- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 21-12-2011

The country needs to implement reforms

It may need to revise the objectives of fiscal policy, if the situation worsens in Europe

The euro fell against most of its major peers amid concern that European Central Bank measures to support its banking sector won’t be enough to arrest region’s worsening sovereign-debt crisis.

The 17-nation currency erased an earlier advance as the ECB said it had awarded 489 billion euros ($637 billion) in 1,134- day loans to banks, more than the 293 billion euros forecast by economists, as investors bet the euro-region debt crisis is far from done. The euro-area economy will probably fail to grow next year after expanding 1.6 percent in 2011, while the U.S. is forecast to accelerate to 2.1 percent from 1.8 percent, according to Bloomberg surveys of economists.

The franc weakened 0.3 percent to 1.2222 per euro and 0.5 percent to 93.64 centimes per dollar.

Yields on Italian two-year notes rose as much as 27 basis points, or 0.27 percentage point, to 5.25 percent, snapping four-straight days of declining borrowing costs, while Spanish debt yields with the same maturity increased 27 basis points to 3.5 percent, after falling for eight days.

The rates have slipped more than one percentage point since ECB President Mario Draghi announced the unprecedented loans on Dec. 8 as investors bet that banks will use the cash to buy government debt.

The number of existing homes sold in the U.S. was revised down by an average 14 percent since 2007, magnifying the depth of the slump that contributed to the last recession. Purchases were revised to 4.19 million for 2010, down 15 percent from a prior estimate of 4.91 million, the National Association of Realtors said today in Washington.

IntercontinentalExchange Inc.’s Dollar Index, a gauge of the greenback against the currencies of six major U.S. trading partners, rose 0.2 percent to 79.980.

Euro-zone fiscal pact a big step

European stocks fell for the first time in three days as lenders sought more funds from the European Central Bank than economists had predicted, reducing optimism that the debt crisis will be contained.

The Frankfurt-based ECB awarded 489 billion euros ($640 billion) in 1,134-day loans, more than economists’ median estimate of 293 billion euros in a Bloomberg News survey. The ECB said 523 banks asked for the funds, which it will lend at the average of its benchmark rate over the term of the loans. They start tomorrow.

The banks borrowed enough cash to refinance almost two- thirds of the debt they have maturing next year amid concern that markets will remain frozen.

German Chancellor Angela Merkel’s government reduced its planned bond sales next year to 250 billion euros, compared with 270 billion euros proposed in the budget and 283 billion euros that it sold this year. The federal government will sell 170 billion euros in bonds and 80 billion euros in shorter maturities, the Frankfurt-based Federal Finance Agency said as it presented the provisional bond calendar for 2012 today.

The head of the world’s biggest bond fund said he sees a more than one-in-three chance that the euro area will break apart and trigger a financial crisis akin to the one that devastated the global economy in 2008.

National benchmark indexes fell in 14 of the 18 western European markets. The U.K.’s FTSE 100 (UKX) slid 0.6 percent, while France’s CAC 40 retreated 0.8 percent and Germany’s DAX declined 1 percent.

SAP lost 6.1 percent to 39.92 euros, the largest decline since October 2009, and competitor Software AG fell 4.9 percent to 27.25 euros. Cap Gemini SA, a computer-services company, retreated 4.9 percent to 24.09 euros.

Oracle, the second-largest business-software maker, posted earnings before some costs in the quarter ended Nov. 30 of 54 cents a share, on revenue excluding certain items of $8.81 billion. Analysts had projected profit of 57 cents and sales of $9.23 billion, according to estimates compiled by Bloomberg.

UniCredit, Italy’s biggest bank, dropped 4.4 percent to 70.8 euro cents and France’s Societe Generale SA slid 3.4 percent to 16.63 euros. A gauge of banks in the Stoxx 600 slipped 0.7 percent.

Konecranes, the Finnish maker of container cranes, retreated 3.6 percent to 13.92 euros after saying it’s restructuring European operations and must cut 100 jobs.

U.S. stocks fell, following yesterday’s rally, as Oracle Corp. tumbled on disappointing earnings and optimism faded about the European Central Bank’s plan to lend euro-area banks a record amount for three years. Spanish two-year government notes fell for the first time in nine days amid fading optimism that the ECB’s three-year loans to euro-area banks will restore confidence in sovereign borrowers. The ECB awarded 489 billion euros ($645 billion) in 1,134-day loans, the most ever in a single operation and more than economists’ median estimate of 293 billion euros in a Bloomberg News survey.

In the U.S., the number of existing homes sold was revised lower by an average 14 percent since 2007, the National Association of Realtors reported today, magnifying the depth of the slump that contributed to the last recession

Dow 12,003.41 -100.17 -0.83%, Nasdaq 2,544.94 -58.79 -2.26%, S&P 500 1,229.71 -11.59 -0.93%

Oracle plunged 14 percent to $25.10. Business-software companies are taking longer to close deals as companies gird for slow economic growth in the U.S. and the possibility of a recession in Europe next year, said Rick Sherlund, an analyst at Nomura Holdings Inc.

Walgreen Co., the largest U.S. drugstore chain, slumped 5.2 percent as profit trailed estimates. A dispute between the company and Express Scripts Inc., an employee-benefits manager, led to a loss of customers, hurting pharmacy demand. CVS Caremark Corp. and Rite Aid Corp. are trying to grab customers amid the standoff over the contract.

Research In Motion Ltd. surged 9.6 percent to $13.72 after reports Microsoft Corp. and Nokia Oyj mulled a bid while Amazon.com Inc. also considered buying the BlackBerry maker.

RIM "turned down takeover overtures" from Amazon because it wanted to fix shortcomings independently, Reuters reported yesterday. A Wall Street Journal article said Microsoft and Nokia "flirted with the idea of making a joint bid" in recent months. Both publications cited unidentified people familiar with the respective matters.

The value of gold goes down in relation to the strengthening of the dollar caused by theresults of the first three years of unlimited auction the European Central Bank.Strengthening of the dollar due to concerns for the euro area growth after three years of unlimited ECB auction in which banks attracted the euro 489.191 billion euros. Earlier, the regulator as a crisis support eurozone banking system to use the maximum annualauctions. Dollar against the basket of six currencies of countries - major trade partners ofthe United States grew by 0.13% - up 79.92 points.

February gold in electronic trading on the New York Stock Exchange on Comex fell to1607.70 dollars per troy ounce.

Oil continues its week-long rise, with those of trading results on Tuesday in the price of oil is added, whiter than 3%. Today, out data on changes in crude oil reserves in the U.S. last week. Crude oil inventories, according to the EIA, declined to 10.570 million barrels, was expected to -2.290 million barrels, the previous change of -1.932 million barrels. At the same time, gasoline inventories fell last week to 0.412 million barrels, the expected 1.240 million barrels, the previous change of 3.824 million barrels, while distillate stocks last week, according to the EIA, decreased by 2.353 million barrels was expected -0.420million barrels, previous change -0.480 million barrels.

WTI crude oil has risen from the start of trading is more pronounced than the oil Brent, due in part to completion before the futures Light Sweet contract period of January, bringing the main interest focused on transactions in the environment at the February contract. The cost of the February futures on U.S. light crude oil WTI (Light Sweet Crude Oil) in trading in New York rose to 99.25 dollars per barrel.

Resistance 3:1254 (Dec 12 high)

Resistance 2:1248 (session high)

Resistance 1:1236 (intradae high)

Current price: 1232,25

Support 1 : 1226 (session low, Dec 16 high)

Support 2 : 1219 (Dec 19 high)

Support 3 : 1200 (resistance line from Dec 8)

USD/JPY Y77.50, Y77.80, Y78.00, Y78.30

AUD/USD $1.0150, $1.0000, $0.9935

EUR/CHF Chf1.2125

EUR/GBP stg0.8380

GBP/USD $1.5650, $1.5600, $1.5900

Nikkei 8,460 +123.50 +1.48%

Hang Seng 18,416 +336.25 +1.86%

FTSE 5,399 -20.18 -0.37%

CAC 3,043 -12.30 -0.40%

DAX 5,839 -8.00 -0.14%

Crude oil: $97.92 (+0,7%).

Gold: $1617,70 (0,0%).

JPMorgan (JPM) was downgraded to a Neutral from Buy at Sterne Agee.

EUR/USD

Offers $1.3225/50, $1.3210/15, $1.3200, $1.3170, $1.3150, $1.3115/25

Bids $1.3020, $1.2980, $1.2955, $1.2545

Data:

09:00 Italy GDP (Q3) final -0.2%

09:00 Italy GDP (Q3) final Y/Y 0.2%

09:30 UK PSNCR (November), bln 10.5

09:30 UK PSNB (November), bln 15.2

09:30 UK PSNBX (November), bln 18.1

09:30 UK BoE meeting minutes (07-08.12)

The euro fell amid concern that European Central Bank measures to support its banking sector may drive down borrowing costs for governments while weakening the value of the region’s currency.

The ECB said it had awarded 489 billion euros ($637 billion) in 1,134 day to banks, more than the 300 billion euros forecast by economists, as investors bet the euro-region debt crisis is far from done.

The euro fell to a fresh 11-month low versus sterling on Wednesday as the single currency reversed brief gains made following a greater-than-expected take-up of the European Central Bank's first ever three-year lending operation.

Market players said sterling was also benefitting from being seen as a relative safe haven from the euro zone's debt troubles.

EUR/USD: the pair has shown high in $1,3200 area then fell in area of a session low $1.3070.

GBP/USD: the pair has tested resistance in $1,5770/80 area then fell below $1.5700.

USD/JPY: the pair was in Y77,65-Y77,90 area.

At 1500GMT, the pace of existing home sales is expected to rise further to a 5.10 million annual rate in November after rebounding to 4.97 million in October. Weekly EIA crude oil stocks data is also due at 1530GMT.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 highs)

Resistance 1: Y78.15 (Dec 14-15 and 19 highs)

Current price: Y77.81

Support 1:Y77.60 (Dec 13 and 16 lows)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

Resistance 3: Chf0.9400 (Dec 19 high)

Resistance 2: Chf0.9380 (Dec 20 high)

Resistance 1: Chf0.9335 (area of session high and support line from Dec 1)

Current price: Chf0.9313

Support 1: Chf0.9240 (session low)

Support 2: Chf0.9180 (area of Dec 8-9 lows)

Support 3: Chf0.9110 (Dec 2 low)

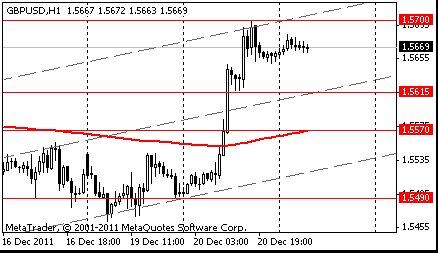

Resistance 2 : $1.5890 (Nov 18 high)

Resistance 1 : $1.5770/80 (area of session high and Nov 30 and Dec 8 highs)

Current price: $1.5681

Support 1 : $1.5660 (session low)

Support 2 : $1.5620 (low of american session on Dec 20)

Support 3 : $1.5560 (Dec 16 high, МА (200) for Н1)

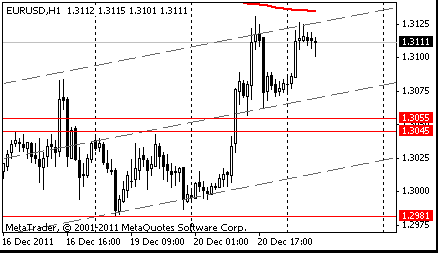

Resistance 3: $ 1.3220-45 (area of 61,8 % FIBO $1.2944-$ 1.3430, support line from Jan 2011 and Dec 13 high)

Resistance 2: $ 1.3200 (area of session high)

Resistance 1: $ 1.3150 (resistance line from Oct 27)

Current price: $1.3090

Support 1 : $1.3070 (session low)

Support 2 : $1.3040 (earlier resistance, Dec 19 high)

Support 3 : $1.2980 (Dec 19 low)

Reversal in sentiment seen post ECB 3-year LTRO, where E489.191bln was alloted and above the market consensus of E250bln-E300bln. However, risks were skewed on a strong take-up, with traders now citing "buy the rumour, sell the fact" adage.

AUD/USD $1.0150, $1.0000, $0.9935

EUR/CHF Chf1.2125

EUR/GBP stg0.8380

GBP/USD $1.5650, $1.5600, $1.5900

Nikkei 225 8,460 +123.50 +1.48%

Hang Seng 18,416 +336.25 +1.86%

S&P/ASX 200 4,140 +86.42 +2.13%

Shanghai Composite 2,191 -24.78 -1.12%

- BOE MPC Voted 9-0 for unchanged bank rate at Dec meeting

- Agreed little merit in changing path of asset buying

- Precision of a policy change outweighed by uncertainty

- inflation report shows more qe may well be needed

- Some BOE MPC thought outlook had deteriorated on the month

- inflation risks more balanced in medium term

The Australian and New Zealand dollars reached one-week highs as Asian equities extended a global stocks rally, boosting demand for higher-yielding assets. The so-called Aussie gained for a second day before the European Central Bank announces results of its first tranche of unlimited three-year loans amid speculation the facility is spurring purchases of the region’s sovereign debt. Demand for New Zealand’s currency was limited after a report showed the country’s current-account deficit widened. The Australian dollar climbed to a record against the euro.

The shortfall was 4.3 percent of gross domestic product in the year ended Sept. 30, from 3.7 percent in the 12 months through June, Statistics New Zealand said in Wellington today. Economists predicted a 3.9 percent gap, according to the median of 11 forecasts in a Bloomberg News survey.

Asian currencies strengthened, as housing data in the U.S. beat economists’ estimates, brightening the export outlook.

Housing starts in the U.S. increased 9 percent to a 685,000 annual rate in November, exceeding the highest estimate of economists surveyed by Bloomberg News, government figures showed yesterday. Chinese Premier Wen Jiabao pledged to take steps to bolster exports, including rebates and capital support to small companies, according to a statement posted on the central government’s website today.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair fell.

The FT looks forward to Wednesday's announcement on the 3-yr LTROs, citing economists looking for today's data to show strong demand encouraged by the ECB. The data is at 1018GMT.UK releases at 0930GMT include the December MPC Minutes from the Bank of England and also the official Public Sector Finances data for November.

Turning to the public finances data, the Office for Budget responsibility raised its forecast for 2011-12 PSNB-X (net borrowing excluding the cost of financial interventions) to Stg126 billion, or 8.4% of GDP, in its November forecast.

US data for Wednesday starts at 1200GMT with the weekly MBA mortgage applications. At 1500GMT, the pace of existing home sales is expected to rise further to a 5.10 million annual rate in November after rebounding to 4.97 million in October. Weekly EIA crude oil stocks data is also due at 1530GMT.

The euro rallied to a one-week high against the dollar after borrowing costs fell at a Spanish bill sale and German business confidence unexpectedly increased, easing concern the region’s debt crisis is worsening. The euro strengthened after the Ifo institute’s business climate index for Germany, based on a survey of 7,000 executives, rose to 107.2 this month from 106.6 in November, boosting optimism that Europe’s largest economy will avoid a recession next year. Economists expected a drop to 106, the median of 36 forecasts in a Bloomberg News survey showed. Spanish two-year notes rose for an eighth day and Italian bonds gained as the European Central Bank offered unlimited three-year loans to the region’s banks, boosting demand for higher-yielding assets, amid speculation banks bought the debt to use as collateral for ECB loans.

The yen weakened against most its major peers as government documents showed the Finance Ministry plans to raise the issuance limit for bills to fund currency intervention to 195 trillion yen ($2.5 trillion), the first increase since Sept. 30. The currency increased to a post-World War II record of 75.35 yen per dollar on Oct. 31.

EUR/USD: yesterday the pair has grown on a figure.

GBP/USD: yesterday the pair has grown on one and a half figure.

USD/JPY: yesterday the pair decreased.

The FT looks forward to Wednesday's announcement on the 3-yr LTROs, citing economists looking for today's data to show strong demand encouraged by the ECB. The data is at 1018GMT.UK releases at 0930GMT include the December MPC Minutes from the Bank of England and also the official Public Sector Finances data for November.

Turning to the public finances data, the Office for Budget responsibility raised its forecast for 2011-12 PSNB-X (net borrowing excluding the cost of financial interventions) to Stg126 billion, or 8.4% of GDP, in its November forecast.

US data for Wednesday starts at 1200GMT with the weekly MBA mortgage applications. At 1500GMT, the pace of existing home sales is expected to rise further to a 5.10 million annual rate in November after rebounding to 4.97 million in October. Weekly EIA crude oil stocks data is also due at 1530GMT.

Most Asian stocks rose as optimism about the outlook for the U.S. economy and resilient economic growth in Asia overshadowed concern that China’s real estate sector might be heading for a hard landing.

Japan’s Nikkei 225 Stock Average (NKY) advanced 0.5 percent, while South Korea’s Kospi Index gained 0.9 percent.

Hong Kong’s Hang Seng Index closed less than 0.1 percent higher after rising as much as 1.1 percent and falling 0.3 percent. China’s Shanghai Composite Index lost 0.1 percent.

Australia’s S&P/ASX 200 fell 0.2 percent after the Reserve Bank of Australia cited risks from Europe in its Dec. 6 decision to cut rates even as growth in Asia’s economies remains “solid,” minutes released today showed.

Exporters advanced after the Fed’s Lacker said the U.S. economy will expand 2 percent to 2.5 percent next year despite slowing global growth.

James Hardie climbed 2.4 percent to A$6.54. LG Electronics Inc. (066570), the world’s fifth-largest maker of mobile phones by sales, gained 1.7 percent to 72,700 won.

Olympus advanced 16 percent to 1,065 yen. The Japanese camera maker may hire financial advisers for a plan to sell 100 billion yen of preference shares to investors that may include companies from Sony Corp. to Siemens AG, the Nikkei newspaper reported, without saying where it got the information.

Noble Group Ltd., the biggest shareholder of Yanzhou Coal Mining Co., climbed 5 percent to S$1.16 in Singapore, poised for its biggest advance this month. Yanzhou Coal, China’s No. 4 producer of the fuel, plans to acquire Australia’s Gloucester Coal for at least $2 billion, a person with knowledge of the matter said. Noble, a Hong-based commodities supplier, owns 65 percent of Gloucester, according to data compiled by Bloomberg.

Hang Ten Group Holdings Ltd., a Hong Kong-based clothier, surged 56 percent to HK$2.65 after receiving a HK$2.65 billion ($341 million) buyout offer from Li & Fung Retailing Ltd., whose parent also controls Li & Fung Ltd.

Cochlear Ltd., maker of the world’s top-selling ear implant, gained 16 percent, the most in seven years, to A$64.33 in Sydney after saying it plans to fix a glitch that had led to a recall costing as much as A$150 million ($149 million).

Among stocks that declined, shares of Chinese property developers dropped after SouFun, China’s biggest real estate website, said property transactions will continue to fall in the first half of 2012. Government data released on Dec. 18 showed the nation’s home prices worst performance this year with more than half of the 70 biggest cities monitored in November recording declines.

China Overseas Land sank 3.5 percent to HK$13.36. China Resources Land Ltd., a state-owned developer, fell 2.1 percent to HK$12.22. Guangzhou R&F Properties Co., the biggest homebuilder in the southern Chinese city, lost 1 percent to HK$6.16.

European stocks posted their biggest rally this month as banks climbed after a report showed German business confidence unexpectedly rose for a second month.

Stocks gained after German business confidence climbed in December, suggesting Europe’s largest economy is weathering the euro area’s debt crisis. The gauge of business confidence, based on a survey of 7,000 executives, rose to 107.2 from 106.6 in November, the Munich-based Ifo institute said today. The median economist forecast called for a drop to 106.

In the U.K., consumer confidence rose in November from a record low as Britons’ expectations for the economy improved in the run-up to Christmas, Nationwide Building Society said.

Spain sold 5.64 billion euros ($7.4 billion) of three-month and six-month bills, the Bank of Spain said, compared with the maximum target of 4.5 billion euros that the Treasury had set for the sale.

The average yield on the three-month debt dropped to 1.735 percent, compared with 5.110 percent when the securities were last issued on Nov. 22. The average six-month yield fell to 2.435 percent from 5.227 percent last month.

National benchmark indexes climbed in every western- European market except Iceland. France’s CAC 40 Index added 2.7 percent, Germany’s DAX Index jumped 3.1 percent and the U.K.’s FTSE 100 Index gained 1 percent.

Lenders paced advancing shares today. UniCredit rallied 6.3 percent to 74 euro cents. BNP Paribas surged 6 percent to 30.14 euros and Intesa climbed 5.8 percent to 1.29 euros.

Arkema soared 9.1 percent to 51.98 euros. The company, which is cheaper than any rival industrial-chemical producer, may be a takeover target for Saudi Basic Industries Corp. (SABIC) and DuPont Co. after deciding to spin off its unprofitable vinyls business.

Bayer rose 5 percent to 46.99 euros after the drugmaker said four of its medicines in development may contribute a combined 5 billion euros to annual revenue.

U.S. stocks climbed, giving the Standard & Poor’s 500 Index its biggest gain of the month, as better-than-estimated housing starts added to expectations the world’s largest economy will weather Europe’s debt crisis.

The S&P 500 rose 3 percent to 1,241.21 at 4 p.m. New York time, as 491 out of 500 stocks gained (SPX), according to preliminary closing data. The gauge fell 1.2 percent yesterday.

Stocks gained as builders broke ground in November on more houses than at any time in the past 19 months. The Federal Reserve sought to curb the risk of financial turmoil by strengthening its tools for preventing the collapse of large firms and demanding stricter oversight by companies’ boards of directors. Concern about Europe’s crisis eased today as German business confidence unexpectedly grew.

Today’s rally trimmed this year’s drop in the S&P 500 to 1.3 percent. The benchmark measure had tumbled 12 percent from a three-year high in April through yesterday as Europe struggled to tame its debt crisis. It’s trading for 13.1 times reported earnings, compared with the average since 1954 of 16.4 times, according to data compiled by Bloomberg.

Financial companies rebounded today. JPMorgan advanced 5.4 percent to $31.75. The shares lost 3.7 percent yesterday. Bank of America, which yesterday ended at the lowest level since March 2009, gained 3.8 percent to $5.12.

Jefferies rallied 23.5 percent to $13.90. The investment bank that’s been fighting speculation about its financial strength rose after fiscal fourth-quarter profit beat estimates on a recovery in fixed-income trading. Jefferies may not have to raise more equity after reducing assets on its balance sheet, Sean Egan of Egan-Jones Ratings Co. said today on CNBC.

Sprint Nextel jumped 10.5 percent to $2.21. AT&T failed to convince the Justice Department, which sued to block the transaction in August, that it could remedy the market impact of absorbing T-Mobile, the nation’s No. 4 mobile-phone operator. AT&T would have spent months in litigation to try to win court approval, and the company also faced possible opposition from the Federal Communications Commission.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high, session high)

The current price: Y77.85

Support 1:Y77.50/60 (area of Dec 9-16 low)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y77.15.

Resistance 3: Chf0.9415 (Dec 16 high)

Resistance 2: Chf0.9380 (Dec 20 high)

Resistance 1: Chf0.9340 (MA (233) H1)

The current price: Chf0.9288

Support 1: Chf0.9270 (Dec 20 low)

Support 2: Chf0.9225 (Dec 7 low)

Support 3: Chf0.9180 (Dec 9 low)

Comments: the pair is on downtrend. In focus support Chf0.9270.

Resistance 3 : $1.5780 (Nov 30 high)

Resistance 2 : $1.5735 (Dec 9 high)

Resistance 1 : $1.5700 (Dec 20 high)

The current price: $1.5670

Support 1 : $1.5615 (low of the American session on Dec 20)

Support 2 : $1.5570 (MA (233) H1)

Support 3 : $1.5490 (Dec 20 low)

Comments: the pair is on uptrend. In focus resistance $1.5700.

Resistance 3: $1.3235 (Dec 13 high)

Resistance 2: $1.3190 (50.0% FIBO $1.2945-$1.3430)

Resistance 1: $1.3145 (MA (233) H1)

The current price: $1.3111

Support 1 : $1.3045/55 (area of Dec 14-19 high)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2944 (Jan 14 low)

Comments: the pair is on uptrend. In focus resistance $1.3145.

Change % Change Last

Nikkei 225 8,336 +40.36 +0.49%

Hang Seng 18,080 +9.99 +0.06%

S&P/ASX 200 4,053 -7.27 -0.18%

Shanghai Composite 2,216 -2.30 -0.10%

FTSE 100 5,420 +54.61 +1.02%

CAC 40 3,055 +81.19 +2.73%

DAX 5,847 +176.32 +3.11%

Dow 12,101.92 +335.66 +2.85%

Nasdaq 2,603.37 +80.23 +3.18%

S&P 500 1,241.21 +35.86 +2.98%

10 Year Yield 1.92% +0.11 --

Oil $97.12 -0.10 -0.10%

Gold $1,617.00 -0.60 -0.04%

04:00 Japan BoJ Interest Rate Decision 0 0.00%-0.10% 0.00%-0.10%

09:30 United Kingdom Bank of England Minutes 0

09:30 United Kingdom PSNCR, bln November -0.6 10.3

09:30 United Kingdom PSNB, bln November 6.5 19.6

13:30 Canada Retail Sales, m/m October +1.0% +0.4%

13:30 Canada Retail Sales ex Autos, m/m October +0.5% +0.4%

14:00 Belgium Business Climate December -12.2 -11.1

15:00 Eurozone Consumer Confidence December -20.4 -21.0

15:00 U.S. Existing Home Sales November 4.97 5.04

15:30 U.S. EIA Crude Oil Stocks change 16.12.2011 -1.9

21:45 New Zealand Gross Domestic Productб q/q Quarter III +0.1% +0.6%

21:45 New Zealand Gross Domestic Product, y/y Quarter III +1.5% +2.2%

23:00 Japan BOJ Governor Shirakawa Speaks 0

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.