- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-05-2023

- NZD/USD remains depressed inside immediate triangle formation.

- Golden cross, steady RSI keeps Kiwi pair buyers hopeful.

- Bulls need validation from 0.6310 to retake control.

NZD/USD remains mostly steady around 0.6285-80 as it makes rounds inside a symmetrical triangle formation established since the last Friday.

Even so, the Kiwi pair buyers remain hopeful amid the “golden cross” on the hourly chart. That said, the golden cross is a moving average crossover suggesting further upside of the underlying by the 50-SMA’s piercing of the 200-SMA from below.

Apart from the “golden cross”, a steady RSI (14) line also underpins the continuation of a slower grind toward the north.

However, the NZD/USD buyers need to cross the stated triangle’s upper line, around 0.6300 by the press time, for confirmation.

It’s worth noting that the 61.8% Fibonacci retracement level of its May 11-12 downturn, near 0.6310, may act as the final defense of the Kiwi pair sellers before directing the quote towards the monthly high surrounding 0.6385.

On the contrary, a downside break of the stated triangle’s bottom line, close to 0.6275 at the latest, isn’t an open invitation to the NZD/USD bears as 50-SMA and 200-SMA, respectively near 0.6270 and 0.6260, can prod the downside moves.

Following that, the one-week-old ascending support line, close to 0.6215 at the latest, appears the key to watch for the pair sellers to break before taking control.

NZD/USD: Hourly chart

Trend: Further recovery expected

- EUR/GBP is looking to recapture the 0.8700 resistance as the focus shifts to UK inflation.

- The street is concerned over UK’s growth potential due to labor market shortages and ongoing low investment and productivity growth.

- A decline in the pace of interest rate hike to 25 bps would allow the ECB to sustainably keep pressure on inflation.

The EUR/GBP pair has rebounded sharply to 0.8695 after a wild gyration move in the early Tokyo session. The cross is looking to recapture the round-level resistance of 0.8700 ahead of the United Kingdom Inflation data, which is scheduled for Wednesday.

As per the preliminary report, the headline UK Consumer Price Index is seen at 8.3%, significantly lower than the prior release of 10.1% annually. Monthly headline CPI has shown a steady growth at 0.8%. Core CPI that excludes the impact of oil and food prices is expected to remain stable at 6.2%.

A decline in monthly UK inflation could be the outcome of lower energy prices. The UK economy has been facing the heat of labor shortages and high food inflation. A steep deceleration in UK inflation might allow the Bank of England (BoE) to pause its policy-tightening spell ahead. Investors should note that BoE Governor Andrew Bailey has already raised interest rates to 4.5%.

Analysts at Rabobank are anticipating decent gains in the EUR/GBP pair in a 9-12 month view. They believe that in that time frame, the market is likely to be focused on the prospect of looser monetary conditions from both the European Central Bank (ECB) and the BoE. Our expectation of GBP underperformance over the medium term is drawn from concerns over UK growth potential related to labor market shortages and ongoing low investment and productivity growth in the UK.”

Meanwhile, Eurozone investors are confident that more interest rate hikes will be welcomed by ECB President Christine Lagarde to tame stubborn inflation. Also, a decline in the pace of interest rate hikes from 50 basis points (bps) to 25bps might allow the ECB to sustainably keep pressure on Eurozone inflation.

“Meeting with US President Joe Biden was ‘productive’ but no agreement had yet been reached on the debt ceiling,” said US House Speaker Kevin McCarthy late Monday per Reuters. The US policymaker spoke after his much-anticipated meeting with US President Biden.

It’s worth noting that a US Republican Patrick Mchenry also crossed wires, via Reuters while saying, “We have a little more of the details we need to get to a package that can pass Congress.”

Additional comments

The meeting was productive in areas where we have differences of opinion.

Tone of discussion was improved from previous times.

Not willing to talk about raising revenue, problem is spending not revenue.

Staff level talks will continue.

Not willing to talk about raising revenue.

Staff will continue to get back together.

Both agreed we want to come to an agreement.

Confident that Biden wants to make a deal.

Instructed negotiators to come back together and find common ground.

Not going to waive the 72-hour rule.

Defense cuts are not on the table.

I believe we can get a deal done.

Nothing is agreed to, everything is being talked about.

Biden and I will talk everyday until we get this done.

Don't think a short-term extension benefits anybody.

Market reaction

The news allowed the US Dollar to pick up bids to 103.25, after an upbeat start of the week.

Also read: Forex Today: Quiet markets ahead of PMIs, awaiting a debt-limit deal

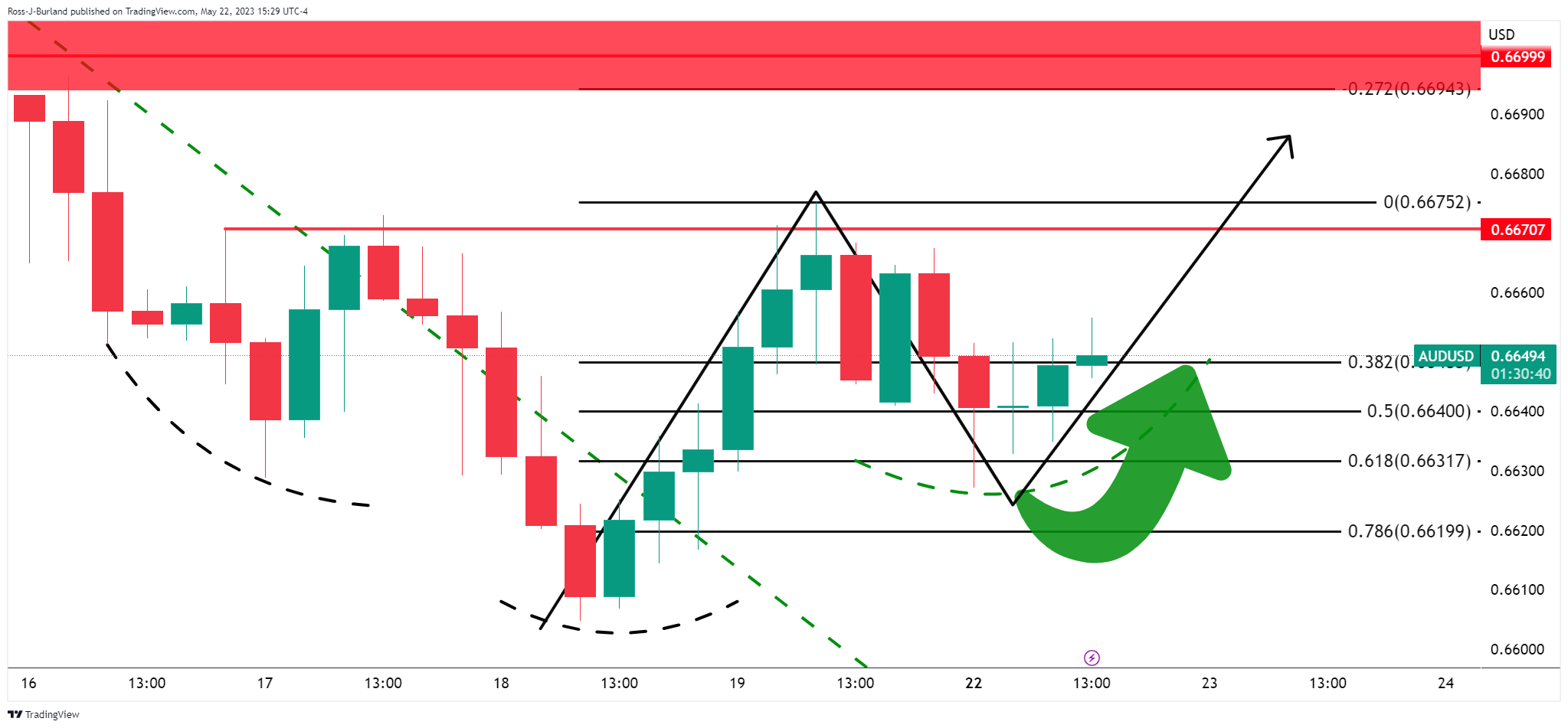

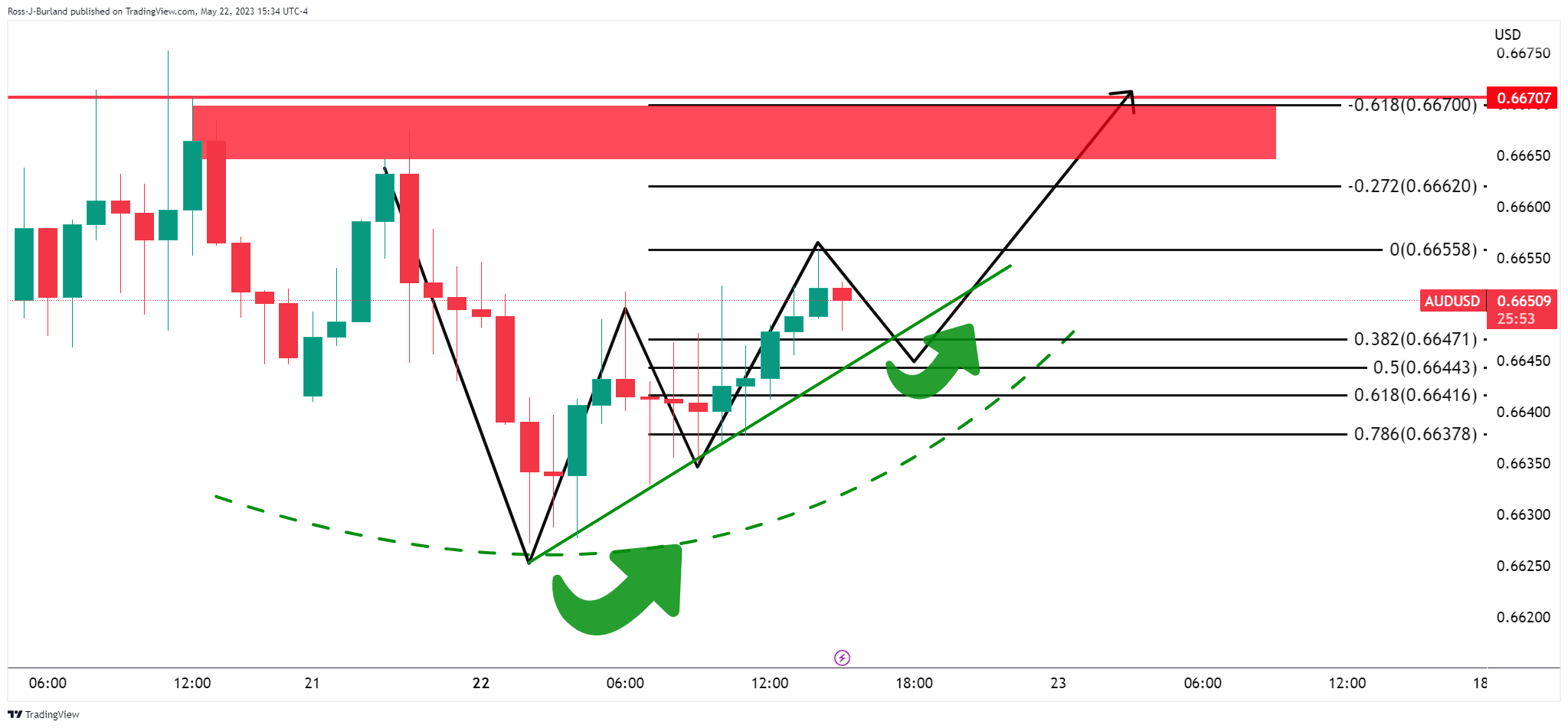

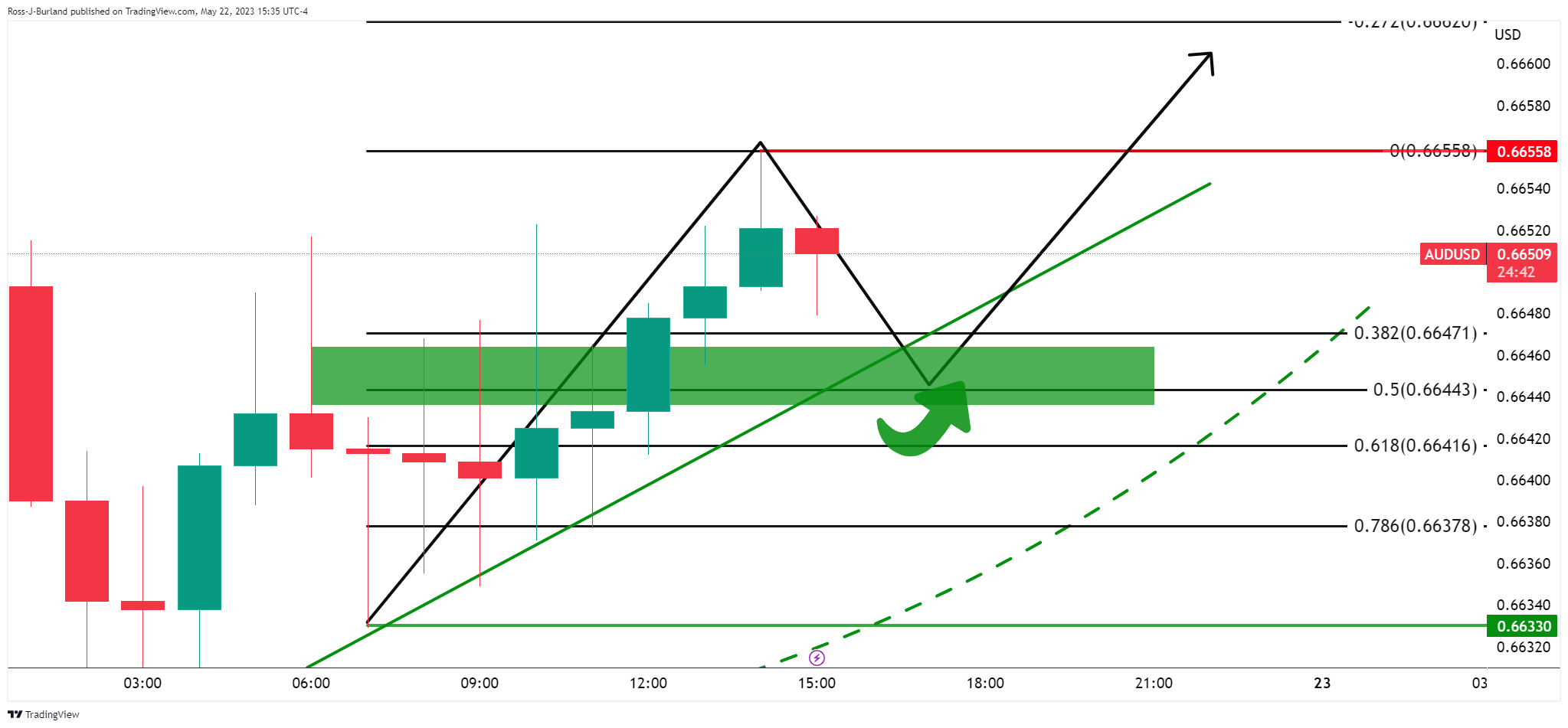

- AUD/USD reverses from intraday high to tease sellers after an inactive Monday.

- Australia’s preliminary S&P Global PMIs for May came in mixed.

- Market sentiment dwindles amid ongoing US debt ceiling negotiations, hawkish Fed concerns and China-linked news.

- US PMIs, risk catalysts will be the key to watch for clear directions.

AUD/USD fades bounce the previous day’s bounce off 0.6630 as it bears the burden of sluggish Australia activity data on early Tuesday. That said, the risk barometer pair marked an unimpressive performance on Monday amid mixed clues and sluggish markets. However, the quote is likely to witness further volatility as the economic calendar becomes active.

Australia’s first readings of the S&P Global Manufacturing PMI for May reprints 48.0 figures versus 47.3 expected whereas the Services PMI eased to 51.8 from 53.7 previous readings and 48.9 market forecasts. With this, the Composite PMI came in at 51.2 compared to 53.0 marked in April.

Elsewhere, the markets remain jittery as the US policymakers’ negotiations to seal the debt ceiling deal appear less impressive even as US President Joe Biden said that he believed they will make some progress on the debt ceiling talks. It should be noted that House Speaker Kevin McCarthy said, “We both believe we need to change the trajectory.”

“The Democratic president and the top congressional Republican have struggled to make progress on a deal, as McCarthy pressures the White House to agree to spend cuts in the federal budget that Biden considers ‘extreme,’ and the president pushes new taxes on the wealthy that Republicans reject,” reported Reuters.

On a different page, the Fed policymakers convey hawkish messages and allow the US Dollar, as well as the yields, to remain firmer, which in turn exerts downside pressure on the AUD/USD prices. That said, Minneapolis Federal Reserve President Neel Kashkari favored the rate hike trajectory while citing the fears of the US default and banking crisis, which in turn allowed the US Dollar to remain firmer. On the same line, St. Louis Federal Reserve President James Bullard ruled out the recession concerns on Monday while saying that He sees two more rate hikes this year before reaching the base rate. Furthermore, Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin and San Francisco President Mary C Daly recently backed the calls for higher rates.

It’s worth observing that jitters surrounding China, Australia’s biggest customer also challenge the AUD/USD pair buyers, even if the latest headlines have been slightly positive. US Official recently mentioned that they’re working directly with China on the Micron issue. Beijing banned chips from US manufacturer Micron, after terming them a security threat, which in turn gave rise to a situation where Washington and Beijing exchanged harsh words. Additionally, the China Securities Journal (CSJ) cited the dragon nation’s sturdy economic transition while the People’s Bank of China (PBoC) defends its status quo, which in turn favors commodity prices, including WTI, due to China’s dominance as the world’s biggest industrial player.

Against this backdrop, Wall Street ended the day mixed but the US Treasury bond yields remained firmer. That said, the US 10-year and two-year Treasury bond yields remain indecisive around the highest levels in 10 weeks after rising for the last seven consecutive days, around 3.72% and 4.32% at the latest.

Having witnessed the initial reaction to the Aussie PMIs, the AUD/USD pair traders should keep their eyes on the US S&P Global PMIs for May and the aforementioned risk catalysts for clear directions.

Also read: US S&P Global PMIs Preview: Dollar set to rise on a slip in the services sector

Technical analysis

Monday’s Doji candlestick joins the AUD/USD pair’s sustained trading below the 21-DMA, close to 0.6675 by the press time, to keep the bears hopeful.

- Silver prices edge toward $23.60 following a dip below $24.00 last week, as US Treasury bond yields surge to 3.721%, curbing safe-haven appetite and softening the USD’s fall.

- XAG/USD holds its double-top chart pattern below the neckline. Although a failure to cross the 100-day EMA at $23.50 hints at the bullish sentiment, a bearish RSI suggests possible retesting.

- If XAG/USD breaks below the 100-day EMA, it eyes $23.00 and then the pivotal 200-day EMA at $22.82.

Silver price retraces toward the $23.60 area after falling below the $24.00 figure in the last week, courtesy of higher US Treasury bond yields, with the 10-year benchmark note rate at 3.721%, climbing more than four basis points. That dented the appetite for safe-haven assets, namely Gold and Silver prices, and cushioned the fall of the US Dollar. At the time of writing, the XAG/USD is trading at $23.62, almost flat as the Asian session begins.

XAG/USD Price Analysis: Technical outlook

The XAG/USD continues to validate a double-top chart pattern, with the XAG/USD’s spot price remaining below the double-top neckline. Failure to break below the 100-day Exponential Moving Average (EMA) at $23.50 keeps Silver buyers hopeful for higher prices. Nevertheless, the Relative Strength Index (RSI) indicator remains bearish, suggesting that the 100-day EMA could be retested soon.

If XAG/USD breaks below the latter, the next support would be the $23.00 figure before testing the “trendsetter” 200-day EMA at $22.82. Once broken, XAG/USD will turn bearish and be exposed to test lower prices. Firstly, the March 28 daily low at $22.83, followed by the March 21 swing low of $22.14.

On the other hand, for XAG/USD’s bullish continuation, Silver must reclaim the $24.00 mark, a troy ounce, followed by the 50-day EMA at $24.14. Once cleared, XAG/USD’s next resistance would be the 20-day EMA at $24.33, ahead of double-top neckline cracking.

XAG/USD Price Action – Daily chart

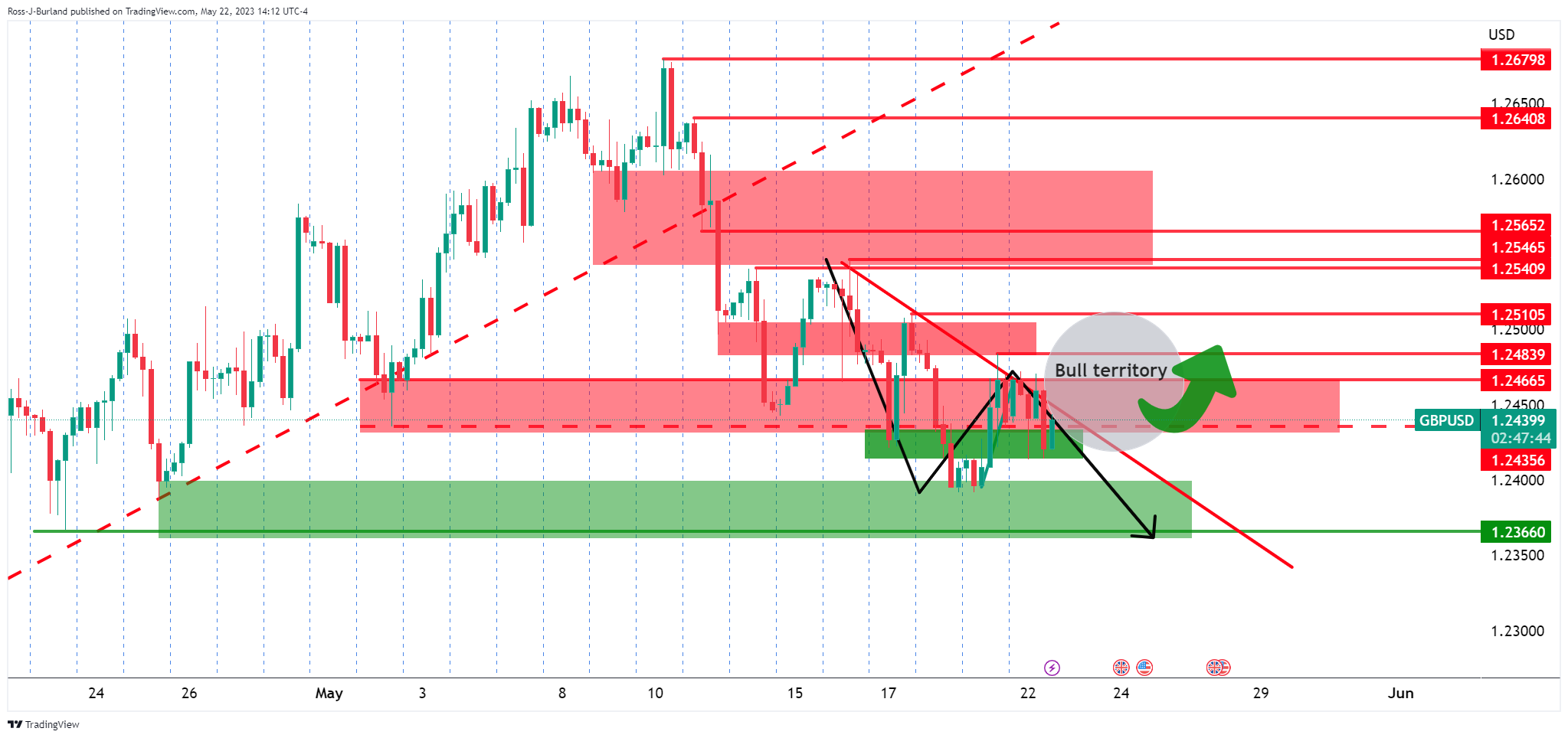

- GBP/USD has come back inside the woods as investors have sidelined ahead of US borrowing cap issues.

- US Biden believes that a deep dive into tax loopholes is necessary to ensure that the wealthy class should pay a fair amount of tax.

- The Cable formed a Head and Shoulder pattern, which indicates a bearish reversal after a breakdown of the neckline placed from 1.2440.

The GBP/USD pair is displaying a sideways auction in a range of 1.2420-1.2470 from Monday. The Cable is inside the woods as the investors are awaiting more developments over US debt-ceiling issues as each day passing is pushing the United States economy to a default situation.

S&P500 remained directionless on Monday as investors are expected to take decisive action after the face-to-face meeting between US President Joe Biden and House of Representatives Kevin McCarthy.

The US Dollar Index (DXY) has defended its immediate support of 103.20. Meanwhile, US Biden has cited that he believes Democrats will make progress on the debt-ceiling but a reduction in spending initiatives is needed. Also, a deep dive into tax loopholes is necessary to ensure that the wealthy class should pay a fair amount of tax.

GBP/USD witnessed a steep fall after a breakdown of the upward-sloping trendline plotted from April 03 low at 1.2275 on a four-hour scale. The Cable formed a Head and Shoulder pattern, which indicates a bearish reversal after a downside break below the neckline placed from April 27 low at 1.2440.

The Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, indicating a lackluster performance ahead of the US borrowing cap issues.

Should the asset decline below May 19 low at 1.2390, US Dollar bulls will get strengthened further and will drag the Cable toward April 10 low at 1.2344 followed by April 03 low at 1.2275.

On the flip side, a recovery move above May 09 high at 1.2640 will drive the major toward the round-level resistance at 1.2700 and 26 April 2022 high at 1.2772.

GBP/USD four-hour chart

- USD/CAD treads water after sluggish start of the week.

- Canada holiday, mixed feeling in the markets and Oil’s rebound together portrayed Loonie pair’s inaction.

- US President Biden, House Speaker McCarthy appear optimistic on debt ceiling talks.

- Preliminary US S&P Global PMIs for May, second-tier Canada data and return of full markets to offer active trading day.

USD/CAD remains sidelined around 1.3500, after two consecutive days of inaction, as traders brace for a busy Tuesday amid early hours of Asian session. In doing so, the Loonie pair fails to justify the recently firmer prices of WTI crude oil, Canada’s key export, as firmer US Dollar and yields play their roles. If we trace the reason behind the pair’s dull performance on Monday, the Canadian Bank Holiday could be held responsible.

That said, the hopes of no United States default and hawkish Federal Reserve (Fed) expectations seemed to have recently underpinned the US Dollar. However, the Oil price appears to cheer China’s readiness for more investment and likely supply-crunch due to the geopolitical tension surrounding the US, Russia and China.

Recently, US President Joe Biden said that he believed they will make some progress on the debt ceiling talks while House Speaker Kevin McCarthy said, “We both believe we need to change the trajectory.”

On the other hand, Minneapolis Federal Reserve President Neel Kashkari favored the rate hike trajectory while citing the fears of the US default and banking crisis, which in turn allowed the US Dollar to remain firmer. On the same line, St. Louis Federal Reserve President James Bullard ruled out the recession concerns on Monday while saying that He sees two more rate hikes this year before reaching the base rate. Furthermore, Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin and San Francisco President Mary C Daly recently backed the calls for higher rates.

Elsewhere, US Official recently mentioned that they’re working directly with China on the Micron issue. Beijing banned chips from US manufacturer Micron, after terming them a security threat, which in turn gave rise to a situation where Washington and Beijing exchanged harsh words. Additionally, the China Securities Journal (CSJ) cited the dragon nation’s sturdy economic transition while the People’s Bank of China (PBoC) defends its status quo, which in turn favors commodity prices, including WTI, due to China’s dominance as the world’s biggest industrial player.

With this, the US Dollar Index (DXY) regained upside momentum on Monday after a downbeat close at the end of the two-week winning streak by Friday, inactive of late. With this, the greenback’s gauge versus the six major currencies ended the day around 103.23, making rounds to the same level by the press time.

It should be noted that WTI Crude Oil began the week on a negative note before bouncing off $70.65 to end the day on a positive side around $72.15.

Amid these plays, Wall Street ended the day mixed but the US Treasury bond yields remained firmer. That said, the US 10-year and two-year Treasury bond yields remain indecisive around the highest levels in 10 weeks after rising for the last seven consecutive days, around 3.72% and 4.32% at the latest.

Looking ahead, the US S&P Global PMIs for May and Canadian Industrial Production for April may entertain the USD/CAD traders as the full markets return.

Technical analysis

USD/CAD portrayed back-to-back Doji candlesticks in the last two days while staying within a one-month-old symmetrical triangle, currently between 1.3515 and 1.3475.

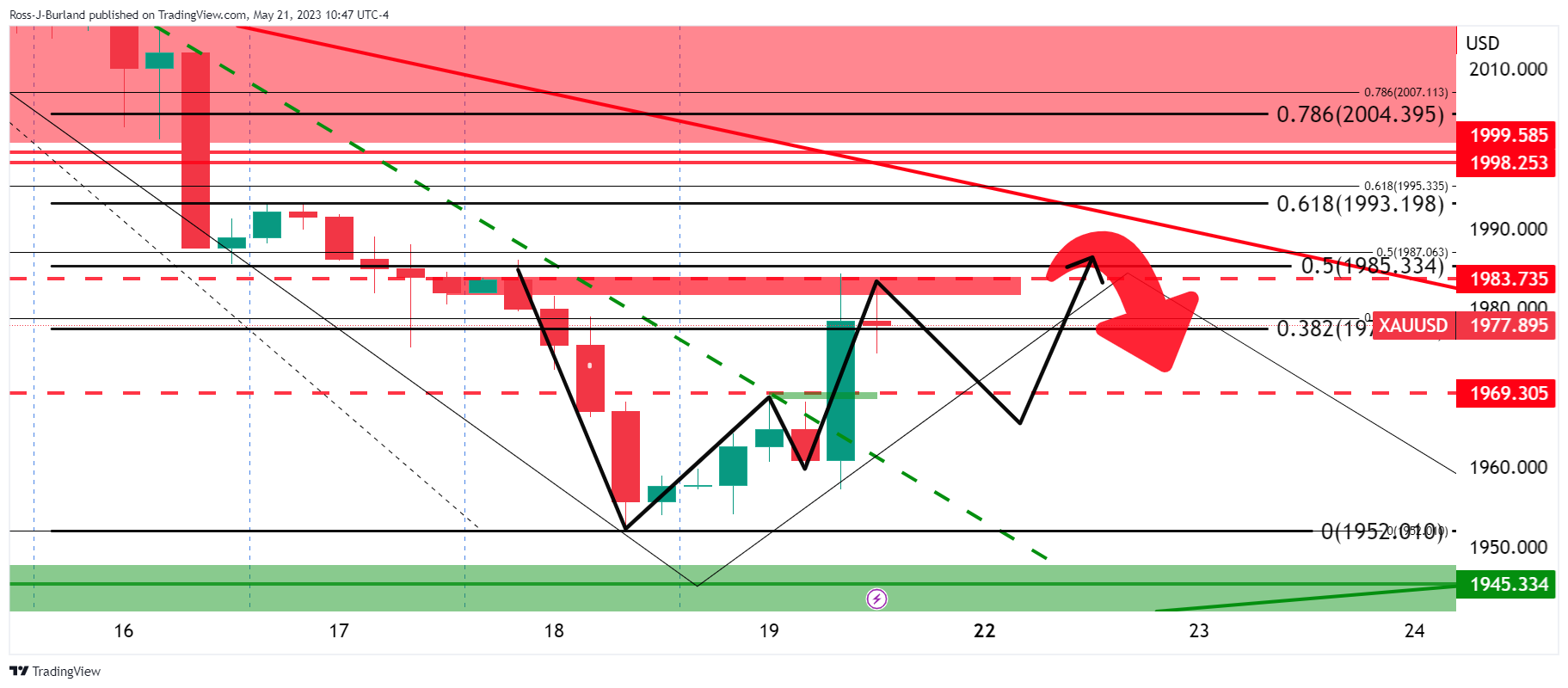

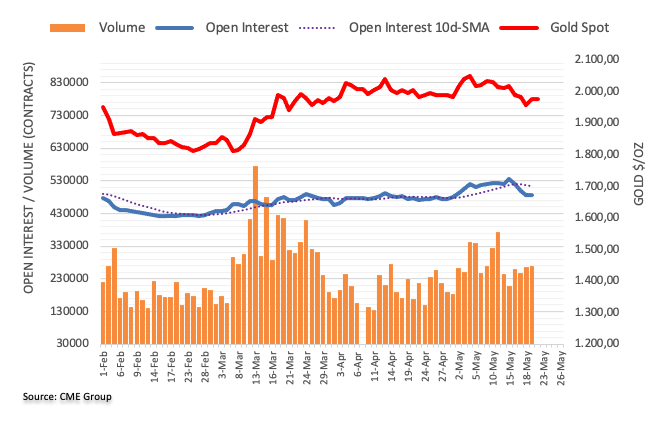

- Gold price seesaws after a downbeat week-start amid firmer United States Dollar, Treasury yields.

- Hawkish Federal Reserve talks, cautious optimism about negotiations over US debt ceiling underpin USD, yields and weigh on XAU/USD.

- Preliminary Purchasing Managers Index for May from US, UK and Eurozone will direct the Gold price.

- Risk catalysts will be more important for clear guide of the XAU/USD.

Gold price (XAU/USD) treads water around $1,970 as markets turn cautious ahead of an active calendar, mostly comprising the Purchasing Managers Indexes from the key global economies, amid early Tuesday morning. That said, the Gold price began the week on a negative footing as the US Dollar regained upside momentum while the Treasury bond yields stayed firmer, backed by hopes of no United States default and hawkish Federal Reserve (Fed) expectations. It’s worth noting that the XAU/USD dropped in the last two weeks even as Friday allowed the XAU/USD bears to take a breather after Fed Chair Powell’s cited downbeat credit conditions reducing the need for higher rates.

Gold price remains pressured on firmer US Dollar, yields

Gold price bears the burden of the upbeat US Dollar and United States Treasury bond yields. That said, the US Dollar Index (DXY) regained upside momentum on Monday after a downbeat close at the end of the two-week winning streak by Friday, inactive of late. With this, the greenback’s gauge versus the six major currencies ended the day around 103.23, making rounds to the same level by the press time.

On the same line, the US 10-year and two-year Treasury bond yields remain indecisive around the highest levels in 10 weeks after rising for the last seven consecutive days, around 3.72% and 4.32% at the latest.

Underpinning the US dollar and yields are the fresh hawkish concerns about the Federal Reserve (Fed) and optimism for a deal over the debt ceiling, which in turn weighs on the Gold price.

Recently, US President Joe Biden said that he believed they will make some progress on the debt ceiling talks while House Speaker Kevin McCarthy said, “We both believe we need to change the trajectory.”

On Monday, US President Joe Biden conveyed positive developments while talking to US House Speaker and Republican Kevin McCarthy as he left Japan after the Group of Seven (G7) Nations meeting in Hiroshima. The policymaker also suggested the talks will resume tomorrow. However, US House Speaker McCarthy showed rejection to mark progress over a deal over the debt ceiling until US President Biden stays abroad. Given the cautious optimism about the US policymakers’ ability to avoid the US debt payment default, the Gold price remains less lucrative, especially amid firmer USD and yields.

Additionally, during an interview with CNBC on Monday, Minneapolis Federal Reserve President Neel Kashkari cited the even odds favoring the increase in the policy rate one more time in June or pausing. It should be noted that Fed’s Kashkari spread fears of the US default and resulting economic pain while saying that the Fed cannot protect the US economy from a debt default. With this, the XAU/USD traders fear higher rates and recall the sellers after a corrective bounce on Friday.

On the same line, St. Louis Federal Reserve President James Bullard ruled out the recession concerns on Monday while saying that He sees two more rate hikes this year before reaching the base rate.

Furthermore, Atlanta Fed President Raphel Bostic, Richmond Fed President Thomas Barkin and San Francisco President Mary C Daly recently backed the calls for higher rates.

While quoting the market’s concerns about the Fed’s next move, the CME Group’s FedWatch Tool shows that markets are again indecisive after the latest Fed talks, especially driven by Fed Chair Powell’s concern for the credit crisis and resulting less pressure for rate hikes. The same signals the market’s pricing in of a rate hike in June, as well as pushing back the rate cuts until late 2023. Additionally, the National Association for Business Economics (NABE) survey showed that economists have deferred their expectations of a US Federal Reserve (Fed) rate cut to the first quarter of next year.

Hence, the Gold price remains on the back foot amid optimism about the US debt ceiling and hawkish Fed concerns.

China fears also weigh on XAU/USD

Apart from the US debt ceiling woes and hawkish Fed, fears surrounding one of the world’s biggest Gold consumers, China also weighs on the XAU/USD. That said, China faced the heat of the Group of Seven Nations (G7) summit in Hiroshima as the global leaders discussed de-risking, or weaning themselves off an over-reliance on Chinese imports at the summit.

Even so, the dragon nation banned imported chips from US manufacturer Micron, after terming them a security threat, which in turn gave rise to a situation where Washington and Beijing exchanged harsh words.

However, US President Joe Biden said that the US-Sino relations to improve ‘very shortly’ whereas China's Commerce Minister Wang Wentao mentioned during a seminar for US firms investing in China that they Will continue to welcome US firms to develop in China.

Gold price to have an active day ahead

Gold Price may witness a busy day filled with multiple Purchasing Managers Indexes for May, from the UK, Euro, Japan, Australia and the US. Should the first readings of the activity data for May remain impressive, especially from the US, the XAU/USD may witness further downside.

Also read: US S&P Global PMIs Preview: Dollar set to rise on a slip in the services sector

Gold price technical analysis

A clear downside break of the 50-DMA and a sustained observance of the 13-day-old descending resistance line, around $1,990 and $1,985 by the press time, keep the Gold price sellers hopeful.

Adding strength to the bearish bias surrounding the XAU/USD are the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator and steady Relative Strength Index (RSI) line, placed at 14.

As a result, the Gold price is likely to decline further, which in turn highlights the latest swing low of around $1,952 ahead of directing the XAU/USD sellers toward the 100-DMA support of near $1,930.

Meanwhile, an upside break of the aforementioned resistance line and the 50-DMA, near $1,984 and $1,990 in that order, becomes necessary for the Gold buyers to take the risk.

Following that, the $2,000 round figure and April’s high of around $2,049 can challenge the XAU/USD bulls.

Overall, the Gold price is likely to remain bearish but the downside appears unimpressive beyond the 100-DMA support of near $1,930.

Gold price: Daily chart

Trend: Further downside expected

- EUR/USD is showing a sideways performance above 1.0800 as the focus is on US debt-ceiling negotiations.

- S&P500 settled marginally positive on Monday after a choppy session, portraying a quiet market mood.

- Republican McCarthy said that talks over raising the U.S. borrowing cap were "on the right path” ahead of discussions with US Biden.

The EUR/USD pair is displaying a topsy-turvy action above the round-level support of 1.0800 in the early Tokyo session. The major currency pair didn’t show a decisive action despite mixed responses from Federal Reserve (Fed) policymakers over the interest rate guidance. Investors are awaiting face-to-face negotiations between US President Joe Biden and House o Representatives Speaker Kevin McCarthy for a major action.

S&P500 settled marginally positive on Monday after a choppy session, portraying a quiet market mood. US equities remained sideways waiting for more development over US debt-ceiling issues.

The US Dollar Index (DXY) has rebounded after a corrective move to near 103.17. Meanwhile, Speaker Kevin McCarthy is optimistic about the approval of the US debt-ceiling. A few hours ahead of a face-to-face meeting with US President Joe Biden, Republican McCarthy said on Monday afternoon that talks over raising the U.S. federal government's $31.4 trillion debt ceiling were "on the right path", as reported by Reuters.

A mixed majority in the House of Representatives and Senate has given importance to a bipartisan deal, which has made US Treasury Secretary Janet Yellen nervous that the economy could announce a default in making obligated payments.

Minneapolis Fed Bank President Neel Kashkari cautioned that while it may appear like the worst period of the banking turmoil is over, history showed more trouble can't be ruled out, as reported by Reuters. On the weekend, Fed policymaker cited that he would support the Fed for holding interest rates in June.

On the Eurozone front, European Central Bank (ECB) policymaker Francois Villeroy de Galhau said "I expect today that we will be at the terminal rate not later than by summer," He further added, "Deceleration in rate increases from 50 bp to 25 bp was wise and cautious." This has allowed the ECB to push its interest rate cycle longer and has safeguarded the economy from any interest rate shocks.

- USD/CHF halts its downtrend and bounces off a daily low of 0.8940, charting its course near the crucial 20-day EMA at 0.8964.

- Market mood tilts as the pair’s technical outlook transitions from a neutral-to-downward bias to neutral, possibly tilting neutral-upward once it reclaims the April 10 daily high of 0.9120.

- For bearish persistence, USD/CHF must pierce the 20-day EMA, potentially exposing the May 22 low of 0.8940 and setting the stage for a potential plunge towards 0.8926.

USD/CHF stalled its downtrend after piercing the 20-day Exponential Moving Average (EMA) at 0.8964 and reached a daily low of 0.8940, but bounced off and closed Monday’s session nearby last Friday’s low at 0.8993. At the time of writing, USD/CHF is trading at 0.8980, almost flat, as Tuesday’s Asian session begins.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF shifted from neutral-to-downward biased to neutral. In early May, the USD/CHF pair reached a new year-to-date (YTD) low of 0.8820; since then, USD/CHF climbed 1.80%, registering on its way up, successive series of new highs-lows, but shy of turning the pair neutral-to-upward biased.

If USD/CHF reclaims the April 10 daily high of 0.9120, that could shift the bias to neutral-upwards, and it might open the door for a rally above the 100-day EMA At 0.9136 before reaching the April 3 high at 0.9196. Upside risks for the USD/CHF lie above 0.9200, with the 200-day EMA at 0.9271 as the only resistance to changing the pair’s bias upwards.

The USD/CHF must fall below the 20-day EMA at 0.8964 for a bearish continuation. A breach of the latter will expose the May 22 low of 0.8940 before clearing the path for the pair towards June 9, 2021, a low of 0.8926, ahead of the 0.8900 figure.

USD/CHF Price Action – Daily chart

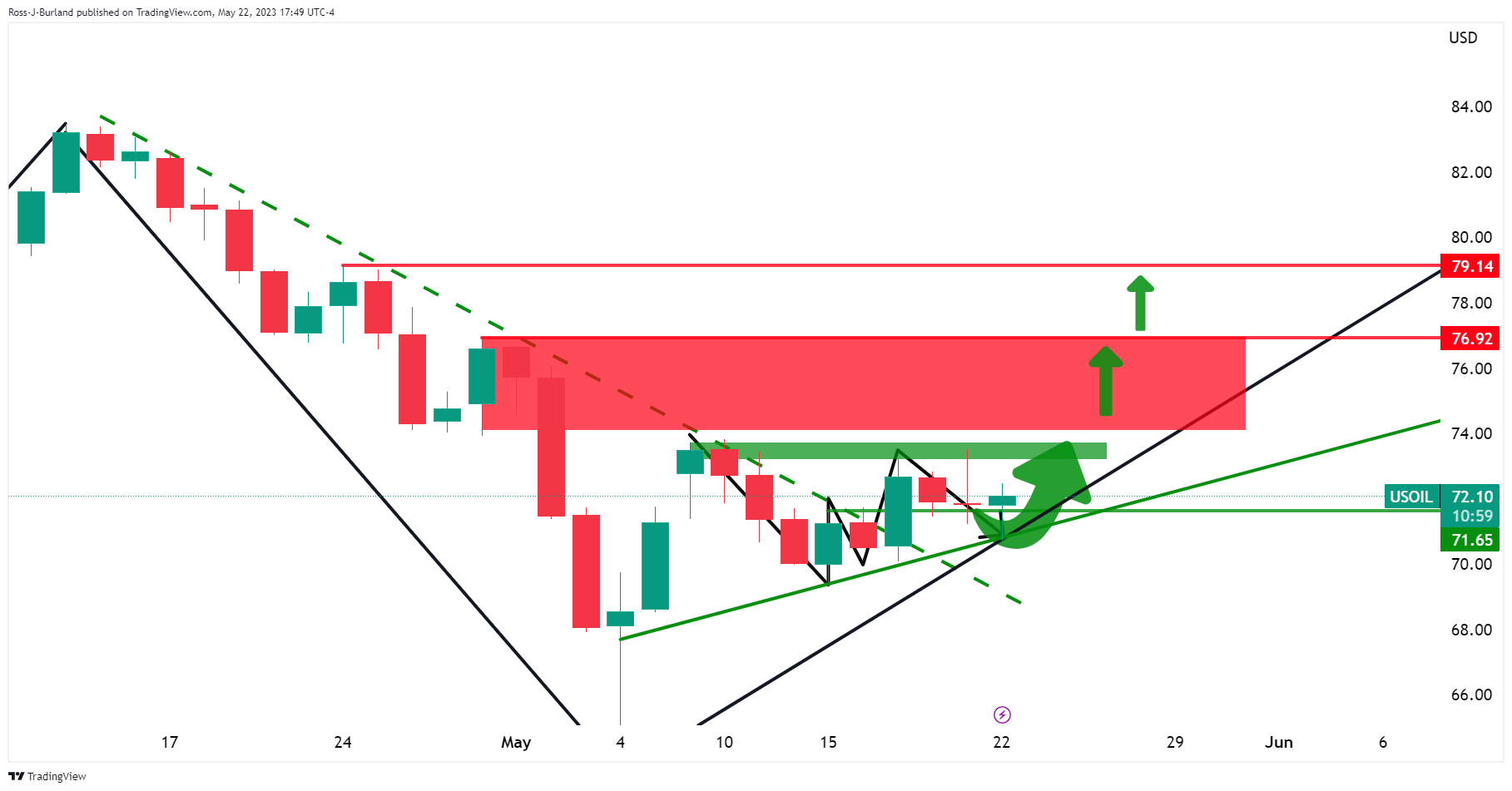

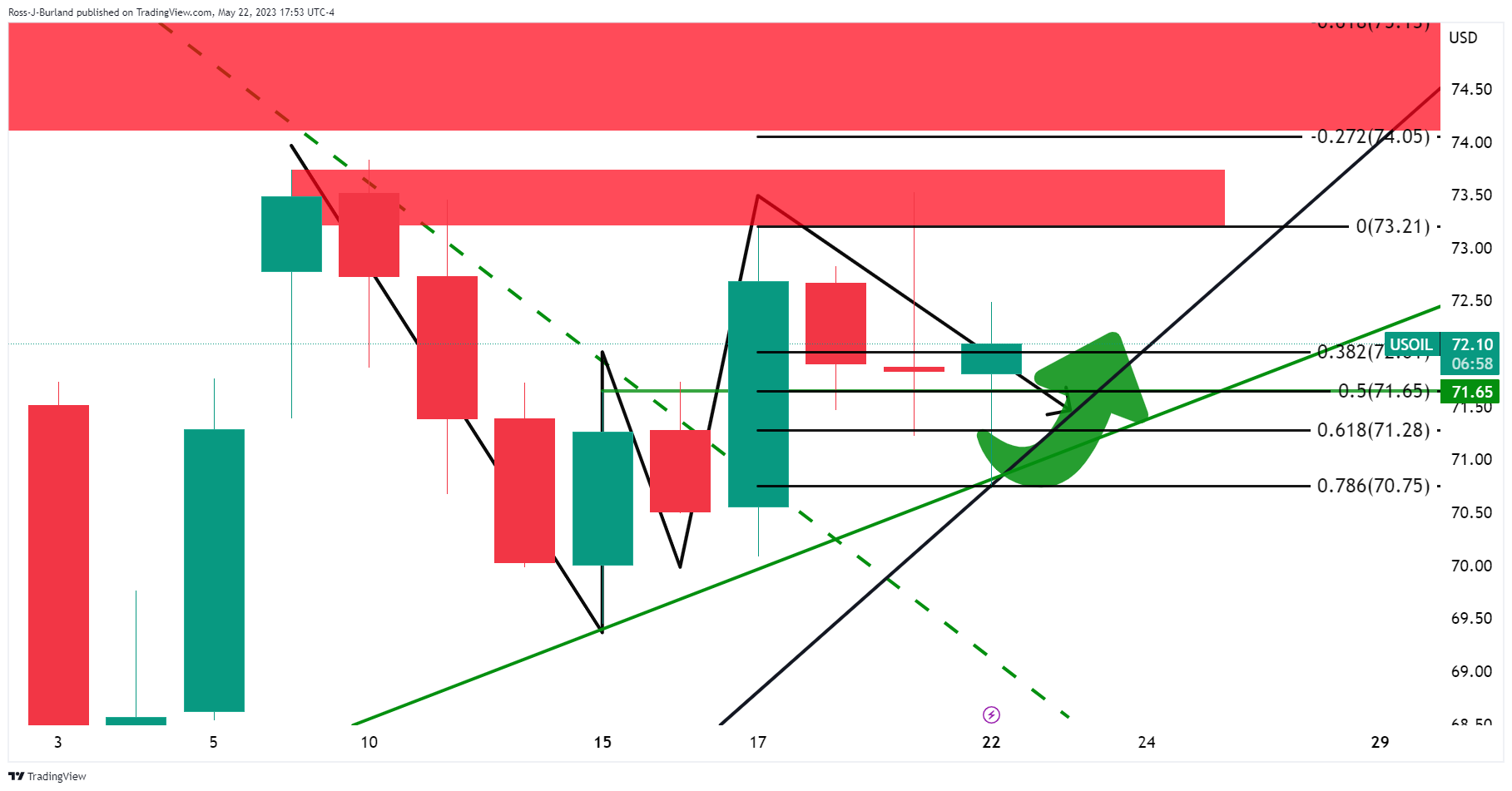

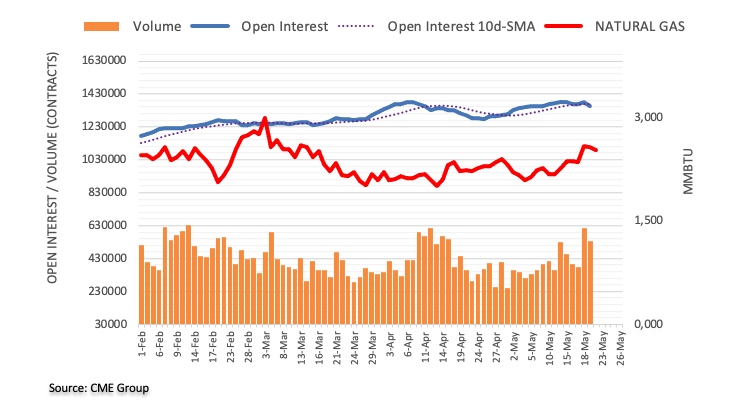

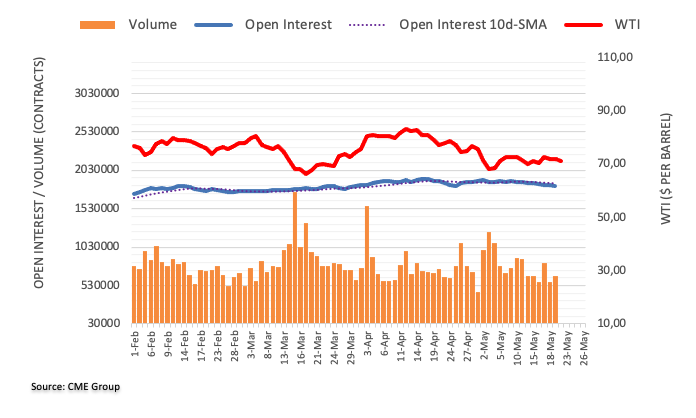

- WTI bulls are engaged at a key area of support.

- The ficus is on an upside correction medium term.

WTI is trading a touch higher by some 0.36% at the time of writing and has climbed from a low of $70.72 to score a high of $72.49 so far. The following is a technical analysis that derives a bullish outlook for the commodity.

WTI daily chart

We have a major double bottom on the longer-term outlook.

Zooming in, we can see that the market has broken out of the bearish trend and is now riding a dynamic support line.

We have a W-formation neckline area that is being respected also.

The Fibonacci retracement tool measured across the bullish impulse sees the 78.6% Fibo meeting the support kline and lows of the correction.

- GBP/JPY reaches a new YTD high of 172.57, driven mainly by risk-on sentiment and a weaker JPY.

- A negative divergence between GBP/JPY’s price action and the Relative Strength Index (RSI) indicates the potential for a pullback.

- A continued GBP/JPY uptrend could see the pair rally toward 173.00 and potentially reach the 174.00 handle.

GBP/JPY reached a new year-to-date (YTD) high of 172.57 in the European session due to a risk-on impulse and a weaker Japanese Yen (JPY), ahead of a crucial week for the Pound Sterling (GBP). The release of PMIs in the United Kingdom (UK), alongside Wednesday’s update on the Consumer Price Index (CPI) for April, could dictate the GBP/JPY pair direction. At the time of writing, the GBP/JPY is trading at 172.34 after hitting a low of 171.19.

GBP/JPY Price Analysis: Technical outlook

During the last week, a break of a falling wedge opened the door for the GBP/JPY to test the YTD high. As the GBP/JPY price action gathers momentum and records higher highs, the Relative Strength Index (RSI) does not. Hence, a negative divergence between price action-RSI could open the door for a test of the falling-wedge top-trendline before posing a threat to higher prices.

Therefore, the GBP/JPY is set for a pullback. The first support would be at the 172.00 figure, followed by the low of May 22 at 171.19. The break below will expose the 171.00 mark, followed by the 20-day Exponential Moving Average (EMA) at 170.04, closely followed by the falling-wedge trendline.

On the other hand, if GBP/JPY resumes its uptrend, it would need to crack the YTD high of 172.57. Once done, the pair could rally toward 173.00 before reaching the 174.00 handle.

GBP/JPY Price Action – Daily chart

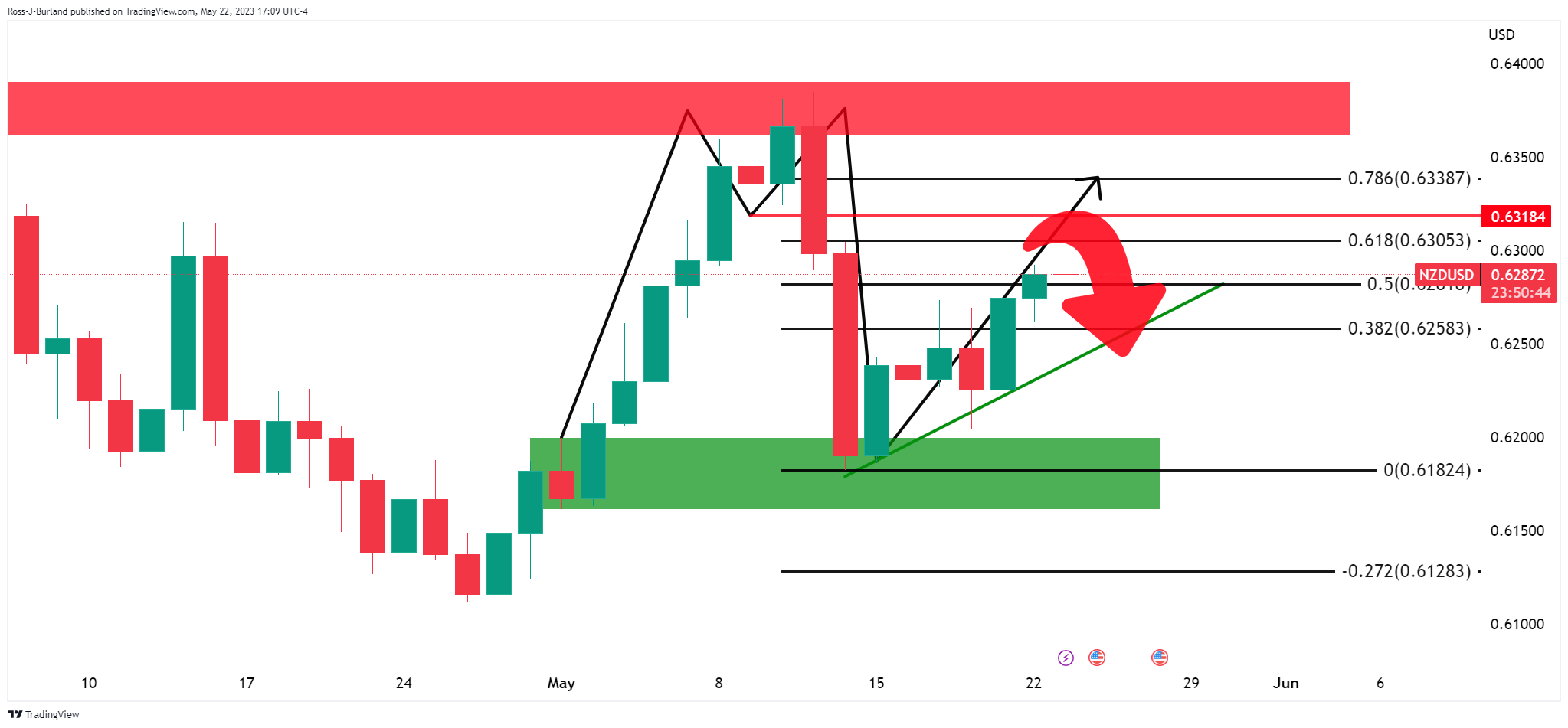

- NZD/USD bulls have been in charge and eye 0.6300.

- The RBNZ is going to be one of the key events for the pair this week.

NZD/USD is up by some 0.2% and has risen from a low of 0.6261 to reach a high of 0.6292 so far. However, we have the Reserve Bank of New Zealand tomorrow which is likely to see the Kiwi tread water ahead of the event.

Markets are split on whether we’ll see a 25 or 50bp hike. ´´After the surprise 50bps hike in Apr, we don't expect another 50bps shocker after the softer Q1 CPI print,´´ analysts at TD Securities said.

´´However, we do acknowledge the risk of one as the budget update shows more fiscal impulse working through the economy from the cyclone rebuild. Focus turns to the new OCR track and an increase in the terminal rate will lead markets to price in further hikes,´´ the analysts added.

Meanwhile, there has been no progress seen in US debt ceiling negotiations and Fedspeak overnight was mixed and did little to shift the USD, as analysts at ANZ Bank noted,.

´´But let’s see what the Fed minutes and US core PCE deflator look like.´´

´´For the Kiwi per se, as we noted yesterday, it seems to be mostly about carry now that some short-end rates are around 6%, which is world-beating. With genuinely expansionary forces (migration/fiscal) behind the reasons most are calling for a higher OCR, higher rates should be NZD-beneficial, twin deficits (fiscal/trade) cast a dark shadow over the background,´´ the analysts added.

NZD/USD technical analysis

NZD/USD is completing the M-formation pattern with a move toward the neckline.

The price has already moved in on the 61.8% Fibonacci retracement level as illustrated above. This pattern´s neckline area could well hold and see a rejection to the downside in the coming days.

Tuesday is an important day for PMIs releases, as it will offer the first glimpse of global economic activity during May. During the Asian session, the S&P Global Composite PMI is scheduled for release in Australia, followed by Japan later in the day. Later will be the turn of Europe and the US.

Here is what you need to know on Tuesday, May 23:

The US dollar ended the day mostly unchanged on a subdued Monday in financial markets. The focus remains on the ongoing negotiations over the US debt limit, with investors keenly awaiting any developments. US President Biden is scheduled to meet with House Speaker McCarthy later on Monday at 21:30 GMT to continue discussions.

Analysts at Wells Fargo warned:

For a deal to be reached and turned into law before early June, a breakthrough in the negotiations will need to occur this week.

Banking concerns continue to ease; however, a report by CNN on Friday indicated that Treasury Secretary Yellen told bank CEOs that more mergers may be necessary. Her comments suggest that a return to normalcy is still a ways off. On Tuesday, attention is expected to shift back to economic data, with the release of the S&P Global PMIs. Additionally, New Home Sales and Richmond Fed Manufacturing will also be released.

US S&P Global PMIs Preview: Dollar set to rise on a slip in the services sector

The Japanese Yen was among the worst performers, weighed down by government bond yields that remain at monthly highs. The 10-year Treasury yield settled at 3.72%, the highest level since March 9. USD/JPY rose above 138.50, toward last week's highs, but faces resistance around the 138.80 area. Monday's data from Japan revealed that the core machinery order unexpectedly dropped by 3.9% in March. The Japan Jibun Bank PMI is due to be released on Tuesday.

After rebounding on Friday, the EUR/USD pair traded flat, moving sideways and testing levels below 1.0800. Market participants are now focused on the release of preliminary Eurozone PMI numbers scheduled for Tuesday. The readings are expected to be crucial (May preliminary), particularly given the current economic environment and the data-dependent forward guidance. Additionally, several European Central Bank (ECB) members, including Guindos, Muller, Nagel, and Villeroy, are set to speak.

GBP/USD finished the day flat, hovering around 1.2430. The UK is set to report on Public Sector Net Borrowing, and PMI data will also be released. On Wednesday, inflation data is due, which could have a significant impact on the pound.

Commodity currencies traded in narrow ranges against the US dollar. USD/CAD rose marginally, closing above 1.3500. The pair continues to move sideways around the 20-day Simple Moving Average (SMA). On Tuesday, Canada is set to release its wholesale inflation data.

AUD/USD remained below the 20-day SMA, but rose to the 0.6650 level during the American session. On Tuesday, Australia is scheduled to release its PMI data.

NZD/USD posted modest gains, managing to record its highest daily close in a week, but still below the 0.6300 level. On Wednesday, the Reserve Bank of New Zealand (RBNZ) is scheduled to announce its decision on monetary policy. Market analysts are expecting a rate hike, with some predicting a 25 basis points increase and others forecasting a 50 bps hike.

The South African rand was the strongest performer on Monday, with USD/ZAR pulling back from record highs to 19.20. In contrast, the Mexican peso underperformed, with USD/MXN rising for the fifth consecutive day and approaching 18.00. On Tuesday, the National Bank of Hungary is scheduled to have its monetary policy meeting.

Gold retraced some of Friday's gains, with XAU/USD sliding towards $1,970/oz. Silver also declined, closing the day at $23.60. Cryptocurrencies had a mixed performance, with BTC/USD failing to reclaim $27,000. Crude oil prices rose modestly; WTI approached $72.00.

Like this article? Help us with some feedback by answering this survey:

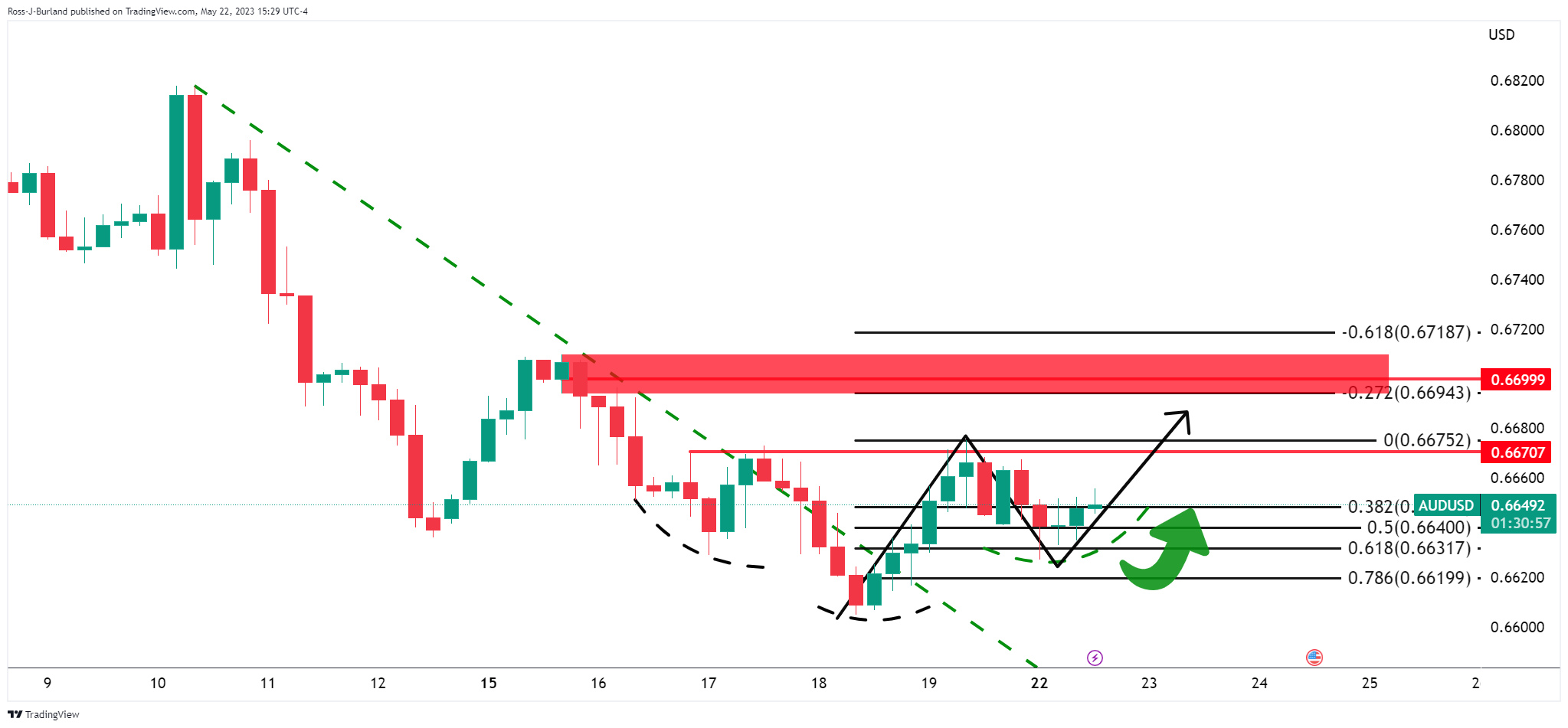

- AUD/USD bulls are moving in and eye upside extension.

- The inverse head and shoulders are a bullish feature on the charts.

AUD/USD was boosted on a dovish Federal Reserve Chairman Jerome Powell on Friday. There is a preference for a pause in June from the Chair of the central bank which has outweighed any other hawkish notes from regional Fed presidents. This has enabled the Aussie to correct higher vs. the Greenback of late as the following technical analysis illustrates:

AUD/USD H4 charts

We have an inverse head and shoulders on the 4-hour charts and a correction into the 61.8% Fibonacci retracement level that leaves the bias bullish above the lows of the right-hand shoulder.

AUD/USD H1 charts

The W-formation is a compelling feature on the hourly chart whereby the reversion pattern´s neckline near a 50% mean reversion could be an attractive area for bulls to engage again.

Zooming into the bullish impulse, we can see that bulls might lean against the trendline support on a pullback.

- GBP/USD holds steady, buoyed by positive US debt ceiling discussions but weighed down by hawkish Federal Reserve comments.

- The US Dollar Index remains flat, preventing further GBP/USD gains.

- Money market futures show a high probability of a Bank of England rate hike at the next meeting, potentially offering further support to GBP.

GBP/USD trades flat in the mid-North American session on Monday, following hawkish remarks by US Federal Reserve officials, which weighed on the Pound Sterling (GBP). Nevertheless, a risk-on impulse spurred by improvements in discussions about raising the debt ceiling in the United States (US) was a headwind for the US Dollar (USD). At the time of writing, the GBP/USD is trading at 1.2437.

Uncertainty about US debt-ceiling discussions dissipates, underpins the GBP/USD pair

GBP/USD is still pressured by market sentiment. Discussions about the US debt ceiling showed some improvement, according to US House Speaker Kevin McCarthy, adding that a deal could be struck tonight or tomorrow. Although an agreement was not reached, he emphasized, “We can make it happen by the debt deadline.”

Another reason that keeps the GBP/USD from appreciating further is that Fed speakers continued with their hawkish rhetoric, with St. Louis Fed President James Bullard eyeing two more rate hikes. Nevertheless, there is a split among officials, with some leaning toward the dovish side like Atlanta’s Fed President Raphael Bostic backing a pause on the Fed’s tightening cycle.

In the meantime, the US Dollar Index (DXY), a gauge that measures the buck’s value vs. a basket of six currencies, is almost flat at 103.190, putting a lid on GBP/USD gains.

Across the Atlantic, an absent UK economic docket keeps traders leaning on Tuesday’s S&P Global PMIs on its final reading for May, alongside inflation figures, on Wednesday. Any hints that the Consumer Price Index (CPI) in April exceeded estimates and the prior’s month reading could open the door for further tightening.

Money market futures predict an 81% chance that the Bank of England (BoE) will raise rates by 25 bps at its next meeting. The BoE has lifted rates 11 times since December 2021 as it scrambles to tame sticky inflation.

GBP/USD Price Analysis: Technical outlook

The GBP/USD is still upward biased, though trapped within the boundaries of the 20 and 50-day Exponential Moving Averages (EMAs), each at 1.2485 and 1.2409, respectively. Although price action suggests further upside is expected, the Relative Strength Index (RSI) indicator pushes below the 50-midline. That warrants sellers are gathering momentum, while the 3-day Rate of Change (RoC), shows that sellers are moving in.

Upside risks lie above the 20-day EMA at 1.2485, followed by the 1.2500 figure. On the flip side, the GBP/USD first support would be the 50-day EMA before cracking the 1.2400 mark.

- EUR/JPY bears need to get below the 149.00 area and then 148.70.

- Bulls eye a break of 150.00 and then 150.40.

EUR/JPY has been trying to come up for air since breaking the prior bullish trend´s support line at the start of May´s business. The pair is now battling with resistance again and the following illustrates the prospects of either a bullish continuation or a break to the downside.

EUR/JPY daily chart

The daily chart shows the pair testing trendline support while being on the backside of the prior bullish trend. The 148.70s is key in this regard. To the upside, there are prospects of a break of 149.80 resistance.

EUR/JPY H4 chart

The 4-hour charts show that the bears need to get below the 149.00 area and then 148.70.

On Monday, US House Speaker Kevin McCarthy expressed optimism about reaching a deal on the debt-limit with White House negotiators, stating that discussions had been productive leading up to a meeting with President Joe Biden later in the day.

With the impending "June X" deadline approaching, McCarthy emphasized the need for decisions to be made, but also stated that a deal could be reached as early as the next meeting or even tomorrow.

- Gold price bears are in the market but bulls are lurking.

- Fed speakers and the debt ceiling are on focus.

As per the prior analysis that was done in the pre-pen on Monday, Gold Price Forecast: XAU/USD bears are in the market but bulls step up, the bears have indeed moved in. Gold price is currently trading down some 0.13% and made a low of $1,968.90 in New York as Wall Street opened.

From a fundamental standpoint, it could be argued that due to a couple of US Federal Reserve officials, the non-yielding bullion was pressured by hawkish rhetoric. At the same time, markets are looking for more clarity around the US debt ceiling negotiations.

´´With the June 1 X-date rapidly approaching, markets will look for signs of progress on a debt ceiling deal,´´ the analysts at TD Securities explained:

´´While there have been positive overtures from both sides, the work is not yet complete. Markets appear to be assuming that negotiations are a done deal, suggesting that any souring in tone as negotiations play out could upset risk sentiment.´´

President Joe Biden and House Republican Speaker Kevin McCarthy are discussing the debt ceiling on Monday. as for Fed speak, Minneapolis Fed President Neel Kashkari told CNBC that "it may be that we have to go north of 6%" to get inflation back to the Fed's 2% target, while St. Louis Fed President James Bullard said there might be the need to go higher on policy rate.

Analysts at TD Securities explained that money managers liquidated some gold length and added shorts as debt ceiling optimism and resilient data aided the apparent formation of a triple top.

´´Still, our positioning analytics argue that selling exhaustion is imminent. After all, we estimate a high bar for subsequent CTA trend follower liquidations, whereas discretionary traders remain underinvested and Shanghai traders have begun adding to their positions once more,´´ the analysts added. ´´As expectations for a deeper Fed cutting cycle rise, discretionary traders should increasingly deploy their hoard of capital in the yellow metal, supporting new cycle highs before year-end.´´

Gold technical analysis

In the prior analysis, it was stated that the W-formation is a reversion pattern, so was something to take note of:

Gold price H4 chart, prior analysis

Gold price update, H4 chart

We have seen the pattern complete. Now the bulls need to step in and get on the back side of the trendline and into bullish territory. Failing that, then the broader bullish trendline could come under pressure:

- USD/JPY pair underpinned by high US T-bond yields, strong US Dollar.

- Despite last week’s negative outcome, the USD/JPY clings to gains above a five-month-old support trendline.

- Upside risks lie at 138.74, followed by 139.00; support is seen at 137.20s, 137.00.

USD/JPY resumes its uptrend, creeping higher above the 138.00 figure as the US Dollar (USD) strengthens, underpinned by higher US Treasury bond yields. Hawkish comments by Federal Reserve (Fed) officials, and positive discussions on the US debt ceiling, keeps the USD/JPY pair trading higher. Hence, the USD/JPY is trading at 138.51, a gain of 0.43%.

USD/JPY Price Analysis: Technical outlook

After finishing the last week with a negative session, the USD/JPY is still trading above a five-month-old resistance trendline, which turned support on May 18, which opened the door to a new year-to-date (YTD) high of 138.74, before a pullback to 137.25. The USD/JPYs bounced off that level and reclaimed the 138.00 figure.

Of note, the USD/JPY reached a new higher-high, while the Relative Strength Index (RSI) did not, peaking around 69.00 before entering overbought conditions, retraced towards the 65.00 area, suggesting buyers are losing momentum. The 3-day Rate of Change (RoC) it’s declining as buyers lose steam.

If USD/JPY breaks above the YTD high at 138.74, the next resistance would be the 139.00 figure, a zone that could propel the pair towards the 140.00 area, but buyers must crack the November 30 daily high of 139.89.

On the other hand, the USD/JPY first support would be 138.00. Break below will expose the May 18 low of 137.28 before challenging the 137.00 mark.

USD/JPY Price Action – Daily chart

- US Federal Reserve Chair Jerome Powell hints at a potential pause in rate hikes, indicating a data-dependent approach to monetary policy.

- St. Louis Fed President Bullard predicts two more rate hikes, while others voice the importance of watching how inflation develops.

- Hawkish rhetoric by European Central Bank officials underpins the EUR/USD pair.

The EUR/USD began the week sideways, clinging to the 1.0800 mark amidst a slightly upbeat market sentiment sponsored by an improvement in US ceiling discussions, despite hawkish rhetoric by Federal Reserve’s (Fed) officials. At the time of writing, the EUR/USD is trading at 1.0804, almost flat, after hitting a daily low of 1.0795.

Investors eye upcoming PMI data and further central bank official comments

The market sentiment remains slightly upbeat, with two of three US equity indices posting gains. During the last week, US Federal Reserve (Fed) Chair Jerome Powell struck a neutral tone on remarks last Friday, saying, “The risks of doing too much or doing too little are becoming more balanced, and our policy adjusted to reflect that.” Fed Chair Powell added that the Fed would be data-dependent, opening the door for a pause.

Earlier Monday, Federal Reserve officials commented that more tightening is needed, namely St. Louis Fed President Bullard, foreseeing two more rate hikes. At the same time, Minnesota’s Fed President, Neil Kashkari, is open to pausing but emphasized that it’s important to “not signaling that we’re done.” Of late, Atlanta’s Fed President Raphael Bostic commented that policy tightening acts with a lag, and he’s “comfortable” waiting for how “things play out.” Richmond’s Fed President Thomas Barkin commented that he’s “still looking to be convinced that inflation is in steady decline.”

Data-wise, the Eurozone (EU) economic docket featured that consumer confidence in the bloc rose 0.1 in May to -17.4 vs. April -17.5, though it came below estimates for an improvement toward -16.8.

European Central Bank policymakers on Friday, led by Christine Lagarde and Isabel Schnabel, stuck to its hawkish rhetoric, which trimmed the Euro’s (EUR) losses towards the weekend. ECB President Lagarde said the ECB would do what is necessary to deliver price stability and commented that she would not trade off price and financial stability. The ECB member Isabel Schnabel commented the ECB must continue to fight inflation “with determination.”

In the meantime, negotiations in the United States (US) would resume on Monday, after US President Joe Biden called US House Speaker Kevin McCarthy on Sunday after McCarthy’s and the Republicans stepped out from talks on Friday. Of late, the US Treasury Secretary Janet Yellen said that chances that the US can pay its bill by mid-June are trimming.

Upcoming events

The EU’s economic docket will feature S&P Global PMIs, Current Account figures, and additional ECB speakers. The US economic agenda will feature Federal Reserve speakers alongside the report of final figures of the S&P Global PMIs on Tuesday.

EUR/USD Technical Levels

Federal Reserve Bank of San Francisco President Mary Daly refrained from commenting on the next possible Federal Reserve policy decision but reiterated that they must be very date-dependent right now, as reported by Reuters.

Additional takeaways

"Want to see if policy tightening is affecting economy."

"Banking stresses have calmed, banks are in solid shape."

"Still lots of data to get before June FOMC."

"Tighter credit conditions may be akin to one to two rate hikes."

"Fed must be on watch for slowing economy."

"Inflation expectations are well anchored."

"Do not know how deep and long credit tightening will be."

"FOMC deciding meeting by meeting is more prudent path."

"Global tightening cycle has slowed activity less than expected."

"Balance sheet draw down working effectively."

"Seeing some signs of slowing in otherwise strong job market."

"Fed forecasts only as good as they day they are printed."

"Real wage growth for most Americans overtaken by inflation."

"Not surprising to see some rise in credit troubles for some Americans."

"Would be historical anomaly to get 2% inflation with sub 4% unemployment."

"Seems completely reasonable to see unemployment go above 4%."

Market reaction

The US Dollar Index clings to small daily gains near 103.30 after these comments.

- Uncertainty around the Mexican government seizing Grupo Mexico’s rail line triggers investor fears, leading to a sharp rise in USD/MXN.

- The unexpected military occupation of company facilities contradicts Mexican President AMLO’s campaign promises, impacting investor sentiment towards the Mexican Peso.

- Federal Reserve speakers and the resumption of US debt ceiling discussions add to the volatility of the USD/MXN pair, keeping traders on their toes.

USD/MXN rises sharply and reaches the 17.9609 three-week high courtesy of broad US Dollar (USD) strength, but also uncertainty around the Mexican government seizing Grupo Mexico’s rail line, increasing fears amongst investors in Mexico. Therefore, the USD/MXN opened the week at around 17.6960, but as of writing is trading at around the 17.85000area.

Mexican Peso dips as investors reposition amidst seizure concerns

An article posted by Bloomberg on Friday showed “A section of track in the state of Veracruz was deemed “of public utility” and transferred to a government entity that’s building a line across the Isthmus of Tehuantepec, a relatively narrow strip of land that separates the Pacific Ocean and the Gulf of Mexico.”

According to Bloomberg, “armed Navy personnel occupied company facilities on the Coatzacoalcos-Medias Aguas stretch of track beginning at 6 a.m. on Friday.” The takeover surprised the business community, contradicting campaign promises made by Mexican President Andres Manuel Lopez Obrador that his government wouldn’t seize private property.

Therefore, investors buying the Mexican Peso amidst its political stability and higher interest rates by the Bank of Mexico (Banxico) at 11.25% began to book profits and reposition themselves as the week started. Earlier in the Asian session, the USD/MXN commenced the week at 17.6960, but in one hour of trading, it jumped 1000 pips, toward 17.7957 on uncertainty about the outcome of the Mexican government’s actions.

Aside from this, US debt ceilings discussions would resume on Monday, as US President Joe Biden returned from the G7 reunion. On Friday, the Republicans stepped out from a reunion, halting the negotiations. The US Treasury Secretary Janet Yellen said that chances that the US can pay its bill by mid-June are trimming.

In the meantime, a light US economic agenda keep USD/MXN traders entertained on further Federal Reserve speakers. The Minnesota Fed President Neil Kashkari said, “I think right now it’s a close call, either way, versus raising another time in June or skipping. What’s important to me is not signaling that we’re done.” Of late, James Bullard, the President of the St. Louis Fed, commented he’s thinking of two more rate hikes this year.

Upcoming events

The US economic calendar will feature additional Federal Reserve speakers alongside the report of final figures of the S&P Global PMIs on Tuesday. On the Mexican front, the agenda will feature the 1st half-month of Inflation and Core Inflation in May.

USD/MXN Price Analysis: Technical outlook

From a technical perspective, the USD/MXN is still neutral to downward biased. However, the slight recovery on Monday threatened to crack the 18.0000 figure, ahead of the 50-day Exponential Moving Average (EMA) at 18.01782. Notably, the Relative Strength Index (RSI) indicator has turned bullish, piercing the 50-midline, which could open the door for further buying strength. Upside risks lie at the May 22 high of 17.9609, followed by the confluence of the 50-day EMA and the 18.0000 figure. A breach of the latter will expose the 100-day EMA at 18.3678. On the other hand, a bearish continuation is likely to happen, below the 20-day EMA at 17.7794 and toward the YTD low of 17.4238.

We are just weeks away from hitting the limit for US government borrowing, and a compromise in Congress has yet to be reached. Economists at UBS analyze the market impact in the event of no agreement.

What happens if the US debt ceiling is not raised?

“In terms of the market impact, we estimate the S&P 500 could fall quickly by more than 10% in this scenario as markets reprice the growth outlook and heightened systemic risks, though it could recover a meaningful portion of this oss if market turmoil pressures Congress into reaching agreement.”

“We think longer-dated Treasury bonds could sell off initially in response to any default, but we would also then expect them to rally back as markets price a heightened probability of recession.”

“A default and subsequent Fed intervention would likely undermine the value of the US Dollar, and we would expect Gold to gain market favor, as it has in previous debt ceiling stalemates.”

"I expect today that we will be at the terminal rate not later than by summer," European Central Bank (ECB) policymaker Francois Villeroy de Galhau said while speaking at an event held at the Bank of France on Monday, per Reuters.

Key takeaways

"Primary question today is not how much further to hike rates, but how large is the pass-through of what is already in the pipe."

"In current tightening cycle, the lag in policy transmission may be at the upper end of 1-2 year range."

"Deceleration in rate increases from 50 bp to 25 bp was wise and cautious."

"We need to monitor the pass-through of our substantial and exceptionally rapid past hikes."

"How long we maintain rates high is now more important than the precise terminal level."

"We will remain data driven, looking meeting by meeting at the outlook for inflation and strength of monetary policy transmission."

Market reaction

EUR/USD stays on the back foot following these comments and was last seen trading a few pips above 1.0800.

According to the findings of the US Federal Reserve's annual survey entitled "Survey of Household Economics and Decisionmaking," households reported a decline in financial well-being.

Key takeaways

"Report shows higher prices have negatively affected most households."

"One third of households cited inflation as their main financial challenge."

"73% of respondents say they were doing 'at least okay financially' in 2022 vs 78% in 2021."

"Share of those saying they were worse off rose to 35%, the highest since the question was first asked in 2014."

"More workers received and asked for a pay increase or promotion in 2022 vs 2021."

"63% of respondents said they would cover a $400 emergency expense with cash, down from record-high 68% in 2021."

"Responses to survey questions suggest there has been some erosion in household financial buffers."

Market reaction

The US Dollar Index clings to small daily gains slightly above 103.20 after this report.

The Dollar’s bounce has run out of steam, but caution is warranted, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

When do we go short USD in earnest again, then?

“The US rates market has now corrected half the fall in end year Fed pricing that we saw as the banking crisis erupted. There may be a little more Dollar support coming from there, but not much.”

“I think we’re left overall, more data-sensitive than we were. In the end, that means a weaker Dollar but it’s still too early to go in selling the Dollar too excitedly.”

Economists at Société Générale analyze S&P 500 technical outlook.

Bulls target next resistance at 4220/4240

“S&P 500 is challenging the resistance of 4220/4240 representing previous bearish gap and low of January 2022. An initial pullback is not ruled out however the 200-DMA near 3970 should provide support.”

“Once the index establishes beyond 4220/4240, the uptrend is expected to extend. Next potential objectives could be at last August high of 4320 and 4510.”

See: S&P 500 could rise to 4,400 by year-end in a soft landing scenario – UBS

EUR/GBP dipped a little lower in the first part of the month. However, economists at Rabobank continue to expect the pair will turn higher in a 12-month view.

There are currently similarities to be drawn between the drivers of both the EUR and GBP

“Unless forthcoming Eurozone economic data surprises on the upside, there may be only a muted reaction to hawkish commentary from ECB officials in the coming weeks. Similarly, the market is also priced for further BoE rate hikes, suggesting there may be limited additional upside for GBP from ongoing hawkish remarks from BoE policymakers. This backdrop is heavily suggestive of range trading for EUR/GBP in the coming weeks.”

“Further out, we retain our forecast that EUR/GBP will grind higher to 0.90 on a 9 to 12-mth view. In that time frame, the market is likely to be focused on the prospect of looser monetary conditions from both the ECB and the BoE. Our expectation of GBP underperformance over the medium term is drawn from concerns over UK growth potential related to labour market shortages and ongoing low investment and productivity growth in the UK.”

- USD/CHF attracts some dip-buying on Monday and reverses a major part of its intraday losses.

- The optimism over US-China relations weighs on the safe-haven CHF and lends some support.

- US debt ceiling woes weigh on the USD and might keep a lid on any meaningful recovery move.

The USD/CHF pair recovers a major part of its intraday losses to a multi-day low and trades around the 0.8975-0.8970 region, down nearly 0.25% for the day, during the early North American session.

Against the backdrop of worries about a global economic slowdown, a surprise breakdown in the US debt ceiling negotiations weigh on investors' sentiment and drives some haven flows towards the Swiss Franc (CHF). Apart from this, subdued US Dollar (USD) price action, exerts some downward pressure on the USD/CHF pair. The US debt ceiling woes, along with less hawkish remarks by Federal Reserve (Fed) Chair Jerome Powell on Friday, triggers a fresh leg down in the US Treasury bond yields and keeps the USD bulls on the defensive.

Speaking at a Fed research conference, Powell said that it is still unclear if interest rates will need to rise further amid uncertainty about the impact of past hikes and recent bank credit tightening. Furthermore, Minneapolis Fed President Neel Kashkari is out with his take this Monday, saying that it was a close call on whether he will be in favour of hiking the policy rate one more time in June or pausing. That said, the optimism over a potential improvement in US-China relations lends support to the USD/CHF pair and helps limit any further losses.

Spot prices attract some buyers near the 0.8940 region, though any meaningful upside still seems elusive ahead of a key meeting between President Joe Biden and House Republican Speaker Kevin McCarthy to discuss the debt ceiling. Apart from this, the US bond yields will influence the USD price dynamics and provide some impetus to the USD/CHF pair in the absence of any relevant market-moving economic releases from the US. This, along with the broader risk sentiment should allow traders to grab short-term opportunities around the pair.

Technical levels to watch

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest trade balance results in Malaysia.

Key Takeaways

“Gross exports declined for a second straight month and the most since May 2020 by 17.4% y/y in Apr (Mar: -1.4%) as a result of a shorter working month, year-ago high base effects, lower commodity price earnings, and dimmer global growth prospects. The reading came in worse than our estimate (-2.5%) and Bloomberg consensus (-5.0%). Gross imports also fell by a double-digit pace for the first time since May 2020 at 11.1% y/y (Mar: -1.8%, UOB est: -3.5% vs Bloomberg est: -2.4%). This brought trade surplus down substantially to MYR12.9bn (from +MYR26.7bn in Mar), the smallest trade surplus since May 2022.”

“The steeper-than-expected export contraction last month was weighed by all three economic sectors and almost all products, except for the refined petroleum products. Sluggish demand was also seen across most major trading partners, with shipments to G3 countries, China, and the ASEAN region all recording a double-digit annual contraction.”

“The latest export outturn has resulted in a year-to-date export contraction of 2.6% in the first four months of 2023 (Jan-Apr 2022: +21.7%), posing downside risks to our full-year export outlook. In view of persistent threats to the export outlook and negative base effects becoming more apparent in coming months, we trim our 2023 full-year export growth projection to -7.0% (from +1.5% previously, BNM est: +1.5%, 2022: +25.0%). Key downside risks include geopolitical tensions, potential financial instability stemming from monetary policy tightening, a pronounced growth slowdown in advanced economies, and a more moderate economic recovery in China.”

- EUR/GBP adds to the current range bound trade.

- Market sentiment remains tilted to the risk-on side.

- EMU Consumer Confidence is due next in the calendar.

Further improvement in the appetite for the risk complex lifts EUR/GBP to the boundaries of the 0.8700 hurdle so far on Monday.

EUR/GBP: Upside appears capped by the 200-day SMA

EUR/GBP moves to 2-day highs and jabs with the critical 0.8700 mark toward the start of the week, a region coincident with the 200-week SMA. Taking a look at the weekly chart, EUR/GBP begins the new trading week with gains after five sequential pullbacks.

Additionally, the cross contributes to the recent marginal advance while remaining well within the multi-session consolidative mood below the 200-day SMA, which is currently near 0.8740.

After it appears that a recession has been avoided on both sides of the Channel, the cross continues to closely monitor developments from the ECB and the BoE as well as the outlook for both economies.

Up until this point, the hawkish views from both central banks support the notion that extra tightening seems the most probable situation in the following month.

EUR/GBP key levels

The cross is gaining 0.08% at 0.8686 and faces the next resistance level at 0.8743 (200-day SMA) followed by 0.8834 (monthly high May 3) and then 0.8875 (monthly high April 25). On the other hand, the breakdown of 0.8661 (2023 low May 11) would expose 0.8547 (monthly low December 1 2022) and finally 0.8386 (weekly low August 17 2022).

Economists at Société Générale analyze USD/MXN technical outlook.

18.20/18.40 likely to contain short-term upside

“USD/MXN extended its downtrend after breaking the lower limit of the range since March. It has achieved the objective of 17.45 representing 2017 lows. An initial bounce is taking shape however it would be interesting to see if the pair can overcome the 50-DMA near 18.20/18.40 which is also recent pivot high. Failure could mean persistence in down move.”

“Break below 17.45 can lead the pair towards next projections at 17.10/16.95 which is also the low formed in 2016.”

- USD/CAD extends its sideways consolidative price move around the 100-day SMA on Monday.

- A modest bounce in Oil prices benefits the Loonie and caps the pair amid subdued USD demand.

- Looming recession risks and US debt ceiling woes help limit the downside for the safe-haven buck.

The USD/CAD pair struggles to a firm intraday direction on Monday and oscillates in a narrow band around the 100-day Simple Moving Average (SMA) through the early North American session. The pair is currently placed around the 1.3500 psychological mark, nearly unchanged for the day, and remains well within a familiar trading range held over the past week or so.

A modest intraday bounce in Crude Oil prices underpins the commodity-linked Loonie and turns out to be a key factor acting as a headwind for the USD/CAD pair amid subdued US Dollar (USD) price action. A surprise breakdown in the US debt ceiling negotiations, along with less hawkish remarks by Federal Reserve (Fed) Chair Jerome Powell, trigger a fresh leg down in the US Treasury bond yields and weighs on the USD.

It is worth recalling that Powell, speaking at a Fed research conference on Friday, said that it is still unclear if interest rates will need to rise further amid uncertainty about the impact of past hikes and recent bank credit tightening. Furthermore, Minneapolis Fed President Neel Kashkari is out with his take this Monday, saying that it was a close call on whether he will be in favour of hiking the policy rate one more time in June or pausing.

Apart from this, the optimism over a potential improvement in US-China relations acts as a headwind for the safe-haven buck. The downside for the USD, however, remains cushioned, at least for the time being, amid worries over slowing global growth, particularly in China. This, in turn, is expected to dent fuel demand, should cap the upside for the Crude Oil prices and contribute to limiting any meaningful slide for the USD/CAD pair.

In the absence of any relevant market-moving economic data from the US, the focus will remain glued to a key meeting between President Joe Biden and House Republican Speaker Kevin McCarthy to discuss the debt ceiling. Apart from this, the US bond yields, along with the broader risk sentiment, will influence the USD. Traders will further take cues from the Oil price dynamics to grab short-term opportunities around the USD/CAD pair.

Technical levels to watch

Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, analyzes EUR/USD outlook.

The Fed is only human too

“EUR/USD levels close to the 1.20 mark are not justifiable in my view. Why? I never had the impression that the market really believed the ‘tough guy’ impression chair Powell wanted to impersonate.”

“For some time now the OIS market has been pricing in Fed rate cuts for the medium term which Powell (it seems to me) wanted to dissuade it from. If I am correct with my (admittedly very subjective) view the US currency does not have far to fall, the realization that the Fed is quite human should then not result in enormous USD depreciation. But nor does it result in EUR/USD levels below 1.08 on a sustainable basis either.”

This could be another good week for the Dollar, according to analysts at ING.

Dollar can find more support

“Given the recent positive short-term reaction of the Dollar to progress on debt-ceiling news and assuming the stalemate will finally be resolved some time this week, we could see the greenback staying supported, especially given that the lack of key data releases should not particularly challenge another hawkish repricing of Fed expectations.”

“A key risk would only come in the form of particularly dovish FOMC minutes, although recent comments by FOMC members are pointing in the opposite direction.”

“We still think that the Fed has already hit the peak, and our US economist expects as much as 100 bps of cuts in late 2023 as the economic outlook deteriorates. With this in mind, we expect any Dollar resilience to prove unsustainable beyond the short term.”

St. Louis Federal Reserve President James Bullard said on Monday that the Fed wants to fight inflation while the labour market remains strong and added that the policy rate will have to go higher this year, perhaps by 50 basis points.

Additional takeaways

"Base case remains relatively slow growth for the rest of this year and into 2024, recession probabilities are overstated."

"SEP median of 5.1% was based on slow growth and inflation improvements that have not occurred."

"Companies are still scrambling for workers; job growth remains above trend."

"Core measures of inflation have not changed much in recent months."

"If inflation is not controlled, the Fed will have to do a lot more, should err on the side of doing more."

"Households are still flush and that will continue to support consumer spending."

Market reaction

These comments failed to trigger a significant reaction in the US Dollar Index, which was last seen trading flat on the day at 103.15.

Senior Economist at UOB Group Alvin Liew reviews the latest Q1 GDP readings in the Japanese economy.

Key Takeaways

“Japan’s 1Q 2023 GDP extended its increase at a stronger than expected pace of 0.4% q/q, 1.6% q/q SAAR while the 0.1% q/q SAAR expansion in 4Q 2022 was revised to -0.1% q/q contraction. With 3Q’s contraction unchanged at -1.0% q/q SAAR, this implied that Japan suffered a brief technical recession (3Q-4Q 2022) and has emerged from it in first quarter of this year.”

“Japan’s growth momentum in 1Q was stronger than forecast as we underestimated the impact of re-opening on private consumption and the surprise jump in business spending, while the fall in commodity prices helped further trim the country’s ballooning import bill. But weaker external demand (as overseas markets continued to slow down) continued to delay the export recovery, exerting a drag on overall growth.”

“Trade Outlook - For the next few months, the expectation is that the global economy will slow further in 2H which in turn means weaker external demand. And given the daunting high base comparison in the rest of 2023, we expect Japan’s exports to contract (y/y) in the next few months of 2023 (after Apr). And while we expect softer demand for Japan’s exports, we also see import declining (y/y) during these months, reducing the trade deficit. We expect Japan’s trade deficit to hit come in just below JPY 7 trillion in 2023. Year-to date, the trade deficit amounted to JPY 5.6 trillion in Apr.”

“Japan GDP Outlook – Weak manufacturing and exports likely to weigh on growth in 2023, while services to provide the much-needed mitigation. That said, the downside risk to services will be the extent of global slowdown in growth. With the weaker 2023 manufacturing outlook, financial market uncertainty and the recession risks in the developed markets of US and Europe on the back of tighter monetary policies while partly cushioned by the improving tourism and barring external events (such as escalating war in Europe, worsening US-China relations and a deadlier variant of COVID-19), we keep our modest 2023 GDP growth forecast of 1.0% (same pace as 2022).”

- USD/JPY rebounds around 80 pips from the daily low and refreshes the daily top in the last hour.

- A combination of factors undermines the safe-haven JPY and lends some support to the pair.

- A modest USD weakness might hold back bulls from placing aggressive bets and cap gains.

The USD/JPY pair attracts some buying following an intraday dip to the 137.50-137.45 region on Monday and climbs to a fresh daily high heading into the North American session. The pair is currently placed around the 138.30-138.35 zone and for now, seems to have stalled its retracement slide from the YTD peak touched on Friday.

Against the backdrop of a more dovish stance adopted by the Bank of Japan (BoJ), the optimism over a potential improvement in US-China relations undermines the safe-haven Japanese Yen (JPY) and acts as a tailwind for the USD/JPY pair. In fact, BoJ Governor Kazuo Ueda said on Friday that tightening monetary policy in the wake of expectations that inflation will slow back below the 2% target in the middle of the current fiscal year would hurt the economy. Ueda added that the BoJ will continue easing with yield curve control.

Meanwhile, US President Joe Biden said during the Group of Seven (G7) summit in Japan that he expects relations between the US and Beijing to improve very shortly. This, to some extent, offsets worries over slowing global growth and weighs on the JPY. The US Dollar (USD), on the other hand, is dragged down by a surprise breakdown in the US debt ceiling negotiations and less hawkish remarks by Federal Reserve (Fed) Chair Jerome Powell. This might hold back traders from placing aggressive bullish bets around the USD/JPY pair.

Speaking at a Fed research conference, Powell said on Friday it is still unclear if interest rates will need to rise further amid uncertainty about the impact of past hikes and recent bank credit tightening. Adding to this, Minneapolis Fed President Neel Kashkari said this Monday that it was a close call on whether he will be in favour of hiking the policy rate one more time in June or pausing. Apart from this, the US debt ceiling woes trigger a fresh leg down in the US Treasury bond yields, which acts as a headwind for the USD and might cap the USD/JPY pair.

In the absence of any relevant market-moving economic data from the US, the focus will remain glued to a key meeting between President Joe Biden and House Republican Speaker Kevin McCarthy to discuss the debt ceiling. Apart from this, the US bond yields will influence the USD price dynamics and provide some impetus to the USD/JPY pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities ahead of the BoJ Core CPI print and the flash Japan Manufacturing PMI, due during the Asian session on Tuesday.

Technical levels to watch

- EUR/USD looks to consolidate the recent breakout of 1.0800.

- Further up comes the transitory barrier at the 55-day SMA.

EUR/USD adds to Friday’s move higher and surpasses the 1.0800 hurdle with some conviction.

While initially supported by the 1.0760 region, occasional bullish attempts could see the pair confront the interim resistance area at the 55-day SMA at 1.0868 prior to the psychological 1.1000 mark.

Extra losses are not ruled out, however, in the current context, although a sustained retracement to the March bottom of 1.0516 (March 15) is not favoured for the time being.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0468.

EUR/USD daily chart

- Oil price opens the week lower on concerns global trade may be impacted by geopolitical wrangling at G7 summit.

- China provokes the United States by banning US-manufactured micro chips.

- Oil recovers after US Dollar weakens on continued debt-ceiling uncertainty as talks reopen in Washington.

Oil price gaps lower at the start of the week on concerns global growth may suffer, after the world’s leading economies antagonized China at the G7 summit in Hiroshima. World leaders discuss ‘de-risking’, or weaning themselves off an over-reliance on Chinese imports at the summit. Washington and Beijing exchanged harsh words as China banned imported chips from US manufacturer Micron, after failing to pass a security test. Support from a weakening US Dollar, however, lifts Crude Oil back up to Friday’s close after the weak open.

At the time of writing, WTI Oil is trading in the upper $71s and Brent Crude Oil in the mid $75s.

Oil news and market movers

- Oil price falls on global growth and trade concerns after major economies clash at the G7 summit in Japan.

- Geopolitics polarizes the G7 into two competing camps – China and Russia, who are seen as threats to world prosperity and peace – and the rest, led by the United States.

- China provokes the US by banning imports of micro chips from US manufacturer Micron, citing security risks.

- Oil price subsequently recovers, however, supported by a weaker US Dollar.

- The Greenback remains under pressure as the debt-ceiling impasse trundles on.

Crude Oil Technical Analysis: Downtrend showing signs of ending

WTI Oil is in a long-term downtrend, making successive lower lows. Given the old adage that the trend is your friend, this favors short positions over long positions. WTI Oil is trading below all the major daily Simple Moving Averages (SMA) and all the weekly SMAs except the 200-week which is at $66.89.

-638203550939866230.png)

WTI US Oil: Daily Chart

A break below the year-to-date (YTD) lows of $64.31 would be required to reignite the downtrend, with the next target at around $62.00 where trough lows from 2021 will come into play, followed by support at $57.50.

Despite the bearish trend dominating, there are signs pointing to a possible conclusion. The mild bullish convergence between price and the Relative Strength Index (RSI) at the March and May 2023 lows – with price making a lower low in May that is not matched by a lower low in RSI – is a sign that bearish pressure is easing.

The long hammer Japanese candlestick pattern that formed at the May 4 (and year-to-date) lows is a sign that it could be a key strategic bottom.

Oil price bulls, however, would need to break above the $76.85 lower high of April 28 to bring the dominant bear trend into doubt.

WTI Oil FAQs

What is WTI Oil?