- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-01-2013

European stocks climbed to a one- week high as euro-area finance ministers met for the first time this year to address the region’s debt crisis.

Euro-area finance ministers gathered in Brussels today to discuss how to channel firewall funds to banks. Policy makers were likely to debate how and when the 500 billion-euro ($666 billion) European Stability Mechanism can bypass governments.

In Asia, the Bank of Japan will expand asset purchases when a two-day meeting concludes tomorrow, according to all 23 economists in a Bloomberg survey. The median estimate projects a 10 trillion yen ($111 billion) increase.

National benchmark indexes climbed in 14 of Europe’s 18 western markets. France’s CAC 40 gained 0.5 percent and the U.K.’s FTSE 100 advanced 0.4 percent, while Germany’s DAX increased 0.6 percent. The Swiss Market Index fell 0.4 percent.

Admiral surged 5.3 percent to 1,215 pence as Goldman Sachs raised its recommendation to buy from neutral and added the shares to its “conviction buy” list, citing the stock’s underperformance over the past six months.

Richemont led luxury companies lower, tumbling 5.6 percent to 74.30 Swiss francs for the biggest decline since June 1. The maker of Cartier jewelry said third-quarter revenue rose 9.3 percent to 2.86 billion euros ($3.8 billion), missing the 2.91 billion-euro average of seven analyst estimates, after Asia Pacific sales stagnated.

Sky Deutschland AG declined 5.4 percent to 4.49 euros after the German pay-TV company forecast a wider-than-estimated annual loss and said it will sell 20.4 million new shares at 4.46 euros apiece.

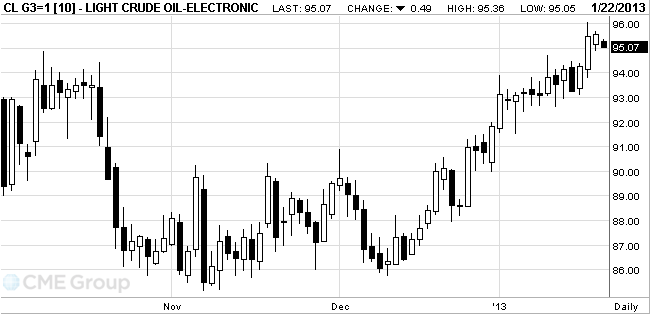

Oil dropped

from the highest level in four months in

West Texas

Intermediate futures slid as much as 0.5 percent, declining for the first time

in four days. House Republicans will use the planned Jan. 23 vote on a

debt-ceiling increase to try to force Senate Democrats to outline their

spending plans. Finance ministers in

Finance

ministers are debating whether the 500 billion euro ($666 billion) European

Stability Mechanism should take over earlier bank bailouts that were routed

through governments, and what to do with so-called legacy assets. A European

Union aide who briefed reporters defined those as loans already on a bank’s

balance sheet that could later cause difficulties.

WTI crude

for February delivery, which expires tomorrow, fell as much as 51 cents to

$95.05 a barrel in electronic trading on the New York Mercantile Exchange. The

more active March contract was down 46 cents at $95.58. Front-month futures

rose 7 cents on Jan. 18 to the highest close since Sept. 17.

With floor

trading closed today for the Martin Luther King Jr. holiday, the average volume

of all WTI contracts was 80 percent below the 100-day average.

Brent for March settlement on the London-based ICE Futures Europe exchange dropped as much as 48 cents, or 0.4 percent, to $111.41 a barrel.

The price of gold is kept in the range of the previous session in anticipation of further easing by the Bank of Japan.

Analysts suggest that the Bank of Japan on Tuesday announced the acquisition of the assets indefinitely as long as inflation does not reach 2 percent. In the past, gold has risen in price for 12 years in a row by the easing of many central banks.

In the past few years, Japan has sold more gold than to buy, but aggressive monetary policy can revive interest in buying precious metal, analysts said.

Demand in the physical market Asia is growing since the beginning of the year on the eve of the New Year according to the lunar calendar in China, which is struggling to India for leadership in the use of gold. Consumption growth will continue until February 10, to this day this year Chinese New Year falls.

On Monday, Citi analysts forecast lowered the price of gold this year, but at the same time raised forecasts for prices for platinum group metals. The bank now expects the average price of gold at the end 2013 at 1675 dollars per ounce, which is 4% lower than the previous forecast. The outlook for platinum price was increased by 1.5% to $ 1,700, and the outlook for palladium - by 4.2% to $ 775 per ounce.

February futures price of gold on COMEX today trading under 1684.80 - 1691.10 dollars per ounce.

The single currency continues to consolidate in a narrow range against the inactive trading session. U.S. financial markets are closed for the celebration of Martin Luther King, and from Eurogroup meetings has not received any news.

EUR / USD has spent much of the day at $ 1.3300/1.3330 sideways, unable to determine the direction of motion. Now the pair is trading in the mid-range, around $ 1.3312/15, almost flat against the opening price.

- Need to do more to spur growth in italy

- Better spreads due to natl, eurozone and ECB effortsThe Canadian dollar is still trading near C$0.9925/30, after a report on Canada's wholesale sales reflected an increase of 0.7% m / m in November, exceeding the forecast of 0.5%, but a little short of the September +0, 8%.

Currently the pair is trading higher by 0.07% at C$0.9927. Next resistance is located at C$0.9945 (January 18 high) and C$0.9977 (December 31 high). Support - at C$0.9908 (session low), C$0.9862 (MA (200) for H1) and C$0.9835 (January 16 low).

EUR/USD $1.3200, $1.3275, $1.3300, $1.3350, $1.3400

USD/JPY Y89.25, Y89.50, Y89.75, Y90.00, Y90.50

GBP/USD $1.5950, $1.5900

AUD/USD $1.0450, $1.0490, $1.0525, $1.0550, $1.0575

Data

00:01 United Kingdom Rightmove House Price Index (MoM) January -3.3% +0.2%

00:01 United Kingdom Rightmove House Price Index (YoY) January +1.4% +2.4%

07:00 Germany Producer Price Index (MoM) December -0.1% 0.0% -0.3%

07:00 Germany Producer Price Index (YoY) December +1.4% +1.7% +1.5%

09:00 Eurozone Eurogroup Meetings -

The yen strengthened against the dollar, departing from the weakest level since June 2010, as officials of the Bank of Japan began its two-day meeting.

Note that in the last month, Japan's currency fell 5.9% against the dollar on speculation that the Bank of Japan, under pressure from the government to increase the incentive program to pull the economy out of recession.

As it became known, most economists predict that the Bank of Japan will increase its program to purchase assets worth 10 trillion yen increase. Recall that Abe also stands for the same increase in incentive programs, and calls for the central bank to double its inflation target of 2%.

Frank continued to strengthen against the euro Friday after last week, it fell to the lowest level since the moment when the Swiss National Bank imposed restrictions on the currency in 2011.

The pound rose against the dollar, which has been associated with the publication of the data, which showed that house prices in the UK rose in January, along with the number of new sellers, as well as improved mood among market participants. According to the report, housing prices in the first week of January rose 0.2%, compared with a fall of 3.3% in December. At the same time, annualized prices were 2.4% higher than during the same month last year.

The euro was little changed against the dollar, even though the fact that the data showed that producer price inflation in Germany rose in December, but at a slower pace than expected.

It is learned that the price of industrial products rose an annualized 1.5%, compared to growth of 1.4%. Note that the annual growth rate is projected to have been 1.7%. At the same time, in monthly terms the index of consumer prices fell by 0.3%, compared with a fall of 0.1% in the past month, as well as experts' expectations at 0.0%

EUR / USD: during the European session varies in the range of $ 1.3300-$ 1.3332

GBP / USD: during the European session, the pair rose to $ 1.5893

USD / JPY: during the European session the pair fell to Y89.32

At 13:30 GMT, Canada will report on changes in the volume of wholesale trade in November. Also on this day the USA celebrates Martin Luther King Day.

EUR/USD

Offers $1.3450, $1.3430, $1.3400/05, $1.3350/60, $1.3330/35

Bids $1.3300, $1.3280, $1.3270, $1.3260/50

GBP/USD

Offers $1.6050/55, $1.6030, $1.5995/000, $1.5980, $1.5950, $1.5920, $1.5900/10

Bids $1.5850, $1.5800

AUD/USD

Offers $1.0590, $1.0575/80, $1.0555/60, $1.0540

Bids $1.0490/80, $1.0475/70, $1.0455/50, $1.0420, $1.0410/00

EUR/JPY

Offers Y120.50, Y120.00, Y119.70, Y119.35/40

Bids Y118.80, Y118.50, Y118.10/00, Y117.50

USD/JPY

Offers Y90.55/60, Y90.40, Y90.20/30, Y89.90/00

Bids Y89.35/30, Y89.10/00, Y88.60/50, Y88.20

EUR/GBP

Offers stg0.8450, stg0.8420, stg0.8400/10

Bids stg0.8355/50, stg0.8300, stg0.8260, stg0.8250, stg0.8225/20

Today in Brussels hosted a meeting of finance ministers of the eurozone. It is planned to discuss the issue of providing funds directly to eurozone banks of stab fund, and will discuss the creation of a financial regulator, which will oversee the activities of banks in the EU.

Along with this will be discussed in Spain, Greece and Cyprus.

The course of trading may also affect what the U.S. financial markets will be closed in observance of Martin Luther King.

FTSE 100 6,166.63 +12.22 +0.20%

CAC 40 3,750.98 +9.40 +0.25%

DAX 7,730.4 +28.17 +0.37%

Shares of Admiral Group Plc and International Consolidated Airlines Group (IAG) rose by 4.8% and 1.8% due to improvement expert recommendations for the securities of both companies.

Goldman Sachs analysts raised their recommendations for the stock Admiral, working in the field of auto insurance, to "actively buy" from "neutral." Recommendations for stocks IAG, owner airlines British Airways, have been promoted by economists Credit Suisse to "overweight" from "neutral." The value of shares Cie. Financiere Richemont SA, the world's largest manufacturer of jewelry, fell during trading up 4.9% as the statements of the company in the last quarter did not meet market expectations.

EUR/USD $1.3200, $1.3275, $1.3300, $1.3350, $1.3400

USD/JPY; Y89.25, Y89.50, Y89.75, Y90.00, Y90.50

GBP/USD$1.5950, $1.5900

AUD/USD $1.0450, $1.0490, $1.0525, $1.0550, $1.0575Most Asian stocks fell amid speculation shares may have risen too far, too fast. Japanese shares as the yen climbed against the dollar after hitting its lowest level in 2 1/2 years.

Nikkei 225 10,747.74 -165.56 -1.52%

Hang Seng 23,590.91 -10.87 -0.05%

S&P/ASX 200 4,777.5 +6.27 +0.13%

Shanghai Composite 2,328.22 +11.15 +0.48%

Sims Metal Management Ltd., the world’s largest scrap metal recycler, dropped 5 percent in Sydney as an internal investigation revealed potential fraud at two of its U.K. businesses.

Fanuc Corp. slid 3.9 percent in Tokyo after the factory-robotics company’s rating was cut at Citigroup Inc.

China Vanke Co., the country’s biggest publicly traded property developer, surged 10 percent in Shenzhen on plans to move trading of its foreign-currency denominated shares to Hong Kong.The euro fell against the dollar after the European Central Bank representative Kere said that the central bank will be forced to repay earlier loans, which were presented to them in a transaction LTRO (long-term refinancing operations), back in 2011. Recall that the loans were offered troubled eurozone banks to increase liquidity of the banking system. Economists say that the early repayment of loans, is likely to cause upward pressure on interbank rates on borrowing, as banks will be forced to go to another place for short-term financing.

The single currency fell to almost maximum, since February 2012, as Kere added that he does not expect the transaction to repay loans LTRO will have an impact on the overnight rate, which is one of two main interbank borrowing rates used in the eurozone. However, since in the last days of borrowing rates rose, the euro began to decline.

The pound fell against the dollar after the published data showed that retail sales fell last month by 0.1%, while analysts had expected an increase of 0.2%. Recall that in the last month, the value of this indicator was unchanged.

The Swiss franc weakened against the euro after the union called on the central bank to change the limit of the exchange rate EUR / CHF up to the level of 1.25 francs, and "defend" it at any cost. Recall that it is now at 1.2 francs, and held at this level since September 2011.

The cost of the Canadian and Australian dollar fell against most currencies, which was due to a decline in commodity prices, including oil.

Asian stocks rose for the first time in three days, with the regional benchmark heading for its biggest advance in a month, after economic reports in the world’s two largest economies beat estimates and the yen traded near a 30-month low.

Nikkei 225 10,913.3 +303.66 +2.86%

Hang Seng 23,601.78 +262.02 +1.12%

S&P/ASX 200 4,771.23 +14.60 +0.31%

Shanghai Composite 2,317.07 +32.16 +1.41%

Honda Motor Co., a Japanese carmaker that gets about 44 percent of sales from North America, climbed 3.2 percent.

Industrial & Commercial Bank of China Ltd., the world’s biggest lender by market value, added 1.2 percent in Hong Kong.

Rio Tinto Group, the world’s second-largest mining company, rose 2.7 percent in Sydney after chief executive officer Tom Albanese resigned without a cash windfall.European stocks were little changed this week as better-than-expected economic data from China and the U.S. offset concern that debt-ceiling talks will weigh on recovering growth in the world’s biggest economy.

Delhaize Group SA (DELB) soared 13 percent as quarterly revenue climbed. JCDecaux SA advanced 11 percent after announcing a contract win. TNT Express NV tumbled 34 percent after United Parcel Service Inc. abandoned its bid for the company. PostNL NV, which holds a stake in TNT, retreated 37 percent.

The Stoxx 600 Europe Index fell less than 0.1 percent to 287.03 this week.

China’s economic growth accelerated for the first time in two years as government efforts to revive demand drove a rebound in industrial output and retail sales.

Gross domestic product advanced 7.9 percent in the fourth quarter from a year earlier, the National Bureau of Statistics said in Beijing on Jan. 18. That compared with the median economist estimate of 7.8 percent in a Bloomberg News survey and growth of 7.4 percent in the third quarter.

National benchmark indexes rose in 12 of Europe’s 18 western markets.

FTSE 100 6,154.41 +22.05 +0.36% CAC 40 3,741.58 -2.53 -0.07% DAX 7,702.23 -33.23 -0.43%

Delhaize rallied 13 percent as the brand repositioning at its Food Lion supermarkets in the U.S. boosted sales volumes. Group revenue for the three months ended Dec. 31 increased 2.3 percent to 5.76 billion euros ($7.66 billion).

JCDecaux (DEC) jumped 11 percent. The world’s largest outdoor advertising company on Jan. 16 announced that its newly formed joint venture with Interstate Outdoor Advertising signed a 20- year partnership with the city of Chicago that will generate $700 million in advertising revenue.

Mediaset SpA (MS) rallied 7.8 percent as analysts including those at Berenberg Bank said they expect a recovery in the advertising market to benefit the broadcaster controlled by former Italian Prime Minister Silvio Berlusconi.

TNT slid 34 percent, the most since at least June 2011. PostNL, which holds a 29.8 percent stake in TNT, tumbled 37 percent. The two stocks posted the worst performances this week in the Stoxx 600. (SXXP) UPS, the world’s biggest package-delivery company, on Jan. 14 terminated a 5.16 billion-euro bid for TNT after the European Commission signaled it may block the deal.

Anglo American Plc (AAL) retreated 7.7 percent. The company’s platinum unit, the world’s largest miner of the metal, said this week that it may fire as many as 14,000 workers as it idles four shafts.

Major U.S. stock indexes began trading in the red rose, but still finished trading mixed trends. For the week DOW index rose 1,20%, Nasdaq rose 0,29%, S & P500 gained 0.95%.

Earlier, the decline somewhat increased after the data was published by the index of consumer sentiment from the Reuters / Michigan. As shown by a report released, according to preliminary data in January, the index fell to 71.3 points, compared with an expected value of 75.1 points and 72.9 points in December.

Reason for the decline is now also profit by market participants after yesterday were updated multi-year highs.

DOW index components show a mixed trend. At the moment, the leader shares in General Electric (GE, +4.04%). Maximum loss carry stock Intel Corporation (INTC, -6.83%). Shares of both companies today are news, the two companies released quarterly reports, which were better and worse than average expectations of the market, respectively.

Sector of the S & P also show mixed results. More than other sectors of manufactured goods rose (+0.8%), and conglomerates sector (+0.8%) is lower than other tech sector (-0.2%) and the health sector (-0.2%).

At the close:

Dow +53.29 13,649.31 +0.39%

Nasdaq -1.29 3,134.71 -0.04%

S & P +4.92 1,485.86 +0.33%

00:01 United Kingdom Rightmove House Price Index (MoM) January -3.3% +0.2%

00:01 United Kingdom Rightmove House Price Index (YoY) January +1.4% +2.4%

The yen rallied from its weakest level in 2 1/2 years as Bank of Japan officials began a two-day policy meeting. All 23 economists in a Bloomberg News survey expect the BOJ to expand its asset purchases, with the median estimate signaling a 10 trillion yen ($112 billion) increase. Abe has announced a spending package of similar size and is calling on the central bank to double it’s 1 percent target for consumer price gains to defeat entrenched deflation. The yen has lost 5.9 percent against the dollar in the past month on speculation that the BOJ, under pressure from the government of new Prime Minister Shinzo Abe, will boost stimulus to lift the economy out of its third recession since 2008. Technical indicators signaled the yen’s decline may have been overdone, while traders became the least bearish on the currency in eight weeks. The yen’s 14-day relative strength index against the dollar was at 26 on Jan. 18, below the 30 level that traders see as a signal an asset’s price has fallen too far, too fast and may be due to reverse course. Versus the euro, it was at 29.

The Dollar Index traded near a one-week high before reports that may show gains in U.S. home sales. In the U.S., sales of existing homes probably climbed 1.2 percent to a 5.1 million annual rate last month, the strongest since November 2009, according to the median estimate of economists polled by Bloomberg before the National Association of Realtors publishes the figures tomorrow. Another report this week may say new-home sales picked up to a 385,000 annual pace for the month, the best showing since April 2010.

EUR / USD: during the Asian session, the pair traded in a range of $1.3300/30.

GBP / USD: during the Asian session, the pair traded in a range of $1.5840/70.

USD / JPY: during the Asian session the pair fell to Y89.40.

In Europe, the Eurogroup is set to meet, with the formal agreement to OK the latest Greek disbursement on the agenda. European data gets underway at 0700GMT, with the release of Germany's December PPI numbers. The UK data calendar gets underway at 0930GMT, with the release of the Bank of England January Trends in Lending and Capital Issuance data, along with the December CML Mortgage Lending numbers. Further EU data is expected at 1000GMT, with the release of the third quarter 2012 government debt statistics.

00:01 United Kingdom Rightmove House Price Index (MoM) January -3.3% +0.2%

00:01 United Kingdom Rightmove House Price Index (YoY) January +1.4% +2.4%

07:00 Germany Producer Price Index (MoM) December -0.1% 0.0%

07:00 Germany Producer Price Index (YoY) December +1.4% +1.7%

09:00 Eurozone Eurogroup Meetings -

13:30 Canada Wholesale Sales, m/m November +0.9% +0.5%

13:30 U.S. Bank holiday -

18:00 Eurozone ECB's Jens Weidmann Speaks© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.