- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 19-12-2011

The euro fell for the first time in three days against the dollar as European finance ministers attempt to meet a self-imposed deadline for funding from the International Monetary Fund to address the region’s debt crisis. The 17-nation European currency has depreciated 2.8 percent versus the dollar this year and 6.6 percent against the yen. After falling to its weakest level against the dollar since January, the euro is poised to depreciate further as measures in the derivatives market show traders expect the blueprint unveiled by European leaders this month for a closer fiscal accord will fail to stem the declines.

The dollar rose against the yen after North Korean said leader Kim Jong Il died, spurring concern instability may increase in Asia. Japan’s currency has advanced 4.6 percent in 2011 against nine developed-nation counterparts, according to Bloomberg Correlation-Weighted Indexes, as investors sought the safest investments amid Europe’s sovereign-debt crisis. The dollar is the next-best performer, strengthening 1.8 percent, while the euro has depreciated 1 percent. Kim died of exhaustion two days ago, the official Korean Central News Agency said. His death ended his 17-year rule. The yen dropped against most of its major counterparts amid concern a destabilization of the Korean peninsula will dim the outlook for Japan’s economy and security.

Most European stocks declined, following two weeks of losses for the Stoxx Europe 600 Index, as euro-area policy makers discussed channeling additional financial support through the International Monetary Fund. Euro-area finance ministers held a conference call today to discuss channeling 200 billion euros ($260 billion) in additional funding through the International Monetary Fund and the mechanics of a so-called fiscal compact that were agreed upon in the Dec. 9 European Union summit accord, according to two people familiar with the matter.

The European Central Bank will offer unlimited funding against collateral for as long as three years in a tender tomorrow in President Mario Draghi’s latest attempt to get cash flowing around the financial system. It’s up to lenders to decide what to do with the money, he told the Financial Times in an interview.

Fitch lowered France’s credit outlook and put the grades of nations including Spain and Italy on review for a downgrade, citing the euro area’s failure to find a “comprehensive solution” to its debt crisis. Fitch placed Spain, Italy, Belgium, Slovenia, Ireland and Cyprus on a “Rating Watch Negative” review, which it expects to complete by the end of January, according to a statement.

National benchmark indexes declined in 12 of the 18 western European markets. France’s CAC 40 Index added 0.1 percent, Germany’s DAX Index slipped 0.5 percent and the U.K.’s FTSE 100 Index sank 0.4 percent.

SGL Carbon declined 9.5 percent to 40.99 euros after Chief Financial Officer Juergen Muth told the Frankfurter Allgemeine Sonntagszeitung that the German maker of carbon and graphite products regards a takeover by Bayerische Motoren Werke AG and the carmaker’s heiress Susanne Klatten as unlikely. BMW and Klatten together hold about 44 percent in SGL.

BP Plc, Europe’s second-biggest oil producer, dropped 1.8 percent to 437.65 pence. Oil and gas companies were among the worst performers of the 19 industry groups in the Stoxx 600.

Vedanta Resources Plc dropped 3.6 percent to 1,046 pence. Antofagasta Plc slid 1.9 percent to 1,150 pence and Xstrata Plc lost 1.4 percent to 956.7 pence.

Copper futures dropped in London and New York as investors speculated that demand will ease after property prices fell in China, the world’s biggest consumer of industrial metals. In November, 49 big cities monitored in China posted house- price declines, the most this year, after the government affirmed plans to maintain property curbs.

Air Berlin rallied 8.3 percent to 2.50 euros after saying that Etihad Airways, Abu Dhabi’s state-controlled airline, will pay 72.9 million euros to increase its stake in the German airline to 29.2 percent. Etihad will purchase 31.6 million new shares at Dec. 16’s closing price of 2.31 euros a piece, Air Berlin said in a statement. Etihad will keep the shares for at least two years and not increase its stake during that time.

Nestle climbed 2 percent to 52.20 Swiss francs as the world’s biggest food company limited declines on the Stoxx 600.

U.S. stocks fell, following a two- day advance for the Standard & Poor’s 500 Index, as European Central Bank President Mario Draghi said substantial risks to the economy remain and banks retreated on concern over stricter international capital standards.

Draghi said the ECB can’t step up government bond purchases under its founding piece of legislation. “The treaty specifies very closely what our remit is, namely to ensure price stability in the medium term,” he told lawmakers in Brussels today. “The treaty also forbids monetary state financing.”

U.S. equities rose earlier today as European finance ministers sought to draw additional aid and form new budget rules to contain the region’s debt crisis. Ministers are holding a conference call to discuss 200 billion euros ($261 billion) in additional funding through the International Monetary Fund and the mechanics of a so-called fiscal compact that was negotiated at a Dec. 9 European Union summit, according to two people familiar with the planning.

Dow 11,812.12 -54.27 -0.46%, Nasdaq 2,544.16 -11.17 -0.44%, S&P 500 1,211.54 -8.12 -0.67%

Bank of America Corp. (BAC) and Citigroup Inc. (C) slumped more than 3.8 percent on a report that large financial institutions will have to hold extra capital. JPMorgan Chase & Co. (JPM) tumbled 4.2 percent to $30.54.

Energy companies dropped 1 percent as a group, while raw material shares declined 1.3 percent. Oil futures fell 0.3 percent after rising as much as 1 percent earlier. Chevron lost 0.6 percent to $100.30. Exxon Mobil tumbled 0.4 percent to $79.84.

Need a firewall big enough to fight temporary instability

EFSF bank license would be effort to circumvent the EU treaty

ECB's monetary policy is accommodative

Refinancing needs mean bond market pressure is unprecendented

ECB does not have FX objective, not in our mandate

Geopolitical tensions in East Asia, especially the Korean peninsula, increased as the North Korean media reported that its “Dear Leader” Kim Jong Il died. Asian stocks declined as the uncertainty arose after the Kim's death, such as how long would Kim Jong Un (Kim Jong Il's son) stay in power, the flee of refugee from North Korea to nearby countries including South Korea and Japan and possibility of reunification of the 2 Koreas, may cause instability in the region. Most Asian bourses fell with the Seoul Composite plunging more than -4% because of the news.

Investors fled to safe-haven assets and the US dollar was obviously their shelter. The market lost interests in Japanese yen this time as Japan is geographically near North Korea. Should Kim's death triggered destabilization in the region, Japan would have to suffer. Indeed, Japan's Prime Minister Yoshihiko Noda said that a crisis management team on North Korea has been set up today so as to verify the announcement of Kim's death and to gauge its implications.

Besides the news, the financial market continued to be pressured by the gloomy outlook in the Eurozone. Fitch Ratings lowered France's credit outlook to negative despite affirmation of the AAA rating. It warned that credit ratings of Belgium, Spain, Slovenia, Italy, Ireland and Cyprus may be cut. Meanwhile, Moody's cut Belgium by 2 notches to Aa3, with a negative outlook, on Friday, citing the contingent liabilities from the Dexia bailout, sluggish economic growth and increasing borrowing costs were major threats of the country's debts.

On the dataflow, the US' NAHB housing market index probably stayed in 20 in December. In China, November's house price index was so far the worst this year. According to the national statistic bureau, new home prices in 49 of the 70 cities monitored fell on monthly basis in November, while 33 cities reported declines in October.

Today, December gold futures on the Comex in New York fall to 1590.50 doll per troy ounce.

OPEC decided to increase its production ceiling to 30 million barrels a day, the first change in three years, moving the group’s target nearer to current output as it grapples with rising exports from post-war Libya.

The new quota is for all members of the Organization of Petroleum Exporting Countries, including Iraq and Libya, and compares with actual November production from those 12 nations of 30.37 million barrels a day, according to OPEC estimates. The target will be reviewed at its next meeting on June 14 and replaces a previous target for 11 OPEC nations, excluding Iraq, of 24.845 million.

Brent crude for January delivery plunged $3.55, or 3.2 percent, to $105.95 a barrel on the ICE Futures Europe exchange. Prices are up 12 percent this year after gaining 8 percent in 2010.

Modest underlying wage and price pressures, risks to med-term outlook broadly balanced

Latest monetary data show heightened uncertainty, pace of mon expansion moderate

ECB non-standard measures should mitigate mkt strains

Non-standard measures should allow SME lending by banks, ECB intends to enhance use of bank loans as collateral

EU leaders compact is a breakthrough, foundations for a fiscal compact have been laid, EU accord should prevent excessive deficits in future

Fiscal compact shows clear trajectory for EMU future, welcomes decisions to strengthen EFSF, ESM

Resistance 2:1233 (50.0 % FIBO 1267-1200)

Resistance 1:1225 (Dec 14 and 16 highs)

Resistance 1:1220 (session high)

Current price: 1214,25

Support 1 : 1213 (intraday low)

Support 2 : 1200 (area of session low and Dec 15 low)

Support 3 : 1193 (61,8 % FIBO 1147-1267)

USD/JPY Y77.10, Y77.65, Y77.80, Y77.95, Y78.00

AUD/USD $0.9950, $1.0000, $1.0075, $1.0250

USD/CHF Chf0.9200

EUR/JPY Y100.00, Y101.50

GBP/USD $1.5500

Euro-area finance ministers will hold a conference call to discuss 200 billion euros ($261 billion) in additional funding through the International Monetary Fund and the mechanics of a so-called fiscal compact that was negotiated at a Dec. 9 European Union summit, according to two people familiar with the planning.

Nikkei 8,296 -105.60 -1.26%

Hang Seng 18,070 -215.18 -1.18%

Shanghai Composite 2,218 -6.60 -0.30%

FTSE 5,388 +0.29 +0.01%

CAC 3,005 +32.64 +1.10%

DAX 5,760 +58.58 +1.03%

Crude oil: $94.15 (+0,7%).

Gold: $1604,70 (+0,4%).

Data:

09:00 EU(17) Current account (October) adjusted, bln -7.5

The dollar rose after North Korean state television said leader Kim Jong Il died, spurring concern instability may increase in Asia and boosting demand for the U.S. currency as a haven.

The euro slid before France and Spain sell bills this week amid concern political action to stem the region’s debt crisis won’t stop the region’s largest economies from seeing their credit ratings cut. Sweden’s krona strengthened before tomorrow’s central bank meeting.

Fitch Ratings lowered its outlook for France’s credit ranking to negative from stable on Dec. 16, saying the country’s budget deficit and government borrowings make it more vulnerable to the region’s debt crisis than other top-rated euro-zone countries. The ratings company separately placed other European nations, including Spain and Italy, on review for a downgrade.

European finance ministers will hold a conference call today to discuss 200 billion euros in additional funding through the International Monetary Fund.

EUR/USD: the pair was limited $1.2980-$ 1.3040.

GBP/USD: the pair was limited $1.5465-$ 1,5520.

USD/JPY: the pair has returned below Y78.00.

Среди североамериканских данных первого дня недели стоит отметить вниманием статистику по изменению объема оптовой торговли в Канаде, которая выйдет в 13:30 GMT. Позже, в 15:00 GMT выйдет индекс цен на жилье от NAHB в США за декабрь (прогноз 21 против 20 в ноябре). Далее внимание стоит обратить на запланированные выступления президента Европейского Центрального Банка Марио Драги (15:30 GMT) и представителя ФРС Джеффри Лэкера (17:30 GMT). День завершиться выходом в 23:00 GMT австралийского индекса ведущих экономических индикаторов от Conference Board.

EUR/USD

Offers $1.3140/50, $1.3100/10, $1.3060/65

Bids $1.2980, $1.2960/45, $1.2910/00, $1.2875/60

GBP/USD

Offers $1.5590/605, $1.5555/65, $1.5550, $1.5520/25, $1.5510

Bids $1.5435/30, $1.5410/00, $1.5395, $1.5350/40

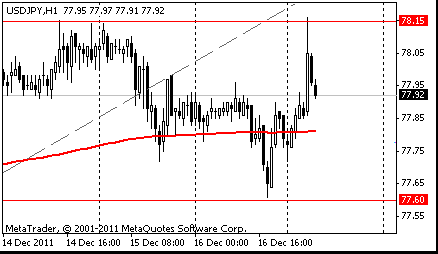

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 highs)

Resistance 1: Y78.15 (Dec 14-15 highs, session high)

Current price: Y77.87

Support 1:Y77.60 (Dec 13 and 16 lows)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

Resistance 2: Chf0.9400/15 (area of session high and Dec 16 high)

Resistance 1: Chf0.9380 (high of european session)

Current price: Chf0.9358

Support 1: Chf0.9350 (area MA (200) for Н1, session low and Dec 15 low)

Support 2: Chf0.9320 (61,8 % FIBO Chf0,9180-CHf0,9550)

Support 3: Chf0.9300 (support line from Dec 1)

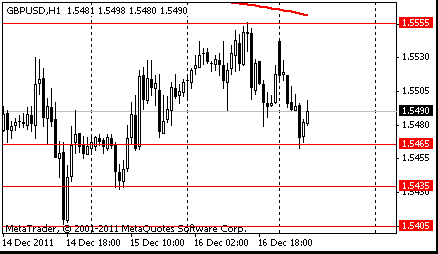

Resistance 2 : $1.5560 (Dec 16 high)

Resistance 1 : $1.5520 (high of european session)

Current price: $1.5490

Support 1 : $1.5465 (session low)

Support 2 : $1.5435 (Dec 15 low)

Support 3 : $1.5400 (area of Dec 14 low)

Resistance 2: $ 1.3080 (Dec 16 high)

Resistance 1: $ 1.3040 (session high)

Current price: $1.3012

Support 1 : $1.2980 (session low, low of american session on Dec 15)

Support 2 : $1.2945 (Dec 14 low)

Support 3 : $1.2910 (Jan 11 low)

- see Germany 2011 inflation 2.5% (2.5%), 2012 1.8% (1.8%) 2013 1.5%;

- see unemployment rate 7.1% in 2011, 7.0% 2012, 6.8% 2013;

- see German 2011 debt 81%/GDP, little change in 2012, 2013;

- global growth to pick up in h2 2012, see 3.5% 2012, 4% 2013.

USD/JPY Y77.10, Y77.65, Y77.80, Y77.95, Y78.00

AUD/USD $0.9950, $1.0000, $1.0075, $1.0250

USD/CHF Chf0.9200

EUR/JPY Y100.00, Y101.50

GBP/USD $1.5500

Nikkei 225 8,296 -105.60 -1.26%

Hang Seng 18,070 -215.18 -1.18%

S&P/ASX 200 4,060 -98.85 -2.38%

Shanghai Composite 2,218 -6.60 -0.30%

Eurozone crisis is depressing inflation

Non-standard measures needed in current environment

The dollar rose against most major peers after North Korean state television said national leader Kim Jong Il died, spurring concern instability may increase in the region and boosting demand for the U.S. currency as a haven.

The yen dropped against the dollar for the first time in three days amid concern a destabilization of the Korean peninsula will dim the outlook for Japan’s economy and security.

The euro slid before France and Spain sell bills this week amid concern the region’s largest economies will have their credit ratings cut.The euro fell for the first time in three days against the dollar before France is scheduled to sell as much as 7 billion euros ($9.1 billion) of bills today. Spain will auction government securities tomorrow maturing in three and six months.

Fitch Ratings lowered its outlook for France’s credit ranking to negative from stable on Dec. 16, saying the country’s budget deficit and government borrowings make it more vulnerable to the region’s debt crisis than other top-rated euro-zone countries. The ratings company separately placed other European nations, including Spain and Italy, on review for a downgrade.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair fell.

USD/JPY: on Asian session the pair rose and showed new week’s high

European events for Monday get started at 0745GMT, when ECB Governing Council member Christian Noyer makes remarks at a conference on the Euro Area Sovereign Debt Crisis, in Paris. Main data starts at 0900GMT with the ECB current account data, which is followed at 1000GMT by EMU construction output. Then, at 1530GMT, ECB President Mario Draghi is due to make a statement at a Quarterly Hearing before European Parliament Economic and Monetary Affairs Committee, in Brussels, which is followed at 1700GMT by the ECB financial stability report. US data for Monday starts at 1430GMT with the weekly MNI Capital Goods Index, which is followed at 1500GMT by the first of the US housing data for the week, the NAHB Housing Market Index, while at 1530GMT we get the weekly MNI Retail Trade Index. At 1815GMT, Richmond Fed President Jeffrey Lacker delivers a speech on the economic outlook to the Charlotte Chamber of Commerce in Charlotte, NC.

On Monday the euro fell to the lowest level in two months versus the dollar as Moody’s Investors Service said it will review the ratings of European Union nations after last week’s summit failed to produce decisive steps to end the debt crisis. Italian bonds slid as the nation sold 7 billion euros ($9.3 billion) of one-year bills to yield 5.95 percent, compared with an average 2.70 percent in the past five years. The dollar and yen strengthened against a majority of their most-traded counterparts as investors sought safer assets on concern crisis-fighting efforts are failing to stop European borrowing costs from rising.

On Tuesday the euro fell on concern European leaders won’t agree on ways to expand the region’s rescue capacities as debt-strapped nations struggle to fund their deficits. The euro dropped after Chancellor Angela Merkel told German coalition lawmakers that the 500 billion euro cap on Europe’s planned permanent bailout fund will stay in place. The dollar declined against the yen before the Federal Reserve holds a meeting amid speculation officials will maintain their pledge to keep borrowing costs at almost zero.

On Wednesday the euro fell below $1.30 for the first time since January as signs of increased funding stress in Europe damped investor appetite for the shared currency. The euro declined as Italian borrowing costs increased at a debt auction and Spanish banks’ borrowings from the European Central Bank climbed by the most in a year. The pound was the biggest gainer against the euro among the major currencies as investors sought protection from the crisis. The pound rose for a third day against the euro as stock declines spurred demand for the perceived safety of the British currency.

On Thursday the euro rose after Spain sold more than its maximum target at a debt auction, easing concern the region’s debt crisis is worsening. The euro pared losses versus the yen after a report showed European manufacturing and service industries contracted less this month than economists forecast. The Swiss franc strengthened against all its major counterparts after the central bank refrained from introducing new measures to weaken the currency at a policy meeting. The franc gained the most in eight weeks against the euro after Switzerland’s central bank left its limit on the currency unchanged, resisting pressure from exporters to further curb its strength as officials take time to assess deflation risks.

On Friday the euro declined against the dollar after Fitch Ratings said it may downgrade Belgium, Spain, Slovenia, Italy, Ireland and Cyprus, adding to concern the region’s debt crisis hasn’t been contained. The euro rose earlier after Luxembourg’s Jean- Claude Juncker said Europe should meet a deadline for arranging loans with the International Monetary Fund as part of a crisis- fighting package.

Asian stocks fell as signs of slowing growth in China and Japan and concern that Europe’s debt crisis is worsening.

The Shanghai Composite Index sank 3.9%. Chinese manufacturing may contract for a second month, according to a survey released Dec. 15 by HSBC and Markit Economics. Hong Kong’s Hang Seng Index declined 1.6%.

Japan’s Nikkei decreased 1.6 percent this week after the Bank of Japan’s Tankan survey showed sentiment among the nation’s largest manufacturers deteriorated more than economists expected.

HSBC dropped 2%. Mitsubishi UFJ Financial Group Inc. decreased 3.8%.

Exporters to China declined on concern shipments will fall amid slowing growth in the world’s second-largest economy. Komatsu sank 7.8%, Fanuc Corp. fell 3.6%.

BHP Billiton Ltd. lost 1.9%.

European stocks fell for a second week as concern lingered that the region’s debt crisis is deepening and the Federal Reserve refrained from taking new action to bolster the world’s largest economy.

The Fed declined to take new action to lower borrowing costs in a statement on Dec. 13, saying the U.S. economy continues to expand even as global growth slows. The central bank repeated a warning at its two previous meetings that the “strains in global financial markets continue to pose significant downside risks to the economic outlook.”

Moody’s Investors Service said it will review the ratings of all European Union countries in the first quarter because an EU summit on Dec. 8 and Dec. 9 failed to deliver “decisive policy measures” to end the debt crisis.

Company news:

Logica fell 23% after reducing its full-year revenue growth forecast.

Telefonica SA slid 7.7% after Spain’s largest telecommunications company cut its dividend for the first time in a decade.

Old Mutual Plc rallied 7.4%as the third-biggest U.K. insurer said it plans to sell its Nordic unit to Skandia Liv for 2.1 billion pounds to reduce debt and return capital to investors.

BNP Paribas SA and Bayerische Motoren Werke AG fell more than 7% as investors shunned companies with profits most tied to economic growth.

U.S. stocks fell as European leaders struggled to solve the region’s debt crisis and the Federal Reserve refrained from additional stimulus.

Equities rose the last two days of the week as data on jobless claims and manufacturing offset concern Europe’s crisis is escalating.

The S&P rebounded after Labor Department figures showed initial jobless claims fell by 19,000 to 366,000 in the week ended Dec. 10, the fewest since May 2008, and two reports showed manufacturing in the New York and Philadelphia regions expanded more than forecast in December.

Caterpillar, the world’s largest construction and mining- equipment maker, tumbled 9.1%, Alcoa, the largest U.S. aluminum producer, sank 8.6%.

Intel Corp. slid 7.1% , pacing declines among technology companies.

Research In Motion Ltd. tumbled 18% percent after delaying the next generation BlackBerry.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high, session high)

The current price: Y77.92

Support 1:Y77.50/60 (area of Dec 9-16 low)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y77.75.

Resistance 3: Chf0.9540/45 (area of Dec 14-15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9430 (high of the American session on Dec 15)

The current price: Chf0.9374

Support 1: Chf0.9340 (Dec 13 low, MA (233) H1)

Support 2: Chf0.9290 (Dec 8 high)

Support 3: Chf0.9250 (Dec 12 low)

Comments: the pair decreases. In focus resistance Chf0.9430

Resistance 3 : $1.5655 (Dec 12 high)

Resistance 2 : $1.5595 (50.0% FIBO $1.5405-$1.5765)

Resistance 1 : $1.5555 (MA (233) H1, Dec 16 high)

The current price: $1.5489

Support 1 : $1.5470 (low of the American session on Dec 15)

Support 2 : $1.5435 (Dec 15 low)

Support 3 : $1.5405 (Dec 14 low)

Comments: the pair is on downtrend. In focus support $1.5465

Resistance 3: $1.3145 (38.2% FIBO $1.2944-$1.3430)

Resistance 2: $1.3085 (Dec 16 high)

Resistance 1: $1.3045 (session high)

The current price: $1.3004

Support 1 : $1.2980 (session low)

Support 2 : $1.2945 (Dec 14 low)

Support 3 : $1.2910 (Jan 11 low)

Comments: the pair is on downtrend. In focus support $1.2980.

ASIA-PAC In Japan, the data calendar is thin in the coming week, with trade figures due out on Wednesday. It's also a quiet week

in Australia but an important one as the minutes of the RBA's last board meeting are released on Tuesday.

EUROPE - In core-Europe, the highlight of the week for data will likely be the German Ifo due on Tuesday. The Riksbank delivers it's

policy decision on Tuesday. The Bank will probably make no adjustments to its current policy. By this time of year, central bank activity

normally quiets down until after the New Year. However, with the euro zone crisis continuing, it opens the possibility of more surprise

announcements like that related to central bank swap lines that took place on November 30.

US - The week ahead leads up to the Christmas holiday and the US bond market will close early on Friday, December 23, and will

remain closed on Monday, December 26. The proximity to the holidaymeans that the second-tier US data releases will get scant attention,

and markets will concentrate on the few big reports for the week - namely housing starts, existing home sales and new orders for durable

goods. Some of the data will be released slightly sooner than usual to allow for holiday schedules. Durable goods data for November is set for release on Friday. The transportation component is widely anticipated to provide a big boost to the overall number. New orders for Boeing aircraft were exceptionally strong at the Dubai Airshow in that month, and demand for new motor vehicles indicates that orders to replenish inventories could be solid. Also, third quarter GDP for 2011 is due on Thursday, although markets will quickly digest the last look at July-September period as the fourth quarter is already well-advanced.

00:00 New Zealand NBNZ Business Confidence December 18.3

00:01 United Kingdom Rightmove House Price Index (MoM) December -3.1%

00:01 United Kingdom Rightmove House Price Index (YoY) December +1.2%

09:00 Eurozone Current account, adjusted, bln October 0.5 -1.9

13:30 Canada Wholesale Sales, m/m October +0.3% +0.6%

15:00 U.S. NAHB Housing Market Index December 20 21

15:30 Eurozone ECB President Mario Draghi Speaks ---

17:30 U.S. FOMC Member Laker Speaks 0

23:00 Australia Conference Board Australia Leading Index October 0.1%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.