- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 09-12-2011

- don't see UK suing to prevent use of EU institutions

- markets will better understand summit result by next week

- if markets rational, will react properly to summit outcome

- Britain has made bad mid-term choice, isolating itself

- no reason why greece could/should be expelled from emu

- decision to cut unanimity from esm framework important

- reassuring that esm needs super-majority in emergencies

- markets wanted flexible, efficient ESM that's now the case

- firewall now more robust than might have been expected

- Greece, Italy, Ireland taken strong convergence/consolidation steps

- Ireland doing really well, proving success of program

- don't see UK suing to prevent use of EU institutions;

- markets will better understand summit result by next week:

- if markets rational, will react properly to summit outcome;

- Britain has made bad mid-term choice, isolating itself;

- no reason why greece could/should be expelled from emu;

- decision to cut unanimity from esm framework important;

- reassuring that esm needs super-majority in emergencies;

- markets wanted flexible, efficient ESM that's now the case;

- firewall now more robust than might have been expected;

- Greece, Italy, Ireland taken strong convergence/consolidation steps;

- Ireland doing really well, proving success of program.

The 17- nation currency fell earlier as U.K. Prime Minister David Cameron said there was “fundamental disagreement” in European Union talks in Brussels and as Finland threatened to withdraw from the permanent bailout fund if changes to decision making are introduced.

Finland is ready to withdraw its support from Europe’s permanent rescue mechanism if the Nordic country’s condition of unanimous decision making is ignored, Finance Minister Jutta Urpilainen said. Europe’s leaders last night agreed on the need for a “qualified majority” to speed up decision-making and prevent individual countries from blocking bailouts.

The Dollar Index fell and higher-yielding currencies gained after U.S. consumer confidence rose to a six-month high. The Thomson Reuters/University of Michigan preliminary index of consumer sentiment rose to 67.7 this month from 64.1 at the end of last month.

Moody's Assumes Price Of $95/Barrel For Brent Crude In 2012, $90 In 2013, $80 Beyond

Oil Prices Face More Risks Of Pressure In 2012

Dow 12,166 +167.94 +1.40%

Nasdaq 2,637 +41.01 +1.58%

S&P 1,253 +19.00 +1.54%

Financial companies had the biggest advance out of 10 sectors in the S&P 500, rising 2.4 percent as a group. Morgan Stanley (MS) increased 4.4 percent to $16.58. JPMorgan Chase climbed 2.6 percent to $33.04. Bank of America added 3.8 percent, the biggest gain in the Dow, to $5.80.JPMorgan Chase (JPM) & Co. and Bank of America Corp. (BAC) climbed more than 2.6 percent as banks rallied amid optimism on Europe. General Electric Co. (GE) jumped 3.7 percent after boosting its dividend for the fourth time since July 2010. Caterpillar Inc. (CAT), the world’s largest construction and mining-equipment maker, and Halliburton Co. (HAL) gained at least 1.5 percent as investors bought shares of companies most tied to economic growth.

FTSE 5,529 +45.44 +0.83%

CAC 3,172 +76.86 +2.48%

DAX 5,987 +112.27 +1.91%

Crude Oil Rises as U.S. Consumer Confidence Increases to Six-Month High

Oil rose for the first time in three days as confidence among U.S. consumers increased to the highest level in six months.

The Thomson Reuters/University of Michigan preliminary index of consumer sentiment rose to 67.7 this month from 64.1 at the end of last month.

Oil for January delivery gained 40 cents, or 0.4 percent, to $98.74 a barrel.

- Global Growth Expected To Remain Sluggish

- Advanced Economies' GDP To Remain Below Potential

- EMU Financial Market Tensions Pose Downside Risks

- ECB Will Remain Dedicated To Price Stability Mandate

Global Growth Expected To Remain Sluggish

Advanced Economies' GDP To Remain Below Potential

EMU Financial Market Tensions Pose Downside Risks

Global Imbalances Need To Be Corrected

ECB Will Remain Dedicated To Price Stability Mandate

Eighteen of 26 surveyed by Bloomberg expect the metal to advance next week, the highest proportion since Nov. 11. Holdings in exchange-traded products backed by gold rose 108.5 metric tons to a record from the start of October, the most since the second quarter of 2010, data compiled by Bloomberg show. The extra bullion is valued at $5.99 billion.

Investors are now making a $130.2 billion bet on gold as European leaders meet in Brussels to seek ways to tackle the crisis that means Germany and France are under threat of losing their AAA rating from Standard & Poor’s. The European Central Bank yesterday cut interest rates for a second consecutive month to shore up growth, increasing the appeal of gold, which earns investors returns through price gains

Nomura says Q4 real GDP growth is tracking +3.9% after trade data, from 3.7% previously.

Barclays says Q4 real growth is now tracking +3.5%.

GS raised their Q4 est by 0.5 to +3.4%.

USD/JPY Y77.50, Y78.00, Y78.10

AUD/USD $1.0000, $1.0100, $1.0150, $1.0225, $1.0280

EUR/CHF Chf1.2375

GBP/USD: $1.5500

EUR/GBP: stg0.8650

European leaders meeting in Brussels tightened anti-deficit rules and agreed to boost their crisis-fighting war chest by as much as 200 billion euros ($267 billion) by funneling money to the International Monetary Fund.

Leaders aim to set up the permanent rescue fund, known as the European Stability Mechanism, in July 2012, a year ahead of schedule. By March, they will reassess plans to cap the overall lending of the ESM and the temporary fund at 500 billion euros. Stock futures pared gains after Chancellor Angela Merkel said Germany opposes adding to the fund’s firepower.

Nikkei 8,536 -128.12 -1.48%

Hang Seng 18,586 -521.58 -2.73%

S&P/ASX 4,203 -77.66 -1.81%

Shanghai Composite 2,315 -14.55 -0.62%

FTSE 5,496 +11.75 +0.21%

CAC 3,134 +38.60 +1.25%

DAX 5,924 +49.16 +0.84%

Crude oil: $97.95 (-0,4%).

Gold: $1715,00 (+0,1%).

07:00 Germany Current account (October) unadjusted, bln 10.3

07:00 Germany Trade balance (October) unadjusted, bln 11.6

07:00 Germany CPI (November) final 0.0%

07:00 Germany CPI (November) final Y/Y 2.4%

07:00 Germany HICP (November) final Y/Y 2.8%

07:45 France Industrial production (October) 0.0%

07:45 France Industrial production (October) Y/Y 2.7%

09:30 UK Trade in goods (October), bln -7.6

09:30 UK Non-EU trade (October), bln -4.6

09:30 UK PPI (Output) (November) unadjusted 0.2%

09:30 UK PPI (Output) (November) unadjusted Y/Y 5.4%

09:30 UK PPI Output ex FDT (November) adjusted 0.0%

09:30 UK PPI Output ex FDT (November) unadjusted Y/Y 3.2%

09:30 UK PPI (Input) (November) adjusted 0.1%

09:30 UK PPI (Input) (November) unadjusted Y/Y 13.4%

The euro rose after the region’s leaders boosted a rescue fund and tightened budget rules to counter the debt crisis.

The euro gained as leaders holding all-night talks in Brussels added 200 billion euros ($267 billion) to their crisis-fighting capacity and toughened anti-deficit rules.

The euro extended gains after Reuters reported that China’s central bank may use $300 billion of its reserves to invest in the U.S. and Europe.

China’s central bank would create the new vehicle to improve returns on reserves, Reuters reported, citing an unidentified person familiar with plan. There will be two funds, one targeting the U.S. and one Europe, Reuters said.

EUR/USD: during european session the pair rose and showed high in $1,3430 area.

USD/JPY: the pair was trading Y77,55-Y77.80.

EUR/USD

Offers $1.3500

Bids $1.3400/395, $1.3375/70, $1.3340, $1.3380, $1.3270/60, $1.3250

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y77.85 (resistance line from Nov 31)

Current price: Y77.66

Support 1:Y77.10 (weekly low)

Support 2:Y76.60 (Nov 18 low)

Support 3:Y75.60 (Okt 31 low)

Resistance 3: Chf0.9330 (Nov 25 high)

Resistance 2: Chf0.9290 (area of Dec 6-8 high)

Resistance 1: Chf0.9240 (low of asian session)

Current price: Chf0.9209

Support 1: Chf0.9180 (session low, Dec 8 low, 50.0 % FIBO Chf0.9295-Chf0.9065)

Support 2: Chf0.9160/50 (Dec 5 low, 61.8 % FIBO Chf0.9295-Chf0.9065)

Support 3: Chf0.9110/00 (area of Dec 2 low)

Resistance 2 : $1.5800 (МА (200) for Н4)

Resistance 1 : $1.5770/80 (area of Dec 8 and Nov 30 highs)

Current price: $1.5723

Support 1 : $1.5660 (high of asian session)

Support 2 : $1.5590 (support line from Nov 30)

Support 3 : $1.5560 (Dec 6 low)

Resistance 3: $ 1.3485 (Dec 5 high)

Resistance 2: $ 1.3450/60 (area of Dec 7-8 highs)

Resistance 1: $ 1.3430 (resistance line from Dec 2)

Current price: $1.3420

Support 1 : $1.3370 (high of asian session)

Support 2 : $1.3280 (session low)

Support 3 : $1.3260 (Nov 30 low)

USD/JPY Y77.50, Y78.00, Y78.10

AUD/USD $1.0000, $1.0100, $1.0150, $1.0225, $1.0280

EUR/CHF Chf1.2375

GBP/USD: $1.5500

EUR/GBP: stg0.8650

Nikkei 225 8,536 -128.12 -1.48%

Hang Seng 18,586 -521.58 -2.73%

S&P/ASX 4,203 -77.66 -1.81%

Shanghai Composite 2,315 -14.55 -0.62%

01:30 China CPI y/y November +5.5% +4.6% +4.2%

01:30 China PPI y/y November +5.0% +3.3% +2.7%

02:00 China Industrial Production y/y November +13.2% +12.8% +12.4%

The euro dropped to a one-week low against the dollar after a summit of European Union leaders failed to forge a unanimous accord, damping prospects for a rapid resolution to the region’s debt crisis. The euro was poised for weekly losses versus the yen and the greenback as French President Nicolas Sarkozy said British Prime Minister David Cameron made “unacceptable” demands regarding treaty amendments.

Leaders agreed to channel as much as 200 billion euros ($266 billion) to the International Monetary Fund and bowed to European Central Bank demands for a tightening of anti-deficit rules. They accelerated the startup of a planned 500 billion- euro rescue fund and scaled back bondholder loss-sharing provisions. Declines in the euro were trimmed as ECB President Mario Draghi called the decisions “a very good outcome for euro-area members,” after 12 hours of talks in Brussels.

Germany and France risk losing their AAA credit ratings in a review of 15 euro nations, Standard & Poor’s said

The yen and dollar climbed against a majority of their most-traded counterparts as Chinese stocks slid after the nation’s statistics bureau said industrial output rose 12.4 percent in November from a year earlier, the slowest pace since August 2009. Consumer prices climbed 4.2 percent from a year earlier, lower than all estimates in a Bloomberg News survey of 35 economists that had a median forecast of 4.5 percent.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair dropped.

USD/JPY: on Asian session the pair fell.

On Friday the European Summit of EU heads of state and government restarts around 0900GMT this morning in Brussels, although this will be the focus for the whole session, as the overnight headlines are padded out. Early European data from Germany at 0700GMT includes final HICP, Q3 Labor costs data and also the trade balance for October. France data at 0745GMT includes industrial output and also government deficit data for October.The UK data schedule is busy at 0930GMT with BOE Quoted Rates as well as the Producer Price Index, the Trade Balance Report and Construction Output.

Yesterday the euro fell after European Central Bank President Mario Draghi said he didn’t signal stepping up bond purchases to spur growth.

The euro reached the lowest level this month versus the greenback, reversing brief gains, after Draghi’s comments damped speculation that the ECB would expand its bond- buying role to stem the region’s debt crisis.

Draghi said during a press conference in Frankfurt that he was “kind of surprised by the implicit meaning” that was given to his comments last week when he said the ECB could follow faster fiscal union with “other elements.”

EUR/USD: yesterday the pair has lost a figure.

GBP/USD: yesterday the pair has lost a figure.

USD/JPY: yesterday the pair fallen, but was restored later returned the lost positions.

On Friday the European Summit of EU heads of state and government restarts around 0900GMT this morning in Brussels, although this will be the focus for the whole session, as the overnight headlines are padded out. Early European data from Germany at 0700GMT includes final HICP, Q3 Labor costs data and also the trade balance for October. France data at 0745GMT includes industrial output and also government deficit data for October.The UK data schedule is busy at 0930GMT with BOE Quoted Rates as well as the Producer Price Index, the Trade Balance Report and Construction Output.

Asian stocks dropped ahead of a European summit on the region’s sovereign debt crisis, and after economic data from Japan and Australia signaled the global economy is slowing.

Pressure on Europe’s leaders to halt the spread of the region’s debt crisis at a summit in Brussels this week intensified as the European Union had its AAA long-term rating put on “creditwatch negative” by S&P following a similar action on 15 euro-area governments.

German Chancellor Angela Merkel and French President Nicolas Sarkozy are expected to argue for rewriting European Union treaties to tighten control of national budgets at the meeting of euro zone leaders tonight and tomorrow.

Company news:

Tokyo Electric Power dropped 11% after the Mainichi newspaper said the government’s Nuclear Damage Liability Facilitation Fund may buy preferred shares worth at least 1 trillion yen ($12.9 billion) from the utility by next summer, without saying where the information came from.

European stocks dropped as the European Central Bank damped speculation it would step up purchases of government bonds and regulators said lenders need to raise more capital than previously forecast.

National benchmark indexes dropped in all of the 17 western European markets that were open today, except Iceland.

The ECB cut interest rates by 25 basis points, or a quarter percentage point, to 1 percent today, matching a record low. It introduced new three-year loans for banks and loosened the collateral criteria it imposes when lending by making credit claims such as bank loans eligible and reducing the rating threshold on asset-backed securities.

Stocks fell as ECB President Mario Draghi said he did not necessarily signal that the central bank would step up government bond purchases when speaking before lawmakers in Brussels last week. He said he was “kind of surprised by the implicit meaning” that was given to his comments when he said the ECB could follow faster fiscal union with “other elements.”

Banks declined, with Commerzbank and Deutsche Bank AG losing 9.5% and 4.3% respectively. Italy’s Intesa Sanpaolo plummeted 8.9%.

Peugeot slumped 7.3% as Thierry Huon, an analyst at Exane BNP Paribas (BNP) SA, cut the French carmaker to “neutral” from “outperform.”

U.S. stocks fell, snapping a three- day rally, as the European Central Bank damped speculation it would boost debt purchases and regulators said the region’s lenders need to raise more capital than previously estimated.

US stocks extended losses in late trading after news Germany rejected some draft measures for the euro zone crisis.

European Commission President Jose Barroso urged government leaders to set aside differences and strike a deal for more fiscal discipline at a European Union summit starting today. In the U.S, data showed that fewer Americans than forecast filed applications for unemployment benefits last week, reflecting a drop in firings that may signal the job market is on the mend.

All groups in the S&P 500 declined as financial shares tumbled 3 per cent as a group.

McDonald's Corp. rallied 0.7%. The world's largest restaurant chain said sales at stores open at least 13 months rose 7.4 per cent globally last month, driven by demand in Japan and China.

Resistance 3: Y78.45 (Nov 2 high)

Resistance 2: Y78.30 (Nov 4 and 29 high)

Resistance 1: Y77.80 (Dec 7-8 high)

The current price: Y77.58

Support 1:Y77.50 (middle line from Nov 29)

Support 2:Y77.30 (Nov 30 low)

Support 3:Y77.10 (Dec 8 low)

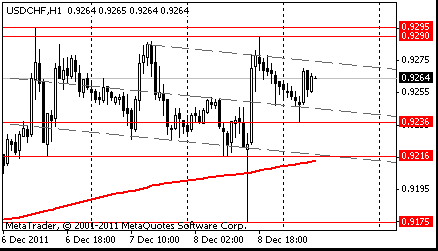

Resistance 3: Chf0.9360 (161.8% FIBO Chf0.9175-Chf0.9290)

Resistance 2: Chf0.9330 (Nov 25 high)

Resistance 1: Chf0.9290/95 (area of Dec 6-8 high)

The current price: Chf0.9264

Support 1: Chf0.9235 (session low)

Support 2: Chf0.9215 (MA (233) H1)

Support 3: Chf0.9175 (Dec 8 low)

Comments: the pair is under pressure. In focus support Chf0.9235.

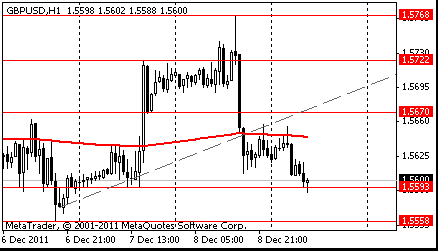

Resistance 3 : $1.5765 (Dec 8 high)

Resistance 2 : $1.5725 (Dec 7 high)

Resistance 1 : $1.5670 (yesterday's support line)

The current price: $1.5600

Support 1 : $1.5590 (Dec 7 low)

Support 2 : $1.5560 (Dec 6 low)

Support 3 : $1.5525 (Nov 30 low)

Comments: the pair is under pressure. In focus support $1.5590.

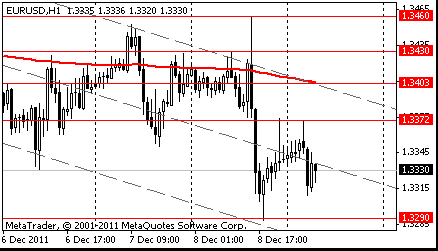

Resistance 3: $1.3430 (high of the Asian session on Dec 8)

Resistance 2: $1.3405 (MA(233) H1)

Resistance 1: $1.3370 (session high)

The current price: $1.3330

Support 1 : $1.3290 (Dec 8 low)

Support 2 : $1.3255 (Nov 30 low)

Support 3 : $1.3210 (Nov 25 low)

Comments: the pair is on downtrend. In focus support $1.3290.

Change % Change Last

Nikkei 8,665 -57.59 -0.66%

Hang Seng 19,108 -132.77 -0.69%

S&P/ASX 4,281 -11.78 -0.27%

Shanghai Composite 2,330 -2.91 -0.12%

FTSE 5,484 -63.14 -1.14%

CAC 3,095 -80.49 -2.53%

DAX 5,874 -120.29 -2.01%

Dow 11,997.70 -198.67 -1.63%

Nasdaq 2,596.38 -52.83 -1.99%

S&P 500 1,234.35 -26.66 -2.11%

10 Year Yield 1.97% -0.05

Oil $97.84 -0.50 -0.51%

Gold $1,711.50 -1.90 -0.11%

01:30 China CPI y/y November +5.5% +4.6%

01:30 China PPI y/y November +5.0% +3.3%

02:00 China Industrial Production y/y November +13.2% +12.8%

07:00 Germany CPI (final), m/m November 0.0% 0.0%

07:00 Germany CPI (final), y/y November +2.4% +2.4%

07:00 Germany Trade Balance October 15.3 14.7

07:00 Germany Current Account October 15.7 14.0

07:45 France Industrial Production, m/m October -1.7% 0.0%

07:45 France Industrial Production, y/y October +2.3% +2.8%

08:00 Eurozone EU Economic Summit 0

09:30 United Kingdom Trade in goods October -9.8 -9.3

09:30 United Kingdom Producer Price Index - Output (MoM) November 0.0% +0.1%

09:30 United Kingdom Producer Price Index - Output (YoY) November +5.7% +5.4%

09:30 United Kingdom Producer Price Index - Input (MoM) November -0.8% +0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) November +14.1% +13.2%

13:30 Canada Trade balance, billions October 1.25 0.8

13:30 U.S. International trade, bln October -43.1 -43.5

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Prelim) December 64.1 65.6

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.