- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 02-12-2011

The euro dropped against the dollar amid speculation its advance this week couldn’t be sustained and on concern European leaders may not agree at a summit Dec. 9 on how to handle the region’s debt crisis.

The shared currency was still headed for its first weekly increase in a month versus the greenback after policy makers acted to make more funds available to lenders and on optimism European central banks may funnel loans through the International Monetary Fund to fight the crisis. The dollar rose against most of its major peers today as stocks pared gains.

The euro advanced earlier after two people familiar with the negotiations said the region’s finance ministers gave the go-ahead for work on the IMF plan at a Nov. 29 meeting attended by European Central Bank President Mario Draghi. They declined to be named because talks are at an early stage. The need for a new crisis-containment tool emerged as the effort to boost the region’s 440 billion-euro ($589 billion) rescue fund to 1 trillion euros fell short.

The 17-nation currency erased gains versus the greenback as the Hill newspaper reported conservative U.S. lawmakers in Washington may try to block the plan to channel central-bank loans through the IMF. Senator Tom Coburn said he’s planning legislation that would direct the government to veto an expanded role for the fund, the Washington-based publication said today.

The yen dropped versus most of its major peers as Japanese Finance Minister Jun Azumi said he’ll take action on speculative currency moves. Japan’s currency climbed to a postwar record of 75.35 per dollar on Oct. 31, prompting the nation to intervene in markets for the third time this year to stem gains that endangered an export-led economic recovery. Japan sold 9.09 trillion yen from Oct. 28 to Nov. 28, the Ministry of Finance said this week, the most on a monthly basis in data going back to 1991.

European stocks climbed, with the Stoxx Europe 600 Index extending its largest weekly rally since November 2008, after a report showed that the U.S. unemployment rate fell below 9 percent last month. A Labor Department report showed unemployment in the U.S. unexpectedly dropped in November to a two-year low, while employers added fewer workers than projected and earnings eased, indicating the labor market is making limited progress.

The jobless rate dropped to 8.6 percent, the lowest since March 2009, the release showed. Payrolls climbed 120,000, with more than half the hiring coming from retailers and temporary- help agencies, after a revised 100,000 increase in October that was more than initially estimated. The median estimate in a Bloomberg News survey had called for a gain of 125,000.

German Chancellor Angela Merkel said earlier today that only fiscal union will tackle the euro area’s debt crisis at its roots, as she used a speech to lawmakers in Berlin to outline her position before a European Union summit on Dec. 9. The euro area needs fiscal oversight that’s “binding” and punishes states that persistently breach debt and deficit rules.

A European proposal to channel loans from national central banks through the International Monetary Fund may deliver as much as 200 billion euros ($268 billion) to fight the debt crisis, two people familiar with the negotiations said.

National benchmark indexes climbed in every western- European market except Norway. France’s CAC 40 Index advanced 1.1 percent and the U.K.’s FTSE 100 Index rose 1.2 percent. Germany’s DAX Index increased 0.7 percent.

Commerzbank surged 11 percent to 1.50 euros as Die Welt said Germany’s second-biggest bank could generate about 1 billion euros by retaining profit through June 30. The lender could boost its core capital by 3 billion euros by offloading some 30 billion euros in risk-weighted assets, the newspaper said, citing options that its supervisory board will discuss today. The lender could also generate as much as 6 billion euros by converting hybrid capital, according to Die Welt. The German newspaper cited banking officials.

Banking shares were the best-performing industry today, soaring 4.3 percent. HSBC Holdings Plc rose 3 percent to 510.7 pence in London, while BNP Paribas SA surged 9.4 percent to 31.60 euros in Paris.

BHP Billiton Ltd. and Rio Tinto Group, the world’s biggest mining companies (BLT), paced gains in commodity stocks, rising 4 percent to 2,000.5 pence and 1.3 percent to 3,346.5 pence, respectively. The industry was among the best performers in the Stoxx 600 this week, surging 12 percent. Aluminum, copper, lead, nickel and zinc all climbed on the London Metal Exchange today.

Daimler AG advanced 1.7 percent to 33.93 euros. A report from Autodata Corp. yesterday showed that U.S. light-vehicle sales accelerated to their fastest pace in 2011. Daimler sells more than 17 percent of its vehicles in the U.S., Bloomberg data shows. Separately, Daimler plans to cut production costs by 10 percent annually in 2012 and 2013, Reuters reported, citing Wolfgang Nieke, a works council member.

ThyssenKrupp AG fell 6.4 percent to 17.80 euros, the biggest decline in the Stoxx 600 today, after Germany’s biggest steelmaker posted a fiscal full-year loss because of 2.9 billion euros of impairments charges, mostly after it delayed the construction of a plant in Brazil.

Price stability best contribution ECB can make, ECB does not have dual mandate

U.S. stocks rose, paring an earlier rally, as concerns about Europe’s debt crisis overshadowed an unexpected decline in the American unemployment rate. Benchmark indexes trimmed gains as the euro and Italian bonds erased earlier advances.

The benchmark index for American equities is little changed for 2011 after rebounding more than 13 percent from its low for the year on Oct. 3. Improving U.S. economic data has helped alleviate concern that the world’s largest economy will relapse into a recession as Europe’s debt crisis threatens to derail the recovery.

Today’s jobs data showed that payrolls climbed 120,000, with more than half the hiring coming from retailers and temporary help agencies, after a revised 100,000 rise in October that was more than initially estimated. The median estimate in a Bloomberg News survey called for a gain of 125,000. The jobless rate declined to 8.6 percent, the lowest since March 2009, from 9 percent, Labor Department figures showed.

The IMF said today it will need more resources to fight Europe’s debt crisis if market conditions worsen. The S&P 500 has rallied this week as the Federal Reserve and five other central banks lowered the cost of dollar funding and China cut the proportion that banks need to hold as reserve capital.

Equity futures rose earlier following a report that as much as 200 billion euros ($270 billion) of national central bank loans may be channeled through the IMF. Germany and France are pushing for closer economic ties among euro-area nations and tougher enforcement of budget rules to counter the region’s debt crisis.

Dow 12,038.04 +18.01 +0.15%, Nasdaq 2,634.36 +8.16 +0.31%, S&P 500 1,248.44 +3.86 +0.31%

Financial stocks posted the largest gains out of 10 groups in the S&P 500, climbing 2.1 percent. JPMorgan surged 7.9 percent, the biggest rise in the Dow, to $32.87, while Morgan Stanley rallied 7.1 percent to $15.54.

Investors purchased corporations most tied to the economy, as industrial and energy companies advanced while utility stocks dropped 0.7 percent. Alcoa Inc. (AA) added 1.1 percent to $9.92 and General Electric Co. (GE) rose 1.9 percent to $16.21.

Western Digital jumped 8 percent to $31.58. The disk-drive maker raised its quarterly revenue forecast after sales rebounded from a flood in Thailand that devastated factories and constrained supplies.

Elsewhere, Zynga Inc. is seeking to raise as much as $1 billion in the biggest initial public offering by a U.S. Internet company since Google Inc. The company is offering 100 million shares for $8.50 to $10 apiece, according to a regulatory filing today. The high end of the range would value San Francisco-based Zynga, the biggest developer of games for Facebook Inc., at $7 billion.

Gold prices are falling due to the appreciation of the dollar caused by the publication of data on unemployment in the U.S. and concerns about rising tensions with Iran.

Production of refined gold in China rose in September by 2.3% m / m to 32.61 m level, and for 9 months of the year figure was 259 tonnes (+4.3% y / y). As a result, in the China Gold Association expected growth in production of precious metals up to 350 tons - China, therefore, retains the title of the largest gold producer in the world.

As noted in the Saxo Bank, gold can not be much progress, despite the worsening recession and active buying of gold by central banks. Meanwhile, investment in gold ETF rose to 2350 tons

ECB since 2011 increased its gold reserves by 25 million ounces (0.8 tonnes) - the last time net purchases were recorded, according to the IMF and the ECB in 1985.

Today, the January futures contract for gold on Comex in New York fell to 1740.01 dollars per troy ounce.

Oil was little changed heading for its first weekly gain in three as concern that tension between Iran and the West will intensify threatened shipments from OPEC’s second-biggest crude producer.

Futures rose as much as 1.4 percent, taking their gain this week to 4.9 percent, after the U.S. Senate passed a bill aimed at Iran’s central bank yesterday and the European Union tightened sanctions. U.S. unemployment unexpectedly dropped in November to a two-year low, while employers added fewer workers than projected and earnings eased.

The Senate bill would give the president the power starting July 1 to bar foreign financial institutions that do business with Iran’s central bank from having correspondent bank accounts in the U.S. If enacted, it could be much harder for foreign companies to pay for oil imports from Iran. The Obama administration opposes the legislation.

Iran pumped 3.56 million barrels of oil a day last month, a Bloomberg News survey showed. Saudi Arabia is the top producer in the Organization of Petroleum Exporting Countries.

Crude oil for January delivery climbed as much as $1.36 to $101.56 on the New York Mercantile Exchange. Brent oil for January settlement rose 6 cents to $109.05 a barrel on the London-based ICE Futures Europe exchange.

Resistance 3:1288 (Oct 27 high)

Resistance 2:1270 (Nov 14 high)

Resistance 1:1262 (session high)

Current price: 1257.75

Support 1 : 1243 (session low)

Support 2 : 1232 (38,2 % FIBO of growth from 1183)

Support 3 : 1222 (50,0 % of growth from 1183)

Operation twist could have been done by tsy as well

Plosser deplores 'increasing calls' to abandon price stab'ty

Fed already 'blurred distinction' between mon/fisc pol

Prolonged fisc debate, uncert'y 'detrimental to growth

Higher taxes would discourage inv'mnt and work effort

Longer credible debt cut plan delayed more econ damage

Trutcural budg defs to persist beyond cycl'l problems

Unsust'ble fiscal path eventually leads to debt monet'zn

Debt monetization can lead to uncontrolled inflation

Using fed bal sheet for fiscal ends endangers independence

EUR/USD $1.3260, $1.3480, $1.3500, $1.3600, $1.3700

USD/JPY Y77.50, Y77.95, Y78.00, Y78.25

AUD/USD $1.0300, $1.0200, $1.0000

USD/CAD C$1.0125

The jobless rate declined to 8.6 percent, the lowest since March 2009, from 9 percent, Labor Department figures showed today in Washington. Payrolls climbed 120,000, with more than half the hiring coming from retailers and temporary help agencies, after a revised 100,000 rise in October that was more than initially estimated. The estimate called for a gain of 119,000.

Equity futures extended their gains following a report that as much as 200 billion euros ($270 billion) of national central bank loans may be channeled through the International Monetary Fund.

Nikkei 8,644 +46.37 +0.54%

Hang Seng 19,040 +38.13 +0.20%

Shanghai Composite 2,361 -26.20 -1.10%

FTSE 5,565 +75.18 +1.37%

CAC 3,187 +57.41 +1.83%

DAX 6,123 +86.96 +1.44%

Crude oil: $100.80 (+0,6%).

Gold: $1756,00 (+0,9%).

10:00 EU(17) PPI (October) 0.1%

10:00 EU(17) PPI (October) Y/Y 5.5%

The euro rose after people familiar said a proposal to channel central bank loans through the International Monetary Fund may deliver up to 200 billion euros ($271 billion) to fight the debt crisis.

The euro extended its weekly gain against the greenback as European stocks rallied, fueling demand for the region’s assets.

The yen and dollar weakened versus their major counterparts before a U.S. report today that economists said will show employers increased hiring last month.

U.S. employers hired 119K workers in November after adding 80,000 the previous month, according to a survey before today’s Labor Department report.

EUR/USD: the pair has grown above $1.3500.

GBP/USD: the pair was in $1.5660-$ 1,5700 range.

USD/JPY: the pair has shown high in Y78.00 area, then receded.

The data calendar is dominated by US non-farm payrolls at 1330GMT, which are forecast to rise 112,000 in November, continuing a trend of modest payrolls gain that are just treading water rather than making any real headway into knocking down unemployment. The unemployment rate is forecast to hold steady at 9.0%.

EUR/USD

Offers $1.3600/15, $1.3570, $1.3530

Bids $1.3450, $1.3440, $1.3430/20, $1.3370/60, $1.3335/25

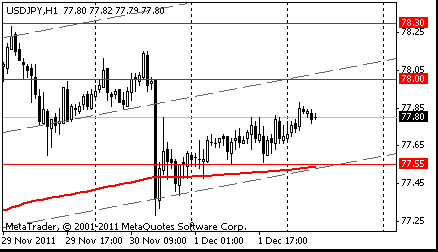

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 4, 28-29 highs)

Resistance 1: Y78.00 (session high)

Current price: Y77.90

Support 1:Y77.70 (support line from Nov 30)

Support 2:Y77.50 (МА (200) for Н1)

Support 3:Y77.30 (Nov 30 low)

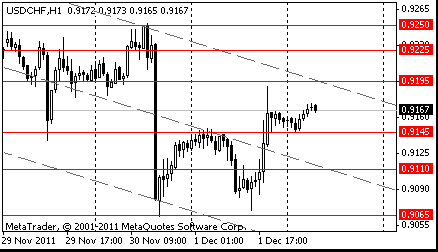

Resistance 3: Chf0.9330 (Nov 25 high)

Resistance 2: Chf0.9250 (Nov 29-30 high)

Resistance 1: Chf0.9190 (Dec 1 high, МА (200) for Н1)

Current price: Chf0.9153

Support 1: Chf0.9140 (session low)

Support 2: Chf0.9060 (Nov 30 low)

Support 3: Chf0.9040 (38,2 % FIBO Chf0,8570-Chf0,9330)

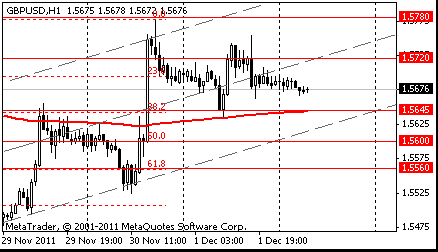

Resistance 3: $ 1.5830 (61,8 % FIBO $1,6090-$ 1.5420)

Resistance 2: $ 1.5780 (Nov 30 high)

Resistance 1: $ 1.5730 (resistance line from Nov 30)

Current price: $1.5691

Support 1 : $1.5670 (support line from Dec 1)

Support 2 : $1.5630 (Dec 1 low)

Support 3 : $1.5580 (МА (200) for Н1)

Resistance 3: $ 1.3570 (Nov 22 high)

Resistance 2: $ 1.3530 (Nov 30 high)

Resistance 1: $ 1.3510 (resistance line from Nov 30)

Current price: $1.3482

Support 1 : $1.3470 (line of support from Dec 1)

Support 2 : $1.3415 (Dec 1 low)

Support 2 : $1.3390 (area of МА (200) for Н1 and 50,0 % FIBO $1,3260-$ 1,3530)

USD/JPY Y77.50, Y77.95, Y78.00, Y78.25

AUD/USD $1.0300, $1.0200, $1.0000

USD/CAD C$1.0125

Nikkei 225 8,644 +46.37 +0.54%

Hang Seng 19,114 +111.51 +0.59%

S&P/ASX 4,288 +59.35 +1.40%

Shanghai Composite 2,361 -26.20 -1.10%

The Australian and New Zealand dollars were set for a weekly gain against most major peers before U.S. data forecast to show employers added workers at a faster pace, boosting demand for higher-yielding assets. U.S. payrolls rose by 125,000 in November after an 80,000 gain the previous month, the Labor Department is forecast to say today, according to the median estimate in a Bloomberg News poll. New Zealand’s currency headed for its biggest five-day advance versus the dollar since May 2009 before German Chancellor Angela Merkel outlines her stance for a Dec. 9 European summit on the region’s debt crisis. Gains in the so- called Aussie may be limited before the Reserve Bank of Australia holds a policy meeting on Dec. 6.

EUR/USD: on Asian session the pair holds in a range $1.3450-$1.3490.

GBP/USD: on Asian session the pair holds in a range $1.5665-$1.5690.

USD/JPY: on Asian session the pair gain.

On Friday UK - European events start at 0800GMT when ECB Governing Council member Ewald Nowotny attends a Kurt Rothschild Memoriam, in Vienna. UK data includes the 0930GMT release of both the Markit/CIPS Construction PMI nd also UK Q3 Construction New Orders. EMU data sees October PPI at 1000GMT. The data calendar is dominated by US non-farm payrolls at 1330GMT, which are forecast to rise 112,000 in November, continuing a trend of modest payrolls gain that are just treading water rather than making any real headway into knocking down unemployment. The unemployment rate is forecast to hold steady at 9.0%. Later, at 1830GMT, Boston Fed President Eric Rosengren gives a presentation on the economic outlook to the Massachusetts Investor Conference, in Boston.

- Crisis Is Worst Since Euro Was Introduced

- Crisis Can't Be Resolved Over Night, No Fast Solution

- Strengthening EMU Will Be Central Theme At EU Summit

- Development Toward Fiscal Union Is On Agenda

- We Have Govt Debt And Confidence Crisis

- ECB Has Other Task Than Fed Or BoE

- Euro Bonds No Rescue Measure For Current Crisis

- Absurd To Say That Germany Wants To Dominate Europe

- Future Of Euro Can't Be Separated Of European Unity

- Crisis Is Worst Since Euro Was Introduced

- Crisis Can't Be Resolved Over Night, No Fast Solution

- Strengthening EMU Will Be Central Theme At EU Summit

- Development Toward Fiscal Union Is On Agenda

- We Have Govt Debt And Confidence Crisis

- ECB Has Other Task Than Fed Or BoE

- Euro Bonds No Rescue Measure For Current Crisis

- Absurd To Say That Germany Wants To Dominate Europe

- Future Of Euro Can't Be Separated Of European Unity

The euro strengthened after Spain sold its maximum target of debt today and French yields dropped at an auction.

Spain sold 3.75 billion euros of bonds, the central bank said, meeting the maximum target. The average yield on the five- year notes was 5.544 percent, compared with 4.848 percent when similar-maturity debt were auctioned on Nov. 3. France sold 1.57 billion euros of 10-year bonds at an average yield of 3.18 percent, down from 3.22 percent at the prior offering on Nov. 3.

The Dollar Index fell for a fourth day before U.S. reports forecast to show manufacturing and employment improved, damping demand for safer assets.

The Institute for Supply Management’s factory index, a gauge of U.S. manufacturing, climbed to 51.8 in November from 50.8 the previous month, according to a survey before report. Employers added 125,000 workers last month after hiring 80,000 in October, a separate survey showed before the Labor Department data.

Frank dramatically weakened on all fronts, falling against the euro and the dollar amid reports that Switzerland is considering the introduction of negative interest rates in order to weaken the currency.

EUR/USD: yesterday the pair has grown.

GBP/USD: yesterday the pair traded nearby $1.5700.

USD/JPY: yesterday the pair rose.

On Friday UK - European events start at 0800GMT when ECB Governing Council member Ewald Nowotny attends a Kurt Rothschild Memoriam, in Vienna. UK data includes the 0930GMT release of both the Markit/CIPS Construction PMI nd also UK Q3 Construction New Orders. EMU data sees October PPI at 1000GMT. The data calendar is dominated by US non-farm payrolls at 1330GMT, which are forecast to rise 112,000 in November, continuing a trend of modest payrolls gain that are just treading water rather than making any real headway into knocking down unemployment. The unemployment rate is forecast to hold steady at 9.0%. Later, at 1830GMT, Boston Fed President Eric Rosengren gives a presentation on the economic outlook to the Massachusetts Investor Conference, in Boston.

Following the session, major stocks of Asian region has shown steady growth against a background of positive news flow. On the eve of a number of major central banks had reached an agreement on lowering interest rates on dollar swaps, and China has lowered the mandatory reserve for banks.

With regard to statistics in the Asian region, in Australia retail sales in October increased by 0.2%, while the expected retention rate of their growth at 0.4%. In China, it registered a decline in business activity index for November from 50.4 points to 49 points.

According to trade in the Japanese Nikkei 225 index rose 2%, China's Shanghai Composite was up 2.3%, and the Australian S & P / ASX 200 and Hong Kong's Hang Seng rose 2.6% and 5.6%.

Reducing mandatory reserve had a positive impact on the quotes of Chinese banks and insurers. For example, China Merchants shares have strengthened in the auction in Hong Kong at 14%, paper Industrial & Commercial Bank of China and China Overseas Land & Investment grew by 11% and 13% respectively.

Quotes of the Chinese real estate developers were also among the growth leaders. For example, Agile Property Holdings shares soared 15%, and paper Evergrande Real Estate Group went to plus 16%. Quotes of the manufacturer of building materials China National Building Material became heavier by 16%.

Shares of the Japanese manufacturer of excavators Hitachi Construction Machinery, about a quarter of sales accounting for the Chinese market, grew by 7.3%.

Rising commodity prices contributed to the fact that the papers were the world's largest mining company BHP Billiton rose at auction in Sydney by 4.1%, shares of Chinese copper producer Jiangxi Copper grew by 13%, but rates have gone Mitsubishi dealer in raw materials, plus a 4, 7%.

European stocks declined, snapping a four-day rally in the benchmark Stoxx Europe 600 Index, as China’s manufacturing contracted in November adding to concern global economic growth is slowing down.

China’s manufacturing recorded the weakest performance since the global recession eased in 2009, underscoring the case for monetary stimulus. A purchasing managers’ index compiled by the China Federation of Logistics and Purchasing slid to 49 in November, lower than all but two of 18 forecasts in a Bloomberg News survey. Readings below 50 signal a contraction.

Spain sold the maximum amount of debt planned at an auction. France sold 4.3 billion euros of securities, compared with a maximum 4.5 billion euros of debt available on offer as 10-year bonds sold were priced to yield 3.18 percent, less than at a previous auction on Nov. 3.

National benchmark equity indexes declined in every western-European market except Switzerland. The U.K.’s FTSE 100 Index dropped 0.3 percent, France’s CAC 40 Index fell 0.8 percent and Germany’s DAX Index fell 0.9 percent.

BNP Paribas SA and Societe Generale SA, the biggest French lenders, declined 2 percent to 28.88 euros and 3.2 percent to 17.50 euros, respectively. Goldman’s Chief Global Equity Strategist Peter Oppenheimer cut the European banking sector to ’underweight’ from ’sell’ as he expects sector to remain under pressure to shore up balance sheets.

Hochtief fell 1.5 percent to 41.78 euros and Vinci SA (DG), Europe’s biggest builder, slipped 2 percent to 32.44 euros. Vinci pulled out of bidding for the purchase of Hochtief’s airport-operating business, Societe Generale said in a research note today, citing Vinci’s chief financial officer.

Norsk Hydro, Europe’s third-largest aluminum maker, fell 2.9 percent to 26.86 kroner after forecasting lower global growth in demand for the metal. Goldman Sachs recommended selling the shares on low returns and near-term weakness.

Burberry Group Plc, the U.K.’s largest luxury-goods maker, rallied 3 percent to 1,308 pence. The company plans to add more stores in Paris after its opening on rue Saint Honore, Les Echos reported, citing Chief Executive Officer Angela Ahrendts.

U.S. stocks declined as better-than- forecast manufacturing growth and a rally in French and Spanish bonds were not enough to extend the biggest three-day gain in the Standard & Poor’s 500 Index since March 2009.

Stocks rose earlier today as Spain and France sold 8.1 billion euros ($10.9 billion) of bonds, sending yields lower across Europe. In the U.S., manufacturing expanded in November at the fastest pace in five months.

Stocks pared declines in the afternoon as investors awaited tomorrow’s jobs report. Payrolls may have climbed by 125,000 workers in November, after rising 80,000 the prior month, economists surveyed by Bloomberg projected ahead of the Labor Department report.

Dow 12,020.03 -25.65 -0.21%, Nasdaq 2,626.20 +5.86 +0.22%, S&P 500 1,244.58 -2.38 -0.19%

Financial stocks fell the most in the S&P 500 among 10 industries, dropping 1 percent, as Massachusetts sued some of the largest lenders over foreclosure practices. JPMorgan decreased 1.7 percent to $30.46. Citigroup slipped 1.8 percent to $26.99. Bank of America added 1.7 percent to $5.53, reversing an earlier decline.

Gauges of commodity shares in the S&P 500 fell at least 0.6 percent after a contraction in China’s manufacturing fueled concern Europe’s crisis is damaging the global economy as yesterday’s moves by central banks were viewed as only a temporary fix. Alcoa, the largest U.S. aluminum producer, dropped 2.1 percent to $9.81.

Kohl’s fell the most in the S&P 500, erasing 6.4 percent to $50.37. The department-store chain said sales at stores open at least one year decreased 6.2 percent in November. Analysts on average estimated an increase of 2.1 percent.

Clearwire Corp. rallied 14 percent to $2.03. The money- losing wireless carrier paid creditors $237 million in interest after striking a new network-sharing agreement with partner Sprint Nextel Corp.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.00 (middle line from Nov 18)

The current price: Y77.80

Support 1: Y77.55 (MA (233), support line from Nov 29)

Support 2: Y77.00 (Nov 24 low)

Support 3: Y76.55 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y77.95.

Resistance 3: Chf0.9250 (Nov 30 high)

Resistance 2: Chf0.9225 (61.8% FIBO Chf0.9065-Chf0.9330)

Resistance 1: Chf0.9195 (50.0% FIBO Chf0.9065-Chf0.9330)

The current price: Chf0.9167

Support 1: Chf0.9145 (session high)

Support 2: Chf0.9110 (middle line from Nov 25)

Support 3: Chf0.9065 (Nov 30 low)

Comments: the pair is on downtrend. In focus support Chf0.9145.

Resistance 3 : $1.5885 (Nov 18 high)

Resistance 2 : $1.5780 (Nov 30 high)

Resistance 1 : $1.5720 (middle line from Nov 25)

The current price: $1.5676

Support 1 : $1.5645 (MA (233) H1)

Support 2 : $1.5600 (50.0% FIBO $1.5420-$1.5780)

Support 3 : $1.5560 (61.8% FIBO $1.5420-$1.5780)

Comments: the pair is on uptrend. In focus resistance $1.5720.

Resistance 3: $1.3570 (Nov 22 high)

Resistance 2: $1.3530 (resistance line from Nov 25, Nov 30 high)

Resistance 1: $1.3490 (session high)

The current price: $1.3460

Support 1 : $1.3425 (MA (233) H1)

Support 2 : $1.3395 (50.0% FIBO $1.3530-$ 1.3255)

Support 3 : $1.3360 (61.8% FIBO $1.3530-$ 1.3255)

Comments: the pair is on uptrend. In focus resistance $1.3490.

Change % Change Last

Nikkei 225 8,597 +162.77 +1.93%

Hang Seng 19,002 +1,012.91 +5.63%

S&P/ASX 200 4,229 +108.78 +2.64%

Shanghai Composite 2,387 +53.45 +2.29%

FTSE 100 5,489 -16.08 -0.29%

CAC 40 3,130 -24.67 -0.78%

DAX 6,036 -52.96 -0.87%

Dow 12,020.03 -25.65 -0.21%

Nasdaq 2,626.20 +5.86 +0.22%

S&P 500 1,244.58 -2.38 -0.19%

10 Year Yield 2.12% +0.05 --

Oil $100.08 -0.12 -0.12%

Gold $1,748.40 +8.60 +0.49%

08:00 United Kingdom Halifax house price index November +1.2%

08:00 United Kingdom Halifax house price index 3m Y/Y November -1.8%

08:15 Switzerland Retail Sales Y/Y October -0.9% +1.2%

09:30 United Kingdom PMI Construction November 53.9 52.2

10:00 Eurozone Producer Price Index, MoM October +0.3% +0.2%

10:00 Eurozone Producer Price Index (YoY) October +5.8%

12:00 Canada Employment November -54.0K +17.2K

12:00 Canada Unemployment rate November 7.3% 7.3%

13:30 U.S. Nonfarm Payrolls November +80K +119K

13:30 U.S. Unemployment Rate November 9.0% 9.0%

13:30 U.S. Average hourly earnings November +0.2%

13:30 U.S. Average workweek November 34.3

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.