- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-10-2012

The euro reached the lowest level in almost three weeks amid a growing divide over Europe’s new bailout strategy and data that showed the region’s three-year- old crisis is weighing on its economy.

Retail sales in Spain dropped 11 percent in September from a year ago, a report showed, and the nation’s central bank set up a so-called bad bank.

The dollar remained stronger versus the euro even after consumer spending in the U.S. climbed more than forecast in September as incomes grew. Household purchases, which account for about 70 percent of the economy, rose 0.8 percent, the most since February, after a 0.5 percent gain the prior month, a Commerce Department report showed today in Washington.

The euro reached its low of the day versus the dollar after the Bank of Spain’s deputy governor, Fernando Restoy, set out plans for establishing a so-called bad bank, ordered by the European Union as a condition of the rescue.

The dollar and yen strengthened amid increased demand for refuge. The U.S. securities industry canceled equity trading on all markets today as Hurricane Sandy headed toward the New York City area.

The euro touched a two-week low against the yen after German Finance Minister Wolfgang Schaeuble rejected another debt restructuring for Greece.

The 17-member common currency slid against the dollar and yen today after Schaeuble, speaking in an interview with German radio Deutschlandfunk broadcast yesterday, said it would be “a bit unrealistic” to impose more losses on private bondholders. German Chancellor Angela Merkel’s government is willing to consider a European Central Bank proposal for a buyback of Greek debt, Steffen Seibert, Merkel’s chief spokesman, said today.

Gains in the yen were limited before Bank of Japan policy makers meet tomorrow after holding off from easing policy on Oct. 5. BOJ board members are facing political pressure to ease policy as data last week showed consumer prices fell for a fifth-straight month, making the central bank’s 1 percent inflation goal elusive. All but one of 27 economists surveyed by Bloomberg expect officials to increase stimulus tomorrow.

The pound weakened against the dollar after a report showed that house prices in England and Wales fell in October, noting the fourth consecutive decline. It is learned that house prices fell by 0.1% in September and 0.4% from a year earlier. At the same time, other data showed that the number of mortgage approvals rose to 50,000 last month from 47,700 in August, but it has not helped the currency recover their lost ground.

European stocks dropped, snapping a three-day advance, as Hurricane Sandy headed toward New York City, prompting the U.S. to suspend equity trading on all markets today.

Italian Prime Minister Mario Monti and his Spanish counterpart Mariano Rajoy meet in Madrid today, less than a week after Monti signaled that he would like Spain to ask for a full sovereign bailout from the European Union.

Greece’s political leaders continued to seek agreement on the labor reforms and structural changes needed to qualify for more aid under the country’s international bailout.

National benchmark indexes fell in 13 of the 18 western- European markets. The U.K.’s FTSE 100 slipped 0.2 percent and France’s CAC 40 lost 0.8 percent. Germany’s DAX slid 0.4 percent, while Greece’s ASE tumbled 6.3 percent.

BT retreated 1.5 percent to 213.9 pence after the person, who asked not to be identified, said that European corporate customers have cut back on its services. The U.K.’s largest fixed-line phone company had said that underlying revenue growth would improve in the fiscal years ending March 2013 and 2014. BT is scheduled to release earnings on Nov. 1.

ThyssenKrupp AG dropped 3.7 percent to 17.19 euros. Germany’s biggest steelmaker asked companies to resubmit offers for its unprofitable Americas unit after deciding the original bids were too low, people familiar with the matter said.

UBS jumped 7.3 percent to 13.12 francs. The lender intends to shrink its fixed-income operations, reducing risk-weighted assets by an additional 100 billion francs ($107 billion), said a person with knowledge of the matter who requested anonymity because the plans are private.

Gold futures down due to concerns about Greece and the lack of guidance on when Spain is planning to apply for financial aid.

Greece's international lenders refused further concessions to amend the labor law, proposed by one of the Greek coalition, while on the verge of bankruptcy the country needs the next tranche of loans, not to be left out of money in mid-November.

Spain's economy again caused concern after data showed that retail sales in Spain in September fell at a record pace. Sales fell by 10.9% compared to the same period of the previous year against the annual reduction of 2% in August. The September decline was the largest since the start keeping statistics in 2004.

The index of U.S. personal spending rose by 1.7% y/y in line with expectations. Personal income rose 0.4% in September, in line with forecasts, and personal expenses - by 0.8%, exceeding expectations.

December futures price of gold on COMEX today fell to 1707.70 dollars per ounce.

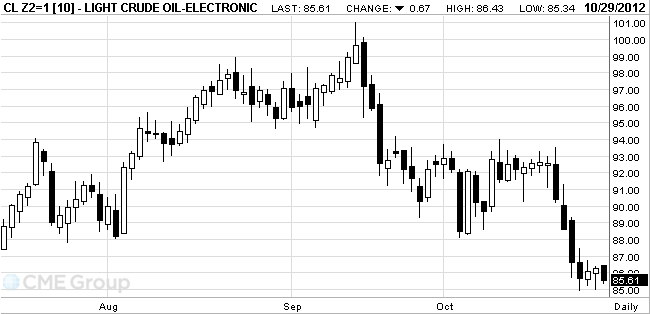

Crude oil declined in New York while gasoline gained as refineries reduced operations on the U.S. East Coast with Hurricane Sandy poised to strike.

Futures dropped as much as 1.1 percent and the motor fuel rose as much as 2.8 percent as Sandy strengthened. The storm will probably make landfall tomorrow, according to a National Hurricane Center advisory. Phillips 66 (PSX), NuStar (NS) Energy LP, Hess Corp. (HES) and PBF Energy Inc. said they are shutting or reducing output at New Jersey refineries and terminals as a precaution.

Crude oil for December delivery fell to $85.61 a barrel on the New York Mercantile Exchange. Prices are down 13 percent this year.

Brent oil for December settlement climbed 47 cents, or 0.4 percent, to $110.02 a barrel on the London-based ICE Futures Europe exchange. The grade rose as four North Sea Forties crude cargoes that were deferred to November from October earlier this month have been postponed by a further two to seven days, according to three people with knowledge of the loading program.

Sold E6.78bln vs target E5.6bln-E6.8bln

- E3.995bln 3-month BTF, avg yield -0.022% (-0.027%), cover 2.58 (3.18)

- E1.594bln 6-month BTF, avg yield -0.012% (-0.011%), cover 3.59 (3.27)

- E1.191bln 12-month BTF, avg yield 0.015% (0.022%), cover 4.10 (3.13)

EUR/USD $1.2890, $1.2900, $1.2950, $1.2975, $1.3000

USD/JPY Y79.50, Y80.20, Y80.50

GBP/USD $1.6000, $1.6100, $1.6195

EUR/GBP stg0.8030, stg0.8060

AUD/USD $1.0200, $1.0250, $1.0300, $1.0340, $1.0350

AUD/NZD NZ$1.2610

Data

09:30 United Kingdom Net Lending to Individuals, bln September -0.4 0.6 1.7

09:30 United Kingdom Mortgage Approvals September 47.7 48.5 50.0

12:30 U.S. Personal Income, m/m September +0.1% +0.5% +0.4%

12:30 U.S. Personal spending September +0.5% +0.6% +0.8%

12:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September +1.6% +1.7% +1.7%

13:00 Germany CPI, m/m (preliminary) October 0.0% 0.0% 0.0%

13:00 Germany CPI, y/y (preliminary) October +2.0% +1.9% +2.0%

The euro approached a two-week low against the dollar ahead of the meeting of prime ministers of Italy and Spain, which will discuss a plan to rescue the region. Also on such dynamics affect data that showed how the crisis affects the economy of the single currency bloc. According to today's report, the level of retail sales in Spain fell 11% in September, compared with last year. The euro fell to a two-week low against the yen as German Finance Minister Wolfgang Schaeuble rejected the restructuring of Greek debt. Note that the euro has appreciated by 0.3% against the dollar this month amid that European officials are waiting for treatment in Spain for financial assistance, which may eventually help draw a line under the debt crisis raging in the region. European policymakers are also waiting for the report, which will show the progress of Greece in achieving the internationally agreed development goals, which were developed by the European Commission, the International Monetary Fund and the ECB.

The dollar and the yen strengthened as signs of a global economic downturn increased the demand for refuge assets.

At the same time, strengthening of the yen has been limited, as many market participants expect the Bank of Japan's policy makers meeting to be held tomorrow and will be able to shed light on the future policy of the country. Also note that the Bank of Japan board members face pressure due to the fact that the presented last week data showed that consumer prices fell again, fixing the fifth decline in a row. Against this background, many analysts expect that the policy of the bank will announce the introduction of an additional stimulus that support flagging growth.

The Australian dollar fell against the decline of Asian stocks and growing concern over the outcome of the U.S. presidential election, which has undermined demand for higher-yielding assets. Note also that the currency losses were limited as traders are awaiting the decision of the Reserve Bank of Australia's interest rate, which will be announced at the meeting next week.

The pound weakened against the dollar after a report showed that house prices in England and Wales fell in October, noting the fourth consecutive decline. It is learned that house prices fell by 0.1% in September and 0.4% from a year earlier. At the same time, other data showed that the number of mortgage approvals rose to 50,000 last month from 47,700 in August, but it has not helped the currency recover their lost ground.

EUR/USD: during the session the pair fell, setting the minimum at $ 1.2385, but is now showing a slight recovery

GBP/USD: Trading in the exchange rate dropped significantly, setting the minimum at $ 1.6027, near which is now

USD/JPY: the exchange rate during the session shows a slight decrease

At 23:30 GMT Japan will release data on changes in the level of household spending and preliminary data on industrial production for September. Also during this time will be published data on the unemployment rate for September.

EUR/USD

Offers $1.3020/25, $1.3000, $1.2980, $1.2950/60

Bids $1.2885/80, $1.2850, $1.2815/00

GBP/USD

Offers $1.6120/25, $1.6140/50, $1.6100/05

Bids $1.6060/50, $1.6030/20, $1.6005/00, $1.5975/65

AUD/USD

Offers $1.0450, $1.0395/00

Bids $1.0320, $1.0305/00, $1.0295/90

EUR/JPY

Offers Y103.80, Y103.50, Y103.40/45, Y103.20/25, Y102.90/00

Bids Y102.50, Y102.20, Y102.00, Y101.80

USD/JPY

Offers Y80.20/25, Y80.00, Y79.80

Bids Y79.30, Y79.20

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050

Bids stg0.8025/20, stg0.8005-00, stg0.7980

Decline began trading on the stock markets of Europe. Investors took a wait and see policy. Today in the U.S. trading on NYSE, NASDAQ OMX Group and BATS suspended because of impending Northeast U.S. hurricane "Sandy."

On Sunday, Greek President Karolos Papoulias said that Europe should not put forward new requirements for the Greek economy. "One can not expect more from this people, and so he gave all" - said Papoulias live local television after the military parade in Thessaloniki on the occasion of the national holiday in Greece.

Next week, the Greek parliament will consider a package of austerity measures up to fourteen billion, in exchange for which the country plans to get the next tranche of around 31.5 billion euros from the EU and IMF.

The government is going back to reduce pensions and salaries of civil servants, as well as cut back on the rights of workers and lay off thousands of employees of the public sector.

FTSE 100 5,773.01 -33.70 -0.58%

CAC 40 3,405.28 -29.81 -0.87%

DAX 7,187.42 -44.43 -0.61%

BT Group Plc lost 1% after rumors that the telecommunications company may cut sales forecasts. UBS shares rose 5% percent after the largest bank in Switzerland, announced the decision to cut as much as 10.000 jobs.

EUR/USD $1.2890, $1.2900, $1.2950, $1.2975, $1.3000

USD/JPY Y79.50, Y80.20, Y80.50

GBP/USD $1.6000, $1.6100, $1.6195

EUR/GBP stg0.8030, stg0.8060

AUD/USD $1.0200, $1.0250, $1.0300, $1.0340, $1.0350

AUD/NZD NZ$1.2610

Asian stocks dropped for a second day after companies including Honda Motor Co. reported earnings that disappointed investors and Hong Kong developers slid on a new real estate tax targeting foreign buyers.

Nikkei 225 8,929.34 -3.72 -0.04%

S&P/ASX 200 4,476.86 +4.48 +0.10%

Shanghai Composite 2,058.94 -7.27 -0.35%

Honda, Japan’s third-largest carmaker, tumbled 4.7 percent after cutting its full-year profit forecast.

New World Development Co. led Hong Kong’s property companies lower, dropping 7.1 percent.

LG Display Co. climbed 7.6 percent in Seoul after posting its first profit in more than a year.

On Friday the euro rose sharply against the dollar, but was unable to hold its positions, and yet depart from the maximum values reached with the opening levels of the day, which was due to concern over the fact that Spain will ask for financial assistance to meet their problems. Also in the course of the day the single currency fell after the Spanish unemployment data showed that the unemployment rate has reached record levels.

Note that a request for help from Spain, which is the fourth largest economy in the euro zone will be considered positive for the euro, because this will allow the European Central Bank to start buying bonds, and reducing the cost of borrowing for countries with high debt.

Also, in a joint statement, the European Central Bank and the European Commission said that Spain is on the way to fix your problems in the financial sector, but this requires more drastic measures that will be used to address some problem banks.

The dollar sharply and suddenly fell against the euro after data showed that U.S. GDP grew by 2.0% in the third quarter, following growth of 1.3% in the second quarter, and the expectations of 1.9 %.

The dollar fell against the yen, after reaching a four-month high on expectations that the Bank of Japan will take further measures to mitigate the monetary policy during its meeting next week. Experts predict that the central bank will increase the asset purchase program as the target inflation rate of 1%, is likely to be unattainable, even in the financial year starting in April 2014.

The dollar index (DXY), which is used to track the value of the dollar against the currencies of six U.S. partner has changed a bit while still achieving the level of 80.094.

Asian stocks fell, with the regional index poised to erase this month’s gains, as companies including Fanuc Corp. and China Unicom Ltd. reported earnings that disappointed investors. South Korea’s Kospi Index sank 1.6 percent after Bank of Korea data today showed the nation’s gross domestic product expanded 1.6 percent in the three months to September from a year earlier, the slowest pace in three years.

Nikkei 225 8,933.06 -122.14 -1.35%

S&P/ASX 200 4,472.4 -38.10 -0.84%

Shanghai Composite 2,065.3 -36.28 -1.73%

Fanuc, an industrial robot manufacturer, slid 2.8 percent in Tokyo, while China Unicom, the nation’s No. 2 mobile-phone company, sank 7.1 percent in Hong Kong.

Woongjin Coway Co., a maker of water purifiers, surged 11 percent in Seoul after its parent agreed to stick with a plan to sell a controlling stake to MBK Parters Ltd.

China Unicom retreated 7.1 percent to HK$12.78 in Hong Kong after third-quarter net income rose 27 percent to 2.02 billion yuan ($324 million). The result, derived from nine-month earnings reported by the Beijing-based company, compares with the 2.21 billion-yuan median estimate in a Bloomberg News survey.

European (SXXP) stocks closed little changed, with the Stoxx Europe 600 Index completing a weekly drop, as data showed the U.S. economy expanded more than forecast in the third quarter, offsetting concern company earnings are deteriorating.

Straumann Holding AG (STMN) jumped 7.9 percent after Bank of America Corp. recommended buying the shares. Belgacom SA (BELG) surged by a record 7.8 percent after raising its 2012 forecasts. Ericsson AB (ERICB) tumbled 3.9 percent after missing its third-quarter gross-margin target.

The Stoxx 600 rose 0.1 percent to 270.51 in London. The Stoxx 600 still lost 1.3 percent this week as euro-area manufacturing shrank and corporate earnings weakened.

Gross domestic product rose at a 2 percent annual rate after climbing 1.3 percent in the prior quarter. The median forecast of 86 economists surveyed by Bloomberg called for a 1.8 percent gain.

In Europe, reports showed that French consumer sentiment dropped in October, while Spain’s unemployment rate climbed to a record in the third quarter as a deepening recession left one in four workers jobless.

National benchmark indexes advanced in ten of the 17 western-European markets that were open today. The Vienna market was closed.

FTSE 100 5,813.01 +7.96 +0.14% CAC 40 3,434.8 +23.27 +0.68% DAX 7,229.75 +29.52 +0.41%

Straumann jumped 7.9 percent to 118.1 Swiss francs, the biggest gain in more than five months, after Bank of America raised the world’s biggest maker of dental implants to buy from underperform.

Belgacom, the largest phone company in Belgium, advanced 7.8 percent to 23.14 euros, the strongest rally since it sold shares to the public in March 2004, as the company raised its 2012 forecasts and announced a special dividend.

Anglo American Plc (AAL) gained 4.1 percent to 1,933.50 pence after saying Chief Executive Officer Cynthia Carroll will quit.

Ericsson dropped 3.9 percent to 58.15 kronor, the sharpest decrease since May 4. The world’s largest maker of mobile-phone networks reported a third-quarter gross margin, or the percentage of sales remaining after production costs, that slid to 30.4 percent from 35 percent, missing the average estimate of 32.2 percent.

Novo Nordisk A/S (NOVOB), the world’s biggest insulin maker, fell 3.3 percent to 930 kroner after U.S. regulators disclosed that a scheduled advisory-panel meeting on the diabetes treatment Tresiba will focus on cardiovascular risks.

Randstad Holding NV (RAND) slid 4.7 percent to 25.32 euros after Goldman Sachs Group Inc. downgraded the company’s shares to neutral from buy.

Mediaset SpA (MS) declined 3.1 percent to 1.34 euros. Former Italian Prime Minister Silvio Berlusconi was found guilty of tax fraud and sentenced to four years in prison in a film-rights case involving the television company.

Renault SA (RNO) fell 1.8 percent to 34.74 euros, retreating for the sixth straight day, after third-quarter revenue plunged 13 percent to 8.45 billion euros, the carmaker said yesterday after the market close. The figure missed the 8.97 billion-euro average of analyst.

Major U.S. stock indexes significantly retreated from two-month lows and will use the positive territory and ended the session with a slight advantage. For the week the index DOW fell 1,77%, Nasdaq fell 0,59%, S & P500 lost 1.48%.

Indexes started the session due to the strong growth of the U.S. GDP data for the third quarter. However, later published the final data on consumer sentiment from Reuters / Michigan in October. The preliminary value of the index was revised up to 82.6 points against 83.1 and 82.7 of the forecast.

Thus today's statistics have been mixed, as investors again focused on the negative messages that came from Europe.

GDP data are important to investors, but the overall situation continues to deteriorate. Many companies report worse than expected and lower their expectations for the coming quarters, remains unresolved problems in Europe.

Investor is not in a hurry to open positions ahead of the U.S. presidential election. The upcoming election adds uncertainty to the markets, as long as the chances of winning Obama and Romney are approximately equal. There is a high probability that before the election, the markets will be consolidated in the band, and only after the elections we will see strong movements. Recall that the U.S. presidential election will be held on November 6.

Most of the components of the index DOW reduced in price. More than the others fell in the share price Bank of America Corporation (BAC, -1.30%). Shares have risen above the rest Microsoft Corporation (MSFT, +1.33%).

Almost all sectors are in the red zone. More than the others dropped the financial sector (-0.6%). Growth shows only service sector (+0.3%) and sector conglomerates (0.5%).

At the close:

Dow +3.61 13,107.29 +0.03%

Nasdaq +1.83 2,987.95 +0.06%

S & P -1.03 1,411.94 -0.07

23:50 Japan Retail sales, y/y September +1.8% +0.4%

The yen remained higher after its biggest one-day gain in two months as signs of weakness in the global economy increased demand for haven assets. The Bank of Japan is scheduled to meet tomorrow after holding off from easing policy on Oct. 5.

Japan’s currency maintained last week’s advance versus the euro before reports tomorrow that may show Spain’s gross domestic product shrank last quarter, while Germany’s jobless rate rose this month for the first time in more than three years. The Spanish economy probably shrank 0.4 percent in the three months ended Sept. 30 from the previous quarter, according to the median estimate of economists surveyed by Bloomberg News before preliminary government data tomorrow. Germany’s unemployment rate may have risen to 6.9 percent this month from 6.8 percent in September a separate poll showed ahead of tomorrow’s release. That would be the first gain since June 2009,

The Australian dollar slid on speculation concern over the outcome of the U.S. presidential election is sapping demand for higher-yielding assets. U.S. President Barack Obama and Republican challenger Mitt Romney entered the final stretch of the presidential contest, where opinion polls have tightened.

The Securities Industry and Financial Markets Association suggested that trading end at noon New York time today in dollar-denominated fixed-income securities in the U.S. because of Hurricane Sandy. The New York Stock Exchange and New York Mercantile Exchange canceled floor trading for the day.

EUR / USD: during the Asian session the pair fell to $1.2915.

GBP / USD: during the Asian session the pair fell to $1.6075.

USD / JPY: during the Asian session, the pair traded in the range of Y79.60-75.

We begin the trading week with a fairly limited calendar Monday, especially on the European side. Spanish September retail sales are dueto be published at 0700GMT. The only scheduled UK data is the release of UK October BOE M4 data and UK October BOE Bankstats, due at 0930GMT. US data kicks off at 1230GMT, with the release of US September Personal Income, which is expected to rise 0.4% in September.

11:30 United Kingdom Net Lending to Individuals, bln September -0.4 0.6

11:30 United Kingdom Mortgage Approvals September 47.7 48.5

14:30 U.S. Personal Income, m/m September +0.1% +0.5%

14:30 U.S. Personal spending September +0.5% +0.6%

14:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1%

14:30 U.S. PCE price index ex food, energy, Y/Y September +1.6% +1.7%

15:00 Germany CPI, m/m (preliminary) October 0.0% 0.0%

15:00 Germany CPI, y/y (preliminary) October +2.0% +1.9%

01:30 Japan Unemployment Rate September 4.2% 4.2%

01:30 Japan Household spending Y/Y September +1.8% +0.8%

01:50 Japan Industrial Production (MoM) (preliminary) September -1.6% -3.1%

01:50 Japan Industrial Production (YoY) (preliminary) September -4.6% -7.1%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.