- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 05-12-2011

The euro fall as the European ratings story from the FT is circulated and receives attention, FT report asserting that S&P has warned Germany, France, Netherlands, Austria, Finland and Luxembourg that their ratings are at risk because of the EU crisis. Earlier the euro advanced after France and Germany said they want a rewrite of the European Union’s governing treaties to tighten economic cooperation in the region. The 17-nation currency was supported as Italy’s cabinet approved a deficit-cut plan, easing concern the region’s debt crisis in worsening.

Sterling strengthened as an index of U.K. services unexpectedly gained and U.S. services expanded in November at the slowest pace since January 2010.

Willing to work with republicans on paying for tax cut

Urges congress to pass unemployment insurance

European stocks rose, with the benchmark Stoxx Europe 600 Index extending its biggest weekly rally since November 2008, as Italy’s Prime Minister Mario Monti introduced a proposal to cut his nation’s debt.

Monti presented a plan to reduce the European Union’s second-biggest debt to the Chamber of Deputies in Rome today. The budget package came at the start of a critical week for Europe’s efforts to prevent Italy and Spain from succumbing to the crisis and causing a breakup of the single currency. France and Germany want a new EU treaty to set out the rules for euro-area governments, President Nicolas Sarkozy said after meeting Chancellor Angela Merkel.

Merkel and Sarkozy are developing a plan for stricter enforcement of the region’s deficit rules that they will present to EU leaders at a summit on Dec. 9.

National benchmark indexes climbed in every western- European market. France’s CAC 40 Index advanced 1.2 percent and the U.K.’s FTSE 100 Index rose 0.3 percent. Germany’s DAX Index increased 0.4 percent.

A gauge of European banks advanced 2.5 percent. UniCredit, Italy’s biggest lender, jumped 5.4 percent to 83.6 euro cents. Intesa Sanpaolo added 3.9 percent to 1.35 euros and BNP Paribas, France’s largest bank, rose 4.9 percent to 33.16 euros.

SAP slipped 2.5 percent to 43.61 euros. The German software maker agreed to buy San Mateo, California-based SuccessFactors on Dec. 3 to better meet demand for new technologies such as cloud computing, real-time analytics and mobile applications.

Commerzbank AG declined 4.1 percent to 1.44 euros as Germany’s second-largest bank offered to repurchase as much as 600 million euros of hybrid equity instruments.

U.S. stocks rose, after the biggest weekly gain since 2009 in the Standard & Poor’s 500 Index, as Italy’s Mario Monti proposed budget cuts and Germany and France pushed for a new European Union treaty to fight the debt crisis.

Italian borrowing costs dropped as Italy’s Prime Minister Monti will lobby parliament to support a 30 billion-euro ($40 billion) package of austerity and growth measures. German Chancellor Angela Merkel and French President Nicolas Sarkozy pushed for a rewrite of the EU’s governing treaties to tighten economic cooperation as a first step to ending the debt crisis.

Merkel’s government won’t stand in the way of Bundesbank help to fight the crisis by means of loans channeled through the International Monetary Fund, a senior Merkel ally said.

Stocks rose even as the Institute for Supply Management’s non-manufacturing index fell to 52 in November from 52.9 a month earlier. The measure was projected to rise to 53.9, according to the median forecast in a Bloomberg News survey. Separate data showed that American factories received fewer orders in October for a second month.

Dow 12,159.70 +140.28 +1.17%, Nasdaq 2,669.79 +42.86 +1.63%, S&P 500 1,264.29 +20.01 +1.61%

All 10 groups in the S&P 500 gained, led by financial shares. Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) climbed at least 4 percent.

MetLife Inc., the largest U.S. life insurer, advanced 4.7 percent after saying earnings will probably increase in 2012.

Dollar General Corp. added 1.5 percent after the dollar store chain raised its annual earnings forecast and said it will buy back as much as $500 million in shares.

Gold rose in the hope that the forthcoming EU summit will allow politicians to reach a new level of problem solving the debt crisis in the eurozone. French President Nicolas Sarkozy and German Chancellor Angela Merkel met in Paris to coordinate their positions on the issue of centralizing the management of the budgets of the euro area in an attempt to stop the debt crisis that threatens the collapse of the currency bloc. The leaders of France and Germany to overcome the remaining differences in order to submit a final proposal at the EU summit which starts in Brussels on Thursday.

Today, December gold futures trading at the New York Stock Exchange on the Comex rose to 1752.60 dollars per troy ounce.

Oil rose for a second day in New York on concern that tension in the Middle East threatens supplies. West Texas Intermediate oil gained as much as 0.8 percent, after posting the first weekly increase in three. Iran said crude will surge above $250 a barrel if nations threaten to ban its purchases, according to the Shargh newspaper.

Even verbal threats to block exports of Iranian oil will cause crude prices to increase, Ramin Mehmanparast, a Foreign Ministry spokesman, told Tehran-based Shargh in an interview published yesterday. Iran pumped 5 percent of the world’s oil last year, according to BP Plc’s Statistical Review of World Energy.

The European Union added 180 Iranian officials and companies to a blacklist on Dec. 1 to try to pressure the world’s third-largest crude exporter to curtail its nuclear program. The U.S., U.K. and Canada announced measures on Nov. 21 making it harder for President Mahmoud Ahmadinejad’s government to receive payments for crude exports, though they stopped short of banning trade in Iranian oil.

Crude for January delivery climbed to $102.44 a barrel in electronic trading on the New York Mercantile Exchange. Brent futures for January settlement rose 91 cents, or 0.8 percent, to $110.85 a barrel on the London-based ICE Futures Europe exchange. The European benchmark contract traded at a premium of $9.33 a barrel to the U.S.-traded West Texas Intermediate grade.

USD/JPY Y77.60, Y77.95, Y78.00, Y78.05

AUD/USD $1.0000, $1.0200, $1.0250, $1.0300, $1.0400, $1.0450, $1.0465

GBP/USD $1.5700, $1.5945

EUR/JPY Y103.50

- want automatic sanctions for deficit over 3.0% of GDP;

- no comments on ECB, respect its independence.

- want automatic sanctions for deficit over 3.0% of GDP;

- no comments on ECB, respect its independence.

Italian borrowing costs dropped as Monti will lobby parliament to support a 30 billion-euro ($40 billion) package of austerity and growth measures.

Nikkei 8,696 +52.23 +0.60%

Hang Seng 19,180 +139.30 +0.73%

Shanghai Composite 2,333 -27.43 -1.16%

FTSE 5,599 +46.89 +0.84%

CAC 3,213 +47.70 +1.51%

DAX 6,148 +67.01 +1.10%

Crude oil: $102.34 (+1,3%).

Gold: $1737,60 (-0,8%).

Alcoa (AA) was downgraded to a Neutral from Buy at Goldman Sachs.

Data:

08:50 France PMI services (November) 49.6

08:55 Germany PMI services (November) seasonally adjusted 50.3

09:00 EU(17) PMI services (November) 47.5

09:30 UK CIPS services index (November) 52.1

10:00 EU(17) Retail sales (October)adjusted 0.4%

10:00 EU(17) Retail sales (October) adjusted Y/Y -0.4%

The euro advanced as Italy’s cabinet approved a plan to cut its deficit before a European summit on the region’s sovereign debt crisis.

Italian Prime Minister Mario Monti announced 30 billion euros of austerity and growth measures yesterday. The premier will present the package, which includes a tax on luxury goods, resurrects a property levy on first homes, and forces many workers to delay retirement. The proposal will go before both houses of parliament today.

The euro appreciated after people familiar with the negotiations said a proposal to channel European Central Bank loans through the International Monetary Fund may deliver as much as 200 billion euros ($269 billion) to fight the crisis.

The yen and dollar weakened as European stocks gained, damping demand for safer investments.

The ECB will cut its benchmark interest rate to 1 percent from 1.25 percent when it meets Dec. 8, according to the median estimate of economists.

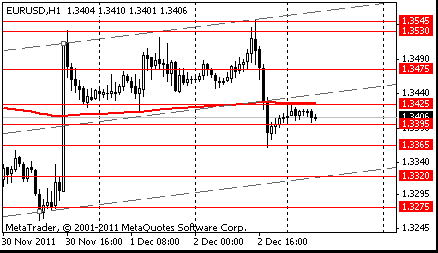

EUR/USD: the pair has grown, showed high in $1,3460 area.

GBP/USD: the pair has lead the most part of the european session in $1.5620-$ 1,5660 area.

USD/JPY: the pair was in Y77.90-Y78.10 area.

US data starts at 1430GMT with the weekly MNI Capital Goods Index. This is followed at 1500GMT by both the ISM data and Factory Orders as well as the latest Employment Trends Index.

EUR/USD

Offers $1.3600/15, $1.3570, $1.3550, $1.3500/10, $1.3480/85

Bids $1.3420, $1.3400/390, $1.3340, $1.3315/10

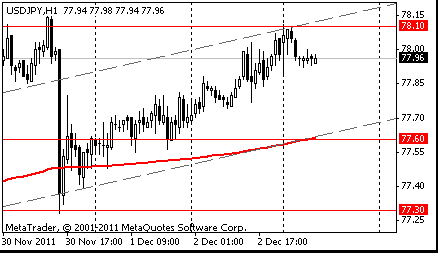

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.30 (Nov 4 and 29 highs)

Current price: Y78.01

Support 1:Y77.90 (session low)

Support 2:Y77.60 (МА (200) for Н1)

Support 3:Y77.30 (Nov 30 low)

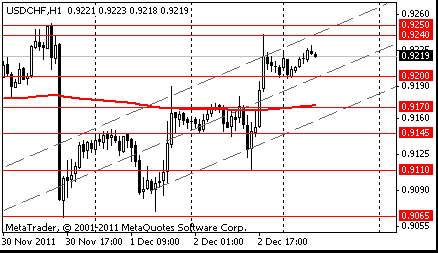

Resistance 3: Chf0.9370 (high of March)

Resistance 2: Chf0.9330 (Nov 25 high)

Resistance 1: Chf0.9240/55 (Nov 30 and Dec 2 high)

Current price: Chf0.9213

Support 1: Chf0.9190 (session low)

Support 2: Chf0.9110 (Dec 2 low)

Support 3: Chf0.9060/70 (Nov 30 and Dec 1 low)

Resistance 3: $ 1.5780 (Nov 30 high)

Resistance 2: $ 1.5700 (resistance line from Nov 30)

Resistance 1: $ 1.5670 (session high)

Current price: $1.5629

Support 1 : $1.5599/80 (area of session low, МА (200) for Н1 and support line from Nov 25)

Support 2 : $1.5520 (Nov 30 low)

Support 3 : $1.5460 (area of Nov 28-29 lows)

Resistance 3: $ 1.3570 (Nov 22 high)

Resistance 2: $ 1.3550 (Dec 2 high)

Resistance 1: $ 1.3460 (session high)

Current price: $1.3427

Support 1 : $1.34000 (area of session low and support line from Nov 30)

Support 2 : $1.3360 (Dec 2 low)

Support 3 : $1.3310 (support line from Nov 25)

USD/JPY Y77.60, Y77.95, Y78.00, Y78.05

AUD/USD $1.0000, $1.0200, $1.0250, $1.0300, $1.0400, $1.0450, $1.0465

GBP/USD $1.5700, $1.5945

EUR/JPY Y103.50

Nikkei 225 8,696 +52.23 +0.60%

Hang Seng 19,180 +139.30 +0.73%

S&P/ASX 4,321 +33.32 +0.78%

Shanghai Composite 2,333 -27.43 -1.16%

00:30 Australia ANZ Job Advertisements (MoM) November -0.7% 0.0%

The euro gained against most major peers as Italy advanced a plan to cut its deficit before a European summit on the region’s sovereign-debt crisis. The 17-nation currency rose versus the dollar after two people familiar with the negotiations said a proposal to channel European Central Bank loans through the International Monetary Fund may deliver as much as 200 billion euros ($268 billion) to fight the crisis. Italian Prime Minister Mario Monti announced 30 billion euros of austerity and growth measures yesterday. The premier will present the package, which includes a tax on luxury goods, resurrects a property levy on first homes, and forces many workers to delay retirement, to both houses of parliament today. German Chancellor Angela Merkel is scheduled to meet French President Nicolas Sarkozy to advance a plan for stricter enforcement of the region’s deficit rules. European Union leaders will hold a summit in Brussels this week.

The greenback held a two-week climb against the yen after a Dec. 2 report showed the U.S. jobless rate slid to the lowest since March 2009.

The Australian dollar rose after Italy’s Cabinet approved austerity and growth measures before a summit on Europe’s debt crisis, supporting demand for riskier assets. Gains in the so-called Aussie may be limited on speculation the Reserve Bank of Australia will cut interest rates when it meets tomorrow.

EUR/USD: on Asian session the pair holds in a range $1.3395-$1.3425.

GBP/USD: on Asian session the pair holds in a range $1.5585-$ 1.5625.

USD/JPY: on Asian session the pair traded nearby Y78.00.

European events for Monday include the final services PMI releases for November, including France at 0848GMT, Germany at 0853GMT

and the main EMU number at 0858GMT. EMU data also includes the 1000GMT release of EMU retail trade. At 1230GMT, German Chancellor Angela Merkel and French President Nicolas Sarkozy are due to meet in Paris to discuss the upcoming EU summit. UK data also sees the Markit/CIPS Services PMI for November at 0928GMT. US data starts at 1430GMT with the weekly MNI Capital Goods Index. This is followed at 1500GMT by both the ISM data and Factory Orders as well as the latest Employment Trends Index.

Asian stocks ended mostly higher, as hopes rose for strong results from the key U.S. jobs report due out later in the global day.

The moves came ahead of the key monthly U.S. nonfarm payrolls report. While economists’ median forecast called for the addition of 125,000 jobs and a steady unemployment rate of 9.0%, strong private-employment data from ADP earlier in the week raised hopes for an upside surprise.

Japan’s Nikkei rose 0.5%, and Australia’s S&P/ASX 200 index rallied 1.4%. Hong Kong’s Hang Seng Index turned around late in the session to end 0.2% higher, helped by gains for bank shares, but the Shanghai Composite Index which closes trade an hour earlier — failed to catch the updraft and ended with a 1.1% loss.

Australian banks staged a late rally to push the benchmark higher by the close, with Westpac Banking Corp. (+1,4%) and Commonwealth Bank of Australia (+1,6%). The gains for the banks came despite a Standard & Poor’s credit downgrade for Westpac, CBA and others, as the agency applied new rating standards for banks worldwide.

In Tokyo, stock in Nissan Motor Co. added 1,1% after the auto maker posted an almost 20% gain in its November U.S. sales. Shares of Toyota Motor Corp.— which posted a more modest rise in U.S. sales — also added 1,1%.

Many Japanese retailers also advanced, with J. Front Retailing Cogaining adding 2,1%, and convenience-store operator Seven & I Holdings Co. adding 2,3%.

In Hong Kong, banking shares added to their large gains in the previous session on hopes of Chinese policy easing, driving the Hang Seng Index into positive territory late in the day. Bank of China (+4,5%), China Merchants Bank (+2.02%), and HSBC Holdings (+1,6%).

On the downside, shares of Belle International Holdings Ltd fell 6,6% in Hong Kong after reports said shareholder CDH Investments will sell 50 million shares of the footwear firm.

In Seoul, Samsung Electronics Co. dropped 2,2% after Australia’s top court extended a sales ban on its Galaxy Tab 10.1 computer for at least another week, as the Korean firm fights patent-infringement charges from Apple.

European stocks climbed, with the Stoxx Europe 600 Index extending its largest weekly rally since November 2008, after a report showed that the U.S. unemployment rate fell below 9 percent last month. A Labor Department report showed unemployment in the U.S. unexpectedly dropped in November to a two-year low, while employers added fewer workers than projected and earnings eased, indicating the labor market is making limited progress.

The jobless rate dropped to 8.6 percent, the lowest since March 2009, the release showed. Payrolls climbed 120,000, with more than half the hiring coming from retailers and temporary- help agencies, after a revised 100,000 increase in October that was more than initially estimated. The median estimate in a Bloomberg News survey had called for a gain of 125,000.

German Chancellor Angela Merkel said earlier today that only fiscal union will tackle the euro area’s debt crisis at its roots, as she used a speech to lawmakers in Berlin to outline her position before a European Union summit on Dec. 9. The euro area needs fiscal oversight that’s “binding” and punishes states that persistently breach debt and deficit rules.

A European proposal to channel loans from national central banks through the International Monetary Fund may deliver as much as 200 billion euros ($268 billion) to fight the debt crisis, two people familiar with the negotiations said.

National benchmark indexes climbed in every western- European market except Norway. France’s CAC 40 Index advanced 1.1 percent and the U.K.’s FTSE 100 Index rose 1.2 percent. Germany’s DAX Index increased 0.7 percent.

Commerzbank surged 11 percent to 1.50 euros as Die Welt said Germany’s second-biggest bank could generate about 1 billion euros by retaining profit through June 30. The lender could boost its core capital by 3 billion euros by offloading some 30 billion euros in risk-weighted assets, the newspaper said, citing options that its supervisory board will discuss today. The lender could also generate as much as 6 billion euros by converting hybrid capital, according to Die Welt. The German newspaper cited banking officials.

Banking shares were the best-performing industry today, soaring 4.3 percent. HSBC Holdings Plc rose 3 percent to 510.7 pence in London, while BNP Paribas SA surged 9.4 percent to 31.60 euros in Paris.

BHP Billiton Ltd. and Rio Tinto Group, the world’s biggest mining companies (BLT), paced gains in commodity stocks, rising 4 percent to 2,000.5 pence and 1.3 percent to 3,346.5 pence, respectively. The industry was among the best performers in the Stoxx 600 this week, surging 12 percent. Aluminum, copper, lead, nickel and zinc all climbed on the London Metal Exchange today.

Daimler AG advanced 1.7 percent to 33.93 euros. A report from Autodata Corp. yesterday showed that U.S. light-vehicle sales accelerated to their fastest pace in 2011. Daimler sells more than 17 percent of its vehicles in the U.S., Bloomberg data shows. Separately, Daimler plans to cut production costs by 10 percent annually in 2012 and 2013, Reuters reported, citing Wolfgang Nieke, a works council member.

ThyssenKrupp AG fell 6.4 percent to 17.80 euros, the biggest decline in the Stoxx 600 today, after Germany’s biggest steelmaker posted a fiscal full-year loss because of 2.9 billion euros of impairments charges, mostly after it delayed the construction of a plant in Brazil.

U.S. stocks were little changed, after wiping out an early rally, as a drop in the jobless rate to a two-year low wasn’t enough to extend the biggest weekly advance since March 2009 for the Standard & Poor’s 500 Index.

The benchmark index for American equities has trimmed its decline for 2011 to 1.1 percent after rebounding 13 percent from its low for the year on Oct. 3. Improving U.S. economic data has helped alleviate concern that the world’s largest economy will relapse into a recession as Europe’s debt crisis threatens to derail the recovery.

Today’s jobs data showed that payrolls climbed 120,000, with more than half the hiring coming from retailers and temporary help agencies, after a revised 100,000 rise in October that was more than initially estimated. The median estimate in a Bloomberg News survey called for a gain of 125,000. The jobless rate declined to 8.6 percent, the lowest since March 2009, from 9 percent, Labor Department figures showed.

Equity futures rose earlier following a report that as much as 200 billion euros ($270 billion) of national central bank loans may be channeled through the IMF. Germany and France are pushing for closer economic ties among euro-area nations and tougher enforcement of budget rules to counter the region’s debt crisis.

Financial stocks posted the largest gains out of 10 groups in the S&P 500, climbing 1.4 percent. JPMorgan (JPM) surged 6.1 percent, the biggest rise in the Dow, to $32.33, while Morgan Stanley rallied 7 percent to $15.52. Citigroup Inc. jumped 4.4 percent to $28.17 and Goldman Sachs Group Inc. added 3 percent to $97.25.

Caterpillar (CAT), the world’s largest construction and mining- equipment maker, slid 0.6 percent to $96.29, after rallying as much as 1.2 percent. Chevron Corp. slumped 0.1 percent to $101.69, after rising as much as 1.3 percent.

Western Digital jumped 7.5 percent, the most in the S&P 500, to $31.44. The disk-drive maker raised its quarterly revenue forecast after sales rebounded from a flood in Thailand that devastated factories and constrained supplies.

Hospital and medical device stocks tumbled after a report that insurers who handle Medicare payments in 11 states will perform audits on hospital stays related to heart and orthopedic procedures. Hospitals will have to wait 30 to 60 days while hospital records are reviewed to determine whether procedures performed during the stay were medically necessary, the Wells Fargo Securities note said today.

Health-care companies posted the biggest losses as a group today, falling 1.3 percent. Tenet Healthcare plunged 11 percent to $4.18. Boston Scientific erased 6.8 percent to $5.50.

Resistance 3: Y78.60 (resistance line from Nov 18)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.10 (session high)

The current price: Y77.98

Support 1: Y77.60 (MA (233) H1)

Support 2: Y77.30 (Nov 30 low)

Support 3: Y77.00 (Nov 24 low)

Comments: the pair is on uptrend. In focus resistance Y78.10.

Resistance 3: Chf0.9330 (Nov 25 high)

Resistance 2: Chf0.9305 (Nov 28 high)

Resistance 1: Chf0.9240/50 (area of Nov 28 - Dec 2 high)

The current price: Chf0.9223

Support 1: Chf0.9200 (session low)

Support 2: Chf0.9170 (MA (233) H1)

Support 3: Chf0.9145 (low of the Asian session on Dec 2)

Comments: the pair is on downtrend. In focus support Chf0.9325.

Resistance 3 : $1.5725 (Dec 2 high)

Resistance 2 : $1.5685 (resistance line from Dec 1)

Resistance 1 : $1.5625 (session high)

The current price: $1.5601

Support 1 : $1.5575 (Dec 2 low)

Support 2 : $1.5525 (Nov 30 low)

Support 3 : $1.5470 (Nov 29 low)

Comments: the pair is on downtrend. In focus support $1.5575.

Resistance 3: $ 1.3530/45 (Dec 30 high)

Resistance 2: $ 1.3475 (61.8 % FIBO $1.3360-$1.3550)

Resistance 1: $ 1.3425 (session high, MA (233) H1)

The current price: $1.3402

Support 1 : $1.3395 (session low)

Support 2 : $1.3365 (Dec 2 low)

Support 3 : $1.3320 (support line from Nov 25)

Comments: the pair is corrected in uptrend. In focus support $1.3395.

00:30 Australia ANZ Job Advertisements (MoM) November -0.7%

08:50 France Services PMI November 49.3 49.3

08:55 Germany Purchasing Manager Index Services November 51.4 51.4

09:00 Eurozone Purchasing Manager Index Services November 47.8 47.8

09:00 Eurozone Sentix Investor Confidence December -21.2 -21.4

09:30 United Kingdom Purchasing Manager Index Services November 51.3 50.7

10:00 Eurozone Retail Sales (MoM) October -0.7% +0.2%

10:00 Eurozone Retail Sales (YoY) October -1.5% -0.8%

15:00 U.S. ISM Non-Manufacturing November 52.9 53.6

15:00 U.S. Factory Orders October +0.3% -0.2%

17:10 U.S. FOMC Member Charles Evans Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.