- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-12-2012

The yen fell against the dollar to the lowest level since September 2010 as Japan’s Prime Minister Shinzo Abe said he would push for “bold monetary easing.”

Abe said in a speech in Tokyo today he would carry out a flexible fiscal policy. Taro Aso was named finance chief today. During his 12 months as prime minister through September 2009, the one-time Olympian compiled three extra budgets worth about 20 trillion yen, abandoned a target to balance the budget by March 2012 and distributed a 12,000 yen-per-person cash handout.

The Japanese currency slid versus all its major peers as minutes of the Bank of Japan’s November meeting showed that a board member suggested conducting open-ended asset purchases.

An unnamed BOJ board member said that an option would be to “clearly present” in a policy statement that the central bank would continue monetary easing, including asset purchases, “without setting any time frame” until 1 percent inflation is achieved, the minutes showed. The BOJ’s 76 trillion-yen ($890 billion) program that buys securities ranging from government bonds to stock funds will expire at the end of next year.

The Dollar Index fell as investors waited for U.S. Congress and President Barack Obama to resume talks on averting the so-called fiscal cliff.

Obama plans to leave his Hawaii vacation today and return to Washington, a White House aide said on condition of anonymity. Congress will resume negotiations tomorrow about more than $600 billion in tax increases and spending cuts due to take effect next month.

Markets in Canada, Australia and the U.K. were shut for a holiday.

Commodity currencies after the resumption of trading initially strengthened, and then found themselves under pressure to the USD, helped by falling stock markets and low trading volumes. Investors are also awaiting signs of progress in the negotiations on the "fiscal cliff" in the United States.

AUD/USD updated daily high at 1.0384, but then updated the 5-week low at 1.0344 and is now kept at 1.0360, only slightly below the opening level.

The Canadian dollar also weakened - USD / CAD from a low of 0.9915 jumped to a 3-day high at 0.9951 (0.3% intraday).

NZD / USD fell back to 5-week low at 0.8155, helped by decline in risk appetite.

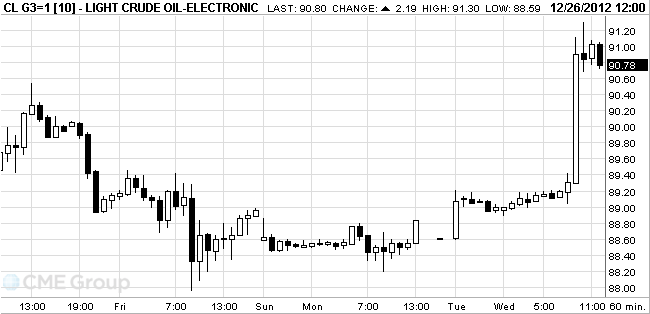

Oil advanced to a two-month high in New York and the dollar slipped against the euro as President Barack Obama plans to leave for Washington to resume talks to avert spending cuts and tax gains that threaten the economy.

Crude rose as much as 3 percent and the dollar approached an eight-month low against the euro before lawmakers return to discuss ways to avoid more than $600 billion in automatic measures that will take effect Jan. 1. Gains accelerated after United Arab Emirates’ security forces arrested members of a cell that was planning to carry out terrorist attacks.

Obama plans to leave for Washington today from his Christmas vacation in Hawaii, while his family will stay behind, the White House said yesterday. Lawmakers plan to return tomorrow, the same day Obama will arrive in Washington.

UAE officials said members of the group had obtained equipment and materials to carry out their attacks, according to WAM, the country’s official news agency. Saudi Arabia assisted in uncovering the terrorist cell, WAM said.

Crude oil for February delivery climbed to $91.30 a barrel, the highest level in two months on the New York Mercantile Exchange.

Brent oil for February settlement rose $1.75, or 1.6 percent, to $110.55 a barrel on the London-based ICE Futures Europe. The number of contracts trading was 73 percent lower than the 100-day average. The European benchmark crude was at a premium of $19.67 to WTI, down from $20.19 on Dec. 24.

Gold prices show an increase on light volume amid uncertainty of investors in the ability of American politicians to prevent the financial crisis.

U.S. President Barack Obama is likely to interrupt vacation in Hawaii and returning to Washington on Wednesday night to continue negotiations with the Congress of the "fiscal cliff." Although gold is usually more expensive in times of economic uncertainty, in recent times, it behaves more like a risky asset and can grow in value, if the problem is "budget break" will be solved.

Gold has had a reduction in support for the U.S. dollar, after it became known that in October, the price of housing in the country decreased slightly, but registered a significant increase in the annual ratio.

The composite index of home prices in 20 cities in the U.S. S & P / Case-Shiller registered in October, a decline of 0.1% after a 0.2% gain in September. In annual terms prices rose by 4.3%, which was the highest result since May 2010, beating forecast 4.0%.

In addition, in December, the index of manufacturing activity fell from the Federal Reserve Bank of Richmond the previous month 9 to mark 5, confounding forecasts of growth in 12. Employment component dropped to -3 against three in November, and the new orders index eased from +11 to +10.

On the physical market, dealers say interest from jewelers in South-East Asia.

February futures price of gold on COMEX today rose to 1668.70 dollars per ounce.

U.S. stock-index futures advanced as President Barack Obama and Congress prepared to resume budget discussions and amid expectations Japan’s new government will act to bolster the economy.

Global Stocks:

Nikkei 10,230.36+150.24 +1.49%

Shanghai Composite 2,219.13+5.52 +0.25%

Crude oil $89.32 +0.80%

Gold $1662.30 +0.17%

Data

00:00 Switzerland Bank holiday

00:00 Eurozone Bank holiday

00:00 United Kingdom Bank holiday

00:00 Canada Bank holiday

In today's trading the Japanese currency weakened to the level of Y85 to the dollar, which was the first time since April 2011. This sharp decline was due to the news that Abe was confirmed as prime minister of Japan, and amid speculation that he will ask the central bank to increase the cash infusion into the economy.

Meanwhile, the yen fell against all major currencies, as the report of the Bank of Japan showed that a member of the Board of Directors proposed a public asset purchases.

Traders note that the currency collapse is also accelerated, after she overcame Level 85 yen per dollar, prompting with stop-loss orders.

In addition, the pressure on the currency was that the leader of the Liberal Democratic Party of Japan and its coalition partner - the head of the party "Komeito" Natsu Yamaguchi - yesterday agreed on a target for inflation of 2%. In addition, they decided to major in terms of stimulus package designed to support the growth of the Japanese economy and defeat deflation. Reviewing the legislation, according to the central bank of the country you are working, do not get up, but it can be discussed if the need arises.

Note that the yen has fallen this year by 13%, showing the biggest drop among the 10 major currencies. The second worst performance showed the dollar, which lost 2.8%.

EUR/USD: during the European session, the pair fell to $ 1.3185

GBP/USD: during the European session the pair fell $ 1.6123

USD/JPY: during the European session is around Y85.26-Y85.44

At 14:00 GMT the U.S. will index of housing prices in 20 major cities and nationwide composite price index S & P / CaseShiller for October, and 15:00 GMT Fed's manufacturing index for December of Richmond.

EUR/USD

Offers $1.3295/310, $1.3250/55, $1.3230/35, $1.3200

Bids $1.3125/15, $1.3100

AUD/USD

Offers $1.0530/35, $1.0510, $1.0500, $1.0480, $1.0450/55

Bids $1.0350, $1.0340

USD/JPY

Offers Y85.90, Y85.80, Y85.50, Y85.40

Bids Y83.80, Y83.50, Y83.40

EUR/JPY

Offers Y113.00, Y112.50, Y112.40

Bids Y111.80, Y111.60, Y111.50, Y111.20

Asian stocks rose, with the regional benchmark index trading less than 1 percent from its highest close for the year, as the yen dropped and Shinzo Abe was approved as Japan’s prime minister after promising to promote more stimulus measures.

Nikkei 225 10,230.36 +150.24 +1.49%

S&P/ASX 200 Closed

Shanghai Composite 2,219.13 +5.52 +0.25%

Nissan Motor Co. , a carmaker that derives almost 80 percent of sales overseas, gained 2.1 percent in Tokyo.

Hitachi Ltd. rose 2.1 percent after its president said the company plans to double its operating margin.

Tradewinds (Malaysia) Bhd., a palm oil and rice producer, jumped 15 percent in Kuala Lumpur after receiving a takeover offer.00:00 Switzerland Bank holiday-

00:00 Eurozone Bank holiday-

00:00 United Kingdom Bank holiday-

00:00 Canada Bank holiday-

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/yOctober +3.0%+3.9%

15:00 U.S. Richmond Fed Manufacturing IndexDecember 912© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.