- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 06-12-2011

The euro fell against yen after Standard & Poor’s warned it may downgrade the European Financial Stability Fund, reinforcing concern that policy makers haven’t contained the region’s debt crisis. The 17-nation euro fluctuated against the dollar as U.S. stocks rose. The euro area’s six AAA rated countries are among those placed on a negative outlook, and their ratings may be cut depending on the result of a summit of European leaders on Dec. 9, S&P said yesterday in a statement. The company said ratings may be cut by one level for Austria, Belgium, Finland, Germany, the Netherlands and Luxembourg, and by up to two levels for the other governments.

The Swiss franc weakened against all its major counterparts after consumer prices dropped in November. S&P added the bailout fund today to the 15 euro nations placed on a negative outlook yesterday before a summit meeting this week.

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher a second day, on speculation European leaders may act to contain the debt crisis after S&P put 15 euro nations on review for possible downgrade.

German Finance Minister Wolfgang Schaeuble said S&P’s warning will help force European leaders to ratchet up efforts to resolve the crisis. Six nations may lose their AAA ratings depending on the result of a summit of European Union leaders this week, S&P said yesterday. S&P today said the European Financial Stability Facility may lose its top credit rating if any of its guarantors have their own debt grade cut.

Financial stocks in the S&P 500 fell 0.2 percent as a group. JPMorgan declined 1.1 percent to $33.15. Citigroup lost 1.6 percent to $29.34.

Darden fell 11 percent to $42.28. Full-year earnings per share growth from continuing operations will be 4 percent to 7 percent, down from a previous forecast of 12 percent to 15 percent, the Orlando, Florida-based company said today in a statement. Total sales growth will be 6 percent to 7 percent, reduced from a prior forecast of 6.5 percent to 7.5 percent.

A measure of transportation shares had the biggest decline in the S&P 500 among 24 industries, falling 1 percent. Union Pacific Corp. lost 2.3 percent to $102.20. CSX Corp. declined 1.6 percent to $21.68.

3M rallied 1.6 percent to $82.24. Sales may be $30.2 billion to $31.5 billion, according to a presentation on the company’s website, in line with the $30.6 billion average estimate from analysts surveyed by Bloomberg. The maker of Scotch-Brite sponges and Nexcare thermometers expects earnings per share of $6.25 to $6.50 next year, also tracking estimates.

GE added 2.3 percent to $16.71. Sanford C. Bernstein raised its recommendation for the Fairfield, Connecticut-based company to “outperform” from “market perform,” citing rising dividends and energy orders starting in 2012.

MetroPCS Communications Inc. added 7.1 percent to $8.94 for the biggest gain in the S&P 500. The pay-as-you-go U.S. wireless carrier was raised to “outperform” from “market perform” at William Blair & Co., which said the stock’s price doesn’t reflect the company’s “ healthy balance sheet.”

Crude oil for January delivery declined 55 cents, or 0.5 percent, to $100.44 a barrel at 10:12 a.m. on the New York Mercantile Exchange. Yesterday, the contract gained 3 cents to $100.99, the highest settlement since Nov. 16. Futures are up 9.9 percent this year.

Brent oil for January settlement fell 17 cents to $109.64 a barrel on the London-based ICE Futures Europe exchange. The euro area’s six AAA rated countries are among nations to be placed on a negative outlook depending on the result of the summit, S&P said yesterday.

German Finance Minister Wolfgang Schaeuble said S&P’s downgrade warning will spur European leaders to ratchet up efforts to resolve the two-year-old debt crisis in Brussels.

The European Union accounted for 16 percent of global oil demand last year, according to BP Plc’s annual Statistical Review of World Energy. The U.S., the world’s biggest oil user, consumed 19.1 million barrels a day, or 21 percent of the total.

Oil climbed earlier as Germany’s Economy Ministry said factory orders rose the most in 19 months in October after three straight declines. Adjusted for seasonal swings and inflation, orders jumped 5.2 percent from September, when they fell 4.6 percent. Economists in a Bloomberg News survey projected a 1 percent gain. Germany is Europe’s biggest economy.

An Energy Department report tomorrow will probably show that U.S. crude oil stockpiles decreased by 1 million barrels last week, according to the median of 11 analysts surveyed by Bloomberg News. Inventories of distillate fuel, a category that includes heating oil and diesel, rose 1.1 million barrels, and gasoline supplies gained 1 million barrels, the survey showed.

The industry-funded American Petroleum Institute will release its own supply data at 4:30 p.m. today in Washington.

Oil in the U.S. will average $100 a barrel in 2012 and is more likely to rise above that level than fall below it, ConocoPhillips Chief Executive Officer Jim Mulva said.

Gold prices drop on the background of the new negative from Europe and the subsequent strengthening of the dollar, to which precious metals are usually traded in different directions. Falling prices for precious metals comes amid statements by S & P lowered ratings of a possible 15 of the 17 eurozone countries, including France and Germany. On Tuesday, the agency also placed on the list to review with rating downgrade of the European Financial Stability Fund (EFFS), loans to Portugal and Ireland.

Today, December gold futures trading at the New York Stock Exchange on Comex fell to 1703.0 dollars per troy ounce.

Consensus estimates are for earnings of $6.28 and sales of $30.59B.

Shares of MMM +1.78%.

USD/JPY Y78.00, Y78.50, Y79.00

AUD/USD $1.0000, $1.0200/05, $1.0250

GBP/USD $1.5850

CHF/JPY Y85.50

USD/CHF Chf0.9100, Chf0.9150, Chf0.9300

U.S. stock futures erased gains after Standard & Poor’s said it may downgrade debt issued by Europe’s bailout fund, a day after it also put 15 euro nations on review.

Nikkei 8,575 -120.82 -1.39%

Hang Seng 18,942 -237.46 -1.24%

Shanghai Composite 2,326 -7.32 -0.31%

FTSE 5,566 -2.42 -0.04%

CAC 3,182 -19.06 -0.60%

DAX 6,037 -69.23 -1.13%

Crude oil: $100.43 (-0,6%).

Gold: $1711,90 (-1,3%).

Microsoft (MSFT) was initiated with Equal Weight at Barclays.

Data:

08:00 UK Halifax house price index (October) -0.9%

08:00 UK Halifax house price index (October) 3m Y/Y -1.0%

10:00 EU(17) GDP (Q3) revised 0.2%

10:00 EU(17) GDP (Q3) revised Y/Y 1.4%

11:00 Germany Manufacturing orders (October) seasonally adjusted 5.2%

11:00 Germany Manufacturing orders (October) not seasonally adjusted, workday adjusted Y/Y 5.4%

The euro fell against the dollar and the yen after Standard & Poor’s warned it may downgrade the European Financial Stability Fund.

The euro area’s six AAA rated countries are among those placed on a negative outlook, and their ratings may be cut depending on the result of a summit of European leaders on Dec. 9, S&P said yesterday in a statement. The company said ratings may be cut by one level for Austria, Belgium, Finland, Germany, the Netherlands and Luxembourg, and by up to two notches for the other governments.

EUR/USD: during european session the pair receded from low reached on asian session and could become stronger above $1,3400.

GBP/USD: the pair has trading in $1.5590-$ 1,5660 area.

USD/JPY: the pair has decreased in Y77.60 area.

Bank of Canada rate announcemet is due at 1400GMT. The BoC is not expected to make any policy change at this time. The overnight rate is 1%, and while the Bank views this as very accommodative. While the Bank may have some inclination tighten, conditions in the global economy and financial markets have kept policy on hold. At 1500GMT, Fed Governor Daniel Tarullo is due to testify before a Senate Banking Committee on the Dodd-Frank reforms, in Washington.

EUR/USD

Offers $1.3500/10, $1.3470, $1.3450/55

Bids $1.3400, $1.3375/70, $1.3330, $1.3310/00, $1.3280

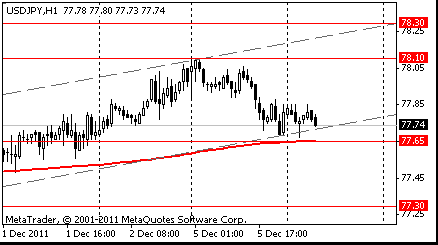

Resistance 3: Y78.30 (Nov 4 and 29 high)

Resistance 2: Y78.00 (resistance line from Oct 31)

Resistance 1: Y77.85 (session high)

Current price: Y77.74

Support 1:Y77.60 (session low)

Support 2:Y77.30 (Nov 30 low, МА (200) for Н4)

Support 3:Y77.00 (Nov 24 low)

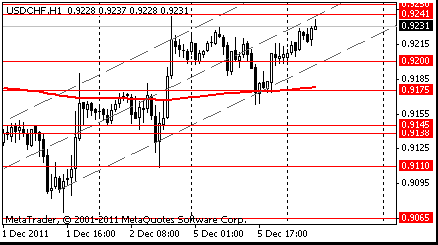

Resistance 3: Chf0.9330 (Nov 25 high)

Resistance 2: Chf0.9300 (session high)

Resistance 1: Chf0.9240/55 (area of Nov 30 and Dec 2 highs)

Current price: Chf0.9237

Support 1: Chf0.9200 (session low, МА (200) for Н1)

Support 2: Chf0.9160 (Dec 5 low)

Support 3: Chf0.9110/00 (area of Dec 2 low)

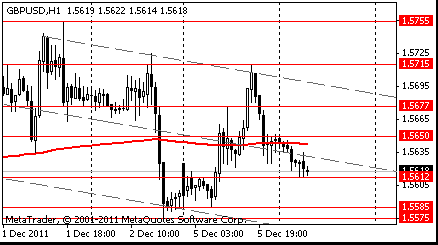

Resistance 3: $ 1.5830 (МА (200) for Н4)

Resistance 2: $ 1.5780 (Nov 30 high)

Resistance 1: $ 1.5660/80 (session high, resistance line from Nov 30)

Current price: $1.5637

Support 1 : $1.5590/75 (area of Dec 2 low, session low and МА (200) for Н1)

Support 2 : $1.5520 (Nov 30 low)

Support 3 : $1.5460 (area of Nov 28-29 lows)

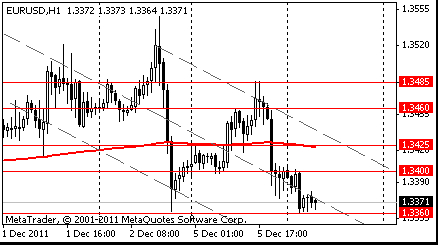

Resistance 3: $ 1.3550 (Dec 2 high)

Resistance 2: $ 1.3490/00 (area of Dec 5 high)

Resistance 1: $ 1.3430 (session high, resistance line from Dec 2)

Current price: $1.3411

Support 1 : $1.3380 (МА (200) for Н1)

Support 2 : $1.3330 (session low, support line from Nov 25)

Support 3 : $1.3260 (Nov 30 low)

USD/JPY Y78.00, Y78.50, Y79.00

AUD/USD $1.0000, $1.0200/05, $1.0250

GBP/USD $1.5850

CHF/JPY Y85.50

USD/CHF Chf0.9100, Chf0.9150, Chf0.9300

- Banks' Earnings Outlook Deteriorated Since Oct

- Banks Likely Less Able To Boost Capital With Earnings

- Strong Case For Limiting Bank Bonuses

- ROE Targets Could Reduce Incentives To Build Capital

- Fears On Bank Encumbrance May Be Lifting Borrowing Costs

- Current Risk Weights Opaque, Could Dent Confidence In Rules

- Clearing Houses Need Robust Arrangements To Manage Losses

Nikkei 225 8,575 -120.82 -1.39%

Hang Seng 18,926 -254.08 -1.32%

S&P/ASX 4,262 -59.35 -1.37%

Shanghai Composite 2,326 -7.32 -0.31%

Asian stocks rose for a sixth day, with Asia’s benchmark index headed for its longest winning streak since Oct. 13, as Italy took steps to trim its debt before European Union leaders meet this week to tackle the region’s crisis.

Stocks gained after Italian Prime Minister Mario Monti yesterday announced 30 billion euros ($40 billion) of austerity and growth measures. Monti will present the package, which includes a tax on luxury goods, resurrects a property levy on first homes, and forces many workers to delay retirement, to both houses of parliament today. German Chancellor Angela Merkel meets French President Nicolas Sarkozy today to advance a plan for stricter enforcement of the region’s deficit rules that will be presented to European leaders at a summit in Brussels on Dec. 9.

Japan’s Nikkei 225 Stock Average rose 0.6 percent and Australia’s S&P/ASX 200 added 0.8 percent. South Korea’s Kospi Index advanced 0.4 percent. Hong Kong’s Hang Seng Index rose 0.7 percent.

Banking shares gave the biggest boost to the MSCI Asia Pacific index amid optimism Europe’s debt crisis won’t damage the global financial system. Six central banks led by the Federal Reserve on Nov. 30 introduced measures to lower dollar borrowing costs for European lenders.

Mitsubishi UFJ Financial Group advanced 2.1 percent to 345 yen, and Sumitomo Mitsui Financial Group Inc., Japan’s second- biggest bank by market value, gained 2.2 percent to 2,212 yen. Commonwealth Bank of Australia, Australia’s biggest lender by market value, rose 0.8 percent to A$49.96.

Exporters to the U.S. advanced. Li & Fung added 3.3 percent to HK$16.94 in Hong Kong. Toyota Motor Corp., the world’s biggest carmaker by market value, gained 2.7 percent to 2,663 yen in Tokyo.

Gains in Asian stocks were limited as Chinese stocks fell after a purchasing managers’ index for November dropped to 49.7 from 57.7 the previous month, the China Federation of Logistics and Purchasing said on its website. The Shanghai Composite Index, which tracks the biggest Chinese stock exchange, slid 1.2 percent.

Anhui Conch Cement Co., China’s largest maker of the building material, dropped 2.1 percent to HK$25.75 in Hong Kong. China Railway Group Ltd., which is helping build the mainland’s train rail system, dropped 3.4 percent to HK$2.55.

Australian mining companies rose after the nation ended a ban on uranium exports to India to open a new market for suppliers and strengthen diplomatic ties between the countries.

Energy Resources, controlled by Rio Tinto Group, rose 9.8 percent to A$1.57 at the close of trading in Sydney. Exploration company Deep Yellow surged 10 percent. BHP Billiton Ltd. rose 1.7 percent to A$37.26 and Rio Tinto gained 1 percent to A$67.

European stocks rose, with the benchmark Stoxx Europe 600 Index extending its biggest weekly rally since November 2008, as Italy’s Prime Minister Mario Monti introduced a proposal to cut his nation’s debt.

Monti presented a plan to reduce the European Union’s second-biggest debt to the Chamber of Deputies in Rome today. The budget package came at the start of a critical week for Europe’s efforts to prevent Italy and Spain from succumbing to the crisis and causing a breakup of the single currency. France and Germany want a new EU treaty to set out the rules for euro-area governments, President Nicolas Sarkozy said after meeting Chancellor Angela Merkel.

Merkel and Sarkozy are developing a plan for stricter enforcement of the region’s deficit rules that they will present to EU leaders at a summit on Dec. 9.

National benchmark indexes climbed in every western- European market. France’s CAC 40 Index advanced 1.2 percent and the U.K.’s FTSE 100 Index rose 0.3 percent. Germany’s DAX Index increased 0.4 percent.

A gauge of European banks advanced 2.5 percent. UniCredit, Italy’s biggest lender, jumped 5.4 percent to 83.6 euro cents. Intesa Sanpaolo added 3.9 percent to 1.35 euros and BNP Paribas, France’s largest bank, rose 4.9 percent to 33.16 euros.

SAP slipped 2.5 percent to 43.61 euros. The German software maker agreed to buy San Mateo, California-based SuccessFactors on Dec. 3 to better meet demand for new technologies such as cloud computing, real-time analytics and mobile applications.

Commerzbank AG declined 4.1 percent to 1.44 euros as Germany’s second-largest bank offered to repurchase as much as 600 million euros of hybrid equity instruments.

U.S. stocks rose, following the best weekly rally since 2009, as optimism that Europe will tame its debt crisis helped the market weather a late-day selloff on reports that euro-area nations' credit outlooks may be cut.

Italian borrowing costs dropped as Prime Minister Mario Monti offered parliament a 30 billion-euro ($40 billion) package of austerity and growth measures. German Chancellor Angela Merkel and French President Nicolas Sarkozy pushed for a rewrite of the EU’s governing rules to tighten economic cooperation. Merkel and Sarkozy presented a common platform for a Dec. 8-9 summit of EU leaders in Brussels.

Stocks pared gains in the afternoon as two officials familiar with the S&P decision said the agency may downgrade euro nations. After the market closed, S&P announced that it put 15 euro nations on review for possible downgrade. Germany, France, Netherlands, Austria, Finland and Luxembourg, the euro area’s six AAA rated countries, are among the nations being placed on “creditwatch negative,” pending the result of the EU summit, S&P said.

All 10 groups in the Standard & Poor’s 500 Index gained, with a gauge of financial shares adding 2.1 percent. JPMorgan Chase & Co. (JPM) and Bank of America Corp. (BAC) advanced at least 2.6 percent.

MetLife climbed 3.7 percent to $32.92. Next year’s operating profit, which excludes some investment results, will be $4.80 to $5.20 a share, the New York-based company said today in a statement. That compares with the average $5.08 estimate (MET) of 20 analysts surveyed by Bloomberg.

Gannett surged 10 percent, the biggest gain since September 2009, to $13.13. The company was raised to “buy” from “neutral” at Lazard Capital Markets, which cited increased chances for a dividend boost.

Tenet Healthcare Corp. soared 12 percent to $4.70, pacing gains in hospital operators. A program to pre-approve Medicare hospital payments for pacemakers and joint replacements is limited to Florida, a U.S. doctor’s group said. Hospital and medical device stocks tumbled on Dec. 2 after a report said Medicare, the U.S. health plan for the elderly and disabled, won’t pay for a range of heart and orthopedic procedures in 11 states until contractors confirm the care was appropriate.

SuccessFactors Inc. surged 51 percent to $39.75. SAP AG, the largest maker of business-management software, agreed to buy the company for $3.4 billion in cash to keep pace with rival Oracle Corp. in the cloud-computing market.

00:30 Australia Current Account, bln Quarter III -7.4 -5.5 -5.6

03:30 Australia Announcement of the RBA decision on the discount rate 4.50% 4.25% 4.25%

The Australian dollar fell against all of its major peers after the Reserve Bank of Australia cut interest rates by 25 basis points for a second-straight month to 4.25 percent. The Australian dollar dropped 0.9 percent.

New Zealand’s dollar also declined as Standard & Poor’s put 15 euro-zone nations on watch for downgrades. Losses in the South Pacific currencies were limited after France and Germany said they want a rewrite of the European Union’s rules to enable closer cooperation in tackling the region’s debt problems. New Zealand’s currency, nicknamed the kiwi, fell 0.5 percent.

German Chancellor Angela Merkel and French President Nicolas Sarkozy strengthened their push for new rules to tighten euro area economic cooperation as Standard & Poor’s said it may downgrade credit ratings across the region.

The leaders of Europe’s two biggest economies responded in a joint statement late yesterday that they “took note” of the move by S&P, while both countries “reinforce their conviction” that common proposals for closer fiscal union in the European Union will “strengthen coordination of budget and economic policy,” and promote stability and growth.

Germany and France risk losing their AAA credit ratings in a review of 15 euro nations for possible downgrade, S&P said. Investors say such moves might pave the way for the European Central Bank to do more to fight the debt crisis.

EUR/USD: on Asian session the pair is under pressure.

GBP/USD: on Asian session the pair fell.

USD/JPY: on Asian session the pair traded in range Y77.65-Y77.85.

European events for Monday include the final services PMI releases for November, including France at 0848GMT, Germany at 0853GMT

and the main EMU number at 0858GMT. EMU data also includes the 1000GMT release of EMU retail trade. At 1230GMT, German Chancellor Angela Merkel and French President Nicolas Sarkozy are due to meet in Paris to discuss the upcoming EU summit. UK data also sees the Markit/CIPS Services PMI for November at 0928GMT. US data starts at 1430GMT with the weekly MNI Capital Goods Index. This is followed at 1500GMT by both the ISM data and Factory Orders as well as the latest Employment Trends Index.

In first half of yesterday the euro advanced as Italy’s cabinet approved a plan to cut its deficit before a European summit on the region’s sovereign debt crisis. Italian Prime Minister Mario Monti announced 30 billion euros of austerity and growth measures yesterday. The premier will present the package, which includes a tax on luxury goods, resurrects a property levy on first homes, and forces many workers to delay retirement. The proposal will go before both houses of parliament. The euro appreciated after people familiar with the negotiations said a proposal to channel European Central Bank loans through the International Monetary Fund may deliver as much as 200 billion euros ($269 billion) to fight the crisis.

But later the euro fall as the European ratings story from the FT is circulated and receives attention, FT report asserting that S&P has warned Germany, France, Netherlands, Austria, Finland and Luxembourg that their ratings are at risk because of the EU crisis. Earlier the euro advanced after France and Germany said they want a rewrite of the European Union’s governing treaties to tighten economic cooperation in the region. The 17-nation currency was supported as Italy’s cabinet approved a deficit-cut plan, easing concern the region’s debt crisis in worsening.

Sterling strengthened as an index of U.K. services unexpectedly gained and U.S. services expanded in November at the slowest pace since January 2010.

EUR/USD: yesterday the pair has grown, but lost positions later.

GBP/USD: yesterday the pair rose.

USD/JPY: yesterday the pair decreased.

Scheduled data on Tuesday starts at 0920GMT, German Finance Minister Wolfgang Schaeuble appears on a panel discussing

Europe's financial and economic situation, in Vienna. EMU data at 1000GMT sees the second estimate of Q3 GDP data. US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data, which is followed at 1355GMT by the weekly Redbook Average The

Bank of Canada rate announcemet is due at 1400GMT. US data continues with the 1500GMT release of the latest IBD/TIPP Economic Optimism Index. At the same time, 1500GMT, the Canadian Ivey Purchasing Managers Index is due. Late US data sees the 2000GMT release of Treasury STRIPS data for November.

Resistance 3: Y78.70 (resistance line from Nov 18)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.10 (Dec 5 high)

The current price: Y77.73

Support 1: Y77.65 (MA (233) H1)

Support 2: Y77.30 (Nov 30 low)

Support 3: Y77.00 (Nov 24 low)

Comments: the pair is corrected in uptrend. In focus support Y77.65.

Resistance 3: Chf0.9305 (Nov 28 high)

Resistance 2: Chf0.9285 (Oct 7 high)

Resistance 1: Chf0.9240/50 (area of Nov 28 - Dec 2 high)

The current price: Chf0.9234

Support 1: Chf0.9200 (session low)

Support 2: Chf0.9175 (Nov 28 low)

Support 3: Chf0.9135/45 (area of Dec 2 low, Nov 29 low)

Comments: the pair is on uptrend. In focus resistance Chf0.9250.

Resistance 3 : $1.5715 (Dec 5 high)

Resistance 2 : $1.5677 (high of the European session on Dec 5)

Resistance 1 : $1.5650 (session high)

The current price: $1.5619

Support 1 : $1.5612 (session low)

Support 2 : $1.5575/85 (area of Dec 2-5 low)

Support 3 : $1.5525 (Nov 30 low)

Comments: the pair is on downtrend. In focus support $1.5612.

Resistance 3: $1.3485 (high of the European session on Dec 5)

Resistance 2: $1.3425 (MA(233) H1)

Resistance 1: $1.3400 (session high)

The current price: $1.3371

Support 1 : $1.3360 (session low)

Support 2 : $1.3315 (support line from Dec 2)

Support 3 : $1.3285 (Nov 29 low)

Comments: the pair is on downtrend. In focus support $1.3360.

Change % Change Last

Nikkei 225 8,597 +162.77 +1.93%

Hang Seng 19,002 +1,012.91 +5.63%

S&P/ASX 200 4,229 +108.78 +2.64%

Shanghai Composite 2,387 +53.45 +2.29%

FTSE 100 5,489 -16.08 -0.29%

CAC 40 3,130 -24.67 -0.78%

DAX 6,036 -52.96 -0.87%

Dow 12,020.03 -25.65 -0.21%

Nasdaq 2,626.20 +5.86 +0.22%

S&P 500 1,244.58 -2.38 -0.19%

10 Year Yield 2.12% +0.05 --

Oil $100.08 -0.12 -0.12%

Gold $1,748.40 +8.60 +0.49%

00:30 Australia Current Account, bln Quarter III -7.4 -5.5

03:30 Australia Announcement of the RBA decision on the discount rate 0 4.50% 4.25%

08:00 United Kingdom Halifax house price index November +1.2%

08:00 United Kingdom Halifax house price index 3m Y/Y November -1.8%

08:15 Switzerland Consumer Price Index (MoM) November -0.1% +0.1%

08:15 Switzerland Consumer Price Index (YoY) November -0.1% -0.3%

09:30 United Kingdom Bank of England Minutes 0

10:00 Eurozone GDP (QoQ) Quarter III +0.2% +0.2%

10:00 Eurozone GDP (YoY) Quarter III +1.4% +1.4%

11:00 Germany Factory Orders s.a. (MoM) October -4.3% +1.0%

11:00 Germany Factory Orders n.s.a. (YoY) October +2.4% +1.9%

13:30 Canada Building Permits (MoM) October -4.9% +3.2%

14:00 Canada Bank of Canada Rate 0 1.00% 1.00%

15:00 Canada Ivey Purchasing Managers Index November 54.4 55.1

15:00 U.S. FOMC Member Tarullo Speaks 0

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.