- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-10-2012

The euro strengthened to a one-month high against the dollar after Spain kept its investment-grade credit rating from Moody’s Investors Service, easing concern the region’s debt crisis was spreading. Moody’s said yesterday it kept Spain’s credit rating at Baa3, one step above junk, as the risk that the nation would lose market access had fallen because of the European Central Bank’s willingness to purchase its bonds.

The 17-nation currency appreciated for a fifth day versus the yen as Spanish and Italian bonds rallied. Spain’s 10-year bond yield fell as much as 29 basis points to 5.51 percent, the lowest since April 4, while Italian 10-year yields declined to the least since March 19. Benchmark Spanish borrowing costs have dropped more than 2 percentage points from their record high of 7.75 percent on July 25.

The dollar weakened versus all of its major peers as U.S. housing starts rose to a four-year high last month, damping demand for safer assets.

The pound rallied against the greenback after U.K. jobless claims unexpectedly declined.

European stocks rose for a third day, the longest winning streak in five weeks, as Moody’s Investors Service kept its investment-grade debt rating on Spain and U.S. new-home construction surged to a four-year high.

Moody’s kept an investment-grade credit rating on Spain late yesterday, citing a reduction in the risk of losing market access because of the ECB’s willingness to buy the nation’s debt.

New-home construction in the U.S. surged in September to the highest level in four years. Starts jumped 15 percent to an 872,000 annual rate last month, the most since July 2008 and exceeding all forecasts of economists, Commerce Department figures showed today. The median estimate of 81 economists surveyed called for a reading of 770,000.

In the U.K., jobless claims unexpectedly fell in September and a wider measure of unemployment dropped to the lowest rate in more than a year as the London Olympics helped push employment to a record.

National benchmark indexes rose in 16 of the 18 western European markets. The U.K.’s FTSE 100 (UKX) gained 0.7 percent, Germany’s DAX increased 0.3 percent and France’s CAC 40 climbed 0.8 percent. Spain’s IBEX 35 surged 2.4 percent.

Waertsilae soared 8.1 percent to 29.02 euros in Helsinki, the biggest increase since November. The company reported third- quarter earnings that exceeded estimates and boosted its full- year sales-growth forecast.

Peugeot climbed 4.1 percent to 6.03 euros. Banks may delay the repayment of 4 billion euros ($5.3 billion) in loans from Peugeot’s credit division, Banque PSA Finance, Le Figaro reported, without saying where it got the information. The automaker is examining funding options for the unit, said Jean- Baptiste Mounier, a spokesman for Peugeot.

Danone dropped 3 percent to 47.33 euros, the largest decrease since Aug. 2. The world’s biggest yogurt maker reported third-quarter revenue growth that missed analysts’ estimates as sales of dairy products in Spain and Italy fell. Revenue adjusted for acquisitions, divestments and currency swings rose 5 percent, the Paris-based company said, trailing the 6.1 percent average of 15 forecasts.

ASML Holding NV dropped 5.3 percent to 39.15 euros as Europe’s biggest semiconductor-equipment maker forecast fourth- quarter sales of about 1 billion euros, trailing estimates of 1.16 billion euros. The company’s gross-margin outlook was 41 percent, compared with a 42.6 percent estimate. Separately, ASML agreed to buy Cymer Inc. for 1.95 billion euros.

TeliaSonera AB , Sweden’s biggest phone company, slipped 1.6 percent to 45.40 kronor after it reported third-quarter earnings that missed analysts’ projections because of slowing sales

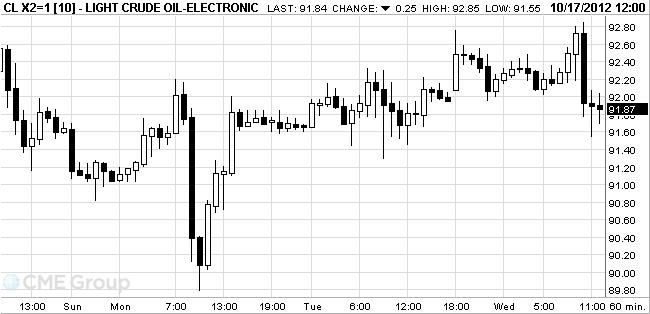

Oil futures retreated after U.S. supplies rose to the highest level for this time of year since Energy Department records began in 1982.

Inventories climbed 2.86 million barrels last week to 369.2 million barrels, the Energy Department said in Washington. That exceeded the 1.5 million-barrel median estimate by analysts. U.S. oil output surged to the highest level since May 1995.

U.S. production increased for a sixth week to 6.61 million barrels a day, the department said. Gasoline inventories climbed 1.72 million barrels to 197.1 million last week. They were expected to increase 500,000 barrels.

Crude oil for November delivery slid to $91.55 a barrel on the New York Mercantile Exchange. Oil traded at $92.64 a barrel before release of the inventory report.

Brent for December settlement fell 84 cents, or 0.7 percent, to $113.16 a barrel on the London-based ICE Futures Europe.

The price of gold rises in trading on Wednesday after the confirmation of the investment rating of Spain by Moody's and in anticipation of making the EU summit, which starts on Thursday.

The euro rose to a month high against the dollar after ratings agency Moody's confirmed the rating of Spain at "Baa3" to reassure investors, who feared a downgrade to "junk."

Gold generally follows the currency markets, but investors inactive pending decisions EU summit, which starts on Thursday.

Investors also await Chinese GDP data for the third quarter. Meanwhile, stocks of gold-ETFs ETF on Tuesday rose by 16,700 ounces.

South African gold producer Gold Fields announced the completion of an unauthorized strike at the mines in South Africa.

November futures price of gold on COMEX today rose $ 5.80 and is now $ 1750.90 an ounce.

EUR/USD $1.3000, $1.3030, $1.3100, $1.3115

GBP/USD $1.6010

AUD/USD $1.0205, $1.0215, $1.0220, $1.0240, $1.0250, $1.0300

EUR/GBP stg0.8150

USD/JPY Y78.50, Y78.90, Y79.00

USD/CHF chf0.9345, chf0.9350, chf0.9375

U.S. stock futures are mixed as new-home construction surged to the highest level in four years and investors weighed corporate earnings.

Global Stocks:

Nikkei 8,806.55 +105.24 +1.21%

Hang Seng 21,416.64 +209.57 +0.99%

Shanghai Composite 2,105.62 +6.81 +0.32%

FTSE 5,903.27 +32.73 +0.56%

CAC 3,512.5 +11.56 +0.33%

DAX 7,386.09 +9.82 +0.13%

Crude oil $92.64 +0,60%

Gold $1746.70 0.02%

Cantor Fitzgerald downgrades CSCO to Hold from Buy and lowers their tgt to $19.50 from $20.50

FBR Capital raises their GS tgt to $145 from $130

Societe Generale downgrades IBM from Hold to Sell

Data

08:30 United Kingdom Bank of England Minutes -

08:30 United Kingdom Claimant count September -15.0 -0.2 -4

08:30 United Kingdom Claimant Count Rate September 4.8% 4.8% 4.8%

08:30 United Kingdom ILO Unemployment Rate August 8.1% 8.1% 7.9%

08:30 United Kingdom Average Earnings, 3m/y August +1.5% +1.6% +1.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August +1.9% +2.0% +2.0%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October -34.9 -28.9

09:00 Eurozone Construction Output, m/m August -0.3% +0.7%

09:00 Eurozone Construction Output, y/y August -4.7% -5.5%

The euro strengthened to one-month high against the dollar after Moody's affirmed the long-term rating of Spain at Baa3, and the rating outlook is negative.

The single currency rose for a fifth day against the yen on speculation that European Union leaders at tomorrow's meeting in Brussels, agreed to grant additional aid for Greece. Also today, the yield on 10-year bonds in Spain fell by 29 basis points to a level of 5.51%, the lowest level since April 4, while the yield on 10-year Italian bonds reached the lowest level since March 19.

At the same time, options traders reduced their short positions in the euro against the dollar up to the minimum values for more than two years.

Dollar fell ahead of the report from the United States, which, as economists say, will increase the level of housing construction in the last month.

The pound rose against the dollar after the data from the UK showed that the unemployment rate unexpectedly fell. At the same time, it was a record number of workers, which was due to the Olympic Games.

The dollar index, which is used to track the value of the dollar against the currencies of six U.S. partner, decreased by 0.5% to 79.034.

Australia's currency rose to a two-week high against the U.S. dollar, as investors sought higher-yielding assets.

EUR/USD: pair rose sharply, updating the current session high, and is now trading at $ 1.3121

GBP/USD: the pair is trading with a significant increase in the vicinity of the maximum values of the day at $ 1.6165

USD/JPY: the pair decreased and is now close to the minimum values of the day at Y78.65

At 12:30 GMT the United States will report on the volume of building permits issued and the number of new foundations of bookmarks for September. At 14:30 GMT the U.S. will release data on stocks of crude oil from the Department of Energy in October.

EUR/USD

Offers $1.3220, $1.3150

Bids $1.3080/70, $1.3040, $1.3010/00, $1.2985/80

GBP/USD

Offers $1.6250, $1.6200

Bids $1.6105/00, $1.6050

AUD/USD

Offers $1.0450, $1.0420, $1.0400, $1.0350

Bids $1.0270, $1.0250, $1.0220, $1.0205/00

EUR/JPY

Offers Y104.80, Y104.50, Y104.00

Bids Y102.70/60, Y102.50, Y102.40/30, Y102.10/00

USD/JPY

Offers Y79.80, Y79.50, Y79.00

Bids Y78.50, Y78.40

EUR/GBP

Offers stg0.8250, stg0.8200, stg0.8180, stg0.8150

Bids stg0.8100, stg0.8085/80, stg0.8050, stg0.8040, stg0.8025/20

Markets are waiting for the summit of EU leaders, which will address the issue Banking Association, but at the moment it was announced that the Swedish Prime Minister Fredrik Reinfeldt during a meeting with German Chancellor Angela Merkel has made it clear to her and the whole of Europe that his country is ready in the EU banking union on terms offered by the European Commission, according to Reuters.

Greece begins large-scale privatization of state property, which can improve its solvency.

Rating agency Moody's confirmed the long term rating of Spain at Baa3, the rating outlook is negative, the agency said on its website.

Short-term rating remained at Prime-3. In October, Standard & Poor downgraded the rating of Spain by two notches, short term - on one level.

Of macroeconomic data should pay attention to the amount of construction in the Eurozone. In August year on year index decreased by 5.5%, while in the month rose by 0.7%.

At the moment:

FTSE 100 5,891.17 +20.63 +0.35%

CAC 40 3,510.24 +9.30 +0.27%

DAX 7,391.14 +14.87 +0.20%

ASML Holding NV shares fell by 2.9% due to a decrease in the forecast of the demand for semiconductors in Europe. Danone fell to 4-month level, due to the fact that the company's profit was below forecasts. Peugeot Citroen gained 2.4% in relation to the information that the French government may credit the automaker.

EUR/USD $1.3000, $1.3030, $1.3100, $1.3115

GBP/USD $1.6010

AUD/USD $1.0205, $1.0215, $1.0220, $1.0240, $1.0250, $1.0300

EUR/GBP stg0.8150

USD/JPY Y78.50, Y78.90, Y79.00

USD/CHF chf0.9345, chf0.9350, chf0.9375

Asian stocks advanced, with the regional benchmark index headed for the biggest two-day gain in a month, after U.S. industrial production beat estimates and Spain retained its investment-grade credit rating from Moody’s Investors Service.

Nikkei 225 8,806.55 +105.24 +1.21%

S&P/ASX 200 4,528.2 +36.70 +0.82%

Shanghai Composite 2,105.89 +7.08 +0.34%

Mobile-phone maker LG Electronics Inc., which gets about 45 percent of its sales from North America and Europe, rose 2.5 percent in Seoul.

Fujikon Industrial Holdings Ltd., which manufactures electronic products, surged 9.8 percent in Hong Kong after saying it expects first-half profit to rise.

Ten Network Holdings Ltd., Australia’s third-ranked television broadcaster, slumped to a record low in Sydney as a plan to sell its Eye Corp. billboard unit faltered.

Yesterday the euro rose above $1.30 for the first time in a week amid speculation that Spain is moving toward asking for financial assistance, reducing concern the region’s debt crisis is worsening.

The 17-nation currency strengthened for a fourth day versus the yen after Germany was said by two senior coalition lawmakers to be open to providing Spain a precautionary credit line. Comments by Michael Meister, a deputy caucus leader of German Chancellor Angela Merkel’s Christian Democratic bloc, and Norbert Barthle, her party’s budget spokesman, indicate a rolling back of German resistance to a full sovereign bailout for Spain. Schaeuble cautioned Spain against seeking aid on top of its bank bailout as recently as last month.

The dollar and the yen fell against most of their major counterparts as U.S. industrial production rose more than forecast last month, damping demand for the safest assets. Output at U.S. factories, mines and utilities rose 0.4 percent after a 1.4 percent decline in August that was the biggest since March 2009, the Federal Reserve reported today in Washington.

The Canadian dollar fell against most major peers after Bank of Canada Governor Mark Carney suggested he may reduce his economic outlook and delay raising policy interest rates.

The pound fell against the euro, as inflation in the UK slowed to the lowest level in nearly three years. It is learned that consumer prices in the UK rose by 2.2% compared to the previous year, and an increase of 2.5% in August. Thus, the annual dynamics was the lowest since 2009, which was in line with analysts' forecasts.

Asian stocks rose, with the regional benchmark index headed for the biggest gain in two weeks, as exporters advanced after the U.S. reported better-than-expected retail sales. Asian banks followed gains among U.S. banks after Citigroup unexpectedly reported a third-quarter profit and a surge in bond-trading revenue. Financial shares accounted for 28 percent of the advance in the MSCI Asia Pacific Index today.

Nikkei 225 8,701.31 +123.38 +1.44%

S&P/ASX 200 4,491.5 +8.07 +0.18%

Shanghai Composite 2,095.19 -3.51 -0.17%

Samsung Electronics Co., which gets a fifth of its sales in Americas, rose 2.3 percent in Seoul.

Mizuho Financial Group Inc., Japan’s third-largest bank by market value, gained 1.6 percent, pacing gains among lenders after Citigroup Inc.’s profit beat estimates.

Softbank Corp. jumped 9.6 percent after Japan’s third-largest mobile-phone company agreed to acquire 70 percent of Sprint Nextel Corp. for $20.1 billion.

European stocks rose as two German lawmakers said the country is open to Spain seeking a precautionary credit line from Europe’s rescue fund, and German investor confidence advanced more than expected in October.

Germany is open to Spain seeking a precautionary credit line from Europe’s rescue fund, two senior coalition lawmakers said. The comments by Michael Meister, a deputy caucus leader of Chancellor Angela Merkel’s Christian Democratic bloc, and Norbert Barthle, her party’s budget spokesman, signal a reversal of Finance Minister Wolfgang Schaeuble’s position that Germany is opposed to a full sovereign bailout for Spain.

FTSE 100 5,870.54 +64.93 +1.12%, CAC 40 3,500.94 +80.66 +2.36%, DAX 7,376.27 +115.02 +1.58%

BNP Paribas SA and Deutsche Bank AG paced gains among banking shares. Deutsche Bank and Commerzbank gained 5.1 percent to 34.60 euros and 4.1 percent to 1.56 euros, respectively.

Rio Tinto gained 2.7 percent to 3,053 pence. The company reported a 6 percent increase in third-quarter iron-ore output to 52.6 million metric tons, beating the mean analyst estimate of 50.65 million tons. Iron-ore output from Australia’s Pilbara region rose to a quarterly record.

GKN Plc fell 3.3 percent to 205 pence after the maker of car drive shafts warned that weakening demand in some European automotive and industrial markets will affect fourth- quarter profit.

U.S. stocks rallied, giving the Standard & Poor’s 500 Index its biggest gain in a month, as industrial production rose more than forecast and corporate earnings topped estimates.

Output at factories, mines and utilities rose 0.4 percent in September after a 1.4 percent decline in August that was the biggest since March 2009, the Federal Reserve reported today in Washington.

Johnson & Johnson, the world’s biggest maker of health-care products, climbed 1.4 percent to $69.55. Third-quarter earnings beat analyst estimates on rising demand for medical tools acquired with the Synthes purchase and new prescription medicines. The drugmaker raised its 2012 earnings forecast to $5.05 to $5.10 a share excluding certain items, after trimming the forecast last quarter by 5 cents to $5 to $5.07 a share.

Kroger Co., a supermarket operator, increased 4.3 percent to $24.43. Jefferies Group Inc. upgraded the stock to buy from hold.

Coca-Cola Co. slumped 0.6 percent to $37.90. The world’s largest soft-drink maker said third-quarter revenue advanced less than 1 percent to $12.3 billion, trailing the $12.4 billion average of analysts’ estimates compiled by Bloomberg.

Clearwire Corp. tumbled 17 percent to $2.23. People with direct knowledge of the situation said Sprint Nextel Corp. has no immediate plans to take over Clearwire. Sprint, which agreed to sell a 70 percent stake to Softbank Corp. for $20.1 billion, was unchanged at $5.69.

At the close:

Dow 13,552 +128 +0.95%

Nasdaq 3,101 +37 +1.20%

S&P 500 1,455 +15 +1.03%

23:30 Australia Leading Index August +0.4% +0.5%

The euro advanced to a one-month high on speculation Spain will move toward seeking financial assistance, helping contain Europe’s debt crisis. The 17-nation currency rose versus most major counterparts after Moody’s Investors Service held Spain’s credit rating at investment grade and as European Union leaders prepare for a summit in Brussels this week. Moody’s said in a statement yesterday it assigned a negative outlook on Spain’s Baa3 sovereign debt as it concluded the review for possible further downgrade of the country’s rating that it had initiated in June.

Spain will sell bonds due in 2022, 2016 and 2015 tomorrow. The nation’s 10-year yield fell one basis point to 5.81 percent yesterday after an auction of bills beat the maximum target.

The dollar slid against most of its major peers before data that may show new housing construction in the U.S. climbed last month, curbing demand for safer assets. The data will probably show that new construction rose to a 770,000 annual pace in September from 750,000 in the previous month, according to the median estimate of economists surveyed by Bloomberg News.

Australia’s currency reached a two-week high as Asian stocks extended gains in equities worldwide.

EUR/USD: during the Asian session the pair updated monthly high, but later fell to the opening level.

GBP/USD: during the Asian session, the pair rose to yesterday's highs.

USD/JPY: during the Asian session the pair fell to Y78.60.

A very limited day for European data Weds, with the UK taking centre stage. On the continent, at 0900GMT, the EMU Aug construction output numbers will hit screens. Wednesday sees the EFP leaders, heads of EU centre-right parties, meeting in Bucharest. At 0825GMT, the UK BOE/FPC member Andrew Bailey is set to deliver a Speech at the BBA Annual Conference. No doubt LIBOR will be to the fore. At 0830GMT, the UK's October BOE MPC Minutes will be released. On the continent, at 0900GMT, the EMU Aug construction output numbers will hit screens. At 0915GMT UK BOE Deputy Governor Paul Tucker Speaks at the BBA Annual Conference.

Change % Change Last

Gold 1,749 +11 +0.66%

Oil 92.09 +0.24 +0.26%

Change % Change Last

Nikkei 225 8,701.31 +123.38 +1.44%

S&P/ASX 200 4,491.5 +8.07 +0.18%

Shanghai Composite 2,095.19 -3.51 -0.17%

FTSE 100 5,870.54 +64.93 +1.12%

CAC 40 3,500.94 +80.66 +2.36%

DAX 7,376.27 +115.02 +1.58%

Dow 13,552 +128 +0.95%

Nasdaq 3,101 +37 +1.20%

S&P 500 1,455 +15 +1.03%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3098 +1,17%

GBP/USD $1,6119 +0,30%

USD/CHF Chf 0,9231 -1,10%

USD/JPY Y78,86 +0,22%

EUR/JPY Y103,30 +1,36%

GBP/JPY Y127,10 +0,50%

AUD/USD $1,0302 +0,50%

NZD/USD $0,8170 +0,13%

USD/CAD C$0,9863 +0,56%

08:30 United Kingdom Bank of England Minutes -

08:30 United Kingdom Claimant count September -15.0 -0.2

08:30 United Kingdom Claimant Count Rate September 4.8% 4.8%

08:30 United Kingdom ILO Unemployment Rate August 8.1% 8.1%

08:30 United Kingdom Average Earnings, 3m/y August +1.5% +1.6%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August +1.9% +2.0%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October -34.9

09:00 Eurozone Construction Output, m/m August -0.3%

09:00 Eurozone Construction Output, y/y August -4.7%

12:30 U.S. Building Permits, mln September 0.803 0.810

12:30 U.S. Housing Starts, mln September 0.750 0.770

14:30 U.S. Crude Oil Inventories - +1.7

21:00 New Zealand ANZ Job Advertisements (MoM) September +0.9%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.