- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-05-2023

- USD/JPY has shown a solid recovery above 138.60 despite higher-than-projected Japan inflation.

- Japan’s National headline CPI jumped to 3.5% while core CPI accelerated to 4.1%.

- Market sentiment is quite upbeat amid optimism for US debt-ceiling raise.

The USD/JPY pair has rebounded firmly to near 138.68 as the Statistics Bureau of Japan has reported higher-than-anticipated inflation numbers (April). National headline Consumer Price Index (CPI) jumped to 3.5% from the prior release of 3.2% while the street was anticipating a deceleration to 2.5%. Core CPI that excludes food and energy prices accelerated to 4.1% vs. the consensus of 3.4% and the former release of 3.8%.

Despite a jump in Japan’s inflation, the Bank of Japan (BoJ) would favor a continuation of ultra-dovish monetary policy to keep inflation steadily above 2% for a longer period.

Earlier this week, Japan’s Gross Domestic Product (GDP) showed a decent rise in Q1 numbers. Preliminary Q1 GDP accelerated by 0.4% vs. the estimates of 0.1%. In the last quarter, the GDP growth remained stagnant. Japan’s Economy Minister Shigeyuki Goto cited “Economy likely to continue moderate pickup ahead due to improving sentiment, wage hikes and strong corporate appetite for investment.

Meanwhile, S&P500 futures have continued their two-day winning performance in the Asian session, portraying a strong risk appetite of the market participants. The rationale behind the positive market sentiment is the optimism for the US debt-ceiling raise as related parties have admitted that there is no alternative to escalating the US borrowing cap to avoid a default by the US Treasury in addressing obligated payments.

The US Dollar Index (DXY) is struggling in extending its rally further above 103.63, however, the upside seems favored as investors are anticipating that more liquidity flush into the United States economy through an increase in the US borrowing limit could cause a rebound in inflation and might force the Federal Reserve (Fed) to raise interest rates further.

- Gold price grinds near seven-week low, bears take a breather after three-day downtrend.

- Optimism about United States debt ceiling talks, hawkish Federal Reserve comments underpin USD strength and weigh on XAU/USD.

- Recent challenges to US debt limit extension, US-Taiwan trade deal prod the Gold price.

- Fed Chair Powell’s speech, Sunday’s press conference of US President Biden will be crucial for the Gold price direction.

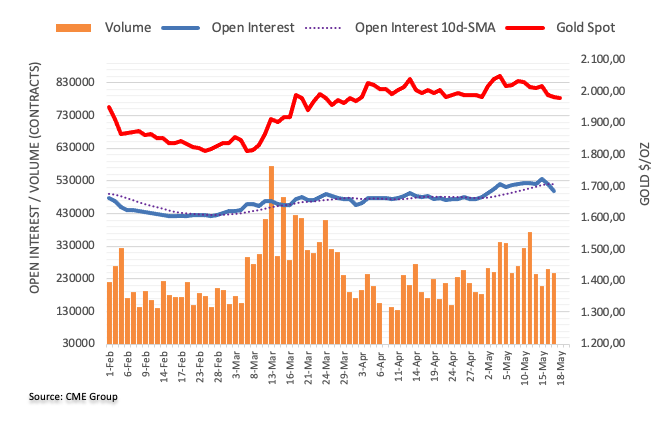

Gold price (XAU/USD) licks its wounds at the multi-day low amid Friday’s sluggish Asian morning as the market’s previous optimism fades amid recent challenges for the key risk catalysts. Even so, the optimism surrounding the United States debt ceiling passage and the hawkish Federal Reserve (Fed) bets are strong enough to prod the XAU/USD bulls ahead of Fed Chair Jerome Powell’s speech. That said, the Gold price steadied near $1,960 by the press time, after falling to the lowest levels since April 03 the previous day during its three-day downtrend.

Gold price nosedives on strong United States Treasury bond yields, US Dollar

Gold price bears the burden of the strong United States Treasury bond yields and the US Dollar as it stays near the multi-day low marked the previous day. That said, hawkish Fed bets and favorable US data join the concerns that the US policymakers will be able to extend the debt ceiling seem to underpin the recent run-up by the US T-bond yields and the USD, which in turn weigh on the XAU/USD.

Talking about the data, US Initial Jobless Claims for the week ended on May 12 dropped to 242K on Thursday, versus 254K expected and 264K prior whereas the Philadelphia Fed Manufacturing Survey gauge for May improved to -10.4 from -31.3 prior, versus -19.8 market forecasts. Further, US Existing Home Sales for April eased to 4.28M versus analysts’ estimations of 4.3M and 4.44M prior. It’s worth noting that the US Retail Sales and Industrial Production for April printed upbeat figures earlier in the week and inspired the Fed hawks to defend their “higher for longer rates” bias, which in turn allowed the US Dollar to regain its power and drown the Gold price.

In a case of the Federal Reserve officials’ comments, Dallas Federal Reserve President Lorie Logan said on Thursday, as reported by CNBC, that data at this time does not support skipping an interest rate hike at the next meeting in June. On the same line, Fed Governor Philip Jefferson said on Thursday that inflation remains too high whereas St Louis Fed President James Bullard reiterated his support for higher rates and exerting downside pressure on the XAU/USD price.

Due to the aforementioned catalysts, the market’s bets on the Fed rate cuts in 2023 drop heavily in recent days while the odds of a 0.25% rate hike in June gained acceptance, even with little speed. The same allows the US Dollar and yields to remain firmer and please the XAU/USD bears. That said, the US Dollar Index (DXY) jumped to the highest levels since March 20 while the US 10-year and two-year bond coupons jumped to the March 15 tops. Further, Wall Street closed on the positive side amid cautious optimism in the market.

Elsewhere, the latest speeches from US President Joe Biden and Republican US House Speaker Kevin McCarthy keep markets hopeful of witnessing no default of the US in paying its government debt. The same allows the Gold price to drop amid a firmer US Dollar.

Challenges for US President Biden, fears of Sino-American tensions prod Gold bears

Contrary to what’s mentioned above, the latest challenges for US President Biden in avoiding the US default and the likely escalation in the US-China tussles due to the trade deal between the US and Taiwan seem to put a floor under the Gold price. Adding strength to the XAU/USD recovery could be the market’s anxiety ahead of Federal Reserve Chairman Jerome Powell’s speech.

As markets turn optimistic about no US default, backed by the latest speeches from US President Joe Biden and Republican US House Speaker Kevin McCarthy, Reuters came out with a warning note while citing the powerful group of the US decision-makers, namely the House Freedom Caucus. “The small but powerful Republican faction warned this week that they could try to block any agreement to raise the $31.4 trillion debt ceiling from passing the House of Representatives, if the accord does not contain ‘robust’ federal spending cuts,” said the news.

On the other hand, the US Trade Representative's (USTR) office announced on Thursday that The US and Taiwan reached an agreement on the first part of their ‘21st Century’ trade initiative, covering customs and border procedures, regulatory practices, and small business. This comes ahead of planned meetings between China's Commerce Minister Wang Wentao and USTR Tai and US Commerce Secretary Gina Raimondo, which in turn can propel the Sino-American tension and prod the US Dollar advances, which in turn may favor the Gold price.

Amid these plays, S&P 500 Futures struggle to track Wall Street’s gains while posting a minor upside near 4,220 level.

XAU/USD eyes Fed’s Powell, US policymakers’ deal to avoid default

Looking forward, Federal Reserve (Fed) Chairman Jerome Powell’s speech and US debt ceiling negotiations will be the key as US President Joe Biden said to have the decision to avoid a default by Sunday. Should Fed Chair Powell manage to defend the latest hawkish bias about the US central bank, the Gold price may have a further downside to track. On the other hand, US President Joe Biden’s inability to seal the deal could fuel the XAU/USD price.

Gold price technical analysis

Gold price extends the downside break of a two-month-old ascending trend line and the 50-DMA as it prods the $1,950 support comprising the late January peak.

Adding strength to the seller’s dominance are the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator. However, the Relative Strength Index (RSI) line, placed at 14, remains well below the 50 level and suggests bottom-picking of the Gold price.

As a result, the 100-DMA and an upward-sloping support line stretched from November 2022, respectively near $1,927 and $1,920, may restrict the XAU/USD’s further downside.

In a case where the Gold price remains bearish past $1,920, the odds of witnessing a slump to the $1,900 round figure can’t be ruled out.

On the contrary, the 50-DMA the previous support line, close to $1,984 and $1,995 in that order, will precede the $2,000 round figure to restrict short-term recovery of the Gold price.

Should the XAU/USD remains firmer beyond the $2,000 psychological magnet, highs marked in late March and early April, around $2,010 may act as an extra check ahead of fueling the quote towards the five-week-old horizontal resistance near $2,050.

To sum up, Gold price is likely to decline further but appears to have limited room towards the south.

Gold price: Daily chart

Trend: Further downside expected

- EUR/JPY sees steady gains, fueled by upbeat market sentiment due to advancements in US debt ceiling talks.

- Technical analysis suggests a potential break toward the 150.00 level; however, buyer hesitation may slow the upward momentum.

- In case of a decline, immediate supports sit at the daily pivot point of 149.19, and the S1 pivot at 148.94.

EUR/JPY advances as the Asian session begins, following Thursday’s gains of 0.14%, trades at 149.40, up by 0.02%. An upbeat market sentiment courtesy of an improvement on the US debt ceiling talks amidst a light economic calendar in the Eurozone (EU) was the main catalyst for EUR/JPY’s price action.

EUR/JPY Price Analysis: Technical outlook

As of writing, the EUR/JPY hovers around the weekly highs, which, once cleared, could pave the way for further upside, with buyers eyeing the psychological 150.00 figure. Oscillators like the Relative Strength Index (RSI) are in bullish territory but almost flat, suggesting buyers might pause before launching an assault on the year-to-date (YTD) high of 151.61.

On the flip side, an EUR/JPY drop below 149.00 could put into play the 2022 swing high of 148.40, ahead of falling toward the May 17 low of 148.06.

Short term, the EUR/JPY 1-Hour chart remains upward biased and is trending up in an ascending channel, diving towards the daily pivot point at 149.19. If EUR/JPY falls below 149.19, that will expose the confluence of the S1 pivot and the bottom-trendline of the ascending channel at 148.94. Once cleared, the EUR/JPY could fall to the S2 pivot at 148.52 before testing last year’s high of 148.40.

EUR/JPY Price Action – Hourly chart

“The Reserve Bank of New Zealand (RBNZ) will hike interest rates by a final quarter point on Wednesday then end its most aggressive tightening cycle since adopting the cash rate in 1999,” according to a Reuters poll of 25 economists conducted during May 15-18 period.

The survey also shows that economists expect RBNZ to adopt a pause until year-end.

Key findings

Over 80% of economists, 21 of 25, polled on May 15-18, expected the RBNZ to raise its Official Cash Rate (OCR) y 25 bps to 5.50% at its May 24 meeting, on par with the central bank's projected peak rate.

The remaining four expected no change in the survey, conducted before the budget.

Among economists who had a long-term view, 14 of 21 forecast rates to stay at 5.50% next quarter. Of the others, four saw rates at 5.75% or higher and three at 5.25%.

Median forecasts showed rates at 5.50% until end-2023 but nearly 30% of respondents predicted at least one 25 bps cut by then.

Inflation was not expected to fall within the RBNZ's target range of 1-3% until the second half of 2024, a separate Reuters poll showed.

Also read: NZD/USD extends corrective bounce towards 0.6250 despite mixed NZ trade data, Fed’s Powell eyed

- AUD/NZD has dropped sharply to near 1.0620 amid the release of upbeat NZ Trade Balance data.

- The RBNZ is to end its most aggressive tightening cycle after raising interest rates one more time by a quarter point next week.

- Higher interest rates by the RBA have started impacting the Australian labor market.

The AUD/NZD pair has witnessed extreme selling pressure after the release of upbeat Trade Balance data (April). Monthly Trade Balance (in NZ terms) has reported a trade surplus of $427M vs. a trade deficit of -$1,586M. However, the annual trade deficit has landed at -$16.8M, remaining close to the former release.

Investors’ focus is majorly on the interest rate decision by the Reserve Bank of New Zealand (RBNZ), which is scheduled for May 24. According to a Reuters poll, RBNZ Governor Adrian Orr will hike interest rates by a final quarter point on Wednesday and then end its most aggressive tightening cycle since adopting the cash rate in 1999. Also, the RBNZ would keep its Official Cash Rate steady at 5.50% (after a quarter-point hike on May 24) till year-end.

New Zealand’s inflation is still hovering around 6.7% as recorded in March, three times more than the desired rate. And, now a budget with higher spending of 11.5 billion NZ dollars in comparison with tax receivables is going to fuel up the overall inflation ahead. Fiscal support to the overall inflation would keep the RBNZ on its toes to keep the monetary policy as restrictive as possible.

On the Australian Dollar front, investors anticipate that the Reserve Bank of Australia (RBA) would return to the neutral interest rate policy as higher interest rates have started impacting the Australian labor market. In April, the Australian labor market witnessed a decline of 4.3k employees while the street was anticipating a jump of 25K. The Unemployment Rate has also jumped firmly to 3.7%.

As per the latest announcement from the US Trade Representative's (USTR) office, published late Thursday by Reuters, “The US and Taiwan reached agreement on the first part of their ‘21st Century’ trade initiative, covering customs and border procedures, regulatory practices, and small business.”

The official announcements also accompany comments from USTR Katherine Tai who said, “The deal strengthens US-Taiwan relations and demonstrates that they can work together to advance trade priorities for their populations.”

Additional details

The pact is not expected to alter goods tariffs but proponents say it will strengthen the economic bonds between the U.S. and Taiwan, open the Chinese-claimed island to more U.S. exports, and increase Taiwan's ability to resist economic coercion from China.

China has reacted furiously to Taiwan's President Tsai Ing-wen's recent engagements with high-ranking US politicians, including an April meeting with US House of Representatives speaker Kevin McCarthy.

The announcement of the trade pact comes just ahead of planned meetings between China's Commerce Minister Wang Wentao and USTR Tai and US Commerce Secretary Gina Raimondo.

Market implications

The news challenges the market’s optimism amid fears of more US-China tension, which in turn may prod the US Dollar buyers, especially due to the latest concerns about the hardships for the US debt ceiling deal passage. Even so, the AUD/USD and NZD/USD fail to immediately react to the news.

Also read: US House hardliners could try to block debt-ceiling deal without 'robust' cuts

- NZD/USD picks up bids to extend late Thursday’s rebound despite mixed NZ trade numbers.

- New Zealand Trade Balance improves on MoM but eases on YoY, Imports drop while Exports grow in April.

- Hopes of no US default, hawkish Fed bets favor greenback bulls but upbeat NZ budget, RBNZ expectations favor Kiwi bulls.

- New Zealand Credit Card Spending, Fed Chair Powell’s speech will be important for intraday directions.

NZD/USD renews intraday high near 0.6240 as it stretches the late Thursday’s rebound despite mixed New Zealand trade numbers on early Friday. Even so, firmer US Dollar and hawkish hopes from the Fed, as well as cautious mood ahead of the key data/events, prod the pair Kiwi buyers.

That said, New Zealand’s headline Trade Balance improves to $427M MoM in April from $-1586M prior but eased on YoY to $-16.8B versus $-16.76B previous readings. That said, Imports dropped to $6.38B from $7.87B (revised) whereas Exports increased to $6.8B versus $6.28B prior (revised).

Apart from the mixed NZ trade numbers, the recently hawkish expectations from the Reserve Bank of New Zealand (RBNZ), mainly due to the previous day’s New Zealand (NZ) annual budget, also propel the NZD/USD prices of late.

In the no-frills budget for 2023, the New Zealand (NZ) Treasury expects the economy to avoid recession while also anticipating a return to budget surplus delayed one year to 2026. While announcing the annual budget, NZ Finance Minister Grant Robertson also said, “Recent widening of current account deficit expected to reverse.”

“Yesterday’s Budget announcement resulted in a significant lift in expected bond issuance in order to fund the additional spending,” said Analysts at the ANZ.

Moving on, New Zealand Credit Card Spending for April and Fed Chairman Jerome Powell’s speech will be important to watch for NZD/USD pair’s immediate directions. However, major attention will be given to the US debt ceiling negotiations as President Joe Biden said to have a decision to avoid a default by Sunday. Following that, the next week’s RBNZ decision will be the key for the Kiwi pair.

Technical analysis

Although the 21-DMA defends NZD/USD bulls around 0.6225, the Kiwi pair buyers need validation from the 100-DMA hurdle surrounding 0.6275.

As markets turn optimistic about no US default, backed by the latest speeches from US President Joe Biden and Republican US House Speaker Kevin McCarthy, Reuters came out with a warning note while citing the powerful group of the US decision-makers, namely the House Freedom Caucus.

“The small but powerful Republican faction warned this week that they could try to block any agreement to raise the $31.4 trillion debt ceiling from passing the House of Representatives, if the accord does not contain ‘robust’ federal spending cuts,” said the news.

Reuters adds that while there are many variables at play, opposition from the Freedom Caucus could, at a minimum, slow down passage of a bill at a time when the economy can ill afford it, given the Treasury Department's warning that the federal government could be unable to pay all its bills as soon as June 1.

Key quotes

The caucus issued its official position on Thursday, urging the Democratic-led Senate to enact the Republican debt-ceiling bill that passed the House in April, which would pare discretionary spending to fiscal year 2022 levels and cap future annual growth at 1%.

Freedom Caucus member Bob Good is one of several hardliners who say they stand ready to oppose bipartisan legislation that fails to meet their goals, despite the risk of a default that could cripple the U.S. economy and unsettle global financial markets.

While a bipartisan deal could still pass despite Freedom Caucus opposition, a split within the Democratic caucus over the right approach could give the faction greater sway in a debt-ceiling vote, especially if the group adopted a formal position that led members to vote en bloc.

FX implications

The news challenges the market’s latest optimism and allows the US Dollar bulls to take a breather amid fears of a delay in the US debt ceiling decision.

Also read: Forex Today: Not even risk appetite slows the Dollar

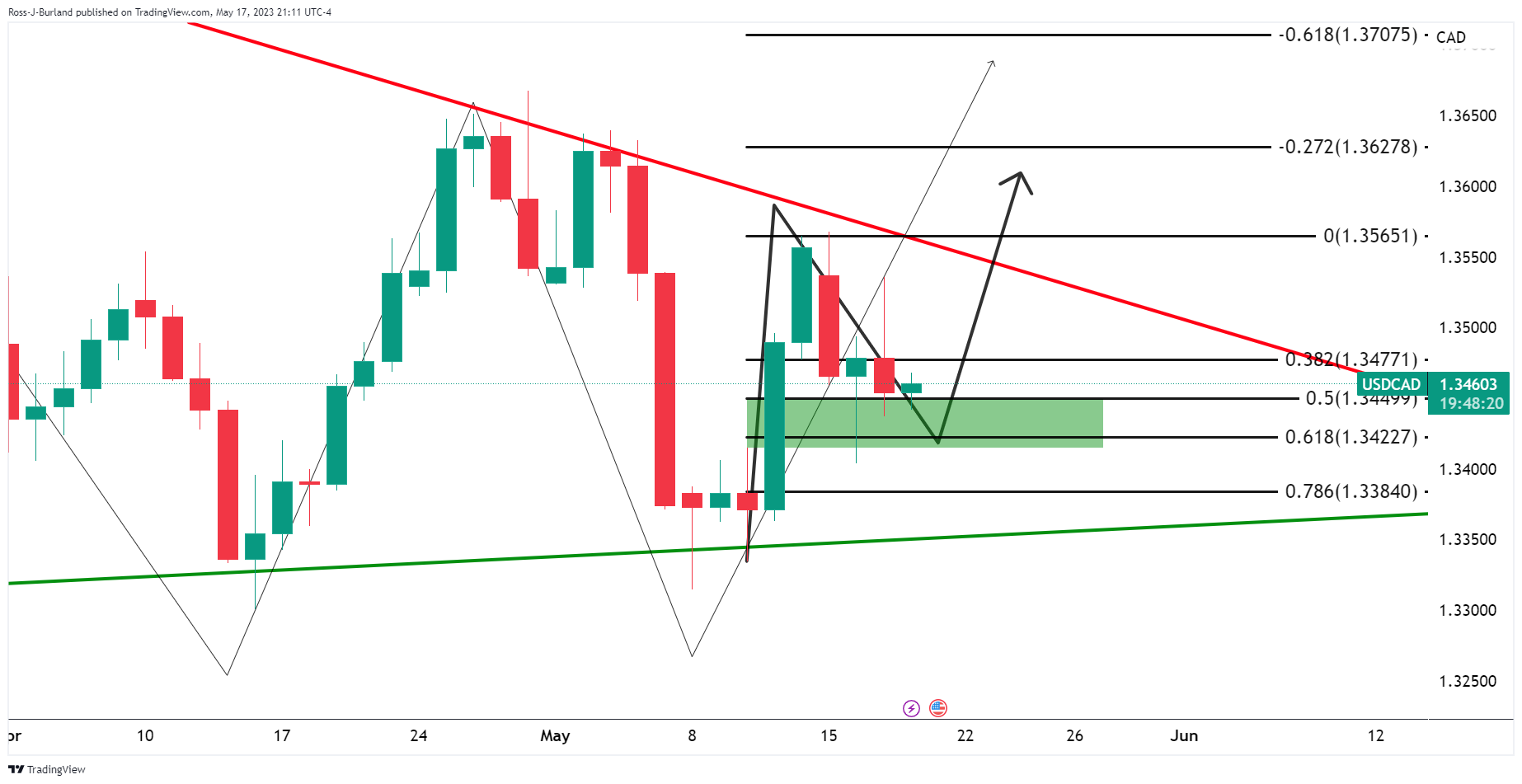

- USD/CAD has slipped sharply below 1.3500 amid a sharp recovery in the oil price upside exhaustion in the USD Index.

- Monthly Canadian Retail Sales data is seen contracting by 1.4% vs. a contraction of 0.2% recorded earlier.

- USD/CAD is auctioning in a Symmetrical Triangle chart pattern, which indicates a volatility contraction.

The USD/CAD pair has dropped below the psychological support of 1.3500 in the early Tokyo session. The Loonie asset has sensed selling pressure as the oil price has rebounded sharply above $72.00 amid optimism over the US borrowing cap raise and the US Dollar Index (DXY) has retreated after a less-confident pullback.

Investors should note that Canada is the leading exporter of oil to the United States and a recovery in the oil price supports the Canadian Dollar.

Going forward, investors will keep an eye on monthly Canadian Retail Sales data (March). Monthly Retail Sales data is seen contracting by 1.4% vs. a contraction of 0.2% recorded earlier. A decline in househoulds’ demand would allow the Bank of Canada (BoC) to keep its interest rate policy steady further.

USD/CAD is auctioning in a Symmetrical Triangle chart pattern on an hourly scale, which indicates a volatility contraction. The Loonie asset sensed selling pressure while attempting a breakout of the neutral triangle. The downward-sloping trendline from April 28 high at 1.3668 is acting as a major barricade for the US Dollar bulls.

The 20-period Exponential Moving Average (EMA) at 1.3492 is close to the asset price, indicating a lackluster performance.

Also, the Relative Strength Index (RSI) (14) has slipped back into the 40.00-60.00 range, which signals that investors await a potential trigger for a decisive move.

The upside bias will get strengthened if the Loonie asset manages to surpass the round-level resistance of 1.3600. This will expose the asset to May 21 low at 1.3644 followed by the round-level resistance at 1.3700.

On the flip side, a break below May 18 low at 1.3452 will fade the upside bias and will drag the asset toward April 04 low at 1.3406 and May 08 low at 1.3315.

USD/CAD hourly chart

USD/CHF bulls take a breather at the highest levels since April 11 after rising the most in two months the previous day as it justifies the bullish options market bias for the Swiss Franc (CHF) pair amid a broad US Dollar rally ahead of the key data/events.

That said, the US Dollar traces upbeat Treasury bond yields amid hawkish Fed bets and favorable data at home. Adding strength to the greenback could be the hope that the US policymakers will be able to extend the debt ceiling after the latest positive comments from them.

Also read: Forex Today: Not even risk appetite slows the Dollar

At home, the one-month risk reversal (RR) of USD/CHF, a gauge of the spread between calls and puts, braces for the second weekly positive close with the 0.0895 latest figures. It’s worth noting that the daily RR also printed a two-day uptrend with the 0.005 number by the end of Thursday’s North American session, per Reuters options market data.

While the fundamentals are in favor of the USD/CHF bulls, the Swiss Franc (CHF) pair’s further upside hinges on Fed Chairman Jerome Powell’s speech and US debt ceiling negotiations.

Hence, USD/CHF buyers are in the driver’s seat but fresh long positions should be taken with care.

- GBP/JPY rises to a fresh weekly high of 172.16, supported by a breakout from a falling wedge pattern.

- Upside targets include resistance levels at 173.00 and the psychological barrier at 175.00, with 2016 high at 177.87 as the ultimate target.

- A potential double-top formation could be confirmed if GBP/JPY breaks the May 11 daily low of 167.84.

GBP/JPY rose to a fresh weekly high of 172.16 after a confirmed upbreak of a falling wedge, a bullish chart pattern, though it fell shy of achieving a new year-to-date (YTD) high of 172.33. At the time of writing, the GBP/JPY is trading at 172.07 as the Asian session begins.

GBP/JPY Price Analysis: Technical outlook

The daily chart shows that the GBP/JPY is upward biased, though it remains shy of testing the YTD high, which could pave the way for further upside. Noteworthy that the Relative Strength Index (RSI) indicator is registering lower peaks contrarily to GBP/JPY’s price action, achieving higher highs. That means a negative divergence is forming between price action and oscillators, warranting of further losses.

Additionally, the GBP/JPY could be forming a double-top, which could be confirmed once the pair cracks the May 11 daily low of 167.84.

If GBP/JPY cracks the YTD high, the next resistance would be 173.00, and the psychological barrier 175.00. A breach of the latter will clear the path to test the 2016 high at 177.87.

Conversely, a GBP/JPY’s fall below 172.00 could pave the way for a correction. Firstly, the GBP/JPY could dip toward the May 16 high at 170.83. Once cleared, the next demand area would be the 170.00 figure, followed by the confluence of the falling-wedge top trendline and the 20-day Exponential Moving Average (EMA) at the 169.50-70 area.

GBP/JPY Price Action – Daily chart

- EUR/USD licks its wounds after falling to nearly two-month low, marking the biggest slump in three weeks.

- US Dollar cheers upbeat data, hawkish Fed bets and strong yields to please bulls.

- ECB’s de Guindos appear less impressive as a hawk and fails to lift Euro amid absence of major data/events.

- ECB’s Monthly Economic Bulletin, speech from Fed’s Powell and US debt ceiling drama eyed for clear directions.

EUR/USD holds lower grounds near 1.0770 as bears take a breather at the lowest levels in nearly eight weeks amid early Friday morning in Asia, after falling the most since late April the previous day. In doing so, the Euro pair portrays the market’s cautious mood ahead of this week’s key event, namely Fed Chairman Jerome Powell’s speech. Also proding the Euro bears is the anxiety ahead of the US President Joe Biden’s promised announcement on Sunday to avoid the default, as well as concerns about the European Central Bank (ECB) Bulletin.

The major currency pair dropped the most in three weeks the previous day as the US Dollar jumped to a two-month high while tracing upbeat Treasury bond yields amid hawkish Fed bets and favorable data at home. Adding strength to the greenback could be the hopes that the US policymakers will be able extend the debt ceiling after the latest positive comments from them.

With this, the US Dollar Index (DXY) jumped to the highest levels since March 20 while the US 10-year and two-year bond coupons jumped to the March 15 tops. That said, Wall Street closed on the positive side amid cautious optimism in the market.

On Thursday, US Initial Jobless Claims for the week ended on May 12 dropped to 242K versus 254K expected and 264K prior whereas the Philadelphia Fed Manufacturing Survey gauge for May improved to -10.4 from -31.3 prior, versus -19.8 market forecasts. Further, US Existing Home Sales for April eased to 4.28M versus analysts’ estimations of 4.3M and 4.44M prior. Additionally, the US Conference Board Leading Index matches -0.6% market forecasts to print the 13th consecutive decline, indicating a worsening economic outlook, versus -1.5% prior. It’s worth noting that the US Retail Sales and Industrial Production for April printed upbeat figures earlier in the week and inspired the Fed hawks to defend their “higher for longer rates” bias, which in turn allowed the US Dollar to regain its power.

Following the data, Dallas Federal Reserve President Lorie Logan said on Thursday, as reported by CNBC, that data at this time does not support skipping an interest rate hike at the next meeting in June. On the same line, Fed Governor Philip Jefferson said on Thursday that inflation remains too high whereas St Louis Fed President James Bullard reiterated his support for higher rates.

On the other hand, European Central Bank (ECB) Vice President Luis de Guindos delivered a speech while saying, “Inflation in services is the most worrying for the ECB.” The policymaker also added that there is still scope to keep raising rates.

Looking ahead, the Euro bears are likely to keep the reins but their further dominance hinges on the European Central Bank’s (ECB) Monthly Economic Bulletin. More importantly, Fed Chairman Jerome Powell’s speech and US debt ceiling negotiations will be the key as US President Joe Biden said to have a decision to avoid a default by Sunday.

Technical analysis

A daily closing below the 100-DMA, around 1.0810 by the press time, directs EUR/USD toward the mid-March swing high of near 1.0760 while nearly oversold RSI (14) line may prod bears afterward.

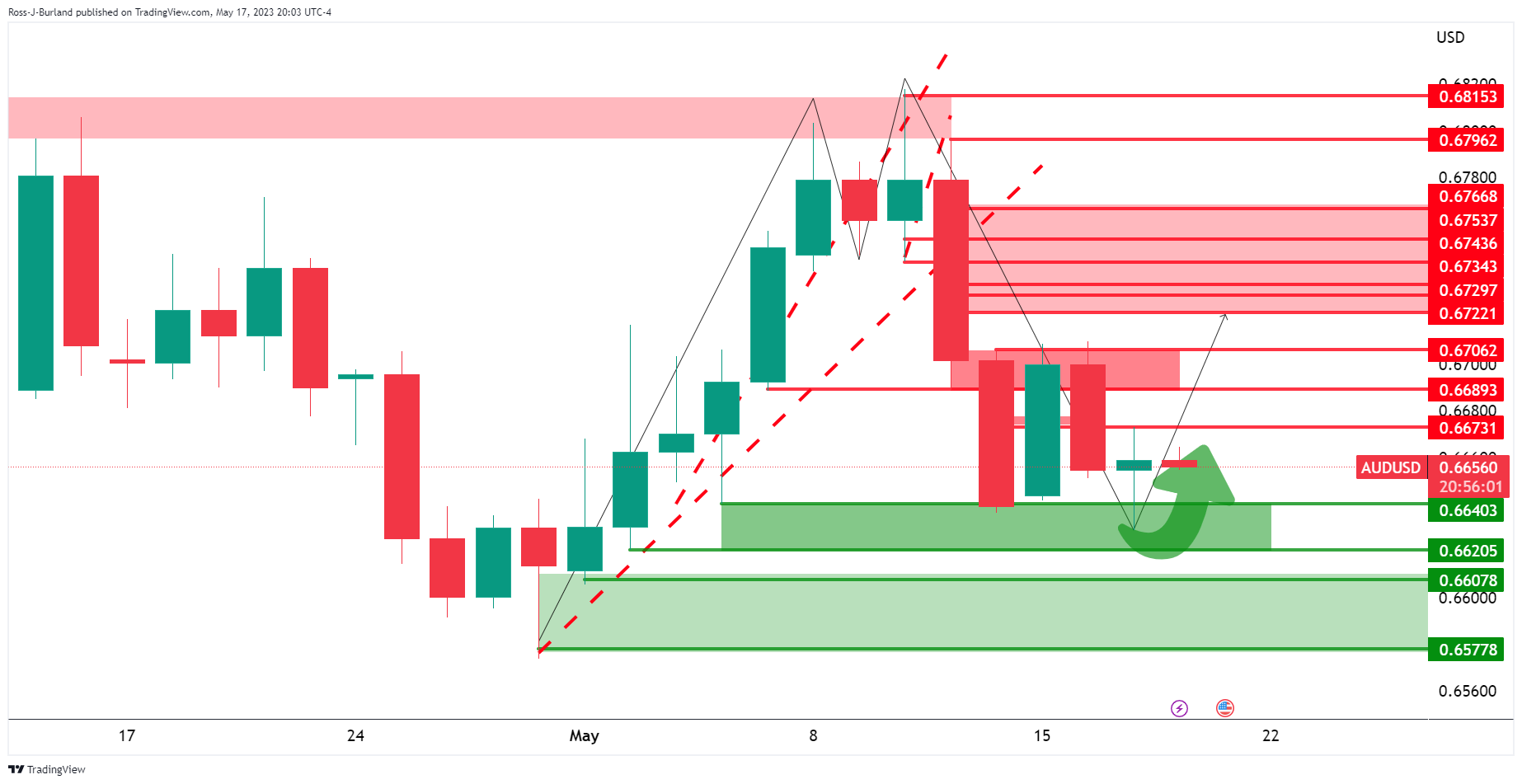

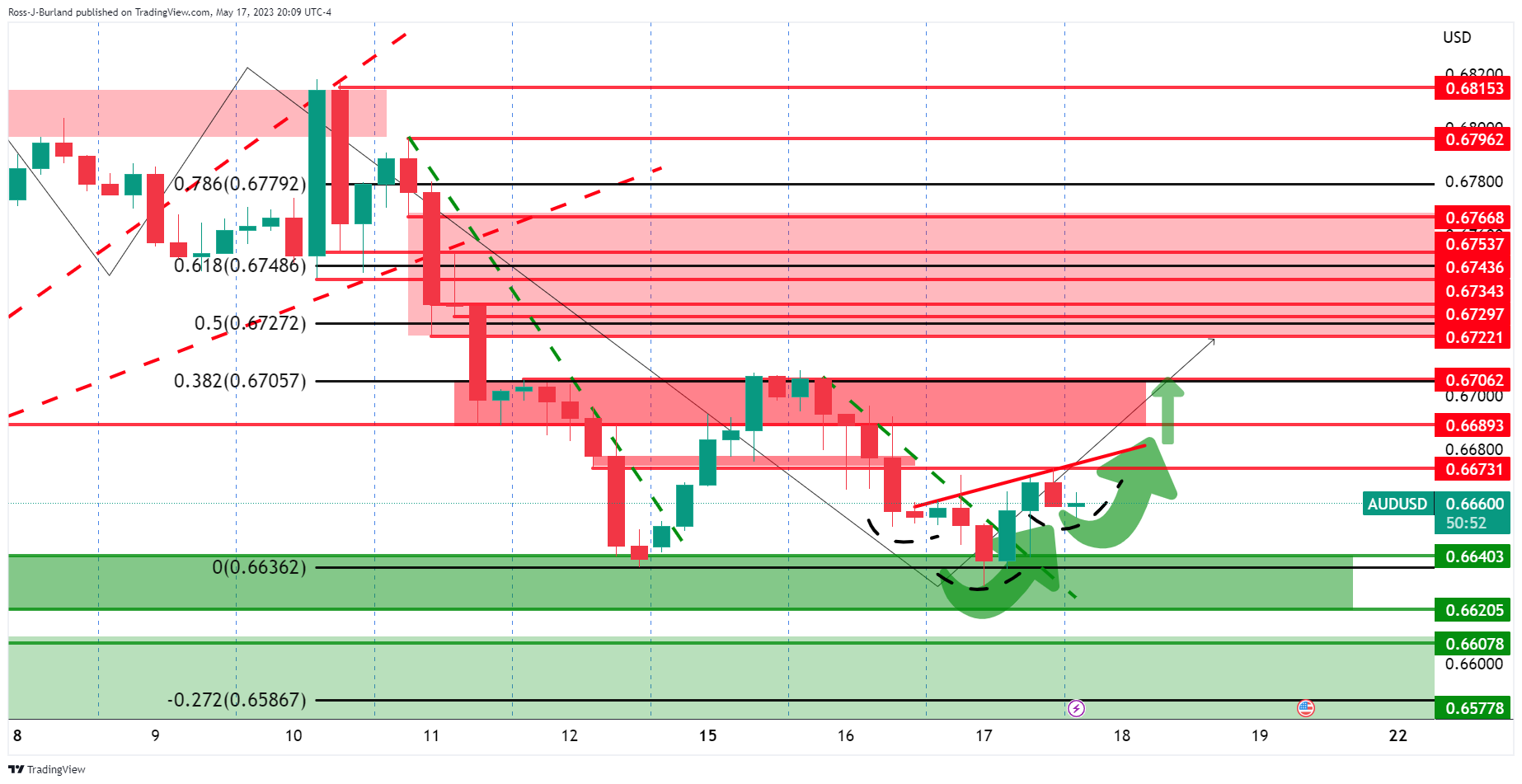

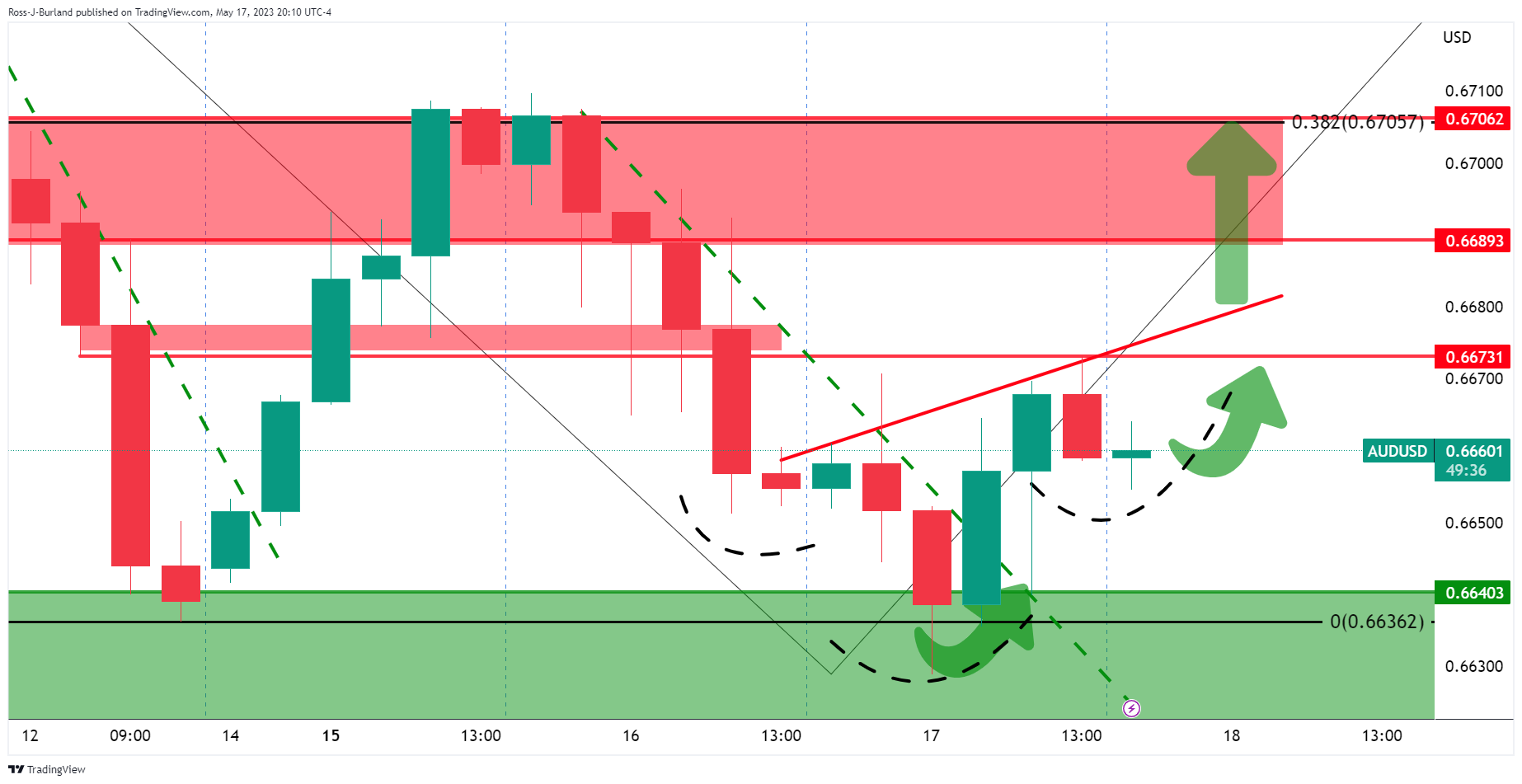

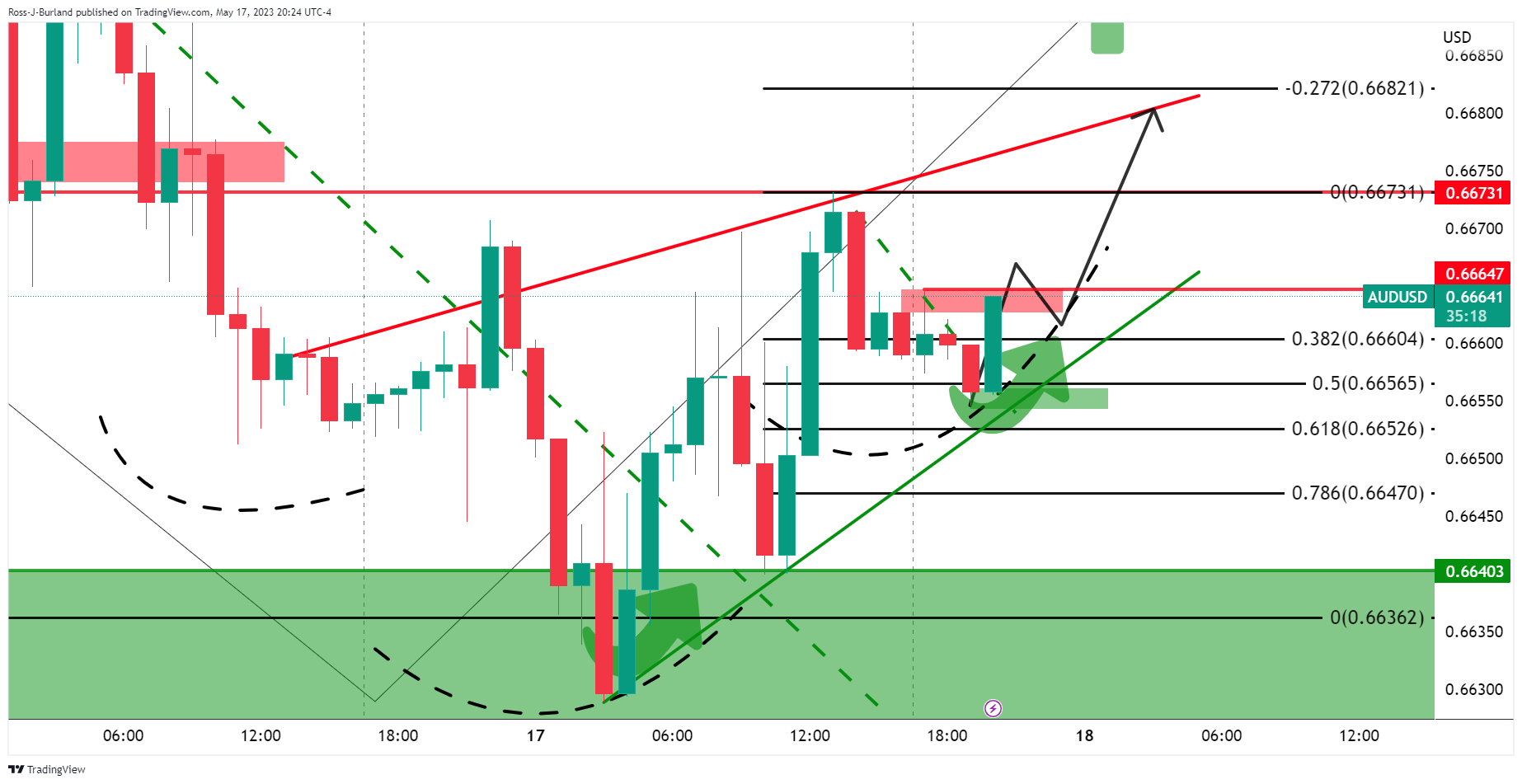

- AUD/USD has sensed selling pressure around 0.6650 as investors are anticipating a neutral policy stance by the RBA.

- The appeal for US equities seems solid amid optimism over approval of the US debt-ceiling raise.

- Other US leaders have shown frustration for US Biden on his willingness to involve in a bipartisan deal to increase the US borrowing cap limit.

The AUD/USD pair has extended its reocvery above 0.6650 in the early Asian session. The Aussie asset has managed in extending its recovery further as the US Dollar Index (DXY) has witnessed an exhaustion in the upside momentum.

S&P500 continued its bullish performance, settled with significant gains on Thursday consecutively. The appeal for US equities seems solid amid optimism over approval of the US debt-ceiling raise by the White House and Republican leaders.

Meanwhile, other US congressional leaders have shown frustration for US President Joe Biden on his willingness to involve in a bipartisan deal to increase the US borrowing cap limit as lower spending initiatives in the budget would create tougher work requirements for food aid recipients, as reported by Reuters.

The demand for US government bonds has dropped dramatically as investors are anticipating that US debt-ceiling negotiations will get thumbs up from Republicans. The 10-year US Treasury yields have jumped strongly above 3.65%.

On the Australian Dollar front, weak Employment data released on Thursday is expected to reinforce the Reserve Bank of Australia (RBA) to return to a steady monetary policy stance. In April, the Australian labor market witnessed a decline in laborforce numbers by 4.3K. April’s Unemployment Rate has jumped to 3.8%.

Therefore, RBA Governor Philip Lowe might keep interest rates steady at 3.85% in its June monetary policy meeting as higher interest rates have started biting firms’ production levels due to the bleak economic outlook.

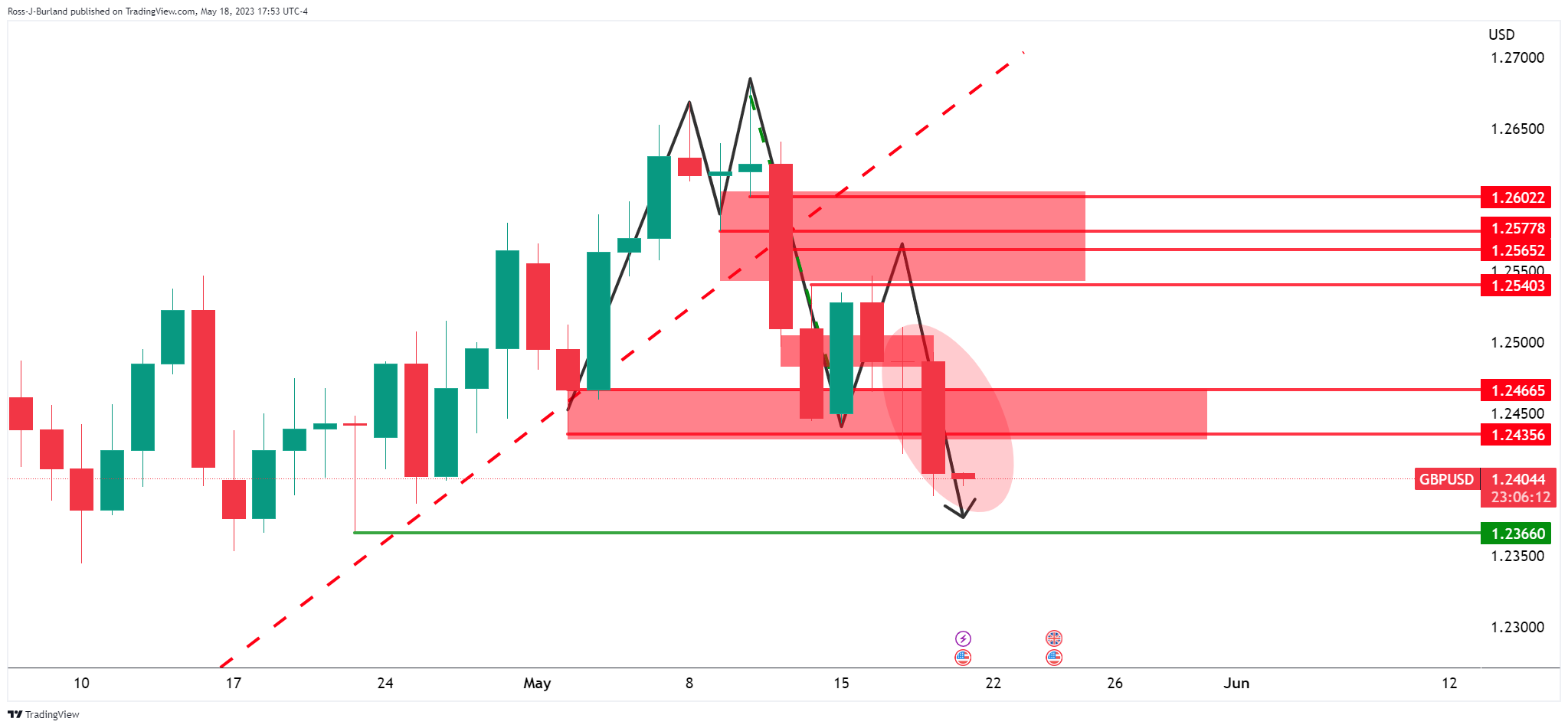

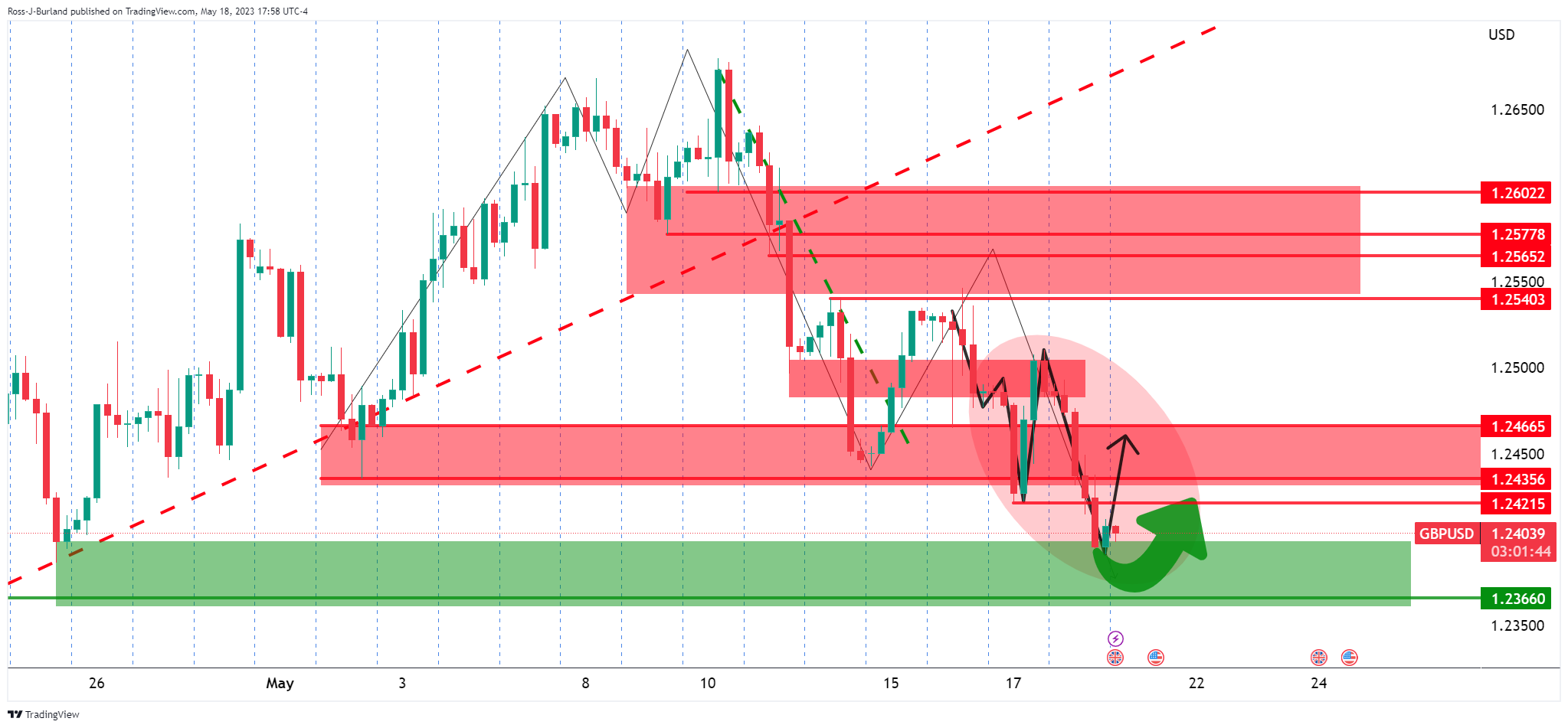

- GBP/USD slides in a meltdown from the topping pattern.

- GBP/USD could be on the verge of a correction to restest the prior area of support, 1.2420 and 1.2450 in the main.

In the prior analysis, GBP/USD Price Analysis: Bears are moving in on the risk rally, it was explained that the M-formation was explained to be a topping pattern that had formed as the potential for the final stage of the prior bullish rally:

GBP/SD prior analysis, daily chart

The price was on the backside of that trendline where traders were anticipated to trade on the short side.

GBP/USD prior analysis, H4 chart

The price has shot up to test resistance and while there are prospects of an onward continuation, the price can easily head lower as illustrated in the chart above.

GBPUSD live updates

The price is now in an area where we could now see a correction to restest the prior area of support, 1.2420 and 1.2450 in the main.

- Gold price bears are eyeing a continuation to the daily support area.

- Gold price pressured by a resurgence in the US Dollar.

Gold price traded by over 1% lower for a third-straight session on Thursday as the US Dollar continues to strengthen and bond yields rise. The US Dollar index was last seen up 0.69 points to 103.55, making gold more expensive for international buyers, and is poised for the largest weekly percentage drop since October.

Gold price fell to a low of $1,957.50 from a high of $1,986.07. Bond yields also climbed, with the US two-year note last seen paying 4.241%, up 7.7 basis points, while the 10-year note was up 7.3 basis points to 3.642%.

The drop in the Gold price comes as the greenback rises with talks between the Whitehouse and Congress over raising the debt ceiling continue, with investors eyeing the possibility of a default on US debt should talks fail. President Joe Biden and Speaker of the House Kevin McCarthy reiterated their aim to strike a deal soon to raise the $31.4 trillion federal debt ceiling and agreed to talk as soon as Sunday. President Joe Biden on Wednesday said he was confident of reaching a deal to avoid defaulting on US debt. McCarthy said a debt-ceiling deal might be "doable" by Sunday. However, market experts cautioned that reaching a deal is merely the first step in what could be a fraught process.

The debt ceiling has drawn attention away from uncertainty about the Federal Reserve's stance on interest rates, but economic data showed the number of Americans filing new claims for jobless benefits fell more than expected last week, suggesting the labor market remains tight, giving the Fed more cushion to continue raising rates. In the week ended 13 May, Initial Claims fell 22k to 242k. That was 4k below the same week in April and points to another strong labour market report. ´´The current strength of the labour market does not support the Federal Reserve view that unemployment rate will lift to 4.5% by year-end,´´ analysts at ANZ Bank explained.

Meanwhile, Dallas Federal Reserve Bank President Lorie Logan and Fed Governor Philip Jefferson said on Thursday the economy does not appear to be softening fast enough for the central bank to pause its rate hike cycle.

´´Without an additional macro catalyst, we expect discretionary trader flow tied to market expectations for a deepening Fed cutting cycle over the next year to support gold towards new cycle highs over the coming months,´´ analysts at TD Securities said.

Gold technical analysis

The Gold price could be leveling out here but the bulls will need to get on the backside of the bearish trendline. In any case, the bears eye an eventual move toward the support area:

The economic calendar is light on Friday. During the Asian session, New Zealand will report on exports and imports, as well as Credit Card Spending. Japan will release inflation data and the Tertiary Industry Index. Later in Europe, the highlight will be German wholesale inflation. The rally of the US dollar is in focus, and the slide in Gold price also deserves attention.

Here is what you need to know on Friday, May 19:

US stocks had another positive day, with the Dow Jones gaining 0.34% and the Nasdaq jumping 1.51%. Optimism about a debt ceiling deal, as well as upbeat economic data, fueled risk appetite. The US dollar rose across the board, even against high-yielding currencies. The US Dollar Index rose 0.65% to settle at 103.50, its highest level in two months. The dollar looks firm, however, most currency pairs show extreme oversold readings.

Economic data from the US came in above expectations, with Jobless Claims and the Philly Fed. Hawkish comments from Federal Reserve officials, along with hopes of a resolution to the debt ceiling drama, triggered a selloff in Treasury bonds. The US 10-year yield rose to 3.65%, the highest in two months. Investors continue to pare bets of Fed rate cuts by year-end and consider the possibility of another rate hike in June. More Fed talk is scheduled for Friday, including Chair Powell.

EUR/USD dropped towards 1.0750, falling for the fifth time in the last six trading days. On Friday, Germany will report the Producer Price Index for April. The European Central Bank (ECB) will release its Economic Bulletin, and ECB officials Schanbel and Lagarde will speak.

GBP/USD tumbled, testing levels under 1.2500. EUR/GBP finished flat around 0.8680, holding weekly losses.

The Japanese Yen was the worst performer, affected by rising government bond yields. USD/JPY advanced for the sixth consecutive day, reaching levels above 138.50, the highest since November. Inflation data from Japan is due on Friday.

The Australian dollar lagged following the Australian employment data. AUD/USD dropped below 0.6640 and is looking at 0.6600.

NZD/USD held above 0.6200 and posted modest losses after the presentation of the Budget and wholesale inflation figures. Trade data and Credit Card Spending are due in New Zealand.

USD/CAD rose toward 1.3500 and remains in a familiar range. On Friday, March retail sales will be released in Canada.

Gold suffered heavy losses after breaking the $1,970 support area and fell to $1,950. The yellow metal remains under pressure. Silver also lost ground, extending weekly losses, with XAG/USD settling at $23.50, the weakest close since late March.

Like this article? Help us with some feedback by answering this survey:

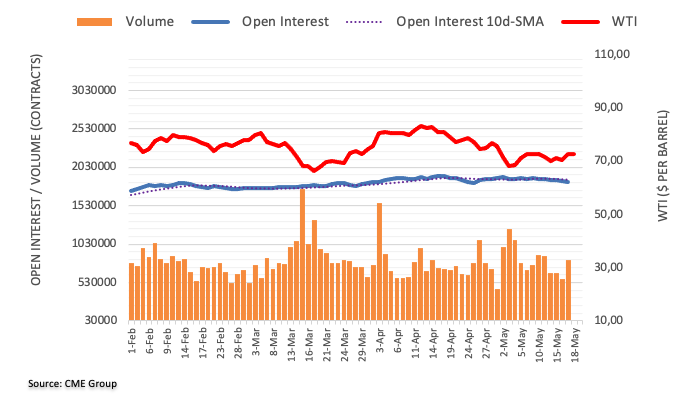

- WTI sinks despite the upbeat mood on Wall Street.

- US oil is down by some 0.9% meeting a new low on the day of $71.47.

West Texas Intermediate crude oil is corecting and down by some 0.9% and has fallen from a high $72.83 to a low of $71.47. Oil sank despite an upbeat tone on Wall Street over the prospects of debt-ceiling negotiations that continue in Washington ending in a solution.

On Wednesday, President Joe Biden and McCarthy reiterated their aim to strike a deal soon to raise the $31.4 trillion federal debt ceiling and agreed to talk as soon as Sunday. President Joe Biden on Wednesday said he was confident of reaching a deal to avoid defaulting on US debt.

The debt ceiling has drawn attention away from uncertainty about the Federal Reserve's stance on interest rates, but economic data showed the number of Americans filing new claims for jobless benefits fell more than expected last week, suggesting the labor market remains tight, giving the Fed more cushion to continue raising rates. In the week ended 13 May, Initial Claims fell 22k to 242k. That was 4k below the same week in April and points to another strong labour market report. ´´The current strength of the labour market does not support the Federal Reserve view that unemployment rate will lift to 4.5% by year-end,´´ analysts at ANZ Bank explained.

Meanwhile, Dallas Federal Reserve Bank President Lorie Logan and Fed Governor Philip Jefferson said on Thursday the economy does not appear to be softening fast enough for the central bank to pause its rate hike cycle.

Elsewhere, the US also reported inventories unexpectedly rose last week, with the Energy Information Administration reported a five-million barrel rise in stocks, while most analysts expected a drop. Wednesday's EIA report showed that (1) U.S. crude oil inventories as of May 12 were -0.1% below the seasonal 5-year average, (2) gasoline inventories were -6.4% below the seasonal 5-year average, and (3) distillate inventories were -16.4% below the 5-year seasonal average. US crude oil production in the week ended May 12 fell -0.8% w/w to 12.2 million bpd, only 0.9 million bpd (-6.9%) below the Feb-2020 record-high of 13.1 million bpd.

Baker Hughes reported last Friday that active US oil rigs in the week ended May 12 fell by -2 to an 11-month low of 586 rigs, falling further below the 2-1/2 year high of 627 rigs posted on December 2. U.S. active oil rigs have more than tripled from the 17-year low of 172 rigs seen in Aug 2020, signaling an increase in U.S. crude oil production capacity.

- Banxico leaves interest rates unchanged at 11.25%, ending the hiking cycle initiated in June 2021, causing a muted reaction in the USD/MXN.

- Banxico’s statement indicates a disinflationary process underway, yet it acknowledges a complicated and uncertain inflationary outlook with potential upside risks.

- The USD/MXN exchange rate experiences limited reaction, maintaining a position above the 17.7000 figure, with the 18.0000 level eyed as the next key resistance.

The Mexican Peso (MXN) depreciates sharply after the Bank of Mexico’s (Banxico) decision to keep rates unchanged at 11.25%, ending its hiking cycle in June 2021 after 700 basis points of increases. At the time of writing, the USD/MXN is trading volatile at around the 17.70000 – 17.7500 area, with US Dollar (USD) buyers eyeing the 18.000 psychological barriers.

Summary of the monetary policy statement by Banxico

Bank of Mexico based its decision even though core inflation has shown some resistance to decline, but commented that several central banks halted their reference rates. Banxico assessed the global economic growth as tilted to the downside but commented that inflation in Mexico has decreased since the last monetary policy meeting, emphasizing that core inflation decreased more “markedly than in previous months.”

The Governing board evaluated the magnitude and diversity of the inflationary shocks and considered the economy has started to undergo a disinflationary process, given that many pressures have eased. The board will monitor inflationary pressures and “estimates that the inflationary outlook will be complicated and uncertain throughout the entire forecast horizon, with upward risks.”

The Governing Board finalized the statement saying they will maintain the reference rate at its current level for an extended period.

Must read: Mexico: After 15 consecutive hikes, central bank keeps key rate unchanged at 11.25%

USD/MXN Reaction

The USD/MXN reaction was muted, with the exchange rate holding above the 17.7000 figure after clashing earlier in the day with the 20-day Exponential Moving Average (EMA) at 17.7682, limiting the rally on the USD/MXN. Above that level, the psychological 18.0000 figure emerges, ahead of the 50-day EMA at 18.0332

On the downside, any drops below the May 17 high of 17.6914 could open the door to retesting lower levels, at around 17.6000, followed by the lows of July 2017 at 17.4500.

As expected, the Bank of Mexico held its key interest rate unchanged at 11.25%. The last time the bank left interest rates unchanged was in May 2021. Since then, it has raised the key rate from 4% to 11.25% in 15 consecutive meetings. The board stated that it "considers that it will be necessary to maintain the reference rate at its current level for an extended period," and the decision was unanimous.

Key takeaways from the statement:

“The Governing Board evaluated the magnitude and diversity of the inflationary shocks and their determinants, along with the evolution of medium- and long-term inflation expectations and the price formation process. It considered that the economy has started to undergo a disinflationary process given that many pressures have eased.”

“It deemed that these pressures continue having an incidence on inflation, as it remains high and the inflationary outlook is still very complex.”

“The Board will thoroughly monitor inflationary pressures as well as all factors that have an incidence on the foreseen path for inflation and its expectations. It estimates that the inflationary outlook will be complicated and uncertain throughout the entire forecast horizon, with upward risks.”

“In order to achieve an orderly and sustained convergence of headline inflation to the 3% target, it considers that it will be necessary to maintain the reference rate at its current level for an extended period. “

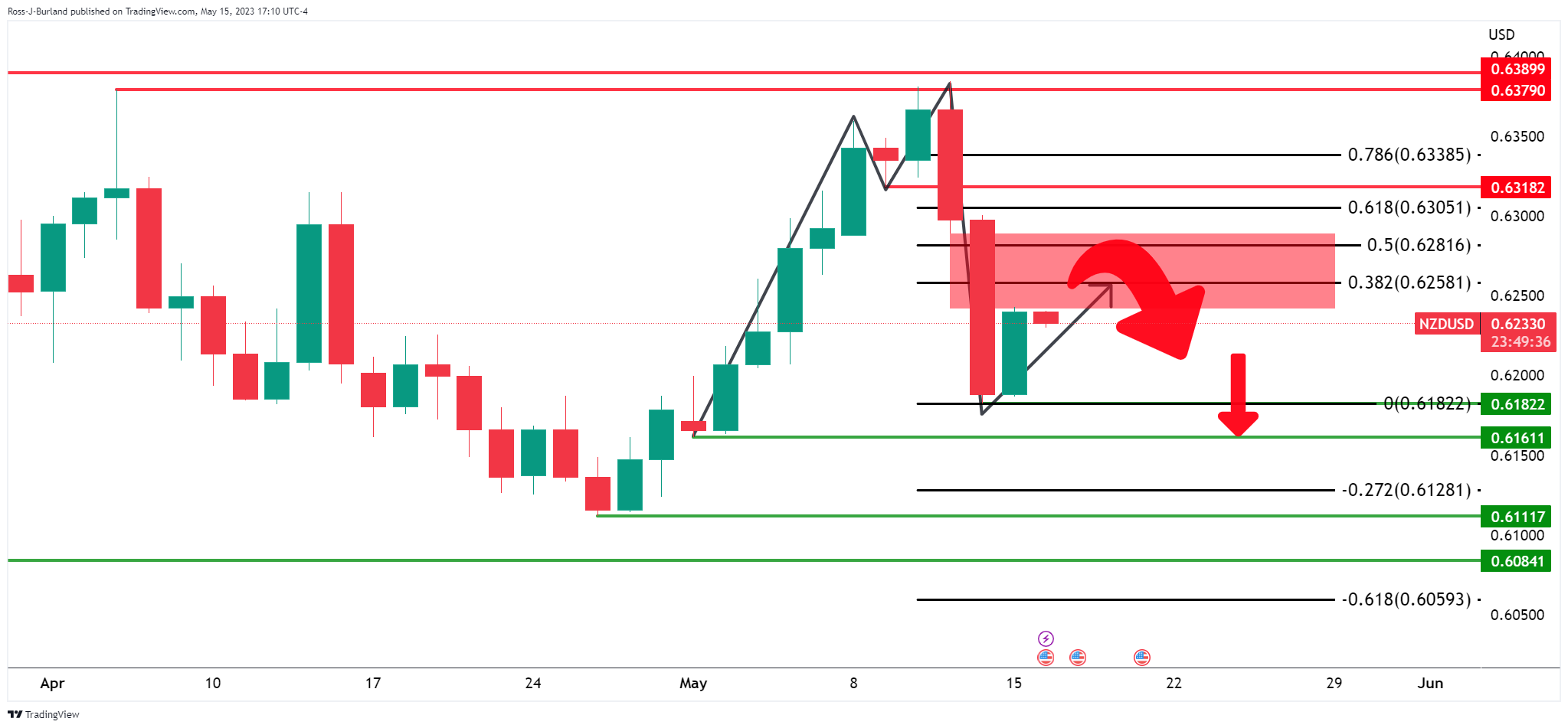

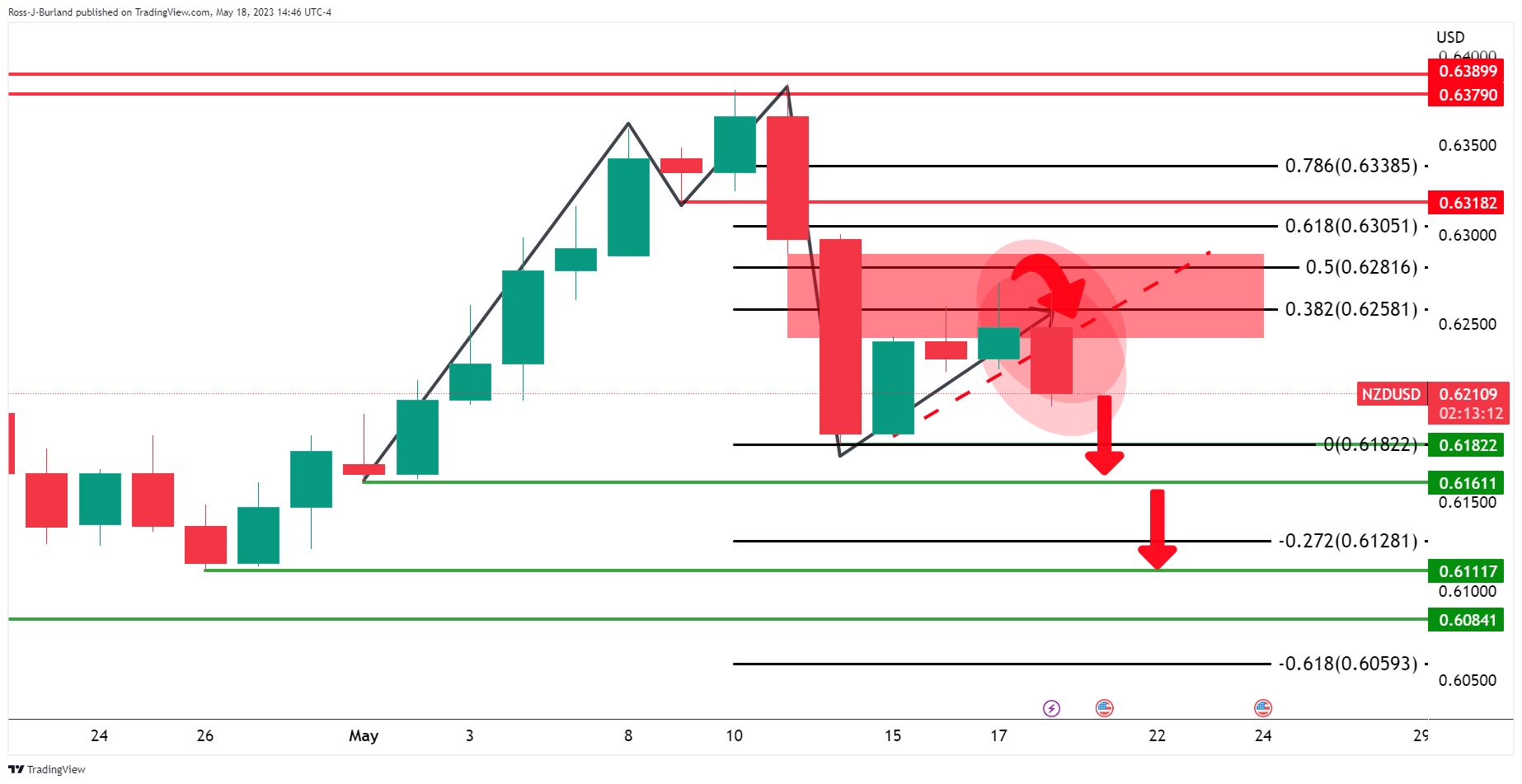

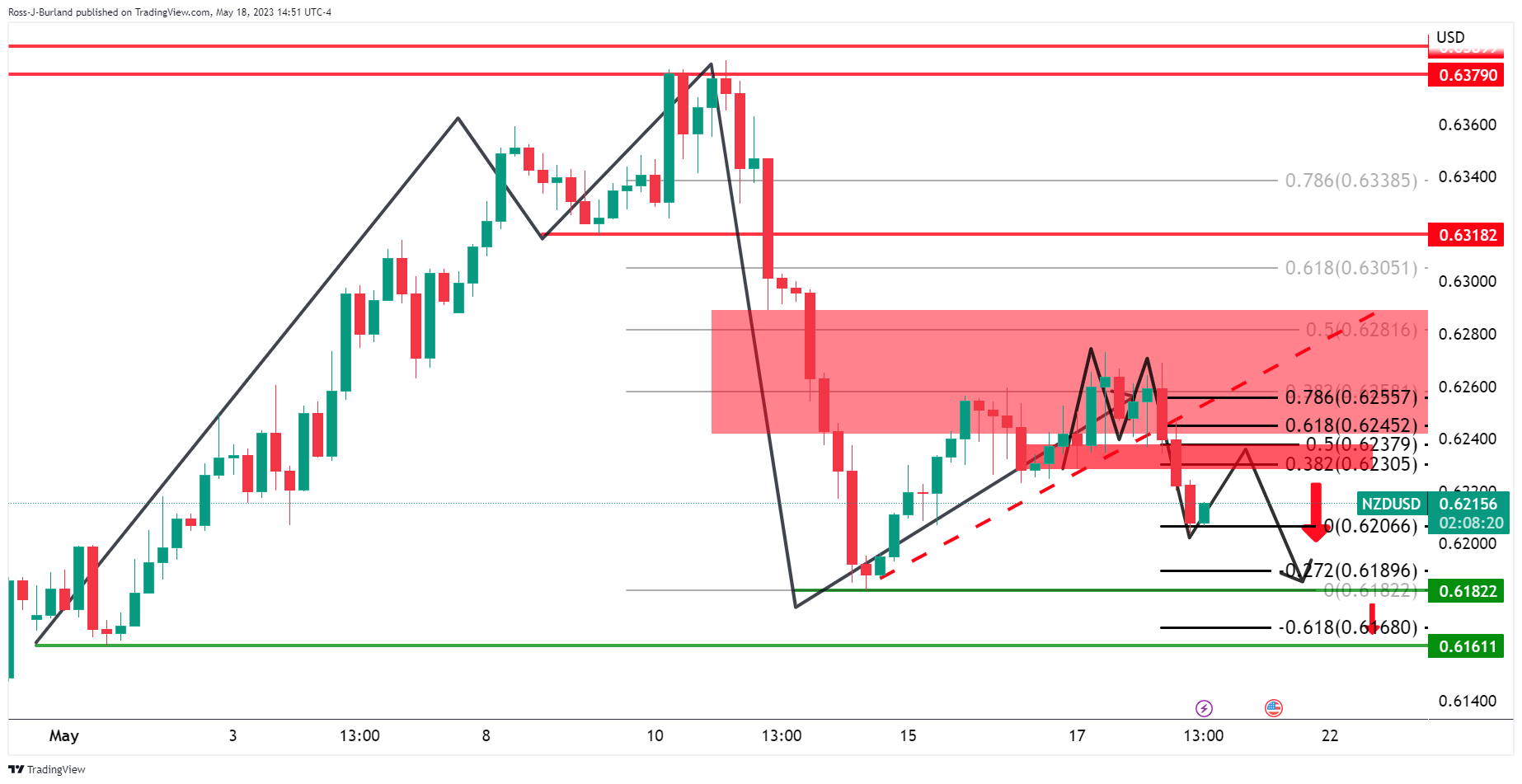

- NZD/USD bears are moving in and eye a downside extension.

- NZD/USD´s M-formation could stall the momentum.

As per the prior analysis from earlier this week, NZD/USD bulls in the market and eye a firm correction, the pair moved up into the 38.2% Fibonacci resistance and came close to a 50% mean reversion before starting to melt to the downside:

Prior analysis:

Update 1:

Update 2

There are still prospects of a move lower although the 4-hour and 1-hour charts can be used to gauge as to whether there is going to be a deceleration in the bullish correction and so far, it is early days still. After all, the price is still on the front side of the bullish dynamic trendline support.

NZD/USD update, live market:

NZD/USD H4 chart

NZD/USD has fallen below the trendline support which now turns to the counter trendline. The M-formation is a compelling feature on the chart as it is a reversion pattern. A pullback could be an opportunity for the bears to sell at a premium in the pursuit of lower grounds longer-term.

- A robust US jobs report supports bullish sentiment for the greenback, suggesting a potential pause in Federal Reserve’s tightening cycle is less likely.

- Progress in US debt ceiling negotiations drives positive sentiment, with an agreement anticipated within the week to prevent potential default.

- Canadian housing data disappoints as the New Housing Price Index contracts in April, adding to downside pressures for CAD.

USD/CAD rises sharply and reclaims the 1.3500 figure after hitting a daily low of 1.3442. US political issues regarding the debt ceiling had taken center stage, and progress on the theme triggered an upbeat sentiment. Additionally, a solid US jobs report could deter the US Federal Reserve (Fed) from pausing its tightening cycle. At the time of writing, the USD/CAD is trading at 1.3516.

Solid US data and positive sentiment drive USD/CAD, overcoming Canadian housing market headwinds

Fundamental news from the United States (US) bolstered the appetite for the greenback. A goodish US jobs report showed the tight labor market, with Initial Jobless Claims rising below estimates. Meanwhile, the Philadelphia Fed Manufacturing production for May was negative, though it showed some improvement amidst several headwinds like sticky inflation and higher interest rates. Given the backdrop, it might deter Federal Reserve officials from pausing due to the tightness of the labor market.

Meanwhile, US equities got bid as negotiations about an increase of the US debt ceiling. Recent remarks from House Speaker Kevin McCarthy underlined the urgency for an agreement to be finalized this week and for Congress to vote next week ahead of the US default deadline.

Of late, remarks from US Senate Majority Leader Schumer commented that debt limit talks are making progress. Biden’s economic adviser Lael Brainard said that Congress’s most significant risk is failing to prevent a default.

On the Canadian front, housing data pointed to further deterioration. The New Housing Price Index for April plunged -0.1% MoM, below the prior’s month report, and annually based, dropped -0.2%, below March’s 0.2% gain.

On the central bank note, Federal Reserve officials sounded hawkish, with Dallas Fed President Lorie Logan saying that data this time does not support skipping rate hikes at the next meeting, adding that the Fed has not made the progress we need on inflation.

Bank of Canada’s Governor Tiff Macklem and Deputy Governor Rogers said financial institutions should adjust to higher rates. Macklem added that April CPI data was stronger than expected and economic data will guide June’s rate decision.

USD/CAD Technical Level

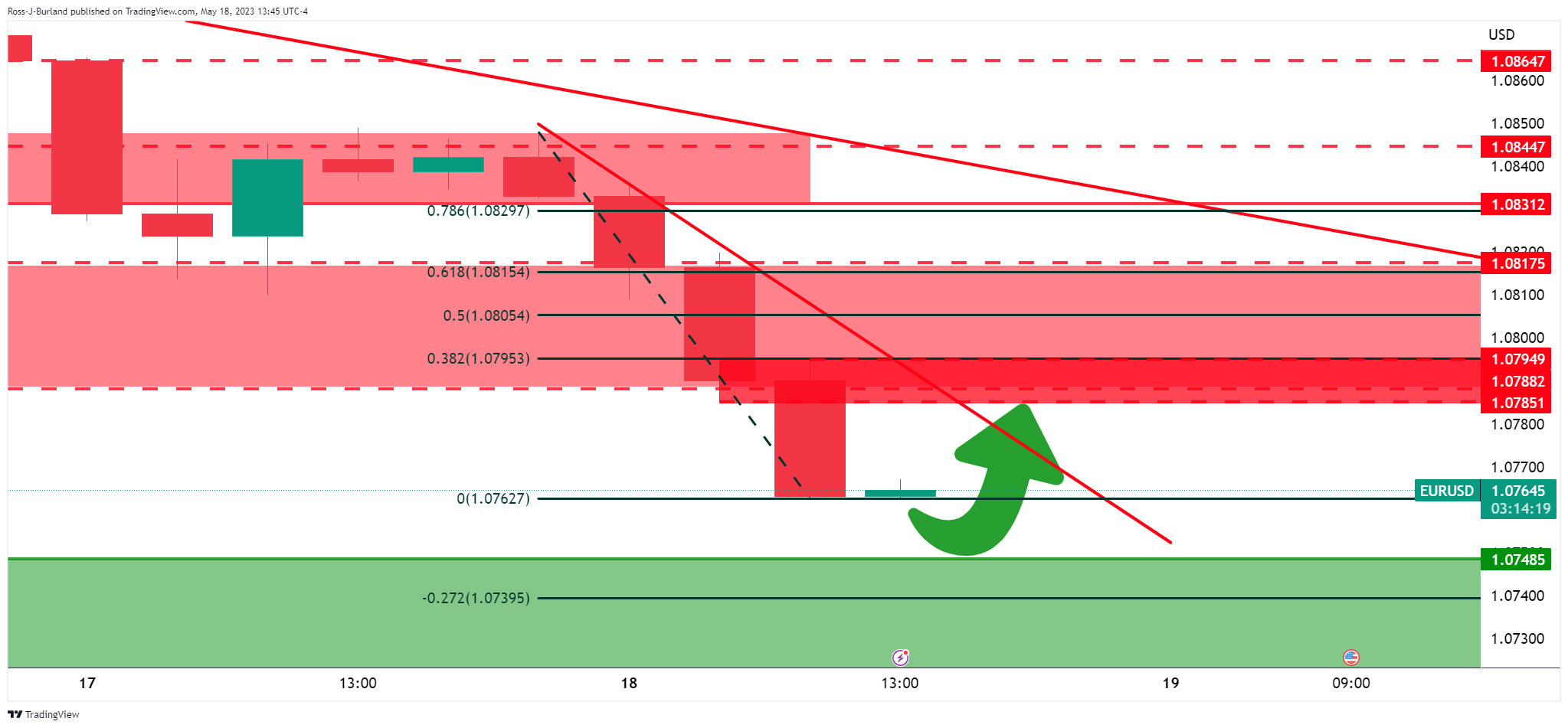

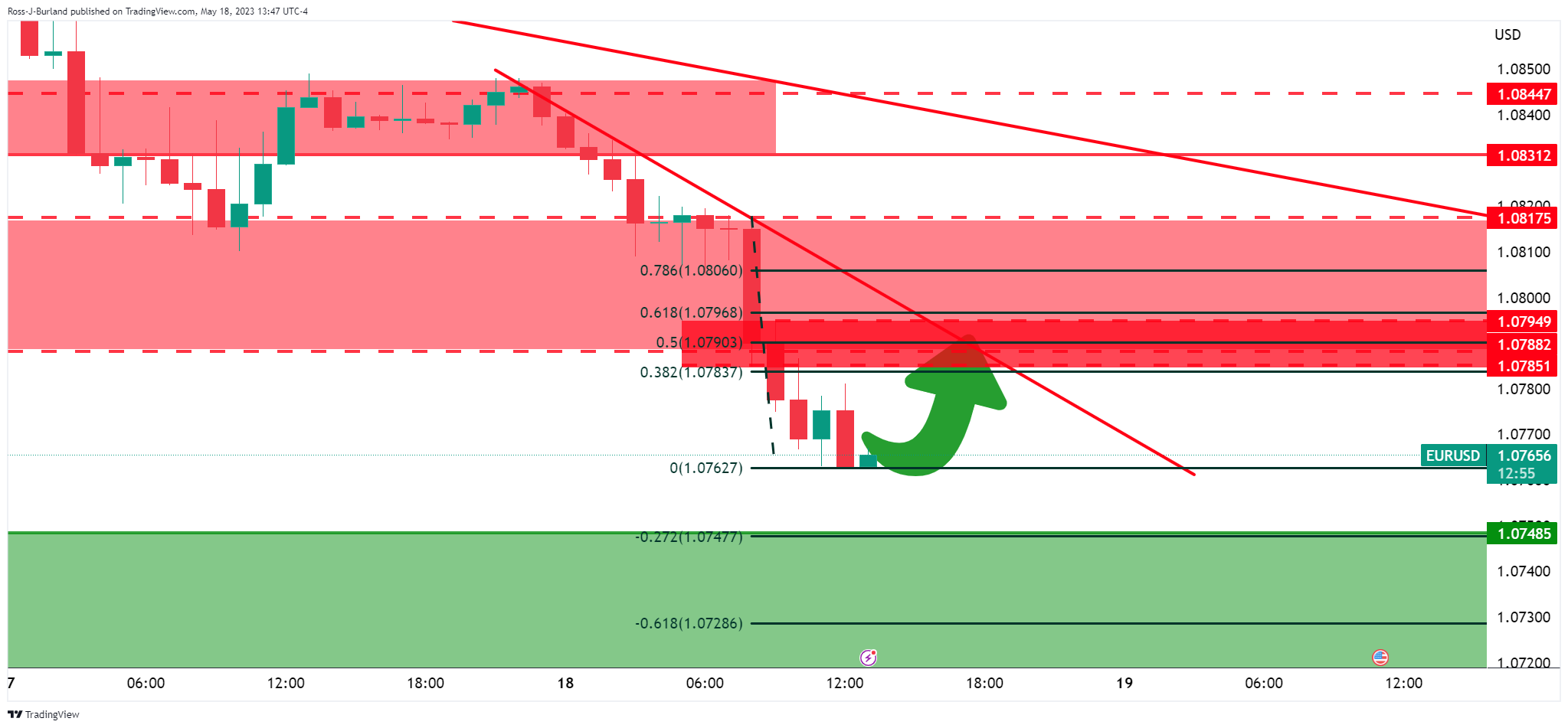

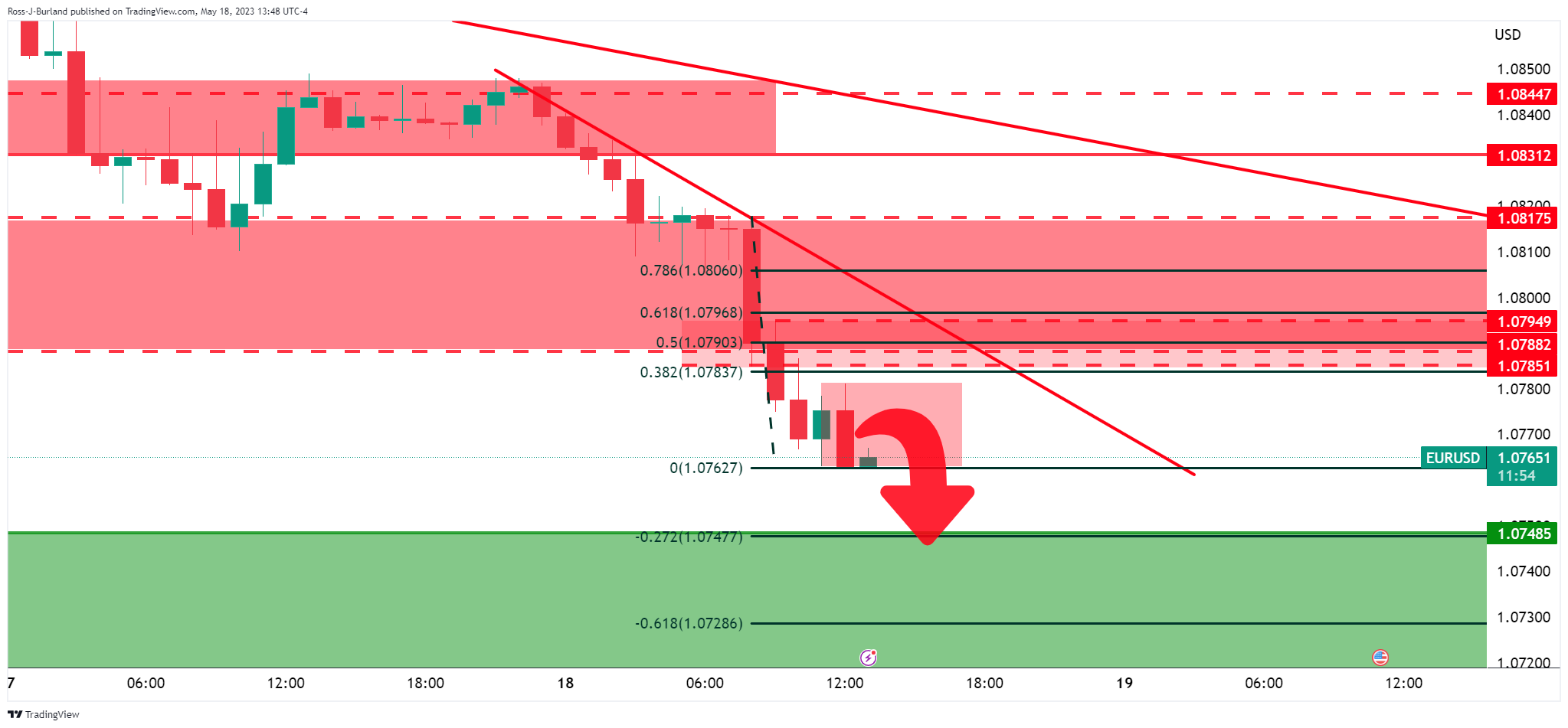

- EUR/USD bears are in the market but bulls are showing up.

- The bulls need to get above the 1.080s and trendline resistance.

EUR/USD is attempting to correct the heavy selling that has taken place over the course of several days. EUR/USD is currently trading at 1.0766 and is down some 0.66%, traveling between a low of 1.0762 and 1.0848 the high.

The Euro has been pressured by a firmer US Dollar that again enjoyed another round of solid economic data amid market optimism about a US debt ceiling deal to avert a potential default. Technically, however, the offer in EUR/USD is decelerating as the following charts will illustrate, raising prospects of a correction. With that being said, the bulls have their work cut out:

EUR/USD daily charts

EUR/USD remains heavily offered and has broken the 1.0780s prior support. This gives way to prospects of a continuation to the potential support area between the 1.0750s and 1.0700

EUR/USD H4 chart

However, the bulls can start to monitor for signs of deceleration and a potential correction. The 4-hour trendline and horizontal resistance will be key in this regard. A failure to break above these will leave the bears in control.

EUR/USD H1 charts

The hourly chart is also showing signs that the bears are not done yet although if the bulls commit, then there will be prospects of a move to test 1.0780s and 1.0790s and then 1.0800 and the 1.0820s.

On the other hand, we could easily see a continuation from below the 1.0770s.

- USD/JPY rally driven by positive sentiment around US debt ceiling talks, solid US job data, and upbeat retail and industrial figures.

- Despite breaching the resistance at 138.00, potential resistance levels at 139.00 and 139.89 might cap gains, with the psychological 140.00 mark as the next target.

- While signs of overbought conditions emerge, suggesting potential for a downward correction, the overall bullish trend remains solid.

USD/JPY climbs to new year-to-date (YTD) highs of 138.67, bolstered by higher US Treasury bond yields, amidst an upbeat sentiment sponsored by improvement in the US debt ceiling talks. In addition, solid US jobs data, alongside strong Retail Sales, Industrial Production, and a surprising hawkish comment by Dallas Fed President Lorie Logan, propelled the USD/JPY. At the time of writing, the USD/JPY is trading at 138.57 after hitting a low of 137.28.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart shows the pair remains in a solid uptrend after breaking a resistance trendline alongside the 138.00 figure. On the upside, the USD/JPY will clash with solid resistance levels like the 139.00 figure, followed by the November 30 daily high of 139.89. A decisive break will expose the 140.00 psychological figure. On the other hand, if USD/JPY drops below 138.00, it will exacerbate a correction toward the 20-day Exponential Moving Average (EMA) at 135.52.

In the short term, the USD/JPY 1-hour chart, the pair peaked around the R2 daily pivot, with two subsequent attempts to clear the latter, as buyers are eyeing the 139.00 figure. If USD/JPY fails to crack the R2 daily pivot level, a pullback toward the R1 pivot at 138.15 is on the cards before reaching the 20-EMA at 137.98.

The Relative Strength Index (RSI) indicators at overbought territory register lower peaks as price action reaches higher highs. That means negative divergence forms, opening the door for a downward correction. In addition, the 3-period Rate of Change (RoC) shows buyers losing momentum.

USD/JPY Price Action – 1-Hour chart

- GBP/USD extends its fall, hitting a three-week low of around 1.2397 amid the fading fear of a possible US default and buoyant market sentiment.

- The robust US labor market report from the Bureau of Labor Statistics and an unexpected Philadelphia Fed Manufacturing Index recovery apply downward pressure on the pair.

- Bank of England speakers suggest a gradual and predictable approach to Quantitative Tightening, providing little support for the Pound.

GBP/USD prolongs its falls past the 1.2400 figure, reaching a new three-week low at around 1.2397, as the Pound Sterling takes a hit, taking advantage of a light economic calendar in the United Kingdom (UK). Fears of a possible default in the United States (US) are fading, as talks between US Congress leaders and the White House showed hope that an agreement would emerge before June 1. The GBP/USD is trading at 1.2423 after hitting a daily high of 1.2492.

Positive US labor market and fading default fears weighed on the GBP

US equities are trading mixed, though earlier it rode a wave of optimism, posting gains due to a buoyant market atmosphere. Discussions regarding the US debt ceiling remain ongoing, underscored by recent statements from US House Speaker Kevin McCarthy. McCarthy stressed the critical need for an agreement this week, reiterating the urgency for Congress to vote to avert a potential default in the forthcoming week.

The US Bureau of Labor Statistics (BLS) released a robust labor market report. Initial Jobless Claims for the week ending May 13 recorded a lower-than-expected rise of 242K, a noticeable drop from the previous week’s 254K. It’s noteworthy, however, that the prior week’s figures were somewhat distorted due to fraudulent claims reported in Massachusetts.

In the meantime, although negative, the Philadelphia Fed Manufacturing Index outperformed expectations, with the index dropping to -10.4, better than the anticipated fall of -19.8, and showed a significant recovery from April’s dismal -31.3. This upturn primarily stems from a rebound in new orders, despite a decline in the employment component and a rise in the price gauge. The increase in producer prices might discourage the Federal Reserve (Fed) from putting its tightening cycle on hold.

Following the release of the data, the GBP/USD dropped from around 1.2440s. The pair fell sharply toward its weekly low before reclaiming the 1.2400 figure. The greenback continued to rise in the day, as shown by the US Dollar Index, which measures the buck’s performance against a basket of six currencies; it is up 0.66%, at 103.541, eyeing a test of the 2017 high oat 103.820.

Regarding the central bank speakers, Dallas Fed President Lorie Logan said that data this time does not support skipping rate hikes at the next meeting, adding that the Fed has not made the progress we need on inflation.

Meanwhile, the UK economic docket featured Bank of England’s (BoE) speakers, who commented that Quantitative Tightening (QT) would be gradual, predictable, and not an active policy instrument. They added that it has some economic effects but is fairly small. BoE’s Michael Ramsden said, “We’re probably going to have several years to go for QT.”

GBP/USD Technical Levels

- AUD/USD continues to tumble for the second day in the week, currently trading at 0.6606.

- US debt ceiling discussions, strong labor market data, and Fed speakers boost USD strength.

- Australia’s jobs report shows the economy lost 27,100 jobs, pushing the unemployment rate from 3.5% to 3.7% in April.

AUD/USD tumbles for the second day in the week after Wednesday’s pause formed a doji, but a break of an upslope support trendline, opened the door for further losses. Reasons like a positive sentiment due to debt ceiling negotiations, solid economic data from the United States (US ), and Fed speakers were the main drivers of the US Dollar (USD) appreciation against the Australian Dollar (AUD). At the time of writing, the AUD/USD Is trading at 0.6606.

AUD weakens on disappointing jobs report, while USD got bolstered by positive US economic data

Wall Street continues to print gains amidst an upbeat market sentiment. The US debt ceiling discussions would continue through the latest comments by US House Speaker Kevin McCarthy, who said it’s essential to have an agreement principle this week and emphasized that the US Congress must vote next week to meet the “default” deadline.

Aside from these comments, a strong labor market report by the US Bureau of Labor Statistics (BLS) showed that unemployment claims continued to downtrend. Initial Jobless Claims for the last week ending on May 13 rose by 242K below estimates and the prior’s week figures of 254K, though it should be said that figures from the last’s week were “inflated” by fraud in a claims report in Massachusets.

Meantime, the Philadelphia Fed Manufacturing Index plunged to -10.4, less than the estimated fall of -19.8, and improved compared to April’s -31.3. The improvement is mainly attributed to a recovery in new orders, though the employment subcomponent deteriorated while a price gauge rose. Although hiring moderated, higher prices paid by producers would deter the Federal Reserve (Fed) from pausing its tightening cycle.

Therefore, the AUD/USD continued its downtrend and hit a daily low of 0.6604 as US data hit the screens. The US Dollar Index is soaring sharply more than 0.50%, up at 103.574, about to test the 2017 high of 103.820. A breach of the latter could weigh on the AUD/USD, which is about to dive below the 0.6600 figure, with the following support area found at the April 28 low of 0.6573.

The AUD/USD weakened during Thursday’s Asian session; the latest Australian jobs report showed the economy lost 27,100 jobs, and the unemployment rate rose from 3.5% to 3.7% in April. Even though it remains at historically low levels, the report could help the Reserve Bank of Australia (RBA) to hit its inflation target of 2%-3%. The market expects the RBA to hold rates unchanged at its June 7 meeting.

AUD/USD Price Analysis: Technical outlook

The AUD/USD pair remains downward biased and might accelerate its fall toward the April 18 low of 0.6573, followed by a test of the year-to-date (YTD) low of 0.6564. The Relative Strength Index (RSI) indicator is in bearish territory, suggesting selling pressure remains in charge, while the 3-day Rate of Change (RoC) shifted to negative readings, supporting a continuation of the downtrend.

Economists at ANZ Bank retain a bullish view and forecast Gold at $2,120 by the first quarter of the next year.

Risk could stem from divergence between Fed’s actions and market expectations

“Prolonged geopolitical tensions, such as that between the US and China, will lend support to investment demand as well as central bank buying. Therefore, we continue to be bullish, expecting prices to reach $2,120 by Q1 2024.”

“The risk to our bullish view could stem from a divergence between the US Fed’s actions and market expectations. Consensus estimates are for a rate cut in 2023, but our baseline forecast is for no cuts in 2023. Any unexpected policy action could trigger price corrections, but such dips should be perceived as buying opportunities.”

The Bank of Canada (BoC) has released its Financial System Review, which expresses increased concern compared to last year about the ability of households to pay their debts. In the document, the BoC noted that the spillover effects on Canada from recent stress in the global banking sector have been limited.

Key takeaways from the Financial System Review—2023:

“Bank funding is becoming scarcer and more expensive.”

“Overall, the banking system in Canada remains robust.”

“A severe recession could lead to credit losses for banks.”

“To date, spillover effects in Canada from the recent stresses in the global banking sector have been limited.”

“Higher global interest rates are increasing funding costs for Canadian banks, both in wholesale markets and through a reduction in demand deposits.”

“Future episodes of market stress—if they last long enough—could put additional upward pressure on the cost of funding and reduce banks’ capacity to provide liquidity to market participants.”

“Canadian banks remain robust, but they are not immune to international developments. The reliance of Canada’s large banks on wholesale funding makes them vulnerable to deteriorating conditions in global financial markets.”

“If the cost of wholesale funding were to rise significantly due to a persistent period of global financial stress, it could lead to Canadian banks tightening lending conditions, making it more difficult and expensive for Canadian households and businesses to access credit.”

“In light of higher borrowing costs, the Bank of Canada is more concerned than it was last year about the ability of households to service their debt. More households are expected to face financial pressure in the coming years as their mortgages are renewed. The decline in house prices has also reduced homeowner equity, and some signs of financial stress—particularly among recent homebuyers—are beginning to appear.”

"To date, spillover effects in Canada from the recent stresses in the global banking sector have been limited.”

The market is nibbling away at pricing for H2 Fed rate cuts and Dollar shorts are feeling the squeeze. It is “just a correction” but it is painful all the same, according to Kit Juckes, Chief Global FX Strategist at Société Générale.

Dollar and end-year Fed expectations edging higher together

“As the regional banking crisis erupted, the market briefly priced end-year rates below 4% but that’s back above 4 ½% now and the Dollar is grinding higher in the process. I doubt we can get back to where we were in early March, but the market’s short Dollars and this kind of grinding uptrend can be painful.”

“As for EUR/USD, the long-term rate trends suggest that there’s still considerable upside potential. The current correction is just that, even if it does last several more weeks and cause further pain.”

- Oil price trades with modest losses as the US Dollar strengthens on hawkish Federal Reserve speeches, US debt-ceiling uncertainty.

- Data showing a greater-than-expected rise in inventories weighs but is balanced by competing data showing rising global demand.

- Oil price is technically in a downtrend – but signs are building for a potential recovery.

Oil price edges lower on Thursday, trading about a fifth of a percentage point down at the time of writing, after the US Dollar – which Oil is primarily priced and traded in – makes gains and data from the Energy Information Administration (EIA) showed a larger-than-expected rise in inventories.

WTI Crude Oil is trading around $72.60 and Brent Crude Oil near $76.60 at the time of writing. The commodity is finding some support after data from the Joint Organizations Data Initiative (JODI) showed a surge in global demand for Oil in March, on Thursday.

Oil news and market movers

- EIA Crude Oil Stocks Change (May 12) data released late Wednesday shows a 5.04M barrel rise versus estimates of a 0.92M barrel fall, indicating robust supply and putting downward pressure on Oil price.

- The US Dollar gains putting downside pressure on Oil after hawkish comments on Tuesday from Loretta Mester, Federal Reserve’s President for Cleveland. Mester upset expectations that the Fed would not need to raise rates any further after she said that given how stubborn inflation was she couldn’t say for sure that the Fed Funds Rate was at a level “where it’s equally probable that the next move could be an increase or a decrease.”

- Uncertainty over US debt-ceiling talks is a win-win for the US Dollar because of its safe-haven status. Growing fears are thus supportive – as is optimism for a resolution, which would provide more proxy stimulus for the economy, raising US Treasury yields in the process, making further rate hikes more likely and thus supporting USD.

- Data from the Joint Organizations Data Initiative (JODI) showed a surge in global demand for Oil in March, on Thursday, putting a floor under Oil price losses.

- The JODI report showed a surge in global demand of 3M barrels per day (bpd) in March.

- Demand was especially strong in China, according to the report by the Riyadh-based agency, where total product demand jumped by 1.6M barrels per day (bpd) month-on-month to 16.79M bpd in March. It was the third-highest ever increase in demand from the country.

- The US also showed an increase in total product demand of 1.77M bpd month-on-month, to a total of 21.77M bpd, whilst at the same time Oil production in the US declined by a quarter of a million bpd.

Crude Oil Technical Analysis: Downtrend showing signs of ending

WTI Oil is in a long-term downtrend, making lower lows. Given the old adage that the trend is your friend this favors short positions over long positions. It is trading below all the major daily Simple Moving Averages (SMA) and all the weekly SMAs except the 200-week at $66.89.

WTI US Oil: Daily Chart

A break below the year-to-date (YTD) lows of $64.31 would be required to reignite and reconfirm the downtrending, however, with the next target at around $62.00 where trough lows from 2021 will come into play as archaic supports.

Despite the dominant downtrend, there are signs that it might be reaching a conclusion. There is mild bullish convergence between price and the Relative Strength Index (RSI) at the March and May 2023 lows, with price making a lower low in May that is not matched by a lower low in RSI. This is a sign bearish pressure is easing.

The long hammer Japanese candlestick pattern that formed at the May 4 (and year-to-date) lows is a further sign this may have been a key strategic bottom.

Oil price bulls, however, would need to break above the $76.85 lower high of April 28 to bring the dominant bear trend into doubt.

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Economists at Rabobank share their USD/JPY forecasts for the coming months.

Adjust in YCC key to the forecasts

“While technically it is possible that the BoJ could be tightening policy when the Fed is easing, we would consider the odds of this scenario to be very small. If the BoJ cannot find the justification to adjust YCC this summer, it may find that the boat has sailed. Japan’s April CPI release could thus be instrumental in deciding whether July is in play for a policy adjustment or not.”

“We currently forecast USD/JPY at 135 in 3 months and 128 in 12 months. These forecasts assume a change in YCC this cycle.”

Economists at TD Securities have materially upgraded their euro-area inflation forecasts. Jointly, they have upgraded their expectations of the ECB's terminal policy rate.

Cuts to begin in June 2024

“We have materially upgraded our inflation forecast for the euro-area through 2023. We now expect headline inflation to be 3.6% YoY in 23Q4 (ECB: 2.8%) and core inflation to be 4.3% that quarter (we had previously been below 4%).”

“We've flagged upside risks to our call of a 3.50% terminal, and the totality of ECB communication at and since its May decision, coupled with continued strong momentum in economic data, to our eyes suggest that the ECB will continue hiking into the summer, reaching a terminal rate of 4.00% by September.”

“We look for cuts to begin in June 2024 at regular 25 bps increments until 2025 when a neutral 2.00% rate is reached.”

- Existing Home Sales in the US fell unexpectedly sharply in April.

- US Dollar Index holds near daily highs after the data.

Existing Home Sales in the US dropped by 3.4% in April to an adjusted annual rate of 4.28 million, the National Association of Realtors (NAR) reported on Thursday. This reading followed March's contraction of 2.6% (revised from -2.4%) and came in below the market expectation of 0.1%. Salles are down 23% from one year ago.

“The median existing-home sales price slipped 1.7% from one year ago to $388,800. The inventory of unsold existing homes increased 7.2% from the previous month to 1.04 million at the end of April, or the equivalent of 2.9 months' supply at the current monthly sales pace,” the NAR further noted.

"Home sales are bouncing back and forth but remain above recent cyclical lows," said NAR Chief Economist Lawrence Yun. "The combination of job gains, limited inventory and fluctuating mortgage rates over the last several months have created an environment of push-pull housing demand."

Market reaction

The US Dollar Index is up by 0.55% on Thursday, supported by comments from Federal Reserve’s Logan. The Dollar trades at monthly highs versus the Euro and the Yen. Other economic reports released earlier showed numbers above expectations (Jobless Claims and Philly Fed).

- EUR/USD intensifies the leg lower to 1.0780 on Thursday.

- ECB’s A. Müller ruled out rate cuts in early 2024.

- US Philly Fed index, weekly Claims surprise to the upside.

EUR/USD accelerates losses and breaks below the key support at 1.0800 the figure to print new multi-week lows on Thursday.

EUR/USD debilitates to 2-month lows

EUR/USD offers additionally ground and withdraws for the third consecutive meeting on Thursday, breaching at a similar energy the 1.0800 key support to record new lows near 1.0780 against the backdrop of the intense rebound in the buck.

As seen in past days, the persisting risk aversion appears propped up by uncertainty around the US debt ceiling issue, while now dwindling speculation of a potential pause by the Fed in June also adds to the dollar’s upside bias.

Additionally burdening the euro emerges the now milder tone from ECB's rate setters, after VP L. De Guindos contended before in the session that the bank has proactively done the vast majority of the tightening cycle, while his colleague A. Müller discarded the idea of interest rate cuts as soon as early in 2024.

No data releases in the euro docket leaves the attention to the US data space, where Initial Jobless Claims rose by 242K in the week to May 13 and the Philly Fed Manufacturing index improved to -10.4 in May. In addition, Existing Home Sales dropped 3.4% MoM in April (4.28M units) and the CB Leading Index contracted 0.6% MoM in April.

What to look for around EUR

EUR/USD extends the weekly decline and breaks below the key 1.0800 neighbourhood to print new multi-week lows around 1.0780 on Thursday.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle in June and July (September?). Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.52% at 1.0782 and faces immediate contention at 1.0775 (monthly low May 18) seconded by 1.0712 (low March 24) and finally 1.0516 (monthly low March 15). On the flip side, the breakout of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

Federal Reserve Governor Philip Jefferson said on Thursday that inflation remains too high. A the same time, he mentioned the lagged effects of monetary policy.

Key takeaways from the speech:

“Despite heightened uncertainty, due to banking-sector stress, geopolitical instability, and the aftermath of the pandemic, I expect the economy to grow in the second quarter. The pace of growth, however, will be slower than what we observed in the first quarter, when real GDP increased at an annual rate of 1.1 percent.”

“I acknowledge that there are downside risks, among them the possibility that the degree of bank lending restraint and uncertainty could weigh on economic activity more than I expect.”

“My expectation is that the slowing economy will soon begin to reduce job growth, with labor supply and labor demand coming into better balance.”

it is hard to tell how much of this tightening was in train already, after continued increases in interest rates, and it is likewise difficult to say how much the stress in midsized banks will ultimately curtail credit in the coming year.”

“So what factors will I consider in the coming weeks as I contemplate the appropriate stance of monetary policy going forward? Over the next few weeks, we will receive a considerable amount of data on economic activity for April and May, including the employment report for May and a report on May CPI inflation.”

“On the one hand, inflation is too high, and we have not yet made sufficient progress on reducing it. On the other hand, GDP has slowed considerably this year, and even though the effect has been muted in the labor market so far, demand clearly has begun to feel the effects of interest rates that are 5 percentage points higher than they were a little over a year ago.”

“History shows that monetary policy works with long and variable lags, and that a year is not a long enough period for demand to feel the full effect of higher interest rates.”

Market reaction

The US Dollar is rising across the board boosted by Fed’s Logan comments and US data. The DXY is up by 0.55%, trading near 103.50, at the highest level since mid-March.

- GBP/USD dives to over a three-week low and is pressured by strong follow-through USD buying.

- The technical setup favours bearish traders and supports prospects for a further near-term fall.

- A move above the ascending channel support breakpoint is needed to negate the bearish bias.

The GBP/USD pair comes under intense selling pressure on Thursday and drops to over a three-week low, around the 1.2415-1.2410 region during the early North American session.

A combination of supporting factors pushes the US Dollar (USD) to a nearly two-month high, which, in turn, is seen exerting heavy downward pressure on the GBP/USD pair. Against the backdrop of expectations that the Federal Reserve (Fed) will keep interest rates higher for longer, the latest optimism over the US debt ceiling remains supportive of elevated US Treasury bond yields. This, along with a softer tone around the equity markets, lends additional support to the safe-haven Greenback.

From a technical perspective, the emergence of fresh selling around the GBP/USD pair on Thursday reaffirms the recent break through the lower end of over a one-month-old ascending trend channel. Moreover, oscillators on the daily chart have started drifting in the bearish territory and add credence to the negative outlook. That said, it will be prudent to wait for some follow-through weakness below the 1.2400 mark, or the 50-day Simple Moving Average (SMA), before placing fresh bearish bets.

The GBP/USD pair might then accelerate the downfall towards the next relevant support near the 1.2375-1.2370 region before eventually dropping to the 1.2300 mark. A convincing break below the latter will set the stage for an extension of the recent sharp retracement slide from over a one-year high, around the 1.2680 region touched earlier this month.

On the flip side, any meaningful recovery attempt might now attract fresh sellers ahead of the 1.2500 psychological mark and remain capped near the 1.2530 support-turned-resistance. That said, a sustained strength beyond could trigger a fresh bout of a short-covering and allow the GBP/USD pair to reclaim the 1.2600 round figure. The momentum could get extended further towards the 1.2625-1.2630 intermediate hurdle, above which bulls might aim to retest the YTD peak, around the 1.2680 area.

GBP/USD daily chart

Key levels to watch

- Gold price remains under heavy selling pressure on Thursday and drops to its lowest level since April.

- The USD jumps to a nearly two-month top and turns out to be a key factor weighing on the XAU/USD.

- The optimism over the US debt ceiling contributes to driving flows away from the safe-haven metal.

Gold price continues drifting lower for the third successive day on Thursday - also marking the sixth day of a negative move in the previous seven - and dives to its highest level since April 03 during the early North American session. The XAU/USD is currently placed around the $1,960-$1,961 region, down over 1% for the day, and seems poised to prolong its recent sharp retracement slide from the all-time high touched earlier this month.

A combination of supporting factors pushes the US Dollar (USD) to a nearly two-month high, which, in turn, is seen weighing heavily on the Gold price. Against the backdrop of the recent hawkish signals from several Federal Reserve (Fed) officials, the optimism over the potential lifting of the US debt ceiling remains supportive of the elevated US Treasury bond yields and acts as a tailwind for the Greenback. The intraday USD buying picks up pace following the release of the mostly upbeat US macro data, which showed that Initial Jobless Claims fell to 242K last week and the Philly Fed Manufacturing Index improved to -10.4 in May from -31.3 previous.