- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-12-2012

The dollar index touched a two-week high, while the bidders follow the last-ditch attempt to prevent U.S. lawmakers' fiscal cliff. "

The dollar index ICE, tracks the greenback against a basket of six other major currencies, rose to 79.680 against 79.622 in late everoamerikanskoy Thursday session.

The dollar began to show growth due to the fact that investors think about is whether the U.S. government to reach an agreement on the prevention of automatic tax increases and spending cuts to the tune of several billion dollars. Legislators have only a few days to complete the negotiations.

U.S. President Barack Obama has asked congressional leaders to come to the White House on Friday for talks with a view to reaching agreement on the prevention of tax increases and spending cuts next year.

The euro fell against most of its 16 major counterparts after data showed that producer prices in Italy in November decreased by 0.1% compared with October, the decline has been observed for the third consecutive month. At the same time, the data on GDP growth in France in the 3rd quarter were revised by the National Bureau of Statistics on Friday to 0.1% from 0.2% previously announced due to reduction in investment.

Japanese Yen recovered against the U.S. dollar and the euro in low trading volume on Friday after Japanese Finance Minister Taro Aso said that Japan is not seeking a sharp decline in its national currency.

According to Aso, the U.S. government should work hard to achieve a strengthening of the dollar, while Japan is not seeking "a radical weakening of the yen." Such statements helped the yen to recover some lost ground against the dollar and the euro during the European session.

Earlier, the Japanese currency reached a 28-month low against the dollar and a 17-month low against the euro. The Japanese currency fell against major currencies after data earlier on Friday who reported that industrial production in Japan in November decreased by 1.7% compared to the previous month. This report was worse than expected. Meanwhile, data on consumer prices indicated that the country is still suffering from deflation.

European stocks fell in the year’s last full week of trading, snapping a five-week rally, as the deadline neared for a U.S. lawmakers to agree a deal to halt $600 billion of automatic tax increases and spending cuts.

President Barack Obama is due to meet at 3 p.m. in Washington with House Speaker John Boehner and Senate Minority Leader Mitch McConnell, who are Republicans, along with Senate Majority Leader Harry Reid and House Minority Leader Nancy Pelosi, both Democrats. The president had been negotiating one- on-one with Boehner.

Obama returned early from his holiday in Hawaii yesterday as lawmakers disputed which party would be responsible for missing the deadline for a debt deal, a failure that could hurt the U.S. credit rating and cause an economic recession.

Confidence among U.S. consumers declined more than forecast in December as the budget debate soured Americans’ outlook for the economy. The Conference Board’s sentiment index fell to 65.1 from a revised 71.5 reading the prior month, figures from the New York-based private research group showed.

National benchmark indexes retreated in 16 of western Europe’s 18 markets this week. France’s CAC 40 dropped 1.1 percent and the U.K.’s FTSE 100 Index declined 0.3 percent. Germany’s DAX also slipped 0.3 percent, paring this year’s rally to 29 percent.

Bankia tumbled 40 percent for the biggest drop on the Stoxx 600 this week. Spain said the lender has a negative value of 4.15 billion euros in an exercise to determine how much of the rescued lender remains in shareholders’ hands. The stock will be excluded from the benchmark IBEX 35 as of Jan. 2.

Bankia group, including its parent, Banco Financiero y de Ahorros, is set to receive 18 billion euros of European funds, making it the largest recipient of the country’s bank bailout.

Banco Popular Espanol, Spain’s sixth-biggest bank, declined 7.3 percent.

Clariant (CLN) rose 4.3 percent after selling units for 502 million Swiss francs ($550 million). The specialty-chemicals maker said it will get about 460 million francs in cash for selling the textile chemicals, paper specialties and emulsions businesses to SK Capital Partners, a U.S. buyout company.

Porsche advanced 7.2 percent. The maker of the 911 sports car won an appeals court ruling in New York state dismissing a lawsuit by hedge funds that accused the German carmaker of concealing a plan to corner the market in Volkswagen AG shares.

Atari SA retreated 6.4 percent after the video-game maker said it sees a “significant” fiscal-year loss. Atari also forecast a second-half operating loss exceeding its deficit in the first half and said it’s looking at all additional means of raising or preserving cash.Crude fell for a second day after a government report showed gasoline supplies climbed to a nine- month high as demand weakened.

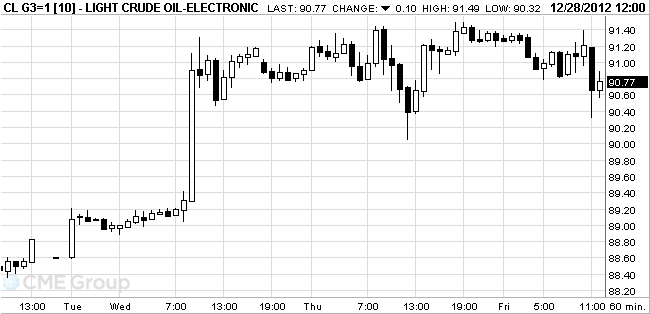

Prices dropped as much as 0.6 percent as the Energy Department said gasoline stockpiles rose to 223.1 million last week and inventories of heating oil and diesel also increased. President Barack Obama summoned congressional leaders to a meeting three days before a year-end deadline to avoid $600 billion in spending cuts and tax increases, collectively known as the fiscal cliff.

West Texas Intermediate oil for February delivery fell to $90.32 a barrel on the New York Mercantile Exchange. Prices have gained 2.2 percent this week. Oil traded at $91.24 a barrel before the release of the report at 11 a.m. in Washington, two days later than usual because of the Christmas holiday.

Brent oil for February settlement slid 66 cents, or 0.6 percent, to $110.14 a barrel on the London-based ICE Futures Europe. The number of contracts trading was 45 percent lower than the 100-day average. The European benchmark crude was at a premium of $19.53 to WTI.

The price of gold is reduced for the first time in a week amid headlines that President Obama is reported to offer a reduced budget package when he meets with congressional leaders on Friday night.

President Barack Obama and Vice President Joe Biden on Friday to meet with congressional leaders from both parties to resume negotiations on the "budget cliff", and the House of Representatives will meet on Sunday to make a final attempt to solve the financial problem.

If politicians fail to agree, gold will go up as a low-risk assets, but since many investors buy gold as well as stock prices can go up and in the case of an agreement following the stock prices.

Since the budget issue is now the focus, better statistics on the industry and the housing market have had little support to the market. So, today it became known that the U.S. industry has gained pace in December, and the index of pending home sales rose in November by 1.7% to 106.4 points, exceeding economists' forecasts.

Over the year, prices will rise the 12th year in a row due to the extremely low interest rates, concerns over the financial stability of the eurozone and purchases of gold by central banks. In 2013, global demand for gold will rise by China and India, which will contribute to further price increases, according to the World Gold Council.

Premium for gold bullion held in Singapore at $ 1,00-1,20 per ounce to spot prices in London.

February futures price of gold on the COMEX fell today to 1654.20 dollars per ounce.

U.S. stock futures fell amid concern talks between President Barack Obama and Republican lawmakers may not yield a budget deal by the year-end deadline.

Global Stocks

Nikkei 10,395.18+72.20 +0.70%

Hang Seng 22,666.59+46.81 +0.21%

Shanghai Composite 2,233.25+27.35 +1.24%

FTSE 5,923.01-31.29 -0.53%

CAC 3,639.12-35.14 -0.96%

Crude oil $91.06 +0.21%

Gold $1662.60 -0.07%

EUR/USD $1.3200, $1.3285, $1.3300

USD/JPY Y85.50

EUR/DKK Dkk7.4500

AUD/USD $1.0320, $1.0350, $1.0400Data

01:30 Japan Labor Cash Earnings, YoY November +0.2% -0.4% -1.1%

07:45 France Consumer spending November -0.2% 0.0% +0.2%

07:45 France Consumer spending, y/y November -0.5% -0.6% -0.2%

07:45 France GDP, q/q(finally)Quarter III +0.2% +0.2% +0.1%

07:45 France GDP, Y/Y(finally)Quarter III +0.2% +0.1% 0.0%

In today's trading the dollar has appreciated sharply against the euro, while showing the greatest growth this week, driven by speculation that U.S. lawmakers will not be able to avoid the so-called "financial cliff", which is reflected in higher taxes and spending cuts more than $ 600 billion

Meanwhile, the dollar index (DXY) rose to two-week high, as many market participants are waiting for a meeting of U.S. President Barack and the leaders of the Democratic and Republican parties, to be held today, and the purpose of which will be to address the situation.

The euro fell against all but two of the 16 major currencies, after the yield on Italian bonds maturing in November 2022 rose to the level of 4.48%, compared to 4.45% at the previous auction, while on bonds maturing in November 2017 rose to 3.26% from 3.23%. Well as the pressure on the currency has a report that showed that the French economy grew less than previously estimated.

The yen weakened to a 28-month low against the dollar after data showed that Japanese consumer prices and industrial production fell more than expected. At the same time, economists note that the weak economic reports increase the likelihood of increased stimulus measures by the central bank of the country.

Also today, JPMorgan Chase & Co. downgraded its forecast for the yen, saying the currency will fall to Y90 to the dollar in the second quarter of next year amid deteriorating trade surplus of Japan. Earlier, it was reported the fall of the yen to the level of Y83.

EUR / USD: during the European session, the pair fell to $ 1.3167, and is now trading at $ 1.3187

GBP / USD: during the European session the pair fell to $ 1.6076, but then recovered, setting all new session high.

USD / JPY: during the European session the pair fell to Y85.95, then increased and is now at around Y86.10

At 14:45 GMT the U.S. will index of business activity in the manufacturing sector according to the Chicago Association of Managers for December. At 15:00 GMT the United States will be published on the number of pending home sales for November. At 16:00 GMT the United States will report on oil reserves according to the Ministry of Energy.

EUR/USD

Offers $1.3295/310, $1.3280/85, $1.3195/205

Bids $1.3160/50, $1.3125/15, $1.3100, $1.3085/80, $1.3070/60

GBP/USD

Offers $1.6285/300, $1.6260, $1.6225/35, $1.6200/10, $1.6170/80, $1.6150/55, $1.6130/35

Bids $1.6085/75, $1.6050, $1.6010/00

AUD/USD

Offers $1.0510, $1.0500, $1.0480, $1.0450/55, $1.0420/30, $1.0400

Bids $1.0335/30, $1.0310/00, $1.0240/30

EUR/JPY

Offers Y115.50/60, Y115.10/15, Y115.00, Y114.80/85, Y114.15/20

Bids Y113.10/00, Y112.70/50, Y112.00, Y111.60/50

USD/JPY

Offers Y87.50, Y87.20/25, Y86.85/7.00, Y86.64

Bids Y85.60/50, Y85.30, Y85.10/00, Y84.85/80

EUR/GBP

Offers stg0.8280, stg0.8245/50, stg0.8200/05

Bids stg0.8185/80, stg0.8170/65, stg0.8150, stg0.8125/20, stg0.8115/10The decrease observed in the indices of stock markets in Europe against the background of the U.S., where the issue remains unresolved threat "fiscal cliff."

The leader of the Democratic majority in the Senate, Harry Reid, said that the prospect of an agreement between Democrats and Republicans is becoming dimmer.

This means that from 1 January in the U.S. at the same time may increase taxes for all Americans and reduce the social costs.

Speaking in the Senate, Harry Reid said that the time to reach an agreement by Monday, Dec. 31, remains. Senators and President Obama returned to Washington, while members of the House of Representatives continue to recess.

Experts say that if the "fiscal cliff" happens, the U.S. economy faces a recession.

It also remains unclear fate Kipra.Na last week the international rating agency Standard & Poor's downgraded the sovereign rating of Cyprus from "B" to "CCC +" and short-term rating - with a "B" to "C" the European Union is a difficult situation: save or not to save Cyprus from financial ruin. This is stated in an article published in the newspaper Corriere della Sera. Germany initially claimed that the aid will go to Cyprus by the end of the year. But now the silence around Cyprus. And not because they forgot about it. Unexpected delay in care due to the fact that the report of the German military intelligence BND said that the island packed with Russian oligarchs and their money of dubious origin ", - stated in the article.

FTSE 100 5,951.31 -2.99 -0.05%

DAX 7,633.47 -22.41 -0.29%

CAC 3,646.42 -23.88 -0.77%

Spanish paper Bankia fallen by 25% - to the lowest since the IPO in July 2011, 41.3 cents on news that the troubled bank stocks will be excluded from the index IBEX 35 as of 2 January.

Atari capitalization decreased by 4.2% after a video game developer said that he could get a "significant" loss for the current financial year.

EUR/USD $1.3200, $1.3285, $1.3300

USD/JPY Y85.50

EUR/DKK Dkk7.4500

AUD/USD $1.0320, $1.0350, $1.0400

Asian stocks rose, with Japanese shares posting their biggest annual advance since 2005, after a report that the country’s consumer prices fell fanned speculation the central bank will respond to government calls for more asset purchases.

Nikkei 225 10,395.18 +72.20 +0.70%

S&P/ASX 200 4,671.3 +23.34 +0.50%

Shanghai Composite 2,233.25 +27.35 +1.24%

Canon Inc., the world’s biggest camera maker, increased 2.1 percent, leading gains among Japanese exporters.

Toshiba Corp. climbed 5 percent after the manufacturer said it’s in talks to sell a stake in its Westinghouse Electric atomic-power unit.

BHP Billiton Ltd., Australia’s largest oil producer, advanced 1.1 percent after crude and metal prices rose.

Yesterday the dollar erased losses against the euro after Senate Majority Leader Harry Reid said the U.S. may fall off the so-called fiscal cliff of tax increases and spending cuts that may tip the nation into recession. Reid said a resolution to the U.S. budget dispute before Jan. 1 appears unlikely because Republicans won’t cooperate.

President Barack Obama and U.S. Congress return to Washington to resume negotiations over the fiscal cliff of more than $600 billion in automatic tax increases and spending cuts set to take effect next month. Treasury Secretary Timothy F. Geithner said there’s “significant uncertainty” around tax and spending policies, according to a letter sent to congressional leaders.

The 17-nation euro climbed to an almost eight-month high earlier today after French consumer confidence unexpectedly improved and Italian business sentiment increased.

An index of French household sentiment rose to 86 in December from 84 in November, the first monthly increase since May, the national statistics office Insee said. Economists forecast an unchanged reading of 84. A gauge of Italian business climbed to 88.9 from 88.5, according to Rome-based national statistics institute Istat.

The yen reached a 28-month low against the dollar as John Taylor, founder and chairman of New York-based currency hedge fund FX Concepts LLC, said Japan’s currency may weaken to 90 per dollar for the first time since June 2010. The yen slumped after Prime Minister Shinzo Abe was approved as prime minister yesterday by parliament. His Liberal Democratic party won a landslide victory in lower house elections on Dec. 16, pledging to weaken the currency.

Asian stocks rose, with the regional benchmark index headed for a second month of advance, as the yen touched a 27-month low on prospects for more stimulus and China’s industrial companies’ profit gained.

Nikkei 225 10,322.98 +92.62 +0.91%

S&P/ASX 200 4,647.96 +12.77 +0.28%

Shanghai Composite 2,205.9 -13.23 -0.60%

Mazda Motor Corp., an automaker that gets 28 percent of its sales in North America, advanced 7.1 percent in Tokyo as newly installed premier said “bold’ monetary policy is one of the three pillars of his economic measures.

Guangzhou R&F Properties Ltd., a builder in the southern Chinese city, rose 0.8 percent in Hong Kong, whose equity market reopened after a two-day holiday.

SK Telecom Co., the mobile telephone carrier among 119 companies trading without rights to year-end dividends on South Korea’s benchmark index, dropped 4.1 percent.

European stocks were little changed as U.S. jobless-benefit claims dropped and home sales climbed to a two-year high, offsetting Senate Majority Leader Harry Reid’s comments that a budget deal is unlikely.

President Barack Obama is pressing for U.S. lawmakers to craft an interim deal to avert more than $600 billion in tax increases and spending cuts, known as the fiscal cliff. Republican House leaders hold a conference call with their rank- and-file members today to discuss the path forward, according to a leadership aide who asked for anonymity.

A Labor Department report showed fewer Americans than forecast filed claims for unemployment insurance last week. Applications for jobless benefits decreased by 12,000 to 350,000 in the week ended Dec. 22. Economists forecast 360,000.

National benchmark indexes climbed in 13 of the 18 western European markets. France’s CAC 40 (CAC) rallied 0.6 percent, Germany’s DAX advanced 0.3 percent and the U.K.’s benchmark FTSE 100 was little changed.

Clariant rose 3 percent to 12.20 Swiss francs after selling units for 502 million francs ($550 million). The specialty chemicals maker said it will get approximately 460 million francs in cash for selling the textile chemicals, paper specialties and emulsions businesses to SK Capital Partners, a U.S. buyout company.

Bayerische Motoren Werke AG (BMW) gained 1.1 percent to 73.46 euros. Chief Financial Officer Friedrich Eichiner said he is confident the carmaker has surpassed its 2011 profit total, according to a report by Die Welt.

A gauge of mining shares on the Stoxx 600 advanced 0.7 percent. Rio Tinto Group and BHP Billiton Ltd. (BHP) rose 0.9 percent to 3,541.5 pence and 0.8 percent to 2,156.5 pence, respectively.

After the session, the major U.S. stock indexes began to decline under the pressure of the lack of progress in addressing the "fiscal cliff" and confounding expectations of macroeconomic data. But by the end of trading were able to recover their losses after House Speaker John Boehner said lawmakers will meet for talks on December 30.

Today to resume talks on the "fiscal cliff," but their start was not very successful: Majority Leader Harry Reid in the Congress, in particular, commented on the issue of "fiscal cliff" as follows - "it seems to be something that we're going."

Timothy Geithner also said yesterday that on 31 December the U.S. debt ceiling to reach, and he will have to take "extraordinary measures" to prevent default two months.

In addition, the index had a drop in consumer confidence in December - had dropped more than expected to 65.1 from 73.7 points. The rest statistics show evidence of: the number of initial claims for unemployment benefits fell to 350 thousand at an average 360 thousand expectations, new home sales rose in November by 4.4% to 0.377 million, and the index of business activity in the industry Chicago Fed, which tracks the industry dynamics in the Midwest rose to 93.7 points from 92.1 points.

Most of the components of the index DOW dropped in price (24 of 30). Lost more than 1% shares Alcoa (AA, -1.26%) and Cisco Systems (CSCO, -1.36%).

Most sectors of the S & P is below the zero mark. Maximum losses in the sectors of Public Utilities (-0.3%) and conglomerates (-0.3%).

American developer of microchips Marvell Technology Group lost 3.5% of value of shares on news that the court found the company guilty of violating two patents owned by Carnegie Mellon University. It is also reported that the Marvell Technology Group would have to pay a fine of $ 1.17 billion

Quotes solar manufacturer Hanwha SolarOne soared by 7.4%, after it became aware of the opening of a credit line in the amount of about $ 475 million Bank of Bank of Beijing.

Shares of weapons of Smith & Wesson Holding rose 3.8% on reports of plans to repurchase shares for $ 15 million

At the close:

Dow 13,096.31 -18.28 -0.14%

Nasdaq 2,985.91 -4.25 -0.14%

S & P 500 1,418.10 -1.73 -0.12%01:30Japan Labor Cash Earnings, YoYNovember +0.2%-0.4%-1.1%

The yen sank to a 28-month low as data showing a decline in Japanese consumer prices fanned speculation the central bank will heed government calls to step up cash infusions to end deflation. Finance Minister Taro Aso said today that he agreed with BOJ Governor Masaaki Shirakawa to strengthen cooperation between the government and the central bank. BOJ policy makers next meet Jan. 21-22.

JPMorgan Chase & Co. and Nomura Holdings Inc. cut forecasts for the Japanese currency citing stimulus plans from newly installed Prime Minister Shinzo Abe’s plan. JPMorgan revised its yen projections today, saying the currency will fall to 90 against the dollar in the second quarter next year as Japan’s trade surplus worsens and overseas investors factor in changes under Abe’s administration. Its previous estimate was 83.

U.S. President Barack Obama plans to meet Democratic and Republican congressional leaders today as a year-end budget deadline approaches. U.S. House Republican leaders announced that the chamber will meet on Dec. 30 -- the first Sunday session in more than two years. Lawmakers are seeking to resolve their impasse over spending cuts and tax increases worth more than $600 billion, known as the fiscal cliff, that take effect next month.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3225-55.

GBP / USD: during the Asian session, the pair rose to $ 1.6125.

USD / JPY: during the Asian session, the pair rose to Y86.65.

US data starts at 1300GMT with the November Building Permits Revision. At 1445GMT, the MNI Chicago Report's business barometer is forecast to rise slightly to 51.0 in December after rising above 50 in November. US data continues at 1500GMT with NAR Pending Home Sales, followed at 1530GMT by the weekly EIA Natural Gas Storage and at 1600GMT by the weekly EIA Crude Oil Stocks data.

Change % Change Last

Oil$91.03+0.16+0.18%

Gold$1,664.60+0.90+0.05%Change % Change Last

Nikkei 225 10,230.36 +150.24 +1.49%

S&P/ASX 200 Closed

Shanghai Composite 2,219.13 +5.52 +0.25%

FTSE 100 5,954.3+0.12 0.00%

CAC 403,674.26+21.65 +0.59%

DAX 7,655.88+19.65 +0.26%

Dow13,096.31-18.28-0.14%

Nasdaq2,985.91-4.25-0.14%

S&P 5001,418.10-1.73-0.12%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD$1,3231 +0,07%

GBP/USD $1,6098 -0,24%

USD/CHF Chf0,9131 0,00%

USD/JPY Y86,09 +0,56%

EUR/JPY Y113,97 +0,68%

GBP/JPY Y138,60 +0,34%

AUD/USD $1,0377 +0,03%

NZD/USD $0,8206 +0,15%

USD/CAD C$0,995 +0,09%

01:30Japan Labor Cash Earnings, YoYNovember +0.2%-0.4%-1.1%

07:00United Kingdom Nationwide house price indexDecember 0.0%+0.1%

07:00United Kingdom Nationwide house price index, y/yDecember -1.2%

07:45France Consumer spendingNovember -0.2%0.0%

07:45France Consumer spending, y/yNovember -0.5%-0.6%

07:45France GDP, q/q(finally)Quarter III +0.2%+0.2%

07:45France GDP, Y/Y(finally)Quarter III +0.2%+0.1%

14:45U.S. Chicago Purchasing Managers' IndexDecember 50.451.2

15:00U.S. Pending Home Sales (MoM)November +5.2%-0.3%

16:00U.S. Crude Oil Inventories- -1.0© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.