early North American session. This, along with a scheduled speech by Fed Governor Richard Clarida and the broader market risk sentiment, might produce short-term trading opportunities around the USD/CHF pair.

From a technical perspective, the pair has been oscillating in a familiar/narrow trading band over the past one week or so. This constitutes the formation of a rectangle on short-term charts and points to indecision amid traders over the USD/CHF pair's near-term trajectory. This, in turn, warrants some caution before placing aggressive bets.

Technical levels to watch

Suan Teck Kin, CFA, at UOB Group’s Global Economics & Markets Research comments on last Friday’s release of the US labour market report for the month of September.

Key Takeaways

“After the big miss in the Aug nonfarm payrolls (NFP), the pace of job creation in the US disappointed yet again. NFP increased 194,000 in Sep – the smallest advance this year – well below expectations of 450,000 and slower than the upwardly revised 366,000 gain in Aug. Cumulatively, nonfarm employment has increased by 17.4 million since the trough in April 2020, but is still down by 5.0 million, or 3.3%, from its pre-pandemic level in Feb 2020. Nonetheless, the US Labor Department’s employment situation report (8 Oct) shows that the unemployment rate improved to 4.8%, 0.4% point lower than 5.2% in Aug, and is at the lowest since the pandemic began.”

“Of the 194,000 increase in NFP, the private sector contributed 317,000 jobs (Aug: 332,000) which was offset by public sector job losses of 123,000, a reversal from an increase of 34,000 in Aug.”

“Despite another disappointing headline NFP, the US labor market continues to make steady progress to recover from the depth of job losses. At about 5 million jobs short of the pre-pandemic level, it is a vast improvement compared to the 22 million job losses at the worst point of the pandemic. In addition, job creation in the private sector remains the main driving force in the US labor market, with the creation of more than 17 million jobs since the recovery started in May 2020, vs. the cumulative addition of 670,000 government jobs.”

“As such, we believe that the Fed would not be deterred by the latest job report and will proceed with the tapering of its bond buying program at the 2/3 Nov FOMC and completing in 8 months by Jul 2022, as outlined in our report on the Sep FOMC. This will be followed by the first Fed rate increase of 25bps starting from Dec 2022, and then another 2 more 25bps hikes in 2023.”

- EUR/GBP witnessed heavy selling during the early part of the European session on Tuesday.

- Hawkish BoE signals helped revive the GBP demand and prompted selling around the cross.

- Disappointing ZEW Survey results weighed on the euro and contributed to the intraday slide.

The EUR/GBP cross faded an early European session bullish spike to three-day tops and dropped to fresh daily lows, back below the key 0.8500 psychological mark in the last hour.

The cross gained some positive traction during the first half of the trading action on Tuesday, albeit struggled to capitalize on the move and witnessed an intraday turnaround from the 0.8520 area. A sudden pickup in demand for the British pound turned out to be a key factor that prompted aggressive selling around the EUR/GBP cross.

Over the weekend, the Bank of England (BoE) officials, including Governor Andrew Bailey, signalled an imminent interest rate later this year. The money market seems to have fully priced in a 25bps BoE rate hike in December. This was evident from a spike in the UK 10-year gilt yield, which rose to the highest level since May 2019, at 1.222% on Monday.

On the other hand, the European Central Bank (ECB) chief economist Philip Lane said that the medium-term inflation dynamic is too slow and that the trigger for monetary policy action is not there. This widened the UK-German 10-year bond yield differential to the highest since mid-2016, favouring the GBP bulls and acting as a headwind for the EUR/GBP cross.

Apart from this, worsening economic sentiment in the Eurozone's largest economy – Germany – undermined the shared currency and contributed to the EUR/GBP pair's sudden fall over the past hour or so. In fact, the German ZEW Economic Sentiment Index fell to 22.3 from 26.5 previous and missed consensus estimates pointing to a reading of 24.0.

That said, a modest US dollar weakness extended some support to the euro and helped limit any deeper losses for the EUR/GBP cross, at least for the time being. Nevertheless, the fundamental backdrop seems tilted in favour of bearish traders and supports prospects for an extension of the recent sharp pullback from the very important 200-day SMA.

Technical levels to watch

- USD/TRY has more room to rise, with fresh record highs in sight.

- The spot charted a bull pennant breakout on the 1D chart last Friday.

- RSI stays overbought but impending bull cross keeps buyers hopeful.

USD/TRY is hovering close to fresh all-time highs of 9.04, as the bulls gather strength for the next push higher.

In doing so, the pair extends its bullish momentum into the third straight day, eyeing fresh record highs in the coming sessions.

The upside potential is well depicted by USD/TRY’s daily technical setup, which shows that the pair confirmed a bull pennant breakout on the said time frame last Friday after closing above the falling trendline resistance, then at 8.92.

With the big technical breakout, the upside opens up towards the measured target of 9.61. Ahead of that the 9.50 psychological level could come into play.

Impending bull cross, with the 50-Daily Moving Average (DMA) set to cross the 100-DMA for the upside, adds credence to a potential move higher.

However, with the 14-day Relative Strength Index (RSI) trending within the overbought territory, there remains a risk for a minor pullback before the next upswing kicks in.

USD/TRY: Daily chart

On the downside, the bull pennant resistance now turned support at 8.92 will offer immediate respite to the buyers on any pullbacks.

Further south, the original support of the bullish continuation pattern at 8.88 could challenge the buyers’ commitments.

A breach of the latter on a daily closing basis will lead to a pattern failure, opening floors for a test of the bullish 21-DMA at 8.76.

Following the release of the monthly ZEW Survey for Germany, the country’s highly influential institute presents a dour outlook of the economy.

Key takeaways

“Assessment of the economic situation in Germany has worsened in the current survey.”

“Compared to the previous month, the outlook for the economic development in the next six months has noticeably deteriorated.”

“Further decline of the ZEW indicator of economic sentiment is mainly due to the persisting supply bottlenecks for raw materials and intermediate products.”

“Financial market experts expect profits to go down, especially in export-oriented sectors such as vehicle manufacturing and chemicals/pharmaceuticals.”

“49.1 percent of the experts still expect the inflation rate to rise further in the next six months.”

Related reads

- German ZEW Economic Sentiment Index drops to 22.3 in October, misses estimates

- EUR/USD Forecast: Euro stays near 2021 lows as ECB doubles down on dovish outlook

- AUD/USD gained some positive traction on Tuesday amid a modest USD weakness.

- A combination of factors might act as a tailwind for the USD and cap gains for the pair.

- Acceptance above the 0.7315-20 resistance zone supports prospects for further gains.

The AUD/USD pair built on its steady intraday ascent and climbed to the 0.7365 region, back closer to four-week tops during the early part of the European session.

The pair attracted some dip-buying on Tuesday and now looks to build on last week's breakout through the 0.7315-20 horizontal resistance zone. The uptick was exclusively sponsored by a modest US dollar weakness, though lacked bullish conviction and warrants some caution before positioning for any further appreciating move.

Expectations that the Fed remains on track to begin rolling back its massive pandemic-era stimulus and the possibility for an interest rate hike in 2022 should act as a tailwind for the greenback. This, along with a generally softer risk tone, might hold investors from placing aggressive bullish bets around the perceived riskier aussie.

Investors remain worried that the recent surge in crude oil/energy prices could stoke inflation. This comes on the back of signs of a slowdown in the global economic recovery and has been fueling concerns about stagflation. Apart from this, fears of a spillover from China Evergrand's debt crisis took its toll on the global risk sentiment.

From a technical perspective, acceptance above the 0.7315-20 resistance breakpoint favours bullish traders and supports prospects for additional gains. Some follow-through buying beyond the overnight swing highs, around the 0.7375 region, will reaffirm the positive outlook and allow push the AUD/USD pair to aim back to reclaim the 0.7400 mark.

Market participants now look forward to the US economic docket, featuring the release of JOLTS Job Openings data. This, along with a scheduled speech by Fed Governor Richard Clarida, will influence the USD. Traders might further take cues from the broader market risk sentiment for some short-term trading opportunities around the AUD/USD pair.

Technical levels to watch

- German ZEW Economic Sentiment arrived at 22.3 in October, down from 26.5 previous.

- The ZEW Current Situation for Germany came in 21.6 at in October vs. 31.9 in September.

- EUR/USD remains unfazed around 1.1560 on downbeat ZEW data.

The German ZEW headline numbers for October showed that the Economic Sentiment Index worsened to 22.3 from 26.5 previous while missing estimates of 24.0.

Meanwhile, the Current Conditions sub-index dropped to 21.6 in October as against 31.9 recorded in the previous month and 29.5 expectations.

The Eurozone ZEW Economic Sentiment for October fell to 21.0 for the current month as compared to the 31.1 previous and 37.0 consensus forecast.

FX market reaction

The euro kept its retreat from daily highs intact on the downbeat ZEW Surveys, but EUR/USD held well above the 1.1550 level.

The spot was last seen trading at 1.1563, up 0.10% on the day.

- Gold price tests the higher levels once again amid steady USD, Treasury yields.

- Gold traders remain cautious of the critical US inflation data, Fed minutes.

- Gold on the back foot as NFP fails to alter taper prospects.

Gold price is posting modest gains but remains well within the recent trading range above the $1750 level so far this Tuesday. A flight to safety amid intensifying stagflation fears offers support to the traditional safe-haven gold. Further, a pause in the US Treasury yields rally aides the rebound in gold price. However, the Fed’s tapering expectations continue to limit gold’s upside potential, as investors await the return of full markets and Wednesday’s critical US inflation report for a fresh directional move in gold price.

Read: Gold Price Forecast: Will XAU/USD find a foothold above 21-DMA? US inflation in focus

Gold Price: Key levels to watch

According to the Technical Confluences Detector, gold is moving back and forth, without a clear directional bias, with a bunch of healthy barriers stacked up in either direction.

Immediate upside is capped at $1762, which is the convergence of the Bollinger Band one-hour Upper and the previous day’s high.

The next significant topside hurdle is seen at $1765, where the Fibonacci 38.2% one-month aligns.

The Fibonacci 61.8% one-week at $1767 will then challenge the bearish commitments.

Gold bulls need to find acceptance above the pivot point one-day R3 at $1771 to initiate a meaningful uptrend.

Alternatively, gold buyers will once again challenge bids at $1755, the convergence of the Fibonacci 23.6% one-week and Fibonacci 38.2% one-day.

A sustained move below the latter will expose the $1750 psychological level, below which the next downside target at $1748 could get tested. That level is the Fibonacci 23.6% one-month.

The next cushion appears around $1745, where the previous week’s low intersects the pivot point one-day S2.

The pivot point one-week S1 at $1741 will be the level to beat for gold bears.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest foreign portfolio figures in Malaysia.

Key Takeaways

“Malaysia continued to receive foreign portfolio inflows for the second consecutive month, albeit moderate at MYR1.4bn in Sep (Aug: +MYR7.7bn), bringing the accumulated overseas capital inflows to MYR4.1bn in 3Q21 (2Q21: +MYR5.3bn). Non-residents remained net buyers of domestic debt securities (+MYR0.6bn) and equities (+MYR0.7bn) for two months in a row in Sep. This helped to push up year-to-date overall foreign portfolio inflows to the highest level since 2016, at MYR24.3bn (Jan-Sep 2020: -MYR17.5bn).”