- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 14-12-2011

The euro fell below $1.30 for the first time since January as signs of increased funding stress in Europe damped investor appetite for the shared currency.

The euro declined as Italian borrowing costs increased at a debt auction and Spanish banks’ borrowings from the European Central Bank climbed by the most in a year.

The euro’s 14-day relative strength index versus the dollar weakened to 28.8 today, the lowest level since Oct. 3. A reading below 30 signals that an asset may be oversold and due to reverse direction.

The pound was the biggest gainer against the euro among the major currencies as investors sought protection from the crisis.

The pound rose for a third day against the euro as stock declines spurred demand for the perceived safety of the British currency.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the U.S. currency against those of six trading partners, rose to highest since January.

S&P 500 1,219 -6.89 -0.56%

NASDAQ 2,549 -29.95 -1.16%

Dow 11,881 -73.45 -0.61%

U.S. stocks retreated, sending the Standard & Poor’s 500 Index lower for a third straight day, as growing funding stress in Europe fueled concern the region is struggling to contain its sovereign debt crisis.

Stocks pared losses (SPX) as the Wall Street Journal reported that S&P has not warned about a possible French downgrade. Financial shares in the S&P 500 rose 0.4 percent, rebounding from a decline.

The S&P 500 has struggled to stay above its 2010 closing level of 1,257.64 since topping it during the last week of October after slumping below it for almost three months. The index is down 2.5 percent for the year through yesterday, led by a 21 percent slide in financial shares.

The Morgan Stanley Cyclical Index slumped 1.3 percent, while the Dow Jones Transportation Average lost 1.3 percent.

Chevron sank 1.7 percent to $101.89. Mosaic, a fertilizer producer, slumped 4.7 percent to $47.18.

Joy Global slumped 11 percent to $75.40. Sales for the latest quarter rose 27 percent to $1.34 billion from $1.05 billion, lower than the $1.35 billion average of 11 estimates compiled by Bloomberg.

Other industrial companies declined. Caterpillar Inc. (CAT), the largest construction and mining-equipment maker, dropped 4.7 percent, the most in the Dow, to $86.72. Cummins Inc. retreated 2.5 percent to $86.97.

First Solar plunged 20 percent to $34.14. The company said global production of solar panels has tripled in recent years as more companies, including Chinese suppliers, enter the market.

Economic Outlook For Emerging Markets In 2012 Is More Benign

Failure To Address Sovereign Debt Problems In Europe, US, Could Lead To More Pronounced Downturn

Global Banking System Is Likely To Continue To Be In A Difficult Position In 2012

US Housing Market Seems To Still Be A Long Way From Rebounding

US Nonfinancial Corp Issuers Likely To See Balance Between Positive, Negative Rating Actions

FTSE 100 5,379 -110.86 -2.02%

CAC 40 2,988 -91.04 -2.96%

DAX 5,687 -86.88 -1.50%

Futures declined as much as 1.8 percent, after surging 2.4 percent yesterday in the biggest gain in almost four weeks. OPEC agreed to a production limit of 30 million barrels a day, Venezuela’s Energy Minister Rafael Ramirez said at the group’s meeting in Vienna today. U.S. crude supplies rose last week and gasoline consumption decreased, the industry-funded American Petroleum Institute said yesterday. Crude extended its declines as equities fell and the euro reached its weakest level against the dollar since January.

Gold tumbled the most in 11 weeks as the Federal Reserve refrained from taking more stimulus measures and as a stronger dollar curbed demand for alternative assets.

The dollar rose to an 11-month high against the euro as Italian borrowing costs increased at a debt auction. The Standard & Poor’s GSCI index of 24 commodities dropped as much as 2.7 percent. The Federal Reserve yesterday said the U.S. economy is maintaining its expansion and refrained from taking new action to bolster the economy.

Resistance 2:1226 (session high)

Resistance 1:1212 (Dec 13 low)

Current price: 1208,35

Support 1 : 1208 (50,0 % 1147-1267)

Support 2 : 1193 (61,8 % 1147-1267)

Support 3 : 1133 (area of Nov 28 and 30 lows)

USD/JPY Y77.00

AUD/USD $0.9900, $1.0000, $1.0100, $1.0125, $1.0200

EUR/CHF Chf1.2300, Chf1.2400, Chf1.2450, Chf1.2500

USD/CHF Chf0.9250

The cost of insuring against default on European sovereign debt approached a record. German Chancellor Angela Merkel said there’s no easy and fast solution to the euro region debt crisis. Speaking to lawmakers in the German parliament today, she reiterated her opposition to euro bonds as a tool for dealing with the euro region’s debt crisis. “They are not appropriate as a rescue measure,” Merkel said.

Italy experienced more woe today at a bond auction as investors put to rest any hopes that the eurozone's fiscal union pact will calm the markets. Yields rose to a fresh euro-era high of 6.47% in a sale of €3B of five-year bonds, surpassing the previous record of 6.29% that Italy paid last month. In the secondary market, 10-year yields were up midday in Europe after initially falling.

Nikkei 8,519 -33.68 -0.39%

Hang Seng 18,354 -92.74 -0.50%

Shanghai Composite 2,229 -20.06 -0.89%

FTSE 5,432 -58.26 -1.06%

CAC 3,023 -55.29 -1.80%

DAX 5,708 -66.01 -1.14%

Crude oil: $97.95 (-2,2%).

Gold: $1622,30 (-2,4%).

Data:

09:30 UK Claimant count (November) 3K

09:30 UK Claimant count rate (November) 5.0%

09:30 UK Average earnings (3 months to October) Y/Y 2.0%

09:30 UK Average earnings ex bonuses (3 months to October) Y/Y 1.8%

09:30 UK ILO Jobless rate (October) 8.3%

10:00 EU(17) Industrial production (October) -0.1%

10:00 EU(17) Industrial production (October) Y/Y 1.3%

The euro fell below $1.30 as Italian borrowing costs increased at a debt auction and Spanish banks’ borrowings from the European Central Bank climbed by the most in a year.

The euro declined as European stocks declined, damping demand for the region’s currency.

Italy sold 3 billion euros of five-year bonds, the maximum target for the auction, and borrowing costs rose to the highest since 1997 as Parliament prepared to approve a 30 billion-euro emergency budget plan. The Treasury sold the bonds to yield 6.47 percent, up from 6.29 percent at the prior auction on Nov. 14.

EUR/USD: the pair has shown low in $1,2960 area then returned back above $1.3000.

GBP/USD: the pair was in $1.5460-$ 1.5530.

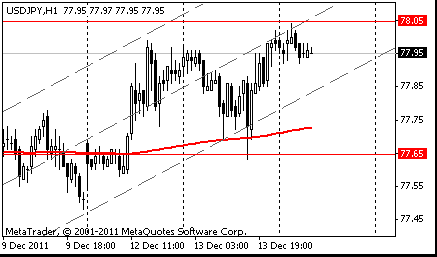

USD/JPY: the pair has grown above Y78.00.

EUR/USD

Offers $1.3070, $1.3040/45, $1.3030, $1.3010

Bids $1.2960/50, $1.2910/00, $1.2875/60

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.05 (session high)

Current price: Y78.02

Support 1:Y77.90 (session low)

Support 2:Y77.80 (МА (200) for Н1)

Support 3:Y77.65 (resistance line from Oct 31)

Resistance 2: Chf0.9540 (Feb 18 high)

Resistance 1: Chf0.9490 (session high)

Current price: Chf0.9486

Support 1: Chf0.9430 (session low, support line from Dec 9)

Support 2: Chf0.9370 (38,2 % FIBO Chf0.9180-Chf0.9490)

Support 3: Chf0.9330 (area of 50.0 % FIBO Chf0.9180-Chf0.9490 and Dec 13 low)

Minor barrier interest seen at $1.2980/75, a break here to expose larger barrier interest at $1.2950.

Resistance 2 : $1.5660 (resistance line from Dec 8)

Resistance 1 : $1.5530 (session high)

Current price: $1.5481

Support 1 : $1.5450 (Dec 13 low)

Support 2 : $1.5420 (Nov 25 low, support line from May’2010)

Support 3 : $1.527 (low of October)

Resistance 2: $ 1.3100 (resistance line from Dec 9)

Resistance 1: $ 1.3070 (session high)

Current price: $1.3007

Support 1 : $1.3000 (session low, Dec 13 low)

Support 2 : $1.2870 (low of 2011)

Support 3 : $1.2830 (the bottom border of the down channel from Oct 27)

Ifo Sees German GDP Up 3% In 2011

Japanese stocks fell after ratings companies said last week’s European summit did little to resolve the debt crisis that has roiled markets this year.

Moody’s Investors Service said the latest European summit didn’t produce “decisive” measures to end the crisis. Fitch Ratings said the summit did little to ease pressure on Europe’s sovereign bond ratings. Futures on the S&P 500 index were little changed today.

Exporters of cars and electronics contributed the most to the Topix’s decline. Sony fell 2.6%. Honda Motor Co. dropped 2.9%.

In China, housing transactions declined in 27 out of 35 cities tracked by Soufun Holdings Ltd. during the week of Dec. 5-11, with 13 cities seeing a drop of more than 50 percent. Transactions fell more than 60 percent in at least 4 cities, including Tianjin and Hangzhou, according to the operator of the nation’s biggest real-estate website.

Hitachi Construction fell 2.6%. Komatsu Ltd. lost 1.9%.

Japanese manufacturers of semiconductors and chipmaking equipment dropped today after Intel, the world’s largest chipmaker, slashed its sales forecast.

European stocks finished session mixed as Spain sold more securities than it had planned at a debt auction and a report showed that investor confidence in Germany improved.

Stocks pared an advance as Reuters reported that German Chancellor Angela Merkel has rejected increasing the upper limit for the funds held by Europe’s planned permanent rescue facility, citing sources in Merkel’s ruling coalition. The gauge has still declined 14 percent this year amid concern the euro area’s sovereign-debt debt crisis will derail the global economic recovery.

The ZEW Center for European Economic Research said that its index of German investor and analyst expectations, which aims to predict developments six months in advance, posted a reading of minus 53.8 in December. That was better than the median estimate of economists.

Spain sold 4.94 billion euros ($6.5 billion) of 12- and 18- month bills, the Bank of Spain said, compared with the maximum target of 4.25 billion euros the Treasury set for the sale.

A U.S. Commerce Department report showed that retail sales in the world’s largest economy increased 0.2 percent in November, a slower pace than the 0.6 percent rate that economists had predicted.

Shell rose 2.1%, BP advanced 1.7%. Crude oil briefly surged above $100 a barrel.

Commerzbank AG sank 4.6%.

U.S. stocks retreated, reversing an earlier advance, after Federal Reserve policy makers refrained from taking new actions to bolster growth at the world’s largest economy.

Eight out of nine groups in the S&P declined, led by companies most-dependent on economic growth.

The central bank said it would continue its exchange of $400 billion of short-term debt with long-term securities to lengthen the average maturity of its holdings, a move dubbed Operation Twist. The Fed also did not alter its policy of reinvesting its portfolio of maturing housing debt into agency mortgage-backed securities.

USD/JPY Y77.00

AUD/USD $0.9900, $1.0000, $1.0100, $1.0125, $1.0200

EUR/CHF Chf1.2300, Chf1.2400, Chf1.2450, Chf1.2500(large)

USD/CHF Chf0.9250

- EU Economic Reforms Step In Right Direction

- Next Stage Of Crisis Threatens Rising Inflation

- Wage Indexation Not Unrelated Higher Inflation

- Non-Conventional Measures Are Temporary By Design

- Inflation Risks Are Balanced

EU Economic Reforms Step In Right Direction

Next Stage Of Crisis Threatens Rising Inflation

Wage Indexation Not Unrelated Higher Inflation

Non-Conventional Measures Are Temporary By Design

Inflation Risks Are Balanced

Nikkei 225 8,519 -33.68 -0.39%

Hang Seng 18,421 -26.24 -0.14%

S&P/ASX 200 4,190 -2.90 -0.07%

Shanghai Composite 2,229 -20.06 -0.89%

01:30 Australia RBA Deputy Gov Battellino Speaks

04:30 Japan Industrial output final October 2.4% 2.4% 2.2%

04:30 Japan Industrial output final Y/Y October -3.3% 0.1%

The euro traded 0.2 percent from an 11-month low as European nations prepare to sell bonds amid concern the region’s debt crisis is far from resolution. Italy is scheduled to auction as much as 3 billion euros of debt maturing in 2016 today, while Germany plans to sell 5 billion euros of two-year notes. Spain will offer debt maturing in 2016, 2020, and 2021 tomorrow.

The dollar held gains from yesterday against most of its 16 major peers after the Federal Reserve said the U.S. economy is maintaining its expansion and refrained from taking new action to lower borrowing costs, easing concern policy makers are devaluing the world’s reserve currency.

The yen was near the highest level in more than two months versus the 17-nation euro as Asian equities dropped, boosting demand for safer assets.

“If the European economy were to slow markedly over the next year or so, Australia would be affected,” Battellino said in Sydney today. “It is also likely, however, that if that were to eventuate, the exchange rate of the Australian dollar would fall, as it has when global growth has weakened in the past.”

EUR/USD: on Asian session the pair traded in range $1.3515-$1.3550.

GBP/USD: on Asian session the pair traded in range $1.5465-$1.5495.

USD/JPY: on Asian session the pair holds in range Y77.90-Y78.05.

European data for Wednesday starts at 0730GMT with the BoF retail survey from France. EMU industrial output data then follows, at 1000GMT. US data starts at 1200GMT with the weekly MBA Mortgage Application Index. US data at 1330GMT sees the Import/Export Price Index, while at the same time, Atlanta Fed President Dennis Lockhart is due to deliver a speech about Atlanta at the Midtown Alliance Annual Meeting. The weekly EIA Crude Oil Stocks data is then due, at 1530GMT.

The euro fell on concern European leaders won’t agree on ways to expand the region’s rescue capacities as debt-strapped nations struggle to fund their deficits.

The euro dropped after Chancellor Angela Merkel told German coalition lawmakers that the 500 billion euro cap on Europe’s planned permanent bailout fund will stay in place.

The dollar declined against the yen before the Federal Reserve holds a meeting today amid speculation officials will maintain their pledge to keep borrowing costs at almost zero.

The European Financial Stability Facility sold 1.97 billion euros of 91-day bills at an average yield of 0.222 percent, the Bundesbank said. The sale was its first fund-raising since European leaders agree on a closer fiscal accord and additional resources to combat the region’s debt crisis at a summit in Brussels last week.

EUR/USD: yesterday the pair has fallen on one and a half figure.

GBP/USD: yesterday the pair has decreased on a figure.

USD/JPY: yesterday the pair has fallen, but restored the positions later.

European data for Wednesday starts at 0730GMT with the BoF retail survey from France. EMU industrial output data then follows, at 1000GMT. US data starts at 1200GMT with the weekly MBA Mortgage Application Index. US data at 1330GMT sees the Import/Export Price Index, while at the same time, Atlanta Fed President Dennis Lockhart is due to deliver a speech about Atlanta at the Midtown Alliance Annual Meeting. The weekly EIA Crude Oil Stocks data is then due, at 1530GMT.

Japanese stocks fell after ratings companies said last week’s European summit did little to resolve the debt crisis that has roiled markets this year.

Moody’s Investors Service said the latest European summit didn’t produce “decisive” measures to end the crisis. Fitch Ratings said the summit did little to ease pressure on Europe’s sovereign bond ratings. Futures on the S&P 500 index were little changed today.

Exporters of cars and electronics contributed the most to the Topix’s decline. Sony fell 2.6%. Honda Motor Co. dropped 2.9%.

In China, housing transactions declined in 27 out of 35 cities tracked by Soufun Holdings Ltd. during the week of Dec. 5-11, with 13 cities seeing a drop of more than 50 percent. Transactions fell more than 60 percent in at least 4 cities, including Tianjin and Hangzhou, according to the operator of the nation’s biggest real-estate website.

Hitachi Construction fell 2.6%. Komatsu Ltd. lost 1.9%.

Japanese manufacturers of semiconductors and chipmaking equipment dropped today after Intel, the world’s largest chipmaker, slashed its sales forecast.

European stocks finished session mixed as Spain sold more securities than it had planned at a debt auction and a report showed that investor confidence in Germany improved.

Stocks pared an advance as Reuters reported that German Chancellor Angela Merkel has rejected increasing the upper limit for the funds held by Europe’s planned permanent rescue facility, citing sources in Merkel’s ruling coalition. The gauge has still declined 14 percent this year amid concern the euro area’s sovereign-debt debt crisis will derail the global economic recovery.

The ZEW Center for European Economic Research said that its index of German investor and analyst expectations, which aims to predict developments six months in advance, posted a reading of minus 53.8 in December. That was better than the median estimate of economists.

Spain sold 4.94 billion euros ($6.5 billion) of 12- and 18- month bills, the Bank of Spain said, compared with the maximum target of 4.25 billion euros the Treasury set for the sale.

A U.S. Commerce Department report showed that retail sales in the world’s largest economy increased 0.2 percent in November, a slower pace than the 0.6 percent rate that economists had predicted.

Shell rose 2.1%, BP advanced 1.7%. Crude oil briefly surged above $100 a barrel.

Commerzbank AG sank 4.6%.

U.S. stocks retreated, reversing an earlier advance, after Federal Reserve policy makers refrained from taking new actions to bolster growth at the world’s largest economy.

Eight out of nine groups in the S&P declined, led by companies most-dependent on economic growth.

The central bank said it would continue its exchange of $400 billion of short-term debt with long-term securities to lengthen the average maturity of its holdings, a move dubbed Operation Twist. The Fed also did not alter its policy of reinvesting its portfolio of maturing housing debt into agency mortgage-backed securities.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.05 (session high)

The current price: Y77.97

Support 1:Y77.65 (Dec 13 low)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y78.05.

Resistance 3: Chf0.9600 (Feb 17 high)

Resistance 2: Chf0.9540 (Feb 18 high)

Resistance 1: Chf0.9480 (Dec 13 high)

The current price: Chf0.9450

Support 1: Chf0.9390 (23.6% FIBO Chf0.9475-Chf0.9065)

Support 2: Chf0.9340 (Dec 13 low)

Support 3: Chf0.9300 (61.8% FIBO Chf0.9475-Chf0.9180)

Comments: the pair is on uptrend. In focus resistance Chf0.9480.

Resistance 3 : $1.5615 (MA (233) H1)

Resistance 2 : $1.5660 (resistance line from Dec 9)

Resistance 1 : $1.5510 (middle line from Dec 9)

The current price: $1.5483

Support 1 : $1.5450 (Dec 13 low)

Support 2 : $1.5420 (Nov 25 low)

Support 3 : $1.5375 (Sep 23 low)

Comments: the pair is on downtrend. In focus support $1.5450.

Resistance 3: $1.3235 (Dec 13 high)

Resistance 2: $1.3145 (23.6% FIBO $1.3160-$1.3550)

Resistance 1: $1.3100 (psychological level)

The current price: $1.3030

Support 1 : $1.3000 (psychological level)

Support 2 : $1.2970 (support line from Dec 12)

Support 3 : $1.2860 (2011 low)

Comments: the pair is on downtrend. In focus support $1.3000.

Change % Change Last

Nikkei 8,553 -101.01 -1.17%

Hang Seng 18,447 -128.49 -0.69%

S&P/ASX 4,193 -59.45 -1.40%

Shanghai Composite 2,249 -42.95 -1.87%

FTSE 5,490 +62.29 +1.15%

CAC 3,079 -10.87 -0.35%

DAX 5,774 -11.17 -0.19%

Dow 11,954.94 -66.45 -0.55%

Nasdaq 2,579.27 -32.99 -1.26%

S&P 500 1,225.73 -10.74 -0.87%

10 Year Yield 1.96% -0.05

Oil $99.94 -0.20 -0.20%

Gold $1,634.30 -28.80 -1.73%

01:30 Australia RBA Deputy Gov Battellino Speaks 0

04:30 Japan Industrial output final October 2.4% 2.4%

04:30 Japan Industrial output final Y/Y October -3.3%

08:15 Switzerland Producer & Import Prices, m/m November -0.2% -0.2%

08:15 Switzerland Producer & Import Prices, y/y November -1.8% -1.9%

09:30 United Kingdom Claimant count November 5.3 17.3

09:30 United Kingdom Claimant Count Rate November 5.0% 5.1%

09:30 United Kingdom Average Earnings, 3m/y November 2.3% 2.0%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y November 1.7% 1.7%

09:30 United Kingdom ILO Unemployment Rate November 8.3% 8.3%

10:00 Eurozone Industrial production, (MoM) October -2.0% 0.1%

10:00 Eurozone Industrial Production (YoY) October 2.2% 2.1%

13:30 Canada Leading Indicators, m/m November 0.2% 0.3%

13:30 U.S. Import Price Index November -0.6% 1.0%

13:30 U.S. FOMC Member Dennis Lockhart Speaks 0

13:30 U.S. Export Price Index November -2.1%

15:30 U.S. EIA Crude Oil Stocks change 09/12/2011 1.3

23:50 Japan BoJ Tankan survey IV quarter 2 -2

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.