- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-10-2012

The dollar fell the most in almost two weeks against the euro amid speculation damage from Atlantic Ocean tropical cyclone Sandy will be less severe than earlier anticipated, damping demand for safer assets. The U.S. currency dropped against all its 16 major counterparts as European shares and U.S. stock futures rallied.

The euro strengthened after a Spanish report showed the economy contracted less in the third quarter than the central bank estimated last week.

The yen rose to a one-week high against the dollar after the BOJ expanded its asset-purchase program by 11 trillion yen to 66 trillion yen at a policy meeting in Tokyo. Fifteen economists forecast the BOJ to add 10 trillion yen to its 55 trillion yen program that buys assets such as government bonds, real estate investment trusts and stock funds. Four saw it increasing purchases by as much as 20 trillion yen.

The pound rose for the first time in three days against the dollar after a report showed an index of U.K. retail sales climbed to a four-month high in October, damping speculation the Bank of England will boost monetary stimulus. The data followed a report last week showing Britain’s GDP expanded 1 percent in the third quarter, as the nation emerged from a double-dip recession.

European stocks rose the most in two weeks as companies from BP Plc to Deutsche Bank AG reported earnings that topped estimates and U.S. house prices climbed.

Teleconference was held today between the Ministry of Finance of the Eurogroup, in which officials discussed the situation in Greece and how to get the country back on the path of sustained recovery ahead of the meeting, scheduled for November 12. Another meeting will be held tomorrow, at which EU leaders are going to help the problem state by another reduction program.

The Bank of Japan on Tuesday expanded the program of buying up assets and lending by 11 trillion yen to 91 trillion yen, and launched a program of unlimited long-term loans to banks at low rates.

The September unemployment rate in Germany was revised from 6.8% to 6.9%, remained unchanged in October. Spanish GDP surprised annual decline, the data on consumer confidence, though the eurozone improved slightly, but still remained weak. Italy sold five-and 10-year bonds at a lower yield, and the balance of sales in the UK, according to research by CBI, was 30 in October.

National benchmark indexes advanced in 15 of the 18 western-European markets. Germany’s DAX climbed 1 percent, the U.K.’s FTSE 100 gained 0.8 percent and France’s CAC 40 rallied 1.4 percent.

BP jumped 4.4 percent to 443.7 pence, the largest jump in 11 months. The company said third-quarter net income rose to $5.4 billion from $5 billion in the same period of 2011 and raised its dividend by 12.5 percent to 9 cents a share. Profit adjusted for one-time items and changes in inventory was $5.2 billion, compared with the average estimate of $4 billion.

Eni SpA added 2.1 percent to 17.69 euros as Italy’s largest oil producer reported third-quarter adjusted net income from continuing operations of 1.78 billion euros ($2.3 billion). Analysts had forecast 1.56 billion euros.

Deutsche Bank increased 4.5 percent to 34.80 euros. The lender said third-quarter profit rose 3 percent after investment-banking revenue exceeded targets. Net income climbed to 747 million euros in the three months through September from 725 million euros a year earlier, the company said. That beat the 563.9 million-euro average estimate of analysts.

UBS climbed 5.9 percent to 13.89 Swiss francs, its highest price since July 2011. The bank said it plans to save about 3.4 billion francs ($3.7 billion) in additional annual costs by the end of 2015 as it reduces headcount by 10,000 to about 54,000. The company will target a return on equity of at least 15 percent starting in 2015, compared with a previous goal of 12 percent to 17 percent.

Danske Bank slumped 9.4 percent to 94 kroner, its biggest drop since February 2011. Denmark’s largest lender said it plans to sell 7 billion kroner ($1.2 billion) in new shares as part of an effort to achieve a core Tier 1 capital ratio in excess of 13 percent by the end of next year.

Oil rose from the lowest level in almost four months in New York on speculation that demand will soon rebound after Atlantic superstorm Sandy made landfall on the U.S. East Coast.

Futures climbed as much as 0.8 percent after the storm came ashore in southern New Jersey at 8 p.m. local time yesterday and drove floodwaters to life-threatening levels in a region with 60 million residents. Phillips 66 (PSX), Hess Corp. (HES), NuStar Energy LP (NS) and PBF Energy Inc. (PBF) reduced refinery operations on the U.S. East Coast because of Sandy.

Six refineries curbed production because of Sandy, accounting for 1.22 million barrels of the area’s crude- processing capacity of 1.29 million barrels a day, according to data. The storm may cut East Coast gasoline supplies to the lowest level since at least 1990, based on Energy Department data.

Crude oil for December delivery rose to $86.24 a barrel on the New York Mercantile Exchange. The contract settled at $85.54 yesterday, the lowest since July 10. Prices are down 13 percent this year.

Brent oil for December settlement slipped 24 cents to $109.20 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude premium to West Texas Intermediate contract narrowed to $23.25. The spread widened for a sixth day yesterday to $23.90.

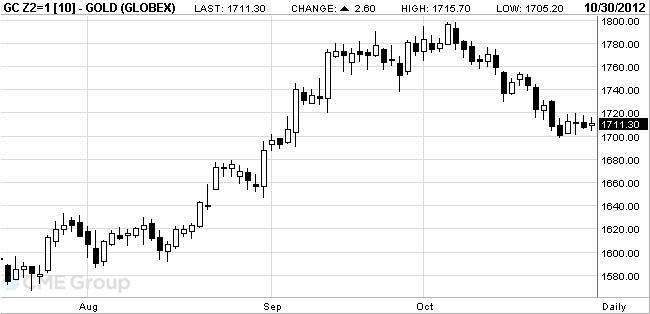

Gold is slightly more expensive due to the weaker dollar, but holding back growth expectations employment report in the U.S..

According to analysts, the number of jobs in the U.S. in September grew by 125,000 and the unemployment rate rose to 7.9 percent from 7.8 percent in August. Rising unemployment is cause for optimism for the gold, because it increases the likelihood of further stimulus measures.

The Bank of Japan on Tuesday expanded the program of buying up assets and lending by 11 trillion yen to 91 trillion yen, and launched a program of unlimited long-term loans to banks at low rates. According to experts, the actions of the central bank, as any incentives, support gold, though not unexpected.

Importers of gold in India - the world's largest consumer of the precious metal - increase purchases in November, on the eve of the upcoming Hindu festival of light Diwali and on the background of wedding season.

December futures price of gold on COMEX today rose to 1715.70 dollars an ounce and is now trading at 1711.30 dollars per ounce.

EUR/USD $1.2850, $1.2865, $1.2880, $1.2900, $1.2925, $1.3000

USD/JPY Y79.00, Y79.25, Y79.50, Y80.00, Y80.50

EUR/JPY Y103.75

GBP/USD $1.6050, $1.6100

EUR/GBP stg0.8050

EUR/CHF Chf1.2090

The Canadian dollar is still trading around the level of parity against the dollar, has not changed much since the last economic reports showing that in September the prices of Canadian producers increased by 0.1%, while prices in the U.S. rose more than expected.

Yesterday, USD / CAD struck 1.0000 the first time in three months amid risk aversion, reaching a high of 1.0018 earlier, then stabilized around the psychological mark was down 0.1% on the day.

Data

00:00 Australia HIA New Home Sales, m/m September -5.3% -3.7%

03:00 Japan BoJ Interest Rate Decision - 0.10% 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement -

06:00 Japan BOJ Outlook Report October

07:00 Switzerland UBS Consumption Indicator September 1.02 1.07

07:25 Japan BOJ Press Conference -

08:00 Eurozone ECB President Mario Draghi Speaks -

08:55 Australia RBA Assist Gov Lowe Speaks -

08:55 Germany Unemployment Change October 12K 10K 20K

08:55 Germany Unemployment Rate s.a. October 6.9% 6.9% 6.9%

10:00 Eurozone Business climate indicator October -1.34 -1.42 -1.62

10:00 Eurozone Industrial confidence October -15.9 -17.0 -18.0

11:00 United Kingdom CBI retail sales volume balance October 6 8 30

12:30 Canada Raw Material Price Index September +3.4% +1.2% +1.3%

12:30 Canada Industrial Product Prices, m/m September -0.1% +0.2% +0.5%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August +1.2% +1.9% +2.0%

The yen strengthened against the dollar, reaching a maximum at the same level for more than a week, as the Bank of Japan announced a second round of easing over the past two months has disappointed some investors. As it became known to the Bank of Japan expanded its asset-purchase program to 11 trillion yen to the level of 91 trillion yen. Note that the economists predicted that the amount of expansion will be from 10 to 20 trillion. yen.

Also released today data showed that industrial production in Japan fell by 4.1% in September, topping with the most pessimistic estimate of economists.

At the same time, demand for the yen as a safe haven asset is increased by the background that the largest tropical storm "Sandy" reached the U.S. north-east coast.

The pound sterling rose against the dollar after a report showed that retail sales according to the Confederation of British Industry UK has increased significantly in October and reached a level of 30, compared with a value of 6 in the last month. Note that many economists expect that figure to increase to the level of just 8.

The dollar fell against the euro on concerns about the weather conditions in the United States. Decline continued even after data showed that the number of unemployed in Germany rose in September to two times more than expected and reached 20,000 people. Also, the report showed that the unemployment rate rose to the level of 6.9% as compared to the previous month, the index for which was revised upwards. The situation has not changed even after the published price index of S & P / Case-Shiller showed a growth rate of 2.0% in August, compared with expectations of 1.9% and an increase of 1.2% last month.

At the same time, data from the National Statistics Institute in Madrid showed that Spain's economy declined in the third quarter, registering with the fifth quarterly decline.

The Canadian dollar rose during trading above parity with the U.S. dollar, which was the first time since August, as the appetite for risk among investors has declined. But in spite of this, the exchange rate could still recover all their lost ground, and continued to strengthen after the published data showed that the index of commodity prices and the prices of industrial goods rose more than analysts had forecast.

EUR/USD: during the session, the pair shows a rapid growth, and is now trading at the maximum values of the day

GBP/USD: pair increased significantly, by setting high at $ 1.6080 and then retreated slightly

USD/JPY: pair during the session trading in a narrow range

At 20:30 GMT, the U.S. announced the change of volume of crude oil, according to the API for October. At 21:45 GMT New Zealand reported a change in the volume of building permits issued in September.

EUR/USD

Offers $1.3020/25, $1.3000

Bids $1.2885/80, $1.2850, $1.2815/00

GBP/USD

Offers $1.6120/25, $1.6140/50, $1.6085/100

Bids $1.6005/00, $1.5975/65, $1.5950

AUD/USD

Offers $1.0500, $1.0450, $1.0395/00

Bids $1.0320, $1.0305/00, $1.0295/90

EUR/GBP

Offers stg0.8100, stg0.8080

Bids stg0.8025/20, stg0.8005-00, stg0.7980, stg0.7945/40

EUR/JPY

Offers Y104.00, Y103.80, Y103.50, Y103.20

Bids Y102.55/50, Y102.00, Y101.80, Y101.50

USD/JPY

Offers Y80.20/25, Y80.00, Y79.80

Bids Y79.20, Y79.05/00, Y78.85/80

European stock markets on the rise of the indices. This is caused by the positive statements of the oil giant BP and Germany's biggest lender Deutsche Bank.

Were lower than forecast data on the index of business optimism and business sentiment in the Eurozone. Data on the labor market in Germany was at the level of the forecast.

U.S. financial markets do not work today with Hurricane Sandy.

FTSE 100 5,840.35 +45.25 +0.78%

CAC 40 3,440.99 +32.10 +0.94%

DAX 7,269.57 +66.41 +0.92%

BP shares rose 3.5%. BP's net profit in the third quarter of 2012 compared to the same period last year increased by 7.7% - to $ 5.434 billion profit, adjusted for one-off factors, was $ 5.2 billion expected by analysts at Bloomberg $ 4 billion company also announced an increase in dividend by 12.5% - to 9 cents per share.

Capitalization of Deutsche Bank AG rose 3.3%. Germany's largest bank increased its net profit in the third quarter of 2012 by 3% - up to 747 million euros from 725 million euros in the same period last year.

UBS AG shares jumped 5.6%. So the market reacted to the statement of the planned reduction in 10 thousand jobs, which has been discussed by investors and the release of kapitalozatratnyh trading.

5.1% shares fell Danske Bank, the largest bank in Denmark. This related to statements of intent to carry out an additional issue for 7 billion euros ($ 1.2 billion) by the end of next year to bring the capital adequacy ratio of the first order and 13%.

EUR/USD $1.2850, $1.2865, $1.2880, $1.2900, $1.2925, $1.3000

USD/JPY Y79.00, Y79.25, Y79.50, Y80.00, Y80.50

EUR/JPY Y103.75

GBP/USD $1.6050, $1.6100

EUR/GBP stg0.8050

EUR/CHF Chf1.2090

Most Asian stocks fell after the Bank of Japan’s expansion of its asset-purchase program failed to allay concern economic growth in the world’s third-largest economy is waning. Hurricane Sandy forced U.S. markets to shut for a second day.

Nikkei 225 8,841.98 -87.36 -0.98%

S&P/ASX 200 4,485.69 +8.83 +0.20%

Shanghai Composite 2,062.35 +3.40 +0.17%

Toyota Motor Corp. lost 0.5 percent, reversing earlier gains, after the central bank’s announcement. BYD Co., the Chinese automaker partially owned by Warren Buffett’s Berkshire Hathaway Inc., tumbled 5.5 percent after saying profit may fall as much as 98 percent this year.

Sharp Corp. surged 6.2 percent in Tokyo on a report the maker of liquid-crystal displays is in partnership talks with Apple Inc. and Google Inc.

BOARD MEMBERS SATO, KIUCHI AGAINST FY14 CPI VIEW

BOJ, GOVT AGREE MUST OVERCOME DEFLATION SOON

Shirakawa DECLINES COMMENT IF CPI RISE TO HIT 1% IN FY15

WEAKER GLOBAL ECON BEHIND TODAY'S DECISION

BOARD MEMBERS SATO, KIUCHI AGAINST FY14 CPI VIEW

BOJ, GOVT AGREE MUST OVERCOME DEFLATION SOON

Shirakawa DECLINES COMMENT IF CPI RISE TO HIT 1% IN FY15

WEAKER GLOBAL ECON BEHIND TODAY'S DECISION

Yesterday the euro reached the lowest level in almost three weeks amid a growing divide over Europe’s new bailout strategy and data that showed the region’s three-year- old crisis is weighing on its economy.

Retail sales in Spain dropped 11 percent in September from a year ago, a report showed, and the nation’s central bank set up a so-called bad bank.

The dollar remained stronger versus the euro even after consumer spending in the U.S. climbed more than forecast in September as incomes grew. Household purchases, which account for about 70 percent of the economy, rose 0.8 percent, the most since February, after a 0.5 percent gain the prior month, a Commerce Department report showed in Washington.

The euro reached its low of the day versus the dollar after the Bank of Spain’s deputy governor, Fernando Restoy, set out plans for establishing a so-called bad bank, ordered by the European Union as a condition of the rescue.

The dollar and yen strengthened amid increased demand for refuge. The U.S. securities industry canceled equity trading on all markets today as Hurricane Sandy headed toward the New York City area.

The euro touched a two-week low against the yen after German Finance Minister Wolfgang Schaeuble rejected another debt restructuring for Greece.

The 17-member common currency slid against the dollar and yen today after Schaeuble, speaking in an interview with German radio Deutschlandfunk broadcast, said it would be “a bit unrealistic” to impose more losses on private bondholders. German Chancellor Angela Merkel’s government is willing to consider a European Central Bank proposal for a buyback of Greek debt, Steffen Seibert, Merkel’s chief spokesman.

Gains in the yen were limited before Bank of Japan policy makers meet after holding off from easing policy on Oct. 5. BOJ board members are facing political pressure to ease policy as data last week showed consumer prices fell for a fifth-straight month, making the central bank’s 1 percent inflation goal elusive. All but one of 27 economists surveyed by Bloomberg expect officials to increase stimulus.

The pound weakened against the dollar after a report showed that house prices in England and Wales fell in October, noting the fourth consecutive decline. It is learned that house prices fell by 0.1% in September and 0.4% from a year earlier. At the same time, other data showed that the number of mortgage approvals rose to 50,000 last month from 47,700 in August, but it has not helped the currency recover their lost ground.

Asian stocks dropped for a second day after companies including Honda Motor Co. reported earnings that disappointed investors and Hong Kong developers slid on a new real estate tax targeting foreign buyers.

Nikkei 225 8,929.34 -3.72 -0.04%

S&P/ASX 200 4,476.86 +4.48 +0.10%

Shanghai Composite 2,058.94 -7.27 -0.35%

Honda, Japan’s third-largest carmaker, tumbled 4.7 percent after cutting its full-year profit forecast.

New World Development Co. led Hong Kong’s property companies lower, dropping 7.1 percent.

LG Display Co. climbed 7.6 percent in Seoul after posting its first profit in more than a year.

European stocks dropped, snapping a three-day advance, as Hurricane Sandy headed toward New York City, prompting the U.S. to suspend equity trading on all markets today.

Italian Prime Minister Mario Monti and his Spanish counterpart Mariano Rajoy meet in Madrid today, less than a week after Monti signaled that he would like Spain to ask for a full sovereign bailout from the European Union.

Greece’s political leaders continued to seek agreement on the labor reforms and structural changes needed to qualify for more aid under the country’s international bailout.

National benchmark indexes fell in 13 of the 18 western- European markets. The U.K.’s FTSE 100 slipped 0.2 percent and France’s CAC 40 lost 0.8 percent. Germany’s DAX slid 0.4 percent, while Greece’s ASE tumbled 6.3 percent.

BT retreated 1.5 percent to 213.9 pence after the person, who asked not to be identified, said that European corporate customers have cut back on its services. The U.K.’s largest fixed-line phone company had said that underlying revenue growth would improve in the fiscal years ending March 2013 and 2014. BT is scheduled to release earnings on Nov. 1.

ThyssenKrupp AG dropped 3.7 percent to 17.19 euros. Germany’s biggest steelmaker asked companies to resubmit offers for its unprofitable Americas unit after deciding the original bids were too low, people familiar with the matter said.

UBS jumped 7.3 percent to 13.12 francs. The lender intends to shrink its fixed-income operations, reducing risk-weighted assets by an additional 100 billion francs ($107 billion), said a person with knowledge of the matter who requested anonymity because the plans are private.

The main U.S. stock markets are closed due to weather conditions

00:00 Australia HIA New Home Sales, m/m September -5.3% -3.7%

03:00 Japan BoJ Interest Rate Decision - 0.10% 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement -

06:00 Japan BOJ Outlook Report October

The yen climbed against all of its major counterparts as the Bank of Japan’s second round of easing in two months disappointed some investors expecting more. The BOJ expanded its asset-purchase program by 11 trillion yen ($138 billion) to 66 trillion yen, the central bank said after a policy meeting today. The Nikkei newspaper reported earlier that the BOJ may increase the program by 10 trillion yen.

Japan’s industrial production slid 4.1 percent in September from the previous month, the most since last year’s earthquake and tsunami in March, government data showed today. The decline exceeded the most pessimistic estimate of economists surveyed by Bloomberg.

The Dollar Index was near a seven-week high amid demand for refuge assets as Atlantic superstorm Sandy ravaged the American Northeast coast and before reports that may show Europe’s debt crisis is damping growth.

Euro remained before reports that may show Spain’s gross domestic product shrank last quarter, while Germany’s jobless rate rose this month for the first time in more than three years. The Spanish economy probably shrank 0.4 percent in the three months ended Sept. 30 from the previous quarter, according to the median estimate of economists surveyed by Bloomberg News before preliminary government data today. Germany’s unemployment rate may have risen to 6.9 percent this month from 6.8 percent in September a separate poll showed ahead of today’s release. That would be the first gain since June 2009,

EUR / USD: during the Asian session the pair was trading around the level of $1.2900.

GBP / USD: during the Asian session the pair was trading around the level of $1.6030.

USD / JPY: during the Asian session the pair fell to Y79.30.

There is a fairly robust calendar Tuesday, although most of the schedule is more skewed towards second tier data. Eurozone data kicks off at 0700GMT, with the release of the German ILO employment change for September. At 0800GMT, we see the release of Q3 GDP data for Spain. German October unemployment data is due to be published at 0855GMT. EMU October consumer confidence is due out at 1000GMT, along with the EMU October business climate indicator. UK data is scheduled for release at 1100GMT, with the Confederation of British Industry's October Distributive Trades survey of the retail sector.

Change % Change Last

Gold 1,710 -2 -0.11%

Oil 85.29 -0.99 -1.15%

Change % Change Last

Nikkei 225 8,929.34 -3.72 -0.04%

S&P/ASX 200 4,476.86 +4.48 +0.10%

Shanghai Composite 2,058.94 -7.27 -0.35%

FTSE 100 5,795.1 -11.61 -0.20%

CAC 40 3,408.89 -26.20 -0.76%

DAX 7,203.16 -28.69 -0.40%

Dow closedNasdaq closed

S&P closed

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2902 -0,28%

GBP/USD $1,6028 -0,47%

USD/CHF Chf0,9363 +0,19%

USD/JPY Y79,79 +0,19%

EUR/JPY Y102,95 -0,09%

GBP/JPY Y127,88 -0,27%

AUD/USD $1,0332 -0,38%

NZD/USD $0,8192 -0,43%

USD/CAD C$1,0009 +0,42%

00:00 Australia HIA New Home Sales, m/m September -5.3% -3.7%

03:00 Japan BoJ Interest Rate Decision - 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement -

06:00 Japan BOJ Outlook Report October

07:00 Switzerland UBS Consumption Indicator September 1.03

07:25 Japan BOJ Press Conference -

08:00 Eurozone ECB President Mario Draghi Speaks -

08:55 Australia RBA Assist Gov Lowe Speaks -

08:55 Germany Unemployment Change October 9K 10K

08:55 Germany Unemployment Rate s.a. October 6.8% 6.9%

10:00 Eurozone Business climate indicator October -1.34 -1.42

10:00 Eurozone Industrial confidence October -16.1 -17.0

11:00 United Kingdom CBI retail sales volume balance October 6 8

12:30 Canada Raw Material Price Index September +3.4% +1.2%

12:30 Canada Industrial Product Prices, m/m September -0.1% +0.2%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August +1.2% +1.9%

14:00 U.S. Consumer confidence October 70.3 72.4

19:30 Canada BOC Gov Carney Speaks -

21:45 New Zealand Building Permits, m/m September +1.9% +3.0%

23:15 Japan Manufacturing PMI October 48.0

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.